How to Create and Use a Reusable Invoice Template for Efficient Billing

Managing client payments and generating accurate billing documents can be time-consuming and prone to errors. The right approach to creating consistent, professional billing records can significantly simplify this task. With the use of well-designed, adaptable documents, businesses can ensure that each transaction is clearly outlined and easy to process, saving valuable time and effort.

Having a set format that can be reused for multiple clients or projects eliminates the need for starting from scratch with every new transaction. These ready-to-use documents can be customized as needed, allowing you to maintain a high level of consistency while reducing manual input. This strategy not only improves efficiency but also enhances the overall professional appearance of your communication with clients.

Whether you are a freelancer, small business owner, or part of a larger organization, adopting this approach can lead to smoother administrative operations. It provides a solid foundation for tracking payments and managing records, helping you stay organized and avoid costly mistakes in the future.

Understanding Reusable Invoice Templates

In any business, generating clear and consistent billing statements is crucial for smooth financial operations. When a business needs to issue multiple payment requests over time, it’s more efficient to use a standardized approach rather than creating each document from scratch. This method allows for easy customization while ensuring that all the necessary information is always included and correctly formatted.

Such pre-designed documents offer a flexible and efficient way to manage billing. They are structured in a way that enables quick adjustments, making them ideal for businesses that deal with various clients and projects. By leveraging a consistent format, you can save significant time and reduce the risk of errors that often occur when manually crafting payment records for every transaction.

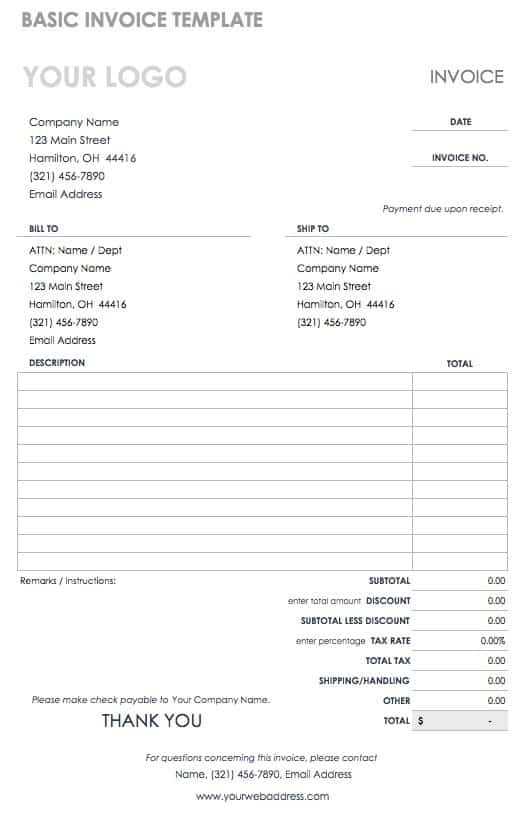

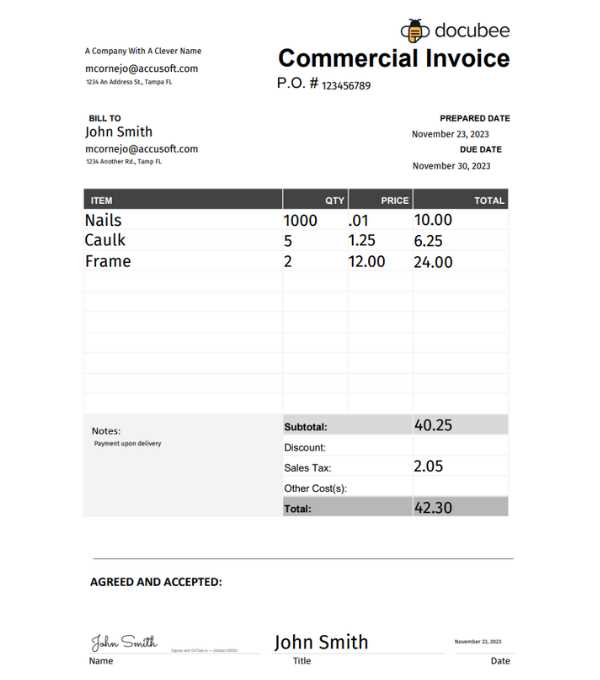

Below is an example of a basic structure commonly found in these documents, highlighting essential elements often included in every bill or request for payment:

| Section | Description |

|---|---|

| Business Details | Company name, address, and contact information. |

| Client Information | Client’s name, address, and payment details. |

| Itemized List | A breakdown of services or products with costs. |

| Payment Terms | Details on due dates, late fees, and payment methods. |

| Total Amount | The final total of the products or services listed. |

Using such structured formats ensures all relevant details are clearly communicated, providing both parties with a clear understanding of what is owed. This approach is a simple yet powerful tool for maintaining financial accuracy and professionalism in all your business dealings.

Benefits of Using Reusable Invoice Templates

Adopting a standardized approach to generating billing documents offers numerous advantages for businesses of all sizes. By using pre-designed, customizable forms for your payment requests, you can simplify the process, reduce errors, and maintain a professional image. Below are some key benefits that this method brings to the table:

- Time Efficiency: Instead of creating each billing document from scratch, a pre-made structure allows you to quickly fill in relevant details, saving valuable time on administrative tasks.

- Consistency: Using a set format ensures that all documents maintain the same layout and style, contributing to a uniform presentation and a more organized business approach.

- Reduced Errors: With a structured format, the likelihood of missing important information or making manual mistakes decreases significantly. The process becomes more streamlined, ensuring fewer chances for error.

- Customization Flexibility: These forms can be tailored to fit specific needs, from client details to the breakdown of services. They can adapt to any business model or transaction, making them versatile.

- Professional Image: Sending out well-organized, clear, and consistent documents enhances the overall perception of your business. Clients appreciate transparency and professionalism, which can lead to stronger business relationships.

- Easy Record Keeping: Maintaining a uniform format helps in organizing and tracking payments, simplifying financial record-keeping and making it easier to review past transactions.

By adopting this efficient system, businesses can improve both their internal processes and client interactions, ultimately leading to smoother financial management and more satisfied customers.

How to Create an Invoice Template

Designing a structured document for billing purposes is essential for maintaining consistency and professionalism in financial transactions. Creating an effective and adaptable document involves including all necessary details while ensuring flexibility for various client needs. By following a few simple steps, you can set up a reliable structure that can be used repeatedly for different projects or clients.

Step 1: Define the Key Components

The first step in creating a billing document is to determine which essential elements it must contain. These key sections ensure clarity and completeness:

- Business Information: Include the name, address, phone number, and email of your business for easy contact.

- Client Information: Include the client’s name, company (if applicable), address, and contact details.

- Description of Goods/Services: Provide a detailed breakdown of what was provided, including quantities, rates, and any relevant item numbers.

- Total Amount Due: The total cost, including applicable taxes, fees, and discounts, should be clearly displayed.

- Payment Terms: Include due dates, accepted payment methods, and any late fees or penalties for overdue payments.

Step 2: Choose a Format

Once you’ve defined the necessary sections, choose a format that allows easy editing and customization. You can create your document using v

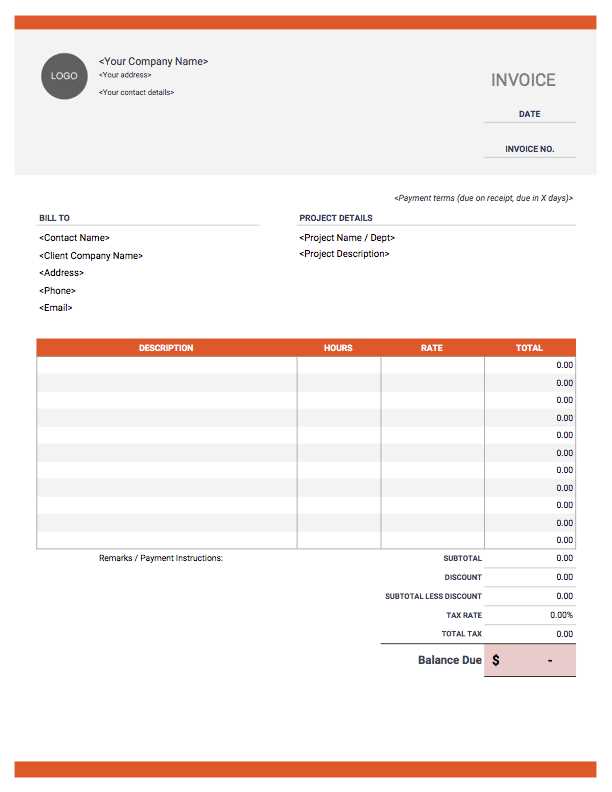

Customizing Your Invoice Template for Your Business

Adapting your billing documents to reflect the specific needs of your business is key to ensuring clarity and professionalism. By tailoring the structure to suit your company’s branding, products, or services, you can create a more cohesive and personalized experience for your clients. Customization also ensures that the document accurately represents the details relevant to each transaction.

Adding Your Business Branding

Incorporating your business’s visual identity, such as logos, color schemes, and fonts, into the billing document helps reinforce your brand. A personalized document not only looks more professional but also provides consistency across all your communications with clients.

| Element | Customization Tips |

|---|---|

| Logo | Place your company logo at the top of the document for easy identification. |

| Color Scheme | Use colors that match your brand’s identity to make the document visually appealing. |

| Font Style | Choose clear and professional fonts that reflect your brand’s tone. |

Including Specific Business Details

Tailor the content of the document to reflect the services or products you provide. For example, if your business offers different types of services, it may be beneficial to break down your offerings into categories. If you often deal with recurring payments, include clear fields for subscription periods and payment cycles.

Adding sections for discounts, promotional

Choosing the Right Software for Invoices

When managing financial transactions, selecting the right software is crucial for streamlining operations and ensuring accuracy. The right tool can simplify your billing process, help you maintain consistency, and save you valuable time. With so many options available, it’s important to understand your specific needs before deciding on a solution that works best for you or your business.

Factors to Consider

There are several aspects to consider when choosing billing software. First, think about the size and complexity of your business. If you deal with numerous clients or handle various types of transactions, opt for a solution that supports advanced features like custom fields and automated reminders. Flexibility is key: Your tool should easily adapt to the changing nature of your business as it grows or diversifies.

Ease of Use and Support

The simplicity of the interface is another important factor. You should be able to navigate the software without a steep learning curve. Additionally, reliable customer support is essential. Look for a provider that offers comprehensive help resources, such as tutorials and live chat, to assist you in resolving any issues quickly.

Finally, don’t forget to consider pricing. While many software options offer competitive rates, make sure you’re getting the features you need without paying for unnecessary extras. Keep these elements in mind as you search for the ideal solution to streamline your billing processes.

Key Elements to Include in an Invoice

When creating a document for billing purposes, it’s essential to ensure all necessary information is clearly outlined. A well-structured document not only ensures clarity between you and your clients but also helps maintain a professional appearance and facilitates smooth payment processing. Key components should be present to avoid confusion and delays in the transaction process.

Basic Information

The first thing to include is the identifying information of both parties. This includes the full name, address, and contact details of both the sender and recipient. Additionally, a unique reference number can help track payments and correspondence efficiently. Always make sure that the date of the transaction and a clear due date for payment are specified as well.

Details of Services or Products

Next, a detailed list of the products or services provided should be included. Specify the quantity, description, and unit price for each item. If applicable, include any taxes, discounts, or additional fees that are part of the overall amount. This breakdown helps both parties understand the calculation behind the total sum and prevents any misunderstandings.

Design Tips for a Professional Invoice

A well-designed document for billing purposes is essential for establishing trust and credibility with your clients. A clean and organized layout not only makes the document easier to understand but also reflects the professionalism of your business. Focusing on key design elements can help create a polished and effective presentation that enhances your communication.

Essential Design Considerations

When designing your billing document, keep the following points in mind:

- Clarity and Readability: Use clear fonts and appropriate font sizes to ensure the text is easy to read. Avoid overly decorative fonts that may distract from the key information.

- Consistent Layout: Keep a consistent structure throughout the document. Group related information (like item descriptions and pricing) together for easy navigation.

- Branding: Incorporate your business’s logo, colors, and fonts to create a cohesive and branded look. This adds to the professional appearance and reinforces your identity.

- Whitespace: Don’t overcrowd the page. Proper use of whitespace between sections allows for a more visually appealing layout and helps highlight important details.

Practical Features for Ease of Use

In addition to the visual aspects, certain features can enhance the functionality of your billing document:

- Clear Contact Information: Include your company’s contact details at the top, so clients can easily reach you if needed.

- Organized Payment Details: Clearly outline payment instructions, terms, and methods to a

Saving Time with Automated Invoice Templates

Streamlining administrative tasks is a key factor in improving business efficiency, and automating certain processes can save significant amounts of time. By using automated systems for generating billing documents, you can reduce manual effort, eliminate errors, and speed up the overall process. This approach not only saves you time but also ensures consistency and accuracy in every transaction.

Efficiency Through Automation

One of the main benefits of automation is that it eliminates the need to create each document from scratch. By setting up pre-designed formats with placeholders for customer information, items, and payment terms, you can quickly generate new records with just a few clicks. This speeds up the process, allowing you to focus on other important tasks.

Consistency and Accuracy

Automated systems reduce the risk of human error, such as forgetting to include key details or making calculation mistakes. Each time you generate a new document, the system pulls accurate information from your database, ensuring consistency across all your communications. This not only improves your workflow but also creates a more professional and reliable experience for your clients.

By leveraging automation, businesses can streamline their billing processes, save time, and enhance their overall productivity without sacrificing quality or accuracy.

How Reusable Templates Improve Accuracy

Consistency in business documentation is essential for maintaining professionalism and ensuring that all information is correct. By using pre-set formats for creating your documents, you eliminate the need for manual data entry every time, reducing the chance of errors. This approach not only saves time but also enhances the overall precision of your records.

Reducing Human Errors

When creating documents from scratch, it’s easy to overlook important details or make mistakes in calculations. By using established formats with predefined fields, much of the information is automatically filled in, reducing the risk of missing crucial elements. This approach minimizes:

- Data entry mistakes: Key fields such as client names, addresses, and amounts are automatically populated, reducing the chance of typing errors.

- Incorrect calculations: Many systems are programmed to perform automatic calculations, ensuring that totals, taxes, and discounts are always accurate.

- Inconsistent formatting: With a fixed structure, the format remains uniform across all documents, ensuring consistency in presentation and clarity.

Improved Data Accuracy

By using a structured approach, it becomes easier to track and verify data. Predefined fields for items, prices, and terms allow you to avoid duplication or conflicting information. Additionally, integration with your accounting or CRM software can automatically pull up client details, ensuring that everything is up-to-date and accurate.

By relying on consistent formats, businesses can significantly reduce errors, improve the quality of their records, and maintain better relationships with clients, thanks to precise and reliable documentation.

Reducing Human Error with Template Use

Human errors in documentation can lead to costly mistakes, delays, and misunderstandings. By utilizing standardized formats for recurring documents, businesses can minimize the risk of incorrect entries, forgotten details, or calculation errors. This approach ensures greater accuracy and reliability in all communications, streamlining the process and improving overall efficiency.

How Templates Prevent Common Mistakes

Using pre-designed layouts significantly reduces the chances of errors by eliminating manual data input. When you rely on a consistent format, many elements are automatically populated or come with predefined fields, lowering the risk of mistakes. Here’s how it helps:

- Consistency in Data Entry: Fields for customer details, dates, and amounts are automatically filled, ensuring uniformity across all documents.

- Accurate Calculations: With preset formulas and automated arithmetic, calculations such as totals, taxes, and discounts are handled seamlessly, reducing errors.

- Correct Formatting: Standardized designs ensure that important sections like terms and conditions, payment methods, and due dates are always properly presented.

Efficiency in Workflow

By reducing the need to manually input details for each document, the use of a consistent structure allows employees to work more efficiently. This means less time spent verifying information and fewer chances for errors to creep into the workflow. Additionally, automating repetitive tasks frees up time for employees to focus on higher-priority activities.

Incorporating standardized formats into your workflow not only increases accuracy but also boosts productivity, ensuring that all documents are error-free and aligned with business standards.

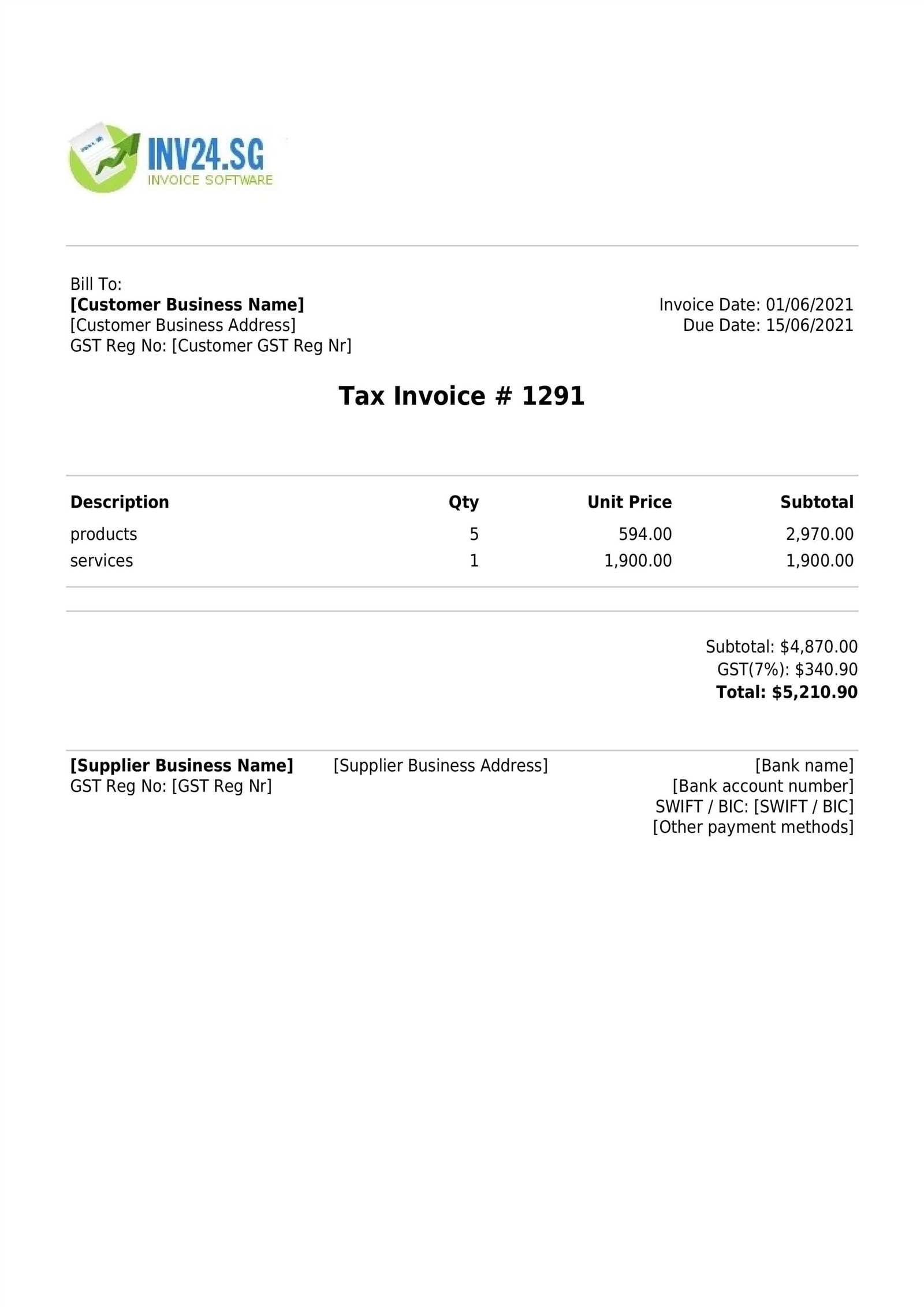

Invoice Templates for Different Industries

Different industries have unique requirements when it comes to documenting transactions and managing payments. A well-crafted, industry-specific structure ensures that all necessary details are included, improving efficiency and avoiding misunderstandings. Tailored formats can help businesses meet their sector’s specific needs while maintaining a professional image and staying compliant with regulations.

Creative and Freelance Services

For businesses in creative fields like graphic design, writing, or photography, the format should focus on flexibility and clarity. Freelancers often offer bespoke services, so it’s essential to include:

- Project Description: A detailed breakdown of services provided, including deliverables and milestones.

- Hourly or Project Rates: Clear pricing for time worked or project-based fees.

- Usage Rights: Information on the transfer of intellectual property or licenses, if applicable.

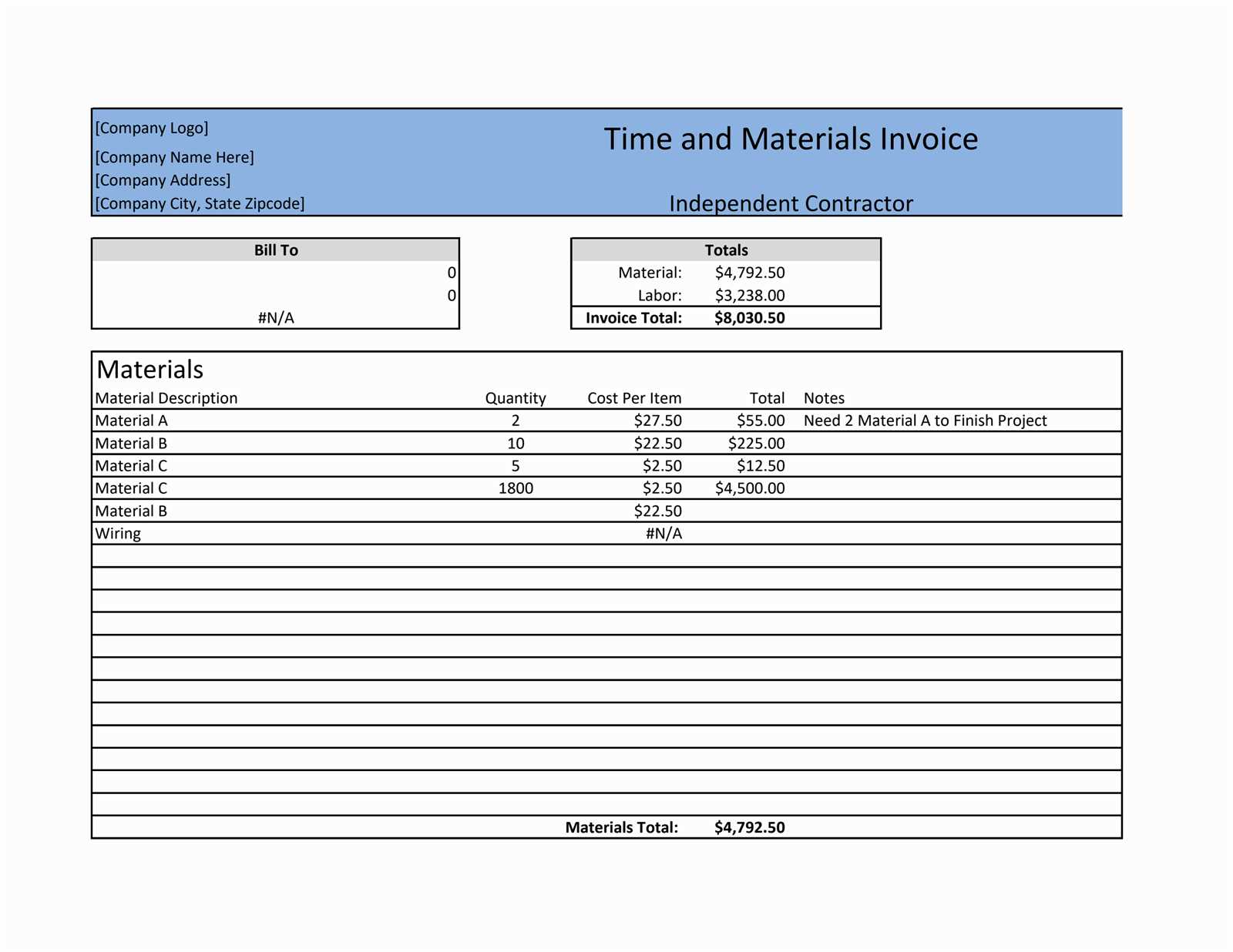

Construction and Contracting

For the construction and contracting industry, the documentation should be more detailed, addressing the scope of work and materials used. Key elements include:

- Labor and Materials: Separate sections for the cost of labor and materials used, including quantities and rates.

- Work Progress: Milestone payments tied to the completion of specific stages of the project.

- Terms and Conditions: Clearly defined payment terms, including retention and deposits.

Retail and E-Commerce

Retailers and e-commerce businesses often deal with high volumes of transactions. Their billing records must be precise and efficient, including:

- Itemized List: A clear list of products, including descriptions, quantities, and prices.

- Shipping Details: Accurate information regar

Managing Multiple Clients with One Template

Handling multiple clients simultaneously can be a challenge, especially when managing large volumes of documentation. By using a standardized format for creating your business documents, you can streamline the process and easily adapt the same structure for different clients. This approach reduces the time spent on administrative tasks and helps maintain consistency across all client communications.

Customization for Each Client

Even though you use the same structure, it’s important to be able to tailor each document to the specific needs of each client. Here are key elements to adjust for each transaction:

- Client Details: Automatically populate the name, address, and contact information for each client, ensuring all records are personalized.

- Service or Product Information: Update the list of services or items provided, along with the relevant prices and quantities.

- Payment Terms: Customize payment terms, such as due dates or installment schedules, depending on the agreement with each client.

Efficient Workflow and Record Keeping

By using a uniform structure across all documents, you can manage large numbers of transactions with ease. Here’s how it helps:

- Time Savings: Save time by not having to design each document from scratch, while still maintaining accuracy and relevance for each client.

- Consistency: Maintain a consistent layout and format for all clients, which strengthens your brand identity and makes documents easier to read and understand.

- Better Organization: Storing and retrieving past documents becomes simpler when they follow a uniform structure, allowing for quick access to important details when needed.

With a standardized approach, you can efficiently manage multiple clients while ensuring that each document meets the unique requirements of every transaction, all while minimizing errors and administrative overhead.

Legal Considerations for Invoice Templates

When creating documents for billing purposes, it is essential to ensure that they meet legal requirements to avoid potential disputes or issues. Adhering to relevant laws and regulations helps protect both the business and its clients. These documents must include certain key information and be structured in a way that complies with local and international financial and tax laws.

Key Legal Elements to Include

Regardless of the type of document being used, there are several mandatory elements that must be present to ensure compliance with legal standards:

- Business Identification: Include the full legal name, address, and contact details of the business issuing the document. This ensures that the document is traceable back to the proper entity.

- Client Information: The document must clearly state the recipient’s details, including their name, address, and contact information. This helps to identify both parties involved in the transaction.

- Document Number: Each record should include a unique identifier or reference number for tracking purposes. This helps to avoid confusion and provides a clear record for auditing and payment tracking.

- Clear Payment Terms: Specify due dates, payment methods, and any late fees or interest charges in case of non-payment. This ensures that both parties understand the payment expectations.

- Legal Tax Information: Include applicable tax identification numbers and any relevant tax information such as VAT, sales tax, or other duties that may apply to the transaction.

Jurisdictional Compliance

Different regions and countries have their own specific legal requirements for business transactions. It is important to understand the rules in the jurisdiction where the business operates and where the client is located. Some key aspects to consider include:

- Tax Regulations: Ensure that all taxes are correctly calculated and displayed according to local tax laws. Incorrect tax reporting could lead to legal penalties.

- Currency and Payment Methods: Make sure the document specifies the correct currency and includes accepted methods of payment based on the business location and client preferences.

- Record Retention: In some jurisdictions, businesses are required to keep copies of financial records for a certain number of years. Ensure that your documents are easily accessible for future reference or audits.

By incorporating these legal considerations into your documentation process, you can ensure that your transactions are legally compliant, reducing the risk of disputes and protecting both your business and your clients.

How to Track Payments Using Templates

Efficient management of financial transactions requires a clear system to monitor payments. By utilizing well-structured documents, businesses can ensure that incoming funds are recorded accurately and promptly. These documents not only simplify the process of tracking payments but also help maintain organized financial records, making it easier to follow up on outstanding amounts or verify completed transactions.

Creating a Structured Payment Log

A comprehensive payment log serves as the foundation for tracking all incoming funds. This log should include essential details such as the date of the payment, the payer’s information, the amount paid, and the outstanding balance. Each payment entry allows business owners to quickly assess the status of their accounts and identify any discrepancies or overdue amounts.

Essential Components to Include

When setting up a tracking system, it is crucial to include several key elements that provide a full overview of the payment history:

Date Customer Name Amount Paid Remaining Balance Payment Status 2024-11-01 John Doe $200 $0 Paid 2024-11-03 Jane Smith $150 $50 Partial 2024-11-05 ACME Corp. $500 $0 Paid By tracking these details, businesses can easily monitor payment progress and ensure that all amounts due are received in full. Additionally, this method allows for quick identification of clients who may need reminders for outstanding balances.

When to Update Your Invoice Template

Keeping your financial documents up to date is essential for maintaining accuracy and professionalism. Over time, certain changes in your business operations or external factors may require you to modify your document layout or content. Regularly reviewing and updating your records ensures that all relevant information is captured correctly and that your billing process remains efficient and compliant with any new regulations or industry standards.

1. Changes in Tax Rates or Regulations

If there are updates to tax laws or other financial regulations, you must adjust your documents to reflect these changes. For example, a new sales tax rate or a revised set of invoicing requirements can impact the details you need to include. Failing to update your forms could result in errors or compliance issues.

2. Modifications in Your Business Details

As your business grows or evolves, your contact details, payment terms, or services offered might change. It’s important to revise your documents whenever there are updates to your company’s name, address, phone number, or email, as well as to any payment methods or terms. This ensures that clients always have the correct information for processing payments.

3. New Products or Services

If you introduce new offerings, make sure your financial documents reflect these additions. Whether it’s adjusting item descriptions or including new pricing structures, keeping your records aligned with your current offerings helps avoid confusion and maintains clarity for both your business and your customers.

Regularly reviewing and updating your forms helps streamline your financial operations and ensures that your documents stay accurate, professional, and legally compliant.

Free vs Paid Invoice Template Options

When choosing a document design for billing and payment tracking, businesses have two main options: free or paid solutions. Both have their advantages and limitations, and the choice depends on your specific needs, budget, and the level of customization or professional features you require. Free options might be suitable for small businesses or freelancers, while paid versions often offer advanced features and more customization options to meet the demands of larger operations or those requiring specialized formats.

Free Options: Simple and Accessible

Free billing document designs are often basic but functional. They provide a straightforward way to create and send professional-looking records without incurring any costs. However, these options may lack advanced customization, integration with accounting software, or certain professional features that paid designs can offer. For those just starting out or with minimal needs, free formats can be a great way to get started.

Paid Options: Advanced Features and Customization

Paid solutions generally offer more flexibility, customization, and added functionality. These may include the ability to automatically generate documents, integrate with payment systems, and provide customer support. Additionally, many paid options include professional-grade design elements, more security features, and the option to store and manage records efficiently. For growing businesses with complex needs, investing in a paid design can save time and enhance overall operations.

Feature Free Option Paid Option Customization Basic formatting, limited options Extensive design and Integrating Invoice Templates with Accounting Software

Integrating your billing documents with accounting software can greatly streamline financial processes and improve accuracy. By automating the transfer of payment details and other key information between your records and your financial system, you can reduce manual data entry, minimize errors, and gain real-time insights into your business’s financial health. This integration ensures that your records are consistently up to date and easily accessible when needed for reporting, tax filing, or audit purposes.

Most modern accounting systems offer built-in features or third-party plugins that allow you to link your billing records directly with the software. This integration can enable automatic syncing of payment data, customer details, and even tax calculations, making the entire invoicing and accounting process faster and more efficient. Furthermore, it allows you to quickly generate financial reports, track overdue payments, and manage your cash flow in a more organized manner.

For businesses with high transaction volumes or those that need to maintain precise financial documentation, this integration is particularly valuable. It reduces the risk of errors caused by manual data entry, ensures that all transactions are correctly categorized, and saves time by eliminating the need for duplicate work between systems.