Customizable Remodeling Invoice Template for Contractors and Home Renovations

Managing financial transactions effectively is a crucial part of any construction or home improvement project. Whether you are a contractor, designer, or subcontractor, having a clear and organized method for documenting services and charges ensures smooth communication and timely payments. A well-structured record of completed tasks and associated costs not only reflects professionalism but also builds trust with clients.

For businesses handling residential or commercial updates, using the right tools to present costs can greatly simplify the payment process. Clear records of labor, materials, and additional fees are essential for keeping clients informed and minimizing misunderstandings. This approach benefits both service providers and customers, ensuring transparency throughout the project’s duration.

In this guide, we will explore various options for creating structured, easy-to-understand billing forms. With the right format, you can save time, reduce errors, and maintain a consistent standard for all your projects. Learn how to tailor these documents to fit your specific needs and streamline the way you manage payments.

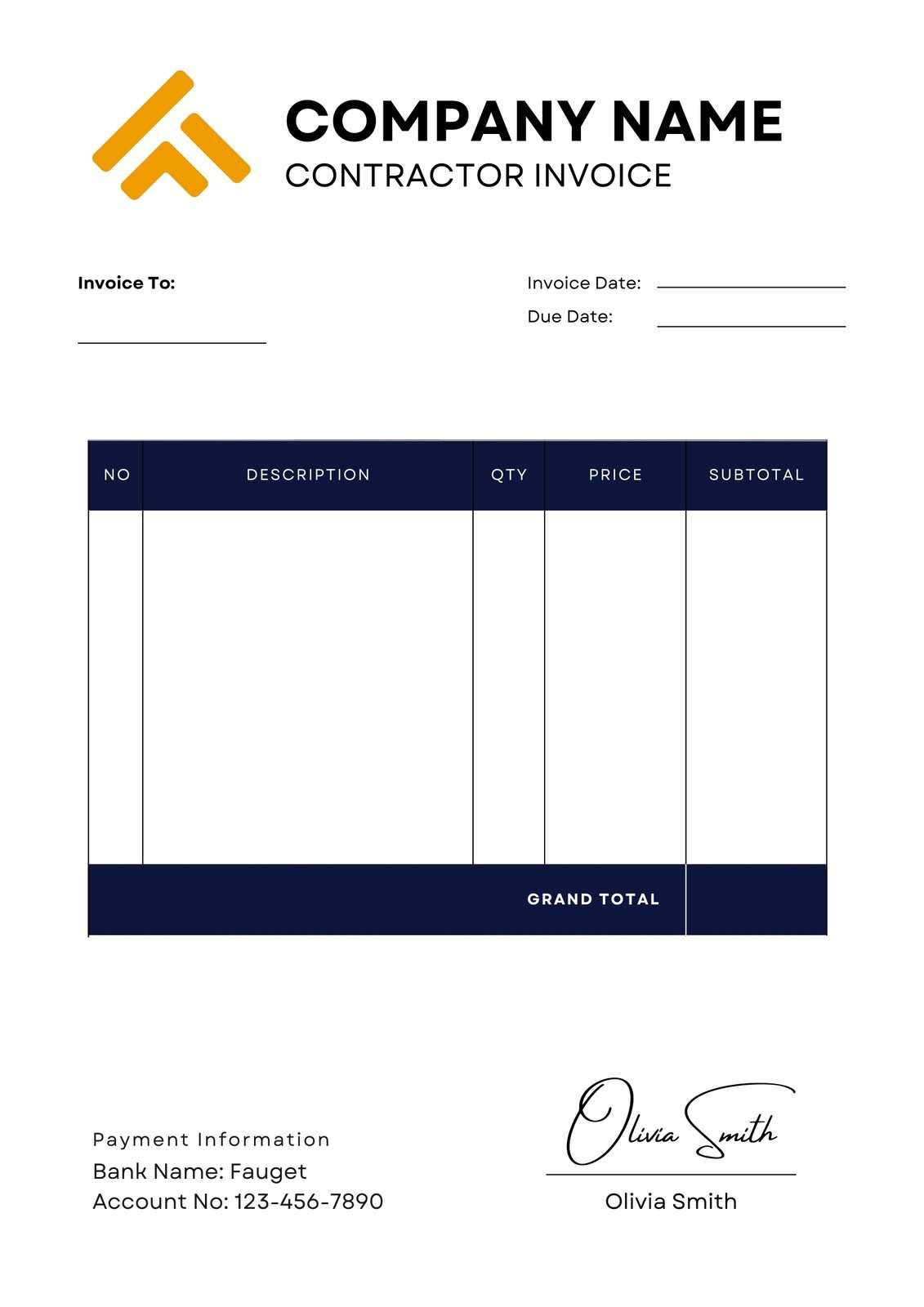

Remodeling Invoice Template Overview

For any home improvement or construction project, having a professional and organized way to document the costs of labor and materials is essential. Proper documentation helps ensure that clients understand the breakdown of charges, and it provides clear evidence for any future discussions or disputes. A well-structured document is a tool that both contractors and clients rely on to keep track of work completed and payments due.

Such a document typically includes important details such as the scope of work, hours worked, materials used, and any additional costs related to the project. These documents not only serve as an official request for payment but also offer transparency into how much the service provider is charging for specific tasks. Customizing this form to suit different types of projects ensures flexibility and reduces the potential for confusion.

Creating an efficient and easy-to-use structure for these records can greatly improve the workflow, helping professionals save time and avoid errors. By focusing on clarity and detail, this document ensures that every party involved is on the same page when it comes to financial transactions throughout the course of the project.

Importance of Accurate Invoices in Remodeling

Clear and precise billing plays a critical role in any home renovation or construction project. When the details of services provided, materials used, and additional costs are accurately documented, both clients and contractors benefit from a transparent and trustworthy relationship. An error-free record ensures that all parties are fully aware of the financial obligations, helping to avoid misunderstandings and delays in payment.

