How to Use a QuickBooks Automotive Invoice Template for Your Business

Efficient billing is essential for businesses focused on repair and maintenance services. Clear, organized payment requests not only help keep records straight but also make transactions smoother for clients. With organized records and simplified payment processes, businesses can foster trust and ensure timely payments.

Creating detailed payment documents can often be time-consuming, especially in service industries where the scope and nature of work vary greatly from job to job. Standardized formats can save time, reduce errors, and make it easier to track costs. Utilizing a ready-to-use billing format allows business owners to focus more on their services and less on the administrative work that follows.

Templates designed specifically for service-oriented enterprises ensure that all necessary details are included, from work descriptions to material costs. By using preformatted options, service providers can present a polished and professional image that enhances client satisfaction and improves financial management.

QuickBooks Automotive Invoice Template Guide

Creating an organized payment structure for service-based businesses requires careful planning. With consistent document formatting, businesses can streamline the billing process, minimizing errors and simplifying record-keeping. This approach not only enhances productivity but also builds a professional image that benefits both the business and its clients.

Setting Up a Professional Billing Format

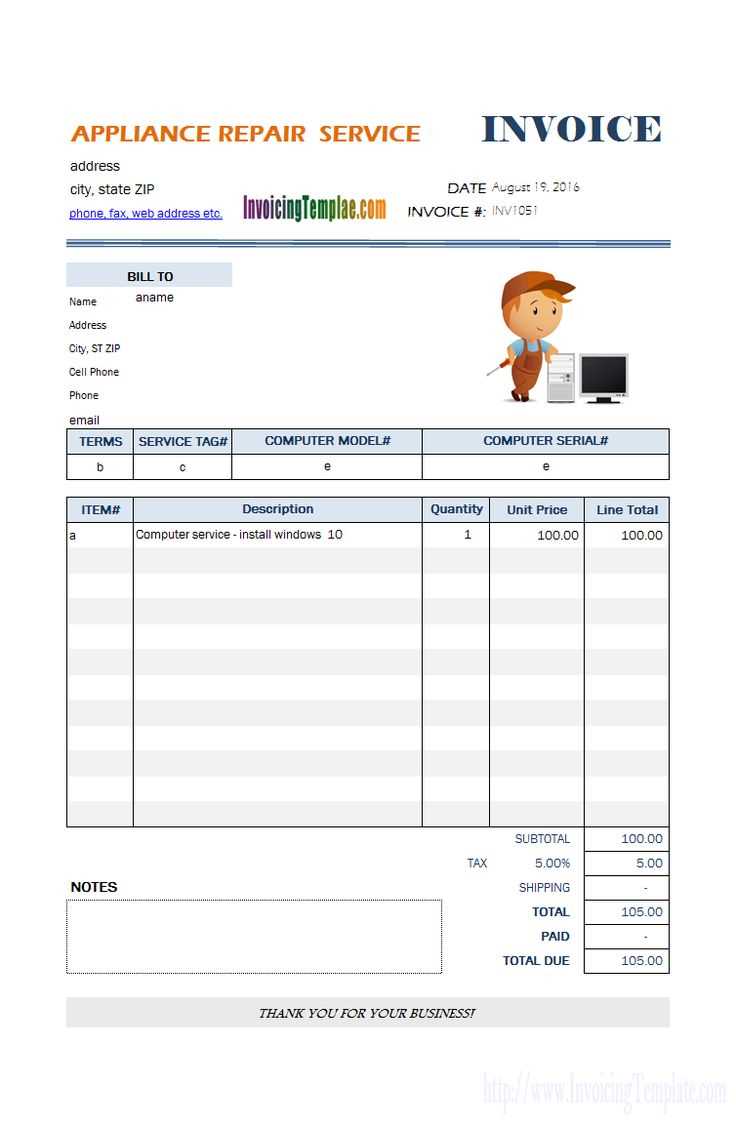

To create a practical and professional format, it’s essential to include key details that clarify the work performed and the costs involved. This level of detail improves transparency and helps clients understand each charge. Organized formats also allow for easier tracking and reporting, making it simpler for business owners to manage finances effectively.

- Itemized List: Clearly break down labor, parts, and additional charges.

- Dates and Contact Information: Include service date, contact details, and any unique reference numbers.

- Detailed Descriptions: Provide a concise yet informative description of services performed to avoid confusion.

Benefits of Structured Billing

Using a standardized format offers several benefits, particularly for those who handle complex or varied service tasks. A structured layout ensures that all essential information is in place, improving both client communication and internal organization.

- Time Efficiency: Reduces the time spent creating new documents from scratch.

- Improved Accuracy: Helps prevent errors by following a consistent layout.

Benefits of Using Invoice Templates in QuickBooks

For businesses providing specialized services, maintaining organized records and ensuring accurate billing is essential. A ready-made billing structure can help achieve this by offering a standardized approach to document each transaction, making it simpler to keep track of charges and streamline financial tasks.

Enhanced Efficiency and Time Savings

Using preformatted layouts allows service providers to quickly create detailed billing records without starting from scratch each time. By saving time on repetitive tasks, businesses can focus more on core activities, enhancing productivity and reducing administrative burdens. This not only optimizes daily operations but also minimizes the likelihood of billing errors.

Moreover, reusing a familiar structure ensures consistency across documents, which is particularly beneficial for long-term clients. With clear and consistent records, businesses can easily review transaction history, making future interactions and billing adjustments straightforward.

Professionalism and Client Trust

Incorporating a standard layout into business practices contributes to a more professional appearance. When clients receive clear, detailed records of work done, they gain a better understanding of each charge, promoting transparency. This level of clarity fosters client trust and improves overall satisfaction, making it more likely that clients will return for future services.

In summary, adopting a structured approach to billing can offer significant advantages, including increased efficiency, reduced errors, and a boost in client confidence, all of which positively impact business growth.

