QuickBooks Progress Invoice Templates for Efficient Project Billing

For professionals managing extensive projects, the importance of a well-organized billing system is essential. When payments are broken into stages, it helps create transparency and builds trust with clients. By tailoring billing practices, it’s possible to capture detailed financial snapshots, simplify cash flow management, and maintain precise records without overwhelming either party.

This approach also supports businesses that handle various client engagements by offering a flexible way to handle finances based on work phases. Breaking down large sums into smaller, manageable transactions allows both service providers and clients to monitor expenses more accurately. This way, each project stage is accounted for, helping reduce financial discrepancies while ensuring clarity.

With this setup, businesses can adapt their billing models to meet specific project needs and better align with their clients’ expectations. Leveraging these adaptable billing methods fosters better communication, enhances customer satisfaction, and ultimately leads to more streamlined financial processes.

QuickBooks Progress Invoice Templates Guide

Handling complex projects often requires a structured approach to billing, particularly when work is completed in stages. Dividing the payment process into manageable segments not only eases financial planning but also ensures clients remain informed of the costs associated with each phase of the project. By using organized methods for such billing needs, businesses can better manage cash flow, keep detailed records, and foster clear communication with clients.

Benefits of a Phased Billing System

Implementing a phased billing approach offers several advantages that enhance both financial clarity and customer satisfaction.

QuickBooks Progress Invoice Templates Guide

Handling complex projects often requires a structured approach to billing, particularly when work is completed in stages. Dividing the payment process into manageable segments not only eases financial planning but also ensures clients remain informed of the costs associated with each phase of the project. By using organized methods for such billing needs, businesses can better manage cash flow, keep detailed records, and foster clear communication with clients.

Benefits of a Phased Billing System

Implementing a phased billing approach offers several advantages that enhance both financial clarity and customer satisfaction. Here are some primary benefits:

- Transparency: Clients have a clearer view of the costs involved at each stage, leading to fewer misunderstandings.

- Improved Cash Flow: By invoicing incrementally, companies can maintain steady cash inflows, even during long-term projects.

- Enhanced Record-Keeping: Keeping track of charges at each stage helps in organizing financial data and reduces the risk of errors.

Creating a Custom-Built Billing Outline

To create a phased billing model that fits specific projects, it’s essential to consider the project scope and timeline. Here are steps to develop an effective structure:

- Define Project Milestones: Break the project into key phases that mark significant points of completion.

- Set Payment Amounts: Assign a portion of the total cost to each phase based on the work completed.

- Schedule Payments: Decide on payment dates or requirements for each stage, helping clients prepare for costs.

- Communicate Clearly: Ensure clients understand the billing outline and the purpose of each stage charge.

Using these methods, businesses can build a billing system that aligns with their operational needs while promoting transparency and efficiency for clients.

Benefits of Using Progress Invoices

For projects that extend over time or involve multiple stages, breaking down the payment process can significantly streamline financial management. This approach allows both businesses and clients to handle costs incrementally, aligning payments with the work completed. By adopting a staged billing method, companies can reduce financial risks while providing clients with a clear understanding of the expenses as they accrue.

Enhanced Cash Flow Management

One of the primary advantages of staged billing is the improvement in cash flow. Instead of waiting until a project’s completion, businesses can secure payments as each phase concludes. This provides a steady influx of funds to support ongoing work and operational needs.

- Consistent Income Stream: Regular payments ensure businesses have the resources to manage project expenses effectively.

- Reduced Financial Strain: Incremental billing minimizes reliance on credit or reserves by offering timely payments.

- Improved Budgeting: Staged billing makes it easier to anticipate and allocate reso

Creating Effective Progress Billing Templates

Designing a structured billing format that aligns with project phases can simplify financial tracking and communication with clients. An organized approach ensures each payment request is clear, detailing the work completed and the costs involved. Building a well-planned billing format not only aids in record-keeping but also supports smoother cash flow management and client satisfaction.

To develop a streamlined billing layout, begin by structuring sections that reflect each project milestone. This approach allows clients to see the work progression, creating a transparent view of charges that directly relate to the services delivered. It’s important to ensure that each section is straightforward, presenting essential information without overwhelming details.

