How to Create and Customize QuickBooks IIF Invoice Template

In today’s fast-paced business environment, efficiency and accuracy in financial management are crucial. One of the most effective ways to streamline the process of handling customer transactions is by using automated billing systems. These systems allow businesses to generate professional and consistent records for every sale, ensuring that all details are properly captured and formatted.

When customizing your financial documents, it’s essential to understand how to create and modify them to suit your specific needs. By using the right tools, you can build a structure that meets both your operational requirements and your clients’ expectations. This approach reduces errors and helps maintain clear, organized records for future reference or tax purposes.

In this guide, we will explore how to configure and fine-tune your billing structures to maximize productivity and minimize errors. From setting up the basic structure to ensuring compatibility with various software systems, you’ll learn how to create a system that works seamlessly within your business operations.

QuickBooks IIF Invoice Template Overview

In the world of business accounting, efficient and accurate billing plays a vital role in maintaining smooth financial operations. A structured system for creating and managing financial records is essential for both small and large enterprises. This approach allows businesses to generate uniform and organized documents that can easily be imported, edited, and processed by financial software.

One of the most useful methods for handling business records is by creating a structured format that ensures consistency and reliability. By using a specific layout, businesses can quickly input data, minimize errors, and automate their financial workflows. This method offers a straightforward way to maintain accurate records without the need for manual intervention for every transaction.

In this section, we will explore how such systems are designed to meet the needs of modern businesses. You will learn how to create and customize your documents, integrate them into your accounting platform, and ensure that your records are easy to manage and update as needed.

What is an IIF Invoice Template

When managing financial records for a business, consistency and ease of data entry are paramount. One way to ensure this is by using a pre-structured format that simplifies the process of generating business documents. This type of structure allows for easy integration into accounting systems, ensuring accuracy while reducing the manual workload.

Understanding the Structure

A structured format is designed to capture all relevant details in an organized manner. These formats typically include fields for customer information, transaction dates, payment terms, and item descriptions. By using a predefined structure, businesses can avoid the risk of missing key details and streamline the entire process of creating and managing documents.

Why Businesses Use This Format

- Improves accuracy by reducing manual data entry.

- Ensures consistency across all records.

- Facilitates seamless integration with financial software.

- Speeds up the process of creating and updating business documents.

This structure is designed to be user-friendly, allowing businesses to focus on their core operations while automating many aspects of their financial record-keeping. By adopting this format, companies can reduce errors, save time, and create professional documents with minimal effort.

Benefits of Using IIF Templates

Adopting a predefined format for business documentation brings numerous advantages to companies of all sizes. These structured formats help streamline operations, improve accuracy, and save time by automating the creation and management of financial records. Whether for regular transactions or more complex billing situations, using this approach enhances overall efficiency.

Improved Accuracy and Consistency

By using a predefined structure, businesses ensure that every piece of information is accurately captured in the correct format. This reduces the risk of errors that often arise from manual entry or inconsistent document creation. The consistency in how data is recorded also simplifies auditing and reviewing records later.

Time-Saving and Automation

Automation is one of the key benefits of using such formats. With a set structure in place, creating and managing records becomes significantly faster. Once the initial format is established, businesses can easily import data and generate multiple records with minimal effort, saving both time and resources.

| Benefit | Description |

|---|---|

| Accuracy | Ensures that every document follows a consistent format, reducing the chances of human error. |

| Efficiency | Automates document creation and processing, allowing for quicker turnaround times. |

| Consistency | Uniform document formats make it easier to manage records and perform audits. |

| Data Integration | Seamlessly integrates with financial software, improving overall workflow. |

Incorporating this structured method into everyday operations not only improves the workflow but also helps businesses maintain control over their financial documents. With these benefits, businesses can focus more on growth and less on administrative tasks.

Steps to Set Up IIF Templates

Setting up a structured format for business records requires careful planning and execution. This process ensures that all necessary fields are included and that the format can be easily integrated into your accounting system. Proper setup helps streamline operations and ensures that the documents created follow the desired structure, improving efficiency and accuracy.

Follow these steps to configure and implement a streamlined format for your business documents:

| Step | Description |

|---|---|

| 1. Plan the Structure | Decide on the essential fields and information that should appear in each document, such as customer details, dates, and payment terms. |

| 2. Create the Format | Use a software tool or a simple spreadsheet to arrange the necessary fields in a logical order, ensuring that it aligns with your business needs. |

| 3. Input Sample Data | Test the structure by entering sample data to ensure that the format captures all relevant details correctly. |

| 4. Import the Structure | Once the format is ready, import it into your accounting system to make sure it integrates smoothly and operates as expected. |

| 5. Test and Adjust | Run a few trial documents to check if everything is working. Adjust any errors or issues with the setup. |

By following these steps, you can ensure that your business documentation is both accurate and easy to manage. A well-configured format streamlines the process and reduces errors, saving you time and improving workflow efficiency.

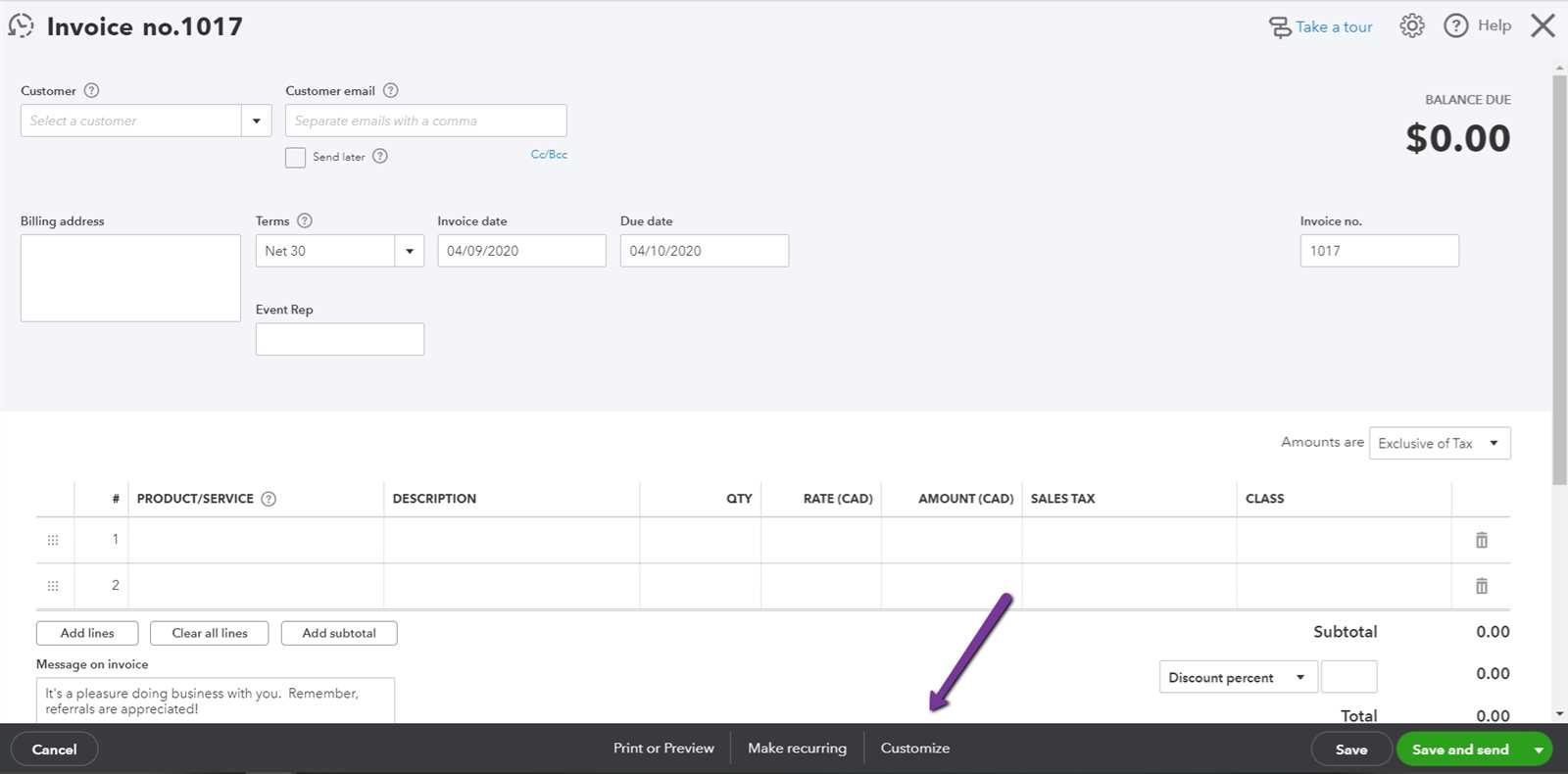

Customizing Your Billing Document

Tailoring your business documents to reflect your brand and meet operational needs is crucial for both professionalism and efficiency. A customizable format allows you to adjust the layout, fields, and design to ensure it suits your specific transaction requirements. This flexibility enhances the appearance of your records and streamlines data entry.

When customizing your billing format, you can make changes to key elements such as the header, footer, item details, and payment terms. It is important to ensure that these adjustments do not affect the accuracy or functionality of the document, allowing for easy integration with your financial system.

Key areas to focus on when customizing:

- Header design: Include your company logo, contact details, and business name for a professional look.

- Itemization: Adjust the fields to clearly list products or services, including descriptions, quantities, and prices.

- Payment terms: Ensure payment terms, due dates, and any late fees are clearly stated to avoid confusion.

- Currency and tax settings: Customize how taxes and currency are displayed to reflect your business standards.

By adjusting these elements, you can create a document that not only meets your accounting needs but also provides a professional and personalized experience for your clients. Customization is key to maintaining consistency and brand identity throughout your business operations.

Essential Fields in IIF Templates

When creating structured documents for business transactions, it’s crucial to include specific fields that capture all relevant details. These fields ensure that the records are complete, accurate, and ready for processing. Each document should have essential sections to provide clarity and support financial tracking, making it easier to manage data efficiently.

Key Information to Include

The following fields are critical for maintaining accurate and organized records:

- Customer Information: Include details such as the customer’s name, address, and contact information to identify the transaction party clearly.

- Transaction Date: Always specify the date of the transaction to ensure proper chronological organization.

- Items or Services: List the items or services sold, including quantities, unit prices, and descriptions to provide full transparency.

- Payment Terms: Clearly state payment terms, including the due date and any applicable discounts or late fees.

- Tax Information: Make sure to indicate the tax rate or amount if applicable, so that the final amount is accurate and complies with local regulations.

Why These Fields Matter

Each field serves a specific purpose in ensuring the integrity of the document. Customer and transaction details enable easy identification and record-keeping, while item descriptions and payment terms provide clarity on the financial aspects. Including these fields also ensures that the document can be efficiently processed by accounting systems, minimizing errors and reducing manual input.

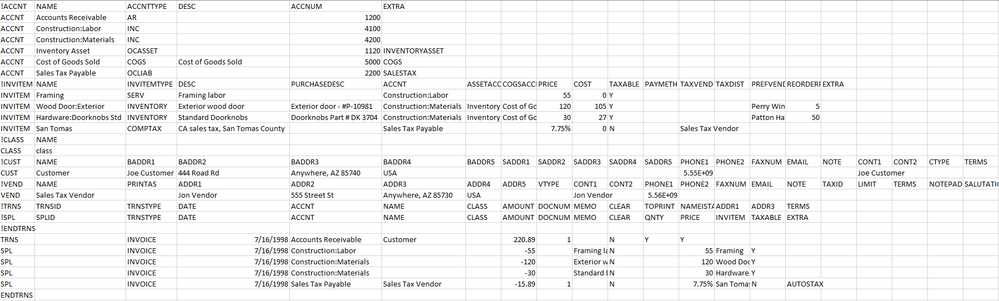

Importing IIF Files into QuickBooks

Importing structured business documents into your accounting system is a crucial step in streamlining financial operations. By bringing in pre-formatted records, you can easily update your system without manually entering each transaction. This process simplifies data management and ensures that all records are consistent and accurately reflect the transactions made.

Steps to Import Files

To ensure a smooth import process, follow these steps to bring your structured documents into the accounting software:

| Step | Description |

|---|---|

| 1. Prepare the File | Ensure the document is in the correct format, with all necessary fields properly filled in. Double-check for errors before importing. |

| 2. Open the Software | Launch your accounting software and navigate to the file import section of the system. This is typically found in the “File” or “Utilities” menu. |

| 3. Select the File to Import | Choose the pre-formatted document from your file directory. Be sure to select the correct file type for your system. |

| 4. Map Fields (if necessary) | If your system requires it, match the fields in the document to the corresponding fields in the software to ensure proper data mapping. |

| 5. Review and Confirm | Review the import preview to check for any discrepancies. Confirm that everything appears correctly before completing the process. |

| 6. Finalize the Import | Once everything is in order, finalize the import and ensure the system successfully processes the records. |

Things to Keep in Mind

Before importing, it’s essential to verify that the document contains all the necessary data and is formatted correctly. This will minimize the risk of errors during the import process. Additionally, ensure your accounting software supports the specific document format you’re importing, as different systems may have different compatibility requirements.

By following these steps, you can effortlessly update your accounting system with structured data, saving time and reducing the chance of manual entry errors.

How to Modify an Existing Template

Modifying an existing structure for business documentation allows you to adjust the format to better suit your evolving needs. Whether you want to update fields, change the design, or incorporate additional information, the process is straightforward. Customizing an existing document format ensures it aligns with your current business requirements, improving efficiency and clarity.

Steps to Modify Your Document Format

Follow these steps to make changes to your existing business record layout:

- 1. Open the Existing Document Structure: Locate the file or structure you want to modify. Open it in the relevant software or editor.

- 2. Identify the Sections to Update: Look over the layout and identify which fields or sections need to be updated. These may include customer information, pricing, or dates.

- 3. Edit the Fields: Modify the fields to match your updated business needs. This could involve adding new information, removing outdated fields, or altering existing ones.

- 4. Adjust Design Elements: If necessary, update the design, including font styles, logos, and colors, to reflect your brand or organizational changes.

- 5. Save the Changes: After making all the necessary adjustments, save the document in the correct format and test it to ensure everything works correctly.

Things to Keep in Mind

When modifying a structure, ensure that all the essential fields are maintained, and the document remains compatible with your accounting system. Testing the new version before fully implementing it is crucial to ensure no errors occur during processing. Regular updates help keep your records relevant and accurate, improving workflow and reducing potential issues down the line.

Common Issues with IIF Files

When working with structured data files for accounting and financial transactions, various issues can arise that may disrupt the smooth flow of information. Common challenges often involve formatting errors, missing data, or incompatibilities with the system into which the document is being imported. Understanding these potential problems can help ensure the correct handling and smooth processing of records.

Frequent Issues to Watch Out For:

- Formatting Errors: Incorrect field placement, missing separators, or extra spaces can prevent the system from reading the file correctly.

- Inaccurate Data Mapping: Sometimes the fields in the document do not match the fields expected by the software, leading to discrepancies in the records.

- Missing Required Fields: Omitting necessary data, such as transaction dates or customer information, can cause incomplete records or errors during the import process.

- Currency and Tax Issues: Incorrect currency settings or tax rates can lead to inaccuracies in financial reporting, affecting the overall record integrity.

- Version Incompatibility: Files created in an outdated format may not be compatible with newer systems, leading to errors or failed imports.

How to Avoid These Problems:

- Double-check file formatting: Always verify that the document adheres to the system’s required structure.

- Validate all fields: Ensure all required fields are populated correctly and match the software’s data expectations.

- Test imports: Run a test import before finalizing the file to catch any potential errors early.

By staying mindful of these common issues and taking proactive steps, you can minimize disruptions and ensure that your records are accurate and compatible with your financial system.

Best Practices for IIF Invoices

When managing business records and transactions, adhering to best practices ensures accuracy, efficiency, and smooth data processing. By following a few simple guidelines, you can optimize how records are structured, preventing common issues and improving overall workflow. These practices help maintain consistency, reduce errors, and improve the overall reliability of the financial data you work with.

Key Practices to Follow

Here are some essential practices for ensuring the quality and effectiveness of your records:

| Practice | Description |

|---|---|

| Consistency in Formatting | Ensure that all documents follow a consistent structure, with correct alignment and field placements to prevent errors during processing. |

| Accurate Field Population | Double-check that all required fields are filled with correct and up-to-date information, including customer details, transaction amounts, and dates. |

| Data Validation | Before importing any file, validate the data by running tests to confirm the accuracy and completeness of the information within the document. |

| Regular Updates | Ensure that the document format is updated regularly to match any changes in your accounting system or business needs. |

| Backup Your Records | Always keep backups of your records in case of system failure or data corruption, ensuring that no information is lost. |

Additional Tips: Regularly review your document structures for areas of improvement, especially when adding new types of transactions or updating your accounting practices. Keep communication open with your accounting team to ensure that everyone is aligned with the data entry and import guidelines. By implementing these best practices, you can ensure that your records remain accurate, timely, and compliant with all required standards.

How to Troubleshoot IIF Errors

When working with data files for accounting and transaction management, errors can occur that may prevent successful imports or lead to incorrect entries. Troubleshooting these issues requires a methodical approach to identify the root cause and resolve it effectively. Understanding common problems and how to fix them can save time and ensure smooth integration of your data.

Steps to Identify and Resolve Errors

If you encounter problems while importing or processing your data, follow these steps to troubleshoot and correct the issues:

- 1. Review the Error Message: The first step is to carefully read any error message that appears. This will often give you clues about what went wrong, such as incorrect formatting or missing data.

- 2. Check for Formatting Issues: Ensure that your file follows the correct structure and alignment. Look for misplaced commas, missing fields, or extra spaces that could cause problems during the import.

- 3. Verify Field Data: Confirm that all fields are populated correctly with the required information. Missing or incorrect values, such as dates or account numbers, can result in errors.

- 4. Test with Sample Data: Run a test import using a small set of data. This can help pinpoint any recurring errors and identify specific issues with the file format or data.

- 5. Check for Compatibility: Ensure the file version is compatible with the system you are using. Files created with outdated formats may not be recognized correctly by newer systems.

- 6. Use Diagnostic Tools: Many accounting software solutions offer diagnostic tools or logs that can help pinpoint issues. These tools can provide deeper insights into what might be causing the problem.

Common Errors and Their Fixes

Here are some typical issues you may encounter and their solutions:

| Error | Solution |

|---|---|

| Formatting Error | Check for misplaced commas, missing quotation marks, or extra spaces. Ensure that each field is separated correctly. |

| Missing Required Fields | Verify that all mandatory fields, such as transaction dates, amounts, and account numbers, are filled in. |

| Data Mapping Error | Ensure that the fields in your document match the expected field names or formats in the receiving system. |

| Version Incompatibility | Update the file to the latest format or version compatible with your accounting software. |

Final Tip: After resolving any issues, always run another test to ensure that everything is working as expected. Troubleshooting can sometimes involve trial and error, but with patience and attention to detail, you can ensure that your data imports correctly every time.

Automating Invoice Creation in QuickBooks

Automating the process of generating billing documents can significantly reduce the time spent on manual data entry and improve overall efficiency. With the right tools and settings, you can streamline the creation and management of your business records, ensuring that they are accurate and up-to-date. Automation not only minimizes the risk of errors but also helps maintain consistency across all documents.

Steps to Automate Document Creation

Follow these steps to set up automation for generating billing records:

- 1. Set Up Recurring Transactions: If you have regular customers or repeat billing, you can create recurring transactions that automatically generate the required documents at specified intervals, such as weekly or monthly.

- 2. Use Customer Templates: Customize a document format for each customer, including their specific details, pricing, and terms. This way, the system can automatically fill in the information based on pre-set customer profiles.

- 3. Link to Payment Methods: Integrate your payment processing system with your record management platform to ensure that payments and billing documents are automatically linked and updated.

- 4. Automate Notifications: Set up automatic reminders or email notifications to send out documents to clients as soon as they are generated, improving communication and speeding up the payment cycle.

- 5. Customize Automated Workflows: Create specific rules and workflows that allow for different types of documents to be generated based on transaction types, customer preferences, or predefined criteria.

Benefits of Automation

Automating the document creation process provides several key advantages for businesses:

- Improved Efficiency: Reduce manual data entry, allowing staff to focus on higher-value tasks.

- Consistency: Ensure that all documents follow the same structure and include the correct details, minimizing human error.

- Faster Turnaround: Automatically generate records, speeding up the process of invoicing and reducing delays.

- Time Savings: Eliminate the need for repetitive work, freeing up time for more strategic activities.

- Better Cash Flow Management: Automatically track and send billing records, leading to quicker payments and improved cash flow.

Final Tip: While automation is an excellent way to streamline operations, it is important to regularly review and adjust your automated settings to ensure they continue to meet the evolving needs of your business.

Exporting IIF Data from QuickBooks

Exporting financial and transactional data from your accounting system can be an essential step for various purposes such as reporting, data analysis, or integration with other platforms. The ability to export data seamlessly allows for better management of business information and ensures that records are accessible for audits, analysis, or sharing with other stakeholders.

Steps to Export Data

To export your data effectively, follow these steps:

- 1. Open the Export Wizard: Begin by accessing the data export feature within your accounting software. Look for the option that allows exporting financial records or transaction data.

- 2. Select the Data Type: Choose the specific type of data you want to export, such as financial transactions, sales records, or account balances. This will ensure that only relevant information is included in the export.

- 3. Choose File Format: Select the format for the export, ensuring that it matches the requirements of the platform you intend to use for analysis or reporting. A common format might be a .csv file or a specialized format designed for import into another system.

- 4. Filter and Customize Data: Apply filters or customize the export settings to match your needs. For instance, you might only want data from a specific date range or particular customers.

- 5. Complete the Export: Once you’ve configured the export settings, finalize the process to generate and download the data file.

Why Exporting Data is Important

Exporting data offers several advantages for business operations, including:

- Data Backup: Regular exports help back up your financial and transactional data, ensuring that it’s safe and accessible outside of your primary accounting system.

- Data Analysis: Exported records can be analyzed using external tools such as spreadsheets or business intelligence platforms, enabling deeper insights into your business performance.

- Integration with Other Systems: Exported data can be easily imported into other business management tools, allowing for smooth integration across various software solutions.

- Audit and Compliance: Maintaining exportable records makes it easier to comply with regulatory requirements and to present necessary data during audits.

Tip: Regularly exporting data ensures that your records are up to date and ready for use when needed, helping maintain smooth business operations and improving decision-making processes.

Using IIF for Bulk Invoicing

When managing large volumes of transactions or customer orders, manually creating individual billing records can be time-consuming and inefficient. To streamline this process, bulk invoicing allows businesses to create multiple billing entries at once, significantly reducing the workload and minimizing human error. By automating the process, you can ensure that invoices are generated quickly and accurately, saving valuable time and resources.

How Bulk Billing Works

Bulk invoicing involves creating a single file that contains multiple billing entries. These entries are then imported into your financial system in one go, eliminating the need to input each record manually. The key is structuring the data correctly and ensuring it adheres to the system’s format requirements. Here’s how you can do it:

- 1. Prepare the Data: Gather all the necessary information for each transaction, including customer names, amounts, due dates, and other relevant details. Ensure that each entry is complete and accurate.

- 2. Organize the Information: Structure the data in the correct format. This might include using specific fields such as customer ID, product code, quantity, and price. A consistent structure across all records is crucial for smooth processing.

- 3. Create the Bulk File: Once the data is organized, create a bulk file in a compatible format that can be imported into your system. This file will contain all the entries to be processed at once.

- 4. Import the File: Upload the bulk file into your financial system using the appropriate import feature. Ensure the system recognizes and processes each entry correctly.

- 5. Review and Confirm: After the file is imported, review the results to confirm that all records have been processed without errors. It’s important to verify that all billing entries are correct before finalizing the process.

Advantages of Bulk Invoicing

Using bulk invoicing can offer several benefits for businesses, especially those handling large volumes of transactions:

- Time Savings: Bulk invoicing eliminates the need to create individual billing entries manually, saving significant time, particularly when dealing with hundreds or thousands of transactions.

- Increased Efficiency: Automating the billing process reduces human error, ensuring that all entries are processed accurately and consistently.

- Improved Cash Flow: With faster billing processes, businesses can send out invoices promptly, leading to quicker payments and better cash flow management.

- Scalability: As your business grows, bulk invoicing allows you to easily scale your operations without needing to increase administrative resources or manually input data.

Tip: When using bulk invoicing, it’s important to validate the data thoroughly before importing it into your system to avoid costly mistakes and ensure accuracy in billing records.

Integrating IIF with Other Software

Integration of your financial system with other business tools can greatly enhance operational efficiency. By enabling seamless communication between different software solutions, you can reduce manual data entry, improve data accuracy, and streamline workflows. Connecting various platforms together ensures that data flows smoothly between applications, resulting in a more cohesive and automated business process.

Many businesses rely on a combination of systems to handle different aspects of operations, such as customer relationship management (CRM), inventory management, and project tracking. When these systems are properly integrated, information can be automatically shared, minimizing the risk of errors and inconsistencies. Integration also allows for quicker decision-making and reporting by consolidating data from various sources into one central platform.

Methods of Integration

There are several methods for integrating financial software with other business applications:

- 1. Direct API Integrations: Some software solutions offer direct API integrations that allow for smooth data exchange. These integrations can be set up to automatically sync data from one system to another, ensuring real-time updates.

- 2. Middleware Solutions: Middleware platforms act as intermediaries between two systems, facilitating data transfer and ensuring compatibility. They can be useful for integrating systems that don’t natively support direct connections.

- 3. CSV or Excel Imports/Exports: Many platforms support importing and exporting data through CSV or Excel files. This method requires manual exports from one system and imports into another but can still be automated through scheduled tasks.

- 4. Third-Party Integration Tools: There are third-party tools specifically designed to bridge gaps between various software platforms. These tools help automate the integration process without needing custom development.

Benefits of Integration

Integrating your financial system with other business software offers numerous advantages:

- Enhanced Accuracy: Reduces the need for manual data entry, thereby minimizing human errors and ensuring that the data across systems is consistent.

- Improved Efficiency: By automating data transfer, employees can focus on higher-level tasks rather than spending time on repetitive administrative work.

- Real-Time Data Access: Integration provides immediate access to updated information, improving decision-making and allowing businesses to respond faster to changes in the market.

- Cost Savings: Streamlining processes through integration can lower operational costs by reducing the need for manual intervention and the risk of errors that can lead to costly mistakes.

Note: When planning integration, it’s essential to ensure that the software being connected is compatible and that the data formats align for a smooth transfer of information.

Tips for Formatting IIF Files Correctly

Ensuring that your data files are properly formatted is critical for smooth operations, especially when transferring data across different software systems. Correctly structured files not only prevent errors but also allow for seamless integration and synchronization. Formatting plays a vital role in ensuring data integrity and reducing the need for troubleshooting later on.

When preparing your files for import or export, careful attention should be paid to every detail, including data structure, field consistency, and compliance with system requirements. Below are some essential tips to follow when working with structured data files:

Key Formatting Tips

- 1. Maintain Consistent Field Delimiters: Always use the appropriate delimiter (commas, tabs, or semicolons) to separate data fields. Inconsistent delimiters can cause the file to be unreadable or incorrectly parsed.

- 2. Check for Required Fields: Make sure that all mandatory fields are included in your file. Missing essential data can lead to errors during processing or incomplete entries.

- 3. Use Correct Data Types: Ensure that numerical values, dates, and text are formatted correctly. For example, dates should follow the prescribed format (e.g., MM/DD/YYYY), and numeric fields should not contain any characters or symbols.

- 4. Validate File Encoding: Files should be saved in the correct encoding format (usually UTF-8) to avoid issues with character display, especially when dealing with special characters or non-English alphabets.

- 5. Avoid Extra Spaces or Characters: Double-check for unnecessary spaces or hidden characters, as they can cause the file to be misinterpreted or rejected by the software.

Common Mistakes to Avoid

Even with careful attention to detail, some common mistakes can arise when preparing data files:

| Common Mistakes | Solution |

|---|---|

| Incorrect delimiter usage | Ensure the correct delimiter is used consistently throughout the file. |

| Omitting required fields | Check the documentation to confirm all necessary fields are included. |

| Invalid date or number format | Review format specifications to match the system’s requirements. |

| Inconsistent file encoding | Always save files in UTF-8 format to avoid character encoding issues. |

By following these tips, you can ensure that your data files are properly formatted, which will help avoid unnecessary errors and improve the efficiency of your workflow. Consistency, accuracy, and attention to detail are key components of working with structured data files successfully.

Understanding IIF Template Limitations

While structured data files offer significant advantages in streamlining workflows and facilitating seamless transfers, they also come with certain constraints that users should be aware of. Understanding these limitations is crucial for effectively utilizing them without encountering unexpected issues. These limitations may impact the ease of use, flexibility, and compatibility with other systems, making it important to know where potential challenges lie.

In this section, we will explore the main restrictions and challenges that users might face when working with structured data files, and how these limitations can affect overall efficiency. Recognizing these issues beforehand can help you plan for potential roadblocks and implement appropriate workarounds.

Common Limitations

| Limitation | Impact | Possible Solutions |

|---|---|---|

| Lack of Flexibility in Field Customization | Fields are predefined and may not be easily customizable to meet unique business needs. | Consider using predefined fields or working with third-party tools for additional flexibility. |

| File Size Restrictions | Large files may lead to performance issues or even failures during import or export processes. | Split large files into smaller, manageable batches or optimize data prior to transfer. |

| Compatibility Issues with Other Software | Certain data formats may not seamlessly integrate with all systems or software applications. | Ensure proper configuration and conduct compatibility tests with other tools before use. |

| Error-Prone Manual Formatting | Manual errors in formatting can lead to rejected or incorrect data entries. | Automate formatting wherever possible or use validation tools to check the accuracy of the file. |

By understanding these limitations, you can mitigate the challenges associated with structured data files and use them more effectively. Whether you are working with large datasets, integrating with other systems, or customizing fields, awareness of potential restrictions will help you navigate and optimize the process for better results.