How to Use and Customize QuickBooks Online Template Invoice

Efficiently managing client billing is essential for any business. Using well-structured and customizable documents can significantly enhance the professionalism of your transactions. These tools allow businesses to create clear, accurate, and personalized records for services rendered or products sold.

Whether you’re running a small enterprise or handling multiple clients, setting up these forms to fit your specific needs can save time and reduce errors. Automating parts of the process also ensures that your operations remain smooth and that customers receive professional, easy-to-understand documents for payments.

In this guide, we will explore how to set up and tailor these essential documents, helping you maintain a consistent and effective approach to your business transactions. From initial customization to advanced features, you’ll discover everything you need to streamline your workflow and boost your financial operations.

QuickBooks Online Invoice Templates Overview

Professional billing forms are vital tools for ensuring clarity and consistency when dealing with clients. These pre-designed structures provide businesses with a streamlined approach to creating accurate and aesthetically pleasing records for payments. By utilizing customizable options, companies can adapt these forms to meet their specific requirements, offering flexibility and control over how they communicate with customers.

These forms can be tailored to include various details, such as payment terms, due dates, tax rates, and company branding. Using such tools reduces errors and saves time by eliminating the need to design each document from scratch. Let’s dive into the essential features that make these forms a crucial asset for businesses of all sizes.

Key Features of Customizable Billing Forms

The following are the primary attributes businesses can expect when using professional billing forms:

| Feature | Description |

|---|---|

| Customization Options | Adapt layouts, colors, fonts, and fields to reflect your brand identity. |

| Payment Terms | Set specific terms for due dates, early payment discounts, or late fees. |

| Tax Inclusion | Automatically calculate and apply tax rates based on location and product/service type. |

| Recurring Billing | Generate recurring forms for subscription-based or regular services. |

| Client Information | Store and automatically populate client details to save time and reduce errors. |

Advantages of Using Pre-Formatted Billing Documents

Utilizing ready-made billing forms offers numerous benefits to businesses. First, it increases efficiency by saving time and effort, ensuring that each document is consistent and professional. Second, it reduces the risk of errors that may arise when manually creating or editing documents. Lastly, it helps businesses maintain accurate financial records, which is essential for tax purposes, audits, and overall financial management.

