Rent a Car Invoice Template for Efficient Billing

Managing transactions effectively is crucial for any business, especially when dealing with services and temporary possessions. A well-structured payment record not only ensures smooth financial operations but also builds trust between providers and clients. A properly designed billing sheet allows for clear communication regarding costs and terms of service.

Streamlining the process of generating billing statements can significantly save time and reduce errors. With a customizable format, service providers can easily include all necessary details, such as rental duration, charges, and additional fees, offering both professionalism and transparency. An efficient billing solution helps maintain organization and minimizes disputes over payments.

Adopting a ready-made document can simplify this process. By choosing a flexible layout, businesses can quickly adjust the document for various customers or rental scenarios. This approach not only boosts operational efficiency but also guarantees consistency across all issued statements.

Rental Billing Document Overview

Effective financial management is essential for businesses providing temporary goods or services. A well-designed document ensures both parties clearly understand the terms, costs, and payment methods involved. It is a crucial tool for professionals to maintain transparency and avoid misunderstandings regarding transactions.

Key Elements of a Proper Document

A comprehensive billing sheet typically includes several important details that provide clarity to the customer and ensure smooth processing of payments. These elements help define the structure of the document:

- Service Provider Information: Name, address, and contact details of the business.

- Customer Information: Name, contact information, and any identification number if applicable.

- Service Details: A clear description of the services provided, including the duration of usage and any additional terms.

- Total Charges: A breakdown of the cost, including applicable taxes, fees, and any discounts.

- Payment Terms: Due dates, payment methods, and any penalties for late payments.

Benefits of Using a Structured Billing Sheet

Utilizing a structured document brings several advantages to both the business and the client:

- Professionalism: Clear and well-organized documents promote a positive image and build trust.

- Time-saving: Pre-designed formats allow for faster creation and fewer errors during processing.

- Consistency: Using a standardized layout ensures all necessary information is included each time.

- Easy Tracking: With all details clearly stated, it becomes easier to monitor payments and track outstanding balances.

How to Create a Rental Billing Document

Creating an effective billing document requires careful attention to detail and a clear structure. A well-organized record ensures that both the provider and the customer have a full understanding of the service provided, its costs, and payment terms. Following a simple step-by-step approach can make the process of generating such documents straightforward and efficient.

Here are the essential steps to create a comprehensive billing sheet:

- Step 1: Gather Necessary Information – Before you begin, collect all the details related to the transaction, including customer information, rental dates, and the services offered. This ensures accuracy when entering data.

- Step 2: Define the Service Details – Clearly describe what was provided, such as the type of item or service rented, the duration, and any additional features that might affect the price.

- Step 3: Calculate the Total Cost – Break down the pricing into categories such as daily rates, additional fees, and taxes. Provide a detailed summary to ensure transparency.

- Step 4: Include Payment Terms – Specify the due date, available payment methods, and any penalties for late payments.

- Step 5: Format the Document Clearly – Ensure the document is easy to read, with well-organized sections and clearly labeled headings. Use a consistent font and layout to enhance professionalism.