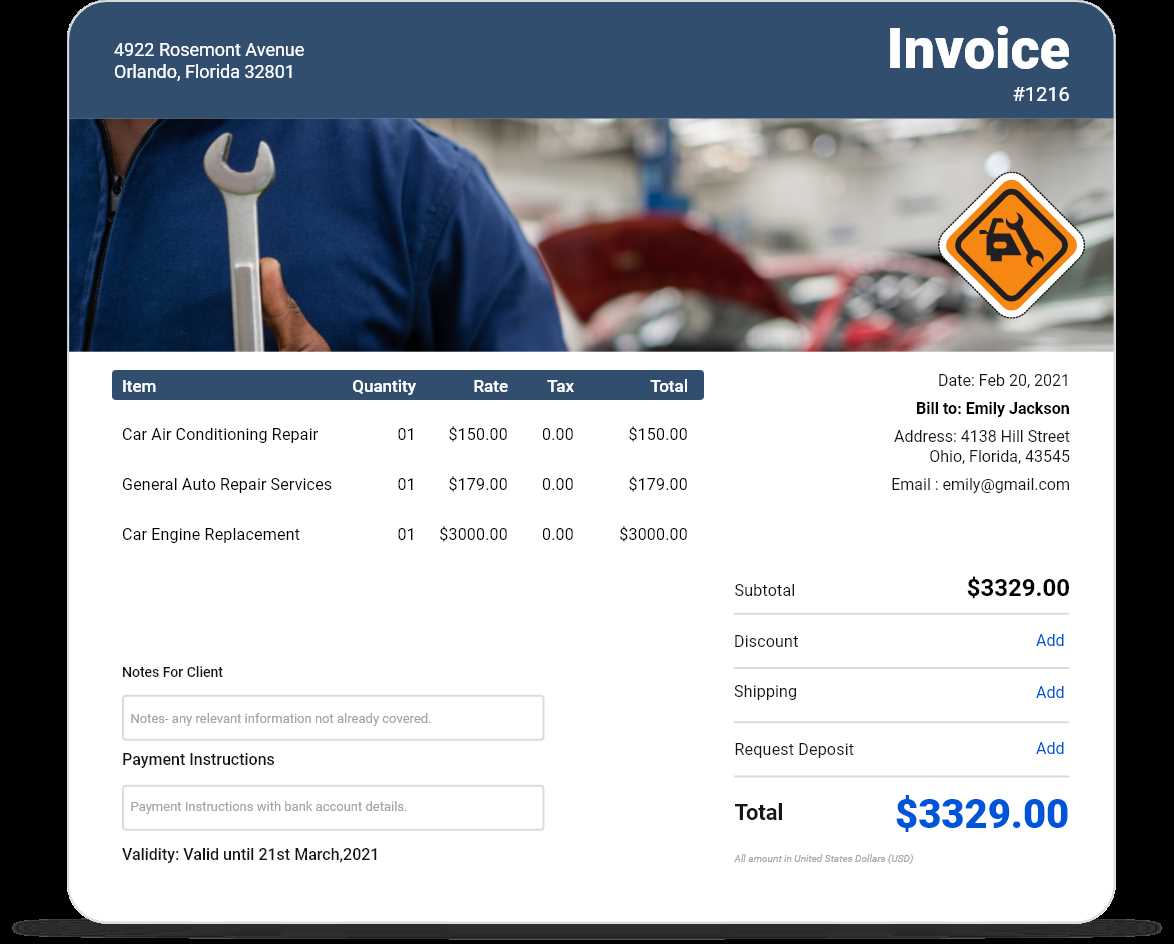

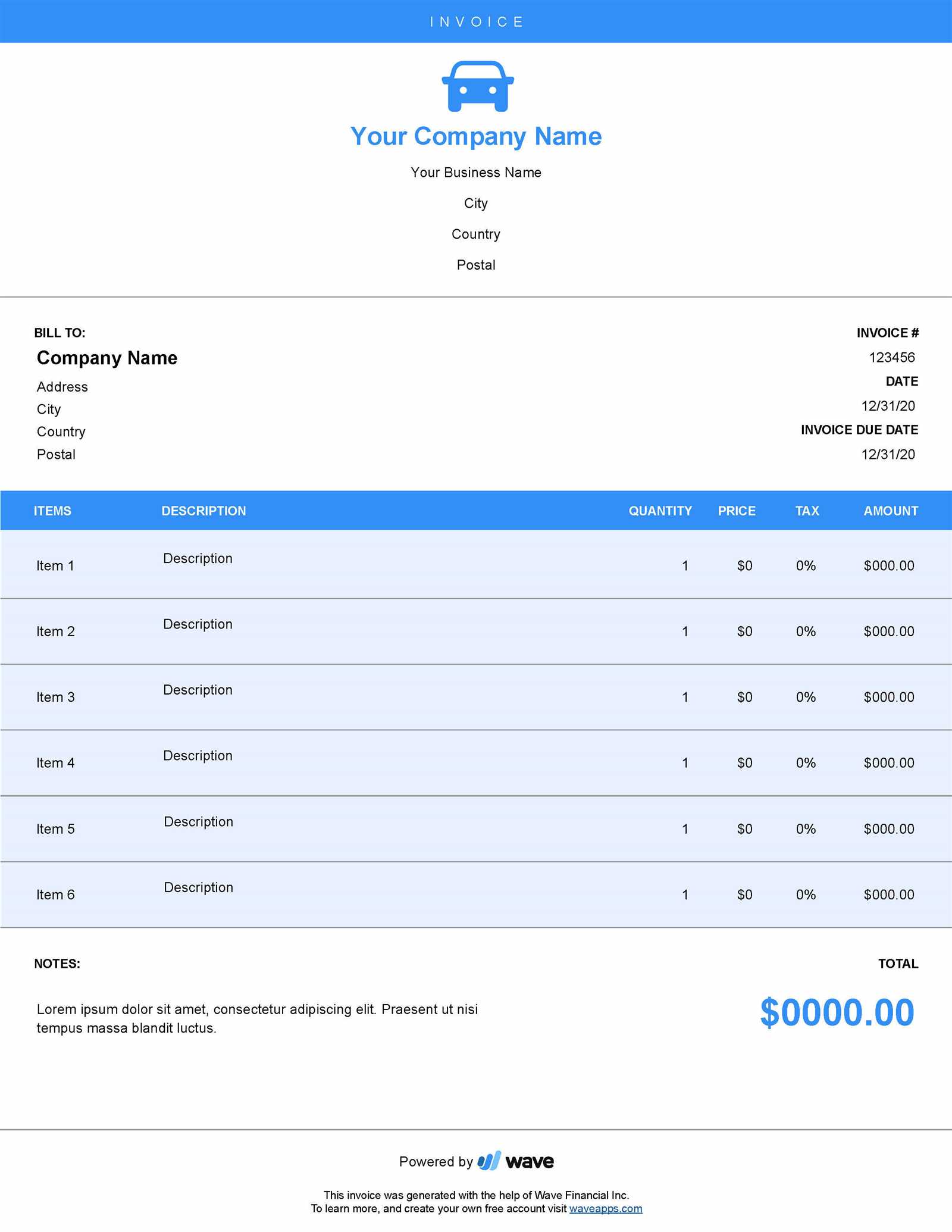

How to Customize an Automotive Invoice

Adapting a billing document to meet the unique needs of a service-based business helps create a professional image while ensuring all relevant details are captured. Customization allows for greater flexibility, enabling the addition of specific fields, branding elements, and unique charges related to the work performed.

Adding Essential Details for Clarity

One of the first steps in creating a tailored billing document is to identify which details are critical for clients and internal records. Including these elements provides clarity and minimizes potential misunderstandings about charges.

- Company Logo and Contact Information: Adding a logo and contact details enhances brand recognition and provides clients with easy reference points for future interactions.

- Detailed Service Descriptions: A section for specific work performed, including labor and parts, helps clients understand each line item.

- Customizable Rate Fields: Create fields for variable costs, allowing you to adjust rates for different types of services or parts.

Organizing Layout and Enhancing Readability

A well-organized document layout contributes to ease of reading and improves the client’s experience. By carefully arranging sections, you can present complex information in a clear and accessible way.

- Group Related Information: Organize charges and descriptions into logical sections, such as labor, parts, and taxes, to simplify review.

- Use Descriptive Labels: Clearly label each section

