Download and Customize Your Receipt Invoice Template

When it comes to managing financial transactions, having a well-organized method to document payments is crucial for both businesses and clients. An effective billing document not only provides clarity but also helps in maintaining accurate records for future reference. These records can serve as proof of transaction and simplify accounting processes.

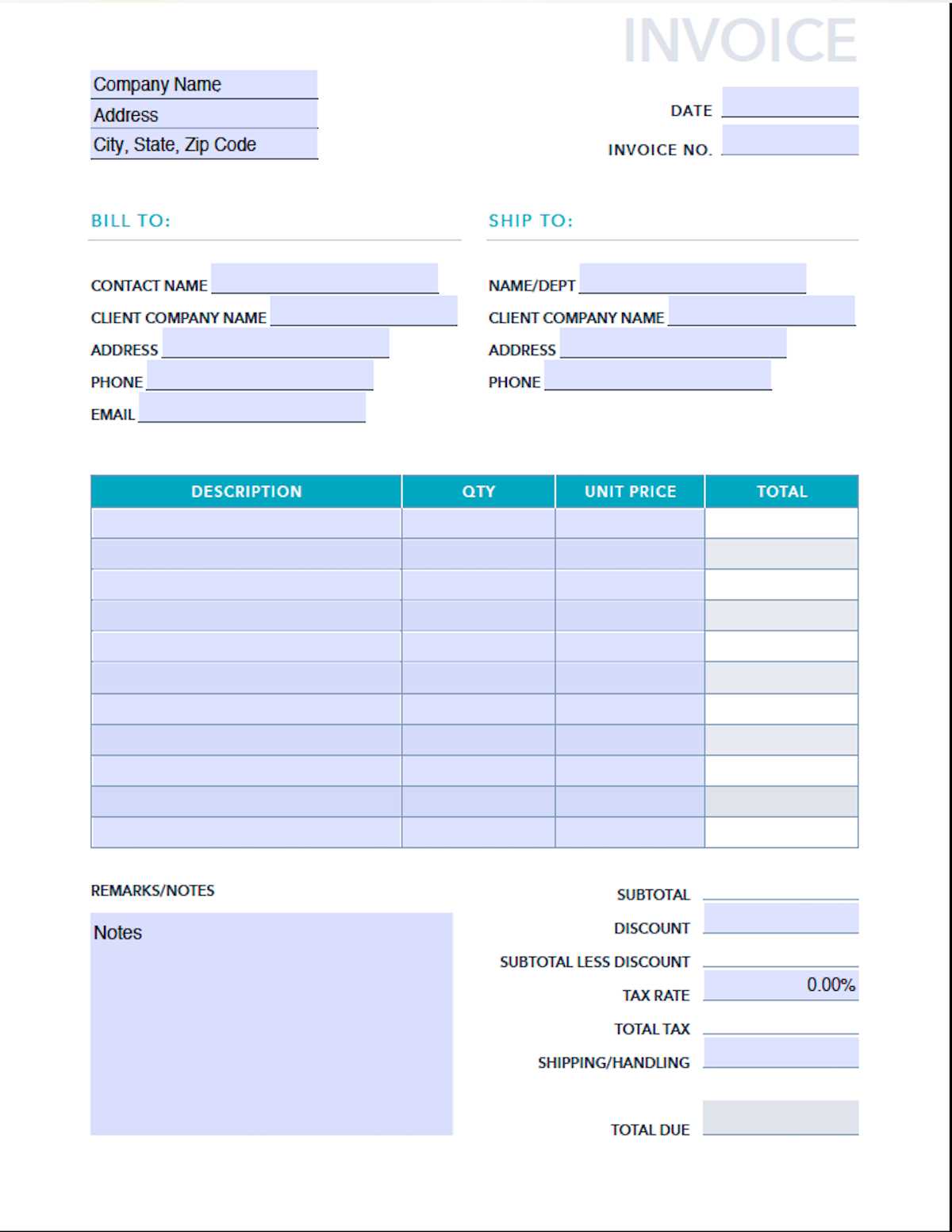

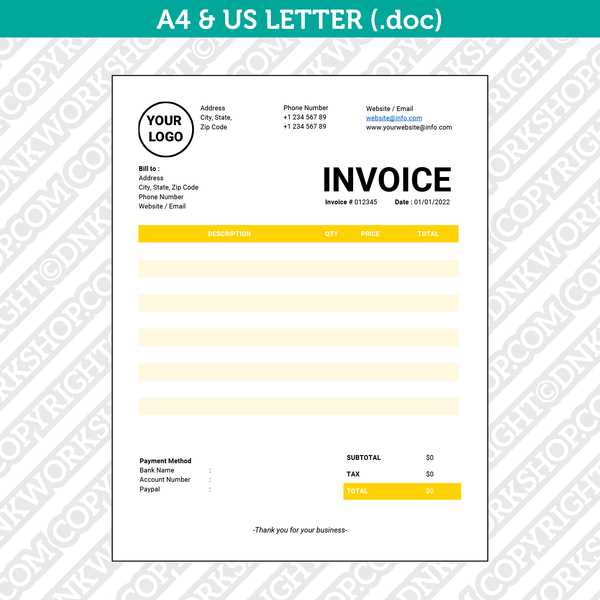

Designing such a document requires attention to detail, ensuring it includes all essential elements such as payment amount, transaction date, and involved parties. Customizing these documents to reflect your brand’s identity can also create a professional image while facilitating easier communication with your customers.

In this section, we will explore the importance of a structured billing record and provide insights on how to create a document that meets your business needs efficiently. From choosing the right format to personalizing each entry, this guide will help you develop a reliable and professional tool for every transaction.

Receipt Invoice Template Overview

Creating clear and well-organized documents for payment confirmation is an essential practice for businesses of all sizes. These documents ensure both the buyer and seller have a mutual understanding of the transaction details, making it easier to resolve any disputes and keep track of financial activities. The right structure for such records is not only about including the necessary information but also about ensuring that it’s easy to understand and visually appealing.

Key Features to Include

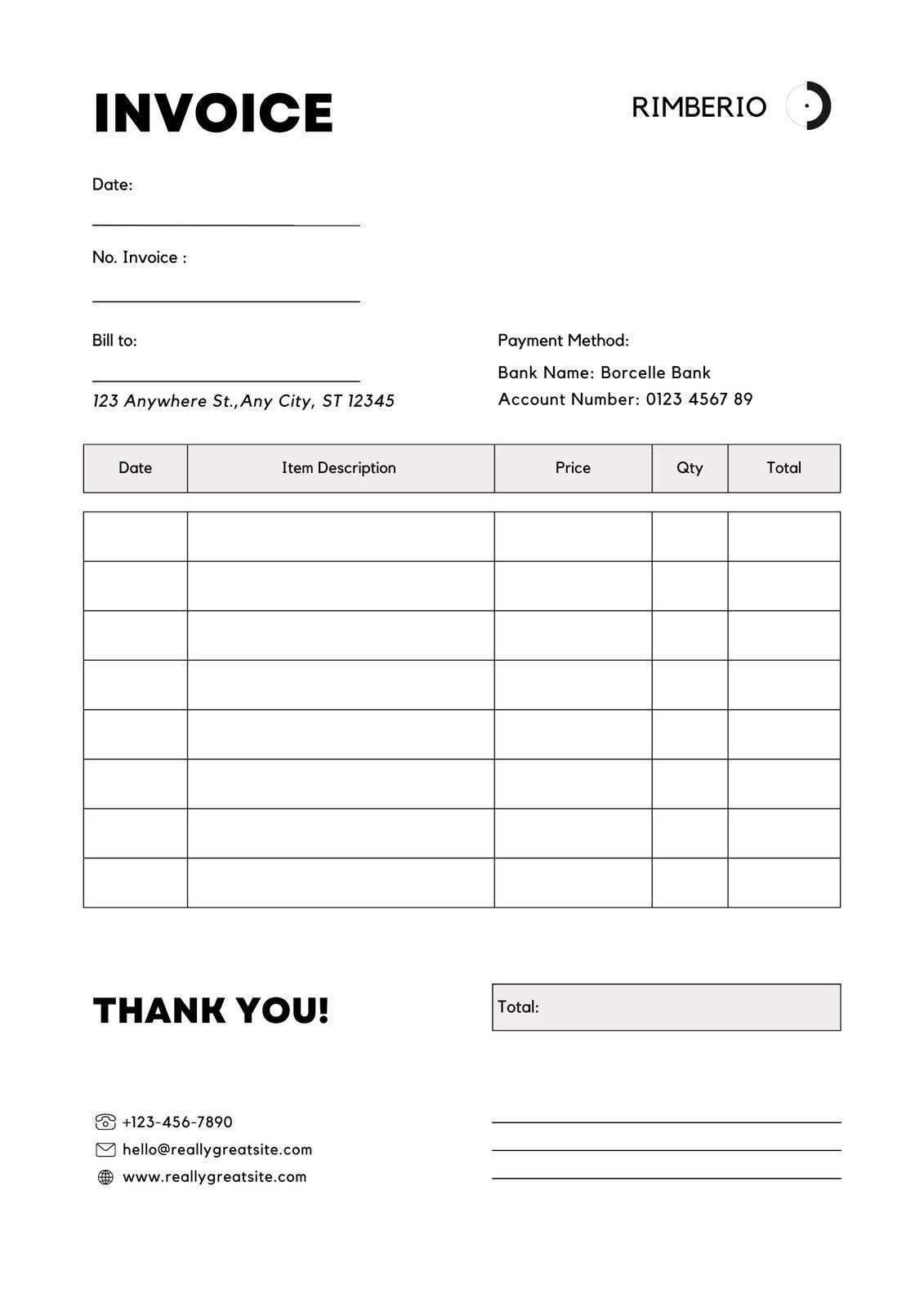

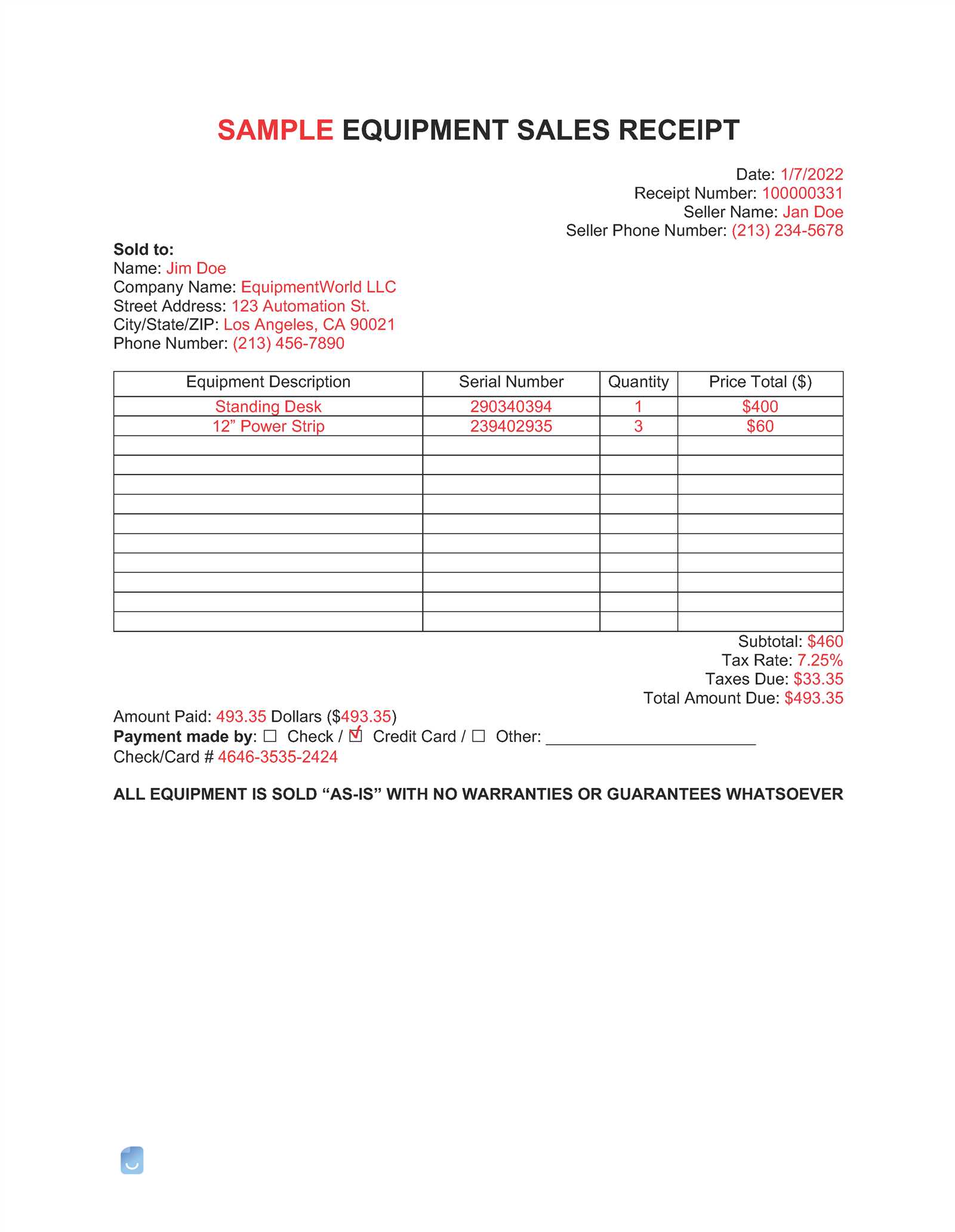

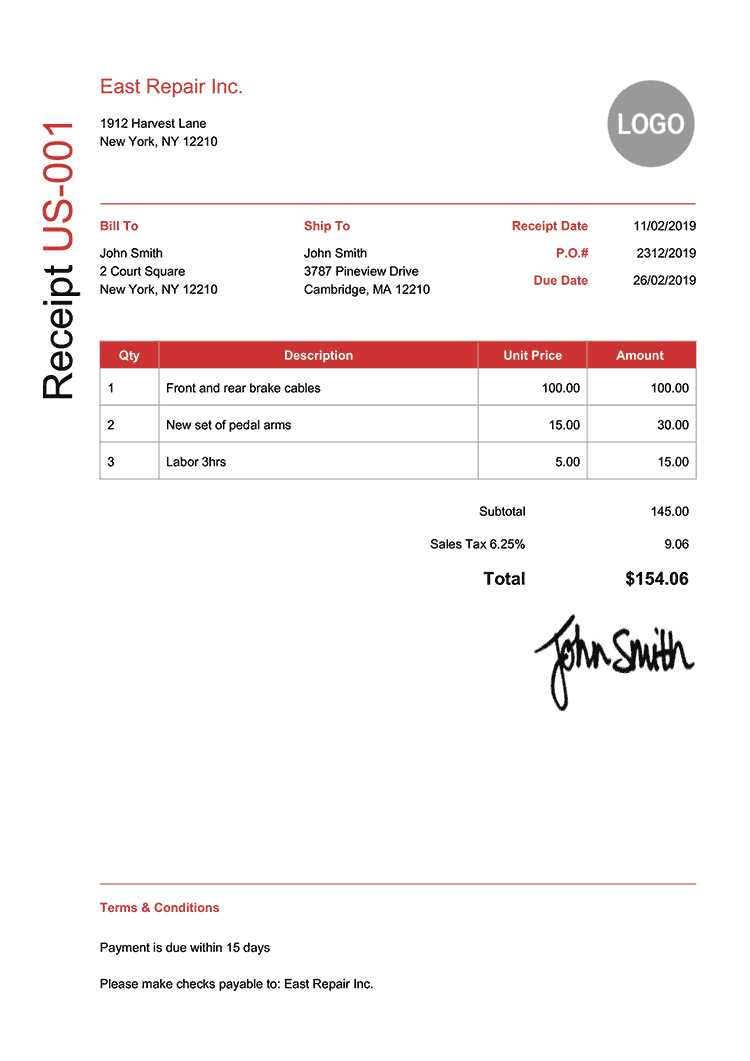

In order to effectively document a transaction, certain core elements should be present in every record. Transaction details such as the date, amount, and method of payment are critical for accuracy. Additionally, including information about both parties–such as names, contact details, and addresses–adds another layer of transparency. Clear categorization of the items or services purchased helps avoid confusion.

Customization and Flexibility

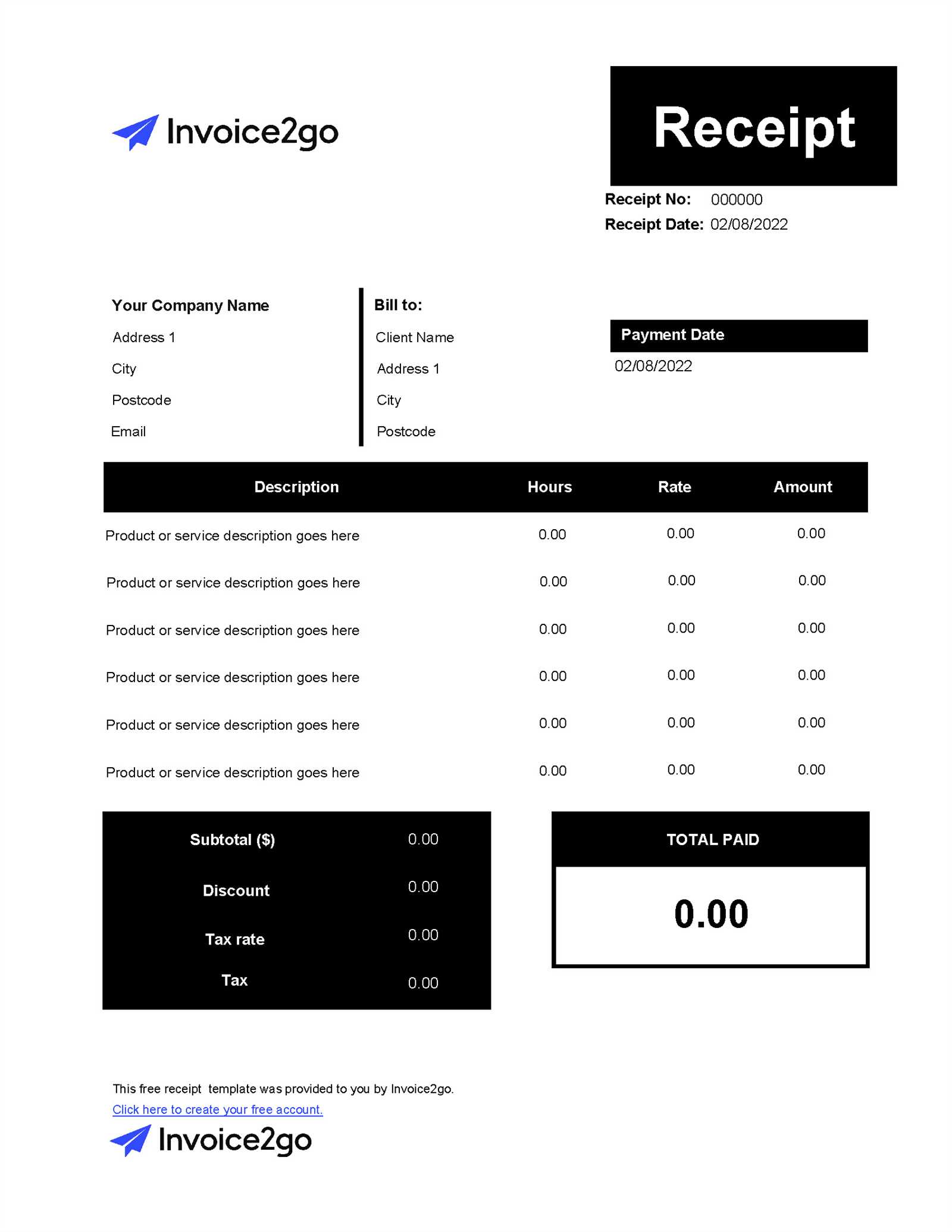

Each business has unique needs, which is why customization is key when developing these documents. Adjusting the layout, adding a company logo, and adapting the style to reflect your brand can make a significant difference in how the document is perceived. Flexibility in design allows businesses to create a solution that fits their operational workflow, ensuring that the document suits specific legal or administrative requirements.

Benefits of Using Invoice Templates

Utilizing pre-designed documents for transaction records brings a range of advantages to businesses, large and small. These ready-made formats offer convenience and consistency, ensuring that every payment record is created efficiently and accurately. They provide a structured approach to documenting financial exchanges, eliminating the need to start from scratch with each new transaction.

Time and Cost Efficiency

One of the most significant benefits is the time-saving factor. With a pre-formatted design, there’s no need to manually arrange sections or worry about formatting issues. Automating the process allows businesses to focus more on their core activities. Additionally, using a standardized record can reduce errors, which ultimately helps save both time and money on revisions or corrections.

Professional Appearance and Branding

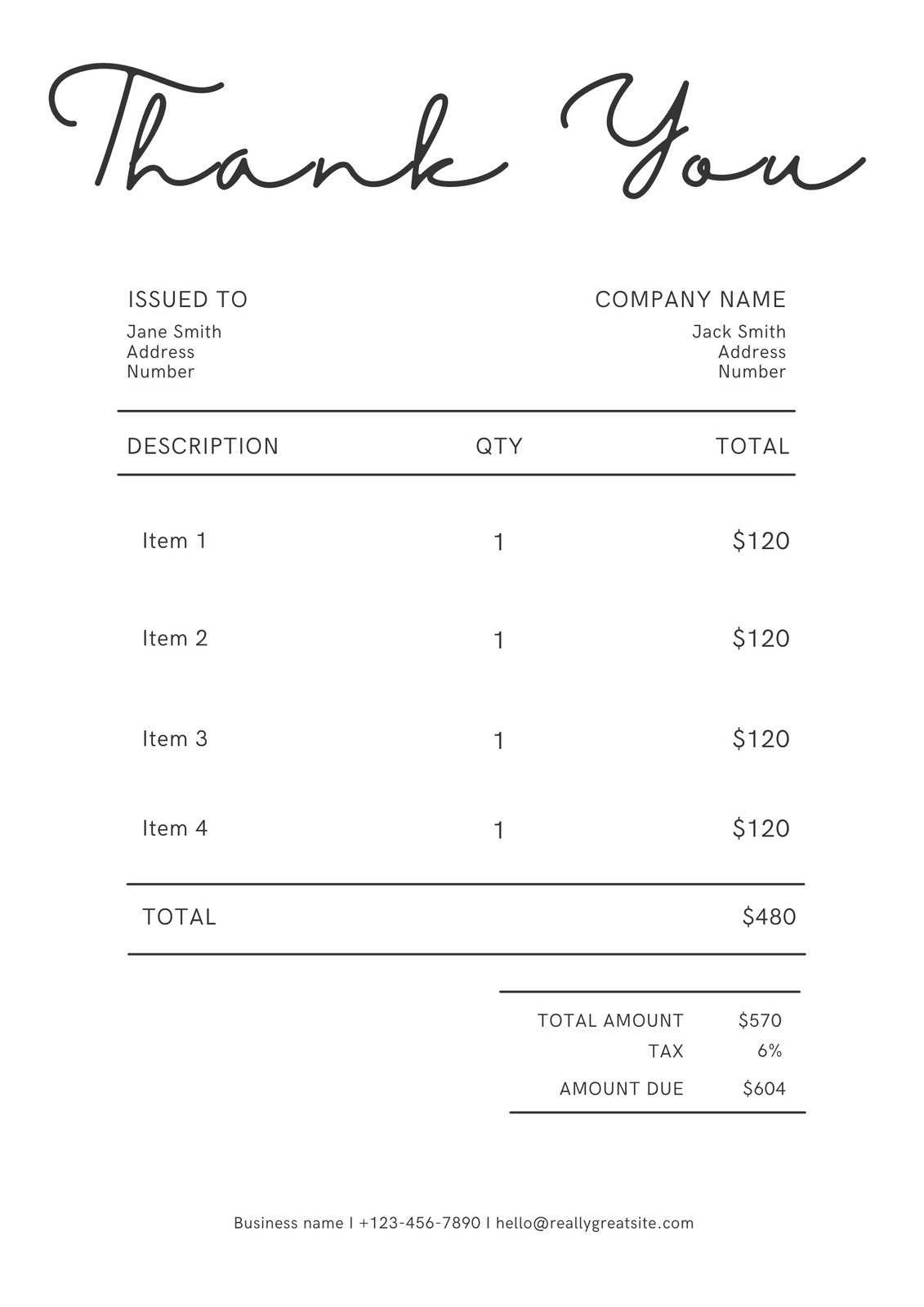

Customizing these ready-made documents with a company logo and unique branding elements provides a polished, professional appearance that can enhance your brand’s reputation. A well-structured document reflects your attention to detail and commitment to professionalism, building trust with clients and customers.

How to Customize Your Template

Customizing your payment records ensures that they align with your business needs and reflect your unique brand. Whether you want to incorporate your logo, adjust the layout, or add specific sections, personalizing these documents can significantly improve their appearance and functionality. The ability to make adjustments allows you to meet both your professional and legal requirements with ease.

Steps to Personalize Your Document

Follow these steps to effectively tailor your document for your business:

- Choose a suitable design: Select a format that fits the style of your business while keeping the structure clear and easy to navigate.

- Incorporate branding elements: Add your company’s logo, colors, and fonts to make the document visually consistent with your other materials.

- Adjust sections: Customize the fields to match the type of transactions you typically handle, such as adding or removing payment methods or descriptions.

- Legal compliance: Ensure that all necessary legal or tax information is included to meet industry regulations.

Additional Customization Options

Beyond basic changes, consider the following enhancements to further personalize your document:

- Include a personalized message or note section for customers.

- Use custom icons or graphics to visually represent specific products or services.

- Offer different currency options or language settings to accommodate international clients.

Key Elements of a Receipt Invoice

When creating a document to confirm a transaction, it’s important to include all the necessary information to ensure both parties understand the terms clearly. A well-structured document not only reflects professionalism but also ensures accuracy in record-keeping. The core elements of such a document should capture the essential details about the exchange while providing clarity and transparency.

Essential Information to Include

The following details are critical for a complete and effective transaction record:

- Transaction Date: This marks the day the payment was made or the service/product was provided.

- Parties Involved: Include the names, contact information, and addresses of both the buyer and the seller.

- Amount and Payment Method: Clearly state the total amount due, the payment method used (e.g., cash, credit card, bank transfer), and any taxes or additional fees.

- Items or Services: List the products or services purchased, including quantities, prices, and descriptions.

Additional Considerations

In addition to the core elements, consider including:

- Unique Identification Number: A reference number for easy tracking and organization of records.

- Payment Status: Indicate whether the payment has been completed or is pending.

- Terms and Conditions: Include any return or refund policies, if applicable.

Choosing the Right Template for Your Business

Selecting the appropriate format for documenting transactions is crucial for any business. The right design can streamline your operations, ensure consistency, and present a professional image to your clients. It’s important to consider factors such as your business size, industry, and the nature of the products or services you offer when making your choice. A well-suited format can also improve efficiency by simplifying record-keeping and payment tracking.

Factors to Consider

There are several key aspects to evaluate when selecting the right format for your business:

- Industry-Specific Needs: Different sectors may require specific fields or sections, such as item descriptions for retail or hourly rates for service-based businesses.

- Branding and Design: Choose a layout that aligns with your company’s branding, reflecting your style and professional image.

- Ease of Use: Select a design that is simple to customize and easy for your staff to use consistently.

Customizing for Your Workflow

Once you’ve chosen a suitable format, you can adjust it to better fit your workflow. This may involve adding or removing sections based on how you track payments or how your clients interact with your business. Whether it’s including space for multiple products or detailing service charges, personalization ensures that the document supports your unique operational needs.

Free vs Paid Receipt Invoice Templates

When choosing a document format for transaction records, businesses often face the decision between free and paid options. While both types offer basic functionality, the differences in customization, features, and support can make one more suitable for your business than the other. Understanding these differences can help you make an informed choice based on your specific needs and budget.

Comparing Free and Paid Options

Each option has its pros and cons, and the best choice depends on the complexity of your requirements and the level of customization you need. Below is a comparison of key features:

| Feature | Free Options | Paid Options |

|---|---|---|

| Customization | Limited options for design and fields | Full control over layout, branding, and fields |

| Support | Minimal or no customer support | Access to customer support and updates |

| Complexity | Suitable for simple transactions | Ideal for businesses with complex needs |

| Cost | Free of charge | Requires a one-time or recurring payment |

| Features | Basic functionalities only | Advanced features like automation, integration, and customization |

Which One is Right for Your Business?

For small businesses or those just starting out, free formats may be sufficient to handle basic transaction records. However, as your business grows and your needs become more complex, investing in a paid option may be worthwhile to gain access to advanced features, better customer support, and a more polished final product.

Legal Requirements for Receipt Invoices

In many regions, there are specific legal guidelines that govern the creation and distribution of transaction records. These regulations ensure transparency, protect both parties involved in a transaction, and help businesses maintain accurate financial documentation for tax and audit purposes. It’s essential for companies to adhere to these requirements to avoid potential legal issues or penalties.

Legal requirements can vary depending on the country, industry, and type of transaction. However, there are common elements that businesses should include in their records to comply with local laws. These typically include transaction dates, payment amounts, detailed descriptions of goods or services provided, and the involved parties’ contact information. Furthermore, in some regions, businesses are also required to include tax-related details such as VAT or sales tax numbers.

Ensuring that all legal obligations are met not only protects your business but also fosters trust with clients by providing them with clear and legitimate documentation of every transaction.

How to Automate Invoice Generation

Automating the creation of transaction records can significantly improve efficiency and reduce errors in your business. By setting up systems that automatically generate these documents, you can save time, streamline operations, and ensure consistency across all records. Automation allows businesses to quickly issue transaction confirmations without manual input, freeing up resources for more important tasks.

Steps to Automate the Process

To start automating the creation of your transaction records, follow these essential steps:

- Select an automation tool: Choose software that fits your business needs and integrates with your accounting system or CRM.

- Set up templates: Customize automated formats with the necessary fields and branding, ensuring they align with your business practices.

- Integrate with your payment system: Link the automation tool with your payment processor to automatically generate records once a payment is completed.

- Schedule automatic delivery: Configure the system to send out transaction records as soon as payments are confirmed or services are provided.

Benefits of Automation

By automating the creation and delivery of these documents, businesses can enjoy:

- Consistency: Every transaction record is formatted and structured in the same way, maintaining professionalism.

- Time-saving: Reduces manual work and ensures that records are generated and sent in real time.

- Accuracy: Minimizes the risk of human error in record creation, ensuring all necessary information is included.

Best Software for Creating Invoices

Choosing the right software for generating transaction records is essential for streamlining your business operations. The right tool can help you create professional documents, track payments, and manage financial records with ease. There are many software options available, each offering unique features that cater to different business needs. Selecting the best option depends on your specific requirements, such as automation, customization, or integration with other systems.

Here are some of the best software solutions for creating transaction records:

- QuickBooks: A comprehensive accounting tool that allows businesses to create and send professional transaction records, track payments, and manage finances in one platform.

- FreshBooks: Ideal for freelancers and small businesses, offering easy-to-use features for creating, customizing, and sending transaction confirmations quickly.

- Wave: A free, user-friendly option with essential features for creating and managing transaction documentation, particularly suited for small businesses or startups.

- Zoho Invoice: A customizable and feature-rich solution for creating detailed transaction records, automating billing, and tracking payments.

- Invoicely: Offers a range of features, including multi-currency support and automated reminders, making it a great choice for international businesses.

Each of these tools provides specific benefits that cater to different business needs. Whether you need a simple solution for managing basic transactions or a more advanced tool for automating workflows, the right software can help improve efficiency and accuracy in your business’s financial documentation process.

Integrating Payment Methods in Invoices

Incorporating various payment methods into transaction records is an essential step in facilitating smooth and flexible financial transactions between businesses and their clients. By offering multiple payment options, businesses can cater to the preferences of their customers, making the payment process more convenient and improving cash flow. This integration can be done seamlessly within the documents, ensuring that clients can quickly pay using their preferred method.

Including payment options in your transaction records not only enhances customer experience but also ensures clarity regarding how payments should be made. Common methods such as bank transfers, credit cards, and online payment gateways like PayPal or Stripe can be easily integrated into the documents, providing all necessary information in one place.

By presenting clear and accessible payment details, businesses reduce the likelihood of delays and misunderstandings, allowing for quicker and more efficient payments.

Tips for Professional Invoice Formatting

Creating a polished and clear financial document is crucial for maintaining a professional image and ensuring that clients can easily understand the details of a transaction. A well-structured record not only reflects your business’s professionalism but also minimizes confusion, reducing the chances of delays or disputes. Proper formatting plays a key role in making the document easy to read and understand, which in turn facilitates prompt payment.

1. Keep it Organized

A clean layout with clearly defined sections is essential. Start with a header that includes your business name, logo, and contact information. Follow this with the transaction date, a unique reference number, and client details. A well-organized document ensures that your client can quickly locate important information.

2. Use Consistent Font Styles

Choose legible fonts and stick to a consistent style throughout the document. Avoid using too many font types, as this can make the document appear cluttered. A simple, professional font such as Arial or Times New Roman is often the best choice for financial documents.

Additional Tips:

- Include clear itemized descriptions: Break down the goods or services provided with their respective costs to avoid confusion.

- Highlight payment terms: Ensure that the payment due date and method are easy to find, avoiding potential delays.

- Double-check for accuracy: Before sending, verify that all amounts, client details, and dates are correct to prevent mistakes.

How to Track Payments with Invoices

Effectively monitoring payments is a vital part of managing finances and ensuring that businesses stay on top of their cash flow. Properly documenting and tracking financial transactions helps prevent missed payments, reduces the risk of errors, and provides clarity when reviewing outstanding balances. By including key information in your transaction documents, you can easily keep track of paid and unpaid amounts.

Here are some ways to track payments efficiently:

- Use a Unique Reference Number: Assigning a unique identifier to each transaction makes it easier to track and cross-reference payments against the records.

- Record Payment Status: Clearly note the payment status (e.g., paid, pending, overdue) on the document to avoid confusion when reviewing your financial records.

- Include Payment Dates: Always specify when a payment is due and the date it was received. This helps keep track of outstanding balances and manage follow-ups effectively.

Automating Payment Tracking

Automating the tracking process can save you significant time and effort. Many accounting software solutions allow you to integrate payment tracking directly with your transaction documentation, offering features like automatic payment reminders, balance updates, and reports on outstanding invoices.

Regularly Review Payment Status

Set aside time to regularly review your payment status, either manually or through automated reports. Keeping up with payments ensures that you can take action promptly when payments are overdue, maintaining a smooth cash flow for your business.

Printable vs Digital Invoice Formats

When managing financial transactions, businesses often need to choose between physical or digital formats for documenting payments. Each format offers its own set of advantages and considerations, depending on the nature of the business and the preferences of both the company and its clients. Understanding the differences between printable and digital formats can help you make an informed decision about which method works best for your needs.

Printable records are tangible documents that can be handed over in person or mailed, while digital formats are stored and transmitted electronically. Both formats can be easily customized and can serve the same purpose–providing a clear record of transactions–but they differ in terms of accessibility, cost, and environmental impact.

| Feature | Printable Format | Digital Format |

|---|---|---|

| Accessibility | Requires physical delivery or mailing | Accessible on any device with an internet connection |

| Cost | Printing and postage costs involved | No physical costs, though software may require a subscription |

| Environmental Impact | Paper usage, waste | Environmentally friendly, paperless |

| Storage | Physical storage space needed | Stored electronically with easy access |

Each option has its place, depending on client preferences and business operations. For example, businesses that work with clients who prefer physical documents may choose printed formats, while others that prioritize quick and efficient delivery may lean toward digital records. Ultimately, the decision depends on the unique needs of your business and how you interact with your customers.

Managing Invoice Templates Across Platforms

For businesses that operate across different software and platforms, maintaining consistency in transaction records can become challenging. Managing documentation seamlessly across multiple systems requires effective coordination to ensure that all platforms are aligned with your business needs and customer expectations. Whether you are using accounting software, email clients, or document management tools, streamlining how your transaction documents are handled can save time and improve efficiency.

Here are several strategies to help manage your transaction documents effectively across various platforms:

- Centralized Storage: Store all your documents in a cloud-based system that can be easily accessed from any device. This allows for easy updating and sharing across different platforms without losing consistency.

- Platform Integration: Many accounting software solutions can integrate with other tools such as payment processors, email services, and CRM systems, ensuring a seamless flow of information and reducing manual data entry.

- Uniform Design: Standardize the layout and information on your transaction documents so that regardless of the platform, the final product looks consistent and professional.

- Automation Tools: Use automation features within your software to generate and send documents automatically. This minimizes errors and speeds up the process, reducing the amount of manual work involved.

- Data Syncing: Ensure that all platforms you use are synced to prevent discrepancies between records. Data syncing helps maintain accurate, up-to-date information across multiple systems.

By implementing these strategies, you can ensure that your transaction documents remain organized, professional, and accessible across all the platforms you use, enhancing the overall efficiency of your business operations.

How to Maintain Consistent Invoicing Practices

Establishing a reliable and efficient approach to documenting financial transactions is crucial for any business. Maintaining consistency in your billing processes not only ensures accuracy but also helps in building trust with clients and keeping your financial records organized. By implementing a set of standard practices, businesses can minimize errors, improve workflow, and ensure that every transaction is properly documented.

To achieve consistency in your documentation practices, consider the following strategies:

- Standardize Your Process: Set up a clear and consistent process for creating, sending, and tracking transaction records. This includes defining specific steps, from the initial creation to final payment confirmation, so that every document follows the same structure.

- Use Consistent Terminology: Ensure that all transaction records use the same language, terminology, and formats across your business. This helps avoid confusion and keeps the process professional.

- Implement Automation: Automate repetitive tasks such as document generation and reminders for pending payments. Automation reduces human error and ensures that each document is created and sent without delays.

- Set Clear Payment Terms: Clearly define payment terms (such as due dates, late fees, and payment methods) and ensure that they are consistently applied across all transactions. This helps avoid misunderstandings with clients.

- Track Payments Effectively: Keep an organized record of all received payments, including partial payments, overages, and discounts. Regularly updating your records ensures accurate financial tracking and reduces the risk of oversight.

- Review and Improve: Periodically review your invoicing practices to identify any areas for improvement. This can help refine the process, making it more efficient and effective as your business grows.

By following these guidelines, you can ensure that your documentation practices remain consistent, leading to smoother operations and stronger client relationships.