Free Recruitment Agency Invoice Template Download

Managing financial transactions efficiently is crucial for any business, especially when handling services provided to clients. Keeping track of payments, setting clear terms, and ensuring professional communication are essential components of a smooth operation. One effective way to manage these tasks is by using structured documents designed to outline the details of your services and payments.

By utilizing a pre-designed document that meets your business needs, you can save time and reduce the risk of errors. These documents not only provide clarity for both you and your clients but also help maintain a professional appearance. Whether you are just starting or are an experienced professional, a well-organized system can make a significant difference in your financial management.

Customizable formats allow you to tailor the details as per your requirements, ensuring that all necessary information is included. With various options available online, you can choose the one that best fits your workflow, saving time and effort while enhancing your business processes.

Free Recruitment Agency Invoice Templates

For any business providing services, having a document that clearly lays out the terms of payment is essential for smooth operations. These documents not only help in securing payments but also serve as a professional communication tool between you and your clients. The availability of ready-made documents can make the process much easier, allowing you to focus on your core business tasks while ensuring accuracy in financial records.

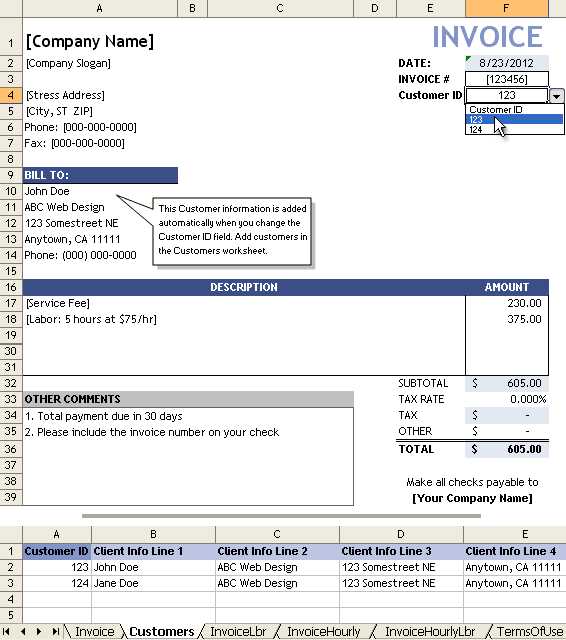

Accessing pre-made documents at no cost is a great option for businesses looking to reduce overhead. Many online platforms offer a variety of options that can be customized to suit specific needs, eliminating the need for designing one from scratch. Below is a comparison of some popular options for businesses seeking easy-to-use, customizable solutions.

Key Features of Pre-designed Billing Documents

When choosing a document format, consider the following features to ensure it meets your requirements:

| Feature | Importance |

|---|---|

| Customization | Allows you to tailor the document to match your business details. |

| Clear Layout | Ensures all important information is easy to read and understand. |

| Legal Compliance | Meets the necessary legal standards for formal transactions. |

| Simple Design | Reduces the time spent editing and increases efficiency. |

Where to Find These Documents

Numerous websites offer a variety of options for businesses looking to download these helpful documents. Many of these platforms provide simple and straightforward formats that are suitable for different industries. Whether you’re looking for something basic or a more detailed layout, you’re likely to find a solution that meets your needs without any cost.

Why Use an Invoice Template for Agencies

Having a standardized document to manage payments and billing helps streamline the process, reducing the chances of mistakes and confusion. Whether you’re a small business or a larger operation, clear and consistent communication regarding financial transactions is key to maintaining healthy client relationships and ensuring timely payments. Using a well-structured document can simplify this task significantly, allowing you to focus on providing your services while keeping all financial aspects organized.

By utilizing a pre-designed document, you ensure that all necessary information is included and formatted correctly. This not only speeds up the billing process but also adds a professional touch that can improve your brand’s credibility. Moreover, these documents often come with fields that help track important details such as service dates, amounts, and payment terms, which can help both you and your clients stay on the same page.

Customization is another significant advantage, as you can easily adjust the document to suit your specific needs, adding or removing sections as required. Consistency in your financial documents also promotes a sense of reliability and trustworthiness, crucial for long-term client relationships.

