Room Rental Invoice Template for Simple and Professional Billing

Managing financial transactions for property agreements can be a complex task, but having a structured approach to document payments makes the process much smoother. Whether you’re a landlord, property manager, or real estate agent, ensuring clarity and accuracy in your financial records is crucial for both you and your tenants.

Creating a clear and professional document that outlines payment details can help avoid misunderstandings and delays. These documents serve not only as a receipt for tenants but also as a reference for tracking payments over time. With a well-organized form, you can simplify communication and maintain a transparent relationship with your clients.

In this guide, we will explore how to effectively craft such documents, offering customizable formats that can be tailored to suit any lease agreement. By using the right format, you’ll ensure that every transaction is properly recorded and easy to manage, whether you are dealing with short-term or long-term leases.

Room Rental Invoice Template Overview

Having a standardized document for billing is essential for ensuring clear communication and proper payment tracking. This type of document simplifies the process of requesting and recording payments for property use, making it easier to maintain accurate financial records. Whether you’re managing a single unit or multiple properties, such a tool can save time and reduce errors.

Key Features of a Billing Document

A well-designed form should include several key components that make the transaction details clear to both parties. These elements ensure transparency and help prevent disputes over payment amounts or due dates. Below are the main features that should be included in any effective financial document for property use:

| Feature | Description | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Tenant Information | Details such as the tenant’s name, address, and contact information. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Property Details | Information about the leased property, including location and unit number. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Payment Breakdown | A clear breakdown of charges, including rent, utilities, and any other fees. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Due Date | The exact date by which payment must be received to avoid late fees. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Payment Methods | Accepted methods for payment, such as bank transfer, check, or onli

Why Use a Room Rental Invoice?Creating a formal document to request payment is essential for both landlords and tenants. This process ensures that financial transactions are documented, making it easier to track and manage payments. By providing a clear and professional record of charges, both parties benefit from greater transparency and fewer misunderstandings. Advantages for Property Managers and TenantsUsing a structured billing document provides numerous benefits, not only for landlords but also for tenants. It helps establish clear expectations, ensures timely payments, and maintains a record of transactions for future reference. Here are some key advantages:

How It Streamlines TransactionsBy using a Key Elements of a Rental InvoiceTo ensure a smooth and transparent financial transaction, it’s important to include all the necessary information in a payment request. A well-structured document clearly outlines the charges, payment terms, and other relevant details. This not only helps in avoiding confusion but also makes the process more professional for both landlords and tenants. There are several essential components that should be present in any document requesting payment for property use. These elements ensure that all the important information is clearly communicated, making the transaction straightforward and easily trackable. Below are the key sections that should be included:

Including al How to Customize Your Invoice TemplateWhen creating a payment request for property use, it’s important to tailor the document to suit your specific needs and preferences. Customization allows you to include only the relevant information and create a professional look that aligns with your brand or business style. By adjusting various sections, you can ensure the form works efficiently for your particular situation, whether you’re managing one property or multiple units. Personalizing the DocumentTo begin customizing, start by adjusting the basic details of the document, such as your company logo, business name, and contact information. Adding your logo and branding elements not only makes the document look professional, but it also enhances your business’s credibility. You can also modify the layout to suit your aesthetic preferences or to ensure clarity for the recipient. Adjusting the ContentNext, tailor the content sections to reflect the specifics of the property and the terms of the agreement. Here are some customizations you might consider:

By making these adjustments, you ensure that the document is fully aligned with the specific terms of each arrangement and that it reflects the professionalism of your business. A personalized form will also make it easier for tenants to understand their obligations and responsibilities, reducing confusion and potential delays in payment. Benefits of Using a TemplateUtilizing pre-designed formats for managing payment records offers several advantages for both service providers and clients. By adopting a standardized approach, businesses can streamline their processes, reduce errors, and save valuable time. These ready-made structures are not only efficient but also ensure consistency in communication and documentation. One of the key benefits is the significant reduction in administrative work. With a pre-structured document, the time spent on creating or reviewing each individual record is minimized, allowing businesses to focus on other important tasks.

