Reimbursement Invoice Template for Efficient Expense Management

Efficiently managing employee expenses and ensuring accurate reimbursement processes is crucial for both businesses and individuals. A well-structured form can simplify the process, making it easier to track, verify, and approve financial claims. By using the right tools, organizations can minimize errors, reduce administrative workload, and ensure timely compensation for expenses incurred.

These forms serve as a critical part of the financial workflow, allowing for quick and clear documentation of costs, providing a standardized approach for all parties involved. With a clear structure, businesses can guarantee transparency and avoid confusion, ensuring all claims are accurately processed in line with company policies.

Customizable solutions are available to cater to various industries, offering flexibility while maintaining essential details like dates, amounts, and payment methods. Embracing digital solutions enhances efficiency and reduces the risk of human error, streamlining the entire financial management process from start to finish.

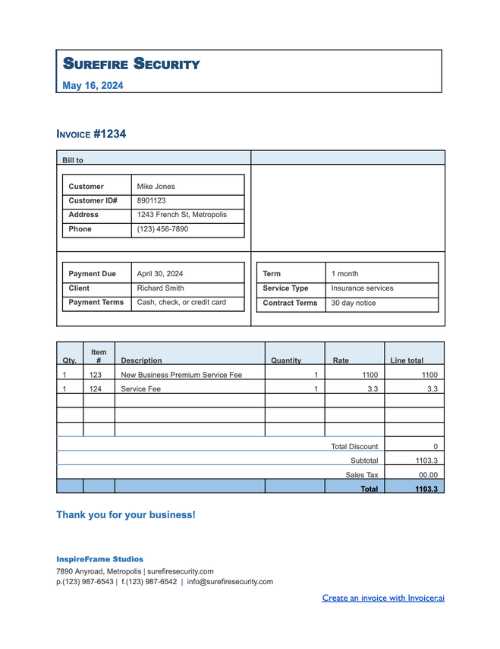

What is a Reimbursement Invoice Template

A well-structured document designed to request compensation for out-of-pocket expenses is essential for both employees and employers. This tool provides a standardized format that allows individuals to submit their costs in a clear and organized manner. By using a consistent approach, it ensures that all necessary details are included, making the approval and processing of financial claims more efficient.

Core Purpose and Function

The primary purpose of this document is to outline the expenses incurred during work-related activities and to facilitate their repayment. It serves as an official record of the costs, listing each item with its corresponding amount, along with other vital information such as dates and payment methods. When completed correctly, it provides transparency and ensures that all parties are aligned on the details of the claim.

Key Benefits of Using Structured Forms

Using a standardized approach reduces errors and simplifies the approval process. Accuracy is vital when handling financial transactions, and a clear, predefined structure helps avoid confusion. Additionally, it speeds up the reimbursement procedure, allowing employees to receive their funds faster while minimizing administrative workload for finance departments.

Why Use a Reimbursement Invoice Template

Using a standardized document for expense claims provides both clarity and consistency in the financial process. It eliminates the need for handwritten forms or scattered receipts, ensuring that all necessary details are included in a clear, easy-to-understand format. This approach not only improves efficiency but also minimizes errors, which is especially important when dealing with financial transactions.

Streamlined Process and Increased Efficiency

By utilizing a predefined structure, businesses can expedite the approval and processing of expense requests. A consistent format reduces the time spent on verifying details and speeds up reimbursement. This is particularly helpful for organizations with numerous employees or frequent claims, as it simplifies the workflow and ensures that all necessary information is captured without delays.

Accuracy and Compliance

Using a structured document helps maintain accuracy by ensuring that all relevant fields are filled out correctly. Standardization reduces the risk of missing information, which could cause delays or misunderstandings. Furthermore, it ensures compliance with company policies and financial regulations, as all claims follow the same approved format.

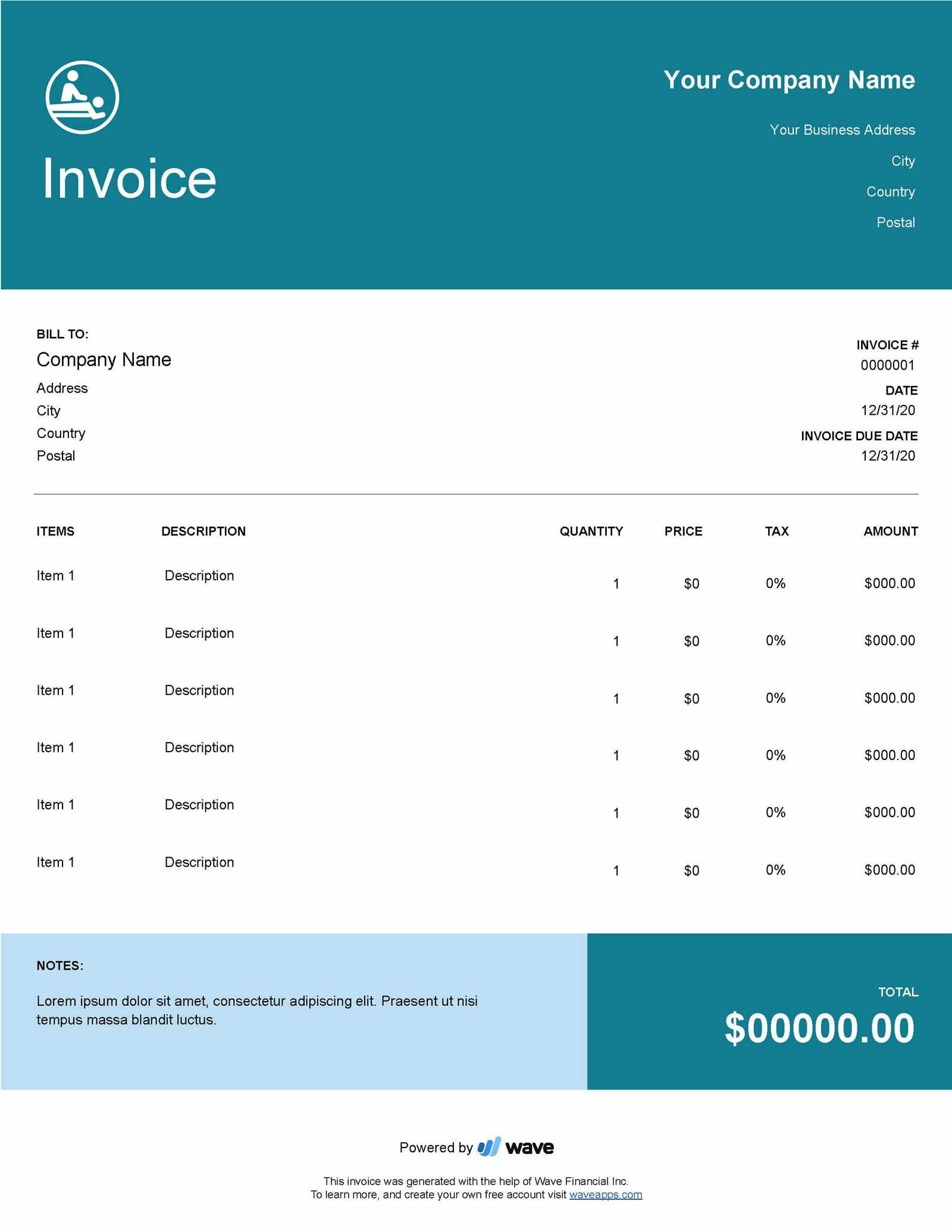

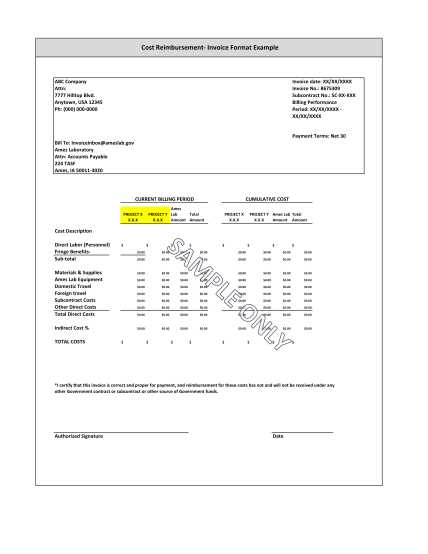

Key Features of an Invoice Template

A well-designed document for expense claims includes several key components that ensure the request is processed smoothly and efficiently. These essential elements provide both clarity and consistency, helping individuals and organizations track and manage claims effectively. Below are the core features that make such a document functional and user-friendly:

- Claimant Information: The document should include fields for the person submitting the claim, such as their name, contact details, and department, if applicable.

- Expense Breakdown: A detailed list of each expense, including the date, description, and cost. This section allows for easy verification of individual charges.

- Total Amount: A summary of all claimed expenses, with the total clearly displayed for approval and processing.

- Payment Method: Information on how the claimant prefers to receive their payment, whether by bank transfer, check, or other means.

- Dates and Deadlines: Including the date of submission and any relevant deadlines helps to ensure that claims are processed within a reasonable timeframe.

- Company Policy Acknowledgement: A space to confirm that the expenses comply with company guidelines, reducing the chances of disputes or misunderstandings.

These features contribute to a streamlined and transparent process, allowing businesses to easily track, approve, and reimburse claims while maintaining consistency and accuracy in financial reporting.

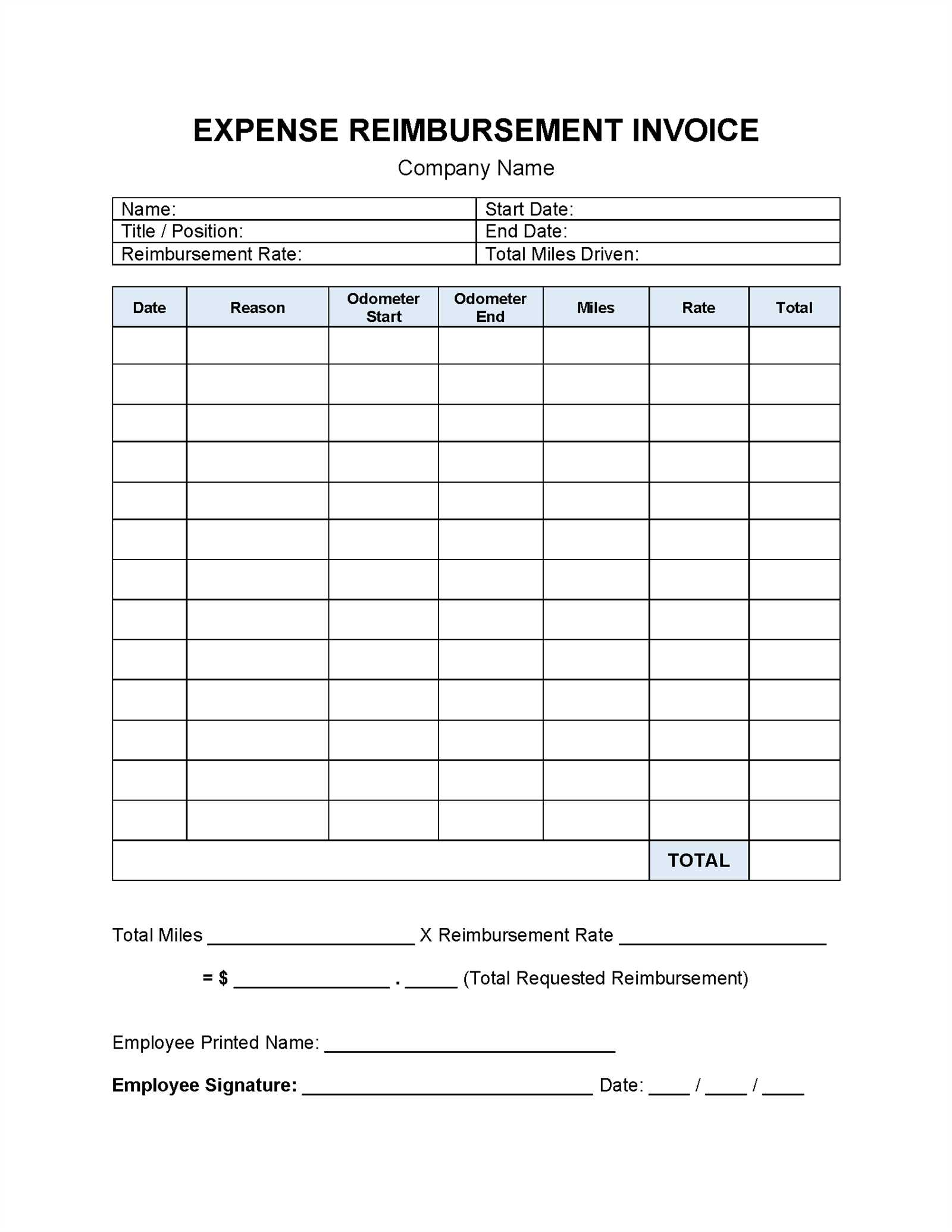

How to Create a Reimbursement Invoice

Creating a well-organized document for claiming work-related expenses is crucial for ensuring accuracy and speed in processing requests. The process involves gathering the necessary information, structuring it properly, and presenting it in a clear format. Below are the essential steps to follow when creating a document for financial claims.

- Gather Your Information: Before creating the form, collect all relevant details, such as receipts, purchase dates, descriptions of the items, and the total cost for each expense.

- Start with Basic Contact Details: At the top of the document, include the claimant’s name, department (if applicable), contact information, and any relevant reference number for the claim.

- List Each Expense: Create a table or list where each item is described, along with the date of purchase, the nature of the expense, and the amount spent. This should be done clearly and accurately to avoid confusion.

- Summarize the Total Amount: At the end of the list, calculate the total amount to be reimbursed and clearly highlight it for easy reference.

- Include Payment Preferences: Specify how the claimant prefers to receive the payment, such as via direct deposit, check, or another method.

- Set Clear Dates: Add the date of the claim submission and any relevant deadlines for processing to ensure timely reimbursement.

- Review and Submit: Double-check all information for accuracy before submitting the document for approval. Ensure all receipts and supporting documentation are included.

By following these steps and maintaining a consistent structure, you can create a professional and efficient expense claim form that minimizes errors and speeds up the approval process.

Essential Information to Include in Templates

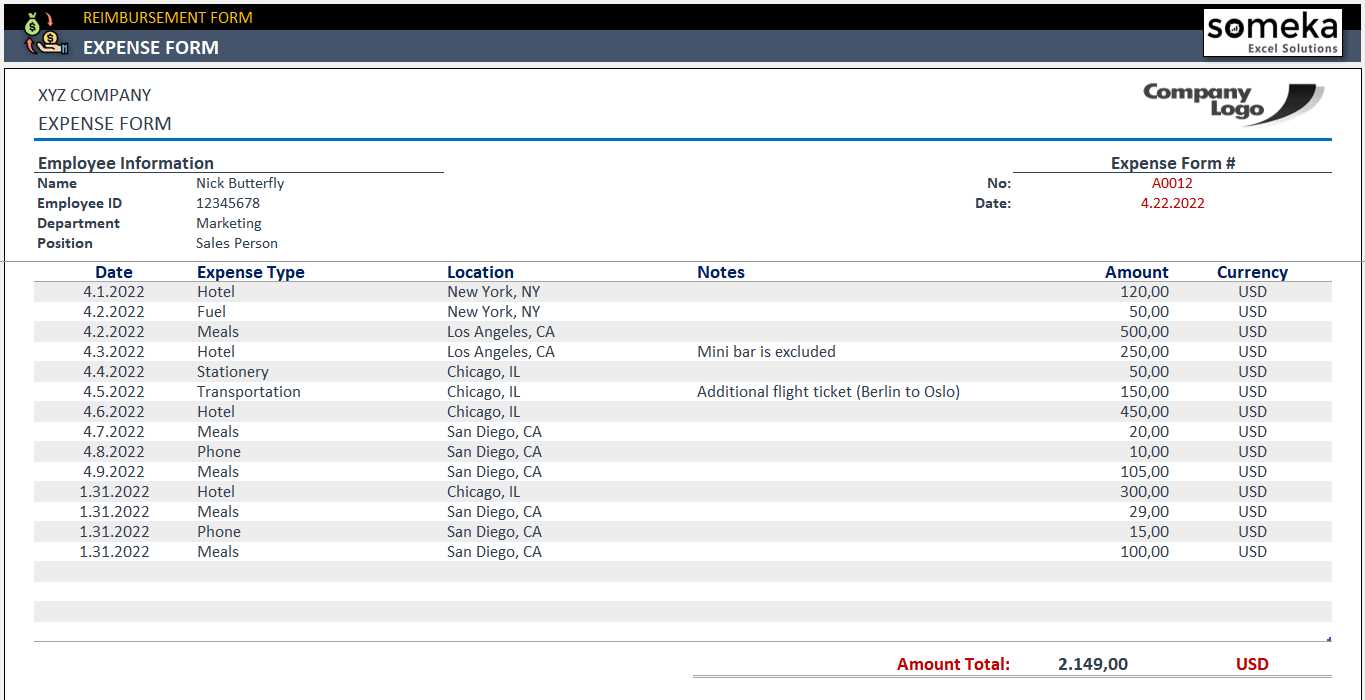

For a claim document to be processed effectively, it must contain all the necessary details that clearly outline the nature of the expenses. A properly structured form ensures transparency, minimizes errors, and accelerates the approval process. Below are the key pieces of information that should be included in every claim form to make it comprehensive and easy to process.

Basic Information and Identifiers

At the beginning of the document, you should include essential identifiers such as the claimant’s name, department, employee ID, and the date the document is submitted. This helps ensure that the claim can be tracked and properly assigned to the right individual or department.

Expense Details and Summaries

Each claimed expense should be detailed with the following information:

- Description: A brief explanation of what the expense was for.

- Date: The date the expense was incurred.

- Amount: The cost of the individual item or service.

- Category: An optional field to categorize expenses (e.g., travel, meals, office supplies).

Additionally, the total sum of all expenses should be clearly calculated and prominently displayed, ensuring there are no discrepancies in the amounts being claimed.

Including these elements ensures that the document is both clear and complete, enabling faster and more accurate processing of claims.

How Templates Simplify Expense Reporting

Using a structured form for submitting work-related expenses makes the entire reporting process more organized and efficient. A well-designed form helps both the employee and the finance department by standardizing the way expenses are tracked and submitted. This reduces errors, saves time, and ensures that all necessary information is captured accurately, leading to faster approval and payment processing.

Standardization Reduces Errors

By utilizing a predefined structure, businesses can ensure that every expense report follows the same format, which eliminates the risk of missing crucial details. Employees no longer need to worry about forgetting important information like the date of purchase or the purpose of the expense. This consistency also makes it easier for approvers to review and process claims quickly.

Improved Efficiency and Faster Processing

With all the required fields already outlined in the document, employees can submit their claims with minimal effort. Finance teams, on the other hand, can easily verify the information and approve claims without unnecessary back-and-forth communication. As a result, both sides benefit from a streamlined process that saves time and reduces the administrative workload.

Using a standardized form not only helps keep the reporting process on track but also ensures that each claim is processed efficiently and without confusion. The result is a smoother experience for both the claimant and the approver.

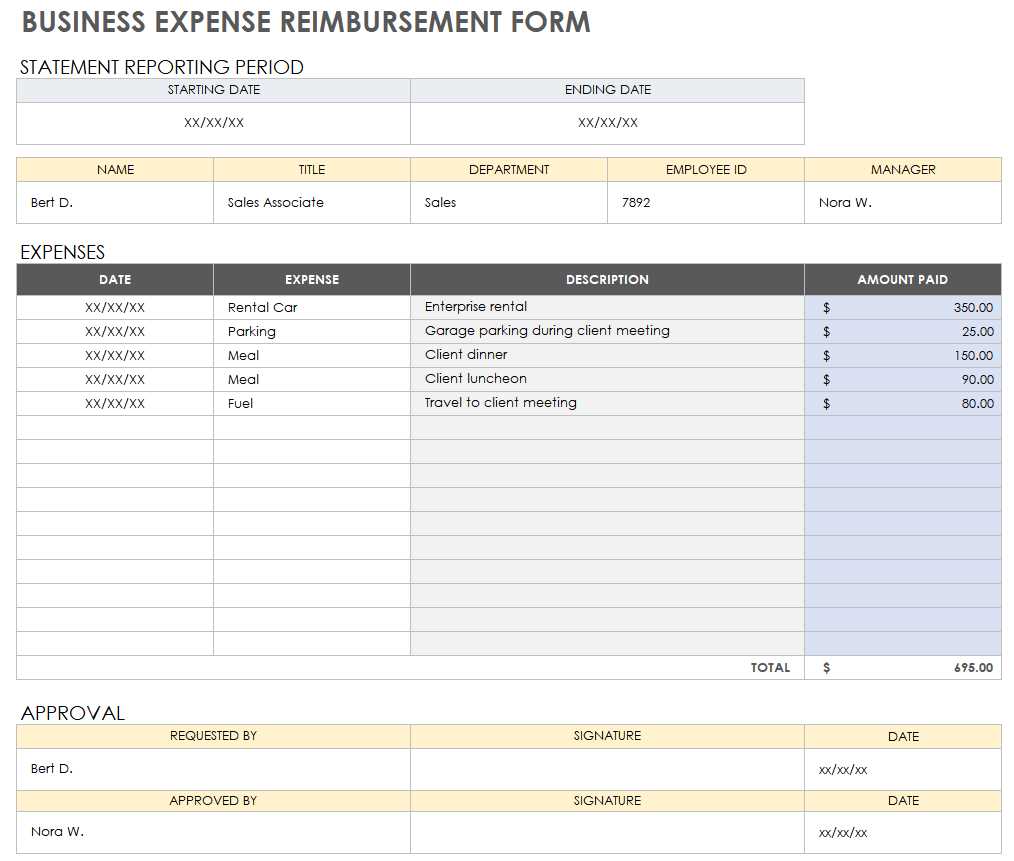

Best Practices for Using Invoice Templates

When using a structured form for submitting expense claims, it’s important to follow best practices to ensure the process is as smooth and efficient as possible. Adopting a consistent approach not only reduces errors but also helps streamline the approval process. Below are key guidelines to help you get the most out of your expense claim forms.

Ensure Accuracy and Completeness

Before submitting any claim, double-check all the information included in the form. Make sure that every expense is clearly described, with accurate amounts and proper supporting documentation. Completeness is key to avoiding delays or misunderstandings, so always review the document to ensure it includes all the necessary details such as dates, amounts, and purpose of the expense.

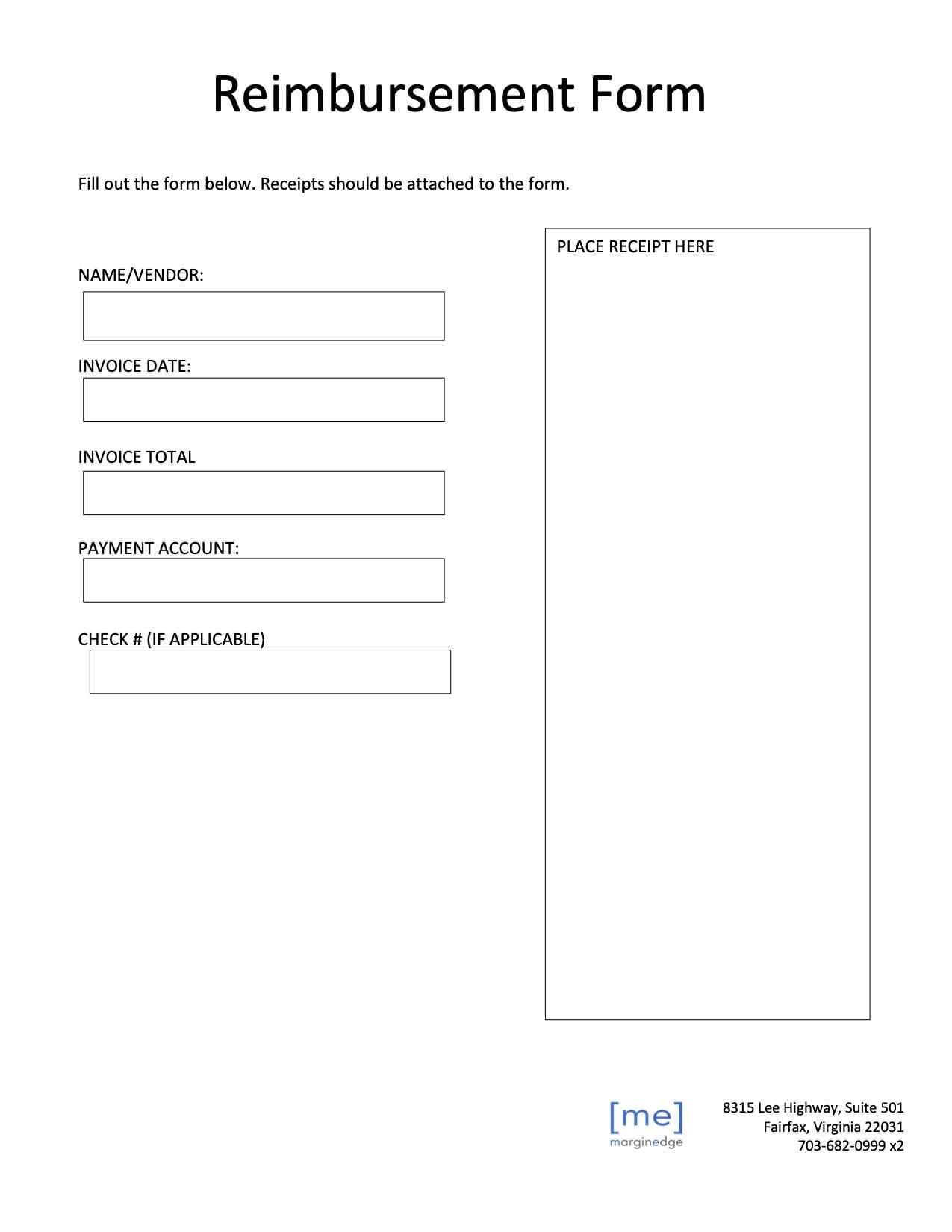

Customize the Form to Your Needs

While standardized forms are helpful, it’s essential to tailor them to fit the specific needs of your organization. Depending on your industry or internal policies, you may need to add or remove certain fields. For example, some businesses may require additional approval signatures, while others may prefer to categorize expenses by project or department. Customization allows you to align the form with your company’s unique workflow, improving efficiency and compliance.

By following these best practices, you can make sure that the process of submitting and approving claims is efficient, accurate, and consistent, leading to a smoother experience for all parties involved.

Common Mistakes in Reimbursement Invoices

While submitting expense claims is a routine task, several common mistakes can delay the approval process or cause confusion. These errors often arise from incomplete information, improper formatting, or a lack of attention to detail. Understanding and avoiding these pitfalls can significantly improve the efficiency of handling financial claims and reduce the chances of rejection or delays.

Missing or Inaccurate Documentation

One of the most frequent mistakes is failing to provide the necessary supporting documents, such as receipts or invoices for purchases. Without clear documentation, it becomes difficult for approvers to verify the legitimacy of the expenses. Additionally, providing inaccurate information, such as incorrect amounts or dates, can lead to discrepancies and slow down the approval process. Always double-check that all receipts are included and that the amounts listed match the actual costs incurred.

Failure to Follow Company Policies

Each organization has specific guidelines regarding what qualifies for reimbursement and how claims should be submitted. Failing to follow these guidelines is another common error. This could include submitting expenses that are not eligible for reimbursement or neglecting to use the correct format for submitting the claim. Familiarizing yourself with your company’s policies and ensuring that the form adheres to them is essential for timely processing.

Avoiding these common mistakes will help make the submission process smoother and prevent unnecessary delays, ensuring that all claims are processed correctly and efficiently.

How to Customize Your Template

Customizing a form for expense submissions is essential to ensure it aligns with your organization’s specific needs and policies. While standardized forms provide a useful starting point, tailoring them can make the entire process more efficient and ensure compliance with internal procedures. By adjusting certain elements, you can create a form that fits the unique requirements of your business while maintaining clarity and ease of use.

To customize the form, start by adding fields that are relevant to your company’s financial structure, such as project codes or department names. You may also want to include specific categories for different types of expenses, like travel, meals, or supplies, to streamline reporting and tracking. Additionally, consider including sections for approval signatures or departmental reviews to ensure proper authorization before processing claims.

Once you’ve made the necessary adjustments, be sure to test the form to ensure all fields are functional and the layout is clear. A customized form should reflect your company’s policies while still being user-friendly for all parties involved in the approval process.

Legal Requirements for Reimbursement Invoices

When submitting claims for work-related expenses, it is essential to ensure that all necessary legal requirements are met. These requirements are put in place to maintain transparency, prevent fraud, and ensure compliance with tax laws. Businesses must follow specific guidelines to make sure that their claims are valid, legally sound, and can stand up to scrutiny if required.

Key legal considerations include the following:

- Accurate Documentation: All claims must be supported by legitimate documentation such as receipts, invoices, or proof of payment. This helps verify the authenticity of the claimed expenses and ensures compliance with accounting standards.

- Proper Categorization: Expenses must be categorized correctly according to the company’s policies. This may include differentiating between personal and business-related costs, and ensuring that only eligible expenses are submitted for reimbursement.

- Compliance with Tax Regulations: Some expenses may be subject to tax regulations, either as taxable income or deductible costs. It’s important to be aware of local tax laws regarding the types of expenses that can be claimed and ensure they are accurately reflected in the document.

- Approval Processes: Legal requirements often include the necessity of obtaining proper approvals before expenses can be reimbursed. This ensures that claims are reviewed for accuracy and compliance with company policies.

- Time Limits: Many organizations and jurisdictions set time limits on when claims can be submitted. Claims submitted beyond these limits may not be eligible for reimbursement or may require additional documentation to be processed.

By ensuring that all of these legal requirements are met, you can help protect your organization from potential legal and financial risks, ensuring that claims are processed smoothly and compliantly.

Managing Multiple Reimbursement Requests Efficiently

Handling numerous expense claims simultaneously can be a daunting task, especially when each claim requires careful review and approval. Without a streamlined system, the process can become chaotic, leading to delays, errors, and frustration for both employees and finance teams. Implementing efficient strategies can help manage multiple claims smoothly, ensuring timely processing and minimizing administrative workload.

Utilize Digital Tools and Automation

One of the most effective ways to manage multiple claims is to leverage digital tools that automate parts of the process. Using expense management software allows for quick submission, tracking, and approval of claims in a central system. These tools often include built-in features like automatic categorization, validation checks, and reminders, which help speed up the entire process while reducing the risk of human error.

Set Clear Guidelines and Deadlines

Establishing clear guidelines for claim submission and approval helps avoid confusion and ensures that all claims meet the necessary criteria. Additionally, setting specific deadlines for submitting claims encourages timely submissions and helps avoid the backlog of requests. Clear deadlines also allow finance teams to prioritize claims and prevent delays.

By adopting these strategies, businesses can handle multiple claims efficiently, ensuring that all expenses are processed accurately and promptly while reducing administrative strain.

Free vs Paid Reimbursement Invoice Templates

When deciding how to handle work-related expense claims, businesses are often faced with the choice between using free or paid document formats. Both options have their advantages and drawbacks, depending on the specific needs of the organization. While free forms may provide basic functionality, paid options typically offer more advanced features and customization that can make the process more efficient and compliant with company policies.

Advantages of Free Expense Claim Forms

Free forms are an attractive option for small businesses or those with straightforward expense reporting needs. These forms are often available online and can be quickly downloaded or filled out. Basic features are typically included, such as fields for the claimant’s name, date of expense, description, and total amount. For businesses with limited budgets or simple expense structures, free forms are a cost-effective solution.

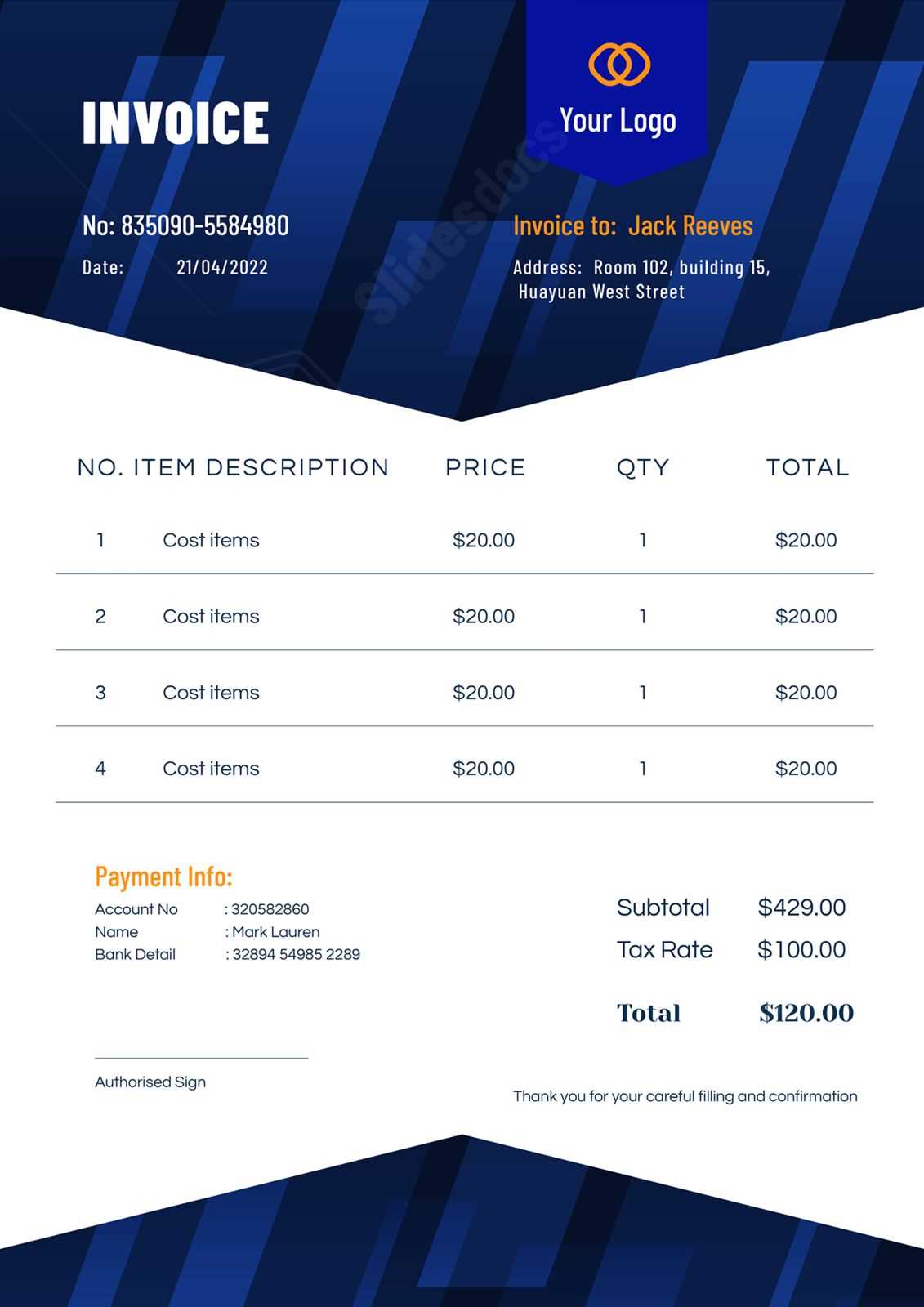

Benefits of Paid Expense Management Forms

Paid forms generally offer more advanced features and greater flexibility. These options often come with customization capabilities, allowing businesses to tailor the layout and fields to better suit their specific reporting needs. Some paid systems also offer integration with accounting software, automatic calculations, and enhanced security measures. For larger organizations or those with complex expense reporting processes, paid forms provide a more professional and scalable solution.

Ultimately, the decision between free and paid options depends on the complexity of the organization’s needs and its budget. For businesses with growing or complex requirements, investing in a paid solution may be the best choice for long-term efficiency and accuracy.

How to Automate Reimbursement Processes

Automating the process of handling work-related expense claims can significantly reduce administrative burden and speed up approvals. By integrating technology into the claims workflow, businesses can eliminate manual data entry, improve accuracy, and ensure faster processing times. Below are key steps to help automate your expense management system efficiently.

| Step | Action | Benefit |

|---|---|---|

| 1 | Use Expense Management Software | Automates the submission, approval, and tracking of expenses in a central platform, reducing manual errors. |

| 2 | Integrate with Accounting Tools | Syncs expense data with accounting software for automatic updates and streamlined financial reporting. |

| 3 | Set Approval Workflows | Automates the approval process with predefined rules, ensuring the right people sign off on claims without delays. |

| 4 | Enable Receipt Scanning | Scan and automatically extract key information from receipts, saving time on manual data entry. |

| 5 | Implement Policy Compliance Checks | Built-in features that automatically flag non-compliant claims, ensuring only eligible expenses are approved. |

By following these steps and leveraging the right automation tools, businesses can streamline the entire process of managing claims, ensuring efficiency and reducing the likelihood of errors or delays.

Benefits of Digital Reimbursement Invoices

Switching to digital forms for submitting and processing work-related expense claims offers numerous advantages over traditional paper-based methods. Digital systems streamline the process, making it more efficient, secure, and cost-effective. By adopting a digital approach, businesses can save time, reduce errors, and improve overall compliance.

One of the primary benefits is the speed at which claims can be submitted, reviewed, and approved. Employees can instantly upload supporting documentation, and managers can quickly approve or reject claims with just a few clicks. This eliminates the delays associated with physical paperwork, allowing for faster reimbursement.

Additionally, digital systems reduce the risk of errors and missing documentation. With automated features like data validation and required fields, claims are less likely to be submitted with incomplete or incorrect information. This improves accuracy and minimizes the need for follow-ups or corrections.

Another significant advantage is the environmental and cost savings. Going digital reduces the need for printing, filing, and storing physical documents, which in turn lowers office supply costs and space requirements. Furthermore, digital documents are easier to track and access, providing better visibility into the status of each claim.

Overall, switching to digital systems for handling expense claims leads to a more organized, efficient, and eco-friendly process that benefits both employees and finance teams alike.

How to Track Payments and Reimbursements

Effectively tracking the status of expense claims and their corresponding payments is critical for maintaining accurate financial records and ensuring timely settlements. By establishing a clear tracking system, organizations can easily monitor the approval, payment, and outstanding balances for each claim. Below are key steps and tools to help streamline this process.

| Step | Action | Benefit |

|---|---|---|

| 1 | Use Expense Management Software | Centralizes all claims in one system, allowing you to track approvals, pending payments, and completed reimbursements. |

| 2 | Implement Status Tracking Fields | Incorporating fields such as “Submitted,” “Approved,” “Paid,” and “Pending” makes it easy to visually track each claim’s progress. |

| 3 | Set Up Notifications and Alerts | Automated reminders can notify both employees and finance teams when a claim is due for approval or payment. |

| 4 | Maintain a Payment Log | Regularly update a payment log or tracking sheet to record the amount paid, payment date, and any remaining balances. |

| 5 | Reconcile with Financial Systems | Linking claim data with accounting software ensures accurate financial records and helps identify discrepancies between claims and actual payments. |

By following these steps and leveraging the right tools, businesses can ensure greater transparency and efficiency in managing expense claims and payments, preventing any overlooked claims or delays in reimbursements.