For contractors, an accurate document reflects professionalism and attention to detail, which can lead to stronger client relationships and future business opportunities. It also ensures compliance with legal and tax requirements, which can prevent complications down the road. Properly itemized charges and clear payment terms protect the service provider in case of disputes and provide a solid foundation for any legal or financial reviews.

For clients, having an easily understandable and accurate record provides peace of mind, knowing exactly what they are being charged for and why. This transparency helps build trust and encourages prompt payment, as customers can clearly see the value they are receiving in exchange for their investment. Whether it’s for a minor repair or a full-scale renovation, well-detailed records are essential to keeping the entire project on track.

Key Components of a Remodeling Invoice

To ensure smooth financial transactions and prevent misunderstandings, it’s essential that every document outlining the costs of home improvement work includes several key details. These components help both contractors and clients stay organized and informed about the scope of work, pricing, and payment expectations. Properly structured billing forms are designed to clearly break down the work completed and the associated costs, creating a transparent process for everyone involved.

Essential Details for a Comprehensive Record

Here are the fundamental elements that should be included in every financial statement for home renovation or construction projects:

- Contact Information: The names, addresses, and contact details of both the service provider and the client.

- Project Description: A brief overview of the work completed, including specific tasks, services, or materials provided.

- Itemized List of Charges: A breakdown of all charges, including labor, materials, and any additional fees, with unit prices and quantities where applicable.

- Payment Terms: The due date, payment methods accepted, and any applicable late fees or discounts for early payment.

- Tax Information: Details about any applicable taxes or fees added to the total cost.

- Total Amount Due: A clear and concise summary of the total balance to be paid.

Additional Considerations

While the above components are crucial for every billing record, there are a few other elements that can enhance clarity and professionalism:

- Project Timeline: Including the start and end dates can help clarify when the work was completed and the timeframe for payment.

- Terms and Conditions: Any policies related to cancellations, warranties, or scope changes should be included to avoid future disputes.

By incorporating these key components, contractors can ensure they maintain professional relationships and avoid complications in the payment process. A well-organized record not only makes the billing process smoother but also builds trust and confidence with clients.

