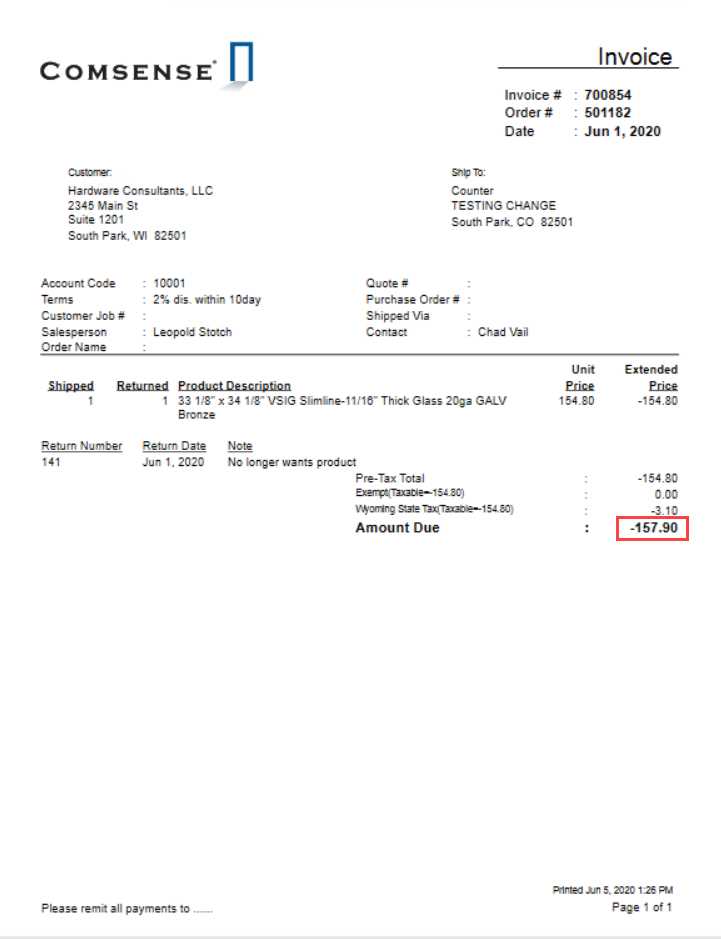

Refund Invoice Template for Easy Customization and Use

When handling financial transactions, especially those involving returns or corrections, it’s crucial to have clear, structured documentation. This ensures both businesses and customers are on the same page regarding the amounts involved and the reasons for adjustments. A well-designed form for tracking these adjustments simplifies communication, reduces errors, and strengthens business relationships.

By utilizing a pre-designed format, businesses can save time and effort while maintaining accuracy in their records. These forms typically include all necessary fields to capture relevant details such as the transaction amount, the reason for the modification, and the involved parties. Whether dealing with customer returns, product defects, or pricing discrepancies, having a standardized document ensures that all financial changes are properly recorded and can be easily referenced in the future.

Having a consistent approach to creating and managing such documents not only streamlines operations but also helps to avoid common pitfalls, such as missed details or miscommunication. With the right tools, these forms can be customized to meet the specific needs of any business, ensuring accuracy and professionalism in every transaction.

Refund Document Format: What You Need to Know

When a financial adjustment is necessary, having a clear and organized document to outline the details is essential for both businesses and customers. This form acts as a formal record of the changes made to a previous transaction, ensuring transparency and providing a basis for further communication. It helps to avoid confusion and ensures that both parties agree on the amounts involved and the reasons for the adjustment.

For businesses, creating such a document from scratch each time can be time-consuming and error-prone. That’s why many opt to use a pre-made structure that can be easily customized to fit specific needs. These documents generally include essential fields such as transaction references, the corrected amount, and explanations for the financial change. A standardized approach ensures that all relevant details are captured accurately, reducing the likelihood of mistakes and missed information.

Customizing these forms allows businesses to tailor them to their specific needs, whether it’s for product returns, service discrepancies, or price adjustments. By using a reliable structure, companies can speed up the process, maintain professionalism, and keep their financial records in order. Understanding the basics of these documents will help businesses ensure they meet both legal and operational requirements effectively.

Understanding the Importance of Refund Documents

Clear and accurate financial documentation is essential when handling transaction adjustments. Whether it’s due to a product return, pricing error, or service issue, having a well-organized record of these changes ensures transparency and accountability for both businesses and customers. Such documentation serves as an official acknowledgment of the financial modification, reducing the potential for misunderstandings and disputes.

Key Reasons for Using Proper Documentation

Utilizing a structured document for adjustments brings several benefits. It helps businesses maintain clear records, ensures compliance with financial regulations, and builds trust with customers by showing that their concerns are addressed professionally. Additionally, having a detailed record helps companies track their financial changes and avoid errors that could lead to discrepancies in their accounting systems.

How Proper Documentation Benefits Both Parties

For businesses, proper documentation simplifies the tracking of financial transactions and allows for easy reference in case of future inquiries. Customers, on the other hand, receive a clear breakdown of their financial changes, helping to ensure they feel informed and satisfied with the resolution. Below is a table outlining the advantages for both parties:

| Benefit | For Businesses | For Customers |

|---|---|---|

| Clarity in Records | Easy tracking of financial changes | Clear understanding of adjustments |

| Regulatory Compliance | Ensures adherence to financial laws | Confidence in the process |

| Dispute Resolution | Reduces the chance of errors and confusion | Quick resolution of issues |

By recognizing the significance of these documents, businesses can improve their operational efficiency and customer service, ensuring smooth transactions and stronger relationships.

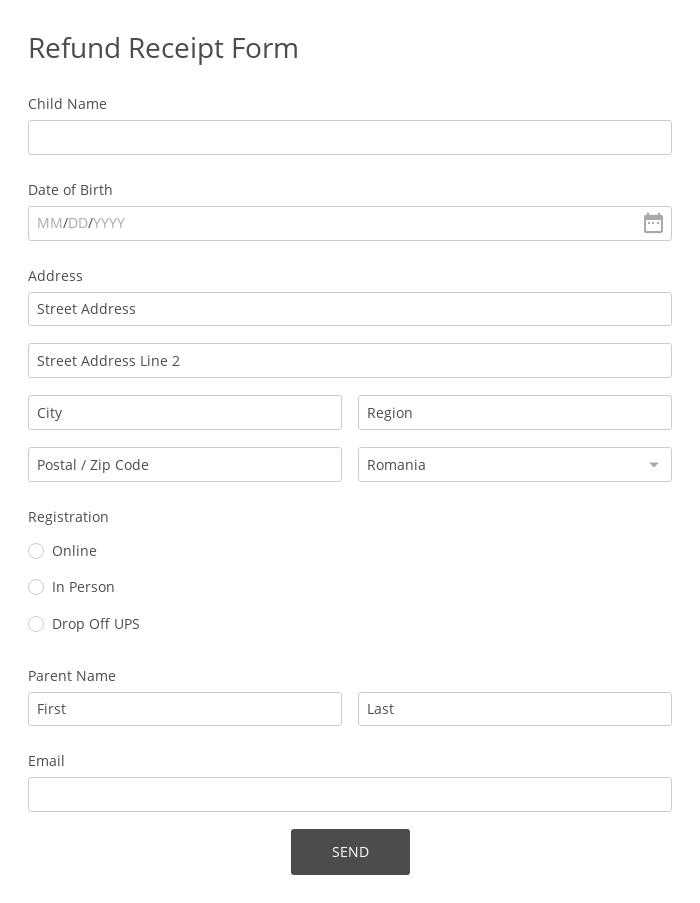

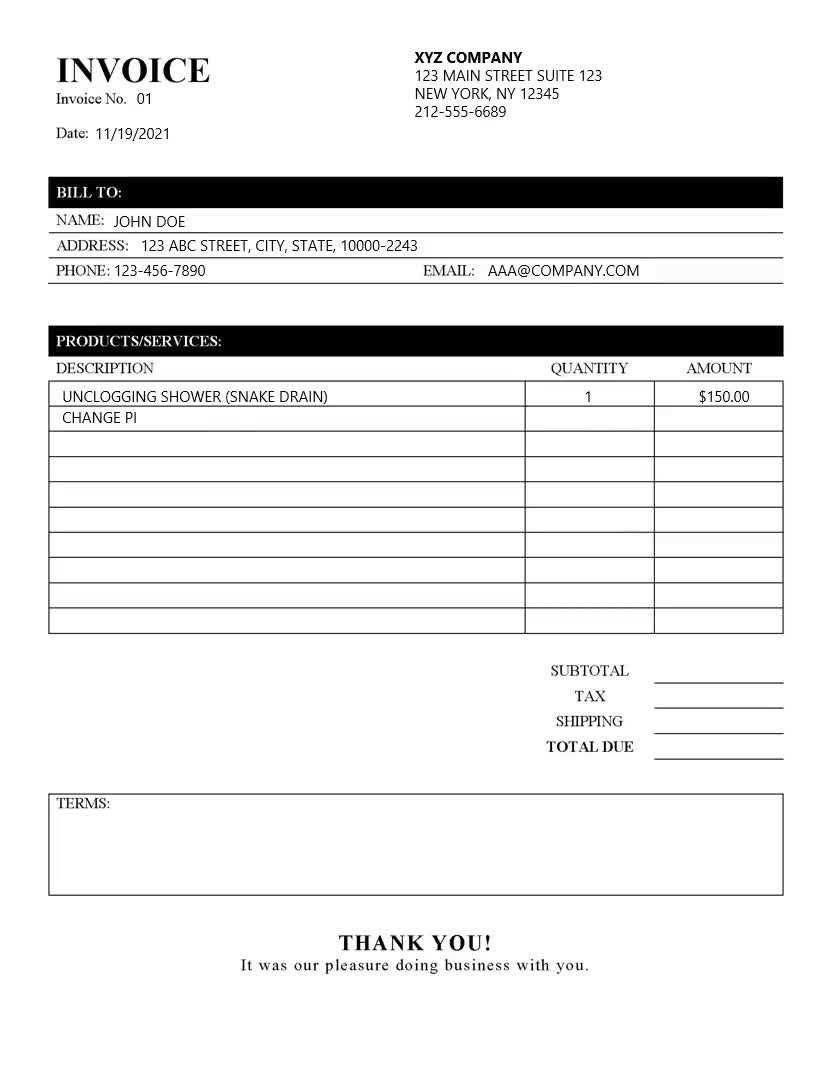

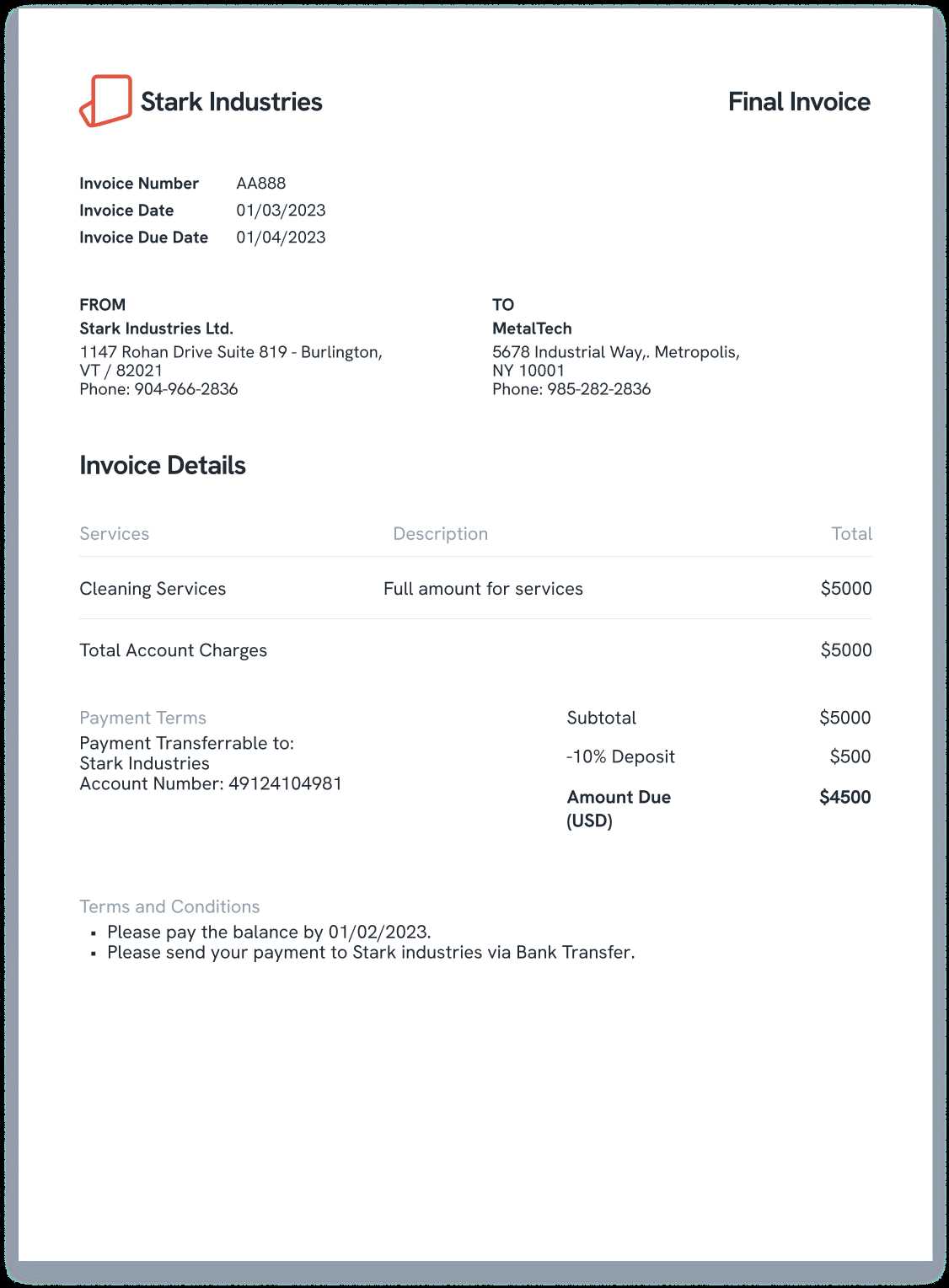

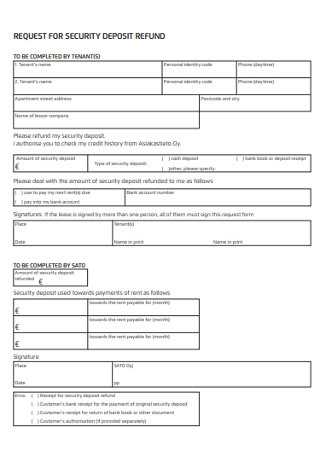

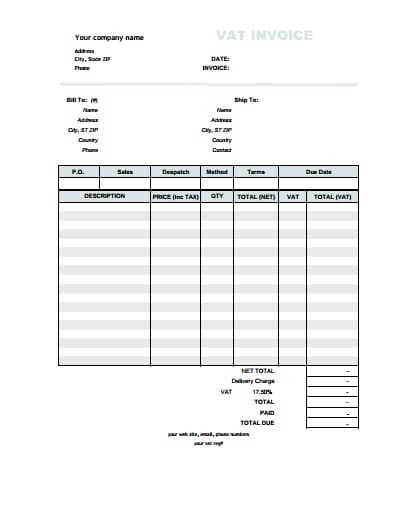

How to Create a Financial Adjustment Document

Creating an accurate and professional record of a financial adjustment is essential for maintaining clear business practices and ensuring transparency. Whether it’s for a returned product, an overpayment, or a billing error, having a proper structure helps to avoid confusion and ensures that all relevant details are captured. By following a few key steps, businesses can produce these documents quickly and efficiently while ensuring that they meet all necessary requirements.

To create an effective document for transaction modifications, it’s important to include several critical elements. These elements will serve as a guide to ensure the record is clear and comprehensive. Below are the key components that should be included when designing such a document:

| Field | Description |

|---|---|

| Transaction Reference | A unique identifier for the original transaction that is being adjusted. |

| Reason for Adjustment | A clear explanation of why the financial change is being made (e.g., product return, price discrepancy, etc.). |

| Adjusted Amount | The exact amount that is being refunded or credited to the customer. |

| Customer Information | Details such as the customer’s name, address, and contact information to ensure the right individual is receiving the adjustment. |

| Business Details | The company’s name, address, and contact information for reference and communication. |

| Date of Adjustment | The date on which the modification was processed or issued. |

Once these elements are included, the document should be reviewed for accuracy to avoid any discrepancies or misunderstandings. After finalizing the details, it can be sent to the customer for their records or processed internally for bookkeeping and auditing purposes.

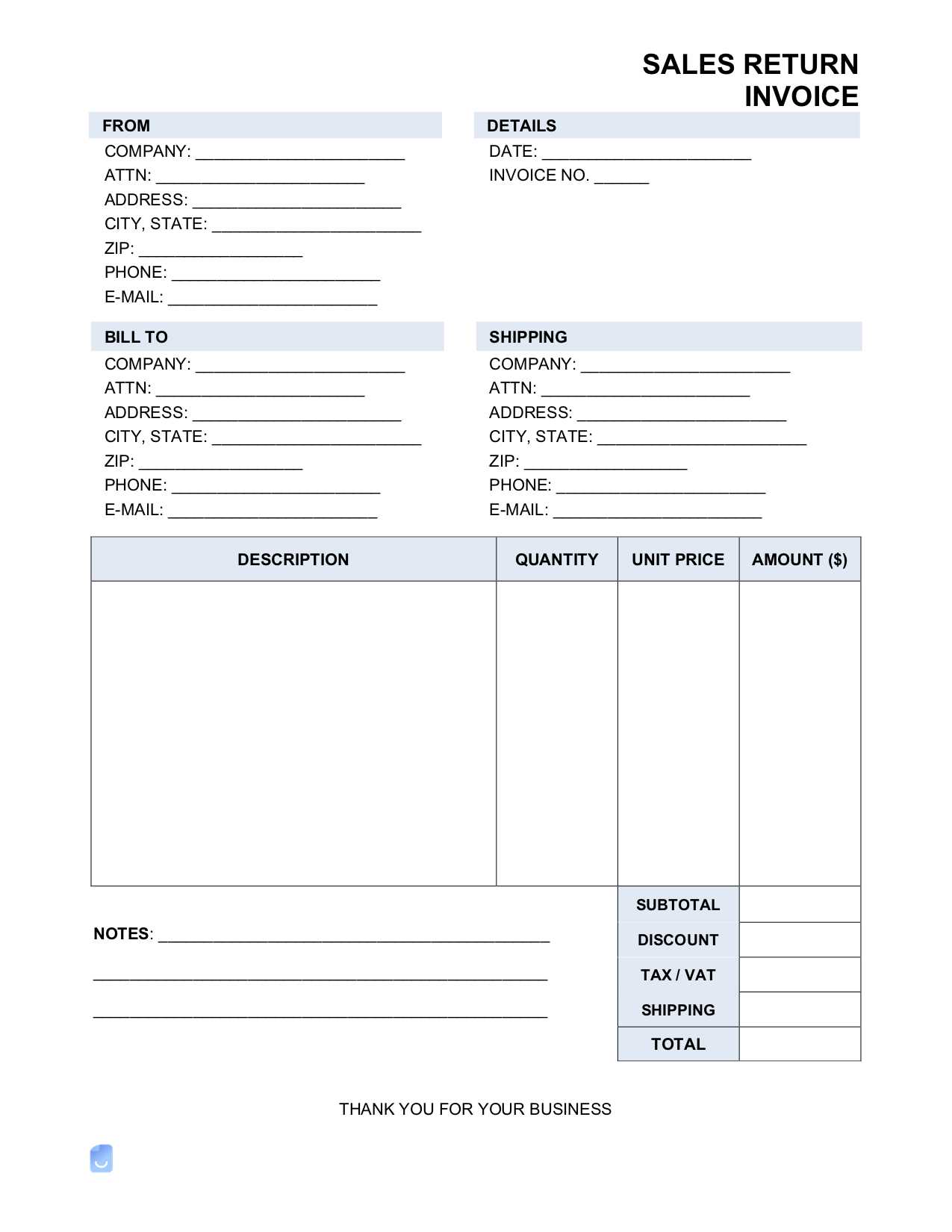

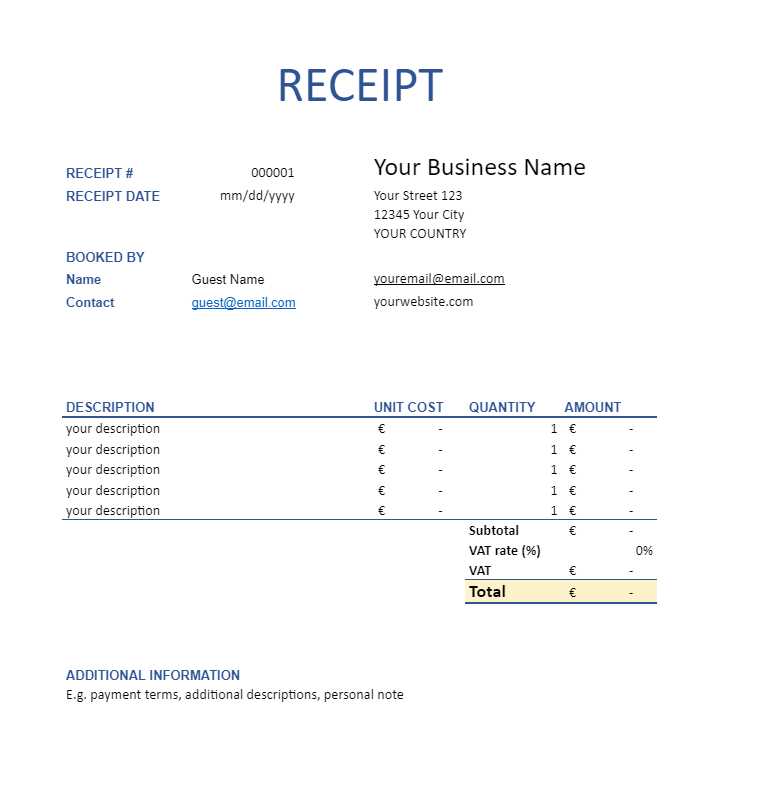

Essential Elements of a Financial Adjustment Document

When creating a formal record of a financial change, it’s crucial to include all relevant details that clarify the nature of the modification and ensure both parties are in agreement. A well-structured document not only helps businesses maintain accurate financial records but also builds trust with customers by providing a transparent breakdown of the transaction. Below are the key components that must be included in any document used for such adjustments.

The essential elements of this document serve to provide a clear understanding of the modification and its impact on the transaction. Each part plays a specific role in ensuring the accuracy and completeness of the record. The following table outlines these components:

| Component | Description |

|---|---|

| Reference Number | A unique number assigned to the original transaction to link it to the adjustment. |

| Reason for the Change | A concise explanation outlining why the adjustment is necessary (e.g., return, overcharge, product defect). |

| Adjusted Amount | The exact amount that is being credited or reimbursed. |

| Customer Information | Details about the customer receiving the adjustment, such as name, address, and contact details. |

| Business Information | The company’s name, address, and contact information to identify the party issuing the adjustment. |

| Date of Issue | The date the adjustment was processed or issued to the customer. |

| Payment Method (if applicable) | The method through which the customer will receive their credit or reimbursement (e.g., bank transfer, store credit). |

By including all of these components, businesses can ensure that their financial adjustment documents are both thorough and clear, helping to prevent any misunderstandings and providing both parties with a reliable

Benefits of Using a Financial Adjustment Document Structure

Adopting a pre-designed structure for documenting financial changes offers several advantages for businesses, streamlining the entire process while maintaining accuracy and consistency. These advantages go beyond simply saving time; they help ensure that every adjustment is recorded with the necessary details and in a standardized format. This not only enhances efficiency but also minimizes the risk of errors or missing information.

Time-Saving and Efficiency

One of the primary benefits of using a predefined structure is the significant time savings it provides. Instead of starting from scratch each time an adjustment needs to be made, businesses can simply fill in the relevant details. This reduces administrative burden and allows employees to focus on other important tasks. In addition, having a consistent format speeds up the process, ensuring that no steps are skipped.

Accuracy and Professionalism

Using a structured approach reduces the likelihood of mistakes that could lead to financial discrepancies or confusion. By following a clear and standardized format, businesses can ensure that all necessary fields are completed correctly. This also promotes professionalism, as customers receive a neatly organized document that clearly explains the changes made, fostering trust and confidence in the company’s handling of the transaction.

Overall, utilizing a reliable structure for financial modifications is an essential practice for any business looking to maintain efficient operations and uphold a high level of service. By adopting this approach, companies can improve both internal processes and customer relations.

Free Financial Adjustment Document Formats: Where to Find Them

For businesses looking to streamline their processes, finding pre-designed structures for recording financial adjustments can be a real time-saver. Fortunately, there are many sources where you can find these professionally created formats at no cost. Whether you’re looking for something simple or more comprehensive, there are options available for every need.

Many websites offer free downloadable formats, ranging from basic designs to more detailed layouts, which can be customized according to your specific requirements. These can be found on various platforms, such as accounting websites, business blogs, or even document-sharing sites. Below are a few common sources where you can access these free resources:

1. Accounting and Finance Websites

Many online accounting platforms and business resource websites provide free downloadable forms as part of their offerings. These documents are often created by experts in the field, ensuring they meet industry standards and legal requirements. Some well-known accounting websites offer a variety of formats to suit different industries and purposes.

2. Document-Sharing Platforms

Websites that host document-sharing services often have free resources available for download. Users can find both editable and printable versions of the required forms, designed for easy customization. These platforms allow users to browse different categories and download documents that fit their specific needs.

Using these free resources not only saves time and effort but also ensures that your financial records are consistent, professional, and legally sound. By choosing a trusted source, you can be sure that the format you use meets necessary requirements and can be tailored to fit your business needs.

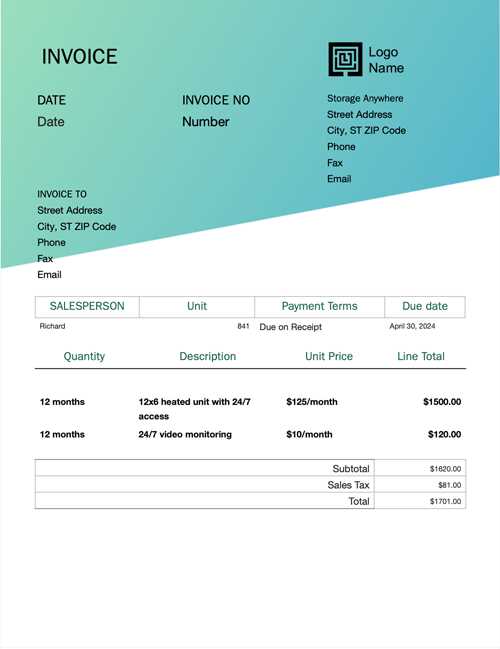

Customizing Your Financial Adjustment Document

Customizing your financial modification document allows you to tailor it to the specific needs of your business while ensuring it remains clear and professional. A personalized structure ensures that all the relevant details are included and that the document aligns with your brand’s identity and operational requirements. Whether you need to add extra fields or adjust the format, customization provides the flexibility to create a document that works best for your company.

Steps to Customize Your Document

Customizing a document for financial adjustments involves several steps that help ensure the final version meets both your functional and aesthetic needs. Here are some key steps you can follow:

- Identify Required Information: Begin by reviewing the essential fields to include, such as transaction reference, reason for the change, and adjusted amount. You may also need to add additional fields depending on your industry or specific needs.

- Adjust Layout and Design: Choose a format that aligns with your business branding. Adjust fonts, colors, and logos to create a professional look that reflects your company’s style.

- Add Business-Specific Fields: If necessary, include fields that are specific to your business, such as order numbers, customer membership IDs, or any other details relevant to your transactions.

- Ensure Legal Compliance: Make sure that the document includes any legally required disclaimers or terms related to financial adjustments.

Benefits of Customization

Customizing these documents offers several benefits for your business:

- Brand Consistency: Tailoring the format to match your company’s style helps maintain consistency across all customer communications.

- Improved Clarity: Adding relevant fields and removing unnecessary ones ensures that both parties can easily understand the transaction details.

- Increased Efficiency: Customization can streamline the process by ensuring all necessary information is pre-configured, saving time on each transaction.

By making these adjustments, you ensure that each document is not only effective in communicating the details of the financial change but also aligned with your company’s standards and operational flow.

Common Mistakes to Avoid in Financial Adjustment Documents

When creating documents to record financial adjustments, accuracy is crucial. Even small mistakes can lead to confusion, delays, or legal issues. It’s important to be aware of the common errors that can occur and take steps to avoid them. Below are some of the most frequent mistakes businesses make when preparing these documents.

Frequent Errors to Watch Out For

Here are some common mistakes that can compromise the clarity and effectiveness of your financial adjustment documents:

- Incomplete or Missing Information: Failing to include all necessary details, such as the original transaction number, the reason for the modification, or the correct adjusted amount, can cause confusion and disputes.

- Incorrect Calculation of Amounts: Ensure that the adjusted amount is accurate and reflects the correct calculation after considering any applicable discounts, taxes, or fees. Miscalculations can lead to financial discrepancies.

- Not Including Contact Details: Leaving out important contact information for both the business and the customer can make it difficult to resolve issues quickly. Make sure these are included for easier follow-up.

- Unclear or Vague Reasons for Adjustment: Avoid vague statements like “general adjustment” or “error correction.” Be specific about why the change was made (e.g., “product return,” “overcharge,” or “service issue”).

- Missing Date or Reference Information: Failing to add the date of the adjustment or the original transaction reference can complicate record-keeping and future queries. Always include clear reference points.

How to Avoid These Mistakes

By following a few simple practices, you can ensure that your financial adjustment documents are clear, professional, and accurate:

- Double-Check All Details: Always review the document before finalizing it. Confirm that all fields are filled out correctly and that calculations are accurate.

- Be Specific: Clearly explain the reason for the adjustment, making sure it is easy to understand. Avoid generic descriptions.

- Include All Necessary Information: Don’t leave out essential fields such as contact details, reference numbers, and dates.

- Use a Standard Format: Stick

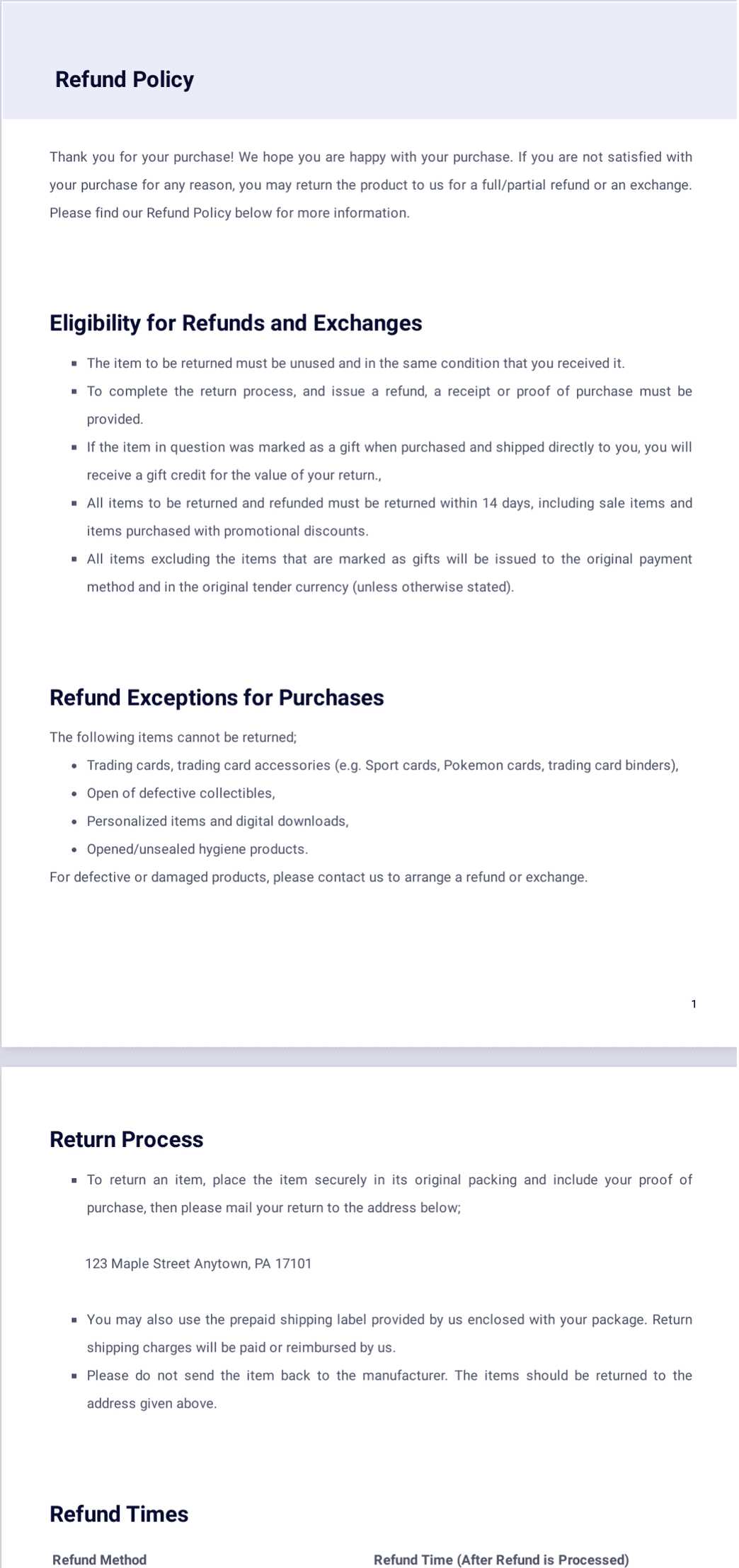

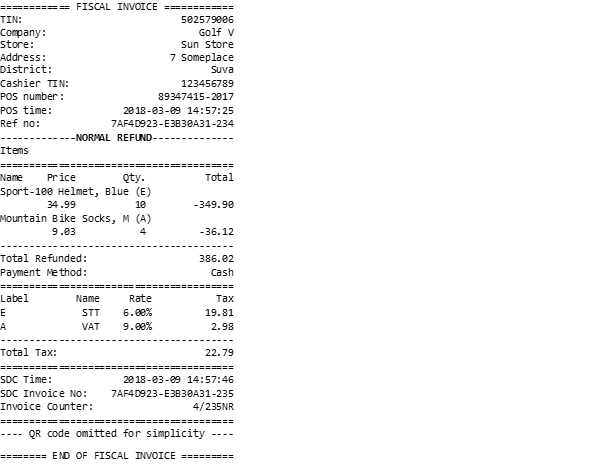

Refund Documents for Different Industries

Different industries often have unique requirements when it comes to documenting financial adjustments. Whether it’s due to product returns, service issues, or billing discrepancies, each sector may need specialized formats to meet both operational and legal needs. Understanding how these documents are tailored for specific industries ensures that businesses maintain accuracy and professionalism in their transactions.

Retail and E-commerce

In the retail and e-commerce sectors, financial adjustments are frequently related to product returns, exchanges, or price corrections. For these industries, it’s essential to include detailed information such as the item returned, original purchase details, and the reason for the return (e.g., defective product, wrong item shipped). In addition, including return shipping costs and any restocking fees can provide clarity for both the customer and the business.

- Transaction ID: Links the return to the original order.

- Product Details: Describes the item being returned or exchanged.

- Shipping Fees: Clarifies whether shipping is refunded or deducted.

Services and Consulting

For service-based industries such as consulting, finance, and software, financial adjustments may occur due to issues like overcharging, incomplete service delivery, or billing errors. These businesses must ensure that their documents are clear about the nature of the service provided, the time period in question, and the exact adjustment being made. Often, providing a breakdown of hours worked or services rendered can help customers understand the rationale behind the adjustment.

- Service Description: A breakdown of the service provided and the issue prompting the change.

- Billing Period: Specifies the time frame for which the adjustment is applied.

- Hourly Rates or Service Fees: Includes the original rates and any changes made to them.

By customizing these documents to fit industry-specific needs, businesses can enhance transparency, ensure accuracy, and foster better relationships with their clients and customers.

How Financial Adjustment Documents Help with Accounting

Financial adjustment records play a critical role in ensuring accurate and transparent accounting practices. By formally documenting any modifications to transactions, businesses can maintain precise financial records, track changes to their revenue and expenses, and stay compliant with regulatory requirements. These documents serve as vital tools for reconciling accounts, preparing for audits, and managing tax reporting.

In accounting, it is essential to keep track of all financial transactions, including those that involve returns, price changes, or billing corrections. Financial adjustment documents help by providing a clear and standardized format for recording these changes. This allows accountants to quickly identify the impact of adjustments on the company’s books and ensure that they are reflected accurately in financial statements.

Here are a few ways in which these records contribute to effective accounting:

- Accurate Revenue Tracking: When a customer returns a product or a service is canceled, the adjustment document ensures that revenue is correctly reduced, providing a more accurate picture of the company’s earnings.

- Expense Management: These records help track refunds and credits issued, which can be categorized as part of the company’s expenses, ensuring that all financial outflows are documented.

- Tax Compliance: Properly recorded adjustments ensure that businesses can accurately calculate taxes owed, including VAT or sales tax, and prevent over-reporting of income or under-reporting of expenses.

- Audit Readiness: Well-maintained records make it easier to provide documentation in the event of an audit, proving that all financial adjustments were made accurately and in accordance with accounting standards.

By properly utilizing these documents in accounting processes, businesses can improve their financial management, reduce errors, and ensure that their books reflect the true financial position of the company.

Legal Considerations for Financial Adjustment Documents

When handling financial changes, it’s essential for businesses to consider the legal implications involved in issuing documents for modifications. These documents serve not only as a formal record of the adjustment but also as a legal tool that can be used to resolve disputes, comply with consumer protection laws, and protect both businesses and customers in case of legal action. Understanding the legal requirements surrounding these records ensures that businesses stay compliant with the law and minimize risks related to financial transactions.

Consumer Protection and Rights

In many countries, consumers are entitled to specific protections regarding product returns, service issues, and billing corrections. Financial adjustment documents must clearly outline the reasons for the change and ensure that they align with local consumer protection laws. For example, businesses must provide accurate records of the amount refunded, the method of reimbursement, and the timeline within which the adjustment was processed. Failing to comply with these regulations can lead to legal disputes and penalties.

- Transparency: The document should fully disclose the reason for the change and how the adjustment is being processed.

- Consumer Rights: Ensure that the document complies with consumer rights laws, including refund policies and time frames for returns.

- Clear Terms: Include terms that specify the business’s policy on refunds, exchanges, and cancellations to avoid misunderstandings.

Tax and Financial Reporting Compliance

Financial adjustments must also meet the requirements of tax and financial reporting regulations. Inaccurate documentation of refunds and credits can lead to tax reporting errors, which may result in fines or audits. Businesses must ensure that adjustments are properly reflected in their financial statements and that any taxes (such as VAT or sales tax) are calculated correctly in accordance with local laws.

- Proper Documentation: The document should include clear references to the original transaction and adjusted amounts, which are critical for tax purposes.

- Compliance with Tax Laws: Ensure that the financial adjustment is accounted for in a way that complies with tax regulations, including sales tax or VAT adjustments.

- Accurate Record-Keeping: Retain copies of all financial adjustment records for a sufficient period, as required by law, in case of an audit.

By keeping these legal considerations in mind, businesses can minimize their exposure to legal risks, maintain compliance with relevant laws, and ensure that their financial practices are transparent and trustworthy.

How to Organize Your Financial Adjustment Documents

Properly organizing your financial adjustment records is key to maintaining efficiency and ensuring that all adjustments are easily accessible when needed. An effective organization system helps streamline the reconciliation process, improves record-keeping, and simplifies audits. It also minimizes errors and ensures that any adjustments made are properly documented and reflected in your financial statements.

There are several strategies you can implement to ensure that these records are organized in a way that supports both operational efficiency and legal compliance. Here are some best practices for managing these important documents:

1. Categorize by Type of Adjustment

Begin by organizing the documents based on the type of adjustment. For example, you could separate records for product returns, service cancellations, or billing corrections. This way, it becomes easier to find specific documents when needed and track patterns over time. You can also create sub-categories within each group for additional organization, such as refunds related to different departments or product categories.

- Product Returns: Group all documents related to returned items or products.

- Service Adjustments: Organize adjustments related to canceled services or issues with service delivery.

- Billing Corrections: Keep track of documents related to errors in pricing or overcharges.

2. Implement a Filing System

Using a well-structured filing system, whether digital or physical, is essential for maintaining organization. For physical records, use folders or binders to store the documents, clearly labeled by categories and date ranges. For digital records, make use of file folders and subfolders on your computer or cloud storage platform, ensuring they are appropriately named and easy to search.

- Folder Naming: Use clear naming conventions, such as “Return – Product A – March 2024,” to make it easy to locate documents.

- Digital Storage: Implement a consistent file naming system and back up your digital records regularly to avoid data loss.

- Paper Records: If keeping paper records, use dividers, labels, and dates to help easily separate and organize documents.

3. Keep Records by Date

Another effective method of organizing these documents is by date. This allows you to quickly access adjustment records for a particular time period, making it easier to track changes and perform reconciliations at the end of each month or quarter. Sorting by date ensures that you can find the most recent adjustments when preparing financial statements or audits.

- Monthly or Quarterly Sorting: Group documents by month or quarter for easier reconciliation.

- Digital vs. Paper Financial Adjustment Documents

When it comes to managing financial adjustment records, businesses must decide between using digital or paper formats. Both approaches have their advantages and challenges, and the choice largely depends on factors such as business size, industry, and regulatory requirements. Understanding the pros and cons of each method can help businesses make an informed decision about which format best suits their needs and operational workflow.

Benefits of Digital Financial Adjustment Records

Digital records have become increasingly popular due to their convenience, accessibility, and ease of storage. These documents are typically stored on cloud-based platforms or local servers, making them accessible from anywhere and reducing the need for physical storage space. Additionally, digital documents can be easily edited, searched, and shared, which enhances efficiency and reduces the risk of errors.

- Accessibility: Digital records can be accessed remotely, allowing employees to manage adjustments from different locations and devices.

- Space-Saving: Storing documents electronically eliminates the need for physical filing cabinets and storage space.

- Efficiency: Search and sorting features make it easier to find specific documents quickly, streamlining workflows.

- Environmental Impact: Using digital records reduces paper waste, making it a more environmentally friendly option.

Benefits of Paper Financial Adjustment Records

Despite the growth of digital tools, many businesses still rely on paper records, especially in industries with strict legal requirements or where employees are not as familiar with digital tools. Paper records can offer a sense of security, as they are not subject to the risks of data breaches or technical failures. For some businesses, physical documents may feel more reliable and tangible, and they may be required by regulatory authorities in certain jurisdictions.

- Legal Requirements: Some industries or countries may require paper documentation for certain types of transactions or for record retention purposes.

- Security: Paper records are not vulnerable to cyberattacks, which can affect digital systems.

- Traditional Business Practices: For companies that have long-established paper-based processes, physical records can feel more secure and familiar.

- No Technical Dependence: Paper documents are not subject to technical glitches, software issues, or power outages.

Ultimately, whether a business chooses digital or paper-based financial adjustment documents will depend on its specific needs and operational requirements. Many companies opt for a hybrid approach, maintaining paper records for compliance or legal reasons while transitioning o

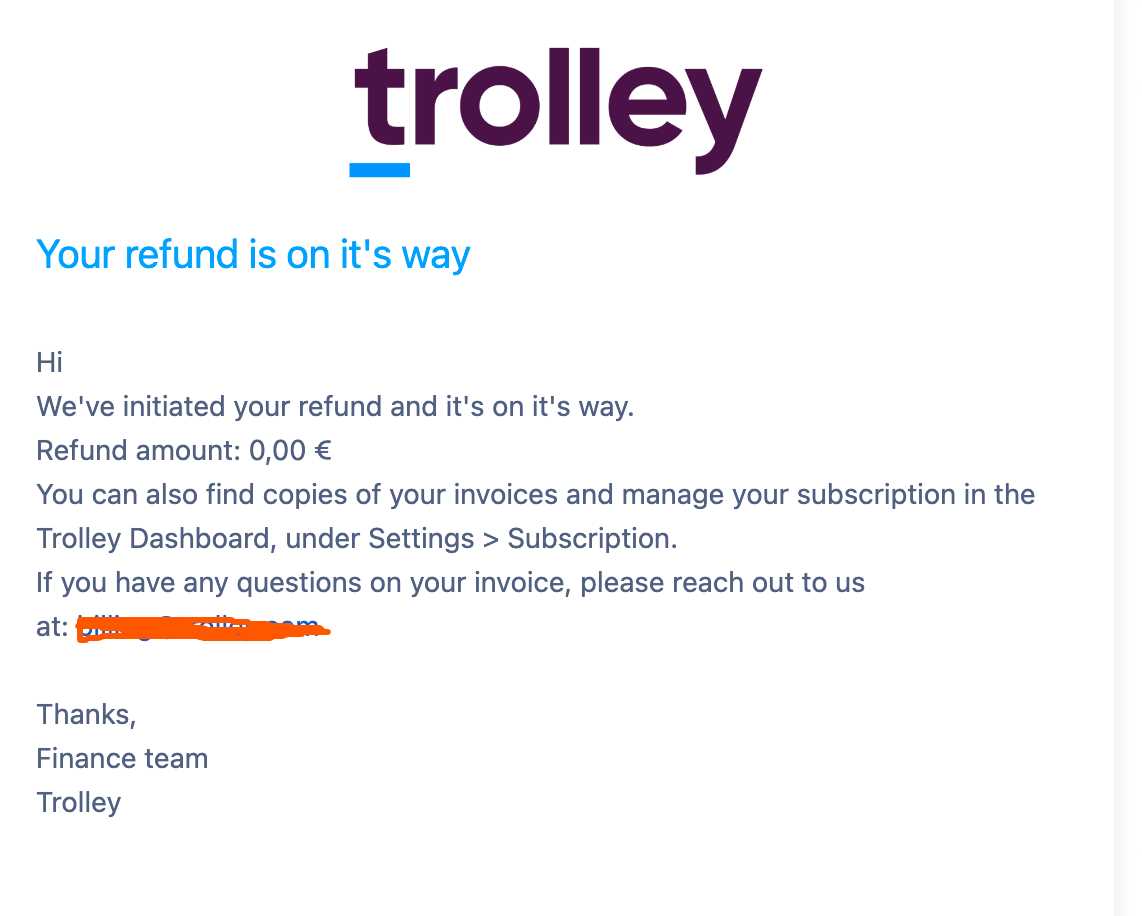

Financial Adjustment Documents and Customer Relationships

How a business handles financial adjustments can have a significant impact on its relationship with customers. The way these documents are issued and managed reflects the company’s commitment to customer satisfaction, transparency, and professionalism. A clear and efficient process for handling adjustments fosters trust and helps maintain positive customer interactions, even in situations where products or services do not meet expectations.

Building Trust Through Transparency

One of the key factors in maintaining strong customer relationships is transparency. When customers request a change or return, they want to feel confident that the process will be smooth, fair, and clear. Providing well-structured financial adjustment documents that detail the reasons for the change, the amount adjusted, and the method of reimbursement can help build trust. Customers appreciate knowing exactly what to expect and how their concerns are being addressed, which encourages loyalty and repeat business.

- Clarity: Ensure the document clearly explains why the adjustment is being made and how it affects the customer.

- Timeliness: Processing adjustments quickly and efficiently shows that the company values the customer’s time and business.

- Open Communication: Clear, respectful communication regarding the reason for the adjustment can help diffuse potential frustration or confusion.

Enhancing Customer Loyalty Through Efficient Processes

In a competitive marketplace, how businesses handle financial adjustments can be a key differentiator. When a company has a well-organized and efficient process for handling returns, corrections, or disputes, it not only resolves issues quickly but also creates an opportunity to strengthen customer loyalty. A seamless experience that includes prompt resolution and clear documentation encourages customers to return, even if they had an issue with a product or service initially.

- Efficiency: Customers are more likely to remain loyal if the adjustment process is fast and hassle-free.

- Customer-Centric Approach: Offering a customer-friendly process, with options for refunds or credits, enhances the overall experience.

- Consistency: Consistent handling of adjustments helps establish a reliable reputation, making customers feel more secure in their decision to do business with the company.

Ultimately, how financial adjustments are managed can significantly impact customer satisfaction. By prioritizing transparency, efficiency, and clear communication, businesses can build lasting relationships with their customers and turn potentially negative experiences into positive ones.

How Financial Adjustment Records Improve Cash Flow

Managing cash flow effectively is essential for the stability and growth of any business. While financial adjustments are often associated with returns or corrections, they can also play a crucial role in improving cash flow management. Proper documentation of these adjustments ensures that funds are properly accounted for, allowing businesses to track refunds, credits, and other transactions that affect their bottom line.

By addressing issues quickly and efficiently, these records can help businesses maintain healthy cash flow and avoid unnecessary delays in payments. Properly documenting financial modifications also provides a clear overview of transactions, ensuring transparency and minimizing the risk of accounting errors that can disrupt cash flow management.

1. Streamlining Payment Processes

When financial adjustments are well-documented, it becomes easier to process payments and credits, reducing delays in the payment cycle. For example, once a transaction adjustment is made, businesses can quickly issue reimbursements or credits to customers, which leads to quicker resolution of financial discrepancies. By making the adjustment process efficient and transparent, companies can avoid prolonged payment disputes that could negatively impact cash flow.

- Speed: Quick processing of adjustments leads to faster refunds and reconciliations, improving cash flow turnover.

- Clarity: Well-documented changes reduce confusion, ensuring both parties are aligned on the terms of the financial modification.

- Less Delays: A smooth process ensures that customer or supplier relationships are not strained due to slow financial transactions.

2. Preventing Future Financial Disputes

Financial adjustments can often stem from disputes over pricing, product defects, or billing errors. By addressing these issues swiftly and with clear documentation, businesses can prevent prolonged disputes that might delay payments or result in additional costs. When customers see that their concerns are being handled efficiently, it strengthens trust and reduces the likelihood of future payment issues.

- Minimized Disputes: Clear documentation helps to quickly resolve any issues, reducing the risk of extended disputes.

- Improved Relationships: Customers are more likely to return if they feel that financial adjustments are handled professionally and in a timely manner.

- Reduced Legal Costs: By avoiding prolonged conflicts, businesses can save on legal fees and other related expenses.

3. Better Forecasting and Planning

Having a clear and structured system for handling financial modifications allows businesses to better forecast their cash flow. By understanding the frequency and reasons for adjustments, companies can make more accurate predictions about future cash inflows and outflows. This allows for better budgeting and resource allocation, helping businesses plan for both expected and unexpected chan

Tracking Financial Adjustments with Structured Documents

Tracking financial modifications efficiently is essential for maintaining accurate records and ensuring that all adjustments are properly accounted for. By using a well-organized system to document these transactions, businesses can monitor adjustments in real-time, ensuring they remain transparent and up-to-date. A clear structure for these documents provides both the company and its customers with a simple way to track changes and ensure that payments are processed correctly.

Having a consistent format for tracking financial modifications offers several benefits. It helps businesses stay on top of their financial obligations, ensures transparency with customers, and provides a reliable audit trail for compliance purposes. Below are some key methods for effectively tracking these documents and the adjustments they represent.

1. Organizing Adjustments by Date and Transaction

One of the best ways to track financial adjustments is by organizing them chronologically and according to the related transaction. By doing so, businesses can easily see when adjustments were made and how they correlate with previous purchases or payments. This method helps to quickly identify any discrepancies and makes it simpler to resolve issues as they arise.

- Time-based Sorting: Arrange the records by date to quickly locate recent adjustments and assess their impact on the overall financial picture.

- Transaction Links: Clearly connect each adjustment to its corresponding purchase or service transaction for easy tracking.

- Clear Identification: Assign unique identifiers to each adjustment for easy reference during audits or customer inquiries.

2. Using Digital Solutions for Real-Time Tracking

Digital tools offer a powerful way to track adjustments as they occur. By using software or cloud-based platforms, businesses can monitor changes in real time, providing instant access to records and ensuring that all modifications are logged accurately. Digital tracking also simplifies data sharing and reporting, reducing the time and effort needed to reconcile financial records.

- Cloud-Based Storage: Store documents in a cloud system for easy access from any location and device, ensuring up-to-date information is available.

- Automated Alerts: Set up notifications for any financial changes or approvals, ensuring that nothing is overlooked.

- Integrated Systems: Integrate with accounting software to automatically update records, reducing the risk of human error and ensuring consistency across platforms.

3. Categorizing Adjustments for Better Analysis

For more detailed tracking, categorizing adjustments can help businesses better understand trends and identify recurring issues. Categories can include product returns, service cancellations, billing discrepancies, or promotional adjustments. By grouping adjustments into relevant categories, businesses can more easily analyze thei

Tips for Efficient Financial Document Management

Efficient management of financial records is essential for businesses to ensure smooth operations, accurate reporting, and timely payments. A structured approach to tracking transactions, processing adjustments, and maintaining documentation not only simplifies accounting tasks but also reduces the risk of errors. Here are some practical tips to help streamline financial document management and enhance overall workflow efficiency.

1. Implement a Clear Organization System

One of the key components of managing financial records effectively is organizing them in a way that allows for easy access and retrieval. Whether using a digital system or physical storage, having a clear organizational structure is crucial to maintaining an accurate and up-to-date record of all transactions.

- Use Folder Structures: Categorize documents by date, client, or type of transaction to make it easier to locate specific records.

- Standardized Naming Conventions: Implement a consistent naming system for files, such as including the transaction date and reference number, to improve searchability.

- Document Indexing: Keep an index or a master list of all records with key details to speed up the search process and ensure nothing is overlooked.

2. Automate Record-Keeping and Tracking

Automation can save a significant amount of time and reduce the risk of human error in financial document management. Using digital tools and software for tracking and processing records ensures that transactions are accurately logged in real time, making it easier to monitor adjustments and generate reports.

- Cloud-Based Solutions: Store records in cloud systems to enable remote access and real-time updates, ensuring that all stakeholders are working with the most current information.

- Automated Alerts: Set up noti