Download QuickBooks Online Invoice Templates for Easy Billing

Managing your business finances can be time-consuming, especially when it comes to creating documents for customer payments. Using pre-designed forms that can be easily adapted to suit your needs offers a significant advantage. These ready-to-use formats help save time and ensure consistency across your financial records.

With a wide variety of customizable options available, you can tailor these forms to reflect your brand’s identity while keeping them professional. This allows for a smoother and more efficient invoicing experience, freeing up time for more important tasks such as expanding your business or improving customer relations.

Efficient customization is key when it comes to optimizing your billing workflow. Whether you’re a freelancer, a small business owner, or managing a larger operation, finding the right structure for your documentation can improve accuracy and presentation. Additionally, automating repetitive tasks like payment requests will make your operations more streamlined and professional.

QuickBooks Online Invoice Templates Overview

In today’s fast-paced business environment, having access to pre-designed forms that can be tailored to specific needs is crucial for maintaining efficient financial management. These customizable documents not only simplify the billing process but also ensure a consistent and professional appearance across all transactions. Whether you are a freelancer or managing a large organization, utilizing these resources can streamline your workflow and improve accuracy in your record-keeping.

Why Use Pre-designed Forms?

Customizable forms offer several benefits to businesses, including saving time, reducing errors, and enhancing the overall efficiency of your financial tasks. These documents are structured in a way that allows for easy adjustments, helping you avoid the hassle of creating new ones from scratch each time a transaction occurs.

Key Features of Custom Billing Forms

These pre-designed documents come with essential fields and options that allow businesses to quickly input relevant information, from customer details to payment terms. Key features include customizable branding, such as logos and colors, which help maintain consistency with your business’s identity. They also often include automatic calculations for taxes and totals, reducing the chances of errors and improving accuracy in your records.

| Feature | Description |

|---|---|

| Customization | Adjust layout, colors, and text to match your business branding. |

| Automatic Calculations | Automatic tax and total calculations to reduce manual input. |

| Professional Design | Pre-built structure that ensures a polished and consistent look. |

| Time-saving | Pre-designed fields and layouts reduce the time spent creating documents. |

Overall, these resources are a powerful tool for anyone looking to simplify their financial tasks and improve business efficiency. By using these forms, you can ensure that your transactions are accurate, timely, and aligned with your company’s professional image.

Why Use QuickBooks Templates

Efficient document management is key to maintaining smooth business operations. Using pre-designed and customizable forms for billing and payment tracking simplifies many administrative tasks. By relying on structured documents, you can save time, reduce errors, and improve consistency across your financial records.

Time Efficiency and Consistency

One of the main reasons to use these ready-made resources is the time they save. Creating billing documents from scratch for every transaction can be tedious and error-prone. With pre-built forms, all you need to do is enter relevant details, which drastically cuts down on manual work. Additionally, the consistent layout across all documents helps present a professional image to clients, enhancing trust and credibility.

Customizability and Accuracy

These resources can be easily tailored to your specific business needs, including adding branding elements like logos, adjusting text fields, and changing the design to match your company’s identity. This flexibility ensures that every document reflects your business style, while built-in calculation features eliminate the chances of errors, ensuring greater accuracy in every transaction.

How to Download Invoice Templates

Accessing and obtaining pre-designed billing documents is a simple and quick process. Once you have decided on the type of structure that best suits your business, you can easily retrieve these ready-to-use forms from various platforms. These customizable resources can be saved to your device and later used whenever you need them.

Steps to Retrieve Your Forms

Follow these steps to access and save the necessary documents for your billing needs:

- Visit the platform or website offering customizable billing forms.

- Browse the available document designs to select one that fits your requirements.

- Click on the chosen form, which will allow you to preview and customize it.

- Once satisfied, choose the option to save or store the document on your device.

Customizing Your Downloaded Document

After retrieving your document, you can personalize it according to your preferences. Here are a few common customizations:

- Adjust text fields to include company name, client information, and transaction details.

- Change the layout to match your branding, including logo placement and colors.

