Quickbooks Self Employed Invoice Template for Freelancers and Small Businesses

Efficient billing is essential for independent professionals and small business operators who need to keep their finances organized and secure timely payments. With the right resources, managing the financial side of a business can be both straightforward and effective, allowing for better focus on growth and client relationships.

A ready-to-use format for generating bills simplifies the process of creating professional, branded documents. By utilizing pre-designed layouts, professionals can easily add their details, itemize services, and present a clear breakdown of costs for clients. This approach reduces manual work, prevents errors, and ensures all essential information is present, creating a seamless experience for both parties.

Additionally, an adaptable billing format allows users to tailor each document according to project specifics or client requirements. With customization options, including logo placement, color schemes, and contact details, independent workers can convey a polished image that aligns with their brand identity. This extra level of personalization contributes to a more cohesive and tru

Understanding Quickbooks for Self-Employed Professionals

For independent professionals and small business owners, managing finances efficiently is crucial to sustaining a healthy cash flow and ensuring long-term success. A digital financial tool can serve as an essential resource, providing intuitive solutions for organizing income, expenses, and project-based transactions.

Key Features and Functionalities

Designed with simplicity and ease of use in mind, this platform offers essential functions that streamline the process of tracking income sources, categorizing business expenses, and creating detailed records of transactions. With dedicated sections for financial management, users can organize data by project, client, or transaction type, which helps in maintaining accurate records.

Why It’s Ideal for Freelancers and Small Businesses

This solution is particularly valuable for those who manage their own finances, as it offers automation and customization features that save time and reduce manual entry. Users can easily set up recurring processes, generate professional documents, and adjust details to suit specific business needs. With these features, managing billing, tracking expenses, and monitoring cash flow becomes a seamless p

Benefits of Using Invoice Templates

For independent contractors and small business operators, adopting structured billing formats can be a game-changer in maintaining professionalism and efficiency. Using predefined layouts for billing documents reduces the time spent on administrative tasks and ensures a consistent, polished presentation to clients. This streamlined approach enhances trust and provides a clear view of service charges, promoting a smooth payment process.

Time Savings and Accuracy

Ready-made billing formats save valuable time by allowing users to fill in essential details without starting from scratch each time. Since these documents are preformatted, there’s less chance of omitting critical information or making errors. This increases accuracy, minimizes misunderstandings, and helps clients quickly understand the scope and cost of services provided.

Professional Appearance and Brand Consistency

A consistent, branded billing layout makes a positive impression, helping business owners reinforce their brand identity with each transaction. Customizable options allow users to incorporate logos, colors, and contact details, giving each document a unique touch while maintaining a unified look. This approach not only conveys professionalism but also supports better client relationships and brand recognition.

