Referral Fee Invoice Template for Streamlined Payment Processing

Referral Fee Invoice Template Overview

When managing business agreements where a commission or reward is given for bringing in clients or opportunities, clear documentation is essential. A well-structured document ensures both parties understand the payment terms and prevents misunderstandings. This tool is designed to simplify the process by offering a straightforward method for recording agreed-upon amounts for services rendered. Using a well-defined structure helps maintain professionalism and clarity in financial transactions.

Importance of Accurate Record-Keeping

Accurate records are vital for tracking payments and maintaining transparency. By using a detailed document, businesses can easily reference past transactions and ensure that both the service provider and the recipient of the payment are aligned on what is owed. This clear approach helps prevent any disputes and ensures that all parties are satisfied with the terms of their agreement.

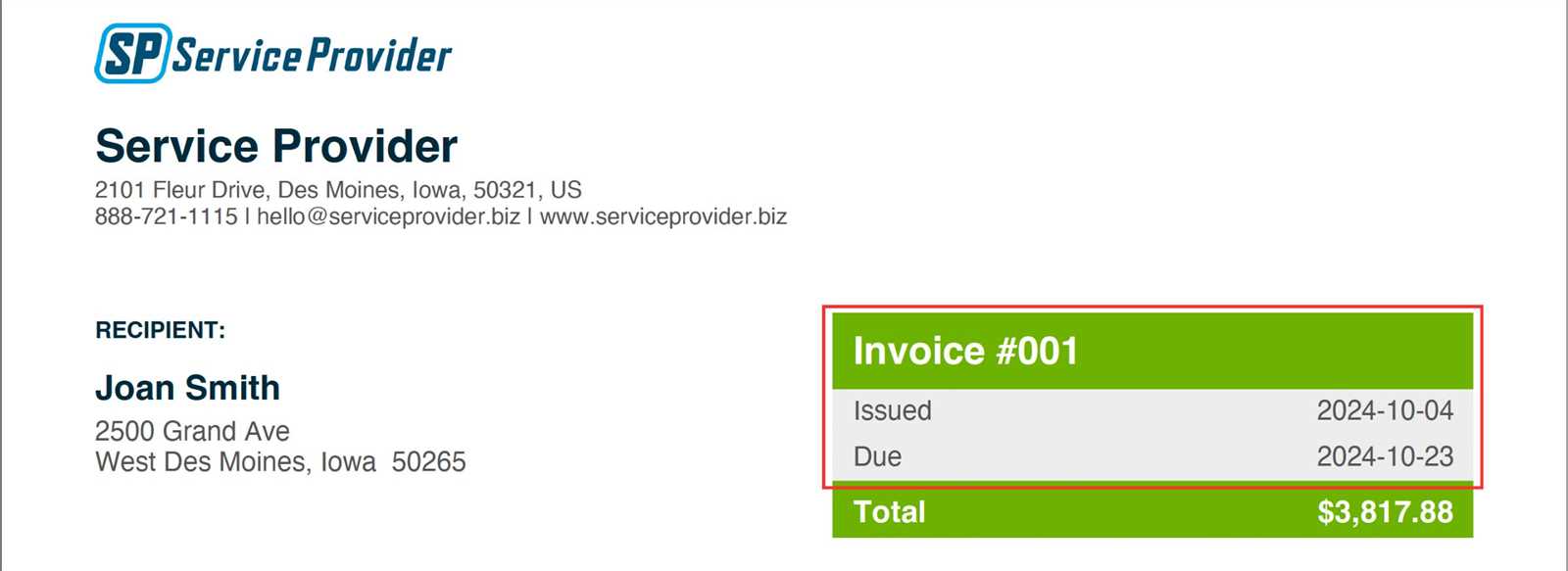

Essential Components of the Document

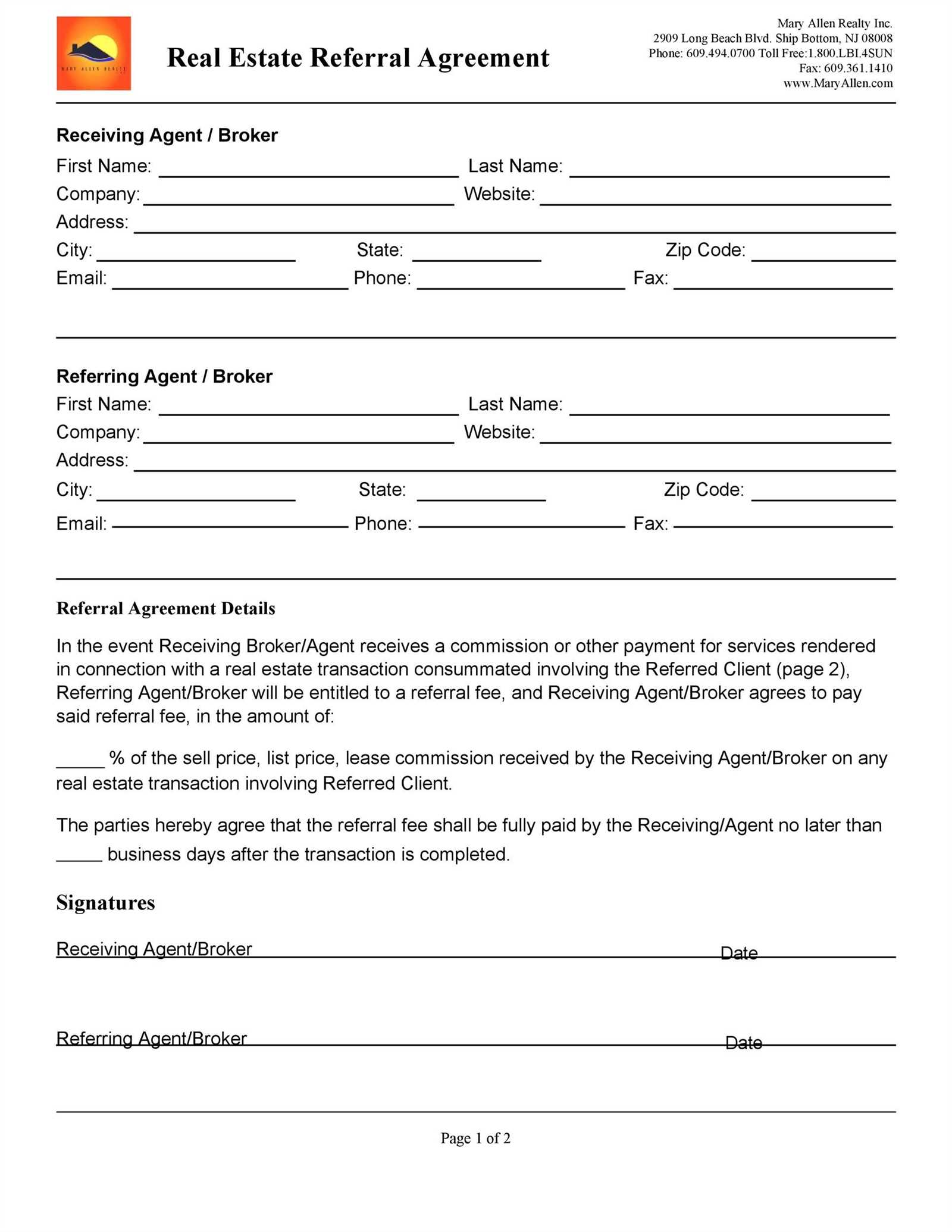

A good structure should include essential elements such as the recipient’s details, payment amount, due date, and any conditions tied to the arrangement. It is also crucial to state the method of payment and whether there are any late fees or penalties associated with overdue amounts. Including clear instructions and payment terms will further enhance the document’s utility and avoid any ambiguity.

Understanding Referral Fees in Business

In many industries, businesses reward individuals or organizations for bringing in new clients or opportunities. This practice is commonly used to incentivize partnerships and expand networks. By offering a set amount for successful introductions or deals, companies can encourage people to actively seek potential customers or business connections. These agreements can be structured in various ways, often depending on the scope of services provided and the value of the leads generated.

Such compensation agreements typically depend on the terms established between both parties, including how the value of the referral is calculated. Clarifying payment conditions and outlining specific requirements for earning a reward helps avoid confusion and ensures smooth transactions. Often, a percentage-based system is used, but fixed amounts may also apply depending on the industry or agreement type.

These arrangements play a critical role in many sectors by fostering collaboration and helping businesses grow their reach without upfront marketing costs. It also creates a mutually beneficial relationship where the referrer is compensated for their efforts in connecting clients to the business, ultimately supporting long-term success and profitability for all involved.

Why Use an Invoice Template

Using a structured document for business transactions is essential for ensuring that all the necessary details are captured clearly and efficiently. These documents provide a standardized format that saves time and effort, making it easier for both parties to understand the terms of the arrangement. Instead of manually creating a new document for each transaction, a well-organized form can be reused, ensuring consistency and reducing the likelihood of errors.

Benefits of Using a Structured Document

- Consistency: A standardized format ensures that all critical information is included every time.

- Time-Saving: Reusing an established document reduces the time spent on creating new forms from scratch.

- Professionalism: A clear and polished form gives a professional impression and reflects well on the business.

- Clarity: Clearly outlining payment terms and conditions helps both parties understand the agreement with no ambiguity.

- Easy Tracking: Having a set format makes it easier to track past transactions and follow up on pending payments.

How It Helps in Business Transactions

These forms play a key role in maintaining smooth and transparent financial processes. By using a consistent format, businesses ensure that all payments and terms are properly documented, avoiding misunderstandings and potential disputes. Moreover, it provides both parties with a clear record for future reference, whether for accounting purposes or to resolve any issues that may arise during the payment process.

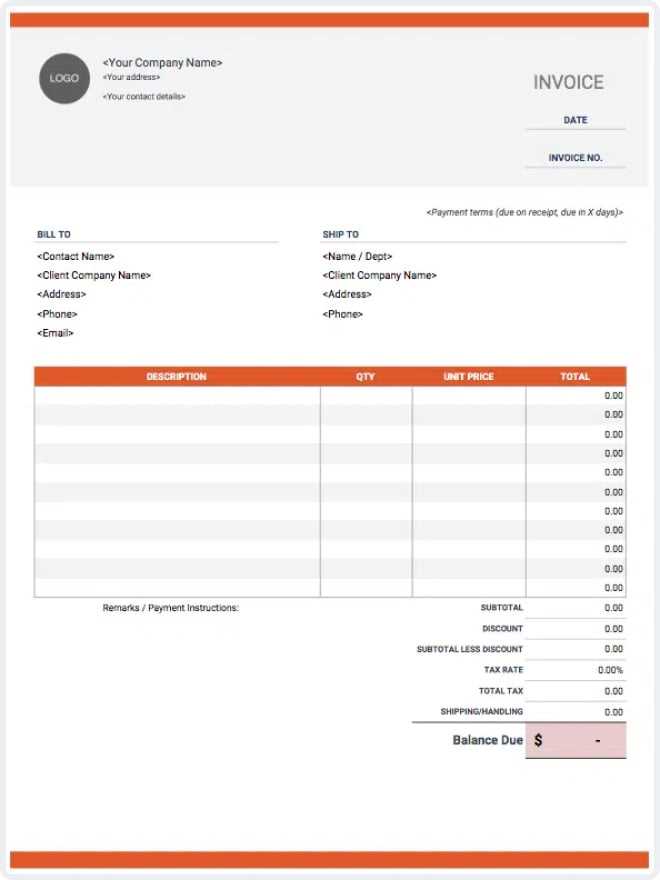

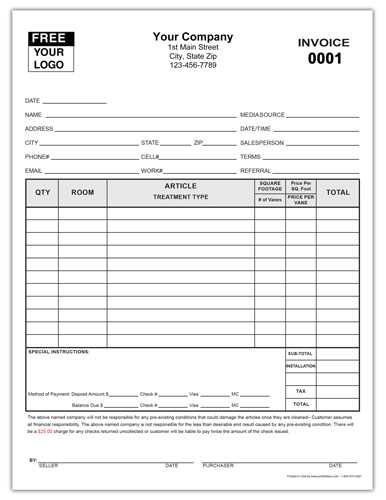

Key Elements of an Invoice

When creating a formal document to request payment for services or products, it’s important to include all the necessary details that ensure clarity and prevent confusion. This document serves as a record of the transaction, so every element must be carefully considered to provide a complete picture of the agreement. Including all required information helps avoid potential disputes and streamlines the payment process.

Essential Information to Include

- Identification Details: Include your business name, address, and contact information, as well as the recipient’s details.

- Unique Document Number: Assign a unique reference number to each document for easy tracking and record-keeping.

- Date: Specify the date of issuance and the payment due date to establish a clear timeline for payment.

- Detailed Description of Services: Clearly outline the services or products provided, including quantities, rates, and any applicable terms.

- Total Amount Due: Clearly list the amount owed, including any taxes or additional charges, to ensure transparency.

- Payment Instructions: Include the preferred method of payment, bank details, or any other necessary instructions for the transaction.

Additional Considerations

- Late Payment Terms: Specify any penalties or late fees for overdue payments to encourage timely processing.

- Discounts or Promotions: If applicable, mention any discounts or special offers applied to the total amount.

- Terms and Conditions: Include any relevant terms or conditions that outline the rights and obligations of both parties i

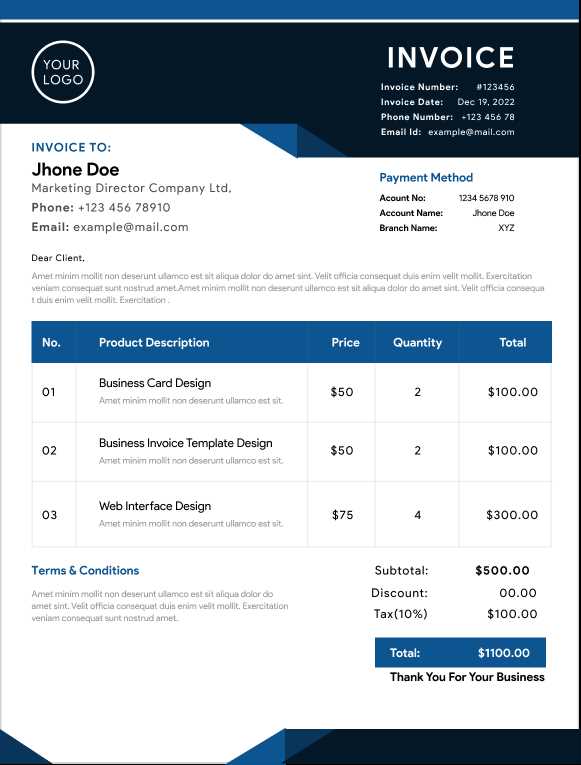

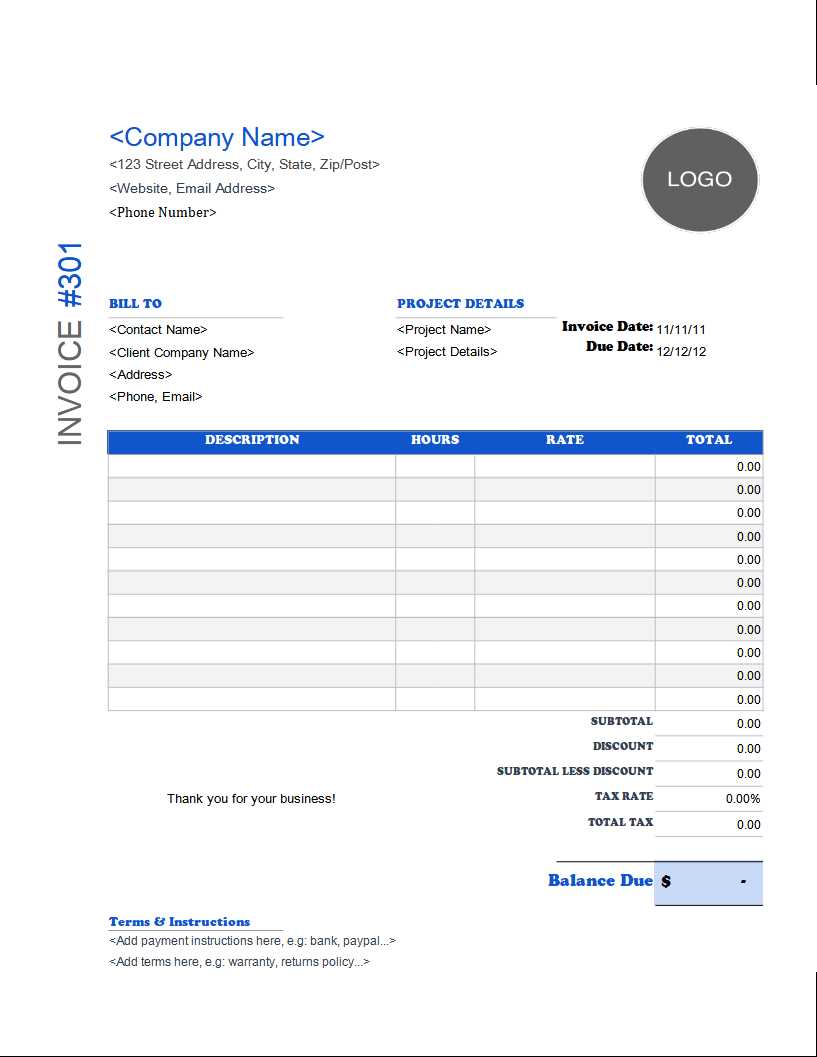

Creating a Professional Invoice

When preparing a document to request payment, professionalism is key. The format should reflect the nature of the transaction while ensuring that all necessary information is presented clearly and concisely. A well-crafted document not only ensures accuracy in financial dealings but also helps establish a trustworthy relationship with clients and partners.

To create a professional document, it’s important to focus on several key elements, such as organization, clarity, and design. Clear and consistent formatting will make the document easy to read, while ensuring that all relevant details are included helps avoid confusion and delays in payment. Additionally, providing contact details and clear instructions for payment builds credibility and fosters confidence in the transaction.

Another important aspect is maintaining a formal tone and using appropriate language. A professional document should be free of errors, use proper grammar, and include any legal terms or conditions that may apply to the arrangement. By paying attention to these details, businesses can ensure their documents are viewed as professional and reliable, which can lead to smoother and more efficient financial transactions.

Referral Fee Calculation Methods

Calculating compensation for services or successful introductions is an essential part of many business agreements. The method of calculation can vary depending on the specifics of the arrangement, including the type of service provided, the value of the transaction, and the agreed-upon structure between the parties involved. Understanding different methods of compensation helps ensure fairness and transparency in the financial dealings.

One common approach is to offer a percentage of the total value of the deal or sale. This method aligns the compensation with the success of the transaction and can be adjusted depending on the complexity or value of the service. Percentage-based compensation offers flexibility, as it allows for different percentages to be applied based on varying criteria such as the level of involvement or the type of product or service sold.

Alternatively, a fixed amount can be agreed upon for each successful referral, regardless of the value of the deal. This method is straightforward and ensures that both parties are clear on the amount to be paid. It is often used when the value of each deal is relatively consistent, making it easier to set a fixed rate that is fair to both sides. Another approach might include tiered compensation, where the amount paid increases based on the size or number of successful transactions.

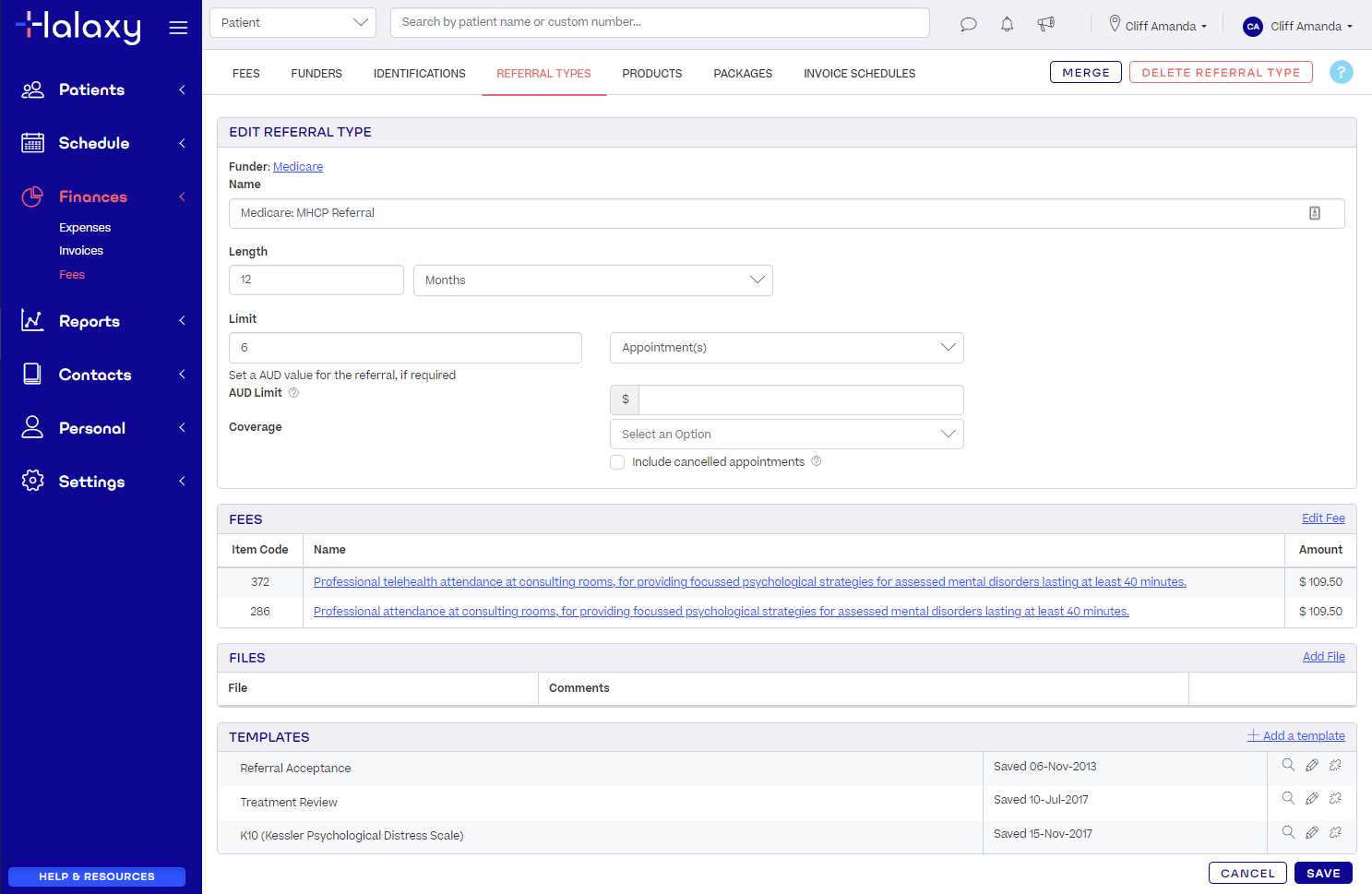

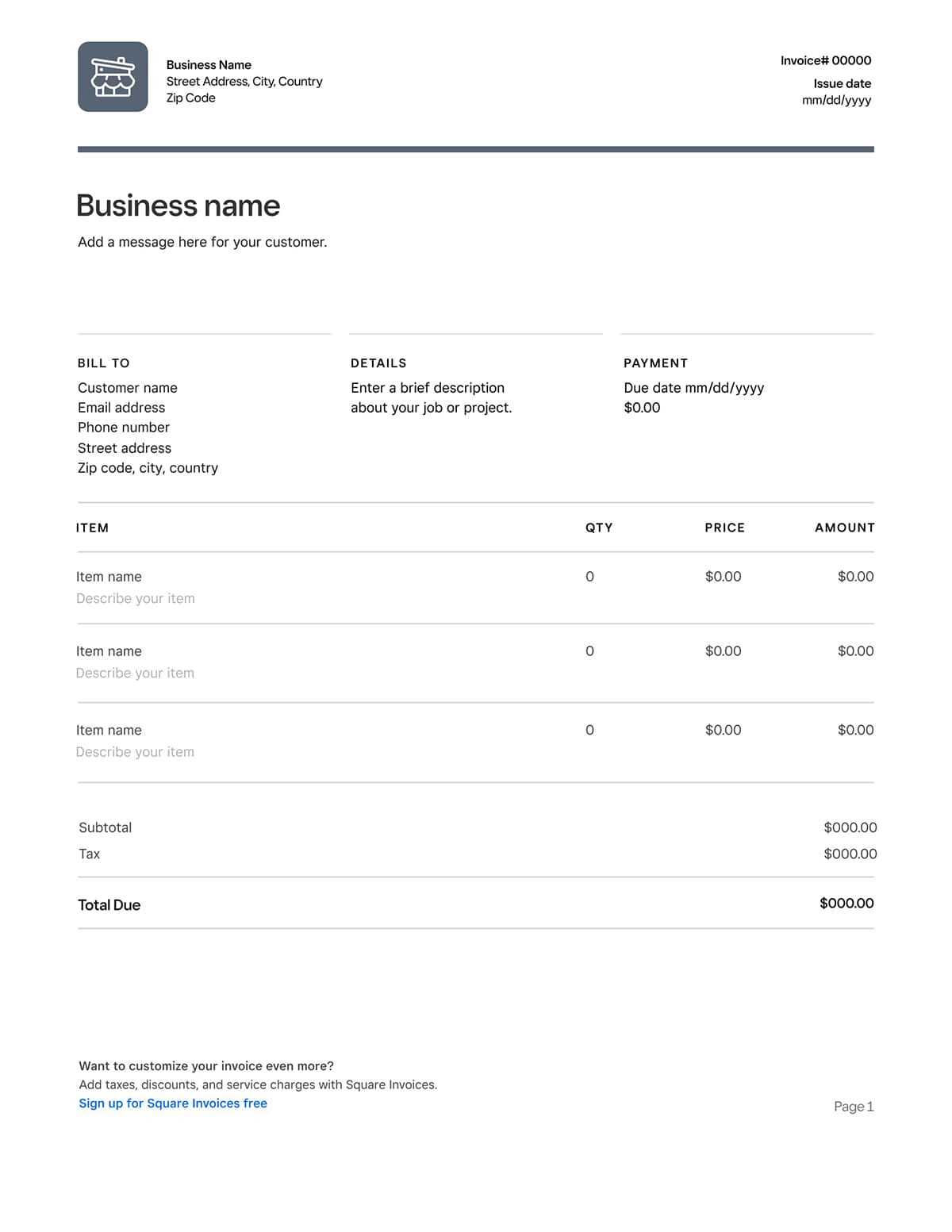

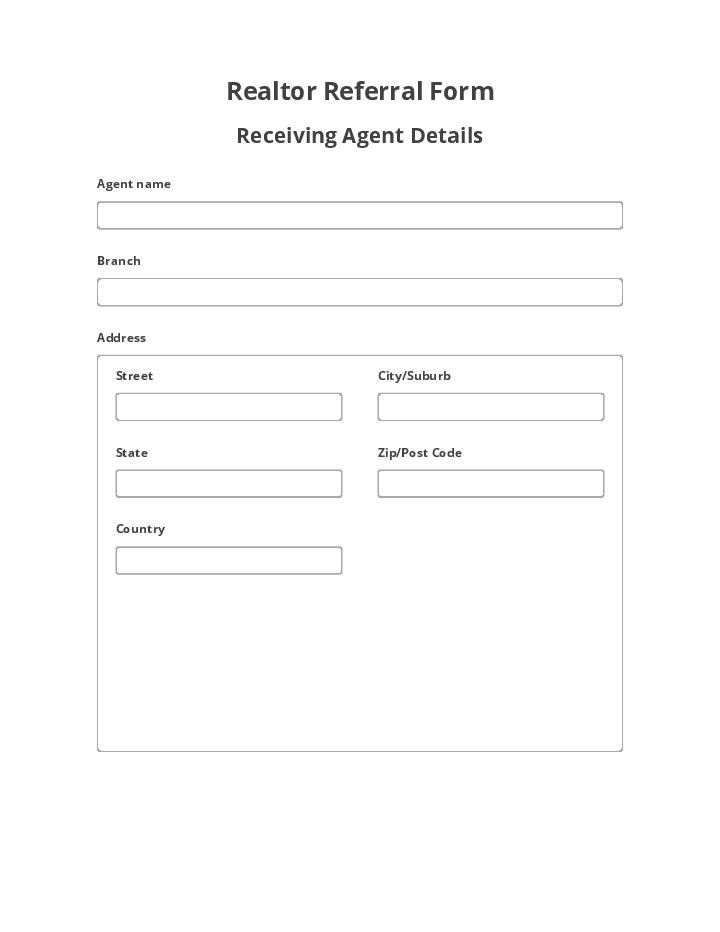

Customizing Your Referral Fee Template

Personalizing a payment request form is a crucial step in ensuring that it meets the specific needs of your business or agreement. A customized document not only reflects your brand but also ensures that all the necessary details are included in a way that is relevant to your arrangement. By adjusting the layout, language, and structure, you can create a form that is both functional and professional, catering to your unique business requirements.

Start by incorporating your company’s logo, name, and contact details, making sure that these elements are placed prominently. Using a consistent color scheme and font style can help maintain a cohesive look with your other business documents. Additionally, it’s important to adjust the language of the form to match the tone and formality of your industry, ensuring clarity and professionalism.

Another key aspect of customization is ensuring that all transaction-specific information is easily editable. Include sections for payment terms, commission percentages, or fixed amounts that may differ based on the service or deal. Providing space for relevant legal terms and conditions can also help in safeguarding both parties’ interests. By making these adjustments, you’ll ensure that your form aligns with the specific details of each transaction while presenting a polished and organized document.

Tracking Payments and Due Dates

Effective management of financial transactions requires careful attention to payment timelines and outstanding amounts. Keeping track of when payments are due, as well as monitoring the status of these payments, is essential to maintain cash flow and ensure that all parties fulfill their obligations on time. By staying organized, businesses can avoid overdue payments and reduce the risk of missed deadlines.

One method of tracking is to include a clear payment due date in each document and set reminders for when payments are approaching. Creating a payment schedule that outlines key dates and amounts will help both parties stay informed about their financial responsibilities. Regularly checking the status of payments can also ensure that no invoices are overlooked and that any delays are promptly addressed.

To make the process more efficient, consider using digital tools or software that automate tracking. These platforms often allow businesses to set automatic reminders and generate reports on outstanding payments. By incorporating such systems, you can improve your cash flow management and ensure that payments are received in a timely manner, thus enhancing the financial health of your business.

Managing Multiple Referrals with Templates

Handling numerous transactions or introductions at once can become overwhelming without a structured approach. When dealing with multiple agreements, it’s essential to maintain organization and ensure that each payment request is clear, accurate, and tracked effectively. Using a well-structured document for each case allows businesses to streamline the process and prevent any confusion or errors, even when managing a high volume of activities.

By having a standardized format for each transaction, you can easily adapt to different scenarios and ensure that all necessary details are captured. A consistent format helps in tracking each transaction’s status, including payment due dates and outstanding balances. It also provides a way to efficiently manage varying terms or commissions, ensuring that each agreement is handled according to its specific conditions without unnecessary delays.

Additionally, organizing these records digitally can save significant time. Many businesses utilize software that allows them to manage multiple records simultaneously, simplifying tracking and follow-ups. This approach not only improves efficiency but also reduces the risk of missing important details or deadlines, making the overall process smoother and more reliable.

Common Mistakes to Avoid in Invoices

When creating a document to request payment, attention to detail is crucial. Even small mistakes can lead to confusion, delayed payments, or disputes. To avoid such issues, it’s important to ensure that all required information is accurate and clearly presented. Inaccurate details or omissions can complicate the payment process and harm professional relationships.

One common error is failing to include all relevant identification details, such as the correct names, addresses, and contact information for both parties. Missing or incorrect information can delay payment and may require time-consuming follow-ups. Another issue is not specifying the due date clearly, leading to misunderstandings about when payment is expected.

Another frequent mistake is leaving out a detailed breakdown of services or products provided. Without a clear description, it may be difficult for the recipient to understand what they are being charged for, which could result in payment delays. Additionally, failing to include the correct payment terms or instructions, such as accepted payment methods or bank details, can cause confusion and make it difficult for the client to fulfill the payment.

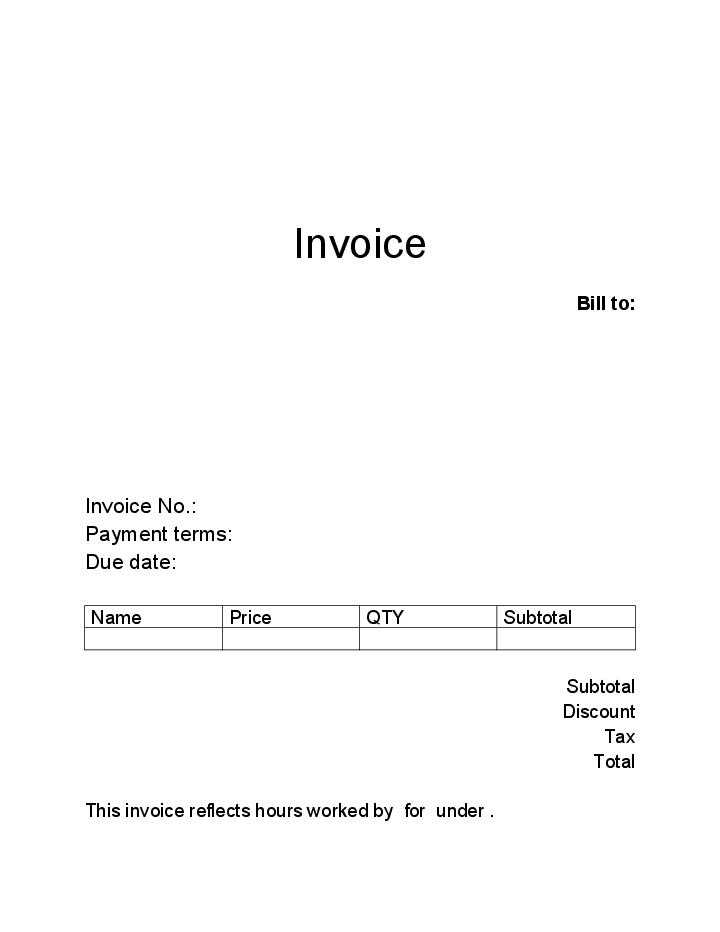

How to Format Your Payment Request Document

Creating a well-structured document to request payment is key to ensuring clarity and efficiency in business transactions. Proper formatting makes it easy for the recipient to understand the terms of the agreement, the amount owed, and how to fulfill the payment. A clear and consistent layout helps avoid confusion and reduces the chances of delays in payment.

When formatting your request document, consider the following key elements:

- Header: Include your company name, contact information, and logo at the top for a professional appearance. Make sure the recipient’s details are also clearly listed.

- Document Number: Assign a unique reference number to each document. This helps with tracking and organization.

- Payment Details: Clearly state the amount owed, including a breakdown of any charges or commissions. If applicable, indicate the percentage or flat rate applied.

- Payment Terms: Specify the due date for payment and any additional terms, such as penalties for late payment.

- Instructions: Provide clear instructions on how the payment should be made, including acceptable methods (bank transfer, cheque, etc.) and necessary account information.

By organizing these elements in a logical and consistent manner, you ensure that the document is easy to understand and helps facilitate timely payments. Keep the format simple and professional, focusing on the essential details to avoid unnecessary clutter.

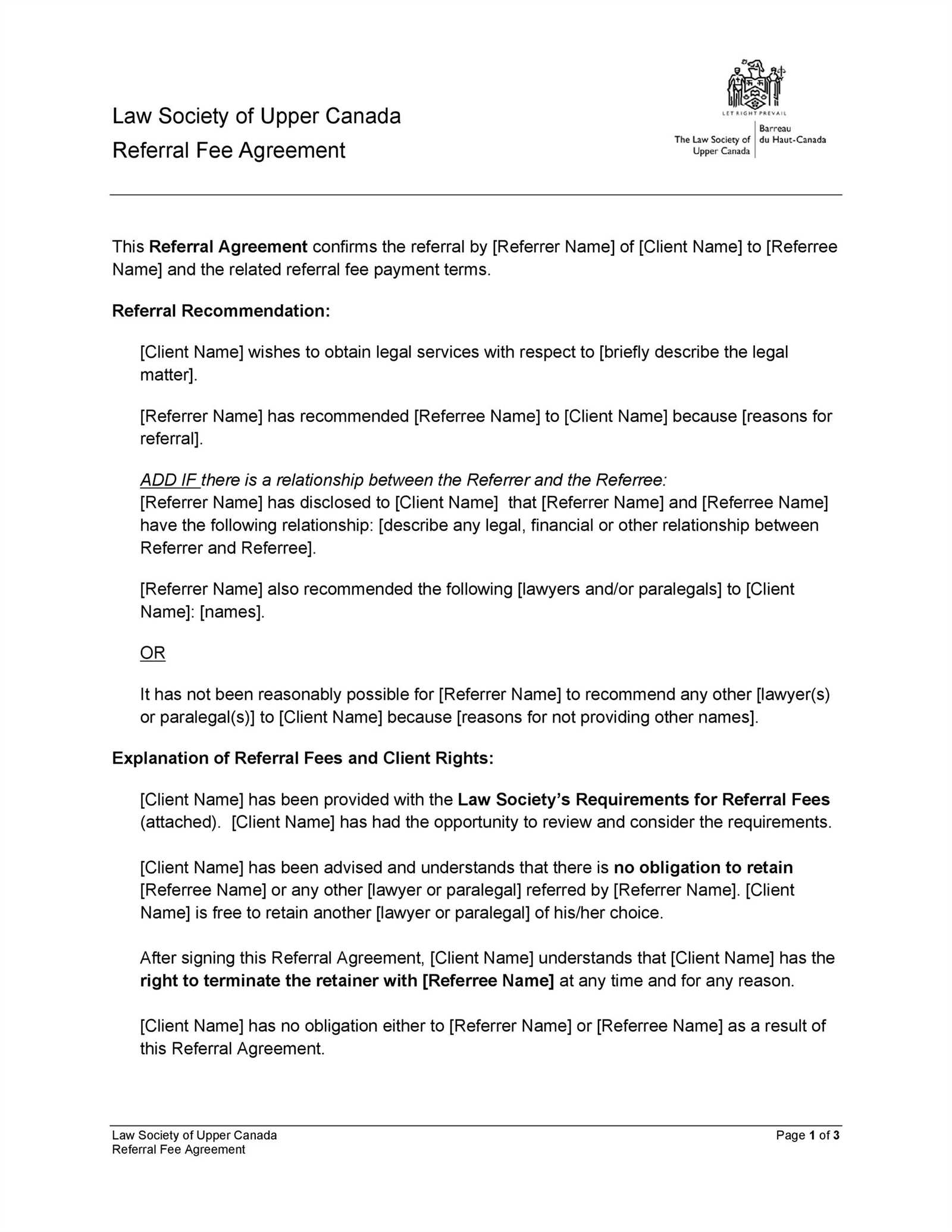

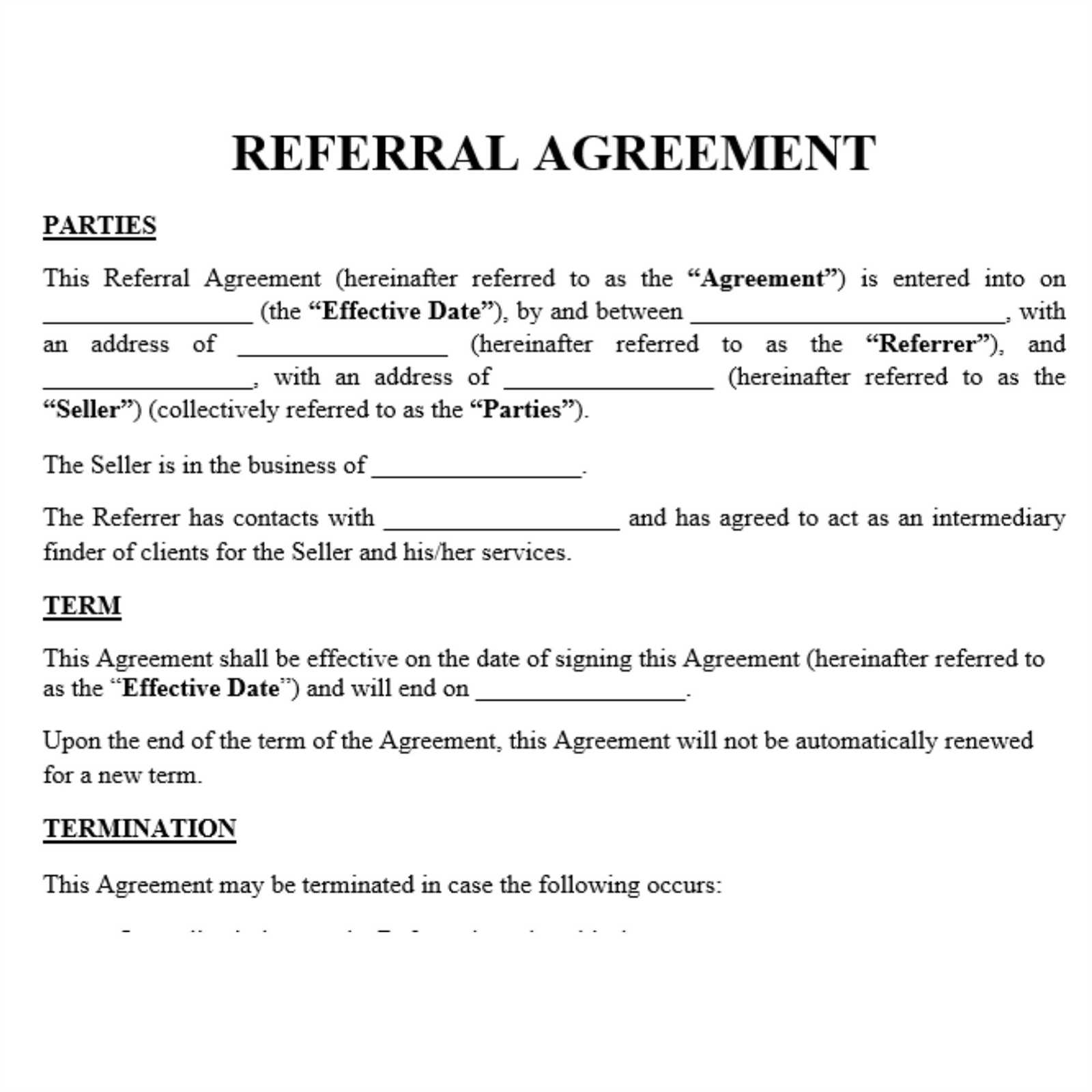

Legal Considerations for Referral Fees

When engaging in financial agreements that involve compensation for introductions or recommendations, it’s crucial to understand the legal implications. Such arrangements must be clearly defined and documented to avoid disputes and ensure compliance with relevant laws. Ensuring that both parties are aware of their rights and obligations is essential to avoid misunderstandings and potential legal issues.

One of the primary considerations is ensuring that the terms of the agreement are outlined in writing. This includes specifying the compensation structure, payment conditions, and the exact services or actions that warrant a reward. Clear documentation protects both parties by providing a point of reference in case of a dispute or misunderstanding.

Additionally, it is important to be aware of local and industry-specific regulations. In some jurisdictions, there may be restrictions on the types of arrangements or the percentages that can be paid for certain activities. Some industries also have ethical guidelines that must be followed, particularly in fields like healthcare or real estate. Understanding these regulations ensures that your business practices remain compliant and helps to mitigate legal risks.

Digital vs. Physical Documents for Payment Requests

When it comes to requesting payments for services or introductions, businesses often choose between digital or paper formats for the documentation. Both options come with their own set of advantages and considerations. Understanding the key differences can help you determine which method is most suitable for your business operations and the preferences of your clients.

Benefits of Digital Documents

Digital records are increasingly favored due to their speed and convenience. With just a few clicks, you can send a request via email or an online platform, reducing the time it takes for the recipient to receive and process the document. Additionally, digital documents are easy to store, organize, and retrieve, minimizing the risk of losing important records. They can also be customized with automated tools, reducing manual input and potential errors.

Advantages of Physical Documents

While digital formats are on the rise, some businesses and clients prefer traditional paper documents for the tangible aspect they provide. Physical documents can be signed manually, which may be required in some industries for legal or regulatory reasons. Additionally, some clients may feel more comfortable handling payments through paper-based requests, especially if they have limited experience with digital systems.

Ultimately, the choice between digital and physical formats depends on your specific needs and the expectations of your clients. Both methods can be effective, but selecting the right one ensures smoother transactions and improves overall efficiency.

Best Software for Payment Request Documents

When creating professional documents to request compensation for services or introductions, choosing the right software can make the process quicker and more efficient. Various tools are available to help you craft, manage, and send these requests with ease, ensuring accuracy and a polished appearance. Below are some of the best software options that can assist in streamlining the creation of payment documents.

- QuickBooks: A widely used accounting software that offers customizable options for creating payment documents, including easy integration with your financial system for tracking payments.

- FreshBooks: Ideal for small businesses, FreshBooks simplifies the process of generating payment requests, with templates that can be personalized to suit your specific needs.

- Zoho Invoice: A cloud-based tool that allows you to create professional documents quickly. It includes features like automated reminders and payment tracking.

- Wave: A free accounting software that lets you create, send, and manage payment documents. It’s a great choice for freelancers and small businesses.

- Microsoft Word or Google Docs: While not dedicated accounting tools, these word processors offer customizable document templates and are simple to use for creating basic payment requests.

By selecting the right software, you can save time and reduce errors while ensuring that all the necessary details are included in your payment requests. Choose the one that best fits your business’s needs and level of complexity.

Setting Up Automatic Payment Reminders

Automating payment reminders is a practical way to ensure that you get paid on time without having to manually follow up with clients. By using automated tools, you can set reminders based on specific due dates, reducing the risk of late payments and saving time on administrative tasks. These reminders can be sent through email or other communication channels, ensuring that your clients are always informed about upcoming payment deadlines.

Benefits of Automation

Automation offers several key advantages for businesses managing regular transactions. With automatic reminders, you can:

- Save time: No need to manually track due dates or send follow-up emails.

- Ensure consistency: Reminders are sent at the same time for every client, ensuring no missed payments.

- Reduce administrative workload: Automating this process frees up your time to focus on other tasks.

How to Set Up Reminders

Most accounting or payment management software allows you to set up automatic reminders. After entering the payment details and due dates, you can configure the system to send notifications a few days before the payment is due, as well as follow-up reminders if the payment remains unpaid. Many systems also allow you to customize the reminder frequency and content to align with your business style.

By implementing automatic reminders, you can improve cash flow and maintain positive relationships with clients by ensuring timely payments without added stress.

Handling Disputes Over Compensation Requests

Disputes over payments can arise in any business transaction, especially when it comes to agreements involving compensations for introductions or referrals. It’s essential to handle such situations professionally to avoid strained relationships and ensure that both parties are satisfied with the outcome. By establishing clear terms and maintaining open communication, you can prevent misunderstandings and resolve conflicts effectively.

Steps to Resolve Disputes

When disagreements occur, following a structured approach can help you address the issue without escalating it further. Here’s a simple guide to managing such disputes:

Step Action 1. Review the Agreement Revisit the original terms to confirm both parties’ expectations and responsibilities. 2. Communicate Clearly Initiate a respectful conversation to understand the other party’s concerns. 3. Offer a Resolution Suggest a solution that aligns with the original agreement or propose a compromise if necessary. 4. Document the Outcome Ensure both parties agree on the resolution and document it for future reference. Preventing Future Disputes

To avoid similar issues in the future, it’s vital to set clear expectations from the start. This can be done by drafting detailed agreements that outline payment terms, timelines, and the responsibilities of each party involved. Additionally, regularly checking in with your clients or partners can help ensure that all parties are on the same page and prevent misunderstandings.

By handling disputes professionally and setting up solid agreements, you can maintain positive working relationships while safeguarding your business interests.

How to Share Compensation Requests

Sharing compensation requests with clients or partners is an essential step in ensuring smooth business transactions. It’s important to use the right methods to send these documents to ensure clarity, professionalism, and prompt payments. By choosing the most effective communication channels, you can streamline the process and keep all parties informed.

Methods of Sharing

There are several ways to share documents related to compensation claims, each with its advantages. Here are the most common methods:

- Email: The most popular method. Attach the document as a PDF or a secure link, ensuring that it’s easy to open and read.

- Online Platforms: Use cloud-based solutions like Google Drive, Dropbox, or other document-sharing platforms that allow real-time access and collaboration.

- Printed Copies: In some cases, you may prefer sending a hard copy through postal services, especially for clients who prefer physical records.

Best Practices for Sharing Documents

When sharing compensation-related documents, it’s important to adhere to best practices to ensure professionalism and avoid confusion:

- Be Clear: Always provide a clear and concise explanation of the document’s purpose and any required actions from the recipient.

- Use Secure Methods: For sensitive information, use encrypted email or password-protected documents to safeguard both parties.

- Follow Up: After sending the document, follow up with a brief message or reminder to confirm receipt and address any potential questions.

By using the appropriate sharing methods and adhering to best practices, you can ensure that compensation requests are delivered professionally and are processed in a timely manner.

Benefits of Using Compensation Request Formats

Using pre-designed formats for documenting compensation claims offers a wide range of advantages for businesses. These formats can streamline administrative processes, reduce errors, and ensure consistency in communication. Whether you’re handling a single transaction or managing multiple agreements, adopting standardized methods can improve overall efficiency and accuracy.

Time Efficiency

One of the most significant benefits of using structured formats is the amount of time saved. Rather than starting from scratch with each request, a pre-set format allows you to focus on the specific details of the transaction without worrying about formatting or layout.

- Quick Setup: With predefined fields, filling out the necessary details becomes a quick process, cutting down on manual entry time.

- Reduced Errors: Templates help minimize the chance of missing key information, which could otherwise cause delays or confusion.

Professional Appearance

Having a consistent, polished format enhances the credibility of your business dealings. It conveys professionalism and attention to detail, which builds trust with clients and partners.

- Standardized Layout: A well-structured document presents a uniform look that looks professional and polished, regardless of the number of transactions.

- Clear Communication: Templates often include headings, bullet points, and sections that clearly separate key pieces of information, making it easier for recipients to understand and respond.

Ultimately, using structured formats can make the process of documenting and sharing compensation claims more efficient and reliable, while fostering a professional relationship with your clients and partners.