Benefits of Customizable Invoice Formats

Using flexible and adaptable billing formats offers a range of advantages for businesses looking to maintain efficiency and professionalism in their financial transactions. Customization allows you to tailor documents to the specific needs of your clients and services, ensuring that all relevant details are included in a way that works best for you and your team. This level of control can make managing payments much easier and more streamlined.

One of the main benefits of customizable formats is the ability to add or remove fields according to the nature of the work or the client’s preferences. Whether you need to include a detailed breakdown of hours worked, project milestones, or special discounts, the flexibility to adjust the layout can significantly improve clarity and communication. Additionally, personalizing these documents with your brand elements, such as logos and colors, enhances the professional appearance of your communications.

Consistency is also a key advantage. By using a customized format for all your financial documents, you create a uniform experience for your clients, which builds trust and reliability. Customizable formats ensure that you don’t miss important details and help maintain accuracy across all transactions, reducing the risk of disputes or confusion.

How to Create an Effective Invoice

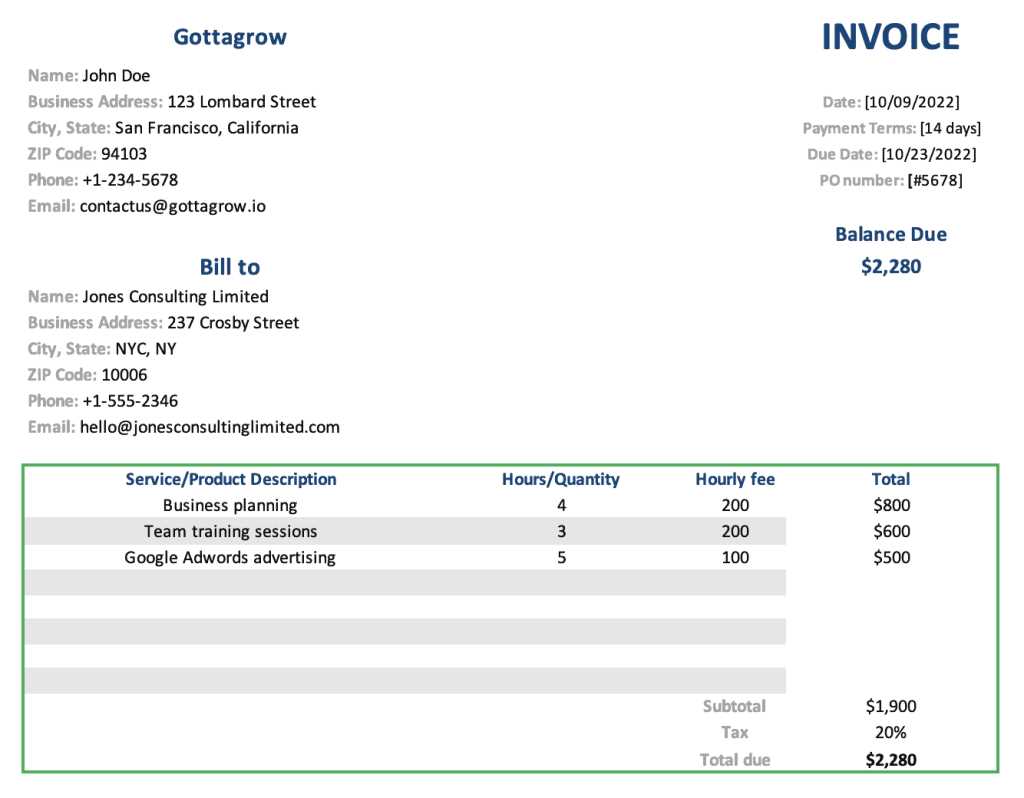

Creating a well-organized document to request payment is crucial for ensuring smooth transactions and clear communication with clients. A well-crafted payment request not only helps you get paid on time but also reflects your professionalism and attention to detail. An effective document should be easy to understand, comprehensive, and reflect the specific terms of the services provided.