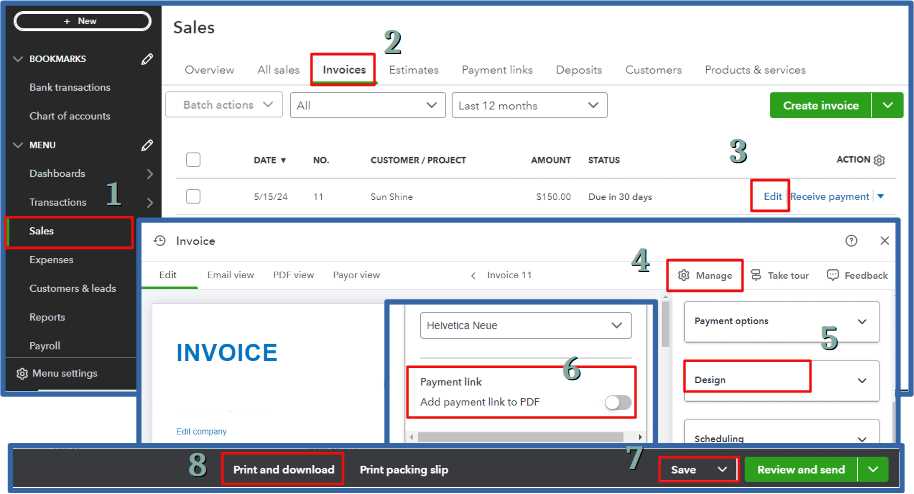

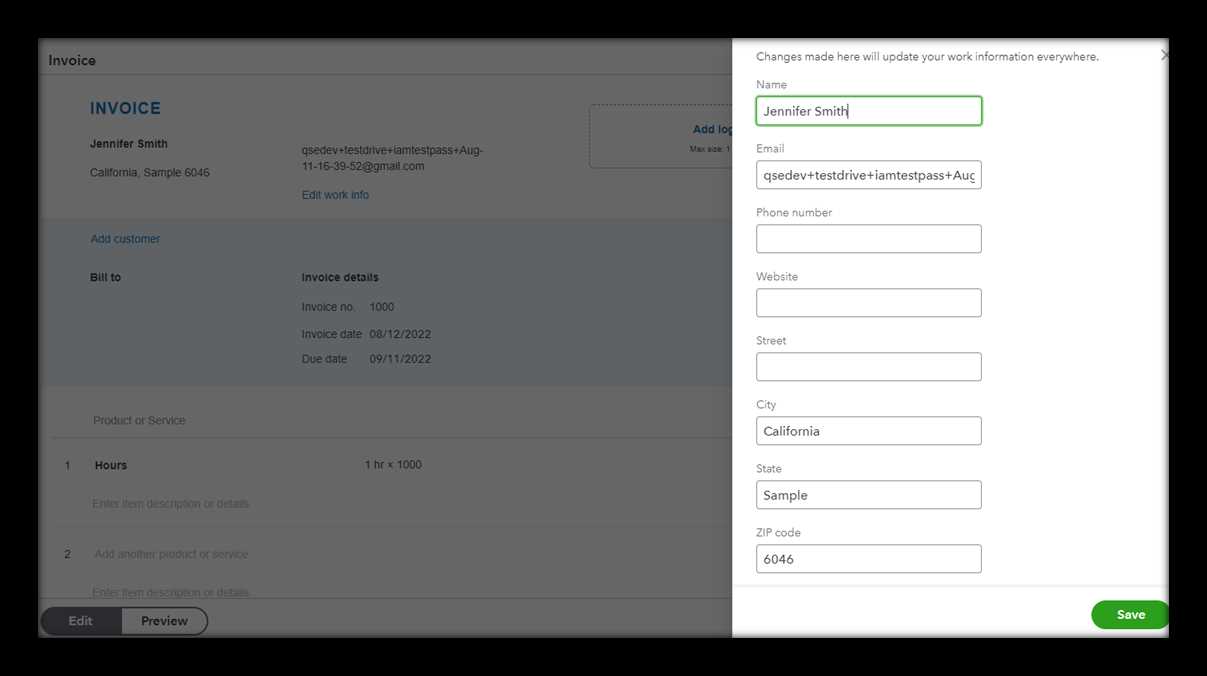

Setting Up Quickbooks for Invoicing

For freelancers and small business owners, establishing a streamlined billing process is essential for maintaining efficient financial operations. A digital financial tool can simplify this setup, allowing users to configure their billing practices according to their business needs. By setting up key features, users can enhance the clarity and accuracy of their financial documents.

To start the setup, follow these steps:

- Account Configuration: Begin by creating a dedicated account for managing business-related transactions. This will help separate personal finances from professional ones, making tracking and reporting easier.

- Client Profiles: Set up profiles for each client. Include essential details such as contact information, billing terms, and preferred payment methods to save time on future entries.

- Service Descriptions: Define the services or products offered by the business. Include descriptions, rates, and any relevant details to ensure consistency across documents.

