Customizable Roof Repair Invoice Template for Professional Billing

Managing financial transactions in the construction industry requires clear and professional documentation. Ensuring clients understand the costs involved and the services provided is essential for maintaining good business relationships. By organizing your payment details effectively, you streamline operations and reduce misunderstandings, ultimately improving cash flow.

When offering services that involve home or building maintenance, it is crucial to use a well-structured document to outline all the work done and the associated charges. This tool not only reflects professionalism but also simplifies the payment process for both parties. Having a standardized format helps save time, reduces errors, and fosters trust between contractors and their clients.

In this guide, we will explore various ways to create and personalize such documents, making them fit your specific needs and ensuring they comply with industry standards. Whether you are a small business owner or a large contractor, having an efficient way to bill clients can lead to smoother operations and better financial management.

Roof Repair Invoice Template Guide

Creating a professional document to outline services provided and corresponding charges is essential for any service-oriented business. A well-structured form not only helps clients understand what they are paying for, but it also simplifies the payment process, ensuring transparency and clarity. In this section, we will provide a step-by-step guide to help you design an effective and comprehensive billing statement for your construction projects.

Key Components to Include

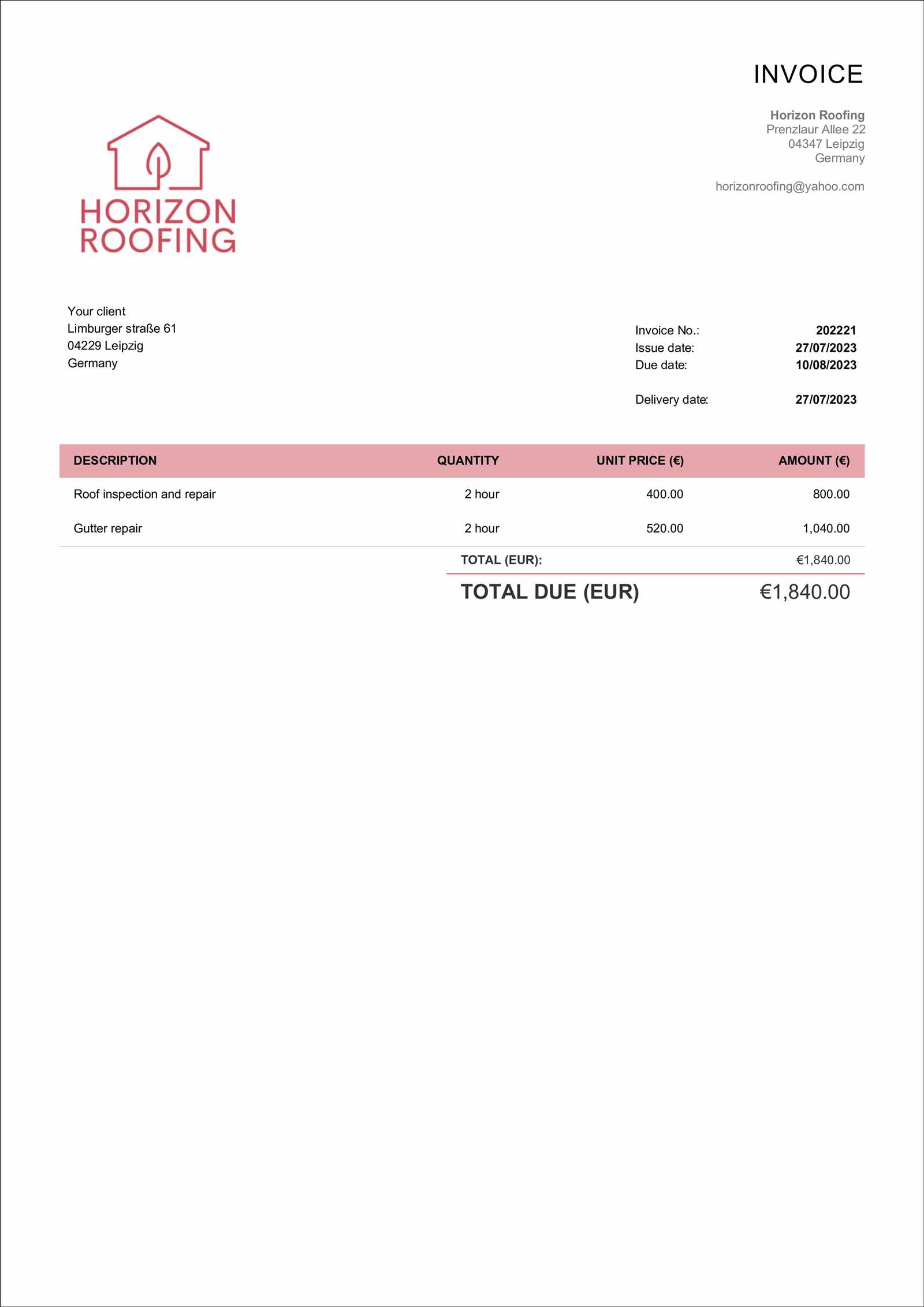

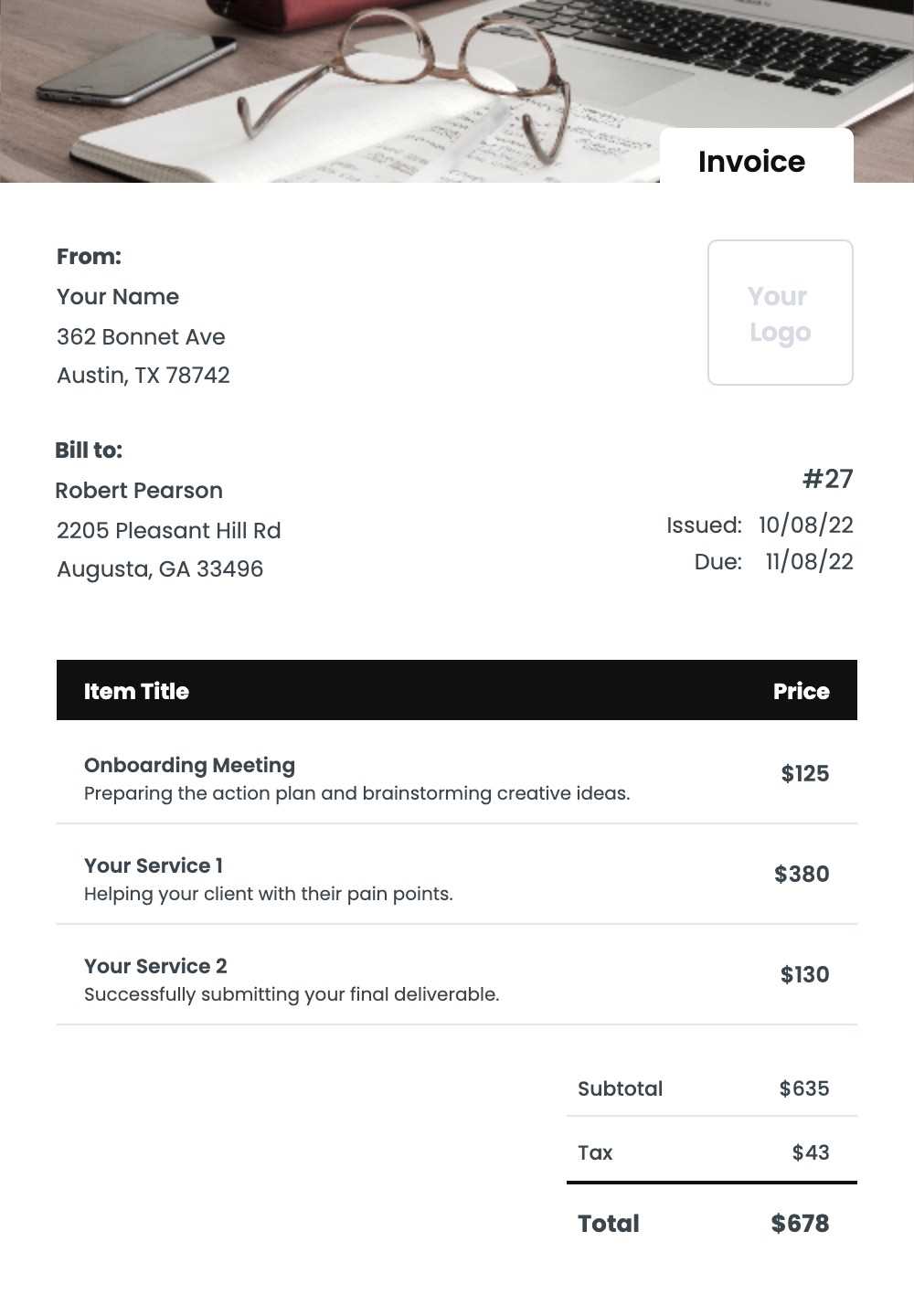

When drafting a payment summary, it is important to include specific elements that both you and your client can easily reference. Start by ensuring your business information, such as your company name, contact details, and license numbers, is clearly displayed. Alongside this, list a breakdown of services provided, including descriptions and quantities, as well as the costs associated with each task.

Formatting Tips for a Clear Layout

Clarity is key when presenting financial details. A clean, organized layout allows for easy understanding and reduces confusion. Ensure the structure is logical and user-friendly. Bold headers and section dividers are useful for distinguishing different parts of the document, and using tables to organize service details and costs can improve readability.

Customization is also important–tailor the document to suit your business needs by including additional notes, payment terms, or even a section for client feedback. A customized approach can set your business apart, showcasing professionalism and attention to detail.

Why Use an Invoice Template

Having a standardized method for documenting services and associated costs is essential for ensuring smooth financial transactions. By using a pre-designed form, you can eliminate confusion, save time, and present a professional appearance to your clients. These documents provide a clear record of the work completed, along with detailed charges, creating a transparent and trustworthy relationship between service providers and customers.

Efficiency is one of the main advantages of using a structured format. Instead of recreating documents from scratch each time, you can simply input relevant information into a pre-made structure. This not only speeds up the billing process but also reduces the likelihood of errors, making it easier to manage multiple projects simultaneously.

Additionally, using a ready-made form helps ensure consistency across all transactions. Every client receives the same well-organized breakdown of services, minimizing misunderstandings and potential disputes. Professionalism is critical in establishing trust, and using a formalized document reinforces this image, helping you stand out in a competitive market.

Key Elements of a Roof Repair Invoice

To create an effective billing document, certain components must be included to ensure both clarity and transparency for clients. A well-structured form not only outlines the services provided but also highlights the financial aspects in an easily digestible manner. Below are the essential elements that should be present in every service-related billing statement.

Essential Information for Clarity

- Business Details: Include the company name, address, phone number, email, and license numbers, ensuring the client knows exactly who provided the service.

- Client Information: Clearly state the client’s name, contact information, and billing address to avoid any confusion.

- Unique Identification Number: Assign a unique reference number to each document for tracking purposes, which is particularly helpful for record-keeping.

- Date of Service: Specify the exact date when the work was completed to maintain accurate records of when payment is due.

Detailed Breakdown of Services and Costs

- Service Description: Provide a brief yet comprehensive description of each task performed. This helps the client understand exactly what they are being charged for.

- Quantity and Rate: Include the quantity of services provided (e.g., hours worked, materials used) and the corresponding rate to calculate costs.

- Total Amount Due: Clearly state the total amount the client owes, including any taxes or additional fees.

- Payment Terms: Specify when payment is due and what forms of payment are accepted (e.g., bank transfer, credit card).

By ensuring these core elements are present, you make the document easy to understand, reduce the chances of disputes, and present a professional image to your clients.

Benefits of Customizable Invoice Templates

Using a flexible billing document offers several advantages, especially for businesses that need to adapt their records to specific client needs or project requirements. Customizing your forms enables you to tailor the layout, details, and even the content, ensuring that each statement accurately reflects the work completed and aligns with your business practices.

Efficiency is one of the primary benefits. By adjusting the structure of the form to fit your specific service offerings, you eliminate unnecessary fields and streamline the process. This reduces the time spent preparing each statement and allows you to focus more on providing quality service to your clients.

Professionalism also improves with customization. A document that is branded with your business logo, color scheme, and contact information presents a more polished and professional image. Clients are more likely to trust a company that takes the time to provide personalized, consistent documentation for every job.

Additionally, flexibility allows you to include extra information that may be specific to certain projects. Whether it’s a special discount, a warranty, or a note on payment terms, the ability to adapt the document ensures that all important details are included without the need for additional paperwork.

How to Create a Roof Repair Invoice

Creating a professional billing document requires careful attention to detail to ensure that all relevant information is included and easy to understand. The process involves organizing service details, calculating costs, and presenting the information in a clear format. This step-by-step guide will help you create an accurate and effective document for your business transactions.

Step 1: Start by including your business details, such as company name, address, contact number, and email. It’s also important to provide your business registration or license number, if applicable, to reinforce your professionalism and legitimacy.

Step 2: Next, include your client’s information, such as their name, address, and contact details. This ensures the billing document is correctly assigned and easy to reference by both parties.

Step 3: Add a unique reference number to the document for tracking and record-keeping purposes. This will help you manage multiple transactions and keep your records organized.

Step 4: Detail the services provided in a clear, concise manner. For each task completed, include a description, the number of hours worked, or the quantity of materials used, along with the rate or price for each item.

Step 5: Calculate the total amount due. Make sure to add any applicable taxes or additional fees, such as travel or disposal charges. Clearly itemize all costs to avoid confusion.

Step 6: Define the payment terms, including the due date, accepted payment methods, and any late fees that may apply. Providing this information upfront helps prevent delays and ensures smoother financial transactions.

Step 7: Finally, review the document to ensure all information is accurate, clear, and properly formatted. Once everything looks good, send the statement to your client in a timely manner.

By following these steps, you’ll create a clear and professional document that not only helps you get paid on time but also fosters trust and transparency between you and your clients.

Essential Details to Include in Invoices

For a billing statement to be effective, it must contain specific information that ensures clarity, transparency, and accuracy. Including all the necessary elements not only helps avoid confusion but also promotes timely payments. Below are the crucial components that should always be present in any document that outlines services and charges.

Basic Information

- Business Information: Include your company name, address, contact phone number, and email address. Additionally, if applicable, include your tax identification number or business registration number.

- Client Details: Provide the client’s name, address, and contact information to ensure the billing is correctly attributed.

- Unique Reference Number: Assign a distinct number to each document for tracking and record-keeping purposes.

- Date of Service: Clearly state the date when the work was completed to avoid any confusion regarding payment timelines.

Financial Breakdown

- Detailed Service Descriptions: Each task performed should be listed, along with a brief description and the quantity of work (e.g., hours, units, or materials used).

- Unit Prices and Rates: For each service, include the price or rate per unit or hour, so the client can easily see how the charges are calculated.

- Subtotal: Calculate the subtotal for all services before applying taxes or discounts.

- Taxes and Additional Fees: List any applicable sales tax, VAT, or additional fees such as travel or material costs.

- Total Amount Due: Clearly state the total amount the client is required to pay, including all fees and taxes.

Including these essential details ensures that your clients have all the information they need to process the payment without delays, while also reinforcing your professionalism and transparency.

Free Roof Repair Invoice Templates

There are many free resources available online that provide customizable forms for billing clients. These ready-to-use documents can save you time and effort, offering a convenient way to structure and organize your financial transactions. By using these free options, you can ensure that your records are both professional and comprehensive without the need for creating a document from scratch.

Here are some key benefits of using free billing forms:

- Cost-Effective: Free options allow you to manage your business finances without the need for purchasing expensive software or tools.

- Customizability: Most free templates allow you to modify fields and adjust the layout according to your specific needs, making them ideal for businesses of all sizes.

- Time-Saving: Instead of spending hours drafting a billing document, you can simply fill in the required information and focus on other important aspects of your business.

- Professional Design: Free templates are often designed by experts, ensuring that your billing documents look clean and well-organized, which adds to your business’s credibility.

When choosing a free form, consider the following options:

- Excel or Google Sheets Templates: These provide an easy-to-use grid structure for calculating totals, tax rates, and discounts. They’re ideal if you want a simple and flexible approach.

- Word or Google Docs Templates: These templates are perfect if you prefer a more text-heavy document with customizable fonts and styles.

- Online Billing Tools: Some websites offer free online billing tools that let you generate professional documents directly from the platform, with easy export options to PDF.

Using free resources can streamline your financial process, improve accuracy, and help you maintain a professional image without extra costs or hassle.

How to Format Your Invoice Professionally

Presenting a clear and polished document to your clients is essential for establishing professionalism and ensuring that all necessary details are easily understood. A well-organized layout not only helps clients process payments more quickly but also improves your overall business image. By following some key formatting guidelines, you can create documents that are both functional and visually appealing.

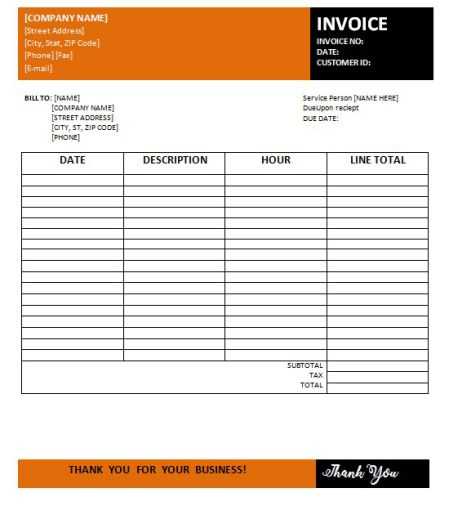

1. Use a Clean, Simple Layout: Ensure that the document is easy to read by using plenty of white space and separating sections clearly. Avoid cluttering the page with unnecessary graphics or distracting fonts. A simple, organized layout with headers and subheaders will make the information more digestible for your clients.

2. Include Clear Headings and Sections: Break down the document into distinct sections such as business details, client information, service descriptions, payment terms, and totals. This separation helps guide the reader through the document and ensures that no key details are missed.

3. Use Consistent Fonts and Sizes: Stick to professional fonts like Arial, Times New Roman, or Calibri. Use larger text for headings and a smaller size for details, ensuring that all text is legible. Consistency in font choice and size throughout the document contributes to a polished look.

4. Include Your Branding: If applicable, incorporate your company logo, color scheme, and other branding elements at the top of the document. This adds a professional touch and reinforces your company’s identity in the client’s mind.

5. Number Your Documents: Assign a unique reference number to each document to ensure easy tracking and future reference. This is essential for organizing your financial records and helps your clients easily identify the specific statement in question.

6. Clearly State Payment Terms: Specify the due date, accepted payment methods, and any late payment fees. Clear instructions help avoid misunderstandings and ensure that both parties are on the same page when it comes to financial expectations.

By following these formatting tips, you can create a professional and well-organized document that enhances your client relationships and contributes to smoother financial transactions.

