Free Rental Invoice Word Template for Easy Customization and Use

Creating accurate and professional payment requests is essential for anyone involved in leasing or property management. Whether you’re renting out an apartment, a house, or any other space, having a well-structured document to outline the details of the transaction can streamline your business processes. An organized and easy-to-use form helps ensure clarity for both you and your tenants.

By using a simple yet effective document format, you can save time and avoid errors, ensuring that all relevant information is captured correctly. From the rental period to the payment amount and terms, every detail needs to be clearly stated. Customizable formats allow you to tailor each request to suit your specific needs, making the entire invoicing process more efficient.

With the right tools, you can create professional-looking documents quickly, reducing the chance of confusion or disputes with tenants. Incorporating these practices into your management routine not only improves accuracy but also promotes trust and professionalism in your dealings.

Rental Invoice Word Template Overview

Efficiently managing payment requests is crucial for anyone in the property leasing business. Having a pre-made document format for billing helps streamline the entire process, ensuring that all essential information is included while saving time on formatting. Such a document provides a structured approach, minimizing the risk of missing key details and ensuring accuracy for both landlords and tenants.

These ready-to-use forms allow you to quickly generate payment requests that reflect all necessary elements, from the rental period to the total amount due. By offering customizable options, this tool gives you the flexibility to tailor each request according to specific needs while maintaining a professional appearance.

Key Benefits of Using a Pre-made Document Format

- Time Efficiency: Quickly create professional documents without needing to start from scratch.

- Consistency: Ensure all key details are included consistently every time you generate a new form.

- Customizability: Adapt the document to suit different properties, clients, or pricing structures.

- Accuracy: Reduce the risk of errors and missing information by following a standard format.

Important Elements to Include

- Contact Information: Include both your details and the tenant’s to ensure clarity.

- Payment Details: Outline the total amount due, payment due date, and any applicable late fees.

- Property Information: Specify the address or location of the leased property.

- Rental Period: Clearly state the start and end dates of the lease period.

By using these tools, you can ensure that every payment request is accurate, timely, and professional, creating a seamless experience for both parties involved in the leasing process.

Why Use a Document Template for Payment Requests

Using a pre-designed format for creating payment requests offers several advantages, especially when managing multiple properties or tenants. A structured layout allows for faster document generation, ensuring that you don’t have to recreate the same content each time you need to bill a tenant. This approach not only saves time but also reduces the chance of errors, making it easier to maintain consistency across all payment documents.

By leveraging a customizable design, you can tailor each document to your specific needs while still following a clear and professional format. This flexibility ensures that you can manage various rental agreements with ease, regardless of the type of property or terms involved.

Advantages of Using a Pre-Formatted Document

- Time-Saving: Quickly create payment requests without having to format them from scratch.

- Consistency: Ensure that all important information is always included and presented in the same way.

- Professional Appearance: Maintain a polished and organized look, which builds trust with tenants.

- Customization: Adjust the document to suit specific agreements or preferences.

Why Efficiency Matters in Property Management

- Faster Transactions: By reducing the time spent on creating payment documents, you can focus more on managing your properties.

- Improved Communication: Clear and consistent billing documents help prevent misunderstandings between you and your tenants.

- Record Keeping: Organized, easy-to-create documents make it simpler to maintain accurate financial records.

Overall, using a pre-designed document ensures that you can produce clear, accurate, and professional payment requests quickly, reducing stress and improving your overall property management experience.

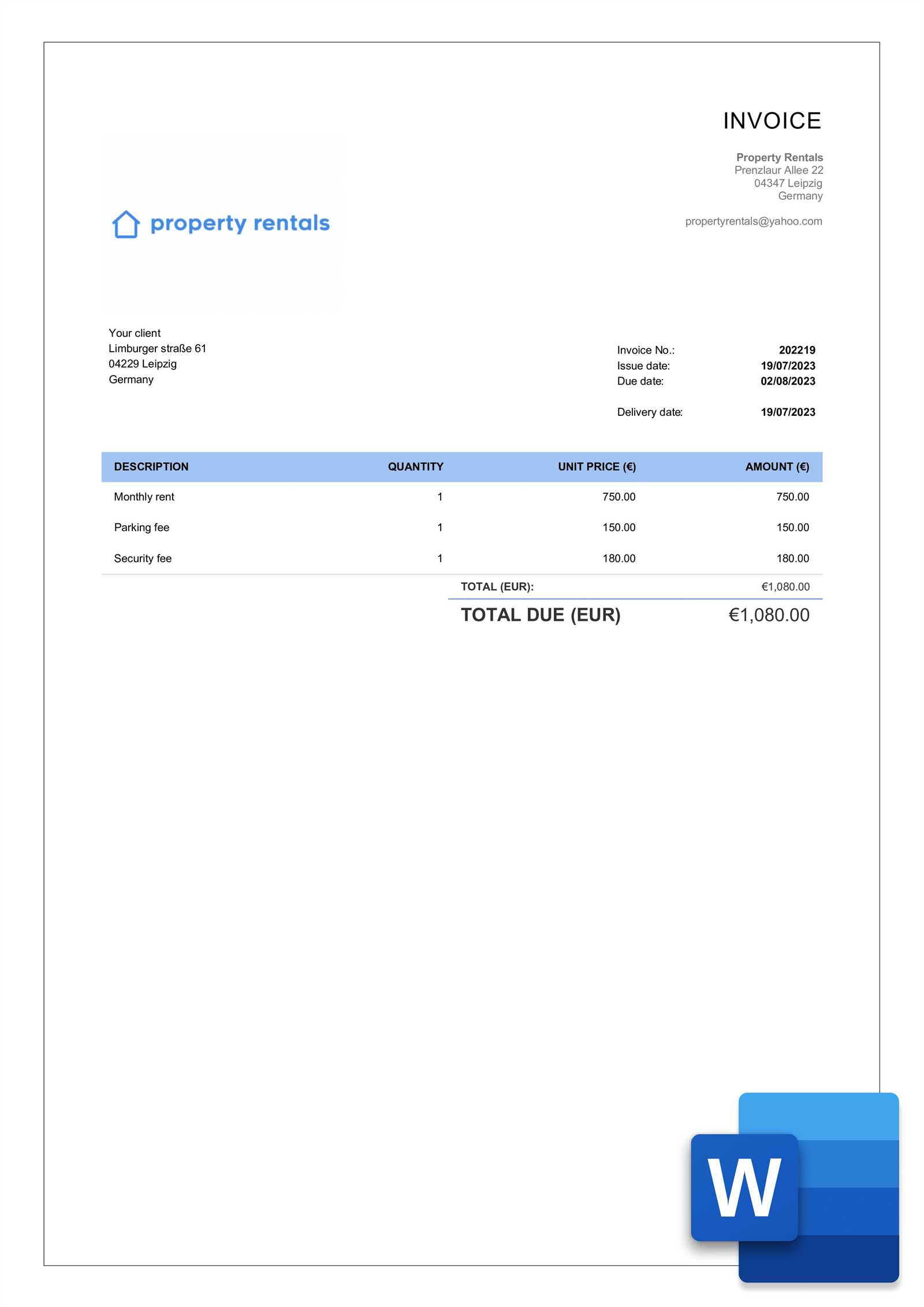

How to Create a Payment Request in Word

Creating a formal document to request payment from your tenants can be a straightforward task when you follow a structured approach. By using the right tools and layout, you can ensure that every detail is covered, from the rental period to the total amount due. The process involves several key steps that allow you to personalize the document while keeping it professional and clear.

To start, you’ll need to set up a blank document and include all relevant information that your tenants will need to make the payment. Once the basic structure is in place, you can customize it for each tenant or property, ensuring that the details are specific to each case.

Steps to Create a Payment Request

- Open a New Document: Begin by opening a blank document in your preferred program.

- Add Your Contact Information: Include your name, address, phone number, and email address at the top of the page.

- Include Tenant Information: Below your details, add the tenant’s name, address, and contact information.

- Specify the Rental Period: Clearly state the start and end dates of the lease or rental agreement.

- List the Charges: Break down the payment due, including rent, utilities, and any additional fees.

- Payment Terms: Specify the due date for payment and any late fees if applicable.

- Final Review: Double-check the document for accuracy, ensuring all details are correct before sending.

Customizing Your Document

- Adjust the Layout: You can format the document to suit your preferences, changing fonts, colors, and alignment.

- Add a Logo or Branding: If applicable, include your business logo or brand colors to maintain a professional appearance.

- Include Additional Terms: You can add specific instructions or additional clauses based on your lease agreement.

Once the document is finalized, you can save it for future use, making it easy to create similar payment requests for other tenants in the future. The ability to reuse and modify the layout helps save time and ensures c

Key Components of a Payment Request

When creating a formal request for payment, certain details are essential to ensure clarity and avoid misunderstandings. Including the right information not only ensures that the tenant understands the charges but also helps you maintain accurate financial records. Each section of the document plays an important role in communicating the necessary details about the charges, terms, and responsibilities.

By including all the key elements in your document, you can create a comprehensive and professional payment request that is both easy to read and legally sound. These components form the backbone of the document and should be carefully tailored to reflect the specifics of the agreement between you and the tenant.

Essential Elements to Include

- Contact Information: The document should clearly list both your details (landlord/owner) and the tenant’s contact information.

- Property Information: Make sure to specify the property or unit being leased, including its address and any relevant identifiers.

- Payment Period: Clearly state the period for which payment is being requested, typically by including the start and end dates of the lease or rental period.

- Charges and Fees: List all charges due, including base rent, utilities, maintenance fees, or any other costs as outlined in the agreement.

- Payment Due Date: Clearly indicate when the payment is due and include any late fees or penalties for overdue payments.

- Payment Instructions: Provide clear instructions on how the tenant should make the payment, whether by bank transfer, check, or other methods.

Optional Components to Enhance Clarity

- Notes and Terms: If there are special conditions, such as agreements on late payments or early terminations, include these to avoid future confusion.

- Tax Information: For landlords managing multiple properties, including tax identification numbers or relevant tax rates may be important for legal and accounting purposes.

- Discounts or Promotions: If applicable, include any discounts, credits, or promotional offers that may reduce the total due.

These key components will ensure that your payment request is clear, comprehensive, and professional. Having all the necessary information in one document helps protect both parties by reducing the chances of disputes and ensuring that all charges are understood and agreed upon.