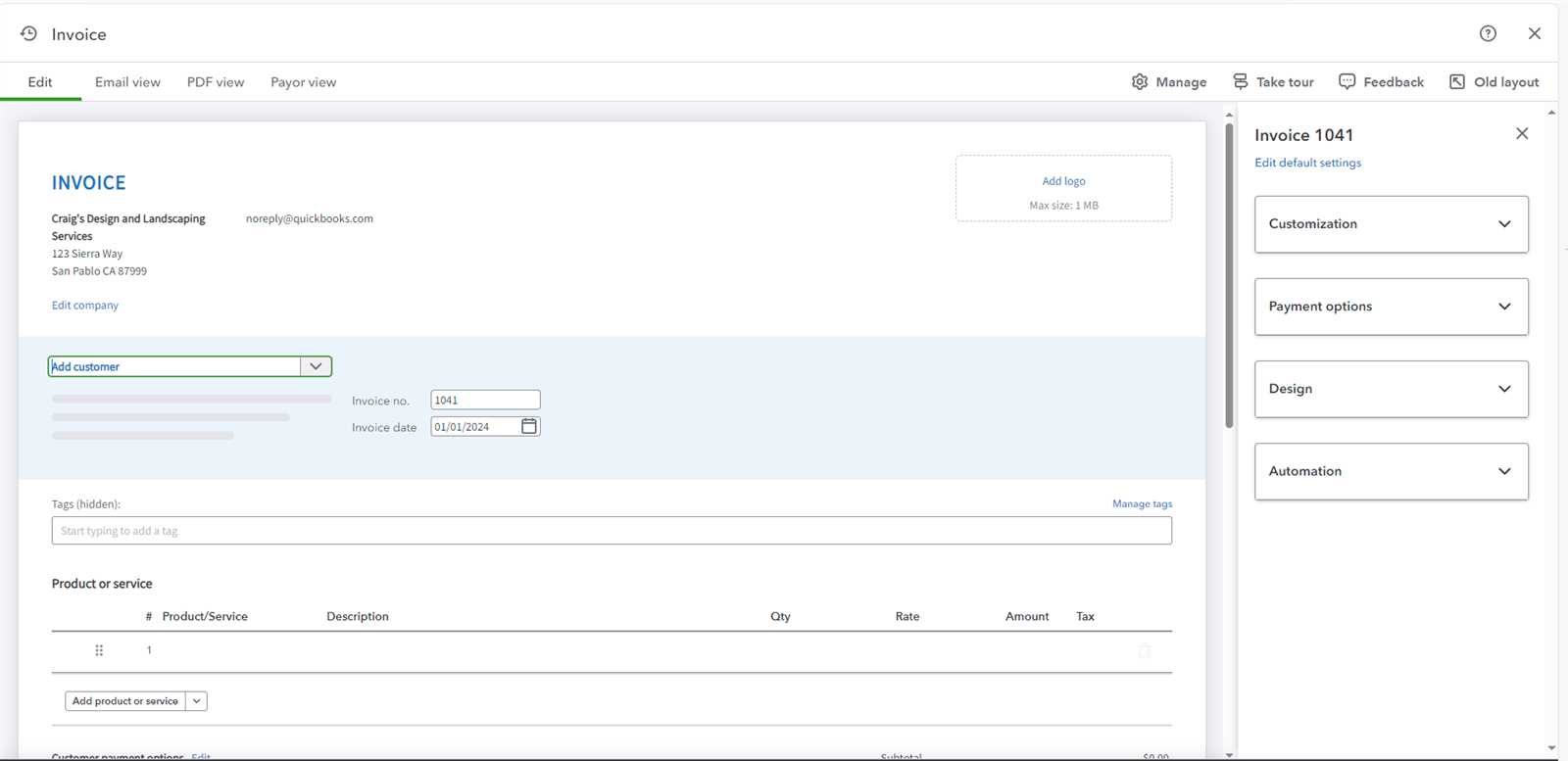

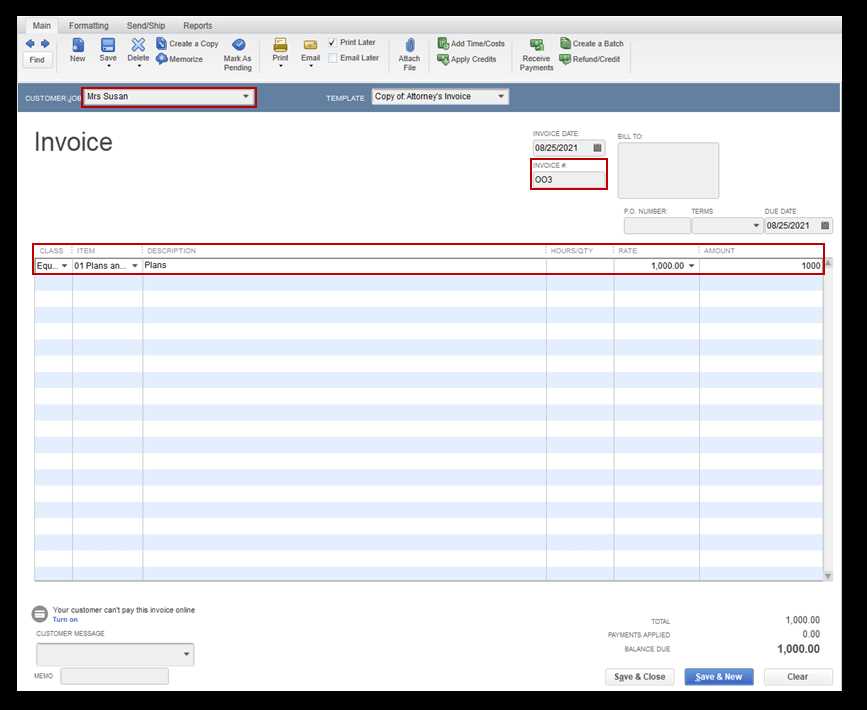

How to Create an Invoice in QuickBooks

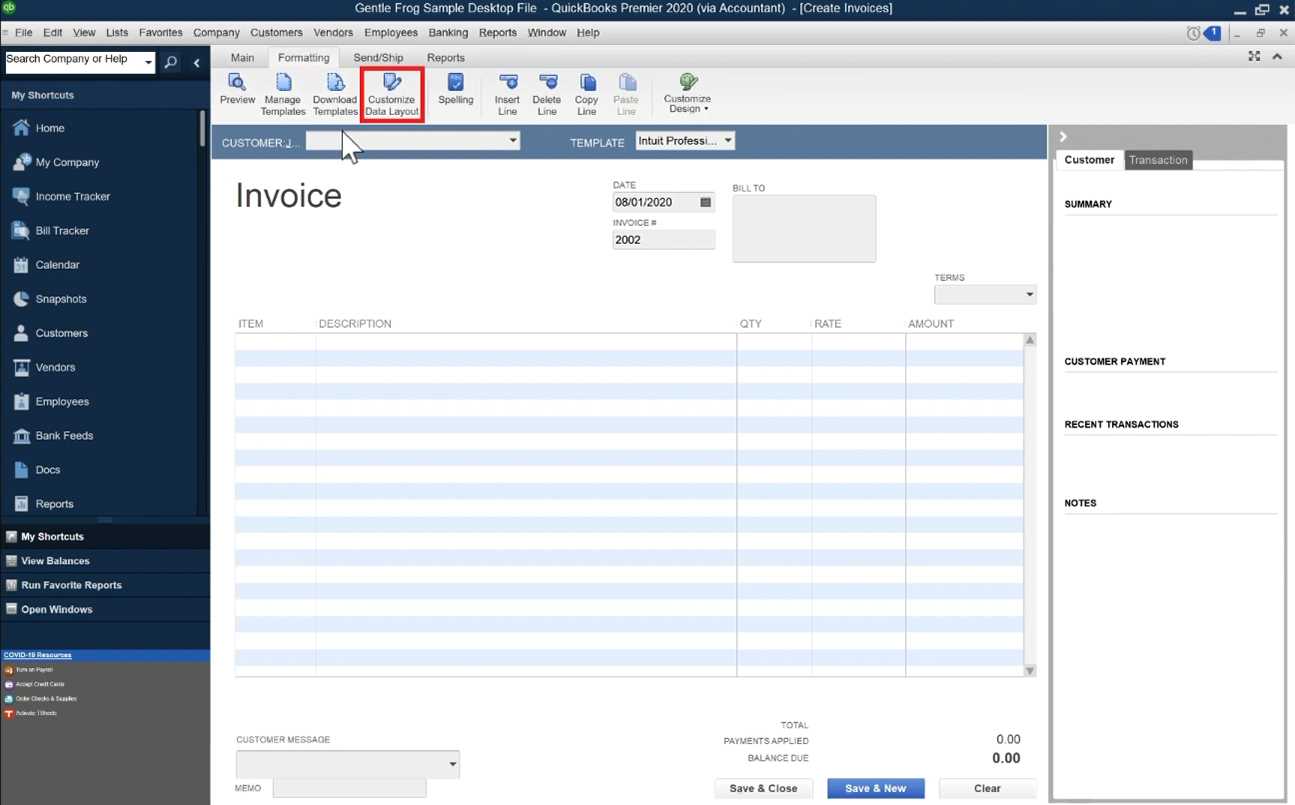

Creating a professional billing document is a straightforward process when using the right tools. These platforms allow you to quickly generate clear, accurate records for services or products provided to clients. By following a simple step-by-step approach, businesses can ensure their transactions are well-documented and organized.

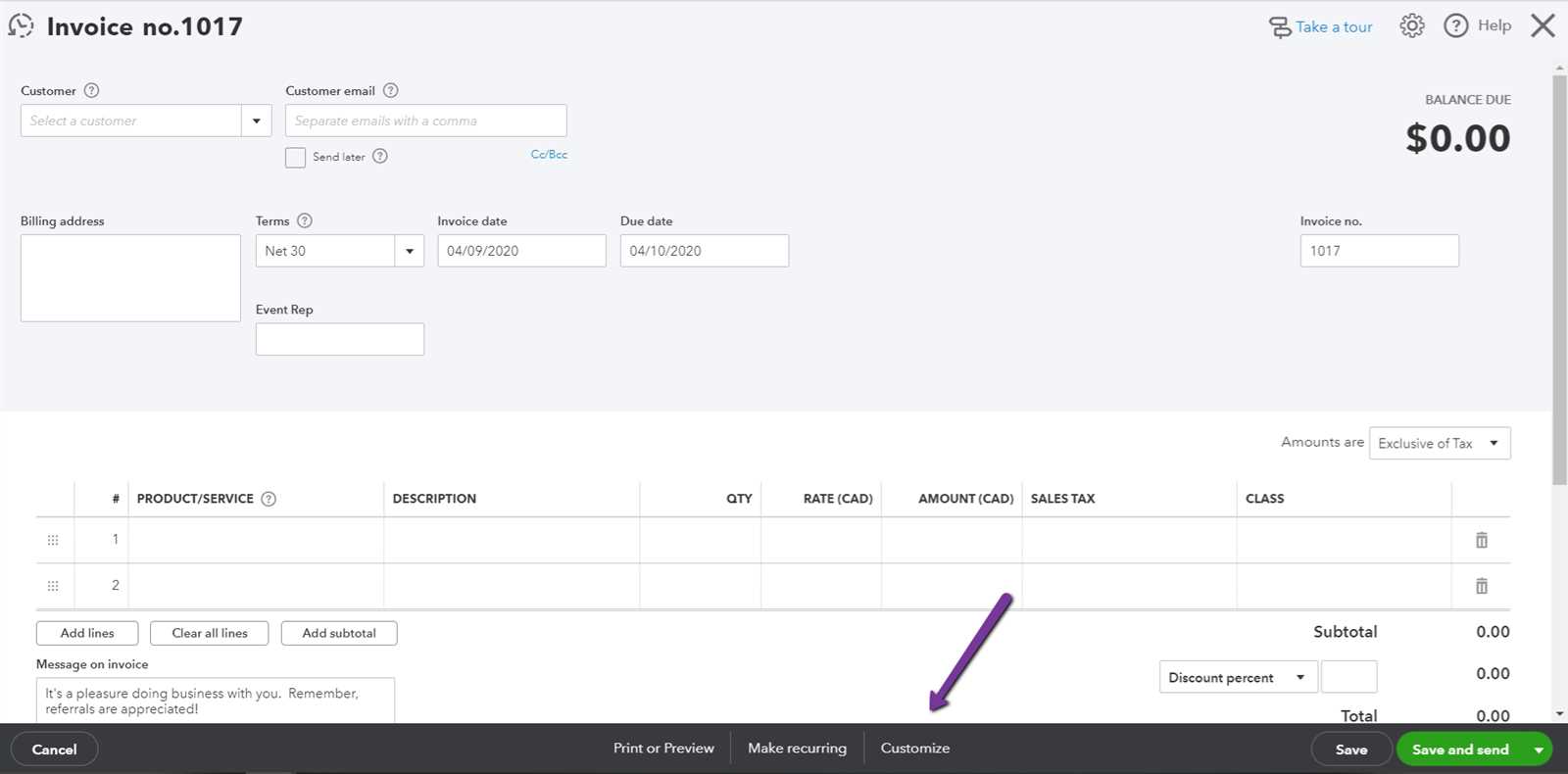

The process begins by accessing the billing section within your system and selecting the option to create a new record. From there, you will enter key details about the transaction, such as client information, items sold or services rendered, payment terms, and any applicable taxes or discounts. Once all necessary information is entered, you can customize the document to meet your specific needs.

Steps to Create a Billing Record

- Navigate to the “Create New” or “Sales” section of your platform.

- Select “Create a New Record” from the available options.

- Choose the customer from your saved contacts or input new details manually.

- Fill in the items or services being charged, including quantities, rates, and descriptions.

- Add any taxes, discounts, or additional charges if applicable.

- Set the due date and payment terms based on your agreement with the customer.

- Review the document for accuracy before finalizing.

- Save or send the document directly to the client via email or print for physical delivery.

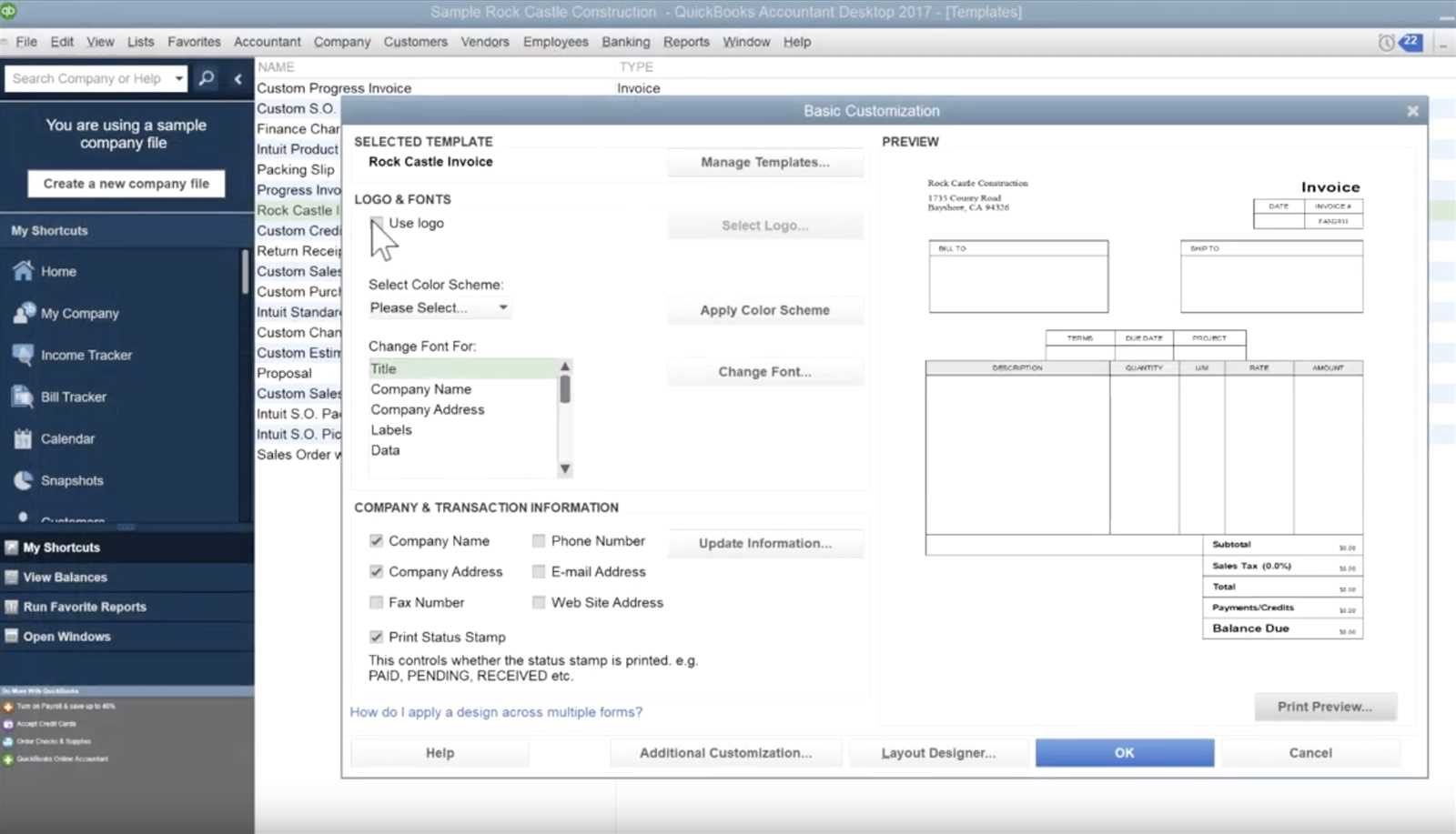

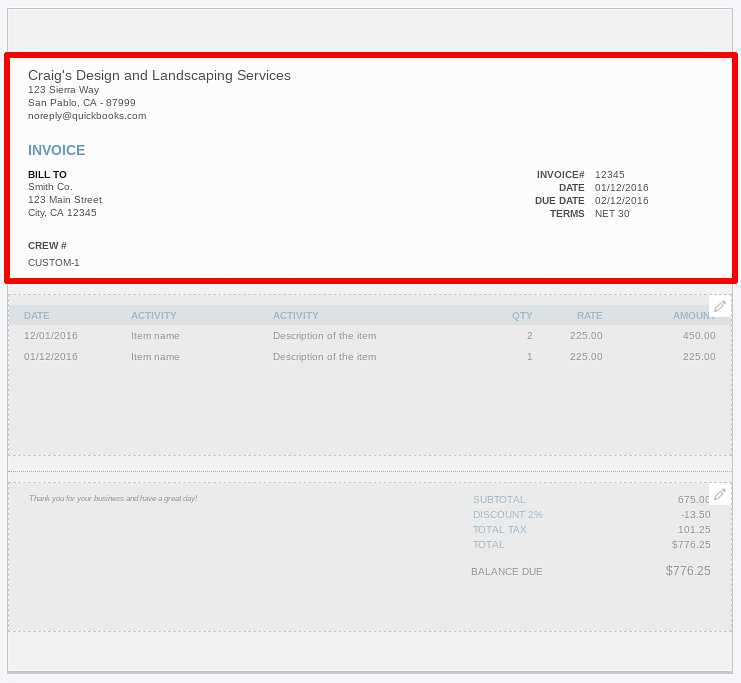

Customizing Your Document

Personalizing your billing record is easy with the built-in customization options. You can adjust the appearance by adding your company logo, changing fonts, and rearranging sections to suit your brand style. Additionally, adding specific payment instructions or terms helps maintain clarity for your clients.

- Customize layout, fonts, and colors.

- Add your business logo and contact details.

- Include payment instructions or additional notes for your clients.

- Save and reuse custom formats for consistency in future transactions.

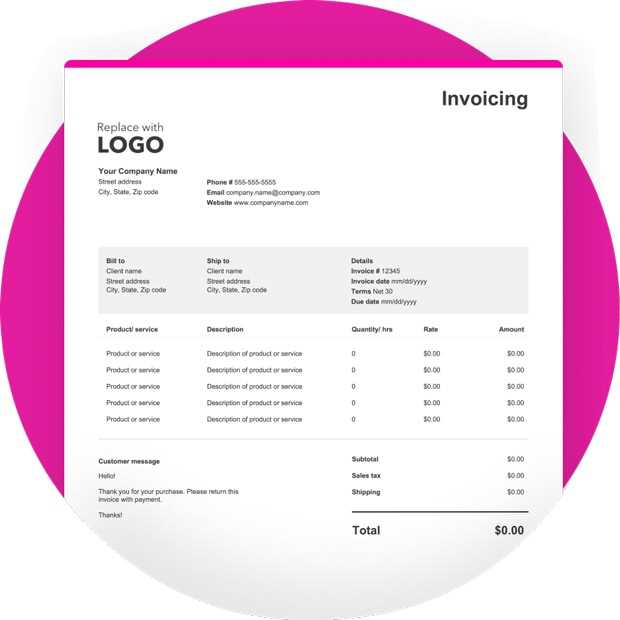

Choosing the Right Template for Your Business

Selecting the ideal billing document layout is crucial for ensuring that your transactions are both professional and easy to manage. A well-suited format reflects your business identity, provides clarity to your clients, and streamlines the overall billing process. Choosing the right design should take into consideration your industry, the complexity of your services, and the preferences of your customers.

Each business has unique needs when it comes to presenting charges and payment details. For example, a freelance consultant may require a simple, clean design, while a product-based company might need a more detailed layout to list items, quantities, and pricing. The goal is to make sure that the form is functional, aesthetically pleasing, and tailored to your specific requirements.

Factors to Consider When Choosing a Layout

Here are some key factors to consider when selecting the right document structure for your business:

| Factor | Description |

|---|---|

| Industry Type | Choose a design that matches the style and complexity of your services or products. |

| Client Preferences | Consider whether your clients prefer simple or more detailed documents, and tailor the layout accordingly. |

| Required Information | Ensure the format accommodates all necessary details, such as payment terms, discounts, taxes, and contact information. |

| Branding | Make sure the design reflects your brand identity, including logos, colors, and fonts. |

| Ease of Use | Choose a layout that is easy for you to manage and update regularly without additional complexity. |

Understanding the

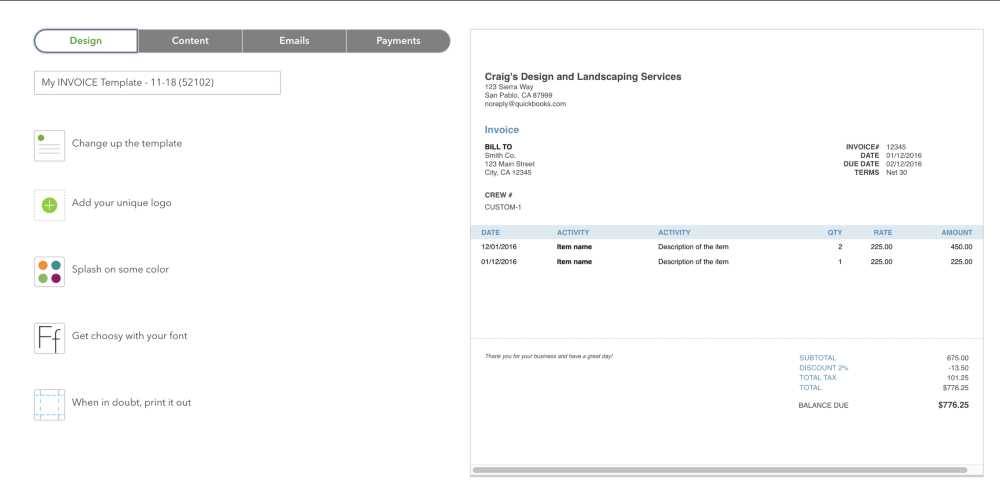

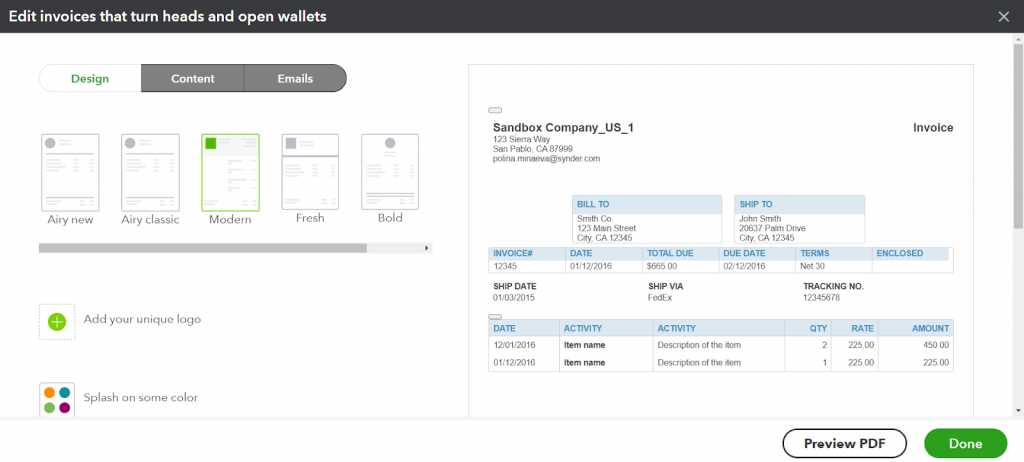

Steps to Customize QuickBooks Invoice Template

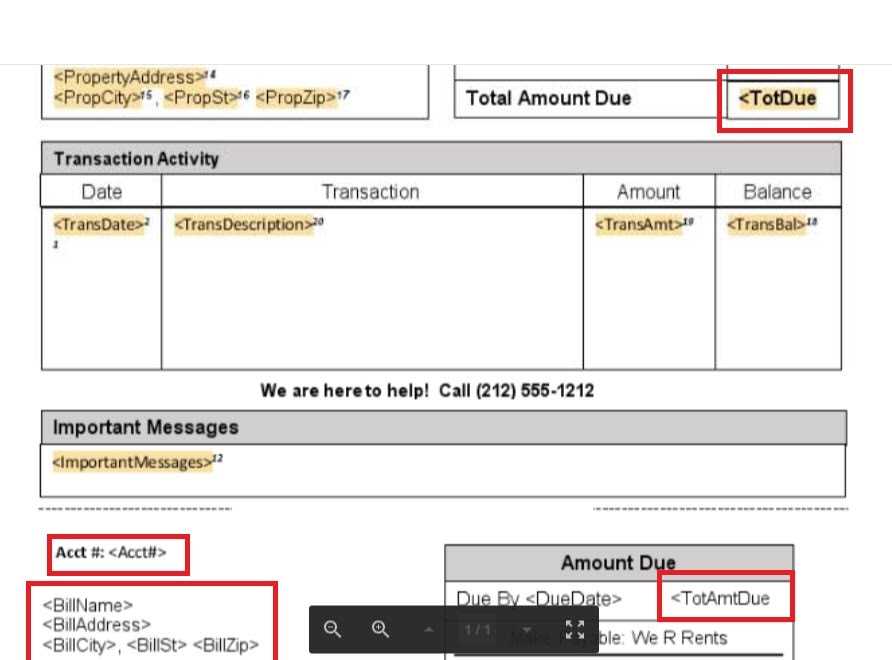

Personalizing your billing documents is essential to ensure that they align with your business’s branding and specific requirements. Customizing the layout of these forms allows you to add relevant details, such as your company logo, specific payment terms, and tailored descriptions of the products or services offered. The customization process is simple and offers flexibility, so you can create professional documents that reflect your brand identity while remaining functional and easy to understand.