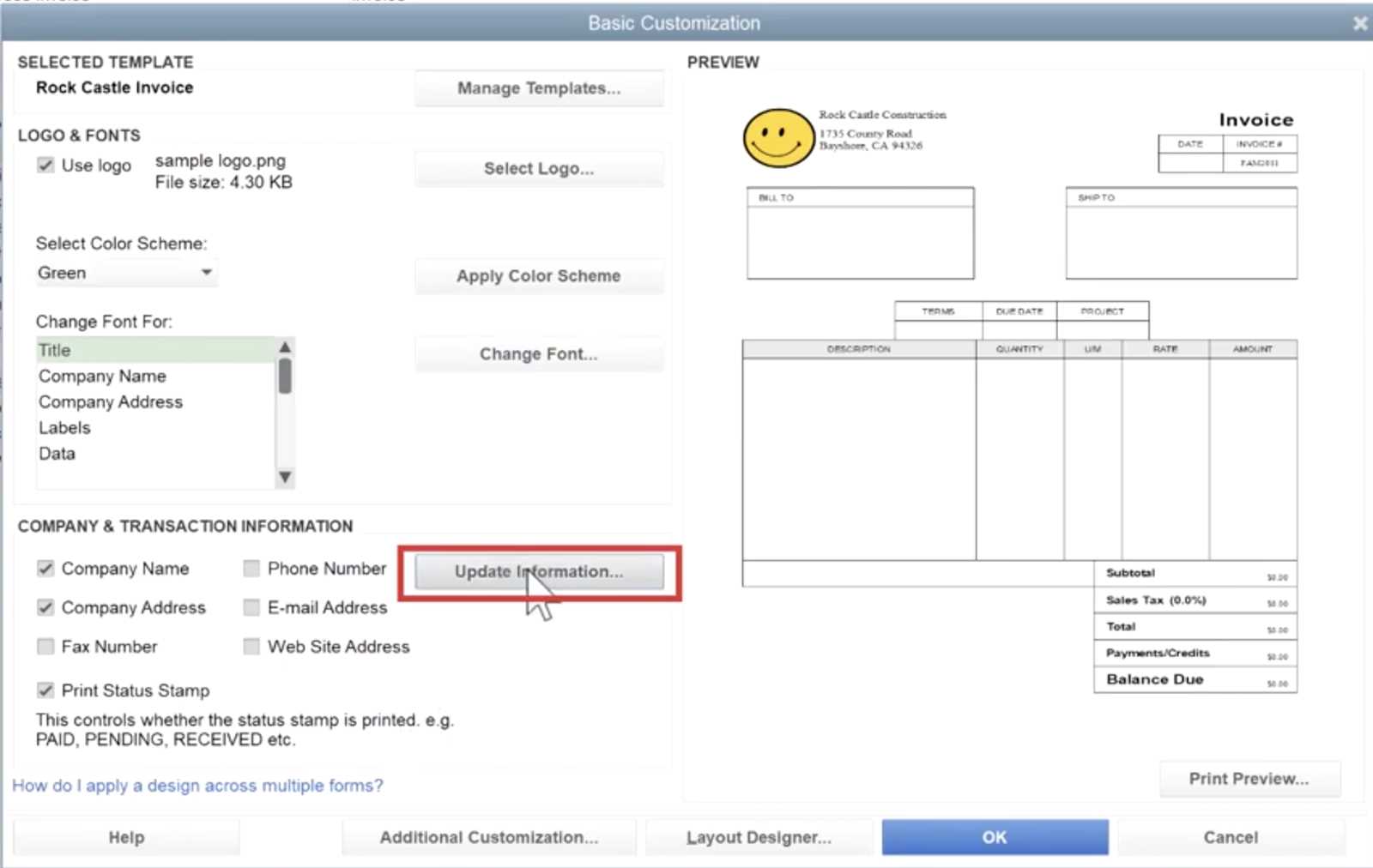

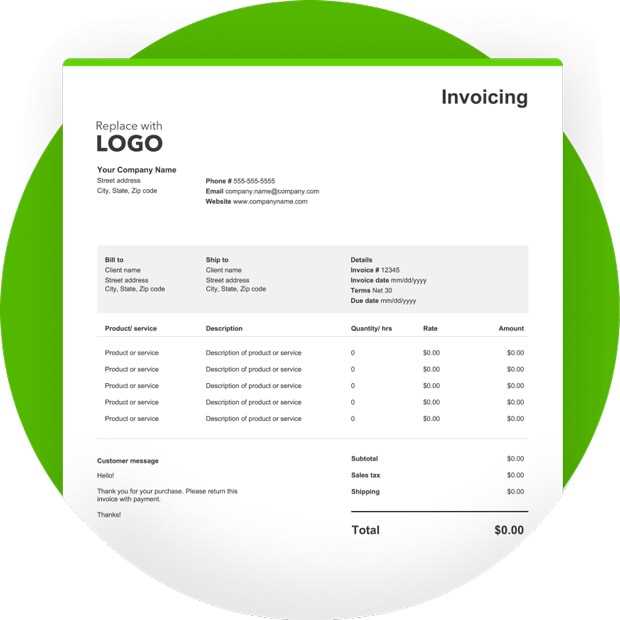

- Logo and Branding: Add a company logo and select colors that align with your brand. This reinforces your business identity and helps clients recognize your documents at a glance.

- Font Style and Size: Choose fonts that are professional yet readable. Adjust sizes to highlight important sections, such as totals and payment terms, without overwhelming the page.

- Contact Information Placement: Position contact details prominently to ensure clients can easily reach you with any questions. This might include phone numbers, emails,

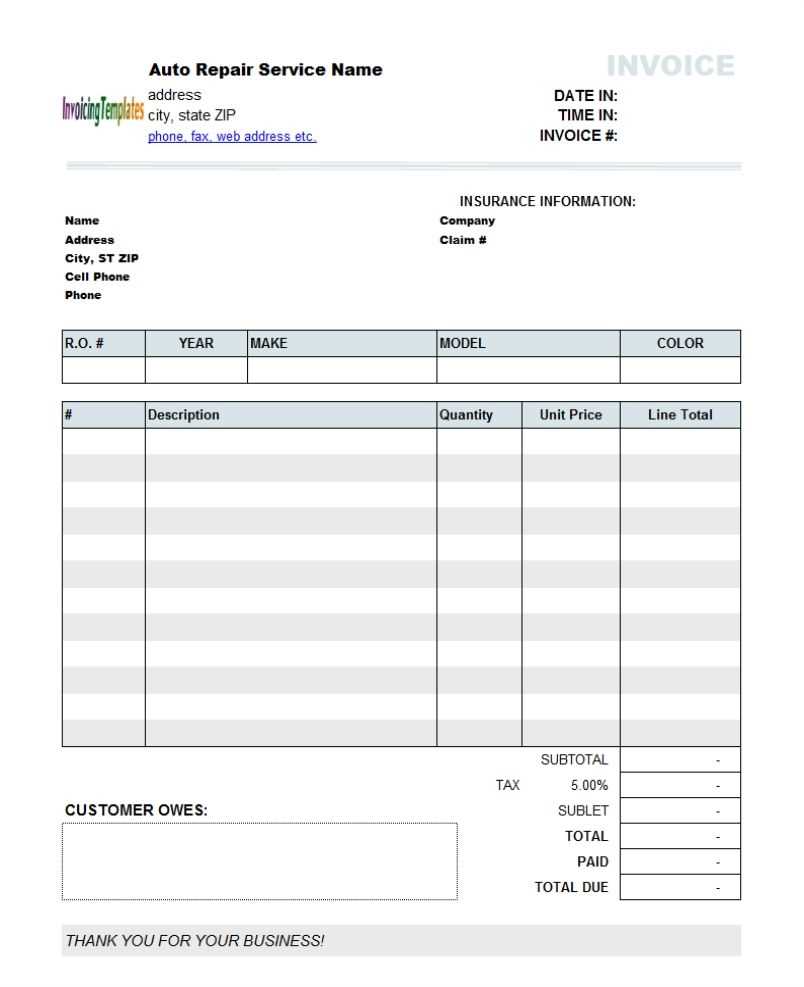

Choosing the Right Template Style

Selecting an appropriate format for your billing documents is essential for creating a positive impression and ensuring clear communication with clients. The style you choose should align with your brand’s identity and meet the specific needs of your business, as well as enhance readability and organization for a smooth transaction process.

Considerations for a Professional Look

When selecting a layout, it’s important to think about the tone and image you wish to convey. A clean, minimalist style often works well for creative professionals, emphasizing clarity and ease of reading. Meanwhile, a more formal layout with structured sections may suit legal or consulting services, presenting a polished and reliable appearance.

Essential Features to Include

In any chosen style, make sure to incorporate key sections to keep the document comprehensive and client-friendly:

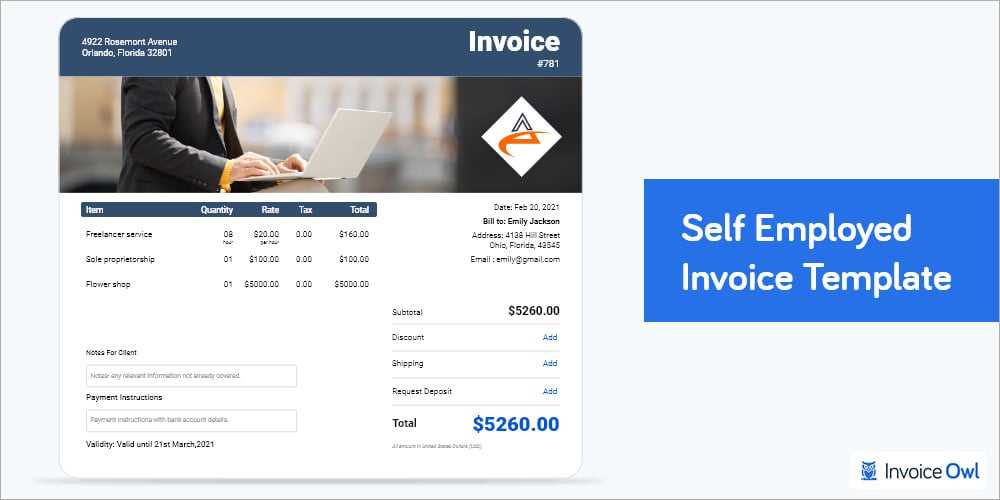

- Header with Logo: Start with a well-designed header that includes your business name, logo, and contact information for immediate brand recognition.

- Servic

Adding Essential Invoice Details

Including the right information in your financial documents is crucial for ensuring clarity and professionalism. It helps prevent confusion, facilitates smooth transactions, and ensures that both you and your client are on the same page regarding the terms and services provided. Key details not only establish your credibility but also ensure that the payment process is straightforward and transparent.

To create a comprehensive and well-structured document, include the following essential elements:

- Client Information: Clearly list the client’s name, address, and contact details. This ensures that the document is properly attributed and can be easily referenced.

- Unique Identifier: Each document should have a unique number or reference code. This makes tracking easier and helps with organization, especially for future reference.

- Detailed Service Breakdown: Provide a clear description of the services or products provided, along with the quantity, rate, and total for each item. This promotes transparency and helps clients understand the charges.

- Payment Terms: Clearly state the payment terms, including the due date and acceptable payment methods. This avoids misunderstandings and establishes clear expectations.

- Taxes and Additional Charges: If applicable, include any taxes or additional fees to be paid. This ensures that clients are aware of all the costs involved.

By including these critical details, you ensure that your financial documents are not only complete but also easy for clients to understand, streamlining the payment process and promoting a professional relationship.

Including Business Branding in Invoices

Incorporating your company’s branding into your financial documents is an effective way to reinforce your brand identity and create a consistent experience for your clients. Adding your logo, colors, and other brand elements to your documents not only boosts professionalism but also helps clients recognize your business at a glance. This attention to detail can foster trust and contribute to a more positive business relationship.

Here are key elements to consider when adding branding to your financial documents:

Branding Element Benefits Logo Promotes recognition and makes the document feel official and professional. Brand Colors Helps create visual consistency across all documents, aligning with your marketing materials. Tagline or Business Name Reinforces your company’s mission or name, ensuring clients remember your business. Font Style Maintains a cohesive aesthetic, aligning with your branding for a polished look. By strategically placing your brand elements in key areas of the document, such as the header or footer, you make sure that your business stays top of mind, even after the transaction is completed. This simple addition can go a long way in strengthening your brand’s visibility and creating a professional, polished impression for your clients.

Managing Client Information Efficiently

Efficient management of client data is vital for ensuring smooth transactions and maintaining a professional relationship. Keeping accurate and up-to-date records helps avoid errors, reduces delays, and allows for quick access to important details whenever needed. Having an organized system for tracking client information not only saves time but also enhances communication and streamlines your overall workflow.

To manage client information effectively, consider the following practices:

- Centralized Data Storage: Use a digital platform or system that allows easy access to client details, such as contact information, past projects, and payment history. A centralized system ensures that all data is stored in one place and can be easily updated when necessary.

