Repair Service Invoice Template for Simple and Professional Billing

Efficient billing is an essential part of any business, ensuring that you maintain a smooth workflow and get paid on time. Having a structured document for tracking charges, payments, and client information can simplify the entire process. This approach not only helps avoid confusion but also contributes to building trust with clients by providing clear and accurate financial records.

In this guide, we’ll explore how to craft a comprehensive billing document that covers all the necessary details while maintaining professionalism. By using the right structure, you can ensure that each transaction is documented properly and your business stays organized. From pricing breakdowns to payment terms, understanding the core elements of a well-designed bill is key to successful financial management.

Repair Service Invoice Template Overview

When running a business that involves providing solutions to clients, having an organized and clear document to record the details of each transaction is crucial. This document serves as a formal record that ensures both parties are aware of the work performed, the agreed charges, and payment terms. Whether you are working with individuals or companies, having a consistent format for these records helps establish professionalism and fosters trust with clients.

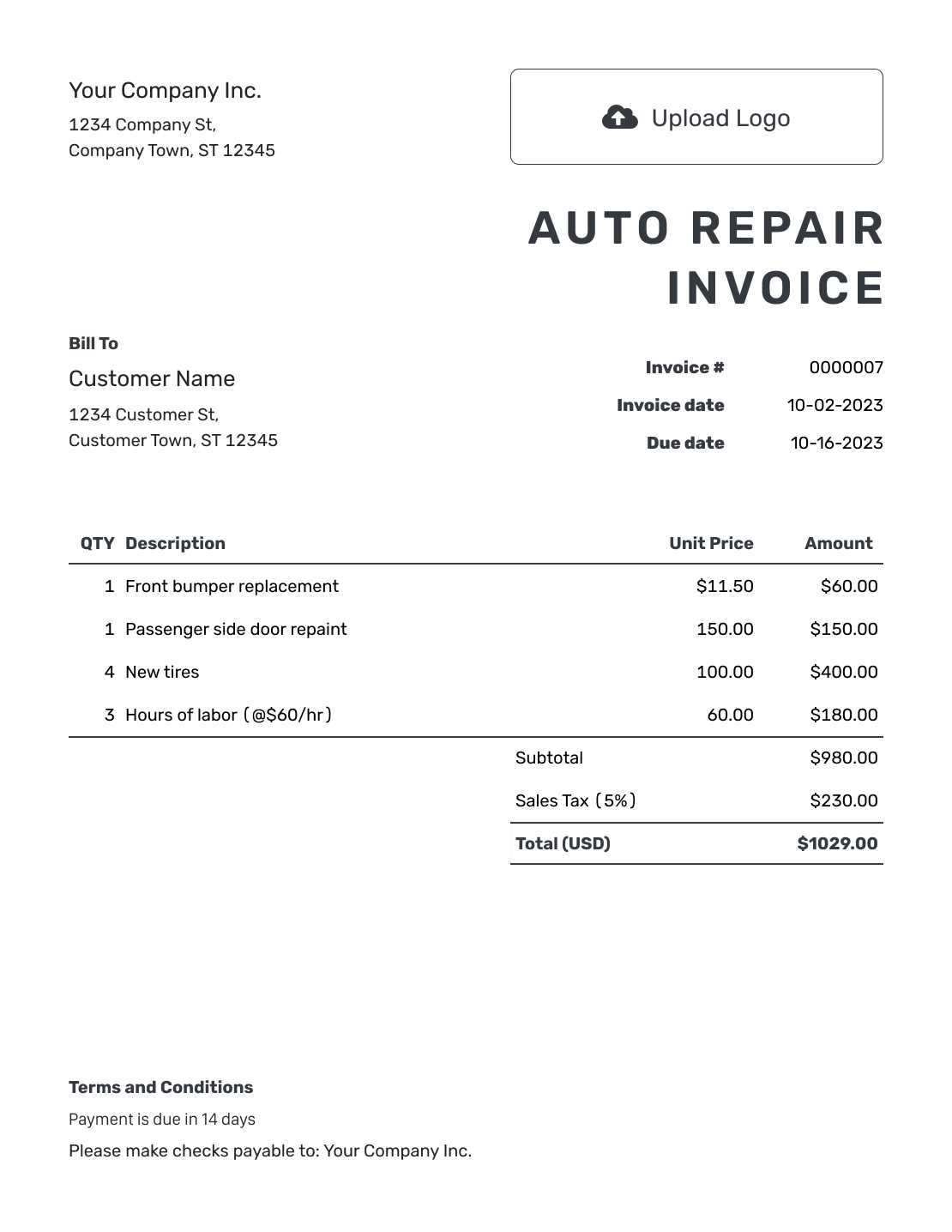

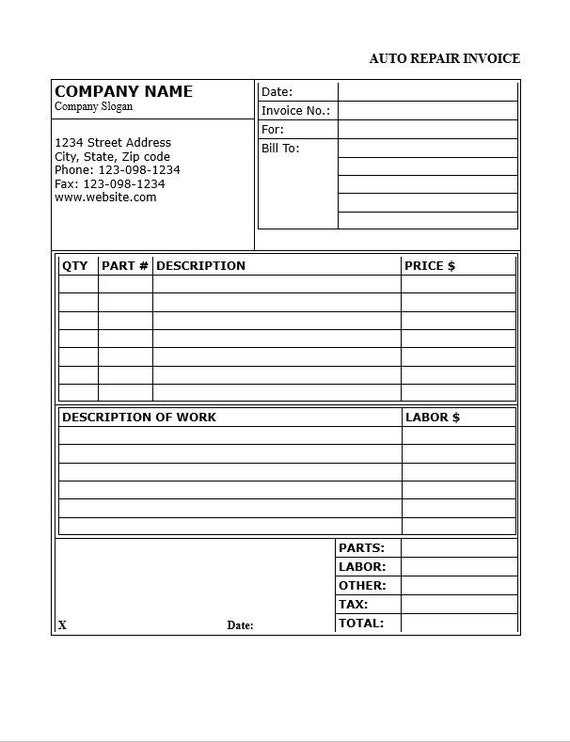

Such documents typically include important sections such as customer information, a description of the work done, pricing breakdowns, payment details, and the terms of service. The key to an effective document is clarity and structure, ensuring that no detail is overlooked and both parties are aligned on expectations.

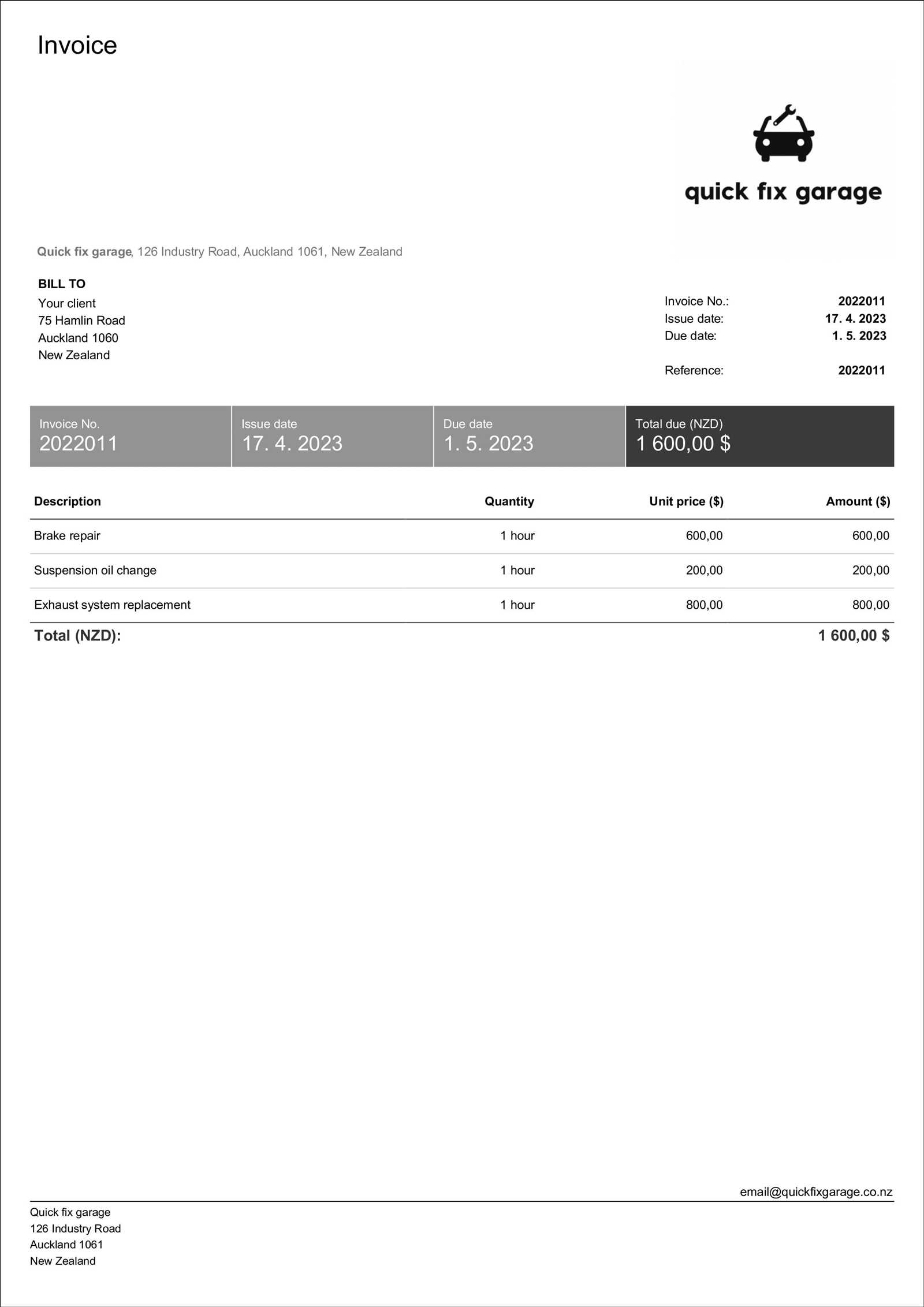

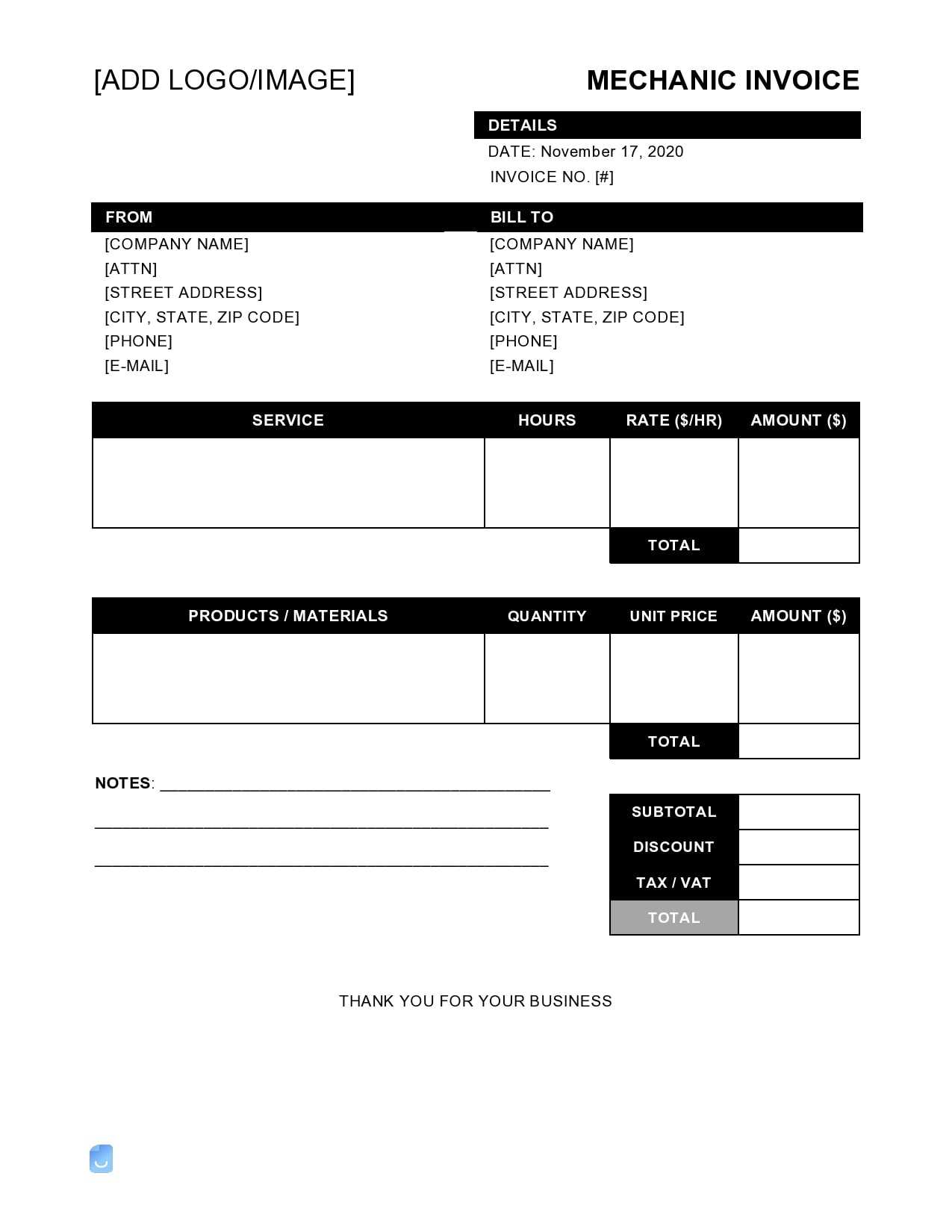

Here is a basic structure for a typical document used to track work completed and associated costs:

| Section | Description |

|---|---|

| Client Information | Details of the customer including name, address, and contact information. |

| Work Description | A clear summary of the work performed or materials provided. |

| Cost Breakdown | A detailed list of charges, including labor and materials. |

| Payment Terms | Details regarding the total amount due, payment methods, and due date. |

| Additional Notes | Any extra information relevant to the agreement or work performed. |

By incorporating these elements into your documents, you can ensure that both you and your clients have a clear understanding of the transaction, reducing the likelihood of misunderstandings or disputes. This also aids in maintaining a well-organized record for future reference and accounting purposes.

Why You Need an Invoice Template

Having a structured document for tracking transactions is essential for maintaining professionalism and organization in any business. It helps ensure that every financial exchange is clearly documented, reducing the chances of disputes and ensuring timely payments. A consistent approach to creating these documents also simplifies accounting and streamlines communication with clients.

Clarity and Accuracy

A standardized format for documenting charges and payment details guarantees that all necessary information is included. This eliminates the risk of missing important elements such as pricing, payment terms, and contact information. Clients will appreciate the transparency and clarity, making them more likely to pay promptly and without confusion.

Time-Saving and Efficiency

Creating these documents from scratch every time can be time-consuming and prone to error. By using a pre-designed structure, you save valuable time and effort. With just a few edits to each document, you can ensure consistency across all transactions, reducing administrative work and allowing you to focus on growing your business.

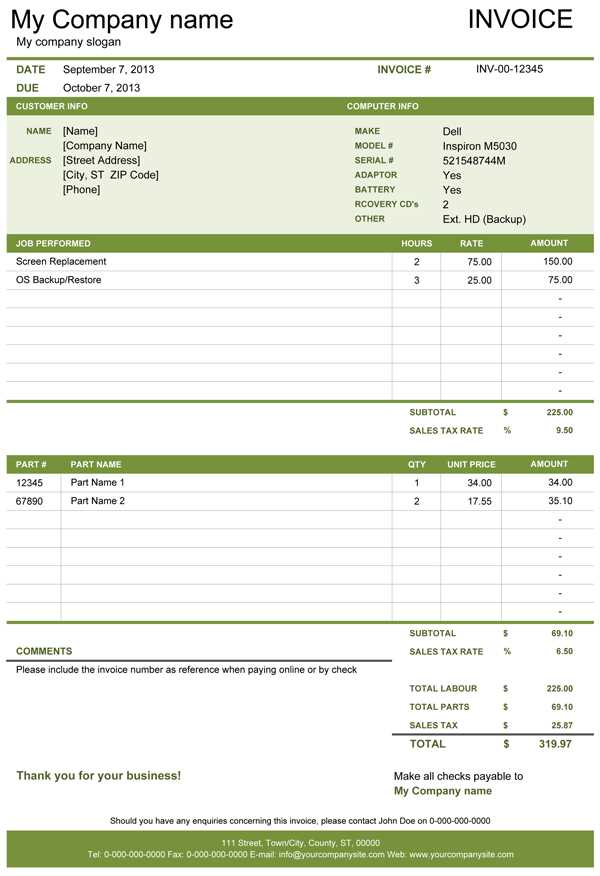

Key Elements of a Repair Invoice

When documenting a transaction for work completed or products provided, there are several essential components that ensure clarity and accuracy. These elements not only help to communicate the details of the transaction but also protect both the business and the customer by outlining the agreement in a clear, formal manner. Including the right information can minimize misunderstandings and facilitate a smooth payment process.

Core Sections to Include

To create a comprehensive document, there are several core sections that should be included. Each section serves a specific purpose, ensuring that all parties involved have a complete record of the work performed, pricing details, and payment terms.

| Section | Description |

|---|---|

| Client Information | Include the customer’s name, address, and contact details for proper identification. |

| Work Description | A detailed description of the work completed or the items provided during the transaction. |

| Cost Breakdown | List individual costs, such as labor charges, materials used, and any additional fees. |

| Payment Terms | Clearly define payment methods, due dates, and any applicable late fees or discounts. |

| Payment Status | Indicate whether payment is pending, completed, or partially paid. |

Additional Information to Include

In addition to the basic sections, you may want to include extra details depending on the specific transaction. This could involve any special notes regarding warranties, guarantees, or follow-up actions that are important for both parties to be aware of. These extra not

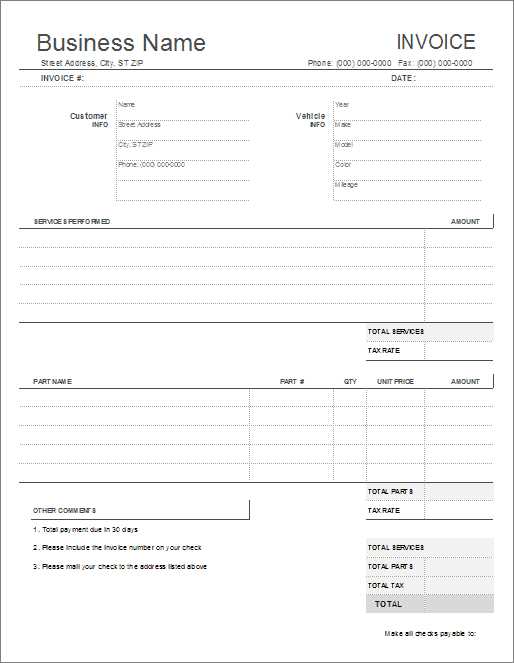

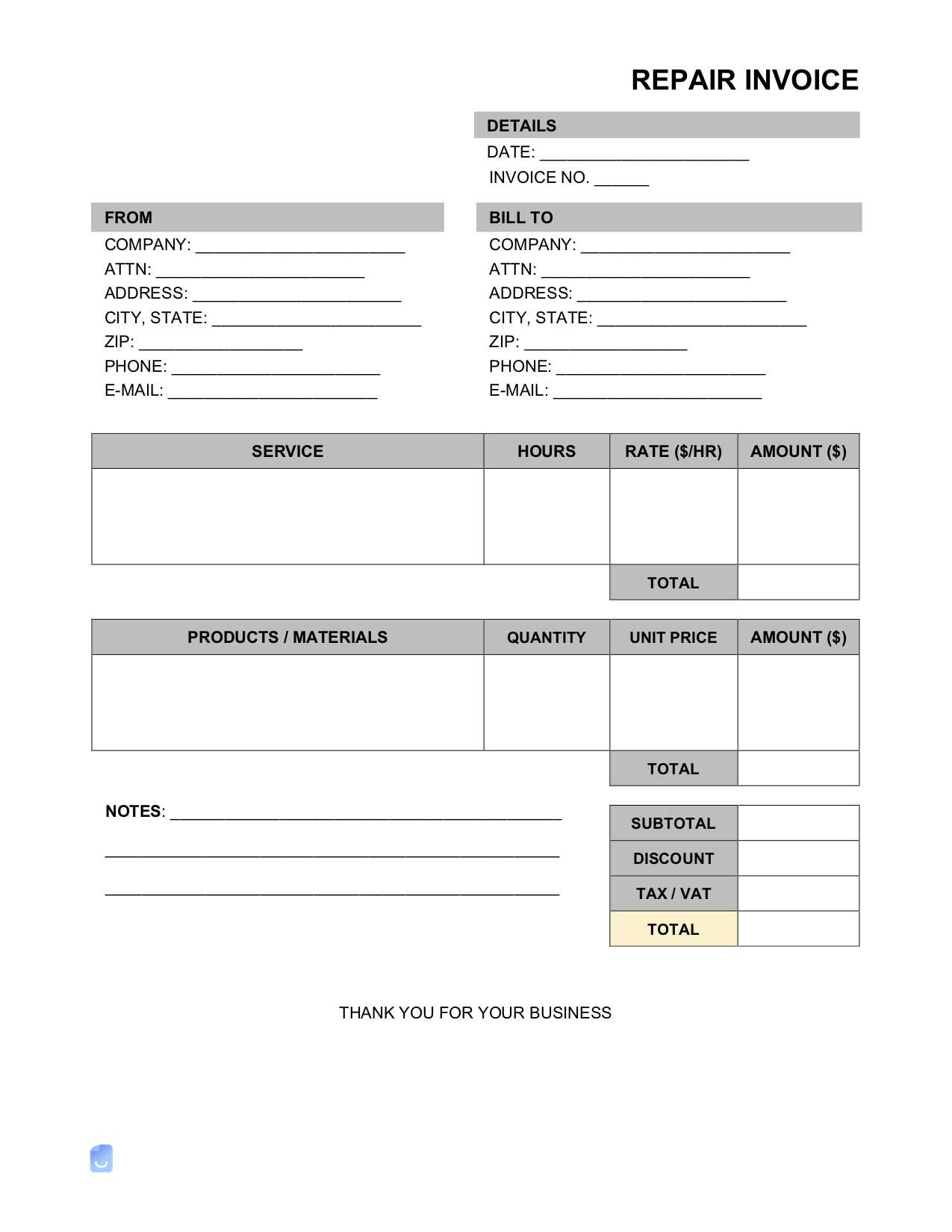

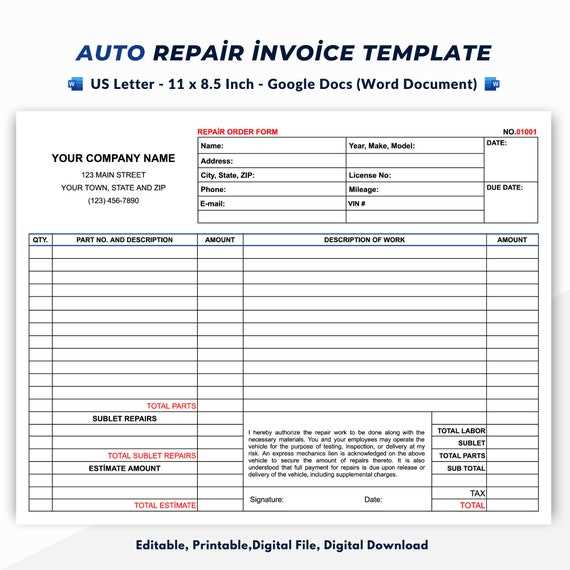

Customizing Your Repair Service Invoice

Customizing your billing document is an important step in ensuring it reflects the specific needs of your business and provides a professional touch to each transaction. Personalizing the layout, design, and content not only enhances your brand identity but also makes it easier for clients to understand the terms and details of the transaction. A tailored document can improve the efficiency of your billing process and help avoid confusion down the line.

Personalizing Content and Layout

One of the key aspects of customization is adjusting the content to suit your business’s unique requirements. This may include adding your company logo, adjusting fonts and colors to match your brand’s identity, or modifying the layout to make it more user-friendly. Additionally, you may want to add or remove certain sections based on the nature of the work you perform. For instance, you might include a section for “parts used” if you are working with physical products or “hours spent” if your charges are hourly.

Including Special Terms and Conditions

Another essential part of customization is setting specific terms and conditions relevant to your business. Whether it’s outlining warranty policies, late payment fees, or service guarantees, having these terms clearly stated helps manage expectations and ensures that both you and your clients are aware of your rights and responsibilities. By customizing this section, you can ensure that important details are not overlooked, providing a more professional and transparent experience for both parties.

Choosing the Right Template Format

Selecting the appropriate format for your billing document is essential for ensuring clarity, ease of use, and professionalism. Different formats offer various advantages, depending on your business needs, whether you prioritize accessibility, customization, or integration with accounting tools. The right choice can streamline your process, making it faster and more efficient to generate and manage these records.

Format Types to Consider

There are several types of formats available, each with its own set of benefits. The most common formats include PDF, Word, and Excel. Each of these provides unique features that might suit different aspects of your business. Choosing between them depends on how you prefer to store, share, and edit your documents.

| Format | Advantages | Disadvantages |

|---|---|---|

| Universally accessible, professional appearance, easy to share and print. | Not easily editable after creation. | |

| Word | Highly customizable, easy to edit and format. | Less secure for sharing, as it can be easily altered. |

| Excel | Perfect for managing large volumes of transactions, automatic calculations. | May look less professional, difficult to share without formatting issues. |

Choosing the Best Fit for Your Needs

Ultimately, the right format will depend on how you plan to use and distribute your documents. If you need to send professional, non-editable records, PDFs are ideal. For ongoing editing and tracking, Word or Excel formats may be more suitable. Consider your workflow and decide which format best supports your business’s needs and the way you interact with clients.

