Responsive Invoice Template for Efficient and Professional Billing

In today’s fast-paced business world, it’s essential to have a streamlined approach to managing financial records. Whether you are a freelancer, a small business owner, or part of a larger organization, a well-designed system for creating and sending billing documents can save time and reduce errors. With the right structure, these documents can be tailored to meet specific client needs and present a professional image every time.

Adapting your billing forms to be flexible and accessible across different devices is crucial for improving client communication. Having a document format that automatically adjusts to various screen sizes ensures that recipients can view, read, and process your details without inconvenience, whether they’re using a smartphone, tablet, or desktop computer.

In this guide, we will explore how to craft effective billing forms that are easy to use, visually appealing, and functional on any device. You’ll learn about key design elements, customization options, and the tools that can help you create a seamless experience for both you and your clients.

Responsive Billing Document Overview

Effective financial documentation is key to maintaining a professional relationship with clients and ensuring smooth transactions. Having a well-organized format that adjusts to different screen sizes allows for quick, easy access and improves the overall user experience. In this section, we will delve into the main characteristics and benefits of flexible billing formats that cater to modern business needs.

Key Characteristics of an Effective Billing Document

An ideal document for sending financial details should meet several criteria to ensure it works seamlessly across various devices. These key characteristics include:

- Adaptability: The layout should adjust smoothly to any device, from smartphones to large desktop screens.

- Clarity: All important details should be easily readable, with a logical structure for quick comprehension.

- Customization: The ability to modify elements like fonts, colors, and logos allows businesses to maintain their unique brand identity.

- Efficiency: Users should be able to quickly generate and send the document without encountering technical issues.

Benefits of Flexible Document Layouts

Using a flexible layout for billing documents offers several advantages for both the sender and the recipient:

- Improved Client Experience: Clients can view their billing details on any device, leading to greater satisfaction and fewer delays.

- Professional Appearance: Customizable options allow businesses to present their financial documents in a polished, consistent manner.

- Time Savings: Easy-to-use formats reduce the time spent creating and sending documents, allowing for more focus on other tasks.

- Enhanced Communication: Clear, well-structured documents help avoid misunderstandings and ensure that all necessary information is included.

Benefits of Using a Flexible Document Format

Adopting a flexible layout for your financial documents offers significant advantages for both businesses and clients. With the increasing use of various devices for viewing and managing documents, ensuring compatibility across screens enhances the overall experience. Here, we explore the key benefits of using an adaptable design for your billing records.

- Wider Accessibility: Clients can access their financial details on any device, whether a smartphone, tablet, or desktop computer, without any loss of readability or formatting issues.

- Improved User Experience: A well-structured and easy-to-read document increases client satisfaction by providing a smooth viewing experience, no matter the screen size.

- Enhanced Professionalism: A modern, adaptable format reflects a business’s attention to detail and commitment to presenting a polished image to clients.

- Faster Transactions: Clients are able to quickly review, process, and act on financial documents without struggling with unreadable or poorly formatted content.

- Cost and Time Efficiency: A universal design reduces the need for creating multiple versions of the same document for different devices, saving both time and resources.

How Flexible Billing Documents Improve Client Experience

Creating an easy-to-navigate and visually appealing billing document can significantly enhance the overall experience for clients. When financial records are easy to read, understand, and interact with, clients are more likely to feel confident and satisfied with the service. An adaptable format that ensures readability across devices helps build trust and fosters positive business relationships.

Here are some key ways in which flexible formats benefit client interaction:

| Benefit | Client Impact |

|---|---|

| Clear and Readable Layout | Clients can quickly find the necessary information, reducing confusion and errors. |

| Accessibility on Any Device | Whether using a phone, tablet, or desktop, clients can view documents comfortably without formatting issues. |

| Professional Presentation | Well-structured documents reflect positively on the business, promoting a sense of trust and professionalism. |

| Faster Payment Processing | Easy-to-read documents speed up the review process, leading to quicker responses and payments. |

| Customizability | Clients appreciate personalized documents that reflect the brand identity and meet their specific needs. |

By offering a streamlined, device-friendly document that clients can easily process and engage with, businesses can improve their overall relationship and communication with customers, ultimately leading to greater satisfaction and timely payments.

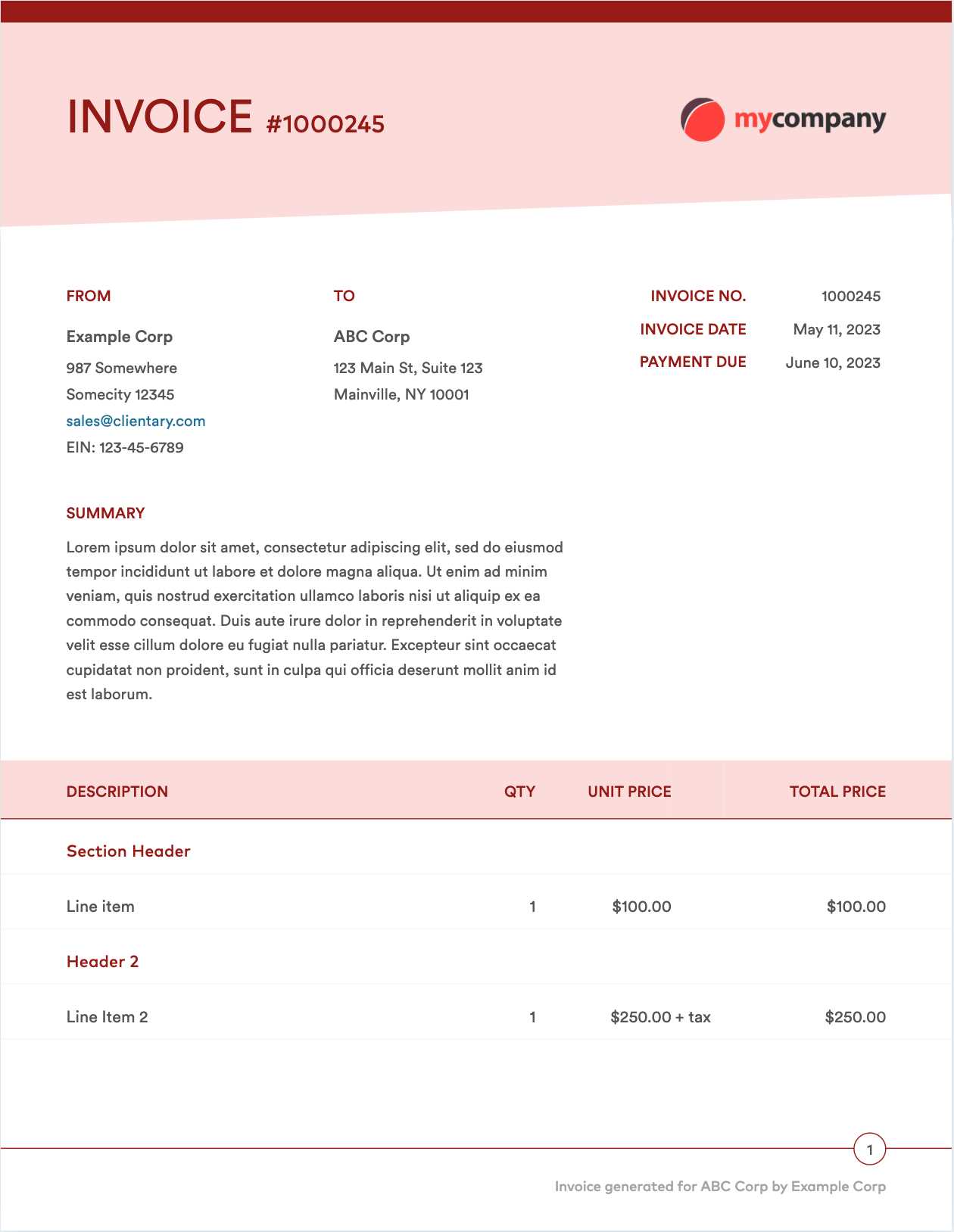

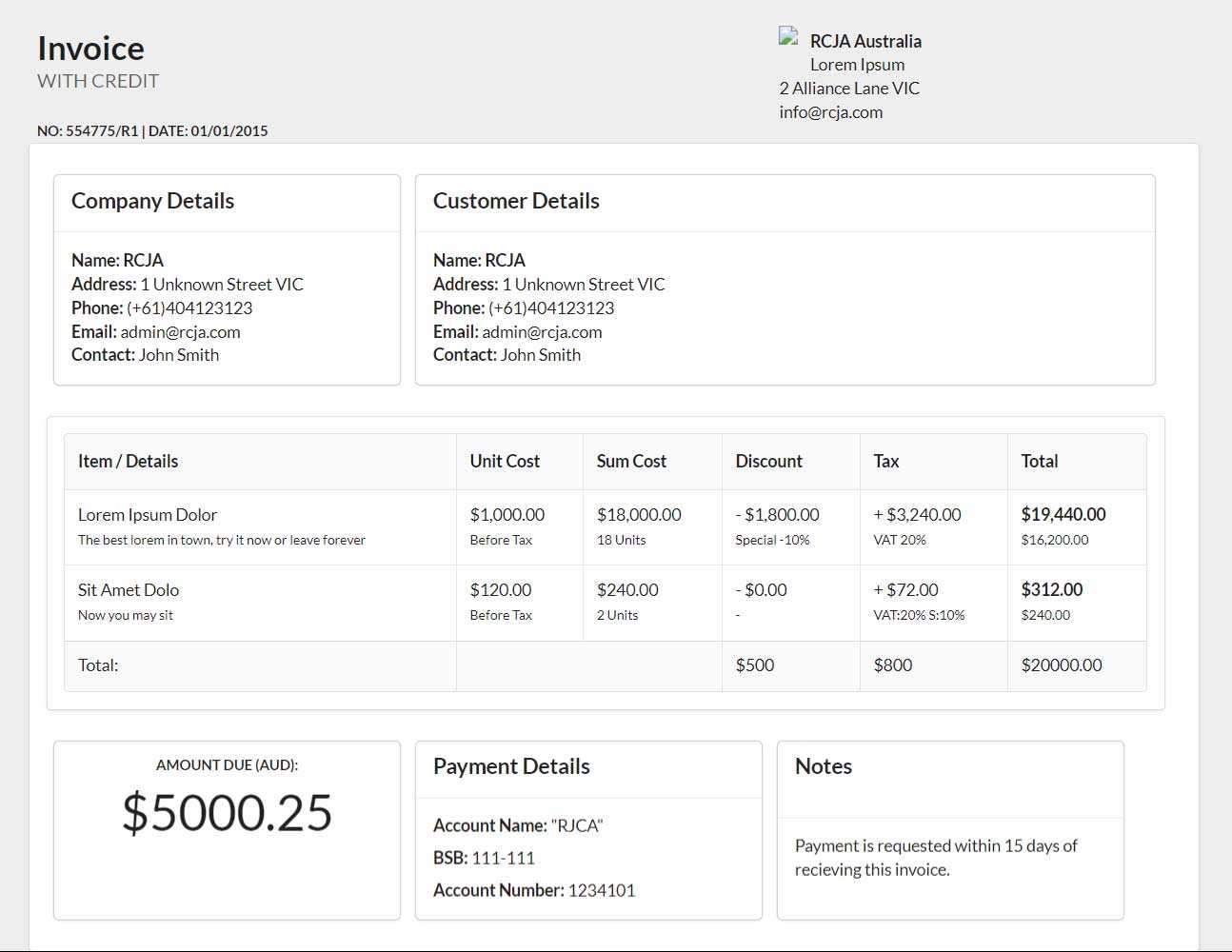

Key Features of a Flexible Billing Document

To create an effective and user-friendly financial record, it is essential to incorporate specific features that enhance both its functionality and appearance. A well-structured document should be clear, organized, and accessible on any device. The following features are crucial for making sure your billing documents serve their purpose efficiently and provide a seamless experience for both businesses and clients.

- Adaptability Across Devices: The layout should automatically adjust to fit various screen sizes, ensuring that the document is readable on mobile phones, tablets, and desktop computers.

- Clear Organization: Information should be grouped logically, with sections for contact details, services rendered, and payment instructions, making it easy for clients to find the relevant information quickly.

- Brand Customization: The ability to personalize the document with company logos, colors, and fonts helps maintain a professional and consistent brand image.

- Easy-to-Understand Content: Text should be concise and straightforward, ensuring that all essential details, such as amounts owed and due dates, are highlighted and easy to interpret.

- Incorporation of Payment Methods: Providing clients with multiple payment options within the document itself, such as links or QR codes, streamlines the payment process.

- Interactive Elements: Including clickable links for payment gateways or additional information makes the document more functional and user-friendly.

By ensuring these features are present, businesses can create documents that not only look professional but also facilitate smooth and efficient communication with clients, resulting in faster payments and improved customer satisfaction.

Customizing Your Flexible Billing Document

Personalizing your financial documents is an important step in maintaining a professional and consistent brand identity. By adjusting certain design elements, you can create a document that not only serves its functional purpose but also reflects your company’s style and values. In this section, we will explore key customization options that allow you to tailor your billing forms to meet your specific business needs.