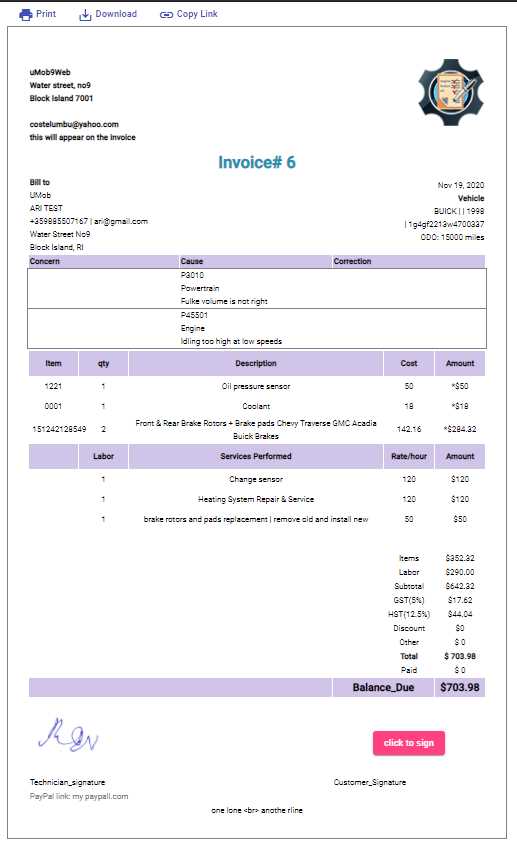

Essential Elements for Automotive Invoices

Creating an effective billing document for service-based businesses requires attention to specific details that ensure both clarity and professionalism. Including key components helps provide clients with a clear breakdown of services, fostering trust and simplifying payment processes.

- Service Date and Unique Identifier: A designated date and a unique reference number make each document easily traceable, aiding in both record-keeping and client communication.

- Client and Company Details: Including contact information for both the service provider and the client ensures clear communication channels and builds a professional impression.

- Detailed Work Descriptions: A section that itemizes each task performed and any parts used allows clients to understand exactly what they are being charged for.

- Labor and Parts Breakdown: Separate sections for labor charges and parts costs offer transparency, helping clients see a clear division of charges.

- Applicable Taxes and Fees: Display any additional charges, such as taxes or fees, to ensure the final amount is transparent and accurate.

- Payment Terms and Due Date: Clearly state payment terms, including due dates and accepted payment methods, to encourage timely payments.

Including these essential components not only improves the document’s usability for clients but also helps the business maintain organized records, reducing the likelihood of disputes or missed payments. A well-structured document reflects a commitment to professionalism and clie

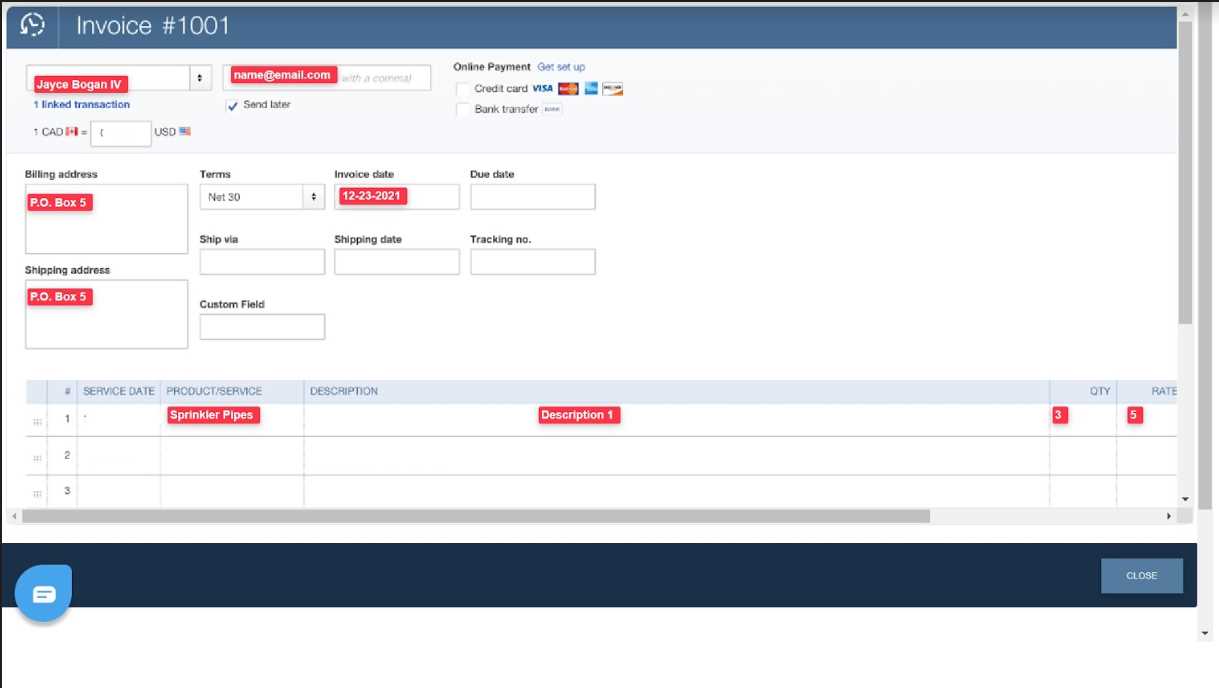

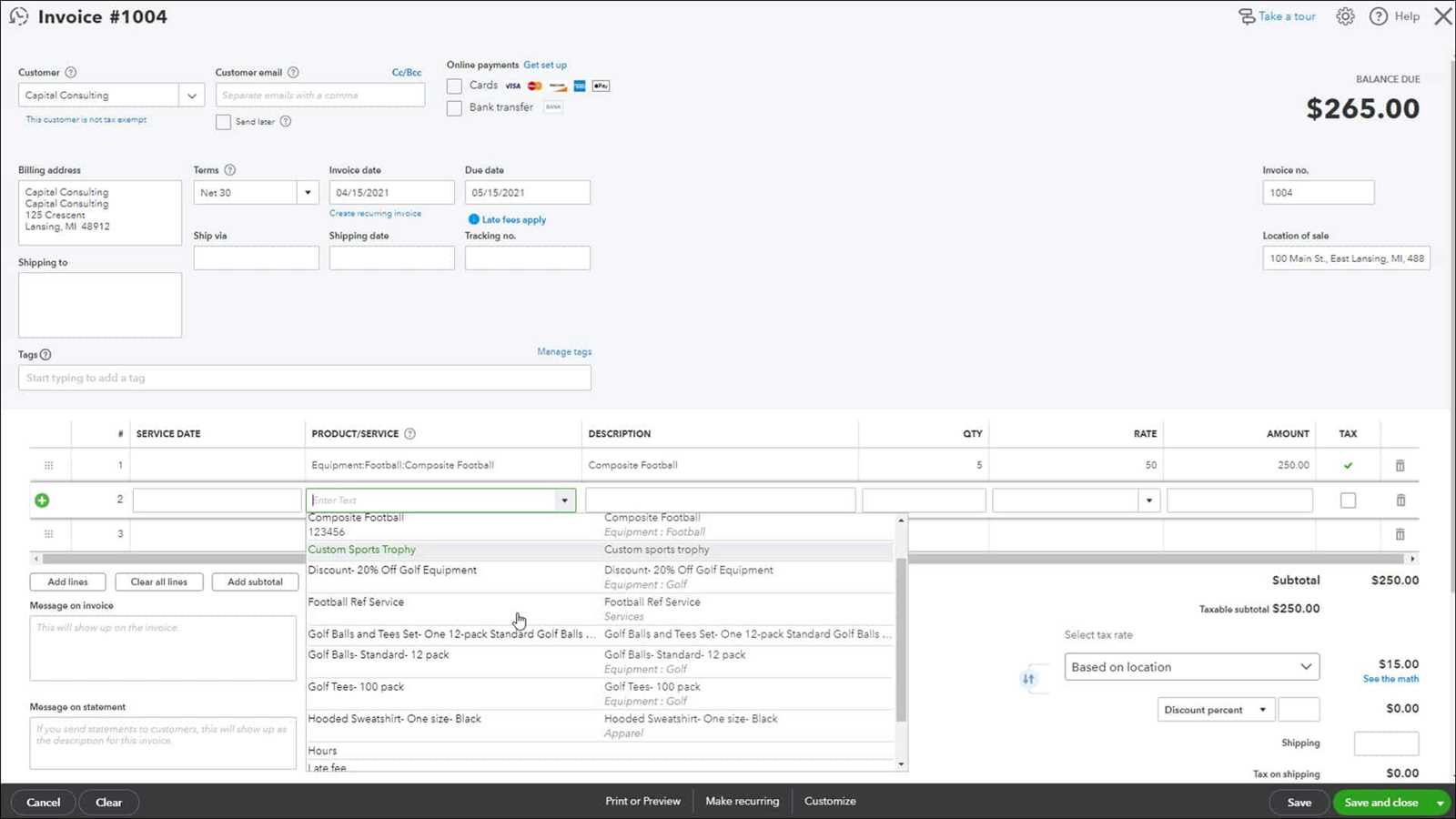

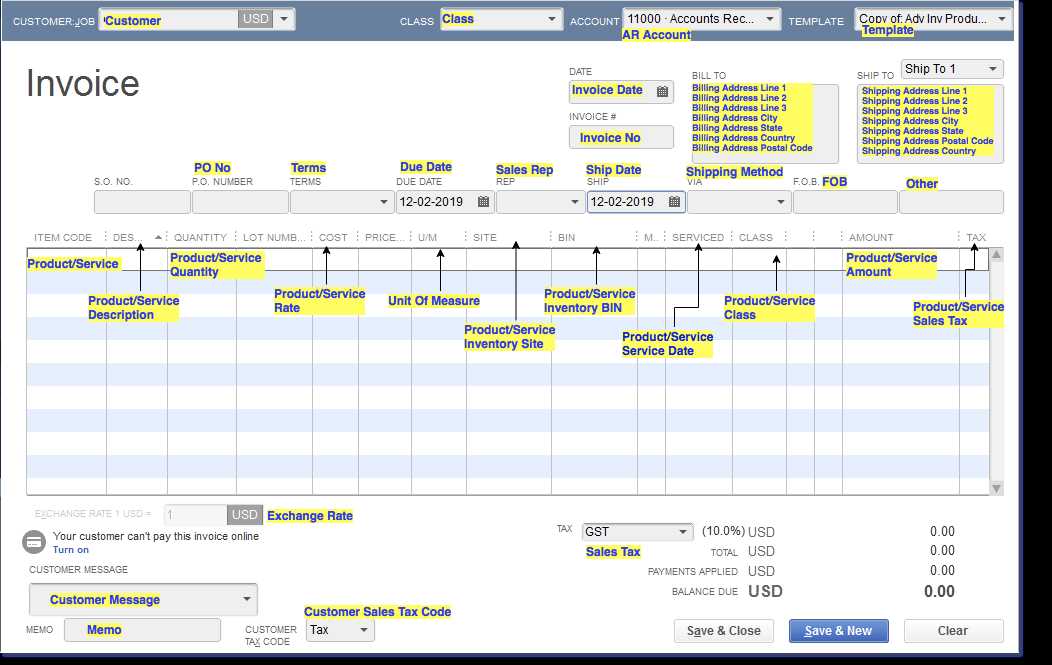

Step-by-Step Setup for QuickBooks Templates

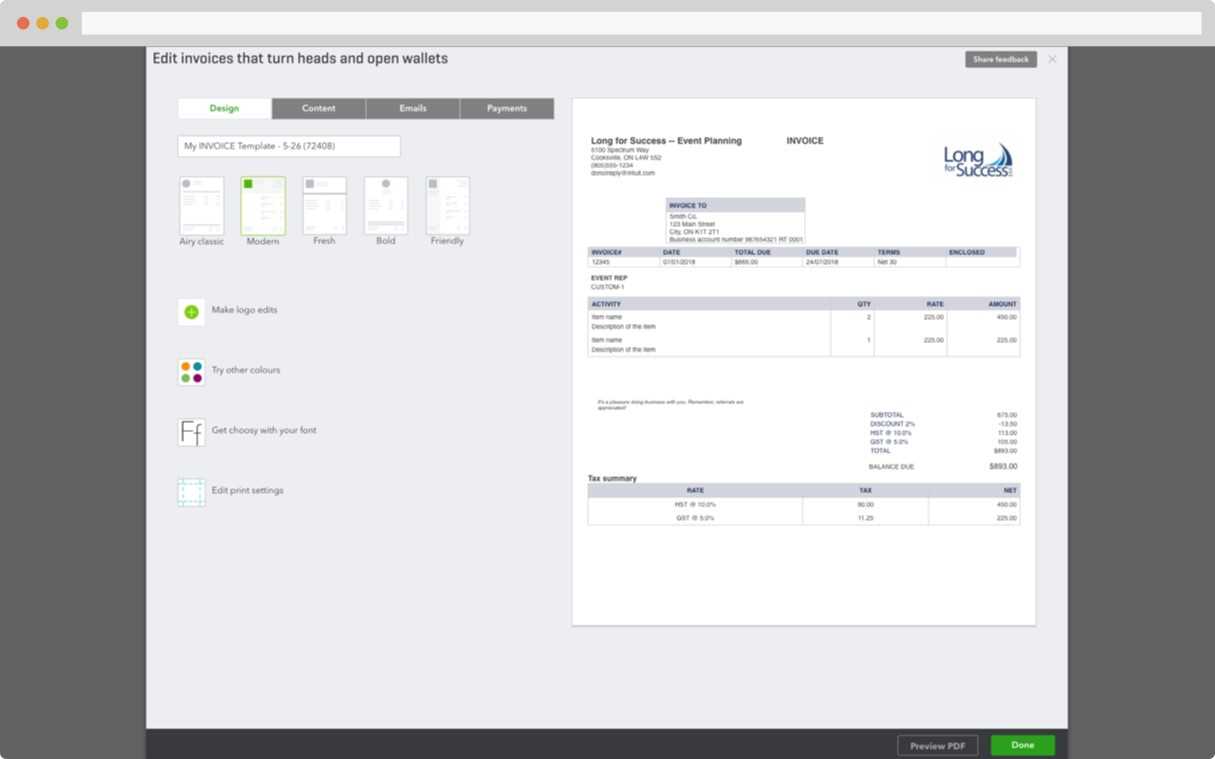

Setting up a tailored billing layout allows businesses to organize their payment requests clearly and effectively. Following a structured approach helps ensure all essential information is included, allowing for consistent and professional documentation.

- Access the Customization Settings: Begin by navigating to the layout options where adjustments can be made to suit your business needs.

- Select a Base Format: Choose a standard layout that closely aligns with the type of service you provide. This base format will serve as the foundation for further customization.

- Adjust Branding Elements: Incorporate your business’s logo, colors, and contact information to give the document a unique and recognizable look.

- Add Specific Service Fields: Create fields for various services or parts that your business frequently uses. This simplifies future entries by having commonly used items readily available.

- Configure Payment Instructions: Clearly specify the terms of payment, including accepted methods and due dates, to ensure clients understand how and when to pay.

- Preview and Test the Layout: Before finalizing, preview the document to ensure that all elements appear correctly. Send a test version if possible, to confirm that clients will receive the document as intended.

By foll

Managing Automotive Service Charges Efficiently

Efficiently handling service costs ensures that businesses remain organized and transparent when billing clients. By streamlining the process of tracking and presenting charges, businesses can enhance customer satisfaction and improve cash flow management.

- Track Labor and Parts Separately: Break down the costs of labor and parts in distinct sections. This allows clients to see exactly where their money is going, increasing transparency and trust.

- Use Standardized Pricing: Implement a consistent pricing structure for common services to reduce confusion and create predictability in billing.

- Automate Common Charges: For regularly used services or parts, automate the process to speed up billing and reduce manual errors.

- Include Optional Services: Clearly list optional or add-on services that clients can choose from, allowing for easier upselling and a more personalized experience.

- Adjust for Discounts and Promotions: Make provisions for applying discounts or promotional offers. This flexibility helps businesses attract and retain clients.

- Regularly Review Pricing: Periodically review and adjust prices based on market trends, inflation, and competitor pricing to remain competitive while maintaining profitability.

By implementing these strategies, businesses can not only streamline their billing processes but also provide clients with a transparent and clear breakdown of their service costs. This helps foster strong customer relationships and ensures that financial management is efficient and accurate.

Best Practices for Professional Invoices

Creating a well-structured billing document is crucial for maintaining a professional image and ensuring smooth transactions. Following a set of best practices helps ensure that the document is clear, accurate, and effective in encouraging prompt payment.

Key Elements of a Professional Document

- Clear Contact Information: Include both the client’s and the service provider’s contact details, making it easy for both parties to communicate.

- Unique Reference Number: Assign a unique identifier to each document, which will help keep records organized and facilitate easy reference.

- Detailed Descriptions of Services: Clearly describe each task completed, specifying any materials or parts used. This ensures clients understand exactly what they are paying for.

- Proper Payment Terms: Clearly state payment methods, due dates, and any applicable late fees to avoid confusion and encourage timely payment.

- Tax and Fees Breakdown: Show all taxes or additional charges separately to give the client a clear view of how the total amount is calculated.

Formatting Tips for Clarity

- Consistent Layout: Use a consistent and professional layout to make the document easy to read and navigate. Proper use of headings and sections will enhance readability.

- Use of Clear Fonts: Choose legible fonts and appropriate font sizes to ensure that the document is easy to read and understand.

- Keep It Concise: Avoid cluttering the document with unnecessary information. Stick to the essential details to maintain clarity.

By adhering to these best practices, businesses can create professional and effective billing documents that encourage timely payments and help maintain strong relationships with clients.

Tracking Automotive Repairs with QuickBooks

Efficiently monitoring service tasks and repairs is essential for managing customer relationships and ensuring accurate billing. By utilizing specialized software, businesses can track work progress, inventory, and customer payments, ensuring nothing is overlooked and all details are properly recorded.

- Monitor Service History: Keep a detailed record of each vehicle’s repair history, including services performed and parts used. This allows easy access to past work for reference or future jobs.

- Track Labor and Parts Costs: Keep accurate records of both labor hours and the cost of parts used in each service. This helps in setting fair prices and managing overall costs effectively.

- Set Service Reminders: Implement reminders for regular maintenance or follow-up repairs, ensuring timely service and better customer retention.

- Inventory Management: Track parts and materials to prevent shortages, reduce overstock, and streamline purchasing processes.

- Generate Reports: Create reports detailing service history, outstanding payments, and inventory usage, allowing businesses to analyze performance and plan accordingly.

- Client Communication: Use tracking features to send automated reminders or updates to customers about the status of their vehicle repairs, keeping them informed throughout the process.

By incorporating these practices, businesses can enhance operational efficiency, ensure accurate record-keeping, and provide customers with a reliable and transparent service experience.

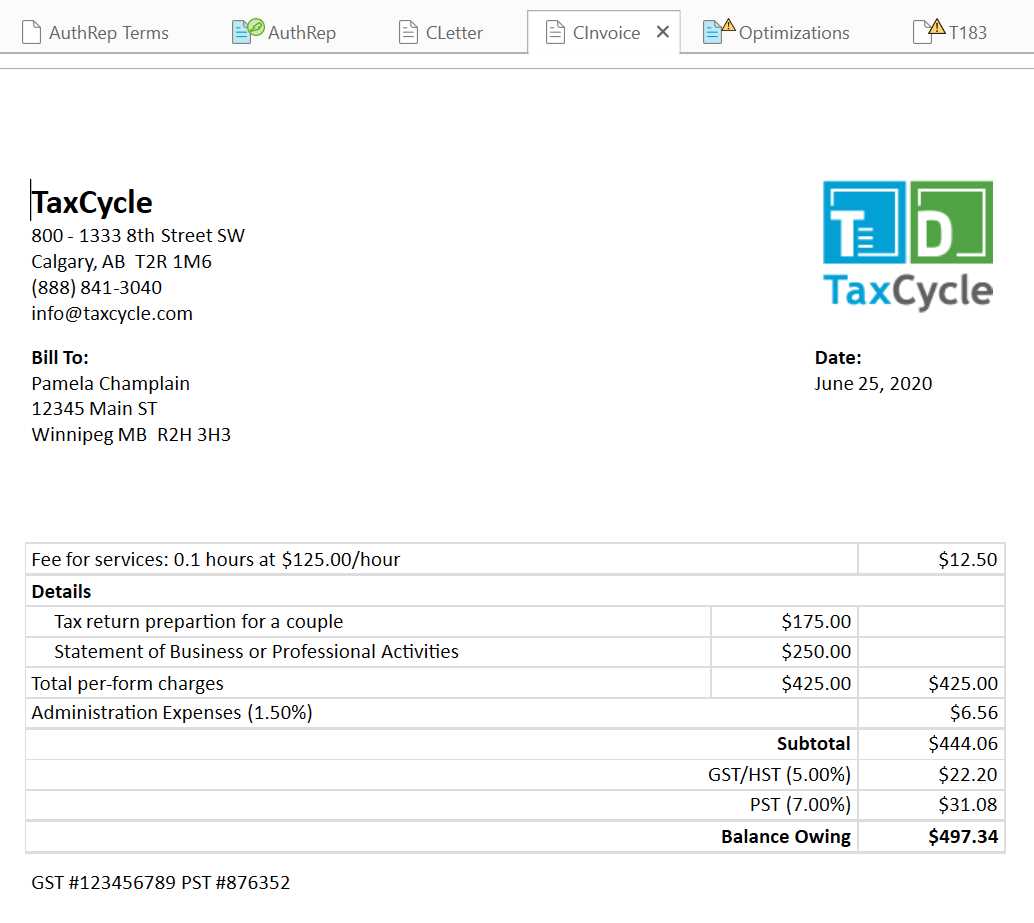

Organizing Parts and Labor Costs

Efficient management of material expenses and workforce compensation is crucial for maintaining a profitable business model. Organizing these costs not only helps in pricing services accurately but also ensures transparency and smooth financial operations. Properly tracking parts and labor ensures that all charges are accounted for and prevents costly mistakes.

Tips for Efficient Organization

- Track Inventory Costs: Regularly monitor the cost of parts and materials used in each service to maintain an up-to-date inventory record. This helps avoid over-purchasing and stock shortages.

- Document Labor Charges: Keep a detailed log of time spent by each worker on a job, ensuring that labor costs are aligned with the pricing structure.

- Use Categories for Costs: Organize expenses into clear categories, such as parts, labor, and overhead, to understand where funds are allocated and identify areas for improvement.

- Set Standard Rates: Establish standardized rates for common tasks or materials to streamline pricing and reduce the risk of errors when estimating service costs.

- Regularly Review Financial Data: Frequently analyze cost breakdowns to ensure profitability and adjust pricing strategies when necessary to stay competitive in the market.

Benefits of Proper Organization

- Improved Profit Margins: By accurately tracking material and labor expenses, businesses can ensure that services are priced correctly, leading to higher profits.

- Faster Billing Process: Clear organization reduces the time needed to prepare and send invoices, improving cash flow and client satisfaction.

- Better Financial Decision Making: Having detailed records of costs helps in budgeting, forecasting, and making informed decisions for the business.

By organizing parts and labor costs effectively, businesses can improve efficiency, profitability, and overall financial management.

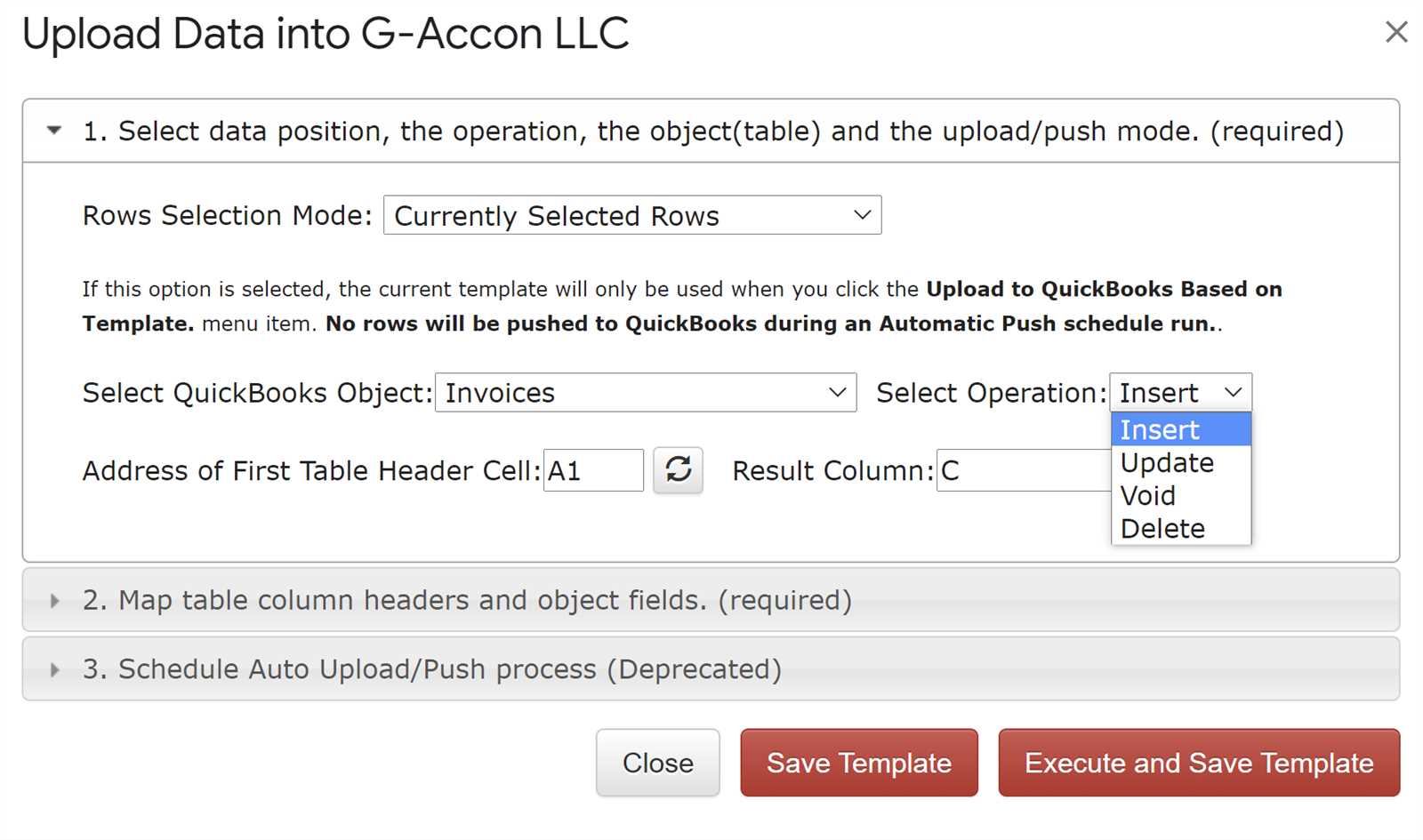

Automating Invoice Processes for Shops

Streamlining billing tasks is crucial for shops aiming to save time, reduce errors, and improve customer satisfaction. By automating certain processes, businesses can ensure that the financial aspects of operations run smoothly without requiring constant manual input. Automation helps maintain accuracy, speed up transaction processing, and ensures that all charges are captured and billed appropriately.

Steps to Implement Automation

- Set Up Recurring Billing: For services provided regularly, automate the creation of recurring charges to avoid manually entering the same information each time.

- Integrate with Payment Systems: Link your billing system with payment gateways to automatically process payments and update account statuses once transactions are complete.

- Utilize Predefined Service Codes: Implement service categories or codes that auto-fill pricing details, eliminating the need for manual input and reducing the chances of mistakes.

- Generate Reports Automatically: Set up your system to create financial reports at specified intervals, helping you track sales, expenses, and profits with minimal effort.

- Link to Inventory Management: Connect your billing system with inventory management to automatically update stock levels and pricing when new products or services are added.

Benefits of Automating Billing

- Increased Efficiency: Automation speeds up the entire billing process, allowing your team to focus on other essential tasks and improving overall productivity.

- Enhanced Accuracy: Automated systems minimize the risk of human errors, ensuring that all charges are correct and consistent.

- Faster Payments: By automating payment reminders and processing, customers can be invoiced promptly, leading to quicker payments and improved cash flow.

- Better Customer Experience: Automation ensures that customers receive accurate, timely bills, improving satisfaction and loyalty.

By automating billing processes, shops can save time, reduce errors, and create a more efficient and customer-friendly workflow.

Integrating Payment Options in Invoices

Incorporating multiple payment methods in billing documents is essential for providing convenience to customers and streamlining the payment process. By offering a range of payment options, businesses can increase the likelihood of timely payments and improve overall satisfaction. Integrating diverse payment choices ensures that customers have flexibility in how they settle their balances, whether through online systems, credit cards, or traditional methods.

Payment Method Description Advantages Credit/Debit Cards Allows customers to pay instantly using their cards. Fast processing, secure transactions, widely accepted. Bank Transfers Direct transfer from one bank account to another. Low transaction fees, secure, preferred by businesses for large amounts. Online Payment Platforms Enables payments via services like PayPal, Stripe, or Venmo. Convenient, global access, often used for online purchases. Checks Traditional paper check payments. Familiar method, can be used for large payments, no online setup required. Cash Physical cash payments at the time of service. Immediate payment, no transaction fees, useful for local businesses. Including a variety of payment options in your billing documents allows businesses to cater to a wider audience and makes the transaction process more seamless for customers. It also reduces delays and minimizes the chances of late payments, enhancing your company’s cash flow.

Common Mistakes to Avoid in Templates

When creating billing documents, certain missteps can lead to confusion or delays in processing payments. Ensuring that all information is accurate, clear, and well-organized is key to creating an efficient document that serves both business and customer needs. Avoiding common errors in document setup will help maintain professionalism and ensure smooth transactions.

Frequent Mistakes to Watch Out For

Issue Description Impact Incomplete Details Leaving out essential information like the client’s contact details or item descriptions. Confusion, delay in payment processing, and potential legal complications. Incorrect Pricing Entering the wrong price for services or products. Incorrect charges, customer dissatisfaction, or loss of revenue. Unclear Payment Terms Not specifying due dates or acceptable payment methods clearly. Late payments, misunderstandings, and unclear expectations. Lack of Consistency Using inconsistent fonts, styles, or formatting. Unprofessional appearance, potential difficulty in reading the document. Missing Tax Information Not including the necessary tax rates or calculations. Non-compliance with tax regulations, incorrect totals, and potential penalties. How to Avoid These Mistakes

To minimize errors, double-check all fields before finalizing your billing documents. Consistency, clarity, and accuracy are critical in ensuring your records are professional and effective. Regularly reviewing the document’s structure and updating it to include necessary details will help prevent mistakes that can affect customer satisfaction and your business operations.

Improving Customer Satisfaction with Clear Invoices

Creating well-structured billing documents can greatly enhance customer trust and satisfaction. When clients receive clear, accurate, and easy-to-understand statements, they are more likely to feel confident in their transactions and maintain a positive relationship with your business. Properly formatted documents prevent confusion and ensure that the terms of service are transparent, which is essential for fostering long-term customer loyalty.

By paying attention to detail and organizing the content in an easy-to-read format, businesses can avoid misunderstandings and delays. Providing clear descriptions of products or services, including payment terms, and ensuring accurate totals can significantly improve the customer experience. This level of professionalism not only builds credibility but also helps in reducing disputes, making the payment process smoother for everyone involved.

Tips for Accurate Automotive Billing

Ensuring precision in billing is crucial for maintaining trust and fostering positive relationships with clients. Accurate charges help avoid misunderstandings, delays in payments, and prevent disputes. By following a few essential practices, businesses can streamline the billing process, ensure fair pricing, and offer transparent billing statements to their customers.

Double-Check Parts and Labor Costs

It is important to carefully record all materials used and the time spent on each task. This includes verifying the correct part numbers, quantities, and labor rates. Any mistakes in these areas can lead to undercharging or overcharging, affecting both customer satisfaction and the business’s profitability.

Include Detailed Descriptions

Providing thorough descriptions of the services performed and the parts used ensures that clients understand what they are being charged for. Clear descriptions also prevent confusion and can make the billing process more transparent. Itemized breakdowns make it easier for customers to review and pay, leading to faster processing and fewer questions.

Choosing the Right Format for Invoices

Selecting the most effective format for billing documents is essential to ensure clarity and efficiency. The right structure not only improves communication with clients but also helps maintain a professional image for the business. Depending on the nature of the services provided and customer preferences, there are several factors to consider when deciding on a suitable format.

- Clarity: Choose a layout that is easy to read and understand. Avoid clutter and make sure the details are clearly separated.

- Customization: Opt for a format that allows you to personalize the document with your company’s logo, color scheme, and specific terms and conditions.

- Digital vs. Paper: Depending on your business needs, consider whether a digital format or a printed version is more appropriate. Digital formats can be sent quickly via email and stored easily, while paper versions may be preferred by some customers for physical records.

- Itemized Details: Ensure the format includes space for a detailed list of services provided, parts used, and individual charges to give a transparent breakdown for your customers.

- Compliance: Choose a format that includes all necessary information to comply with legal requirements, such as tax rates and payment terms.

Customizing Invoices to Reflect Your Brand

Your billing documents are not just functional tools but also an extension of your business’s identity. By personalizing these documents, you can reinforce your brand’s presence and leave a lasting impression on your clients. Customization allows you to incorporate elements that represent your company’s values, aesthetics, and professionalism, making each transaction feel unique and personal.

Incorporating Branding Elements

- Logo: Add your company’s logo to the top of the document to create instant brand recognition.

- Color Scheme: Use your brand’s colors throughout the document to maintain consistency with your marketing materials.

- Font Style: Choose fonts that align with your brand’s voice–whether it’s modern, traditional, or creative–while ensuring readability.

Personalized Messaging

- Company Tagline: Include your brand’s tagline to reinforce your message and add a personal touch to every transaction.

- Custom Notes: Use the space for personalized messages, like thanking the customer for their business or providing a special offer on future services.