QuickBooks Invoice Excel Template for Simple and Efficient Billing

Handling financial documentation can be streamlined with the right digital tools, ensuring an efficient workflow and accurate record-keeping. This method allows businesses to organize transaction details effectively, helping to maintain a clear financial overview. With an optimized approach, creating and sending billing forms becomes faster and more accurate.

A well-prepared form simplifies communication with clients, delivering a polished look that reflects professionalism. Using a customizable digital format, businesses can adapt each document to meet specific branding needs, giving every interaction a cohesive and unique touch.

In addition, managing and tracking these documents in one place can significantly improve financial oversight. Automated calculations reduce errors, while reusable formats save time, allowing small businesses and freelancers to focus more on growth and less on administrative tasks.

QuickBooks Invoice Excel Template Guide

For small businesses and freelancers, organizing transaction records in a digital format brings both efficiency and clarity to financial tasks. This guide will walk you through setting up a personalized format for your financial documents, enabling you to maintain a professional and consistent approach with every client interaction.

Creating a customized form that reflects your business identity is straightforward. Follow these steps to structure your form effectively:

- Download a Blank Format: Start by downloading a blank file that allows you to input all necessary details. Ensure it includes essential fields, such as client information, transaction summary, and payment details.

- Customize with Your Logo: Add your branding elements, such as your business logo and color scheme. This adds a personal touch and strengthens your professional image.

- Set Up Automated Calculations: Use formulas to automate totals and taxes. This not only saves time but also reduces the risk of calculation errors, ensuring accuracy with each new document.

- Organize Key Information: Include a structured format for service descriptions, quantities, and costs. Clear organization makes it easier for clients to review the

How to Download an Invoice Template

Accessing a ready-made form for financial documentation can save time and simplify your workflow. A pre-formatted digital file provides all essential sections for billing details, making it easier to keep transactions organized and professional. With a few simple steps, you can download a form that meets your business needs.

Finding a Reliable Source

Begin by selecting a trusted platform or website where you can download customizable forms for business transactions. Many platforms offer free or premium versions that suit various business requirements. Make sure to choose one that aligns with your industry standards and includes fields for important information, such as client contacts, service details, and payment terms.

Steps to Download

- Locate the Download Option: On the website, look for a download button or link specific to your chosen form. Some platforms may require creating an account before downloading.

- Select the Right Format: Choose a file type that works with your preferred software. Common options include formats compatible wi

Benefits of Using Excel for Invoices

Creating financial documents digitally offers flexibility, accuracy, and control over your billing process. Using a spreadsheet format can significantly streamline financial tasks, giving small business owners and freelancers an efficient tool to manage transaction records. Here are some advantages that come with using a structured document for billing.

Enhanced Organization and Efficiency

- Easy Customization: A spreadsheet allows for simple adjustments, letting you tailor each document to reflect your brand’s unique style and add specific client details as needed.

- Automated Calculations: Built-in formulas can instantly calculate totals, taxes, and discounts, minimizing errors and saving time on manual calculations.

- Clear Data Layout: Spreadsheets enable you to organize information in a logical, easy-to-read format, ensuring that all relevant details are presented clearly to clients.

Improved Financial Tracking

- Setting Up Your Invoice Template

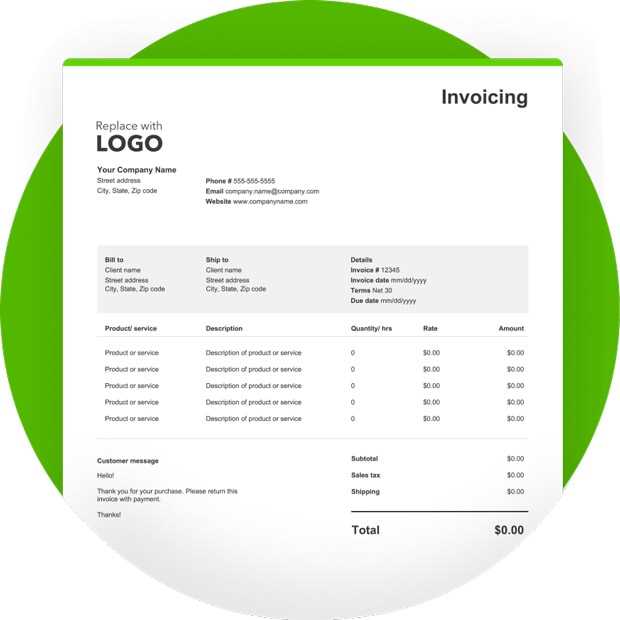

Creating a structured format for your billing documents can enhance both clarity and professionalism. By setting up a customized form, you ensure that each transaction record is consistent, easy to understand, and ready for quick updates. Here’s a step-by-step guide to help you build a reliable document for tracking and managing client payments.

Define Essential Information

Start by identifying the key details that need to be included. Organizing these elements in a clear layout makes it easier for clients to understand each charge and for you to manage records. Below is a simple table structure to guide you:

Section Details to Include Header Business name, logo, contact information Customizing the Template for Your Business

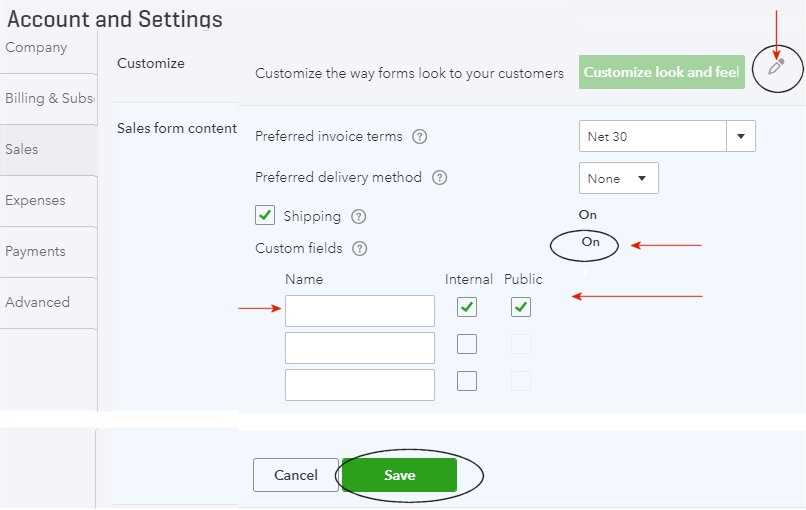

Adapting a financial document format to reflect your business’s unique identity can enhance brand recognition and make each client interaction more personalized. By tailoring the structure, appearance, and content, you can ensure that each document aligns with your professional standards and conveys essential details effectively. Here’s how to make these adjustments for a polished and custom look.

Adding Branding Elements

- Logo Placement: Include your business logo at the top of the document to reinforce brand identity. Make sure it’s positioned where it will be clearly visible but not distracting.

- Color Scheme: Adjust the colors in your document to match your brand palette. Use consistent colors

Customizing the Template for Your Business

Adapting a financial document format to reflect your business’s unique identity can enhance brand recognition and make each client interaction more personalized. By tailoring the structure, appearance, and content, you can ensure that each document aligns with your professional standards and conveys essential details effectively. Here’s how to make these adjustments for a polished and custom look.

Adding Branding Elements

- Logo Placement: Include your business logo at the top of the document to reinforce brand identity. Make sure it’s positioned where it will be clearly visible but not distracting.

- Color Scheme: Adjust the colors in your document to match your brand palette. Use consistent colors for headings, borders, or important details to create a cohesive appearance.

- Fonts and Text Styles: Choose fonts that reflect your brand’s personality. Opt for readable fonts for the main text and consider a bold, professional style for headers and key information.

Personalizing Content Fields

Modify the content sections to ensure all necessary information is covered and presented in a way that fits your business’s services. Consider adding fields specific to your industry or client needs:

- Service Descriptions: Tailor descriptions to highlight the value of each service or product offered. A brief, clear explanation can improve transparency and client satisfaction.

- Customizable Terms: Add or modify fields for payment terms, late fees, or discounts as per your business policies.

- Additional Notes: Consider including a section for special instructions, messages, or thank-you notes to enhance client relationships.

Taking time to personalize your document format ensures it not only meets functional needs but also reflects your business’s professionalism. Customization allows you to stand out and create a consistent, branded experience that resonates with clients.

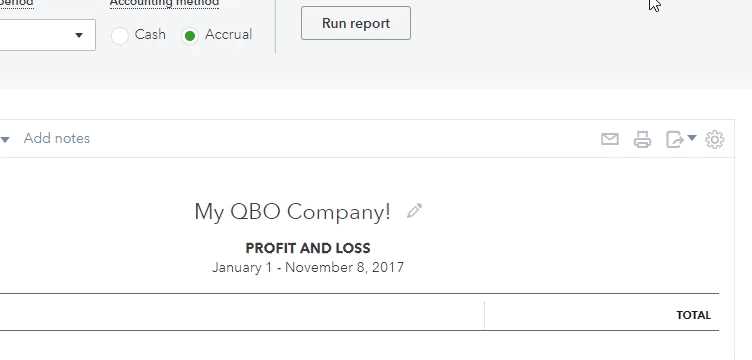

Tracking Invoice Payments in Excel

Managing payments for services rendered or products sold is a crucial part of maintaining smooth financial operations. A systematic approach to tracking received payments helps ensure that you stay on top of outstanding balances and prevent any confusion. Using a structured document can greatly simplify this process, offering an organized view of all transactions.

To begin tracking payments, start by creating a clear system that includes essential payment details. Key elements to include are the client’s name, due dates, amounts due, and the current payment status. This will allow you to easily monitor which payments are pending and which have been completed. You can also set up columns for dates received, method of payment, and any notes about late fees or partial payments.

Automating Payment Updates can save time by allowing you to easily mark when payments are made. Consider incorporating simple formulas to automatically adjust outstanding balances when payments are received. This reduces manual updates and prevents errors in tracking.

Organizing by Payment Status helps identify overdue payments. You can use color codes or conditional formatting to highlight invoices that are still unpaid, helping you prioritize follow-ups. Keeping this data organized in one place ensures that no payment is overlooked, and you can quickly generate reports on cash flow and outstanding balances.

Having a clear system for tracking payments is essential for maintaining financial clarity. By using a structured document, you can streamline your workflow, reduce errors, and ensure that your business stays on top of its financial obligations.

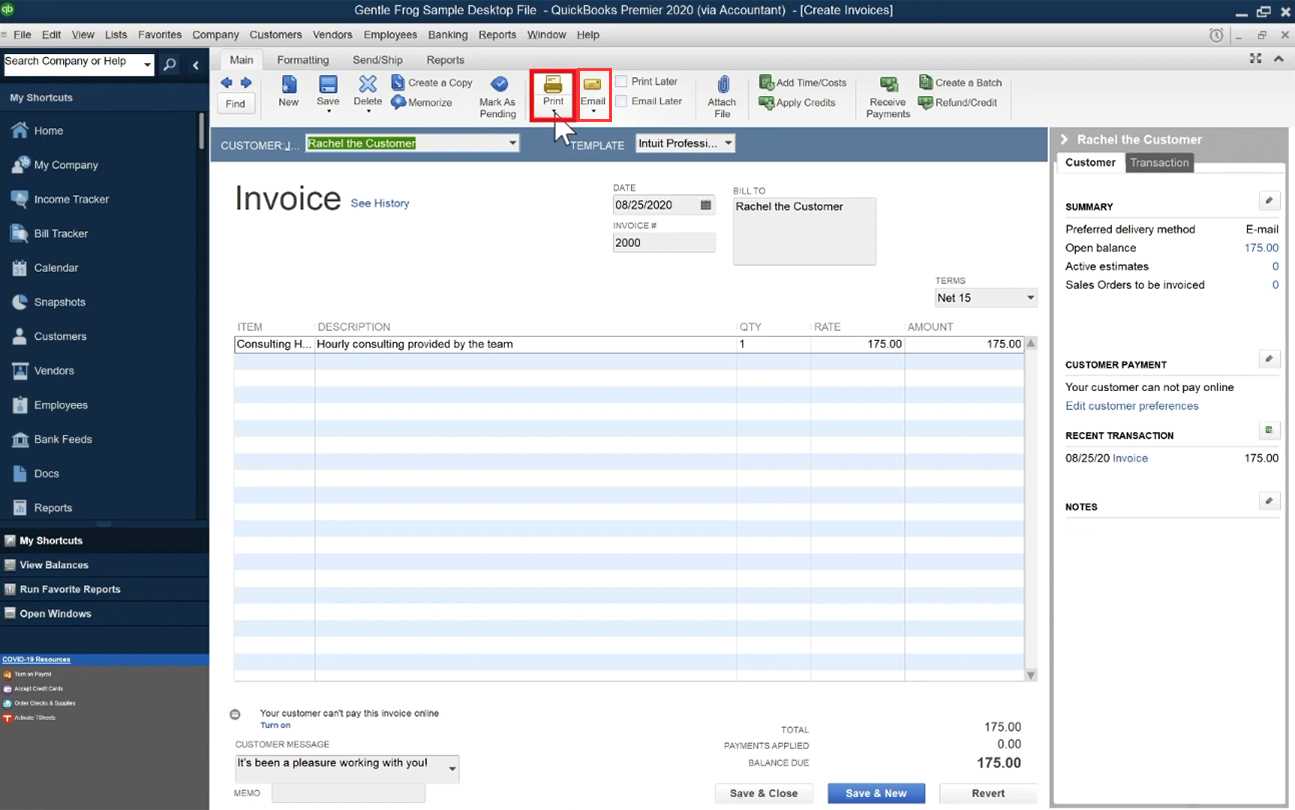

Converting Excel Invoices for QuickBooks

Converting your financial documents to a software-friendly format can simplify the integration process and allow for seamless data management. By transferring your manually created records into an accounting platform, you can streamline reporting, tax calculations, and overall financial management. Here’s how to convert your document records for easy import into a popular accounting system.

Step-by-Step Conversion Process

- Prepare Your Document: Ensure all fields are correctly filled and consistent. Double-check amounts, dates, and client information to avoid errors during the transfer.

- Format the Data for Import: The key to a successful conversion is ensuring your data is structured in a compatible format. This usually involves arranging fields such as date, amount, client name, and product/service description in a way that matches the structure of the software.

- Save in the Correct Format: Once your data is ready, save it in a format that the software can recognize, such as CSV or another compatible type, for smooth importing.

Tools and Tips for Easy Conversion

- Use Import Templates: Many accounting systems offer predefined templates that guide you on how to set up your document for easy import. These templates help structure your data correctly from the beginning.

- Data Validation: After importing, always validate the data by reviewing a few records to ensure everything transferred correctly. This helps avoid mistakes before generating reports or tax filings.

Converting your financial records into a format that can be easily integrated with accounting software is a simple yet effective way to manage your business’s finances more efficiently. By following these steps, you can ensure that your data remains consistent, accurate, and ready for analysis.

Using Formulas to Automate Totals

Automating calculations in your financial records can save time and reduce the risk of human error. By using formulas, you can automatically calculate totals, taxes, and discounts, ensuring that the calculations are always accurate. This eliminates the need for manual updates and allows you to focus on other important aspects of your business.

Basic Formulas for Total Calculation include simple operations like addition, subtraction, multiplication, and division. For example, you can use a formula to calculate the total amount by multiplying the quantity of an item by its price. The result is automatically updated whenever the numbers change, making it easier to manage large quantities of data.

Using Conditional Formulas helps you adjust totals based on specific conditions, such as applying discounts for bulk orders or adding tax automatically. With a conditional formula, the document can dynamically adjust the final amounts based on predefined criteria, ensuring that the final total is always correct.

Automating Grand Totals ensures that you do not need to manually sum up the amounts. By using a formula to add up all item totals or subtotals, the grand total will always be automatically calculated and displayed, reducing errors and ensuring consistency.

Formulas simplify financial management and provide a more efficient way to handle your records. By leveraging basic and conditional formulas, you can save valuable time and maintain accuracy in your business transactions.

How to Save and Reuse Templates

Efficiently managing your financial documents becomes easier when you can save and reuse previously created structures. By saving a well-designed document format, you can avoid repetitive data entry and ensure consistency in every transaction. This process allows for quick adjustments, reducing the time spent on creating new records from scratch.

Saving Your Document involves creating a base version that contains all the necessary fields and placeholders for information. Once this structure is finalized, you can save it in a reusable format. It’s essential to choose the right file format to ensure compatibility and easy access whenever needed. Common formats like CSV or others that allow easy editing are ideal for this purpose.

Reusing Saved Structures means you can open the saved format and make any necessary updates without having to recreate the layout. Each time you need to generate a new record, you simply modify the relevant fields such as dates, amounts, and client names. This reduces the effort required to create new documents while ensuring that each record follows the same structure.

Updating the Base Document is also important for maintaining consistency. As your business evolves, you may find that certain fields need to be adjusted. Updating your saved structure ensures that all future documents reflect these changes without having to manually edit them every time.

By saving and reusing your well-organized format, you streamline the process and ensure that your financial documents are always accurate and consistent. This method helps reduce time and improve efficiency in managing your business’s transactions.

Organizing Invoices for Easy Access

Maintaining a clear and systematic record of all business transactions is crucial for effective management. By organizing your financial documents, you ensure that they are easily accessible when needed for review, payment tracking, or reporting purposes. A well-structured system minimizes time spent searching for files and helps keep your operations running smoothly.

Creating a Logical Filing System

To organize your records efficiently, start by grouping them according to specific criteria, such as date, client name, or payment status. This way, you can quickly identify the documents you need without sifting through unrelated files. Here’s an example of how you can categorize them:

Category Description By Date Group documents by the date of issue or due date for quick reference. By Client Sort documents based on the client or business name for faster retrieval. By Payment Status Separate documents into paid and pending categories to monitor outstanding balances. Digital Organization Tools

For businesses dealing with a large volume of records, digital tools are invaluable for keeping everything organized. Using file management software or cloud-based storage services helps store your records securely while ensuring easy access across different devices. With proper naming conventions and tags, you can further simplify the search process and ensure all documents are up-to-date.

By implementing an effective system for organizing your financial documents, you will save time and reduce the risk of misplacing critical files. This structured approach allows you to access and manage your records with ease, leading to more efficient business operations.

Managing Customer Information on Invoices

Accurate and organized customer information is essential for ensuring smooth transactions and proper record-keeping. When creating transaction documents, it is crucial to include all necessary details about your clients. Proper management of this data not only streamlines billing processes but also enhances communication and minimizes errors.

Essential Customer Details to Include

To create comprehensive and clear records, include the following key customer information on each transaction document:

- Customer Name: Ensure the full name or business name is correctly listed.

- Contact Information: Include the customer’s address, phone number, and email to facilitate communication.

- Billing Address: Clearly state where the payment should be sent, especially for companies with different billing and shipping locations.

- Account Number: If applicable, include any client-specific account or reference numbers to avoid confusion.

- Payment Terms: Specify any special payment conditions or due dates to avoid misunderstandings.

Organizing Customer Data for Future Use

Efficiently organizing customer details ensures that you can quickly access and update information when necessary. Consider the following methods:

- Digital Databases: Store all customer details in a digital format for easy retrieval and updates.

- Cloud-Based Systems: Use cloud storage to keep customer information safe and accessible from multiple devices.

- Client History: Maintain a record of past transactions for future reference and personalized service.

By maintaining organized and accurate customer information, businesses can enhance their invoicing efficiency, build stronger client relationships, and reduce errors in financial documents.

Creating Invoice Templates for Different Services

When providing a variety of services, it is essential to have flexible and professional billing structures in place. Customizing your billing documents to suit the specific needs of each service ensures clarity and accuracy, whether you are offering consulting, maintenance, or product-based services. Tailoring these documents allows for efficient communication and ensures your clients are aware of the services rendered and the terms of payment.

For each type of service, consider including specific sections that address the particularities of the work completed. For example:

- Consulting Services: Include a detailed breakdown of hours worked, rates per hour, and the specific tasks performed during the consultation.

- Maintenance Services: Specify the type of maintenance provided, materials used, and whether the service was part of a scheduled visit or an emergency request.

- Product Sales: List each item sold, including quantities, prices, and any applicable discounts or promotions.

By adjusting the layout and content for different services, you can create clear, concise, and tailored documents that align with your business needs and the expectations of your clients. This flexibility ensures that you can efficiently manage various types of transactions while maintaining professionalism and transparency.

Tips for Clear and Professional Invoices

Ensuring that your billing documents are clear and professional is crucial for maintaining a positive relationship with your clients. Well-structured and easy-to-understand records help prevent confusion and reduce the likelihood of payment delays. Here are some helpful tips to enhance the quality of your documents:

1. Include Essential Information

Make sure to include all necessary details such as:

- Your business name and contact details: Ensure that your clients can easily reach you if needed.

- Client information: List the full name, address, and contact details of the recipient.

- Clear description of services or products: Break down what was provided, including specific quantities, rates, and other pertinent details.

- Payment terms: Specify the due date and any late payment penalties.

2. Organize the Layout

A well-organized layout makes it easier for your clients to read and understand the details of the document. Consider the following:

- Use headings and subheadings: Clearly differentiate sections like “Services Provided,” “Amount Due,” and “Terms.”

- Align the text and figures: Make sure all numbers, especially amounts, are neatly aligned for clarity.

- Highlight important information: Use bold or italics for essential details such as due dates or amounts due to ensure they stand out.

By following these tips, you can create documents that are not only clear but also convey professionalism and enhance your credibility with clients.

Ensuring Data Accuracy in Excel Invoices

Maintaining precise data in your billing documents is essential for avoiding errors, ensuring timely payments, and building trust with clients. Accurate records help streamline the financial process and prevent misunderstandings. Here are a few strategies to ensure that your details are always correct:

1. Double-Check Your Calculations

Always verify the numbers you input, especially when calculating totals, taxes, and discounts. Use the built-in functions of your software to automate calculations and minimize human error:

- Use formulas: Apply formulas to calculate totals, taxes, and discounts automatically.

- Cross-check values: Manually check for errors when manually entering amounts, particularly for large figures.

- Leverage rounding functions: Round off figures correctly to avoid discrepancies in smaller amounts.

2. Keep Data Consistent

Consistency is key when inputting information across multiple documents or systems:

- Standardize naming conventions: Use the same format for client names, product descriptions, and terms across all documents.

- Ensure uniform formatting: Align dates, amounts, and other important figures to the same style for easy reading.

- Validate contact details: Regularly update and verify your clients’ contact information to avoid sending documents to the wrong address.

By paying attention to these details and utilizing available tools, you can ensure the accuracy of your financial documents, leading to smoother transactions and better client relationships.

Quick Troubleshooting for Template Errors

When working with your billing documents, errors can sometimes arise unexpectedly, whether it’s due to formula malfunctions, missing data, or incorrect formatting. Identifying and correcting these issues quickly can save time and ensure smooth operations. Below are some common troubleshooting steps to address common errors:

1. Check for Formula Mistakes

If your calculations aren’t adding up, the issue may lie in the formulas:

- Revisit formula syntax: Ensure that all formulas are written correctly and are referencing the right cells.

- Update ranges: Sometimes the selected range in formulas becomes outdated. Make sure the data range includes all relevant cells.

- Verify cell references: Look out for relative and absolute cell references–incorrectly using one type over the other can lead to errors.

2. Review Data Entry for Missing Information

Missing or incomplete data can cause incorrect totals or formatting issues:

- Check for empty fields: Look for any empty spaces that should contain data, such as amounts or dates.

- Ensure consistent data entry: Verify that all required fields, like client names, item descriptions, and quantities, are filled out properly.

- Confirm correct formatting: Ensure all numbers are formatted correctly, especially for currency and percentages.

3. Investigate Formatting Issues

Improper alignment or formatting can make your document appear unprofessional and may cause confusion:

- Align columns: Ensure that all columns are evenly spaced and aligned to improve readability.

- Check for hidden characters: Sometimes hidden spaces or line breaks can cause issues–use the “Find and Replace” tool to remove them.

By systematically checking these common areas, you can quickly address most issues and get your documents back on track in no time.