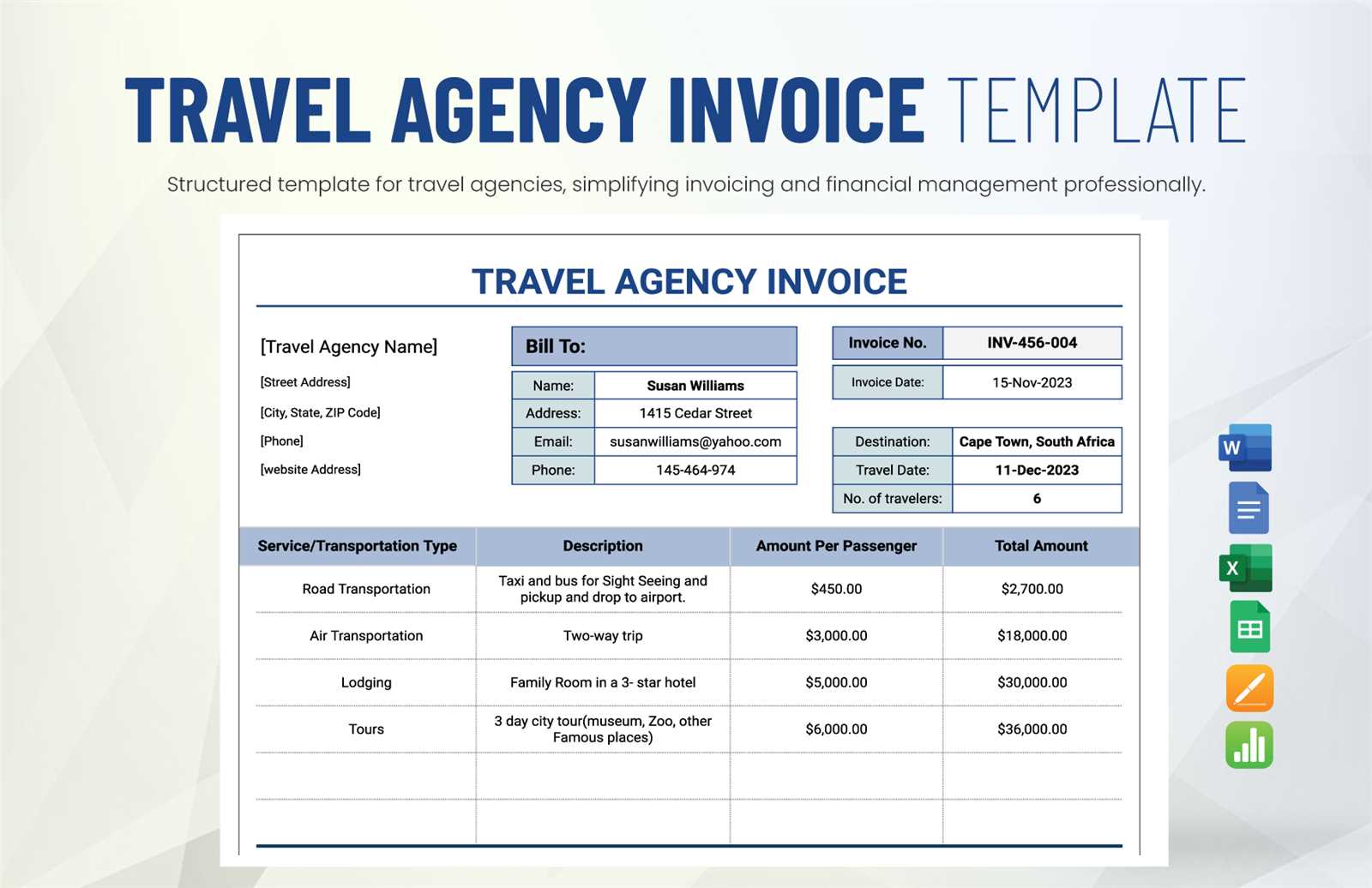

The first step in creating an effective document is to include all necessary details, such as the client’s information, the service description, the amount due, and the payment terms. It’s essential to be clear about the service provided, the time frame, and any agreed-upon pricing. This transparency reduces the likelihood of disputes and ensures both parties are on the same page.

Formatting plays a key role in making the document easy to read. Organizing the information in a clear and logical way, with bold headings and properly aligned columns, improves readability. Adding a unique reference number for each transaction can also help keep records organized and streamline tracking. Consistency in formatting ensures that your financial documents maintain a professional appearance and are easily recognized by your clients.