Key elements of a well-crafted billing format include:

- Clear Project Phases: Break down each phase, specifying the scope of work and completion percentage. This provides a logical sequence for clients to follow.

Customizing Templates for Different Projects

Adapting billing formats to fit the unique needs of each project can greatly improve clarity and efficiency. Different projects often require varied approaches to payment structuring, depending on factors like project length, complexity, and the client’s preferences. A tailored billing structure allows businesses to better reflect the work completed at each phase, ensuring both accurate financial management and enhanced client satisfaction.

To create an adaptable billing format for diverse project types, consider the following customizations:

- Define Project Scope: Clearly outline the primary tasks, deliverables, and milestones specific to the project. This provides a foundation for assigning costs to each phase.

- Adjust Payment Milestones: For lengthy or complex projects, break down payments into smaller, frequent installments. For shorter projects, a few larger payments might be more suitable.

Tracking Partial Payments in QuickBooks

For long-term projects or those requiring multiple stages of payment, keeping track of partial payments is essential for maintaining accurate financial records. Managing these payments efficiently helps businesses monitor client balances, avoid overpayments, and ensure that all outstanding amounts are settled appropriately. Having a system in place to track these incremental payments ensures clarity for both businesses and clients throughout the project’s duration.

To track partial payments effectively, consider these essential steps:

- Record Each Payment: As clients make partial payments, ensure that each transaction is recorded with the corresponding amount and date, reflecting the client’s progress in settling their balance.

- Apply Payments to Specific Stages: Link each payment to the relevant project phase or milestone to ensure proper allocation and visibility into what has been paid versus what is still due.

- Maintain a Running Balance: Keep track of the remaining amount for each client after every partial payment, ensuring that any outstanding balance is clear.

- Generate Payment Receipts: Provide clients with receipts or payment confirmations for each installment to keep them informed and avoid disputes.

- Monitor Payment Schedule: Stay on top of upcoming payments by setting reminders or due dates based on the payment plan agreed with the client.

By following these practices, businesses can effectively track payments over time, ensuring accurate financial management and fostering good relationships with clients by keeping them informed and up-to-date on their balance.

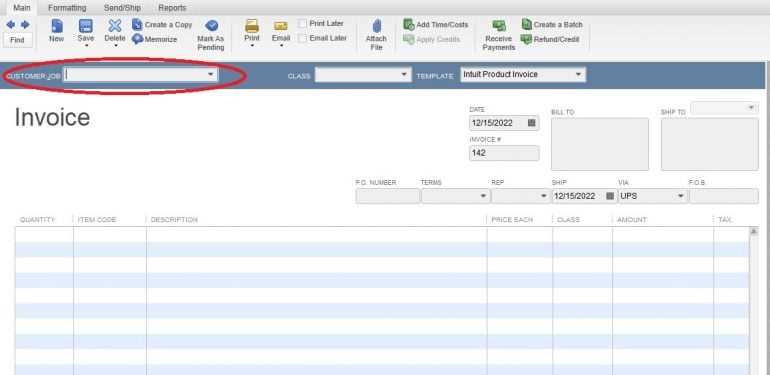

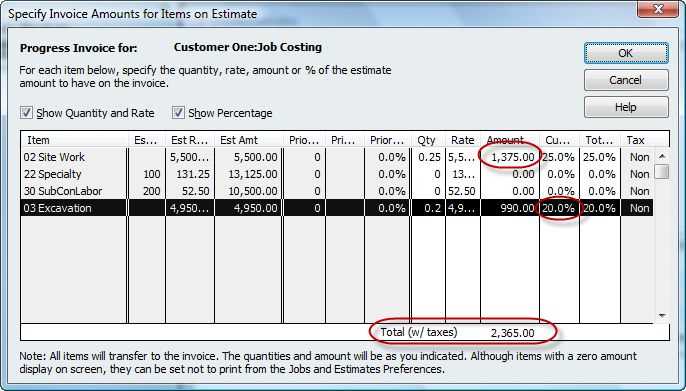

How to Set Up Progress Invoicing

Setting up a system to handle payments over multiple stages can significantly improve how you manage long-term projects. This approach allows you to bill clients incrementally, based on the work completed at various phases, and ensures a smoother cash flow throughout the life of the project. Proper setup requires aligning milestones with billing periods and customizing your payment schedules according to the project’s timeline.

