Rental Invoice Templates for Streamlined Billing

Managing payment records for properties can be a complex task without the right tools. To streamline the process, a well-structured document is essential for tracking charges, payments, and due amounts. This helps ensure transparency and reduces the chances of errors or misunderstandings between landlords and tenants.

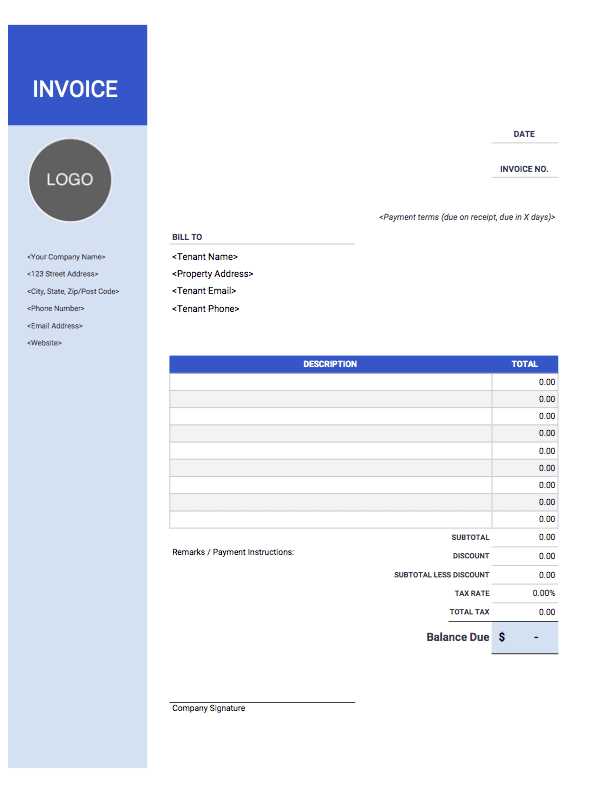

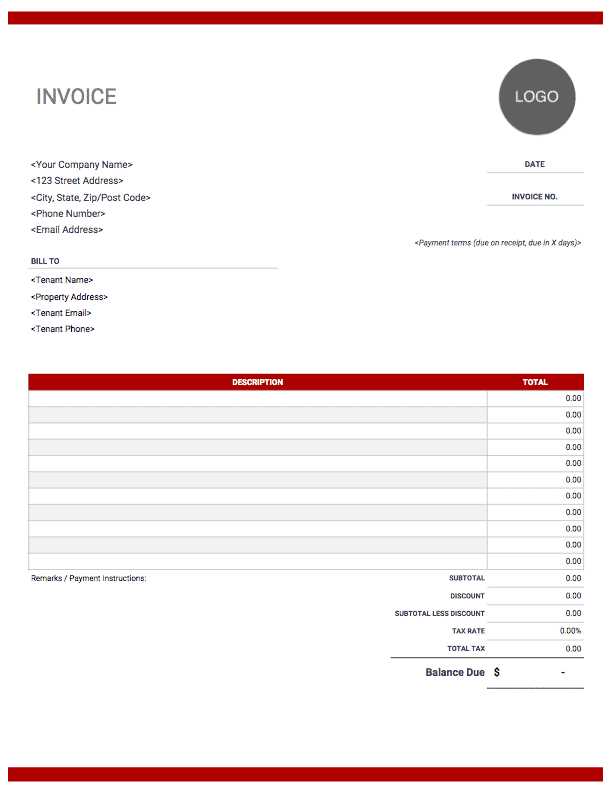

Customizable templates allow landlords to create professional documents quickly, saving time and effort while maintaining a clear and consistent format. By using these ready-made structures, property owners can easily outline the necessary details such as rental periods, fees, and payment terms.

Whether managing long-term leases or short-term agreements, having a standardized document simplifies communication and guarantees that all financial transactions are properly documented. A well-crafted document not only helps with legal clarity but also aids in maintaining a positive relationship with tenants by ensuring that all financial obligations are clearly stated and easily understood.

Rental Invoice Templates

For property owners, managing payments efficiently requires reliable tools that simplify the process. One of the most effective ways to ensure clarity in financial transactions is by utilizing well-organized forms designed to capture all essential details. These forms allow landlords to quickly outline charges, dates, and payment instructions, making it easier to track and confirm payments.

Advantages of Pre-Formatted Billing Documents

Pre-designed documents offer significant time-saving benefits, eliminating the need to start from scratch each time a payment needs to be recorded. With customizable sections, landlords can adapt the document to suit different rental agreements, payment schedules, and tenant requirements. This flexibility ensures that all information is accurately captured while maintaining a professional appearance.

How to Choose the Right Billing Structure

When selecting a suitable document, it’s important to consider the specifics of each rental arrangement. For long-term leases, a more detailed breakdown of monthly charges may be necessary, while short-term rentals may benefit from simpler, quicker formats. Regardless of the property type, a clear and concise document helps avoid confusion and ensures that both parties are on the same page regarding financial obligations.

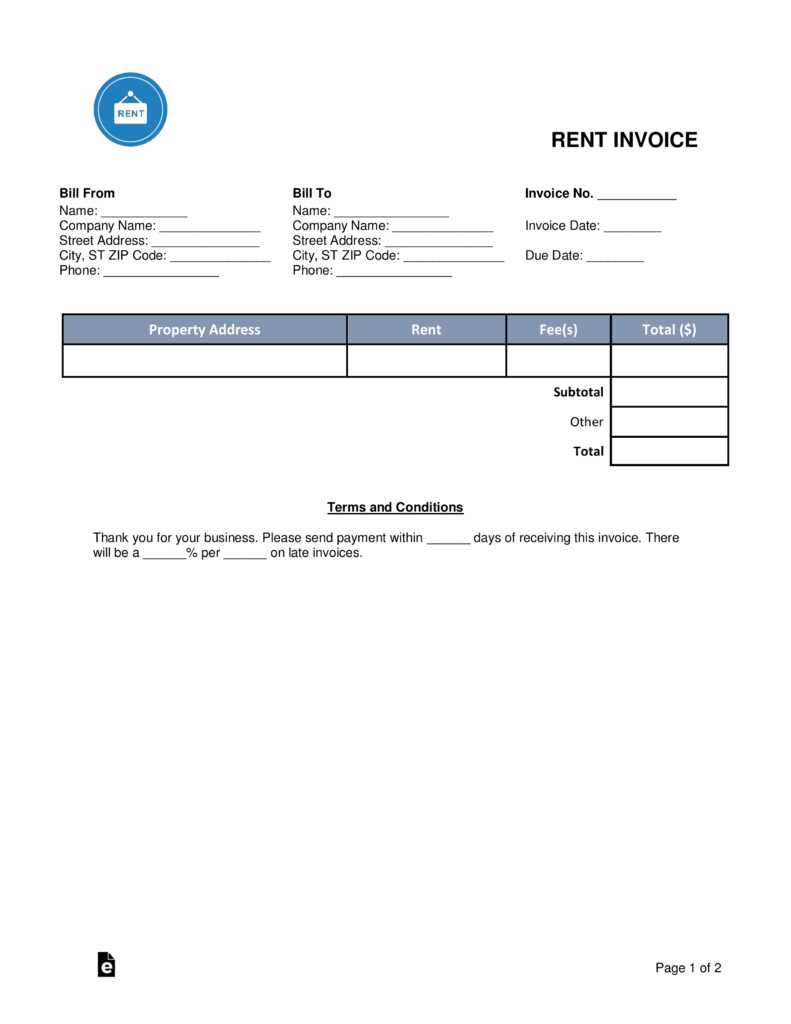

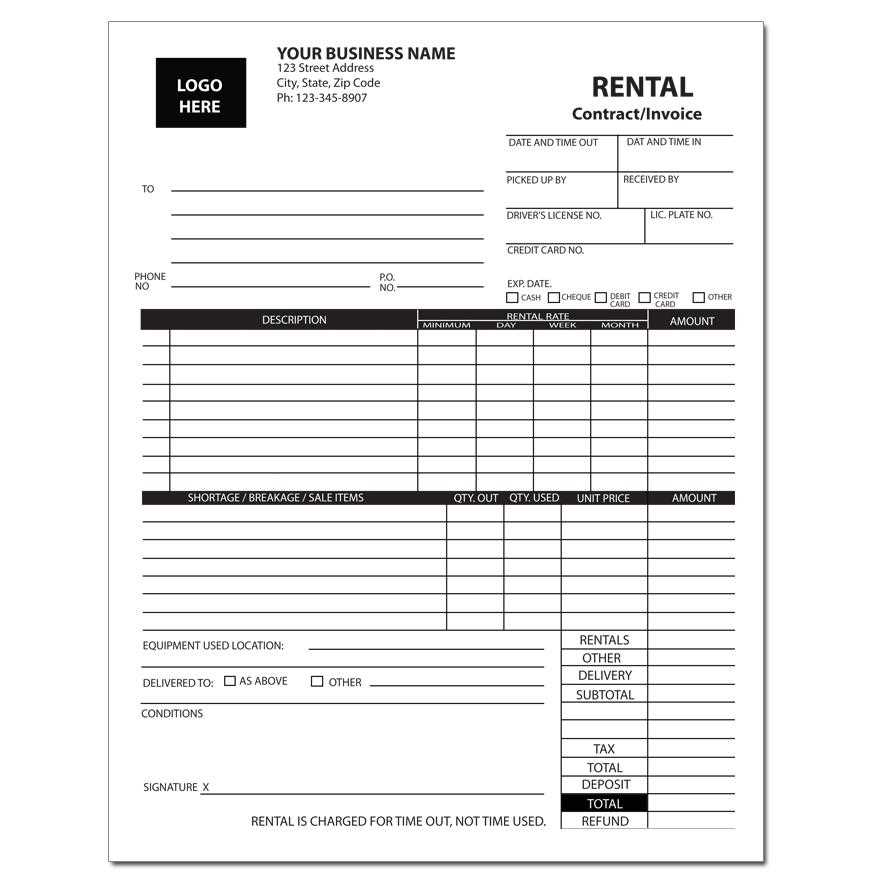

How to Create a Rental Invoice

Creating a document for billing property charges involves several key steps to ensure all necessary details are captured clearly. Whether you’re managing a single property or multiple units, it’s important to structure the document in a way that is easy to understand and includes all relevant financial information.

Here are the essential components that should be included in your billing document:

- Contact Information – Include the names and addresses of both the landlord and tenant to avoid confusion.

- Document Number – Assign a unique number to each document for record-keeping purposes.

- Payment Period – Clearly state the start and end dates of the billing period.

- Amount Due – List the amount owed, including any taxes, service fees, or late charges.

- Payment Instructions – Provide details on how the tenant should make the payment (e.g., bank transfer, online payment system).

- Due Date – Specify the date by which payment must be received to avoid penalties.

Once you’ve gathered all the necessary information, use a clean and simple layout to make the document easy to read. You can create it manually or use a software program to generate the structure automatically. Here’s a suggested workflow for creating your billing document:

- Gather all tenant and property details.

- Specify the charges and payment schedule.

- Include clear instructions for payment.

- Review the document for accuracy.

- Send the completed document to the tenant.

By following these steps, you ensure that both you and the tenant have a clear understanding of the financial agreement, helping to avoid disputes or confusion down the line.

Essential Components of Rental Invoices

To create an effective document for property-related charges, it’s important to include specific elements that make it clear, professional, and easy to understand. These components ensure that both parties–landlords and tenants–are on the same page regarding payment obligations, terms, and deadlines.

Key Information to Include

- Tenant and Landlord Details: Full names, addresses, and contact information for both parties.

- Unique Reference Number: A distinct number for easy tracking and record-keeping.

- Billing Period: Clearly specify the time frame the charges cover, such as the start and end date of the lease period.

- Charge Breakdown: Itemize each charge, such as rent, maintenance fees, or utilities.

- Total Amount Due: Clearly state the total amount that must be paid by the tenant.

- Payment Instructions: Provide clear details on how the tenant should make the payment (e.g., bank transfer, online payment).

- Due Date: Indicate when the payment is due to avoid late fees.

Formatting for Clarity

For the document to be effective, the information must be presented in a structured and easy-to-read format. A simple, logical layout helps the recipient quickly find the necessary details. Use clear headings and sections to separate the various elements, making it easier to locate specific information such as charges or payment instructions.

By including these essential elements, you ensure that the document serves its purpose: providing clarity on financial transactions and fostering trust between landlords and tenants.

Customizing Your Rental Invoice Template

Personalizing your billing document is an important step in making it suit your specific needs and style. By adjusting key elements, you can ensure that the document is both functional and professional while aligning with your unique rental agreements. Customization allows you to incorporate details that are relevant to your business and make the document more user-friendly for tenants.

Important Customization Options

- Branding: Add your business logo, color scheme, and contact information to create a professional look.

- Payment Terms: Adjust the payment terms to reflect your specific policies, such as due dates, late fees, or discounts for early payment.

- Charge Breakdown: Customize the list of fees and charges to reflect your property’s unique costs, such as utilities, parking, or maintenance fees.

- Additional Notes: Include any special instructions or disclaimers, such as renewal policies, service details, or important tenant reminders.

- Language and Formatting: Customize the wording to match your tone and style, and format the document for clarity and ease of use.

Creating a Consistent Look

Consistency is key when customizing your billing forms. Whether you’re managing a single unit or multiple properties, maintaining a consistent look across all documents helps build credibility and trust with tenants. Ensure that all essential components are included and formatted in a way that is easy to read and understand, making payments more straightforward for both you and your tenants.

Why Use Digital Rental Invoice Templates

Switching to digital documents for managing property-related billing offers several advantages over traditional paper methods. Digital formats streamline the process, reduce errors, and provide easy access for both landlords and tenants. By using electronic forms, property owners can automate many aspects of the billing process, saving time and enhancing efficiency.

Benefits of Going Digital

- Efficiency: Digital documents can be created, edited, and shared quickly, eliminating the need for manual data entry and reducing the risk of mistakes.

- Instant Delivery: Send the document to tenants via email or an online platform, ensuring it reaches them immediately without postal delays.

- Security: Electronic records are easier to store, back up, and protect from damage or loss compared to physical paperwork.

- Environmentally Friendly: Reducing paper usage not only lowers costs but also contributes to sustainability efforts by minimizing waste.

Cost Savings and Time Management

By eliminating the need for printing, mailing, and filing physical documents, digital solutions help reduce overhead costs. Property owners can also manage multiple properties more efficiently, as all documents are stored in one centralized system that is accessible at any time. This also reduces the time spent organizing and retrieving physical paperwork, freeing up time for other important tasks.

Benefits of Professional Invoice Templates

Using professionally designed billing documents can significantly enhance the quality and efficiency of managing financial transactions. These ready-made formats help ensure that all necessary details are included and presented clearly, reducing the risk of errors or misunderstandings. By adopting a polished structure, property owners can create a more reliable and professional image.

Consistency is one of the primary advantages of using a professional format. With a standardized design, every document will look uniform, giving tenants a sense of trust and confidence. This consistency also simplifies the process of tracking and organizing payments, as the format remains the same across all documents.

Time savings is another key benefit. A professional document reduces the need for manual formatting, allowing landlords to focus on more important tasks. Whether you’re managing one property or multiple, the ability to quickly generate accurate, well-designed documents helps improve workflow and minimize delays.

Professional designs often include useful features like customizable fields, automatic calculations, and built-in reminders for due dates. These features not only make the process faster but also ensure that no essential information is overlooked, leading to fewer mistakes and more efficient financial management.

Common Mistakes in Rental Invoices

When creating billing documents for property-related charges, there are several common errors that can cause confusion or delays in payments. These mistakes can range from missing information to incorrect formatting, which can lead to misunderstandings between landlords and tenants. Avoiding these pitfalls ensures a smoother process for both parties.

Missing or Incorrect Details

- Incomplete Contact Information: Failing to include full names, addresses, or phone numbers can make it difficult for tenants to respond or ask questions about the charges.

- Incorrect Payment Dates: Mistakes in due dates or payment periods can cause confusion, leading to missed payments or unnecessary late fees.

- Unclear Charges: Not providing a clear breakdown of costs can lead to disputes over amounts owed, especially if certain fees or services are not explained in detail.

Poor Formatting and Organization

- Inconsistent Layout: A lack of clear sections or headings can make the document difficult to read, causing tenants to overlook important information.

- Missing Payment Instructions: Not including clear payment methods or instructions can delay payments, as tenants may be unsure how to submit the amount owed.

- Wrong Calculations: Simple math errors can lead to inaccurate totals, creating frustration and confusion for both landlords and tenants.

By addressing these common issues and double-checking documents before sending them, property owners can improve communication and ensure timely payments, avoiding unnecessary complications.

Best Practices for Billing Tenants

Establishing clear and consistent billing practices is essential for maintaining smooth financial transactions between landlords and tenants. By following best practices, you can minimize disputes, improve cash flow, and create a more professional experience for your tenants. Proper billing ensures that both parties understand their obligations and responsibilities, reducing the likelihood of misunderstandings.

One of the most important practices is to provide detailed and transparent documentation. Always include a complete breakdown of charges, payment due dates, and any applicable fees. This helps tenants understand exactly what they are paying for and prevents any confusion. Additionally, it’s important to set clear expectations by providing tenants with an overview of the payment schedule and preferred methods for submitting payments.

Another key practice is to communicate promptly. Sending reminders before due dates, and following up on overdue payments, helps keep everything on track. Clear communication also involves being approachable and ready to answer any questions tenants may have about their charges.

Finally, maintaining consistency in how you issue bills, enforce late fees, and handle payment methods establishes trust and reliability. By keeping the process uniform, tenants will know what to expect and can plan accordingly, reducing the chance of late or missed payments.

Tracking Rental Payments with Invoices

Efficiently managing and tracking payments is crucial for property owners to ensure that financial records are accurate and up to date. Proper documentation plays a significant role in monitoring when payments are made, what amounts are outstanding, and any discrepancies that may arise. By using a clear and organized approach to track payments, landlords can maintain smooth operations and avoid financial mismanagement.

One effective method for tracking payments is to issue a detailed document for every transaction. This serves as a reference point for both the property owner and the tenant, helping to clearly outline amounts owed, due dates, and payment status. Keeping a record of each transaction ensures that any missed or late payments are easily identifiable, allowing for timely follow-up.

Moreover, digital tools can help streamline the process. With online payment systems and automated records, landlords can easily track payments, set up reminders for overdue amounts, and maintain an organized history of transactions. This digital approach not only reduces the risk of human error but also allows for more efficient management of multiple tenants and properties.

By systematically tracking payments and maintaining accurate records, property owners can keep their financials in order and build stronger, more transparent relationships with their tenants.

Understanding Terms in Rental Invoices

When managing property transactions, it is essential to have a clear understanding of the key terms used in financial documents. These terms help define the charges, payment schedules, and responsibilities of both parties involved. Properly interpreting these terms ensures smooth communication and minimizes the likelihood of disputes over payments and services.

Key Terms Explained

- Due Date: The date by which payment is expected. It is important to clearly specify this date to avoid confusion and late payments.

- Late Fees: Additional charges applied if payments are not received by the specified due date. These are often a percentage of the outstanding amount.

- Deposit: An upfront payment required before the start of a rental agreement, typically used to cover potential damages or unpaid balances.

- Balance Due: The total amount that remains unpaid after any previous payments have been applied.

- Service Charges: Fees for additional services provided, such as maintenance, utilities, or parking spaces.

Clarifying Payment Structures

- Installments: Payments that are made in multiple smaller amounts, often due at regular intervals, such as monthly or quarterly.

- Discounts: Reductions in the amount owed, which may be offered for early payments or as a promotional incentive.

- Tax Information: Any applicable taxes that need to be added to the total cost, often dependent on local laws.

Understanding these key terms will help tenants and property owners navigate the payment process effectively and ensure that all obligations are met on time.

Free vs Paid Rental Invoice Templates

When choosing a format for documenting property-related charges, you have the option of using free or paid solutions. Both options offer unique advantages and may suit different needs depending on the complexity of the requirements. Understanding the differences between these two can help property owners make an informed decision based on their budget and business needs.

Advantages of Free Options

- Cost-effective: Free solutions are accessible to everyone, making them ideal for small-scale landlords or those just starting out.

- Basic Functionality: Many free designs offer enough features for simple transactions, such as clear breakdowns of charges and payment due dates.

- Easy to Use: Free formats are often user-friendly, with straightforward layouts that require little customization.

Benefits of Paid Options

- Professional Design: Paid solutions tend to offer more polished, visually appealing layouts that create a stronger impression with tenants.

- Customization: These formats often allow for greater customization, letting landlords tailor the document to their specific needs, including branding and advanced fields.

- Additional Features: Paid solutions may include extra features such as automatic calculations, tracking tools, and integration with accounting software, helping landlords manage their finances more efficiently.

While free options can be a great start, paid solutions offer more robust features that may be worth the investment, especially for those managing multiple properties or looking for greater flexibility and professionalism.

How to Format Rental Invoices Effectively

Properly structuring your financial documents is essential for ensuring clarity and reducing potential misunderstandings. When creating a document for property-related payments, it’s important to organize the content in a way that is easy for both the property owner and tenant to understand. An effective format provides all necessary information in a clear, concise manner, ensuring smooth transactions and minimizing disputes.

Start by clearly identifying the document type at the top, making it easy to distinguish from other paperwork. Following this, include the landlord’s name and tenant’s information prominently. It’s important to include details such as the full address of the property, the rental period, and the payment amount. The payment schedule should also be clearly outlined, specifying the due date and any applicable late fees.

Next, a breakdown of charges, such as base rent, utilities, and any additional fees, should be organized in a logical sequence. For maximum clarity, use a table to list these items separately. Providing an itemized list helps tenants understand exactly what they are paying for and prevents confusion.

Finally, including a section for payment methods and instructions helps facilitate smooth transactions. Specify accepted payment types, due dates, and any special instructions for processing payments. An effective format also leaves space for any additional notes or agreements that are pertinent to the transaction.

By following these guidelines, you can ensure that your financial documents are not only clear and professional but also effective in minimizing errors and delays.

Legal Requirements for Rental Invoices

When creating financial documents for property agreements, it is important to adhere to the legal requirements to ensure that the document is valid and enforceable. These documents must meet certain criteria to protect both parties in the transaction and comply with local regulations. Understanding these legal obligations is crucial for avoiding disputes and ensuring smooth business operations.

Key Legal Elements to Include

- Full Identification of Both Parties: The names and contact information of both the property owner and the tenant should be clearly listed.

- Clear Payment Terms: The document must specify the total amount due, the payment due date, and any potential late fees or penalties.

- Itemized List of Charges: All charges related to the rental arrangement, including rent, utilities, and any additional fees, should be broken down and clearly explained.

- Legal Jurisdiction: The jurisdiction or the region in which the rental agreement is governed should be mentioned, ensuring that both parties are aware of the applicable laws.

Regulatory Compliance

- Tax Requirements: Some regions may require the addition of taxes to the total amount due, so it’s essential to understand local tax laws and apply them correctly.

- Proper Documentation: Depending on local laws, some regions may require specific formats or additional documentation to be attached to the transaction, such as proof of property ownership or certificates for certain services.

Ensuring that these elements are correctly included will not only fulfill legal obligations but also provide a professional and transparent experience for both parties involved in the rental agreement.

Using Rental Invoices for Record Keeping

Maintaining accurate financial records is crucial for any property management business. By properly documenting transactions, property owners ensure they stay organized and compliant with tax regulations. Financial documents not only serve as a tool for tracking payments but also help in managing cash flow and monitoring outstanding debts.

Benefits of Organized Record Keeping

- Efficient Tracking: By keeping a systematic record of all payments, landlords can quickly identify overdue payments and keep tenants informed about their account status.

- Tax Reporting: Having a clear record of financial transactions helps when filing taxes, as it provides proof of income and can also show deductible expenses related to property management.

- Dispute Resolution: If any payment issues arise, having detailed documentation makes it easier to resolve disputes, as both parties can refer to the original records to clarify any misunderstandings.

Best Practices for Effective Record Keeping

- Consistency: Regularly update records for every transaction, ensuring that all payments and adjustments are logged immediately after they occur.

- Digital Storage: Storing records digitally in secure software or cloud-based systems ensures easy access and prevents physical document loss.

- Clear Categorization: Organize records by categories such as rent, utilities, and maintenance fees, making it easier to track different types of charges and expenses.

By leveraging financial documents for proper record keeping, property owners ensure they have an accurate and accessible overview of their rental activities, which simplifies both business operations and compliance with legal requirements.

Generating Invoices for Multiple Properties

Managing multiple properties can quickly become complex when it comes to documenting payments and expenses. Property owners and managers must ensure each unit has accurate records for tenants, while keeping track of any variations in rent, services, and additional fees. Automating the process of generating financial statements for each property can help streamline operations and reduce the risk of errors.

Organizing Multiple Property Records

- Separate Accounts for Each Property: Keeping individual records for each unit helps prevent confusion and ensures that payments are accurately tracked for all properties under management.

- Consolidated Payment System: Use a centralized system to generate statements for all properties, making it easier to track payments and calculate totals across your portfolio.

- Customizable Entries: Ensure the financial document reflects unique charges for each property, including specific rent amounts, maintenance fees, and any other property-related costs.

Streamlining the Process

- Template Automation: Use customizable financial tools that allow you to generate similar documents for multiple properties with ease. This reduces time spent on manual entry and ensures consistency.

- Bulk Generation Features: Some software tools offer bulk generation, allowing you to create and send multiple statements in one go, saving significant administrative time.

- Track Payment Histories: Maintaining a clear history for each unit’s payments over time is essential for understanding the tenant’s payment patterns and for resolving any potential disputes.

By adopting an organized and automated system for generating payment records across several properties, property owners can improve efficiency, reduce mistakes, and have a clearer overview of their rental business operations.

Invoice Templates for Short-Term Rentals

Managing payments for short-term accommodations requires a streamlined process that accurately reflects each booking. Whether it’s a vacation home, a city apartment, or a guest house, creating a clear and professional payment document is key for both property owners and tenants. Such documents should include all necessary details for clarity, including the duration of stay, services provided, and applicable taxes or fees.

Key Components for Short-Term Rental Documents

For short-term accommodations, these are the typical elements that should be included in each financial document:

| Component | Description |

|---|---|

| Property Name and Address | Include clear details about the property location to avoid confusion. |

| Tenant Details | Provide the tenant’s name, contact information, and booking reference. |

| Booking Dates | Include the check-in and check-out dates for the specific stay period. |

| Rate per Night | Specify the nightly rate and total charges based on the duration of stay. |

| Cleaning Fees | Indicate any additional charges for cleaning or other services. |

| Taxes | Ensure applicable taxes are clearly listed and calculated. |

With these essential components, the document will provide a detailed breakdown of the payment and allow both parties to track expenses and verify charges. This ensures transparency and reduces the likelihood of confusion, especially when dealing with multiple short-term tenants over time.