Real Estate Commission Invoice Template for Agents and Brokers

When managing transactions in the property industry, it’s crucial to have a reliable system for handling payments. A well-organized billing structure ensures that all parties involved are compensated fairly and promptly. Whether you’re working as a real estate agent, a broker, or a consultant, having an efficient method to track and manage your earnings is essential for maintaining professionalism and financial transparency.

With a standardized document for requesting payments, you can streamline your accounting processes and avoid confusion. These tools help outline the necessary details of the transaction, including services provided, payment due, and deadlines for settlement. By using an easy-to-customize form, you ensure consistency in your transactions while saving valuable time on administrative tasks.

Adopting a clear and structured approach to payment requests will not only improve your workflow but also enhance your reputation in the industry. In the following sections, we will explore how to craft an effective payment request and the key elements to include for a smooth financial transaction.

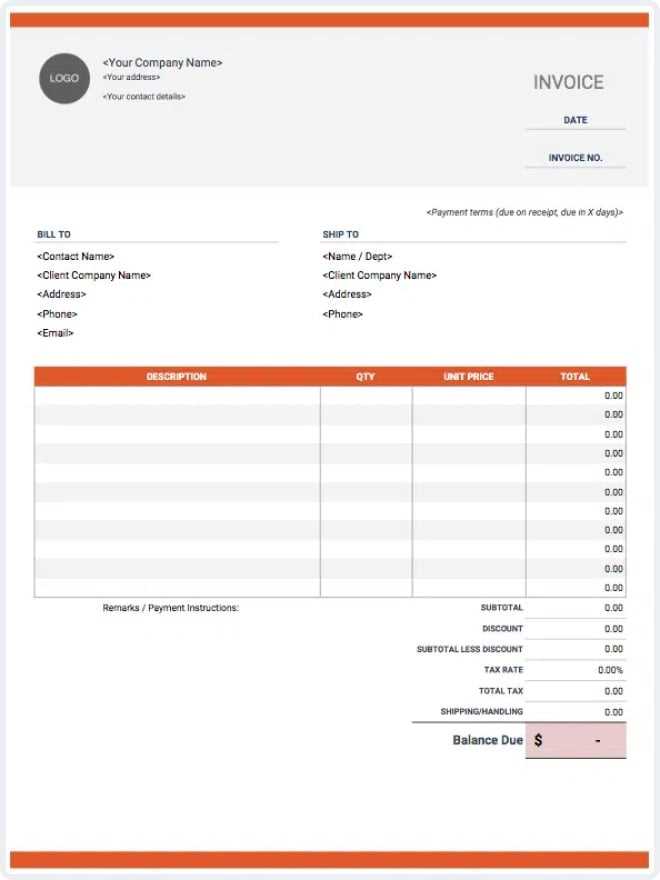

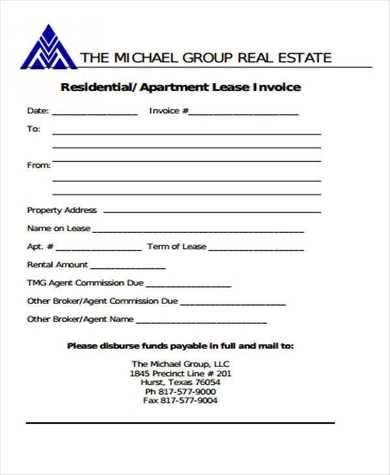

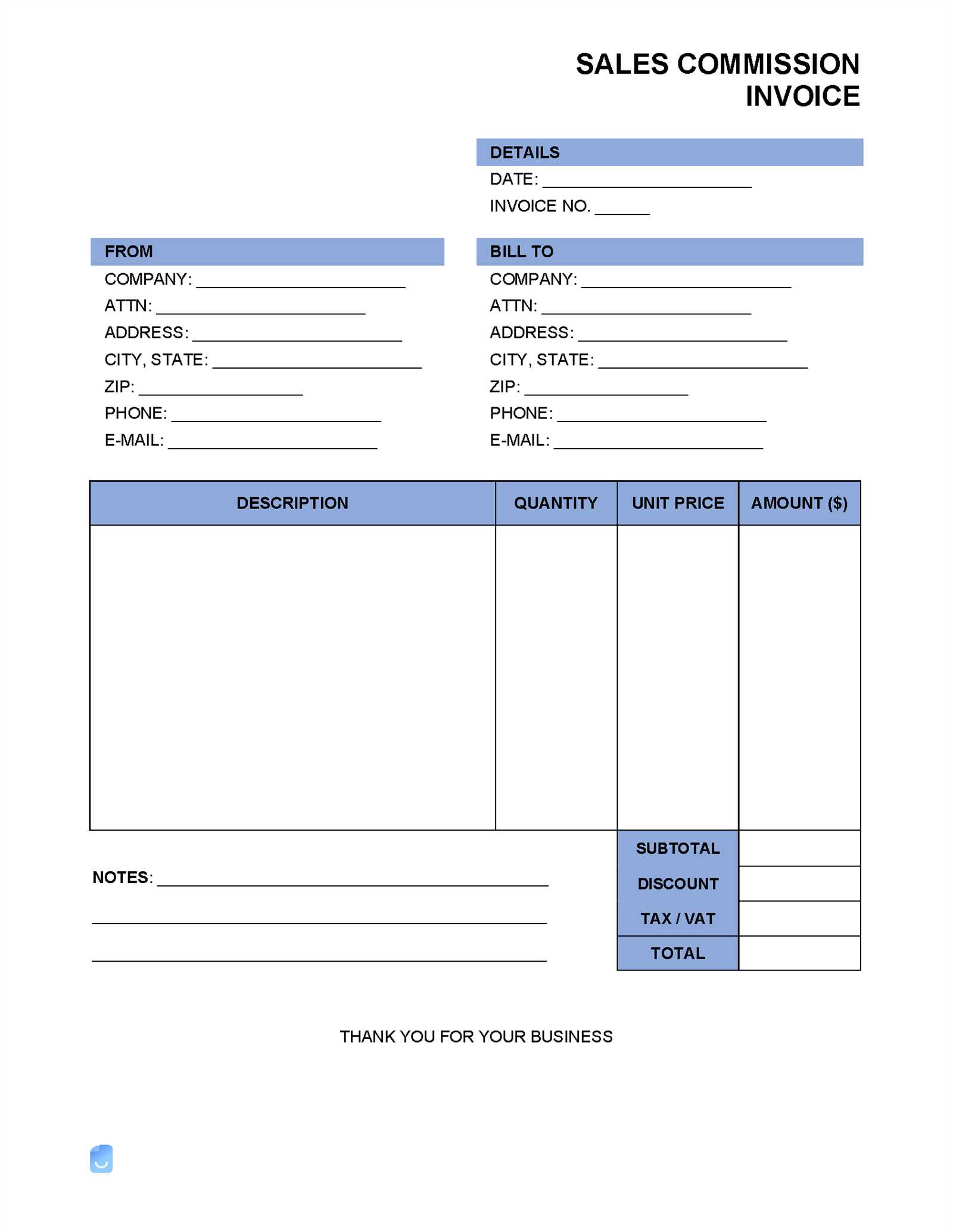

Real Estate Commission Invoice Template

When managing transactions in the property sector, having a standardized document for requesting payments is essential. Such a document simplifies the billing process, ensuring that all relevant details are captured clearly and accurately. By using an easy-to-fill-out structure, professionals can save time and avoid errors when seeking compensation for their services.

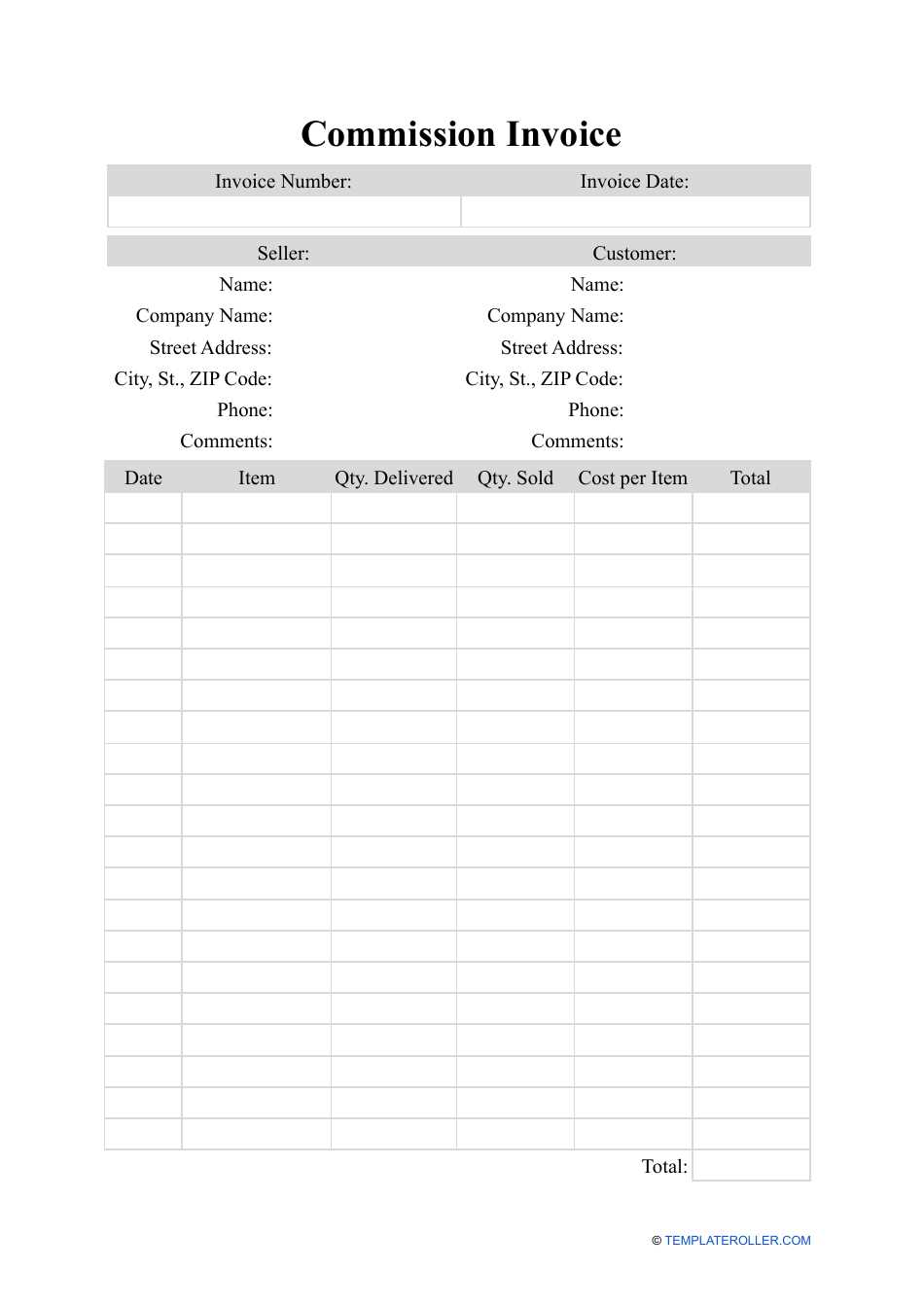

Key Elements of a Payment Request Document

To create a comprehensive payment request, certain essential details should always be included. These components help to ensure clarity and avoid potential misunderstandings between parties involved in the transaction.

- Sender Information: Include the name, address, and contact details of the person or agency requesting payment.

- Recipient Information: Clearly list the buyer or client receiving the services, along with their contact information.

- Description of Services: Provide a detailed breakdown of the services rendered, including specific tasks performed.

- Payment Amount: Clearly indicate the total amount due for the services, along with any applicable rates or percentages.

- Due Date: Include the payment deadline to ensure timely transactions.

- Terms and Conditions: Outline any special conditions, including late fees or payment schedules.

Benefits of Using a Standardized Document

Utilizing a standardized structure for payment requests offers several advantages, both for professionals and their clients:

- Clarity: With all relevant information in one place, there’s no confusion about what’s being requested.

- Time-Saving: A ready-made document means less time spent on creating each request from scratch.

- Professionalism: Consistency in documentation creates a professional image and can enhance trust with clients.

- Accuracy: Standardizing the process reduces the risk of mistakes or missed information.

Why Use a Commission Invoice Template

Efficiently managing payment requests is essential for any professional working in property transactions. A standardized document helps streamline the billing process, reduces errors, and ensures all necessary details are included in each request. By relying on a pre-designed structure, individuals and agencies can handle payments more efficiently and maintain a higher level of professionalism.

Consistency and Accuracy

One of the main advantages of using a standardized document is the consistency it provides. Each payment request follows the same format, ensuring that all important information is consistently presented. This reduces the chance of missing key details and helps maintain accuracy throughout the entire process.

- Standardized Layout: A consistent format makes it easier for both the sender and recipient to understand the request.

- Reduced Risk of Errors: By following the same template each time, you eliminate common mistakes like missing amounts or incorrect dates.

Time and Efficiency Benefits

Using a ready-made structure not only saves time but also improves workflow efficiency. Instead of creating a new payment request from scratch for each transaction, professionals can quickly fill in the necessary details and send the request. This makes managing multiple transactions or clients more manageable.

- Quick Setup: A pre-built document reduces the time spent on drafting each request.

- Faster Processing: With everything in place, clients can process payments faster, leading to quicker settlement times.

How to Customize Your Invoice

Customizing a billing document allows you to tailor it to specific transactions or client needs. By adjusting key sections, you ensure that all relevant details are captured and presented clearly. Personalization helps reflect the nature of the services provided and can also ensure compliance with industry standards or legal requirements.

Essential Details to Include

To make your billing request complete and professional, certain sections must be customized for each transaction. These sections vary based on the type of services provided but generally include the following:

- Client Information: Customize the document to include the full name, address, and contact details of the person or business being billed.

- Service Description: Clearly outline the tasks or services provided, specifying the nature of the work and the time spent, if applicable.

- Payment Amount: Adjust the payment details, including the total due, hourly rates, or any agreed-upon percentage for the transaction.

- Due Date: Customize the deadline for payment, considering your terms and the client’s expectations.

- Special Terms: If applicable, add any conditions such as late fees, installment options, or discounts.

Designing for Clarity and Professionalism

It’s important that the layout of your billing document is clear and easy to understand. A well-organized document ensures that clients can quickly locate the information they need. Here are a few design tips:

- Use Clear Fonts: Choose legible fonts and sizes to ensure easy readability.

- Separate Sections: Break up different sections (e.g., service details, payment breakdown, terms) with headers or lines for clarity.

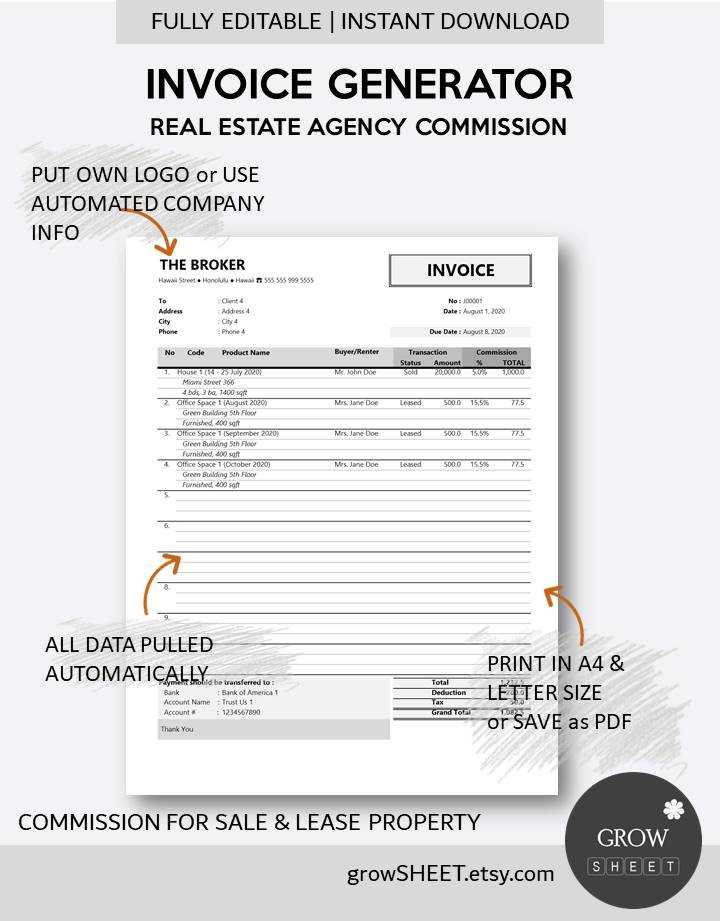

- Branding: Add your logo or business name to maintain a professional image.

Essential Information for Commission Invoices

For any payment request document, it’s crucial to include all necessary information to ensure clarity and avoid confusion. By providing detailed and accurate data, both the service provider and the client will have a clear understanding of the terms, amounts, and expectations. Without the right information, delays or disputes can arise, so including the following key elements is vital for smooth transactions.

The most important details to include are those that identify both parties involved, outline the services performed, and specify the agreed-upon payment structure. Additionally, providing clear terms for payment deadlines, penalties, and other conditions will ensure both parties are on the same page. Each of these components helps streamline the process and reduces the likelihood of misunderstandings.

- Client and Provider Information: Include the full names, addresses, and contact details of both the person issuing the request and the one receiving the services.

- Description of Services: Clearly outline the tasks completed or services rendered, including dates, quantities, and any other relevant specifics.

- Amount Due: State the total amount due for the services, clearly broken down by rates or agreed percentages, as applicable.

- Payment Terms: Include payment due dates, any installment plans, or conditions related to early payment or late fees.

- Special Conditions: Mention any additional terms or provisions that are important for the agreement, such as cancellation policies or additional fees.

Benefits of Using Invoice Templates

Using a standardized document for payment requests provides several advantages that enhance both efficiency and professionalism. By adopting a consistent format, professionals can streamline their billing process, reduce the risk of errors, and save valuable time. This approach also fosters trust with clients and helps ensure that all necessary information is included in every transaction.

Here are some key benefits of using a pre-designed structure for payment requests:

| Benefit | Description |

|---|---|

| Time-Saving | Ready-made documents eliminate the need to create payment requests from scratch, allowing for quicker generation and dispatch. |

| Consistency | Using the same format for all transactions ensures that every detail is presented uniformly, which reduces confusion for clients. |

| Professional Appearance | Well-organized and polished documents give a professional impression, improving the credibility of your business. |

| Accuracy | With a set structure, important details are less likely to be overlooked, helping to avoid mistakes in amounts or terms. |

| Customization | Templates can be easily adjusted to suit specific services or client requirements while maintaining a consistent format. |

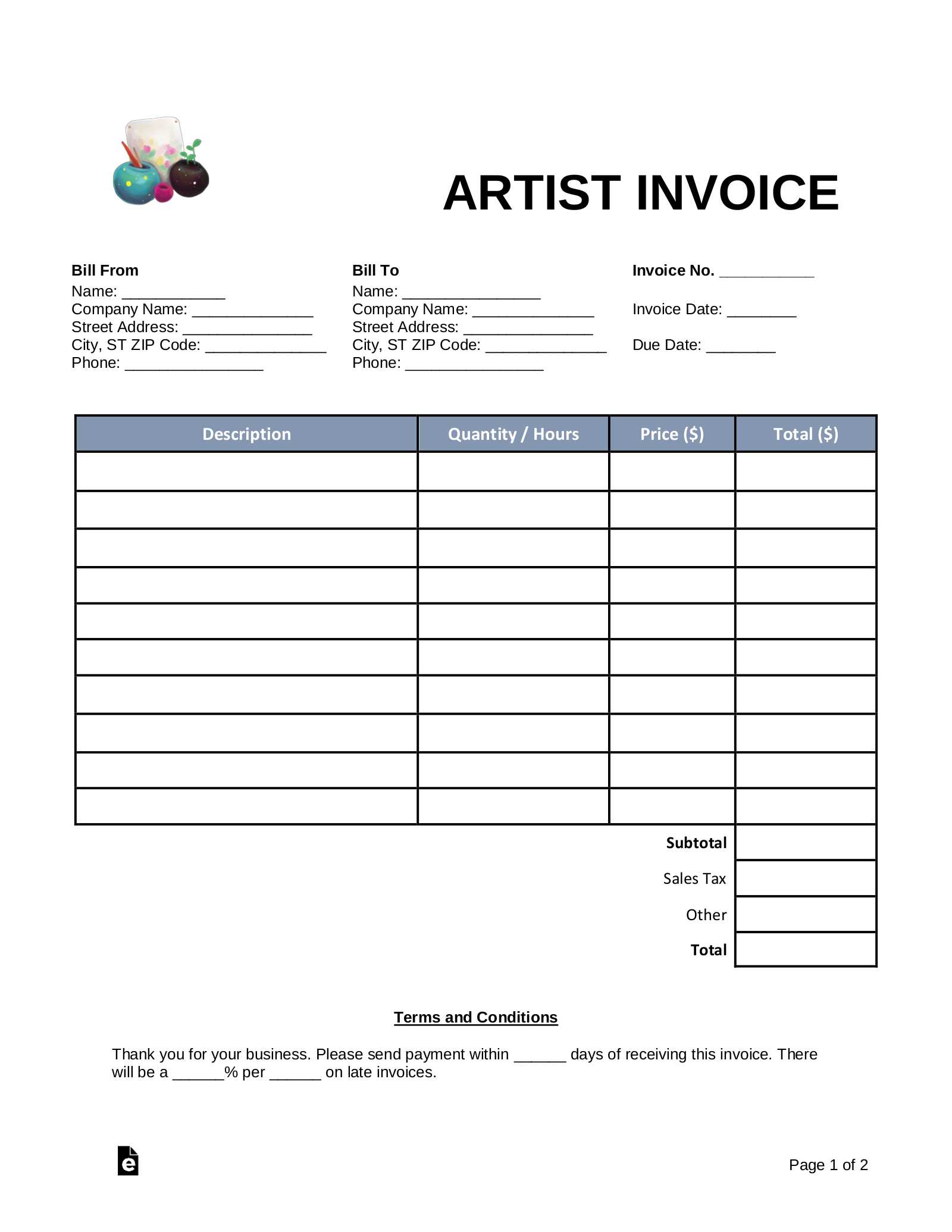

Free Real Estate Invoice Templates

There are many free resources available online that provide ready-made billing documents for professionals in the property industry. These no-cost options allow you to streamline your payment requests without the need for expensive software or complex designs. Free documents can be easily downloaded and customized to suit your specific needs, saving both time and money.

Where to Find Free Templates

Many websites offer downloadable versions of payment request documents at no cost. These resources typically feature simple, user-friendly designs that can be edited in common programs like Microsoft Word, Google Docs, or Excel. Some of the most popular platforms include:

- Template Websites: Websites like Template.net and Invoice Simple offer a variety of free options, often tailored to different types of professionals.

- Google Docs and Sheets: Google’s free suite of tools provides customizable templates that can be edited directly in your browser without the need for additional software.

- Microsoft Office: Both Word and Excel have free downloadable options available in their template gallery, offering a variety of layouts and formats.

Advantages of Free Templates

Using free documents has several advantages, especially for those just starting in the property industry or those looking to simplify their processes without investing in costly solutions.

- No Cost: These documents are free to download, making them accessible for individuals or small businesses with limited budgets.

- Ease of Use: Most free templates are designed to be intuitive and easy to customize, allowing users to quickly tailor them to their needs.

- Variety of Formats: Many free resources offer different formats, from basic text documents to more detailed spreadsheets, ensuring a solution that fits your specific preferences.

- Time Efficiency: By using an already-designed structure, you can avoid having to create a new document from scratch each time a payment request is needed.

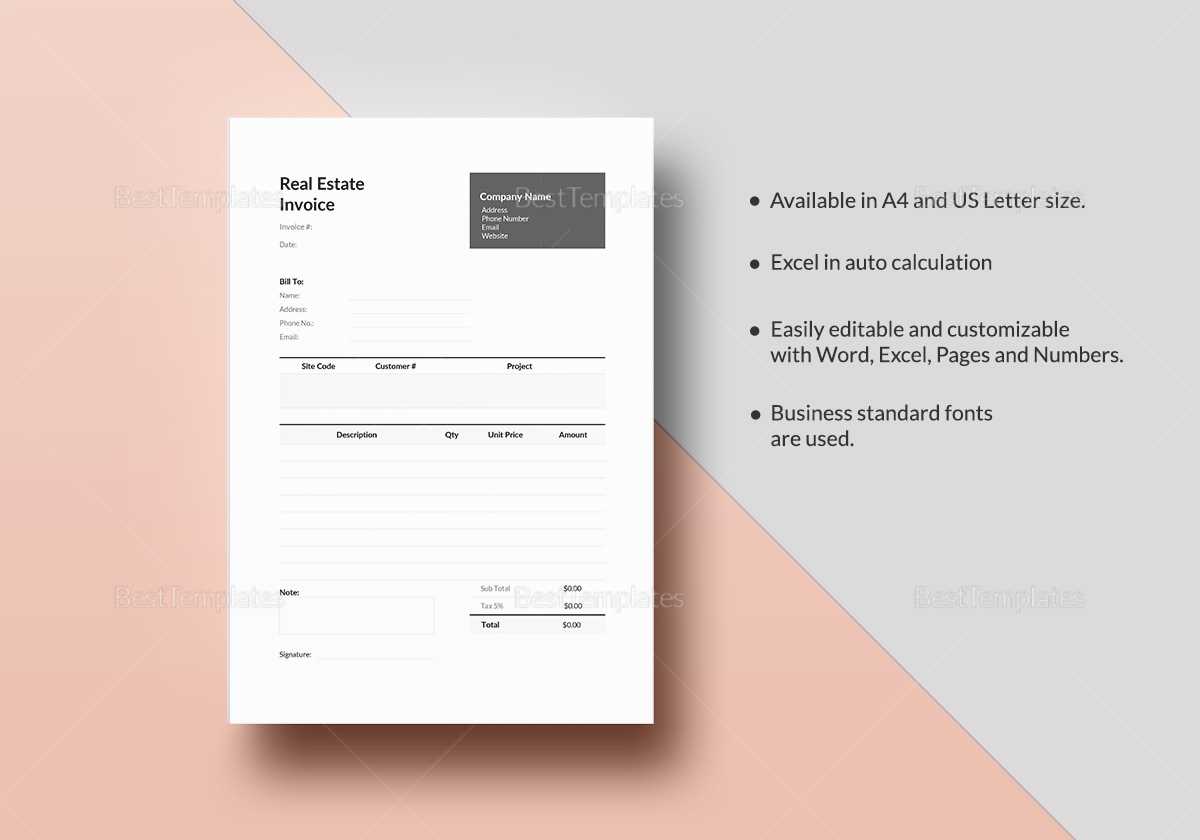

Choosing the Right Invoice Format

Selecting the correct format for your payment request documents is crucial for ensuring clarity, professionalism, and ease of use. The format should align with the nature of the transaction and the expectations of your clients. Whether you opt for a simple text document or a more detailed spreadsheet, the key is to provide all necessary information in a clear and organized manner.

Factors to Consider When Choosing a Format

Before deciding on a format, consider the complexity of the services you provide and how much detail needs to be included in the document. For straightforward transactions, a basic text layout may suffice, but more complex deals may require a detailed breakdown of rates, percentages, and services rendered. The right format should help you present this information in an easily digestible way.

| Format | Best For | Advantages |

|---|---|---|

| Text Document | Simple transactions, small businesses, individual professionals | Easy to create, customizable, accessible on most platforms |

| Spreadsheet | Detailed breakdowns, large transactions, recurring payments | Clear itemization, automatic calculations, easy to track payments |

| Professional transactions, official records | Fixed format, ensures consistency, easy to share securely | |

| Online Tools | Quick generation, tech-savvy users, automated billing | Fast, often integrated with payment systems, customizable |

When to Use Each Format

Understanding when to use each format will help ensure that you are providing your clients with the most effective and professional documentation. For straightforward transactions or clients who prefer simplicity, a text document is often the best choice. However, for more complex transactions involving multiple services or extended payment terms, a spreadsheet or online tool might be the better option due to its ability to handle detailed itemizations and automatic calculations.

How to Calculate Real Estate Commission

Calculating compensation for services rendered in property transactions typically involves determining a percentage of the sale price. This process ensures that professionals are fairly compensated for their work, and it’s important to understand the correct method of calculation. By following a few straightforward steps, you can accurately determine the payment amount for each transaction.

Steps for Calculating Payment

To calculate the amount owed for services, start by identifying the total sale price and the agreed-upon percentage for the payment. Here are the general steps:

- Determine the Sale Price: The total amount for which the property was sold is the starting point for the calculation.

- Identify the Percentage Rate: The rate at which payment is calculated, typically agreed upon in the contract, is usually a fixed percentage of the sale price.

- Multiply Sale Price by Percentage: Multiply the total sale price by the agreed percentage (as a decimal). For example, if the sale price is $300,000 and the rate is 3%, multiply $300,000 by 0.03.

- Calculate Total Payment: The result of this multiplication gives you the total amount due for the services provided.

Example Calculation

Let’s look at an example to clarify the process:

- Sale Price: $400,000

- Percentage Rate: 2.5%

- Calculation: $400,000 × 0.025 = $10,000

- Total Payment: $10,000

In this example, the payment for services would be $10,000. This method can be applied to any property transaction to ensure accurate calculations of owed compensation.

Common Mistakes in Commission Invoices

When creating payment requests for services provided in property transactions, certain errors can lead to confusion or delays in payment. It’s essential to ensure that all relevant details are included and correctly calculated. Mistakes can lead to disputes, which can delay payments or even result in lost business opportunities. Here, we highlight some of the most common errors and how to avoid them.

Common Mistakes to Avoid

Below are some of the most frequent mistakes made when preparing payment documents, along with tips on how to avoid them:

| Mistake | Explanation | How to Avoid |

|---|---|---|

| Incorrect Calculation of Amount | Errors in percentage calculations can lead to incorrect amounts being requested. | Double-check the percentage and sale price before performing the calculation to ensure accuracy. |

| Missing Client Information | Omitting important client details can make the document confusing and less professional. | Ensure that the full name, address, and contact details of the client are included. |

| Unclear Service Descriptions | Vague descriptions of services can lead to misunderstandings or disputes over what was agreed upon. | Provide a clear breakdown of all services provided, including dates, tasks, and timeframes. |

| Missing or Incorrect Payment Terms | Failure to clearly outline payment deadlines or conditions can result in delayed or missed payments. | Clearly state payment due dates, late fees, and any other payment conditions upfront. |

| Lack of Professional Format | Documents that appear unorganized or unprofessional may lead to a lack of trust or credibility. | Ensure the document follows a clear, professional layout with all necessary sections organized logically. |

By avoiding these common mistakes, you can ensure a smooth payment process and maintain professionalism in all your transactions.

How to Include Taxes on Commission Invoices

When preparing payment documents for services rendered, it’s essential to account for taxes accurately to ensure compliance with local tax regulations. This includes calculating the applicable sales tax or value-added tax (VAT) and ensuring it is clearly listed on the document. Including taxes correctly helps avoid legal issues and ensures transparency between service providers and clients.

Steps to Add Taxes to Payment Requests

Including taxes on a billing document requires careful calculation and clear presentation. Here are the steps you should follow:

- Identify the Tax Rate: Determine the correct tax rate based on the location of the transaction or your client’s business. This could be a national, state, or local rate, depending on applicable laws.

- Calculate the Tax Amount: Multiply the total amount due by the tax rate. For example, if the total payment is $1,000 and the tax rate is 10%, the tax amount will be $100.

- Add the Tax to the Total: After calculating the tax, add it to the original amount due to determine the total amount the client will need to pay.

- Clearly Present Tax Information: Clearly label the tax amount on the document to avoid confusion. This should include the tax rate, the amount being charged, and the total after tax.

Example of Tax Calculation

For example, let’s say a service fee of $500 is subject to a 7% tax rate:

- Service Fee: $500

- Tax Rate: 7%

- Tax Amount: $500 × 0.07 = $35

- Total Amount Due: $500 + $35 = $535

This breakdown clearly indicates how the tax is calculated and added to the total, ensuring the client knows exactly how much they owe.

Other Considerations

When adding taxes to a payment request, it’s important to include any additional details that may be relevant, such as the type of tax applied (e.g., VAT, sales tax), and to check that the tax rate is up-to-date. Furthermore, if your business operates across multiple regions with different tax rates, make sure you apply the correct rate based on the client’s location.

Best Practices for Invoicing Real Estate Deals

Creating clear and professional payment requests for property transactions is essential for ensuring smooth financial operations. Following best practices can help avoid misunderstandings, ensure timely payments, and maintain positive relationships with clients. These guidelines will help you create transparent, effective, and accurate billing documents for every transaction.

Key Practices to Follow

When preparing a payment request, consider these best practices to improve both the clarity and professionalism of your documents:

- Be Clear and Detailed: Provide a detailed breakdown of services rendered, including dates, descriptions, and amounts. This helps clients understand exactly what they are paying for and reduces the likelihood of disputes.

- Use Professional Language: Always maintain a formal tone in your documents. Avoid casual language and ensure that all terms are clearly defined to prevent any confusion.

- Include Payment Terms: Clearly state the payment due date, late fees (if any), and acceptable payment methods. This ensures that both parties are aware of the terms and deadlines for the transaction.

- Provide Accurate Contact Information: Include your full name, business name, and contact information, along with that of the client. This ensures that both parties know how to reach each other if needed.

- Double-Check All Details: Before sending the document, carefully review all the details, including the calculation of fees, taxes, and discounts. Accuracy is crucial to avoid errors that could delay payment.

Incorporating Taxes and Fees

Including taxes and additional fees in your payment requests can sometimes lead to confusion. To avoid this, ensure that the tax rate is clearly labeled, and break down any extra charges separately from the service fees. Always ensure that the total amount reflects both the service fees and any applicable taxes or additional costs.

By following these best practices, you can enhance the professionalism of your billing process, ensure faster payments, and maintain a good relationship with your clients. Clear, accurate, and transparent documents are essential in any property transaction, and these steps will help you stay organized and efficient in your business dealings.

How to Handle Multiple Commissions

In property transactions, it is common for professionals to earn compensation from multiple sources, especially when dealing with joint efforts or collaborative deals. Managing multiple payments effectively requires clear documentation and organization. Understanding how to break down each contribution and assign the correct portion to each party is essential for avoiding confusion and ensuring everyone is paid fairly.

Steps to Handle Multiple Payments

When you are involved in transactions with multiple payees or participants, it’s important to manage and document each party’s share clearly. Here’s how to do it:

- Identify All Parties Involved: List all individuals or entities that will be receiving compensation, including their roles and the amount of work or responsibility they took on during the transaction.

- Determine the Split: Calculate how the total payment should be divided. This might be based on an agreed-upon percentage, the scope of services provided, or a fixed rate. Be sure to get agreement from all parties on how the division will occur.

- Break Down the Payment Amount: In your documentation, clearly show how the total payment is split between all parties. This transparency will help avoid misunderstandings about who is owed what amount.

- Adjust for Any Additional Fees: If additional charges, such as referral fees or administrative costs, are included in the total, ensure these are appropriately subtracted or allocated to the correct individual or group.

Example of Handling Multiple Payments

Consider a scenario where three individuals worked together on a property transaction:

- Total Payment: $10,000

- Party A’s Share: 50% ($5,000)

- Party B’s Share: 30% ($3,000)

- Party C’s Share: 20% ($2,000)

In this case, each individual receives their agreed-upon portion, and the total payment is divided clearly according to their respective contributions. By providing this breakdown in the payment request, each party will understand their entitlement, ensuring a smooth payment process.

By clearly outlining the contributions and ensuring the accurate division of payments, handling multiple compensation sources becomes a straightforward task. Proper documentation fosters transparency, reduces errors, and ensures that everyone involved is fairly compensated for their efforts.

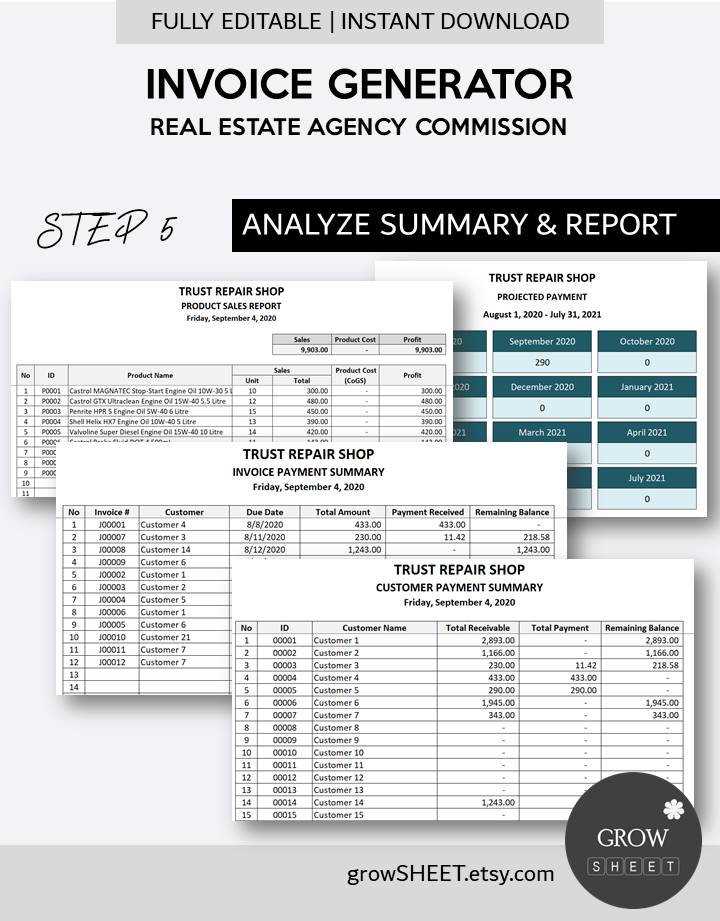

Tracking Payments from Commission Invoices

Effectively managing payments is crucial for maintaining a steady cash flow and ensuring that all financial transactions are recorded accurately. Tracking payments from billing documents helps you stay organized, avoid missed payments, and address any discrepancies quickly. Whether you’re managing a few transactions or many, a systematic approach to tracking payments will save time and prevent financial errors.

Steps for Tracking Payments

Here are the essential steps to track payments from payment requests effectively:

- Record All Payments: As soon as a payment is received, log it into your financial system. This will help you keep track of what has been paid and what remains outstanding.

- Maintain a Payment Schedule: Set up a system to track due dates and ensure payments are received on time. A simple spreadsheet or payment tracking software can help you monitor payment deadlines.

- Monitor Partial Payments: If a client makes a partial payment, make sure to record the amount paid and the balance remaining. Keep a clear record of these payments to avoid confusion.

- Cross-Reference with Your Documentation: Regularly compare your payment records with your billing documents. This helps to ensure all amounts match and no payments are missed or underpaid.

- Follow Up on Overdue Payments: If payments are overdue, reach out to clients promptly. Sending reminders or issuing updated documents can help speed up the payment process.

Tools for Payment Tracking

There are various tools available to make payment tracking easier. Here are a few options:

- Spreadsheets: A simple spreadsheet can be an effective tool for tracking payments. Create columns for the transaction details, amount due, amount paid, and the balance remaining.

- Accounting Software: Platforms like QuickBooks or Xero allow you to track payments automatically and integrate with your bank accounts for seamless tracking.

- Online Payment Systems: Payment processing tools like PayPal or Stripe can also track payments and send automated receipts, providing you with a clear record of transactions.

By tracking payments effectively, you can ensure accurate financial records and maintain smooth business operations. Proper tracking will also help you identify any late payments early, giving you the opportunity to resolve issues before they become bigger problems.

How to Organize Your Invoice Records

Maintaining an organized system for your payment records is essential for smooth business operations, tax preparation, and financial management. Properly organized records ensure that you can quickly access important documents, track payments, and avoid errors when reviewing past transactions. Whether you’re managing a small or large volume of payments, a structured approach can save time and reduce stress.

Steps to Organize Payment Records

Here are some key steps to help you effectively organize your payment documents:

- Create a Filing System: Organize your records either digitally or physically. For physical records, use file folders or binders, and for digital records, create clearly labeled folders on your computer or cloud storage.

- Label Documents Clearly: Ensure that each document is clearly labeled with relevant details such as the date, client name, and transaction amount. This makes it easier to search for specific documents when needed.

- Keep a Chronological Record: Organize your records by date, keeping the most recent documents at the top or in the front. This allows for easy reference and quick access to current or overdue payments.

- Track Payments and Balances: Create a tracking system for payments received, balances due, and any outstanding amounts. This could be a simple spreadsheet or accounting software that helps you monitor the status of each transaction.

Tools for Organizing Your Records

Utilizing the right tools can help streamline the process of organizing and managing your documents:

- Spreadsheets: Use spreadsheet software (like Excel or Google Sheets) to create a digital ledger for tracking payments, balances, and dates. You can easily update and sort this data as needed.

- Accounting Software: Platforms such as QuickBooks or FreshBooks offer integrated tools to organize payments, track outstanding balances, and generate reports automatically.

- Cloud Storage: Cloud-based file storage systems like Google Drive or Dropbox allow you to store and access your documents from any device, ensuring that your records are secure and accessible.

By implementing these organizational strategies, you can maintain a clean, accessible, and efficient record-keeping system. Staying organized will also make it easier to respond to client inquiries, complete tax filings, and ensure that all payments are properly accounted for.

Legal Considerations for Real Estate Invoices

When preparing billing documents for property transactions, it is essential to comply with legal requirements to protect both parties involved. Proper documentation ensures that payments are processed smoothly and legally, while also reducing the risk of disputes or complications. Understanding the legal considerations surrounding payment requests can help ensure compliance with local laws and industry regulations.

Key Legal Aspects to Consider

Here are the primary legal elements to consider when preparing billing documents:

- Accurate and Transparent Information: Always ensure that the details provided in the payment document are clear and accurate. This includes the services rendered, agreed-upon amounts, taxes applied, and payment terms. Transparency prevents misunderstandings and ensures that both parties are on the same page.

- Clear Payment Terms: Establish and communicate the terms of payment, including the due date, accepted payment methods, and penalties for late payments. Clearly outlining these terms helps avoid legal disputes and delays.

- Tax Compliance: Ensure that the correct tax rates are applied based on local regulations. This includes sales tax, VAT, or any other applicable taxes. Failing to collect and remit the proper taxes could lead to legal consequences for both you and your clients.

- Signatures and Authorizations: Depending on the jurisdiction, certain payment documents may require signatures or formal approval. It’s important to understand if and when a signature or other form of authorization is needed for your records to be legally binding.

- Record Keeping Requirements: Many jurisdictions require businesses to retain copies of payment documents for a certain period. Make sure to store these records in an organized and accessible manner to comply with local laws, especially when it comes to tax audits or legal inquiries.

Contracts and Agreements

In addition to the payment document itself, it’s important to ensure that any underlying agreements, such as contracts or service agreements, are legally sound. These documents should clearly define the scope of services, payment amounts, and timelines. A well-drafted contract helps mitigate the risk of legal issues and provides a basis for resolving disputes if they arise.

By keeping these legal considerations in mind, you can ensure that your billing process is not only efficient but also compliant with the law. Properly managing payment documents reduces the likelihood of disputes and protects both your interests and those of your clients.

How to Automate Real Estate Invoicing

Automating the process of generating and sending billing documents can save you significant time and reduce the risk of errors in your transactions. By using automation tools, you can streamline repetitive tasks such as calculating amounts due, applying taxes, and sending payment reminders. Automating invoicing not only ensures greater accuracy but also improves your workflow efficiency and provides clients with timely, professional documentation.

Steps to Automate Billing for Property Transactions

Here are some key steps to set up automated billing processes for property-related payments:

- Choose Automation Software: Select a reliable software platform that suits your needs. Popular tools for automating billing processes include QuickBooks, FreshBooks, and Zoho Invoice. These platforms allow you to create, send, and track payment documents automatically.

- Set Up Client Information: Input client details into your chosen automation tool, including their name, contact information, and payment terms. This will allow the system to generate personalized payment requests without needing to manually enter information each time.

- Create Custom Payment Templates: Customize payment documents to reflect your brand and the specific terms of each transaction. Most software allows you to create reusable templates with pre-filled fields, saving time on each new request.

- Automate Recurring Payments: For clients with ongoing agreements or repeat transactions, set up automatic billing schedules. This way, you don’t need to manually create documents every month or quarter. The software will automatically generate and send them based on predefined rules.

- Enable Online Payment Integration: Integrate your billing system with online payment processors such as PayPal, Stripe, or bank transfer services. This allows clients to pay directly through the payment request, and your system will automatically update the payment status once it is processed.

Benefits of Automating Payment Requests

Automating your billing process offers several key advantages:

- Efficiency: Automating routine tasks saves you time, allowing you to focus on more important aspects of your business.

- Accuracy: Automated calculations reduce the risk of human error when calculating amounts, taxes, and discounts.

- Consistency: Automated billing ensures that every transaction is handled in the same professional manner, maintaining consistency in your business practices.

- Timeliness: Automated systems ensure that payment documents are sent out promptly, helping to reduce delays in payment collection.

By automating your billing process, you not only improve your workflow but also enhance your clients’ experience by providing them with timely, accurate, and professional payment documentation. In the long run, this leads to smoother financial management and a more efficient business operation.

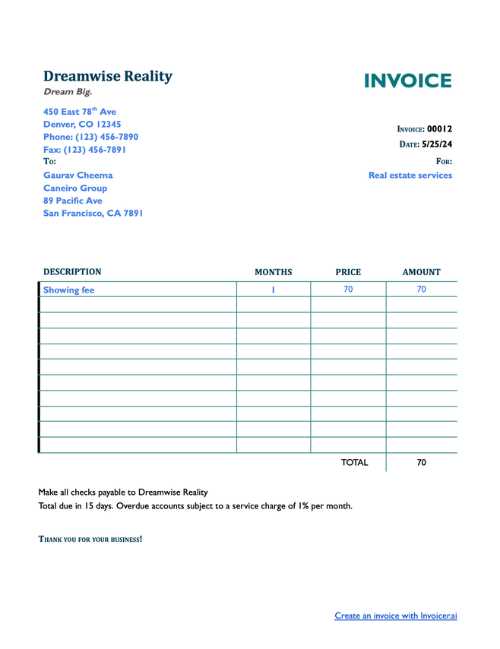

Tips for Professional Invoice Design

Creating well-designed payment documents is essential for maintaining a professional image and ensuring clear communication with clients. A clean, structured layout not only makes the document easier to read but also helps establish trust and credibility. Whether you’re sending one-time requests or recurring billing statements, a polished design enhances the overall client experience and ensures your business is taken seriously.

Key Design Tips for Professional Documents

Here are some design tips to make your billing documents stand out and look professional:

- Use a Clean and Simple Layout: Keep the layout uncluttered with enough white space to ensure the document is easy to read. A minimalist design helps the client focus on the important information without distractions.

- Brand Consistency: Include your company logo, brand colors, and fonts. Consistent branding helps reinforce your business identity and adds a personal touch to each document.

- Clearly Highlight Key Information: Make important details such as payment amounts, due dates, and payment instructions stand out. Use bold or larger fonts for these elements to ensure they catch the client’s eye.

- Organize Information Effectively: Arrange the details in a logical order, such as the client’s name and address at the top, followed by the payment breakdown and any additional notes or terms. Grouping similar information together improves readability.

- Include Clear Payment Instructions: Specify acceptable payment methods, such as bank transfer, credit card, or online payments. If applicable, include any payment portals or links directly in the document for easy access.

Additional Design Considerations

Here are a few more elements to consider for enhancing the look and feel of your payment documents:

- Use High-Quality Fonts: Select legible, professional fonts for your documents. Stick to basic fonts like Arial or Helvetica, as they are easy to read and look clean on both digital and printed copies.

- Include Legal and Tax Information: Always ensure that any required tax details, business registration numbers, or legal disclaimers are included in the footer of the document.

- Include Unique Identifiers: Add unique reference numbers for each document. This helps track and organize transactions, making it easier for both you and the client to reference specific payments in the future.

A well-designed billing document conveys professionalism and ensures that important details are easy to understand. By following these design tips, you can create payment documents that are not only functional but also visually appealing, leaving a lasting positive impression on your clients.