Invoice Templates for Roofing Contractors

For contractors in the roofing industry, providing clear, accurate, and professional billing documentation is crucial. A well-structured financial statement helps ensure timely payments, reduces the risk of disputes, and reflects positively on your business. Customizing your billing forms to fit the specific needs of your services can make the whole process smoother, both for you and your clients.

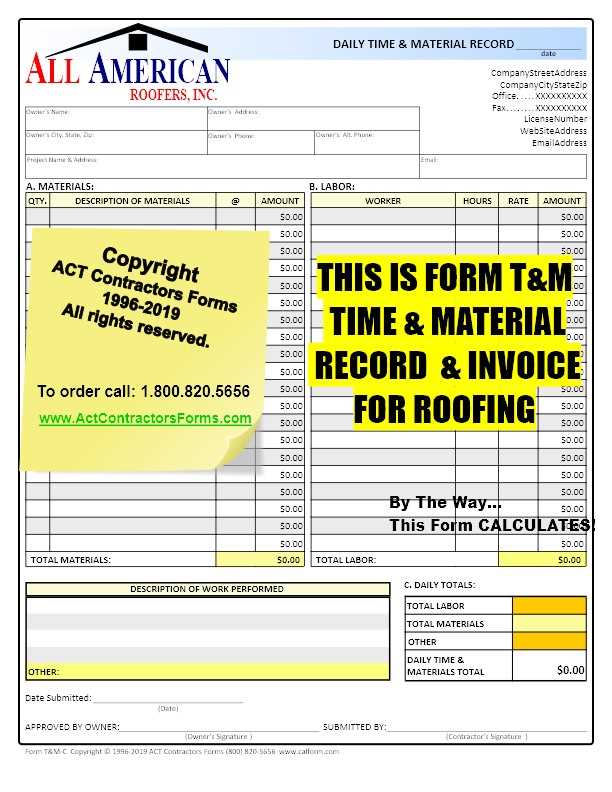

Why Contractors Need a Customizable Billing Form

As a contractor, your work often involves unique projects with varying scopes, materials, and labor. Using a flexible billing document allows you to capture all relevant details and charges. This includes labor hours, material costs, travel fees, and any special services. A customizable document lets you adjust sections depending on the specifics of each job, ensuring accuracy and fairness in every transaction.

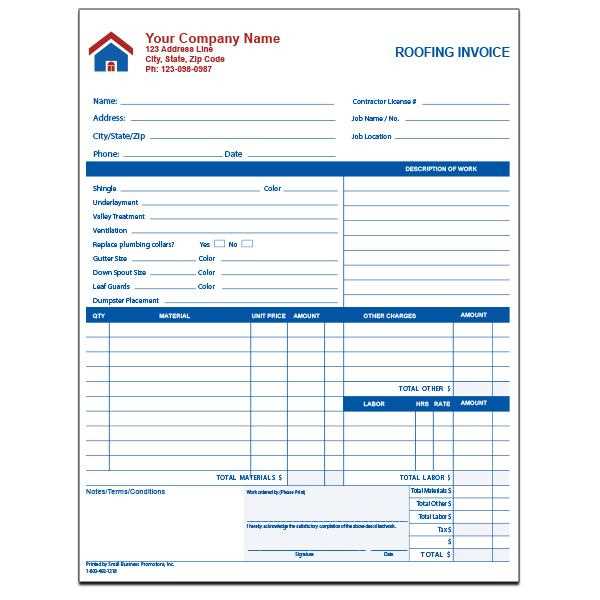

Key Features for Roofing Service Billing Forms

- Itemized Service Breakdown: For each project, it’s important to list all tasks completed and the materials used. This transparency builds trust with your clients and prevents misunderstandings.

- Clear Payment Instructions: Ensure that your payment terms are clearly stated. Include due dates, acceptable payment methods, and any penalties for late payments.

- Tax and Additional Fees: Include tax calculations and any additional costs, such as delivery fees or permits, to avoid any surprises for your clients.

- Company Branding: Personalize your forms by adding your business logo, contact details, and a professional design to reinforce your brand identity and leave a lasting impression.

By using a tailored billing form, roofing contractors can present a more professional image and simplify the process of getting paid for services rendered. It also minimizes administrative work, allowing contractors to focus more on their craft while maintaining accurate financial records.

How to Automate Your Billing Process

Automating your financial documentation and payment collection can greatly improve efficiency and accuracy in your business operations. By reducing the time spent on manual tasks, you can focus on providing better service to your clients while ensuring that all payments are processed in a timely and accurate manner. Implementing an automated system for managing transactions helps eliminate human error and makes financial management more streamlined and reliable.

1. Use Accounting Software: One of the most effective ways to automate your billing is by using accounting or invoicing software. These platforms allow you to create, send, and track payment requests without needing to manually input each detail. Many programs also offer templates that can be easily customized for your needs, saving you time on repetitive tasks.

2. Set Up Recurring Billing: For clients who require regular services, automating recurring payments is a smart choice. Most modern billing platforms allow you to schedule payments on a weekly, monthly, or project-specific basis, ensuring that clients are billed consistently without any additional effort on your part.