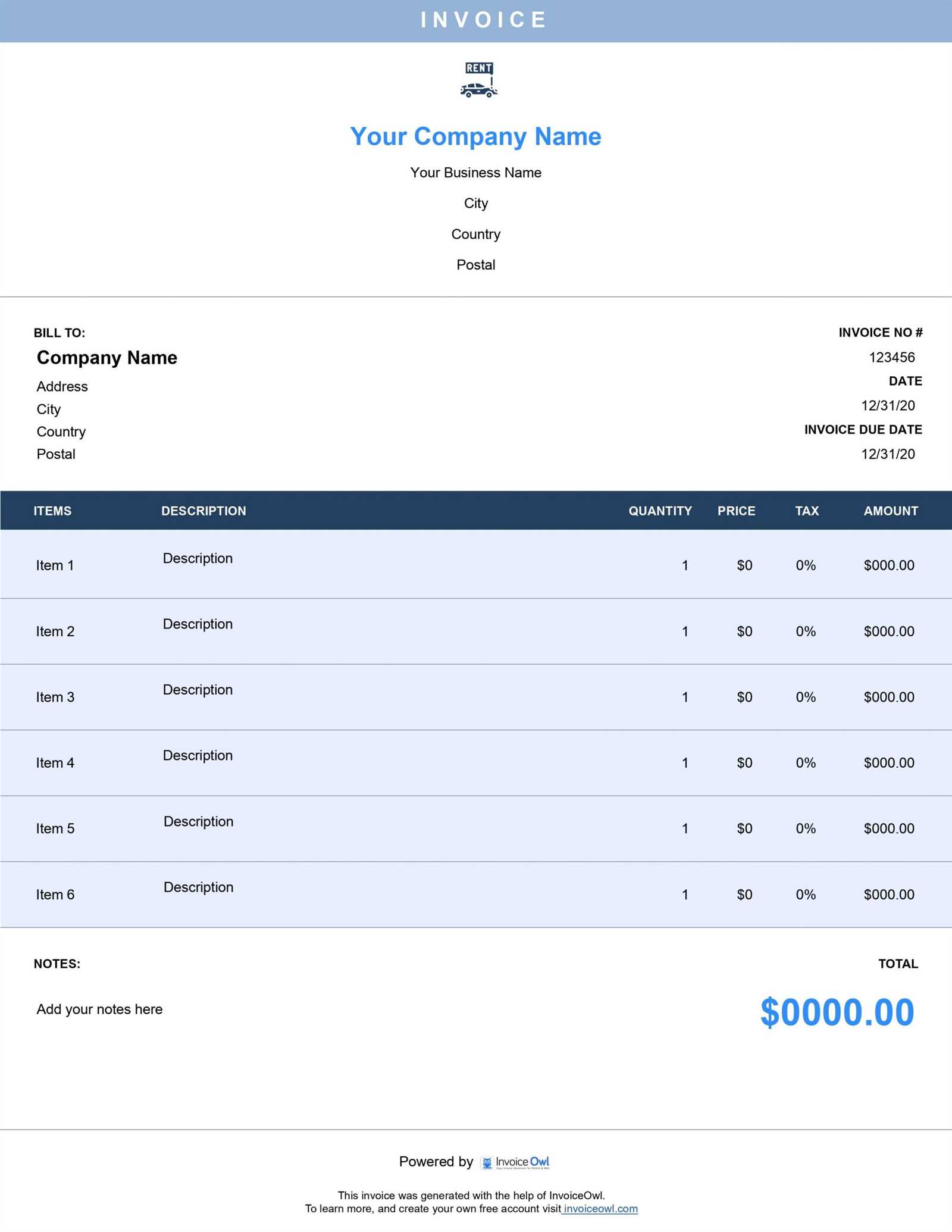

Essential Elements of a Rental Billing Statement

A well-structured payment statement is crucial for ensuring clarity and transparency between the service provider and the customer. To avoid confusion and ensure that both parties are on the same page, certain key elements must be included. These components provide a clear breakdown of the services, fees, and payment expectations.

Here are the core elements that should be present in every billing document:

- Provider Information: The name, address, and contact details of the business or service provider.

- Customer Information: The customer’s full name, address, and contact information, along with any identification number if relevant.

- Service Description: A detailed description of what was provided, including the type of service, duration, and any specific terms of the agreement.

- Pricing Breakdown: A list of the charges involved, including base rates, additional services, taxes, and any discounts applied.

- Payment Terms: Information about when the payment is due, accepted methods of payment, and any late fees or penalties for overdue payments.

- Unique Reference Number: A transaction or invoice number that helps track the specific billing record for both the provider and the customer.

Benefits of Using a Billing Format

Utilizing a pre-designed document format for payment records brings several advantages to businesses and service providers. A standardized layout can save time, reduce errors, and ensure consistency across all issued statements. It also enhances the professionalism of the billing process, making the transaction clearer and more reliable for both the provider and the client.

Time Efficiency

Streamlining the billing process saves valuable time by eliminating the need to manually create each document from scratch. With a predefined structure, you can quickly input the necessary details and generate a polished payment record in minutes, allowing you to focus on other important aspects of your business.

Improved Accuracy

Minimizing errors is another key advantage. A fixed format ensures that all relevant information is included consistently, reducing the likelihood of missing details or miscalculations. This leads to fewer disputes and confusion over payments, making financial management smoother for both parties.

Professional Appearance is also important. A neat and well-organized billing document reflects positively on your business and creates a sense of trust and credibility with customers. It shows that you are serious about your operations and helps to maintain a good reputation in the industry.

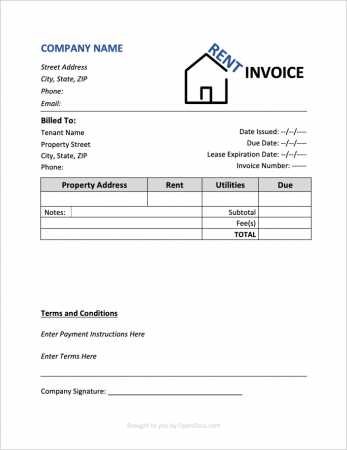

Customizing Your Rental Billing Document

Adapting a standard payment record to suit your business needs is an essential step in streamlining your financial processes. Customizing the document ensures that it aligns with your branding, reflects specific terms, and includes all relevant details for a seamless transaction. By tailoring the format, you can enhance the clarity and professionalism of each bill.