- Ensure that necessary fields for payment terms, dates, and amounts are included.

Once customized, you can begin using the form for your business transactions, helping you maintain a professional image and streamline your billing process.

Choosing the Right Template for Your Business

Selecting the appropriate document structure for your billing needs is essential for maintaining professionalism and efficiency. With various styles and designs available, it’s important to choose one that aligns with your business’s image and meets its specific requirements. The right form can enhance your workflow, save time, and create a consistent experience for both you and your clients.

Consider the nature of your business when making your choice. If you offer services, a simple, clean layout with space for work descriptions and payment terms may work best. For product-based businesses, a design that includes itemized lists, pricing, and quantities is likely more suitable. Understanding your needs will guide you in selecting a structure that fits perfectly.

Another important factor is customizability. The best forms are those that allow you to add your branding elements, such as logos, colors, and company details, to create a professional and cohesive look. This not only reinforces your brand identity but also helps establish trust with your clients.

Customizing Your Billing Documents

Customizing your billing forms ensures that each document reflects your business identity while meeting specific transaction needs. With the right adjustments, you can create a professional, consistent experience for your clients. Personalization not only enhances your brand but also makes your billing process more efficient by adding relevant fields and features.

When tailoring your forms, there are several aspects to consider, including design elements, field content, and layout. You can modify the color scheme to match your brand, adjust fonts for readability, and add your logo to reinforce your business identity. Additionally, customizing the content to include payment terms, item descriptions, and tax calculations ensures that your clients receive clear and accurate information.

| Customization Aspect | Description |

|---|---|

| Design | Adjust colors, fonts, and layouts to match your business branding. |

| Field Content | Modify text fields to include necessary details like company name, payment terms, and service descriptions. |

| Logo and Branding | Incorporate your logo to strengthen brand recognition and make your documents more professional. |

| Tax and Calculations | Ensure automatic calculations for taxes and totals to reduce errors. |

By making these adjustments, you ensure that your billing documents are not only functional but also reflect the professionalism and attention to detail that your business offers.