3. Integrate Payment Gateways: By linking a payment processor like PayPal, Stripe, or credit card systems directly to your billing software, you can offer clients the convenience of paying online. Automating payment collection in this way reduces delays, makes tracking easier, and improves cash flow by making it easier for clients to pay on time.

4. Automate Reminders: Setting up automated reminders for overdue payments can help prevent missed deadlines. Most invoicing systems allow you to schedule follow-up emails or alerts, ensuring that clients are reminded of outstanding balances in a timely and professional manner.

5. Data Syncing: Automating your billing also means syncing your financial data across different platforms. This can help with managing expenses, taxes, and other important business records. Automation ensures that all your data is updated in real-time, reducing the need for manual record-keeping and preventing discrepancies.

By leveraging automation tools, you can streamline your billing process, enhance the client experience, and improve your overall business efficiency.

Customizing Templates for Your Business

Personalizing your financial documents is a key step in presenting a professional and cohesive image for your business. Customizing your forms allows you to reflect your unique brand, tailor the document structure to your specific services, and streamline your processes for maximum efficiency. The more you adapt the layout and content, the more it suits your business needs and client expectations.

Why Customization Matters

By tailoring your billing forms, you ensure that the documents match your company’s branding, business model, and customer interactions. Customized records help you stand out in a competitive market, reinforcing your professionalism and attention to detail. It also creates consistency across all your financial communication, making it easier for clients to understand and trust your services.

Key Elements to Customize

- Branding: Add your company’s logo, colors, and contact details at the top of the document to personalize it and enhance recognition.

- Service Categories: Modify sections to reflect the specific services your business provides, whether it’s by type of work, hours, or materials used.

- Payment Terms: Tailor payment deadlines, late fees, and payment methods to suit your business model. This can include adding discounts for early payments or specifying preferred payment channels.

- Additional Notes: Include custom fields for client-specific details, such as special requests, warranties, or follow-up instructions, to make the document more informative and relevant.

Customizing your billing documents ensures they reflect your business’s needs, client expectations, and branding. Whether you use software, spreadsheets, or online platforms, customization allows you to adapt forms for any project, creating a professional, organized appearance every time.

Invoice Template Software for Roof Repair

Using specialized software to manage your billing documents can significantly simplify the process of creating and sending statements to your clients. These tools allow you to automate many of the tasks involved, from formatting to calculations, while providing customizable options that suit your business’s unique needs. For businesses offering home improvement services, including specialized jobs, such software helps save time and reduce errors, ensuring that every transaction is documented professionally.

Benefits of Using Invoice Software

Invoice management software offers a range of features that make the billing process faster and more accurate. These tools can generate forms automatically, calculate totals and taxes, and even track payment statuses. Moreover, they allow you to maintain organized financial records and avoid the hassle of manually creating each document from scratch.

Key Features to Look For

| Feature | Description |

|---|---|

| Customizable Layouts | Software allows you to adjust the design and structure of your documents to match your business branding and service types. |

| Automated Calculations | Calculations for services, taxes, and discounts are performed automatically, minimizing errors and saving time. |

| Payment Tracking | Track outstanding balances, due dates, and paid amounts in real time, ensuring you stay on top of your finances. |

| Recurring Billing | For ongoing projects or long-term clients, set up recurring payments or reminders to streamline the billing process. |

| Integration with Payment Gateways | Direct integration with payment processors like PayPal or Stripe makes it easier for clients to pay online. |

Using specialized software for your financial documentation not only makes the process more efficient but also ensures that all details are accurate and professional. Whether you’re working on a one-time project or managing long-term contracts, these tools help you manage all aspects of billing with ease.

Common Mistakes to Avoid in Invoices

When preparing billing documents for clients, it’s easy to overlook small details, which can lead to confusion, payment delays, or even disputes. Ensuring that your documents are clear, accurate, and professional is crucial to maintaining a positive relationship with clients and managing cash flow efficiently. By avoiding a few common mistakes, you can ensure that your billing process runs smoothly and clients are more likely to make timely payments.

1. Inaccurate Details: Double-check the accuracy of all information before sending any billing documents. This includes your business details, the client’s name and address, and the specific services or goods provided. A small mistake in contact information or project details can lead to confusion and delays.

2. Missing Payment Terms: Always include clear payment terms in your documents. Failing to state due dates, late fees, or acceptable payment methods can cause misunderstandings. Clients may not know when the payment is expected or what happens if it’s late.

3. Overlooking Taxes and Additional Charges: Make sure to clearly list any taxes, extra fees, or discounts applied to the total amount. Leaving these out or failing to break down charges can lead to disputes or miscalculations that damage your credibility.

4. Lack of Detailed Descriptions: It’s essential to provide a breakdown of the services or products rendered, including quantities, unit costs, and labor hours. Vague descriptions can make clients question the accuracy of the charges and may lead to delays in payment.

5. No Reference Numbers: Always assign a unique reference number to your billing document. Without it, tracking payments and managing your records becomes more difficult. A reference number helps both you and your client keep track of specific transactions.

6. Unclear Payment Instructions: Be explicit about how clients can pay. Include information about payment methods, bank account details, or any online payment platforms you use. Providing this information ensures that the payment process is quick and straightforward.

Avoiding these common mistakes will help streamline your billing process, minimize confusion, and increase the likelihood of receiving timely payments. A well-organized and accurate document reflects your professionalism and contributes to the overall success of your business.

How to Add Tax Information on Invoices

Including accurate tax details in your billing documents is crucial for ensuring compliance with tax laws and maintaining transparency with your clients. Correctly listing taxes not only helps avoid legal issues but also clarifies the total amount due for your services. It’s essential to follow the appropriate format and structure when adding tax-related information to ensure clarity and accuracy.

Here’s how you can effectively include tax information in your financial documents:

| Step | Description |

|---|---|

| 1. Specify the Tax Rate | Clearly indicate the applicable tax rate for your services. This could vary depending on your location or the nature of the work. Be sure to mention whether the rate is a percentage or a fixed amount. |

| 2. Itemize Taxes | List taxes separately from the cost of goods or services to make it easy for clients to understand the breakdown of charges. This transparency helps clients see exactly how the tax was calculated. |

| 3. Include Tax Identification Number | For businesses required to collect taxes, include your tax ID number on the document. This assures clients that your business is authorized to charge taxes and adds a layer of professionalism. |

| 4. Show Subtotal and Total Amount | Clearly show the subtotal before taxes are applied and the total amount after tax is added. This helps clients understand how much of the final charge is attributable to taxes and provides clarity in payment calculations. |

| 5. Indicate Tax Exemptions (If Applicable) | If certain services or goods are tax-exempt, make sure to clearly state this on the document. This ensures your client knows why no tax is applied and avoids confusion. |

By properly adding tax details, you ensure that your clients understand their financial obligations, while also staying compliant with tax regulations. A clear breakdown of taxes not only fosters trust but also prevents potential issues with payments and audits.

Creating Clear Payment Terms for Clients

Establishing transparent and precise payment terms is essential to ensure that both you and your clients are aligned on expectations from the outset. Clear payment guidelines help avoid misunderstandings, delays, and disputes, ensuring that both parties are on the same page regarding when and how payments should be made. Well-defined terms also contribute to a more professional relationship and improve cash flow management for your business.

Key Elements to Include in Payment Terms

- Payment Due Date: Clearly specify when the payment is expected. Whether it’s due within a certain number of days after the document is issued or upon completion of the service, having a set due date reduces confusion.

- Accepted Payment Methods: Indicate which payment methods are accepted, such as credit cards, bank transfers, checks, or online platforms. Offering multiple options can make it easier for clients to pay.

- Late Fees: Outline the consequences of late payments, such as interest charges or a flat fee. This helps encourage clients to pay on time and discourages delays.

- Deposit Requirements: If you require an upfront deposit or partial payment before beginning a project, make sure this is clearly stated. Include the amount or percentage due before work starts.

- Payment Plans: If applicable, offer the possibility of installment payments. This can be helpful for larger projects or clients who may need more time to settle their balance.

How to Present Payment Terms Effectively

- Simple Language: Use clear and simple language to avoid ambiguity. Avoid jargon or overly complex terms that might confuse the client.

- Highlight Important Points: Make sure key terms–such as the due date, payment methods, and late fees–are easy to locate. You can bold or underline these sections for emphasis.

- Include Payment Reminders: Consider adding a reminder for the client a few days before the payment is due, reinforcing the terms and encouraging timely payment.

By establishing and communicating clear payment terms, you help ensure that financial transactions proceed smoothly and professionally, fostering trust with your clients and enhancing your business’s reputation.

How to Send Repair Invoices

Sending accurate and timely financial documents is a vital part of maintaining good relationships with your clients and ensuring prompt payments. The method in which you send these documents can impact your professionalism and the likelihood of receiving payments on time. By following the proper steps, you can streamline the process and avoid any unnecessary delays or confusion.

Methods for Sending Billing Documents

- Email: One of the most common and efficient methods is sending the document directly via email. This allows for quick delivery and ensures the client receives a digital copy for their records. Ensure that the document is in a universally accepted format, such as PDF, to prevent compatibility issues.

- Postal Mail: For clients who prefer traditional methods, mailing a physical copy of the document is still an option. Ensure you use reliable mailing services and include a return envelope if necessary to make it easy for your client to pay.

- Online Payment Systems: If you are using an online billing platform, most services allow you to send invoices directly through the system, often with the ability to pay instantly via integrated payment gateways like PayPal, Stripe, or credit card options.