Step-by-Step Process for Setting Up

Follow these steps to configure a staged payment system that fits your project’s needs:

- Define Milestones: Break the project into clear stages, each representing a distinct phase of completion.

- Determine Payment Amounts: Assign a payment amount to each milestone, ensuring it reflects the value of work completed at that stage.

- Create Payment Schedule: Set up dates for when payments are due for each milestone, based on project timelines.

- Track Payments: Keep detailed records of the payments made against each phase to ensure everything is accounted for.

Sample Payment Schedule

Here’s an example of how a payment schedule could look for a project with multiple stages:

Milestone Description Payment Amount Due Date Stage 1 Initial Project Setup $5,000 March 1, 2024 Stage 2 Design Completion $7,500 April 15, 2024 Stage 3 Final Delivery $10,000 June 1, 2024 Once these steps are completed, you’ll have a clear structure for collecting payments in line with project progress. This system helps both you and your clients stay on top of financial expectations, ensuring smooth operations from start to finish.

Best Practices for Tracking Project Costs

Effectively managing project expenses is key to staying within budget and ensuring the financial success of any undertaking. By accurately tracking costs as a project progresses, businesses can identify potential issues early, prevent overspending, and provide clients with transparent financial updates. Developing a reliable system for tracking expenses at each phase of a project helps streamline financial planning and enhances project management efficiency.

Essential Techniques for Accurate Cost Tracking

To ensure your cost tracking is thorough and accurate, implement the following practices:

- Define Budget Categories: Break down your budget into specific categories such as labor, materials, and overhead. This makes it easier to monitor where money is being spent and adjust accordingly.

- Use Detailed Records: Keep precise records of all transactions, including receipts, invoices, and purchase orders. This will help you track costs more effectively and prevent discrepancies.

- Regularly Update Cost Estimates: Regularly compare actual expenses with your initial estimates. If costs exceed expectations, update the budget or adjust your project plan to keep finances in check.

- Monitor Cash Flow: Keep an eye on cash flow to ensure there is enough capital to cover ongoing expenses. This will also help prevent delays due to financial shortfalls.

Leveraging Technology for Tracking Costs

Modern tools and software can simplify the tracking process and improve accuracy. Using project management software or financial tracking platforms can help automate data entry and provide real-time updates on project expenditures.

- Automated Expense Tracking: Use software that can automatically record and categorize costs as they occur, saving time and reducing the risk of human error.

- Generate Reports: Generate detailed financial reports that show cost breakdowns and projections, enabling quick decision-making and adjustments.

- Integrate Systems: Integrating project management tools with accounting systems ensures seamless data flow and helps avoid double entry of information.

By following these best practices, businesses can maintain financial control over their projects, avoid unexpected costs, and deliver projects within budget.

Common Mistakes to Avoid in Invoicing

When managing financial transactions, accurate and timely billing is essential for maintaining healthy cash flow and strong client relationships. However, mistakes during the billing process can lead to confusion, delayed payments, and lost revenue. Understanding and avoiding common invoicing errors can help ensure smoother financial operations and clearer communication with clients.

Key Mistakes to Avoid

Here are some common mistakes businesses should watch out for when preparing and sending bills:

- Inaccurate Billing Details: Failing to include correct client information, such as the billing address or contact details, can lead to delayed payments. Always double-check that all information is accurate before sending a bill.

- Missing Payment Terms: Not specifying clear payment terms can cause confusion. Always include due dates, payment methods, and any penalties for late payments to avoid misunderstandings.

- Omitting a Detailed Breakdown: Clients may question charges if the bill doesn’t include a detailed breakdown of the services or products provided. Be sure to list everything clearly to enhance transparency and reduce disputes.

- Failure to Follow Up: Sending an invoice and not following up can lead to overdue payments. Make sure to send reminders or check in on past due amounts to ensure timely payment.

- Overcomplicating the Invoice: A complicated or cluttered invoice can confuse clients and delay payment. Keep your invoices simple and easy to understand, with clear, organized sections.

Preventing These Errors

To minimize mistakes, establish a system that ensures consistency and accuracy in your billing process. Using digital tools or software that automatically generates bills with pre-set information can significantly reduce human error. Regularly reviewing your invoicing process and providing training to staff can also help avoi

Organizing Client and Project Data

Efficiently managing client and project information is critical for ensuring smooth business operations. By keeping data organized, businesses can streamline their workflow, improve communication with clients, and track progress with ease. A well-structured approach to handling data not only helps in day-to-day management but also provides a foundation for accurate reporting and decision-making.

Effective Strategies for Organizing Data

Here are some key strategies for keeping client and project data in order:

- Create Centralized Client Profiles: Maintain a single, comprehensive record for each client that includes contact information, project history, and billing preferences. This allows for easy access to all relevant details in one place.

- Track Project Milestones: Organize project details by milestones, keeping track of deadlines, key deliverables, and payment schedules. This helps ensure that no important details are overlooked throughout the project lifecycle.

- Use Digital Tools: Leverage project management and customer relationship management (CRM) software to store and organize client and project data. These tools allow for easy updates, tracking, and retrieval of information in real-time.

- Set Up Clear Categorization: Categorize projects by type, client, or status to create an efficient filing system. This simplifies searching for specific details, whether for invoicing, reporting, or communication.

Benefits of Organized Data Management

By maintaining organized client and project data, businesses can experience several advantages:

- Improved Communication: Quick access to client and project information ensures that all team members are on the same page, reducing the risk of miscommunication.

- Increased Efficiency: With organized data, you can quickly find what you need, whether for billing purposes or progress updates, leading to faster decision-making and reduced administrative overhead.

- Accurate Reporting: Well-organized records enable easy generation of financial and project reports, allowing businesses to assess profitability, project timelines, and other key metrics with accuracy.

Organizing client and project data efficiently can transform the way businesses manage their operations, leading to smoother workflows and enhanced client satisfaction.

Tips for Managing Long-Term Projects

Managing long-term projects requires careful planning, ongoing monitoring, and flexibility to adapt to changing circumstances. Whether dealing with large-scale developments or extended client engagements, staying on top of every detail is crucial for success. Effective strategies can ensure smooth execution, prevent delays, and guarantee that both resources and client expectations are properly managed throughout the project lifecycle.

Key Strategies for Successful Project Management

Here are several tips to help streamline the management of long-term projects:

- Set Clear Milestones: Break the project down into achievable phases or milestones. This not only makes it easier to monitor progress but also helps maintain focus and motivation as the project evolves.

- Establish Regular Check-ins: Schedule routine meetings with your team and clients to review progress, address challenges, and realign on objectives. Frequent check-ins ensure that nothing falls through the cracks.

- Manage Resources Effectively: Keep track of the resources allocated to each phase of the project. This includes both human and material resources, ensuring that there are no shortages or misallocations that could cause delays.

- Use Project Management Tools: Leverage digital tools for task assignment, scheduling, and communication. These platforms can provide real-time updates and foster collaboration among all stakeholders.

Maintaining Flexibility and Control

Although a clear plan is vital, flexibility is equally important in long-term projects. Here are some tips to keep the project on track without rigid constraints:

- Anticipate Risks: Identify potential risks early and prepare contingency plans. This can help you respond swiftly to unforeseen challenges without disrupting the overall timeline.

- Track Costs and Time: Regularly monitor both the financial and time resources spent on the project. This helps you stay within budget and avoid overrun, adjusting strategies as necessary.

- Communicate Proactively: Keep clients and stakeholders informed about the status of the project, including any adjustments or delays. Transparency fosters trust and helps manage expectations.

By following these practices, project managers can reduce the likelihood of setbacks and enhance the likelihood of delivering a successful, on-time, and on-budget project.