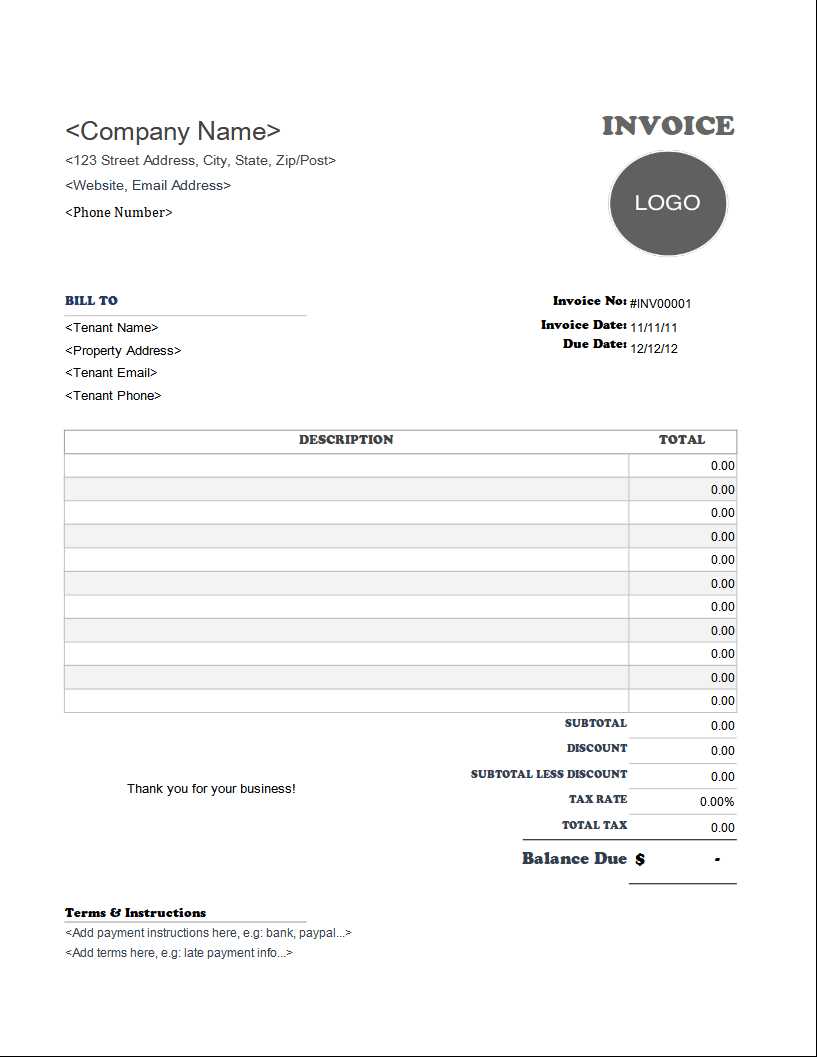

Customizing Your Rental Invoice Template

When creating documents for billing purposes, it’s essential to tailor them to fit the specific needs of your business. Adjusting certain aspects of the form allows you to maintain a professional look while reflecting the nature of the services provided. Personalizing these documents helps streamline the payment process and ensures that all necessary information is easily accessible for both the service provider and the recipient.

Adjusting Key Elements

Start by identifying the most critical components that need modification. These elements usually include:

- Business name and contact details

- Dates and terms of the agreement

- Specific item or service descriptions

- Pricing structures

Adding Personal Touches

Adding extra touches to make the document more personalized can improve the customer experience. Consider these options:

- Company logo for branding

- Payment instructions or discounts for early settlement

- Customized footer with legal terms or thank-you notes

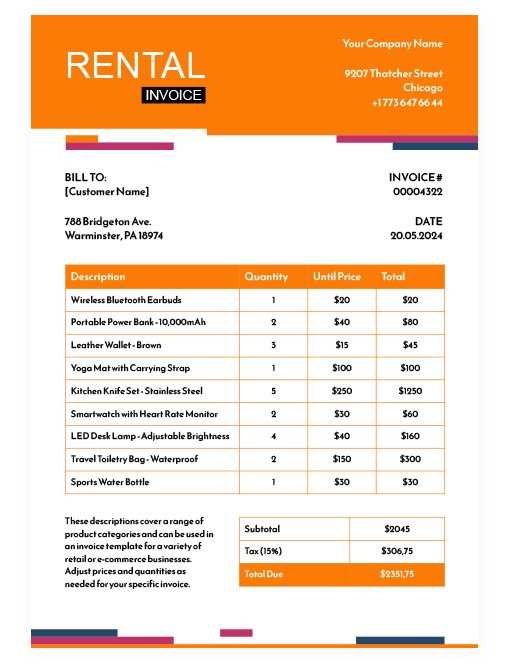

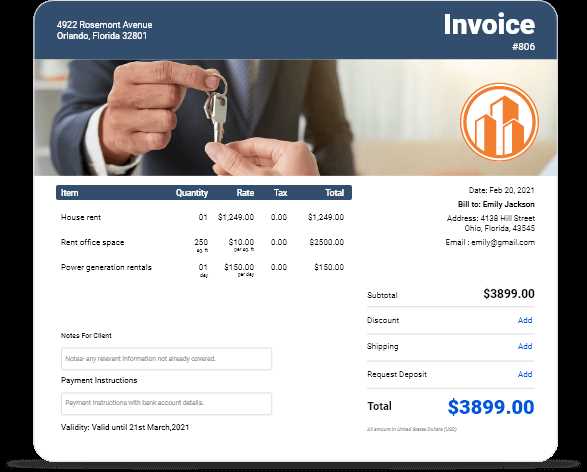

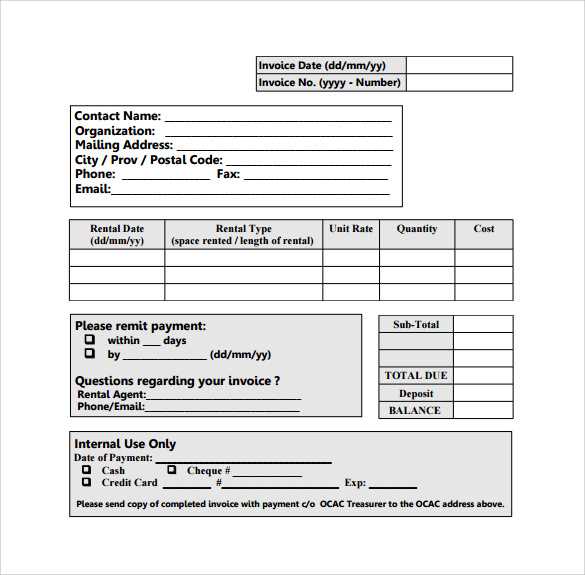

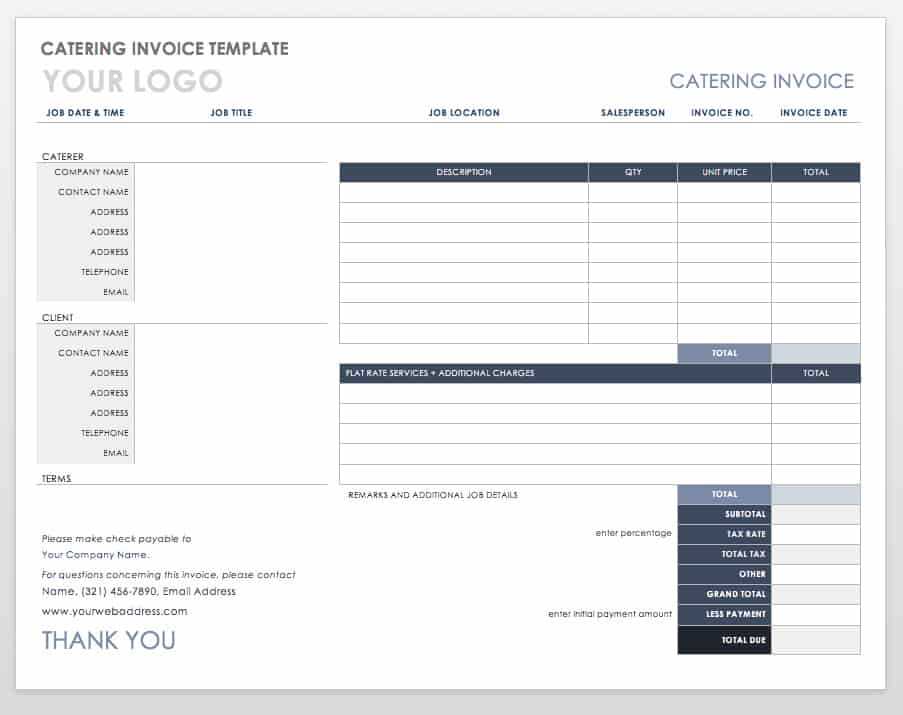

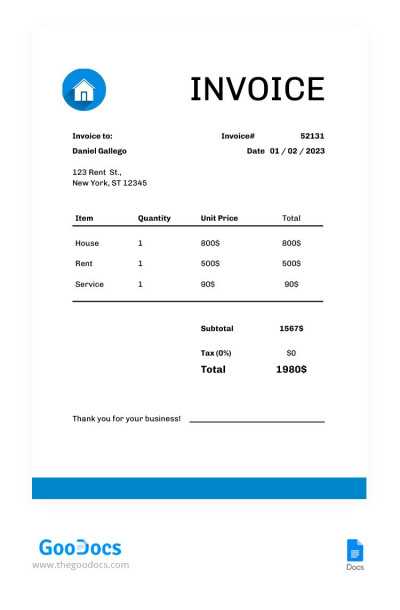

Free Rental Invoice Word Templates Available Online

There are numerous resources available online that provide customizable documents for billing purposes. These free tools can help you create professional forms without the need for expensive software. Many websites offer a variety of layouts, allowing you to select one that best fits your business needs.

By downloading these documents, you can save time and effort, quickly tailoring the format to suit your specific services and preferences. The templates are often simple to use, with fields that can be adjusted for various payment structures, ensuring your customers have a clear understanding of the charges.

Key Benefits:

- Free to use with no hidden costs

- Easy to customize with your business details

- Variety of designs to match your brand

Exploring different sites can help you find the best option, whether you’re looking for a minimalistic style or a more detailed, feature-rich design. Once downloaded, you can modify the content and reuse the document whenever needed, streamlining your billing process.

Tips for Professional Invoicing in Rentals

Creating clear and professional documents for billing is essential for maintaining a smooth business operation. A well-structured form not only helps in avoiding confusion but also builds trust with your clients. By following a few simple tips, you can ensure that all necessary details are covered and presented in a way that enhances your business’s reputation.

Key Elements to Include

To ensure your documents are complete and professional, include the following critical information:

- Clear identification of your business, including logo and contact details