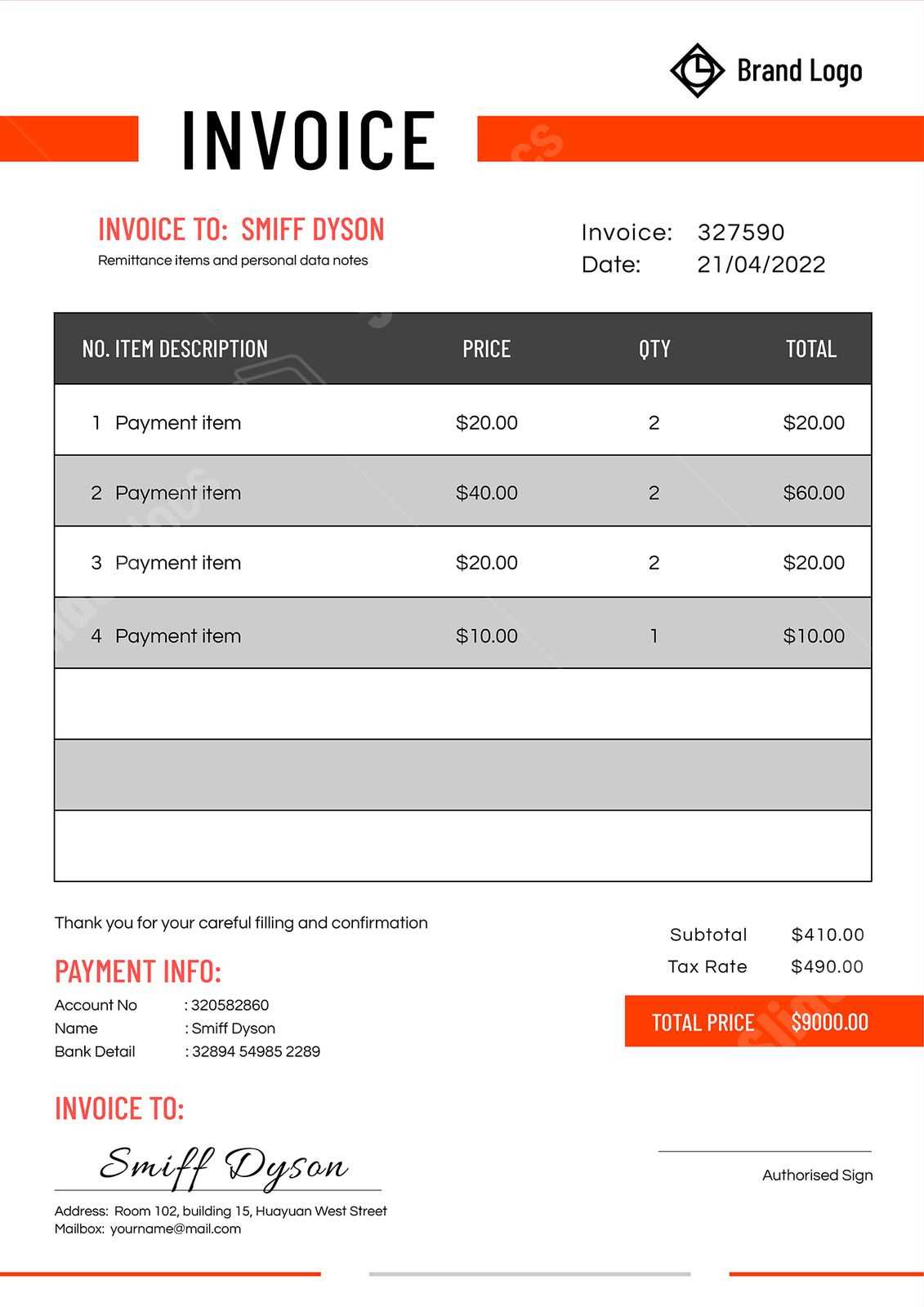

Branding and Visual Customization

One of the most effective ways to personalize your financial records is through branding. Customizing the visual elements ensures that your documents align with your company’s overall look and feel. Key aspects to modify include:

- Logo Placement: Including your company’s logo at the top of the document makes it immediately recognizable to clients.

- Color Scheme: Adjusting the color palette to match your brand’s colors creates a cohesive and professional appearance.

- Font Style and Size: Selecting fonts that are consistent with your branding and adjusting the size for readability enhances the document’s visual appeal.

Content Personalization

In addition to design, it’s important to customize the content of your billing document to suit your specific needs. This may include:

- Payment Instructions: Tailor the payment methods section by including the most relevant and convenient options for your clients, such as bank details or online payment links.

- Terms and Conditions: Modify the terms to reflect your specific policies on payments, returns, or service charges.

- Client-Specific Information: Customize each document with the client’s name, address, and other relevant details to make the document feel personal and accurate.

By customizing both the visual design and content of your billing forms, you can ensure that they are not only functional but also aligned with your business’s branding and client needs.

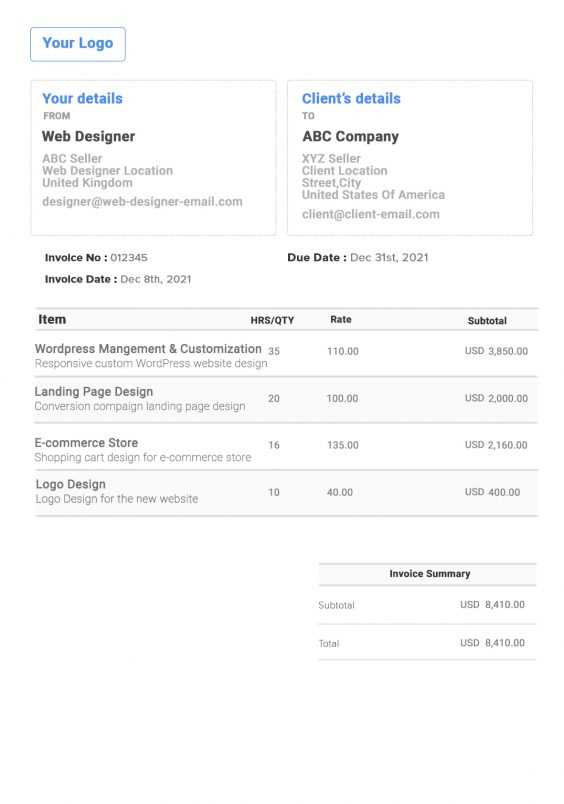

Best Practices for Billing Document Layout Design

Designing an efficient and visually appealing billing document is essential for ensuring that clients can quickly process and understand the details. The layout should be clear, organized, and easy to navigate, ensuring that all the important information stands out. Following best practices in layout design helps achieve this and improves both the sender’s and recipient’s experience.