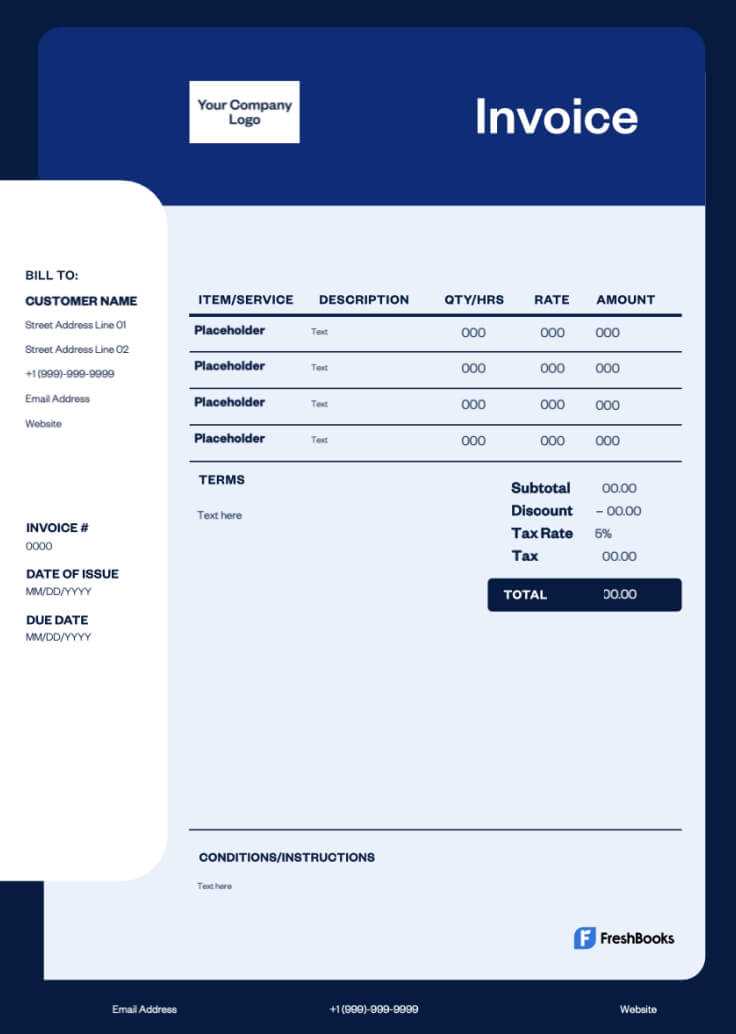

Personalizing the Design

One of the first adjustments you can make is to customize the document’s appearance. This includes incorporating your company logo, brand colors, and fonts to create a cohesive look that aligns with your overall brand identity. A professional design makes the statement more recognizable and reflects positively on your business.

Adding Custom Fields

Depending on your service, you may need to include additional sections or information that aren’t part of a standard billing structure. You can add fields such as:

- Special conditions: Any specific rental terms or policies.

- Discounts or promotional offers: Custom discount rates for loyal customers or seasonal promotions.

- Notes or instructions: Space for any other relevant details that might be useful to the client.

By tailoring these elements, you can create a document that fits your unique needs while maintaining a professional and consistent appearance.

Common Mistakes in Rental Billing Statements

When creating payment records, it’s easy to overlook certain details, leading to errors that can cause confusion or disputes. Common mistakes in these documents can range from simple formatting issues to missing or incorrect information. By understanding and avoiding these errors, businesses can ensure that the billing process is clear, professional, and free from misunderstandings.

Here are some of the most frequent mistakes to watch out for when preparing rental billing documents:

- Incorrect Dates: Failing to specify the exact rental duration or using the wrong dates can lead to confusion about the terms of service.

- Missing Customer Details: Not including full customer contact information or identification can make it difficult to track payments and resolve issues.

- Inaccurate Pricing: A common mistake is not properly calculating the total cost or forgetting to add taxes and fees, leading to discrepancies in the amount due.

- Lack of Clear Payment Terms: Not specifying due dates, payment methods, or late fees can result in delayed payments and misunderstandings about financial expectations.

