Effective Reminder Invoice Email Template for Payment Follow Up

Maintaining consistent communication with clients is essential when it comes to collecting outstanding balances. Sending a well-crafted message can help prompt prompt payments while preserving positive business relationships. Knowing how to structure these messages can make a significant difference in both the tone and outcome of the communication.

In this guide, we will explore the best approaches for drafting clear and polite notifications that encourage quick resolution of overdue amounts. The key is to ensure your correspondence is professional, direct, and respectful. With the right strategy, you can turn late payments into opportunities for smoother future transactions.

Reminder Invoice Email Template Guide

Effective communication is crucial when it comes to requesting overdue payments. Crafting a well-structured message not only conveys professionalism but also increases the likelihood of receiving timely payment. The goal is to clearly communicate the outstanding amount, set expectations for payment, and maintain a positive relationship with the recipient.

In this section, we’ll break down the essential components of a well-written payment follow-up. From the subject line to the closing statement, every detail plays a role in ensuring the message is clear, polite, and motivating. By understanding these key elements, you can craft follow-up correspondence that encourages prompt action without damaging client relationships.

Why Use Reminder Invoices for Payments

Sending polite follow-up messages for overdue balances is an essential practice for maintaining healthy cash flow in any business. These communications serve as gentle nudges that keep outstanding payments at the forefront of a client’s mind. By clearly outlining the amount owed and the due date, these reminders help avoid confusion and reduce the likelihood of delayed payments.

Maintaining Professional Relationships

While the purpose of these reminders is to ensure timely payments, they also play a crucial role in maintaining positive relationships with clients. A well-written message conveys respect and professionalism, reassuring clients that their business is valued while addressing financial matters. This balance between assertiveness and politeness can go a long way in strengthening long-term partnerships.

Improving Cash Flow and Reducing Delays

Regular follow-ups on overdue payments can significantly reduce the time it takes for outstanding balances to be cleared. By sending a clear and timely reminder, you improve the chances of faster payments, which in turn helps keep your business running smoothly. These messages also reduce the likelihood of accumulating a backlog of unpaid balances, making financial management more straightforward.

