Free Residential Cleaning Invoice Template for Your Business

For any service-oriented business, having a clear and organized way to document transactions is essential. Whether you’re managing a small company or working as an independent contractor, ensuring that your clients receive accurate records of the work done is key to maintaining a smooth financial operation. A well-structured billing document helps establish trust and professionalism, while also streamlining your accounting process.

When offering home-based services, the billing process can become quite varied depending on the type and scope of work provided. Customizable documents allow service providers to adapt their bills to the specifics of each job, making it easier to include all relevant details and ensure that clients understand exactly what they’re paying for. A well-designed statement can also serve as an important tool for maintaining transparency and avoiding disputes.

In this guide, we will explore the different aspects of creating a comprehensive billing record that suits your business needs. From choosing the right format to incorporating essential information, you’ll learn how to build a professional document that not only enhances your reputation but also improves the overall efficiency of your financial management.

Understanding Home Service Billing Documents

For service providers, a well-structured document outlining the cost of work completed is a vital component of maintaining clear financial records. It not only serves as a request for payment but also helps to ensure that both parties are on the same page regarding the scope and details of the services rendered. This document can vary in format and content depending on the type of work performed, but its purpose remains consistent: to detail the agreed-upon charges and establish the terms for compensation.

At its core, this financial record should include essential details such as the services provided, the total amount due, payment terms, and contact information for both the provider and the client. By clearly outlining these elements, the service provider helps foster trust and avoid misunderstandings. Additionally, a properly documented statement helps businesses track their earnings and manage their cash flow more effectively.

Understanding the key components of such documents allows businesses to create accurate and professional records that can streamline the payment process and enhance customer satisfaction. Whether you’re just starting out or looking to refine your current approach, knowing what to include and how to format these documents is crucial for ensuring both clarity and compliance with industry standards.

Why You Need a Billing Document Layout

Having a predefined structure for your billing records is essential for ensuring consistency, accuracy, and professionalism in your business transactions. Without a standardized format, it becomes easy to overlook important details or present information in a way that can confuse clients. A pre-designed framework allows you to systematically include all necessary components, making the billing process more efficient and less prone to error.

Efficiency and Time-Saving

Using a structured layout saves valuable time. Instead of creating each document from scratch, you can simply fill in the relevant details, ensuring a fast turnaround and minimizing the chances of mistakes. This efficiency also helps you manage multiple clients simultaneously without losing track of important information.

Professionalism and Consistency

A uniform approach to generating financial records helps present your business as organized and reliable. Clients will appreciate receiving clear, professional documents that are easy to read and understand. This consistency in appearance and content reinforces your brand’s credibility and enhances client satisfaction.

| Benefit | Explanation |

|---|---|

| Time-Saving | Pre-made layouts allow you to quickly generate records without missing key details. |

| Clarity | A consistent format ensures that all important information is easy to find and understand. |

| Professionalism | Providing clients with organized and well-structured documents enhances your business’s reputation. |

| Accuracy | Standardized formats reduce the risk of errors in calculations or missing information. |

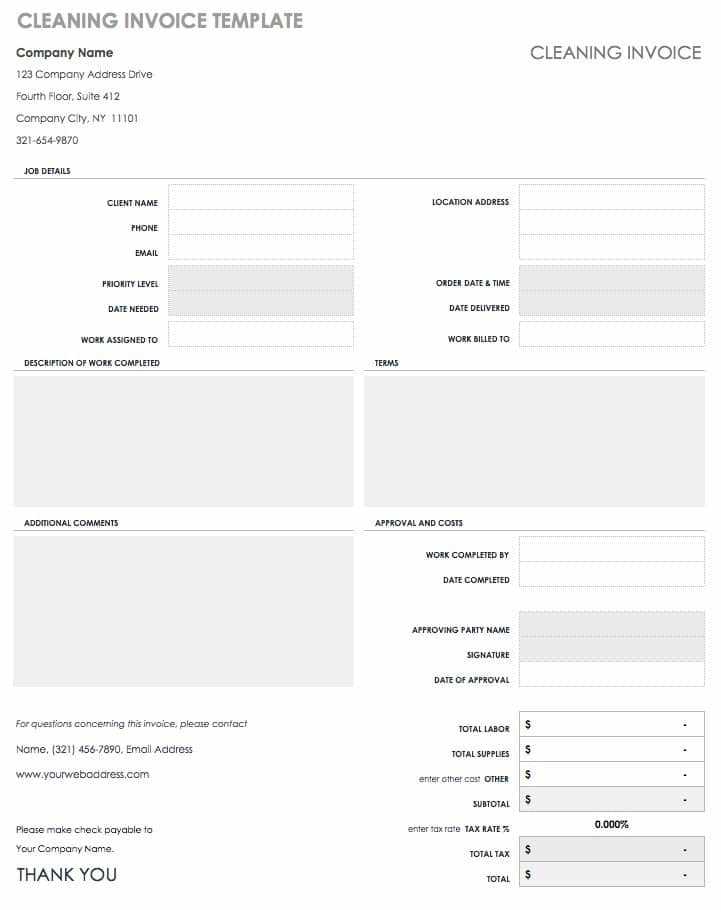

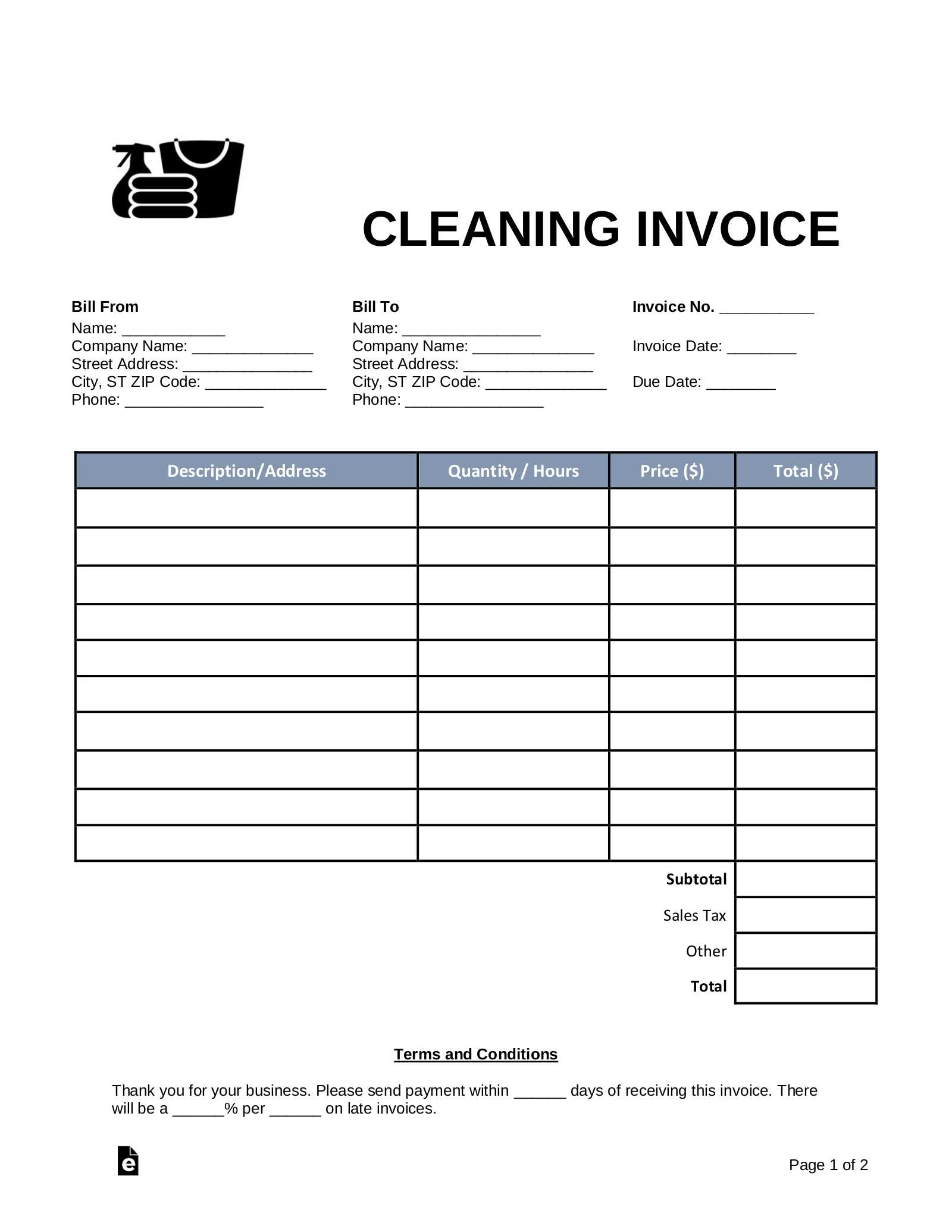

Key Elements of a Billing Document

When creating a document for services rendered, there are several important components that must be included to ensure clarity and professionalism. Each section plays a role in detailing the work completed, the amount due, and the terms of payment. By ensuring that all the key elements are present, you provide your client with a clear understanding of the charges and help streamline the payment process.

- Business and Client Information: The document should begin with both the service provider’s and the client’s contact details. This includes names, addresses, phone numbers, and email addresses.

- Description of Services: Clearly outline the tasks or work performed, including any relevant dates. This helps the client understand exactly what they are being charged for.

- Amount Due: Specify the total cost for the services rendered. Be sure to break down the pricing if multiple services were provided, including hourly rates or flat fees.

- Payment Terms: Include the due date for payment, accepted payment methods, and any late fees or penalties for overdue payments.

- Tax Information: If applicable, ensure that taxes are calculated and clearly stated. This helps maintain transparency with the client regarding the total amount due.

- Unique Reference Number: Assign a reference number to each document for easy tracking and organization.

By incorporating these essential elements into your document, you can ensure that both parties are well-informed and that the payment process goes smoothly. A comprehensive billing document not only keeps your business organized but also fosters a sense of trust and professionalism with your clients.

How to Create a Custom Billing Document

Creating a personalized billing record allows service providers to maintain control over their financial transactions while ensuring that all necessary details are captured accurately. Customizing your documents ensures they reflect the specifics of each job and meet the needs of your business. By following a few simple steps, you can create a professional and comprehensive statement that suits both you and your clients.

- Choose a Format: Decide whether you want to create a document from scratch or use an existing layout as a starting point. Digital tools or software can help streamline this process.

- Include Basic Information: Start by adding your business’s name, logo, and contact details. Next, include the client’s name and contact information for easy identification.

- Detail the Services Provided: Write a clear and concise description of the work completed. Include dates, hours worked, and any specific tasks to avoid confusion.

- Set Payment Terms: Clearly specify the payment methods you accept and the due date for payment. If applicable, note any late fees or discounts for early payment.

- Calculate the Total: Break down the pricing for individual services or tasks. Add any applicable taxes or additional fees, and then calculate the final amount due.

- Assign a Unique Reference Number: This helps both you and your client track the document in case of any future inquiries or disputes.

- Review for Accuracy: Before sending the document, double-check all the information for accuracy. Ensure the numbers add up and that no important details are missing.

By following these steps, you’ll create a document that not only looks professional but also functions as an efficient and transparent tool for both you and your clients. Customizing your billing records ensures they are tailored to your specific needs while maintaining clarity and professionalism throughout the transaction.

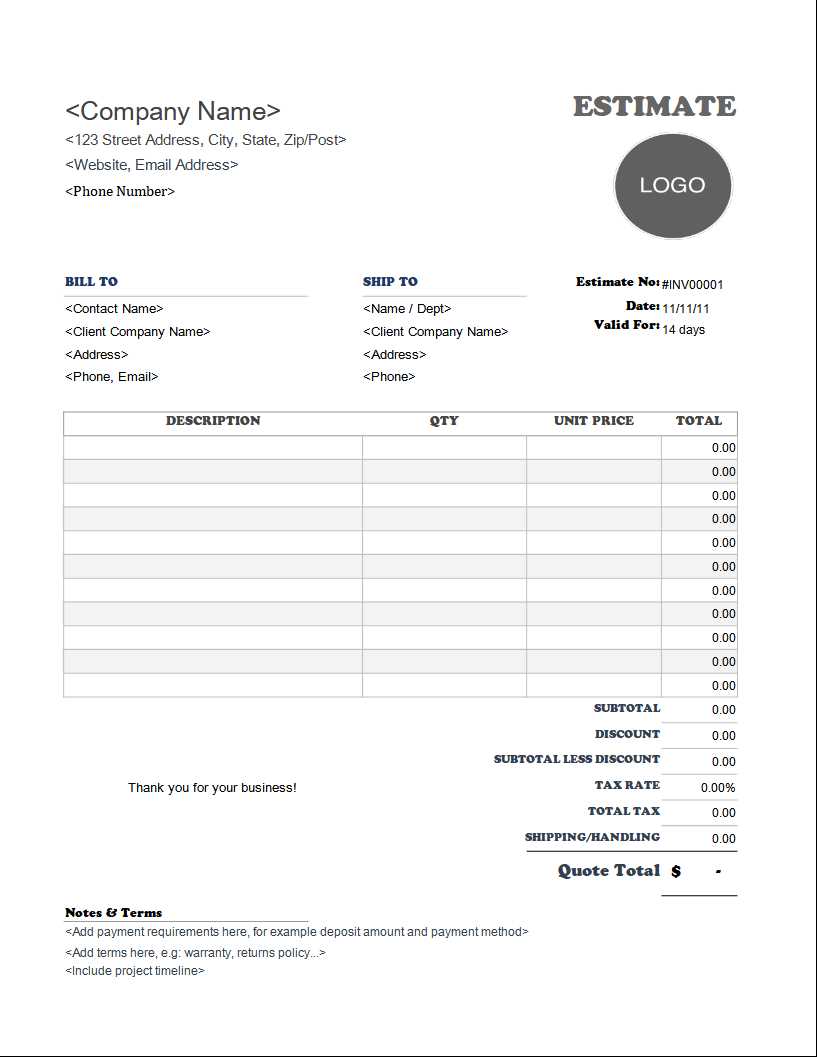

Choosing the Right Billing Format

Selecting the appropriate layout for your billing documents is crucial for ensuring clarity and professionalism. The format you choose not only affects how your information is presented but also influences how easily clients can understand and process the details. Whether you opt for a digital or paper format, the structure should support the key elements of the document and align with your business practices.

Digital vs. Paper Formats: In today’s world, digital records are often the preferred option due to their convenience, ability to be easily stored, and environmental benefits. Electronic formats can be sent via email or uploaded through client portals, allowing for quick and efficient delivery. On the other hand, physical copies may be necessary for clients who prefer traditional methods or require printed records for their own filing purposes.

Simple vs. Detailed Layouts: The complexity of the format depends on the nature of your business and the preferences of your clients. A simple layout may suffice for small jobs or one-time clients, while more detailed formats may be necessary for ongoing work or clients with specific billing requirements. Always ensure that the format you choose is easy to follow and includes all the necessary details, such as service descriptions, pricing, payment terms, and contact information.

Ultimately, the goal is to provide a professional, organized, and easy-to-understand document that fosters transparency and expedites the payment process. By carefully selecting the right layout, you can improve communication with your clients and enhance your overall business efficiency.

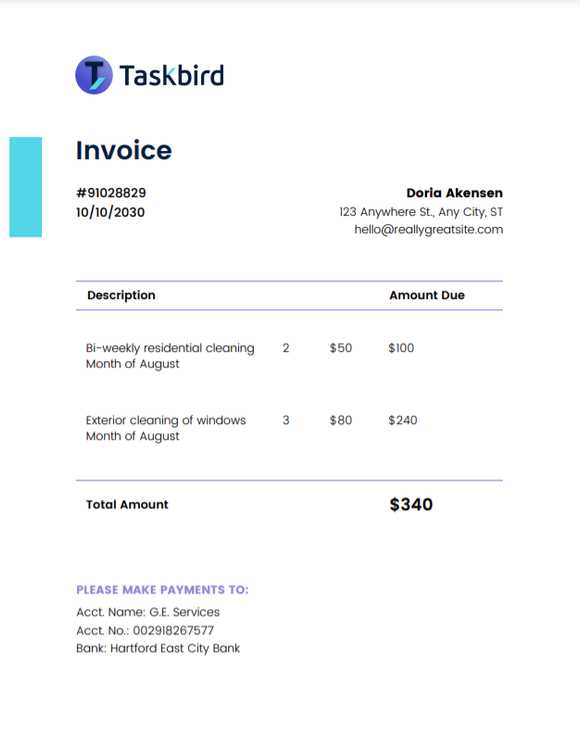

Including Service Details on Billing Records

When creating a billing document, it is essential to include a clear and comprehensive description of the services provided. By outlining the specifics of the work performed, you help clients understand exactly what they are being charged for, which enhances transparency and reduces the potential for confusion. Properly detailing each task ensures that both you and the client have a shared understanding of the services rendered and their associated costs.

Each record should specify key aspects of the work, including:

- Service Description: Provide a brief but detailed explanation of each task completed. This could include the type of work, the location, or the specific areas attended to.

- Time and Duration: Indicate how long each task took to complete, whether you’re charging by the hour or using flat rates for specific jobs.

- Materials and Products Used: If any special tools, products, or materials were required for the job, be sure to mention them, along with their costs if applicable.

- Frequency and Recurrence: For ongoing services, note the frequency of visits (e.g., weekly, monthly) and any associated pricing changes.

By incorporating these details, you ensure that your client has a clear understanding of the work completed and its cost breakdown. This level of detail can help prevent disputes and promote trust in your services.

What Payment Terms Should Be Listed

Clearly defining payment terms on your billing documents is crucial to ensure that both you and your clients are on the same page regarding when and how payments are to be made. Properly outlined terms help avoid misunderstandings and encourage timely payments. A well-structured payment section not only provides the client with all necessary details but also establishes professional expectations for the transaction.

Common Payment Conditions

Due Date: Always specify when payment is due. Whether it’s within a certain number of days after the service is completed (e.g., 30 days), or immediately upon receipt of the document, setting a clear due date prevents delays and ensures that both parties know when to expect the payment.

Accepted Payment Methods: Clearly list all the payment methods you accept, such as credit/debit cards, bank transfers, checks, or online payment platforms. This ensures that your client knows their available options for completing the payment.

Late Fees and Discounts

Late Payment Penalties: If applicable, include information about any late fees or interest charges that will be added if the payment is not received by the specified due date. This encourages timely payments and protects your business from cash flow disruptions.

Early Payment Discounts: If you offer discounts for early payments, make sure to include those details. For example, you might offer a 5% discount if the client pays within 10 days. This can incentivize prompt payment and benefit both parties.

By outlining clear payment terms, you create transparency and reduce the chances of delays or confusion, allowing for smoother financial transactions and a stronger working relationship with your clients.

Tracking Time and Services Provided

Accurately tracking the time spent on tasks and the specific services performed is essential for creating clear and fair billing documents. It helps ensure that clients are charged appropriately for the amount of work completed and prevents any misunderstandings regarding the scope of the job. By keeping detailed records of both time and services, you not only maintain transparency but also establish a foundation for better business management and client satisfaction.

How to Track Time Effectively

For service-based businesses, it is critical to monitor the duration of each task to ensure proper compensation. There are several ways to track time:

- Manual Tracking: You can record the start and end times of each task on a simple notepad or document. While this is easy to implement, it may be prone to human error.

- Time Tracking Software: Using apps or software specifically designed to track work hours can increase accuracy and reduce administrative effort. These tools often come with additional features like reporting and invoicing.

- Job-Based Time Records: For recurring jobs, maintaining a log of average task durations helps set standard billing rates and expectations with clients.

Detailing Services in Billing Documents

Each service provided should be clearly described, outlining the specific tasks performed during the visit. This not only helps justify the charges but also gives clients a better understanding of what they’re paying for. Include the following details for each service:

- Task Description: Provide a brief but specific explanation of the work done. For example, “Window washing” or “Deep floor scrub.” Avoid vague terms.

- Materials Used: If any special equipment or products were used, list them. This can help justify any extra costs beyond labor.

- Time Spent: Note how long each task took, especially if charging by the hour. This helps avoid disputes over work duration.

By tracking both time and specific services, you provide a detailed and transparent breakdown that clients can review, ensuring they understand the full scope of the work completed and are more likely to make timely payments.

How to Add Taxes and Fees

Including taxes and additional fees in your billing documents is essential for maintaining accuracy and complying with local regulations. Properly calculating and displaying these charges ensures that both you and your clients are aware of the total amount due. By clearly outlining taxes and any applicable extra fees, you also avoid potential disputes and ensure transparency in your financial transactions.

Calculating Taxes

Taxes are a critical component of any service charge, and how they are applied can vary based on location and service type. Here’s how to approach adding taxes to your billing record:

- Determine the Tax Rate: Research the applicable tax rate for your region or consult with a tax professional to ensure you’re using the correct percentage.

- Apply the Tax Rate: Multiply the total amount for services by the tax rate. For example, if the total charge is $100 and the tax rate is 8%, the tax would be $8, bringing the total to $108.

- Include Tax Information: Clearly list the tax amount on your billing document, alongside the original charges. This allows clients to see how much tax they are being charged and gives you a clear record for tax reporting purposes.

Adding Extra Fees

In addition to standard service charges and taxes, you may also need to include additional fees for special circumstances or materials. These can include:

- Travel Fees: If a job requires significant travel time, you may charge a travel fee. Clearly indicate this on the document, specifying the reason for the charge.

- Late Payment Fees: If your client is overdue on payment, apply a late fee according to your terms and include it in the total charge.

- Material Fees: If special products or materials were used, such as cleaning supplies or equipment, itemize these separately and include their cost.

By accurately calculating and listing all applicable taxes and fees, you ensure that your billing process is clear, transparent, and in line with legal requirements. This helps build trust with your clients and reduces the likelihood of disputes over charges.

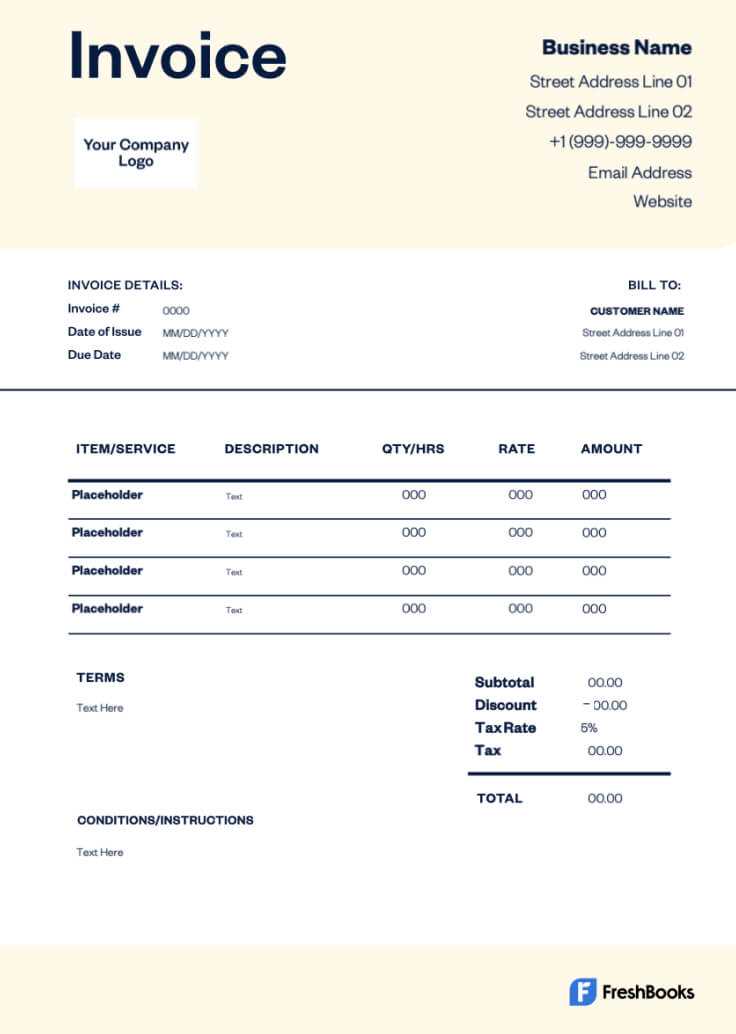

Personalizing Your Billing Document

Customizing your billing document can help enhance your business’s professionalism and make your communications with clients more personal. By incorporating unique elements, such as your logo, business values, or specific service details, you not only make the document visually appealing but also reinforce your brand identity. Personalizing the document ensures that it stands out and leaves a lasting impression on your clients.

Branding Your Document

Adding branding elements to your billing document can help build recognition and convey a sense of trustworthiness. Consider including the following elements:

- Business Logo: Place your logo at the top of the document to make it clear that the billing document represents your business.

- Color Scheme: Use your company’s brand colors in the document design to create a cohesive and professional look.

- Custom Font: If appropriate, use a font that aligns with your business’s identity to make the document feel more personalized.

Including Personalized Details

Personalization also involves adding specific information that makes the billing record more relevant to the client. For example:

- Client’s Name: Address your client directly by including their name at the top of the document. This simple detail can make the client feel valued and appreciated.

- Special Notes: Include a short note of thanks or specific details about the work completed to show attention to the client’s needs.

- Tailored Payment Terms: Customize the payment conditions based on the client’s needs or history with your business, such as offering personalized discounts or extended payment options.

| Element | Purpose |

|---|---|

| Business Logo | Reinforces brand identity and professionalism. |

| Client’s Name | Adds a personal touch and shows attention to detail. |

| Special Notes | Enhances the client experience by showing appreciation. |

By incorporating these personalized elements, you create a more memorable and professional billing document that reflects the values of your business while catering to the unique needs of your clients.

Digital vs Paper Billing Records: Pros and Cons

When it comes to billing, businesses face the decision of whether to use digital or paper records. Each method has its advantages and drawbacks, depending on your needs, preferences, and the nature of your business. Understanding the key benefits and challenges of both options can help you make an informed choice that suits your operations and enhances your customer experience.

Advantages of Digital Billing

Digital billing has become increasingly popular due to its convenience and efficiency. Some of the main benefits include:

- Speed: Sending digital records is nearly instantaneous, allowing for faster communication and quicker payments.

- Cost-Effective: Eliminates the need for paper, printing, and postage costs, which can add up over time.

- Accessibility: Digital files can be easily stored, organized, and retrieved, reducing the risk of losing important documents.

- Environmentally Friendly: Reduces paper waste and the environmental impact associated with printing and mailing physical copies.

- Automation: Many digital tools allow for automated billing, reminders, and reporting, saving time on administrative tasks.

Challenges of Digital Billing

While digital billing offers many advantages, there are a few challenges to consider:

- Technical Issues: Relying on digital systems means dealing with potential software glitches, hardware malfunctions, or connectivity issues.

- Security Concerns: Digital records may be vulnerable to hacking, data breaches, or loss if not properly encrypted or backed up.

- Client Preference: Some clients may prefer receiving physical copies or may not be comfortable with digital transactions.

Advantages of Paper Billing

Paper billing remains a reliable method for many businesses. Its benefits include:

- Tangible Document: Some clients prefer having a physical record to keep for their personal files, making it easier to track and store on paper.

- Widely Accepted: Paper documents are universally accepted and do not require internet access or technological proficiency to view.

- Trust and Tradition: For certain industries or clients, receiving a physical document may feel more formal, professional, or trustworthy.

Challenges of Paper Billing

Despite its advantages, paper billing comes with several drawbacks:

- Time-Consuming: Mailing physical copies can be slow, especially for distant clients or recurring billing cycles.

- Costly: Paper, ink, printing, and postage fees can add up over time, especially for businesses with many clients.

- Storage Is

Best Practices for Sending Billing Documents

Sending billing documents efficiently and professionally is essential for maintaining positive relationships with clients and ensuring timely payments. Following best practices can help you streamline the process, reduce errors, and create a better experience for both you and your customers. Whether you’re sending a paper or digital record, the approach you take can have a significant impact on your business’s financial operations.

Timeliness and Consistency

Send Promptly: The sooner you send out your billing documents after completing the service, the faster you can expect payment. Aim to send your documents within 24-48 hours of service completion to avoid unnecessary delays.

Be Consistent: Develop a routine for sending documents. Whether it’s weekly, bi-weekly, or monthly, having a set schedule ensures you don’t miss any billing cycles and keeps your cash flow predictable.

Clear and Accurate Information

Double-Check Details: Before sending any document, ensure that all information is accurate. This includes checking client details, the services performed, the dates, and any charges applied. Small mistakes can lead to confusion or delays in payment.

Include All Required Information: Always include a clear breakdown of services, total costs, taxes, and payment terms. A well-organized document helps your client understand the charges and makes it easier for them to process the payment.

Choosing the Right Delivery Method

Digital or Paper: Choose the delivery method that best suits your client’s preferences. If they prefer digital records, email or secure portals may be the best option. However, for clients who are not comfortable with digital formats, paper documents may be necessary. Always ask for their preferred method beforehand.

Follow-Up Reminders: If payment is not received by the due date, send a polite reminder. Many digital tools can automatically send reminders, or you can manually follow up to ensure the client is aware of the outstanding balance.

Professional Presentation

Maintain Professionalism: The way your billing document looks matters. Whether digital or paper, make sure your document is clear, legible, and well-organized. A professional appearance builds credibility and demonstrates attention to detail.

Branding and Personal Touch: Including your business’s logo, colors, and contact information makes your document look polished and reinforces your brand. Adding a brief thank-you note or a message of appreciation for their business can also help build stronger client relationships.

By following these best practices, you ensure that your billing process is smooth, professional, and efficient. This helps foster trust with your clients and contributes to a positive and long-lasting business relationship.

Common Billing Mistakes to Avoid

Errors in billing documents can lead to confusion, delayed payments, and damage to your professional reputation. It’s essential to carefully review your records before sending them to ensure accuracy and clarity. By avoiding common mistakes, you can improve the efficiency of your billing process and build stronger relationships with clients.

Common Errors to Watch For

Here are some of the most frequent mistakes businesses make when preparing billing documents:

- Missing or Incorrect Contact Information: Always verify that your business’s contact details and the client’s information are accurate. Mistakes here can cause delays in communication and make it difficult for your client to reach you with any questions.

- Unclear Service Descriptions: Vague or overly broad descriptions of services can lead to confusion. Be specific about the work completed so clients know exactly what they are being charged for.

- Incorrect Billing Amounts: Double-check your calculations, including taxes and any additional fees. Errors in pricing can lead to disputes and loss of trust with your clients.

- Omitting Payment Terms: Always include clear payment conditions, such as the due date, late fees, and accepted payment methods. Failing to specify these terms can result in delays and misunderstandings.

- Failure to Include a Unique Reference Number: A unique reference number makes it easier for clients to track payments and for you to manage records. Without it, you may face challenges in organizing your financial records.

How to Avoid These Mistakes

To reduce the risk of making these common mistakes, consider the following tips:

- Review Before Sending: Always double-check the information on your billing document. Look for any missing or incorrect details that might cause confusion later on.

- Use Software Tools: Many invoicing platforms include built-in error-checking features, which can help you spot common issues before sending the document to your client.

- Establish a Template: Using a consistent format for your billing records can help reduce mistakes. A pre-designed format will ensure that all essential information is included every time.

By avoiding these common billing mistakes, you can streamline your billing process, prevent payment delays, and maintain a professional relationship with your clients.

Tips for Faster Payments

Receiving payments on time is crucial for maintaining healthy cash flow in any business. There are several strategies you can implement to encourage quicker payments and avoid delays. By streamlining your billing process and improving communication with your clients, you can ensure that payments arrive promptly and efficiently.

Effective Strategies for Timely Payments

Here are some practical tips that can help speed up the payment process:

- Send Bills Immediately: The sooner you send out your billing records after completing the service, the quicker your client can process and pay. Aim to send your documents within 24 hours to kickstart the payment cycle.

- Offer Multiple Payment Options: Provide your clients with various ways to pay, such as credit cards, online transfers, or checks. The more options available, the easier it is for clients to settle their dues.

- Set Clear Payment Terms: Clearly specify the due date, late fees, and payment methods on your documents. This gives clients a clear understanding of what is expected and when the payment is due.

- Offer Early Payment Discounts: Consider offering a small discount for early payments. This incentivizes clients to pay sooner and can improve your cash flow.

- Follow Up on Overdue Payments: Send polite reminders if payment hasn’t been made by the due date. A gentle nudge can help keep the payment on the client’s radar.

Payment Terms Breakdown

One key factor in encouraging timely payments is ensuring that your payment terms are clear and straightforward. The following table outlines essential elements that should be included in your terms:

Element Purpose Due Date Clearly states when the payment is expected, helping to avoid confusion and delays. Late Fees Specifies penalties for late payments, motivating clients to pay on time. Accepted Payment Methods Lists the payment options available, giving clients flexibility in how they can settle the bill. Early Payment Discounts Encourages clients to pay ahead of schedule by offering a financial incentive. By implementing these practices and ensuring clear payment terms, you can encourage faster payments and reduce delays. A well-organized and client-friendly approach can make a significant difference in how quickly you receive payments, improving your business’s financial stability.

Using Billing Records for Business Management

Billing documents are not just tools for requesting payment; they can be valuable assets for managing various aspects of your business. Properly formatted and detailed records allow for easier tracking of income, monitoring cash flow, and keeping tabs on the services provided. In addition, they help in creating an organized system for finances, which is essential for long-term business success.

Benefits of Billing Records for Business Operations

Here are several ways that billing documents contribute to effective business management:

- Tracking Financial Performance: Billing documents give you a clear view of your earnings. Regularly reviewing them allows you to track revenue and identify trends in income over time.

- Improving Cash Flow: Consistently issuing detailed bills helps ensure payments are processed on time, improving cash flow and allowing you to manage your expenses more efficiently.

- Budget Planning: By analyzing the data from your billing records, you can better plan your budget, allocate resources, and make informed decisions about the growth of your business.

- Tax Preparation: Having organized records simplifies the process when it comes time to file taxes. Proper documentation of income and expenses makes it easier to report accurately and avoid issues with tax authorities.

- Building Client Relationships: Clear and consistent billing helps build trust with clients, showing them that you are professional and transparent in your business dealings.

Using Billing Records for Financial Tracking

To make the most of your billing records, ensure that you track and organize key financial data. The table below outlines some essential financial aspects that can be monitored using your billing documents:

Financial Aspect How Billing Documents Help Revenue Shows the total amount received for services, helping to track business income over time. Outstanding Balances Helps identify unpaid invoices and follow up with clients to ensure timely payment. Expenses Detailed records allow you to track any additional charges or expenses related to specific services. Payment History Provides a comprehensive overview of all past transactions, making it easier to spot payment patterns and identify recurring clients. By leveraging billing documents for these functions, you can manage your business’s finances with greater precision and confidence. Maintaining organized and up-to-date billing records is a key step in ensuring long-term business growth and financial health.

Legal Considerations in Billing Document Creation

When creating billing documents, it is essential to be aware of various legal considerations that can affect the validity and enforceability of your financial records. Ensuring that your records are legally compliant not only protects your business but also helps to avoid potential disputes or misunderstandings with clients. From tax requirements to payment terms, understanding the legal framework around your billing process can safeguard your interests and foster transparency.

Key Legal Aspects to Include in Billing Documents

To ensure that your billing records are legally sound, consider including the following essential elements:

Legal Element Description Tax Information Ensure your documents include the correct tax rates and calculations, as per local laws. This helps avoid tax issues and ensures you comply with regulations. Clear Payment Terms Specify due dates, late fees, and accepted payment methods to avoid confusion. This ensures that both parties are aware of the conditions under which payment should be made. Business Identification Include your business’s name, registration number, and c Top Tools for Creating Billing Records

Creating professional and accurate financial documents is essential for businesses of all sizes. Whether you’re handling services for clients or managing multiple transactions, having the right tools can streamline the process and ensure you produce well-organized, error-free records. In this section, we will explore some of the best tools available to help you create and manage your billing documents with ease.

Best Tools for Crafting Billing Documents

The following tools are highly recommended for simplifying the creation of your financial records:

- QuickBooks: A popular choice among businesses of all sizes, QuickBooks offers a comprehensive suite of features, including invoice generation, expense tracking, and financial reporting. It integrates with various payment systems, making it easier to manage your financial operations.

- FreshBooks: Known for its user-friendly interface, FreshBooks makes it simple to create and send invoices, track time, and monitor payments. It’s ideal for small business owners and freelancers who need to stay organized.

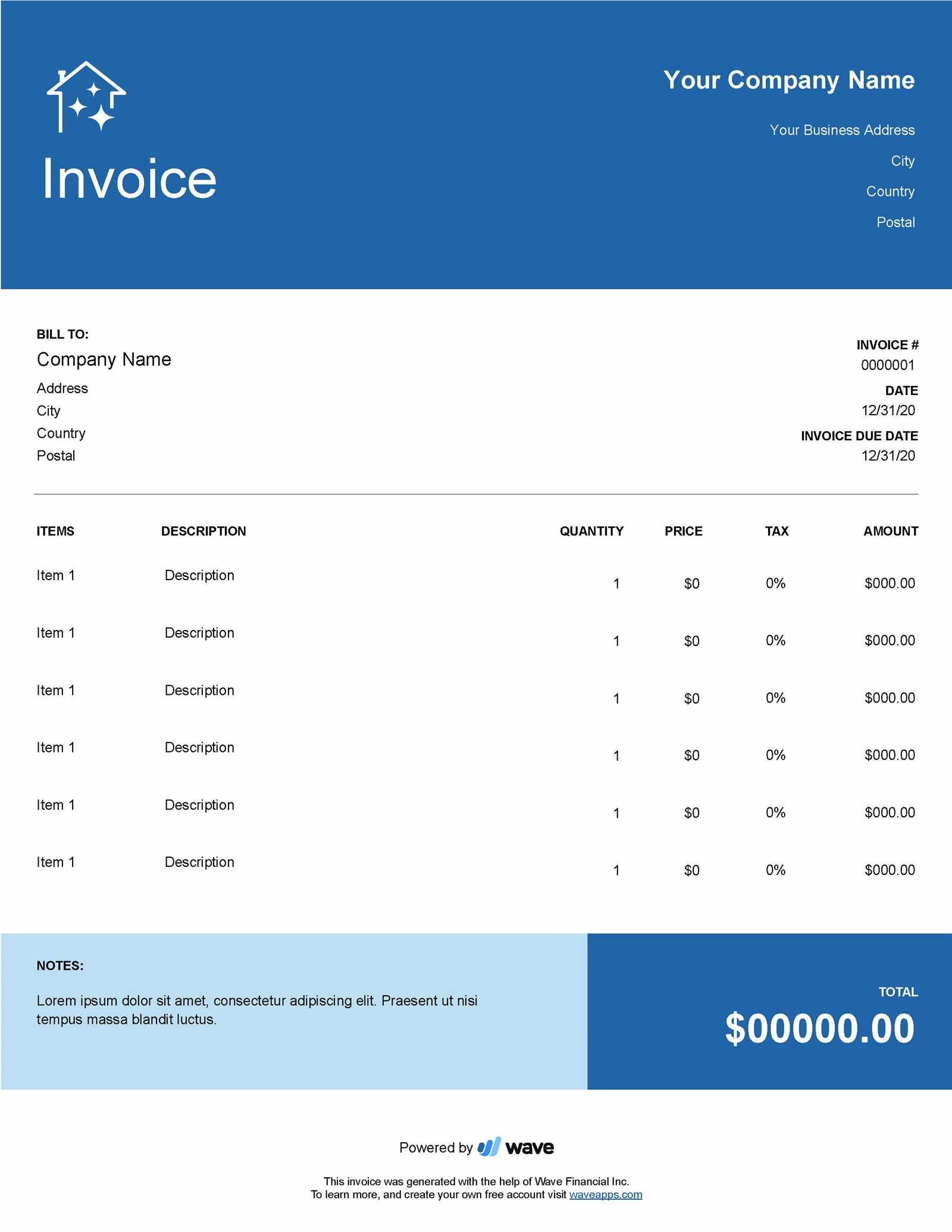

- Wave: Wave offers free invoicing software with an intuitive design and essential features such as automatic billing reminders, customizable templates, and easy integration with payment systems.

- Zoho Invoice: This tool allows for unlimited invoicing with customizable templates, automated payment reminders, and detailed reports. Zoho is a great option for businesses looking to automate their billing process.

- Invoicely: With both free and paid plans, Invoicely is a solid option for businesses needing simple invoicing capabilities. It supports multiple currencies, recurring invoices, and integrates with payment gateways.

Choosing the Right Tool for Your Business

When selecting a tool for creating financial records, consider your business needs and the features that will provide the most value. Here are some factors to help guide your decision:

- Ease of Use: Choose a tool that fits your level of technical expertise and offers an intuitive interface to save time.

- Integration Options: Ensure the tool integrates seamlessly with other software you use, such as accounting systems, payment processors, or customer relationship management (CRM) tools.

- Customization: Look for software that allows you to personalize the format, style, and content of your billing documents to reflect your business identity.

- Reporting Features: Having access to financial reports is essential for business management. Make sure your tool provides insightful reports to help you track income, payments, and outstanding balances.

By selecting the right tool for creating your billing documents, you can save time, improve accuracy, and focus on growing your business with more efficiency and professionalism.