- Unorganized Layout: Poor formatting can make it difficult for the customer to understand the details of the document, which can cause frustration and potential disputes.

By avoiding these mistakes and ensuring that all necessary information is clear and accurate, you can improve the quality of your billing process and enhance customer satisfaction.

Understanding Rental Charges and Fees

When providing services that involve temporary use of goods, it’s essential to clearly outline the associated costs to avoid confusion or disputes. A well-defined breakdown of charges helps customers understand exactly what they are paying for and ensures that both the service provider and the client are on the same page regarding expectations.

Types of Charges

The total amount a customer is asked to pay typically consists of several different charges. These may vary depending on the nature of the service, duration, and additional factors. Common charges include:

- Base Fee: The core charge for the service provided, usually based on duration or usage.

- Additional Services: Extra charges for add-ons like insurance, GPS devices, or extra equipment.

- Security Deposit: A refundable amount collected upfront to cover potential damages or extra costs during the service period.

- Late Fees: Charges imposed if the service is returned or concluded after the agreed-upon time.

- Taxes: Applicable local or national taxes that are added to the total cost of the service.

Clear Breakdown of Fees

Providing a transparent and itemized list of these charges on the billing document ensures that customers can easily verify the amounts they are being asked to pay. It helps maintain trust and avoids any confusion regarding the overall cost. Being detailed about each charge makes the transaction more professional and fosters a better relationship with clients.

Automating Your Billing Process

Streamlining the billing process through automation can significantly reduce time and effort while improving accuracy and efficiency. By implementing automated systems, businesses can handle routine tasks such as creating, sending, and tracking payment records without manual intervention. This allows service providers to focus on other important areas of their business while ensuring a seamless transaction process for customers.

Benefits of Automation

Efficiency is one of the most significant advantages of automating the billing process. Automated systems can generate payment documents instantly based on preset criteria, eliminating the need for manual entry. This reduces the risk of errors and speeds up the overall process, enabling businesses to manage a larger volume of transactions with less effort.

Customization and Integration

Many automated billing solutions offer customizable options to tailor the process to specific needs. These systems can be integrated with existing customer databases, payment gateways, and accounting software, allowing for seamless updates and synchronized data. Automated tools also offer features like recurring billing, reminders, and real-time tracking of payment status, making the entire system more flexible and customer-friendly.

By automating your payment records, you can improve operational efficiency, reduce human error, and provide a better experience for both customers and business owners.

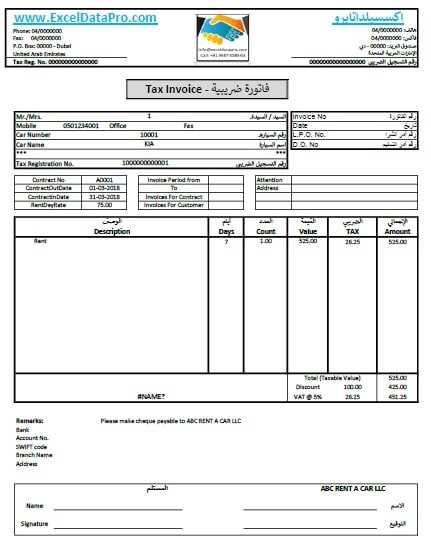

Legal Requirements for Rental Billing Statements

Every business that provides temporary use of goods or services must ensure that their billing documents meet certain legal standards. These requirements help protect both the service provider and the customer by ensuring transparency, accuracy, and compliance with local laws. Understanding the necessary components of a legally compliant billing record is essential for avoiding disputes and maintaining a professional operation.

Legal standards typically dictate that certain key pieces of information must be included in all billing records. These requirements can vary based on location, business type, and the nature of the services provided. However, common legal stipulations include:

- Complete Provider Information: Full business name, contact details, and any applicable registration numbers or tax ID numbers must be listed clearly.

- Clear Customer Details: The name and address of the customer, and sometimes their identification number, should be included to ensure proper identification.

- Service Description: A detailed explanation of the provided service, including duration, any included products or services, and specific terms of agreement.

- Proper Tax Calculation: Taxes must be accurately calculated and displayed, along with the applicable tax rates based on local regulations.

- Legal Disclaimers: Certain legal disclaimers or terms of service must be present to protect both parties from potential legal issues, such as late payment fees or insurance conditions.

Complying with these legal requirements not only ensures the validity of the billing documents but also promotes trust between service providers and customers. Maintaining accurate and legally compliant records is an important step toward minimizing disputes and fostering long-term business relationships.

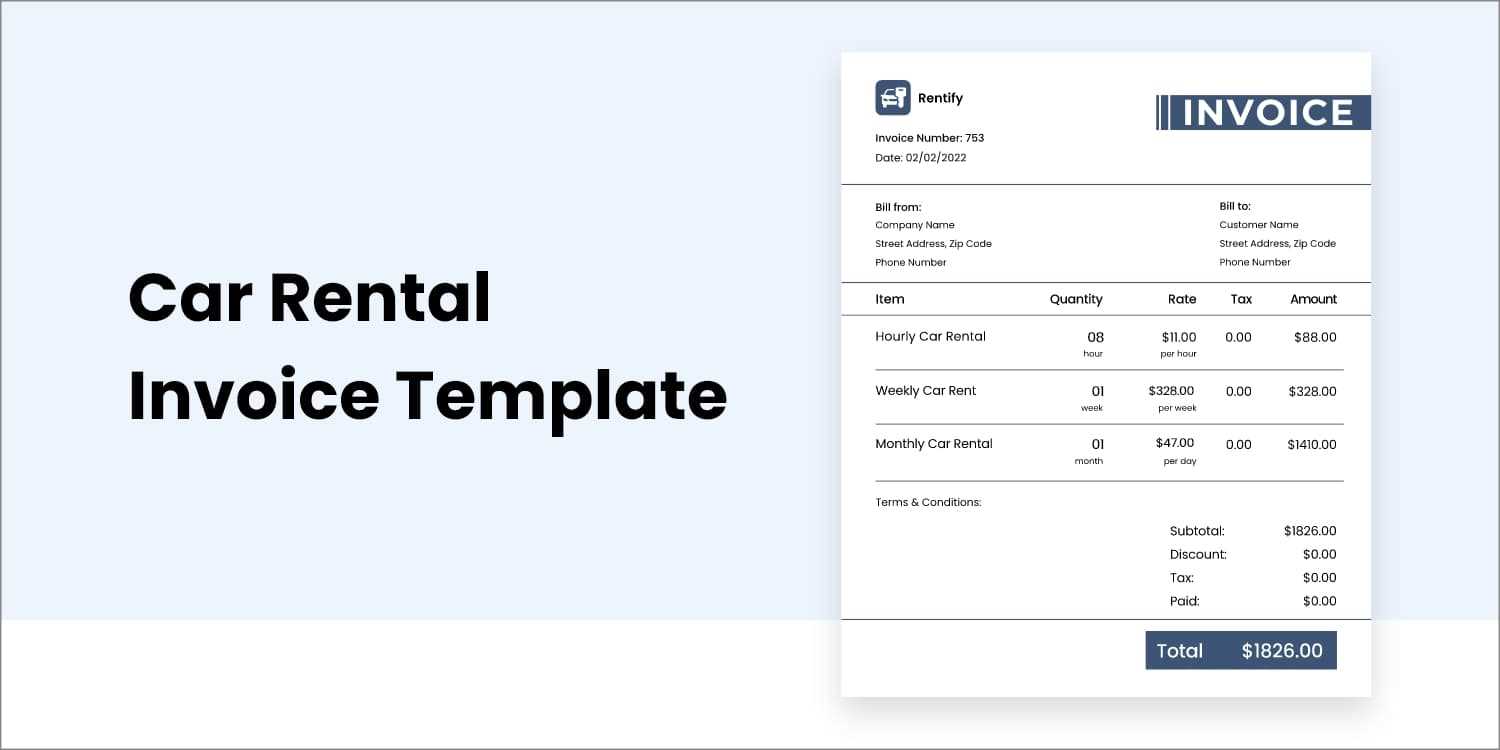

Formatting a Professional Rental Billing Statement

Presenting billing documents in a professional and organized manner is essential for creating a positive impression and ensuring clarity for both the service provider and the customer. A well-formatted payment statement not only helps in communicating important details but also enhances the credibility of the business. The structure of the document should be clean, logical, and easy to read.

Key elements to focus on when formatting a professional billing record include:

- Header Information: The top section should include your business name, logo, and contact details, along with the customer’s name and contact information. This section ensures that both parties can be easily identified.

- Itemized Breakdown: Clearly list the services or products provided, including a description, quantity, rate, and any additional fees. This transparency helps avoid confusion and sets clear expectations.

- Total Amount: The total amount due should be clearly highlighted, with any discounts or additional charges specified in the breakdown. It should be easy to find and understand.

- Payment Terms: Outline the terms for payment, including due dates, accepted methods of payment, and any penalties for late payments. This helps to ensure that the customer is aware of their responsibilities.

- Professional Design: Use clean fonts and a simple layout to make the document easy to navigate. White space is important for readability, and the use of borders or boxes around sections can help to organize information effectively.

By paying attention to these formatting details, businesses can create billing documents that are not only professional but also functional, promoting smooth and efficient financial transactions.

How to Add Discounts and Taxes

When preparing billing documents, it’s important to accurately include any discounts and applicable taxes to ensure transparency and proper accounting. These adjustments not only reflect the correct final amount due but also help maintain clarity between service providers and customers. Adding such components involves calculating and presenting the figures in an understandable way.

Including Discounts

Discounts can be applied to the overall amount or to specific items in the breakdown. These reductions can be a flat amount or a percentage of the total charge. Make sure to clearly indicate the discount applied and show the amount deducted from the total price to avoid any confusion.

Applying Taxes

Taxes should be calculated based on the applicable tax rate for the location or service type. It’s important to ensure that the tax is clearly identified as a separate line item to avoid any misunderstandings. Different services may have different tax rates, so it’s essential to specify the tax amount and rate for each applicable charge.

| Description | Amount |

|---|---|

| Original Service Charge | $200.00 |

| Discount (10%) | -$20.00 |

| Subtotal | $180.00 |

| Tax (5%) | $9.00 |

| Total Due | $189.00 |

By clearly indicating discounts and taxes in the billing document, you provide customers with a transparent view of how their final amount is calculated, which helps prevent any confusion and builds trust.

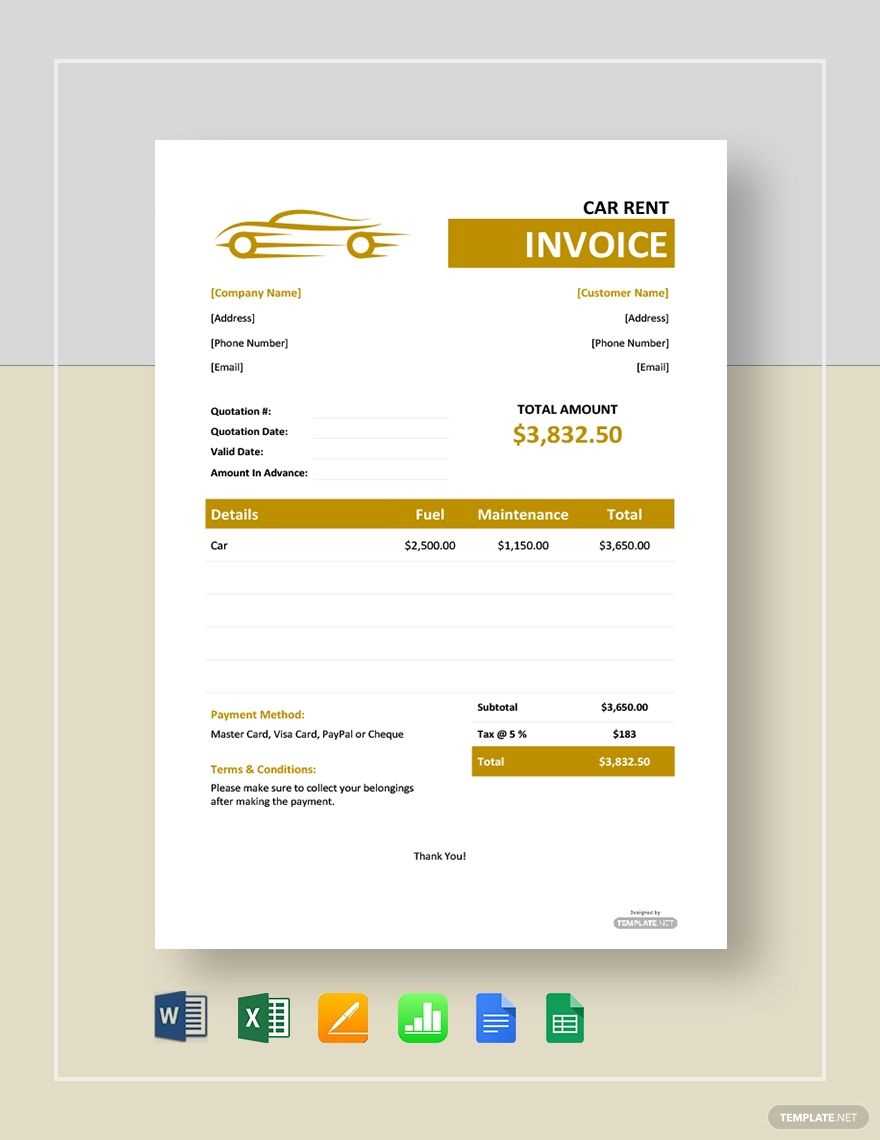

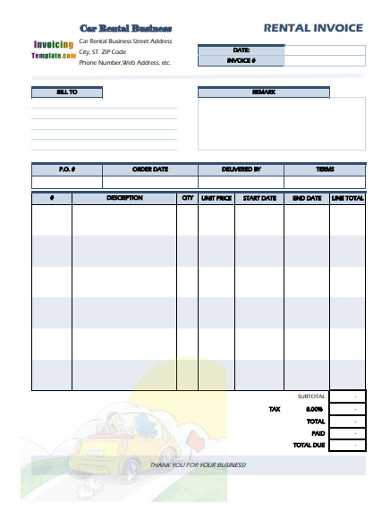

Invoice Document Options for Vehicle Rentals

When preparing payment records for temporary vehicle use, it is essential to choose an appropriate format that fits the business needs and ensures clarity. Several options are available to create a document that effectively communicates the details of the transaction while maintaining professionalism. Understanding the different formats and how they can be customized is key to producing well-organized and easy-to-understand records.

Basic Formats

There are a variety of document types available for creating rental records. Each format serves a specific purpose depending on the complexity of the transaction and the level of detail required.

- Simple Text Documents: A straightforward approach, using plain text for essential information such as service dates, amounts, and basic contact details.

- Spreadsheet Formats: Useful for businesses that handle numerous transactions. Spreadsheets allow for easy calculations and can be customized with formulas for tax and discount inclusion.

- PDF Documents: Popular for professional use, offering a clean, fixed format that can be shared electronically or printed for physical records.

Advanced Formats

For those requiring more advanced features, there are options that allow for deeper customization and integration with other systems.

- Cloud-Based Systems: These platforms allow businesses to generate and store records online. Cloud-based solutions also support automated billing and real-time updates.

- Integrated Accounting Software: This type of format can be directly linked with the business’s accounting system, automatically generating and tracking billing statements based on entered data.

Choosing the right format for your billing documents can streamline your processes, improve accuracy, and enhance your customers’ experience by providing clear, professional records of their transactions.

Creating a Clear Payment Terms Section

A well-structured payment terms section is crucial in any billing document. This part outlines the conditions under which payments are expected, ensuring both the service provider and the customer are on the same page regarding due dates, accepted payment methods, and late fees. Clear payment terms help avoid confusion and potential disputes, fostering a professional relationship between both parties.

Key Elements to Include

The payment terms should be straightforward and easy to understand. Here are the most essential components to consider:

- Due Date: Specify the exact date by which payment should be completed. This can help prevent delays and ensure timely processing of payments.

- Accepted Payment Methods: Clearly state the payment methods you accept, whether it’s credit cards, bank transfers, or online payment systems.

- Late Fees: If applicable, outline any penalties or additional fees that will be incurred for overdue payments. This encourages customers to settle their bills on time.

- Discounts for Early Payment: Offering a discount for early settlement can be an attractive incentive for customers to pay sooner.

Best Practices for Clarity

Ensure that the terms are written in clear, concise language that is easy for anyone to understand. Avoid complex legal jargon that could confuse customers. Use bullet points or numbered lists to present the information in an organized manner, making it easy to find the relevant details quickly.

By defining clear payment terms, you set expectations for both parties and create a transparent framework that helps avoid misunderstandings and ensures a smooth transaction process.

How to Track Payments on Billing Statements

Properly tracking payments on billing statements is essential for maintaining accurate financial records. It ensures that all transactions are accounted for and helps businesses keep track of outstanding balances. Having an efficient system for monitoring payments allows service providers to identify any overdue amounts and avoid potential cash flow issues.

Methods to Track Payments

There are several ways to track payments, each with varying levels of complexity depending on the size of the business and the volume of transactions. Here are a few methods commonly used:

- Manual Tracking: Some businesses prefer to manually track payments by updating a ledger or spreadsheet each time a payment is received. This method is simple but can become time-consuming with larger volumes of transactions.

- Accounting Software: Accounting platforms offer automated tools that integrate with bank accounts, allowing businesses to track payments in real-time. These platforms can generate reports and alert businesses to overdue amounts.

- Payment Confirmation: Every time a payment is made, ensure that a payment confirmation is sent to the customer, and update the billing document accordingly. This helps ensure clarity and prevents confusion later.

