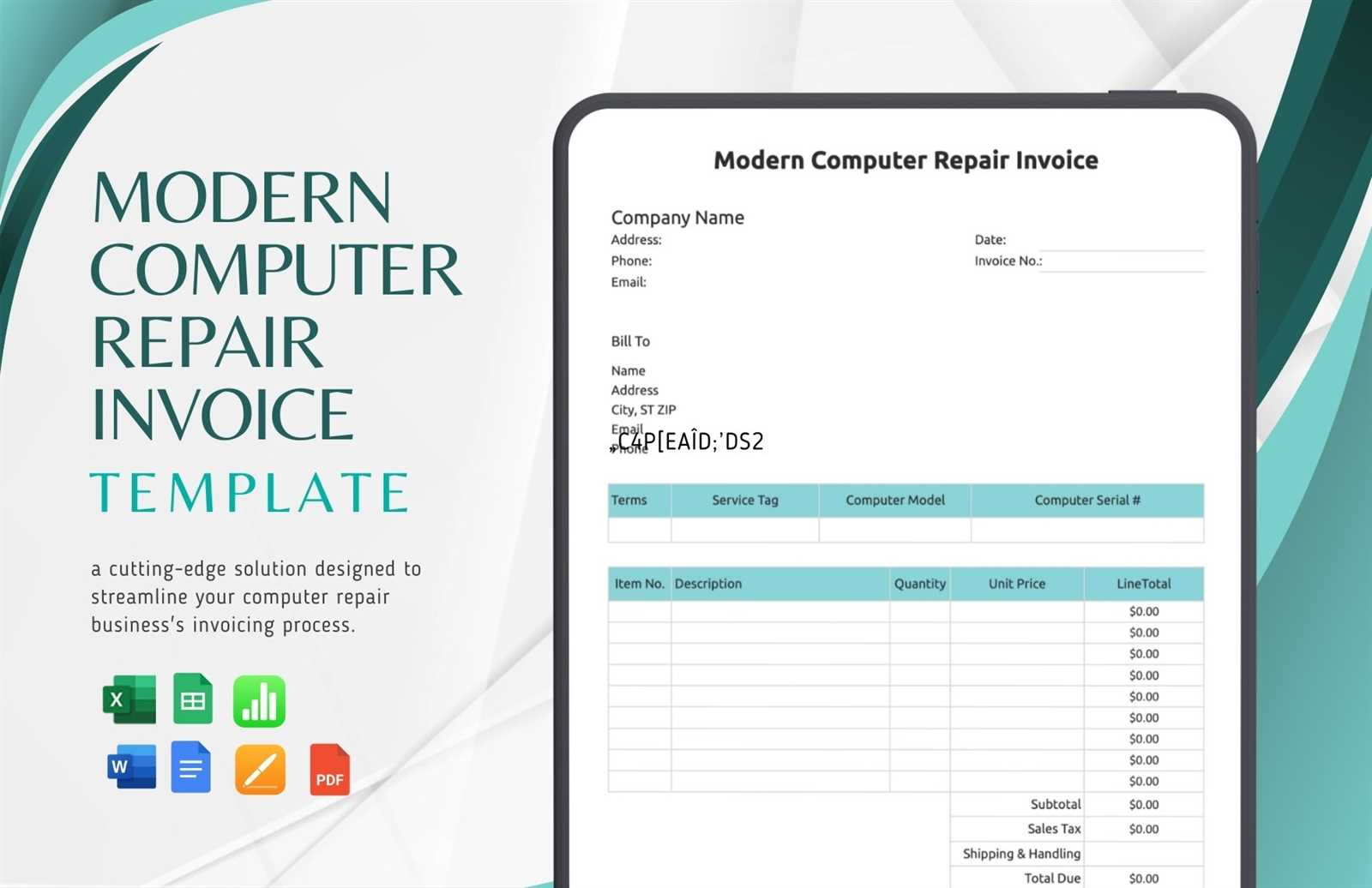

Download Free Repair Invoice Template and Customize for Your Business

For businesses offering technical or maintenance services, providing clear and professional documentation of work performed is crucial. A well-structured document not only ensures smooth transactions but also fosters trust between service providers and clients. It helps outline the scope of work completed, costs incurred, and payment expectations, making it easier to maintain financial records.

Using customizable billing documents can streamline the payment process, reduce errors, and enhance your professional image. These documents are designed to accommodate various business needs, ensuring they reflect the unique nature of each service offered. With the right format, it becomes simple to outline key details, from labor charges to material costs, all while ensuring clarity and transparency.

In this guide, we will explore the essential components of these billing documents and explain how to create or adapt them for your specific services. Whether you are a freelancer or part of a larger business, having a standardized billing format will save you time and help you maintain accurate financial records.

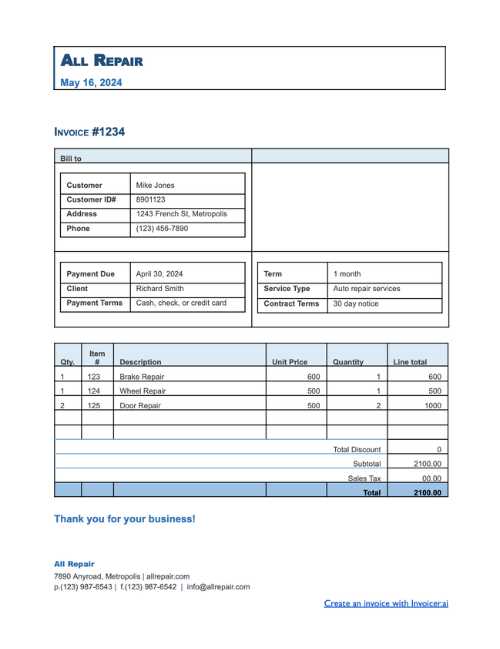

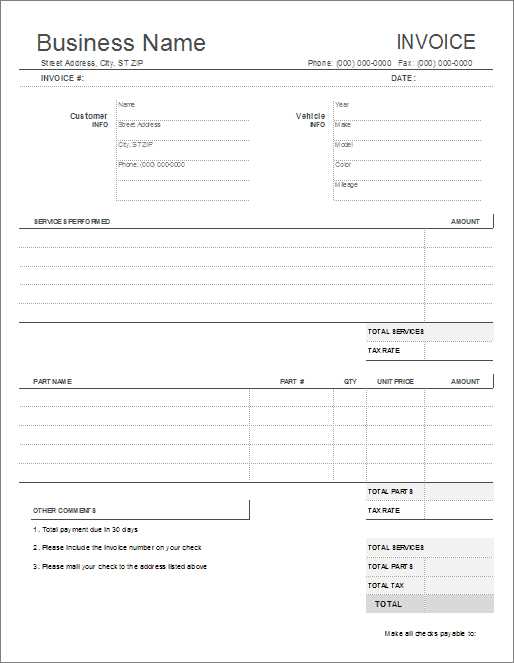

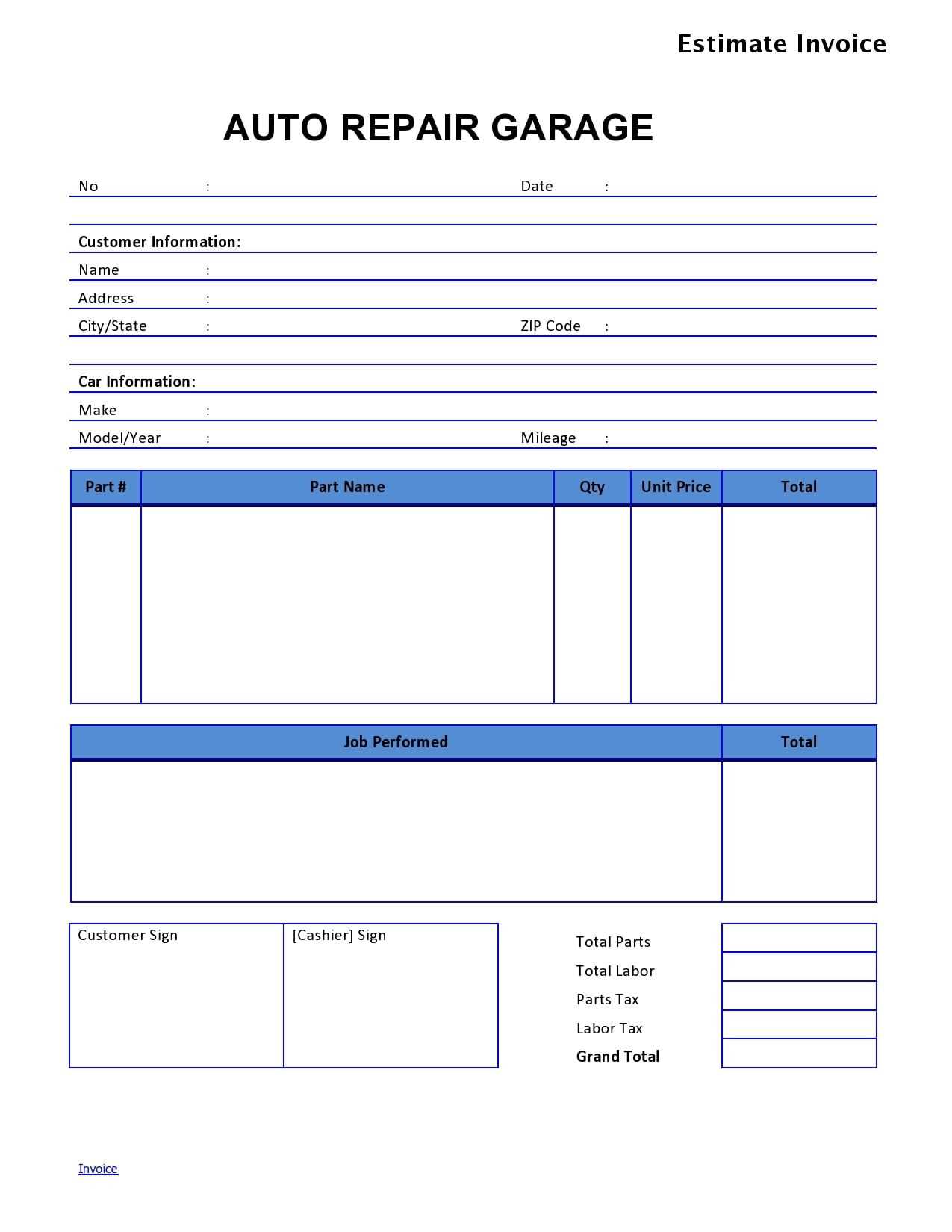

Repair Invoice Template Overview

When providing services, it’s essential to document the work performed and the associated costs in a professional manner. This allows both the service provider and the customer to clearly understand the terms of the transaction. Having a structured document to summarize the work completed helps ensure transparency, reduce confusion, and facilitate smooth payments.

Such a document typically includes several key components that contribute to its clarity and usefulness. These components include details of the service provided, the costs involved, and payment instructions. By using a standardized format, businesses can save time and improve the efficiency of their billing process.

- Customer information: Name, address, and contact details

- Work description: Clear summary of the tasks completed

- Cost breakdown: Itemized list of charges for labor, materials, or additional services

- Payment terms: Due date and acceptable payment methods

- Additional notes: Any important disclaimers or terms for the client

In the following sections, we will delve into how to customize these documents, ensuring they meet the specific needs of your business, whether you’re working with individuals or larger corporate clients. With the right format, these documents can simplify your financial workflow and enhance professionalism in your dealings.

Why Use a Repair Invoice Template

Having a structured document to outline services rendered and associated costs offers numerous advantages for both businesses and clients. When service providers use a consistent format, it helps ensure accuracy, professionalism, and timely payments. Rather than creating each document from scratch, relying on a ready-made structure can save time and minimize errors, ensuring a smoother transaction process.

Improved Accuracy and Consistency

By using a predefined structure, you eliminate the risk of missing critical details or making mistakes in the billing process. A consistent format guarantees that all the necessary information is included every time, which is especially helpful when dealing with multiple clients or recurring work. Additionally, this approach reduces the chances of discrepancies or misunderstandings between the service provider and the client.

Professional Appearance and Clarity

A clear and organized billing document reflects well on your business. Clients appreciate transparency, and using a standardized document ensures that all aspects of the transaction are communicated effectively. Whether it’s the work completed, the charges applied, or the payment terms, presenting all details in an easy-to-read format enhances trust and shows that you are organized and reliable.

Streamlined Financial Management is another key benefit. With standardized forms, businesses can more easily track payments, manage their finances, and maintain accurate records. This ultimately leads to better cash flow management and reduces the time spent on administrative tasks.