Streamlining Project Reports in Financial Management Systems

Efficient project reporting is a key element of successful project management. With the right tools and strategies in place, businesses can easily track financial progress, assess resource allocation, and monitor project health. Streamlining the reporting process helps in minimizing errors, improving communication, and saving time, making it easier for managers to focus on high-level decisions and project goals.

Best Practices for Effective Reporting

Here are several practices to help optimize project reporting within your financial system:

- Automate Report Generation: Set up automated reporting to generate consistent, real-time updates without manual intervention. Automation ensures that reports are accurate and delivered on time, allowing for better oversight and decision-making.

- Use Customizable Templates: Create or use pre-built report formats that match your project’s specific needs. Customizing reports ensures that you are tracking the most relevant data points, without overloading stakeholders with unnecessary information.

- Centralize Data Sources: Integrate all financial and project data into a centralized system to avoid discrepancies and reduce the time spent gathering information. This allows for quick access to up-to-date figures and streamlined reporting.

- Prioritize Key Metrics: Focus on the most critical metrics that directly impact project success. These may include budget tracking, resource usage, timelines, and client milestones. Ensuring reports are concise and focused on key areas will make them more actionable.

Benefits of Streamlined Reporting

Streamlining your project reports leads to numerous benefits:

- Enhanced Decision-Making: Timely and accurate reports provide valuable insights that inform better decision-making and ensure that project adjustments can be made quickly if necessary.

- Increased Efficiency: With automated, centralized reports, project managers spend less time gathering and analyzing data, allowing them to focus on driving project success.

- Improved Client Communication: Providing clients with easy-to-understand, consistent reports helps manage their expectations, maintain transparency, and build trust throughout the project lifecycle.

By streamlining project reports, businesses can significantly improve both internal operations and client relationships, ultimately contributing to smoother project delivery and better financial control.

Integrating Financial Management Systems with Project Management Tools

Integrating financial tracking systems with project management platforms can greatly enhance a business’s ability to monitor and control project progress. By syncing these tools, teams can ensure that financial data is seamlessly updated and that project milestones are tracked in real-time. This integration eliminates the need for manual data entry, reduces errors, and ensures that both financial and project status are aligned at all times.

Key Benefits of Integration

There are several advantages to connecting your financial management system with project tracking software:

- Improved Accuracy: Integration helps to synchronize financial data and project updates, ensuring that both systems reflect the same information, reducing the risk of discrepancies.

- Real-Time Updates: As project details evolve, financial updates are instantly reflected, providing a current view of both budget and progress. This leads to better-informed decision-making.

- Streamlined Workflows: Automating data transfers between the two systems minimizes manual data entry, reducing time spent on administrative tasks and improving overall efficiency.

- Better Collaboration: Project teams, finance departments, and stakeholders can access the same information in real-time, improving communication and collaboration across departments.

How to Integrate Financial Systems with Project Management Tools

Integrating these systems is easier than you may think. Here’s how to get started:

- Choose Compatible Tools: Ensure that your financial management system and project management software are compatible with one another or can easily integrate via APIs or third-party connectors.

- Automate Data Syncing: Set up automatic data synchronization so that financial figures and project updates are consistently aligned without requiring manual intervention.

- Customize Integration Settings: Tailor the integration to meet the specific needs of your business. This could include setting up custom fields, reporting preferences, or specific triggers for data updates.

- Monitor and Adjust: After integration, closely monitor the system to ensure data flows correctly and troubleshoot any issues. Make adjustments to improve efficiency as needed.

By combining financial management and project tracking systems, businesses can improve both project delivery and financial oversight, ensuring that projects are completed on time and within budget.

Automating Recurring Billing for Projects

Automating recurring billing for ongoing projects can save time, reduce administrative workload, and ensure consistent cash flow. By setting up a system to handle regular charges, businesses can eliminate the need for manual billing every month or on specific intervals. This not only ensures that all payments are timely and accurate but also improves efficiency by allowing team members to focus on higher-priority tasks.

Why Automation is Beneficial

Automating repetitive billing tasks offers several key advantages:

- Consistency in Payments: By automating billing, businesses can avoid delays or errors in payment collection, ensuring that clients are billed on schedule, every time.

- Time Savings: Setting up automatic billing eliminates the need for manual data entry and tracking, allowing employees to focus on more valuable tasks.

- Reduced Human Error: Automation minimizes the risk of mistakes that can occur during manual invoicing, such as incorrect amounts or missed charges.

- Better Cash Flow Management: Regular, automated billing ensures a predictable income stream, which helps businesses better manage their finances and plan for upcoming expenses.

How to Set Up Automated Billing

Setting up automated billing for projects involves several steps:

- Select Billing Frequency: Determine how often you need to bill your clients–whether it’s weekly, monthly, or another frequency–and configure the system accordingly.

- Set Up Recurring Charges: Create templates or schedules for the recurring charges that need to be applied. Include any applicable discounts, taxes, or additional fees.

- Configure Payment Methods: Allow clients to select their preferred method of payment, whether it’s through credit card, bank transfer, or another method, and ensure the system supports automated processing.

- Review and Test: Before going live, test the automation process to ensure that everything works smoothly. Verify that clients are billed accurately and that payment receipts are generated automatically.

By automating recurring billing, businesses can streamline their operations, improve accuracy, and create a smoother experience for both the company and the client, ultimately contributing to better financial stability and project success.

Handling Client Payments and Reminders

Efficiently managing client payments and sending timely reminders is crucial for maintaining cash flow and fostering strong business relationships. By having a clear process for receiving payments and following up with clients who may miss deadlines, businesses can ensure a smooth financial operation. Automating these tasks can save time and reduce the need for manual intervention, while also ensuring that clients are always aware of their obligations.

Best Practices for Handling Client Payments

There are several strategies businesses can use to manage client payments more effectively:

- Clear Payment Terms: Always establish and communicate clear payment terms upfront, including due dates, accepted payment methods, and any late fees or penalties.

- Multiple Payment Options: Offering clients various payment options–such as credit card, bank transfer, or digital wallets–can make it easier for them to pay on time.

- Payment Plans for Large Amounts: If a client is unable to pay in full, consider offering flexible payment plans that can be automatically billed in installments.

- Regular Payment Monitoring: Consistently track payments as they are made and immediately identify any overdue amounts, enabling timely follow-up.

Creating and Sending Payment Reminders

Sending payment reminders is a vital part of managing client payments, especially for those who may overlook or forget their obligations:

- Automated Reminders: Set up automated reminders that are sent out a few days before the due date, the day after the due date, and at regular intervals until the payment is received.

- Personalized Communication: While automation is useful, ensure that reminders are personalized and respectful, maintaining a professional tone even when requesting late payments.

- Incentives for Timely Payments: Consider offering discounts or other incentives for clients who pay early or on time to encourage prompt payments.

- Late Fee Alerts: If a payment becomes overdue, inform the client of any late fees that may apply and the consequences of continued non-payment.

Table: Sample Payment Reminder Schedule

Reminder Stage Action Timing Initial Reminder Send a gentle reminder about the upcoming payment 3-5 Days Before Due Date First Late Reminder Notify the client of a missed payment and provide a link to pay 1 Day A Top Tips for Accurate Record-Keeping

Maintaining accurate records is essential for tracking business transactions, ensuring compliance, and managing finances efficiently. Whether you are a small business owner or managing a larger organization, proper documentation can help avoid mistakes, improve decision-making, and facilitate audits. By following a few simple strategies, you can ensure that your records remain precise and up-to-date.

1. Organize Your Financial Documents

One of the first steps to accurate record-keeping is organizing your financial documents. This includes receipts, contracts, bank statements, and payment records. Proper organization not only saves time but also makes it easier to access necessary documents when needed.

- Use Categories: Sort your documents into clear categories such as income, expenses, taxes, and business loans.

- Digital vs. Paper: Consider digitizing your records to reduce the risk of loss or damage, while still keeping a physical copy for important documents.