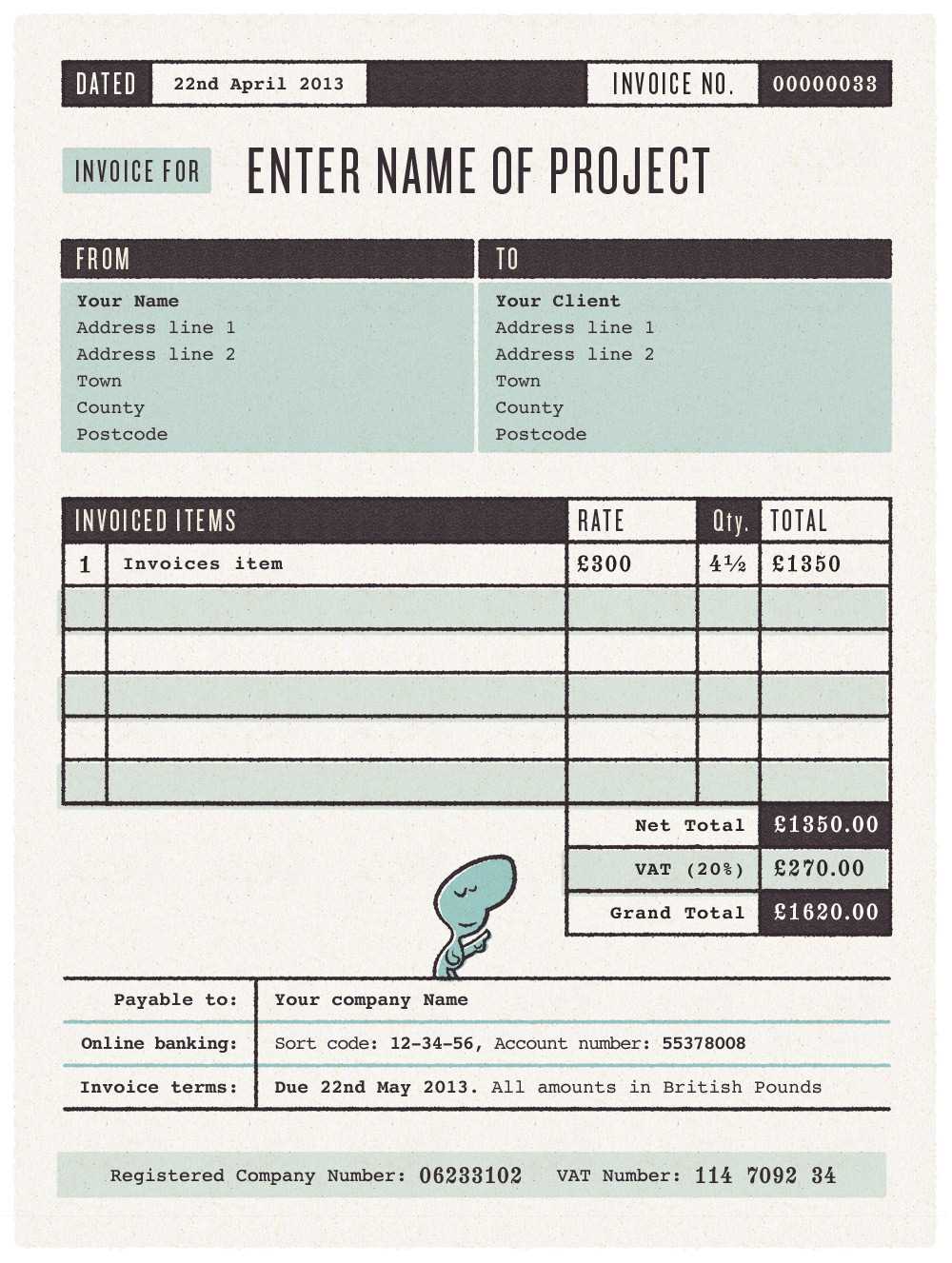

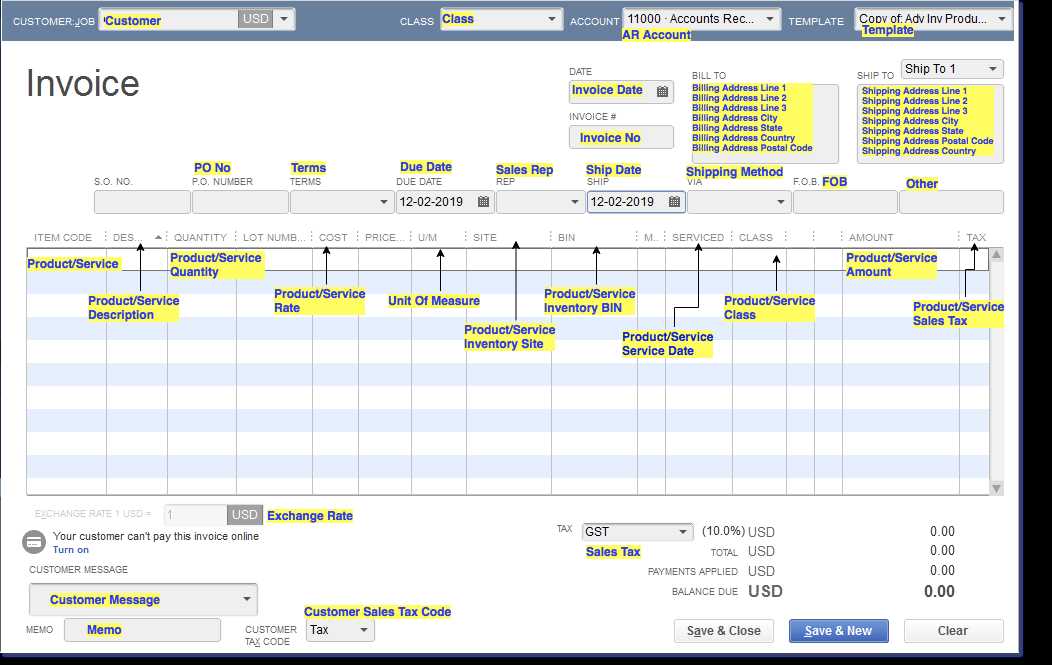

Understanding Invoice Fields and Options

To create accurate and professional billing documents, it’s important to understand the various fields and options available. These fields are designed to capture essential details about the transaction, ensuring clarity for both you and your clients. Knowing how to utilize and customize these fields will help streamline the billing process and avoid common errors.

Here are the most important sections commonly found in a billing document:

- Business Information: Includes your company name, address, phone number, and logo. This ensures that your clients can easily identify and contact you.

- Client Details: Contains the client’s name, address, and other relevant contact information, ensuring that the document is personalized and accurate.

- Transaction Description: A detailed breakdown of the goods or services provided, including quantities, unit prices, and a clear description of each item or service.

- Payment Terms: Specifies the payment due date, any early payment discounts, or late fees that may apply.

- Tax Information: Includes tax rates, tax amounts, and total cost, ensuring compliance with local tax laws.

- Total Amount: The final amount due, including any taxes or additional fees, presented clearly at the bottom of the document.

Each field is customizable to ensure that the document meets your specific needs. By adjusting the contents of these sections, you can provide your clients with a transparent and professional overview of the transaction, fostering trust and helping avoid misunderstandings.

Advantages of Using QuickBooks Templates

Utilizing pre-designed forms for your financial transactions offers numerous benefits for businesses of all sizes. These structured documents not only save time but also help maintain consistency, accuracy, and a professional image. By choosing the right format, businesses can streamline their billing processes, reduce errors, and ensure a smooth experience for both clients and staff.

Time Efficiency and Simplicity

One of the biggest advantages of using ready-made forms is the amount of time they save. Rather than creating documents from scratch for each transaction, you can quickly input the necessary information into a pre-existing structure. This eliminates the need to reformat each document, significantly speeding up your workflow.

Improved Professionalism and Accuracy

Pre-designed forms help maintain a consistent, polished appearance that reflects positively on your business. By using forms with built-in fields and calculations, you reduce the risk of errors in tax rates, totals, and client information. The result is a more professional look and accurate records, which builds trust with your clients and simplifies bookkeeping tasks.

In conclusion, these forms offer an efficient, reliable, and professional solution to everyday business transactions. With features that can be customized to suit your specific needs, they ensure that your billing is accurate, timely, and aligned with your business goals.

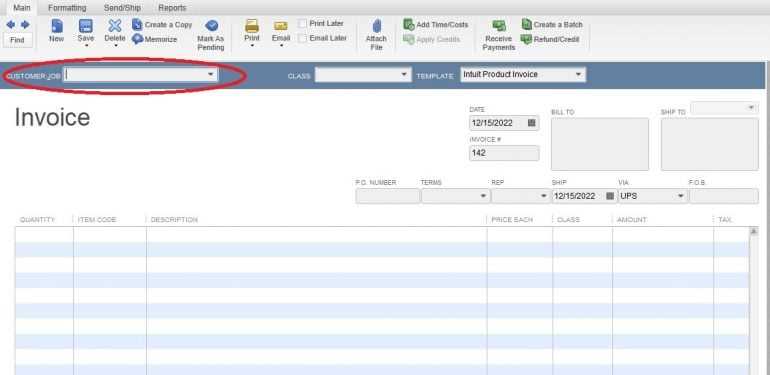

How to Apply Templates to Invoices

Applying pre-designed billing forms to your transactions can greatly streamline the process and ensure consistency in your documents. By following a few simple steps, you can easily integrate these ready-made structures into your workflow, making your billing process faster and more efficient.

Here’s how you can apply these customizable forms to your transaction records:

- Select the Document Structure: Start by choosing a design that fits your business needs. Many platforms offer various pre-made options that can be tailored to your brand and requirements.

- Input Client and Transaction Details: Once you’ve selected the appropriate form, fill in the necessary fields such as client name, address, product or service descriptions, and pricing information.

- Customize for Specific Transactions: If necessary, adjust the layout to include any specific terms, discounts, or taxes. Make sure all the important details are visible and clear to your client.

- Apply the Form: After customization, save or apply the form to your transaction. Depending on the platform, this can usually be done with a simple “Apply” button or similar option.

- Review and Finalize: Double-check all details for accuracy, ensuring there are no missing elements, and that the document is professional and complete.

By following these steps, you can efficiently use structured forms for all your business transactions, making your processes more organized and professional.

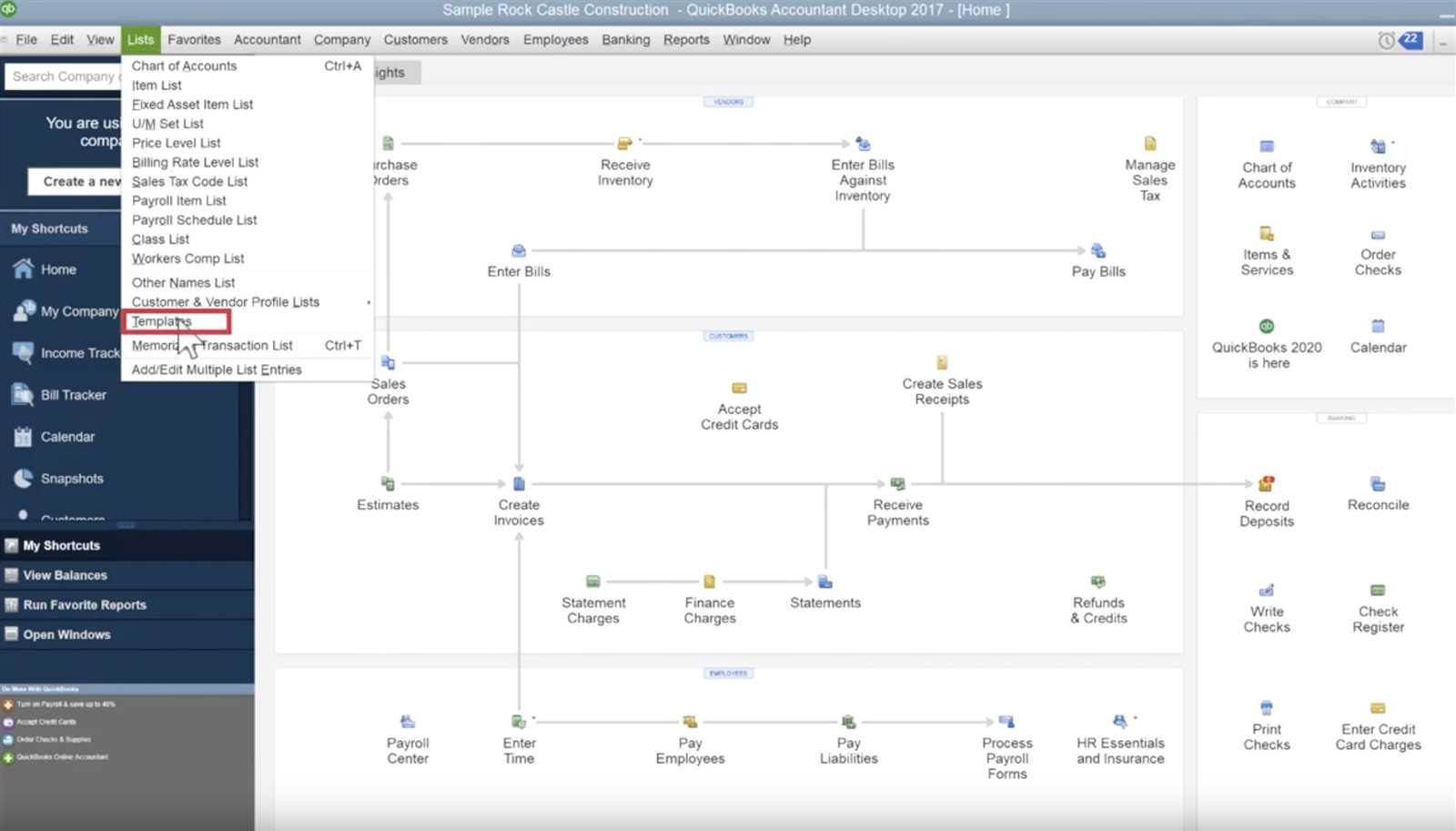

Template Compatibility with QuickBooks Versions

When selecting pre-made billing forms for your business, it’s essential to ensure compatibility with the version of your accounting software. Different software versions may have unique features or restrictions that affect how these forms function. Understanding these compatibility factors will help you avoid issues and streamline the integration process.

Each version of the software may support different functionalities and customizations. Some versions may offer advanced features, such as automatic calculations, while others may have more basic options. It’s crucial to verify that the form you choose is fully supported by your current version to ensure all elements work correctly.

Compatibility Considerations include:

- Software Version: Verify that the version you’re using supports the format and customization features of the form you intend to apply.

- Updates and Upgrades: If you’re using an older version, make sure it’s up-to-date or consider upgrading to avoid missing features that might be required for the template to function correctly.

- Customization Options: Some versions allow for more flexible adjustments, such as adding logos or adjusting layouts. Check whether your current version supports these capabilities.

- Compatibility with Features: Ensure that your version supports all relevant features, like tax calculations, automatic total sums, or payment reminders, that you may need to apply to your billing forms.

In conclusion, understanding the compatibility of your software version with the forms you plan to use is key to ensuring smooth and efficient business operations. By confirming compatibility in advance, you can avoid errors and make the most out of your chosen forms.

Saving and Storing Customized Templates

Once you’ve designed a billing form that suits your business needs, it’s essential to save and store it properly. This ensures that you can easily access and reuse it whenever needed, without the risk of losing your customizations. Proper storage and organization will save time in the future and maintain consistency in your documents.

Here are some tips for saving and storing your customized forms effectively:

- Choose a Clear Naming Convention: Give your customized forms clear, descriptive names to make it easy to identify them later. For example, include the type of document or specific customer details in the name.

- Save in a Centralized Location: Store your forms in one place, such as a dedicated folder or cloud storage service, to ensure easy access from any device or location.

- Version Control: If you make changes to your forms over time, consider saving different versions of the same form. This helps track improvements or modifications and ensures you always have access to previous versions if needed.

- Use Cloud Storage for Easy Backup: Cloud storage services provide secure backup options and make it simple to access your customized forms from anywhere.

- Regular Backups: Perform regular backups to avoid the risk of losing your files due to hardware failure or software issues. This extra step helps ensure your forms are always protected.

By following these practices, you can ensure that your customized documents are well-organized, easily accessible, and secure for future use.

Common Errors and Troubleshooting Tips

When working with pre-designed billing forms, users may encounter several issues that can affect the smooth functioning of the document creation process. Understanding these common errors and knowing how to resolve them can save time and help maintain accuracy in your financial records.

Here are some of the most frequent problems and tips to troubleshoot them:

- Missing Fields or Incorrect Information: One common issue is fields not appearing or displaying incorrect data. This often happens if certain fields have not been filled out or if there’s an error in the form’s configuration. Solution: Double-check the form setup, ensuring that all necessary fields are completed and correctly mapped to your records.

- Formatting Issues: Sometimes, the layout of the document may not appear as expected, such as text overlapping or fields being misaligned. This can be caused by compatibility issues between your software version and the form design. Solution: Ensure that your software is up-to-date and that you’re using a compatible form. If the problem persists, try adjusting the layout or choosing a simpler format.

- Calculation Errors: Automatic calculations for totals, taxes, or discounts might not function as expected, leading to incorrect amounts. Solution: Verify that all relevant fields for calculations are correctly configured. Check the formulas used in the fields and make sure that they align with your business rules.

- File Not Saving Properly: If your form isn’t saving or the changes aren’t being applied, it could be due to technical issues or a corrupted file. Solution: Try saving the form in a different location or reloading your platform. If this doesn’t work, consider using a different version of the form or creating a new document from scratch.

- Slow Performance: Sometimes, working with customized documents may cause delays in saving or processing. This can happen due to heavy file sizes or numerous customizations. Solution: Reduce the size of the file by removing unnecessary elements or simplifying the design. Clear the cache of your platform to improve performance.

By addressing these common issues, you can troubleshoot most challenges effectively and continue creating accurate and professional documents with ease.

Integrating Templates with Your Accounting Workflow

Efficiently incorporating pre-designed forms into your daily accounting tasks can streamline processes and save time. By integrating these forms with your existing financial management practices, you can ensure consistency, reduce manual entry errors, and automate routine tasks. Understanding how to seamlessly add these tools into your workflow will enhance overall productivity and accuracy in record-keeping.

Here are some steps to help you effectively integrate these forms into your accounting routine:

- Automate Data Entry: By linking the forms to your accounting system, you can automatically populate fields with data from your customer and transaction records, reducing the need for manual input.

- Establish a Consistent Process: Develop a step-by-step procedure for creating, sending, and storing the forms. Ensure all team members are on the same page and follow the same standardized process for improved efficiency.

- Integrate with Payment Systems: Connect your forms to your payment processing software to automatically track payments and adjust outstanding balances in your financial records.

- Link to Reports: Make sure the forms are integrated with your reporting tools, so you can easily generate financial statements and track the performance of transactions across different periods.

- Use for Recurring Transactions: Set up recurring billing forms for regular clients to save time on repetitive tasks. Schedule these forms to be generated automatically based on your agreed-upon intervals.

- Maintain Accurate Records: Ensure the forms are properly stored and categorized in your system. This will help you easily retrieve previous documents and maintain an organized record of all transactions.

By integrating these forms into your workflow, you create a more organized, automated, and efficient accounting system that saves time, reduces errors, and improves the overall management of financial data.

Best Practices for Professional Invoices

Creating clear, organized, and professional billing documents is crucial for maintaining good business relationships and ensuring timely payments. Adhering to best practices when designing and issuing these documents will not only improve the customer experience but also enhance the efficiency of your financial processes. Proper formatting, accurate details, and a well-structured approach will help you stand out and avoid common mistakes.

Here are some key guidelines to follow when crafting your billing forms:

- Use Clear and Concise Language: Avoid jargon or complicated terminology. Keep the information simple, easy to understand, and to the point. Customers should be able to immediately identify what they are being billed for and the total amount due.

- Include Essential Information: Always ensure that the form includes the necessary details such as the business name, contact information, due date, and a unique reference number. This will help both parties stay organized and avoid confusion.

- Itemize Charges: Break down the charges into separate line items to give your clients a transparent view of what they are paying for. Include descriptions, quantities, and unit prices where applicable to avoid misunderstandings.

- Make Payment Terms Clear: Clearly state payment terms, including the due date and any penalties for late payments. If applicable, include details about accepted payment methods or bank account information to facilitate quick processing.

- Maintain a Consistent Layout: Use a consistent format and layout for all your documents. This helps reinforce your brand image and makes it easier for clients to review their bills. Consider using logos, color schemes, and fonts that reflect your business identity.

- Keep Records for Future Reference: Always keep copies of issued forms, whether in digital or hard copy form. Organized records will make tracking payments and managing your finances more efficient, especially during audits or disputes.

By following these best practices, you ensure that your billing documents are both professional and functional, contributing to smoother business operations and fostering trust with your clients.

Using Templates for Recurring Invoices

For businesses that offer subscription-based services or have regular clients, automating the creation of recurring billing documents can significantly reduce administrative time and effort. Using pre-designed forms for repetitive transactions allows for consistent billing practices and ensures that payments are processed on time, every time. This method helps eliminate the need to manually enter the same information repeatedly, improving both efficiency and accuracy.

Here are some benefits and tips for using pre-configured billing forms for recurring charges:

- Save Time on Repetitive Tasks: Once you set up a recurring billing document, it can be automatically generated at set intervals, saving time and ensuring no details are missed each cycle. This reduces the chance of human error.

- Standardize Billing Information: With a preset structure, all your recurring billing forms will have the same layout and style, ensuring consistency. This makes it easier for your clients to review and understand their charges.

- Customize for Each Client: While the basic structure remains the same, you can still personalize each form with specific client information, such as custom payment terms, discount rates, or unique service descriptions.

- Automate Payment Tracking: Many billing systems can automatically track when payments are made for recurring services, updating your records in real time. This streamlines your financial tracking and reduces the risk of missing payments.

- Increase Client Satisfaction: Automated billing ensures timely, accurate charges and fosters a sense of professionalism and reliability with your clients. Knowing they won’t have to worry about missed or late bills can improve overall satisfaction.

- Maintain Flexibility: Even though you’re using a recurring system, you can still modify individual charges, adjust payment dates, or offer one-off discounts for particular clients or services without needing to redesign the entire form.

By adopting a systematic approach to recurring billing, you can focus more on growing your business and less on administrative tasks. Automating the process with pre-structured forms provides both convenience and professionalism, ensuring that your clients receive consistent, accurate statements on time.

Exporting and Printing Billing Documents

When managing financial records, it’s often necessary to create hard copies or digital versions of your billing statements. Exporting and printing your generated documents ensures that you have both physical and electronic backups for your accounting needs. Whether for archiving, sharing with clients, or submitting for tax purposes, having these records easily accessible and in the correct format is crucial for smooth business operations.

How to Export and Print Billing Statements

Follow these simple steps to ensure that your billing documents are exported and printed effectively:

- Step 1: Access the document you wish to print or export from your billing system.

- Step 2: Choose the appropriate option to either export as a PDF or another file format, depending on your preferences and needs.

- Step 3: Select the specific page or range of documents you want to print or save, ensuring you capture all necessary information.

- Step 4: Adjust print settings, such as orientation and page size, for optimal output. Check for any layout issues before proceeding.

- Step 5: Click print or export, depending on the method chosen, and verify that the file or printout matches the required specifications.

Why Export and Print Billing Documents

- Record Keeping: Exporting and printing helps you maintain accurate records for compliance, audits, and tax filing purposes.

- Client Communication: Printed documents can be mailed to clients or handed over during meetings, offering a professional touch.

- Backup Options: Having physical copies of your documents serves as a backup in case digital files are lost or corrupted.

- Easy Sharing: Exported files are easily shared via email or cloud storage for collaboration with stakeholders or team members.

By regularly exporting and printing your financial documents, you ensure that you have full control over your business’s financial records while maintaining compliance and professionalism.

Updating Templates for Business Growth

As your business expands, the need to streamline and enhance administrative tasks becomes more critical. Customizing and refining your business documents helps maintain a professional appearance, improves client communication, and supports operational efficiency. Regularly updating these documents to reflect growth ensures that they align with your evolving business needs, keeping them relevant and effective for both you and your clients.

Adapting to Changes in Your Business

Over time, the products, services, and policies of your business will likely evolve. These changes should be reflected in your official documents to maintain accuracy and professionalism. Consider the following adjustments when updating:

- Branding Updates: Ensure your logo, color scheme, and business name are up-to-date to reflect the latest brand image.

- Service or Product Changes: Add or remove services, adjust descriptions, or update pricing details as necessary.

- Legal or Policy Updates: Modify terms and conditions, payment terms, and contact information to stay compliant with any new regulations or business policies.

Benefits of Regularly Updating Your Documents

- Improved Customer Perception: Modern, clear, and professional documents help build trust with clients.

- Increased Efficiency: Streamlined documents save time, reducing errors and the need for repetitive manual adjustments.

- Consistency Across Your Business: Ensuring all client-facing documents are aligned with your current business strategy helps reinforce a cohesive brand message.

By regularly updating your business documents, you can position your company for sustained growth and ensure that all client interactions remain smooth and professional, reflecting the true value of your expanding business.