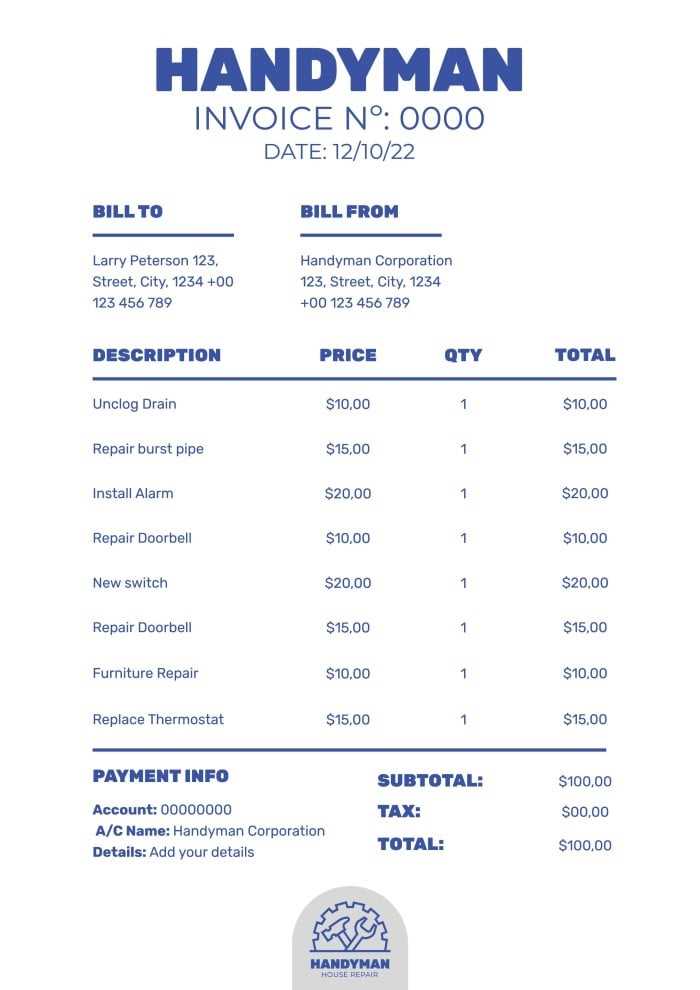

Benefits of Customizing Your Invoice

Customizing your billing document offers several advantages that can enhance both your professional image and business efficiency. A tailored approach allows you to reflect the unique nature of your services, ensuring that every aspect of the transaction is clearly communicated. Personalizing the structure and content can also help create a more seamless experience for your clients, fostering trust and transparency.

- Branding Opportunities: Customize your document with your logo, color scheme, and business information to maintain consistency with your branding.

- Clearer Breakdown of Costs: Tailored documents allow you to provide detailed descriptions of services, labor, and materials, ensuring clients understand what they are paying for.

- Enhanced Professionalism: A personalized document gives the impression of a more professional approach, making your business appear more established and reliable.

- Improved Client Communication: Customizing payment terms, including deadlines and accepted methods, can reduce misunderstandings and delays.

- Flexibility for Different Jobs: Adapt the format to fit the specific nature of the work completed, whether it’s a one-time service or ongoing maintenance.

By customizing your billing documents, you not only present a more polished image to clients but also ensure that the transaction process is straightforward and efficient. Tailoring your documents to your specific needs can help streamline your workflow and contribute to better financial management.

Key Elements of a Repair Invoice

A well-structured billing document is essential for maintaining transparency between service providers and clients. To ensure clarity and prevent misunderstandings, it’s important to include several key components that outline the work performed and the associated costs. These elements are not only useful for proper record-keeping but also help facilitate prompt and accurate payments.

- Client Information: Include the client’s name, address, and contact details to ensure proper identification and communication.

- Service Description: Clearly describe the tasks performed, outlining the work completed in detail so that the client understands what they are being charged for.

- Cost Breakdown: Provide an itemized list of charges, including labor, materials, and any additional fees. This helps the client see exactly how the total amount is calculated.

- Payment Terms: Specify payment deadlines, acceptable payment methods, and any late fees or discounts for early payment.

- Unique Reference Number: Assign a reference number to each document for easy tracking and future reference. This is particularly useful for both your business and the client when discussing the document later.

- Company Information: Include your business name, address, contact information, and any relevant tax or registration details, ensuring the document is legitimate and traceable.

These key elements create a comprehensive and professional record of the services provided and the financial terms agreed upon. Including all necessary information ensures that both parties are on the same page, minimizing the potential for disputes and facilitating smooth transactions.

How to Create a Repair Invoice

Creating a professional billing document is a straightforward process that can be done in a few simple steps. By organizing essential information in a clear and concise manner, you ensure that both parties–service provider and client–are fully informed about the work completed and the costs incurred. This not only helps facilitate timely payments but also strengthens your professional reputation.

Follow these steps to create a comprehensive and effective billing document:

- Start with Contact Information: Include your business name, address, and contact details at the top of the document. Also, include the client’s information to make it clear who the bill is directed to.

- Describe the Work Completed: Provide a detailed account of the services rendered, including any specific repairs or maintenance tasks. This helps avoid confusion over what was provided.

- Itemize the Charges: List all costs separately–labor, materials, and additional expenses. This transparency ensures that clients can see exactly what they are being charged for.

- Include Payment Terms: Clearly state the due date for payment, the accepted payment methods (bank transfer, check, etc.), and any late fees or discounts for early payment.

- Assign a Unique Reference Number: Give each document a unique identifier to make it easy to reference in future communications.

- Review and Finalize: Double-check all the details for accuracy–correct prices, dates, and descriptions. Once everything is confirmed, send the document to your client.

By following these steps, you will create a well-organized and professional billing document that ensures clear communication and smooth transactions. Customizing it to reflect your business and services will help set you apart and build trust with your clients.

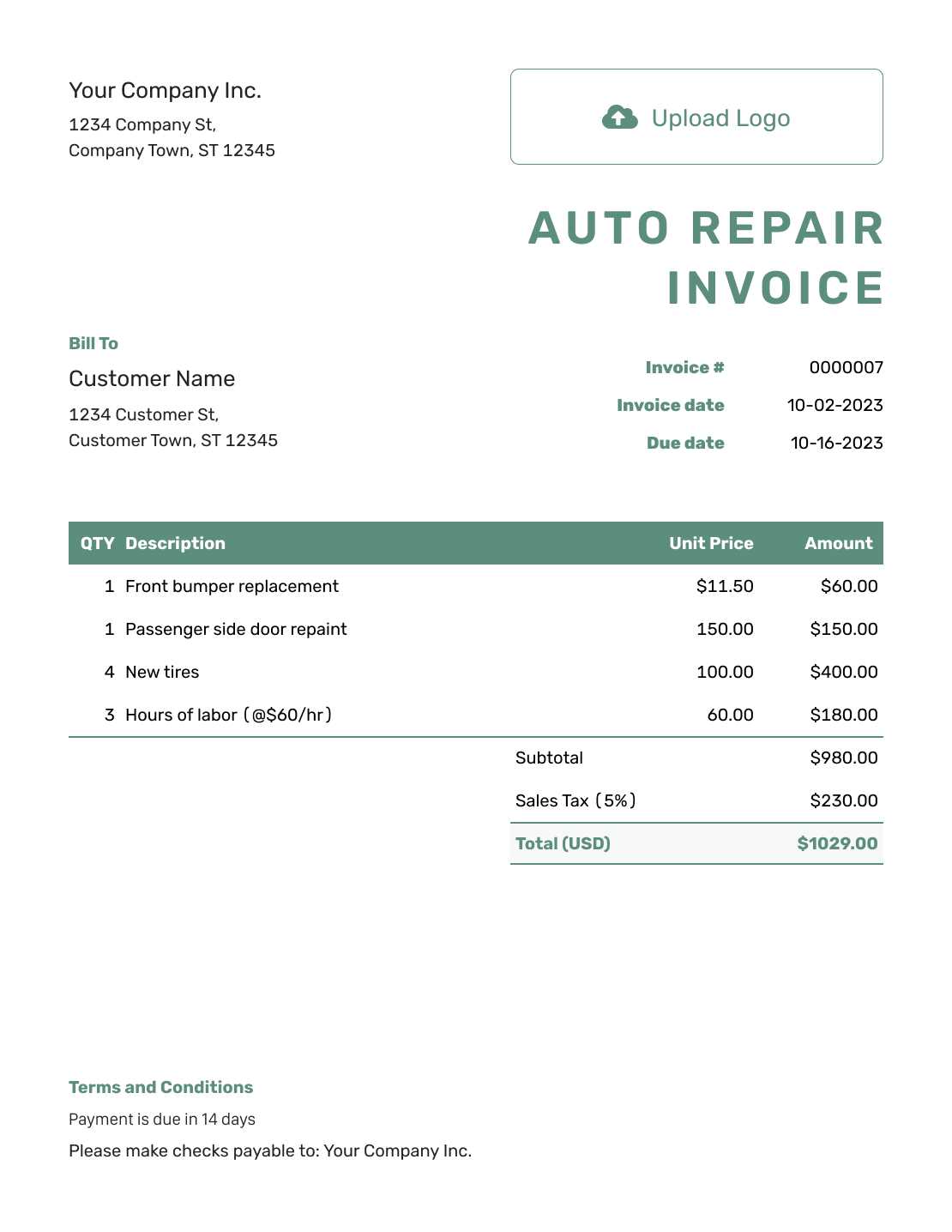

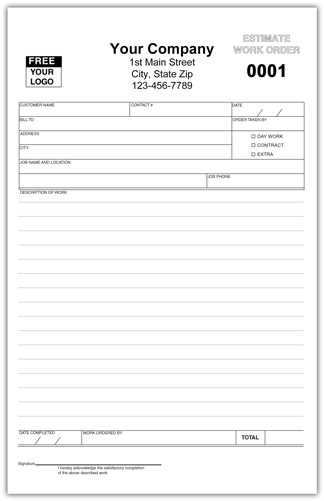

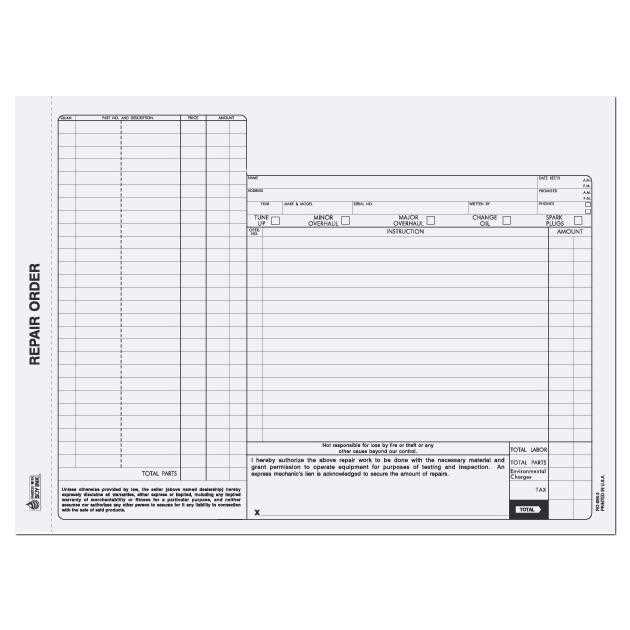

Free Repair Invoice Templates for You

If you’re looking for a convenient and efficient way to manage billing for your services, free customizable documents can be an excellent solution. These ready-made structures save time and ensure that all the necessary details are included in every transaction, allowing you to focus more on the work itself and less on paperwork. Whether you’re a small business owner or a freelancer, having access to these templates can make the billing process seamless and professional.

Advantages of Using Free Billing Documents

- Time-Saving: No need to create a document from scratch. Simply fill in the blanks and adjust it to your needs.

- Professional Layout: Most free documents come with a clean, organized format that gives a professional appearance to your business.

- Easy Customization: You can modify the document to fit your branding, including adding your logo, adjusting colors, and tailoring the layout to your preferences.

- Cost-Effective: These templates are free to download and use, which is especially beneficial for small businesses or independent contractors with limited budgets.

Where to Find Free Templates

- Online platforms like Google Docs and Microsoft Word offer free templates that can be customized.

- Many accounting and business websites provide downloadable options that can be tailored to your specific service needs.

- Various open-source tools allow for easy customization of templates, so you can adjust the layout, font, and structure to suit your business style.

By utilizing these free resources, you can ensure your billing documents are clear, professional, and consistent–without the need for expensive software or complex designs.

How to Include Service Details on Invoice

Including accurate and detailed descriptions of the work performed is crucial for any billing document. Clear service details ensure that both the provider and client are aligned on what has been completed, reducing the chance of disputes and ensuring transparency. A well-documented breakdown of services also helps clients understand the value they are receiving and justifies the costs involved.

Steps to Include Service Details

- Provide a Clear Description: Begin by outlining the specific tasks or services performed. Be as detailed as possible to avoid ambiguity. For example, instead of just saying “fixing plumbing,” describe the specific repair, such as “replacing faulty pipe under kitchen sink.”

- Break Down Tasks: If multiple tasks were completed, list them separately to ensure the client can easily follow the scope of work. This can include labor hours, parts replaced, and any other relevant actions taken during the job.

- Include Materials and Equipment: If materials were used or special equipment was required, mention these items in detail, including quantities and costs. This helps clients understand the breakdown of their charges.

- Be Specific About Time: If labor is part of the charges, specify how much time was spent on each task. For example, “2 hours of labor to replace a faulty valve.” This not only adds transparency but justifies the labor costs.

- Note Special Conditions: If the work involved particular challenges or required special handling, mention it. For example, if extra care was needed due to a sensitive environment, make a note of that to justify additional costs.

Why Service Details Matter

Including comprehensive service details not only helps establish trust with clients but also protects you as a business owner by providing a clear record of the work done. It allows both parties to have a mutual understanding of expectations, helps prevent misunderstandings, and ensures payment is made for the right services.

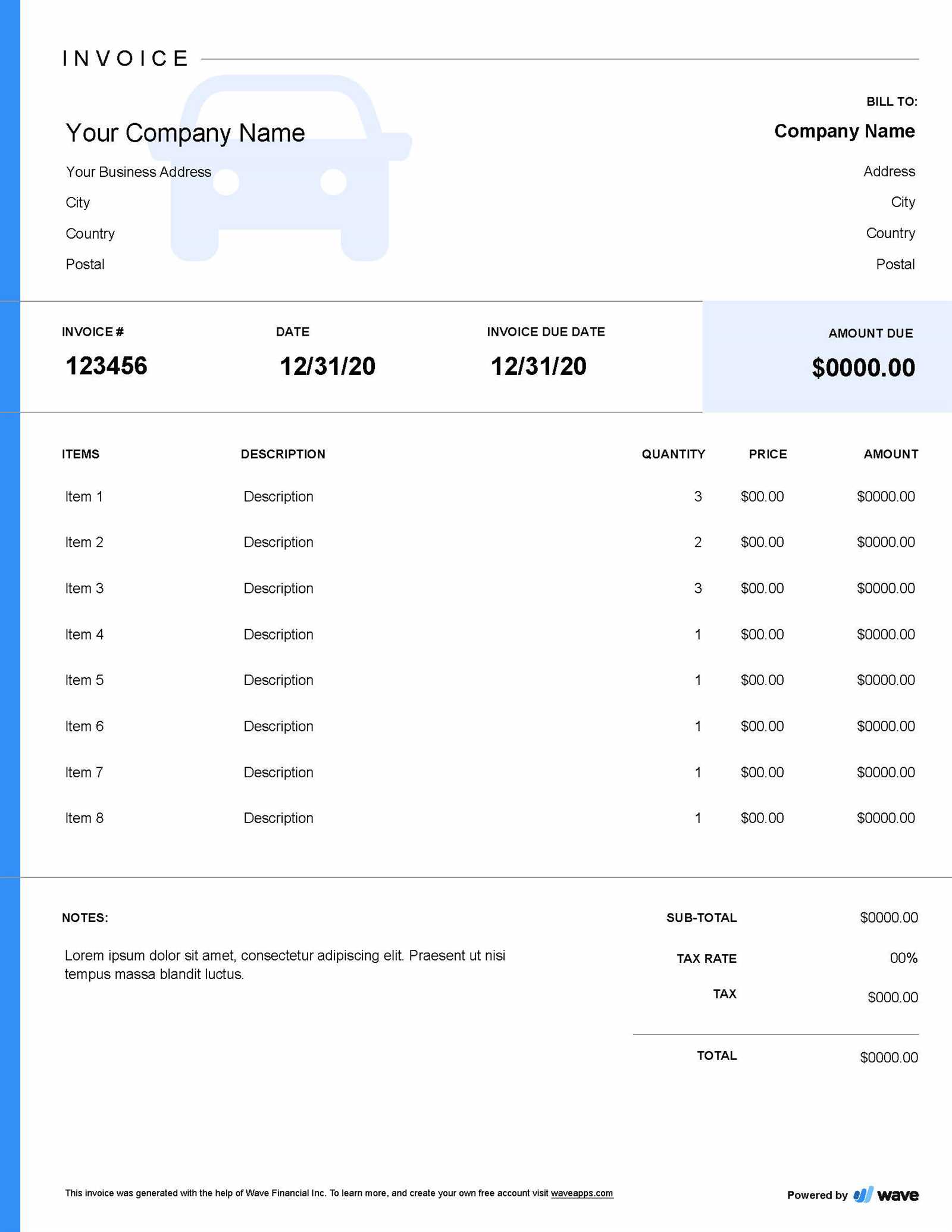

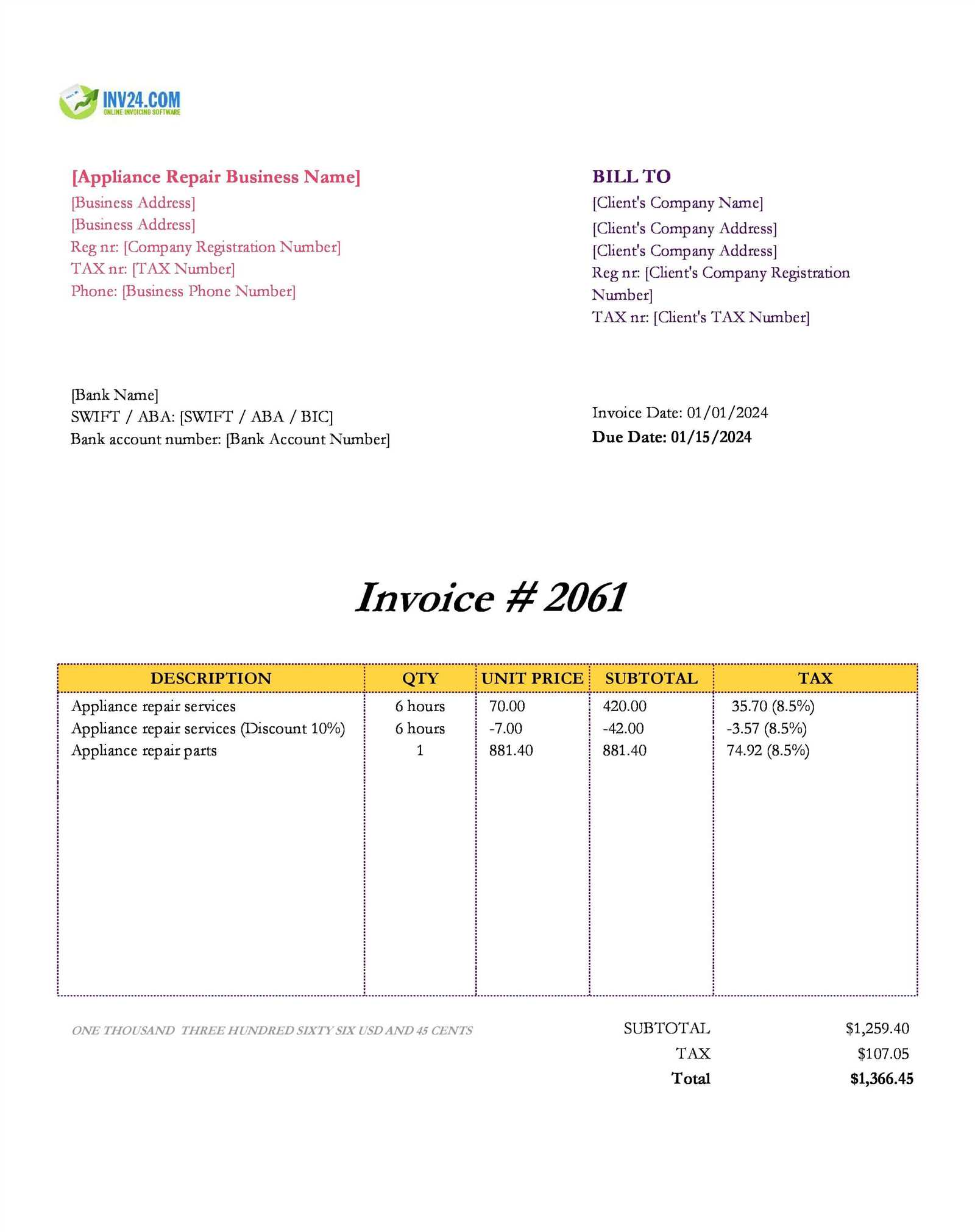

Adding Labor and Material Costs to Invoices

Properly detailing labor and material costs in your billing document is essential for maintaining transparency and ensuring accurate payments. By clearly separating these charges, clients can see exactly what they are paying for, whether it’s the time spent on the job or the materials used to complete it. This clarity helps avoid confusion and strengthens trust between you and your clients.