- Segmented Client Profiles: Organize clients into categories based on factors such as industry, project type, or payment preferences. This segmentation makes it easier to personalize communication and streamline workflows.

- Automated Data Entry: Use tools that allow for automatic entry of client details, such as form submissions or integrations with your website. Automation reduces the risk of human error and speeds up the process of adding new clients.

- Consistent Updates: Ensure that client profiles are regularly updated with the latest contact details, project information, and payment status. This will help avoid mistakes and miscommunications.

By implementing these strategies, you can ensure that client data is well-organized, accessible, and up-to-date, leading to smoother operations and stronger client relationships.

Tracking Payments with Financial Software

Efficiently tracking payments is essential for managing cash flow and keeping your business operations smooth. Using a digital system to monitor incoming payments ensures that you can quickly identify which clients have paid, which invoices are pending, and where there may be discrepancies. This method not only helps maintain accurate financial records but also allows you to easily follow up with clients and avoid any missed payments.

Key Steps for Tracking Payments

- Record Payments Promptly: As soon as a payment is received, log it into the system. This ensures that all transactions are accurately recorded and can be easily accessed later.

- Categorize Payments: Use categories such as “Paid,” “Pending,” or “Overdue” to organize payments. This classification makes it easier to spot any issues and prioritize follow-ups.

- Set Payment Reminders: Automated reminders can notify you when payments are due or overdue. Setting these alerts helps prevent delays and encourages clients to settle their bills on time.

Benefits of Tracking Payments Effectively

- Improved Cash Flow: With accurate payment tracking, you can manage your cash flow more efficiently and avoid financial surprises.

- Reduced Administrative Work: Automation and organized records minimize the time spent on manual tracking, allowing you to focus on other aspects of your business.

- Better Client Relations: Keeping clients informed about their payment status and maintaining clear records helps build trust and ensures timely payments.

By implementing a payment tracking system, you can ensure that all payments are accounted for, reduce errors, and maintain a professional relationship with your clients.

Handling Recurring Invoices

Managing regular billing cycles can be time-consuming, but automating this process is crucial for maintaining consistency and ensuring timely payments. When dealing with ongoing services or products, setting up a system to automatically generate and send bills can save a lot of time and reduce the chance of errors. By streamlining these repetitive tasks, businesses can focus more on their core operations.

Setting Up Recurring Billing

- Determine the Billing Frequency: Decide how often you need to bill your clients–monthly, quarterly, or yearly. This decision depends on the nature of your service or product.

- Use Automation Tools: Set up automation to generate and send bills automatically at the determined intervals. This ensures that clients are billed without manual intervention.

- Clear Terms and Conditions: Make sure that both parties agree on the payment terms upfront, including the amount and frequency. This helps avoid any confusion or disputes later.

Benefits of Recurring Billing

- Time Savings: Automating recurring bills eliminates the need for manual creation and sending of invoices, freeing up valuable time.

- Consistent Cash Flow: Regular payments help maintain a steady income, which is vital for small businesses and freelancers.

- Reduced Errors: Automation minimizes human error, ensuring that each client receives an accurate and timely bill.

By adopting a system that handles recurring charges, businesses can simplify their processes, ensure reliable cash flow, and improve their overall efficiency in managing client accounts.

Exporting and Sharing Invoices

After creating billing statements, sharing and exporting them with clients is an essential step in the payment process. This ensures clients have the necessary documents to review charges, make payments, and keep their records updated. Using efficient methods for distributing these documents is key to maintaining a smooth workflow and timely payments.

Methods for Exporting and Sharing

- Email: Send the document directly to your client via email as a PDF attachment, ensuring it is easy to open and view on any device.

- Cloud Storage: Upload the document to a secure cloud storage service, allowing clients to download it at their convenience.

- Physical Mail: For clients who prefer traditional methods, printing and mailing the document ensures they receive a hard copy.

Table of Exporting Options

Method Advantages Best For Email Fast, paperless, and easy to track Clients with email access Cloud Storage Convenient access anytime, secure Clients comfortable with digital platforms Physical Mail Traditional, formal, and tangible Clients without digital access or preference for hard copies Choosing the right method for sharing your documents can enhance your relationship with clients, making the process more efficient and professional. Always ensure your clients have the necessary information to process payments smoothly and on time.

Automating Invoice Reminders

Staying on top of outstanding payments can be a time-consuming task. However, setting up automatic reminders for clients who have pending payments can streamline the process and ensure that no dues are forgotten. Automated notifications help maintain a professional communication flow, encourage timely payments, and reduce the administrative burden on businesses.

Benefits of Automated Reminders

- Efficiency: Set reminders once, and let the system handle the follow-ups, saving valuable time and effort.

- Consistency: Ensure clients receive timely notifications, reducing the chances of delayed payments due to missed reminders.

- Professionalism: Sending timely, polite reminders maintains a professional relationship with clients and reinforces expectations.

Table of Reminder Options

Reminder Frequency Advantages Best For One-Time Reminder Ideal for immediate follow-ups after the due date Clients with a single outstanding payment Recurring Reminders Set up reminders on a regular basis, such as weekly or monthly, for ongoing payments Clients with long-term or subscription-based agreements Pre-Due Date Reminders Send reminders before the payment due date to prevent late fees Clients with upcoming due dates By automating the reminder process, businesses can reduce the administrative workload while ensuring timely payments and maintaining positive client relations. Choose the right reminder system that suits your business needs and helps improve cash flow management.

Optimizing Invoices for Tax Season

As tax season approaches, having well-organized and clear payment records becomes crucial for both businesses and individuals. Ensuring that the financial documents you generate are comprehensive, accurate, and easy to interpret can help streamline tax preparation and minimize potential errors. This section outlines how to optimize payment records to ensure a smooth process during tax filing.

Key Elements for Tax Season Optimization

- Clear Descriptions: Each transaction should be detailed with clear descriptions to prevent confusion during tax filing.

- Accurate Date Tracking: Record the date when the service was provided or product delivered, which helps in categorizing income in the correct tax period.

- Itemized Charges: Break down services or products provided to ensure that expenses can be matched correctly against income for accurate reporting.

- Tax Information: Always include any relevant sales tax or applicable fees, making it easier to determine deductible expenses or tax liabilities.

Table of Useful Tax Documentation Features

Feature Description Tax Benefits Itemized List Provide a breakdown of services or products with individual prices Helps to identify deductible expenses and potential tax exemptions Taxable Amount Clearly highlight the taxable portion of each transaction Assists in calculating accurate tax liabilities or credits Payment Terms Specify the payment due date and any late fee conditions Ensures clarity on when income is considered earned for tax purposes By incorporating these elements into your financial records, you not only ensure a smoother tax season but also reduce the chance of errors that could lead to discrepancies or missed deductions. Organized financial documentation is key to maximizing tax returns and avoiding unnecessary complications.

Adding Payment Options to Invoices

Offering multiple payment methods on your financial documents can greatly enhance the ease and speed with which your clients settle their balances. By providing a variety of convenient payment choices, you can cater to different preferences, making it easier for your customers to pay on time. This section explores how to effectively include diverse payment options on your financial statements to improve client satisfaction and streamline payment processes.

Multiple Payment Methods

To ensure flexibility and convenience, it’s important to include a range of payment methods. This can include traditional options like bank transfers and checks, as well as digital options such as credit card payments, online payment services, and even mobile payment apps. The more options available, the more likely your clients will choose one that fits their preferences, leading to faster and more consistent payments.

Clear Payment Instructions

Make sure to clearly communicate the necessary details for each payment method. For bank transfers, include your account number and bank’s name. For digital payments, provide links or instructions for the preferred platform. Clear and concise instructions reduce the likelihood of errors or delays, making it easier for clients to complete their transactions smoothly.

By offering diverse payment options and providing clear instructions, you increase the chances of quicker payments and improved customer satisfaction. A well-structured approach to managing payments ensures your business operates more efficiently and reduces the time spent chasing payments.

Organizing Invoices by Project

Efficiently organizing your financial documents based on individual projects can streamline your accounting process, helping you track payments and outstanding balances more effectively. By categorizing each document according to the specific work completed, you can easily reference and manage financials related to particular jobs or clients. This method not only aids in project tracking but also enhances your overall business organization and reporting accuracy.

Benefits of Organizing by Project

- Improved Tracking: Keeping records separated by project ensures that you can easily monitor the progress and payments for each task. This helps identify any delays or discrepancies.

