Real Estate Rental Invoice Template for Landlords and Property Managers

Managing payments effectively is crucial for property owners and managers. One of the most important aspects of this process is ensuring clear and professional documentation. Properly structured payment records not only help in tracking financial transactions but also provide transparency for tenants and legal protection for property owners. Having an organized system for creating these documents can significantly simplify the management process.

Customized forms are essential tools for landlords, offering a straightforward way to communicate amounts due, payment deadlines, and other important details. These documents should be easy to understand, accurate, and tailored to meet specific needs. In addition to acting as a payment reminder, they serve as an official record in case of disputes or audits.

In this guide, we will explore various options for creating these essential documents. Whether you are a first-time landlord or an experienced property manager, understanding how to generate clear and professional payment records can save time, prevent errors, and enhance tenant relationships.

Understanding Payment Documentation for Property Owners

When managing properties, clear and accurate payment records are essential. These documents serve as a formal request for payment from tenants and provide a structured format for outlining financial obligations. A well-organized payment statement can help prevent misunderstandings, ensuring both landlords and tenants have a mutual understanding of the amounts owed, payment due dates, and any additional fees or charges.

Purpose and Importance of Payment Records

Payment statements are not just transactional tools; they are vital for record-keeping, tax filing, and resolving potential disputes. They provide a written history of financial exchanges between the landlord and tenant, offering transparency and a reliable reference for both parties. Without proper documentation, it can be difficult to track payments, and misunderstandings can arise, leading to unnecessary conflicts.

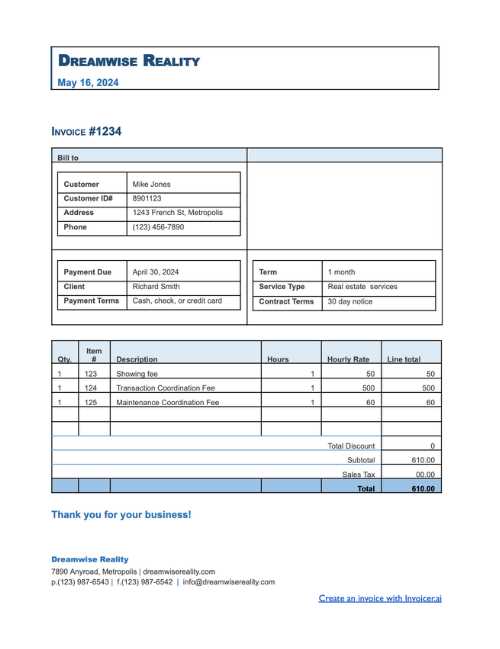

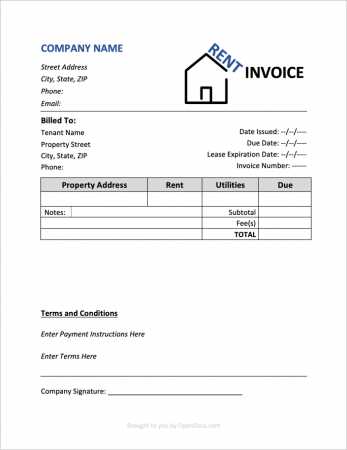

Key Elements to Include in a Payment Statement

A well-drafted payment document should include several key components to ensure clarity. These include the tenant’s name, the property address, the payment period, the total amount due, and any additional fees, such as late charges or maintenance costs. Including these details ensures that both the landlord and tenant are on the same page regarding the financial arrangement, minimizing the risk of errors or disputes.

What is a Payment Request Document?

A payment request document is a structured form used by property owners to formally ask tenants for payments. This document outlines the specific amount due, the payment period, and any other relevant details about the financial transaction. It serves both as a record for the tenant and the landlord, ensuring that both parties have a clear understanding of their financial obligations. Having a standardized format for these documents helps streamline the payment process and reduces the chance of confusion or mistakes.

Why Use a Payment Request Document?

Property managers and landlords use payment request forms to ensure consistency and professionalism when dealing with tenants. These forms help in the following ways:

- Clear Communication: Both the landlord and tenant know exactly what is owed and when it is due.

- Legal Protection: The document acts as a formal record that can be used in case of disputes.

- Efficiency: It simplifies the payment process by laying out all the necessary details in one place.

- Organization: Keeps track of all payments for future reference, making accounting and tax filing easier.

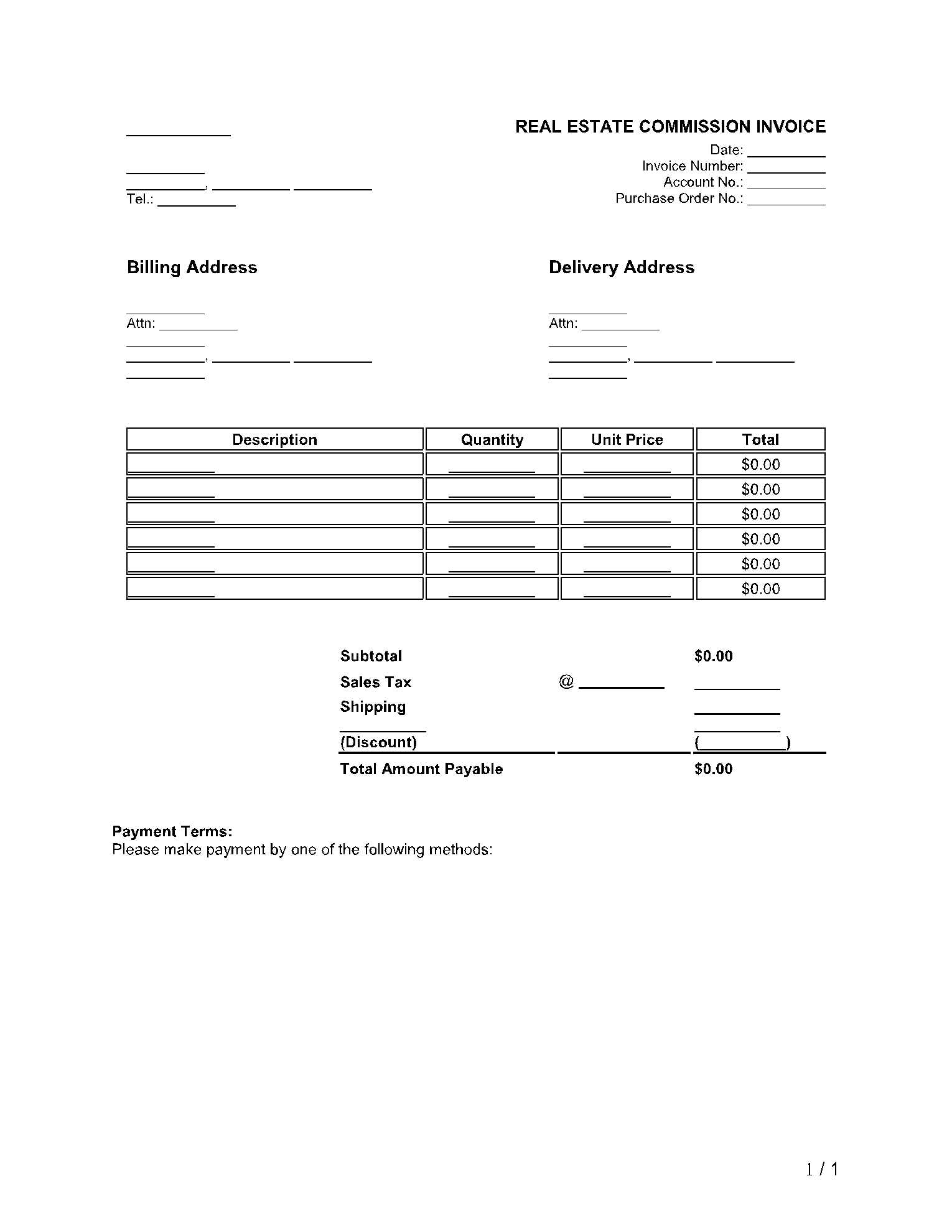

Key Components of a Payment Request Document

A well-crafted payment request should include essential details to avoid confusion. These elements are typically found in most standard forms:

- Tenant Information: Full name and contact details of the person responsible for the payment.

- Property Address: Location of the rented property to ensure clarity.

- Amount Due: Total sum owed, including rent, utilities, or any e

Benefits of Using Payment Request Documents

Using structured payment request documents offers numerous advantages to property owners and managers. These documents help ensure a professional and transparent approach to managing financial transactions between landlords and tenants. By using consistent and well-organized records, both parties can avoid confusion, track payments effectively, and maintain accurate financial documentation. The benefits go beyond simple convenience and can provide legal protection, improve communication, and streamline financial operations.

Clear Communication and Transparency

One of the primary benefits of using formal payment documents is the clear communication it facilitates. Both the landlord and tenant are provided with a clear, detailed summary of what is owed, when payments are due, and any applicable fees or penalties. This clarity reduces the potential for misunderstandings and fosters trust between both parties. Tenants can quickly review their obligations, while landlords can confidently track payments.

Legal Protection and Record Keeping

Structured documents serve as legal records of the financial transactions between a landlord and tenant. In the event of a dispute or legal action, these documents can be used as evidence of agreed-upon terms, payment history, and any outstanding balances. This helps protect both the landlord and tenant, ensuring that any issues regarding unpaid rent or fees can be resolved in a fair and legally supported manner. Additionally, these records are useful for tax purposes, simplifying the process of filing and maintaining accurate financial statements.

Key Elements of a Payment Request Document

For a payment request document to be effective, it must contain specific details that clearly outline the financial expectations and obligations of both parties involved. These elements help avoid confusion and ensure that there is no ambiguity regarding the amounts owed, the due dates, and any additional charges. By including all the necessary information, landlords can provide tenants with a professional and transparent overview of their payment requirements.

Essential Information for Clarity

A complete and clear document should include the following critical components:

- Tenant’s Information: The full name and contact details of the individual responsible for the payment.

- Property Address: The address of the rented property, which helps avoid confusion, especially if the landlord manages multiple properties.

- Amount Due: The total sum that the tenant is expected to pay, including rent, utilities, and any additional fees.

- Due Date: The specific date by which the payment should be made to avoid late fees or penalties.

- Payment Methods: Accepted methods of payment, such as bank transfers, checks, or online payment systems.

Additional Important Details

In addition to the basic information, it is also helpful to include:

- Late Fees: Any charges that will apply if the payment is not received by the due date.

- Breakdown of Charges: A detailed list showing the individual costs, such as rent, maintenance fees, or utilities, to ensure transparency.

- Contact Information: Landlord’s or property manager’s contact details in case the tenant has any questions or concerns about the payment.

By ensuring all these elements are present, property o

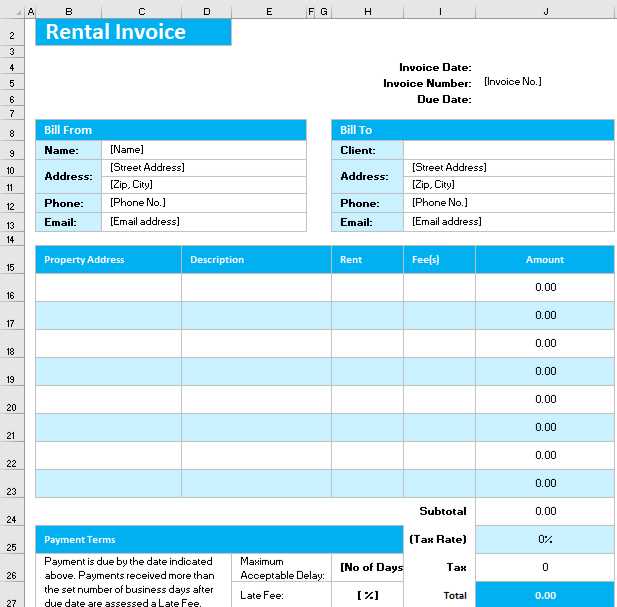

How to Create a Payment Request Document

Creating a payment request document is a straightforward process that ensures both landlords and tenants have a clear understanding of the financial obligations. Whether you are a first-time property manager or an experienced landlord, following a few simple steps will help you create a professional and accurate document. A well-constructed request provides clarity, minimizes the chance of confusion, and facilitates smooth financial transactions.

To create an effective payment document, the following steps should be followed:

- Choose a Format: Select a format that suits your needs. This could be a simple word processing document, a spreadsheet, or an online tool specifically designed for property management.

- Include Key Details: Ensure that all critical information is present, such as the tenant’s name, the address of the property, the amount due, and the payment due date.

- List Charges Clearly: Provide a breakdown of the amount owed, including the base amount, any additional fees (e.g., maintenance, utilities), and late charges if applicable.

- Specify Payment Methods: Clearly outline the methods through which payment can be made (e.g., bank transfer, online payment, or check).

- Include Contact Information: Make sure to include the landlord’s or property manager’s contact details so that the tenant can reach out if they have any questions or concerns about the payment.

- Double Check Accuracy: Review the document for any errors in calculations or missing information to avoid confusion later on.

By following these steps, you will create a comprehensive and transparent payment request document that simplifies the financial interaction between you and your tenant.

Common Mistakes in Payment Request Documents

When creating payment request documents, it’s easy to overlook key details or make simple errors that can lead to confusion or disputes between landlords and tenants. These mistakes can range from missing information to incorrect calculations, and while they may seem minor, they can have a significant impact on the payment process. Identifying and addressing common errors before sending out these documents can help maintain a smooth, professional relationship with tenants.

Common Errors to Avoid

Here are some of the most frequent mistakes when drafting payment documents:

- Missing Tenant or Property Details: Failing to include the tenant’s full name or the property’s address can cause confusion, especially if the landlord manages multiple properties.

- Incorrect Payment Amount: Mistakes in calculating the total amount due–such as missing charges, incorrect fees, or failure to apply discounts–can create unnecessary disputes.

- Unclear Payment Deadlines: Not specifying a clear payment due date or providing vague language can leave tenants uncertain about when the payment must be made.

- Omitting Late Fees: If a late fee is applicable, it should be clearly stated. Omitting this detail may lead to missed payments or misunderstandings when penalties are enforced later.

- Inconsistent Payment Methods: Offering multiple payment options but failing to list all of them in the document can make it harder for tenants to know how to pay.

How to Avoid These Mistakes

To avoid these common errors, landlords should:

- Ensure all essential information is included, including the tenant’s name, property details, total amount due, and payment deadline.

- Double-check the math to make sure all charges are accurate, and add up correctly.

- Clearly specify payment methods and late fees to avoid confusion.

- Proofread the document before sending it to ensure that no important information is missing.

By paying attention to these details, property owners can ensure that their payment request documents are clear, accurate, and professional, helping to avoid unnecessary issues with tenants.

Legal Requirements for Payment Request Documents

When creating payment request documents, landlords and property managers must adhere to certain legal guidelines to ensure that their documents are valid and enforceable. These requirements vary depending on local laws and regulations but generally include specific details that must be included to protect both parties. Failing to comply with these legal standards could lead to disputes or legal challenges, making it essential for property owners to understand the necessary components of such documents.

Key Legal Elements to Include

There are several key elements that should be included in any formal payment request document to meet legal standards:

- Tenant’s Full Name and Contact Information: It is important to clearly identify the party responsible for the payment. This ensures there is no confusion regarding who is being billed.

- Property Address: Including the exact address of the rented property is crucial for clarity, especially if multiple properties are being managed by the landlord.

- Amount Due and Detailed Charges: The total sum should be clearly stated, with a breakdown of all applicable fees, such as rent, utilities, and maintenance charges. This ensures that tenants understand what they are paying for.

- Due Date: A specific due date must be included to ensure tenants know when payment is expected. This is essential for enforcing late fees or other penalties if the payment is delayed.

- Payment Terms: Information on accepted payment methods and instructions on how the payment can be made should be clear and precise.

Legal Protection and Compliance

By ensuring that all legally required information is included, landlords can protect themselves in case of any disputes. Additionally, having a formal document that follows legal guidelines provides evidence that the landlord and tenant agreed to the terms and payment schedule. Depending on the location, landlords may also need to include specific language related to local housing laws or rental agreements, so it is important to consult with legal professionals or property management experts to ensure full compliance.

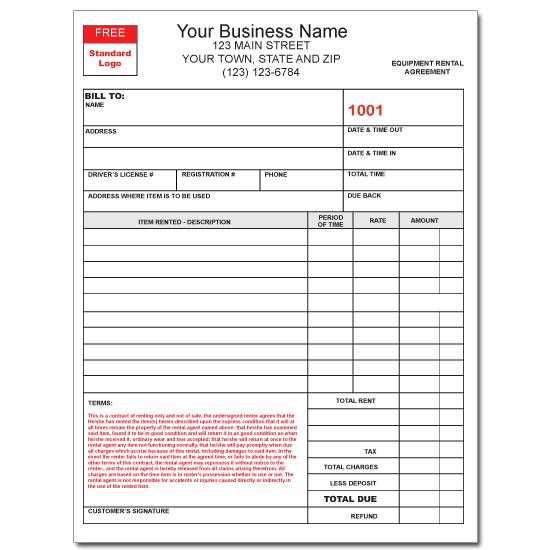

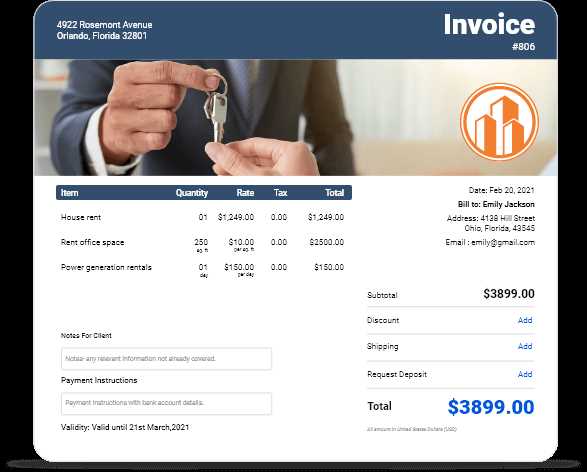

Customizing Your Payment Request Document

Personalizing your payment request document is a key step in ensuring that it aligns with your specific needs and the expectations of your tenants. Customization not only makes the document more professional but also helps reflect the unique terms of your property agreements. Tailoring the document allows for flexibility, such as including additional fees, applying specific payment methods, or adding personalized details like branding and logos to create a cohesive look across your business documents.

Here are some important ways to customize your payment request document:

Adjusting Layout and Design

The first step in customization is designing a layout that is both clear and visually appealing. This might include adding:

- Company Branding: If you manage multiple properties, incorporating your logo and business name can help create a consistent professional appearance.

- Property Information: For each document, make sure the specific address and property details are easy to find, especially if you manage multiple locations.

- Color Scheme and Fonts: Use a simple and professional color palette and readable fonts that align with your branding.

Including Specific Charges or Discounts

Another essential part of customization is adding or removing charges that are specific to your property management practices. You might want to include items like:

- Utility Charges: If utilities are billed separately, ensure they are clearly listed in the document.

- Late Payment Fees: Define any penalties for overdue payments and make sure these are prominent in the document.

- Discounts or Promotions: If you offer discounts for early payments or loyalty, include t

Free vs Paid Payment Request Documents

When selecting a format for creating payment request documents, property managers and landlords often face the decision between using free or paid options. Both choices offer distinct advantages and potential drawbacks depending on the specific needs of the landlord or business. Free versions are often convenient and easily accessible, but they may lack certain features or customization options. Paid versions, on the other hand, typically provide more advanced functionalities, additional design flexibility, and ongoing customer support.

Understanding the differences between these two options can help property owners decide which solution is best for them based on their budget, business needs, and long-term goals.

Advantages of Free Options

Free payment request documents are an appealing choice for landlords just starting out or those with simpler needs. Some of the key benefits include:

- No Cost: As the name suggests, these options come at no expense, making them perfect for small property owners or those just beginning to manage rental properties.

- Easy to Access: Many free formats are readily available online and can be downloaded instantly, saving time in the document creation process.

- Simplicity: Free documents typically focus on the essential features, which can be a good choice if you don’t need advanced features or complex layouts.

Benefits of Paid Options

Paid solutions offer a more comprehensive set of features, making them ideal for property owners who require advanced customization or additional support. Key benefits include:

- Customization: Paid options often come with extensive design tools that allow you to create highly personalized documents that reflect your brand or business style.

- Advanced Features: Features such as automated calculations, recurring billing options, and integration with accounting software can streamline the process and save time.

- Customer Support:

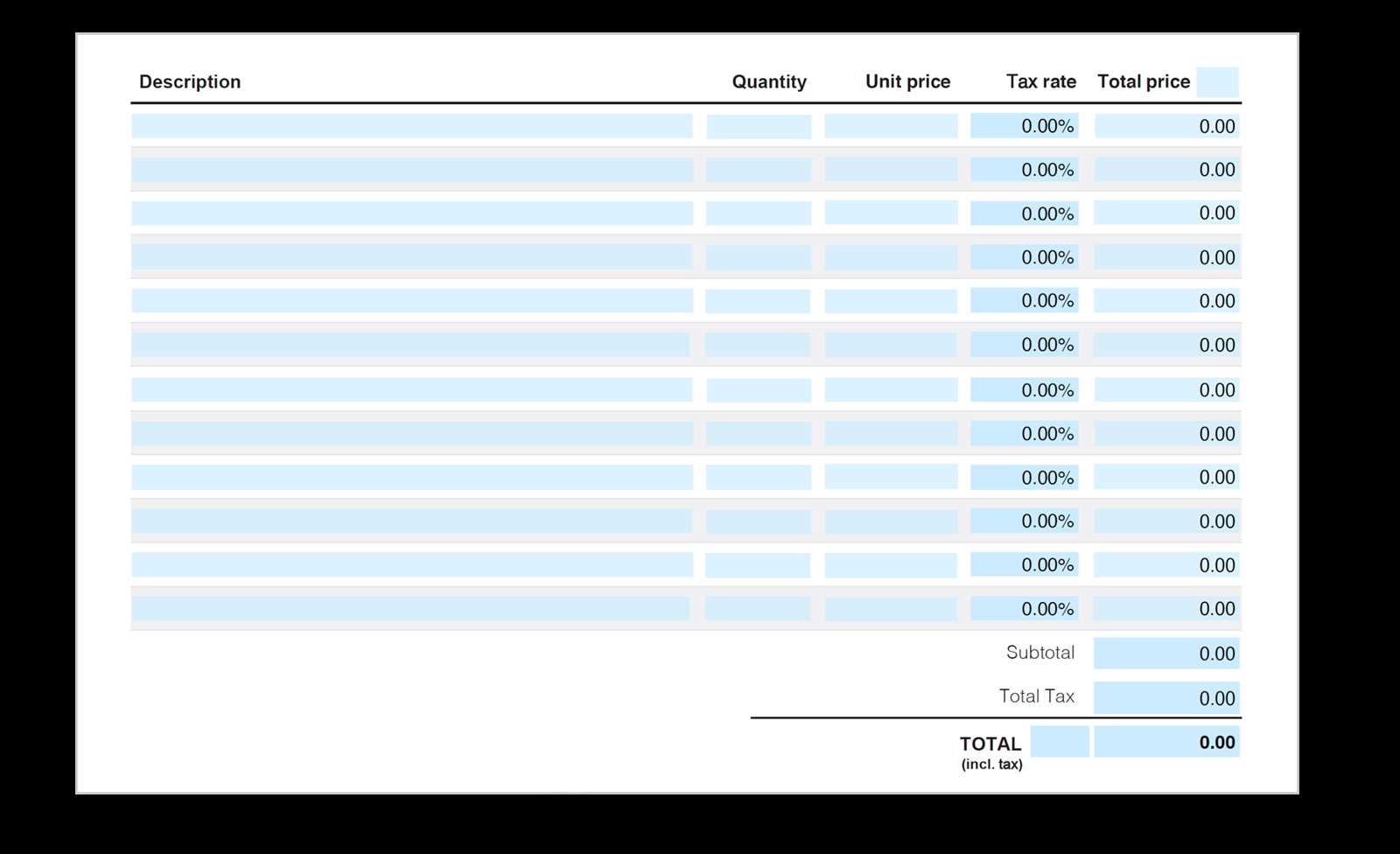

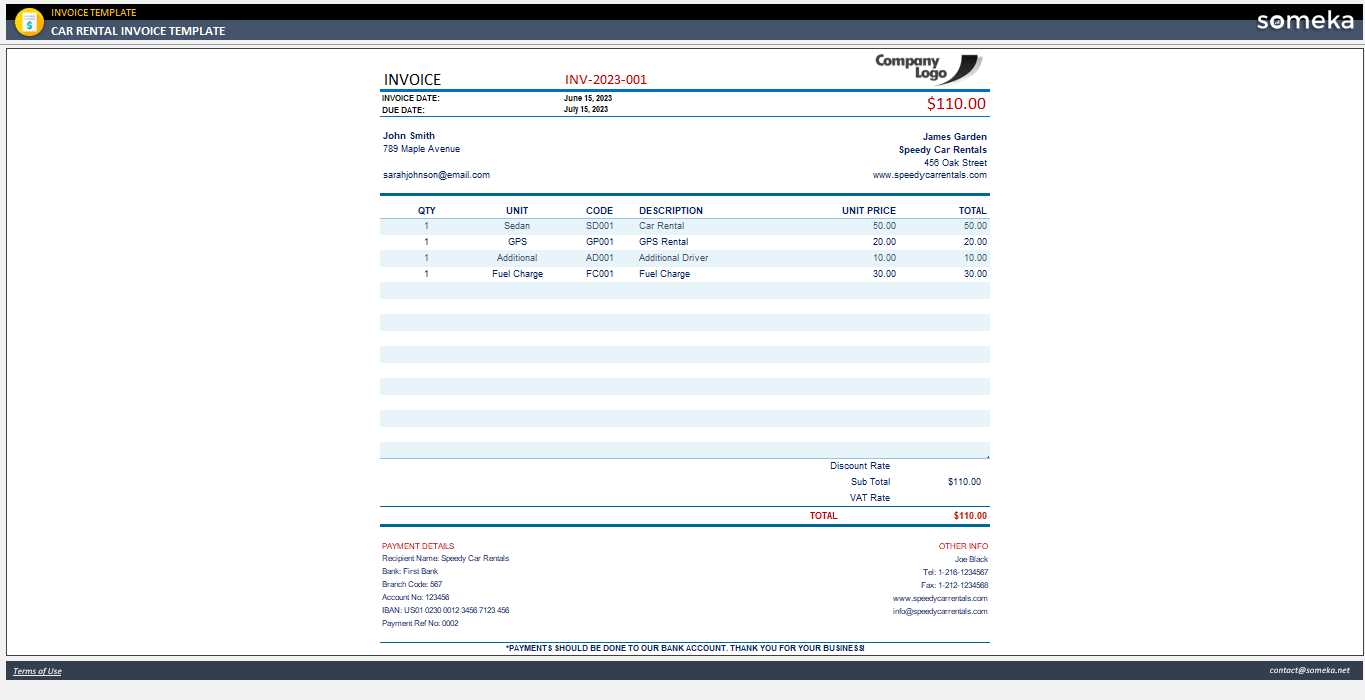

How to Calculate Rent and Fees

Accurately calculating the amount due for a leased property is essential for both property managers and tenants. It ensures clarity and prevents misunderstandings regarding financial obligations. Rent and additional fees should be calculated in a way that reflects both the terms of the lease agreement and any extra services or charges that may apply. By understanding the proper methods for calculating these costs, landlords can provide transparent and professional financial documents for their tenants.

Calculating Base Rent

The base rent is typically agreed upon at the start of the lease and is the primary charge for the use of the property. To calculate the base rent, simply follow these steps:

- Determine the Monthly Rent: Identify the agreed-upon amount for the rental space per month.

- Adjust for Lease Length: If the tenant has a shorter or longer-term lease, adjust the rate accordingly if the lease terms dictate different pricing.

- Include Special Agreements: If the lease includes any special conditions that affect the rent, such as a rent discount for early payment or a rate increase after a certain period, ensure these are factored in.

Adding Additional Fees

In addition to the base rent, landlords may charge extra fees for services or amenities that are not included in the regular lease terms. Common additional charges include:

- Utility Fees: Charges for electricity, water, gas, or internet services may be billed separately, depending on the lease agreement.

- Maintenance Charges: Fees for repairs or maintenance work that goes beyond standard upkeep can be added if outlined in the lease.

- Late Payment Fees: If a tenant fails to pay on time, landlords may impose a late fee as a penalty. This should be clearly stated in the agreement and calculated based on the number of days late.

- Parking or Pet Fees: If the property offers parking spaces or allows pets, additional fees may apply and should be included in the overall calculation.

To avoid any confusion, it’s crucial to clearly list all charges and provide an itemized breakdown. This ensures that both parties understand the financial responsibilities and helps foster a positive landlord-tenant relationship.

Handling Late Payments in Payment Request Documents

Late payments are a common issue that landlords and property managers must address to ensure their cash flow remains steady. Delays in payment can be frustrating for both parties, but having a clear and enforceable policy in place is essential to managing these situations effectively. By setting clear expectations and including specific terms in the payment request document, landlords can help minimize late payments and maintain a professional relationship with tenants.

Setting Clear Payment Terms

One of the best ways to prevent late payments is to clearly outline the payment terms in the agreement. This includes specifying:

- Due Date: Make sure the exact date by which payment must be made is clearly stated in the document.

- Grace Period: Some landlords may offer a short grace period (e.g., 3–5 days) after the due date before applying penalties. It should be clear if and how this grace period works.

- Late Fees: Include the exact late fee amount or percentage to be charged if payment is received after the due date. Be sure this is outlined in the original agreement.

- Payment Method: Specify acceptable methods for payment, such as online transfers, checks, or direct deposit, to avoid delays due to confusion over how to pay.

Enforcing Late Fees and Penalties

When payments are delayed, it’s crucial to enforce the terms outlined in the agreement. Here’s how to handle the situation:

- Apply Late Fees: If the payment is not received by the due date (or grace period), apply the agreed-upon late fee. Make sure to communicate this to the tenant clearly.

- Send a Reminder: If the payment is overdue, send a reminder letter or email stating the amount due, the applied fees, and a new payment deadline.

- Offer Payment Plans: In some cases, tenants may be struggling to make a full payment. Consider offering a payment plan to help them get back on track while ensuring you still receive the amount owed.

By establishing clear terms from the start and consistently enforcing them, landlords can reduce the risk of late payments and avoid potential conflicts. A well-structured payment document serves as both a reminder and a legal tool to ensure financial obligations are met on time.

Tracking Payments with Payment Request Documents

Keeping track of payments is essential for landlords and property managers to ensure financial stability and clarity. Documenting each payment transaction helps to maintain an organized record, making it easier to spot any missed or delayed payments. By using structured payment documents, property owners can efficiently track tenant payments, identify patterns, and stay on top of financial obligations. This not only ensures smooth operations but also provides a legal record of all transactions in case of disputes.

Benefits of Using Payment Documents for Tracking

Tracking payments through formal request documents offers several key advantages:

- Clear Payment History: A well-organized record of all payments allows landlords to quickly verify when a payment was made, the amount, and if it was paid in full.

- Automated Reminders: With digital or automated systems, landlords can easily send reminders for upcoming payments or overdue balances.

- Financial Record Keeping: Using documents to track payments helps maintain an accurate financial history for tax purposes and future reference.

- Legal Protection: Having a documented history of payments can serve as evidence in case of disputes regarding missed or partial payments.

Best Practices for Tracking Payments

To ensure accurate tracking of payments, landlords should consider the following best practices:

- Issue Detailed Payment Documents: Each payment request should include specific details, such as the tenant’s name, the amount due, and the payment due date.

- Mark Payments as Received: Once a payment is made, update the payment record to reflect the received amount. Include the payment date and any applicable late fees or discounts.

- Set Up Digital Tracking: Consider using accounting software or online platforms to track payments automatically. These systems often provide a clear dashboard of all transactions and help prevent errors.

- Keep Copies of Documents: Retain copies of all payment request documents and receipts, either digitally or physically, to have a complete record of all financial exchanges.

By incorporating these practices, landlords can effectively track payments and maintain an organized financial system, reducing the likelihood of confusion and ensuring smooth transactions with tenants.

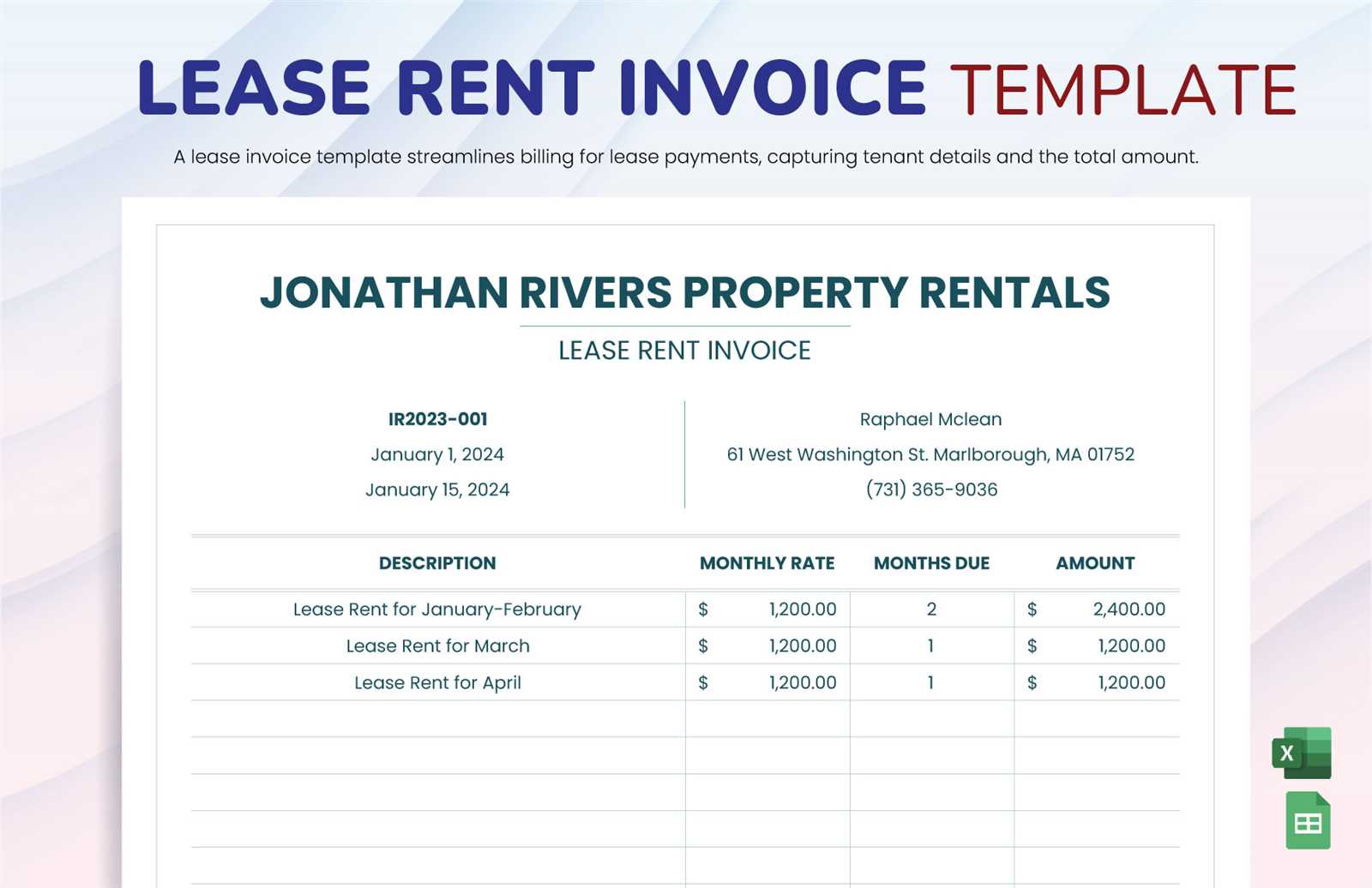

Payment Request Documents for Different Property Types

Each type of property may have different requirements and terms when it comes to financial agreements and documentation. Whether you are managing a single-family home, an apartment complex, or a commercial space, it’s important to tailor payment documents to reflect the specific nature of each property type. This ensures that all relevant charges, terms, and details are appropriately captured, making the document both clear and legally compliant.

Customizing Documents for Various Property Types

When creating payment documents, it’s essential to consider the specific characteristics of the property being rented. Different property types often come with unique features or expenses that need to be addressed in the payment request. Below is an overview of common property types and how to adjust the documents for each:

Property Type Special Considerations Key Charges to Include Single-Family Homes Typically leased as standalone units. No shared amenities. Base rent, utilities, maintenance, landscaping fees. Multi-Family Apartments Multiple tenants in a single building, often with shared amenities. Base rent, utility fees, common area maintenance fees, parking charges. Commercial Properties Used for business purposes; often includes more complex terms and longer lease agreements. Base rent, property taxes, insurance, maintenance, CAM (common area maintenance) charges, utilities. Vacation Homes Leased for short-term stays, may include more flexible terms. Base rent, cleaning fees, security deposit, booking fees, taxes. Why Customization Matters

By customizing your payment documents for each type of property, you ensure that all specific charges, such as maintenance fees, parking costs, or utilities, are clearly outlined. Additionally, customizing these docum

How to Send Payment Requests to Tenants

Sending payment documents to tenants is an important task for landlords and property managers. The process should be clear, professional, and timely to ensure that tenants understand their financial obligations and can make payments without confusion. There are several methods to send these documents, each with its own advantages and considerations. By choosing the right method and following best practices, landlords can maintain smooth communication and timely payments.

Methods for Sending Payment Requests

There are a variety of ways to deliver payment documents to tenants, each suited for different preferences and needs. Here are some common methods for distributing payment requests:

Method Advantages Considerations Email Fast, efficient, and easily accessible for both parties. Allows for quick confirmation of receipt. Req Using Digital Tools for Payment Requests

In today’s fast-paced world, digital tools have become invaluable for managing payment requests. These platforms streamline the process of creating, sending, and tracking payment documents, making it easier for property managers and landlords to stay organized. By automating various tasks, such as reminders, due dates, and payment tracking, digital tools can save time and reduce errors, while also providing tenants with a more convenient way to handle their financial obligations.

Advantages of Digital Payment Systems

Adopting digital tools for payment documents offers numerous benefits for both landlords and tenants. These systems not only improve efficiency but also enhance transparency and communication. Some of the key advantages include:

- Automation: With digital systems, many tasks such as sending payment reminders or applying late fees can be automated, reducing the chance for human error.

- Accessibility: Tenants can access payment documents anytime and from anywhere, making it easier for them to review and pay on time.

- Tracking: Digital tools often offer built-in tracking features, allowing both landlords and tenants to monitor the status of payments and see whether they’ve been received or are overdue.

- Convenience: Tenants can easily pay online through secure payment gateways, offering multiple payment options such as credit cards, bank transfers, or digital wallets.

- Environmentally Friendly: By eliminating paper usage, digital tools contribute to a more sustainable, eco-friendly approach to managing payment records.

Popular Digital Tools for Payment Requests

There ar

Ensuring Accuracy and Transparency in Payment Documents

When managing financial documents, accuracy and transparency are critical for maintaining a positive relationship with tenants and avoiding disputes. Clear and precise payment documents help to prevent misunderstandings regarding amounts due, payment terms, and any additional charges. By ensuring that all information is correct and easily understandable, landlords can foster trust and maintain a smooth rental process.

Key Factors for Accurate Payment Documents

To ensure that payment documents are accurate and transparent, landlords should pay attention to several key factors. The following table outlines some important elements to consider when preparing payment documents:

Factor Why It Matters How to Ensure Accuracy Correct Tenant Information Ensures the document is addressed to the correct individual, preventing confusion. Double-check tenant names, contact information, and lease details before sending the document. Accurate Payment Amount Helps avoid disputes over incorrect charges and ensures tenants know exactly what they owe. Carefully calculate rent, fees, and any other applicable charges. Verify totals before finalizing the document. Clear Due Dates Clarifies when payment is expected, preventing late payments and confusion. List the exact due date and provide reminders well in advance of the deadline. Additional Fees or Charges Prevents misunderstandings by explaining any extra charges, such as late fees How to Organize Payment Documents for Tax Season

Preparing for tax season can be a challenging task, especially when it comes to organizing financial records. For landlords, keeping track of all payment documents throughout the year is crucial for accurately reporting income and expenses. By maintaining a well-organized system, you can save time, reduce stress, and ensure that your financial information is readily available when needed. Proper organization also helps to avoid errors that could potentially lead to costly mistakes or audits.

Best Practices for Organizing Payment Records

To make tax season easier, it’s essential to stay on top of recordkeeping throughout the year. Here are some best practices for keeping payment records organized:

- Keep Detailed Records: Track all incoming payments, including rent, fees, and any other charges. Be sure to include payment dates, amounts, and payment methods.

- Separate Personal and Business Finances: Maintain a separate bank account for your property-related transactions. This makes it easier to track income and expenses and reduces the likelihood of mixing personal and business finances.

- Use Digital Tools: Consider using accounting software or property management systems to store and organize payment documents. These tools can help you generate reports quickly, reducing the time spent manually organizing records.

- Maintain a Payment Calendar: Set reminders for payment due dates and track which payments have been received. A payment calendar can also help ensure you don’t miss any deductions or credits available during tax season.

- Categorize Expenses: It’s important to separate income from various types of expenses such as maintenance, utilities, and repairs. This will simplify the tax preparation process when you need to account for deductions.

How to Store Payment Records

Proper storage of payment documents is essential for both accessibility and compliance. Here are some effective ways to store your records:

- Cloud Storage: Store your financial records in a secure cloud-based system that allows easy access and sharing with your accountant or tax professional.