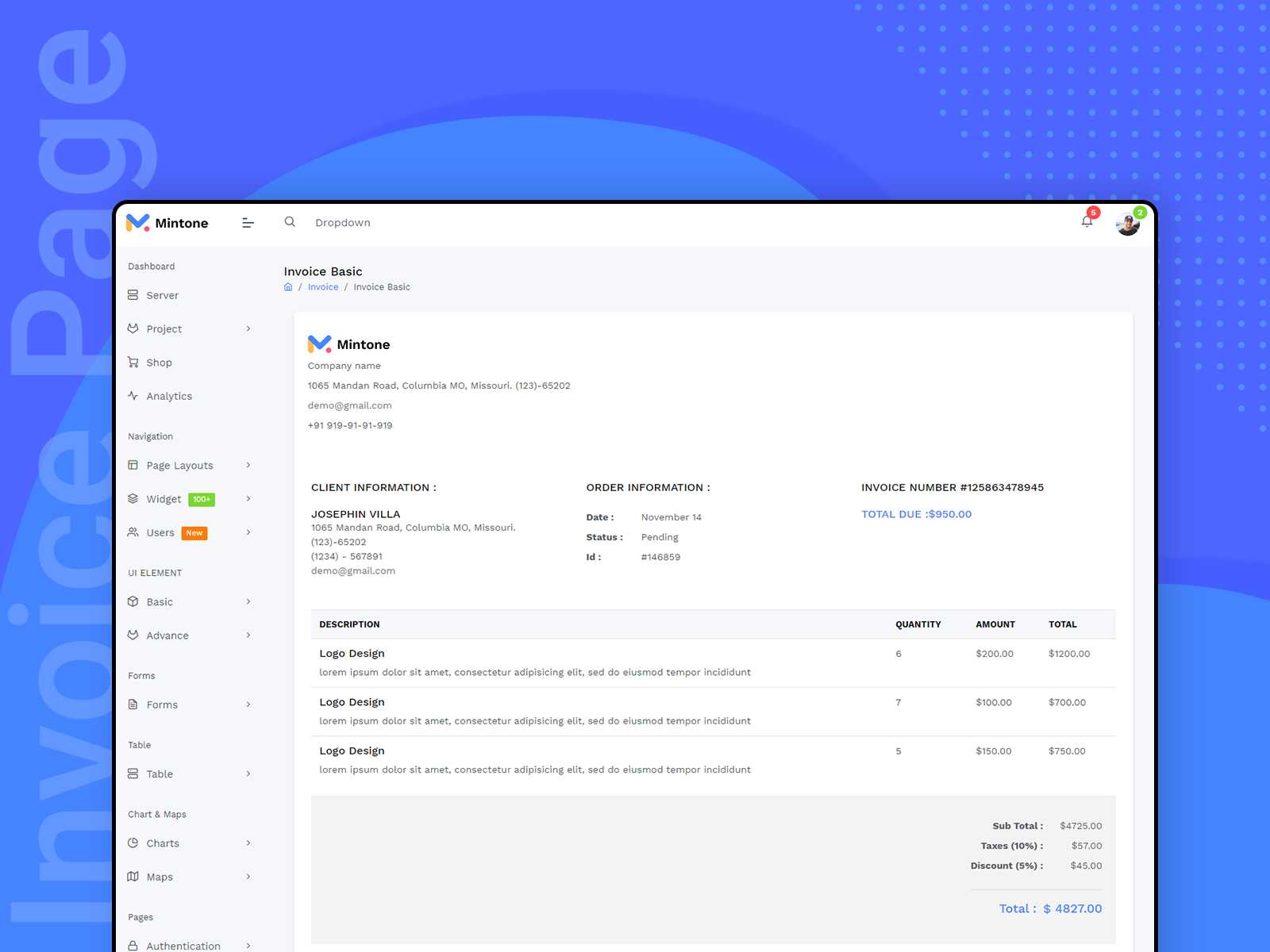

Create Professional Invoices with a React Invoice Template

Creating professional and customizable billing systems can streamline your financial processes and improve overall productivity. With the right approach, businesses can ensure that their clients receive clear and accurate statements, enhancing both the user experience and financial management.

By leveraging modern web development tools, you can design a solution that fits your unique needs. Whether you’re handling simple transactions or complex invoicing workflows, a well-structured platform can help automate repetitive tasks and improve accuracy.

In this guide, we’ll explore how to build a flexible and dynamic system that allows for easy customization and integration with various payment services. You’ll learn how to create a streamlined process that keeps your business running smoothly and ensures that all your billing needs are met effectively.

Why Use a React Invoice Template

Choosing a modern solution for managing billing and financial documents offers numerous advantages, especially when it comes to flexibility and customization. A well-designed platform can help streamline your workflow, reduce errors, and make it easier to adapt to changing business needs. When developing such systems, leveraging the right tools ensures better scalability and performance, which is crucial for businesses of all sizes.

Customization and Flexibility

One of the main reasons businesses opt for this approach is the level of customization it provides. With an adaptable structure, you can modify every aspect of your documents, from design to the details of the transaction. This means you can align your output with your brand, adding personalized touches to make your communications stand out. Whether you need to adjust fonts, colors, or even layout, the flexibility of these systems allows you to create a solution tailored to your specific needs.

Efficient Workflow and Integration

Another compelling reason is the ease of integrating such a solution with existing tools and services. Modern frameworks allow seamless integration with payment processors, databases, and client management systems. This eliminates the need for manual updates, reducing administrative time and the potential for mistakes. As a result, automating your billing system can significantly enhance operational efficiency and ensure smooth, error-free transactions.