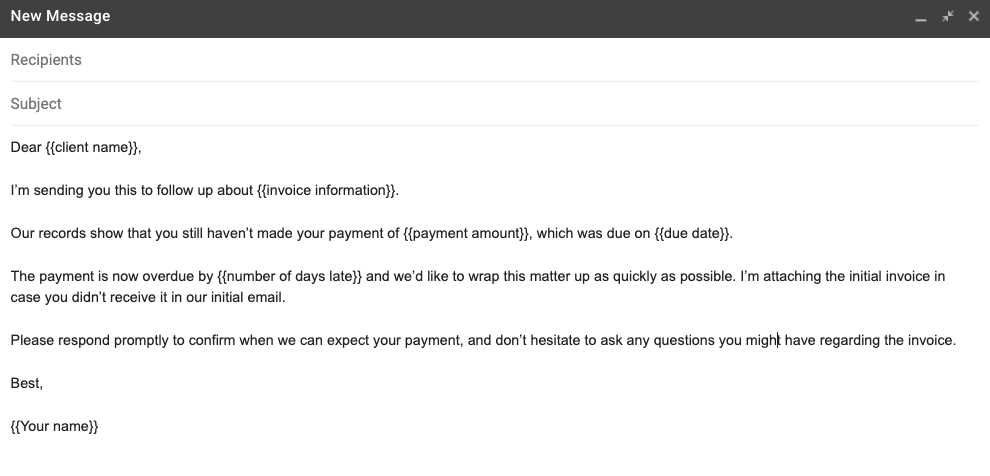

How to Craft a Clear Reminder Email

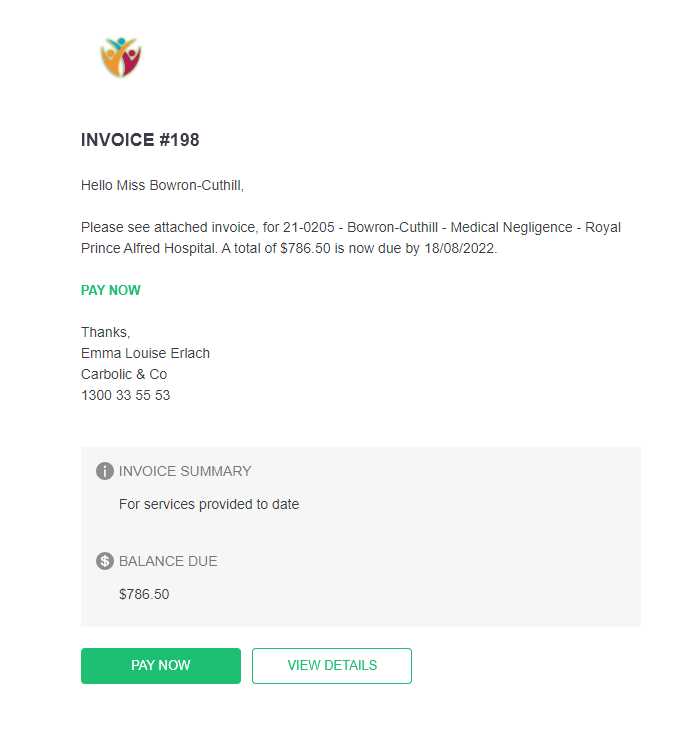

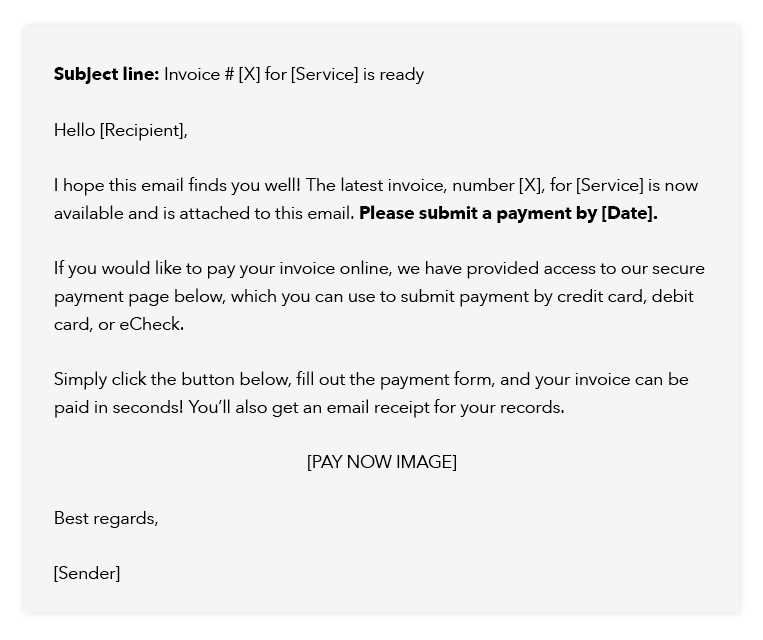

When following up on unpaid amounts, clarity is key. A well-written message should clearly communicate the outstanding balance, the due date, and any necessary instructions for making the payment. It’s important to be direct without sounding aggressive, maintaining a tone that is both polite and professional.

Start with a clear subject line that immediately informs the recipient of the purpose of the message. In the body of the message, include the relevant details, such as the amount due, the original payment deadline, and the preferred method of payment. Be sure to express appreciation for their business and avoid any language that could come across as confrontational. By maintaining a professional tone, you can effectively encourage action without damaging the client relationship.

Key Points to Include: Make sure the total amount due is prominently stated, with a clear request for payment. It’s also helpful to include your contact details or a link for making the payment easily accessible.

Polite persistence paired with clear information is the most effective way to ensure that your clients understand the urgency while feeling respected.

Key Elements of an Invoice Reminder

When crafting a follow-up message for unpaid amounts, certain components are essential to ensure clarity and effectiveness. These key elements help structure the communication in a way that is both professional and informative, increasing the likelihood of timely payment.

- Clear Subject Line: A concise subject line immediately informs the recipient of the purpose of the message, such as “Outstanding Payment Reminder” or “Action Required: Payment Due”.

- Polite Opening: Start the message with a friendly and professional tone, thanking the recipient for their business before addressing the overdue balance.

- Payment Details: Clearly list the amount due, the original payment date, and any relevant invoice or order numbers. This helps avoid any confusion.

- Payment Instructions: Provide simple and clear instructions on how to make the payment, including payment methods or links to online portals if available.

- Deadline Reminder: Politely reiterate the payment due date, emphasizing the importance of making payment promptly to avoid any disruptions.

- Contact Information: Offer a way for the recipient to contact you if they have questions or concerns regarding the payment, ensuring smooth communication.

Including these elements helps create a balanced message that communicates urgency without being overly harsh, fostering a professional relationship while encouraging prompt action.

