Real Estate Photography Invoice Template for Easy and Professional Billing

For photographers offering property-related services, managing payments efficiently is crucial for maintaining a smooth workflow. When working with clients, clear documentation of charges and agreements helps to avoid misunderstandings and ensures timely compensation. A well-structured document is more than just a request for payment; it acts as a professional tool that reflects your business standards.

Having a consistent and polished approach to billing not only saves time but also establishes trust with clients. Whether you’re dealing with residential or commercial projects, organizing your financial transactions with precision is key. In this guide, we will explore the best practices for creating an effective billing document that suits the needs of property photographers.

Learn how to create a document that simplifies your process and reflects your expertise. From setting clear terms to customizing layout elements, this will help you stay organized and professional throughout your business operations.

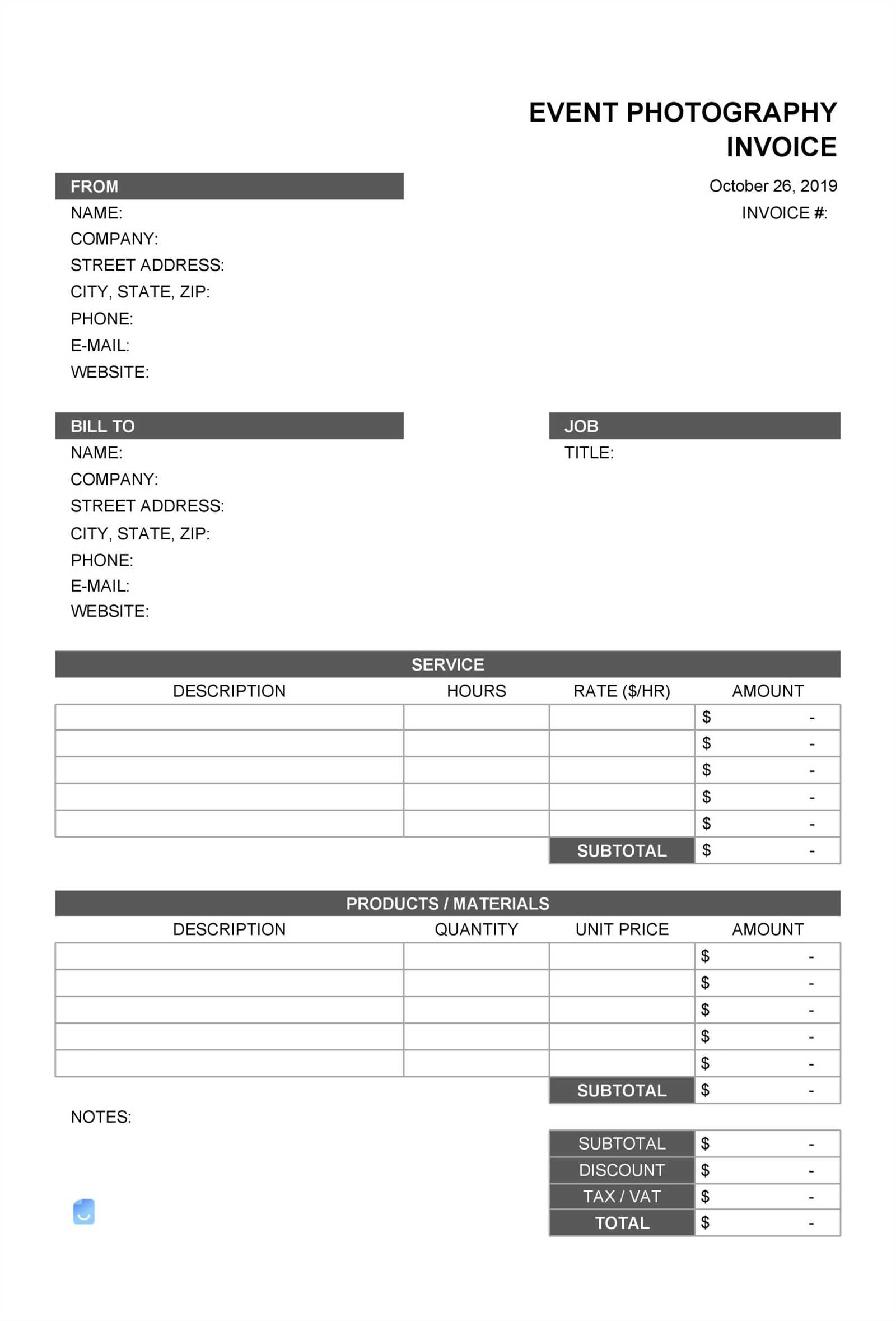

Real Estate Photography Invoice Template Overview

For professionals capturing images of properties, having a reliable and standardized document for billing is essential. This tool helps in ensuring that all charges are clear, easily understood by clients, and processed smoothly. Such a document serves as both a formal request for payment and a record of the work completed. A well-structured format can improve workflow, reduce errors, and enhance professional communication.

Creating an effective document for billing purposes involves several key elements. These elements not only provide transparency but also promote trust and professionalism with clients. Here’s a breakdown of the typical components:

- Contact Information: Includes your name, business details, and client’s information.

- Service Description: A clear list of the services provided, including any special requests or additional tasks.

- Payment Terms: Outlines the amount due, due dates, and acceptable payment methods.

- Itemized Charges: Breaks down the total amount into individual services and fees, offering transparency.

- Tax Information: Necessary tax details based on your location and business regulations.

Using a well-prepared document is important not only for the financial side of your business but also for maintaining a professional reputation. Clients will appreciate the clarity and organization that comes with a properly structured document, which ultimately helps in building long-term business relationships.

Why Use an Invoice Template for Photography

Having a standardized document for requesting payment provides numerous benefits to photographers. It streamlines the entire process, from tracking work completed to managing client expectations. With a clear and organized format, you can avoid confusion and ensure that all necessary details are included, making the transaction smoother for both parties.

Efficiency and Time-Saving

Using a pre-designed structure significantly reduces the time spent on each billing process. Instead of creating a new document from scratch for every job, you can simply fill in the relevant details, allowing you to focus more on your creative work. The time saved can be redirected to other essential tasks, such as marketing or expanding your portfolio.

Professionalism and Accuracy

Presenting a polished and professional document shows clients that you take your business seriously. It helps in establishing credibility and trust. Additionally, a standardized format ensures that no important information is missed, minimizing errors and misunderstandings. Consistency in your billing also reinforces your reputation as a detail-oriented and reliable professional.

By incorporating a standardized billing format into your routine, you ensure both efficiency and professionalism, making your business operations much more effective and organized.

Key Features of an Effective Invoice

An effective billing document goes beyond just requesting payment; it serves as a comprehensive record of the services rendered and ensures smooth communication with clients. To be truly effective, the document must include essential details that leave no room for confusion and promote transparency. Whether for personal or business use, a well-crafted document simplifies the entire financial process for both the service provider and the client.

Clear Breakdown of Services

One of the most important aspects is a clear and concise description of the services provided. Each service should be listed separately with its corresponding cost. This makes it easy for clients to understand what they are paying for and helps avoid any disputes. Including details such as the date of service or any special requests ensures complete transparency.

Accurate Payment Terms

Payment terms should be clearly stated to avoid any confusion. This includes specifying the total amount due, the due date, accepted payment methods, and any late fees if applicable. Setting clear expectations for when payment is due helps in maintaining professional relationships and encourages timely payments. Additionally, including tax information and discounts, if any, ensures that the client understands the full financial picture.

By ensuring that all these components are included, you create a professional and transparent document that facilitates seamless financial transactions with your clients.

How to Customize Your Invoice Template

Customizing your billing document is an essential step to ensure it aligns with your unique business needs and reflects your brand identity. A personalized document not only improves professionalism but also makes the payment process easier for clients by including all necessary details. By tailoring the layout and content, you can make the document functional, aesthetically pleasing, and suited to your workflow.

Design and Layout Adjustments

Start by adjusting the design and layout to match your business style. Choose fonts, colors, and logos that reflect your branding. A clean and simple layout improves readability and ensures clients easily find key information like the amount due, payment methods, and services rendered. Consider using a clear, logical structure, with distinct sections for contact details, services, and payment terms.

Adding Personalization and Details

Incorporate personalized elements such as your business logo, specific service descriptions, and any standard pricing models you use. Make sure to include client-specific information such as their name, address, and job details, which can be easily added through digital tools or manual input. Including fields for customized notes or additional terms can also enhance the document’s relevance to each individual transaction.

By customizing your document, you not only ensure its functionality but also elevate the professionalism of your business communications, making each interaction with your clients more seamless and efficient.

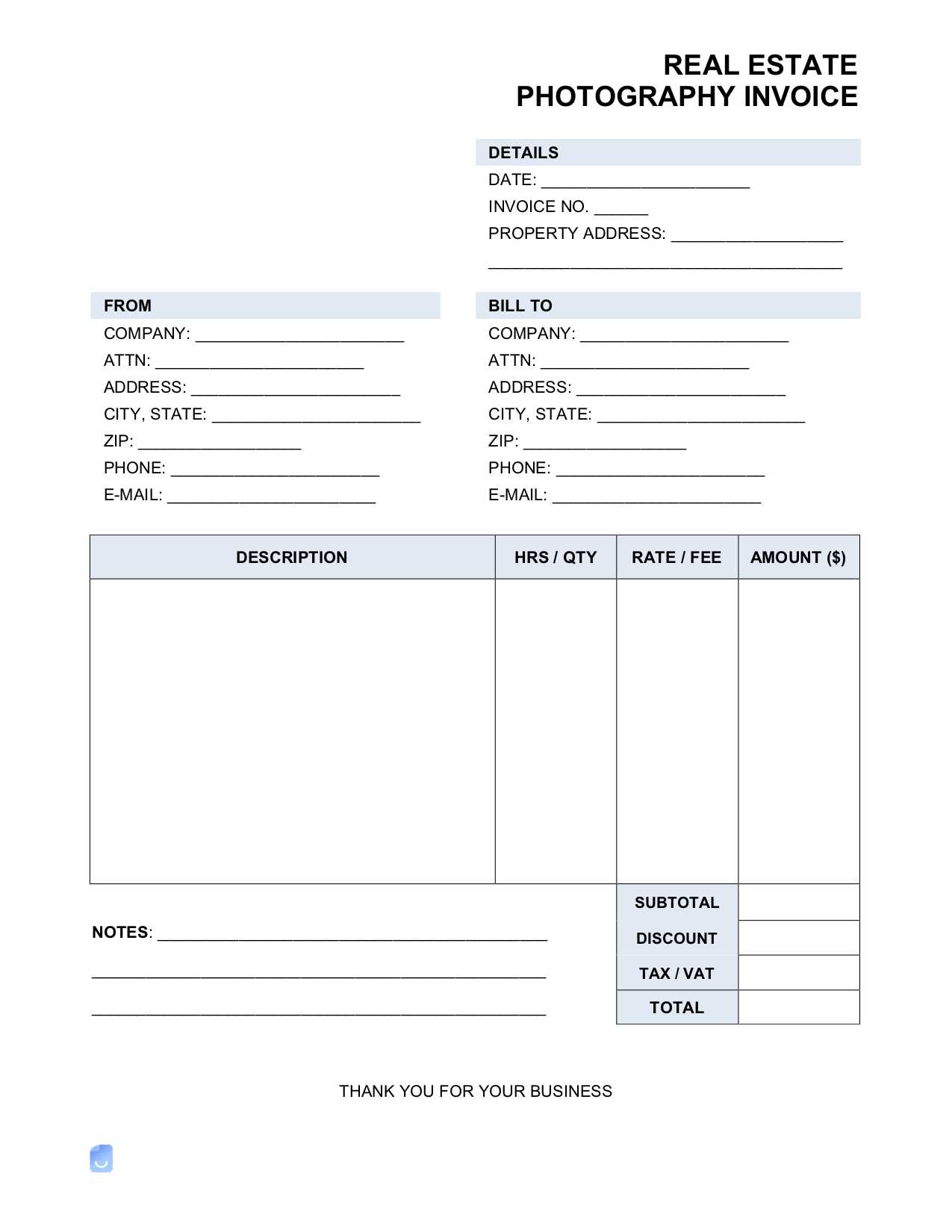

Essential Information for Real Estate Invoices

When creating a billing document for property-related services, it’s crucial to include all the necessary details to ensure clarity and accuracy. This not only helps streamline the payment process but also provides a clear record for both parties. A comprehensive document should cover the core elements that protect both the service provider and the client in any transaction.

At a minimum, the following details should always be included:

- Business and Client Information: Include the service provider’s name, business address, and contact information, along with the client’s name, address, and phone number. This ensures both parties are clearly identified.

- Detailed Service Descriptions: Provide a breakdown of the services rendered, including the type of work completed, the location, and the dates. This helps the client understand exactly what they are paying for.

- Charges and Fees: Include the total amount due, as well as an itemized list of individual costs. For transparency, specify hourly rates, flat fees, or additio

Benefits of Using Digital Invoices

Switching to digital billing offers numerous advantages over traditional paper-based methods. Not only does it simplify the entire process, but it also enhances efficiency, reduces errors, and streamlines communication with clients. Digital documents are quicker to send, easier to track, and can be stored and retrieved with minimal effort, making them a smart choice for modern businesses.

Some of the key benefits of using digital documents include:

- Faster Delivery: Digital documents can be sent instantly via email, ensuring that your clients receive their bills promptly, no matter where they are located.

- Environmentally Friendly: By eliminating paper and reducing the need for physical transportation, you are contributing to a more sustainable business model.

- Improved Organization: Storing digital files is much easier than keeping physical records. You can organize, search, and access your documents quickly with just a few clicks, reducing the risk of losing important information.

- Enhanced Accuracy: Digital tools often include features like automated calculations and error-checking, which can help eliminate common mistakes, ensuring that your billing is precise.

- Easy Tracking and Reporting: With digital records, you can easily track the status of payments, generate reports, and keep tabs on your financials without the hassle of manual entry or paperwork.

Overall, using digital documents not only makes billing more efficient but also allows you to maintain a professional image while keeping your workflow organized and cost-effective.

Common Mistakes in Photography Invoices

When creating a billing document, it’s easy to overlook certain details that can lead to confusion or payment delays. Small errors in your document can make the process more complicated for both you and your clients. Understanding these common mistakes can help you avoid them and ensure smoother transactions moving forward.

Some of the most frequent mistakes include:

- Missing or Incorrect Contact Information: Failing to include accurate details such as your business name, client name, or contact information can delay communication and cause confusion regarding who is responsible for the payment.

- Lack of Itemization: Not breaking down the charges for services provided can lead to misunderstandings. Always ensure that you clearly list each service and its corresponding fee, so the client knows exactly what they’re paying for.

- Vague Payment Terms: If your payment terms are unclear or missing, clients may not know when the payment is due or how to submit it. Always specify the payment due date, preferred methods, and any late fees.

- Forgetting to Include Tax Information: Depending on your location and service, taxes may be applicable. Omitting tax details can cause issues when it comes time for clients to make payments or file their own records.

- Inconsistent Formatting: An inconsistent layout or messy document can look unprofessional and make it harder for clients to find the important details. Maintain a clean, organized, and easy-to-read format.

Avoiding these common errors will not only improve the accuracy of your billing process but also enhance your professionalism in the eyes of your clients.

Choosing the Right Invoice Format

Selecting the appropriate format for your billing document is a key step in ensuring smooth communication with clients and maintaining an efficient workflow. The format you choose should make the process of sending and receiving payments simple, professional, and adaptable to your business needs. Whether you prefer digital or printed versions, the right format can significantly improve the experience for both you and your clients.

Considerations for Selecting the Right Format

When deciding on the best format for your billing document, keep in mind the following factors:

- Client Preferences: Some clients may prefer receiving documents digitally via email, while others may request a printed version for their records. Knowing your client’s preferences can help you choose the best format.

- Ease of Use: The format should be easy for both you and your clients to use. Choose a style that allows for quick customization, clear descriptions of services, and accurate calculations.

- Consistency: Consistent formatting across all your documents helps maintain a professional image. Whether you choose a digital or physical format, ensure that the layout is cohesive and easy to understand.

Digital vs. Paper Formats

There are two main options when it comes to formats: digital and paper. Each has its pros and cons:

- Digital Formats: Digital billing is faster, more cost-effective, and easier to store. It also allows for easier tracking and integration with accounting software. Common digital formats include PDF, Excel, and specialized billing software.

- Paper Formats: Physical documents are still necessary for clients who prefer hard copies. While they are more time-consuming to send and store, they can be more personal and tangible for some clients.

Ultimately, the right format depends on your workflow, client needs, and business model. By understanding these factors, you can choose a format that maximizes efficiency and professionalism.

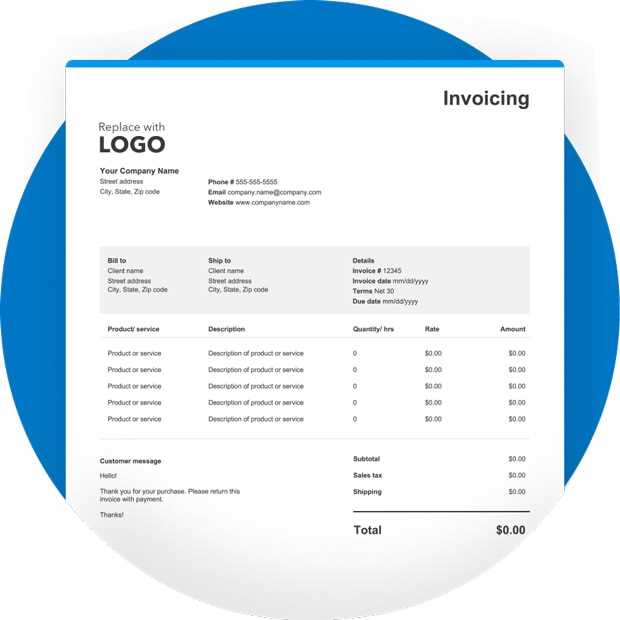

Creating a Professional Invoice Design

Designing a professional billing document is essential for presenting a polished and trustworthy image to your clients. A well-designed document not only makes a positive impression but also ensures clarity and ease of understanding. When creating a layout, it’s important to strike a balance between aesthetics and functionality, making sure that all the essential information is easily accessible.

Key Elements of a Professional Design

To achieve a professional look, consider the following elements when creating your billing document:

- Branding: Include your business logo, color scheme, and fonts that align with your brand identity. This adds a personal touch and reinforces your professional image.

- Clear Layout: Keep the layout clean and organized. Group related information together, such as your contact details, service description, and payment terms, so clients can easily navigate through the document.

- Readable Fonts: Use simple and readable fonts, such as Arial or Helvetica, ensuring that the text is legible both on screen and in print.

- Space for Notes: Include a section for any additional comments, instructions, or personalized notes for your clients. This adds a personal touch while ensuring your communication is clear.

- Professional Footer: Incorporate your business contact information or a tagline in the footer. This ensures clients know how to reach you if they have questions or need further assistance.

Keeping it Simple and Functional

While design is important, functionality should always come first. Avoid overcrowding the document with unnecessary graphics or overly complex layouts. The focus should be on the information being presented. A simple, well-structured document will make it easier for your clients to understand the charges and take action accordingly.

By focusing on clarity, simplicity, and alignment with your brand, you can create a document that is both professional and effective, helping to foster positive relationships with clients.

How to Set Your Photography Rates

Setting the right pricing for your services is essential for maintaining a profitable business while staying competitive in the market. Your rates should reflect the value you offer, your level of experience, and the costs associated with running your business. Establishing clear and fair pricing helps build trust with clients and ensures you are compensated appropriately for your time and expertise.

When determining your rates, it’s important to consider several factors, including your skill level, the type of service, and industry standards. Here’s a simple guide to help you set your prices:

Factor Considerations Skill and Experience Higher rates are usually justified by greater expertise, a larger portfolio, and more years of experience. Consider increasing your pricing as your skill set expands. Service Type Different services (e.g., commercial, residential, or event shoots) may require different rates. Ensure that your pricing reflects the complexity and time commitment of each type of job. Equipment and Costs Factor in the costs of your equipment, software, travel, and any other overhead. Your pricing should cover these costs and still provide a profit margin. Market Rates Research competitors in your area to see what others are charging. Aim to remain competitive while also ensuring you don’t undervalue your services. Client Type Pricing may vary depending on whether you are working with individual clients, agencies, or large corporations. Large projects or corporate clients often have larger budgets, allowing for higher rates. Once you’ve determined these factors, create a clear and simple pricing structure. You can choose to charge hourly, per project, or offer package deals, depending on the type of service and client preference. Make sure to communicate your rates clearly in your billing documents to avoid any misunderstandings.

Setting the right pricing is an ongoing process. As your business grows, revisit your rates regularly to ensure they reflect your current expertise, market demand, and costs. By doing so, you can build a sustainable business that is both profitable and competitive.

Invoice Payment Terms and Conditions

Clearly defined payment terms are essential for ensuring that both you and your clients understand the expectations regarding payments. These terms not only help set clear deadlines for when payments are due but also protect your business in case of delayed or missed payments. By including specific conditions, you ensure smooth financial transactions and maintain professional relationships with your clients.

Common Payment Terms to Include

When drafting payment terms, make sure to include the following essential information:

- Due Date: Clearly specify when the payment is expected, whether it’s immediately, within 30 days, or according to another agreed-upon timeline.

- Accepted Payment Methods: List the payment methods you accept, such as bank transfers, credit cards, PayPal, or checks, to give clients flexibility in making payments.

- Late Fees: Include any penalties or interest that will apply if the payment is not made on time. This encourages prompt payment and compensates for delays.

- Discounts for Early Payments: Offering a small discount for early payment can be an effective incentive to ensure timely transactions.

- Refund Policy: Specify whether you offer refunds for canceled projects or services and under what conditions.

Additional Considerations

Besides the standard payment details, you may also want to include clauses that protect your business in specific situations. These might include terms for:

- Non-Payment: State the steps that will be taken in the event of non-payment, such as sending reminders, pausing work, or pursuing legal action if necessary.

- Dispute Resolution: Define how disputes related to the payment will be resolved, whether through direct negotiation or third-party mediation.

Having clear and concise payment terms in place is crucial to maintaining a professional image and avoiding misunderstandings. By laying out these conditions upfront, you establish trust and ensure that financial matters are handled smoothly.

How to Track Invoice Payments

Tracking payments for the services you’ve provided is crucial for maintaining accurate financial records and ensuring you receive timely compensation. Without a solid system in place, it can be easy to lose track of who has paid, who hasn’t, and what amounts are outstanding. Implementing an effective tracking method helps you stay organized and reduces the risk of missed payments or confusion with clients.

There are several ways to monitor payment status, depending on your preference and the scale of your business:

- Manual Record Keeping: One simple approach is to maintain a spreadsheet that lists all payments. Include columns for invoice numbers, due dates, amounts, and payment status. As payments are made, update the sheet accordingly. This method is low-tech but can work well for small operations.

- Accounting Software: For a more automated solution, use accounting software that integrates payment tracking. Many platforms can automatically update the status of your invoices once payments are received, and they offer reminders for overdue bills. Popular tools include QuickBooks, FreshBooks, and Xero.

- Bank Statements: If you prefer to track payments through your bank, regularly review your statements and match incoming payments with outstanding balances. Some accounting platforms also link directly to your bank account, simplifying this process.

In addition to these methods, it’s essential to send timely payment reminders and keep open communication with your clients. By following up on overdue amounts and staying consistent with your tracking system, you can reduce the chances of missed payments and keep your finances in order.

Client Communication and Invoices

Effective communication with your clients is essential when it comes to billing. Clear, timely, and professional communication ensures that both you and your clients are on the same page regarding services rendered, payment terms, and due dates. By establishing open lines of communication, you not only build trust but also minimize misunderstandings and ensure prompt payment.

Here are some key practices for managing client communication related to billing:

- Setting Expectations Early: From the outset, discuss and agree on payment terms with your clients. Make sure they understand when and how they will be billed, what the payment deadlines are, and what methods of payment are accepted. This sets the foundation for clear communication later on.

- Sending Clear and Detailed Documents: When you send your billing statement, ensure that it is clear, concise, and contains all the necessary details. A well-organized document helps avoid confusion and makes it easier for clients to process the payment.

- Sending Payment Reminders: Don’t hesitate to send reminders if the payment deadline is approaching or has passed. A polite reminder can help ensure that clients don’t forget to pay. Automated reminders through accounting software can save you time and effort.

- Being Available for Questions: If clients have questions about the billing document, be responsive and ready to provide clarification. This helps maintain a positive relationship and ensures that no misunderstandings arise regarding the charges.

- Following Up on Overdue Payments: If payments are delayed, follow up promptly. A courteous but firm message about overdue amounts shows that you value timely payment without damaging the client relationship.

By maintaining open and professional communication throughout the billing process, you can ensure that payments are made on time and that your clients remain satisfied with the services provided.

Legal Considerations for Photography Invoices

When managing billing for your services, it’s essential to be aware of the legal aspects to ensure that your documents are enforceable and comply with applicable laws. Legal considerations help protect both you and your clients in case of disputes, ensuring that payment terms, rights, and responsibilities are clearly outlined and understood.

Key Legal Elements to Include

To safeguard yourself legally, make sure your billing document includes the following elements:

- Clear Payment Terms: Specify the due date, accepted payment methods, and any applicable late fees. Clearly outline the consequences of non-payment, such as the suspension of services or legal action.

- Service Agreement: Include a reference to the service contract or agreement under which the work was completed. This helps clarify the expectations and scope of work agreed upon by both parties.

- Ownership and Copyright: Define the ownership of the delivered work and any usage rights granted to the client. This is crucial, especially in creative fields, where intellectual property can be a significant point of contention.

- Taxes and Fees: Ensure that any relevant taxes, such as sales tax or VAT, are included in the billing document. Failure to account for these could lead to legal and financial complications down the line.

- Refund and Cancellation Policy: State your policy regarding cancellations, refunds, and rescheduling. This protects both parties in case of changes or disputes regarding the scope of work.

Protecting Your Business

In addition to including key legal clauses in your documents, it’s important to maintain organized records of all communications, contracts, and payments. This can serve as evidence should a legal dispute arise. If you are unsure about any of the legal aspects, consulting with a legal professional is a smart investment to ensure compliance with local regulations.

By taking these legal considerations into account, you help protect your business and create a more transparent and professional relationship with your clients.

Integrating Invoices with Accounting Software

Integrating your billing process with accounting software can streamline your business operations, ensuring that all financial data is accurately tracked and easily accessible. By automating the flow of information between your billing system and accounting tools, you save time, reduce the chance of human error, and gain deeper insights into your financial health.

Using software that integrates directly with your payment records offers numerous advantages, from simplifying tax preparation to providing real-time updates on outstanding balances. With this integration, you can keep your accounting organized and up-to-date without needing to manually enter data.

Benefits of Integration

- Time Efficiency: Automatic syncing of billing information into your accounting system eliminates the need for double entry, saving you time and effort.

- Accuracy: Automated systems reduce the risk of errors in tracking payments, ensuring that your financial records are precise and reliable.

- Improved Cash Flow Management: Integration allows you to track unpaid amounts and send reminders to clients more easily, helping you stay on top of cash flow.

- Tax Readiness: Accounting software that integrates with your billing system can generate detailed reports, simplifying the process of tax filing and reducing the chance of mistakes.

- Reporting and Insights: Integrated systems offer powerful reporting tools, allowing you to analyze trends, monitor outstanding payments, and forecast future income.

How to Set Up Integration

To integrate your billing system with accounting software, follow these steps:

- Select Your Software: Choose accounting software that fits your business needs. Popular options include QuickBooks, Xero, and FreshBooks.

- Connect Your Billing System: Many accounting platforms offer direct integration with common billing tools. Follow the software’s instructions to sync your payment records.

- Set Up Automation: Automate tasks like sending payment reminders or generating reports to minimize manual work and ensure consistency.

- Monitor and Adjust: Regularly check your integration to ensure that data is syncing correctly and make adjustments as needed to optimize performance.

By integrating your billing process with accounting software, you enhance the overall efficiency and accuracy of your financial management, allowing you to focus more on growing your business.

How to Handle Late Payments in Photography

Late payments are an unfortunate reality for many service-based businesses, and managing them effectively is essential for maintaining healthy cash flow. Addressing delayed payments professionally helps preserve client relationships while ensuring that your business operations are not disrupted. Knowing how to handle late payments can also help you establish a reputation for professionalism and reliability.

Here are a few key strategies for managing late payments in your business:

- Set Clear Payment Terms: Before any work begins, ensure that your clients understand your payment expectations. This includes specifying due dates, accepted payment methods, and any penalties for late payments. Clear terms help set the stage for timely payments and reduce confusion later on.

- Send Friendly Payment Reminders: If a payment is overdue, send a gentle reminder. Sometimes, clients may simply forget or overlook the due date. A polite email or message can help bring their attention to the matter without causing tension.

- Implement Late Fees: Including a late fee clause in your payment terms can encourage clients to pay on time. Make sure your fee structure is reasonable and clearly communicated upfront, so clients are aware of the consequences for missing deadlines.

- Offer Flexible Payment Options: If a client is experiencing financial difficulties, offering flexible payment plans or alternative payment methods can be a good way to resolve the situation while maintaining a positive relationship.

- Follow Up Regularly: If the payment continues to be delayed, follow up consistently. Regular reminders can serve as a gentle push to ensure the payment is processed and show that you are serious about your terms.

- Know When to Get Legal Help: If a payment remains unresolved for an extended period, it may be time to seek legal assistance. Sending a formal letter from a lawyer or involving a collection agency should be a last resort but can help you recover outstanding amounts when necessary.

By addressing late payments quickly and professionally, you can minimize the impact on your business while still maintaining positive relationships with clients. Setting clear terms, communicating effectively, and knowing when to take action are all vital in managing this common challenge.

Tips for Efficient Invoice Management

Managing billing documents efficiently is crucial for maintaining a smooth and organized business operation. An efficient approach ensures that you can track payments, avoid errors, and reduce the time spent on administrative tasks. By implementing a few key strategies, you can streamline your process and keep your financial records in order.

Here are some practical tips to help you manage your billing system more effectively:

- Automate Wherever Possible: Using accounting software to automate the generation, sending, and tracking of billing documents can save time and reduce errors. Automation can also help you send timely reminders for upcoming or overdue payments.

- Organize Your Records: Keep a well-organized digital or physical record of all documents related to billing. Categorize them by client, date, or project, and ensure you have easy access to past records in case of discrepancies or audits.

- Use Clear and Consistent Formats: Adopt a standardized format for all your documents. This consistency makes it easier to spot discrepancies and allows clients to quickly understand the terms and details of the charges.

- Set Payment Deadlines: Clearly communicate payment due dates upfront, and ensure that they are included in every billing document you send. Establishing deadlines helps clients know when to pay and reduces the likelihood of delays.

- Implement Regular Follow-Ups: Don’t wait too long to follow up on overdue payments. Set a routine for checking unpaid balances and sending reminders in a timely manner to avoid cash flow disruptions.

- Track Payments and Outstanding Balances: Always monitor and update the status of payments. Keep track of what has been paid and what is still outstanding. This will help you avoid missing payments and ensure that all accounts are settled in a timely manner.

- Store Backup Copies: Always maintain backup copies of your billing records. Whether it’s digital or physical, ensuring that you have multiple copies of important documents will provide added security and peace of mind.

By applying these tips to your workflow, you can improve your overall efficiency, reduce administrative stress, and ensure your business finances remain on track. Efficient management of billing documents is key to maintaining financial health and fostering strong client relationships.

How to Use Invoices to Build Client Trust

Billing documents can serve as powerful tools to establish and nurture trust with your clients. When managed well, they not only ensure smooth financial transactions but also reflect your professionalism, transparency, and reliability. A clear, well-structured billing system can help you build stronger, more positive relationships with clients, fostering trust that can lead to repeat business and referrals.

Here are several ways you can use billing documents to enhance client trust:

- Be Transparent with Charges: Always provide a detailed breakdown of the services rendered and the costs associated with each. This clarity helps clients feel confident in what they are paying for, eliminating any ambiguity or potential misunderstandings.

- Stick to Agreed Terms: Consistency is key to building trust. Ensure that the payment terms and conditions you include in your billing documents align with what was discussed and agreed upon at the beginning of the project. Adhering to these terms demonstrates your reliability and professionalism.

- Maintain Professionalism: A clean, organized, and professional-looking document reflects positively on your business. It shows that you care about the details and that you are a serious professional. Invest in creating clear, polished documents that clients will appreciate.

- Provide Timely Billing: Send your billing documents promptly once the work is completed or as per the agreed schedule. Timeliness is essential in building credibility. Clients will appreciate your efficiency and are more likely to pay on time when they see your commitment to professionalism.

- Offer Flexible Payment Options: Provide different payment methods to make the process convenient for your clients. Whether it’s through credit card, bank transfer, or online payment systems, accommodating your clients’ preferred methods of payment shows that you are client-centric and adaptable.

- Include Clear Payment Instructions: Make it easy for your clients to pay by clearly outlining payment methods, due dates, and any necessary steps. This reduces confusion and ensures that there are no delays caused by unclear instructions, reinforcing your image as a trustworthy business.

- Follow Up with Professional Reminders: If a payment is delayed, send a polite and professional reminder. Reminders should be courteous and respectful, showing that you trust the client but also expect timely payment. How you handle overdue payments speaks volumes about your professionalism and respect for your clients.

By applying these practices to your billing process, you can turn routine financial transactions into opportunities to demonstrate your professionalism, reliability, and commitment to client satisfaction. Building trust through transparent and efficient billing ultimately strengthens your business and fosters long-term relationships with clients.