To make your billing records truly your own, follow these steps to adjust various elements of the layout, ensuring it is both visually appealing and informative for your clients.

Steps for Customizing Your Billing Document

| Step | Description |

|---|---|

| Select the Document | Access the billing section and choose the document you wish to customize. |

| Open Customization Settings | Navigate to the customization or settings option to access design tools. |

| Adjust Layout and Design | Choose from a variety of layout styles, and adjust elements like columns, sections, and overall design. |

| Upload Branding Materials | Upload your company logo, set brand colors, and choose fonts that match your business identity. |

| Modify Fields | Customize fields such as payment terms, tax calculations, and discount information to match your business model. |

| Save Your Customizations | Once you’re satisfied with the design, save your customized form for future use and updates. |

These simple steps will help you create personalized documents that are not only practical for managing your transactions but also help to reinforce your brand’s presence. Customization ensures that your billing forms are consistent, clear, and professional, making a great impression on your clients every time.

Why Use QuickBooks Online Invoice Templates

Using pre-designed billing forms offers a range of advantages for businesses, making the process of managing transactions both faster and more accurate. These customizable documents save time and effort by eliminating the need to create new records from scratch. Additionally, they ensure consistency across all customer communications and maintain a professional appearance, which is crucial for building trust with clients.

By utilizing such forms, businesses can streamline their operations and avoid common mistakes, such as miscalculations or missing information. The convenience of automation allows for faster billing cycles and reduces administrative workload, freeing up time for other important tasks. Below are some key benefits of using these ready-made formats.

Key Benefits of Using Pre-Formatted Billing Documents

- Time Efficiency: Pre-designed formats allow you to generate documents quickly without starting from scratch each time.

- Consistency: Using the same structure for all records ensures a uniform look, reinforcing your brand identity.

- Accuracy: Built-in calculations for taxes, discounts, and totals reduce the chance of human error.

- Professionalism: Customizable fields allow you to add your business logo and contact information, making documents look polished and credible.

- Ease of Use: User-friendly interfaces make it easy to create and manage documents, even for those with limited technical experience.

How These Documents Improve Business Efficiency

- Automation: Setting up recurring billing cycles or automated reminders ensures timely payments and reduces the need for manual follow-ups.

- Customization: Tailor your documents to suit your specific needs by adding or removing sections, such as shipping details or service descriptions.

- Improved Organization: These formats help you stay organized by keeping all transactions in one place, which is especially useful for tracking payments and managing client accounts.

Overall, using these tools enhances both the operational side of your business and the client experience, contributing to a smoother workflow and higher customer satisfaction.

Benefits of Customizing Your Invoice Template

Customizing your billing documents offers numerous advantages that can help your business present a more professional image and operate more efficiently. By tailoring your forms to match your brand identity and specific business needs, you can create a seamless experience for both you and your clients. A personalized approach not only makes your documents stand out but also improves clarity and ensures consistency across all transactions.

Customization allows you to streamline your workflow, save time, and avoid errors that could arise from using generic forms. Additionally, having control over the layout and content means you can highlight the most important information for your clients, making payments faster and more straightforward.

Key Advantages of Personalizing Your Documents

- Brand Consistency: Customizing the design, colors, and logo of your documents helps strengthen your brand identity and ensures that all client-facing materials reflect a consistent image.

- Enhanced Professionalism: Tailored billing forms appear more polished and organized, leaving a lasting impression on your customers and building trust.

- Clear Communication: Adjusting the layout allows you to prioritize key information like payment terms, tax rates, and due dates, making it easier for clients to understand and pay promptly.

- Flexibility: Personalizing your forms means you can add or remove sections as necessary, such as discounts, shipping details, or specific payment instructions, ensuring they meet the unique requirements of your business.

- Time-Saving: Once customized, your forms are ready to use repeatedly, reducing the time spent on document creation and allowing you to focus on other tasks.

How Customization Enhances Client Experience

- Professional Appearance: A well-branded document looks more legitimate and can improve customer confidence in your business.

- Improved Clarity: By organizing the content in a way that makes sense for your clients, you minimize confusion and ensure that all relevant details are easy to find.

- Personal Touch: Adding notes or custom messages allows you to engage with clients personally, making them feel valued and encouraging long-term relationships.

Overall, personalizing your billing documents helps you maintain a high level of professionalism while improving communication, efficiency, and customer satisfaction. It is an easy yet powerful way to elevate your business processes.

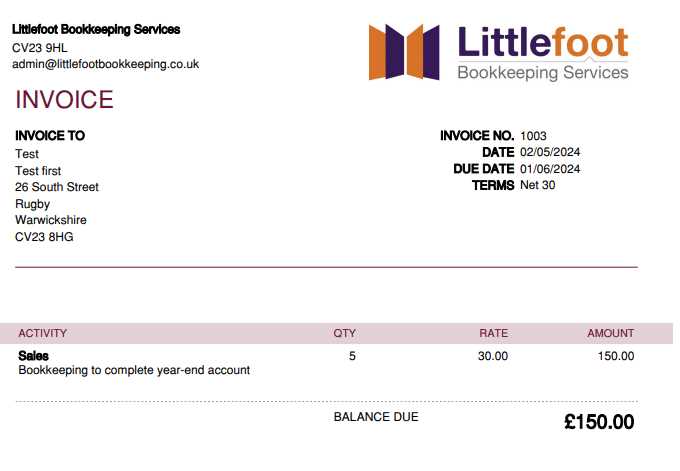

Adding Your Business Logo to Invoices

Including your business logo on billing documents is a simple yet effective way to reinforce your brand identity and present a professional appearance. This small customization ensures that every communication with your clients reflects your company’s image, helping to build recognition and trust. A well-placed logo can make a significant impact, turning standard documents into valuable branding tools.

Adding your logo to each billing record is easy and offers several benefits. It not only makes your documents look more polished but also increases brand visibility, ensuring that clients can easily identify your business. Whether you’re sending digital records or printed copies, having your logo displayed prominently helps convey a sense of legitimacy and professionalism.

Steps to Add Your Logo

- Upload the Image: Access your document settings and upload a high-quality image file of your logo (preferably PNG or JPEG format).

- Position the Logo: Select the area where you want the logo to appear, typically in the header section of the document.

- Resize as Needed: Adjust the size of the logo to ensure it fits within the layout without overpowering other important details.

- Save and Apply: Once satisfied with the placement and size, save the changes. The logo will now automatically appear on all future documents generated from the same format.

Why Adding a Logo Is Important

- Brand Recognition: Your logo serves as a visual representation of your business, helping clients remember and associate your brand with the services you provide.

- Professionalism: A customized document with a business logo appears more official, boosting your company’s credibility and making a positive impression.

- Consistency: Displaying your logo across all documents ensures a consistent brand experience for your clients, no matter how they receive the communication.

By adding your logo to billing records, you ensure that every transaction strengthens your brand image, which can lead to improved client loyalty and trust. It’s a small adjustment that can make a big difference in how your business is perceived.

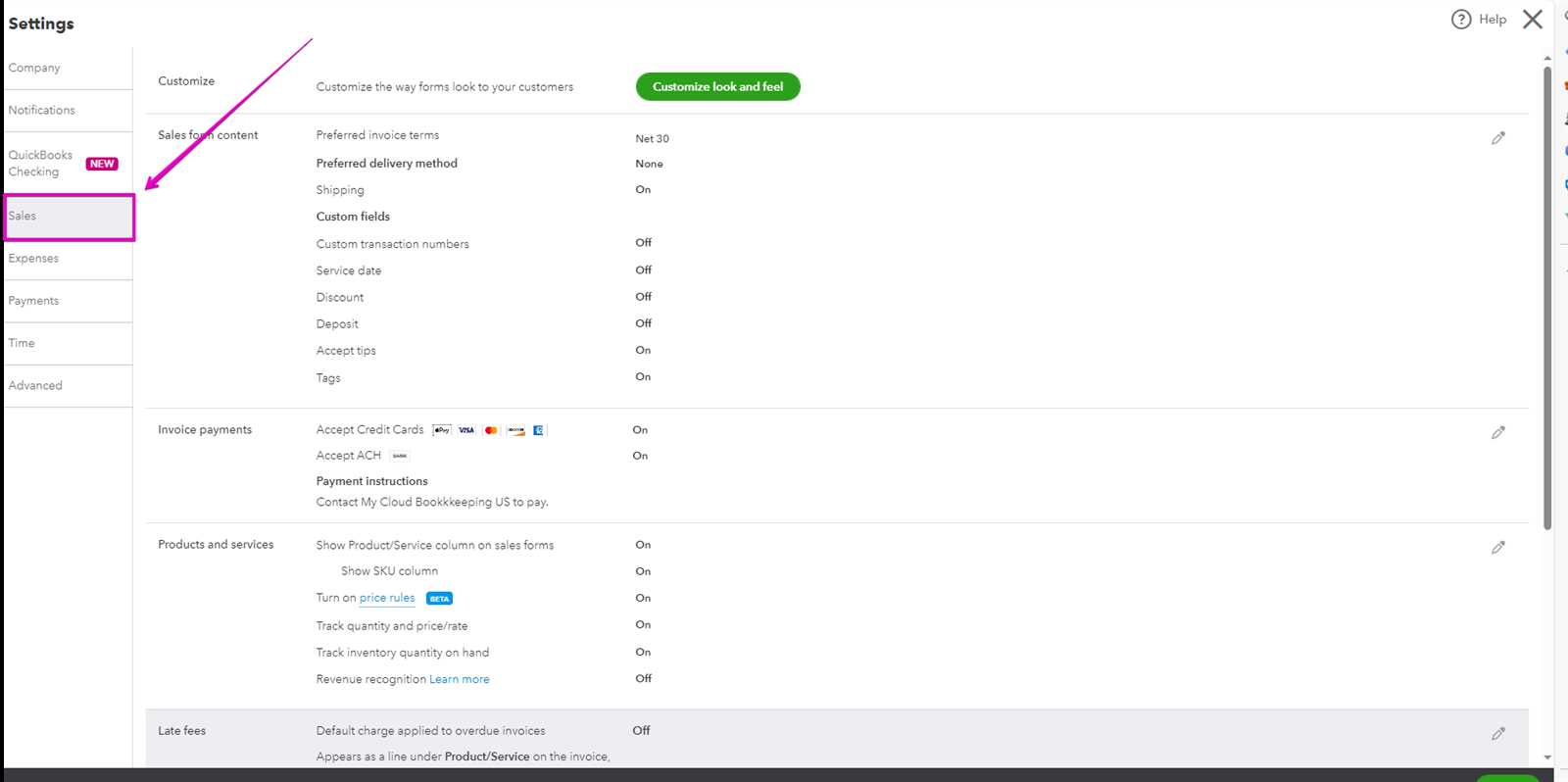

Setting Up Payment Terms in QuickBooks

Establishing clear payment terms is an essential aspect of managing your financial transactions with clients. By setting specific expectations around when payments are due and outlining any discounts or late fees, you help ensure smooth cash flow and avoid misunderstandings. These terms can be easily incorporated into your billing documents, making it clear to clients when payment is expected and under what conditions.

Setting up payment terms involves defining specific rules for due dates, payment methods, and any applicable conditions like early payment discounts or penalties for overdue payments. Customizing these terms can help improve the efficiency of your billing process and promote timely payments. Below are the steps to set up these terms and ensure that they are consistent across all transactions.

Steps to Set Up Payment Terms

- Access the Payment Settings: Navigate to the settings or preferences section of your billing system and locate the payment terms settings.

- Create New Terms: Choose the option to create new terms, where you can define the specific conditions that work for your business.

- Set Due Dates: Specify the number of days after the transaction date when payment is due. Common options include “Net 30” (30 days) or “Due on Receipt.”

- Define Discounts: If you offer early payment discounts, set the percentage and timeframe in which clients can qualify for the discount.

- Add Late Fees: If applicable, define any penalties for overdue payments and specify how much is charged for late payments.

- Save the Terms: After configuring your terms, save the settings and apply them to future billing records.

Why Setting Payment Terms is Important

- Improved Cash Flow: Clear terms help clients understand when payments are due, reducing delays and ensuring timely revenue for your business.

- Consistency: Having standardized terms in place ensures that every transaction follows the same guidelines, preventing confusion and errors.

- Professionalism: Well-defined payment conditions project professionalism, showing that your business is organized and transparent in its dealings.

- Reduced Administrative Work: With automated terms set up, you spend less time manually entering payment details and more time focusing on growing your business.

By setting up clear payment terms, you help your clients understand their obligations while protecting your own cash flow. It’s an essential step in creating a smooth and efficient billing process that bene

How to Include Sales Tax on Invoices

Including sales tax in your billing documents is an important step in ensuring compliance with local tax regulations and maintaining transparency with your clients. By correctly calculating and displaying the tax amount, you help your customers understand the total cost of their purchase and avoid potential legal issues related to tax reporting. Whether you’re selling goods or providing services, properly including sales tax is essential for both your business and your clients.

Sales tax is typically calculated as a percentage of the total amount due and can vary depending on the location of both the seller and the buyer. It’s crucial to configure your system to automatically calculate and add the correct tax amount based on the tax rate applicable to the transaction. Below are the steps you should follow to ensure that sales tax is included accurately in your billing records.

Steps to Add Sales Tax to Billing Documents

- Set Up Tax Rates: First, ensure that the correct tax rates are configured for your region. This may include state, local, and federal rates depending on where you operate.

- Enable Tax Calculation: In the settings, enable automatic tax calculation to ensure that the system will calculate the tax based on the applicable rates for each transaction.

- Assign Tax to Items: For each product or service you sell, assign the appropriate tax category so that the system knows how to calculate the tax.

- Apply Tax to Transactions: When creating a new transaction, ensure that the system applies the appropriate tax to the total amount. This can be done automatically if tax settings are enabled correctly.

- Review and Adjust if Necessary: Before finalizing the document, double-check that the tax is calculated correctly and make adjustments if needed (e.g., for exemptions or special rates).

Why Including Sales Tax is Important

- Legal Compliance: Ensuring that sales tax is correctly calculated and reported helps you stay compliant with tax authorities and avoid fines or penalties.

- Transparency: Displaying the sales tax clearly on the billing document allows your clients to see exactly how much they are paying in taxes, building trust and preventing misunderstandings.

- Accuracy: Automating tax calculations reduces the risk of manual errors and ensures that you’re applying the correct rates every time.

- Efficient Tax Reporting: Having tax d

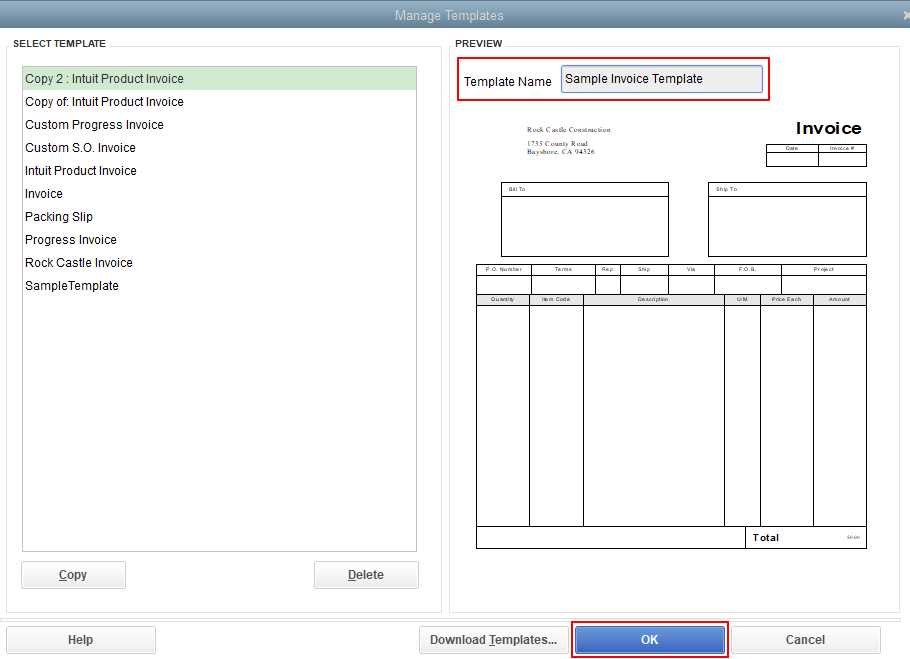

Managing Multiple Invoice Templates in QuickBooks

Managing various billing formats is crucial for businesses that deal with different types of clients or services. By having multiple document layouts at your disposal, you can tailor each one to suit the unique needs of different transactions. Whether you need to display additional details for specific clients, adjust for various payment terms, or highlight different services, having a variety of document styles can streamline your operations and improve your professionalism.

Managing several document designs effectively ensures that each transaction is presented in the most suitable way, helping to avoid confusion and mistakes. It also provides flexibility in maintaining consistency across different business activities, from sales to service agreements. Below are the steps to manage multiple billing formats, ensuring they’re customized and applied correctly for each situation.

Steps for Managing Multiple Billing Formats

- Create Different Document Layouts: Begin by creating multiple document formats tailored to different business needs (e.g., one for service invoices, another for product sales).

- Customize Each Format: Adjust elements such as logo placement, item descriptions, payment terms, and other sections according to the specific requirements of each format.

- Assign Documents to Clients: For each client or transaction type, select the appropriate layout so that the document is customized based on the client’s needs.

- Organize and Label Templates: Label each layout clearly, ensuring you can easily identify which one is intended for which purpose (e.g., “Service Invoice,” “Product Order,” etc.).

- Save and Apply: Once customized, save each document format and apply it to new transactions as needed. This ensures that the correct design is used for each business activity.

Why Managing Multiple Document Designs is Essential

- Efficiency: Having a range of pre-designed documents saves time, as you don’t need to reformat every time you create a new record.

- Customization: Tailoring each format to meet the specific needs of clients or transactions ensures that important details are highlighted correctly.

- Professionalism: Different document layouts allow you to present a more organized, polished, and business-oriented appearance to your clients.

- Flexibility: Managing multiple designs gives you the flexibility to adjust quickly based on customer preferences, industry requirements, or seasonal changes.

Effectively managing various billing designs allows your business to be more agile, responsive, and professional. By setting up different layouts and assigning them appropriately, you can ensure that every document you send reflects the unique need

Invoice Format for Recurring Billing

For businesses that offer subscription-based services or charge clients on a regular basis, automating the billing process can significantly save time and reduce errors. Setting up a recurring billing structure with a pre-designed document layout ensures that clients are invoiced on schedule, with accurate amounts and terms every time. This approach is not only efficient but also helps in maintaining consistent cash flow, while ensuring your customers are charged appropriately for their ongoing services or products.

With a recurring billing setup, you can streamline the process by defining the frequency of payments, whether it’s monthly, quarterly, or annually. Once configured, the system automatically generates and sends invoices according to the agreed terms, reducing the administrative effort required to manually process each transaction. Below are the key features and steps involved in creating and managing a recurring billing system with a pre-set document format.

Steps to Set Up Recurring Billing Invoices

- Define Billing Frequency: Choose how often your customers will be billed, such as weekly, monthly, or annually. This will ensure that the right terms are applied to each recurring charge.

- Customize the Document Layout: Select or design a format that includes relevant fields, such as the start and end date of the billing cycle, payment terms, and recurring charges.

- Set Up Automatic Payment Processing: Link your payment gateway to enable automatic billing and payment collection on each due date, reducing the need for manual follow-up.

- Specify Payment Methods: Allow your clients to choose their preferred method of payment, whether by credit card, bank transfer, or another option, and store these preferences for future transactions.

- Review and Schedule: Once your billing setup is complete, review the details, ensure accuracy, and schedule the automatic creation and sending of invoices according to the defined cycle.

Advantages of Using a Recurring Billing Format

- Automation: Automating the billing process ensures timely and consistent invoicing without the need for manual intervention each cycle.

- Improved Cash Flow: Regular billing schedules mean you can rely on predictable payments, helping with budgeting and financial planning.

- Time-Saving: Once set up, recurring invoices are generated automatically, reducing the time spent on administrative tasks and freeing up resources for other business activities.

How to Export Billing Documents

Exporting billing records from your system is essential for various reasons, such as maintaining financial records, preparing reports, or sharing documents with clients or accountants. Whether you need to generate reports for tax filing, keep track of sales, or provide copies of receipts for customers, exporting these documents can simplify the process. By following a few straightforward steps, you can export the necessary records in a format that best suits your needs, such as PDF or CSV files.

The process of exporting billing records allows you to transfer the data to external systems or applications. This is particularly helpful for businesses that need to keep organized financial records or share documents with third-party services. Below are the steps you can follow to efficiently export your records from your system.

Steps to Export Billing Records

- Access the Billing Section: Begin by navigating to the section of your system where your transactions or records are stored, typically under ‘Sales’ or ‘Transactions.’

- Select the Records: Choose the specific records you wish to export. This could be a range of transactions or just a few select ones depending on your needs.

- Choose the Export Format: Select the desired export format, such as CSV for spreadsheets or PDF for document sharing, based on what is most suitable for your requirements.

- Apply Filters (if needed): Filter your records by date, customer, or status if you need to narrow down the data to a specific subset.

- Download or Send: Once you’ve set the parameters, click to export the documents. You can either download the files to your computer or email them directly to clients or other stakeholders.

Why Exporting Billing Records is Useful

- Financial Tracking: Exported records help you keep an accurate history of transactions, which is vital for bookkeeping and tax purposes.

- Report Generation: Exporting your documents into spreadsheet formats allows you to generate detailed reports for analysis, budgeting, or forecasting.

- Collaboration: Exported documents can be easily shared with other team members, accountants, or external agencies for further review or processing.

- Record Backup: Having a backup of your records ensures that you can recover important financial data if your system encounters issues or data is lost.

Exporting billing records is a simple yet effective way to manage your business’s financial documents. It ensures easy access to vital information and allows for more efficient reporting, sharing, and backup of your data.

Automating Billing Reminders

Automating reminders for overdue payments is a critical step in maintaining smooth cash flow and reducing the time spent on manual follow-ups. By setting up automated reminders, you can ensure that clients are promptly notified of upcoming or overdue payments, without the need for personal intervention each time. This system helps maintain professionalism and consistency, while also improving the likelihood of timely payments from customers.

With automated reminders in place, businesses can schedule notifications to be sent out at specific intervals, such as a few days before a payment is due or immediately after the due date has passed. These reminders can be customized to fit the tone and branding of your business, offering a seamless experience for both you and your clients. Below are the steps to set up automated reminders for billing documents and ensure that your customers stay on track with their payments.

Steps to Set Up Automated Billing Reminders

- Access Reminder Settings: Begin by navigating to the reminder or notification settings within your billing system or platform.

- Create a Reminder Schedule: Choose the frequency and timing of your reminders. For example, you can set reminders to go out a week before the due date and another one immediately after the due date passes.

- Customize Reminder Content: Craft the message you want to send to your clients. This could include the due amount, payment instructions, and a polite reminder of the due date.

- Set Up Delivery Method: Choose how the reminders will be sent–whether via email, SMS, or both–and ensure that contact details for your clients are up to date.

- Activate Reminders: Once you’ve configured your schedule, activate the system to start sending reminders automatically according to your preferences.

Benefits of Automating Payment Reminders

- Reduced Manual Effort: Automating reminders eliminates the need to send individual follow-ups, saving you valuable time and effort.

- Improved Cash Flow: Regular, automated reminders

Integrating Billing Document Layouts with Your Website

Integrating your billing documents with your website can greatly enhance the user experience for both your customers and your team. By embedding document generation directly into your site, you can allow customers to view and download their billing records instantly, while also enabling automated processes for business efficiency. This integration streamlines the transaction process, improves client satisfaction, and helps maintain a professional and consistent appearance across all communication channels.

Whether you’re offering online orders, subscription-based services, or project-based work, having your billing system directly linked to your website ensures that your clients receive the necessary documents promptly and securely. Integrating these layouts can also help manage payments, track services provided, and maintain an organized flow of information. Below are the steps and benefits of embedding this feature into your website.

Steps to Integrate Billing Documents into Your Website

- Choose the Right Platform: Ensure that your website platform supports integration with external billing systems or that it has the necessary plugins or APIs for document generation.

- Set Up Document Generation: Customize and configure the settings for your billing documents to match the design and information needed for your business transactions.

- Embed Document Links: Create links or download buttons on your website where clients can easily access their billing records. Ensure the process is simple and secure.

- Automate Delivery: Set up automation so that once a transaction is completed, the document is automatically generated and available for download or sent to the client via email.

- Test the Integration: Before going live, thoroughly test the integration to ensure everything functions properly, from document generation to client access.

Benefits of Website Integration for Billing

- Enhanced Customer Experience: Clients can easily access their billing records without having to contact customer service, which improves satisfaction and reduces wait times.

- Efficiency: Automating the process through integration minimizes manual work, saving time for your team and reducing the risk of errors.

- Improved Security: Secure integration ensures that sensitive payment information and personal data are protected while providing easy access to clients.

- Consistency: By using the same billing format on your website as in other business communications, you ensure a consistent and professional appearance across all touchpoints.

Integrating billing document layouts directly with your website not only improves the client experience but also enhances

Using Billing Documents for Freelancers

For freelancers, managing finances and ensuring timely payments is essential to maintaining a healthy cash flow. One of the most important tools in this process is a professional billing system that simplifies the creation and tracking of payment requests. Freelancers can greatly benefit from an efficient and automated approach to generating billing records, which helps to maintain a professional image while reducing administrative overhead.

By using a well-organized billing system, freelancers can create customized records for each client, ensuring all necessary details are included, such as services provided, payment terms, and due dates. This not only makes invoicing easier but also helps in maintaining clear records for tax purposes and financial planning. Below are some key ways freelancers can take advantage of billing documents to streamline their workflow and stay on top of payments.

Benefits of Using Billing Documents for Freelancers

- Professional Appearance: Custom billing documents give freelancers a polished and credible look, enhancing their business reputation with clients.

- Clear Payment Terms: Having clear terms, including payment due dates and any applicable fees, ensures both parties understand expectations and helps avoid payment disputes.

- Time-Saving: With automated generation and delivery of billing records, freelancers can focus more on their work and less on administrative tasks.

- Financial Organization: By using a consistent format, freelancers can easily track past transactions, helping them to stay organized and prepare for tax season.

- Customization: Freelancers can tailor each document to reflect the specifics of each project or client, from service descriptions to payment schedules.

Steps to Create Billing Documents for Freelance Work

- Choose a Billing System: Select a platform or tool that allows easy creation of billing records with customizable features suited to freelance work.

- Set Up Client Information: Input client details such as contact information, payment terms, and billing history to streamline the process.

- Customize Your Documents: Include necessary fields like service descriptions, project dates, and payment instructions to ensure clarity and completeness.

- Send and Track Payments: After generating your billing document, send it via email or through a client portal, and use the system to track whether payments are made on time.

- Follow Up: Set up automat

Common Billing Document Mistakes to Avoid

Creating accurate and professional billing records is crucial for maintaining smooth business operations. However, mistakes in these documents can lead to confusion, delayed payments, and damaged client relationships. Understanding common pitfalls and avoiding them ensures that your billing process runs efficiently and your clients receive clear and professional communication. Below are some of the most frequent errors people make when preparing billing documents and how to prevent them.

Common Mistakes in Billing Documents

- Missing Contact Information: Failing to include essential details, such as the client’s full name, email address, or physical address, can cause delays and confusion, especially when it comes to sending reminders or addressing disputes.

- Incorrect Payment Terms: Not specifying the correct payment due date or neglecting to outline payment methods and terms can lead to misunderstandings, making it harder to collect payments on time.

- Omitting Itemized List of Services: A vague or incomplete list of services or products provided may lead to questions from the client. Be sure to include a detailed description and unit prices for transparency.

- Wrong Tax Calculation: Errors in sales tax calculation or not including the correct tax rate can result in legal complications or create confusion for your clients. Always verify tax rates based on local laws and ensure they are accurately reflected.

- Unprofessional Formatting: A disorganized or poorly designed document can create a negative impression. Ensure that your records are clearly formatted, with all necessary information easily visible and legible.

How to Avoid These Mistakes

- Double-Check All Information: Before sending out any billing record, verify that all client and service details are correct and complete.

- Use Clear, Concise Language: Avoid ambiguous descriptions. Be specific about the services provided, rates, and due dates to prevent confusion.

- Verify Tax Rates: Stay updated with current tax regulations to ensure that taxes are applied correctly to each transaction.

- Use a Professional Format: Stick to a clean, organized layout that enhances readability. A consistent, well-designed format adds credibility to your bus