Setting the Right Tone in Emails

When sending a follow-up regarding unpaid balances, the tone of your communication plays a crucial role in how the message is received. Striking the right balance between professionalism and friendliness ensures that the recipient understands the urgency of the situation without feeling pressured or offended. The goal is to maintain a positive business relationship while encouraging timely action.

- Politeness: Always start with a courteous greeting and express appreciation for the recipient’s business. A respectful tone helps set the stage for a constructive conversation.

- Clarity: Be clear and direct in your message. State the facts, such as the amount owed and the payment deadline, in a straightforward manner to avoid any confusion.

- Firmness Without Aggression: While it’s important to emphasize the need for prompt payment, ensure your language doesn’t come across as confrontational. Phrases like “we kindly request” or “we would appreciate your prompt attention” strike the right balance.

- Empathy: Acknowledge that mistakes can happen. Offering flexibility in case the recipient needs more time or has encountered issues can help maintain goodwill.

- Positive Language: Use positive language that encourages cooperation. Instead of focusing on negative consequences, focus on the benefits of resolving the matter quickly.

By adjusting the tone to be both firm and respectful, you can increase the likelihood of receiving the payment without damaging your professional relationship with the recipient.

Personalizing Your Invoice Reminders

Tailoring your follow-up messages to each client can make a significant difference in how they respond. Personalization helps to foster a stronger connection and can make the communication feel less like a generic request and more like a thoughtful interaction. A personalized approach shows the recipient that you value their business and are willing to work with them on resolving outstanding balances.

Use Client-Specific Information

Start by addressing the recipient by name. This small detail immediately makes the message feel more personal and less automated. Additionally, reference specific details such as the services or products they purchased, along with the relevant dates or order numbers. This helps the client recognize the context of the follow-up and avoids confusion.

Show Appreciation for Their Business

Include a sentence that expresses gratitude for their continued partnership. A simple “We truly appreciate your business” or “Thank you for being a valued client” can go a long way in maintaining a positive relationship. Offering flexibility, if needed, can also show empathy and willingness to assist in any way.

Personalization tips: Consider using their first name, referring to past transactions, and offering an easy way to resolve any issues. A tailored approach can transform a routine follow-up into a meaningful conversation.

By making these adjustments, you not only incr

Best Practices for Payment Follow Up

Following up on overdue payments is a delicate task that requires a strategic approach to ensure both professionalism and effectiveness. By adopting best practices, you can increase the chances of receiving payment without damaging relationships. Clear communication, timely actions, and offering flexibility are all key to successful follow-ups.

Timing Your Follow Ups

Knowing when to reach out is essential. Too soon, and it might seem pushy; too late, and it might affect cash flow. The best practice is to send your first communication shortly after the due date, with a gentle reminder. Subsequent follow-ups should be spaced out appropriately to maintain a sense of urgency without being overwhelming.

Maintaining a Professional Tone

While it’s important to convey urgency, it’s equally important to maintain professionalism. A respectful tone will encourage clients to take prompt action while keeping the relationship intact. Be sure to focus on the facts and avoid any language that could be perceived as confrontational.

| Action | Timing | Message Tone |

|---|---|---|

| First Follow-up | 1-3 days after the due date | Friendly reminder |

| Second Follow-up | 7-10 days after the first | Polite but firm |

| Final Follow-up | 14-21 days after the second | Urgent but professional |

By following these best practices, you ensure that your communications remain effective, polite, and professional, which increases the likelihood of receiving payments promptly while maintaining strong client relationships.

Effective Subject Lines for Invoice Reminders

The subject line is the first thing the recipient sees, and it plays a critical role in determining whether your message will be opened. A compelling subject line should immediately convey the purpose of the message while encouraging the recipient to take action. It should be clear, concise, and professional to ensure the content is read and not ignored.

Choosing the right wording for your subject line can make all the difference. The goal is to communicate urgency and the importance of the message without sounding too forceful or aggressive. Below are some examples of subject lines that strike the right balance between professionalism and clarity:

| Subject Line Example | Purpose |

|---|---|

| Action Needed: Outstanding Balance | Clearly indicates the need for action without being overly harsh. |

| Payment Due: Friendly Reminder | Polite yet firm, emphasizing the need for attention. |

| Final Notice: Payment Past Due | Urgent tone for final follow-up, signaling the seriousness of the matter. |

| Reminder: Your Payment is Pending | A softer approach that encourages the recipient to address the pending payment. |

| Payment Due Soon: Please Process | Indicates the approaching deadline while remaining professional. |

By using subject lines that are direct yet respectful, you set the tone for a constructive conversation and increase the likelihood of prompt payment without damaging the client relationship.

When to Send Payment Reminder Emails

Timing is a crucial factor when it comes to following up on unpaid balances. Sending a follow-up at the right time ensures that the message is effective and well-received. Acting too soon may seem premature, while waiting too long can result in delayed payments and potential cash flow issues. A well-timed follow-up not only increases the chances of prompt payment but also helps maintain a positive relationship with the client.

The first follow-up should generally occur soon after the payment due date has passed. This initial communication serves as a gentle reminder, giving the client the benefit of the doubt. If the payment is still not received, follow up again after a few days, but avoid overwhelming the recipient with too many messages. Establishing a clear schedule for reminders can help avoid confusion and keep the process professional.

Here is a general guide for when to send follow-up communications:

- First Follow-Up: Send within 1-3 days after the due date to remind the recipient of the outstanding balance.

- Second Follow-Up: Send 7-10 days after the initial follow-up if the payment is still not made.

- Final Follow-Up: Send 14-21 days after the second reminder, marking the communication as urgent.

By following this timing strategy, you increase the likelihood of receiving the payment in a timely manner while keeping the communication professional and polite.

Common Mistakes to Avoid in Reminders

When following up on outstanding payments, the way you communicate is just as important as the content itself. While the intention is to encourage timely payment, certain mistakes can make the process less effective or damage your relationship with the client. It’s important to approach these communications with clarity, professionalism, and understanding. Avoiding common errors can make a significant difference in ensuring that your messages are well-received and prompt a positive response.

One of the most frequent mistakes is using a harsh or aggressive tone. This can alienate clients and create unnecessary tension. It’s crucial to maintain a polite and respectful tone throughout, regardless of the situation. Additionally, failing to personalize the message or leaving out key details, like specific payment terms or relevant order information, can cause confusion and delay action.

Key mistakes to avoid:

- Being Too Aggressive: Avoid using threatening language or sounding overly demanding. A professional, polite approach yields better results.

- Not Including Relevant Details: Always include necessary information, such as the amount due, due date, and order number, to avoid confusion.

- Sending Too Many Messages: Over-sending follow-ups can irritate clients. Space out your communications appropriately.

- Being Vague or Generic: A generic message that lacks specific information can come off as unprofessional and unclear. Tailor your messages for better clarity and engagement.

- Failing to Check for Errors: Always proofread your messages for spelling or grammatical mistakes that can undermine your professionalism.

By avoiding these common pitfalls, you can ensure your communications remain effective, respectful, and professional, leading to better results in securing payments.

Automating Reminder Emails for Efficiency

Managing overdue payments can be a time-consuming task, especially when follow-ups need to be sent to multiple clients. Automating this process allows businesses to handle payment follow-ups efficiently, ensuring that reminders are sent on time without requiring constant manual effort. By leveraging automation tools, you can streamline this essential part of your operations, saving time and reducing the risk of human error.

Benefits of Automation

Automation not only saves time but also ensures consistency. With scheduled messages, you can make sure that each client receives the correct communication at the appropriate time, without having to manually track and send reminders. It also helps maintain a professional approach by sending well-crafted, timely messages, allowing you to focus on other important aspects of the business.

Setting Up an Automated System

Setting up automation for payment follow-ups is relatively straightforward with the right tools. Many customer relationship management (CRM) systems and payment platforms offer built-in automation features. You can schedule reminders based on your preferred timing intervals, customize the content for each follow-up stage, and even track responses automatically. These systems can also provide reports to help you monitor the effectiveness of your follow-ups.

Key considerations for automation:

- Choose a reliable automation tool that integrates well with your current systems.

- Personalize automated messages to ensure they are client-specific and relevant.

- Set up clear triggers for when reminders should be sent, such as a specified number of days after the due date.

- Monitor the process regularly to ensure that the automation runs smoothly and that no errors occur.

By automating your follow-up process, you can handle overdue payments more efficiently, reduce manual workload, and ensure that your payment reminders are consistent and timely.

How to Encourage Prompt Payments

Encouraging clients to make timely payments is essential for maintaining healthy cash flow and ensuring business sustainability. Clear communication, streamlined processes, and strategic incentives can motivate clients to pay their balances on time. By creating an environment where timely payments are the norm, businesses can reduce the frequency of overdue accounts and improve their financial efficiency.