When listing costs, it’s important to break down the expenses into two main categories: labor and materials. This will allow clients to easily understand the charges and ensure that both you and your customer are on the same page regarding the work completed and its associated costs.

| Description | Quantity | Unit Price | Total Cost |

|---|---|---|---|

| Labor (e.g., hourly rate for technician) | 5 hours | $50/hour | $250 |

| Materials (e.g., pipe, fittings, etc.) | 3 items | $20/item | $60 |

| Total | $310 |

By organizing these costs in a clear table format, you can provide an easy-to-understand breakdown of your charges. This approach not only helps clarify the pricing structure for your clients but also ensures that every expense is accounted for and transparent.

Importance of Clear Payment Terms

Establishing clear and concise payment terms is crucial in any business transaction. By setting out specific expectations regarding payment deadlines, methods, and conditions, you help ensure that both you and your client are aligned, which can prevent misunderstandings or delayed payments. A well-defined payment structure allows for smoother transactions and reinforces professionalism.

How Clear Terms Benefit Your Business

- Reduces Disputes: When payment expectations are clearly communicated, there is less chance for disagreements over due dates or payment amounts.

- Improves Cash Flow: Setting precise deadlines helps you maintain a steady cash flow, ensuring that you can meet your business’s financial needs.

- Strengthens Professionalism: Clearly outlined terms show your clients that you run a well-organized business, enhancing trust and confidence in your services.

- Helps Manage Late Payments: Including late fees or penalties in the payment terms encourages timely payments, reducing the risk of delays.

What to Include in Payment Terms

- Payment Due Date: Specify the exact date by which payment should be made to avoid any confusion.

- Accepted Payment Methods: Clarify which forms of payment you accept, such as credit cards, bank transfers, or checks.

- Late Fees or Discounts: Define any additional charges for late payments or incentives for early settlement, if applicable.

- Installment Options: If you allow clients to pay in installments, make sure to outline the schedule and amounts clearly.

By including precise payment terms in your documentation, you not only make the payment process smoother for both parties, but you also help establish a clear agreement that can be referred to in case of any future disputes. This level of transparency and organization is key to maintaining a professional business relationship.

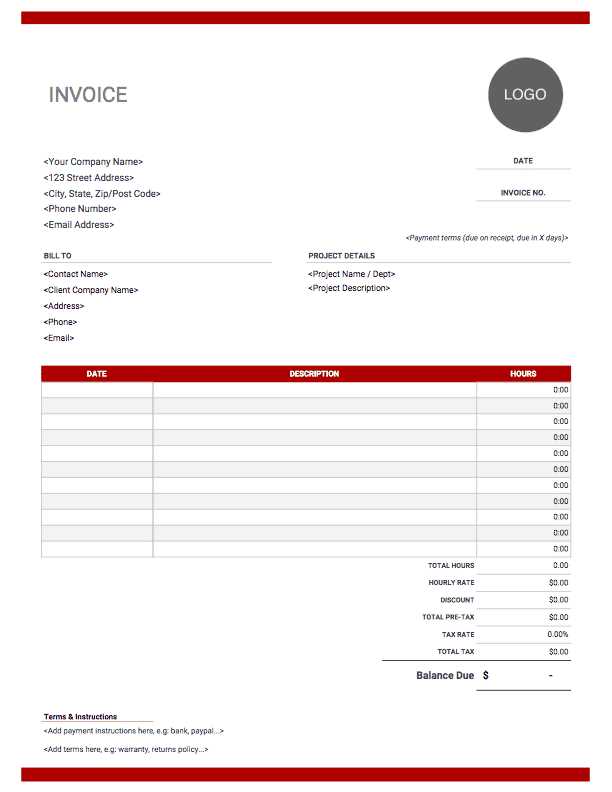

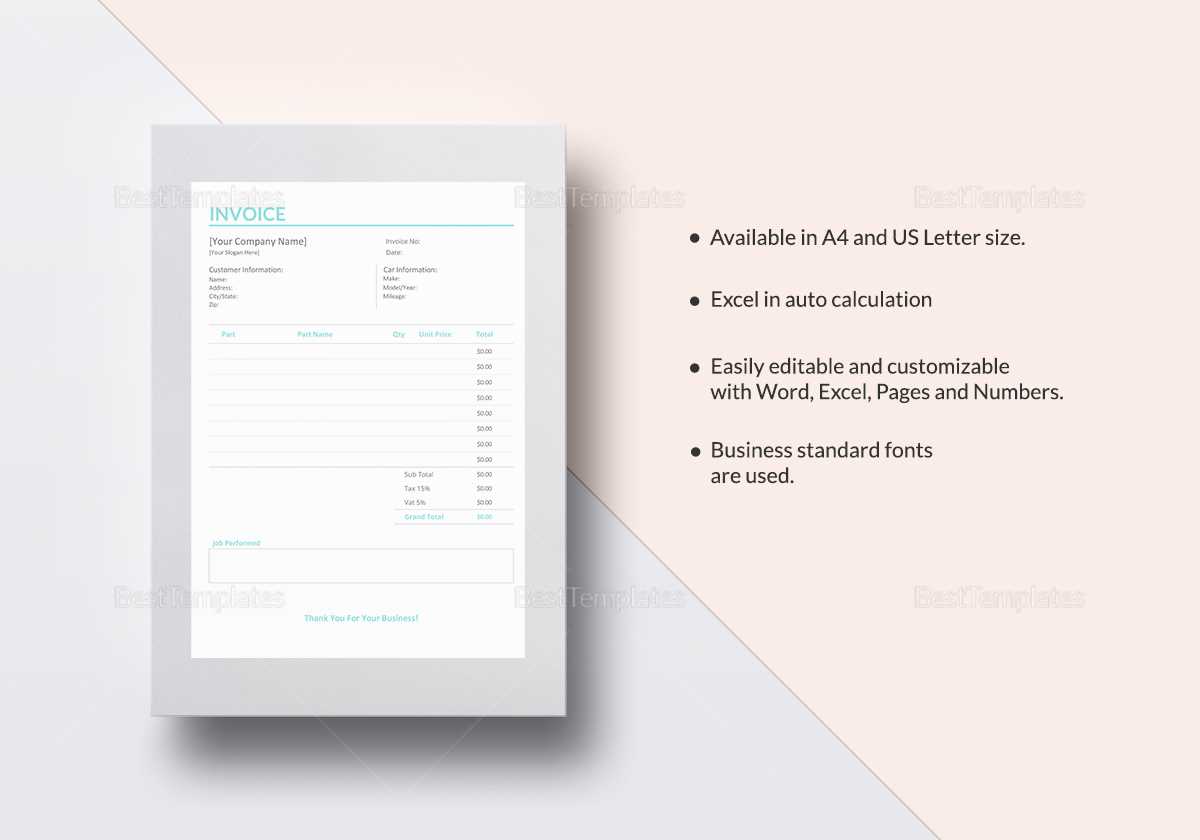

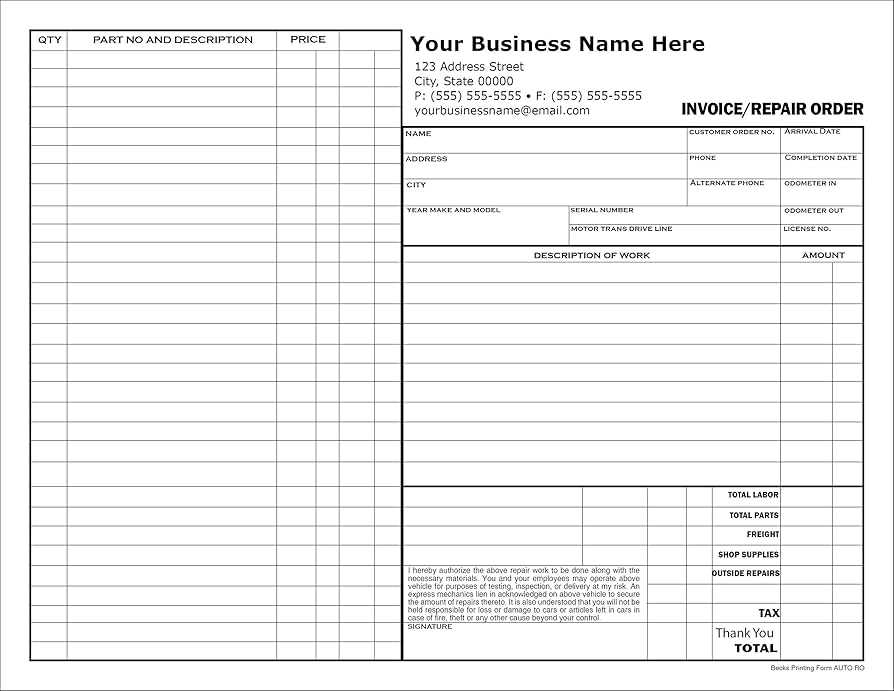

How to Format a Repair Invoice Professionally

Creating a polished and professional billing document is essential for maintaining credibility and ensuring smooth transactions. A well-formatted document not only looks more trustworthy but also makes it easier for your client to understand the charges and the terms of the agreement. By paying attention to structure, design, and clarity, you can create a document that reflects your business’s professionalism.

Key Elements of a Professional Format

- Clear Header: Include your company name, logo, and contact information at the top of the document. This provides a professional appearance and makes it easy for clients to contact you if necessary.

- Client Details: Make sure to include the client’s name, address, and contact information. This ensures that the document is correctly attributed and makes follow-up easier if needed.

- Document Title: Clearly label the document with a title such as “Service Summary” or “Work Completion Record,” so it is immediately clear what the document represents.

- Itemized List of Services: Include a detailed breakdown of all the tasks or services completed, including the date of completion, description of work, hours spent, and costs for materials and labor. The more specific you are, the more professional the document will appear.

- Payment Terms: Clearly define payment due dates, accepted methods of payment, and any penalties for late payments or discounts for early settlement.

- Footer Information: Include your business’s tax information or registration number (if applicable), along with any additional notes, such as warranty information or disclaimers.

Design Considerations for a Professional Appearance

- Use Consistent Fonts: Stick to professional, easy-to-read fonts like Arial or Times New Roman. Avoid overly decorative fonts that may distract from the content.

- Proper Alignment: Ensure that your text is properly aligned, with clear headings and bullet points. This makes the document easy to follow and visually appealing.

- Appropriate Spacing: Leave adequate space between sections to avoid clutter. A clean, spacious layout is more inviting and professional.

- Include Your Branding: Incorporate your logo and business colors into the document. This adds consistency and helps reinforce your brand identity.

By carefully formatting your billing documents, you can ensure that they not only look professional but also provide a clear, organized summary of the work completed. A polished, well-structured document helps to build trust with clients and ensures a smooth, efficient transaction process.

Common Mistakes to Avoid in Invoices

When creating billing documents, it’s easy to overlook certain details that could lead to confusion or delays in payment. Whether it’s minor errors or omissions, mistakes in your billing records can cause frustration for both you and your clients. Avoiding these common pitfalls helps maintain professionalism, ensures clarity, and ultimately results in smoother transactions.

Key Mistakes to Watch Out For

- Missing Client Information: Failing to include the client’s full name, address, and contact information can lead to confusion and delay the payment process. Always ensure that all necessary details are correct and complete.

- Unclear Descriptions: Vague or ambiguous descriptions of services provided can create misunderstandings. Be as specific as possible about the work performed, including dates, tasks, and materials used.

- Incorrect Pricing: Double-check your prices and quantities to ensure they align with the agreed-upon terms. Mistakes in pricing or calculation errors can damage your reputation and result in disputes.

- Missing Payment Terms: Not specifying payment terms, such as due dates or accepted methods, can lead to delays or missed payments. Always outline clear deadlines and payment options to avoid misunderstandings.

- Failure to Include a Unique Reference Number: Not assigning a reference number or invoice ID can make it difficult to track payments and identify specific transactions. Each billing document should have a unique number for easy reference.

- Not Accounting for Taxes: If taxes apply to your services, be sure to include them clearly on your billing record. Omitting taxes or incorrectly calculating them can cause complications later on.

Why These Mistakes Matter

Making even small errors can lead to confusion, delayed payments, or a loss of trust with your clients. Clear, accurate billing records demonstrate professionalism and respect for your clients, while avoiding these common mistakes helps streamline the

How to Track Invoice Payments Effectively

Tracking payments is a critical part of managing your business finances. Ensuring that you receive payments on time and keeping an organized record of those payments is essential for maintaining healthy cash flow. Whether you’re handling a few transactions or managing many, an effective system helps you stay on top of what’s been paid, what’s due, and when follow-ups are necessary.

Steps for Effective Payment Tracking

- Assign Unique Identifiers: Give each billing document a unique reference number. This makes it easier to track payments and resolve any discrepancies.

- Record Payment Dates: For each payment received, mark the exact date on which it was made. This helps you keep an accurate record of when payments were processed.

- Track Partial Payments: If a payment is made in installments, record each partial payment and ensure the remaining balance is clearly noted. This avoids confusion later and provides a transparent payment history.

- Use Accounting Software: Consider using accounting tools or software to automatically track and reconcile payments. These systems can generate reports and send reminders for overdue payments, streamlining the process.

- Maintain a Payment Log: Create a dedicated payment log where all received payments are recorded. Include the amount, date, client name, and method of payment. This log serves as an easy reference for your financial records.

Why Effective Payment Tracking is Essential

By keeping a detailed record of all payments, you ensure that nothing slips through the cracks. This not only improves cash flow but also makes it easier to identify late or missed payments. Having an organized payment tracking system allows you to follow up promptly, improving client relations and reducing the risk of overdue accounts.

Digital vs Printable Repair Invoice Templates

When managing billing documents, choosing between digital and physical formats can have a significant impact on how efficiently you operate. Each method has its advantages, and understanding which one suits your business needs can save time, reduce errors, and enhance client satisfaction. Whether you prefer the convenience of digital tools or the familiarity of paper records, both options offer unique benefits that can streamline your billing process.

Benefits of Digital Billing Documents

- Convenience: Digital formats allow you to send documents instantly via email or online platforms, eliminating the need for physical delivery or mailing.

- Easy Editing: You can quickly edit or update any details in a digital document, such as adjusting pricing or adding new services, without needing to start from scratch.

- Automatic Calculations: Many digital tools can automatically calculate totals, taxes, and discounts, reducing the risk of human error.

- Storage and Organization: Digital files are easy to store, search, and organize. You can keep a record of all documents without worrying about physical storage space.

- Eco-Friendly: By going digital, you reduce paper waste, contributing to a more sustainable approach to your business operations.

Advantages of Printable Billing Documents

- Physical Record: A printed copy can serve as a tangible record that some clients or businesses may prefer for their personal or legal records.

- Professional Presentation: For clients who value physical documentation, handing over a printed copy can appear more formal and professional.

- No Technical Issues: Printable documents don’t rely on technology or internet access, making them ideal for businesses that operate in areas with unreliable connectivity.

- Customizable Layout: Printing allows you to create a document exactly as you envision it, with the flexibility to adjust fonts, colors, and design elements without digital restrictions.

Both digital and printable formats have their place in modern business operations. The decision between them depends on your workflow, the preferences of your clients, and the scale of your operations. By evaluating your business needs, you can choose the method that enhances efficiency and aligns with your overall approach to client service.

How to Handle Invoice Disputes

Disputes over billing documents can arise for a variety of reasons, ranging from discrepancies in pricing to misunderstandings about services rendered. Handling these disputes professionally and efficiently is critical for maintaining strong client relationships and ensuring that payment is received in a timely manner. The key to resolving conflicts lies in clear communication, thorough documentation, and a calm, solution-oriented approach.

Steps to Resolve Billing Disagreements

- Review the Dispute Thoroughly: Before addressing the issue, take time to review the details of the bill and the client’s concerns. Make sure that all charges, services, and terms are accurately reflected in the document.

- Communicate Promptly: Reach out to the client as soon as the dispute is raised. A timely response helps prevent escalation and shows the client that you take the matter seriously.

- Clarify and Explain: Once you’ve reviewed the issue, explain the charges and terms in clear, simple language. If there was an error, acknowledge it and offer a solution. If the charges are correct, provide evidence (such as receipts, signed agreements, or records) to support your case.

- Offer a Resolution: If the dispute stems from an error on your part, offer a correction, discount, or refund as necessary. If the issue is due to a misunderstanding, clarify any ambiguous terms and ensure both parties are aligned moving forward.

- Document the Resolution: After coming to an agreement, document the resolution in writing and ensure that both you and the client have a copy of the final, agreed-upon terms.

Using Documentation to Avoid Future Disputes

Proper documentation can prevent many billing disagreements before they even arise. By keeping clear, itemized records and clearly outlining payment terms, you can avoid misunderstandings that may lead to disputes.

| Description | Example |

|---|---|

| Itemized Services | Breakdown of all tasks and services, including dates, hours, and materials used. |

| Payment Terms | Clear due dates, payment methods, and penalties for late payments. |

| Signed Agreements | Contract or written agreement outlining the terms and conditions of the work. |

By ensuring that all charges are transparent and well-documented, you minimize the risk of disputes and help foster a more collaborative relationship with your clients. Open, honest communication and proper record-keeping are the cornerstones of resolving any billing disagreements.

Integrating Repair Invoices with Accounting Software

Integrating billing records with accounting software streamlines financial management, reducing manual errors and saving time. By connecting your payment documents directly with your accounting system, you can automate data entry, track transactions more efficiently, and generate reports in real-time. This integration improves overall accuracy and helps ensure that your financial records are always up-to-date.

Benefits of Integration

- Automatic Data Transfer: Integration allows for automatic transfer of billing details to your accounting software, eliminating the need for manual entry and minimizing the risk of errors.

- Time Savings: With automated processes, you no longer need to input each transaction separately, allowing you to focus on other areas of your business.

- Real-Time Financial Tracking: Syncing payment documents with your accounting system provides immediate access to your financial data, helping you stay on top of cash flow and outstanding balances.

- Improved Accuracy: By reducing the need for manual data input, integration ensures that your financial records remain accurate and consistent.

- Easy Reporting: Integration simplifies the process of generating financial reports, allowing you to track income, expenses, and outstanding amounts with just a few clicks.

Steps to Integrate Billing with Accounting Software

- Choose Compatible Software: Ensure your accounting software supports the integration of billing documents. Popular options like QuickBooks, Xero, and FreshBooks offer built-in tools for this purpose.

- Set Up Integration: Follow the software’s guidelines to connect your billing system with your accounting platform. This may involve linking accounts or using third-party integration tools.

- Sync Data Regularly: Set up automatic syncing to ensure that your billing data is consistently updated in the accounting software.

- Monitor and Verify: Periodically review the integrated data to ensure accuracy and resolve any discrepancies early on.

By integrating your billing processes with accounting software, you can simplify financial tracking and improve the efficiency of your business operations. The time saved and the accuracy gained will help you focus on growing your business while maintaining a clear financial overview.

Where to Find Premium Invoice Templates

When it comes to creating professional billing documents, having access to high-quality, customizable options can make a significant difference. Premium designs provide both functionality and a polished appearance, helping you present your business in a professional light. Whether you’re looking for a simple layout or something more complex, there are numerous platforms offering premium choices to fit your needs.

Top Sources for Premium Billing Designs

- Template Marketplaces: Websites like Envato Elements and TemplateMonster offer a wide variety of premium designs that can be tailored to your business needs. These platforms often feature both free and paid options, with templates designed by professionals.

- Accounting Software: Many accounting platforms, such as QuickBooks and FreshBooks, provide premium billing templates as part of their subscription services. These templates often come pre-integrated with the software, making it easy to create and send documents directly from the platform.

- Freelance Designers: If you require a completely unique design, consider hiring a freelance graphic designer through platforms like Fiverr or Upwork. This allows for a fully customized approach tailored to your business style.

- Microsoft Office and Google Docs: Both Microsoft Office and Google Docs offer a range of premium billing designs that are easy to download and customize. You can find these options directly in their template galleries, which are available for free or for a small fee.

- Dedicated Template Websites: Sites like Template.net and Invoice Home specialize in offering customizable, high-quality designs. You can find templates that cater to various industries, including construction, retail, and more.

Choosing the Right Design

When selecting a premium design, consider factors like industry relevance, ease of cu