- In-Person Delivery: For clients you work with locally, delivering the document in person is another method. While less common, this adds a personal touch and can be used when discussing services or resolving any issues related to the charges.

Best Practices for Sending Billing Documents

- Clear Subject Line: When sending the document via email, use a clear and descriptive subject line that includes the client’s name, the job, and the document type (e.g., “Billing for Project XYZ – Due Date [Date]”). This helps your client identify the document quickly.

- Follow-Up: If the payment due date passes without receipt of payment, send a polite reminder. Often, clients may forget or delay payment, and a friendly follow-up will keep the process on track.

- Provide Payment Instructions: Ensure you include clear instructions on how the client can make a payment, especially if you offer multiple payment methods. This eliminates confusion and increases the likelihood of timely payment.

Choosing the right method for delivering your billing documents, combined with clear communication, can significantly reduce the chances of payment delays. By providing professional and well-organized documentation, you not only facilitate smoother financial transactions but also enhance your credibility with clients.

Tips for Getting Paid Faster

Getting paid promptly is essential for maintaining healthy cash flow and keeping your business operations smooth. However, sometimes clients delay payments, which can cause frustration and disrupt your financial planning. By adopting some best practices and taking proactive steps, you can reduce delays and ensure that your payments arrive on time.

Strategies for Accelerating Payments

- Set Clear Payment Terms: Establishing clear, upfront payment terms is crucial. Specify the due date, acceptable payment methods, and any penalties for late payments. When clients know exactly what to expect, they are more likely to honor your deadlines.

- Send Prompt and Accurate Documents: Ensure that your financial documents are sent immediately after completing the work and contain all the necessary details. Accuracy is key–any errors or missing information could delay payment.

- Offer Multiple Payment Options: The more convenient you make it for clients to pay, the quicker you will get paid. Offer several payment methods, such as credit card, bank transfer, or online payment systems, to cater to different preferences.

- Send Reminders: If the payment deadline is approaching or has passed, send polite reminders. A gentle nudge can often prompt clients to prioritize your payment, especially if they’re dealing with multiple bills.

- Offer Discounts for Early Payments: Consider incentivizing early payments by offering a small discount for clients who pay ahead of schedule. This can be an effective way to encourage faster payment while maintaining client satisfaction.

Communication and Relationship Building

- Maintain Open Communication: If clients are experiencing difficulty with payment, having an open dialogue can help you understand their situation and work out a payment plan. This can lead to better long-term relationships and smoother transactions in the future.

- Be Professional and Courteous: Always remain professional in your communications, even when following up on overdue payments. A respectful and courteous approach will help you maintain a positive relationship with clients while also ensuring they pay promptly.

By implementing these practices and focusing on clear, efficient communication, you can significantly reduce payment delays and improve your cash flow. Taking proactive steps to make the payment process as smooth and convenient as possible will benefit both you and your clients.

Best Practices for Roofing Invoice Templates

Creating effective billing documents is essential for ensuring timely payments and maintaining professionalism in your business. A well-organized and clearly written document not only helps avoid confusion but also presents your company as reliable and trustworthy. Following best practices when designing your financial paperwork can streamline the process, improve client satisfaction, and enhance cash flow.

Key Elements of Effective Billing Documents

- Clear Client Information: Always include the client’s full name, address, and contact details at the top of the document. This ensures proper identification and avoids any confusion about who the document is meant for.

- Accurate Description of Services: Provide a detailed breakdown of the work completed, including specific tasks and materials used. Clients appreciate transparency, and this also helps avoid disputes about the charges.

- Well-Defined Payment Terms: Clearly state when the payment is due, acceptable payment methods, and any applicable late fees. Being transparent about payment expectations helps reduce misunderstandings and delays.

- Professional Layout: A clean and organized layout makes it easier for clients to read and understand the document. Use headings, bullet points, and adequate spacing to make the document visually appealing and easy to follow.

- Tax Information: Include applicable taxes and explain how they were calculated. This ensures clarity for the client and helps maintain compliance with tax regulations.

Additional Tips for Improving Your Billing Documents

- Personalized Branding: Incorporate your business logo, brand colors, and contact information into the document. This reinforces your brand identity and provides a professional appearance.

- Offer Multiple Payment Methods: Make it convenient for clients to pay by offering various payment options, such as bank transfers, online payment platforms, or credit cards.

- Include a Payment Reminder: If the payment deadline is approaching, consider sending a gentle reminder a few days before the due date. This can encourage clients to prioritize their payment.

- Keep a Copy for Your Records: Always maintain a copy of the document for your own records. This helps track payments, monitor outstanding balances, and resolve potential issues in the future.

By adhering to these best practices, you can create clear, professional, and efficient billing documents that enhance communication with your clients and speed up the payment process. An organized approach not only makes your business more efficient but also builds trust with clients and helps you get paid faster.