QuickBooks Blank Invoice Template for Easy Customization and Use

Running a business means dealing with numerous administrative tasks, and one of the most essential is ensuring proper documentation for financial transactions. Having an efficient and professional way to present your charges can significantly reduce errors and improve client relations. By using customizable documents, you can simplify the billing process and make sure everything is organized and consistent.

Creating personalized forms to suit your unique business needs offers flexibility and convenience. Whether you need to add company logos, adjust fields, or adapt the layout, these adaptable documents make it easy to manage financial records. The right tool can save time and reduce the stress of manual calculations, giving you more time to focus on your business operations.

In this article, we will explore how you can use these customizable documents to improve your billing system–from designing a simple structure to integrating key information for clarity and accuracy. We’ll guide you through all the steps necessary to create a well-organized record that not only meets legal requirements but also enhances your professional image.

QuickBooks Blank Invoice Template Overview

In any business, managing financial transactions efficiently is crucial. Having a customizable document to issue bills or payment requests allows for greater organization and professionalism. These ready-to-use forms can be adapted to suit various business needs, ensuring that every detail is captured accurately and clearly, from client information to pricing and payment terms.

When selecting such a document solution, it is important to consider features like ease of use, flexibility in design, and the ability to integrate with accounting systems. A well-designed form helps businesses save time by eliminating the need for manual entry and reducing the likelihood of errors. It can also contribute to smoother interactions with clients by providing them with clear, professional-looking statements.

In the following sections, we will delve into the benefits and functionalities of these customizable forms, explaining how they can streamline your billing process and improve financial management.

Benefits of Using a Blank Invoice

Having a customizable document for billing offers numerous advantages for businesses of all sizes. The ability to tailor each record ensures that you can include exactly what you need for every transaction, from specific service descriptions to payment terms. This flexibility helps businesses maintain accuracy and consistency across all financial interactions.

One key benefit is the time saved in creating professional-looking documents quickly. With a pre-designed structure, you can focus on entering the relevant information without needing to start from scratch each time. Additionally, these adaptable records ensure compliance with legal requirements, ensuring you don’t miss important details like tax rates or payment due dates.

Another advantage is the enhanced branding and professionalism that comes with using a customized form. Incorporating your company’s logo and choosing a layout that reflects your brand identity can create a lasting impression on clients, reinforcing your company’s credibility and reliability in the eyes of your customers.

How to Download a QuickBooks Template

Obtaining a ready-to-use form for billing purposes is simple and straightforward. These documents can be accessed through various platforms, with options available both for free and as part of a paid service. By following a few basic steps, you can download a customizable version that fits your business needs and start using it immediately to generate professional records.

The process typically involves visiting the provider’s website or accessing a designated section within your accounting software. After locating the right document, you can choose the format that suits your workflow, whether it’s for printing or digital use. Below is an outline of the general steps involved in downloading a suitable document:

| Step | Description |

|---|---|

| 1. Visit the Website | Go to the official site or software interface where the document is offered. |

| 2. Select Your Preferred Format | Choose between options like PDF, Excel, or Word based on your needs. |

| 3. Download the Document | Click the download button to save the form to your computer or cloud storage. |

| 4. Customize Your Document | Edit the form to include your business details and other relevant information. |

After downloading, the form can be easily modified with the specific data you require, and then saved for future use or printed as needed.

Customizing Your QuickBooks Invoice

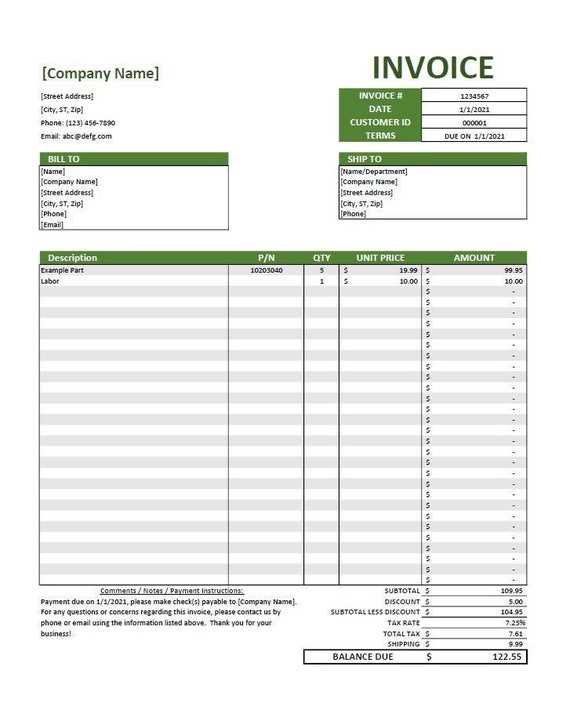

Personalizing your billing documents allows you to align them with your business identity and specific transaction needs. The flexibility to add, remove, or adjust sections ensures that each statement is relevant and tailored to your workflow. Whether you are incorporating branding elements or adjusting the structure to fit your service offerings, a customized form can help make a lasting impression on your clients.

One of the main advantages of customizing such documents is the ability to incorporate your company’s logo, colors, and contact information, which enhances the professional appearance of each bill. This not only makes the document look cohesive with other company materials but also improves your business’s visibility and recognition.

Another important customization feature is adjusting the layout and fields to suit the specific services or products you offer. You can add additional information like discounts, payment terms, or a breakdown of charges. Customizing these details allows you to maintain clear communication with clients and avoid any confusion regarding the amounts owed or services rendered.

Best Practices for Invoice Creation

Creating well-structured billing records is essential for maintaining clarity and professionalism in your business transactions. Following best practices ensures that your documents are not only accurate but also easily understood by clients. Clear communication through well-designed forms can help avoid disputes and streamline payment processes.

Here are some key guidelines to follow when preparing your billing statements:

- Include All Relevant Information: Make sure to list all necessary details such as client names, addresses, payment terms, and a breakdown of services or products provided.

- Use a Clear and Simple Layout: Avoid clutter by organizing the document in a way that is easy to read and navigate. Group similar items together and use bold or italic text for emphasis.

- Provide Clear Payment Instructions: Include specific instructions on how to make payments, including your bank details or online payment links if applicable.

- Be Consistent: Maintain a consistent format for all your documents to help clients recognize and understand your records more easily.

- Double-Check for Errors: Always review your billing forms before sending them to clients. Small mistakes can cause confusion or delays in payment.

By adhering to these best practices, you can ensure your records are clear, professional, and effective in facilitating smooth financial transactions.

Using QuickBooks for Accurate Billing

Effective billing systems are crucial for maintaining financial accuracy and consistency in any business. With the right software, businesses can ensure that every transaction is captured correctly and promptly, reducing errors and enhancing productivity. A reliable tool helps track payments, manage accounts, and automate calculations, making the billing process more efficient.

Streamlining Data Entry

Automation plays a key role in reducing human error. By using a professional accounting solution, you can automate many aspects of the billing process, from adding tax rates to calculating totals. This significantly reduces the risk of mistakes, ensuring that each record is correct and that clients are charged appropriately.

Tracking and Reporting

Another advantage of using accounting software is the ability to generate detailed reports. By tracking all transactions in one place, you can quickly access financial summaries, outstanding payments, and payment history. This transparency helps you stay on top of your finances and quickly identify any discrepancies or overdue amounts.

With an integrated solution, the accuracy of your records improves significantly, allowing you to maintain a professional and organized billing process that clients will trust.

Common Mistakes to Avoid in Invoices

Even the smallest mistake in a billing document can lead to confusion or delayed payments. It’s important to carefully review each record to ensure that all details are accurate and clear. By avoiding common errors, businesses can maintain professionalism and ensure smooth financial transactions.

One of the most frequent mistakes is failing to include essential details like the client’s contact information, payment terms, or a clear description of the services provided. Missing these details can lead to confusion about the charges, causing delays in payment. Always ensure that every section is filled out completely and clearly.

Another common error is incorrect or missing pricing information. Whether it’s a miscalculation or an outdated price, discrepancies in cost can create disputes and hinder timely payments. Double-check all amounts, tax rates, and discounts to confirm that they align with your agreement with the client.

Finally, some businesses forget to include the correct payment instructions, such as bank account details or payment methods. Without these, clients may struggle to make payments, leading to frustration and delays. Always provide clear and specific payment instructions to facilitate the process.

How to Save Time with Templates

Using pre-designed documents for financial records can greatly reduce the amount of time spent on administrative tasks. Instead of creating a new form from scratch every time you need to bill a client, customizable solutions allow you to reuse and adjust existing layouts. This helps streamline the process, making it faster and more efficient.

By relying on a reusable structure, you can focus on entering the specific details for each transaction, rather than worrying about formatting or organizing the layout. This saves valuable time that can be used for other important aspects of your business. Here’s how templates can help you work faster:

| Step | Benefit |

|---|---|

| 1. Predefined Layout | Save time by using an existing structure, avoiding the need to manually arrange sections every time. |

| 2. Automatic Calculations | Quickly calculate totals, taxes, and discounts with built-in formulas, reducing errors and eliminating manual math. |

| 3. Consistency | Ensure uniformity across all documents, making it easier to manage and maintain a professional appearance. |

| 4. Quick Updates | Easily modify sections like prices, services, or client details without altering the overall format. |

By incorporating these ready-made solutions into your workflow, you can enhance productivity and reduce the time spent on repetitive administrative tasks.

Formatting Your QuickBooks Invoice

Proper formatting of your billing documents is essential for clarity and professionalism. A well-structured layout not only makes it easier for clients to read and understand the charges but also ensures that all necessary details are included. Clear, consistent formatting can help avoid confusion and speed up the payment process.

Key Elements of Proper Formatting

When designing your billing documents, there are several key components to keep in mind to ensure that your forms are easy to navigate:

- Header Information: Always include your company name, logo, contact details, and the document title at the top.

- Client Details: Clearly list the client’s name, address, and other relevant contact information to ensure proper identification.

- Clear Itemization: Break down the services or products provided in a clear, easy-to-read list with corresponding prices and quantities.

- Payment Terms: Include due dates, accepted payment methods, and any applicable late fees or discounts for early payment.

Best Practices for Layout

In addition to the basic components, here are some layout tips to further enhance your document’s readability:

- Use Consistent Fonts: Stick to simple, easy-to-read fonts like Arial or Times New Roman. Avoid using too many font styles or sizes.

- Keep it Organized: Use borders or lines to separate sections (e.g., contact information, itemized list) for better organization.

- Highlight Important Details: Use bold text for key pieces of information such as the

Incorporating Your Business Branding

Adding your company’s unique branding to billing documents is an effective way to enhance your business’s professional image and reinforce brand recognition. A cohesive design that reflects your brand’s identity not only makes your documents look more polished but also creates a consistent experience for your clients. Customizing your forms with your logo, color scheme, and typography can make a significant impact on how your business is perceived.

Key Elements to Brand Your Document

To ensure that your documents are aligned with your company’s identity, consider incorporating the following elements:

- Logo: Include your business logo at the top of the document for immediate brand recognition.

- Color Scheme: Use your brand colors throughout the form for a consistent visual identity, whether in the header, footer, or borders.

- Typography: Use the fonts and styles associated with your brand to maintain consistency across all communications.

Creating a Professional Appearance

By aligning your documents with your brand, you not only make them more recognizable but also show your clients that you take professionalism seriously. A well-branded billing document can help build trust and contribute to a positive customer experience. Consistency in design across all business materials, including invoices and financial records, creates a seamless and reliable impression of your company.

Tracking Payments with QuickBooks

Efficiently managing and tracking payments is critical for maintaining healthy cash flow in any business. By using specialized software, you can easily record received payments, track outstanding balances, and monitor the financial status of each client. Having a clear and organized system for payment tracking not only helps ensure you get paid on time but also provides insights into your business’s financial health.

One of the key benefits of using accounting software is the ability to automatically update payment records as transactions occur. This reduces the need for manual entry, decreases errors, and keeps your financial records accurate. Once a payment is made, it can be immediately reflected in your system, helping you stay on top of what is owed and what has been paid.

Another valuable feature is the ability to generate reports that provide a clear picture of your business’s income and outstanding balances. These reports help you identify overdue payments, track trends in customer payment behavior, and make informed decisions about follow-up actions or adjustments to payment terms.

By utilizing these tools, you can streamline your payment process, reduce administrative workload, and maintain a more organized financial system.

Integrating QuickBooks with Other Tools

In today’s fast-paced business environment, integrating accounting software with other tools can greatly enhance efficiency and streamline operations. By connecting your billing system with other applications, you can automate processes, reduce manual input, and gain a more comprehensive view of your financial data. This integration can help you save time, improve accuracy, and make more informed decisions.

Benefits of Integration

When you connect your accounting platform with other software, several advantages come into play:

- Automation: Automatic synchronization between systems reduces the need for double data entry, minimizing errors and saving time.

- Real-Time Updates: Integrated tools allow for instant updates, ensuring that all data is current and reflects recent transactions or changes.

- Centralized Data: With all your systems connected, you can manage everything from one central location, giving you more control and oversight.

- Improved Reporting: Integration allows you to pull data from multiple sources, providing richer, more detailed financial insights.

Popular Tools to Integrate

There are several popular tools and software that can be integrated with your accounting system to improve various aspects of business management:

- CRM Software: Integrate with customer relationship management tools to streamline communication and track client billing histories.

- Payment Processors: Sync with payment platforms such as PayPal or Stripe to automatically record transactions and reduce manual entry.

- Inventory Management: Integrate with inventory tracking systems to automatically update stock levels and reflect product sales in your financial records.

- Time Tracking Tools: Sync time-tracking apps with your system for seamless payroll processing and accurate billing for services rendered.

Integrating these tools with your accounting software not only saves time but also ensures that your financial and business data are aligned and up-to-date across all platforms.

QuickBooks vs Other Invoice Solutions

When it comes to managing billing and financial records, there are many software options available, each with its own set of features and benefits. Choosing the right solution for your business depends on factors such as your specific needs, budget, and the size of your operations. Understanding how different tools compare can help you make an informed decision on which solution works best for your company.

Key Differences Between Solutions

While there are many tools designed to manage billing and finances, here are a few key factors to consider when comparing options:

- Ease of Use: Some platforms offer user-friendly interfaces with minimal learning curves, while others may require more time to master but provide advanced features.

- Customization: Different tools offer varying levels of customization. Some platforms allow you to fully personalize documents, while others provide more basic options with pre-built templates.

- Automation Features: Some systems excel in automating tasks such as sending reminders, generating reports, or calculating taxes, while others might require more manual input.

- Pricing: Cost structures differ significantly. Some software has a subscription model, while others may have a one-time fee. It’s important to evaluate the overall value for the price.

Comparison of Popular Solutions

Here’s a quick comparison of a few popular options in the market:

- Cloud-based Solutions: Many modern tools offer cloud-based billing systems, allowing for easy access from any device and automatic updates. This is especially useful for businesses with remote teams or multiple users.

- Standalone Software: Some options provide more focused features for billing, with limited integration with other business functions like accounting or payroll.

- Free Tools: There are also free solutions available that offer basic functionality, but they may have limitations in terms of customization and reporting features.

Ultimately, the best choice depends on your business’s specific needs. Evaluate how each system fits into your workflow, its ease of use, and the types of integrations and automation it offers to streamline your processes and improve accuracy.

Ensuring Legal Compliance with Invoices

In business, maintaining compliance with local and international regulations is essential for avoiding legal issues and protecting your company’s reputation. Billing documents must adhere to specific legal standards to ensure that both your business and clients are operating within the law. This includes having the right details on your forms, as well as following tax and reporting requirements based on the jurisdiction in which you operate.

Key Legal Requirements for Billing Documents

To ensure your records meet legal standards, it’s important to include the following key details on all documents related to financial transactions:

- Business Information: Include your business name, address, and registration number. This helps identify your company in case of a legal dispute.

- Client Details: Clearly state the client’s name and address to avoid any ambiguity in the transaction.

- Tax Information: For tax compliance, include relevant tax identification numbers, sales tax, VAT, or other applicable taxes based on your country’s requirements.

- Transaction Dates: Ensure that the date of issue and payment due date are clearly indicated to comply with local payment regulations.

- Itemized Charges: A clear breakdown of the services or products provided is often required for legal transparency, particularly in case of audits.

- Payment Terms: Clearly outline the payment methods, deadlines, and any penalties for late payment, as these are often required by law.

How to Stay Compliant

To avoid potential legal issues, consider the following actions:

- Stay Informed: Regularly check the legal requirements in your country or region, as tax and business regulations may change over time.

- Consult a Legal Expert: If unsure about the legal requirements for your billing documents, seek advice from a tax professional or lawyer to ensure full compliance.

- Automate Compliance Checks: Use software solutions that are designed to ensure your documents are compliant with local regulations, including tax calculations and mandatory fields.

By followin

Exporting Invoices from QuickBooks

Exporting financial documents from your accounting system is a crucial feature for businesses that need to share, store, or analyze transaction records. Whether for reporting, tax purposes, or record-keeping, the ability to quickly export your billing data into various formats can save you significant time and effort. This process ensures that your financial information can be transferred seamlessly to other platforms or systems without losing any critical details.

How to Export Financial Records

Exporting your financial records from your accounting software typically involves a few simple steps. Here’s an overview of how to complete this process:

- Select the Document: Choose the specific transaction or set of records you wish to export. This could include a single payment, a series of charges, or all transactions within a particular period.

- Choose Export Format: Most accounting systems offer a variety of formats for exporting, including CSV, PDF, or Excel. Choose the one that best fits your needs.

- Set Filters (Optional): If necessary, apply filters to narrow down the data you want to export. For example, you might select only unpaid transactions or those from a specific customer.

- Complete the Export: Once the necessary fields are selected, confirm the export. The system will generate the file and allow you to download or send it to a specified location.

Benefits of Exporting Your Financial Documents

Exporting your financial records provides several advantages for managing your business’s finances:

- Data Backup: Exported records create an external backup, helping protect against data loss in case of technical failures.

- Seamless Integration: Exported data can be easily integrated into other financial tools or platforms, such as tax preparation software or customer relationship management systems.

- Efficient Reporting: Exporting allows for quicker and more efficient reporting, as you can easily manipulate or analyze the data in spreadsheet programs.

Exporting your financial documents streamlines many aspects of your business operations, ensuring that important records are easy to manage, share, and analyze as needed.

How to Manage Recurring Invoices

For businesses that provide ongoing services or products, handling repetitive billing tasks can become time-consuming and prone to errors. Setting up a system to manage regular payments can streamline this process and ensure that transactions occur smoothly and on time. By automating recurring charges, businesses can reduce administrative workload, maintain a steady cash flow, and avoid delays in payment collection.

Managing recurring transactions involves setting up a process where invoices are automatically generated and sent out at regular intervals, such as weekly, monthly, or annually. This is especially useful for subscription-based businesses or those that work on retainer agreements with clients. Instead of creating each bill manually, the system handles the task, freeing up time for other priorities.

Setting Up Recurring Billing

To properly set up recurring billing, follow these general steps:

- Choose Frequency: Determine the frequency of the billing cycle–daily, weekly, monthly, or yearly. The system should be flexible to accommodate various billing models.

- Define Billing Terms: Clearly specify the amount, services, and any applicable discounts or taxes that will be included in each charge.

- Automate Payment Reminders: Set up automatic reminders to notify customers before each payment is due. This helps reduce missed payments and late fees.

- Payment Collection: Choose how payments will be collected, whether automatically through a payment processor or manually after sending the bill.

Benefits of Managing Recurring Charges

Automating recurring transactions offers several advantages:

- Time Savings: Automating the process eliminates the need to manually create and send invoices, saving valuable time for business owners.

- Improved Cash Flow: Regular payments help maintain a steady income stream, reducing financial uncertainty and helping to plan for expenses.

- Enhanced Customer Experience: Clients appreciate the convenience of automated billing, as it eliminates the need for them to remember to pay regularly.

Managing recurring transactions effectively ensures that your business runs smoothly, minimizing errors and delays while keeping both clients and operations organized. Automation not only saves time but also helps you maintain professional and consistent billing practices.