Benefits of Using an Invoice Template

Utilizing a pre-designed document for tracking transactions brings numerous advantages to any business. These structured records save time, reduce errors, and improve professionalism. By relying on a consistent format, businesses can streamline their administrative tasks, ensuring that all necessary details are included without having to create each document from scratch.

Improved Accuracy and Consistency

One of the key benefits of using a standardized format is that it ensures consistency across all your records. With set fields for customer details, charges, and terms, the risk of omitting important information is greatly reduced. This consistency also leads to greater accuracy in financial tracking and ensures that both you and your clients are always on the same page.

Time-Saving and Efficiency

Creating records manually for every transaction can be time-consuming, especially for businesses handling multiple clients. By using a pre-designed structure, much of the work is already done for you, allowing you to simply input the relevant information. This significantly speeds up the process, freeing up time to focus on other important aspects of your business.

| Benefit | Description |

|---|---|

| Time Efficiency | Automates repetitive tasks and speeds up the billing process. |

| Professional Appearance | Ensures a clean, consistent look that enhances business image. |

| Easy Customization | Templates can be tailored to suit specific business needs or client requirements. |

| Improved Tracking | Helps in maintaining an organized record of all transactions for future reference. |

By using a well-organized format, businesses can easily maintain professional records, enhance customer trust, and simplify financial management, all of which contribute to s

Common Mistakes in Service Invoices

When creating records for completed work or products provided, it’s easy to overlook small details that can lead to confusion or delays in payment. Even minor errors in these documents can cause frustration for both the business and the client, potentially affecting cash flow and the overall professional relationship. By understanding and avoiding common mistakes, you can ensure that your records are accurate and effective.

Frequently Made Errors

There are several common mistakes businesses often make when preparing these financial documents. These errors, if not corrected, can create misunderstandings, delayed payments, and even legal issues. Some of the most frequent issues include:

- Missing Client Information: Failing to include complete customer details such as name, address, or contact information can lead to confusion when referencing a transaction later on.

- Unclear Work Descriptions: Not providing enough detail about the work performed or the materials used can leave clients questioning the charges.

- Incorrect Pricing: Entering wrong amounts for labor or materials can result in disputes and damage your credibility.

- Omitting Payment Terms: Not specifying the payment method, due date, or penalties for late payments can cause delays in receiving payments.

- Inconsistent Formatting: A disorganized or inconsistent format can confuse clients and give an unprofessional impression.

- Failure to Include Tax Information: Forgetting to list applicable taxes or discounts can lead to issues with clients or authorities later on.

How to Avoid These Mistakes

To prevent these issues, businesses should establish a clear process for creating and reviewing these doc