Establish Clear Payment Terms

One of the most effective ways to encourage prompt payments is by setting clear expectations from the start. Make sure that your payment terms are well-defined in contracts and agreements. Clients should understand the due date, acceptable payment methods, and any penalties or incentives for early or late payments. Transparent terms reduce confusion and create accountability.

Offer Incentives and Discounts

Providing incentives for early payments can be an effective strategy. Offering a small discount for clients who pay before the due date encourages faster action. For example, a 2% discount for payments made within 10 days can motivate clients to settle their bills promptly. Be sure to clearly communicate these incentives and set clear guidelines on how they can be earned.

Additional strategies to encourage timely payments:

- Send polite and professional reminders ahead of the due date to keep payment at the forefront of your client’s mind.

- Provide multiple payment options, such as online payment portals, to make the process as easy as possible.

- Offer payment plans for clients who need flexibility, ensuring they still pay on time but in manageable installments.

- Build strong relationships with clients by being professional and approachable, which can encourage them to honor their financial commitments.

By establishing clear terms, offering incentives, and streamlining the payment process, you can create a payment culture that encourages prompt payments and fosters positive relationships with clients.

Legal Considerations in Payment Reminders

When following up on overdue payments, it is essential to understand the legal boundaries surrounding the process. While it’s important to be firm and clear in your communications, the tone and content must align with legal standards to avoid potential liabilities or damaging your reputation. Ensuring that your messages are compliant with local laws and regulations is crucial for maintaining professionalism and safeguarding your business from legal risks.

Understanding Consumer Protection Laws

Consumer protection laws vary by region, but most regulations provide guidelines on how businesses can communicate with clients regarding overdue balances. These laws are designed to prevent harassment and ensure that debt collection efforts are fair and reasonable. As a business, it’s essential to be aware of these rules to avoid actions that could be deemed as unethical or illegal.

Key Legal Guidelines for Payment Follow-ups

Here are some important legal considerations when following up on unpaid amounts:

- Avoiding Harassment: Make sure your follow-up communications do not cross the line into harassment. The frequency of your messages should be reasonable, and the tone should remain professional at all times.

- Clear and Accurate Information: Always provide accurate details in your communications, such as the amount due, payment terms, and any late fees. Misleading information can lead to legal disputes.

- Respecting Privacy: Ensure that any personal information related to the debt is handled with care. Publicizing a client’s overdue payments without consent could violate privacy laws.

- Adhering to Local Regulations: Different countries or regions may have specific rules governing collections, including time limits for pursuing unpaid amounts. Familiarize yourself with these regulations to avoid legal complications.

Additional Considerations:

- Consider consulting a legal professional to draft or review your payment follow-up procedures to ensure compliance.

- Always document all communication efforts, including dates and content, to protect your business in case of legal action.

- Ensure that any late fees or penalties you apply are clearly outlined in the initial agreement and comply with applicable laws.

By following these legal guidelines, you can effectively manage overdue payments while staying compliant with relevant laws and regulations, protecting your business from potential legal risks.