- Accurate descriptions of the services or products provided

- Exact payment terms and deadlines

- Appropriate tax rates and total charges

Best Practices for a Polished Look

For a polished appearance, consider the following tips:

- Use clean, readable fonts and consistent formatting

- Organize the content with logical sections and headings

- Double-check for accuracy in the figures and calculations

- Ensure there is enough space between sections to avoid clutter

How to Add Payment Terms to Your Invoice

Clearly defining payment terms is essential to ensure both parties are on the same page regarding due dates, late fees, and any discounts. Including these terms in your billing documents helps avoid misunderstandings and ensures timely payments. By outlining expectations upfront, you create a professional atmosphere and help clients understand the financial arrangements.

Essential Payment Information to Include

When adding payment terms to your document, consider including the following details:

- Due date: Specify the exact date by which payment should be made.

- Late fees: Outline any penalties or interest for overdue payments.

- Discounts: Offer any early payment discounts, if applicable.

- Accepted payment methods: List the forms of payment you accept.

Best Practices for Clarity

To ensure that your terms are clear and easily understood, follow these best practices:

- Use simple language to describe the terms.

- Position the payment terms in a prominent section of the document.

- Highlight due dates and penalties to draw attention to them.

Ensuring Legal Compliance in Rental Invoices

When creating documents for billing, it is crucial to ensure they meet all legal requirements. These requirements vary depending on the location and type of service being provided, but they generally include specific details that must be included to avoid issues with taxation, disputes, or audits. By adhering to legal guidelines, you help protect both your business and your clients, ensuring a smooth transaction process.

Key Legal Elements to Include

Make sure the following elements are present in your documents to ensure legal compliance:

| Element | Purpose |

|---|---|

| Business Identification | To clearly identify the service provider, including company name, address, and tax number. |

| Payment Terms | To specify when payment is due and the consequences of late payments. |

| Tax Details | To comply with tax regulations, including applicable rates and charges. |

| Legal Disclaimers | To include any terms or conditions related to the service, liability, or warranties. |

Best Practices for Compliance

To ensure full compliance, consider the following best practices:

- Consult with a legal professional to confirm all required information is included.

- Stay updated on local tax laws and adjust the document accordingly.

- Maintain clear and transparent language in all terms and conditions.

How to Calculate Rental Fees and Taxes

Calculating fees and applicable taxes is an essential step when creating billing documents. This process ensures that both the service provider and the client are clear about the charges. It involves understanding the cost structure, applying any relevant taxes, and presenting the final amount in a transparent manner. By following a few simple steps, you can easily determine the total amount due, ensuring accuracy and compliance with local tax laws.

Start by determining the base cost of the service or product being provided. Then, apply the appropriate tax rate, which may vary depending on the location and type of service. Be sure to account for any discounts or additional charges that may affect the final amount. Once the fees and taxes are calculated, add them together to reach the total amount due.

Common Mistakes to Avoid in Rental Invoices

When creating documents for billing, certain mistakes can lead to confusion, delays, or disputes. Avoiding these common errors will ensure that your documents are accurate, clear, and professional. By paying attention to details and following best practices, you can minimize issues and maintain a smooth payment process.

Frequent Errors to Watch Out For

- Incorrect or missing business details, such as your company name or tax ID.

- Failure to specify the payment due date or terms clearly.

- Omitting applicable taxes or miscalculating rates.

- Not including enough information about the services or products provided.

Tips for Accuracy

- Double-check all amounts and calculations before finalizing the document.

- Ensure that all terms and conditions are clear and understandable to the client.

- Review local tax regulations regularly to ensure compliance.

How to Track Rental Payments with Invoices

Keeping track of payments is an essential part of managing financial records. It ensures that all transactions are accounted for and helps maintain accurate books. By using clear, well-organized documents, you can easily monitor whether clients have made the necessary payments and if any amounts are overdue. This process helps avoid confusion and ensures timely collections.

Methods for Tracking Payments

There are several effective ways to track payments, including:

- Marking payments as “paid” on the document once received.

- Setting reminders for due dates to follow up on overdue amounts.

- Using accounting software or spreadsheets to track outstanding balances.

- Including payment reference numbers or methods to easily identify transactions.

Best Practices for Payment Management

- Keep a detailed record of all transactions and communications with clients.

- Offer multiple payment methods to make it easier for clients to pay on time.

- Regularly review your records to ensure everything is up-to-date and accurate.

Best Practices for Sending Rental Invoices

Sending accurate and timely billing documents is essential for maintaining good relationships with clients and ensuring that payments are processed efficiently. By following a few key practices, you can streamline the process and make it easier for clients to understand and pay what is due. This not only helps with cash flow but also ensures a professional image for your business.

Key Considerations When Sending Billing Documents

Here are some best practices to keep in mind when preparing and sending your documents:

| Practice | Benefit |

|---|---|

| Send Documents Promptly | Ensures timely payment and reduces the risk of delays. |

| Provide Clear Payment Instructions | Makes it easier for clients to make payments and reduces confusion. |

| Use Professional and Consistent Formatting | Maintains a polished and trustworthy appearance. |

| Offer Multiple Payment Options | Increases convenience for clients, encouraging prompt payment. |

Effective Communication Tips

- Always confirm receipt of the payment once it’s made.

- Set up automated reminders for clients with overdue payments.

- Ensure the tone of your correspondence is polite and professional.

Using Word Templates for Multiple Rental Units

Managing billing documents for multiple properties or assets can be challenging without an organized system in place. When handling several units, it’s important to ensure each document is tailored to the specific unit, while maintaining consistency and efficiency. By using structured formats, you can save time and minimize errors while managing payments for each property or asset.

Benefits of Using Structured Formats

Utilizing pre-designed documents allows for easy customization and ensures uniformity across all transactions. The benefits include:

- Consistency: Ensures all documents follow the same format, making them easy to track and compare.

- Efficiency: Speeds up the process of creating documents, allowing you to focus on other aspects of your business.

- Accuracy: Reduces the chances of errors or omissions, particularly when dealing with multiple units.

Customizing for Multiple Units

When managing several properties, it’s crucial to modify each document to reflect the unique details of each unit. This can include:

- Unit identification: Ensure each document clearly states which property or asset the charges relate to.

- Specific charges: Adjust pricing based on the different terms or services provided for each unit.

- Payment terms: Modify the payment conditions as needed to match the individual agreements for each property.

How to Save and Edit Your Invoice Template

Once you’ve created a document for billing purposes, knowing how to save and modify it for future use is essential for efficiency. Being able to easily update or adjust the content as needed ensures that you can quickly send out accurate statements without starting from scratch each time. This flexibility also allows you to customize documents based on specific needs or changes in agreements.

Saving Your Billing Document

Saving your document properly ensures that you can quickly access it whenever necessary and make modifications as required. Here are the key steps:

- Choose a clear file name: Give your document a descriptive title to make it easy to identify, such as “Billing Document [Property Name] – [Date].”

- Save in a consistent format: Use formats that are easy to edit and compatible with other software, such as .docx or .pdf.

- Create a dedicated folder: Keep all related documents organized in one place for easy access and reference.

Editing Your Billing Document

When it’s time to update your document for a new transaction, follow these steps:

- Open your saved file: Access the file you saved earlier, ensuring it is the correct version to work with.

- Modify the necessary fields: Update the amounts, dates, client information, or any specific terms that have changed.

- Double-check for accuracy: Review the document for any errors or missing details before finalizing.

Benefits of Automated Billing Systems

Implementing automation in the billing process can significantly streamline the way transactions are managed, saving both time and effort. With automated systems, repetitive tasks are handled more efficiently, ensuring accuracy and consistency in every transaction. This method offers a variety of advantages, particularly for those who need to process numerous billing statements regularly.

Increased Efficiency and Time-Saving

By automating the generation of financial documents, you eliminate the need for manual input, which speeds up the entire process. Key benefits include:

- Faster processing: Automatically generated documents save time by reducing the need for repetitive tasks.

- Minimal human error: Automation ensures fewer mistakes compared to manual data entry, leading to more accurate statements.

- Quick updates: Any necessary changes can be made quickly, with the system updating all relevant fields instantly.

Improved Organization and Tracking

Automation also makes it easier to maintain an organized system for managing billing records. With automated systems, you can easily track payments, outstanding balances, and the history of transactions, providing a clear view of your financials at any given time. This includes:

- Centralized records: All documents are stored in a single place, making it easier to locate and review past transactions.

- Automatic reminders: Payment due dates can be tracked and automated reminders can be sent to clients, reducing the chances of missed payments.

Managing Late Payments with Billing Statements

Late payments can create financial challenges, but with the right strategies in place, they can be effectively managed. It’s important to have a clear approach for dealing with overdue amounts to maintain a healthy cash flow. By implementing consistent communication and tracking practices, you can encourage timely payments and handle delays efficiently.

One key aspect of managing overdue payments is maintaining detailed records of all transactions. This allows you to identify which clients are behind and take appropriate action quickly. Additionally, clear payment terms and due dates should be outlined in each document to set expectations from the beginning.

For clients who fail to make payments on time, a gentle reminder is often the first step. Automated follow-ups or manually sending reminders can help prompt the payer to act. If the delay continues, escalating the matter with more formal communication, such as late fees or legal action, might be necessary to recover the outstanding amount.