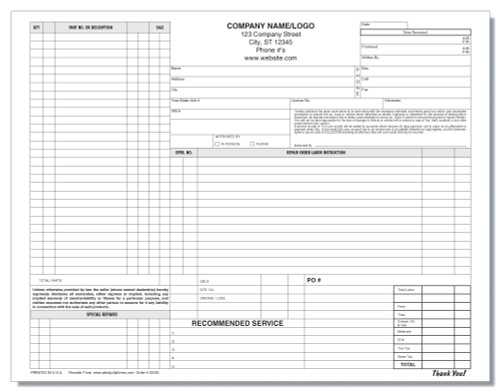

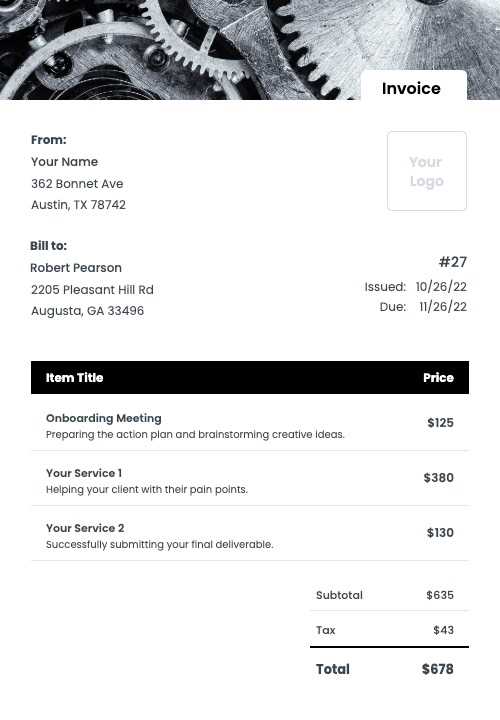

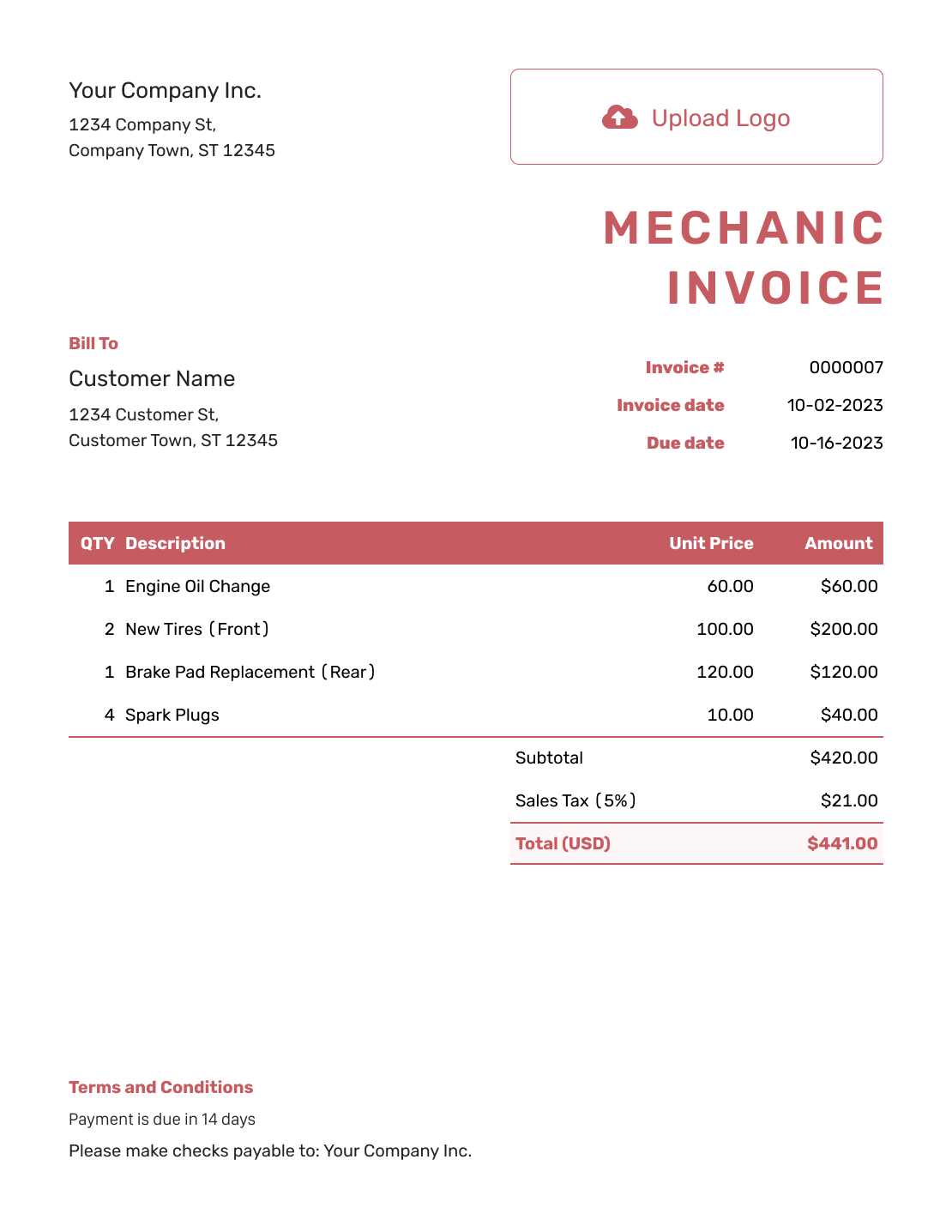

How to Include Labor and Material Costs

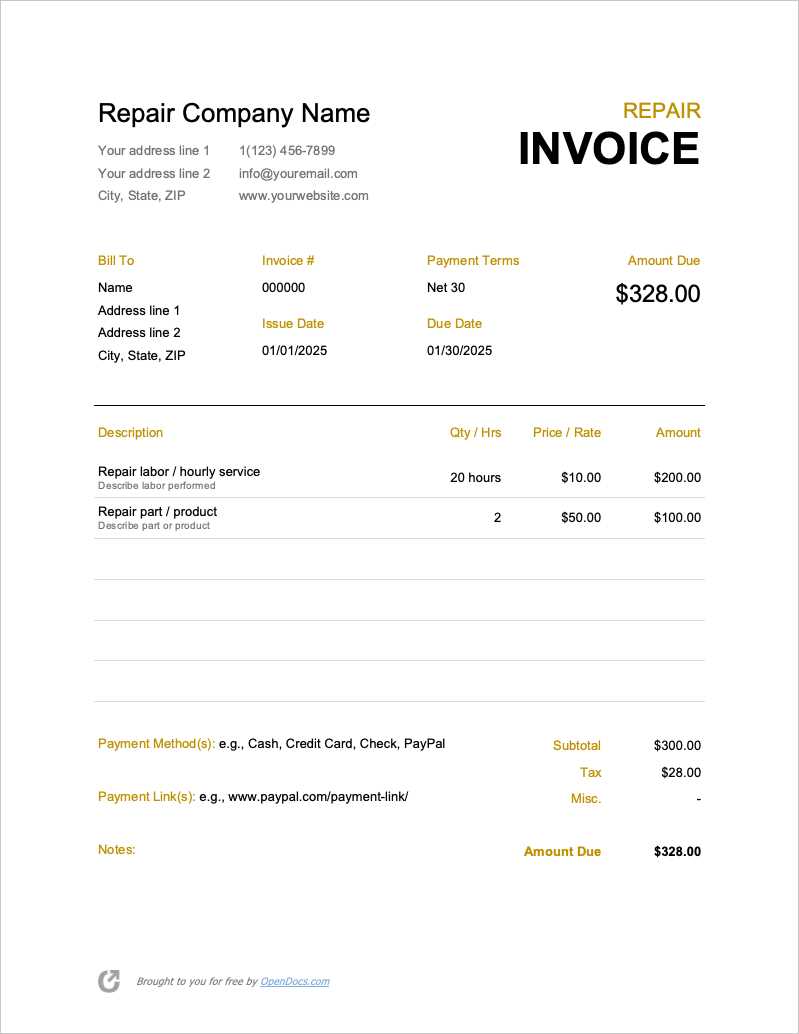

Accurately documenting both labor and material costs is crucial for transparency and ensuring clients understand how their charges are calculated. These two components often make up the majority of the total cost for work completed, and clearly breaking them down ensures there are no misunderstandings. Whether you’re charging for hours worked or materials used, providing a detailed breakdown can build trust and ensure clients are on the same page regarding pricing.

Including Labor Costs

Labor costs refer to the fees associated with the time spent performing a task. When documenting labor, it’s important to include the following information:

- Hourly Rate or Fixed Fee: Specify the rate charged per hour or the agreed-upon flat fee for the job.

- Time Spent: Clearly state the total number of hours worked, or if a flat fee was agreed, mention the number of hours or days estimated.

- Description of Work: Provide a brief description of the tasks performed during the labor period, so clients can understand exactly what they are being charged for.

- Overtime or Premium Charges: If applicable, include additional charges for overtime or work completed outside regular hours.

Including Material Costs

Material costs involve any goods or items used in the completion of the work. To accurately reflect these costs, ensure you include:

- Itemized List of Materials: List each item used along with the quantity and unit cost to ensure full transparency.

- Supplies and Tools: If you provided any specialized tools or supplies, include those items in the cost breakdown as well.

- Total Material Costs: Sum up the total cost of materials used, including any taxes, delivery fees, or additional charges associated with procurement.

By clearly distinguishing between labor and material charges, yo

Setting Payment Terms in Invoices

Clearly outlining payment terms is essential for managing cash flow and ensuring that both you and your clients are aligned on expectations. Establishing clear guidelines regarding when and how payments should be made helps prevent confusion and delays. By specifying the due date, accepted payment methods, and any penalties for late payments, you create a transparent agreement that reduces the likelihood of disputes and ensures timely compensation for the work completed.

Key Elements of Payment Terms

When setting payment terms, it’s important to include several key details to ensure clarity. These terms should be simple, clear, and agreed upon by both parties before the work begins. Here are some common elements to include:

- Due Date: Specify the exact date by which payment must be made. This helps clients understand the timeline and prevents delays.

- Accepted Payment Methods: List all payment options available, such as credit cards, bank transfers, checks, or online payment systems.

- Late Payment Fees: Include any charges that may apply if the payment is not received by the due date, such as a flat fee or a percentage of the total amount due.

- Discounts for Early Payment: Offer incentives for clients who pay before the due date, such as a small percentage off the total amount.