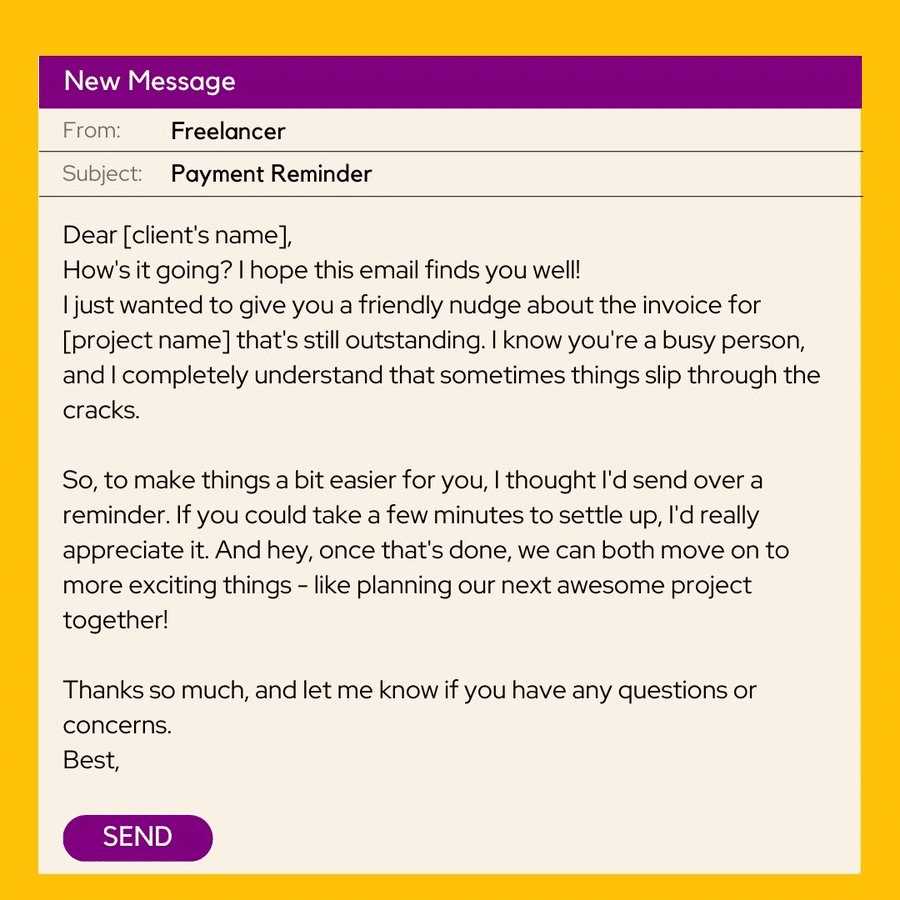

Using Friendly Language to Maintain Relationships

Maintaining positive relationships with clients is key to the long-term success of any business. Even when following up on unpaid balances, it’s essential to use friendly and respectful language. The tone of your communication can significantly impact the way your clients perceive your business and how willing they are to continue working with you. By keeping the conversation warm and professional, you foster goodwill while still addressing the issue at hand.

One of the most effective ways to keep the relationship intact is by ensuring that your communication doesn’t come across as aggressive or demanding. Instead, approach the matter with understanding and a sense of partnership. This can help to keep the client engaged and willing to resolve the issue without feeling alienated or resentful.

Key Strategies for Friendly Communication

Here are some strategies to ensure that your tone remains friendly and approachable while discussing outstanding payments:

- Be Polite and Courteous: Start your communication with a polite greeting and use respectful language throughout. Phrases like “I hope you’re doing well” or “Thank you for your attention to this matter” can make a big difference in tone.

- Use Positive Language: Focus on the positive side of things. For example, instead of saying “You owe us money,” try “We’re looking forward to receiving your payment.” This helps to maintain a constructive approach.

- Empathize with Your Client: Show understanding of your client’s situation. A simple statement like “We understand that unexpected things can come up” makes the interaction feel more human and less transactional.

- Avoid Strong Demands: Rather than using ultimatums or threatening language, suggest mutually beneficial solutions. Offer assistance or alternative payment options to make the process easier for them.

Additional Tips:

- Personalize your communication by addressing the client by name, which creates a sense of direct connection.

- Keep your tone light and friendly, even if the payment is overdue, to maintain a sense of respect and collaboration.

- Always express gratitude and appreciation for the client’s business, even when addressing a sensitive topic.

By maintaining a friendly, empathetic, and respectful tone, you not only address the immediate concern of payment but also preserve a strong, positive relationship with your clients for future interactions.

Tracking Payment Reminder Success Rates

Measuring the effectiveness of follow-up communications is essential for understanding what works best in encouraging timely payments. By tracking the success of these communications, businesses can refine their strategies, improve customer relationships, and ensure a steady cash flow. Understanding the key factors that influence the outcome allows for better decision-making and targeted efforts.

To track the success of payment follow-ups, it is important to measure various metrics, such as response rates, payment speed, and customer engagement. By consistently analyzing these metrics, businesses can identify patterns and adjust their approach to optimize results.

Key Metrics to Track

The following metrics are valuable when evaluating the effectiveness of payment follow-ups:

| Metric | Description |

|---|---|

| Response Rate | The percentage of recipients who open or reply to the follow-up message. |

| Payment Completion Time | The average time taken by clients to settle their outstanding balances after receiving a reminder. |

| Payment Amount Collected | The total value of payments collected after a follow-up message is sent. |

| Customer Satisfaction | Feedback from customers regarding the tone and helpfulness of the follow-up, which can impact future business. |

Using the Data to Improve Strategy

Once the relevant data is collected, businesses can analyze trends and identify which strategies lead to the highest success rates. For example, if response rates increase with more personalized communication, it may be worth investing additional time into customizing messages for individual clients. Similarly, if follow-ups sent within a certain time frame yield faster payments, businesses can implement a more structured schedule for sending these reminders.

By continuously refining the process and adjusting based on data insights, companies can ensure that their follow-ups are as effective and efficient as possible, leading to improved cash flow and client relationships.

Examples of Well-Written Reminder Messages

Crafting an effective follow-up communication requires careful consideration of tone, clarity, and structure. A well-written message can encourage prompt action without damaging the relationship between the business and the client. The key is to strike the right balance between professionalism and friendliness, while clearly communicating the need for timely settlement.

Below are examples of well-crafted follow-up communications that can serve as models for businesses looking to improve their own reminder messages. These examples demonstrate how to approach the tone, content, and structure to encourage positive responses.

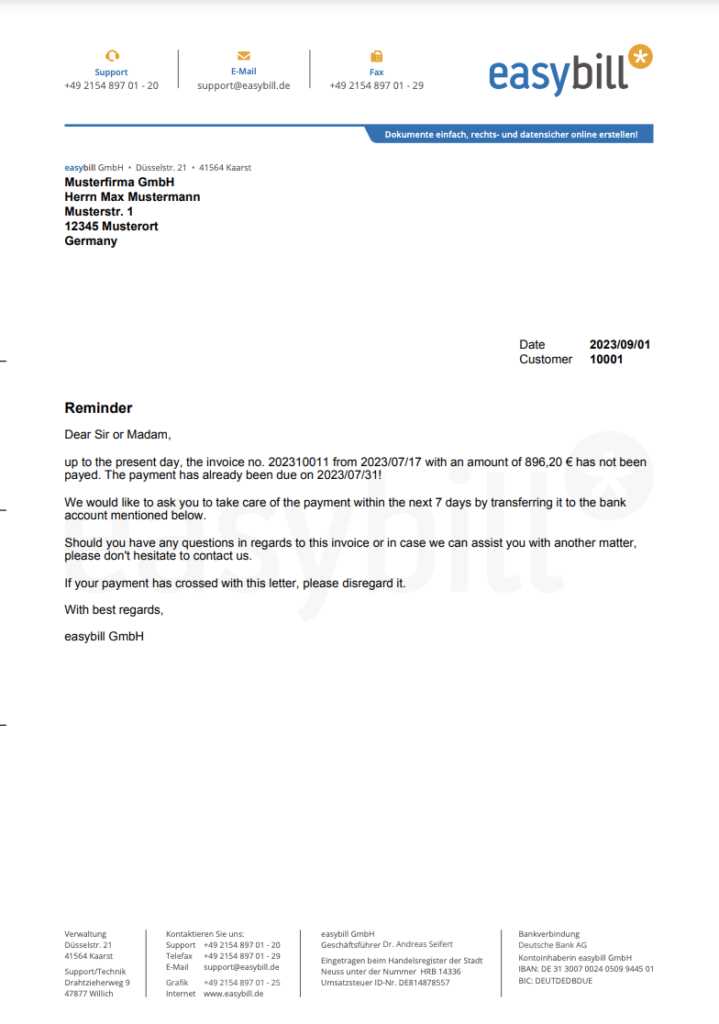

Example 1: Friendly and Professional Reminder

Subject: Friendly Reminder Regarding Your Recent Payment

Dear [Client Name],

I hope this message finds you well. We wanted to kindly remind you that the payment for [product/service] was due on [due date]. We understand that sometimes things can slip through the cracks, so we’d appreciate it if you could look into this at your earliest convenience.

If you’ve already made the payment, please disregard this message. Otherwise, we would be happy to assist you with any questions or concerns you may have regarding the payment process.

Thank you for your continued business, and we look forward to your prompt attention to this matter.

Best regards,

[Your Name]

[Your Business Name]

[Contact Information]

Example 2: Polite and Concise Follow-Up

Subject: Payment Reminder for [Service/Product Name]

Dear [Client Name],

This is a polite reminder that the payment for [service/product] is now [number of days] overdue. We would appreciate it if you could settle the outstanding balance of [amount] as soon as possible. If there are any issues or delays, please let us know so we can assist you further.

We value your business and look forward to resolving this quickly. Thank you for your immediate attention to this matter.

Sincerely,

[Your Name]

[Your Business Name]

[Contact Information]

Both examples provide clear information, maintain a respectful tone, and encourage timely action. By adapting these structures to fit your own business context, you can improve the chances of a positive response while maintaining good relationships with clients.

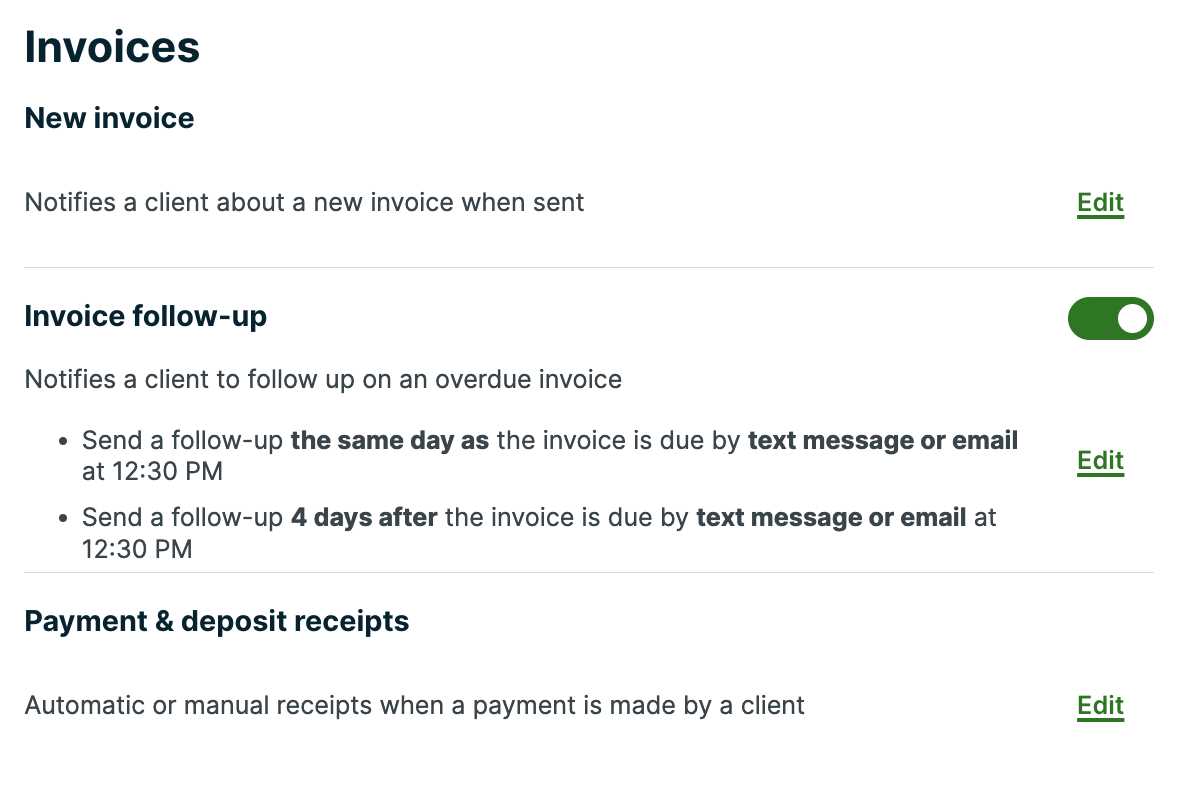

Integrating Follow-Ups into Your Workflow

Incorporating regular follow-up communications into your routine can help streamline the payment process and ensure timely collections. By automating key steps and setting up reminders at strategic points, businesses can reduce manual efforts and improve cash flow without sacrificing customer relations. The process begins by determining the best times to reach out and using tools that integrate seamlessly with your existing workflow.

Here’s how you can effectively embed these follow-ups into your daily operations to improve efficiency and consistency:

Step 1: Identify Key Milestones for Contact

Before integrating follow-ups into your routine, it’s crucial to identify when you should reach out to clients. Common milestones include:

| Milestone | Timing | Purpose |

|---|---|---|

| Before Due Date | 1-3 days before | To remind clients about upcoming obligations |

| First Follow-Up | 1-3 days after | To remind clients of overdue payments |

| Second Follow-Up | 7-10 days after | To reinforce the urgency of the payment |

| Final Reminder | 14-30 days after | To notify the client of next steps if payment is not made |

Step 2: Automate the Process

Integrating automated reminders into your billing software or CRM system can significantly reduce manual tasks. These systems allow you to schedule follow-ups based on predetermined rules and triggers, such as payment due dates or previous contact dates. Automation ensures consistency and frees up time for other important tasks, while also eliminating the risk of forgetting to send a follow-up.

By combining automation with the appropriate timing for reminders, businesses can ensure a smoother workflo