How to Use Quickbooks Enterprise Invoice Template for Streamlined Billing

Managing financial documents efficiently is crucial for businesses of all sizes. A well-organized system can save time, reduce errors, and improve overall productivity. One of the most effective ways to enhance your invoicing workflow is by using automated systems that generate professional, accurate bills tailored to your specific needs.

With the right tools, customizing and tracking payments becomes much simpler. These systems allow users to create customized billing statements, track overdue balances, and generate reports, all while minimizing manual effort. Whether you’re dealing with a handful of clients or hundreds, implementing an organized solution can vastly improve the financial operations of your company.

Utilizing modern solutions for creating financial documents can significantly reduce administrative burdens. From setting up recurring charges to adjusting tax rates, automating these processes allows businesses to focus on growth rather than paperwork. Moreover, these tools offer flexibility, ensuring that each document matches your business’s unique requirements while ensuring consistency across all your records.

Quickbooks Enterprise Invoice Template Overview

In today’s fast-paced business world, having a reliable and efficient system to create and manage billing documents is essential. An automated solution for generating professional financial records not only saves time but also ensures accuracy and consistency across all transactions. These tools are designed to simplify the process, making it easier for businesses to track payments, manage clients, and maintain detailed records without manual effort.

With customizable options, businesses can tailor each document to fit their specific needs. Whether it’s adjusting the layout, adding personalized branding, or modifying payment terms, these tools offer a high level of flexibility. The system can be integrated into existing workflows, ensuring smooth and seamless financial operations. From creating one-time statements to recurring charges, this solution helps streamline the entire billing cycle.

By automating the process, companies can reduce human error, speed up payment processing, and improve overall efficiency. The ability to instantly generate invoices and track their status gives businesses a clear overview of outstanding balances and payment history, leading to more effective financial management.

Benefits of Using Quickbooks Templates

Automated solutions for generating financial documents offer a range of advantages that can greatly improve a company’s operational efficiency. These systems simplify the creation of professional records, ensuring consistency and accuracy across all billing activities. The primary benefit is the time saved in creating and managing documents, which can be especially valuable for small businesses with limited resources.

Time Efficiency

One of the most notable benefits of using these tools is the time saved by automating repetitive tasks. Generating bills, tracking payments, and managing records becomes significantly faster, freeing up time for other important business activities.

Improved Accuracy

By reducing manual input, the risk of human error is minimized. Automated systems automatically calculate totals, taxes, and discounts, ensuring that every financial document is correct. This helps prevent costly mistakes that can arise from manually entering data.

| Benefit | Description |

|---|---|

| Time Savings | Automated processes speed up document creation and management, improving overall efficiency. |

| Consistency | Pre-designed layouts and structures maintain uniformity across all records, giving your business a professional image. |

| Customization | Personalize documents to match your brand and business needs, offering a more tailored experience for clients. |

| Accuracy | Automatic calculations reduce errors and ensure that every detail is correct from the start. |

These benefits work together to enhance the overall financial management process, leading to smoother operations, faster payments, and stronger relationships with clients.

How to Customize Your Invoice Template

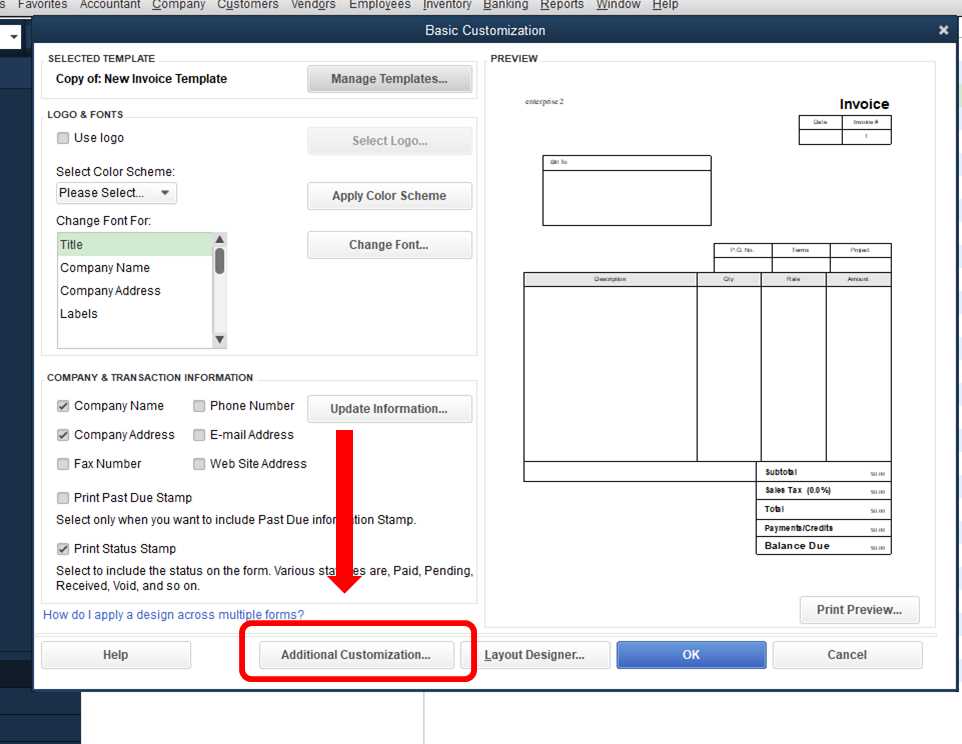

Customizing your billing documents allows you to create a more personalized experience for your clients while ensuring your records meet your specific business needs. Adjusting the design and functionality of these documents is essential for maintaining a professional image and streamlining your financial operations. By tailoring details such as layout, color schemes, and included fields, you can make sure each document aligns with your brand identity.

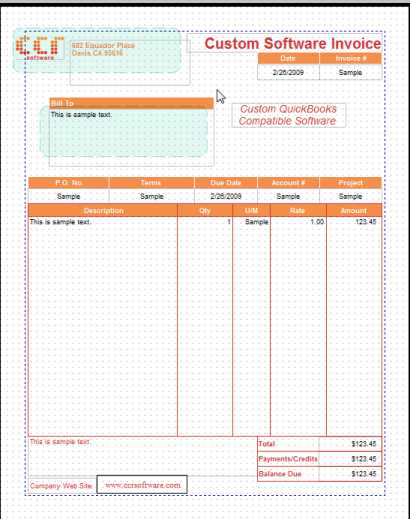

Adjusting Layout and Design

Begin by choosing a layout that suits your business style. You can modify the arrangement of sections like client information, payment terms, and service details. This ensures that the final product not only looks professional but is also easy for clients to understand. Customizing the design with your company logo, colors, and font choices helps establish a consistent brand presence across all your documents.

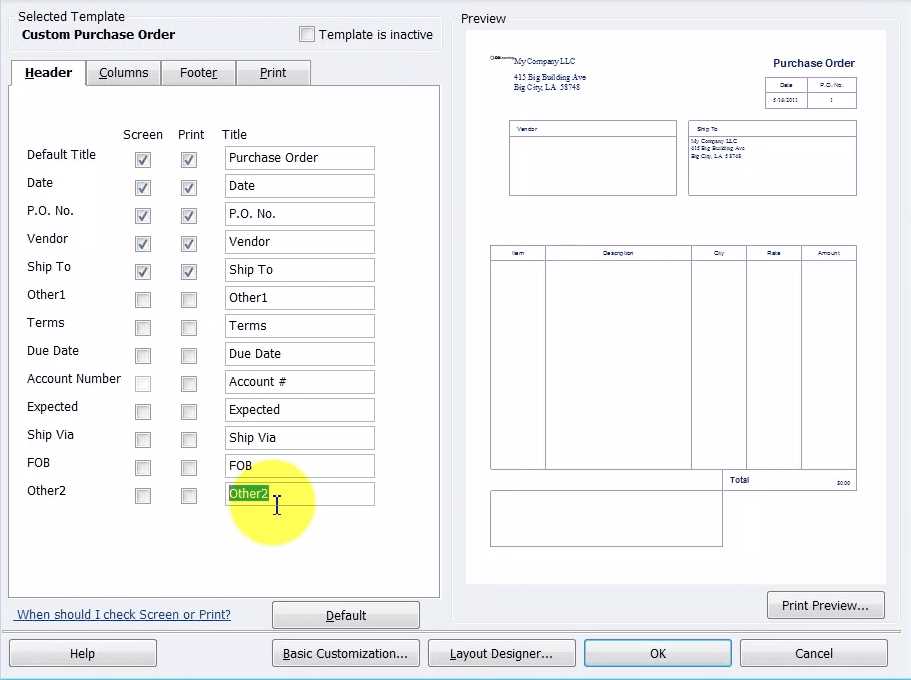

Including Relevant Information

Next, ensure that the necessary fields are present in your records. This includes adding customizable options for discounts, taxes, and additional charges. You can also incorporate fields for tracking payment status or due dates, which will help keep your financial tracking organized. Personalizing each element ensures you have all the details you need without overwhelming the document.

By making these adjustments, you create a billing system that works efficiently and reflects your company’s unique identity. Customization not only improves functionality but also fosters stronger client relationships through tailored, professional interactions.

Top Features of Quickbooks Invoices

Billing systems come with a variety of features designed to streamline financial operations and enhance accuracy. The most effective solutions offer a range of tools that help businesses generate professional documents quickly, track payments, and manage client information. These features not only improve efficiency but also make financial management more transparent and error-free.

Key Features to Look For

- Customizable Layouts: Tailor the design of your documents to match your brand, ensuring consistency and professionalism.

- Automatic Calculations: Automatically calculate totals, taxes, and discounts to avoid manual errors.

- Recurring Billing: Set up automated recurring charges for clients with subscription-based services.

- Payment Tracking: Easily track paid and unpaid bills, helping you stay on top of accounts receivable.

- Multi-Currency Support: Generate documents in different currencies, making it easier to work with international clients.

Additional Benefits

- Digital Delivery: Send records electronically via email to clients, reducing paper usage and speeding up communication.

- Client Management: Keep detailed client records, including billing history and payment preferences, in one place.

- Mobile Access: Create and manage financial documents on-the-go, ensuring flexibility and convenience for business owners.

These features not only save time but also improve the accuracy and consistency of your financial records. By integrating these tools into your workflow, you can ensure smoother operations and a more professional client experience.

Setting Up Your Quickbooks Account

Setting up an account in a financial management system is the first step to organizing your business’s billing and accounting processes. By properly configuring your account, you can ensure that all financial documents are generated accurately and that payment tracking is seamless. Whether you’re just starting out or looking to optimize your current setup, it’s important to follow a few simple steps to get everything up and running smoothly.

The first stage in setup involves entering your basic business information, such as company name, address, and tax details. This information will be used to populate various fields across all documents you create, ensuring consistency. Once this is done, you can proceed to customize additional settings according to your business needs. Setting up payment methods and integrating your bank accounts allows you to automate transactions and streamline financial reporting.

Next, you can configure billing preferences such as payment terms, discount options, and tax rates. These settings are crucial for generating accurate and professional financial documents. Additionally, syncing your client list with the system ensures that invoices are sent to the correct recipients without error, while tracking payments becomes a more straightforward process.

Once the initial setup is complete, you will be able to easily generate and manage all your financial records, allowing you to focus on other aspects of running your business.

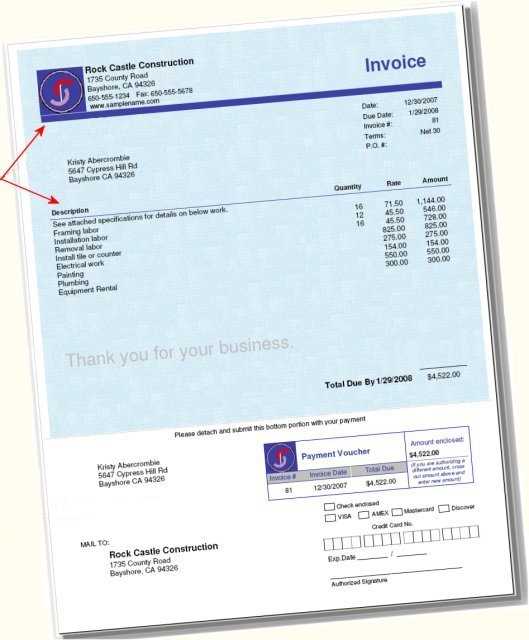

Understanding Invoice Layout Options

Choosing the right structure for your billing documents is essential for both clarity and professionalism. A well-organized layout ensures that all necessary details are presented in a clear and easy-to-read format, helping clients understand the charges and terms with minimal effort. Depending on your business needs, there are various layout options that can be customized to suit your brand and make the financial information more accessible.

One key consideration when selecting a layout is the placement of essential fields such as client details, service descriptions, and payment terms. Organizing these sections in a logical order helps improve readability. For example, positioning the most important information, like the due date and total amount due, at the top of the document ensures that clients can quickly locate critical details.

In addition to the basic layout, you can also adjust elements such as font style, color scheme, and the overall design theme. These customization options allow you to maintain brand consistency and create a more personalized experience for your clients. For instance, incorporating your company logo or using your brand colors can enhance your document’s professionalism while reinforcing your brand identity.

Overall, understanding and selecting the right layout for your business’s financial documents can lead to better communication with clients, faster payments, and a more polished presentation of your services.

Improving Billing Accuracy with Templates

Maintaining accuracy in billing is crucial for any business, as errors can lead to misunderstandings with clients and delays in payments. Using automated systems for generating financial documents is an effective way to eliminate common mistakes associated with manual entry. These tools not only streamline the process but also ensure that calculations are consistent and reliable every time.

One of the primary advantages of using automated billing systems is the reduction of human error. With built-in calculations for taxes, discounts, and totals, these systems ensure that every figure is accurate. Automatic updates also help prevent outdated information from appearing on documents, ensuring that all details reflect the most current rates and charges.

Another significant benefit is the ability to save predefined settings, such as payment terms and item descriptions. By doing so, you can avoid re-entering the same information multiple times. This not only speeds up the process but also reduces the likelihood of mistakes due to oversight. Consistency in document creation leads to more reliable financial records and a smoother transaction process overall.

By integrating these automated solutions into your workflow, you can improve billing accuracy, enhance client trust, and reduce administrative errors, all of which contribute to a more efficient and professional business operation.

Integrating Payments with Quickbooks Invoices

Streamlining payment processing is a critical component of any financial management system. By integrating payment options directly into your billing documents, you can simplify the transaction process for both you and your clients. This integration not only speeds up payment collection but also reduces the chances of errors or delays in processing payments.

Benefits of Payment Integration

- Faster Payments: Enabling clients to pay directly from the document speeds up the payment cycle, reducing the time spent waiting for checks or manual transfers.

- Reduced Errors: Automatic payment recording eliminates the need for manual data entry, minimizing mistakes in payment tracking and accounting.

- Convenience for Clients: Offering multiple payment methods, such as credit cards, bank transfers, or online payment portals, increases client satisfaction by making the payment process more flexible.

- Real-Time Updates: Payments can be automatically logged and reflected in your system, allowing you to track outstanding balances and reconcile accounts instantly.

How to Set Up Payment Integration

- Choose a Payment Processor: Select a payment processor that integrates seamlessly with your financial system, ensuring secure and efficient transactions.

- Configure Payment Options: Set up preferred payment methods, including online payment links or integrated gateways, to be included in your documents.

- Test the System: Before going live, test the payment integration to ensure transactions are processed correctly and that clients receive confirmation emails or receipts.

By adding payment functionality directly to your financial documents, you create a more seamless experience for both your business and clients. This integration not only speeds up cash flow but also enhances overall operational efficiency.

Saving Time on Invoice Creation

Efficiency is key when it comes to generating financial documents. Manual creation of billing records can be time-consuming and prone to errors. By adopting automated tools that streamline this process, businesses can save valuable time and focus on more critical tasks. These tools allow for quicker document generation, reducing the administrative burden while maintaining accuracy.

Automation Features That Save Time

- Pre-filled Client Information: Automatically populating client details from your database reduces the time spent on repetitive data entry.

- Recurring Billing Setup: Automatically create and send documents at regular intervals without needing to manually repeat the process for each billing cycle.

- Bulk Document Creation: Generate multiple financial records at once, saving time on creating documents for various clients or transactions.

- Integrated Payment Tracking: Automatically track and update payment statuses, reducing the need to manually check and enter payment information.

How Automation Reduces Administrative Time

| Task | Time Savings |

|---|---|

| Manual Data Entry | Eliminates repetitive data input by auto-filling client and service information. |

| Repetitive Bill Generation | Automates recurring billing, saving time on monthly or subscription-based charges. |

| Payment Updates | Automates payment tracking and reconciliation, reducing manual effort. |

By utilizing automation features, businesses can reduce the time spent on each financial document. This not only leads to a more efficient workflow but also enables businesses to dedicate more resources to growth and client relationships.

How to Manage Client Information Effectively

Managing client information efficiently is a critical part of maintaining smooth business operations. Having a centralized system where client details, billing preferences, and transaction history are organized can greatly improve both communication and overall service. By keeping accurate and up-to-date records, businesses can avoid errors, reduce time spent searching for information, and ensure a more personalized client experience.

To manage client data effectively, it’s essential to implement an organized database or system that allows easy access to important details. This includes personal contact information, payment history, and past interactions. By maintaining all relevant data in one place, businesses can quickly address client inquiries, track outstanding payments, and stay on top of important deadlines.

Best Practices for Managing Client Information

- Centralized Storage: Use a digital platform or software to store all client information, ensuring quick and easy access when needed.

- Regular Updates: Periodically review and update client details to ensure accuracy, such as new addresses, payment methods, or changes in contact information.

- Track Client Preferences: Record specific client preferences, such as preferred billing cycles, communication methods, or discount eligibility, to offer a more personalized service.

- Payment History: Keep detailed records of payments made, outstanding balances, and any special terms for each client to prevent confusion and missed payments.

Benefits of Effective Client Information Management

- Improved Communication: With easy access to relevant information, businesses can respond to client inquiries promptly and professionally.

- Better Client Relationships: By tracking preferences and history, businesses can offer more tailored services and show clients they are valued.

- Increased Efficiency: A well-organized system reduces the time spent searching for information, allowing for faster and more accurate service.

By organizing and maintaining client details effectively, businesses can enhance their workflow, reduce errors, and provide a more seamless experience for their customers, ultimately leading to stronger relationships and improved retention.

Tracking Sales and Payments in Quickbooks

Efficiently managing sales and payments is key to maintaining healthy cash flow and ensuring business success. Keeping track of transactions allows businesses to monitor incoming revenue, verify payments, and spot any discrepancies quickly. With the right tools, you can automate the tracking process, making it easier to stay organized and up-to-date on outstanding balances.

The first step in tracking sales and payments is setting up a system that categorizes all incoming transactions. This includes setting clear payment terms, entering accurate amounts, and regularly updating payment statuses. By implementing an automated system for sales tracking, businesses can ensure that every transaction is accounted for and that records remain accurate without manual intervention.

Methods for Tracking Sales

- Automatic Sales Entries: Automatically record every sale when a transaction is completed. This eliminates the need for manual data entry and ensures all sales are logged immediately.

- Sales Reporting: Generate detailed sales reports that show total revenue, itemized sales, and sales trends over a specified period. These reports help identify patterns and improve decision-making.

- Tracking Discounts and Taxes: Ensure that any applicable discounts or taxes are automatically applied to sales, avoiding errors that could affect the final amount owed by clients.

Managing Payments Effectively

- Real-Time Payment Updates: Automatically update payment statuses as soon as a payment is made, helping you keep track of who has paid and who still has an outstanding balance.

- Payment Reminders: Set up automatic reminders for clients with overdue payments, reducing the need for manual follow-ups and speeding up payment collection.

- Multiple Payment Methods: Accept various payment options such as credit card, bank transfer, and online payment gateways, allowing clients to pay easily and on time.

By implementing these strategies and tools for sales and payment tracking, businesses can improve cash flow management, reduce errors, and streamline their financial processes, ensuring timely payments and fewer administrative tasks.

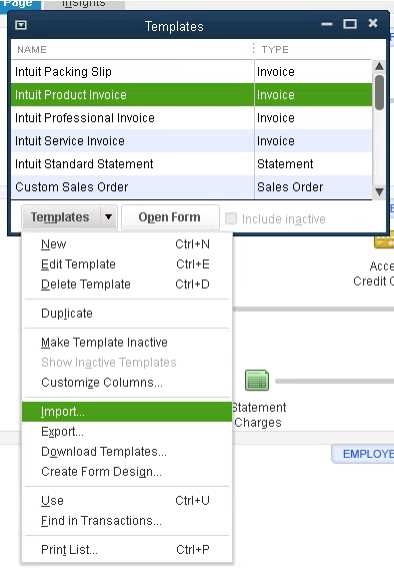

Exporting and Sharing Your Invoices

Efficiently sharing and exporting your billing documents is essential for smooth communication with clients and seamless business operations. Whether you need to send a document directly to a client or store it for future reference, having the right tools to export and share these records ensures both accuracy and convenience. This process can be streamlined through various file formats and sharing options that provide easy access and compatibility across different platforms.

One of the most common ways to export billing records is by saving them in widely accepted formats like PDF or Excel. These formats ensure that your documents maintain their layout and can be opened on almost any device or operating system. Once exported, the document can be easily shared with clients via email, uploaded to a cloud storage service, or even printed for physical distribution. By automating the export process, businesses can save time and reduce the risk of sending incorrect or outdated records.

Export Options for Billing Documents

- PDF Format: A widely used format that preserves the document’s appearance and can be easily shared via email or printed.

- Excel/CSV Format: Ideal for businesses that need to track detailed information or analyze data with advanced tools like spreadsheets.

- Direct Email Integration: Send the document directly from the system to the client’s email, ensuring quick and easy communication.

Sharing Documents Securely

- Cloud Storage: Upload documents to a secure cloud storage service for easy sharing and access by authorized parties.

- Password Protection: Protect sensitive billing information by password-protecting exported files before sharing.

- Link Sharing: Share a secure link to the document hosted on a cloud platform, allowing clients to access the file without the need for email attachments.

By integrating these export and sharing options, businesses can ensure that their billing documents are easily accessible, secure, and ready for quick distribution. This not only speeds up communication but also reduces administrative effort, making it easier to manage client transactions and maintain accurate records.

Common Mistakes to Avoid in Quickbooks

When managing your business’s financial records, it’s easy to make mistakes that can lead to inaccurate reports, payment delays, or even legal issues. Understanding common pitfalls and taking steps to avoid them can save you time, money, and stress. By being aware of potential errors, you can ensure that your financial documents are accurate and compliant, giving you a clearer picture of your business’s financial health.

These mistakes often occur due to rushed entries, misunderstandings of the software, or simple oversight. Whether it’s incorrect data entry, failing to reconcile accounts, or misclassifying expenses, each error can have a significant impact on your accounting processes. To help you navigate the complexities, here are some of the most common mistakes that businesses make when using financial management software.

Top Mistakes to Avoid

- Incorrect Data Entry: Entering incorrect amounts or misplacing decimal points can lead to errors in financial records. Always double-check data for accuracy before saving or submitting any information.

- Failing to Reconcile Accounts: Neglecting to regularly reconcile bank accounts with your software can result in discrepancies that make it difficult to track expenses or profits correctly.

- Misclassifying Transactions: Categorizing business expenses incorrectly can distort your financial reports, leading to inaccurate tax filings or improper financial analysis.

- Not Using Automation Features: Manually entering repetitive transactions is time-consuming and prone to error. Automating recurring transactions, like subscriptions and bill payments, can save time and reduce the risk of mistakes.

- Overlooking Backup and Data Security: Failing to back up financial data regularly or neglecting security protocols can put your business at risk in case of system failure or unauthorized access.

How to Avoid These Mistakes

- Regular Reviews: Set aside time each week or month to review your financial data for accuracy and ensure that everything is up to date.

- Use Built-in Features: Take advantage of the system’s automation and reconciliation features to streamline processes and avoid manual entry errors.

- Double-Check Categories: Ensure that every expense and income is correctly categorized according to your business’s chart of accounts.

- Back-Up Your Data: Implement a regular backup system to protect against data loss and ensure that your records are safe and recoverable.

By being mindful of these common mistakes and implementing best practices, you can ensure that your financial records remain accurate and organized, making your business operations run more smoothly.

How to Adjust Invoice Tax Rates

Adjusting tax rates on billing documents is essential for businesses operating in areas with varying tax laws or changing rates. Accurate tax calculations ensure that your business remains compliant and that clients are charged the correct amount. The ability to easily modify tax rates in your system will help streamline billing and prevent errors that could lead to overcharging or undercharging.

When managing tax rates, it’s important to keep track of any updates in tax laws or regional tax rates that could impact your business. Whether you’re dealing with local, state, or international taxes, having the right settings in place will allow for smooth and accurate calculations for every transaction.

Steps to Adjust Tax Rates

- Access Tax Settings: Navigate to your financial software’s tax settings or configuration page to make adjustments. This is typically found under the “Accounting” or “Settings” section.

- Update Tax Rate Information: If tax rates have changed in your region or for specific products, input the new tax rate percentage. Be sure to include any new tax codes if applicable.

- Apply Tax to Relevant Products: Ensure that the updated tax rate is applied to the correct items or services in your product catalog. Some items may be exempt or taxed at a different rate.

- Enable Automatic Updates: If your software supports it, enable automatic updates for tax rates so that changes are applied without requiring manual adjustments in the future.

Why Accurate Tax Settings Matter

- Compliance: Correct tax calculations help ensure that your business remains compliant with local, state, and national tax laws, avoiding potential fines or legal issues.

- Client Trust: Accurate billing fosters trust with your clients, as they can be confident that they are being charged fairly and in accordance with applicable tax rates.

- Financial Accuracy: Properly adjusting and applying tax rates ensures that your financial statements and reports reflect accurate data, helping with forecasting, budgeting, and audits.

By regularly reviewing and adjusting your tax rates as needed, you can ensure that your business runs smoothly and your clients are billed correctly, avoiding mistakes that could harm your reputation or finances.

Using Quickbooks for Recurring Invoices

For businesses that offer subscription-based services or have regular clients, automating repetitive billing tasks can save time and reduce human error. Setting up recurring billing allows you to generate consistent, accurate charges without having to manually create new documents each cycle. By automating the process, you ensure that both you and your clients are always on the same page when it comes to payments.

Recurring billing systems are designed to streamline the process of charging clients on a set schedule, whether it’s weekly, monthly, or annually. This automation not only helps businesses maintain consistent cash flow but also ensures that invoices are sent on time, reducing the risk of overdue payments. By establishing clear terms and schedules, businesses can focus on growth while managing the billing process with minimal effort.

How to Set Up Recurring Billing

- Identify Recurring Clients: Start by identifying which of your clients will benefit from recurring billing based on the frequency of their purchases or subscription services.

- Set Up Billing Schedule: Choose the frequency (weekly, monthly, etc.) and define the start date for each billing cycle. This ensures that payments are sent at the correct intervals.

- Input Payment Details: Ensure that the client’s payment details (credit card, bank account, etc.) are stored securely in your system, allowing for automated payment processing.

- Automate Notifications: Set up automatic reminders to notify both you and the client before the next payment is due. This helps ensure that both parties are prepared for the transaction.

Benefits of Recurring Billing Automation

- Time Savings: Automating billing reduces the time spent on manual data entry and repetitive tasks, allowing you to focus on other aspects of your business.

- Consistent Cash Flow: With recurring payments, businesses enjoy a predictable income stream, improving financial stability and planning.

- Improved Client Relationships: Clients appreciate the convenience of automated billing, which can be set up to fit their schedules and preferences.

- Reduced Errors: Automating the process minimizes the risk of manual mistakes, ensuring accuracy and reducing disputes over billing amounts.

By integrating recurring billing into your system, you can simplify your financial management, improve efficiency, and foster stronger relationships with clients, all while ensuring that payments are processed promptly and accurately.

Ensuring Compliance with Invoice Standards

Maintaining compliance with legal and industry standards for billing documents is crucial for businesses of all sizes. Adhering to these standards not only ensures that you meet regulatory requirements but also builds trust with clients and protects your business from potential legal issues. Whether it’s meeting tax requirements, following data protection laws, or using the correct formatting, having a clear understanding of the standards will streamline your operations and reduce the risk of costly mistakes.

Each country or region may have specific rules about the information that must be included in billing documents, such as tax rates, payment terms, and business registration details. Furthermore, staying up-to-date with changes in the law is necessary to avoid discrepancies. Setting up processes to ensure that your documents align with all relevant rules will make compliance easier to maintain, preventing problems down the road.

Key Elements for Compliance

- Legal Information: Ensure that your business name, address, registration number, and tax identification number are included in every billing document, as required by local regulations.

- Clear Payment Terms: Define payment terms clearly, including due dates, late fees, and accepted payment methods. This helps avoid confusion and ensures that both parties understand the expectations.

- Accurate Tax Information: Include the correct tax rates and tax identification numbers, and ensure that they comply with the local and international tax laws governing your business.

- Itemized Charges: Break down each charge in detail so that clients know exactly what they are paying for. This transparency can help avoid disputes and improve client trust.

Tips for Maintaining Compliance

- Regular Updates: Stay informed about changes in tax laws and billing regulations to ensure that your documents remain compliant with new standards.

- Use Automated Tools: Consider using automated billing software that can help apply the correct tax rates, generate standardized documents, and ensure that all required information is included.

- Consult Legal Experts: If you’re unsure about specific compliance requirements, consider consulting with a legal or tax expert to ensure that your documents meet the necessary standards.

By ensuring that your billing documents comply with legal and industry standards, you safeguard your business from legal challenges, build stronger relationships with your clients, and maintain smooth financial operations. Consistent attention to compliance can also enhance your business’s reputation and credibility within your industry.

Invoice Template for Multiple Currencies

When conducting business internationally, it’s crucial to ensure that your billing documents can accommodate multiple currencies. Being able to issue invoices in different currencies not only makes transactions easier for clients but also helps businesses manage cross-border financial operations more efficiently. A multi-currency invoicing system allows businesses to seamlessly charge customers according to their local currency, which is especially important for companies with a global client base.

Managing multiple currencies within your billing system requires the flexibility to convert prices and display them correctly according to each client’s location. A robust solution will ensure that the right exchange rates are applied and that the final amounts are clear and accurate. This not only helps with customer relations but also aids in simplifying accounting, tax calculations, and financial reporting.

How to Set Up Multi-Currency Billing

- Select Supported Currencies: Choose the currencies you wish to use, based on your customer base or the countries in which you operate. Most financial software allows you to set up multiple currencies and switch between them easily.

- Set Exchange Rates: Make sure that your system is updated with the current exchange rates. Some platforms offer real-time exchange rate feeds, while others may require manual input.

- Customize Each Transaction: For each customer or sale, select the appropriate currency. Your software should allow you to set the currency for individual invoices, depending on the client’s location.

- Automate Currency Conversion: Many invoicing systems have an option to automatically convert prices to the selected currency based on real-time rates, saving you time and ensuring accuracy.

Benefits of Using Multiple Currencies

- Better Client Communication: Providing invoices in your clients’ native currencies helps avoid confusion and makes payment processing smoother.

- Accurate Financial Reporting: With multi-currency billing, you can generate more accurate financial statements and better track your business’s performance in different markets.

- Streamlined Operations:Tips for Streamlining Your Billing Process

Efficient billing is a critical aspect of any business. A smooth, organized billing process helps reduce administrative overhead, accelerates cash flow, and improves customer satisfaction. By adopting the right strategies and tools, you can simplify and automate many aspects of your billing cycle, making it faster and less prone to errors. Streamlining your billing process not only saves time but also ensures that your business runs more efficiently.

Optimizing the way you handle transactions, client communications, and payments can help eliminate redundancies and reduce the potential for mistakes. Whether you are invoicing regularly or working with occasional clients, having a clear and efficient system in place will keep everything running smoothly, allowing you to focus more on growing your business.

Key Strategies to Streamline Billing

- Automate Repetitive Tasks: Use software that allows for recurring billing and automatic invoice generation. Set up automatic payment reminders and late fee notifications to reduce the need for manual follow-ups.

- Standardize Documents: Create a consistent format for your billing documents. This helps clients recognize and understand your charges quickly, reducing confusion and disputes.

- Leverage Online Payment Systems: Offer clients the ability to pay online. Integrating payment gateways into your billing process makes it easier for clients to pay and speeds up the payment cycle.

- Centralize Client Information: Keep all customer information, payment history, and billing preferences in one system. This reduces the time spent searching for details and improves accuracy.

- Use Batch Processing: If you have many invoices to issue, batch processing tools can help you generate multiple billing documents at once, saving you time and reducing the risk of mistakes.

Additional Tips for Efficiency

- Clear Payment Terms: Always specify your payment terms clearly in your agreements and billing documents. This ensures clients understand when payments are due and the methods of payment accepted.

- Track Payment Status: Keep track of whether invoices have been paid, are overdue, or are in dispute. Implementing a system to monitor payments will help you stay on top of your financial health and avoid missing any outstanding amounts.

- Regularly Review Billing Processes: Periodically assess and improve your billing workflow to ensure it’s as efficient as possible. Look for areas where automation or simplification can help reduce time and effort.

By following these strategies, you can create a more efficient and effective billing process. Streamlining this essential part of your business will not only reduce costs but also improve client relationships and cash flow, which are vital to the long-term success of your company.