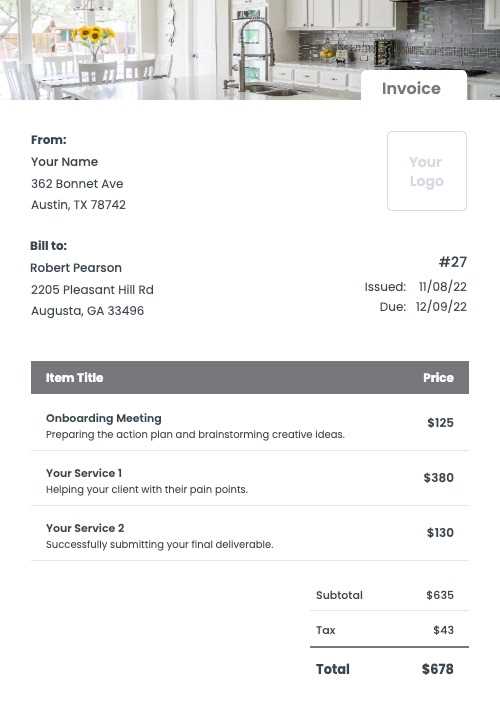

How to Create a Custom Remodeling Invoice

Creating a personalized financial record for home renovation or construction work allows service providers to maintain a professional appearance while ensuring all services rendered are clearly documented. By customizing a document to reflect the specific needs of each project, you can streamline the billing process and ensure accuracy. A custom form can help highlight important details, such as labor costs, material fees, and any special charges related to a project, making it easier for clients to understand and process payments.

Step-by-Step Guide to Creating a Custom Document

Follow these steps to design a clear and professional billing form for your next home improvement project:

- Choose a Format: Decide whether you will use a digital or physical document. Many professionals opt for digital formats as they are easier to edit and store, and can be quickly sent to clients via email.

- Include Client and Contractor Details: Always begin by adding the names, addresses, and contact information of both parties involved. This ensures that the document is specific to the project and can be easily referenced if needed.

- List All Services and Materials: Create an itemized list of all tasks completed, as well as materials used. For each entry, include quantities, unit prices, and total costs. This level of detail prevents misunderstandings and allows clients to see exactly what they are paying for.

- Set Payment Terms: Clearly outline payment due dates, methods accepted, and any applicable fees or discounts. Be sure to specify the terms regarding late payments or penalties for non-payment.

- Include Tax Information: If applicable, be sure to include tax rates and the total amount of tax charged. This is especially important for businesses that are required to collect sales tax.

Final Touches for a Professional Look

Once you’ve included all the necessary information, you can enhance the document with a few additional features:

- Project Timeline: Adding start and completion dates helps clients understand the duration of the work and when the final payment is expected.

- Terms and Conditions: Clearly define your payment policies, refund rules, and warranty information to protect both parties.

- Personalized Branding: Including your company logo, colors, and branding elements can make the document feel more professional and aligned with your business identity.

By following these steps and personalizing each document, you ensure that your billing process is organized, professional, and transparent. A well-crafted form not only simplifies payments but also reinforces your commitment to clear communication with clients.

Free Templates for Remodeling Invoices

There are numerous resources available online that offer free forms designed to simplify the billing process for construction or home renovation projects. These customizable documents provide a quick and efficient way to create professional records without the need for expensive software or time-consuming design. With a few adjustments, these free options can be tailored to suit specific project requirements, ensuring that contractors and clients alike have all the necessary details in a clear and organized format.

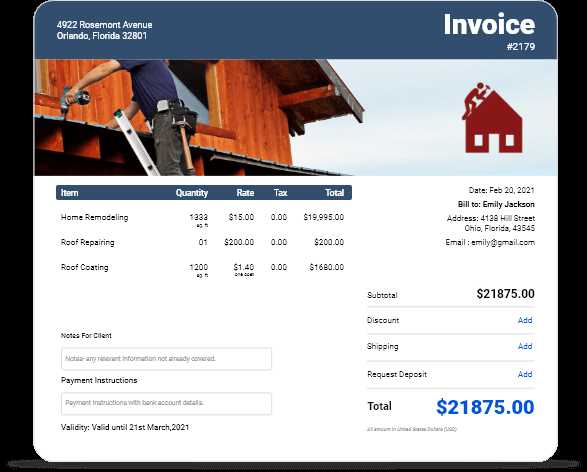

Using a pre-designed form allows you to save time and focus on the specifics of the project. Whether you’re working on a small repair or a large renovation, these free resources ensure you have all the essential components included, from labor costs to material charges. Below is an example of how a typical document layout might look:

| Item | Description | Quantity | Unit Price | Total |

|---|---|---|---|---|

| Labor | Hourly rate for work completed | 10 hours | $50 | $500 |

| Materials | Wood, nails, paint | Various | $300 | $300 |

| Miscellaneous | Tool rental | 1 | $50 | $50 |

| Total Amount Due | $850 | |||

As shown in the example, a good form will clearly itemize the work performed, include detailed descriptions, and provide a clear total due at the end. Many free resources offer this basic structure, allowing you to quickly add your specific project details. By using these pre-made options, you can avoid the hassle of building a new form from scratch while ensuring professionalism and clarity in your financial documentation.

Common Mistakes in Remodeling Invoices

While creating financial records for home improvement projects is essential for smooth transactions, there are several common mistakes that can undermine the effectiveness of these documents. Errors in billing not only delay payments but can also lead to misunderstandings between contractors and clients. Being aware of these common pitfalls and how to avoid them will help ensure clarity and professionalism in every project.

Some frequent issues include missing details, inaccurate charges, or vague descriptions that leave room for confusion. These oversights can result in clients questioning the charges or delaying payments. Below are some of the most common mistakes made when preparing these essential documents:

| Mistake | Explanation | How to Avoid |

|---|---|---|

| Incomplete Contact Information | Not including full contact details of both parties can cause confusion or delays in communication. | Ensure that all contact details, including phone numbers and email addresses, are clearly listed. |

| Missing Itemized Charges | Failing to break down the charges for labor, materials, and other expenses can lead to confusion about the total cost. | Provide a detailed list with descriptions, quantities, and costs for each item or service provided. |

| Unclear Payment Terms | Vague or missing payment terms, such as due dates and accepted payment methods, can lead to late or missed payments. | Clearly state the payment terms, including the due date, payment methods, and penalties for late payments. |

| Inaccurate Calculations | Simple errors in adding up totals can result in overcharging or undercharging clients. | Double-check all calculations and use a calculator or software to ensure accuracy. |

| Lack of Tax Information | Not including the appropriate tax charges can lead to compliance issues or confusion with clients. | Always include applicable taxes, and make sure the correct tax rate is applied. |

Avoiding

Choosing the Right Invoice Format

Selecting the appropriate structure for your billing records is crucial to ensure clarity, accuracy, and ease of use. The right format helps both contractors and clients easily understand the charges, avoid confusion, and facilitate timely payments. Whether you choose a simple document, a digital solution, or a more detailed layout, the format should align with the nature of the work and the preferences of both parties.

For smaller projects or quick tasks, a straightforward document may be sufficient. For larger projects that involve multiple services, materials, and costs, a more detailed layout might be necessary to break down the work into clear sections. Below are some factors to consider when selecting the most suitable format:

- Project Size: Smaller projects may only require basic details, while more extensive work benefits from a detailed breakdown of labor, materials, and additional fees.

- Client Preferences: Some clients may prefer digital records they can easily store and access, while others may prefer physical documentation. Always inquire about their preference to ensure smooth communication.

- Professionalism: A well-organized and clean format reflects your attention to detail and commitment to transparency, which can enhance your professional reputation.

- Legal Compliance: Make sure the chosen structure meets any industry regulations or tax requirements for your region.

- Automation: Digital formats allow for the use of invoicing software that can automate calculations, making the process quicker and reducing the risk of errors.

Choosing the right format is more than just about convenience–it impacts the effectiveness and professionalism of your business transactions. By selecting a clear, customized layout, you ensure that both you and your clients are on the same page, which ultimately promotes a smoother, more efficient billing process.

Professional Invoice Design Tips

Designing a polished and professional financial document is essential for maintaining credibility and promoting clear communication between service providers and clients. A well-designed document not only ensures that the necessary details are presented clearly but also reflects the professionalism of the contractor or business. Thoughtful design can make a significant impact on how clients perceive the work and can facilitate smoother transactions.

When crafting a custom billing form, there are several design principles to keep in mind. Here are some key tips to help create a visually appealing and easy-to-read document:

- Use Clear Headers and Sections: Organize the document into distinct sections, such as client information, services rendered, and total cost. This structure helps guide the reader’s eye and makes it easier to find specific information quickly.

- Maintain Consistency: Use a consistent font, size, and color scheme throughout the document. This creates a cohesive and professional appearance that aligns with your branding or business style.

- Keep It Simple: Avoid cluttering the document with excessive graphics or text. A clean, minimalist design makes the content easier to read and understand.

- Highlight Important Information: Use bold text or underlining to draw attention to key details, such as the total amount due or the due date. This ensures these points are not overlooked by the client.

- Incorporate Branding: Include your company logo, business name, and contact details prominently at the top. This not only reinforces your brand but also makes the document feel personalized and official.

- Ensure Readability: Use a readable font, such as Arial or Times New Roman, and ensure there is enough white space around the text. This helps prevent the document from feeling cramped and overwhelming.

- Provide Clear Instructions: If necessary, include payment instructions or terms in a separate section at the bottom. This reduces confusion and clarifies the next steps for the client.

By following these design tips, you can create a functional and aesthetically pleasing document that not only conveys the necessary information but also reinforces the professionalism of your business. A well-crafted form enhances your reputation and ensures that financial details are presented clearly, helping clients feel more confident and willing to make prompt payments.

How to Include Tax and Discounts

Incorporating taxes and discounts correctly in financial documents is essential to ensure accuracy and compliance with local regulations. Both taxes and discounts affect the total amount due and should be clearly itemized to avoid confusion or disputes. Whether you are adding sales tax to a service or offering a promotional discount to a client, transparency in these areas is key to maintaining professionalism and trust.

Including Tax Charges

When adding taxes to the total amount, it’s important to first understand the applicable tax rates for your region or industry. Most areas require businesses to collect sales tax on goods and services, and failing to do so can lead to compliance issues.

- Specify the Tax Rate: Clearly state the percentage or amount of tax applied. For example, “Sales Tax (10%)” helps the client understand exactly how the tax is calculated.

- Show the Tax Amount: Clearly display the amount of tax added to the total before finalizing the bill. This ensures that the client can see exactly how much of the total is made up of taxes.

- Apply Tax to Relevant Items: If some services or products are exempt from tax, make sure these are specified. For example, certain materials may be taxable while others may not.

Offering Discounts

Discounts can be a great way to incentivize clients or offer rewards for timely payments. However, these should be applied with the same clarity as taxes to avoid any misunderstandings.

- Clearly State the Discount: If a discount is being applied, specify whether it’s a fixed amount or percentage. For example, “10% Discount on Labor Costs” or “$50 Discount on Materials.”

- Specify Conditions: If the discount is conditional–such as for early payment or a special promotion–clearly note these terms. For example, “Discount applies if paid within 10 days.”

- Adjust the Total: After applying the discount, ensure the final total reflects the change. Display the discount separately before showing the revised amount due to highlight the savings.

By carefully including taxes and discounts in your documents, you ensure that clients are fully informed about the final charges. Properly documenting these adjustments helps maintain transparency, reducing the likelihood of confusion and fostering trust with your clients.

Tracking Payments with Remodeling Invoices

Efficiently tracking payments for home improvement projects is crucial for maintaining a smooth workflow and ensuring that both contractors and clients are on the same page regarding financial transactions. Clear documentation of payments helps prevent confusion, delays, and disputes, while also keeping financial records organized for future reference. Whether you’re handling one project or multiple, tracking payments accurately ensures that everything is accounted for and that payments are received on time.

Key Steps for Tracking Payments

Here are some essential steps to help you effectively track payments throughout the course of a project:

- Document Payment Details: Include specific information about each payment made, such as the date, payment method, and the amount paid. This creates a clear record for both parties.

- Track Partial Payments: For larger projects, clients may make payments in installments. Make sure each payment is noted along with any outstanding balances. This helps avoid confusion later on.

- Mark Paid and Unpaid Amounts: On your billing records, clearly mark which amounts have been paid and which are still due. This simple step helps both you and your clients track what’s been completed and what remains.

- Record Payment Methods: Keep track of how payments are made, whether by cash, check, credit card, or bank transfer. This is important for both financial and tax purposes.

Effective Tools for Tracking Payments

There are several tools available that can simplify the process of tracking payments, ensuring everything is accounted for properly:

- Spreadsheets: Using Excel or Google Sheets to create a payment tracking sheet can help you stay organized and calculate totals quickly. Each payment and outstanding balance can be recorded, and formulas can be set up for automatic updates.

- Accounting Software: More advanced tools, such as QuickBooks or FreshBooks, allow you to create detailed records, send reminders for unpaid balances, and generate reports on payments received.

- Manual Tracking: For smaller projects, a simple manual logbook or ledger may suffice. Just be sure to update it regularly and keep a backup of all records.

By staying organized and keeping detailed records of all payments made, contractors can prevent delays and ensure a smooth financial process throughout the entire project. Tracking payments not only streamlines the financial aspects of a job but also builds trust with clients by offering transparency and accountability.

Legal Considerations for Remodeling Invoices

When preparing financial documents for construction or renovation projects, it’s essential to consider the legal implications. Properly structured records not only ensure that you are compliant with regulations but also protect both parties involved. Understanding the key legal elements will help avoid disputes and ensure that your billing process is both clear and enforceable.

Several factors play a critical role in creating legally sound documents. Below are important legal considerations to keep in mind when issuing a billing statement for home improvement services:

- Accurate and Transparent Information: All charges should be clearly defined, including a detailed description of the work done, materials used, and associated costs. This transparency helps prevent misunderstandings or disputes about the services rendered and the amounts owed.

- Payment Terms and Deadlines: Clearly outline payment terms, including due dates, late fees, and acceptable methods of payment. This ensures that both parties agree to the same terms and helps protect your business in case of delayed payments.

- Tax Compliance: Make sure you apply the correct tax rates in line with local regulations. This includes sales tax, value-added tax (VAT), or other regional taxes that may apply. Failing to charge the correct amount of tax can lead to legal consequences.

- Deposits and Advance Payments: If the agreement includes an upfront deposit or progress payments, these should be clearly stated in the agreement and reflected in the financial record. Ensure that the deposit amount and any subsequent payments are specified to avoid confusion later on.

- Legal Language: Use clear and professional language in your document, avoiding ambiguous terms. Legal terminology should be precise to ensure that both parties understand their obligations and rights. This helps prevent any possible legal disputes over contract terms.

- Signature Requirements: Depending on the jurisdiction, both parties may need to sign the document for it to be legally binding. Make sure that the necessary space for signatures is included, and always retain a copy for your records.

- Record-Keeping: Keep copies of all financial documents for future reference or in case of an audit. Some jurisdictions may have legal requirements regarding how long these records must be kept (e.g., 5 or 7 years).

By ensuring that your financial documents include all relevant legal information and comply with applicable laws,

Invoicing for Materials and Labor

When billing for home improvement projects, it’s essential to clearly separate the charges for materials and labor. Each component plays a significant role in the overall cost, and providing a breakdown helps clients understand how their money is being allocated. Properly documenting both aspects ensures transparency, builds trust, and minimizes the risk of misunderstandings regarding pricing.

Below are some best practices for invoicing materials and labor costs:

Billing for Materials

Materials are a crucial part of any construction or renovation project. Properly documenting these costs is important for both accuracy and clarity. Consider the following:

- Itemized List: List each material used, along with its cost. Be sure to include details such as quantity, unit price, and total cost for each item.

- Receipts or Proof of Purchase: If possible, attach receipts or provide proof of purchase for materials. This adds credibility to your billing and ensures clients feel confident in the pricing.

- Markup on Materials: If you are charging a markup on the materials, clearly state the percentage or flat rate markup. This helps clients understand how the pricing is calculated.

Billing for Labor

Labor costs are often a major portion of the total project cost. To ensure clients are clear on what they are paying for, it’s important to break down the labor charges effectively:

- Hourly Rates: If you charge by the hour, specify the hourly rate and the total hours worked. For example, “Labor (10 hours at $50/hour).” This makes the billing more transparent.

- Flat Fees: For certain tasks or jobs, you might charge a flat fee. Be sure to specify the scope of the work included in the flat fee to avoid confusion.

- Worker Details: If multiple workers were involved, list their names or roles and the corresponding labor costs for each. This allows the client to understand exactly who performed the work and how much each person’s time is being charged.

By clearly distinguishing between material and labor charges and providing detailed descriptions for each, you help ensure your billing is transparent and professional. A well-structured breakdown not only improves client relationships but also makes the payment process smoother for both parties.

Best Practices for Sending Invoices

Sending billing statements in a professional and timely manner is crucial for ensuring smooth transactions and maintaining good client relationships. The way you present and deliver your documents can influence how quickly payments are made and how your business is perceived. Adhering to best practices when sending financial documents helps ensure clarity, minimizes errors, and fosters trust with your clients.

Timeliness and Consistency

One of the most important aspects of sending payment requests is doing so promptly. Delaying the sending of billing documents can lead to late payments and strain your client relationships. Here are some guidelines for timely and consistent delivery:

- Send Promptly: Aim to send the statement as soon as the work is completed or at the agreed-upon milestone. The sooner the document is delivered, the sooner the client can process the payment.

- Follow Up: If you haven’t received payment by the due date, send a polite reminder. A gentle follow-up can encourage timely settlement without appearing aggressive.

- Set Regular Schedules: If you’re managing multiple projects, try to establish a regular billing cycle (e.g., weekly, bi-weekly, or monthly). Consistency helps set expectations with clients and streamlines your workflow.

Clear and Professional Delivery

How you deliver your payment requests is just as important as the content within them. Clear and professional delivery helps reinforce your business’s credibility:

- Use Email or Secure Platforms: For faster delivery and better tracking, email your billing records. Ensure that the file is in a widely accepted format (such as PDF) to ensure easy access. Alternatively, you can use secure online platforms designed for professional document exchange.

- Attach Supporting Documents: If needed, include supporting documents like purchase orders, work orders, or receipts to provide context for the charges. This transparency can help prevent disputes.

- Personalize the Message: When sending the document, include a brief and polite message to your client, summarizing the charges and thanking them for their business. This adds a personal touch and shows professionalism.

By following these best practices, you not only make the payment process easier for your clients but also create a mor

How to Handle Late Payments

Late payments can disrupt cash flow and create unnecessary tension between you and your clients. However, how you handle these situations can significantly impact your business’s reputation and future relationships. It’s important to approach late payments with a balance of professionalism, understanding, and firmness to ensure that your interests are protected while maintaining a good rapport with your clients.

Establish Clear Payment Terms

The first step in handling late payments is to establish clear and fair payment terms from the outset. These terms should be explicitly outlined in any agreement or contract and should include:

- Due Dates: Specify when payments are expected. A clear due date reduces ambiguity and helps both parties stay on track.

- Late Fees: If you plan to charge interest or fees for overdue payments, be sure to state this upfront. A reasonable late fee can incentivize timely payments.

- Payment Methods: List acceptable methods of payment, such as checks, bank transfers, or credit cards. Making payment easy for clients can reduce the likelihood of delays.

Steps to Take After the Due Date Has Passed

If a payment becomes overdue, it’s important to take measured steps to resolve the issue while maintaining professionalism:

- Send a Friendly Reminder: Start by sending a polite reminder email or message. Often, clients may simply forget or overlook the due date. A courteous follow-up helps keep the situation amicable.

- Review Your Contract: If no payment is made after the reminder, revisit the terms in your original agreement. Gently reference the agreed-upon terms when communicating with your client to remind them of their responsibility.

- Offer Payment Options: Sometimes clients may be unable to pay the full amount at once. If possible, offer payment plans or partial payments to help them settle their balance. This can help resolve the issue while keeping the relationship intact.

What to Do if Payments Remain Unsettled

If repeated attempts to collect payment fail, you may need to take stronger actions. In such cases, it’s essential to maintain professionalism and follow legal procedures if necessary:

- Faster Processing: Automation reduces the time it takes to generate and send billing statements. Once set up, the system can create and deliver documents instantly, without the need for manual input.

- Consistency: Automated tools ensure that all details are filled out accurately and uniformly. This consistency helps build trust with clients and minimizes the risk of disputes over missing or incorrect information.

- Timely Reminders: Automated systems can send reminders when payments are due or when they are overdue. These reminders ensure that your clients are aware of their responsibilities without you needing to manually follow up.

- Reduced Administrative Burden: By automating routine tasks, you can free up time to focus on the more important aspects of your business, like project management and customer service.

- Accounting Software: Software like QuickBooks, FreshBooks, or Xero can automatically generate payment documents based on the work completed, track outstanding balances, and even calculate taxes and discounts. These platforms can also send automated reminders and payment confirmations to clients.

- Online Payment Systems: Platforms such as PayPal, Stripe, or Square allow you to send electronic bills and receive payments instantly. These services also often offer built-in features for automatic recurring billing, making it ideal for ongoing projects.

- Customizable Billing Tools: Some businesses prefer using more customized automation tools that fit their specific needs. Many invoicing software programs offer flexibility in design and functionality, allowing you to automate the entire process according to your requirements.

- Faster Delivery and Processing: Digital documents can be created, sent, and received instantly, eliminating the delays associated with printing, mailing, and manual processing. This ensures quicker turnaround times and helps businesses maintain a steady cash flow.

- Reduced Errors and Miscommunication: Automated systems reduce the risk of human error, ensuring that all details–such as pricing, dates, and client information–are accurately recorded. Additionally, digital records can be easily edited or updated, minimizing the chances of mistakes that could lead to misunderstandings or disputes.

- Easy Tracking and Organization: Digital records can be easily stored, searched, and accessed. This makes tracking payments and organizing financial documents much simpler compared to paper records. Many platforms also offer automatic tracking of due dates and payment statuses, ensuring nothing is overlooked.

- Improved Client Convenience: Clients can receive digital documents via email or online platforms, making the process more convenient. They can also make payments directly through the document, without having to visit the office or mail a check. This level of convenience can enhance client satisfaction and lead to faster payments.

- Environmental and Cost Savings: Moving away from paper helps reduce waste and lowers printing and mailing costs. By using digital formats, businesses can contribute to environmental sustainability while also saving money on paper, ink, and postage.

- Better Security: Digital solutions offer enhanced security features, such as encryption and password protection, reducing the risk of fraud and unauthorized access. With physical records, the risk of theft or loss is much higher.

- Itemized Breakdown: An itemized list of services and materials makes it easy for clients to see exactly what they’re being charged for, avoiding surprises or hidden fees.

- Clear Payment Terms: Outlining due dates, payment methods, and any late fees ensures that both parties know exactly what to expect, preventing future disagreements.

- Timely Delivery: Sending payment requests promptly and in a professional manner signals reliability and respect for the client’s time.

- Accountability: Providing a comprehensive record of all charges and services ensures that clients can hold the business accountable for the work performed and costs incurred.

Automating Your Invoice Process

Streamlining the process of generating and managing payment requests can significantly improve efficiency, reduce errors, and save valuable time. Automation allows businesses to focus on delivering quality work rather than getting bogged down by administrative tasks. By integrating automated tools into your financial workflow, you can ensure that all the necessary steps are followed, while minimizing human error and delays.

There are several key benefits to automating the payment request process:

To get started with automating your payment requests, consider using the following tools and techniques:

Automating your financial processes is an investment that pays off in the long run. By saving time on repetitive tasks and reducing the risk of errors, automation helps you maintain a professional and efficient business operation. It ensures that you can focus on growing your business while handling billing in an organized and timely manner.

Benefits of Digital Invoices for Remodeling

In today’s fast-paced business environment, adopting digital solutions for financial documentation can offer significant advantages over traditional methods. By moving away from paper-based records, businesses can increase efficiency, reduce administrative costs, and improve overall client satisfaction. Digital payment requests offer a streamlined process that benefits both service providers and clients, making them an ideal choice for modern businesses.

Here are some key benefits of using digital solutions for financial transactions:

By adopting digital tools for managing financial documentation, businesses can not only streamline their operations but also provide a better experience for their clients. The convenience, speed, and accuracy of digital solutions help ensure smoother transactions and st

How Billing Statements Improve Client Trust

Clear and transparent financial documentation plays a critical role in fostering trust between businesses and their clients. When payment records are accurate, detailed, and professionally presented, clients feel more confident in the transaction and in the business itself. By taking the time to provide clear and organized payment statements, businesses can build credibility and strengthen their relationships with customers.

Clarity and Transparency

One of the main factors that influence trust is clarity. When clients receive detailed statements that break down each cost and service, they have a clearer understanding of what they are paying for. Transparency in billing shows that the business has nothing to hide and is committed to fair pricing. This openness helps eliminate any confusion or potential misunderstandings, allowing clients to feel more secure in their dealings.

Professionalism and Accountability

When a business consistently delivers well-structured and timely payment records, it showcases professionalism. This attention to detail demonstrates that the business values its clients and is committed to providing high-quality service. Additionally, if any disputes arise, having a clear record of transactions makes it easier to resolve issues quickly and fairly.

In conclusion, clear and accurate billing statements are not just a way to request payment; they are a tool to build and maintain trust. By prioritizing transparency, professionalism, and detail in financial communications, businesses can create lasting, positive relationships with clients that are built on mutual respect and understanding.