Best Practices for Efficient Tracking

To ensure efficient tracking of payments, it’s important to maintain consistency in how payments are logged and categorized. Here are some best practices to follow:

- Update Records Promptly: As soon as a payment is received, update the corresponding record to reflect the payment status. This ensures that no payments are missed or delayed.

- Use Clear Payment References: Ensure that each transaction is linked to a specific reference number or payment ID. This makes it easier to track payments and resolve any discrepancies that may arise.

- Regular Reconciliation: Perform regular reconciliation between the billing statements and actual payments. This helps ensure that all payments have been properly applied and no errors have been made in the tracking process.

By establishing a clear and efficient system for tracking payments, businesses can maintain better control over their finances, reduce the risk of errors, and ensure that all dues are paid in a timely manner.

Ensuring Accuracy in Rental Billing

Accurate billing is crucial for maintaining trust with clients and ensuring that businesses receive the correct payments for their services. Small errors in calculations, fees, or billing periods can result in financial discrepancies and customer dissatisfaction. It is essential to implement processes and checks that guarantee all charges are correctly applied and transparent.

Key Steps for Ensuring Accuracy

Here are some fundamental practices to ensure accuracy in the billing process:

- Double-Check Calculation Methods: Before finalizing any document, ensure that all charges, taxes, and discounts are correctly calculated. Consider using automated tools to reduce the chance of human error.

- Clear Documentation: Ensure that every charge, fee, and cost is clearly outlined and easy for the customer to understand. Transparency is key to avoiding confusion.

- Use Consistent Rates: Apply consistent pricing for services and always refer to updated rate sheets to avoid using outdated rates by mistake.

- Verify Dates: Make sure that all dates (such as rental periods, payment deadlines, etc.) are correctly entered and consistent throughout the document.

Using Automated Tools to Enhance Precision

One of the most effective ways to ensure billing accuracy is by using automated systems. These tools help to minimize the chance of manual errors and increase overall efficiency. Automated platforms can calculate charges, apply taxes, and generate reports, allowing for faster and more accurate billing.

| Feature | Benefit |

|---|---|

| Automated Calculations | Eliminates errors in charge computations |

| Pre-built Templates | Ensures consistent formatting and reduces oversight |

| Real-Time Updates | Automatically reflects changes in rates or fees |

| Payment Tracking | Helps to track whether payments are received and applied correctly |

By implementing these practices, businesses can greatly reduce the risk of inaccuracies in their billing process, leading to improved customer satisfaction and financial clarity.

How to Share Rental Invoices with Clients

Effectively delivering billing statements to clients is an important part of maintaining good business relations and ensuring timely payments. Clear and accessible communication methods enhance the customer experience and improve the efficiency of the payment process. There are various ways to share these documents, each offering distinct advantages depending on the client’s preferences and the business’s resources.

Methods for Sharing Billing Documents

Several methods can be used to send billing statements to customers:

- Email: Sending documents through email remains one of the most common and efficient methods. It allows for instant delivery and provides a record of correspondence.

- Postal Mail: Although less common in the digital age, some clients may prefer receiving hard copies of their statements. This method is important for maintaining traditional business practices.

- Client Portals: Many businesses offer secure online portals where clients can access their statements, view payment histories, and track outstanding balances.

- SMS Notifications: For quick reminders or links to online statements, text messages are an effective option for clients who prefer mobile communication.

Best Practices for Sharing Billing Statements

When sharing a billing statement, it is important to follow some best practices to ensure clarity and prevent misunderstandings:

- Timely Delivery: Send the statement promptly after the service period has ended, allowing the client sufficient time to review the charges and make any necessary inquiries.

- Clear Subject Line: When sending documents via email, use a clear and informative subject line to help the client quickly identify the purpose of the message.

- Provide Contact Information: Always include contact details for customer service in case clients have questions or need assistance regarding their statements.

Tracking Delivery and Receipt

It is essential to confirm that your clients have received their billing statements. Using tracking features for both email and postal mail can help ensure that your documents have been delivered successfully. For emails, services such as read receipts can confirm when the client opens the message, while delivery confirmation options can be used for physical mail.

| Method | Advantages |

|---|---|

| Instant delivery, cost-effective, ability to track and store records | |

| Postal Mail | Preferred by some clients, provides a physical document |

| Client Portals | Secure, convenient access, clients can download or print anytime |

| SMS | Quick reminders, easy access to links for online statements |

By choosing the appropriate method for your clients and following best practices, you can ensure that billing statements are delivered efficiently, clearly, and in a timely manner, supporting smooth financial operations and maintaining client satisfaction.