- Backups: Regularly back up digital records to secure storage to avoid data loss.

2. Maintain Consistent Documentation Practices

Consistent and regular updates to your financial records are crucial. Rather than waiting until the end of the year or before tax season, keep track of every transaction in real-time.

- Update Records Regularly: Set aside time each week or month to update your financial records to ensure everything is accounted for.

- Use Accounting Software: Use reliable software or spreadsheets that can automate calculations, track expenses, and manage income records.

- Keep Detailed Notes: For each transaction, include relevant details such as the date, parties involved, amounts, and purpose of the transaction.

By staying organized and consistent with your documentation practices, you can avoid costly errors and ensure your financial information is always ready when needed. Accurate record-keeping is not only vital for your day-to-day operations but also essential for long-term business success.

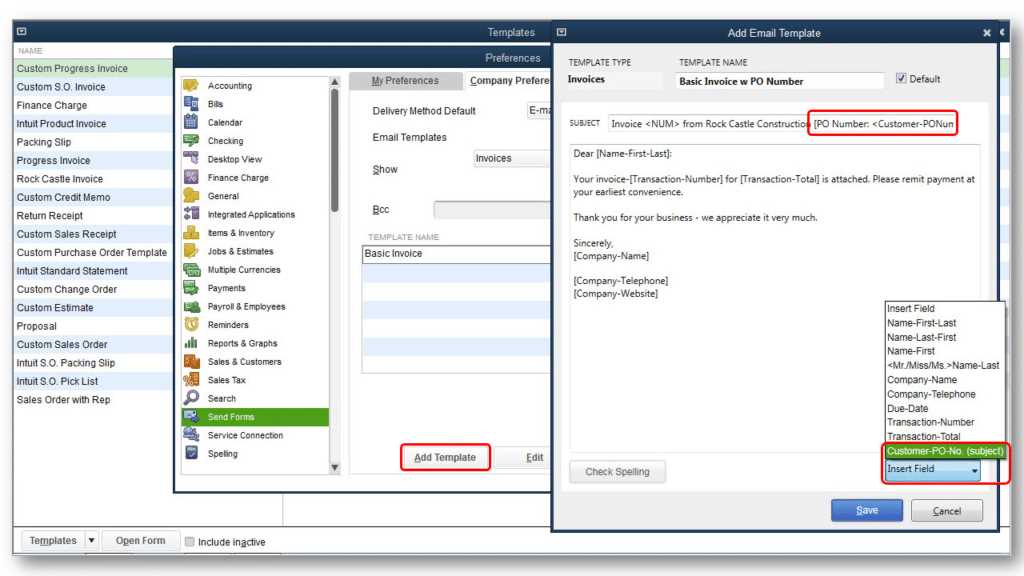

Choosing the Right Template for Your Needs

When managing projects and client billing, selecting the right document format can make a significant difference in efficiency and clarity. Depending on your industry, project type, and the level of detail required, different formats can serve specific purposes. Understanding your requirements is the first step in choosing the ideal document structure to streamline the process and keep everything organized.

1. Understand Your Project’s Complexity

The complexity of your project should determine the type of document you choose. If you’re working on long-term or multi-phase projects, a detailed format may be necessary to track progress and milestone payments effectively. For simpler tasks, a more basic structure may suffice.

- Simple Projects: Use basic formats that focus on essentials like client details, project name, and payment amount.

- Complex Projects: Choose formats that allow for tracking of progress, dates, and segmented payments for each project phase.

2. Consider Client and Project Needs

Each client may have different preferences and requirements. It’s important to choose a format that meets their needs while also ensuring smooth internal processes. Some clients may need more detailed breakdowns, while others may prefer a more concise version for quick reference.

- Client Preferences: Consider whether your clients prefer detailed breakdowns or simpler, one-page documents.

- Project Size: Larger projects typically require more comprehensive documents with space for various line items and payment milestones.

Ultimately, the right structure helps maintain clarity, reduce errors, and enhance communication with clients. Whether it’s for tracking small tasks or larger ventures, selecting an appropriate format ensures that all necessary information is captured and presented professionally.