In short, using a robust and customizable solution for financial documentation can improve both the user experience and your internal processes. With the right technology, you can create a scalable and professional system that meets your growing business demands.

Benefits of React for Invoicing

Modern web frameworks offer significant advantages when building dynamic and responsive systems for business documentation. By utilizing the right technology, you can create efficient, scalable solutions that enhance both functionality and user experience. This is particularly beneficial when developing systems for managing financial records and client transactions.

Speed and Performance

One of the key benefits of using this framework is its ability to efficiently render and update content. When working with complex data, such as financial figures and transaction history, performance can be a challenge. This framework’s virtual DOM ensures quick updates and minimal re-rendering, allowing your application to perform efficiently even with large datasets or frequent updates. As a result, users experience faster load times and smoother interactions.

Component-Based Architecture

Another major advantage is the use of a component-based structure. This approach allows developers to break down complex processes into smaller, reusable parts. For example, you can create individual components for handling calculations, payment records, or client details, which can be independently modified or updated without affecting the entire system. This modularity leads to cleaner code, easier maintenance, and faster development.

In conclusion, leveraging a modern framework for financial management systems offers performance benefits and scalability, making it easier to build adaptable and efficient solutions that meet the evolving needs of your business.

How to Get Started with React

Building interactive and dynamic web applications requires a clear understanding of the tools available. A powerful, component-based framework offers a streamlined way to manage complex interfaces while maintaining flexibility. Getting started with such a framework involves a few key steps that set the foundation for a successful project.

Step 1: Set Up Your Development Environment

Before you begin coding, it’s essential to prepare your development environment. This involves installing the necessary software and tools that will allow you to efficiently build and test your application.

- Install Node.js from the official website to handle package management and run local servers.

- Set up a code editor like Visual Studio Code, which offers features like syntax highlighting and debugging support.

- Use the terminal or command prompt to manage dependencies and run your application locally.

Step 2: Create Your First Project

Once your environment is ready, the next step is to create a new project using the framework’s command-line interface. This tool helps automate the setup process, making it faster and easier to get started.

- Open your terminal and use the command

npx create-app my-projectto create a new project directory. - Navigate to your project folder and run

npm startto launch a local development server. - Open your browser and visit

localhost:3000to see your application in action.

By following these steps, you’ll have a basic working environment set up, ready for you to start building customized solutions for your business needs.

Setting Up Your React Project

To start developing a robust, dynamic web application, the first step is to properly set up your project environment. A solid foundation ensures smooth development and allows for easy scalability as your application grows. This section will guide you through the necessary steps to get your development environment up and running, enabling you to focus on building your features.

Step 1: Install Necessary Software

Before you begin writing code, you need to install a few essential tools on your machine. These tools will help manage dependencies, run local servers, and test your application as you build it.

- Node.js: Download and install Node.js, which comes with npm (Node Package Manager), a tool for managing project dependencies.

- Code Editor: Use a code editor like Visual Studio Code, which offers features like auto-completion, syntax highlighting, and integrated terminal.

- Version Control: Install Git for version control to keep track of your code changes and collaborate with others if necessary.

Step 2: Initialize Your Project

Once your development tools are set up, the next step is to initialize your project. This process involves creating a new project directory and setting up the initial files and configuration needed for your app.

- Open your terminal or command prompt and navigate to the directory where you want to create your project.

- Run the command

npx create-react-app my-appto create a new project folder with all the necessary boilerplate code. - Navigate to your project folder by typing

cd my-appand then runnpm startto start the development server. - Visit

localhost:3000in your browser to see your project in action.

Now that your project is set up, you can start building your custom features and tailoring the system to meet your specific business needs.

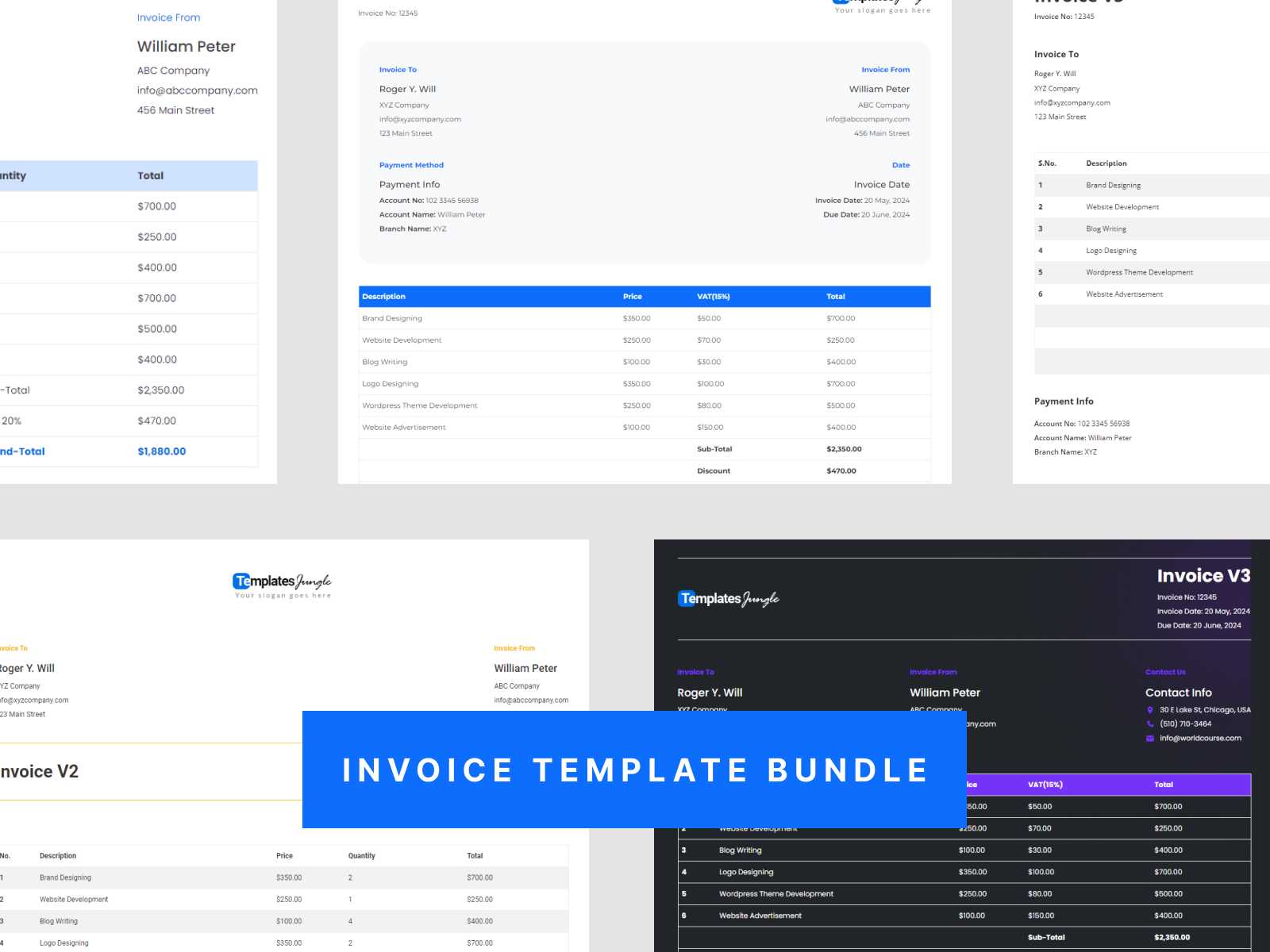

Customizing Your Invoice Design

Personalizing the appearance of your billing documents is crucial to presenting a professional and consistent brand image. Customization allows you to modify various elements such as layout, color schemes, typography, and logos, giving your documents a unique look that aligns with your business identity. This flexibility ensures that your communications not only look polished but also convey the values and professionalism of your company.

Adjusting Layout and Structure

The layout of your documents plays a significant role in making information clear and easy to understand. A well-organized layout helps clients quickly find important details such as amounts, payment terms, and contact information. You can adjust the placement of text fields, tables, and other elements to prioritize key data.

- Reorganize sections to highlight essential details like client information, service descriptions, and total amounts.

- Use grids or tables for a clean and structured design, making the document easy to read.

- Ensure that there’s enough spacing between sections for better visual flow.

Personalizing Visual Elements

Incorporating visual elements such as logos, colors, and fonts can significantly enhance the branding of your documents. These adjustments make your billing system feel more cohesive with the rest of your marketing materials, reinforcing brand recognition.

- Add your company logo in the header or footer for a professional touch.

- Choose colors that align with your brand’s color palette to create a cohesive design.

- Customize fonts to reflect your company’s style, ensuring readability while maintaining a unique look.

By customizing the design of your documents, you can create a visually appealing and functional billing experience that reflects your brand and makes a positive impression on clients.

Integrating Payment Options in React

Providing seamless payment processing within your billing system is essential for ensuring a smooth transaction experience for your clients. By integrating various payment options, you can make it easier for customers to settle their bills, increasing the likelihood of timely payments and customer satisfaction. This section will guide you through the process of adding payment gateways to your application.

Choosing a Payment Provider

The first step in integrating payment methods is selecting a payment provider that fits your needs. There are several popular options available, each offering different features such as security, ease of use, and supported countries. Some of the most commonly used payment gateways include:

| Payment Provider | Features |

|---|---|

| Stripe | Easy integration, supports multiple currencies, and secure payment processing. |

| PayPal | Global reach, widely trusted by users, and simple checkout process. |

| Square | Designed for businesses of all sizes, with both online and point-of-sale options. |

Implementing the Payment Gateway

Once you’ve chosen a payment provider, you need to integrate their API into your application. Most providers offer detailed documentation to help you through the integration process. Here’s a general overview of how to implement a payment gateway:

- Sign up for an account with your chosen provider and obtain the API keys needed for integration.

- Install the provider’s SDK or library into your project, often through npm or yarn.

- Set up the payment form to securely capture customer details like credit card information.

- Handle API responses to ensure payments are processed and errors are managed properly.

By adding payment options, you create a more convenient and efficient way for your clients to pay, improving the overall experience while ensuring that your business receives payments seamlessly and securely.

Managing Invoice Data with React

Handling financial data effectively is essential for any business, especially when dealing with transaction records and client information. A well-organized system ensures that data is easily accessible, accurate, and up-to-date. By using a modern JavaScript framework, you can manage and manipulate this data dynamically, creating an efficient workflow that supports your business operations.

One of the core advantages of working with such a framework is its ability to handle state and data flow in a predictable manner. This allows you to store, update, and display information seamlessly, whether it’s the client’s details, amounts, or payment statuses. Let’s explore how you can manage data effectively within your application.

The first step is to store your data in a centralized place, typically within the application’s state. This allows the data to be shared across components and automatically updated when changes occur. With a state management system, any modification, such as adding a new item or updating a total amount, will instantly reflect across the application, ensuring consistency.

Another critical aspect of managing data is organizing it in a structured manner. Using arrays or objects to store relevant information, such as product descriptions or client contact details, helps keep the data organized and easy to work with. You can also use functions to filter, update, or calculate values based on this data, automating many of the manual processes that would otherwise be time-consuming.

In conclusion, managing financial and transactional data effectively is crucial for maintaining a smooth business workflow. By leveraging a modern framework’s features, you can ensure that your system remains flexible, efficient, and capable of handling complex data tasks with ease.

Best Practices for React Component Structure

Creating a maintainable and scalable application begins with a well-organized and efficient component structure. A modular approach, where each part of your application is broken down into small, reusable pieces, helps improve code readability, testability, and overall performance. By following best practices for organizing and structuring your components, you can ensure that your application is easier to manage and grow over time.

Here are some key practices to follow when designing your components:

1. Keep Components Small and Focused

Each component should have a single responsibility. Keeping your components small ensures that they remain focused on one task, which makes them easier to debug, test, and reuse. Avoid creating large, monolithic components that try to handle too many things at once.

- Break down large components into smaller subcomponents.

- Ensure that each component only manages one piece of functionality.

- Consider using container components to manage state and presentational components for the UI.

2. Use a Consistent Folder Structure

Organizing your files in a consistent and logical manner helps keep the project navigable as it grows. A common structure follows grouping by feature or functionality, which makes it easier to find and maintain relevant files.

- Group by feature: Place components related to the same feature in the same folder.

- Use a components folder: For reusable UI elements like buttons, forms, or headers.

- Separate styles: Keep CSS or styled components in their own files to improve readability.

3. Manage State Wisely

State management is a crucial aspect of React applications. Keeping state local to components when necessary helps prevent unnecessary re-renders and keeps your application performant. For more complex state management across components, consider using a state management library like Redux or React Context.

- Use local state for data that doesn’t need to be shared globally.

- Lift state up to parent components when it needs to be shared among children.

- Use context or external libraries to manage global state in larger applications.

4. Favor Functional Components and Hooks

Functional components, in combination with hooks, provide a more concise and readable approach to building components compared to class-based components. Hooks allow you to manage state and side effects more effectively,

Optimizing React Performance for Invoices

Performance optimization is crucial when building web applications, especially those that handle large amounts of data or require frequent updates. A slow user interface can negatively affect the user experience, causing frustration and potentially lost business. By following best practices to optimize the performance of your application, you can ensure that it runs smoothly, even with complex data sets or dynamic content.

1. Minimize Re-renders

Excessive re-renders can slow down an application, especially when dealing with large datasets or frequently changing UI elements. To improve performance, minimize unnecessary re-renders and make sure components only update when absolutely necessary.

- Use

React.memo: Wrap functional components inReact.memoto prevent re-rendering unless the props change. - Optimize State Updates: Use the previous state when updating values that depend on the current state to avoid unnecessary updates.

- Leverage

useMemoanduseCallback: These hooks help avoid recalculating values or re-creating functions unnecessarily during re-renders.

2. Implement Lazy Loading

Lazy loading is an effective technique to improve load times by loading only the necessary components and resources initially, while deferring others until they are required. This reduces the initial page load time and speeds up interactions.

- React.lazy: Use

React.lazyto dynamically import components only when they are needed, reducing the initial bundle size. - Code Splitting: Break your application into smaller chunks using Webpack’s code-splitting capabilities, ensuring that only relevant code is loaded as the user navigates through the application.

- Suspense: Wrap lazy-loaded components in

Suspenseto handle loading states gracefully, improving user experience.

3. Efficient List Rendering

When displaying large lists of items, such as product details or transaction records, rendering every single item at once can cause performance issues. Implementing efficient rendering techniques can significantly improve performance in such cases.

- Virtualization: Use libraries like

react-windoworreact-virtualizedto render only the visible items in a list, rather than all items at once, reducing DOM nodes. - Pagination: Implement pagination to load data in chunks rather than displaying all items at once.

- Use a fluid grid: A fluid grid layout uses percentages instead of fixed pixel values, allowing elements to resize proportionally as the screen size changes.

- Flexbox for alignment: Flexbox is a powerful tool for aligning elements within containers, ensuring that they adjust dynamically based on available space.

- Minimize fixed dimensions: Avoid using fixed widths and heights for key elements like text boxes or tables to ensure they remain adaptable on different devices.

- Redux: A powerful library for managing global application state, often used in complex applications to maintain a consistent data flow.

Implementing Dynamic Invoice Numbers

Generating unique identifiers for transaction records is crucial in any billing system. A dynamic numbering system ensures that each record is easily distinguishable and can be tracked throughout its lifecycle. By implementing dynamic number generation, businesses can avoid conflicts, maintain proper order, and ensure accurate record-keeping. This approach helps automate the process and reduces the potential for human error.

To implement dynamic numbering, you can choose various strategies based on your system’s requirements. These strategies could range from sequential numbers to more complex schemes that incorporate timestamps or customer IDs for better organization and traceability.

Strategies for Dynamic Numbering

Here are some common strategies for generating dynamic identifiers in your application:

Strategy Description Advantages Sequential Numbers Simply incrementing the previous number by 1 each time a new record is created. Easy to implement, ensures chronological order. Timestamp-based Incorporating the current timestamp (date and time) into the number for uniqueness. Ensures uniqueness, helpful in environments with high transaction volume. Prefix with Customer ID Prefixing the number with a unique customer or transaction ID to create a custom identifier. Helps organize and categorize records easily, useful for multi-client systems. Implementing a Sequential Number Generator

For most systems, a simple sequential number generator may be sufficient. This can be done by storing the last used number in a database and incrementing it every time a new record is created. Here’s a basic outline of the process:

- Store the last used number: Save the last number used in the database so you can easily retrieve and increment it for the next record.

- Generate a new number: On the creation of each new record, retrieve the current number, increment it by 1, and assign it to the new entry.

- Handle concurrency: If your system is handling multiple requests simultaneously, consider adding a mechanism to prevent duplicate numbers, such as using locks

Adding Taxes and Discounts to Invoices

Incorporating taxes and discounts is a fundamental part of billing systems, as these elements directly impact the total amount that a customer needs to pay. By automating the calculation of taxes and discounts, businesses can ensure accuracy and consistency, reducing the chances of errors in manual calculations. Additionally, having the ability to dynamically apply these adjustments makes the system more flexible, allowing it to adapt to various pricing structures, regulations, or promotional campaigns.

When implementing taxes and discounts, it is important to account for local tax regulations, customer-specific discounts, and promotional offers that might apply. This allows for a more precise and transparent billing process, improving both customer satisfaction and legal compliance.

Implementing Taxes

Taxes can vary depending on the region, type of product or service, and specific customer conditions. The ability to dynamically calculate taxes based on these factors is essential for an effective system.

- Fixed Rate Taxes: Apply a percentage-based tax to the subtotal or specific items in the bill. For example, applying a 10% sales tax to all items.

- Tiered Taxes: Taxes that vary depending on the price range of an item or the total bill amount, such as reduced taxes for low-cost items.

- Region-Specific Taxes: Implement logic that calculates different tax rates depending on the customer’s location, which could include national, state, or local taxes.

Adding Discounts

Discounts are commonly used to encourage purchases, reward loyal customers, or clear out inventory. Offering flexible discounting options can help businesses create a better experience for their customers and drive more sales.

- Percentage Discounts: A fixed percentage off the total amount, such as a 20% discount on the final bill.

- Fixed Amount Discounts: A specific monetary amount deducted from the total, such as $10 off a customer’s order.

- Conditional Discou

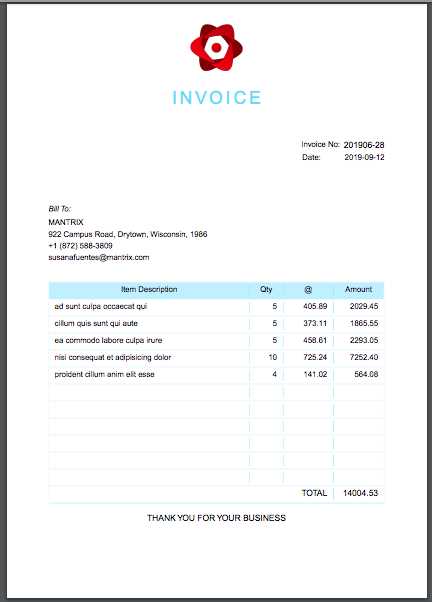

Creating PDF Invoices with React

Generating downloadable documents is an essential feature for any billing or transaction system. One of the most common formats for this is the PDF, due to its universal compatibility and professional appearance. By enabling the automatic creation of PDF documents directly from a web application, users can easily download or print their records as needed. This process can be automated, ensuring accuracy and saving time for both businesses and customers.

When creating these downloadable documents, it’s important to format the content properly, ensuring that all necessary information such as transaction details, customer data, and payment amounts is displayed clearly. Additionally, providing customizable options for branding, such as logos and company details, can enhance the document’s professionalism and alignment with business identity.

To generate PDFs in a web application, you can leverage JavaScript libraries that handle the conversion of HTML content into PDF format. These tools simplify the process, offering easy-to-use APIs for developers.

Popular Libraries for PDF Generation

Here are a few popular libraries that can help you convert content into a PDF document:

- jsPDF: A widely-used library for generating PDF documents in the browser. It offers a simple API and supports a variety of features like text, images, and tables.

- html2pdf.js: A wrapper around jsPDF, this library allows for easy conversion of HTML content into PDFs, including styles and formatting.

- react-pdf: A library that enables the rendering of PDFs as React components, which is useful for applications requiring dynamic PDF generation based on user input or system data.

Steps to Generate PDF Files

To create a downloadable PDF document, follow these basic steps:

- Install the necessary library: Choose a PDF generation library like jsPDF or html2pdf.js, and install it in your project.

- Prepare the content: Design the layout of the document using HTML and CSS. This includes adding transaction details, customer information, and any necessary branding elements like logos.

- Convert HTML to PDF: Use the library’s API to convert the HTML content into a PDF. This typically involves calling a method like

html2pdf()or using jsPDF’shtml()function. - Trigger the download: Once the PDF is generated, trigger a download or open it in a new tab for the user to view or print.

By implementing PDF generation in your system, you can offer customers a professional

Securing Your React Invoice Application

When building any web-based application that deals with sensitive information, security should always be a top priority. This is particularly true for systems that handle financial transactions or customer data. Ensuring that your application is secure not only helps protect user privacy but also builds trust and complies with legal regulations. Security measures should be implemented throughout the development process, from data encryption to proper user authentication, ensuring that your application is resilient against potential threats.

There are several strategies to implement security in your application, including proper data validation, secure communication protocols, and regular monitoring for vulnerabilities. By adopting a proactive security approach, you can reduce the risk of attacks, prevent unauthorized access, and protect your business and its users.

Key Security Measures

Here are some key security measures to consider when developing a secure web application:

- Data Encryption: Encrypt sensitive data both in transit and at rest using industry-standard encryption protocols such as TLS for secure communication and AES for data storage. This ensures that user data is protected from unauthorized access.

- Authentication and Authorization: Use secure authentication methods like JWT (JSON Web Tokens) or OAuth to ensure that only authorized users can access certain parts of the application. Implement role-based access control (RBAC) to limit user permissions based on their role.

- Input Validation: Always validate user input to prevent SQL injection and other malicious attacks. Make sure that any data submitted via forms or APIs is properly sanitized and validated on both the client and server sides.

- Cross-Site Scripting (XSS) Protection: Prevent XSS attacks by sanitizing user-generated content and using security headers like Content Security Policy (CSP). This helps protect against malicious scripts being injected into your application.

- Regular Security Audits: Conduct regular security audits and vulnerability assessments to identify and address potential weaknesses in your application. Use tools like static code analyzers and penetration testing to find and fix security flaws.

Securing APIs and Payment Gateways

If your application integrates with external APIs or payment gateways, it’s essential to ensure that those connections are also secure. Here are some best practices:

- API Authentication: Use API keys or OAuth for authentication to ensure that only authorized systems can access your API endpoints.

- Payment Gateway Integration: When integrating payment gateways, use well-established and secure methods provided by services like Stripe, PayPal, or Square. Always follow best practices for handling payment data and avoid storing sensitive financial information.

- Rate Limiting and Monitoring: Implement rate limiting on your APIs to prevent abuse and overload. Additionally, monitor API usage for unusual patterns or security threats.

By focusing on security from the start, you can significantly reduce the risk of data breaches and ensure that your application provides a safe and trustworthy experience for users. Taking the necessary steps to secure your system will not only protect your customers but also ensure

React and User Authentication for Invoices

User authentication plays a critical role in ensuring that only authorized individuals can access certain parts of an application, particularly when dealing with sensitive information like financial records. Implementing secure authentication mechanisms allows businesses to protect user data and ensure compliance with regulations. In modern web applications, especially those that involve transactions, it is essential to provide users with the ability to securely log in, manage their personal details, and view or manage their transaction history.

Authentication systems can vary in complexity, from simple login forms to advanced multi-factor authentication (MFA) methods. Regardless of the approach, implementing strong security measures is crucial in maintaining a trustworthy and secure environment for users. This section discusses how to integrate robust authentication in applications that manage financial data, focusing on methods for protecting user accounts and their sensitive information.

Authentication Methods for Secure Access

There are several methods for implementing secure user authentication in web applications. Below are some common approaches that can be used depending on your security requirements:

Authentication Method Description Use Cases Password-Based Authentication The most common form, where users create a username and password to access their accounts. Suitable for basic systems, though it should always be coupled with encryption and strong password policies. OAuth A third-party authentication method that allows users to sign in using their credentials from another service (e.g., Google, Facebook). Ideal for simplifying the login process and avoiding the need for users to remember multiple passwords. Multi-Factor Authentication (MFA) Requires users to provide multiple forms of identification (e.g., a password and a verification code sent to their phone). Essential for applications handling highly sensitive data or transactions. Best Practices for User Authentication

To ensure the security of user accounts and their financial data, consider implementing the following best practices:

- Secure Password Storage: Always hash and salt passwords before storing them in your database. Never store passwords in plain text.

- Token-Based Authentication: Use secure token-based systems like JWT (JSON Web Tokens) for session management. This helps prevent unauthorized access to user sessions.

- Unit Testing: Focus on testing individual components or functions in isolation. For instance, test the logic behind data processing, such as calculations for totals, tax, and discounts, ensuring everything is accurate.

- Integration Testing: Ensure that different parts of the system work together as expected. This may involve checking how the user interface interacts with the backend or how data flows between components.

- End-to-End Testing: This tests the entire user flow, from the creation of a document to its download or printing. It ensures the system functions correctly in a real-world scenario.

- UI/UX Testing: Test the user interface to ensure it’s intuitive and works across different devices and screen sizes. Focus on the responsiveness of the document layout, ensuring it looks good on both desktop and mobile devices.

- Performance Testing: Evaluate how the system performs under load, especially if your application handles large amounts of data or requires heavy processing. Make sure it remains responsive even under high usage.

- Jest: A popular testing framework for JavaScript applications, Jest provides unit and integration testing capabilities. It works well for testing individual components and functions.

- React Testing Library: A lightweight testing tool focused on testing React components in a way that simulates how users interact with them, helping you ensure your components are working as expected.

- Cypress: A robust testing

Deploying Your Invoice Application Online

Once you’ve completed the development and testing phases of your application, the next critical step is to deploy it for users to access online. Deployment involves moving your application from your local development environment to a live server or hosting platform where it can be accessed by users. A well-planned deployment process ensures that your application performs well in a production environment, remains secure, and is easily maintainable over time.

During deployment, you’ll need to consider several factors such as server configuration, security protocols, domain management, and performance optimization. The right hosting solution, combined with robust deployment practices, will ensure your application is reliable, scalable, and user-friendly. This section will walk you through some of the key steps to take when deploying your financial tool online.

Steps for Deploying Your Application

To deploy your application smoothly, follow these steps:

Step Description Prepare Your Code for Production Minify your code, remove unnecessary files, and ensure that your app is optimized for performance. This can include code splitting, image optimization, and environment variable configurations. Choose a Hosting Provider Select a hosting provider that fits your needs. Popular options include cloud platforms like AWS, Google Cloud, and Azure, or services like Heroku or Netlify for more straightforward hosting options. Set Up a Domain Purchase a domain name and configure your hosting provider to map the domain to your application. This helps users find and access your application with an easy-to-remember URL. Configure SSL for Security Ensure that your application is secure by enabling SSL (Secure Socket Layer) encryption. This encrypts the data transmitted between your server and the user’s browser, ensuring privacy and preventing data breaches. Deploy and Monitor Once everything is set up, deploy your application. After deployment, continually monitor for any issues such as performance bottlenecks, security vulnerabilities, or downtime. Best Practices for Deployment

To ensure a smooth deployment and avoid common pitfalls, consider these best practices:

- Use a Version Control System: Before depl

Testing Your React Invoice Template

Testing is a crucial step in the development process that ensures the application works as intended, without errors or unexpected behavior. When dealing with financial systems or business tools, testing becomes even more important, as it helps avoid issues such as incorrect calculations, missing data, or poor user experience. Testing your application thoroughly helps catch bugs early, making it more reliable and efficient in real-world use.

In the context of a document-generation tool, where users create and download financial records or transaction reports, testing should cover a variety of aspects, including UI rendering, data accuracy, and the functionality of document export features. By implementing proper testing strategies, you can ensure that your system consistently delivers high-quality output under different conditions.

Types of Tests for Your Application

When preparing your application for production, consider the following types of testing:

Tools for Testing Your Application

Several tools can help automate and streamline the testing process:

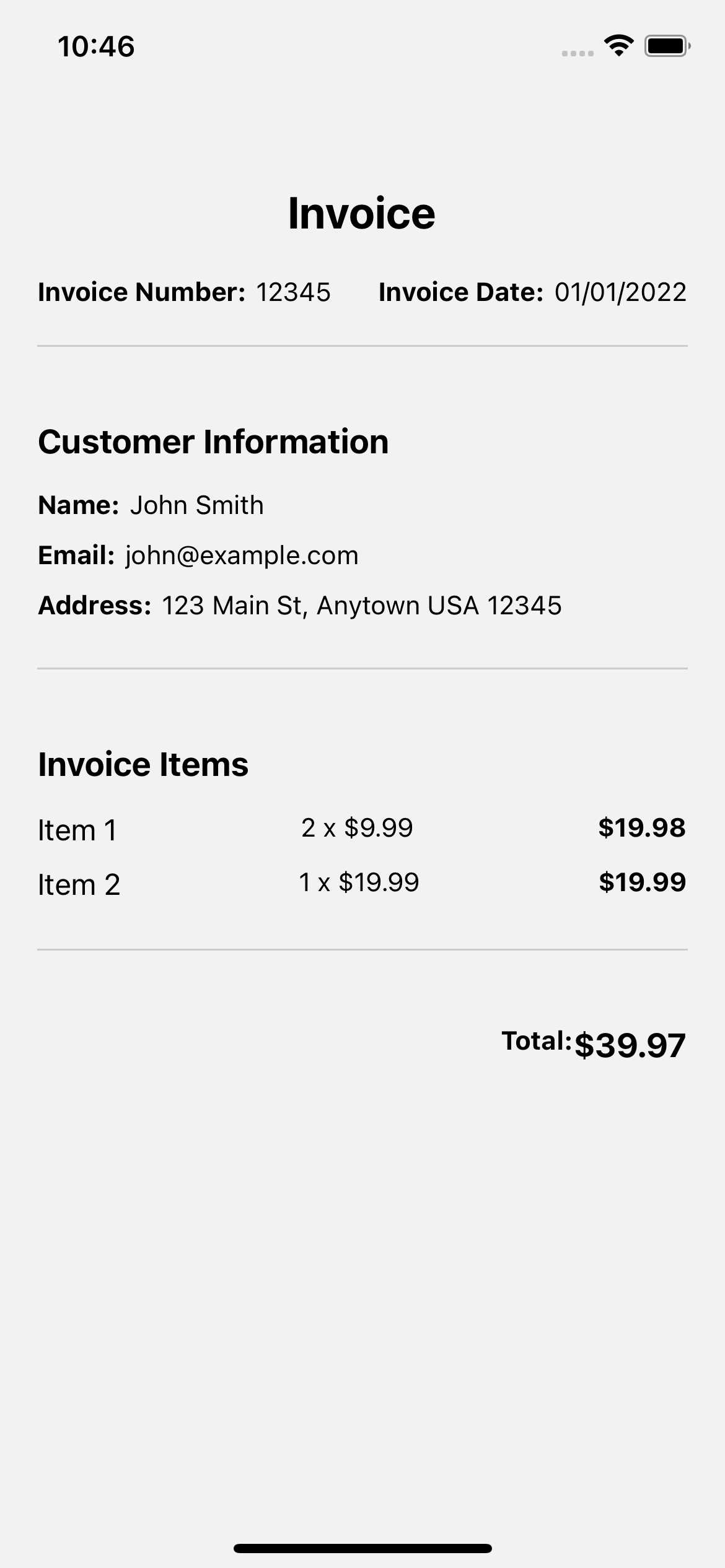

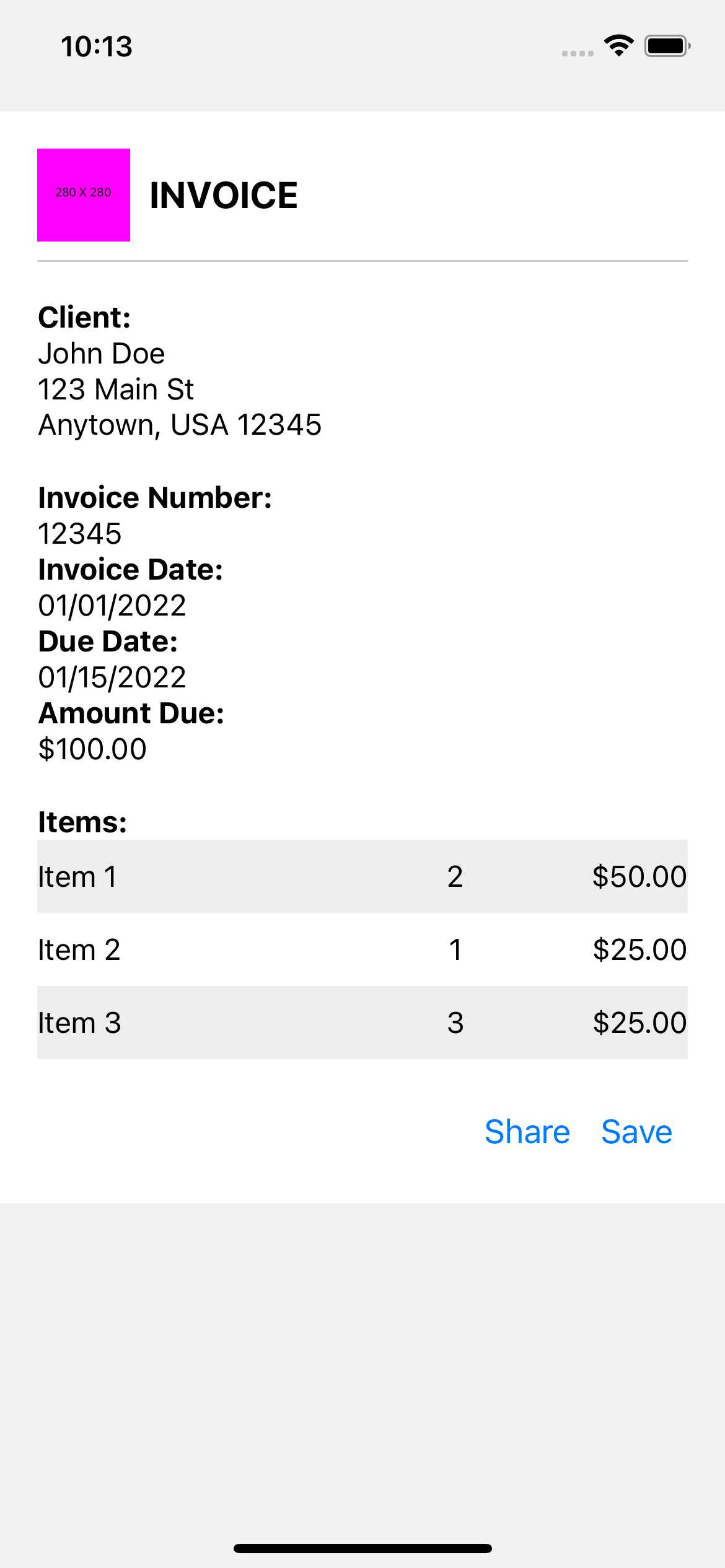

Responsive Invoice Templates in React

Creating a seamless experience across different devices is essential when designing any web-based document system. A responsive layout ensures that your users can view and interact with content efficiently, whether they’re using a smartphone, tablet, or desktop. For billing and transaction documents, ensuring that all essential information is easily readable and accessible on any screen size is crucial for maintaining professionalism and user satisfaction.

When designing responsive layouts, the goal is to ensure that content adapts to varying screen sizes without compromising readability or functionality. This requires using flexible grid systems, media queries, and scalable design elements that automatically adjust based on the device’s display characteristics.

Building a Flexible Layout

To create a design that works across all devices, it’s important to start with a flexible layout structure. A good approach is to use a grid or flexbox layout system that can adjust the position and size of elements based on the screen size. This ensures that the content flows naturally and remains easy to read, regardless of the device.

Implementing Media Queries

Me

Choosing Libraries for React Invoices

When building an application that generates and manages billing documents, selecting the right libraries can significantly improve both the development process and the functionality of your system. Libraries can help streamline tasks such as formatting, generating PDFs, handling payments, or managing state efficiently. Choosing the right tools ensures that your app performs well, remains maintainable, and delivers the best experience for both developers and users.

Popular Libraries for Document Handling

To generate and manage billing documents efficiently, several libraries can assist with rendering, formatting, and exporting content. Some of the most commonly used libraries for handling document creation and presentation include:

| Library | Use Case | Pros |

|---|---|---|

| jsPDF | Generating downloadable PDF documents | Simple API, supports complex document structures, and good for client-side PDF generation |

| html2pdf.js | Converting HTML content into PDF | Easy to implement, supports custom styling, and offers both client- and server-side solutions |

| react-pdf | Rendering PDF documents inside a React app | Allows rendering PDFs as React components, supports dynamic content and interactivity |

Libraries for State Management and Data Handling

Managing state efficiently is key to building scalable applications. Libraries that assist in state management ensure that data flows smoothly through the app without causing unnecessary re-renders or performance issues. Some commonly used libraries include: