Real Estate Agent Invoice Template for Efficient Billing

Managing financial transactions in the property business can be complex, especially when it comes to ensuring accuracy and professionalism in client dealings. Whether you are handling sales, rentals, or other services, having a structured document to outline the amounts due is crucial. This tool simplifies the entire process, allowing you to maintain transparency and clarity with every client interaction.

Professionalism in your billing not only promotes trust but also helps keep track of payments, making it easier to manage your finances. With the right document format, you can quickly adapt to various scenarios, whether it’s a single sale or multiple service charges. Customizing your paperwork allows you to present a polished image, reinforcing your credibility as a trusted service provider.

By utilizing an organized method of charging clients, you also reduce the risk of errors. A carefully crafted document ensures all necessary details are captured accurately, helping you avoid miscommunication or missed payments. This approach saves both time and effort, letting you focus more on delivering excellent service rather than worrying about administrative tasks.

Real Estate Agent Invoice Template Overview

In the property business, maintaining a clear and professional method for billing clients is essential for smooth transactions. A well-structured document that outlines all charges, commissions, and services provided helps both parties understand the financial aspects of the deal. Such a document serves not only as a request for payment but also as a record of the business exchange, which is crucial for both the service provider and the client.

Why You Need a Billing Document

Having a standardized format for each transaction offers several benefits:

- Clarity: It ensures all charges and details are outlined in a straightforward manner, leaving no room for confusion.

- Efficiency: You can easily create and issue the document, saving time and effort on manual calculations and layouts.

- Professionalism: A polished and consistent approach to billing builds trust and credibility with clients.

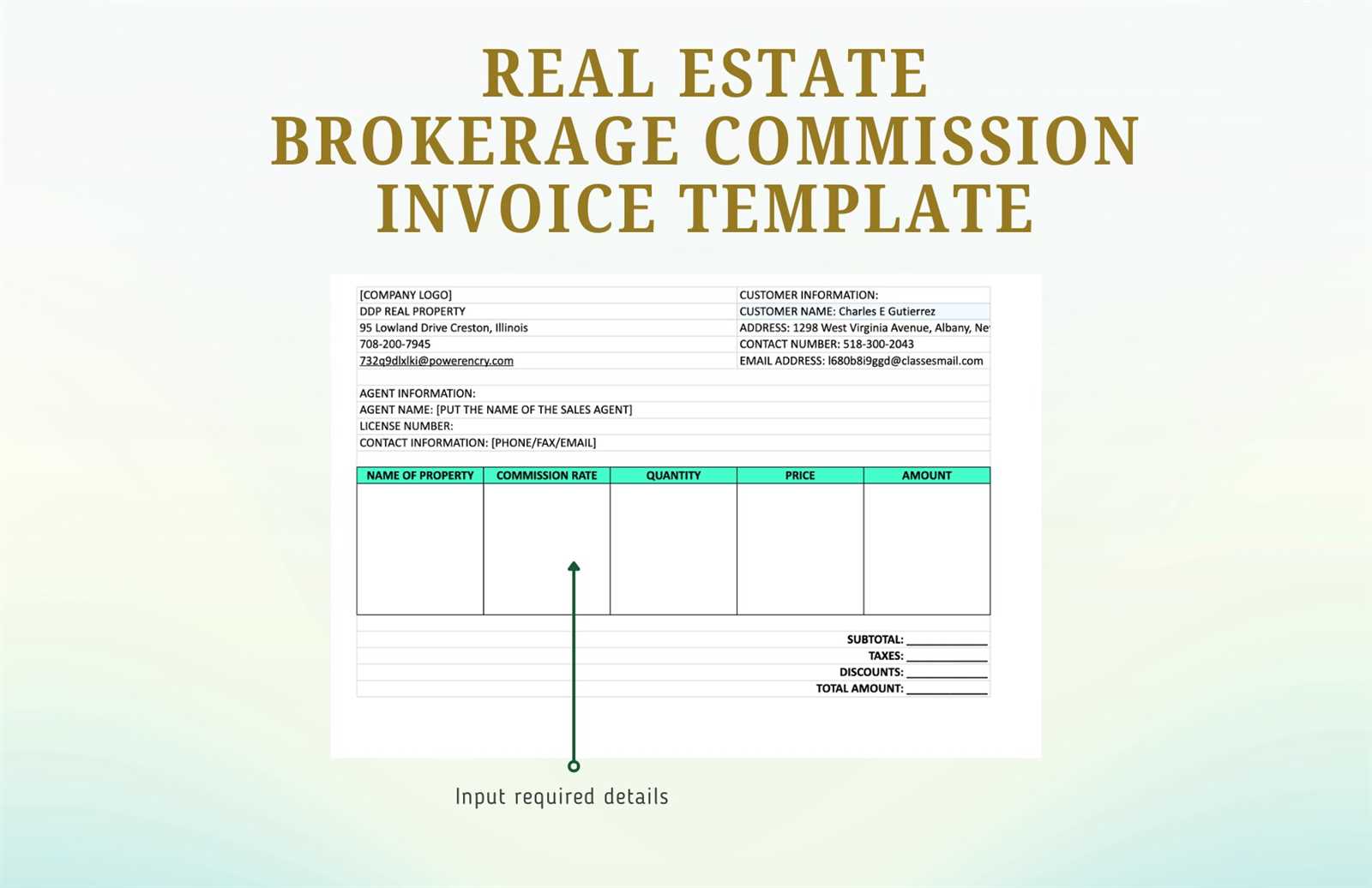

Key Elements to Include

To make sure the document is both effective and legally sound, consider including the following details:

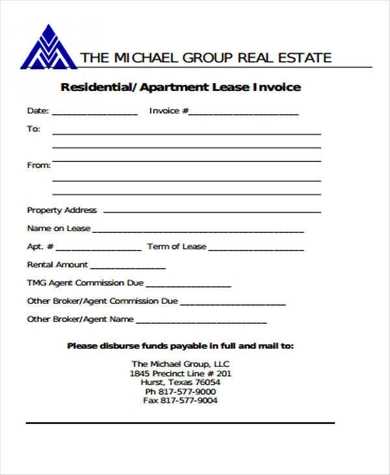

- Contact Information: Include your details, such as name, business name, phone number, and address, as well as the client’s information.

- Services Rendered: Provide a description of the services performed, including dates, hours, and any additional charges.

- Payment Terms: Clearly state when the payment is due, any late fees, and accepted payment methods.

- Total Amount Due: The final amount that the client is expected to pay, including any taxes or fees.

By ensuring all these elements are present, you create a comprehensive document that both protects your interests and fosters trust with clients.

Why Use an Invoice Template

Using a standardized document for requesting payment offers numerous advantages for professionals in the property industry. It streamlines the entire billing process, ensuring that all necessary details are included and that the client receives clear instructions. Adopting a predefined structure reduces the risk of errors and ensures consistency across transactions.

Here are the main reasons to rely on a structured billing document:

- Time-saving: With a ready-to-use format, you no longer have to spend time designing and formatting each document from scratch.

- Accuracy: A consistent layout helps ensure that all relevant information is included and correctly calculated, minimizing mistakes.

- Professionalism: A polished, uniform format conveys a sense of order and professionalism, making a strong impression on clients.

- Easy Tracking: Using a standardized approach simplifies record-keeping and makes it easier to track payments over time.

- Legal Compliance: An organized structure ensures you include all the necessary legal details, protecting both parties in the event of a dispute.

By relying on a consistent, pre-made structure, you enhance both the efficiency and professionalism of your business, ultimately fostering better client relationships and smoother transactions.

Key Features of a Real Estate Invoice

When preparing a billing document for property-related services, certain essential elements must be included to ensure clarity, accuracy, and professionalism. These features help both the service provider and the client understand the financial details of the transaction, avoid misunderstandings, and ensure that all charges are properly accounted for.

Essential Components to Include

A comprehensive document should always include the following core elements:

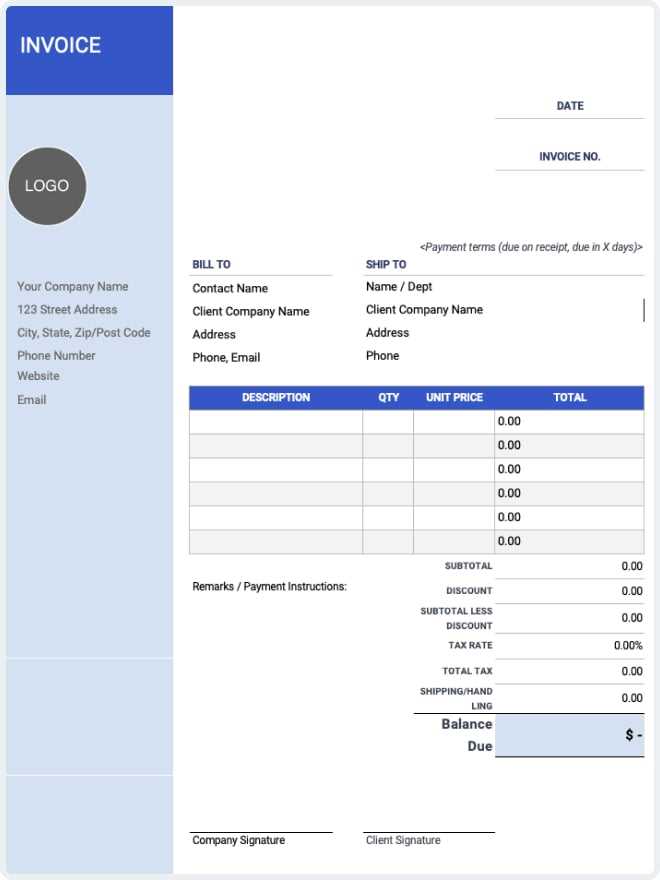

- Contact Information: This includes both the service provider’s and the client’s full names, addresses, phone numbers, and email addresses. Clear identification ensures there is no confusion about who is involved in the transaction.

- Itemized List of Services: A detailed breakdown of the services provided, such as consultations, property viewings, or any additional work completed, helps the client understand the charges clearly.

- Payment Terms: It’s crucial to specify the due date, late fees (if any), and acceptable payment methods. Clear payment terms ensure timely compensation and reduce the risk of disputes.

Additional Important Information

In addition to the basic components, there are other aspects to consider for completeness:

- Commission Fees: If applicable, commission rates or percentages for the services rendered should be clearly stated.

- Tax Information: Ensure that any taxes are properly calculated and included in the total amount due. This is essential for both compliance and transparency.

- Unique Invoice Number: Assigning a unique reference number helps track payments and can be useful for both administrative and legal purposes.

Customizing Your Invoice for Clients

Each client may have different needs, preferences, or requirements when it comes to financial documentation. Customizing your billing document ensures that you present the necessary details in a format that suits the transaction, whether it’s a single sale, ongoing services, or other property-related activities. Personalizing this document helps maintain a professional relationship and increases the likelihood of timely payments.

Adjusting for Specific Client Needs

Different clients may have unique expectations or specific information they want included. Here’s how to tailor your document to meet those needs:

- Service Breakdown: If a client has multiple properties or services, break down the charges for each one separately. This gives clarity and ensures the client understands exactly what they are being billed for.

- Custom Payment Terms: Some clients may prefer longer payment periods, installments, or other specific terms. Be sure to adjust the document to reflect these preferences while keeping things clear and professional.

- Special Discounts or Offers: If applicable, include any discounts, promotions, or bundled services that may affect the final amount due. This shows that you are flexible and attentive to the client’s needs.

Enhancing Client Experience with Personalization

Adding a personal touch can make your billing document stand out and reinforce the client relationship:

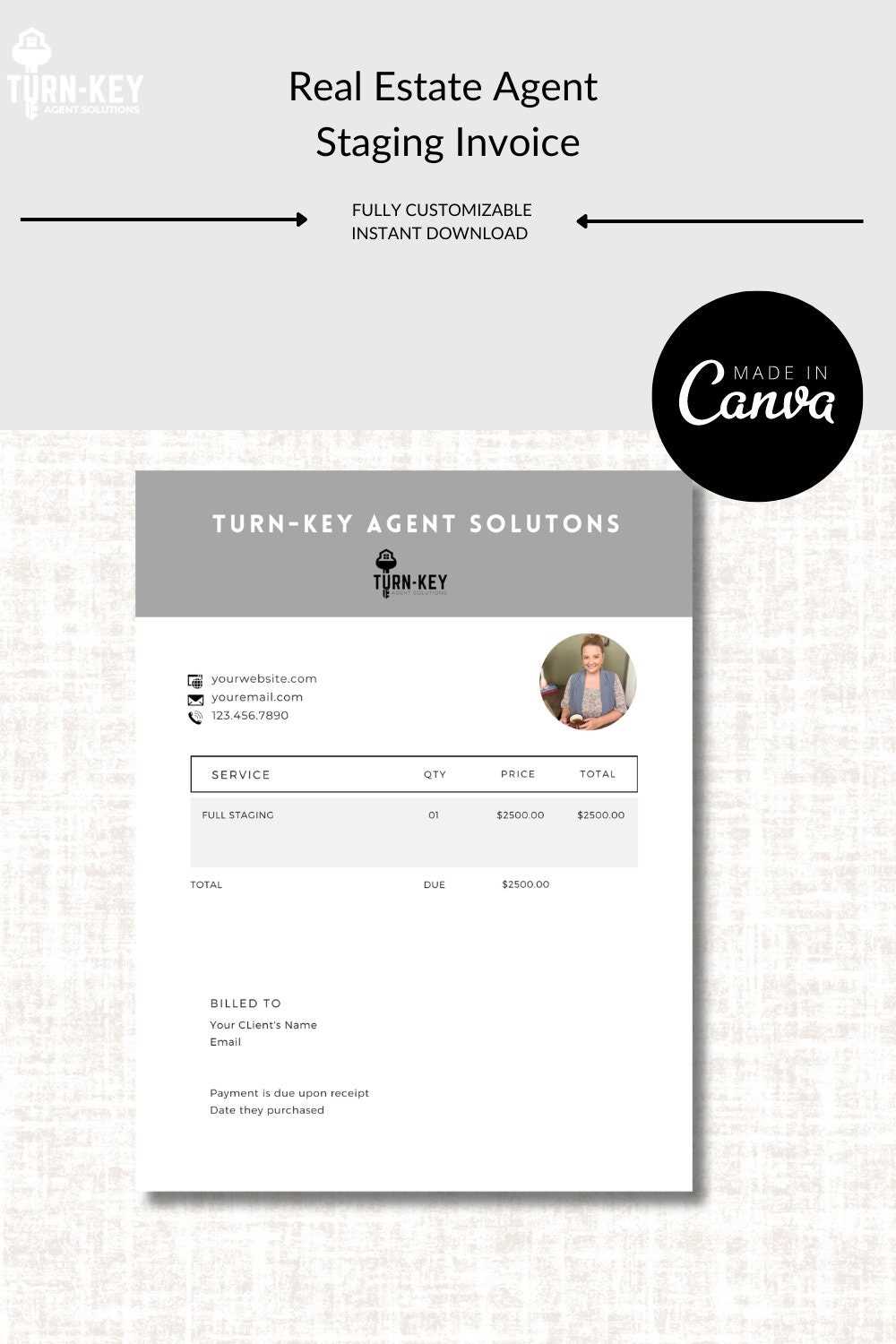

- Custom Branding: Incorporating your business logo, brand colors, or a personalized message can make the document feel more professional and unique.

- Notes and Comments: Including a brief message or thank-you note at the end of the document can help show appreciation for the client’s business, creating a positive impression.

By tailoring your billing documents to each client’s specific situation, you enhance their experience and improve the overall professionalism of your services.

How to Create a Professional Invoice

Creating a professional billing document requires attention to detail and a structured approach to ensure that all essential information is included clearly and accurately. A well-designed document not only ensures timely payment but also reflects the professionalism of your business. By following a few key steps, you can create a document that enhances your credibility and fosters trust with clients.

Step-by-Step Guide to Crafting a Billing Document

Follow these steps to create a comprehensive and professional document:

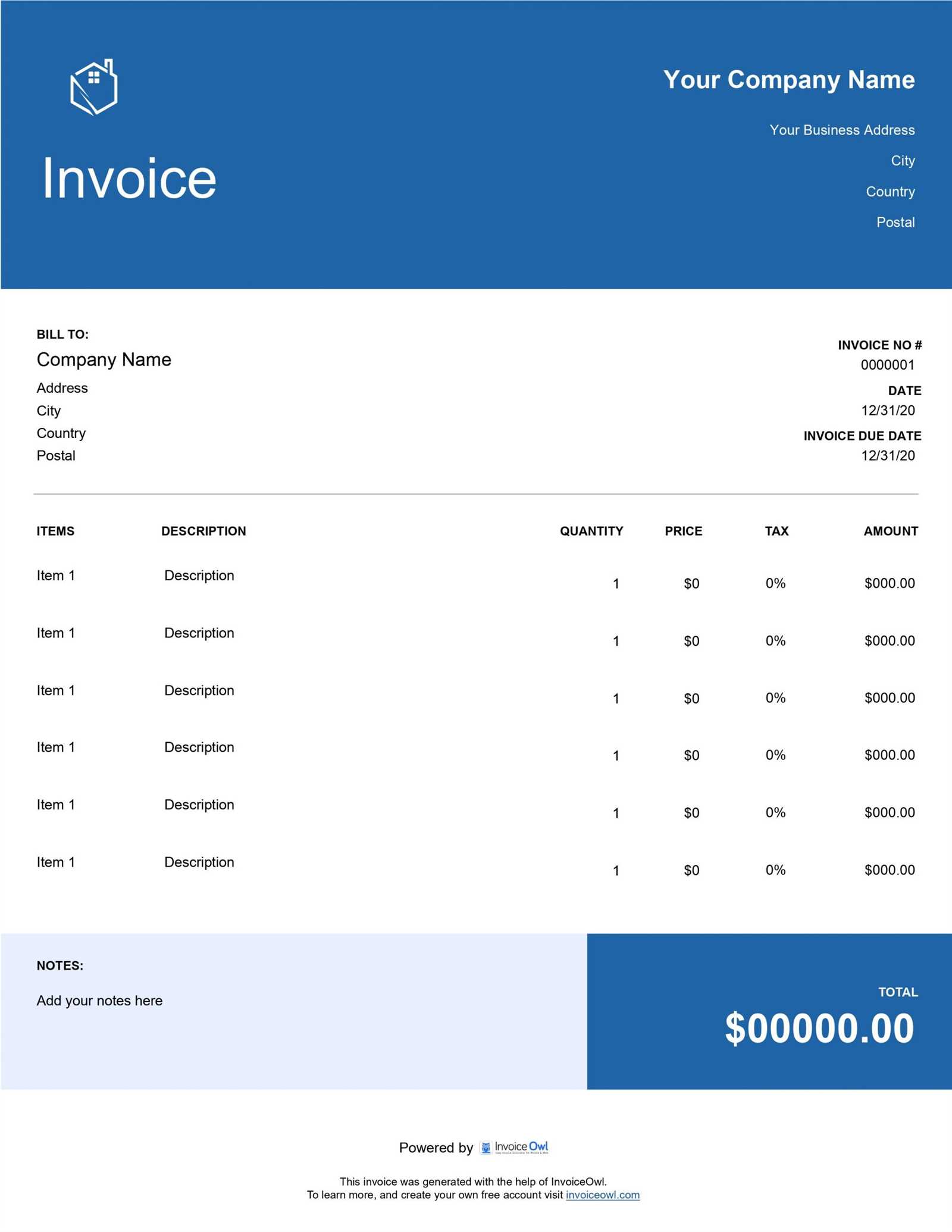

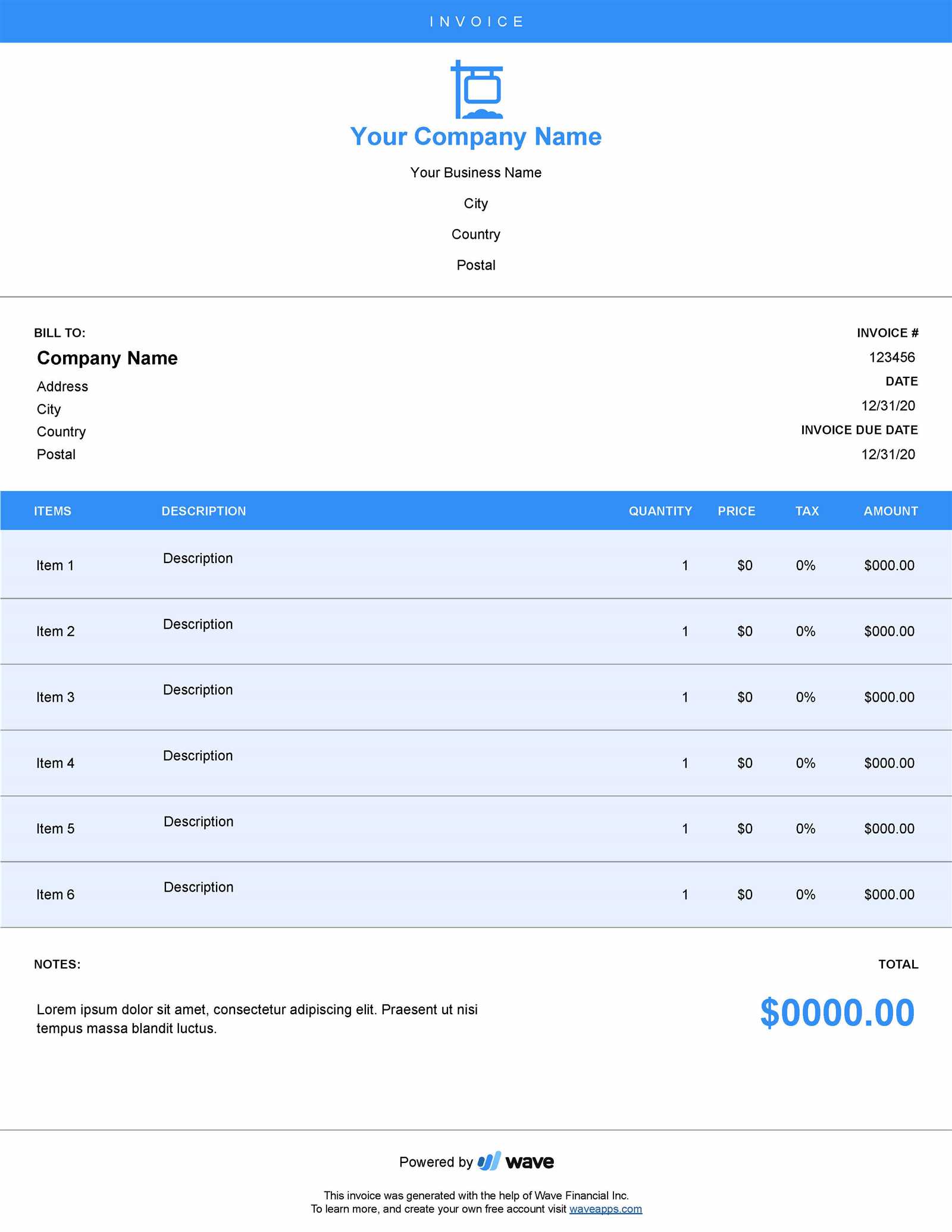

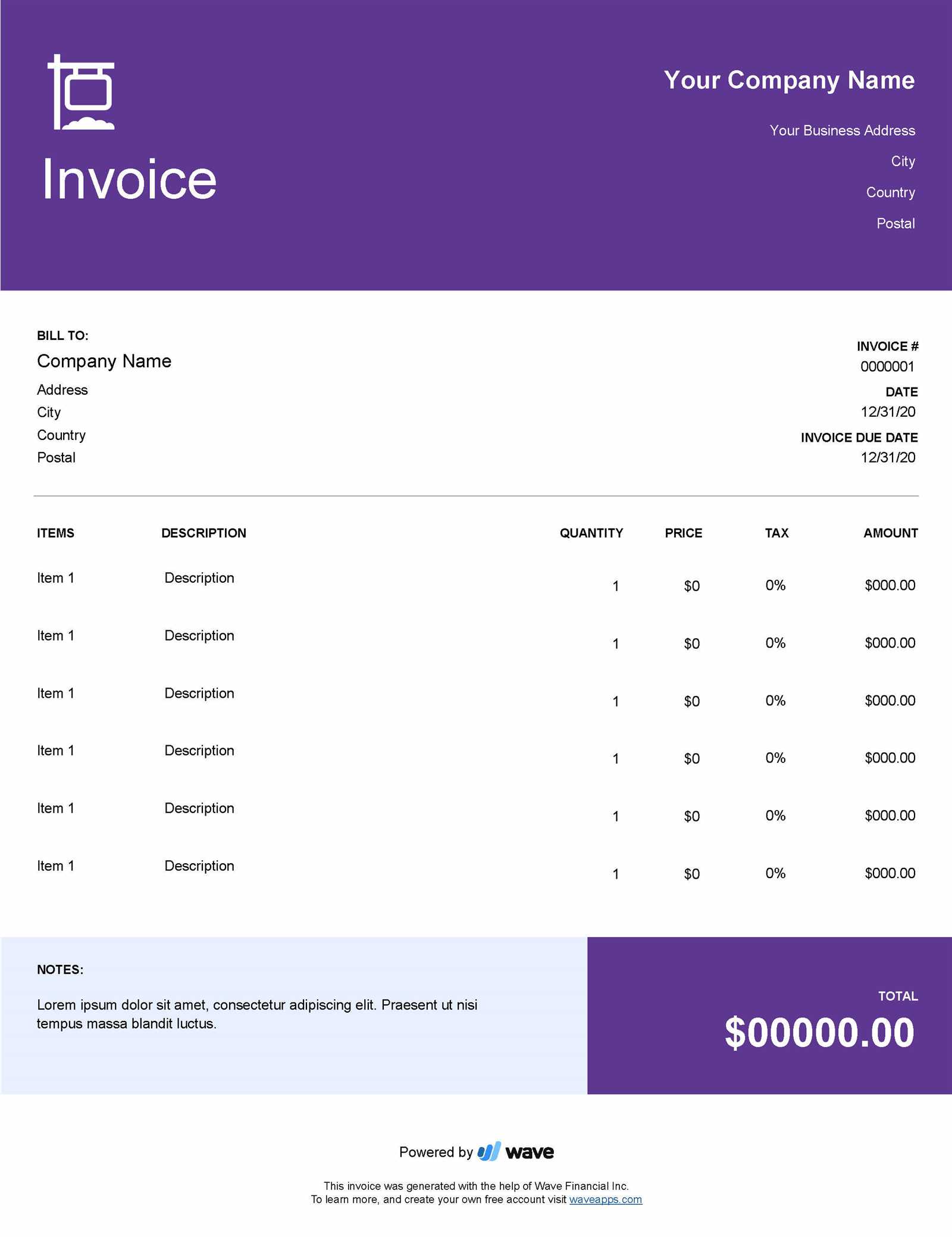

- Choose a Clean Layout: Use a simple, uncluttered layout that prioritizes readability. Avoid excessive use of colors, fonts, or unnecessary images, as this can distract from the core information.

- Include Essential Details: Ensure that both your contact details and the client’s contact information are clearly visible. The document should also include a unique reference number, the date of issue, and the payment due date.

- List Services and Charges: Break down the services provided, including dates, hours, or specific tasks performed, along with the respective charges. A detailed list ensures that the client understands exactly what they are paying for.

- Clearly State the Total Amount: Make sure the final amount due is prominently displayed. Include any taxes or additional fees in the total, and provide a clear breakdown of how the amount was calculated.

Making Your Document Stand Out

To make your document even more professional, consider the following enhancements:

- Branding: Add your logo, business name, and other brand elements to reinforce your identity and make your document easily recognizable.

- Personalization: Address the client by name and include a brief thank-you note or message at the end of the document. This small touch can go a long way in building strong client relationships.

- Payment Instructions: Clearly outline the preferred methods of payment and any late fees or penalties for overdue payments. This will help ensure a smooth transaction process.

By following these s

Benefits of Digital Invoice Templates

Using a digital format for billing documents offers significant advantages over traditional paper-based methods. With the advancement of technology, businesses can streamline their financial processes, enhance efficiency, and reduce the risk of errors. Digital documents are not only more environmentally friendly but also offer a range of features that make managing transactions simpler and more effective.

One of the main benefits of using a digital format is the ease of customization. Unlike printed forms, digital documents can be easily modified to suit individual client needs or specific transactions. Whether you need to adjust payment terms, add custom details, or create a personalized layout, a digital format allows you to make quick changes without starting from scratch each time.

Another advantage is the increased speed and convenience of sending and receiving documents. With just a few clicks, you can email or share a billing document with a client, speeding up the overall payment process. Digital records are also easier to store, organize, and retrieve, helping businesses maintain a more efficient filing system without the need for physical storage space.

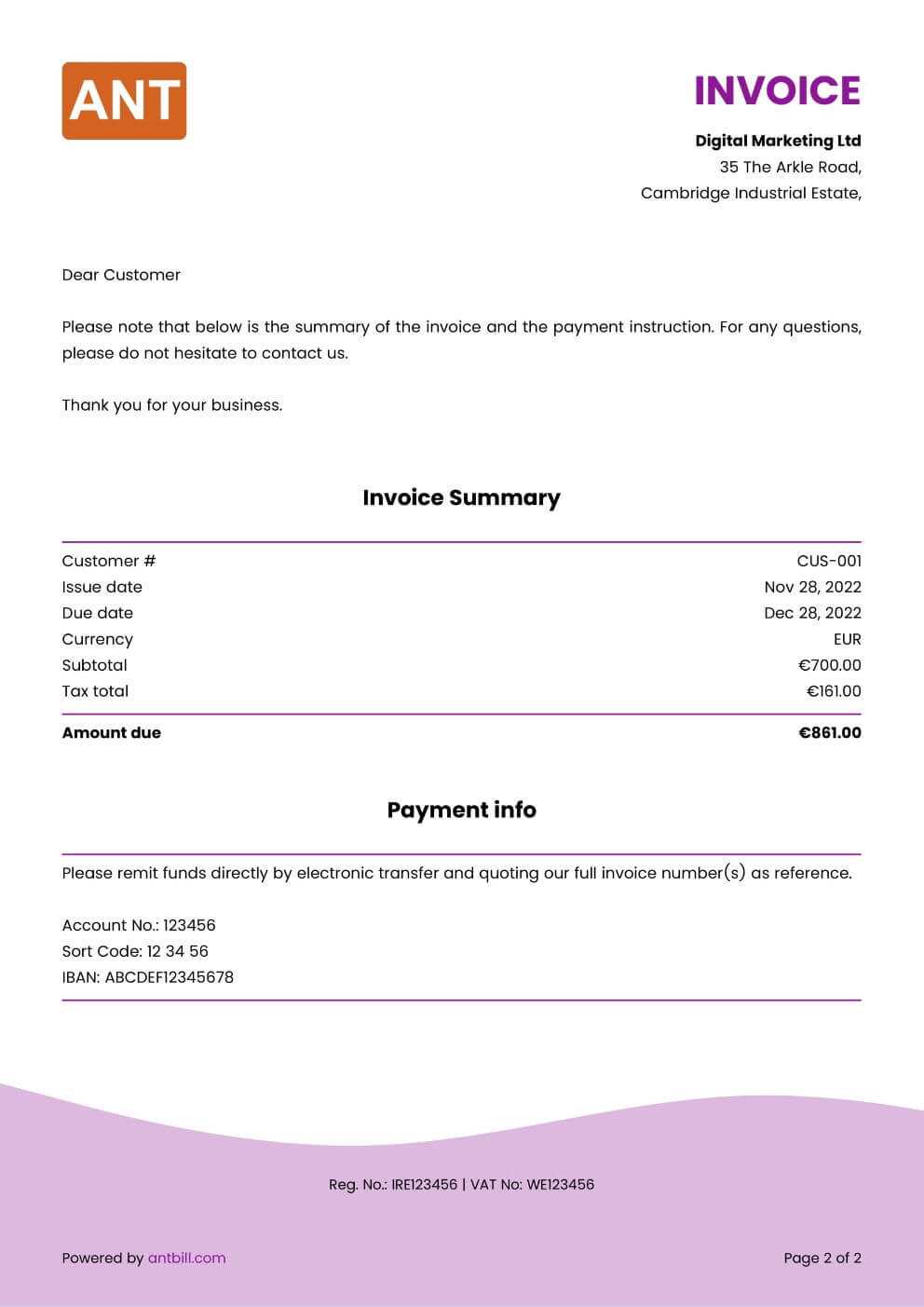

Moreover, digital billing documents can be integrated with accounting software, allowing for automatic calculations, tracking, and reporting. This minimizes the possibility of human error and ensures that every transaction is accurately documented. Additionally, digital formats can include secure payment links, making it easier for clients to pay directly from the document, further reducing delays.

Ultimately, adopting a digital approach to billing not only simplifies administrative tasks but also contributes to a more professional and streamlined business operation. Whether you’re managing multiple clients or tracking payments, digital documents provide greater control, efficiency, and accuracy in your financial dealings.

Essential Information for Real Estate Invoices

When creating a billing document for property-related services, including all the necessary details is crucial to ensure both clarity and accuracy. A well-structured document not only facilitates timely payments but also serves as a record for both the service provider and the client. By including key elements, you can ensure that the transaction is fully understood and processed smoothly.

Key Details to Include

To ensure your billing document is complete, it should contain the following information:

- Contact Information: Clearly include your business name, address, phone number, and email, along with the client’s details. This helps identify both parties and ensures there is no confusion regarding the transaction.

- Unique Document Number: Assigning a unique reference number to each document helps with record-keeping and ensures you can track and manage multiple transactions easily.

- Transaction Date: Clearly state the date the document was issued and any relevant dates related to the services provided. This establishes a timeline for the payment due and the services rendered.

- Payment Due Date: Specify the date by which payment should be made. This helps manage cash flow and prevents delays in payments.

Additional Important Information

In addition to the basic details, consider including the following elements to provide clarity and ensure transparency:

- Detailed Service Breakdown: Provide a clear itemization of the services performed, such as property showings, consultations, or other tasks, along with the corresponding charges. This breakdown gives the client a transparent view of what they are paying for.

- Commission Fees or Charges: If applicable, clearly indicate any commission percentages or additional fees for services rendered. This helps prevent confusion or disputes regarding the final amount due.

- Tax Information: If taxes are applicable, list them separately and ensure that th

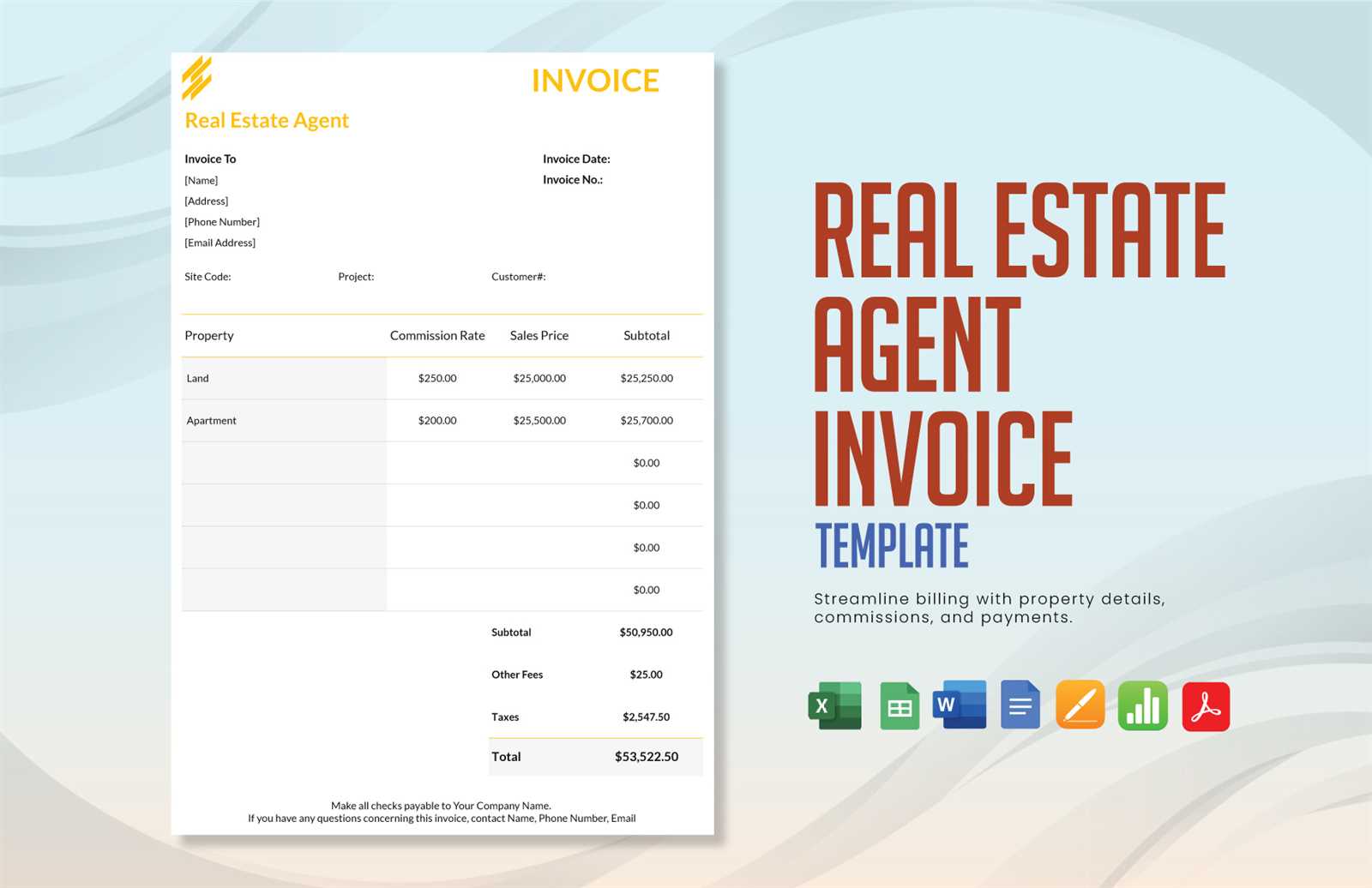

How to Add Property Details on Invoices

When providing services related to properties, it’s essential to include specific property information on your billing document to ensure transparency and clarity. Including these details helps clients understand exactly what they are being charged for, especially when multiple properties or transactions are involved. Properly documenting property-related information also facilitates future reference and prevents potential disputes.

To effectively include property details on your billing document, follow these guidelines:

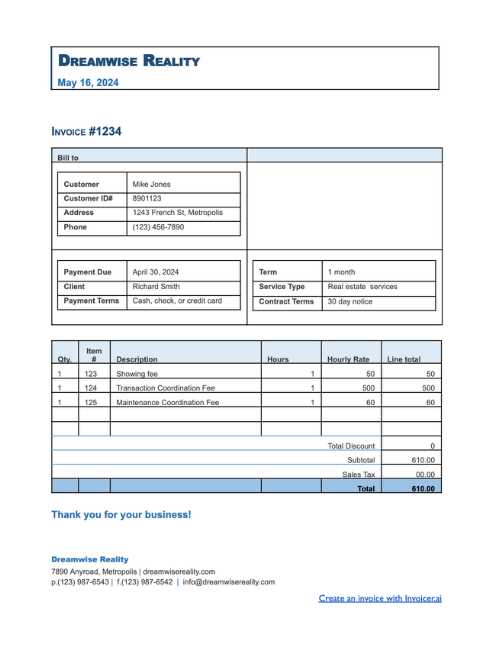

- Property Address: Always include the full address of the property involved in the transaction. This ensures that both parties are clear about which property the services or fees apply to.

- Property Type: Specify the type of property (e.g., residential, commercial, land, etc.) to give additional context to the services provided. This is especially helpful if you are dealing with various property types in your portfolio.

- Listing or Reference Number: If the property is listed or identified with a reference number, include it on the document. This makes it easier to match the bill with the correct transaction or listing.

- Services Provided: Clearly list the specific services related to the property. For example, if the service was a showing, inspection, or consultation, include this information along with the date and hours spent.

- Sale or Lease Price: If applicable, include the final sale price, lease amount, or other relevant financial details related to the property. This helps clarify how the charges are calculated, especially if they are based on a percentage of the property’s value.

By including these key property details, you ensure that the billing document is comprehensive and transparent, providing all the necessary information for the client to understand the charges associated with each property.

Including Commission Fees in Your Invoice

When providing property-related services, commission fees are a common part of the payment structure, especially for services such as sales, rentals, or property management. Including these fees in your billing document clearly and accurately is essential for transparency and to avoid any confusion with the client. Properly outlining commission charges ensures both parties understand how the final amount is calculated and what services are being compensated.

Here’s how to clearly include commission fees in your billing document:

Service Description Amount Commission Percentage Commission Fee Property Sale $300,000 5% $15,000 Rental Agreement $2,500/month 10% $250 Property Consultation $500 20% $100 In the example above, the commission fee is clearly broken down by service type. You can adjust the commission percentage based on the agreement with your client, whether it’s a fixed rate or a percentage of the transaction value. Ensure the commission calculation is transparent by specifying the exact percentage applied and showing the resulting fee.

Including commission details in this manner helps the client understand how the final amount is reached and reinforces the professionalism of your business. It also provides clarity in the case of disputes or questions regarding the payment structure.

Automating Your Invoice Process

Streamlining the billing process can save valuable time and reduce the potential for human error. Automating your billing workflow not only increases efficiency but also ensures consistency across all transactions. By setting up an automated system, you can focus more on delivering services and less on manual tasks like creating, sending, and tracking documents.

Here are the key benefits and steps to automate your billing process:

- Consistency and Accuracy: Automation ensures that every billing document follows the same format, with all necessary details filled out correctly. It minimizes the chances of missing critical information, such as service charges or payment terms.

- Time Efficiency: With automated systems, you can generate and send billing documents in just a few clicks, freeing up more time for other business activities. This is especially useful when managing multiple clients or transactions.

- Faster Payment Collection: Automated systems can include payment links directly in the document, making it easier for clients to pay quickly. Some systems even send automatic reminders when payments are due or overdue, which helps reduce delays.

Steps to Automate Your Billing Process

To effectively set up automation for your billing process, consider these steps:

- Choose the Right Software: Select an automated billing system that integrates well with your existing tools. Many platforms offer features such as recurring billing, client management, and payment tracking.

- Set Up Customizable Templates: Create a standardized layout for your documents, including placeholders for client information, services, charges, and payment details. This allows you to generate new documents quickly by filling in just a few fields.

- Integrate Payment Solutions: Ensure your system can accept a variety of payment methods and include secure payment links directly in your documents. This encourages clients to pay immediately upon receipt of the document.

- Automate Reminders and Follow-ups: Set up automated reminders for clients who have not yet paid. You can customize the timing and frequency of these reminders to fit your business’s needs.

By

Common Invoice Mistakes to Avoid

When preparing billing documents, even small errors can lead to confusion, delays in payment, or strained relationships with clients. Ensuring that your documents are accurate, clear, and professional is crucial for maintaining a smooth financial process. Understanding and avoiding common mistakes will help you create documents that meet both your business’s and your client’s expectations.

Here are some common errors to avoid when preparing your billing documents:

- Missing or Incorrect Client Information: Always double-check the client’s details, including their full name, address, and contact information. Incorrect information can cause delays and confusion, and may even affect the payment process.

- Omitting Service Details: It’s important to provide a detailed list of services rendered. Failure to break down what has been completed can lead to disputes, as clients might not fully understand what they are paying for.

- Incorrect Calculation of Fees: Ensure that all fees, taxes, and commissions are calculated accurately. Simple math errors can cause frustration and may lead to payment delays. It’s essential to double-check these details before finalizing the document.

- Not Including a Payment Due Date: One of the most common mistakes is forgetting to include a clear due date for payment. This can leave both you and the client uncertain about when the payment is expected, leading to potential delays.

- Failure to Provide Payment Instructions: Always include clear and complete instructions on how the client can pay. Whether it’s bank account details, payment links, or other methods, not providing these can slow down the payment process.

- Not Using a Unique Document Number: Without a unique reference number, tracking and managing payments can become difficult. Ensure each document has its own number for easy identification, especially when dealing with multiple transactions or clients.

- Neglecting Follow-up Procedures: If payment isn’t made by the due date, failing to follow up with a reminder can result in delayed payments. Make sure to set up a process for politely reminding

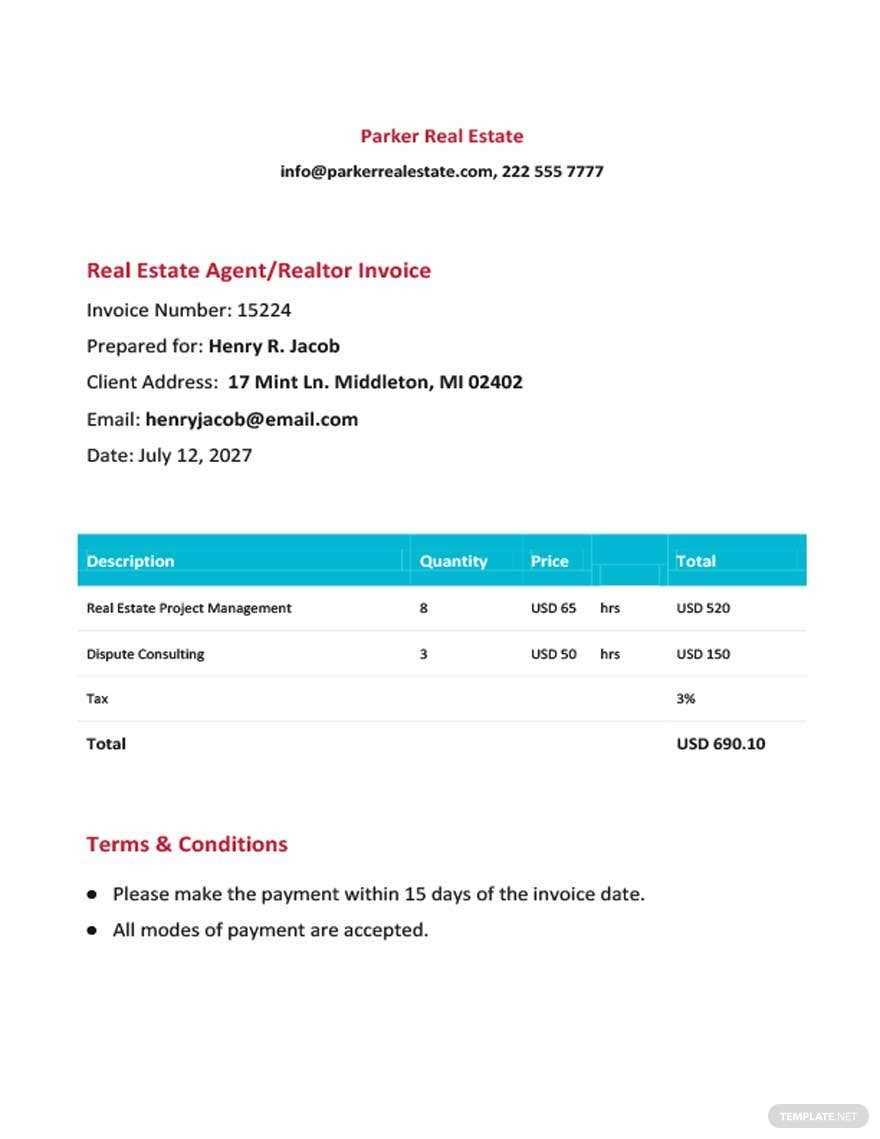

Legal Requirements for Real Estate Invoices

When preparing billing documents for property-related services, it’s important to be aware of the legal requirements that may apply. These regulations help ensure that the transaction is valid, transparent, and compliant with tax laws. Failing to meet legal obligations can lead to financial penalties, disputes, or complications with tax authorities. Understanding the essential legal components that must be included in your documents is crucial for protecting your business and maintaining professionalism.

Essential Legal Information

Regardless of the type of service provided, certain details must be included in your billing document to comply with legal standards:

- Tax Identification Number (TIN): Depending on your jurisdiction, you may be required to include your business’s tax identification number or VAT number on the billing document. This is important for tax reporting and ensures that transactions are properly tracked by authorities.

- Service Description: A clear and detailed description of the services provided must be listed. This helps avoid disputes over the scope of work and ensures that both parties understand exactly what has been agreed upon.

- Transaction Date: The date the service was completed or the billing document was issued must be included. This serves as the basis for determining payment due dates and calculating any applicable taxes.

- Payment Terms: Specify the payment terms, including due dates, interest for late payments, and accepted payment methods. These terms protect both you and your client and clarify when and how the payment should be made.

- Applicable Taxes: If taxes are required, these must be clearly shown on the document. This includes sales tax, VAT, or any other tax that applies to the service being provided. Failure to list taxes can lead to legal and financial consequences.

- Commission or Fee Details: If your fee is based on a percentage of a transaction or sale price, include this calculation clearly to avoid any misunderstandings. Ensure the percentage, calculation method, and final amount are trans

Creating an Invoice for Multiple Transactions

When providing services across multiple transactions or projects, it’s important to consolidate all the relevant details into one clear and organized document. This not only simplifies the payment process for your clients but also makes record-keeping more efficient for your business. A well-structured document allows you to itemize each service and charge separately while maintaining a clear overview of the total amount due.

How to Structure Multiple Transaction Billing

For an effective and transparent billing document involving multiple transactions, consider the following steps:

- List Each Transaction Separately: Break down each service or transaction into individual line items. For example, if you provided multiple consultations, property assessments, or contract negotiations, each of these should have its own entry with a description, date, and fee.

- Include Detailed Descriptions: Make sure to provide clear descriptions of the services performed for each transaction. This allows the client to understand exactly what they are paying for and ensures there are no misunderstandings.

- Show Individual and Total Amounts: For each transaction, list the amount due and the total amount for the entire document. This makes it easy for the client to verify and compare charges across different projects or services.

- Provide Payment Instructions: Clearly explain how and when payments for each transaction are due. You may offer the client the option to pay in installments or request full payment at once, depending on the nature of the transactions.

Organizing Payments Across Multiple Transactions

Managing payments across multiple services can be complex, but organizing your document in a logical, easy-to-follow way will ensure your clients can process everything without confusion. Consider these tips:

- Subtotal for Each Service: Subtotal each service or transaction, and then provide a grand total at the bottom of the document. This allows the client to easily see how each service contributes to the final amount.

- Offer Payment Flexibility: If applicable, offer payment options for each service individually, or allow the client to pay in one lump sum for all services. This flexibility can help accommodate different financial preferences or cash flow constraints.

- Clear Breakdown of Dates: If the services span different dates, list the date range or specific date of service for each transaction. This helps the client track the timeline of the services and associate the charges with specific actions.

By properly structuring your billing document for multiple services, you not only ensure accuracy but also demonstrate professionalism and transparency, which can help foster a stronger client relationship and ensure timely payments.

Tracking Payments with Invoice Templates

Efficiently tracking payments for services provided is essential for maintaining smooth cash flow and ensuring that you receive timely compensation. A well-organized billing document helps you monitor whether payments have been made, and provides a clear record of outstanding balances. By incorporating tracking features into your documents, you can easily follow up on overdue payments and maintain control over your financial processes.

Here are some effective strategies to track payments using your billing documents:

Key Tracking Elements to Include

- Payment Status: Clearly indicate whether a payment has been received or if it’s still pending. This can be done by adding a section that tracks the status of each payment, such as “Paid,” “Pending,” or “Overdue.”

- Payment Due Date: Always include a due date for each service rendered. This helps both you and your clients stay on top of payment expectations. For ongoing services, you may also want to include recurring due dates.

- Amount Paid: Include a field to record the amount paid by the client. If they make partial payments, clearly document each payment, along with the date it was made and the balance remaining.

- Balance Due: Always show the outstanding balance for each service or overall transaction. This can help prevent confusion and make it easy for your clients to understand how much is left to pay.

Organizing Payment Records

To make the tracking process even easier, consider organizing your payment records using these methods:

- Payment History: Create a dedicated section for recording all payments related to a specific transaction. Include the payment method (e.g., bank transfer, credit card, check), the date, and any transaction numbers to keep everything organized.

- Automated Reminders: Some billing software offers automated reminders for clients who haven’t paid by the due date. You can set up automatic follow-ups via email or SMS to notify clients of overdue payments.

How to Manage Invoice Templates Effectively

Managing billing documents efficiently is essential for maintaining a smooth workflow, especially when dealing with multiple clients or projects. Whether you are handling recurring services or one-off transactions, having a system in place for organizing and updating your billing records can save time and reduce errors. By implementing best practices for managing your billing documents, you can ensure consistency, accuracy, and timely payments.

Best Practices for Organizing Your Billing Documents

To effectively manage your billing documents, consider these strategies:

- Use a Standardized Format: Develop a consistent structure for your documents. This should include essential details such as client information, descriptions of services, payment terms, and due dates. Standardization helps maintain clarity and ensures all required information is included every time.

- File Organization: Organize your billing records by client, date, or project. You can use digital folders or cloud storage for easy access and retrieval. Ensure that your files are properly named, such as using client names or transaction dates for better searchability.

- Keep Templates Updated: Regularly review and update your billing documents to reflect any changes in pricing, terms, or services offered. Keeping your documents up-to-date helps avoid mistakes and ensures that you are always providing accurate information to your clients.

- Automate Where Possible: If your business involves recurring services or multiple transactions, consider using automation tools. These tools can help generate and send documents automatically, reducing the risk of manual errors and saving you time on repetitive tasks.

Tracking and Storing Billing Records

Properly tracking and storing your documents is key to maintaining financial accuracy and reducing the likelihood of missed payments or errors:

- Centralized Digital Storage: Use a cloud-based system to store all your billing documents in one place. Cloud storage allows you to access records from anywhere and ensures that your files are backed up securely.

- Record Payme

Best Practices for Real Estate Invoicing

In the property industry, creating professional and accurate billing documents is essential for maintaining smooth business operations and ensuring timely payments. Following best practices for billing ensures clarity and reduces disputes with clients. Implementing a structured approach can make the entire process more efficient, from creating the document to tracking payments and managing your records.

Essential Best Practices for Property Billing

Here are some key best practices to help streamline your billing process and improve accuracy:

- Clarity and Detail: Always include a detailed breakdown of services provided. This will prevent confusion and ensure your clients understand exactly what they are paying for. For instance, if you have provided multiple services such as property assessments, consultations, or marketing, list each service separately with a description.

- Consistent Format: Use a consistent and professional format for all your documents. Include essential fields like service descriptions, dates, amounts due, and payment instructions. Consistency not only makes your billing look more professional but also ensures nothing important is left out.

- Payment Terms and Deadlines: Be clear about payment terms, including due dates and late fees if applicable. This helps set expectations with clients and encourages timely payments. Always ensure that payment terms are outlined before any work begins.

- Include Tax Information: If applicable, include the correct tax rates and amounts on your billing document. Accurate tax calculations are crucial to avoid legal complications and maintain transparency with clients.

- Track Payments: Create a system for tracking payments against your billing documents. Keep a record of whether the payment was made in full, partially, or is still pending. This allows you to follow up on overdue payments more efficiently.

Additional Tips for Efficiency

In addition to the key best practices, here are some additional tips to improve your invoicing efficiency:

- Use Billing Software: