Create a Custom Invoice Template in QuickBooks Online

Designing personalized billing documents allows businesses to maintain a professional appearance while ensuring that important details are clearly communicated to clients. By tailoring these documents to your needs, you can enhance customer satisfaction and streamline your financial processes.

Personalizing your business forms provides a way to showcase your brand identity and create a cohesive experience for your clients. Adding elements like logos, colors, and specific payment details ensures that every interaction is aligned with your business’s values.

Understanding how to modify and adapt these documents can save time and effort in the long run. From adjusting layout preferences to including necessary fields, learning how to craft the perfect billing document is essential for any growing business.

QuickBooks Online Custom Invoice Template Guide

Creating personalized billing forms for your business can significantly improve your client communication and streamline financial tasks. These documents serve as essential tools for ensuring that all necessary details are properly conveyed, from itemized charges to payment terms.

Designing your business documents involves choosing the right layout, incorporating your branding, and ensuring that all relevant fields are included. This not only boosts your professionalism but also allows for a seamless transaction process between you and your clients.

Adapting these forms to meet specific business needs means you can tailor each document to different types of transactions, from simple sales to recurring charges. Mastering this process ensures that every bill accurately reflects the services or products provided, while aligning with your business’s identity.

Understanding the Basics of Custom Invoices

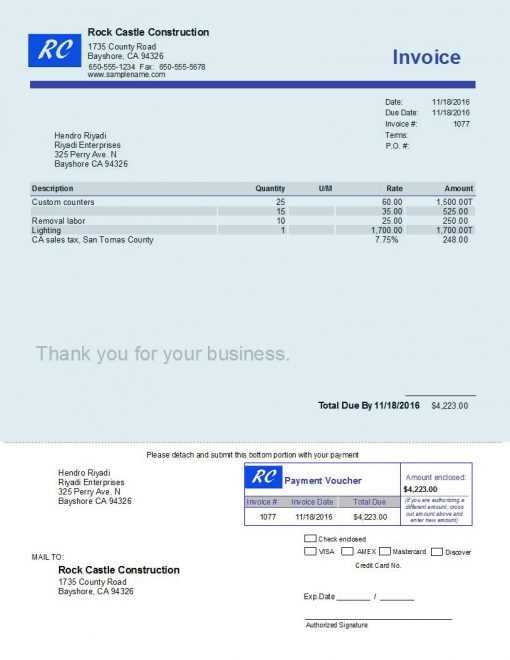

Creating personalized billing documents is an essential part of managing financial transactions. These forms provide clients with a clear breakdown of charges and payment terms, ensuring transparency and professionalism in business dealings.

Designing your billing forms involves selecting key elements that reflect your business needs. From including specific details such as product descriptions to setting payment deadlines, each aspect of the document should be tailored to offer a seamless experience for both parties.

Understanding how to structure these forms effectively is crucial for smooth communication. The layout, clarity, and comprehensiveness of each field ensure that no important information is overlooked, reducing the chances of errors or misunderstandings with clients.

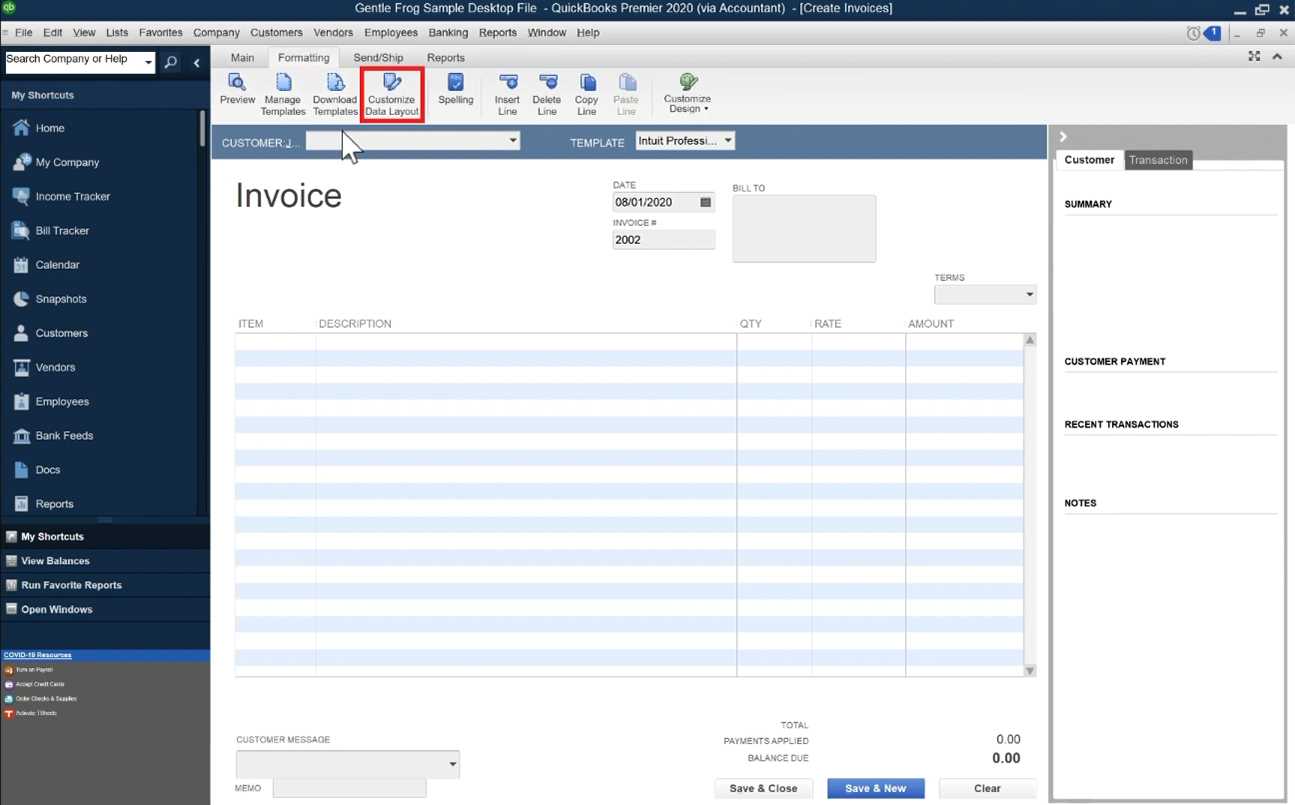

How to Access Invoice Templates in QuickBooks

To create professional billing documents for your business, it’s essential to access the right forms within your accounting software. These pre-designed formats allow for easy customization to suit the unique needs of your transactions.

Here’s a step-by-step guide on how to access and modify the available forms in the system:

| Step | Action |

|---|---|

| 1 | Login to your accounting software and navigate to the ‘Billing’ section. |

| 2 | Click on the ‘Create New’ option to access the available forms. |

| 3 | Select ‘Manage Templates’ to browse and select the one you want to modify. |

| 4 | Choose from the pre-designed options and click ‘Edit’ to make changes. |

By following these steps, you can quickly find and personalize the right forms to match your business requirements.

Designing an Invoice Template for Your Business

Creating a personalized billing document that reflects your brand is crucial for maintaining professionalism and ensuring clarity in transactions. By designing a document that aligns with your business needs, you can provide clients with an organized, easy-to-read statement that clearly outlines the details of the services or products provided.

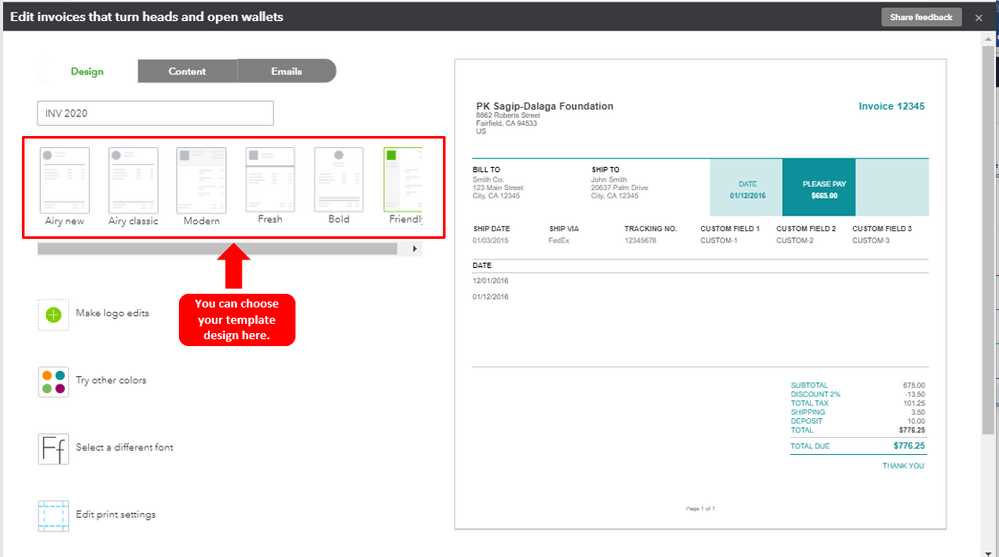

Choosing the Right Layout

The layout of your billing document plays a key role in how your clients perceive your business. A clean, well-structured design with clearly labeled sections helps clients easily understand the charges and payment details. Consider organizing the document with distinct sections for contact information, itemized services or goods, and total amounts due.

Incorporating Branding Elements

Your branding is essential to creating a consistent customer experience. Ensure that your logo, company colors, and font choices are integrated into your document. This creates a cohesive look that reinforces your brand identity and makes your billing process feel more professional and personalized.

Adding Logo and Branding to Your Template

Incorporating your logo and branding into your business documents not only enhances your professional image but also strengthens your brand identity. By personalizing these documents with key visual elements, you can create a more cohesive and recognizable experience for your clients.

Placing Your Logo

Positioning your logo effectively is key to creating a strong visual impression. Most businesses place their logo at the top of the document, ensuring it is visible yet not overpowering. The logo should be clear and high-quality to represent your business well.

Choosing the Right Colors and Fonts

The colors and fonts you use in your document should align with your company’s branding. Consistency in color schemes and font styles will give your document a polished and uniform look, making it instantly recognizable to your clients.

| Step | Action |

|---|---|

| 1 | Upload your logo file to the document editor. |

| 2 | Adjust the size and placement of the logo to ensure visibility. |

| 3 | Set your brand colors for headers, footers, and other key sections. |

| 4 | Choose fonts that match your business’s style guide. |

By following these steps, you can successfully integrate your branding elements into your business documents, ensuring that each communication is professional and aligned with your brand’s identity.

Setting Up Invoice Preferences in QuickBooks

Configuring your document settings ensures that all your billing forms align with your business requirements. By customizing preferences, you can streamline the way you generate and send payment requests, making the process faster and more efficient.

Choosing Your Preferences

In this step, you will define the key options that suit your business style. Customizing fields, setting default terms, and selecting how the documents will look can help create a more consistent and professional experience for your clients.

- Set up default terms, such as payment deadlines and late fees.

- Choose whether to include tax rates or discounts.

- Decide on document numbering conventions for easy tracking.

- Customize your messaging to reflect your company’s tone and policies.

Saving and Applying Preferences

Once you’ve configured your settings, it’s important to save them and apply them to your future forms. This ensures that all newly generated documents follow your established preferences automatically.

- Click ‘Save Preferences’ once you have configured all the necessary options.

- Apply these settings to all new documents for consistent results.

- Review your saved preferences to make any adjustments if needed in the future.

By setting these preferences, you ensure a more streamlined and organized approach to managing your business’s billing process.

Customizing Payment Terms on Invoices

Setting personalized payment conditions on your billing documents is essential for ensuring clarity and smooth transactions with clients. By adjusting the payment terms, you can specify when payments are due and how late fees or discounts will be applied. This helps avoid misunderstandings and keeps your cash flow in check.

When customizing payment terms, it’s important to consider factors such as payment deadlines, late payment fees, and available discounts for early payments. These conditions can be easily adjusted to reflect the nature of each client relationship or specific transaction agreements.

| Option | Details |

|---|---|

| Due Date | Set a specific deadline for when payment should be made, such as “30 days from issue date.” |

| Late Fees | Specify a late fee policy, such as charging 1.5% per month on overdue balances. |

| Early Payment Discount | Offer a discount for early payment, for example, a 5% discount if paid within 10 days. |

| Partial Payments | Allow clients to make partial payments if necessary, detailing the amount and deadlines. |

Once these options are set, you can apply them to each document generated, ensuring that your clients are aware of the expectations upfront and encouraging timely payments.

How to Add Line Items to Your Invoice

Adding individual products or services to your billing documents helps clarify the charges for your clients. By breaking down the total cost into specific line items, you ensure transparency and provide a clear summary of the services or goods provided. Each item can be described with relevant details, such as quantity, price, and any applicable taxes.

To effectively add line items, it’s essential to include accurate descriptions, the correct pricing, and appropriate quantities. This information will give your clients a detailed view of what they are being charged for, minimizing any confusion or disputes.

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Product A | 2 | $50 | $100 |

| Service B | 1 | $200 | $200 |

| Shipping Fee | 1 | $20 | $20 |

Once the line items are added, you can easily adjust the quantities or prices as necessary, ensuring that the final amount reflects the actual services or products rendered. This provides both you and your clients with a precise breakdown of the transaction.

Incorporating Tax Rates and Discounts

Including applicable taxes and offering discounts on your billing documents can significantly impact the final amount owed by your clients. Properly applying tax rates ensures compliance with local tax laws, while discounts can incentivize early payment or reward loyal customers. It’s essential to clearly show both the taxes and discounts on your documents for transparency and accuracy.

Tax rates can vary depending on location and type of service or product, so it’s important to apply the correct rate to each item. This ensures that both you and your clients are aware of the tax responsibilities for each transaction. Additionally, you may need to include different tax categories if the products or services fall under different tax brackets.

Discounts can be added in different ways, such as percentage-based or flat-rate reductions. Clearly specifying the discount amount or percentage helps customers understand the savings they are receiving. Whether it’s a promotional discount or a special offer for bulk orders, it’s important to make the terms of the discount clear.

| Item Description | Amount | Tax Rate | Discount |

|---|---|---|---|

| Product A | $100 | 8% | – |

| Service B | $200 | 10% | 5% ($10) |

| Shipping | $15 | 8% | – |

Once taxes and discounts are incorporated, the final amount can be easily calculated by adding the tax charges and subtracting any discounts. This method provides a clear breakdown for your client and helps avoid any misunderstandings about the amount due.

Creating Recurring Invoice Templates

Setting up recurring billing documents can save valuable time and effort for businesses that provide regular services or products. By creating a reusable structure for periodic charges, you can automate the process and ensure consistent invoicing for clients. This method allows you to reduce the need for manual input while keeping your records organized.

Recurring invoices are ideal for businesses that have regular clients with predictable billing cycles. Whether it’s for monthly subscriptions, annual contracts, or ongoing services, these structures ensure that invoices are sent out automatically based on a set schedule, avoiding any delays.

Automation is key when creating these documents. By choosing the correct intervals–weekly, monthly, quarterly, or yearly–you can ensure that your clients are charged at the appropriate times. This is especially helpful for services with fixed rates that don’t fluctuate over time.

Once you’ve set up the structure, it’s important to review and adjust any recurring details as necessary. Make sure that each billing cycle reflects any potential changes in pricing, discounts, or other terms. Regularly updating the details ensures that your recurring invoices remain accurate and up-to-date.

Previewing Your Customized Invoice Template

Before sending out any billing document, it’s essential to preview how it will appear to your clients. Ensuring that all the details are correctly displayed, formatted, and easy to read is crucial for maintaining professionalism. By reviewing your design and layout, you can confirm that all necessary information is included and presented clearly.

Previewing allows you to check the following:

- Layout: Ensure that the structure looks well-organized and the sections are aligned properly.

- Content Accuracy: Double-check that all client details, product or service information, and pricing are accurate.

- Visual Design: Confirm that branding elements like logos, colors, and fonts are correctly applied.

- Functional Aspects: Make sure that all interactive elements, such as links or payment instructions, work as intended.

Once you’ve made the necessary adjustments, previewing provides an opportunity to fine-tune the final appearance. This step ensures that your documents look professional and are fully ready to be shared with your clients.

Saving and Managing Multiple Templates

Managing various document designs efficiently is key for any business that needs to cater to different client needs. By saving and organizing your different layouts, you can streamline your billing process and ensure that each document fits the specific requirements of a customer or transaction type. Whether you are dealing with one-time clients or recurring transactions, having a variety of well-organized options is essential.

Here are some steps to follow for saving and managing multiple formats:

| Step | Action | Benefit |

|---|---|---|

| 1 | Save each layout under a unique name | Easily identify and access the right one for each occasion |

| 2 | Organize templates by category | Quickly find the template suited for a particular service or customer type |

| 3 | Review and update periodically | Ensure all documents remain relevant and reflect current business branding |

By following these steps, you can save time and avoid errors when creating new documents. Proper management allows for flexibility and ensures that every communication with your clients is consistent and professional.

Using Custom Fields for Detailed Invoices

Adding extra information to your documents can enhance clarity and provide clients with a more comprehensive view of the services or products provided. By utilizing personalized fields, you can incorporate specific data such as special discounts, additional charges, or custom messages. This helps ensure that all important details are clearly displayed, improving communication with your clients.

Why Use Personalized Fields?

Personalized fields allow you to capture and display information that is unique to each transaction or customer, offering more flexibility and precision. Here are some of the key benefits:

- Improved clarity: Include all relevant details that are specific to the transaction.

- Better organization: Keep track of essential information like discounts, payment terms, or special notes.

- Enhanced customer experience: Provide your clients with more transparency and a professional appearance.

Types of Information You Can Include

There are many kinds of data you can integrate using personalized fields. Some examples include:

- Project codes or job references for easy tracking

- Payment terms or conditions specific to the agreement

- Additional service details or custom instructions

- Custom messages for clients (e.g., “Thank you for your business!”)

These fields allow for greater flexibility and control, ensuring that each document contains all the relevant information specific to your business needs. By using personalized fields, you can create more detailed, informative documents that help streamline your communication and enhance your professionalism.

Integrating Payment Links into Invoices

Incorporating payment links into your financial documents makes it easier for clients to settle their dues quickly and securely. By adding a direct link to your payment processor, you allow your customers to complete transactions with just a few clicks. This convenience enhances the overall payment experience and can help reduce delays in receiving payments.

Benefits of Adding Payment Links

Including payment links directly in your documents offers several advantages for both you and your clients:

- Convenience: Clients can pay instantly, avoiding the need to manually input details.

- Faster transactions: Speed up payment processing, reducing the time between issuing and receiving funds.

- Improved cash flow: Streamline your payment system and reduce the chances of overdue payments.

Steps to Add Payment Links

To effectively integrate payment links, follow these steps:

| Step | Action |

|---|---|

| 1 | Choose a payment processor that provides a payment link feature. |

| 2 | Generate a unique payment link for each transaction or customer. |

| 3 | Insert the payment link in a visible section of your financial document, like the bottom or top. |

| 4 | Ensure the link is clickable and leads directly to a secure payment page. |

| 5 | Test the link to ensure it functions properly before sending the document. |

Adding payment links enhances the convenience and efficiency of your billing process, ensuring that clients can easily pay their balances, which ultimately helps maintain smooth business operations.

Common Mistakes to Avoid in Invoice Templates

When designing financial documents, there are several common errors that can hinder the clarity, professionalism, and effectiveness of the document. These mistakes not only affect the look and feel of your paperwork but may also lead to payment delays or confusion. Understanding and avoiding these pitfalls will ensure that your documents remain accurate and straightforward.

Frequent Errors to Watch For

Here are some common mistakes to avoid when creating your financial documents:

- Unclear Payment Instructions: Always ensure that the payment instructions are clear and visible. If clients are unsure how to make payments, it can delay processing.

- Missing or Incorrect Contact Information: Double-check that all business contact details, including email addresses and phone numbers, are accurate and current.

- Omitting or Misplacing Item Descriptions: Providing detailed descriptions of goods or services ensures that clients understand exactly what they are being charged for.

- Not Including Payment Due Dates: Without a specified due date, payments may be delayed or forgotten.

Best Practices for Avoiding Mistakes

To avoid these common mistakes, follow these best practices:

| Step | Action |

|---|---|

| 1 | Review the layout to ensure all essential information is clearly presented and easy to find. |

| 2 | Double-check for errors in dates, amounts, and contact information. |

| 3 | Provide a breakdown of each service or product, including quantities and prices. |

| 4 | Always include a specific payment due date to avoid confusion. |

By following these guidelines, you can ensure that your financial documents are not only error-free but also professionally presented, leading to more efficient and timely transactions.

Best Practices for Invoice Customization in QuickBooks

When tailoring your financial documents to suit your business needs, it is essential to maintain a balance between personalization and professionalism. Proper customization not only reflects your brand identity but also enhances the document’s clarity and functionality. Adhering to best practices ensures that your documents are efficient, clear, and easy to understand by your clients.

Key Customization Tips

- Keep It Simple: While personalizing, avoid over-complicating the design. A clean and simple layout ensures that all essential details stand out clearly.

- Use Consistent Branding: Ensure that your logo, colors, and fonts are consistent with your brand’s visual identity, creating a professional and cohesive look.

- Clearly Display Important Information: Highlight the most crucial details such as payment terms, due dates, and item descriptions so that clients can easily find the necessary information.

- Use Standardized Terms: Stick to commonly understood terminology to avoid confusion. Ensure that all fields are clearly defined to prevent misunderstandings about the charges.

Advanced Customization Considerations

- Incorporate Automation: Where possible, automate recurring elements like payment terms and contact details to save time and reduce errors.

- Leave Space for Additional Information: Provide room for custom fields such as special instructions, discounts, or other specific client requirements.

- Test Your Design: Before finalizing, preview your document and check how it appears to your clients to ensure everything looks professional and functions correctly.

By following these best practices, your financial documents will not only look professional but also be highly functional, streamlining communication with your clients and improving payment efficiency.