How to Use a Retainer Invoice Template for Your Business

For businesses and freelancers, managing advance payments and securing ongoing work is crucial. One of the most efficient ways to establish clear terms with clients is through a structured payment system that ensures both parties are protected. This type of billing arrangement allows service providers to receive upfront payments for future work, streamlining cash flow and setting expectations from the start.

Creating a clear and professional document to outline these payments is essential for maintaining smooth operations. Using a well-designed format helps to ensure that all necessary details are covered, from payment amounts to deadlines. A standardized document not only simplifies the process but also enhances transparency, reducing the chances of misunderstandings between the service provider and their clients.

Whether you’re a freelancer offering consulting services or a business with recurring projects, having a reliable system in place is key. By using an adaptable document that can be tailored to each agreement, you can save time and focus on what matters most–delivering quality work.

Understanding Retainer Invoices

When it comes to professional services, it’s important for businesses and freelancers to establish a clear understanding of payment terms before work begins. One common approach is to request an upfront payment, ensuring financial stability and a commitment from both sides. This type of payment structure is often used for ongoing or long-term projects, where the client agrees to pay for a set amount of work in advance, rather than after each completed task or milestone.

Why Upfront Payments Matter

Upfront payments help service providers manage their cash flow and reduce the risk of non-payment. By securing a portion of the payment before work starts, service providers ensure that they are compensated for their time and resources. For clients, this type of agreement provides assurance that the service provider is committed to delivering the promised work. This arrangement also sets clear expectations for both parties and fosters a professional relationship based on mutual trust.

Key Information to Include

For these agreements to be effective, certain details must be included to ensure clarity and avoid future disputes. The payment terms should be clearly outlined, with specifics on the amount, due dates, and what services are covered. Having all these details in writing helps avoid any confusion later on.

| Key Information | Description |

|---|---|

| Amount | The total sum to be paid in advance |

| Payment Schedule | Dates or milestones when payments are due |

| Scope of Work | A clear description of the services to be provided |

| Terms & Conditions | Any additional rules or agreements related to the work |

By including all necessary information, service providers can protect themselves while offering clients a transparent and professional agreement. Understanding how these agreements work will ensure both parties can confidently move forward with the project.

What is a Retainer Agreement?

A service contract that requires a client to pay in advance for work to be performed over a set period is a common arrangement in many industries. This type of agreement ensures that both the service provider and the client are committed to the project, with clear expectations set from the start. By agreeing to pay upfront, the client secures the service provider’s time and resources, while the service provider is assured of payment for their work.

In essence, such agreements are designed to foster long-term working relationships, with the client guaranteeing a certain amount of business in exchange for priority service. This kind of arrangement is frequently used by professionals such as consultants, designers, lawyers, and other service-oriented businesses.

Key Features of a Service Agreement

- Advance Payment: Clients agree to pay a portion of the total cost upfront, often covering part of the project or a fixed number of hours.

- Defined Scope of Work: The specific services or tasks to be provided are clearly outlined, ensuring both parties understand their obligations.

- Time Frame: The period during which the services will be delivered is usually specified, whether it’s a one-time project or ongoing work over several months.

- Priority Service: In some cases, clients who sign these agreements may receive priority over non-retained clients.

Benefits for Both Parties

Such agreements offer numerous advantages for both the service provider and the client:

- Financial Security: Service providers receive upfront payment, reducing the risk of late payments or non-payment.

- Clear Expectations: Both parties know what to expect in terms of deliverables, deadlines, and payment terms.

- Ongoing Work: Clients are guaranteed access to the service provider’s expertise for a set period, promoting long-term collaboration.

- Improved Cash Flow: Advance payments help service providers maintain steady cash flow, especially for businesses with fluctuating income.

In summary, a service agreement of this kind is a valuable tool for establishing clear terms of engagement, ensuring that both the client and the service provider can move forward with confidence and transparency.

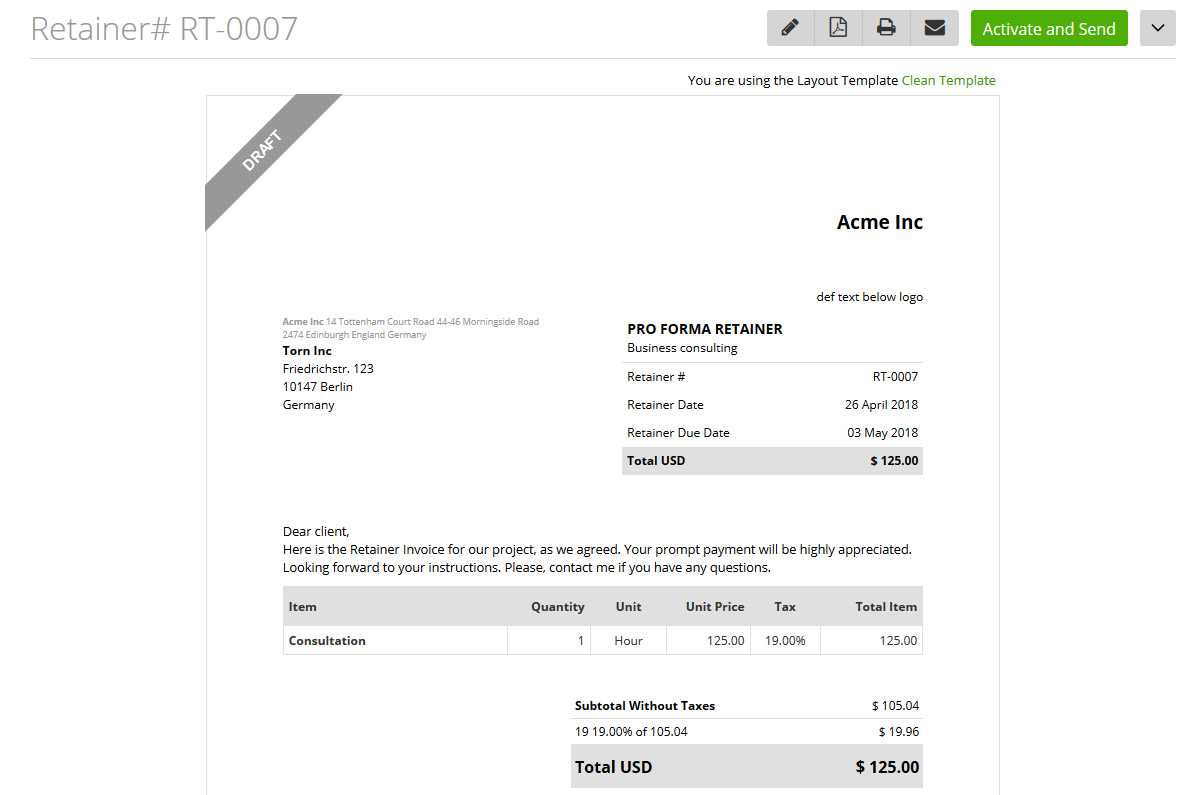

Key Elements of a Retainer Invoice

For any agreement that involves upfront payments for ongoing work, having a clear and professional document outlining the terms is essential. This document serves as both a record and a formal request for payment. It ensures that both the service provider and the client are on the same page regarding the financial aspects of the agreement. To be effective, the document must include several key elements that provide clarity and transparency for both parties.

Essential Information to Include

- Client and Provider Information: The full names, business names, addresses, and contact details of both parties.

- Description of Services: A detailed breakdown of the services or tasks that will be provided, including specific deliverables and timeframes.

- Amount Due: The total payment expected, often broken down into an upfront fee or payment schedule.

- Payment Terms: Specific terms for when payments are due, such as the percentage due upfront, deadlines, and any applicable late fees.

- Terms and Conditions: Any special conditions, including how disputes will be handled, project revisions, or additional fees for extra work.

Additional Features to Enhance Clarity

- Project Timeline: A clear outline of the expected milestones or deadlines for the completion of the work.

- Tax Information: Details on applicable taxes or sales tax, if relevant.

- Payment Methods: The types of payments accepted (e.g., credit card, bank transfer, PayPal) and any payment processing details.

- Refund or Cancellation Policy: Clear guidelines on how cancellations or refunds will be handled, if applicable.

Including these elements not only provides a clear structure but also helps prevent misunderstandings and ensures both parties are well-informed about the terms of the agreement. A well-crafted document serves as a professional representation of the service provider’s commitment to transparency and trustworthiness.

Benefits of Using a Retainer Invoice Template

Using a structured document for upfront payment agreements offers a range of advantages for both service providers and clients. It helps streamline the billing process, ensuring that all necessary information is included and reducing the likelihood of errors. By relying on a pre-designed format, businesses can save time while maintaining professionalism and consistency in their financial transactions.

Time-Saving and Efficiency

One of the primary benefits of using a pre-made format is the significant amount of time it saves. Instead of creating a new document from scratch for each agreement, service providers can simply fill in the relevant details, such as payment amounts and service descriptions. This quick turnaround ensures that clients can receive their payment requests promptly, keeping the project on track.

- Quick Setup: Customize fields with minimal effort to suit each client or project.

- Consistency: Ensure that every agreement is documented using the same format, which promotes professionalism.

- Minimize Errors: Using a ready-made structure reduces the chance of overlooking important details.

Improved Clarity and Transparency

With a clear and standardized format, both the service provider and client can easily review the terms of the agreement. All necessary details, such as payment schedules, services rendered, and deadlines, are laid out in an organized manner. This helps prevent misunderstandings and ensures that both parties know exactly what is expected of them throughout the duration of the agreement.

- Clear Payment Terms: Payment schedules, amounts, and deadlines are clearly outlined, leaving no room for confusion.

- Professional Presentation: A polished document reflects well on the service provider and enhances trust with the client.

- Consistency in Communication: Clients will appreciate the transparency and clarity, which fosters positive business relationships.

By leveraging a pre-designed structure, service providers can ensure that both parties have a mutual understanding of the financial arrangement, leading to smoother project execution and

How to Customize a Retainer Invoice

When creating a formal payment request for upfront work, it’s essential to tailor the document to suit the specifics of each agreement. Customizing the format ensures that both the service provider and the client have all the necessary details clearly outlined. A flexible structure allows for easy modifications, helping you adapt to various project types, client needs, or industry standards.

Steps to Personalize the Document

Personalizing a payment request document is straightforward, especially if you’re using a pre-designed layout. Below are the key steps to follow:

- Include Client and Service Provider Details: Add the full names, contact information, and addresses of both parties involved in the agreement.

- Outline the Scope of Work: Clearly define the services or tasks you will be providing, including the timeline and any deliverables.

- Set Payment Terms: Specify the amount due, the payment schedule (e.g., upfront, monthly, etc.), and the method of payment.

- Add Legal Terms: Include any relevant clauses about late payments, cancellations, or refunds.

Adjusting for Different Needs

Depending on the nature of the agreement, you may need to make additional adjustments to the document. Whether it’s offering a discount for long-term contracts or setting different rates for various services, these modifications can be easily incorporated into your format.

| Customizable Field | Possible Adjustments |

|---|---|

| Payment Amount | Adjust based on project scope or client-specific discounts. |

| Payment Schedule | Choose from lump sum payments, installments, or recurring billing. |

| Service Description | Modify based on the specific tasks, deadlines, or milestones. |

| Terms & Conditions | Include unique clauses for each project, such as intellectual property rights or confidentiality. |

By adjusting these key areas, you can ensure that the document reflects the exact details of the agreement and meets both your and your client’s needs. A customized approach not only enhances professionalism but also ensures a smooth transaction process.

Retainer Invoices vs Regular Invoices

When managing client payments, there are different ways to structure financial agreements. Two common types of documents used for billing are those based on upfront payments for ongoing services and those used for billing after the completion of tasks or projects. While both serve similar purposes, they differ in their structure, timing, and the way they secure payment. Understanding the distinctions between these two options can help service providers choose the best approach for their business needs.

Key Differences

- Payment Timing: The primary difference lies in when the payment is requested. Upfront agreements often require a portion of the payment before work begins, while regular billing is typically done after services are rendered.

- Work Duration: Ongoing projects or services are more likely to use upfront agreements, while one-time tasks or short-term projects usually rely on standard post-service payment requests.

- Clarity of Terms: An upfront agreement clearly defines the scope of work and payment expectations from the start, while regular billing may include more flexibility or uncertainty regarding the exact timing and amount due.

Benefits of Each Approach

- Upfront Agreements:

- Financial security for the service provider, as payment is secured before the work starts.

- Helps establish clear terms and expectations at the outset, reducing the risk of misunderstandings.

- Improves cash flow for businesses that require upfront capital to begin a project.

- Regular Billing:

- Provides flexibility for clients, as payments are made only after the work is completed.

- Often preferred for short-term or one-off tasks where the scope of work is more defined.

- May be easier to track, as payments are tied directly to specific milestones or deliverables.

Each approach offers its own advantages depending on the type of work, project scope, and client relationship. While upfront agreements provide financial security and set clear expectations, regular billing can offer flexibility for shorter-term projects. Ultimately, the decision comes down to the specific needs of the business and the preferences of the client.

Legal Considerations for Retainer Invoices

When establishing a formal agreement for upfront payments, it’s essential to consider the legal aspects to ensure both parties are protected. A well-drafted agreement serves as a legally binding document, outlining the terms, scope, and expectations. Understanding the legal requirements can help prevent disputes, ensure compliance with local laws, and establish a clear course of action in case issues arise. Proper legal considerations can safeguard the interests of both the service provider and the client throughout the duration of the agreement.

Key Legal Aspects to Consider

- Payment Terms: Clearly outline the payment schedule, amounts due, and any potential late fees. This prevents ambiguity and ensures both parties are aware of when and how payments should be made.

- Scope of Work: Define the exact services to be provided, the timeline for delivery, and any agreed-upon milestones. This helps set realistic expectations and can serve as a reference in case of disputes.

- Refunds and Cancellations: Specify under what conditions refunds or cancellations are allowed. Establishing these terms upfront can prevent misunderstandings if either party needs to modify or terminate the agreement.

- Jurisdiction: Indicate the legal jurisdiction that will govern the agreement, especially if the parties are in different locations. This ensures clarity on where any legal action would take place if necessary.

Potential Risks and How to Mitigate Them

- Disputes over Services Rendered: To minimize conflicts, ensure the scope of work is thoroughly documented, including any revisions or adjustments that may occur during the project.

- Non-Payment or Delayed Payments: Include provisions for handling late payments, such as interest rates or penalties, and specify the consequences of non-payment, such as pausing work until full payment is received.

- Ambiguities in Terms: To avoid misunderstandings, use clear and unambiguous language in the agreement. If necessary, have a legal professional review the terms to ensure everything is accurately represented.

By paying attention to these legal considerations and clearly outlining all terms, both the service provider and the client can enter into a mutually beneficial agreement with greater confidence. A legally sound agreement not only provides protection but also fosters trust and professionalism throughout the business relationship.

How to Track Retainer Payments

Effectively managing payments for ongoing projects or services is essential for maintaining a smooth working relationship between service providers and clients. Proper tracking of upfront payments ensures that both parties are aware of outstanding balances, payment schedules, and any remaining amounts due. This process can be streamlined with a well-organized system that records each transaction and helps monitor the financial progress of the project.

Methods for Monitoring Payments

- Spreadsheet Tracking: One of the simplest ways to monitor payments is by using a spreadsheet. Create columns for client details, payment dates, amounts paid, and remaining balance. This allows for easy updates and gives a clear overview of the payment status.

- Accounting Software: Using accounting software can automate the tracking process, providing real-time updates on payments received and outstanding amounts. Many software solutions also send reminders for upcoming payments and generate reports for financial analysis.

- Manual Records: For smaller projects or businesses, manually recording each payment in a ledger or dedicated notebook may work best. Be sure to consistently update these records to avoid confusion or errors.

Important Details to Track

Regardless of the method chosen, tracking the following details is crucial for accurate and up-to-date records:

- Payment Amount: Keep track of each payment made, ensuring it matches the agreed-upon amount in the contract or agreement.

- Payment Date: Record the date when each payment was received to track the payment schedule and avoid overdue issues.

- Remaining Balance: Always update the outstanding balance after each payment, so you can easily determine how much is left to be paid.

- Service Milestones: For projects with multiple stages, link payments to specific milestones to ensure each payment is tied to a completed portion of work.

- Late Payments: Keep an eye on overdue payments and set reminders for follow-up. If necessary, implement a late fee policy or other actions as agreed upon in the contract.

By keeping a detailed record of payments and regularly reviewing the status, service providers can avoid payment-related issues and ensure they receive the proper compensation for their work. Consistent tracking also helps in maintaining good relationships with clients, demonstrating professionalism and a commitment to transparency.

Common Mistakes to Avoid with Retainers

When entering into agreements that require advance payments for services, it’s crucial to avoid common pitfalls that can lead to misunderstandings, missed payments, or even legal disputes. Properly managing the terms of these agreements ensures both the service provider and client maintain a positive working relationship and clear expectations. Here are some of the most frequent mistakes that can occur when working with upfront payment arrangements, and how to prevent them.

Key Mistakes to Watch Out For

- Unclear Scope of Work: One of the biggest errors is failing to clearly define the services or tasks to be provided. Without a well-detailed description, both parties may have different expectations, leading to dissatisfaction and potential disputes.

- Vague Payment Terms: Not specifying the payment schedule, due dates, or any applicable late fees can create confusion. It’s essential to outline the amount due, payment frequency, and methods of payment to avoid misunderstandings.

- Failure to Track Payments: Not keeping a precise record of payments and outstanding balances can result in lost revenue and frustration. Regularly updating payment records helps both parties stay on track and ensures timely financial management.

- Lack of Legal Protection: Not having a contract or formal agreement in place can leave both parties vulnerable. Always ensure that there are clear terms regarding refunds, cancellations, and other contingencies that may arise during the project.

- Not Setting a Timeline: Without a timeline or milestones for the work, it can be difficult to track progress. It’s important to establish deadlines and milestones to ensure both parties understand when to expect results and payments.

How to Avoid These Mistakes

- Provide Clear Documentation: Be specific about the services you will deliver, and include any limitations or exclusions. A well-written agreement helps prevent ambiguity.

- Define Payment Schedules: Ensure that both the payment amounts and due dates are clearly outlined. Be transparent about any extra fees for late payments or additional work.

- Track Payments Regularly: Use spreadsheets or accounting software to keep up with payments. This ensures that you never miss a due amount and helps you monitor progress easily.

- Draft a Formal Agreement: Always have a legally binding contract that both parties agree to. This will protect both the service provider and the client if disputes arise.

- Set Realistic Deadlines: Define a clear timeline and establish key project milestones. This helps both parties track progress and stay aligned on expectations.

By avoiding these common mistakes and establishing clear, well-defined terms, both service providers and clients can ensure a smooth and successful working relationship. Proper communication, documentation, and tracking will ultimately help prevent complications and build trust throughout the project.

How to Create a Retainer Invoice from Scratch

Creating a payment request document from scratch is an essential skill for any service provider working with ongoing contracts or upfront fees. By building a clear, professional document, you can ensure that both parties understand the payment structure and expectations. While there are many tools and templates available, sometimes starting from the ground up gives you more control over the details. Here’s how to create a payment request document step-by-step, ensuring it covers all the necessary elements for a smooth transaction process.

Steps to Create a Payment Request

- Include Basic Information: Start by adding the service provider’s details (name, address, contact information) and the client’s details. This ensures both parties are clearly identified in the document.

- Title the Document: Clearly label the document as a “Payment Request” or “Agreement Summary” so that both parties can easily recognize its purpose.

- Describe the Services: Provide a detailed list of the services or work that will be performed, including any milestones or specific deliverables. This helps ensure transparency about what is being paid for.

- Specify Payment Amount: Clearly state the amount due, whether it is a flat fee, a percentage of the total project cost, or broken down into multiple payments over time.

- Set Payment Terms: Include clear payment terms, such as when payments are due (e.g., within 30 days) and any late fees or penalties for overdue payments.

- Outline Additional Terms: Include any relevant terms and conditions such as refunds, cancellations, or revisions. Also, specify any applicable taxes or fees.

Additional Tips for Customizing the Document

- Be Specific About Dates: Make sure to include payment due dates and the project start and end dates, if applicable. This helps both parties track the timeline and avoid confusion.

- Include a Payment Method: Specify which payment methods are accepted (e.g., bank transfer, PayPal, credit card). This makes it easier for the client to pay promptly.

- Provide Clear Instructions: If the payment needs to be made in installments, make sure each installment’s due date and amount are clearly stated.

By following these steps, you can create a well-structured document that outlines the terms of the agreement and sets clear expectations for both parties. A professional and well-crafted payment request can help ensure timely payments and prevent misunderstandings, creating a positive and transparent business relationship.

Choosing the Right Retainer Invoice Format

Selecting the appropriate format for a payment request document is essential for maintaining clear communication with clients and ensuring smooth financial transactions. The format you choose will depend on the complexity of the services being offered, the preferences of both parties, and the tools you are comfortable using. A well-structured document provides clarity on payment terms, services, and expectations, which helps to avoid misunderstandings and delays.

There are several formats available for creating a payment request, each with its own set of advantages. The key is to choose one that aligns with your business needs, whether it be a simple one-page document for small projects or a more detailed, multi-page contract for larger, ongoing services.

Types of Formats to Consider

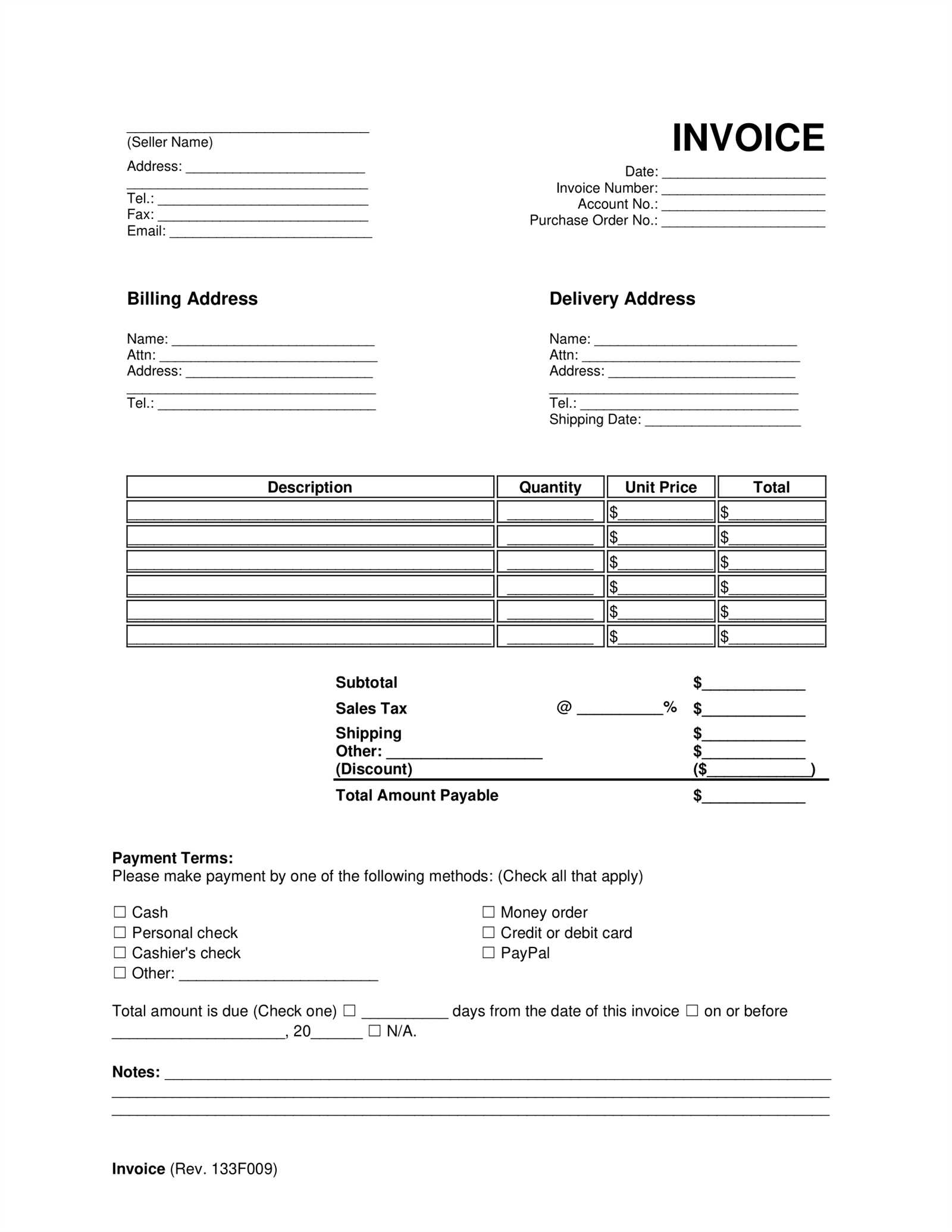

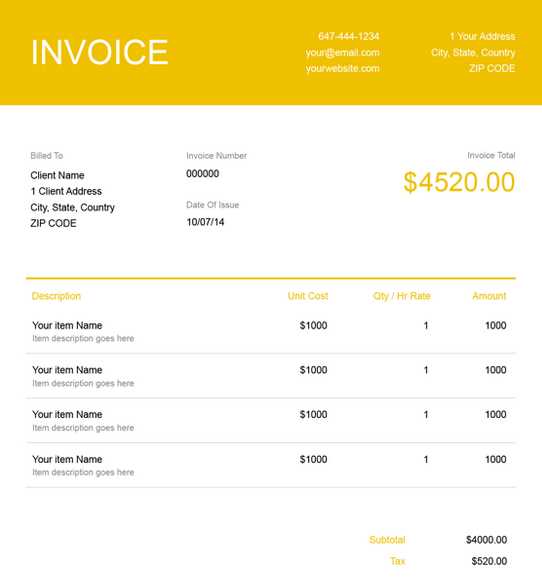

- Simple Payment Request: This format is ideal for straightforward agreements with clear and simple terms. It typically includes the service provider’s information, the client’s details, the amount due, and payment terms. This is a good option for short-term or one-off projects.

- Detailed Agreement Document: For ongoing projects or larger engagements, a more comprehensive document may be required. This format would include detailed descriptions of the work to be performed, milestones, payment schedules, and any applicable terms and conditions. It’s especially useful for long-term clients or complex services.

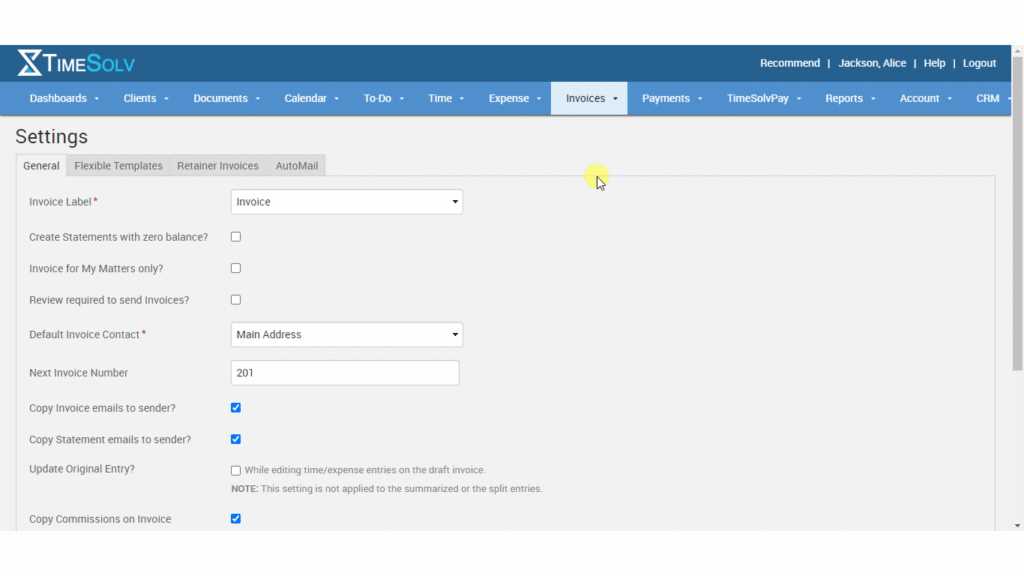

- Digital Payment Request Forms: If you prefer working digitally, consider using specialized software or online platforms that generate automatic payment request documents. These platforms can save time and ensure accuracy by allowing you to input information quickly and store records easily.

Factors to Consider When Choosing a Format

- Project Scope: For simple tasks, a basic document may suffice. However, for large or ongoing projects, a detailed agreement will help keep both parties aligned on expectations.

- Client Preferences: Some clients may prefer a more formal, detailed document, while others may opt for something simpler. It’s helpful to discuss this upfront to avoid confusion.

- Ease of Use: Choose a format that is easy for you to create and for your clients to understand. Whether using a digital platform, spreadsheet, or custom-built document, make sure the process is efficient for both sides.

Ultimately, the right format for your payment request document is the one that best meets the needs of both you and your client, while ensuring all relevant terms are clearly outlined and understood. Whether you go with a simple template or a more detailed document, clarity and professionalism should always be the priority.

When to Issue a Retainer Invoice

Knowing when to request an advance payment for services can help maintain a healthy cash flow and establish clear expectations between a service provider and their client. It is crucial to determine the right time to ask for payment upfront, ensuring that both parties are comfortable with the terms and that the provider has the necessary resources to begin the project. Understanding the timing of these requests can also prevent delays and reduce the risk of misunderstandings throughout the course of the work.

When to Request Upfront Payment

- Before Starting a Long-Term Project: If the project is expected to take a significant amount of time or requires ongoing work, requesting payment in advance can help secure the provider’s resources and confirm the client’s commitment.

- For Ongoing Services: For clients who require regular services over an extended period, an upfront payment ensures financial security and can help in scheduling work and allocating resources effectively.

- When Significant Time and Effort Is Needed: If the project requires considerable time, effort, or upfront costs (e.g., specialized materials, software, or staff), it’s advisable to request payment before starting. This ensures that the client is serious and that the service provider has the capital to meet initial needs.

- When Working with New Clients: If you have not worked with a client before or have concerns about their reliability, requesting an advance can help mitigate the risk of non-payment or project cancellation.

Signs You Should Not Wait Too Long

- Client Requests Immediate Start: If a client is eager to begin work right away but has not yet committed financially, it’s important to request an upfront payment before starting to ensure that both parties are fully engaged in the agreement.

- Unclear Project Scope or Terms: If the project’s scope or terms have not been fully defined, requesting payment in advance can help establish a formal commitment and reduce the risk of ambiguity during the execution phase.

Issuing a payment request at the right time ensures that both the provider and client have aligned expectations and that the project can proceed without financial concerns. By setting clear terms early, service providers can protect themselves from potential delays or non-payment while fostering trust and professionalism with the client.

How to Handle Retainer Disputes

Disagreements over upfront payments can arise in any professional relationship. Whether it’s due to misunderstandings about the scope of services, dissatisfaction with the work provided, or unclear payment terms, handling disputes effectively is crucial for maintaining a positive working environment. Addressing issues early, communicating clearly, and understanding your rights as a service provider can help resolve conflicts efficiently without damaging client relationships.

Steps for Resolving Payment Disputes

- Stay Calm and Professional: It’s important to approach disputes with a calm and professional attitude. Avoid escalating the situation by staying objective and focusing on finding a solution rather than getting defensive or emotional.

- Review the Agreement: Before engaging in any discussions, review the original terms of the agreement to ensure that both you and your client have a shared understanding of the payment terms, deliverables, and expectations. This will serve as the foundation for resolving the issue.

- Communicate Clearly: Open and clear communication is key. Reach out to your client and ask for clarification about their concerns. Discuss the issue in detail and make sure you understand their perspective. This will help avoid miscommunication and prevent unnecessary conflicts.

- Offer Solutions: Once you have identified the problem, offer potential solutions that are fair to both parties. This could involve adjusting payment terms, offering additional services, or negotiating a partial refund if warranted. Be flexible and willing to compromise when possible.

- Put It in Writing: After reaching a resolution, document the agreement in writing. This could be through a formal amendment to the original contract or a written confirmation of the agreed-upon terms. Both parties should sign to acknowledge the updated agreement.

Common Dispute Scenarios and Solutions

| Dispute Scenario | Possible Solutions |

|---|---|

| Client is unhappy with the work provided | Offer to revise the work or provide additional services to meet expectations. |

| Client claims they did not approve the payment terms | Review the initial agreement and offer a discussion to clarify any misunderstandings. If terms were agreed upon, remind them of the signed agreement. |

| Payment was delayed or missed | Send a polite reminder, offer alternative payment options, and review the payment schedule to avoid future issues. |

| Client requests a refund or partial refund | Assess the situation, consider the scope of work already delivered, and negotiate a fair refund policy based on the terms of the agreement. |

Disputes are an unfortunate but common part of working with clients. By handling them calmly, professionall

How Retainers Benefit Freelancers and Clients

Working with upfront agreements offers significant advantages for both freelancers and clients, helping to create a stable and mutually beneficial relationship. For service providers, these agreements ensure that their time and resources are committed to a project with a guaranteed income stream. Clients, on the other hand, can secure priority access to services, often at a more predictable cost, while establishing a deeper level of trust and commitment with the freelancer. The arrangement fosters a stronger working relationship and allows both parties to better plan and execute their respective goals.

Benefits for Freelancers

- Steady Cash Flow: One of the primary benefits for freelancers is the predictable cash flow. Receiving payment upfront or on a scheduled basis helps ensure financial stability, which can be crucial when managing multiple projects or periods of inconsistent work.

- Reduced Administrative Work: With agreed-upon payment terms in place, freelancers spend less time chasing payments or managing invoicing. This allows them to focus more on the actual work rather than on administrative tasks.

- Long-Term Client Relationships: Working with clients on an ongoing basis helps establish trust and a solid reputation. Clients who are committed to recurring services are more likely to continue working with the freelancer, providing a steady stream of projects and referrals.

- Better Planning and Scheduling: With predictable payments, freelancers can plan their work schedule more effectively. This allows for better time management and the ability to take on additional projects without the fear of sudden gaps in income.

Benefits for Clients

- Priority Service: Clients who commit to ongoing agreements often enjoy priority access to services. This can be particularly important for urgent tasks or projects that need continuous attention from the freelancer.

- Cost Predictability: By agreeing to a fixed payment structure, clients benefit from predictable pricing. This helps with budgeting and ensures there are no surprises when it comes to project costs.

- Access to Dedicated Expertise: Long-term agreements allow clients to build a deeper working relationship with a freelancer, gaining access to consistent, specialized expertise and knowledge over time.

- Higher Quality Work: When freelancers are invested in a long-term partnership, the quality of the work typically improves. Freelancers are more inclined to give their best efforts to clients who have shown long-term commitment.

In summary, upfront agreements provide a win-win situation for both freelancers and clients. Freelancers gain stability and more control over their schedule, while clients receive priority service and predictable costs. The mutual commitment of a long-term arrangement helps foster trust, increases work quality, and allows both parties to focus on achieving their goals together.

Best Practices for Retainer Billing

When managing upfront payment agreements, following a set of best practices can help ensure smooth transactions, prevent misunderstandings, and foster long-term professional relationships. The key to successful billing lies in clear communication, well-structured terms, and an organized approach to payment collection. By adhering to these practices, service providers can safeguard their income and maintain positive client relationships.

Clear Communication and Agreement Terms

- Define Payment Schedules: It is essential to set clear payment timelines at the beginning of the project. Whether payments are due monthly, quarterly, or upon completion of certain milestones, both parties should agree on the schedule in advance. This ensures that there are no surprises and that both the service provider and client are aligned on expectations.

- Clarify Scope of Work: Be specific about what is included in the agreed-upon amount. Providing a detailed breakdown of services will help avoid disputes over what is covered under the agreement and make it easier to reference when questions arise.

- Set Refund and Cancellation Policies: Include terms regarding how refunds or cancellations will be handled, should the need arise. These terms should be fair to both parties and provide clarity on what happens if the agreement is terminated early or if services are not delivered as expected.

Organized Billing Process

- Provide Transparent Documentation: Whenever you issue a payment request, include detailed documentation. This can include an itemized list of services or hours worked, payment dates, and the total amount owed. Transparency builds trust and helps clients understand exactly what they are paying for.

- Track Payments and Deliverables: Maintain an organized system to track both incoming payments and the completion of deliverables. Keeping a record of payments received ensures that you can quickly identify when payments are due or overdue.

- Automate Where Possible: To save time and reduce the risk of human error, consider using automated tools for tracking payments, sending reminders, and issuing new requests. There are many platforms that integrate payment tracking with service delivery, helping you streamline the process.

Following these best practices for billing ensures both the service provider and client are on the same page regarding terms and expectations. By fostering a transparent and organized process, you minimize the potential for conflicts and build a foundation for a smooth and successful working relationship.

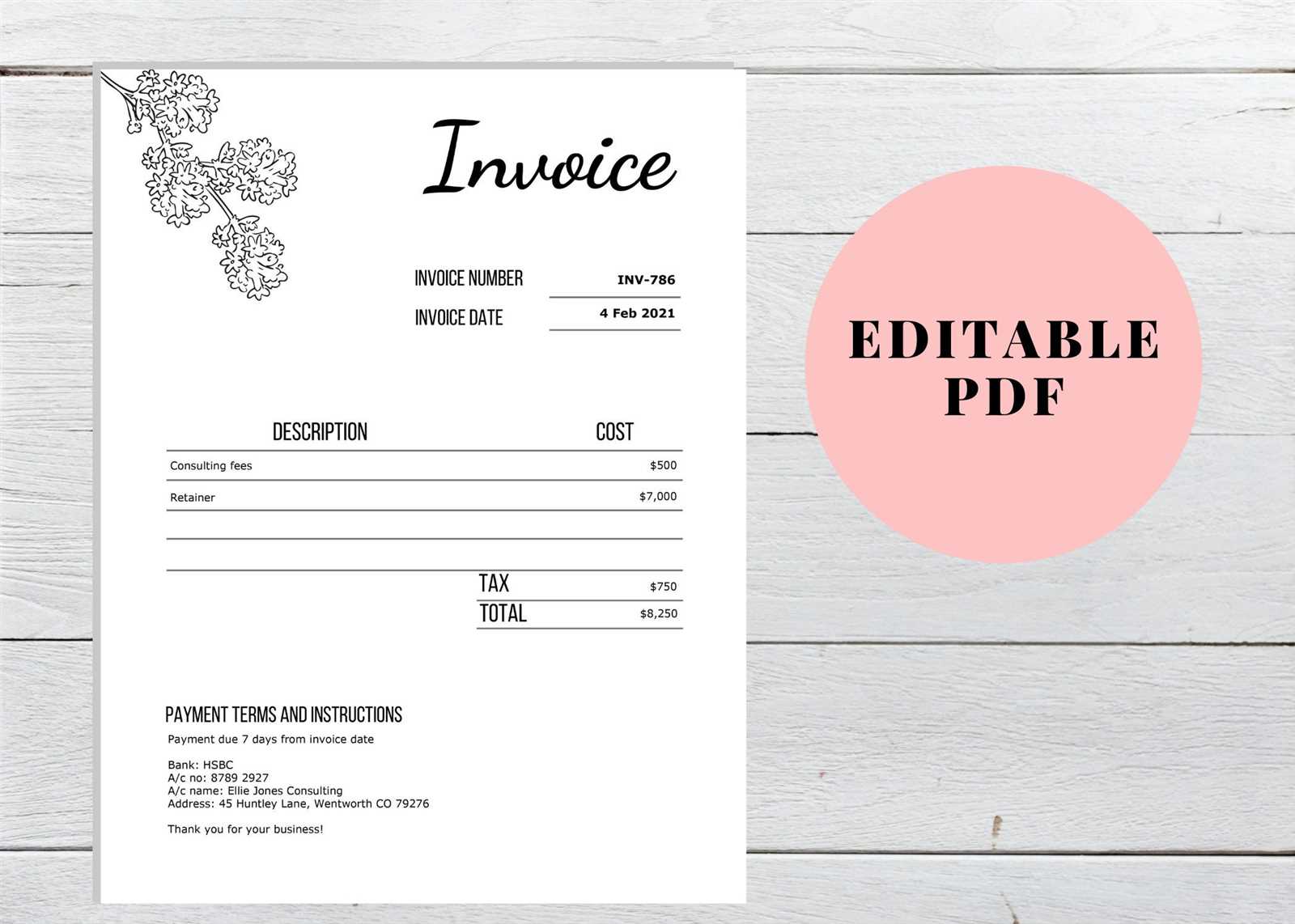

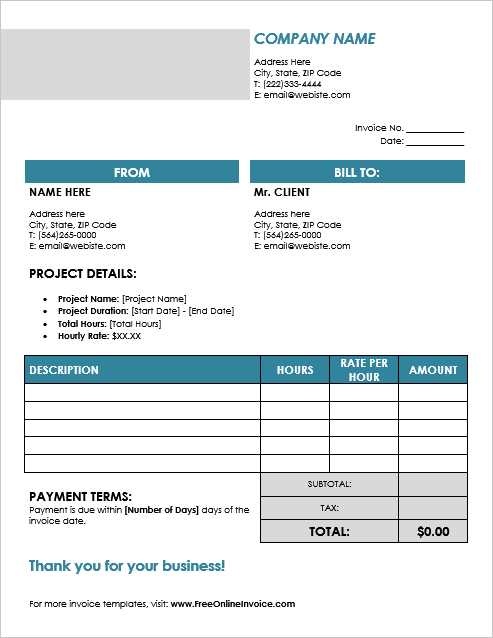

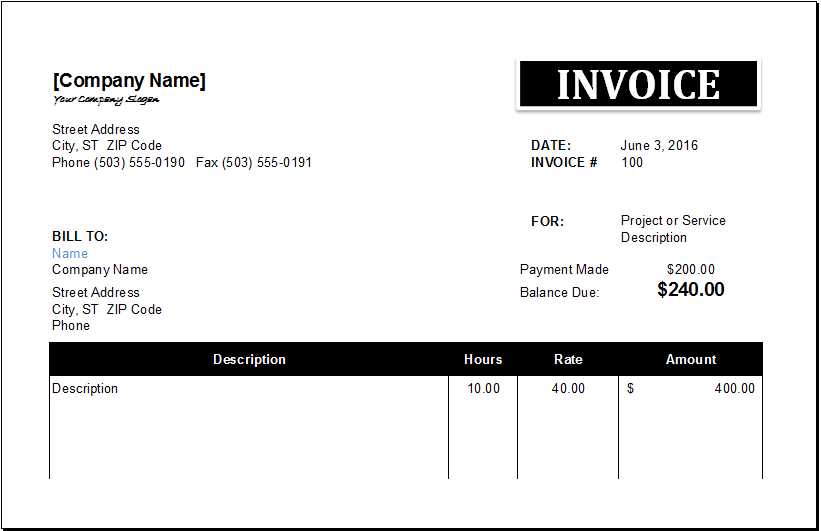

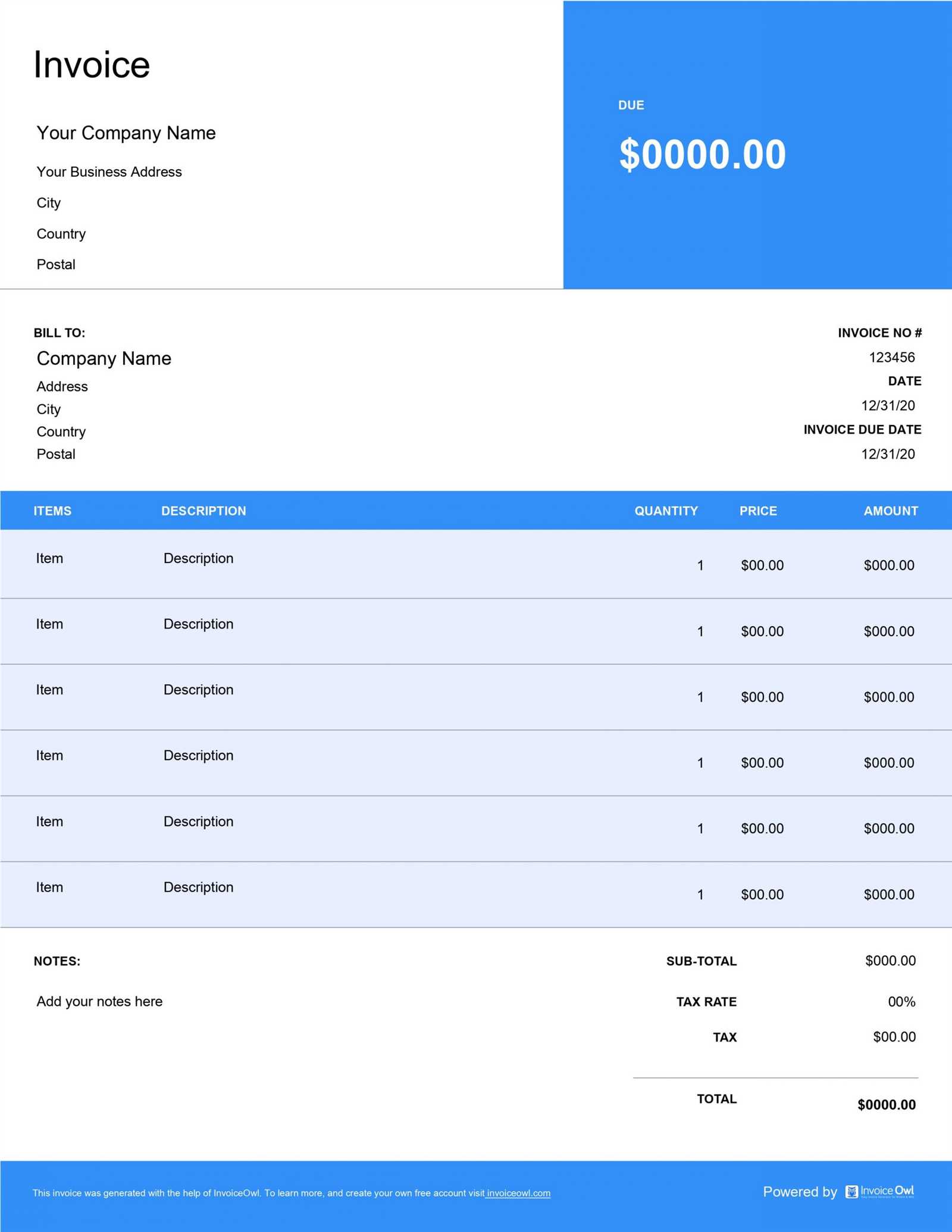

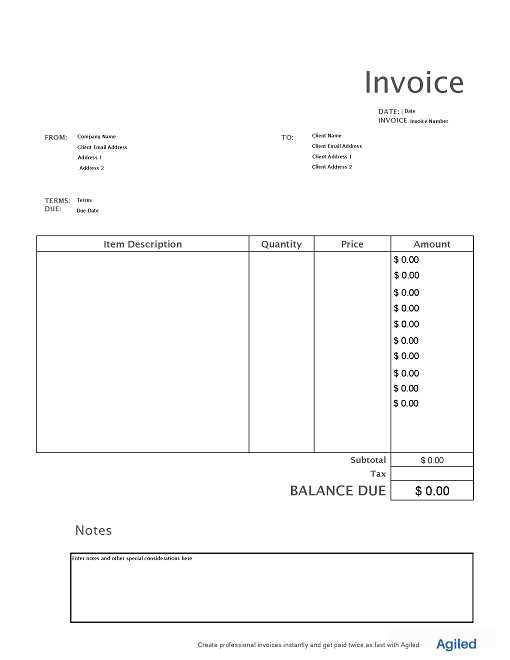

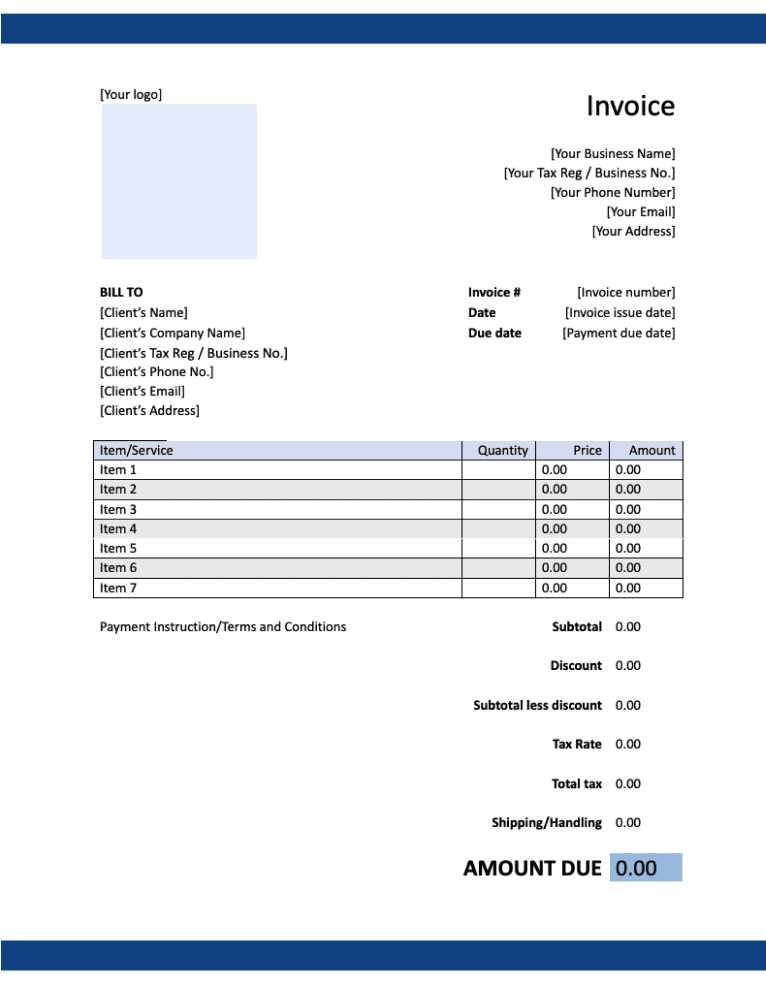

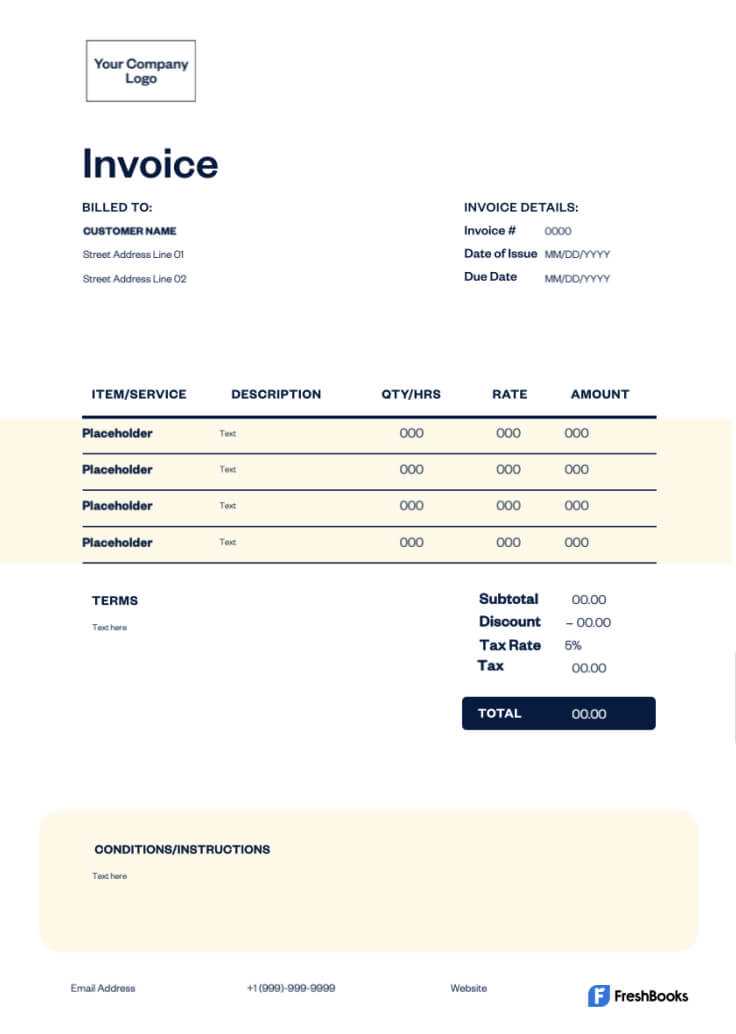

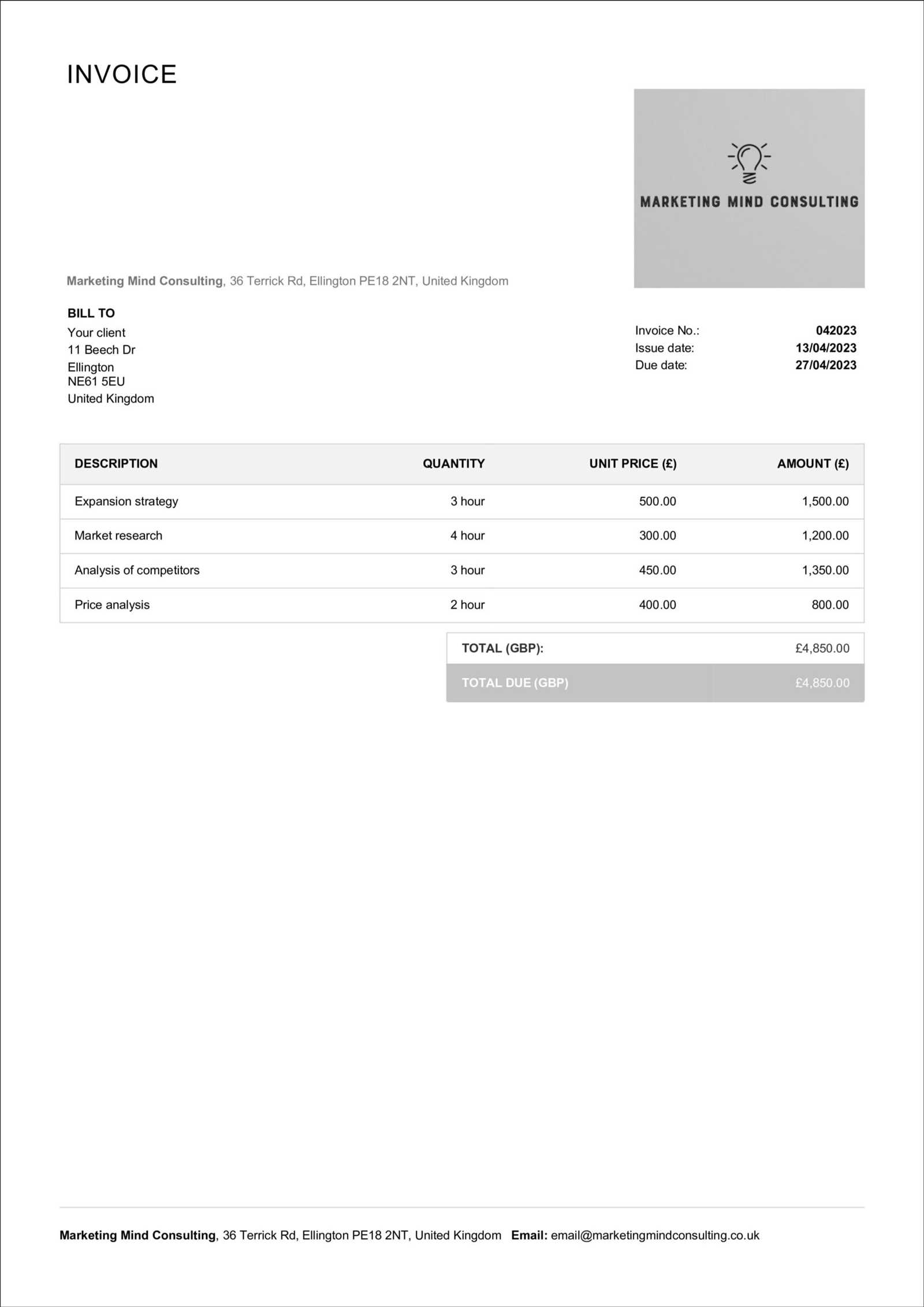

Free Retainer Invoice Templates to Download

Finding the right structure for your payment requests can save valuable time and reduce errors in documentation. Free resources are available online that provide customizable, professional formats for requesting upfront payments for services. These pre-made designs allow you to easily plug in your details, ensuring that you stay organized and meet your client’s expectations without the hassle of creating a new document from scratch.

Why Use Pre-Designed Billing Formats?

- Time-Saving: Using a ready-made structure eliminates the need to design your own document, allowing you to focus more on the work itself rather than administrative tasks.

- Professional Appearance: These documents are typically designed with a clean, organized layout that presents your payment requests in a professional manner.

- Customizable: Most free formats can be easily adjusted to suit your specific needs, including adding personalized terms, adjusting payment amounts, and including service details.

- Accuracy: By using a standardized structure, you reduce the chances of forgetting important details or making mistakes in the billing process.

Where to Find Free Resources

- Online Business Websites: Many business resource websites offer free downloadable formats that you can use for various types of service agreements and payment requests.

- Accounting Software Providers: Some accounting software platforms offer free templates for basic billing, which can be adapted for any professional service agreement.

- Freelancer Communities: Freelance networks often provide useful resources, including downloadable forms for payment requests, which are designed with freelancers in mind.

- Document Sharing Platforms: Websites like Google Docs or Microsoft Word offer free downloadable and customizable formats that can be easily shared with clients.

By taking advantage of free resources, you ensure that your financial documentation is streamlined, professional, and easy to adapt as your business grows. Whether you’re new to requesting upfront payments or have been doing so for years, these ready-made solutions can simplify your workflow and help you stay organized.