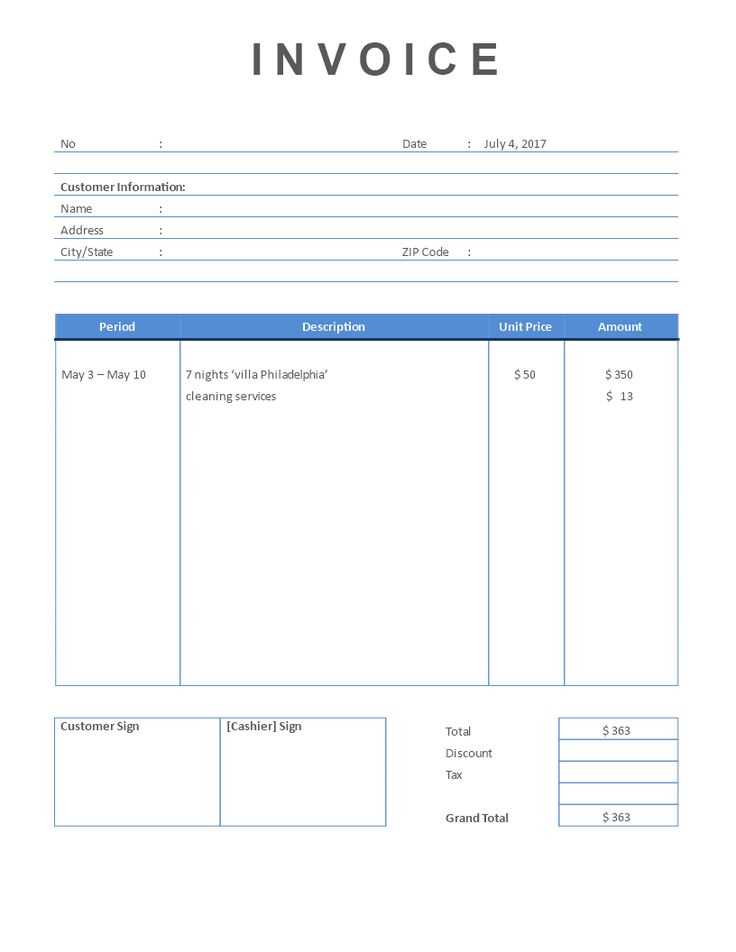

Incorporating such documents into everyday practices not only simplifies workflow but also provides a clear, uniform system for record-keeping, ensuring better organization and professionalism overall. Room Rental Invoice Sample ExplainedUnderstanding the structure of a payment record document is essential for both service providers and customers. A typical example of such a document includes specific fields that help ensure all important details are captured in a clear and organized manner. These documents serve as a formal record of the agreed terms and help prevent misunderstandings between both parties. The sample document typically starts with basic identification information, such as the name and address of both the service provider and the client. This allows for easy identification and communication if needed. Following this, the date of the transaction is noted, which is critical for keeping track of when the service was provided. Next, an itemized list appears, outlining the key components of the charge. This section often includes the duration of the service, any applicable rates, and additional fees such as cleaning or maintenance costs. This level of detail ensures both parties are clear on what exactly is being paid for. Finally, the total amount is clearly displayed, often broken down into separate line items, followed by any applicable taxes. The document may also include instructions for payment, along with acceptable payment methods and terms. This final section serves as a reminder of the expectations surrounding the transaction and helps facilitate timely payment. Essential Information to IncludeTo ensure clarity and avoid any confusion, certain details must be included in any financial document related to services provided. These key elements help establish the terms of the agreement and make the record easily understandable for both parties involved. Without these crucial components, the document may lack the necessary structure and completeness. First and foremost, the contact information of both the service provider and the client should be clearly displayed. This typically includes names, addresses, phone numbers, and email addresses. Having this information ensures that both parties can easily reach each other if there are questions or issues regarding the transaction. Next, the date of the service, as well as the payment due date, should be clearly stated. These dates are essential for tracking the timeline of the agreement and ensuring timely payments. It’s also important to note the duration of the service provided, especially if the charge is based on time or a particular period. The description of services provided is another key element. This section should outline what was included in the agreement, such as the specific features or benefits offered. For transparency, it’s helpful to include any additional charges or fees that might apply, like cleaning or maintenance costs. Finally, the total amount due should be clearly visible, followed by a break Common Mistakes in Room Rental InvoicesWhile creating financial records for services provided, it’s easy to overlook important details that can lead to confusion or disputes. Even small errors can create misunderstandings and delay payments. Being aware of common pitfalls when drafting these documents can help ensure accuracy and professionalism. One of the most frequent mistakes is the incorrect calculation of totals. Whether it’s failing to add up the charges properly or missing additional fees, miscalculating the final amount can cause delays in payment and frustrate clients. It’s essential to double-check all amounts and ensure that taxes and discounts are applied correctly. Another common issue is the lack of clear payment instructions. If clients aren’t sure how to pay or when the payment is due, this can lead to confusion. It’s important to specify payment methods (e.g., credit card, bank transfer, etc.) and the payment deadline to avoid delays. Also, omitting essential details such as the service provider’s full contact information, specific dates, or the description of the services provided can create ambiguity. This lack of clarity may lead to disputes or miscommunication. Make sure all the required information is included and presented in a clear and organized manner. Finally, incorrect or inconsistent formatting is a common mistake. Documents that are difficult to read or lack uniformity in their structure may give a poor impression. It’s important to maintain a clean, professional layout and ensure that all information is easy to fin How to Format Your Invoice for ClarityWhen creating a document to record payment for services, clear formatting is essential to ensure the information is easy to read and understand. A well-structured layout not only improves the overall professionalism of the document but also prevents confusion for both the service provider and the client. By following a few simple guidelines, you can enhance the clarity and effectiveness of your financial records. First, start with a clear and organized header that includes the names and contact details of both parties. This will help the recipient quickly identify who the document pertains to. Following that, make sure the date and reference number (if applicable) are placed prominently, as these elements are essential for record-keeping and future reference. The body of the document should be broken into distinct sections. Each section should contain concise, easy-to-read information, such as a list of services provided, along with their corresponding costs. The more detailed the breakdown, the easier it will be for the client to understand exactly what they are being charged for.

Finally, ensure that the total amount due is easy to find and stands out in the document. This will prevent any misunderstandings about the amount to be paid. Maintain a clean, logical flow of information, and use headings, bullet points, and bold text where necessary to guide the reader’s eye. Choosing the Right Invoice SoftwareSelecting the right software to manage financial documents is essential for efficiency and accuracy. With numerous options available, it’s important to find a tool that matches your business needs while ensuring that all details are captured correctly and professionally. A good solution can save time, reduce errors, and improve communication with clients. Key Features to Look ForWhen choosing software, consider features that enhance automation and customization. The ability to automate calculations, taxes, and discounts is crucial for reducing manual errors. Additionally, being able to customize the document layout to suit your business style will ensure that the final product maintains a professional look that aligns with your brand. Ease of Use and IntegrationIt’s also important to select software that is user-friendly and integrates well with other tools you may be using, such as accounting or payment processing systems. A seamless workflow will make managing records simpler and more efficient. Look for solutions that offer cloud-based storage, as this ensures easy access and security for all your financial records. Ultimately, the right software should make your job easier by streamlining processes, reducing errors, and enhancing overall organization. How to Send Room Rental InvoicesOnce a financial record is prepared, it’s important to send it to the client in a timely and professional manner. The method of delivery can affect how quickly the client processes the document and makes payment. There are several ways to send payment requests, each with its own set of advantages and considerations. Here are the most common methods for sending payment records:

Once you’ve selected the appropriate method, ensure that the document is accompanied by a clear payment deadline and easy-to-follow instructions for how to complete the transaction. This will help minimize confusion and ensure that the payment process goes smoothly. Best Practices for Payment TermsEstablishing clear and fair payment terms is essential for ensuring a smooth transaction process. By setting expectations upfront, both parties can avoid confusion and reduce the risk of delayed payments. Properly structured terms also help maintain a professional relationship and encourage timely settlements. Clear and Transparent Terms

One of the most important aspects of payment terms is clarity. Always outline the payment amount, due date, and any additional fees or penalties for late payments. The clearer the terms, the less likely there will be misunderstandings. It’s also helpful to provide a detailed breakdown of what the payment covers, ensuring the client understands what they are paying for. Flexible Payment OptionsOffering a variety of payment methods can increase convenience and encourage faster payments. Consider accepting bank transfers, credit cards, or even online payment platforms to accommodate different client preferences. Additionally, providing options like installments or payment plans for larger amounts can help clients manage their finances while maintaining steady cash flow for your business. Ultimately, the goal is to ensure that payment terms are mutually beneficial, fostering a positive relationship with clients while securing timely and consistent payments. How to Handle Late PaymentsDealing with delayed payments is a common challenge that businesses face. When payments are not received on time, it can disrupt cash flow and create tension between the service provider and client. However, having a clear strategy for handling late payments can help maintain professionalism while ensuring that you get paid for your services. Establish a Grace PeriodOne effective way to handle late payments is by offering a grace period. A short window, typically 5 to 10 days beyond the due date, can provide clients with a bit of flexibility without causing significant disruptions to your financials. Be sure to clearly state this grace period in your payment terms to avoid confusion. Communicate Early and ClearlyIf a payment is not received by the deadline, reach out to the client as soon as possible. A polite reminder is often enough to prompt action. Be clear about the overdue status, including the amount due and the new payment deadline. If necessary, offer alternative payment methods or a payment plan to help them fulfill their obligation. It’s important to stay professional and empathetic during this process, as building long-term relationships with clients is more valuable than a single transaction. However, if payments continue to be late, it may be necessary to implement stronger measures, such as charging late fees or suspending services until the payment is made. Legal Considerations for Rental InvoicesWhen engaging in the process of leasing a property or space, it is essential to ensure that the financial documentation complies with applicable legal standards. Clear, accurate, and legally sound financial records are crucial for both parties involved to avoid misunderstandings or disputes. Several key factors must be taken into account to ensure the validity of such documents under the law. Compliance with Local LawsThe legal requirements for financial documents differ from one jurisdiction to another. It is important to familiarize oneself with the specific laws that govern rental agreements and the associated billing process in your region. These laws often specify the necessary components that must be included, such as payment due dates, itemized costs, and applicable taxes. Failing to adhere to local regulations can result in financial penalties or legal challenges. Tax Implications and ReportingTaxation plays a significant role in financial agreements related to property leasing. It is important to ensure that any payments or charges are documented in a manner that meets tax reporting requirements. This includes understanding any sales taxes or value-added taxes (VAT) that may apply, and ensuring proper reporting on both ends of the transaction. Inaccurate or incomplete records can lead to complications when it comes to tax filings, audits, or disputes. Tracking Payments with Your TemplateEfficiently monitoring and documenting payments is a critical part of managing any leasing or financial arrangement. By maintaining accurate records of all transactions, you ensure transparency and prevent disputes. A well-structured system can help track the status of payments, highlighting outstanding balances and providing a clear history of financial interactions. Organizing Payment RecordsTo keep track of payments effectively, it is essential to include all relevant details in the document. A comprehensive record should outline the payment amounts, dates, and methods used. This helps both parties to track what has been paid and what remains outstanding. A structured approach to these records will simplify future audits or financial reviews. Sample Payment Tracking Table

How to Adjust Your Template for TaxesIncorporating taxes into your financial documents is a crucial step to ensure that all required payments are collected correctly. Different regions have varying tax laws, so it’s essential to adjust your records to reflect these requirements. By clearly outlining tax-related details, you avoid confusion and ensure compliance with tax authorities. Key Tax ConsiderationsBefore making adjustments to your documents, it’s important to consider the following points:

Steps to Adjust Your Financial RecordsOnce the key tax factors are established, follow these steps to ensure your records are adjusted properly:

|