- Better Client Management: When invoices are organized by project, it’s easier to manage multiple clients, ensuring that all transactions are documented clearly and separately.

- Accurate Financial Overview: Grouping financial documents by project allows for a more precise understanding of your revenue and expenses per project, making it simpler to analyze the profitability of each venture.

How to Organize Documents

To maintain effective organization, you can use the following methods:

- Labeling: Use distinct project names or identifiers in each document to ensure easy sorting and referencing.

- Digital Organization: Use project management or accounting software that allows you to assign invoices to specific projects for automatic organization and tracking.

- Manual Filing: For physical records, create separate folders or files for each project and store all related documents together for easy access.

By organizing your financial documents by project, you can manage your business operations more efficiently and maintain a clearer overview of all active and completed projects. This approach simplifies tax reporting, budgeting, and client communication, leading to smoother operations and improved client satisfaction.

Integrating Accounting Software with Other Tools

Connecting your financial management software with other business tools can significantly improve workflow efficiency and data accuracy. By integrating multiple systems, you can automate various tasks, reduce manual data entry, and ensure that your records are consistent across platforms. This seamless exchange of information helps streamline processes, saving time and enhancing productivity.

Benefits of Integration

- Data Consistency: Integration ensures that information is synchronized across all systems, preventing errors from manual data entry and reducing the risk of discrepancies.

- Time Savings: Automation of tasks such as data transfers and updates eliminates the need for repetitive actions, allowing you to focus on more important aspects of your business.

- Improved Decision-Making: With real-time data synchronization, you gain a clearer view of your financial health, making it easier to make informed decisions and strategic plans.

Common Tools to Integrate With

- Payment Processors: Link your financial software with payment platforms to automatically record transactions and reconcile accounts without manual intervention.

- Customer Relationship Management (CRM) Systems: Integrating with CRM tools allows you to track client interactions and better manage customer relationships alongside your financial records.

- Project Management Software: Synchronizing with project management tools helps keep track of budgets, deadlines, and payments related to specific projects, providing a comprehensive view of each project’s financial status.

- Banking Services: Connect directly with your bank to automate transaction imports and reconciliation, simplifying your financial oversight and ensuring accuracy.

By integrating your financial software with various tools, you can create a more efficient, accurate, and streamlined workflow. This approach reduces the administrative burden and improves business operations, ultimately allowing you to focus on growing your business.

Improving Cash Flow with Better Billing Practices

Enhancing your billing process can have a significant impact on your business’s cash flow. By streamlining the way you request payments and ensuring clear, professional communications, you can reduce delays and increase the likelihood of timely payments. Well-structured bills not only provide clients with clear information, but also demonstrate professionalism, making it easier to collect funds when due.

Key Elements for Faster Payments

- Clear Payment Terms: Specify due dates, payment methods, and late fees upfront to avoid confusion and encourage prompt payment.

- Itemized Charges: Break down each service or product clearly to show clients exactly what they are being charged for. This reduces the chances of disputes and increases transparency.

- Early Payment Discounts: Offer incentives, such as a small discount, to clients who pay before the due date. This can motivate them to settle bills faster.

- Automated Reminders: Set up automatic reminders to notify clients of upcoming or overdue payments. Gentle reminders can help ensure payments are not missed.

Ensuring Efficient Payment Processing

- Multiple Payment Options: Provide clients with various ways to pay, such as credit card, bank transfer, or online payment systems, to make the payment process easier and more convenient.

- Clear Contact Information: Ensure your contact details are easy to find, so clients can easily reach out in case of any questions or issues with the payment process.

- Quick Processing Time: When you receive a payment, process it promptly. This helps in keeping your financial records up-to-date and avoids delays in your accounts.

By implementing these strategies, you can optimize your billing practices to improve cash flow, reduce late payments, and ensure the smooth operation of your business.

Customizing Your Invoice Layout

Personalizing your billing format can significantly enhance the professional appearance of financial documents. By tailoring the structure, look, and details, independent professionals can create a unique and consistent brand image that resonates with clients. Adjusting various elements helps ensure that each document reflects both the business’s identity and the specific requirements of the project or client.

Key Elements to Customize

Consider adjusting the following aspects to create a polished, branded document: