Free QuickBooks Invoice Templates for Streamlined Billing

Managing financial transactions efficiently is crucial for any business. One of the most important aspects is ensuring that you can create clear and professional payment requests. With a few simple tools, you can enhance the way you handle payments, making the process quicker and more effective.

Using pre-designed forms can significantly save time while maintaining a high level of professionalism. These customizable options allow you to tailor the document to meet your needs, helping you stay organized and ensuring that clients receive clear, accurate details every time.

By taking advantage of these resources, you can focus more on growing your business and less on administrative tasks. They are especially useful for small businesses or freelancers looking for an easy way to manage payments without complicated software or high costs.

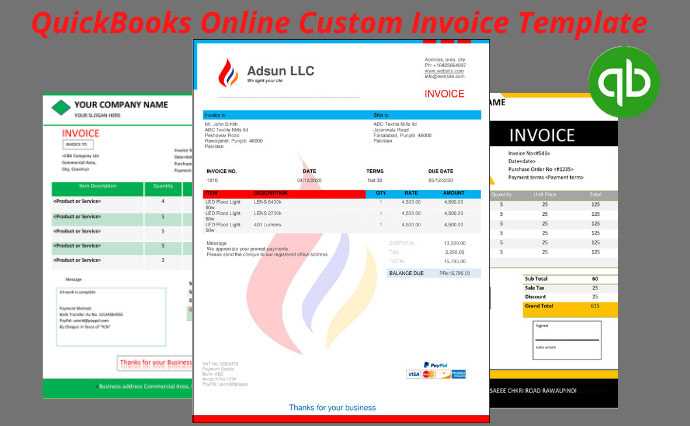

QuickBooks Invoice Template Options

When managing payments, having access to various document formats can greatly improve the speed and accuracy of your work. Different types of forms offer flexibility, allowing you to choose one that best fits the nature of your transactions and business needs. Exploring the options available will help you create polished, professional requests for payment with ease.

Types of Available Document Formats

There are several styles you can choose from, each designed to suit particular business requirements. The following are the most common formats:

- Basic Layouts – Simple, no-frills designs ideal for straightforward transactions.

- Detailed Layouts – Includes more fields to accommodate complex billing needs like taxes, shipping, and itemized costs.

- Customizable Designs – Offers flexibility to add logos, branding, and unique fields to better reflect your business identity.

Choosing the Right Layout

When selecting a format, consider the following factors:

- Transaction Complexity – If your dealings involve multiple products or services, a detailed layout may be necessary.

- Client Preferences – Some clients may appreciate a minimalistic design, while others may expect a more thorough breakdown of charges.

- Professional Image – The form should reflect the professionalism of your business. A clean, well-organized document leaves a lasting impression.

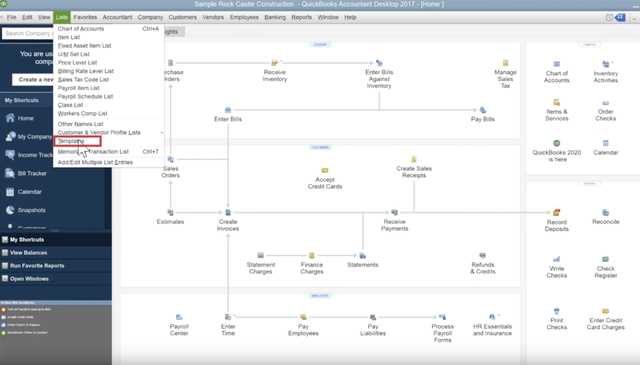

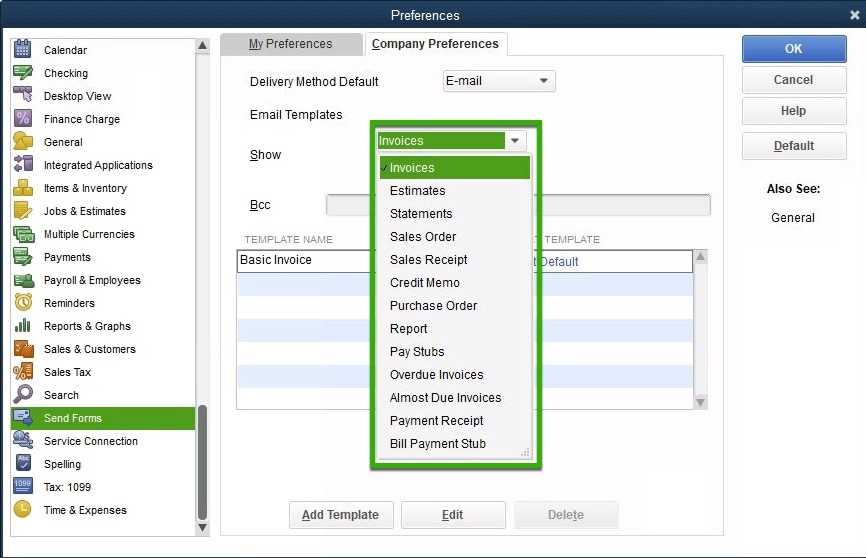

How to Use Free Templates in QuickBooks

Using pre-built forms for billing can save a significant amount of time, allowing you to focus on growing your business. These ready-made documents are designed to be easy to use and can be customized to match your specific needs. Once set up, they automate much of the invoicing process, helping you maintain consistency and accuracy across all transactions.

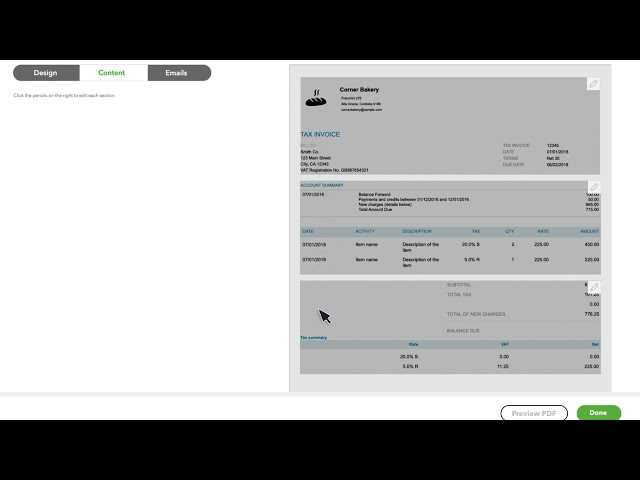

Setting Up Your Document

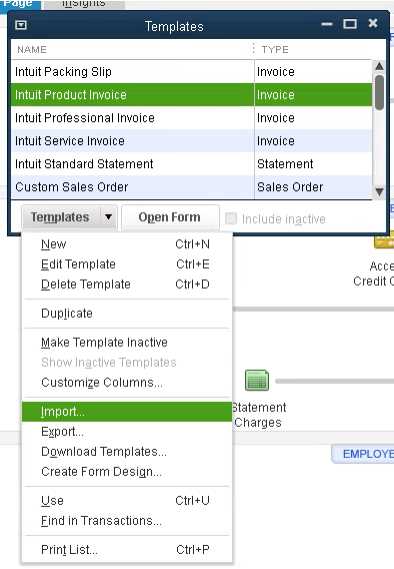

Before using any document format, you need to select one that aligns with your needs. Most systems allow you to choose from a variety of formats, each with different layouts and fields. Follow these steps to get started:

- Choose a format that fits your business style and transaction complexity.

- Customize the document by adding your business details, such as name, logo, and contact information.

- Fill in the required fields for each transaction, including product details, amounts, and payment terms.

Sending and Managing Documents

Once you’ve created and customized your document, sending it to clients is easy. Many systems allow you to directly email the document, track its status, and even send reminders for overdue payments. It’s important to keep these documents organized for future reference.

- Ensure that you send the document promptly after completing a transaction.

- Keep track of sent documents and monitor any unpaid amounts.

- Use automatic reminders to help clients stay on top of payments.

Top Benefits of QuickBooks Invoice Templates

Using pre-designed forms for billing offers several advantages that can enhance your workflow and improve efficiency. These ready-made solutions are designed to save time, reduce errors, and ensure consistency in your financial documents. By leveraging these options, businesses can streamline their accounting processes and maintain a more organized system for tracking payments and transactions.

Time Efficiency and Consistency

One of the key benefits of using these forms is the time saved compared to manually creating each document. By choosing a pre-built design, you can quickly generate accurate documents without the need for extensive formatting or layout adjustments. This consistency not only speeds up the process but also ensures that every document maintains a professional appearance.

Improved Accuracy and Error Reduction

Automated systems reduce the risk of human error, which is common when manually filling out financial forms. With pre-filled fields and built-in calculations, you can rest assured that figures such as totals, taxes, and discounts will be calculated correctly each time. This added accuracy helps maintain trust and professionalism with clients.

- Automatic Calculations: With built-in math functions, the risk of miscalculating amounts is minimized.

- Pre-set Fields: Information like client details and payment terms can be saved for faster future use.

- Easy Customization: While offering a standardized layout, these documents can still be tailored to match your business needs.

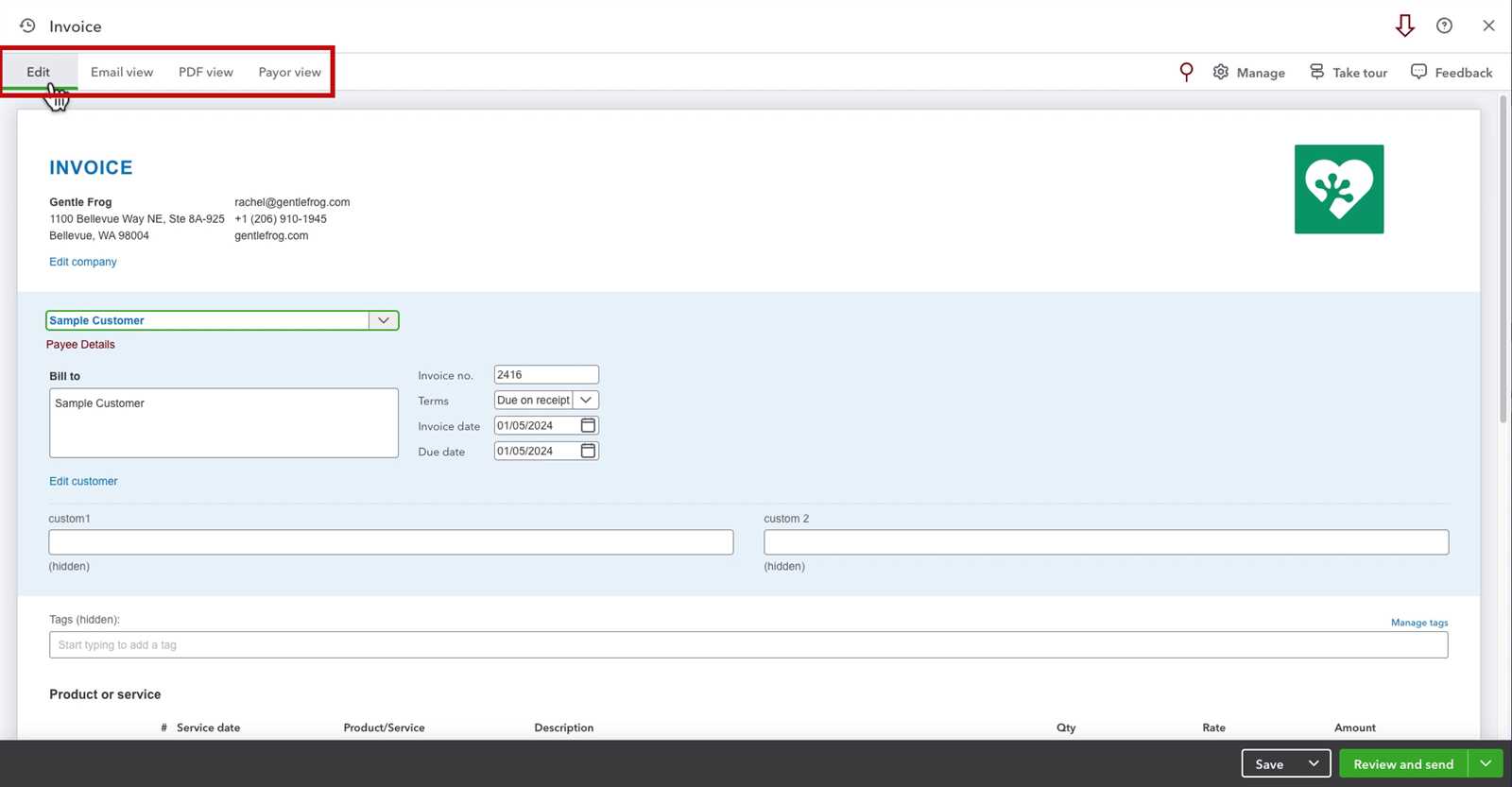

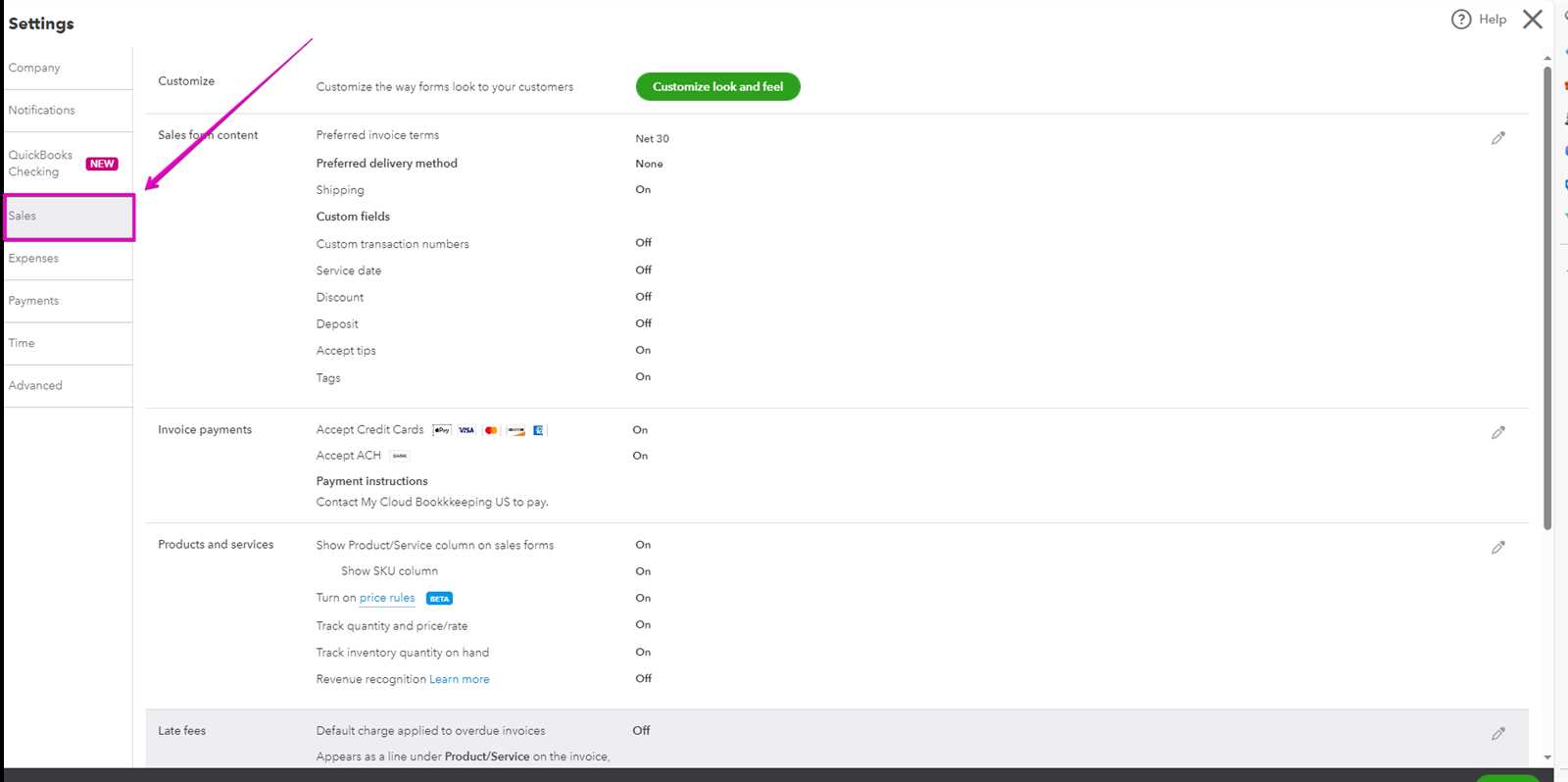

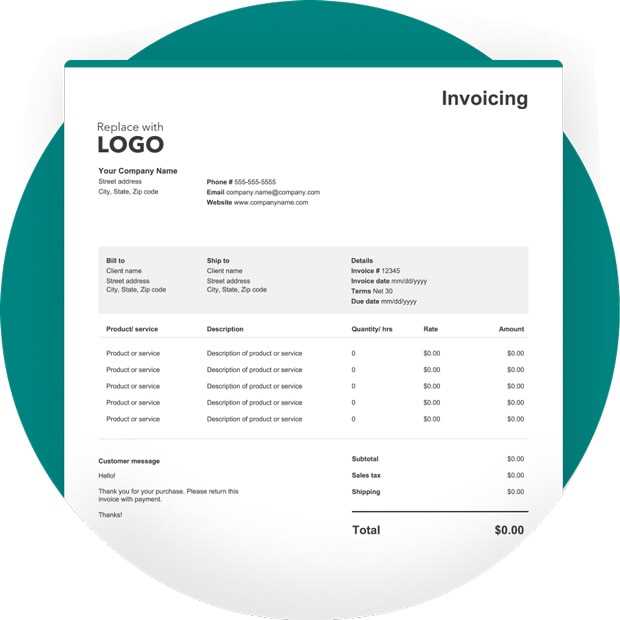

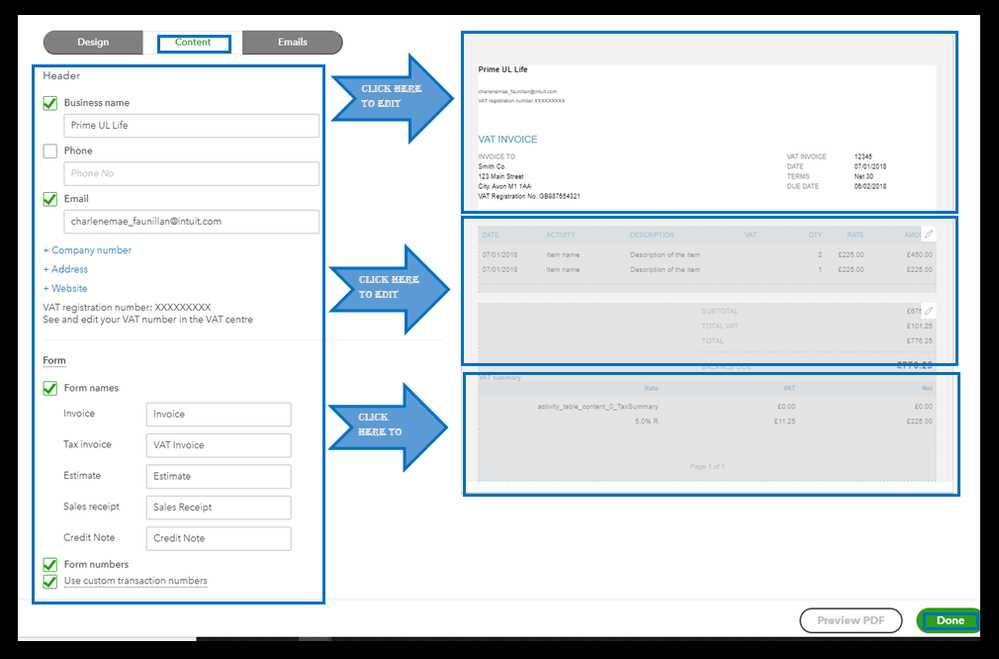

Customizing Your QuickBooks Invoice Template

Personalizing your financial documents can enhance both their functionality and the professional image of your business. By adjusting elements such as layout, colors, and field information, you can create documents that not only meet your specific needs but also reflect your brand identity. Customizing these forms ensures that they are tailored to your business and client requirements.

Personalizing Key Elements

Customizing the layout and content of your forms is straightforward. Here are some key elements you can adjust:

- Business Information: Include your logo, contact details, and business name to make the document recognizable and consistent with your branding.

- Field Adjustments: You can add or remove fields depending on your needs, such as additional line items or payment terms.

- Color Scheme: Choose a color scheme that matches your branding to create a cohesive and professional look.

Advanced Customization Options

Beyond the basics, more advanced customization allows you to fine-tune the document further:

- Automated Fields: Set up recurring information such as client names and addresses to be pre-filled automatically, saving time on each document.

- Payment Instructions: Add detailed payment terms, including accepted methods, due dates, and late fees, to ensure clarity for your clients.

- Custom Layouts: Adjust the placement of elements like totals, item descriptions, or tax information to suit your business preferences.

Where to Find Free Invoice Templates

There are numerous sources available online where you can access no-cost, pre-designed forms for your financial documents. Whether you’re a small business owner or a freelancer, these resources can help you create professional-looking billing documents without the need for costly software or complicated setups. By exploring various options, you can find the perfect fit for your business needs.

Popular Online Resources

Many websites provide a wide range of customizable forms for different industries. Some of the most trusted platforms include:

- Business Software Providers: Several accounting platforms offer complimentary templates as part of their service packages, allowing easy integration into their system.

- Design Websites: Websites focused on templates often have a vast selection of billing documents that you can customize to suit your needs.

- Office Suites: Popular software suites like Microsoft Office or Google Docs have pre-made forms that are easy to use and adapt for any transaction.

Customizable Templates for Specific Needs

Some sources cater to specific industries or business sizes. These templates are tailored to meet the unique requirements of businesses in various sectors:

- Freelancers: Templates designed for freelancers often have customizable fields for hourly rates and project-based work.

- Small Businesses: For small businesses, these forms often include space for multiple items, taxes, and payment instructions.

- Service Providers: Service-oriented templates often focus on work completed, billable hours, and client details.

Choosing the Right Invoice Template Style

Selecting the appropriate design for your billing documents is crucial for ensuring clarity and professionalism. The right style not only improves the look of your documents but also ensures that the information is easy to read and understand. Different business types and client preferences may call for distinct styles, so it’s important to choose one that suits your needs and enhances the overall experience for both you and your clients.

Understanding Your Business Needs

Before selecting a style, consider the nature of your business and the type of transactions you commonly handle. For example:

- Simple Transactions: If your transactions are straightforward, a clean, minimalist design may be sufficient.

- Detailed Billing: If you provide detailed services or multiple products, you may want a more comprehensive layout that includes itemized sections and additional fields.

- Branding Requirements: Ensure that the design reflects your brand’s personality, incorporating elements such as logos, color schemes, and typography.

Factors to Consider When Choosing a Style

Several important factors should guide your decision when choosing the ideal format for your financial documents:

- Clarity: Make sure that the design is easy to read, with clear headings, adequate spacing, and well-organized sections.

- Customization: Choose a style that allows for easy customization so you can adjust it to your specific business needs.

- Client Expectations: Consider the preferences of your clients. Some may appreciate a simple layout, while others may expect a more professional, detailed document.

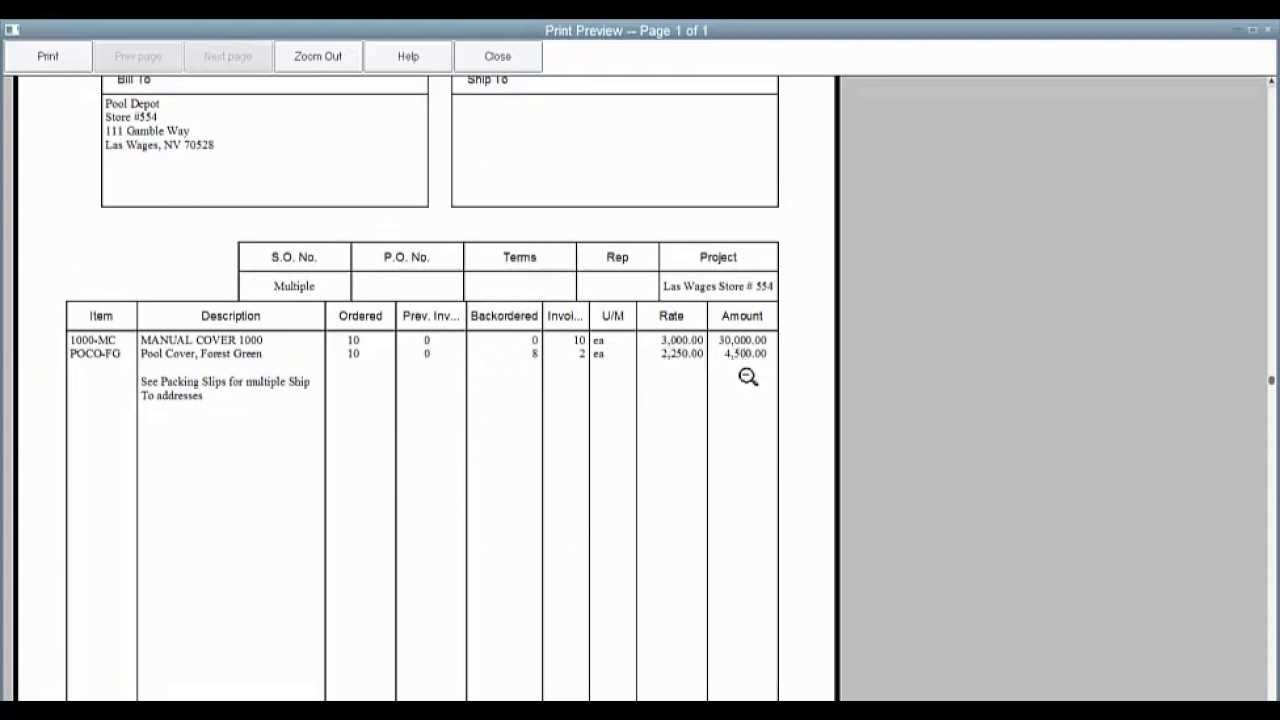

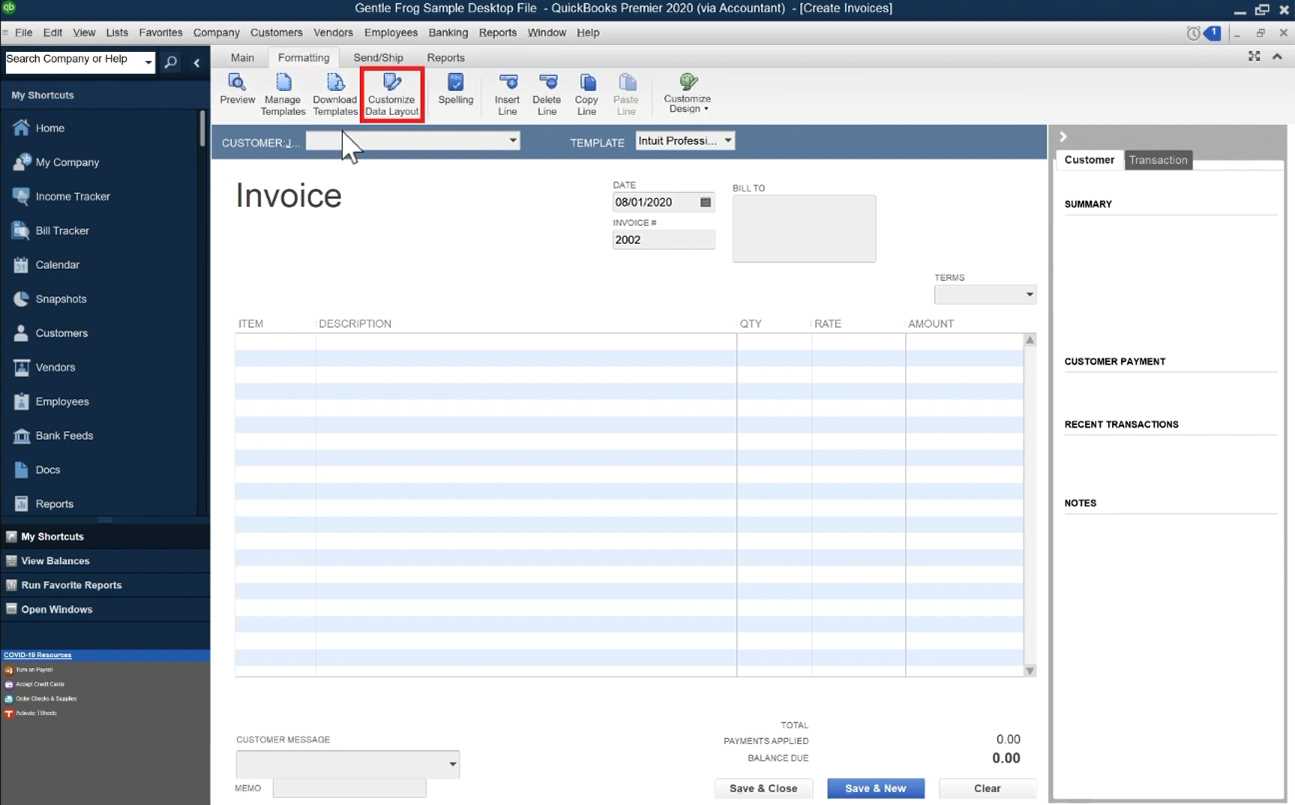

Steps to Set Up an Invoice in QuickBooks

Creating a professional billing document is a straightforward process that involves a few key steps. Setting up these documents properly ensures that all necessary details are included and formatted correctly. By following a simple setup procedure, you can streamline your billing process and maintain consistency in your records.

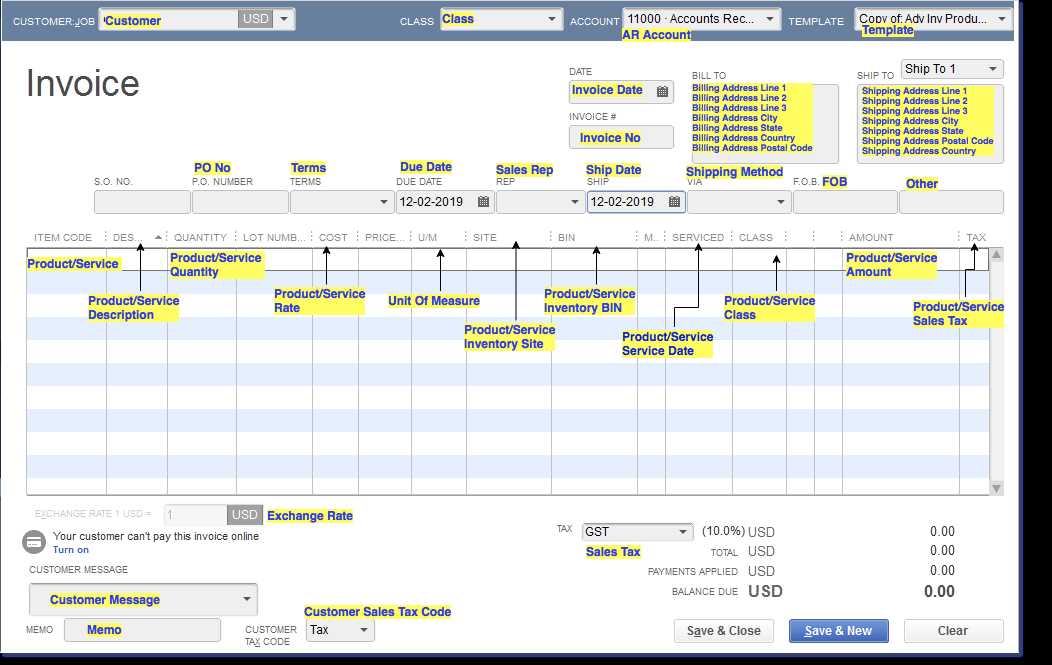

Step 1: Choose a Document Style

The first step is to choose a style that fits your business needs. You can select a simple, minimalist layout for straightforward transactions or a more detailed design if your billing includes multiple items or services. Once the style is selected, you can begin customizing it with your business information.

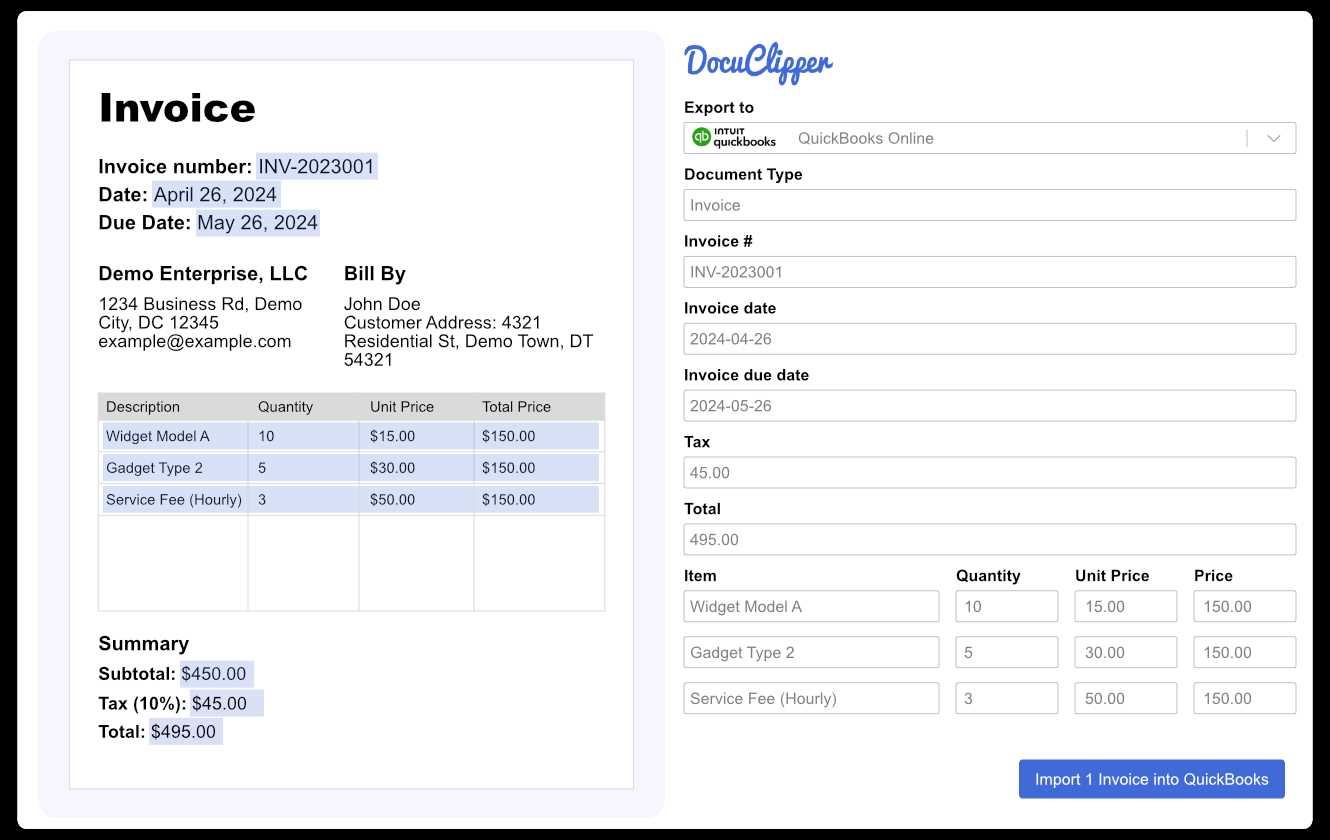

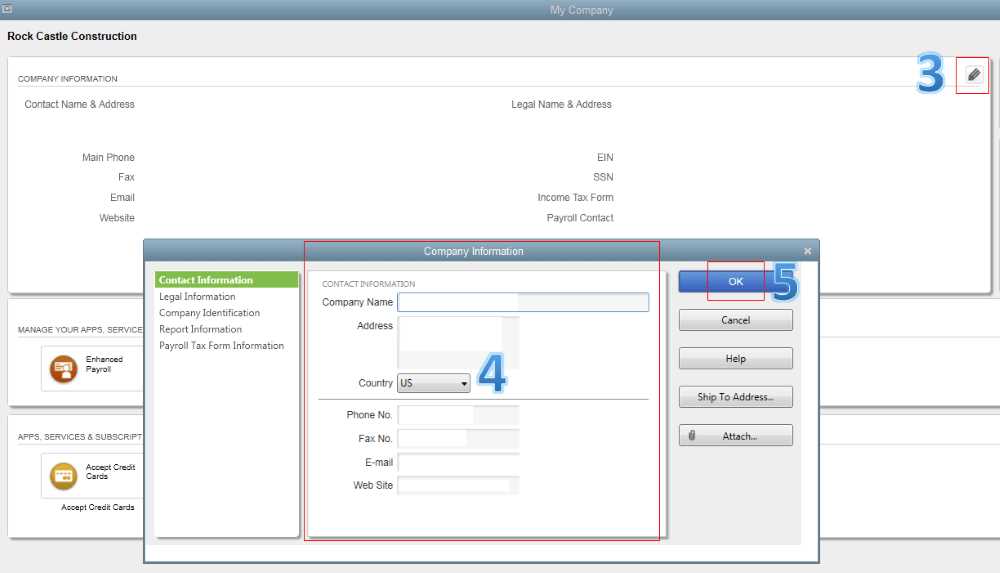

Step 2: Customize Your Document

Next, add your business name, logo, contact details, and any other relevant information that will appear on every document. Be sure to include standard payment terms such as due dates, late fees, and payment methods. This ensures that each document looks professional and includes all necessary details for your clients.

- Add Client Information: Ensure you input the client’s name, address, and contact details to personalize the document.

- Detail the Charges: List each service or product, including descriptions and costs, to provide clarity on the charges.

- Include Payment Instructions: Be clear about how payments can be made and the deadline for submission.

Step 3: Finalize and Send

Once all the necessary information has been added, double-check the details for accuracy. Ensure all calculations are correct, and the payment instructions are clear. After finalizing the document, you can send it directly to your client via email or print it for physical delivery.

Simple Tips for Faster Invoicing

Speeding up your billing process is essential for maintaining cash flow and keeping your business running smoothly. By implementing a few simple strategies, you can streamline your workflow, minimize delays, and ensure that your financial documents are sent out promptly and accurately. These tips will help you save time and avoid common invoicing mistakes.

1. Use Pre-Designed Forms

One of the easiest ways to speed up the billing process is by using pre-designed forms. With ready-to-use documents, you don’t have to spend time setting up each one from scratch. Simply fill in the required details, and you’re done. This eliminates the need for repetitive formatting and reduces the chances of errors.

2. Automate Repetitive Information

Take advantage of automated fields to eliminate the need for entering the same information repeatedly. By setting up recurring client details, payment terms, and services, you can reduce the time spent on each document. Automation ensures accuracy and consistency, making the entire process quicker and easier.

- Save Client Information: Store client details like name, address, and contact information to auto-fill future documents.

- Set Default Payment Terms: Set up standard payment terms and due dates that automatically populate with each new document.

3. Batch Your Work

Rather than creating individual documents one by one, batch your tasks together. Set aside time to complete multiple documents at once, focusing on filling out details for several clients in one go. This helps maintain focus and ensures consistency in all your financial paperwork.

Best Practices for Professional Invoicing

To ensure that your billing process is efficient, transparent, and reflects professionalism, it’s important to follow certain best practices. By adhering to these guidelines, you can avoid common mistakes, build trust with clients, and ensure timely payments. A well-structured and clear document can help enhance your business reputation and streamline your financial operations.

1. Include Clear and Complete Information

Make sure that every document contains all the necessary details, including your business name, client’s name, contact information, services provided, and a breakdown of charges. This helps avoid confusion and ensures that your clients have all the information they need to process payments quickly.

2. Maintain Consistent Formatting

Consistency is key to presenting a professional image. Use a uniform layout and font style throughout your documents to ensure that your financial records are neat and easy to follow. A consistent design not only makes your documents easier to read but also reinforces your brand identity.

- Use Simple and Readable Fonts: Choose easy-to-read fonts like Arial or Times New Roman and avoid using too many different font types or sizes.

- Organize Information Effectively: Ensure that the details such as service descriptions, costs, and payment terms are neatly aligned and grouped logically.

3. Set Clear Payment Terms

Specify your payment terms clearly, including the due date, late payment penalties, and preferred payment methods. This helps manage client expectations and ensures there are no misunderstandings regarding payment deadlines.

4. Double-Check for Accuracy

Before sending out any document, take a moment to double-check all details, such as dates, amounts, and descriptions. Accuracy is crucial to prevent errors that may delay payment or cause confusion with your clients.

Understanding Key Features of QuickBooks Templates

When creating billing documents for your business, it’s important to understand the core features that make the process easier and more efficient. These key elements not only enhance the look of your documents but also ensure that all essential details are captured and presented in a professional way. Familiarizing yourself with these features can help you create streamlined, accurate, and customized records for your clients.

1. Customization Options

The ability to personalize your financial documents is crucial. Customization allows you to align your paperwork with your brand and business needs. Here are some customization options to consider:

- Branding: Add your company’s logo, color scheme, and contact information to make the document uniquely yours.

- Service Details: Tailor the layout to display specific details of your services or products in a way that suits your offerings.

- Payment Terms: Easily incorporate your standard payment terms and deadlines to keep things clear for clients.

2. Automated Calculations

One of the most useful features is the automation of calculations. By using automated fields, you can quickly generate accurate totals without worrying about manual errors. These automated features often include:

- Subtotal Calculations: Automatically add up the costs of individual items or services.

- Tax Calculations: Calculate applicable taxes based on the rates you’ve set, ensuring consistency across all documents.

- Total Amount: Automatically display the final amount due, including taxes and additional fees, reducing manual calculation errors.

3. Easy-to-Fill Sections

Many forms are designed with easy-to-fill sections that simplify the document creation process. These fields typically include:

- Client Information: Easily input your client’s name, address, and other details to personalize each document.

- Itemized List: Quickly add a list of items or services provided, with spaces for descriptions and quantities.

- Due Dates and Payment Methods: Set default due dates and preferred payment methods to streamline the billing process.

Improving Cash Flow with Invoicing

Effective management of your business’s billing process plays a crucial role in maintaining healthy cash flow. By streamlining your financial documents, automating reminders, and ensuring timely payments, you can reduce delays and improve your overall revenue cycle. A well-organized invoicing system can help prevent cash shortages, reduce unpaid dues, and keep your business operations smooth and efficient.

1. Set Clear Payment Terms

Establishing clear and concise payment terms is vital for avoiding misunderstandings with clients. This helps set expectations from the start and encourages timely payments. Here are some tips for setting effective payment terms:

- Specify Payment Due Dates: Clearly define when the payment is due to avoid delays.

- Offer Discounts for Early Payments: Motivate clients to pay faster by offering small discounts for early settlements.

- Outline Late Fees: Set clear consequences for overdue payments, such as interest or penalties, to encourage promptness.

2. Automate Payment Reminders

Sending reminders is one of the simplest ways to ensure timely payments. Automating these notifications reduces the risk of forgetting to follow up with clients and helps maintain consistent cash flow. Here’s how automation can work in your favor:

- Pre-Schedule Reminder Emails: Set up automatic reminders to be sent a few days before or after the payment due date.

- Customize Reminder Frequency: Send multiple reminders at regular intervals to keep the payment top of mind for clients.

- Integrate with Payment Systems: Link your reminders to online payment options for easy and immediate processing.

3. Use Electronic Payment Methods

Allowing clients to pay electronically can significantly speed up the payment process. By offering multiple online payment methods, you eliminate barriers for clients who may not be comfortable with checks or manual transfers. Some options to consider include:

- Credit or Debit Cards: Accept card payments through a secure online portal for fast transactions.

- Bank Transfers: Provide clients with bank account details to facilitate direct transfers.

- Online Payment Services: Use services like PayPal or Stripe to make payments easier for clients, encouraging faster processing.

Free Invoice Templates for Small Businesses

Small businesses often face budget constraints, making it essential to find cost-effective solutions for everyday tasks like billing. One such solution is using pre-designed billing documents that are simple, professional, and customizable. These documents allow small business owners to streamline their operations without the need for expensive software or resources. By choosing the right tools, even businesses with limited budgets can maintain a professional image while ensuring their clients are billed accurately and on time.

1. Simple and Clean Design

For small businesses, simplicity is key. Billing documents that are easy to understand and visually appealing help create a positive experience for clients. Look for options that offer:

- Clear Layout: Minimalist designs that focus on important details without unnecessary clutter.

- Easy Customization: Simple ways to add your business name, logo, and contact information.

- Professional Look: Ensure your documents appear professional with a polished design that builds trust with clients.

2. Customizable Features

As every small business is unique, the ability to customize billing documents is essential. Look for resources that allow you to:

- Add Personal Details: Easily insert client names, addresses, and descriptions of the products or services provided.

- Set Payment Terms: Include important details such as payment deadlines, discount options, and accepted payment methods.

- Adjust Layout: Modify fields and sections to suit your specific needs, whether you’re offering products or services.

3. Simple Automation Features

Even without advanced software, small business owners can benefit from basic automation features to improve efficiency. Consider templates that include:

- Pre-Filled Calculations: Automatically calculate totals, taxes, and discounts based on inputs, reducing errors.

- Recurring Billing: Create recurring documents for regular clients, saving time on repetitive tasks.

- Easy Saving and Sharing: Save your documents as PDFs or send them directly via email to clients for faster processing.

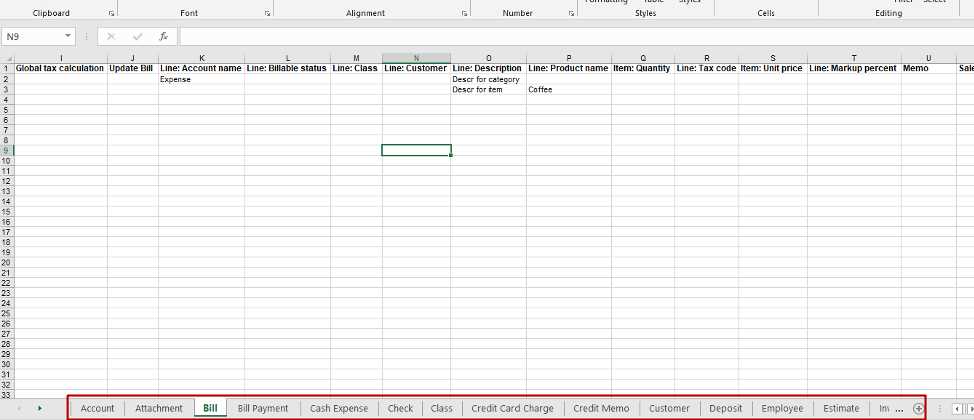

How to Automate Billing in QuickBooks

Automating the billing process can save time and ensure consistency in your business operations. By setting up recurring charges, automated reminders, and instant delivery, you can minimize manual effort and improve your cash flow. This process allows you to focus on other essential aspects of your business while maintaining an efficient and reliable payment system.

1. Set Up Recurring Billing

Recurring billing helps businesses that provide ongoing services or products to automatically charge clients on a set schedule. To streamline this process, consider the following steps:

- Choose Frequency: Select how often the charges will occur, such as weekly, monthly, or annually.

- Customize Billing Details: Include relevant information like the amount, description, and terms for each transaction.

- Set Payment Methods: Ensure that clients can pay through preferred methods like credit cards or bank transfers to speed up processing.

2. Automate Payment Reminders

Sending payment reminders is a simple but effective way to ensure timely payments. Set up automatic notifications to remind clients of due or overdue payments. This feature typically includes:

- Pre-scheduled Reminders: Automatically send notifications before or after a due date to keep payments on track.

- Customizable Message Templates: Personalize your reminder messages to maintain professionalism and clarity.

- Multiple Reminder Options: Set multiple reminders, including a friendly first reminder, a second reminder, and a final notice if necessary.

Saving Time with Pre-made Templates

Utilizing pre-designed documents can significantly reduce the time spent on administrative tasks. By choosing ready-to-use options, businesses can quickly generate professional paperwork without starting from scratch. These solutions are tailored to meet standard needs, providing essential fields and layouts that are already optimized for efficient use.

1. Instant Access to Professional Layouts

Pre-made documents offer a wide variety of styles that are ready to be customized with your business details. This eliminates the need for designing from the ground up, allowing you to:

- Focus on Content: Quickly add customer information, products, and prices without worrying about formatting.

- Ensure Consistency: Use the same layout across all your business communications, reinforcing your brand identity.

- Maintain Quality: Access polished and professional designs that ensure your documents are clear and easy to read.

2. Streamlined Customization Options

While these pre-designed solutions save time, they still offer flexibility to suit specific business needs. Customize the following:

- Business Information: Quickly add your logo, contact details, and payment terms to each document.

- Itemized Listings: Easily adjust the list of services or products you’re providing, with space for descriptions and amounts.

- Payment Instructions: Include preferred payment methods and due dates to guide your clients through the transaction process.

Essential Fields in a Billing Document

To ensure that every transaction is clear and professional, certain information must be included in each billing statement. These essential fields not only help in proper record-keeping but also provide clients with the details they need to process payments efficiently. A well-structured document improves communication and helps avoid potential confusion.

1. Business and Client Information

The core of any billing statement lies in identifying both parties involved. The essential details are:

- Your Business Name and Contact: Ensure that your business name, address, and phone number are easy to find.

- Client’s Name and Details: Include the recipient’s name, company (if applicable), and address for clarity.

- Tax Identification Number: Some regions require a tax ID number to be displayed on official documents.

2. Transaction Details

Along with the identification information, transaction specifics need to be outlined to avoid any ambiguity. These elements typically include:

- Unique Reference Number: Assign a unique code or number to each document for easy tracking and reference.

- Service or Product Description: List each product or service being provided, along with a detailed description to avoid misunderstandings.

- Amount Due: Clearly state the total amount that needs to be paid, breaking it down into smaller charges if applicable.

- Payment Terms: Specify when the payment is due and any late fees or discounts for early payment.

Tracking and Managing Payments Effectively

Keeping track of payments and ensuring that all transactions are properly recorded is crucial for maintaining healthy cash flow in any business. Efficient tracking helps businesses stay organized, avoid errors, and ensures clients are billed accurately and promptly. It also provides clarity when managing overdue payments and can be used for forecasting future cash flow.

1. Organizing Payment Records

To keep your financial operations running smoothly, it is essential to have a clear system for tracking payments. Key points to focus on include:

- Recording Dates: Ensure that each payment and due date is clearly logged, which helps avoid confusion later on.

- Payment Status Updates: Keep your records updated, marking whether a payment is pending, completed, or overdue.

- Multiple Payment Methods: Make note of how payments are made, whether through bank transfer, credit card, or cash, to ensure accurate reporting.

2. Automating Payment Reminders

One of the most effective ways to maintain payment schedules is to automate reminders. By setting up alerts or notifications for upcoming due dates, you can:

- Minimize Late Payments: Automatic reminders reduce the chances of missing a payment deadline.

- Improve Customer Relations: Gentle reminders help maintain positive communication with clients, ensuring timely payments.

- Save Time: Automated processes eliminate the need for manual follow-ups, letting you focus on other important business tasks.