Essential Elements of an Agency Invoice

Creating a clear and detailed document to request payment is crucial for maintaining a professional relationship with clients. To ensure smooth transactions, it is important to include all the necessary components that clearly outline the services provided and the payment terms. These elements not only help clients understand what they are being charged for but also serve as a record for both parties.

The key components of any payment request include the client’s contact information, a description of the services rendered, the total amount due, and the due date for payment. It is essential to break down the charges into easily understandable sections, showing the rate and the time or quantity involved. Additionally, payment terms such as late fees or discounts should be clearly outlined to avoid confusion.

Another important element is the unique identification number for the transaction. This helps track and organize records efficiently. Including your business details, such as name, address, and contact information, ensures transparency and establishes legitimacy. Finally, always include instructions for payment, whether via bank transfer, check, or online platforms, to simplify the process for your client.

Free Templates vs Paid Templates

When it comes to managing financial transactions, choosing between no-cost and premium document formats can significantly impact your workflow. While both options offer solutions, the key differences often lie in the level of customization, features, and support available. Understanding these distinctions can help you make an informed decision based on your specific needs.

No-cost formats are generally accessible to everyone and can be a great starting point for businesses with simpler requirements. They are typically easy to download and use, providing basic functionality such as predefined fields and standard layouts. However, limitations in terms of design flexibility and advanced features may require users to find workarounds or adjust their processes to suit the template.

On the other hand, premium formats often offer a higher level of personalization, including advanced options like detailed breakdowns, multiple currencies, and integration with accounting software. These options are usually more polished, featuring professional designs that reflect a higher standard of branding. Support is another advantage, as paid options typically come with customer service or troubleshooting assistance to ensure the documents meet your exact needs.

Where to Download Free Invoice Templates

If you’re looking to get started with billing documents without investing in premium options, there are plenty of places online offering no-cost solutions. Many websites provide a range of downloadable formats that can be tailored to fit your business needs. These resources allow you to quickly access and use professionally designed documents without the need to create one from scratch.

Here is a list of some popular platforms where you can find various styles of documents available for download:

| Website | Features |

|---|---|

| Microsoft Office | Offers customizable formats for Word and Excel, suitable for different business needs. |

| Google Docs | Provides simple, editable layouts that can be accessed and modified directly online. |

| Canva | Offers visually appealing designs with the option to add logos and brand colors. |

| Invoice Simple | Provides a straightforward, easy-to-use online platform for generating documents quickly. |

These platforms often allow you to choose between various document styles and formats, making it easy to find the one that fits your business needs. Simply download, personalize the content, and start using them immediately for your transactions.

Best File Formats for Invoices

Choosing the right file format for your billing documents is essential for ensuring compatibility, ease of use, and professional presentation. The format you select affects how clients view and interact with the document, as well as how easily you can store and share it. Some formats offer more flexibility and can be edited, while others are designed to maintain a consistent layout across different devices and platforms.

Popular File Formats for Billing Documents

There are several common file types used for creating and sharing payment requests, each with its own set of advantages:

| File Format | Advantages |

|---|---|

| Maintains a fixed layout, ensuring consistency across all devices, and cannot be easily edited by recipients. | |

| Excel (XLS) | Highly customizable, allows for easy editing and formula integration, ideal for complex calculations and tracking. |

| Word (DOCX) | Easy to edit, offering flexibility in design and text placement; perfect for businesses that need to customize documents frequently. |

| Google Docs | Cloud-based and easily shareable, no need for software installation, and allows real-time collaboration on documents. |

Choosing the Right Format for Your Business

The best format for your business depends on factors such as the complexity of your services, the level of customization required, and how you plan to distribute your documents. For simple transactions, PDF is often the most professional and secure choice, while Excel or Word may be more suitable for businesses that need flexibility or frequent updates to their billing documents.

Tips for Personalizing Your Invoice

Customizing your billing documents not only enhances their professionalism but also helps reflect your brand identity. Personalizing these documents ensures consistency across your communications and helps build a stronger relationship with your clients. By incorporating key design elements and specific details, you can create a more memorable and effective payment request.

Branding Your Payment Requests

One of the easiest ways to personalize your billing documents is by incorporating your brand’s visual identity. This includes adding your logo, using brand colors, and choosing fonts that match your overall style. A well-branded document gives a professional impression and reinforces your business’s presence. Including your contact information prominently, such as your website, phone number, and email, also makes it easier for clients to reach you if they have questions.

Customizing the Content

Beyond design, personalizing the content of the document is equally important. Tailor the description of the services provided, especially if you offer a variety of packages or custom solutions. Including a personalized message or note at the end, such as a thank you for doing business or a reminder of a discount for early payment, can enhance the client experience. Adjusting payment terms according to the specific agreement with each client ensures that expectations are clear and avoids misunderstandings.

Common Mistakes in Recruitment Invoices

When creating documents to request payment for services rendered, it’s easy to overlook certain details that can lead to confusion or delayed payments. Small mistakes can have a big impact on your financial management, affecting your cash flow and client relationships. By identifying common errors, you can avoid costly issues and streamline the billing process.

One of the most common mistakes is failing to provide clear descriptions of the services provided. When details are vague, clients may be unsure of what they are being charged for, leading to disputes or delayed payments. It’s crucial to break down the work done, including hours, specific tasks, and agreed-upon rates. Ambiguous payment terms can also cause problems, especially when clients are unclear about when payment is due, or if any late fees will apply.

Another frequent issue is incorrect or missing client information. This could include an incomplete address, wrong contact details, or an outdated payment method. These mistakes can delay the payment process and make it harder to track transactions. Always double-check that all client details are accurate before sending the document to avoid unnecessary follow-up emails or phone calls.

How to Track Payments Using Invoices

Effectively tracking payments is crucial for managing cash flow and maintaining financial accuracy. By using structured billing documents, you can easily monitor the status of outstanding payments and keep a record of completed transactions. Proper tracking ensures that you stay organized, avoid missed payments, and can quickly resolve any issues that arise.

Setting Up a Payment Tracking System

To track payments efficiently, start by assigning a unique reference number to each billing document. This number will help you identify and link payments to specific requests. Additionally, always include the payment due date and any terms related to early payment discounts or late fees. Keeping a separate log or spreadsheet with the reference numbers, amounts due, and payment statuses can be an effective way to monitor payments in real time.

Marking Payments as Complete

Once a payment is received, it’s essential to update your records promptly. Mark the payment as complete and note the payment method, whether it’s through bank transfer, check, or another method. This helps create a clear history of transactions and ensures that you won’t accidentally send duplicate requests. Regularly reviewing your payment log and cross-referencing with your client list can prevent oversights and maintain smooth operations.

Importance of Professional Invoice Design

The appearance of your billing documents plays a significant role in how your business is perceived. A well-designed document not only ensures clarity and professionalism but also helps in building trust with clients. When clients receive a polished and easy-to-read payment request, it reflects positively on your company’s attention to detail and credibility.

A clean, organized design can make it easier for clients to understand the charges and payment terms. Clarity in the layout helps avoid confusion and minimizes the likelihood of disputes. Additionally, a professional design can convey a sense of reliability, which is essential for establishing long-term relationships. It also gives your business a more established and trustworthy appearance, which can be especially beneficial when dealing with new or larger clients.

Furthermore, well-crafted documents help streamline the payment process. A visually appealing layout, with key details such as amounts, due dates, and payment methods clearly highlighted, can accelerate the client’s review and payment of the bill. This improves cash flow and ensures a smoother transaction experience for both parties. Consistency in your design across all financial communications reinforces your brand identity and makes it easier for clients to recognize your business in their records.

Legal Requirements for Recruitment Invoices

When creating billing documents for services rendered, it’s important to ensure that they comply with local laws and regulations. Legal requirements can vary depending on the country or region in which your business operates, but there are several common elements that should always be included to avoid legal issues and ensure smooth transactions. These requirements help protect both the service provider and the client by setting clear expectations and ensuring transparency in the financial exchange.

Mandatory Information to Include

Most jurisdictions require that certain details be included in any formal request for payment. At a minimum, these documents must contain the full legal name and address of both the service provider and the client. Additionally, you should include a clear breakdown of the services provided, the amounts being charged, and the applicable taxes. Payment terms, including the due date and any penalties for late payments, should also be stated explicitly to avoid misunderstandings.

Tax Identification and Legal Compliance

Depending on where your business is located, you may be required to include a tax identification number or VAT number on your billing documents. This is especially important for businesses that deal with international clients, as it helps in tracking and reporting taxes correctly. Ensuring that your documents meet the necessary legal standards can help prevent fines or complications with tax authorities. Additionally, certain jurisdictions may require specific wording related to payment terms, refund policies, or cancellation rights, so it’s essential to stay informed about the legal requirements in your area.

How to Use Invoices for Tax Purposes

Properly managing your billing documents is essential not just for tracking payments, but also for staying compliant with tax laws. These documents serve as official records of the services provided and the amounts charged, which are critical for accurate tax reporting. By organizing and maintaining clear records, you can ensure that your business remains in good standing with tax authorities and make the tax filing process much smoother.

Key Steps to Use Billing Records for Tax Filing

To effectively use your billing documents for tax purposes, it’s important to follow these steps:

- Keep Detailed Records: Maintain a well-organized log of all your transactions. This includes dates, amounts, and descriptions of services or products provided. You should keep both digital and physical copies for reference.

- Include Tax Information: Always include the correct tax rates and your tax identification number (TIN) on all documents. This helps in tracking sales tax or VAT for proper reporting.

- Track Tax-Deductible Expenses: If your business is eligible for tax deductions, make sure your records clearly show expenses that can be claimed, such as materials, services, or travel related to the work performed.

- Monitor Payments Received: Track incoming payments based on the due dates mentioned in your billing records. This will help ensure that you only report income that has been received during the tax year.

Why Accurate Billing is Crucial for Tax Filings

Accurate and complete billing records ensure that you can report your income and expenses properly. Tax authorities often require detailed proof of income, and your billing documents can serve as the necessary evidence. Additionally, maintaining proper records can help you avoid penalties, as missing or inaccurate data could lead to audits or fines. Keeping your financial documents organized and up-to-date is one of the best ways to simplify tax preparation and ensure compliance with tax laws.

Integrating Invoices with Accounting Software

Integrating your billing documents with accounting software can greatly enhance efficiency and accuracy in managing financial records. By automating the flow of information between your payment requests and accounting tools, you can eliminate manual data entry, reduce errors, and ensure that your financial records are always up to date. This seamless integration simplifies the process of tracking payments, managing cash flow, and preparing for tax season.

Benefits of Integration

Connecting your billing system to accounting software provides several key advantages:

- Automation: Reduces manual data entry by automatically syncing details from billing documents to your financial records.

- Improved Accuracy: Minimizes the risk of errors, such as incorrect amounts or missed payments, by linking payment requests directly to your accounting platform.

- Real-Time Financial Insights: Offers up-to-date information on cash flow, outstanding balances, and financial health, making it easier to make informed business decisions.

- Time-Saving: Streamlines the accounting process, saving you time on administrative tasks and allowing you to focus on other areas of your business.

Choosing the Right Accounting Software for Integration

To make the most of integration, it’s important to choose accounting software that supports importing or syncing billing data. Many popular platforms like QuickBooks, Xero, and FreshBooks offer direct integration with payment processing tools, enabling seamless updates to your financial records. Be sure to select software that suits your business size, industry, and reporting requirements. By using a system that automates your accounting tasks, you can ensure greater efficiency and financial accuracy.

How to Ensure Timely Payments

Ensuring that clients pay on time is crucial for maintaining healthy cash flow and a smooth business operation. There are several strategies you can implement to make sure payments are received when expected, avoiding delays and preventing unnecessary follow-ups. A combination of clear communication, proper documentation, and streamlined processes can help encourage clients to settle their balances promptly.

Strategies for Prompt Payments

To facilitate timely payments, consider the following strategies:

- Set Clear Payment Terms: Establish and communicate clear payment expectations from the outset, including due dates, late fees, and payment methods.

- Offer Early Payment Incentives: Offering small discounts for early payments can motivate clients to pay ahead of the due date.

- Send Regular Reminders: Automated reminders or polite follow-ups before the due date can keep your billing request top of mind for clients.

- Use Multiple Payment Methods: Providing various ways to pay, such as bank transfer, credit card, or online payment platforms, makes it easier for clients to settle their bills quickly.

How to Track Payment Status

Tracking payment progress is essential to ensure timely receipts. You can use a simple table or tracking system to stay on top of who has paid and who still owes money:

| Client Name | Amount Due | Due Date | Payment Status |

|---|---|---|---|

| Client A | $500 | 12/15/2024 | Paid |

| Client B | $1,200 | 12/20/2024 | Pending |

| Client C | $300 | 12/18/2024 | Paid |

By regularly updating this table, you can quickly identify overdue payments and take appropriate action to follow up. Additionally, having a clear record of the payment status helps in maintaining transparency with clients and improves the efficiency of your financial management.

Updating Templates for Changing Needs

As your business evolves, so too should the documents you use to manage transactions and communicate with clients. Adapting your billing documents to meet new requirements, reflect changes in services, or incorporate feedback from clients is essential for maintaining efficiency and professionalism. Regular updates ensure that your documents remain aligned with your business practices and legal obligations, keeping your operations running smoothly and preventing errors.

Why You Should Regularly Update Your Documents

Over time, your business may undergo changes such as offering new services, modifying pricing structures, or expanding into new markets. These changes should be reflected in the documents you use for billing and communication. Here are some key reasons why regular updates are important:

- Reflect New Business Practices: Changes in pricing, services, or payment terms must be accurately represented to avoid confusion with clients.

- Stay Compliant with Legal Requirements: Laws and tax regulations may change, requiring modifications in how your documents are formatted or what information must be included.

- Improve Client Experience: Tailoring your documents to client preferences or feedback can improve clarity and streamline the payment process.

How to Update Your Documents Effectively

When updating your documents, it’s important to ensure that changes are both comprehensive and consistent. Below is a simple table that outlines how you can track and implement these updates:

| Update Needed | Description | Deadline | Status |

|---|---|---|---|

| Pricing Update | Adjust service rates and payment terms based on market research. | 01/01/2025 | Pending |

| Legal Compliance | Update documents to meet new tax or regulatory requirements. | 01/15/2025 | In Progress |

| Service Description | Clarify new services offered and remove outdated ones. | 12/25/2024 | Completed |

By systematically reviewing and updating your documents, you can ensure that your business remains agile and responsive to the ever-changing market and legal landscape.

Best Practices for Invoice Filing

Effective management of billing documents is crucial for keeping accurate financial records and ensuring smooth business operations. Proper filing ensures that you can easily track payments, monitor outstanding balances, and stay compliant with legal and tax requirements. By following best practices for organizing and storing your billing records, you can save time, reduce errors, and stay organized throughout the year.

Key Strategies for Efficient Filing

Here are some of the best practices for filing your billing records efficiently:

- Organize by Date: Sort your documents chronologically, so you can quickly find the relevant records when needed. This method makes it easier to track overdue payments or follow up on recent transactions.

- Use a Consistent Naming Convention: Name your files in a standardized way, including important details like the client name, date, and reference number. For example, “ClientName_Invoice_12345_2024-10-15.pdf”.

- Store Documents Digitally: Consider using cloud storage or specialized accounting software to store your billing records. Digital storage is safer, reduces paper clutter, and makes it easier to search and access files from anywhere.

- Back Up Files Regularly: Always have a backup of your important documents. Use external hard drives or cloud services to store copies, ensuring you never lose vital information.

- Separate by Client or Project: If you work with multiple clients or on various projects, create separate folders for each to make it easier to track payments and manage billing for each client individually.

- Maintain a Payment Log: Keep a spreadsheet or log where you can record payment statuses for each client. This allows you to monitor which payments are pending, paid, or overdue.

Maintaining Legal Compliance

Another key aspect of filing billing records is ensuring that you meet any legal requirements for record retention. Tax authorities often require that businesses keep financial documents for a certain number of years. To ensure compliance:

- Follow Local Retention Guidelines: Check the laws in your region to understand how long you need to retain billing records. For example, many regions require keeping records for at least 5 years.

- Store Records Securely: Whether digital or paper, ensure that your billing documents are kept secure and protected from unauthorized access. Use password protection for digital files and lockable filing cabinets for physical documents.

By implementing these best practices for filing, you can keep your financial documents organized, reduce stress during tax season, and maintain a smooth and efficient billing process year-round.