QuickBooks Export Invoice Template Guide for Easy Billing

In the modern business world, streamlining financial tasks is essential for success. Simplifying the process of generating and managing documents for transactions can save time and reduce errors. Finding the right tools to automate and customize these documents is a game changer for companies of any size. Whether you’re handling small client accounts or managing large volumes of transactions, having a reliable system is crucial for smooth operations.

Customizable documents allow businesses to maintain professionalism while ensuring the process is as quick and efficient as possible. By adjusting these tools to your specific needs, you can create a seamless workflow that integrates directly with your accounting systems. This not only helps reduce manual work but also improves overall accuracy.

Adopting this kind of automation can ultimately help you stay ahead of the competition, offering faster service to clients while reducing the administrative burden on your team. Understanding how to use and manage these systems effectively is key to leveraging their full potential for business growth.

QuickBooks Export Invoice Template Overview

Managing billing documents efficiently is a critical task for any business. Automating the creation and distribution of transaction records can significantly improve workflow and reduce administrative errors. With the right tools, businesses can easily generate consistent and professional documents that align with their brand and meet client expectations. This process can be fully customized to reflect specific business needs, ensuring both accuracy and efficiency in every transaction.

Many accounting systems provide built-in solutions that allow users to create tailored forms. These systems offer the flexibility to adapt formats, layouts, and even data fields, giving users complete control over how financial documents are presented. The ability to automate these documents helps reduce manual input, speeding up the overall process and freeing up time for other essential tasks.

By understanding how to utilize these powerful features, businesses can maintain a high level of professionalism and consistency in their financial records. Whether you are managing a small company or a larger enterprise, having a reliable tool to manage and send these important documents can make a significant impact on productivity and client satisfaction.

Benefits of Using Export Invoices

Utilizing automated billing solutions offers numerous advantages for businesses seeking to streamline their financial processes. By implementing digital systems for generating transaction records, companies can save time, reduce errors, and enhance their overall efficiency. These tools not only simplify the document creation process but also ensure that all necessary information is presented consistently and professionally.

Some of the key benefits include:

- Time Efficiency: Automating the creation and distribution of documents reduces the amount of manual work required, freeing up time for other important tasks.

- Accuracy: By minimizing the risk of human error, businesses can ensure that all transaction details are correctly captured and organized.

- Consistency: Automated systems guarantee that all documents follow a consistent format, which enhances professionalism and helps maintain brand identity.

- Customization: Many tools allow for easy customization of fields and layouts, ensuring that documents meet the specific needs of the business and its clients.

- Improved Client Communication: Faster document generation and delivery contribute to better communication with clients, fostering stronger business relationships.

By leveraging these advantages, businesses can focus more on growing their operations and less on manual administrative tasks, ultimately improving both productivity and client satisfaction.

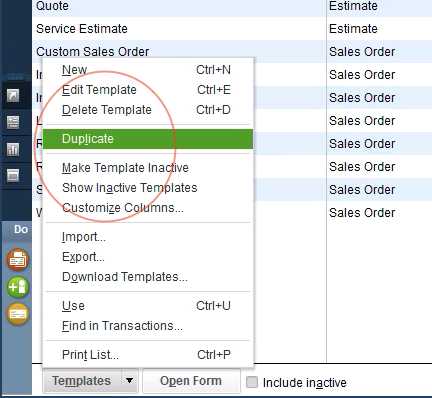

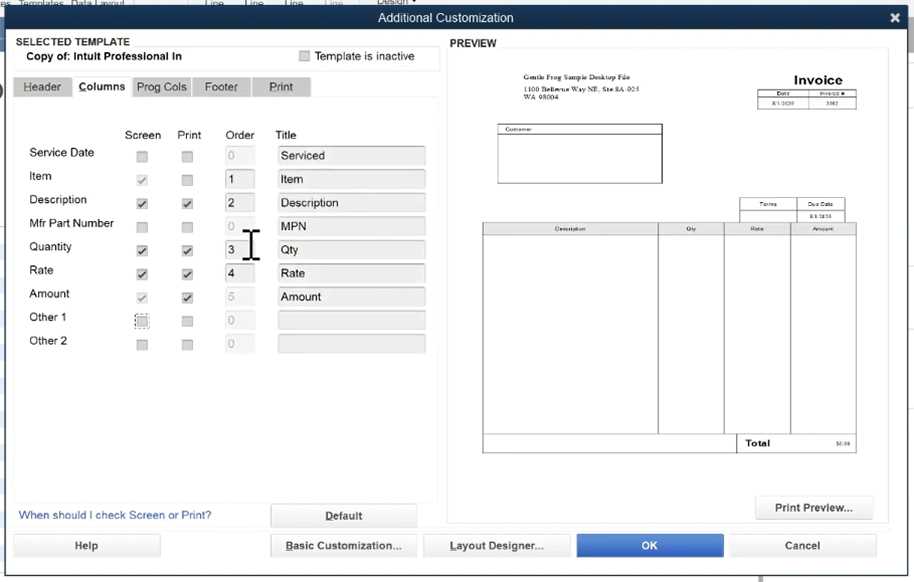

How to Customize QuickBooks Invoice Templates

Tailoring your financial documents to suit the specific needs of your business is a powerful way to enhance both professionalism and efficiency. Customizing the layout, fields, and design elements of these records ensures that they not only contain the necessary details but also reflect your brand identity. By adjusting various settings, you can create personalized forms that are both functional and visually appealing.

To begin customization, first access the design settings within your accounting software. From there, you can choose from several pre-made layouts or create a completely new one. Pay attention to the following elements to create a polished document:

- Header Information: Modify the header to include your company logo, name, address, and contact details for a professional look.

- Data Fields: Adjust fields to ensure all relevant details, such as customer information, transaction dates, and payment terms, are correctly displayed.

- Color Scheme: Personalize the color scheme to match your branding and enhance the document’s visual appeal.

- Fonts: Select fonts that reflect your business’s style while ensuring readability and clarity.

- Footer Details: Add important notes or legal disclaimers at the bottom of the document, if necessary.

By customizing these elements, you can create a cohesive and professional financial document that meets the specific requirements of your business and enhances client trust.

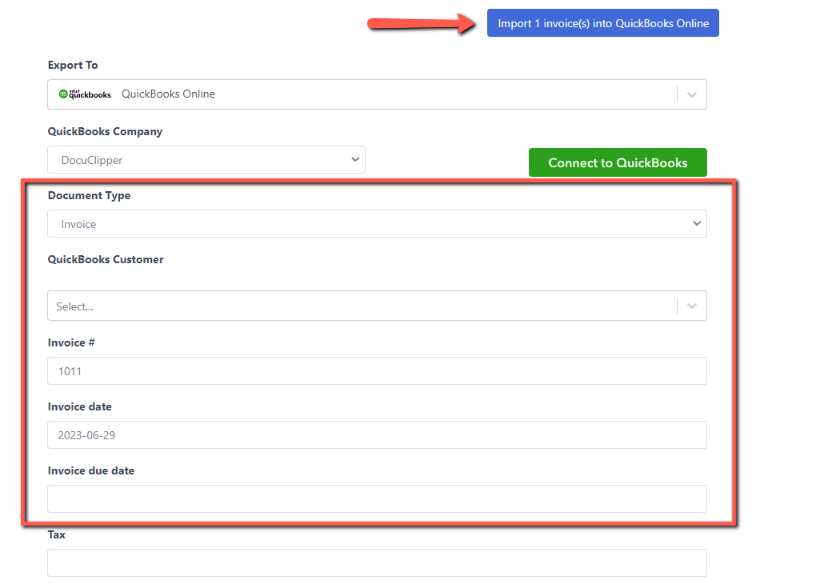

Step-by-Step Guide to Exporting Invoices

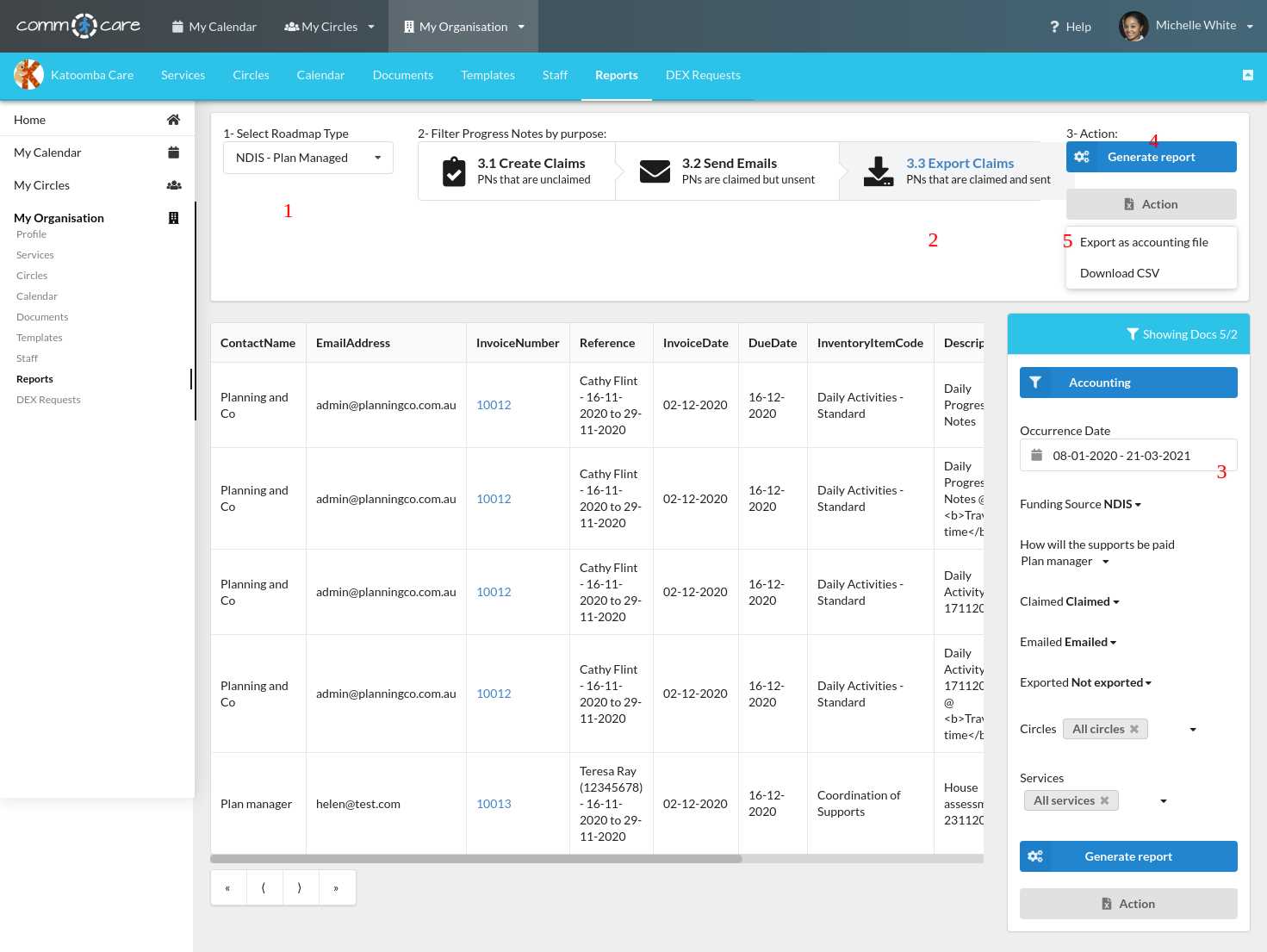

Sending out transaction records to clients or internal teams can be a time-consuming task if done manually. Fortunately, with the right system in place, this process can be automated, allowing you to quickly generate and send financial documents in just a few clicks. Below is a step-by-step guide on how to efficiently extract and distribute these documents from your accounting software.

Follow these steps to get started:

- Access the Billing Section: Begin by navigating to the section where transaction records are stored within your software. This is often found under the “Transactions” or “Sales” tab.

- Select the Records: Choose the transactions you wish to send. You can select individual records or choose multiple transactions at once depending on your needs.

- Choose the Format: Depending on your requirements, select the format in which you want to send the records (e.g., PDF, Excel, CSV). Most systems offer several file types to suit various needs.

- Customize Details: Before exporting, make sure the document fields are correct. Double-check customer names, amounts, dates, and any other relevant information to ensure accuracy.

- Export the Documents: Once everything is in order, click on the “Export” or “Send” button. The software will generate the records in the selected format, ready for delivery.

- Review and Share: After exporting, review the documents to confirm that everything looks correct. You can now send them directly to clients or save them to your files for later reference.

By following these steps, you can streamline the process of creating and sending out transaction records, ensuring greater efficiency and fewer errors in your workflow.

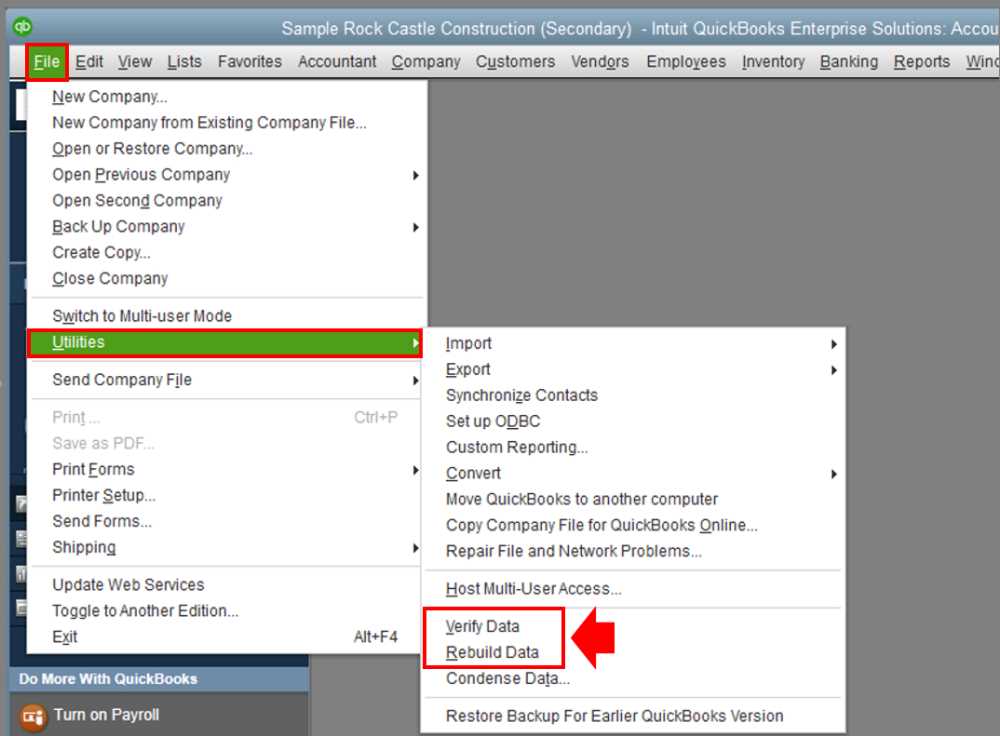

Common Issues with QuickBooks Export Feature

While digital tools for generating and distributing transaction records offer significant advantages, they are not without their challenges. Users may encounter several common issues when trying to extract and send these financial documents. Understanding these problems and their potential solutions can help businesses avoid delays and ensure smoother processes.

1. Formatting Errors

One of the most common issues when creating documents from accounting systems is incorrect formatting. This can result in missing data or improper alignment, making the document difficult to read or incomplete.

- Misaligned fields: Information like client names, amounts, or dates may not appear in the correct sections, leading to confusion or errors.

- Incorrect font styles: When exporting, the font size, style, or color might not carry over as expected, causing the document to look unprofessional.

- Missing logos or branding: If the design elements don’t transfer properly, the document may appear inconsistent with your company’s branding.

2. Data Mismatch or Missing Information

Another frequent problem is discrepancies in the data. This can occur when transaction details are not properly captured or updated in the system.

- Customer information errors: Client details, such as addresses or contact information, may be outdated or incorrect, leading to confusion.

- Incomplete transaction data: Some fields may be left empty or not updated in real-time, causing discrepancies between what’s shown in the document and the actual transaction details.

- Currency or tax errors: Incorrect tax calculations or currency mismatches can make financial documents appear inaccurate or untrustworthy.

By addressing these common issues early, businesses can ensure that the document generation process remains smooth and that all exported records are accurate and professional.

How Export Templates Save Time in Accounting

In the world of accounting, efficiency is crucial. Manual data entry, document creation, and transaction tracking can take up a significant amount of time if done by hand. However, with the right tools, much of this work can be automated, allowing businesses to save time and reduce the risk of human error. Customized systems for generating financial documents streamline many repetitive tasks, freeing up valuable time for accountants and financial professionals.

Automating document creation ensures that accurate and consistent records are produced in just a few clicks. Instead of manually entering information into each document, accountants can rely on pre-set fields and formats that automatically pull the necessary data. This reduces the chances of mistakes, such as incorrect amounts or missed details, which can be costly in the long run.

Furthermore, using pre-designed systems means that financial records are consistently formatted, saving the time needed to adjust and review individual documents. Once a business establishes its preferred layout and style, it can quickly generate reports, contracts, and transaction summaries without needing to start from scratch each time.

By reducing the amount of manual work and increasing the speed of document generation, accountants can focus on more strategic tasks, such as analyzing financial data and improving cash flow management. In the end, automating these processes not only saves time but also increases overall productivity and accuracy.

QuickBooks vs Competitors Invoice Export Tools

When it comes to generating and sending financial documents, businesses have a variety of software options to choose from. Different platforms offer unique features, pricing models, and capabilities, each catering to different business needs. Some tools are specifically designed to handle large volumes of transactions, while others focus on ease of use and customization options. Understanding how these tools compare can help businesses make informed decisions about which one is best suited for their accounting processes.

One of the major advantages of the leading accounting software is its user-friendly interface combined with robust features. These systems typically offer an all-in-one solution, handling everything from transaction recording to document generation and financial reporting. This level of integration ensures seamless workflow and reduces the need for third-party software.

However, competing platforms often provide specialized features that may outperform the all-in-one solutions in certain areas. For example, some alternatives offer more advanced customization options for document design or integrate better with specific industry tools, such as inventory management systems or e-commerce platforms. These tools may also have lower pricing for small businesses that only need basic features, making them more accessible for startups or independent professionals.

Ultimately, the choice between these tools depends on business size, industry requirements, and specific needs for customization, speed, and scalability. While some systems may offer more flexibility or lower costs, others may provide greater convenience and integration, making it essential to evaluate the trade-offs before selecting the best fit for your financial operations.

Integrating QuickBooks with Other Software

Integrating accounting software with other business tools can significantly enhance overall efficiency. By connecting your financial system to platforms used for customer management, inventory tracking, or project management, you can create a seamless flow of data across your operations. This integration eliminates the need for manual data entry, reduces errors, and allows for real-time updates across all systems.

Key Benefits of Integration

- Improved Accuracy: Synchronizing data between platforms ensures consistency across all records, reducing the chances of discrepancies or mistakes.

- Time Savings: Automatic data synchronization means less time spent manually updating multiple systems, allowing employees to focus on more strategic tasks.

- Better Decision-Making: Real-time access to financial and operational data provides business owners with better insights, enabling them to make more informed decisions.

- Streamlined Processes: Integrating tools for tasks like sales, marketing, and inventory management with your financial system helps streamline workflows, making it easier to track the entire lifecycle of a transaction.

Common Integrations to Consider

- CRM Systems: Integrating customer relationship management software allows for automatic updates to customer details, sales histories, and payment tracking.

- Inventory Management: By linking your financial system to inventory software, you can track stock levels, update product information, and generate accurate financial reports without manual input.

- Payment Gateways: Connecting your system to payment platforms allows for automatic recording of transactions, making the payment process faster and more efficient.

- Project Management Tools: Syncing project management platforms ensures that time tracking, expenses, and project costs are automatically reflected in financial records.

By integrating various systems, businesses can create a more cohesive workflow, minimize manual data handling, and improve both accuracy and productivity across all departments.

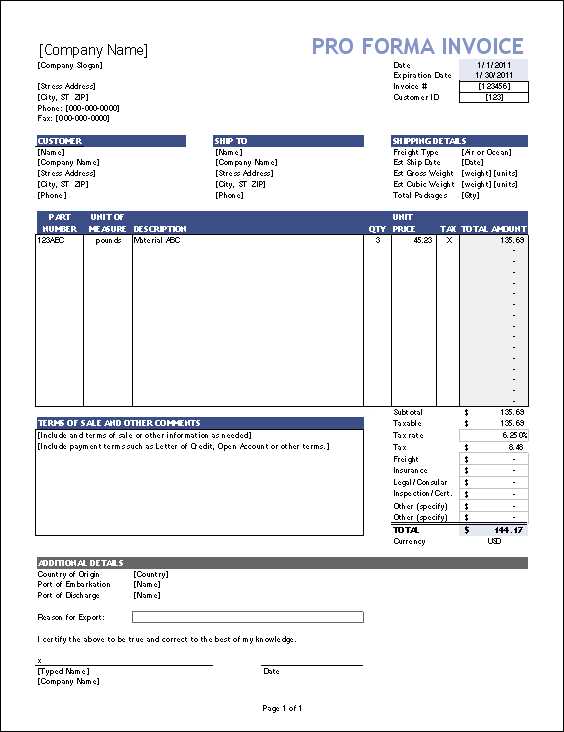

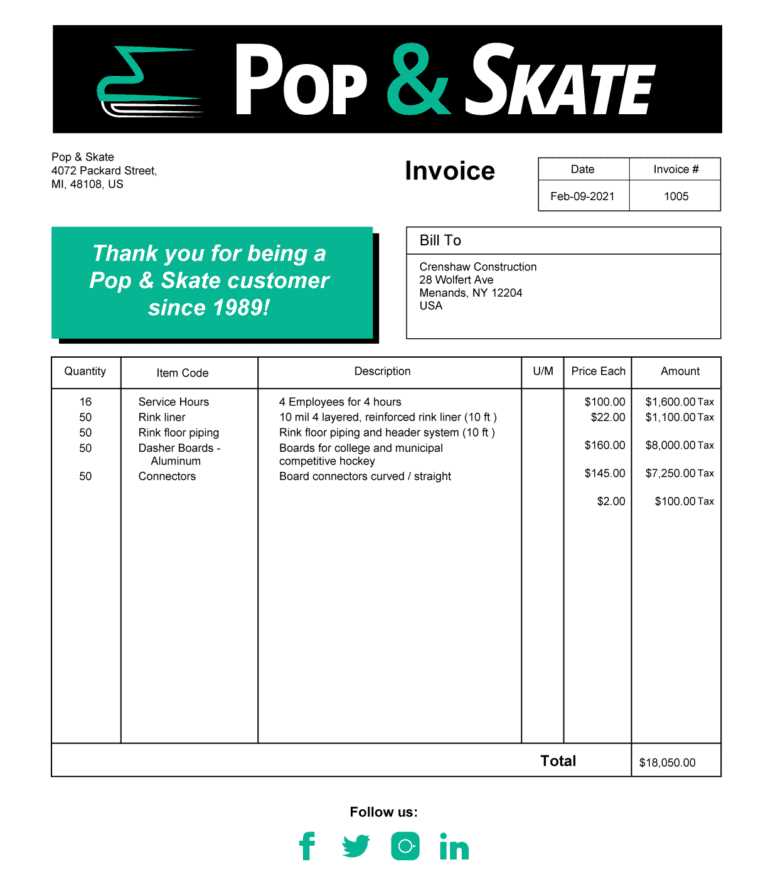

Design Tips for a Professional Invoice

Creating a professional and well-designed financial document is essential for maintaining a positive image with clients. A polished document not only reflects your business’s professionalism but also helps to ensure clarity and accuracy in communication. The design of your records should be both functional and aesthetically pleasing, making it easy for clients to understand the details of their transaction at a glance.

Key Design Elements to Focus On

- Clear Branding: Include your company’s logo, name, and contact information at the top of the document. This reinforces your brand identity and ensures clients know how to reach you.

- Organized Layout: Use a clean and structured layout with distinct sections for client details, payment terms, and itemized charges. Group related information together to make it easy to navigate.

- Consistent Font Choices: Choose professional, easy-to-read fonts. Avoid using too many different styles or sizes, as this can make the document look cluttered and difficult to follow.

- Whitespace: Don’t overcrowd the document. Ample whitespace makes it easier for clients to read and ensures that each section of the document stands out.

- Readable Figures: Ensure that numbers, such as totals, prices, and dates, are clearly legible. Consider using larger or bold text for amounts due to draw attention to critical information.

Enhancing Usability

- Include Payment Instructions: Make sure to include clear instructions on how clients can make payments, including bank details, online payment links, or any other relevant payment methods.

- Provide Terms and Conditions: If necessary, include terms and conditions for late payments or refund policies. This helps set clear expectations and avoid misunderstandings.

- Automatic Calculation of Totals: Utilize automatic calculations to ensure that subtotals, taxes, and total amounts are accurately calculated, minimizing errors.

By paying attention to these design elements, you can create a professional document that enhances your business’s image while making transactions smoother and more transparent for your clients.

Managing Invoice Data After Export

Once financial documents have been generated and sent, the next critical step is managing the data efficiently. Proper handling of this information ensures that your records remain organized and easily accessible for future reference. After documents are created, it’s essential to store, update, and track them effectively, making sure that all data is consistent and accurately reflects your business activities.

Organizing the Data: After generating the records, it’s important to categorize them properly in your system. Consider creating specific folders or labels to group documents by client, project, or date. This practice will make it easier to retrieve and reference these documents when needed.

Data updating should be a regular part of the post-generation process. Ensure that any changes to payment statuses, amounts, or due dates are immediately reflected in your system. Keeping your records up to date helps maintain accurate financial reporting and can prevent any discrepancies or missed payments.

Key Steps for Efficient Data Management

- Centralized Storage: Store all financial documents in a single, organized location. Cloud-based solutions offer secure, easily accessible options for managing data.

- Regular Backups: Ensure that all generated documents are backed up regularly to prevent data loss. Automating this process can save time and reduce the risk of missing information.

- Tracking Payments: Keep track of which clients have paid and which are still outstanding. Using a payment tracking system or spreadsheet can help monitor cash flow and reduce confusion.

- Audit and Reconciliation: Regularly audit the data for accuracy. Reconcile documents with bank statements and other financial records to ensure everything aligns correctly.

By following these practices, businesses can efficiently manage their financial data, maintain up-to-date records, and ensure smooth operations moving forward.

Exporting Recurring Invoices in QuickBooks

For businesses that handle regular billing cycles, automating the creation and management of recurring financial records is a huge time-saver. By setting up these transactions to repeat at specified intervals, businesses can ensure that they are invoicing clients consistently and accurately without having to manually create new records each time. Exporting these recurring documents can help streamline financial operations and provide better tracking for ongoing payments.

Many accounting systems allow users to set up recurring billing schedules for clients who have subscription-based or regular service agreements. Once configured, the system automatically generates the necessary documents based on the predefined schedule, which can then be exported for further processing or distribution.

Steps to Set Up Recurring Transactions

- Access the Recurring Transactions Section: Navigate to the recurring transactions settings within your software and create a new recurring profile.

- Define Billing Frequency: Specify how often the transaction should recur, such as weekly, monthly, quarterly, or annually.

- Enter Client and Payment Details: Provide customer information, payment terms, and amounts to ensure accurate and timely processing of each cycle.

- Set an End Date: Optionally, define an end date or maximum number of occurrences for the recurring transactions if applicable.

Tracking and Exporting Recurring Documents

Once the recurring transactions are set up, it’s important to track their progress and ensure the data is up to date. Most systems will allow you to view a history of past transactions and monitor upcoming ones. When it’s time to send the generated documents, exporting them for review or client distribution is straightforward.

| Action | Description | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Review Recurring Transactions | Check the status of upcoming and past recurring documents to ensure that all data is correct before exporting. | ||||||||||||

| Export Recurring Documents | Select the recurring entries and export them to the desired format (e.g., PDF, CSV) fo

How to Automate Invoice Exports in QuickBooksAutomating the process of generating and sending financial records is one of the best ways to save time and reduce manual errors. By setting up automatic routines for document creation, businesses can ensure timely delivery without needing to manually intervene. This process can be particularly beneficial for businesses with recurring transactions or large volumes of clients, as it helps maintain consistency and streamlines operations. Automation allows for the seamless generation and transmission of financial documents at specified intervals, eliminating the need for manual entry or tracking. Once the settings are configured, the system takes over, ensuring that documents are created and sent based on the established rules and schedule. This helps businesses stay on top of their financial responsibilities, while also improving efficiency and reducing administrative burdens. Steps to Automate Document Generation

Managing and Reviewing Automated Documents

By automating the document generation and distribution process, businesses can significantly reduce the time spent on administrative tasks, improve efficiency, and ensure that clients receive accurate records on time without delay. Best Practices for QuickBooks Invoice ExportsEfficiently managing financial records requires following certain best practices to ensure that data is accurate, consistent, and easily accessible. When generating and transferring financial documents, it’s essential to streamline the process while maintaining high standards of professionalism. By adopting a set of best practices, businesses can reduce errors, improve workflow efficiency, and provide clients with clear and timely records. Key Practices for Managing Financial Document Exports

Optimizing the Export Process

By following these best practices, businesses can ensure their financial document processes run smoothly, ensuring timely payments, minimal errors, and efficient management of records. Keeping a systemized approach will reduce workload, enhance client satisfaction, and foster overall business growth. Common Mistakes When Exporting InvoicesWhen handling the generation and transmission of financial records, it’s easy to make mistakes that can lead to confusion, missed payments, or even lost business opportunities. Whether it’s an error in the data entry, incorrect formatting, or issues with tracking, these missteps can cause significant delays or errors in billing. Identifying and addressing common mistakes can help businesses streamline their processes and maintain professionalism in all their financial dealings. Common mistakes often occur when dealing with large volumes of transactions or when relying on manual processes to transfer data. By being aware of these potential pitfalls, businesses can take proactive steps to avoid them and ensure that all documents are accurate and delivered on time. Frequent Errors and How to Avoid Them

Impact of Mistakes and How to Prevent Them

|