How to Use QuickBooks Import Invoice Template for Efficient Invoicing

Efficiently managing business transactions is crucial for any company looking to stay organized and maintain accurate records. One of the most important aspects of this process is ensuring that payment details are easily transferred between different software tools, reducing manual data entry and the chances of errors. By utilizing the right methods, businesses can automate many aspects of their financial workflows.

Automating data import processes can significantly improve efficiency, especially when dealing with large volumes of transactions. When set up correctly, this approach allows companies to seamlessly transfer data from external sources into their accounting system, saving time and effort. The key is using the right format and structure to ensure smooth integration with existing financial software.

Customization options also play a critical role in adapting the process to the specific needs of the business. Whether you’re dealing with various billing formats or need to include additional information, having the flexibility to modify data imports ensures that all required details are captured accurately. With the right setup, it becomes easier to manage accounts, track payments, and maintain financial integrity.

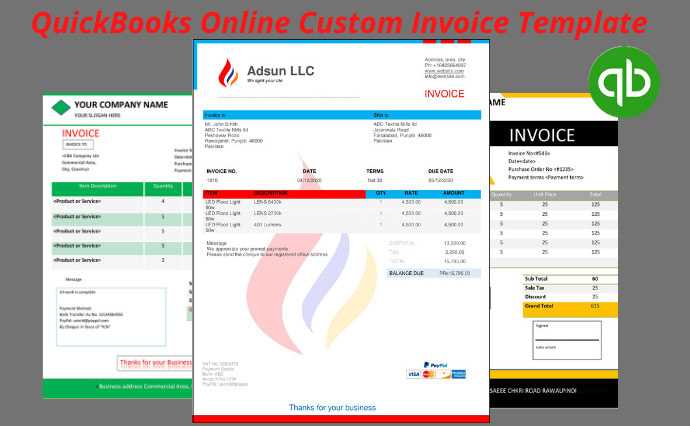

QuickBooks Import Invoice Template Overview

Managing financial records effectively requires tools that simplify data entry and reduce the likelihood of mistakes. With the right features in place, businesses can streamline the process of recording payments and other transaction details. This allows for smoother integration between accounting systems and external data sources, ensuring that everything is captured accurately and efficiently.

One of the most powerful options for businesses is the ability to handle bulk data transfers with minimal manual input. By using an appropriately designed file structure, it becomes possible to quickly transfer essential details like customer information, transaction amounts, and dates into the accounting software. The result is a much more efficient workflow that minimizes human error and accelerates financial reporting.

Customization also plays a key role in adapting this process to unique business needs. Different organizations may require different data fields or formats, and having the flexibility to modify settings ensures that the system can accommodate various requirements. By doing so, businesses can ensure that every transaction is recorded accurately according to their specifications.

Optimizing data entry methods also means increasing productivity. Automation reduces the time spent on repetitive tasks and helps ensure consistency in how information is processed. The combination of easy setup and adaptable features makes this process an essential part of modern financial management.

Why Use QuickBooks Invoice Templates

Automating the way you handle transaction records is a key factor in improving business efficiency. By utilizing the right tools, you can simplify the process of creating and managing financial documents. This approach not only saves time but also reduces errors, ensuring that your records are always up-to-date and consistent.

Efficiency and Time Savings

One of the main advantages of using pre-designed formats for financial documents is the significant time saved. These ready-to-use structures allow you to quickly create accurate records without manually entering each detail. This enables you to focus on other important tasks while maintaining accuracy.

- Automates repetitive tasks, reducing manual data entry

- Ensures consistent formatting and structure

- Speeds up the process of generating transaction records

Improved Accuracy and Consistency

Using predefined formats helps eliminate human error, particularly when dealing with large volumes of transactions. With consistent structures in place, every document follows the same format, reducing the risk of missing or incorrectly inputting important details.

- Minimizes chances of mistakes in financial records

- Ensures uniformity in document presentation

- Reduces the need for manual checks and revisions

By adopting this approach, businesses can greatly enhance the accuracy and efficiency of their financial management processes, ensuring smooth operations and timely reporting.

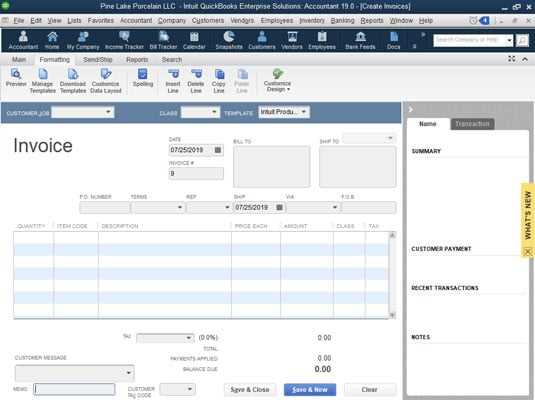

Step-by-Step Guide to Importing Invoices

Transferring transaction data from external sources to your accounting system can significantly improve operational efficiency. By following a clear, structured process, you can quickly move financial records into the system without needing to manually enter each detail. The key is understanding how to organize and format the data before initiating the transfer.

Preparation Before the Transfer

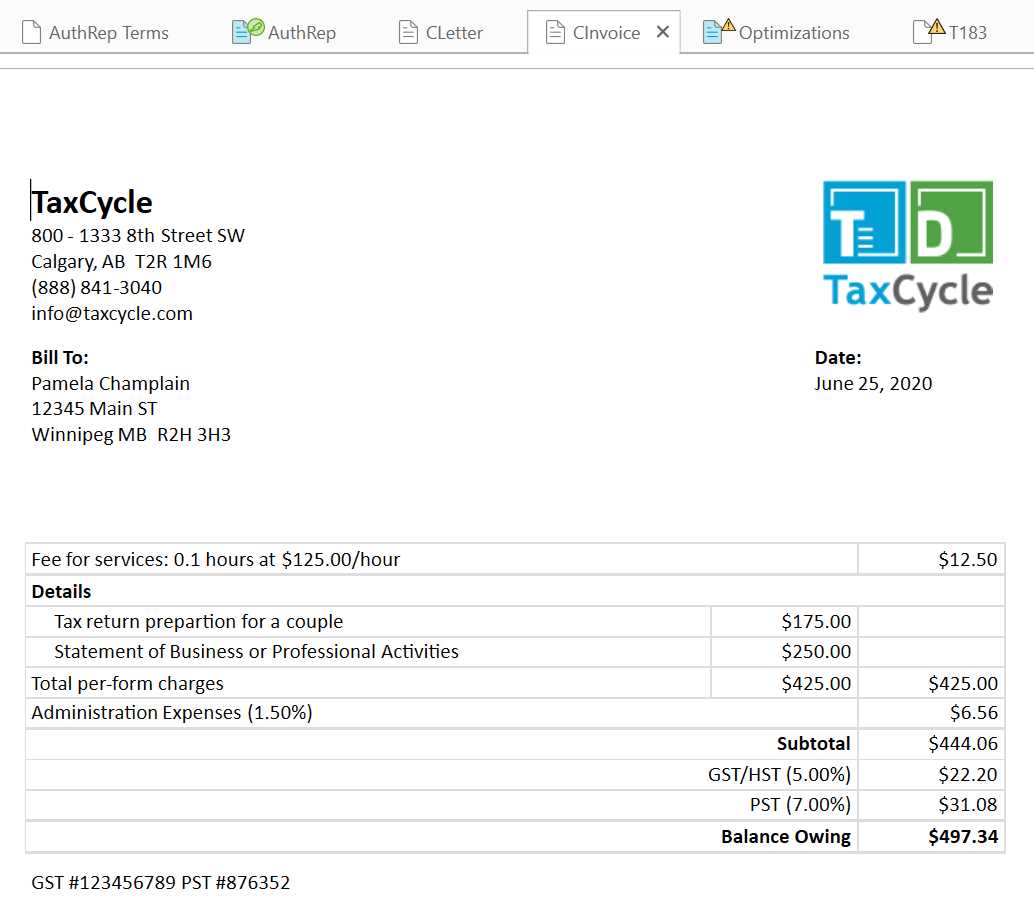

Before starting the transfer process, it is crucial to ensure that the data is correctly structured. This involves organizing the relevant details such as customer names, amounts, dates, and descriptions into a compatible format. Typically, a spreadsheet or CSV file is used for this purpose, as it can easily be processed by most financial software.

- Ensure all necessary fields (customer name, amount, date, etc.) are present

- Format the data in a compatible file format (CSV, Excel, etc.)

- Double-check for any errors or missing information

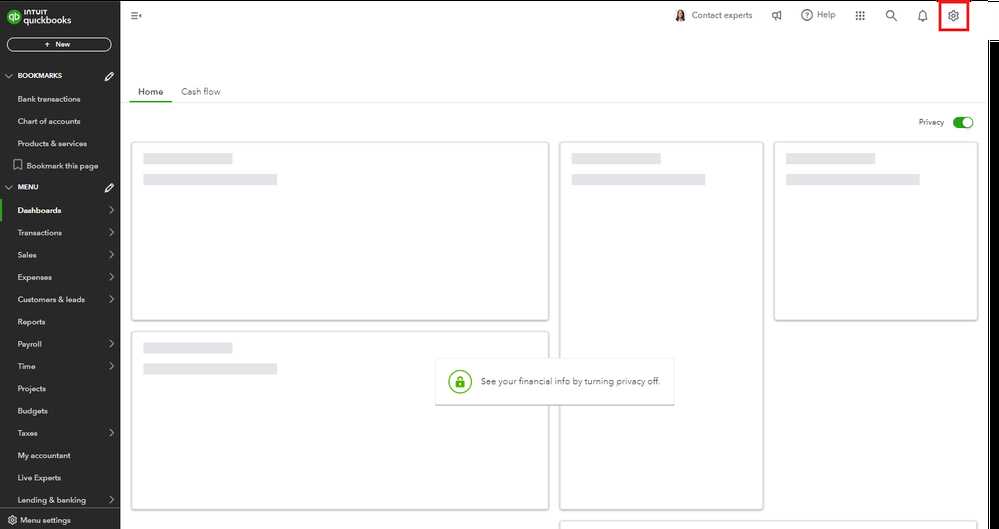

Uploading the Data into the System

Once the data is organized and formatted, the next step is to upload the file into the accounting software. This usually involves navigating to the relevant section of the platform and selecting the option to upload or transfer data. After uploading, it’s important to review the data to ensure everything is correctly mapped and placed into the right fields.

- Access the data management section of the software

- Select the file for upload and initiate the transfer

- Review the preview to ensure all fields are correctly mapped

- Confirm the upload and save the changes

By following these steps, you can quickly and accurately integrate external financial records into your system, making it easier to manage your accounts and keep everything up-to-date.

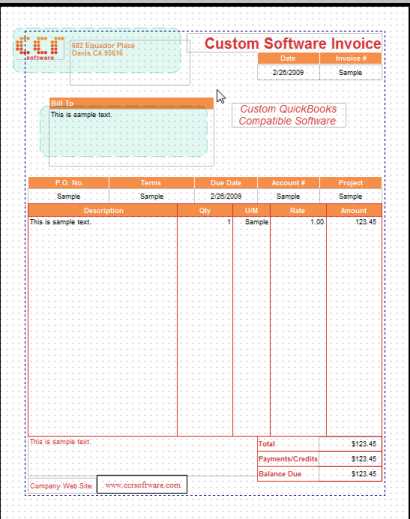

Benefits of Customizing QuickBooks Templates

Tailoring your financial documents to meet the specific needs of your business can greatly improve both efficiency and accuracy. Customization allows for the inclusion of unique fields and formats that align with how your company operates, helping streamline the entire record-keeping process. When you adapt the tools to your own requirements, you not only enhance productivity but also ensure that important data is captured correctly every time.

Improved Efficiency and Time Savings

By adjusting the structure of your financial forms to match your workflow, you can save valuable time. When documents automatically align with your needs, there’s less time spent manually altering them. This streamlined approach enables quicker processing, allowing you to focus on more critical aspects of your business.

- Reduces manual data entry

- Enables faster document creation

- Increases productivity by minimizing redundant tasks

Enhanced Accuracy and Flexibility

Customization ensures that all necessary data fields are included and formatted according to your standards. This not only reduces the chance of missing vital information but also allows for greater flexibility in how you manage your transactions. Whether you need to add custom fields for taxes or specific charges, having the ability to modify your financial documents ensures that nothing is overlooked.

- Prevents missing or incorrect details

- Adapts to unique business needs

- Ensures compliance with industry-specific requirements

Overall, customizing your financial document structure provides both practical and strategic advantages that contribute to smoother operations and more accurate records.

Common Issues with Importing Templates

When transferring data into your accounting system, certain challenges can arise, particularly when working with external files. These issues can lead to errors in the system, incorrect data mapping, or delays in processing. Understanding the common pitfalls can help you prevent these problems and ensure a smoother experience when bringing in financial records.

Data Formatting Errors

One of the most frequent issues faced during the process is improper data formatting. If the external file doesn’t adhere to the required structure, it may not be recognized by the system, leading to failed uploads or inaccurate entries. This often happens when fields are missing, extra columns are added, or data is not in the correct order.

- Ensure all required fields are included

- Check for extra spaces or characters in the file

- Verify that the data matches the software’s format requirements

Incorrect Data Mapping

Another common issue occurs when the fields from the external file do not correctly map to the corresponding fields in the accounting system. This can result in important information being placed in the wrong categories, which may cause errors in financial reports or lead to confusion during data analysis.

- Double-check field mappings before confirming the upload

- Ensure that each field is correctly aligned with the system’s requirements

- Preview the data before completing the transfer to catch any mismatches

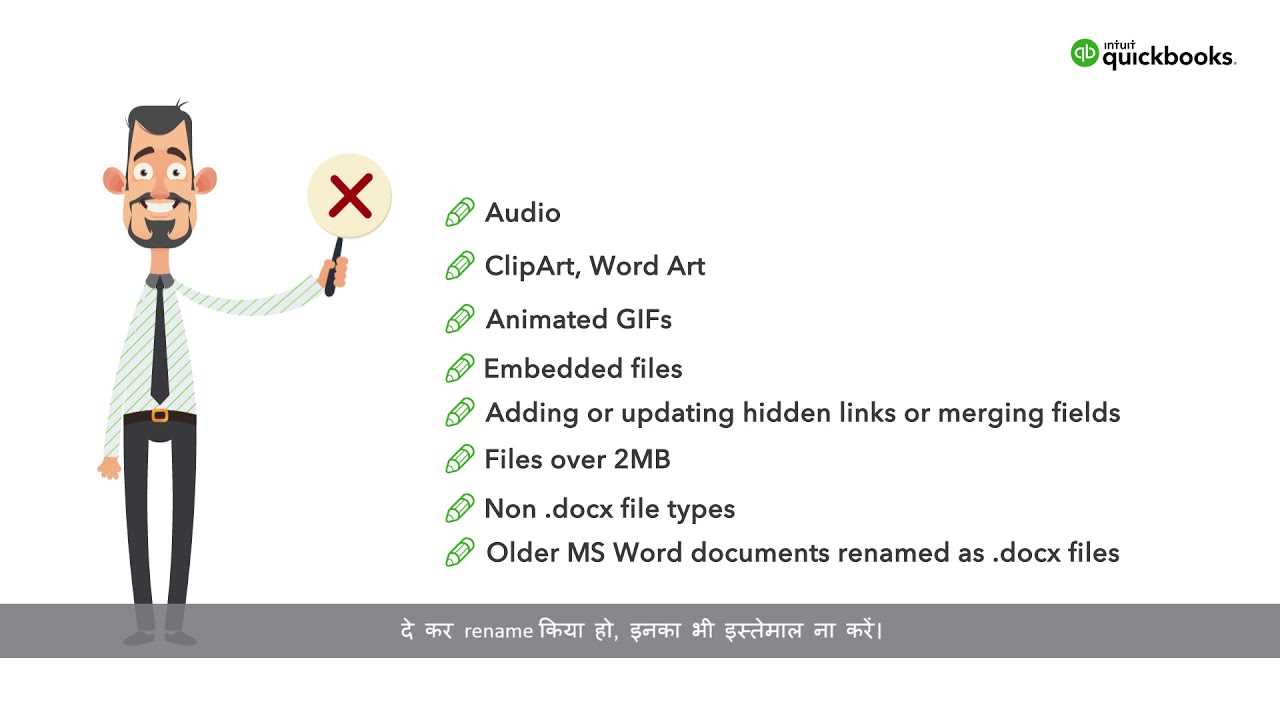

File Size and Compatibility Issues

Large files or incompatible formats can also prevent smooth transfers. Some accounting systems may have file size limitations or specific format requirements, which if not met, can result in upload failures. Ensuring the file is within the acceptable size and compatible with the system is crucial for a successful transfer.

- Check the file size limits of the system

- Convert the file to a compatible format if necessary

- Split large files into smaller sections if needed

By being aware of these common issues and taking proactive steps to address them, you can ensure that your data transfers are efficient and error-free.

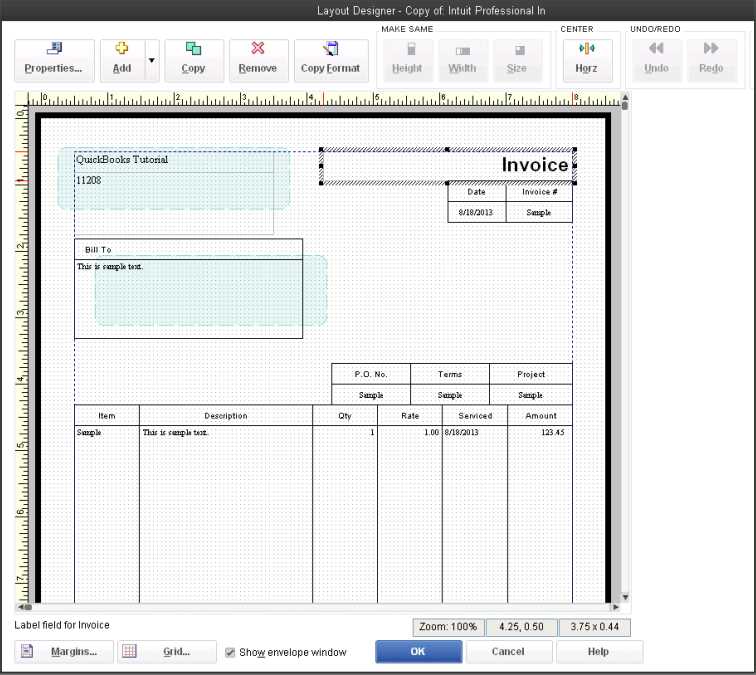

How to Adjust Template Settings

Customizing the settings of your financial document structure is essential to ensure that it meets your specific needs. By making adjustments, you can align the format, fields, and data presentation with how your business operates. This customization process helps streamline workflows, improve accuracy, and ensure that all relevant information is captured correctly.

Adjusting Field Layout

The first step in adjusting settings is determining which fields are necessary for your documents. Depending on your business, you may need additional sections such as custom charges, taxes, or payment terms. Organizing these fields properly will ensure that every document generated contains the required details in the correct places.

- Select the fields you need for your transactions (e.g., client name, due date, amount)

- Arrange the fields in a logical order to match your workflow

- Remove any unnecessary fields that may clutter the document

Setting Up Default Values

Many accounting systems allow you to set default values for common fields, such as payment terms, tax rates, or discounts. This feature can save time by automatically filling in this information for each new record, ensuring consistency and reducing the likelihood of errors.

- Set default payment terms (e.g., Net 30, Net 60)

- Apply default tax rates or discount percentages based on your business needs

- Ensure that these default values align with your company’s financial practices

By adjusting these settings, you ensure that every document created is both accurate and consistent, which can help improve efficiency and reduce administrative burdens.

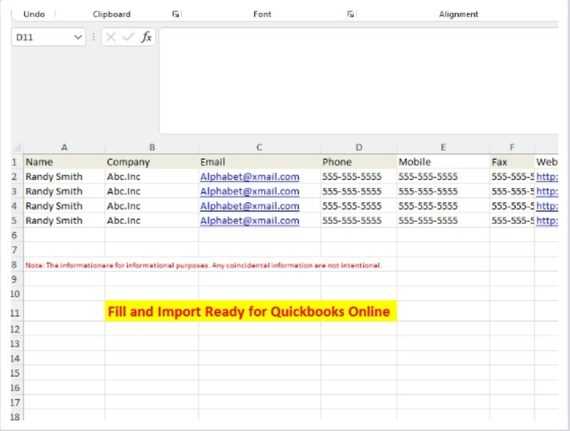

Creating a CSV File for QuickBooks

Creating a CSV file for your financial records is a simple yet essential step in transferring data into your accounting system. A properly formatted CSV file ensures that all necessary details, such as transaction amounts, dates, and customer information, are correctly organized and ready for upload. This method provides a seamless way to manage and process large amounts of data quickly and accurately.

Essential Data Fields for Your CSV File

When preparing your CSV file, it’s important to include all necessary fields to ensure a smooth integration. Below is a list of key fields that should be present in your file:

| Field Name | Description |

|---|---|

| Transaction Date | The date when the transaction occurred |

| Customer Name | The name of the client associated with the transaction |

| Amount | The total amount for the transaction |

| Description | Additional details about the transaction |

| Payment Terms | The terms of payment (e.g., Net 30, Due on receipt) |

| Tax Rate | The applicable tax rate for the transaction |

Formatting Your CSV File

Once you’ve collected all the necessary data, it’s time to format it correctly. CSV files are structured with columns separated by commas, and each row represents a separate record. Make sure the data is consistent across each column and ensure that there are no extra spaces or special characters that could disrupt the transfer process.

- Ensure each field is separated by a comma

- Check that no columns are left empty unless intentionally so

- Save the file with the .csv extension before uploading

By following these steps and ensuring your CSV file is properly formatted, you’ll be able to quickly and accurately transfer your data into the accounting system, minimizing the risk of errors and improving workflow efficiency.

How to Import Multiple Invoices Quickly

Managing multiple financial records at once can be time-consuming if done manually. However, by using the right methods and tools, you can automate the process of transferring large volumes of transaction data in a fraction of the time. The key is preparing your data properly and utilizing the features of your accounting system to handle bulk uploads efficiently.

Step-by-Step Process for Bulk Data Transfer

To quickly transfer multiple records into your system, follow these essential steps. The process involves organizing your data into a structured file, ensuring compatibility with the system, and then uploading it in bulk.

| Step | Action | Description |

|---|---|---|

| Step 1 | Prepare Data | Ensure that each record is correctly structured, with all relevant details (e.g., client names, amounts, and dates) in separate columns. |

| Step 2 | Check Format | Verify that the file is in a compatible format, typically CSV or Excel, and that all fields are properly aligned. |

| Step 3 | Upload File | Access the data management section of your software, select the file, and follow the prompts to upload it. |

| Step 4 | Map Fields | Ensure that each data field (e.g., customer name, amount, etc.) is mapped to the corresponding field in the software to avoid errors. |

| Step 5 | Confirm Upload | Review the data preview and confirm that everything is correct before finalizing the upload process. |

Benefits of Bulk Uploading

Uploading multiple records at once saves time, reduces the likelihood of human error, and ensures that all transactions are processed quickly and accurately. By following this efficient approach, you can keep your financial records organized and up-to-date with minimal effort.

- Save time by processing numerous transactions at once

- Reduce manual errors caused by individual data entry

- Ensure all records are consistent and accurate

With the right approach, you can simplify the process of handling large amounts of transaction data and improve the efficiency of your financial operations.

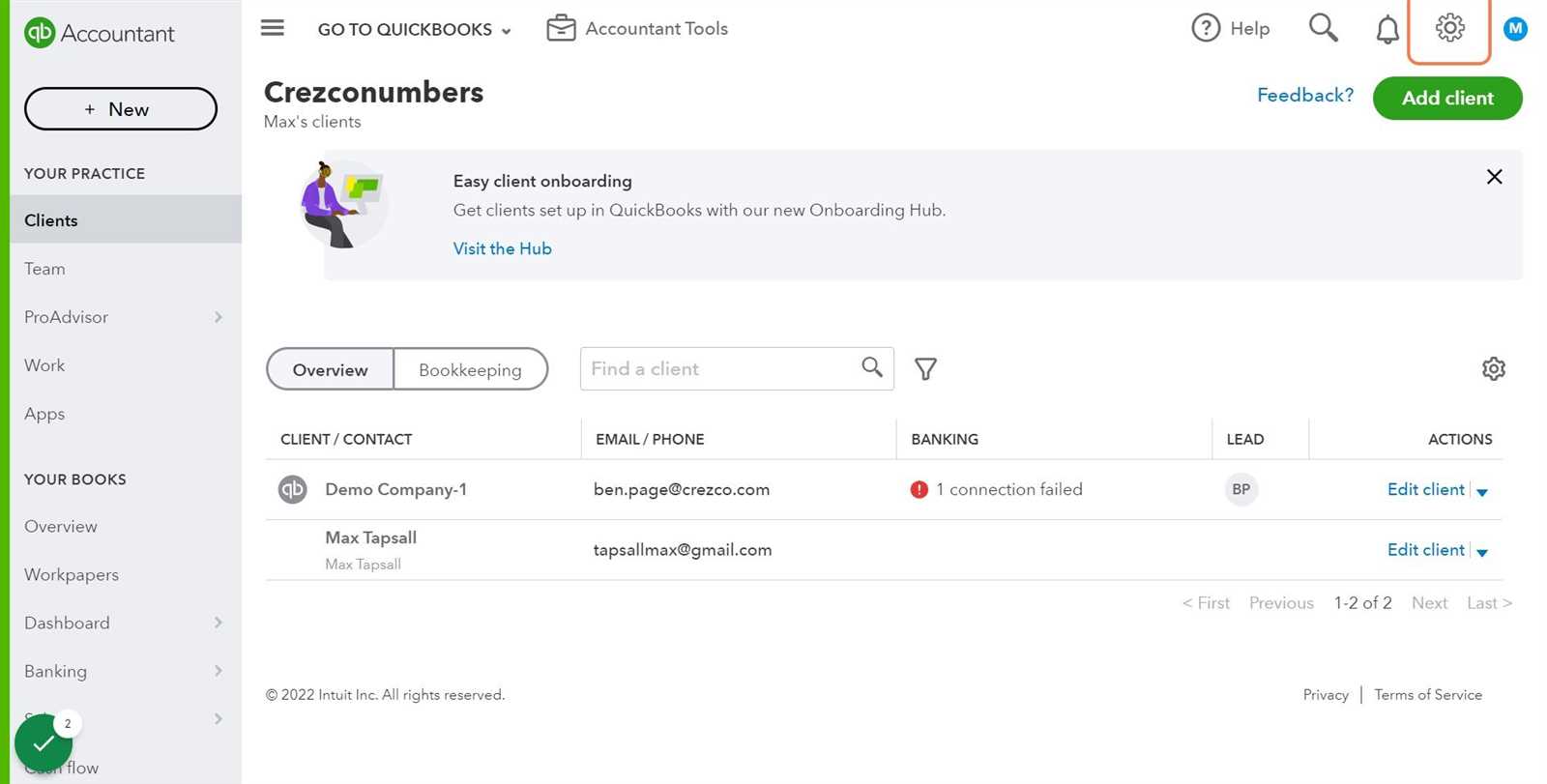

Integrating QuickBooks with Other Tools

Connecting your accounting system with other business tools can significantly enhance your operational efficiency. Integration allows for seamless data transfer between various platforms, ensuring that all systems are synchronized and up-to-date. By linking tools such as payment processors, CRM software, or inventory management systems, you can automate data flow and reduce the need for manual entry.

Benefits of Integration

Integrating your financial software with other applications helps to eliminate redundancy, streamline workflows, and improve data accuracy. It enables different tools to work together, automatically sharing information and updating records in real time. This reduces the likelihood of errors and saves time spent on repetitive tasks.

- Automates data synchronization between platforms

- Improves data accuracy by reducing manual entry

- Enhances workflow efficiency by connecting all relevant tools

Common Integration Scenarios

There are many ways in which accounting software can be integrated with other tools, depending on the specific needs of your business. Some common integrations include connecting with e-commerce platforms for sales data, syncing with inventory management systems to track stock levels, or linking to payroll systems to ensure accurate employee compensation records.

- Integrating with e-commerce platforms for seamless transaction tracking

- Linking with inventory management tools to keep stock data synchronized

- Connecting to payment processors for automatic payment updates

By leveraging integrations, businesses can create a more unified ecosystem, ensuring that data flows smoothly between systems and helping to maintain accurate, real-time records across all platforms.

Tracking Payments with Imported Invoices

Effectively monitoring payments is a crucial aspect of managing business finances. When you bring in financial records from external sources, it’s important to ensure that each payment is accurately recorded and tracked. This helps you maintain clear visibility into outstanding balances, monitor cash flow, and avoid discrepancies between the amounts billed and received.

Organizing Payment Data

Once the transaction records are imported into your system, the next step is to organize payment information in a way that’s easy to track. This typically involves categorizing payments by customer, date, and amount. With the right setup, each payment can be linked to its corresponding transaction, ensuring that all financial activities are properly documented.

- Associate each payment with the corresponding customer record

- Include the payment date and amount to maintain an accurate timeline

- Ensure proper categorization of payments to avoid confusion

Monitoring Payment Status

Keeping track of the payment status for each transaction is vital. By using the built-in features of your accounting system, you can easily see which payments are pending, overdue, or completed. This helps you stay on top of accounts receivable and ensures that all debts are settled on time.

- Set reminders or alerts for overdue payments

- Track partial payments or payment plans to ensure proper balance calculations

- Update payment status automatically as payments are recorded

Tracking payments effectively ensures that you always know the status of your financial records. With accurate payment tracking, your business can manage cash flow more efficiently and reduce the likelihood of errors in financial reporting.

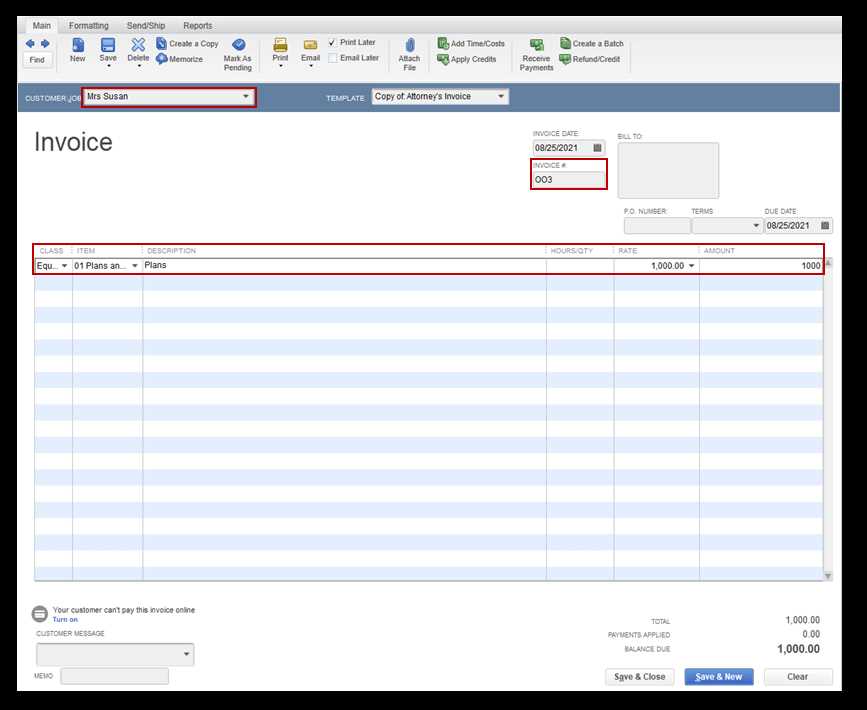

How to Edit Imported Invoice Data

After transferring transaction records into your accounting system, you may need to make adjustments to ensure that all the information is accurate and up-to-date. Editing the imported data is a crucial step to correct any discrepancies, update missing details, or refine the format. Whether it’s correcting a client’s contact details or adjusting amounts, knowing how to efficiently edit the imported records ensures that your system remains reliable.

Accessing and Locating the Imported Data

The first step in editing any imported record is to locate the entry within the system. Most accounting platforms offer an easy way to access the imported data through a specific section or report, where you can view all recent transactions. Once you find the relevant record, you can begin making the necessary changes.

- Navigate to the section containing your recent transactions

- Search for the specific entry using filters like customer name or transaction date

- Select the record you wish to edit

Making Adjustments to Imported Records

Once you’ve found the correct entry, you can begin editing the fields. Common changes include updating amounts, changing customer information, correcting dates, or modifying descriptions. Be sure to double-check your edits before saving, as inaccurate data can lead to issues with financial reports or customer communication.

- Edit amounts or tax rates if there was an error in the original record

- Update customer details or add missing contact information

- Modify transaction dates or payment terms if necessary

- Ensure descriptions accurately reflect the nature of the transaction

Editing imported data gives you greater control over your financial records. By ensuring accuracy and making adjustments as needed, you maintain the integrity of your system and ensure all details are correct for reporting and analysis.

Improving Accuracy with Template Validation

Ensuring the accuracy of your financial records is essential for maintaining reliable business operations. One of the most effective ways to achieve this is through the use of validation checks during the data entry process. By validating the structure and content of your document formats before they are uploaded into your system, you can prevent errors, reduce discrepancies, and enhance data quality.

The Importance of Validation

Validation serves as a safeguard, ensuring that the information entered into your system meets the required standards. By checking for common errors such as missing fields, incorrect data formats, or mismatched columns, you can catch mistakes before they become problematic. This not only ensures consistency but also saves time in the long run by reducing the need for corrections and adjustments.

- Prevents data entry errors before they impact your records

- Ensures that all necessary fields are filled in correctly

- Reduces the risk of data inconsistencies that could affect reporting

How to Implement Validation

There are several ways to implement validation during the data entry process, ranging from simple manual checks to automated tools built into your system. Below are some common practices for ensuring your data is accurate before it’s entered into your accounting software.

- Use built-in validation tools to automatically check for missing or incorrect data

- Ensure that all required fields are filled out correctly, such as dates, amounts, and customer names

- Check that data is formatted properly (e.g., currency values, percentage rates, and text fields)

- Set up alerts to notify you of any discrepancies or errors in the imported data

Validation tools are essential for reducing the risk of mistakes in your financial data. By implementing robust checks, you can significantly improve the overall accuracy of your system, ensuring that all records are reliable and ready for analysis.

Saving Time with Automated Invoice Imports

Manually entering financial transaction data can be a time-consuming process, especially when dealing with large volumes of records. By automating the process of transferring data into your accounting system, you can eliminate the need for repetitive tasks and free up valuable time. Automation allows for faster, more accurate data entry, ensuring that your records are updated in real time without manual effort.

The Benefits of Automation

Automating the data entry process brings numerous benefits to businesses of all sizes. The key advantage is time savings, but it also helps improve accuracy, reduce human error, and enhance overall efficiency. Once set up, automated processes can consistently handle tasks without the need for constant oversight, allowing your team to focus on higher-priority tasks.

- Reduces manual effort and repetitive data entry

- Improves accuracy by eliminating human errors

- Frees up time for more important business tasks

- Ensures that records are updated in real time without delays

How Automation Works

Automation typically involves configuring your system to automatically pull data from external sources, such as emails or spreadsheets, and transfer it into the appropriate fields within your financial software. This can be done through integration with third-party tools or built-in automation features within the accounting software itself. Once set up, the system will automatically match the incoming data with the corresponding entries in your database.

- Set up integrations with third-party tools to receive data

- Map the incoming data fields to the corresponding fields in your system

- Schedule automated data transfers at regular intervals (e.g., daily, weekly)

Automating data imports not only saves time but also ensures that your financial records are consistently updated with minimal manual intervention. By reducing the time spent on data entry, you can focus on growing your business and improving other operational areas.

Exporting Data from Templates

Exporting data from your accounting system is essential for sharing information with other platforms, generating reports, or backing up records for future reference. Whether you need to transfer transaction details, financial reports, or customer information, the process of exporting allows you to easily move data from your system to external files, such as CSV or Excel. This capability ensures you can analyze, share, or archive your financial data without difficulty.

Why Export Data?

Exporting data provides greater flexibility and control over how your financial information is used. It enables you to create backups, integrate with other software, or prepare detailed reports for stakeholders. With the right export settings, you can ensure that the data is structured in a way that meets your needs and makes it easy to work with across various platforms.

- Facilitates data sharing with external systems or partners

- Enables the creation of backup copies for record-keeping

- Allows detailed analysis of financial data in other applications

Steps to Export Data

To export data effectively, follow these simple steps. First, ensure that the data you wish to export is properly categorized and ready for transfer. Then, use the export function within your accounting system to select the data type you need. Finally, choose the desired file format and destination for the export, ensuring compatibility with the external tools or platforms you plan to use.

- Navigate to the export section of your accounting system

- Select the type of data you wish to export (e.g., transactions, reports, customer details)

- Choose the desired file format (e.g., CSV, Excel)

- Set any necessary filters or parameters to specify the data range

- Export the file and save it to your desired location

Exporting data from your system allows you to maintain flexibility and control over how you manage and analyze your financial information. By following these steps, you can easily transfer important data to external formats for backup, sharing, or reporting purposes.

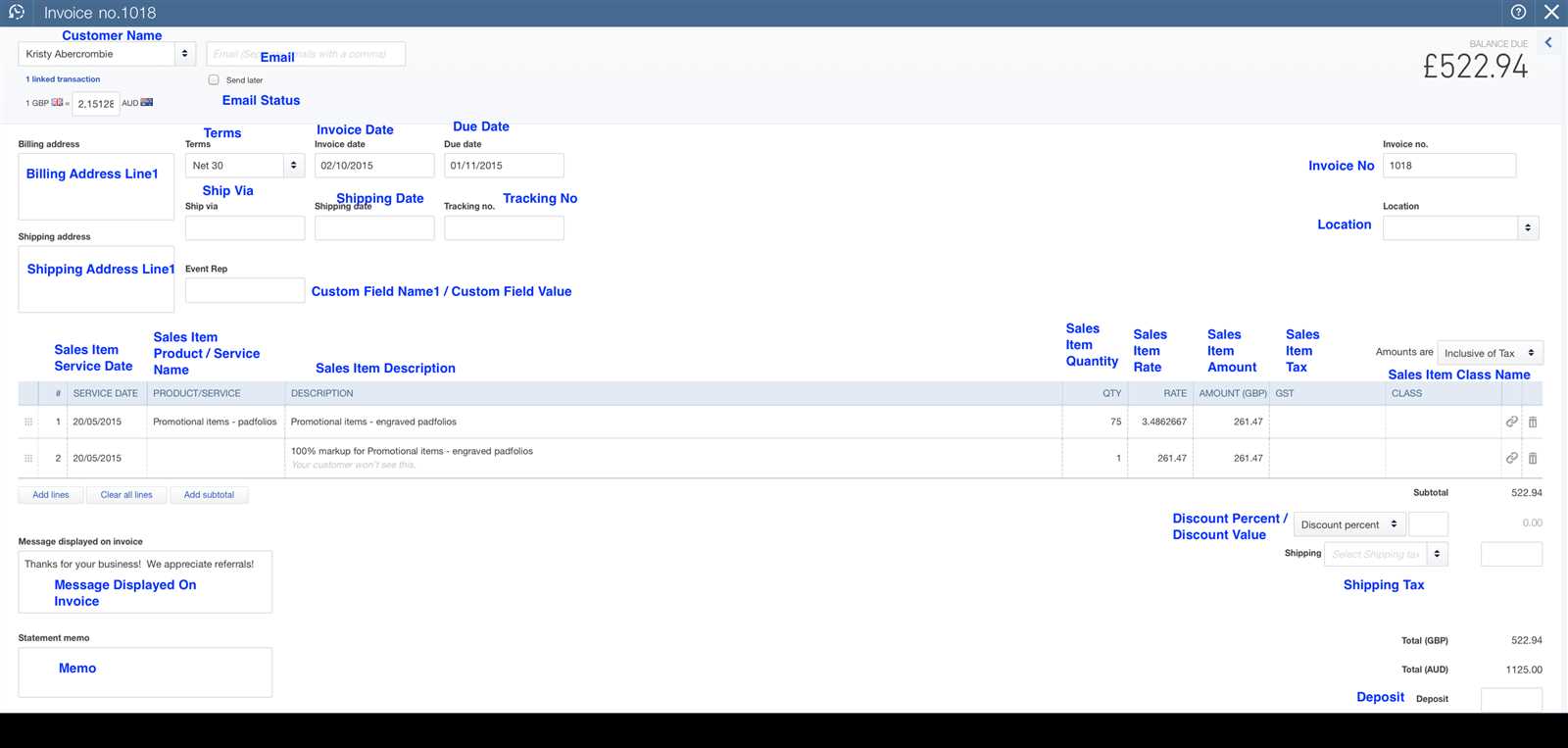

Handling Custom Fields in Invoice Templates

When creating business documents, sometimes the standard fields provided may not be enough to capture all the necessary information. Custom fields allow you to add additional data points that are unique to your business needs, such as project codes, custom discounts, or extra notes. Managing these fields properly is essential to ensure that all relevant information is included and displayed correctly on your documents.

Why Use Custom Fields?

Custom fields offer greater flexibility in tailoring your documents to meet specific requirements. Whether you need to track special offers, include personalized information for clients, or capture additional financial details, custom fields provide a way to extend the functionality of your forms. By integrating these fields, you can make sure your documents include every detail necessary for your business processes.

- Track unique project codes or reference numbers

- Include additional notes or terms specific to each transaction

- Customize documents to reflect specific business requirements

How to Manage Custom Fields

Setting up and managing custom fields typically involves defining the field name, type, and location on the document. You can specify whether the field should accept text, numbers, or dates, and you can place the field in a specific section of the document. Once defined, custom fields can be populated manually or linked to data sources for automatic population.

- Define the field’s name and data type (text, number, date)

- Choose where the field will appear on the document (e.g., header, footer, line items)

- Manually enter data or link fields to external data sources for auto-population

Properly managing custom fields ensures that all your documents are accurate, comprehensive, and tailored to your business needs. By using these fields effectively, you can enhance the functionality of your forms and improve the overall accuracy of your financial records.

Template Troubleshooting Tips

When working with custom document formats in your financial system, issues can sometimes arise that prevent proper data display or cause formatting errors. Understanding common troubleshooting techniques can help resolve these problems quickly and keep your workflow running smoothly. By following a few straightforward steps, you can address most issues and ensure your documents are accurate and ready for use.

Common Issues and How to Fix Them

Several common issues can occur when working with document formats, such as missing fields, incorrect data mapping, or misaligned content. These problems can often be traced back to configuration errors or improper settings. Below are some common troubleshooting tips to help you resolve these challenges.

- Missing Data: Ensure all required fields are correctly mapped and that no essential information is left out. Double-check any custom fields for proper linkage.

- Formatting Problems: If content appears misaligned or out of place, verify that your document layout settings are properly configured, and ensure all sections have adequate spacing.

- Data Mismatch: If numbers or dates don’t appear correctly, check that the fields are using the correct data type (e.g., text, number, date) and that the source data is properly formatted.

- Template Compatibility: Ensure that the template format is compatible with the system or platform you’re using. Some formats may not be supported or may need to be adjusted for compatibility.

Steps to Resolve Issues

To quickly resolve issues, it’s important to follow a systematic approach. Begin by checking the configuration settings and reviewing any error messages. If the issue persists, consider adjusting the layout or consulting any available help resources for further guidance.

- Review the template settings and ensure all fields are mapped correctly.

- Check for compatibility issues with the system or software version.

- Test the template with a small set of data to identify any potential errors.

- Consult documentation or support resources for advanced troubleshooting steps.

Effective troubleshooting ensures that you can resolve issues quickly and keep your document processing on track. By following these steps, you can maintain accuracy and efficiency in your financial operations.

Best Practices for Invoice Data Management

Efficiently managing financial records is essential for maintaining smooth business operations. Proper data management ensures that you can easily access, track, and analyze your records whenever needed. By following best practices, businesses can improve the accuracy, reliability, and security of their financial data, making it easier to manage transactions, generate reports, and streamline operations.

Key Practices for Effective Data Management

To ensure optimal data management, it is important to implement a structured approach. This involves organizing your data, maintaining consistency across entries, and regularly backing up your records. Additionally, adopting automated tools can further enhance accuracy and efficiency, reducing the risk of human error.

- Organize Your Data: Ensure all records are categorized properly (e.g., by date, customer, or project) to simplify tracking and retrieval.

- Standardize Data Entry: Use consistent formats for dates, amounts, and other fields to avoid confusion and ensure uniformity across records.

- Maintain Backup Copies: Regularly back up your data to secure locations to protect against data loss due to system failures or errors.

- Automate Where Possible: Utilize software tools that automate data entry and validation to reduce manual work and minimize mistakes.

Ensuring Data Accuracy and Consistency

Accurate and consistent data is crucial for reliable reporting and analysis. Implementing validation checks and setting clear guidelines for data entry can prevent common errors. Regular audits and reviews also help maintain data integrity and ensure that everything is up to date.

- Implement automated validation checks to detect errors at the point of entry.

- Perform regular audits to ensure the data aligns with actual transactions.

- Establish clear data entry standards for all team members to follow.

- Use software integrations to minimize manual data entry and improve accuracy.

By following these best practices, you can significantly enhance the accuracy, security, and organization of your financial data. This not only streamlines your accounting processes but also ensures that your business remains compliant and efficient.