Organizing Key Information

One of the most important aspects of a well-designed document is how the information is structured. The layout should prioritize clarity and ease of navigation. Some key points to keep in mind:

- Logical Grouping: Group similar information together, such as contact details, service descriptions, and payment instructions, to make it easy to locate.

- Clear Sectioning: Use headings or borders to separate different sections. This helps users quickly find the information they need without confusion.

- Highlight Important Data: Make sure critical details like due dates, total amounts, and payment instructions stand out. You can use bold text or larger fonts to draw attention to these key areas.

Maintaining Visual Appeal

While organization is crucial, visual appeal also plays a big role in making the document user-friendly. Here are some design tips:

- Consistent Alignment: Ensure all text and elements are properly aligned. A clean, uniform appearance adds to the document’s professionalism and readability.

- White Space: Avoid clutter by incorporating white space around sections and text. This creates a more relaxed, readable layout that won’t overwhelm the reader.

- Appropriate Font Choices: Choose easy-to-read fonts and keep the size consistent across similar sections. Avoid using too many different fonts to maintain a cohesive look.

By applying these best practices, you can design billing documents that are not only functional but also aesthetically pleasing and easy for clients to process.

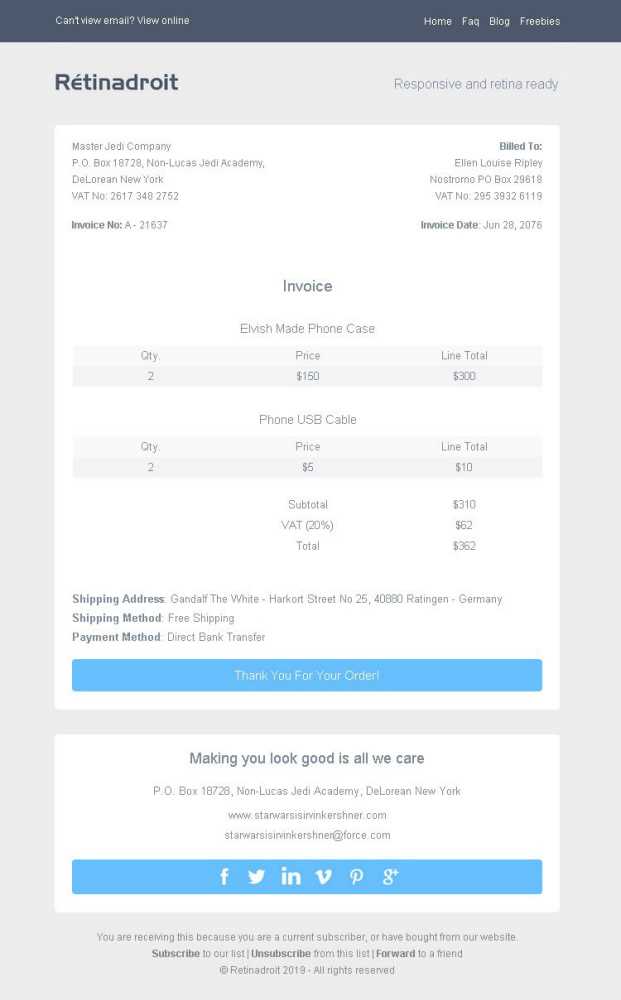

Mobile Compatibility in Billing Documents

In today’s fast-paced world, many people rely on their mobile devices to access important documents. Ensuring that financial documents are optimized for mobile viewing is crucial for enhancing user experience and ensuring that clients can easily view and process their information while on the go. A design that adapts well to smaller screens not only improves accessibility but also helps streamline the client’s interaction with the document.

Why Mobile Compatibility Matters

More than half of internet traffic now comes from mobile devices, and clients expect to access documents with ease, regardless of the device they use. The following benefits highlight the importance of mobile-optimized billing formats:

- Improved Accessibility: Clients can view documents from their smartphones or tablets without any difficulty, ensuring they can handle transactions promptly.

- Increased Engagement: Easy-to-read documents that display well on mobile encourage faster responses and payments from clients.

- Enhanced User Satisfaction: A smooth mobile experience demonstrates that a business values customer convenience, which can build trust and loyalty.

Key Features for Mobile-Friendly Layouts

When designing billing documents for mobile compatibility, certain features should be prioritized to ensure seamless viewing:

- Fluid Layout: The document should automatically adjust to different screen sizes, ensuring that text and tables remain readable without requiring horizontal scrolling.

- Font Size and Readability: Fonts should be large enough for easy reading on smaller screens, with sufficient contrast to make the text stand out clearly.

- Simplified Content: Mobile users benefit from concise, well-organized content that makes key details easy to find without unnecessary scrolling.

By prioritizing mobile compatibility, businesses can ensure their clients have a seamless experience when accessing and interacting with billing documents on any device.

How to Choose the Right Billing Document Format

Selecting the right layout for your financial records is essential for creating a clear, professional, and easy-to-read document. The design you choose should align with your business needs, the nature of the services you provide, and your client’s preferences. Making an informed decision ensures that your documents are both functional and visually appealing, leading to better communication and faster payments.

Here are some key factors to consider when choosing the ideal format for your billing documents:

- Business Type: Consider the nature of your services. A more formal, detailed layout may be suitable for consultancy firms, while a simpler design might be ideal for retail businesses or freelancers.

- Branding Consistency: Ensure the design complements your company’s branding. The color scheme, fonts, and logo placement should reflect your overall business style.

- Ease of Use: The layout should be intuitive for both you and your clients. It should feature clear sections, easy-to-read fonts, and well-organized data presentation.

- Client Preferences: If you serve clients across different industries, it may be beneficial to tailor the format to fit the preferences of your audience. For example, tech clients may appreciate more modern, minimalist designs, while legal clients may prefer something more formal.

- Flexibility: Choose a design that can be easily updated with new information or changes. A flexible structure allows you to quickly adjust data without reformatting the entire document.

- Mobile Compatibility: Consider how your document will display on mobile devices. Many clients will review your records on smartphones or tablets, so a mobile-friendly layout is crucial for ensuring readability on any device.

By considering these factors, you can select a layout that not only suits your business and client needs but also presents a professional image and facilitates clear communication.

Free vs Paid Billing Document Layouts

When choosing a layout for your financial documents, you are often faced with the decision between free and paid options. Both types offer distinct advantages, but understanding their differences will help you select the best fit for your business needs. While free designs may offer basic functionality, paid options often come with additional features and customization capabilities.

Here is a comparison of free and paid options, highlighting the key factors to consider:

Advantages of Free Billing Document Layouts

Free layouts can be a great starting point, especially for small businesses or freelancers with limited budgets. These are some of the key benefits of opting for a free design:

- No Initial Cost: Free designs eliminate upfront expenses, making them an ideal choice for businesses just starting out or those with limited financial resources.

- Easy to Access: Many free layouts are readily available online, and you can often download them immediately without any sign-up or payment process.

- Simplicity: Free layouts tend to be simple, which can work well for businesses with basic invoicing needs. There is less complexity in design, which means less time spent on customization.

Advantages of Paid Billing Document Layouts

Paid designs, on the other hand, offer a more advanced set of features and customization options that can benefit businesses looking for more control over their branding and document presentation:

- Customization Options: Paid layouts typically provide a wider range of customization options, allowing you to adjust fonts, colors, logos, and layout structure to better reflect your brand identity.

- Professional Design: These layouts often come with more polished, professional designs that help make your documents look more sophisticated and trustworthy in the eyes of clients.

- Advanced Features: Paid options may include features such as automated calculations, multi-currency support, or integrated payment links, which can save time and reduce errors.

- Customer Support: Many paid layouts offer customer support or ongoing updates, ensuring you can get help if you encounter any issues or need to make adjustments.

Ultimately, the choice between free and paid layouts depends on your business’s specific needs. If you have st

Integrating Payment Options into Billing Documents

Incorporating payment methods directly into your financial documents streamlines the process for clients, making it easier for them to pay and reducing the chances of delayed payments. By providing clear and accessible payment options, you enhance the user experience and improve your cash flow. Ensuring your documents feature seamless, easy-to-follow payment instructions can lead to faster transactions and higher customer satisfaction.

Benefits of Including Payment Methods

Including a variety of payment options within your documents offers several advantages for both your business and clients:

- Convenience: Clients appreciate having multiple ways to pay, whether through credit cards, bank transfers, or online payment systems like PayPal. The more options available, the easier it is for them to complete the transaction.

- Faster Payments: Simplifying the payment process often leads to quicker settlements. When clients don’t have to hunt for payment instructions or make additional steps, they are more likely to pay sooner.

- Improved Accuracy: Clear instructions reduce the chances of payment mistakes. Providing accurate payment details minimizes errors, ensuring you receive the correct amount without delays.

- Professionalism: Offering integrated payment methods conveys professionalism and trustworthiness. It shows clients that your business is organized and ready to handle transactions smoothly.

Types of Payment Methods to Include

There are several payment options to consider adding to your billing documents, each catering to different client preferences:

- Credit/Debit Cards: Directly including the ability to pay via credit or debit card is a standard method that is familiar and convenient for most clients.

- Bank Transfers: For larger payments, providing bank account details for wire transfers ensures clients can pay directly from their bank accounts.

- Online Payment Systems: Services like PayPal, Stripe, or Square offer fast and secure payment options that many clients prefer for online transactions.

- Cryptocurrency: As digital currencies become more mainstream, offering payment through cryptocurrency like Bitcoin or Ethereum can appeal to a tech-savvy audience.

By clearly indicating payment methods in your documents, you not only make it easier for clients to pay but also improve the efficiency of your entire billing process.

Common Mistakes in Billing Document Layouts

Even well-designed financial documents can fall short if certain mistakes are made during the creation process. These errors can affect the clarity, professionalism, and functionality of the document, leading to confusion for clients and delayed payments. Identifying and avoiding common pitfalls is essential for creating documents that are both effective and easy to use.

Design Mistakes

Many issues stem from poor design choices that can make the document hard to read or navigate. Here are a few key design mistakes to watch out for:

- Cluttered Layout: A busy, overstuffed design can overwhelm the recipient. Overloading the document with unnecessary information or too many elements can make it difficult for the client to find the details they need.

- Poor Font Choices: Using hard-to-read fonts or too many different fonts can detract from the professionalism of the document. It’s best to stick with clean, readable fonts that maintain a uniform appearance throughout.

- Inconsistent Branding: Not aligning the document’s design with your company’s brand can confuse clients. Always ensure that your logo, colors, and style match your overall business identity.

Functional Mistakes

Beyond design, there are also functional aspects of the document that need attention. These mistakes can hinder clients from processing the payment promptly or correctly:

- Lack of Clear Payment Instructions: If payment methods are not clearly outlined or easy to follow, clients may struggle to make payments, leading to delays or mistakes.

- Missing Contact Information: Not providing sufficient contact details or customer service information can leave clients frustrated when they need assistance or have questions about the charges.

- Omitting Important Details: Sometimes, essential elements like payment due dates, breakdowns of charges, or tax information are left out, causing confusion or disputes.

By being mindful of these common errors and ensuring that your documents are clean, clear, and functional, you can improve the client experience and reduce the likelihood of payment delays or misunderstandings.

Billing Documents and Branding Consistency

Maintaining consistency in your brand’s visual identity across all business materials is crucial for building recognition and trust with your clients. This applies not only to your website or marketing materials but also to your financial documents. By aligning your business’s design elements with your documents, you can reinforce your brand’s professionalism and make a lasting impression on your clients.

Key Elements for Brand Consistency

Here are several key elements to ensure your documents stay aligned with your company’s branding:

- Logo Usage: Always include your company logo in a prominent place, ideally at the top of the document. Ensure the logo is high-resolution and matches your brand’s official colors and proportions.

- Color Scheme: Use the same colors as your official branding. Whether it’s your company’s primary colors or more neutral tones, a consistent color palette helps create a professional look and feel.

- Typography: Stick to your brand’s standard fonts to maintain a cohesive look across all materials. Avoid using too many different fonts, as this can detract from a polished appearance.

- Visual Style: The overall visual style should reflect your brand’s personality, whether that’s modern, minimalist, or classic. Consistency in visual elements enhances brand recognition and reinforces your identity.

Why Consistency Matters

Consistency in your financial documents not only improves the aesthetic appeal but also communicates a sense of trustworthiness and reliability. Here’s why it matters:

- Professionalism: Well-designed, consistent documents convey professionalism. Clients are more likely to trust a business that presents itself with attention to detail and coherence in all forms of communication.

- Brand Recognition: Consistent use of colors, logos, and fonts across all business materials strengthens brand recognition. Clients will immediately associate the design with your company, which builds familiarity and trust.

- Enhanced Client Experience: A branded document can make the transaction feel more formal and significant, which may result in quicker payments and stronger business relationships.

By paying attention to the visual consistency of your financial documents, you reinforce your company’s identity and ensure that your clients perceive you as a well-established and reliable business.

How to Automate Billing Document Generation

Automating the creation of financial documents can save significant time and reduce the risk of errors. By setting up an automated system, businesses can streamline their billing process, ensuring consistency and accuracy with minimal manual effort. This is especially beneficial for businesses with a high volume of transactions, as it reduces the administrative workload and improves operational efficiency.

Steps to Set Up Automation

To automate the generation of your financial documents, follow these steps:

- Select the Right Software: Choose a tool or software that offers the automation features you need. Look for platforms that allow customization, integration with other systems, and can handle your business’s specific needs.

- Integrate Client Information: Ensure that your system is connected to your client database, so it can automatically pull in details such as contact information, pricing, and transaction history.

- Set Up Payment Terms: Automate payment terms, due dates, and other standard elements of your documents. This ensures consistency and reduces the chance of human error.

- Customize Document Layout: Create or choose a layout that aligns with your brand. Once set up, the system should generate documents using this layout every time.

- Test the System: Run a few tests to ensure that everything is working as expected. Check that all fields are populating correctly and that the final documents meet your requirements.

Benefits of Automation

Once automated, the process of generating billing documents offers several advantages:

- Time Savings: Automating document creation eliminates manual entry, allowing you to focus on other important tasks while the system handles routine processes.

- Consistency: Automated systems generate documents in the same format every time, ensuring consistency and professionalism with every transaction.

- Accuracy: Automation minimizes human error, ensuring that all client details and amounts are correctly included, reducing disputes and discrepancies.

- Faster Turnaround: Automating document generation speeds up the billing process, which can help ensure timely payments and improved cash flow.

By automating the generation of financial documents, businesses can significantly enhance efficiency, improve accuracy, and free up tim

Security Considerations for Digital Billing Documents

When handling financial documents electronically, security becomes a paramount concern. Digital records are susceptible to various threats, such as data breaches, fraud, and unauthorized access. As businesses increasingly rely on digital systems to manage financial transactions, implementing robust security measures is essential to protect sensitive client information and maintain the integrity of your operations.

Key Security Practices

Here are some critical security practices to consider when dealing with digital billing documents:

- Data Encryption: Always encrypt sensitive information both during transmission and while stored. Encryption ensures that even if the data is intercepted, it remains unreadable to unauthorized parties.

- Access Control: Restrict access to your digital documents to authorized personnel only. Implement strong authentication mechanisms such as multi-factor authentication (MFA) to enhance security.

- Secure Hosting: Ensure that your digital documents are stored on secure, reputable servers with regular security updates and protections against malware and unauthorized access.

- Regular Backups: Regularly back up your digital documents to protect against data loss. In case of a cyberattack or system failure, you can quickly restore your records.

- Audit Trails: Enable audit logging to track any access, changes, or deletions made to your documents. This provides transparency and allows you to detect any suspicious activities promptly.

Protecting Against Fraud and Phishing

Fraudulent activities, such as phishing attacks, can target businesses by tricking employees into disclosing sensitive information or transferring funds. To safeguard against these threats, it’s essential to:

- Educate Employees: Regularly train employees to recognize phishing scams and other common cyber threats. Encouraging vigilance can prevent security breaches caused by human error.

- Verify Transactions: Implement a system of verification for high-value transactions or sensitive information. Always confirm payments and document details directly with clients to avoid fraudulent activities.

- Monitor for Suspicious Activity: Use security software that can detect and alert you to unusual activities, such as large numbers of document downloads or unauthorized logins, which may indicate a security breach.

By taking these steps, businesses can significantly reduce the risks associated with digital documents and ensure that their financial operations remain secure and trustworthy.

Tools for Creating Adaptable Billing Documents

Creating well-structured and visually appealing financial records requires the right tools, especially when aiming for seamless adaptability across devices. Several software options can help you design professional documents that automatically adjust to different screen sizes and resolutions, ensuring an optimal viewing experience for your clients. These tools allow for customization while maintaining functionality and clarity.

Popular Tools for Document Creation

Here are some of the most widely used tools for designing flexible billing documents:

- Microsoft Word: A versatile word processor with customizable templates and design options. It allows you to create professional layouts with a user-friendly interface. With careful formatting, documents can be optimized for viewing on various devices.

- Google Docs: A free, cloud-based alternative to Word. It provides a range of templates and allows for easy collaboration. Google Docs also automatically adjusts documents for mobile devices and web viewing.

- Canva: A design-focused tool that offers visually striking templates for creating documents. Canva allows users to drag and drop elements for quick and easy customization, and its design flexibility works well across different screen sizes.

- Adobe InDesign: A professional design software used for creating highly customized, polished documents. InDesign offers precise control over layout and typography, ensuring that your financial records maintain consistency and readability on all platforms.

- Zoho Invoice: A comprehensive invoicing platform that simplifies document creation and management. It offers pre-built templates that automatically adjust for optimal viewing on mobile devices and computers, and also integrates with other Zoho applications for seamless business operations.

Additional Considerations

While choosing a tool, consider the following:

- Ease of Use: The tool should be intuitive and easy to navigate, especially if you’re not a professional designer. Look for software with drag-and-drop features and user-friendly interfaces.

- Customizability: Ensure that the tool you select allows for sufficient customization. You may want to include your brand’s logo, color scheme, and other unique elements that align with your business’s identity.

- Compatibility: Verify that the tool generates documents that work well across multiple devices, including mobile phones, tablets, and desktop computers. Responsive layouts are crucial for ensuring that clients can easily read and interact with your documents.

By using the right tools, businesses can streamline the process of creating professional and adaptable billing documents, ultimately improving the overall client exp

Why Adaptable Designs Increase Efficiency

Creating adaptable documents that seamlessly adjust to different screen sizes can significantly streamline business processes. When your billing records automatically optimize for various devices, clients have a smoother experience, leading to quicker payments and fewer errors. Such designs not only improve readability but also reduce the amount of time spent on formatting and adjustments, making the entire workflow more efficient.

One of the key benefits of using these flexible designs is that they can be easily generated and sent across multiple platforms without worrying about how they will appear on different devices. This eliminates the need for manual adjustments or reformatting, saving time and reducing the likelihood of mistakes.

Time-Saving Features

With adaptable layouts, time-consuming tasks are minimized:

- Automatic Formatting: No need for constant resizing or adjustments when switching between desktop, tablet, and mobile views.

- Pre-designed Layouts: Many systems come with pre-built layouts that only need minimal customization, enabling faster document generation.

- Streamlined Workflow: These documents are ready to go in just a few clicks, allowing for quicker invoicing and faster turnaround times.

Improved Client Experience

When documents are easy to read and understand on any device, clients can quickly review and approve or pay the amount due. A smoother interaction leads to:

- Faster Payment Processing: Clients are more likely to settle payments promptly when they can easily navigate and comprehend your documents.

- Better Professional Image: Consistent, well-organized records show your attention to detail and commitment to quality.

- Fewer Errors: Clear, well-structured documents reduce misunderstandings and the need for revisions, which in turn cuts down on back-and-forth communication.

Overall, adaptable designs not only save time but also foster stronger, more efficient relationships with your clients, leading to smoother business operations and improved cash flow.