- Deposit Requirements: If applicable, specify if an upfront deposit is required before the work begins and how much is expected.

Why Clear Payment Terms Are Important

By establishing these terms in advance, you ensure that both parties have a clear understanding of expectations, which reduces the chances of misunderstandings. Having a specific due date and pe

Creating Professional and Clear Invoices

Generating clear, professional records for completed work is essential for maintaining a positive relationship with clients and ensuring smooth financial transactions. A well-organized document not only helps communicate important information but also enhances your business’s credibility. The key to creating effective records lies in providing all necessary details in a concise, easy-to-understand format, which allows clients to process payments without confusion or delays.

To create an impactful and professional document, ensure the following aspects are considered:

- Clarity of Information: Make sure every item or service provided is listed with a clear description and corresponding charges, so clients know exactly what they are being billed for.

- Consistent Layout: Use a clean and structured format that allows easy navigation through sections such as client information, work description, charges, and payment terms.

- Branding: Include your company logo and consistent color schemes to reinforce your business’s identity and professionalism.

- Correct Details: Ensure that client details, work descriptions, dates, and payment information are accurate, preventing any potential confusion.

By following these guidelines, you can create records that reflect your business’s professionalism, foster trust with clients, and help ensure timely payments. A well-prepared document is a small but powerful tool in maintaining an organized and efficient workflow.

Tracking Payments with Invoice Templates

Keeping track of payments is crucial for managing your business’s cash flow and ensuring that no outstanding balances go unnoticed. By using structured billing records, you can easily monitor when payments are made and identify any overdue amounts. An organized system helps reduce confusion, prevents missed payments, and allows you to stay on top of your financial transactions.

How to Effectively Track Payments

To effectively track payments, it is important to include specific details within each document that will help you monitor the status of each transaction. Ensure that every record clearly indicates the payment status and includes the necessary tracking information:

- Payment Status: Mark each record as “Paid,” “Unpaid,” or “Partially Paid” to keep a clear record of what has been settled and what is still pending.

- Due Dates: Include a specific due date for each transaction, which will help you follow up with clients before payments become overdue.

- Payment Methods: Indicate how payments were made (e.g., credit card, bank transfer, check) to track preferred payment channels and verify that the correct amounts were received.

- Outstanding Balances: If there is any remaining balance after partial payments, clearly indicate the amount owed and the expected payment schedule.

Benefits of Payment Tracking

Tracking payments through detailed and organized records allows you to quickly identify discrepancies, follow up on late payments, and maintain better financial oversight. Additionally, having a reliable tracking system in place can help you forecast future cash flow and improve business planning. By regularly updating payment statuses, you ensure that both you and your clients have up-to-date records of financial transactions, reducing the risk of misunderstandings or missed payments.

Free vs Paid Invoice Templates

When selecting a structure for documenting completed work and transactions, businesses are often faced with the decision of whether to use free or paid options. Both choices come with their own set of advantages and limitations, which can impact the overall efficiency, professionalism, and customization of your records. Understanding the differences between free and paid solutions can help you make the right choice based on your business needs, budget, and desired features.

Free options typically provide basic functionality and may be ideal for small businesses or individuals just starting out. These options often include standard features that are easy to use and don’t require significant investment. However, free choices may lack advanced customization options, security features, or customer support.

Paid solutions, on the other hand, tend to offer a wider range of features, including more sophisticated designs, enhanced security, and the ability to integrate with other business tools. They often provide greater flexibility, more customization options, and support services to ensure that any issues are addressed quickly. These options are typically suited for businesses that need to handle a higher volume of transactions or require more professional and branded records.

Ultimately, the decision between free and paid options depends on your business size, the complexity of your billing needs, and your long-term goals. While free options can be sufficient for basic needs, a paid solution may be worth considering if you require more advanced features or expect to scale your business.

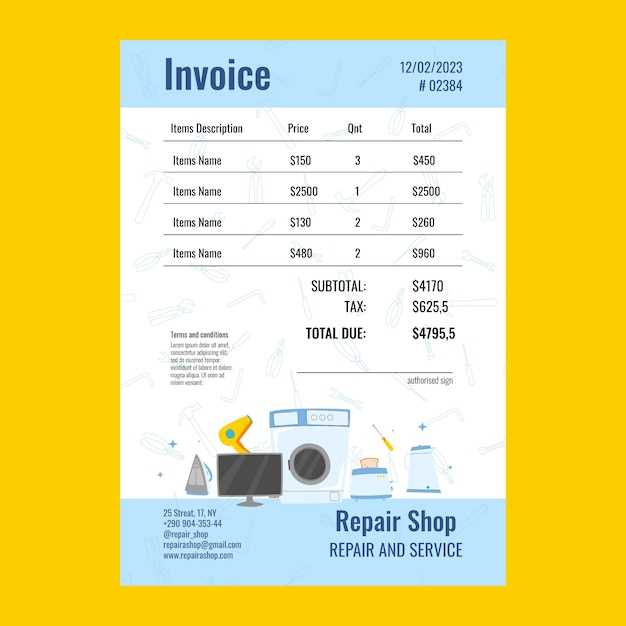

How to Add Discounts and Taxes

Including discounts and taxes in your billing records is an important part of providing transparent and accurate financial documentation. Discounts can encourage early payment or reward customer loyalty, while taxes ensure compliance with local regulations. Properly applying both ensures that your customers are aware of the final amount they owe and helps you avoid any legal issues regarding tax collection.

Adding Discounts

Offering discounts can be a great way to incentivize timely payments or reward loyal customers. To add a discount to your billing document, consider the following steps:

- Percentage or Fixed Amount: Decide whether the discount will be a fixed amount or a percentage of the total cost. Be clear about the method and amount applied.

- Apply Before or After Taxes: Specify whether the discount applies before taxes are calculated or after. This is important for transparency and avoiding confusion.

- Terms of Discount: Include the conditions for the discount, such as a specific due date for early payment or a loyalty reward for repeat customers.

- Clearly Display the Discount: Show the discount as a separate line item in the breakdown, so that it is easily identifiable by the customer.

Including Taxes

Taxes are an essential part of the transaction process, and it is crucial to ensure they are correctly calculated and displayed. Here are some steps for including taxes:

- Tax Rates: Identify the applicable tax rate for the goods or work performed based on local or national tax laws. This can vary depending on the location and nature of the transaction.

- Separate Tax Lines: List the tax amount separately from the base cost and any discounts, so the customer can clearly see the tax being applied.

- Tax Identification Number: Include your business’s tax ID number if required by law, which ensures your business is compliant with tax regulations.

- Specify Taxable Items: Make it clear which parts of the work or products are taxable, particularly if only certain items are subject to tax.

By carefully adding both

Integrating Invoice Templates with Accounting Software

Seamlessly integrating billing records with accounting software can streamline financial management and reduce administrative work. By connecting these two tools, businesses can automate data entry, track payments in real time, and ensure accurate financial reporting. This integration allows for greater efficiency, better cash flow management, and the reduction of errors that may occur when handling billing and accounting separately.

To successfully integrate your billing records with accounting software, here are some key steps to follow:

- Choose Compatible Tools: Select accounting software that supports integration with the format you use for documenting transactions. Many platforms offer built-in integrations or allow you to import and export data easily.

- Set Up Automatic Data Sync: Configure the system to automatically sync details such as customer information, payment status, and transaction amounts from your billing system to the accounting software.

- Customize for Specific Needs: Customize the integration settings to ensure that all relevant information, like tax rates, discounts, or payment terms, is transferred correctly.

- Monitor and Reconcile Transactions: Regularly monitor the integration to ensure everything is syncing properly, and reconcile any discrepancies that may arise between the billing records and the accounting system.

By integrating these systems, businesses can save time, improve accuracy, and focus on more important tasks, such as client relations and business growth. With a well-connected setup, financial tracking becomes easier, and administrative tasks are simplified, leaving you with more time to focus on core business operations.

Legal Considerations for Repair Invoices

When creating financial documents for completed work, it’s crucial to ensure that all the necessary legal requirements are met. These records are not just tools for tracking payments–they also serve as contracts and evidence in the event of disputes. Understanding the legal aspects of billing helps businesses avoid misunderstandings and ensures compliance with local laws and industry standards.

There are several important legal considerations to keep in mind when creating financial documents for work completed:

- Accurate Information: Always ensure that all details on the document are correct, including the names, addresses, and contact information of both the service provider and the client. Inaccurate details can lead to legal challenges or disputes.

- Clear Terms and Conditions: Clearly state the terms of the agreement, including payment due dates, applicable taxes, and any other relevant conditions. This helps set proper expectations and can prevent future conflicts.

- Local Tax Laws: Ensure that your document adheres to local tax regulations. This includes correctly calculating and listing sales taxes, VAT, or any other required charges. Non-compliance can result in fines or legal complications.

- Legal Language: Use clear, legally sound language. If the document serves as a contract or includes clauses that could affect liability or obligations, ensure the terms are written in a way that protects both parties and is easily enforceable.

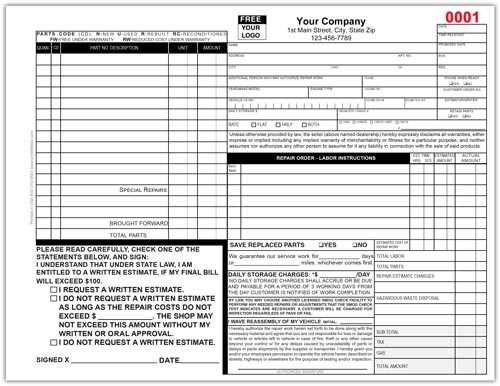

- Signature Requirements: In some cases, it may be necessary for both parties to sign the document to make it legally binding. Ensure that any required signatures or acknowledgment fields are included where appropriate.

By keeping these legal considerations in mind, you can create documents that not only help you maintain clear financial records but also protect your business from potential legal issues. Ensuring compliance and accuracy is crucial to maintaining trust with clients and avoiding future disputes.

How to Send and Manage Invoices

Effectively managing and sending financial documents is an essential part of maintaining a smooth business operation. Proper handling ensures timely payments, reduces administrative overhead, and helps maintain a positive relationship with clients. This section outlines the best practices for sending these documents and keeping track of payment statuses, ensuring a streamlined workflow.

Sending Financial Documents

Sending your billing records to clients in a professional and timely manner is crucial for ensuring that payments are processed without delays. Here are some methods to consider when sending your records:

- Electronic Delivery: Sending documents via email or through an online platform is fast and efficient. Make sure to include a clear subject line and attach the document in a universally accessible format (such as PDF) for ease of viewing and printing.

- Postal Mail: For clients who prefer physical copies, mailing documents may be necessary. Always use a reliable postal service and consider adding tracking or delivery confirmation for added security.

- In-Person Delivery: In some cases, delivering a hard copy in person may be preferred, especially for large or important transactions. This also allows for direct communication with the client regarding the document.

Managing Payment Status

Once the documents are sent, it is important to effectively track the payment status. Here are some best practices for managing payment information:

- Record Payment Dates: Keep track of when payments are made and update your financial records accordingly. This helps you stay organized and ensures you can follow up on overdue payments in a timely manner.

- Monitor Overdue Payments: If a payment is not received by the due date, set up reminders for clients. Using automated reminders through accounting software or manual follow-ups can help speed up the payment process.

- Use Payment Methods: Keep a record of how payments are made (e.g., credit card, bank transfer, check). This will help you identify any discrepancies or issues with payment processing and provide transparency to the client.

By carefully managing the sending and tracking of financial documents, businesses can ensure timely payment processing and a more organized, efficient workflow. Establishing clear communication and consistent follow-ups is essential to maintaining a healthy cash flow and strong client relationships.

Updating and Storing Your Invoice Templates

Regularly updating and securely storing your financial documents is crucial for maintaining accuracy and ensuring compliance with any changes in laws or business needs. This process not only helps keep your records organized but also allows for easier access and retrieval when needed. Whether it’s for tax purposes, audits, or internal record-keeping, ensuring your documents are kept up to date and properly stored can save time and reduce errors in the long run.

Here are a few best practices for managing and maintaining your financial records:

Updating Your Documents

It’s essential to periodically review and revise your records to ensure they meet your current business requirements. Consider the following when updating:

- Monitor Regulatory Changes: Keep track of any changes in tax rates, legal requirements, or industry-specific regulations that may affect how you create and calculate your financial records.

- Enhance Customization: As your business evolves, you may need to add or modify sections to reflect new services, payment terms, or client-specific information.

- Technology Integration: Stay up to date with software updates or new tools that can enhance the functionality of your documents. This could include features such as automated calculations or integration with accounting software.

Storing Your Documents

Proper storage of your financial documents ensures that you can easily retrieve them when needed, while also protecting them from loss or damage. Consider these storage options:

- Cloud Storage: Use a secure cloud-based solution to store and back up your documents. Cloud storage offers the advantage of easy access from any location and reduces the risk of losing important files due to physical damage or hardware failure.

- Local Backups: In addition to cloud storage, consider maintaining local backups on an external hard drive or secure