QuickBooks Auto Repair Invoice Template for Easy Billing

Efficient management of billing processes is crucial for any business in the automotive service industry. With the right tools, you can significantly reduce errors, save time, and ensure a smooth experience for both customers and staff. A well-structured invoicing system allows businesses to maintain professionalism while simplifying payment tracking and service documentation.

Customizable billing solutions offer flexibility, enabling businesses to tailor their documents to meet specific needs. From listing parts and labor to adding taxes and discounts, having a pre-designed structure helps ensure that all necessary information is included, leading to more accurate and timely payments. By incorporating features like automatic calculations and easy editing, these solutions make it easier for service providers to stay organized and focused on their work.

Adopting an organized system not only streamlines daily operations but also enhances customer satisfaction. Clear and concise financial documents help avoid misunderstandings, ensuring both the service provider and the client are on the same page. Ultimately, an effective invoicing method can lead to better financial management and improved cash flow for the business.

QuickBooks Auto Repair Invoice Template Overview

In any service-oriented business, the ability to generate clear, accurate, and professional billing documents is essential. For businesses in the automotive industry, having a reliable system in place to handle customer charges and transactions ensures smooth operations and better customer relationships. A well-structured document generation system helps automate various aspects of billing, reducing human error and increasing efficiency.

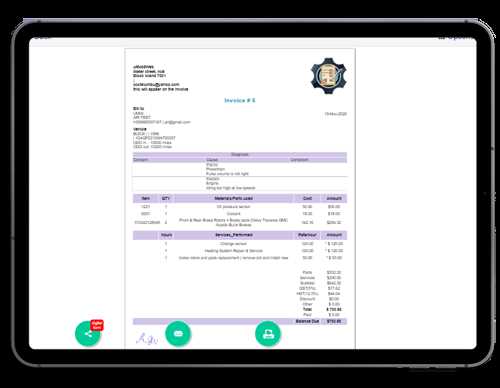

This particular solution allows businesses to customize their billing documents according to their specific needs. Whether you’re dealing with different pricing for parts, labor, or discounts, having a predefined structure helps organize all necessary details in one place. The system also facilitates seamless communication between the service provider and the client, ensuring both parties have a clear understanding of the transaction.

With this system, businesses can easily track payments, set payment terms, and handle taxes, making it easier to manage finances and stay on top of receivables. The following table outlines some of the key components typically included in a standard service document:

| Component | Description |

|---|---|

| Service Description | Details of the services provided, including parts and labor involved. |

| Cost Breakdown | Itemized list of costs for each service, part, or labor charge. |

| Taxes | Applicable taxes based on location and service type. |

| Payment Terms | Details about due dates, late fees, and accepted payment methods. |

| Client Information | Includes customer contact details, job number, and address for reference. |

By utilizing such a system, businesses in the service industry can enhance their billing process

Why Use QuickBooks for Auto Repairs

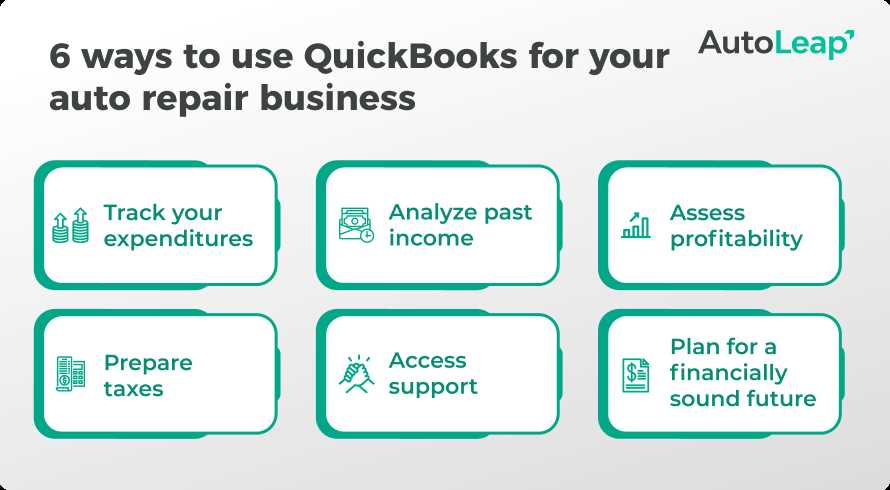

Managing the financial aspects of an automotive service business can be a complex task, especially when dealing with a variety of services, parts, and customer needs. Using an automated system to handle invoicing, payment tracking, and record keeping can save time and reduce errors, allowing business owners to focus on providing quality service rather than getting bogged down in paperwork.

Streamlined operations is one of the primary reasons why many service businesses turn to digital solutions. With a well-designed system, you can easily generate detailed service documents, track expenses, and maintain accurate records. This helps create transparency for both customers and business owners, ensuring that all transactions are clear and organized.

Financial management is made easier with automated features such as tax calculations, customizable pricing structures, and integration with payment systems. These tools can help businesses maintain consistent cash flow and ensure that all financial activities are properly documented for tax purposes and business analysis. With such features, even small businesses can manage their finances like large enterprises, ensuring smooth and efficient operations.

Benefits of Customizable Invoice Templates

Having the ability to adjust your billing documents to suit the specific needs of your business can make a significant difference in how efficiently your financial processes are handled. Customizable billing structures allow businesses to tailor their documents for clarity, accuracy, and consistency, while ensuring they meet both the business’s and the customer’s needs. By having full control over the design and content, companies can present a more professional image and streamline their operations.

Enhanced Professionalism and Branding

Personalized documents not only create a polished and consistent brand image but also help businesses establish trust with their clients. The ability to add logos, adjust color schemes, and modify fonts ensures that each document reflects the company’s unique identity. A professional appearance enhances customer confidence, making them more likely to return for future services.

Improved Accuracy and Flexibility

Customizable systems allow businesses to include all relevant details, such as specific services, parts, and pricing structures, while also leaving space for special notes or discounts. This flexibility makes it easier to adapt to different business models and customer requirements. Accurate and well-organized documentation reduces misunderstandings and disputes, ensuring smooth transactions every time.

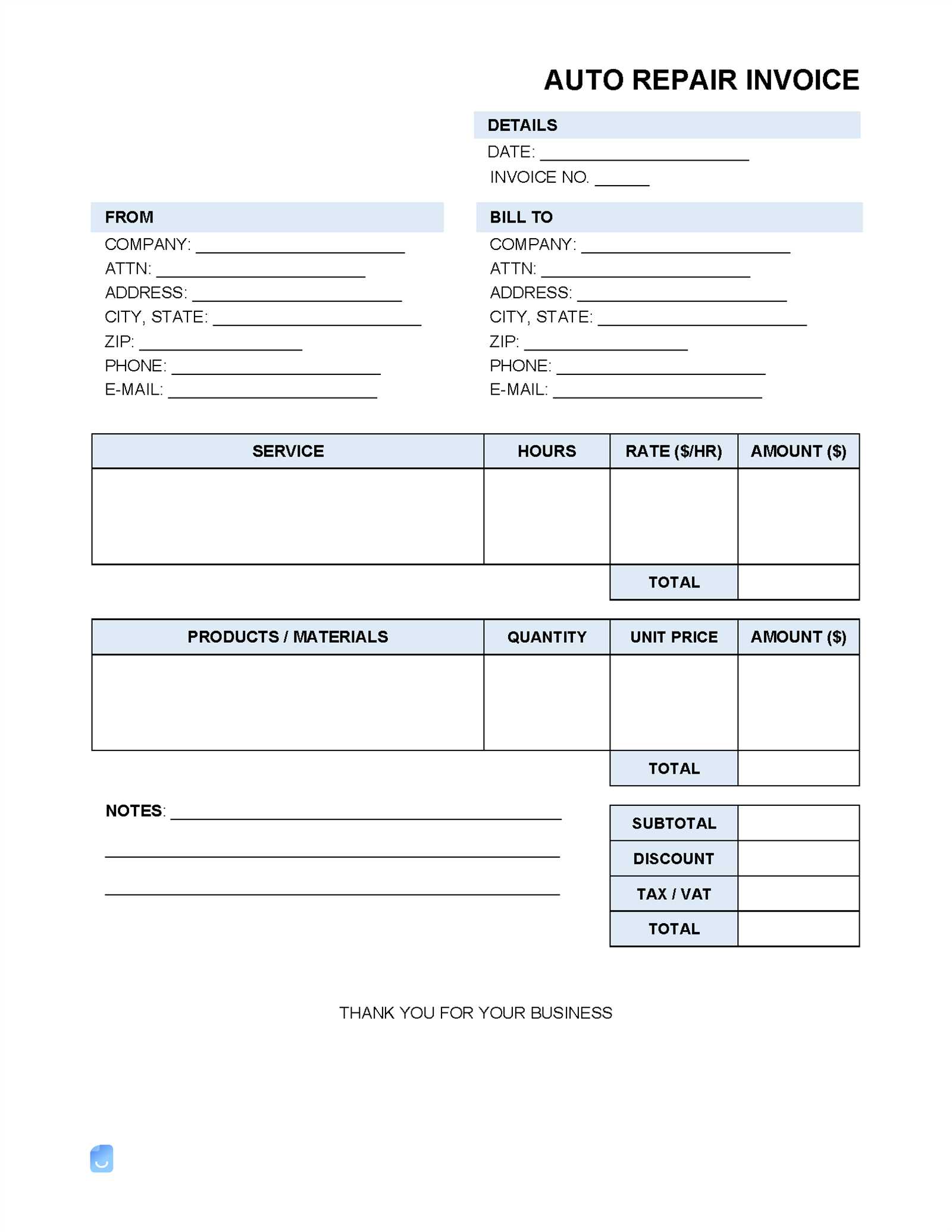

How to Create an Auto Repair Invoice

Creating a well-structured billing document is an essential part of running a service-based business. It ensures clear communication with clients and helps maintain accurate financial records. To create an effective billing document, it’s important to include all necessary details while keeping the design professional and easy to understand. Below are the steps for generating a detailed and accurate bill.

- Step 1: Gather Client Information – Collect all relevant details such as the client’s name, address, phone number, and email. This will help ensure that the document is properly personalized and easy to reference.

- Step 2: Add Service Details – List all the services provided, including any parts used, labor charges, and additional fees. Each item should have a brief description and corresponding cost.

- Step 3: Specify Payment Terms – Clearly state payment deadlines, accepted payment methods, and any penalties for late payments. This ensures both parties are aware of expectations.

- Step 4: Include Taxes and Discounts – Make sure to calculate and apply relevant taxes. If there are any discounts or special offers, list them as separate line items.

- Step 5: Finalize the Total Amount – After adding all the charges, taxes, and discounts, sum up the total amount due and make sure everything matches.

By following these steps, businesses can create accurate, transparent, and professional billing documents that help maintain clear communication with clients while ensuring smooth financial transactions.

Essential Information for Auto Repair Invoices

When creating a billing document for services rendered, it’s essential to include all relevant details to ensure transparency and avoid misunderstandings. A comprehensive statement should capture every aspect of the transaction, from client details to a breakdown of charges. Clear documentation helps both the business and the customer keep track of payments and services provided.

Key information to include in a service bill includes the client’s contact information, a detailed list of services or products provided, along with the costs for each item. Additionally, specifying payment terms, due dates, and applicable taxes ensures both parties are aware of the financial terms and expectations. Including space for any discounts or special offers will further clarify the final amount due.

By making sure all relevant information is included and well-organized, businesses can enhance their professionalism and reduce the risk of errors or disputes during the payment process.

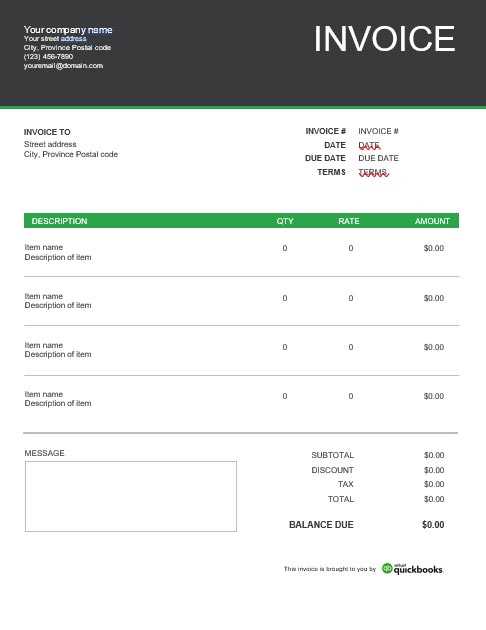

Setting Up Your QuickBooks Template

Creating a well-organized and efficient billing structure is essential for maintaining smooth financial operations in any service-based business. A personalized document creation system can help streamline the process by ensuring consistency and accuracy. Properly setting up your billing documents allows for quick generation and reduces the potential for errors in pricing, taxes, or payment terms.

Start by customizing the layout to reflect your business’s branding, including your logo, business name, and contact details. This adds a professional touch and ensures that your documents are easily recognizable. Next, configure the fields that will be automatically populated with service details, such as itemized charges, taxes, and payment options.

Additionally, ensure that your payment terms–including due dates, accepted payment methods, and late fees–are clearly stated. By setting up your billing system to automatically calculate totals and apply taxes or discounts, you can save time and minimize manual input, leading to faster and more accurate billing.

Tracking Auto Repair Services with QuickBooks

Effective tracking of services and transactions is a key component of running any successful service-based business. By utilizing the right tools, businesses can monitor the progress of each job, track labor and parts, and ensure that all financial records are accurately updated. This approach not only helps with day-to-day operations but also supports long-term business management.

Steps for Efficient Service Tracking

- Document Each Job – Begin by recording the details of each job or service request. This includes the client’s information, a description of the work, and the parts used. Keeping thorough records ensures that you have all the necessary details for future reference.

- Track Labor Hours – Accurately track the time spent on each task. This can be done manually or using time-tracking features, ensuring that all labor costs are accounted for.

- Monitor Parts and Materials – List all the materials and parts used for each job, including quantities and prices. This helps in inventory management and provides clear cost breakdowns.

- Update Financial Records – Ensure that all charges are recorded and that taxes, fees, and discounts are correctly applied. This helps in generating accurate reports and streamlining billing processes.

Benefits of Proper Service Tracking

- Enhanced Accuracy – Proper tracking reduces the risk of errors in billing and service documentation.

- Better Client Communication – Clients can be updated with the status of their job, ensuring transparency and trust.

- Improved Financial Reporting – Accurate service tracking provides insights into job costs and revenue, helping with budgeting and forecasting.

By systematically tracking each service, businesses can ensure that all aspects of their operations run smoothly, from inventory management to client relations, ultimately leading to improved efficiency and customer satisfaction.

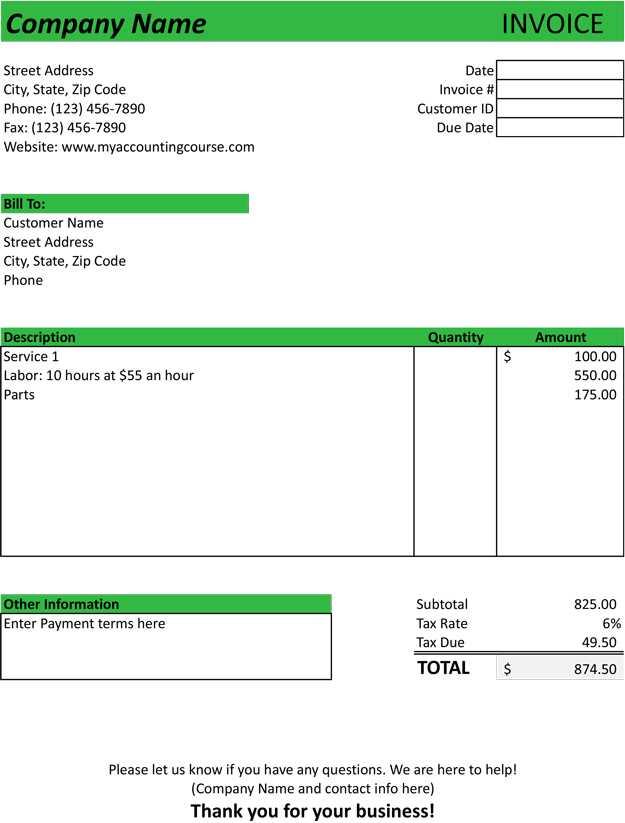

Incorporating Labor and Parts Costs

Accurately accounting for labor and materials is essential to ensure that service pricing is fair and transparent. Both labor costs and the cost of materials directly impact the final price charged to customers and affect business profitability. By carefully tracking and incorporating these costs into the billing process, businesses can maintain consistency and avoid discrepancies in their financial records.

Labor costs typically include technician wages or hourly rates, and these should be calculated based on the time spent on each task. It’s important to track time accurately to reflect the true cost of the labor provided. In some cases, different services may require different rates depending on the level of expertise or the complexity of the job.

Parts and materials costs should also be precisely recorded. Each item used in the service process–whether it’s a replacement part or an accessory–needs to be added to the bill, along with its cost. By documenting each part’s price and quantity, businesses ensure that customers are charged appropriately and that inventory levels are accurately maintained.

Incorporating these costs not only ensures accuracy in financial documentation but also helps businesses make informed decisions about pricing, profit margins, and service efficiency.

Handling Discounts and Taxes in QuickBooks

In any business, managing discounts and taxes properly is crucial to ensuring accurate billing and compliance with regulations. Applying discounts effectively can attract customers, while properly calculating taxes ensures that your business stays on the right side of the law. Both of these factors need to be integrated into your financial processes for smooth operations and customer satisfaction.

Applying Discounts to Service Bills

Discounts can be applied to encourage repeat business or offer promotional deals. It’s important to clearly define how discounts will be handled. For instance, discounts can be applied as a percentage of the total or a fixed amount, depending on the business strategy. Be sure to document the original price, the discount amount, and the final price to maintain transparency.

Calculating and Applying Taxes

Taxes are another key element that must be accurately calculated. The tax rate varies depending on location and the type of services offered. It’s essential to stay updated on local tax laws to ensure compliance. Once the correct tax rate is identified, it should be applied to the appropriate items or total service cost. Make sure to break down the tax amount clearly on any financial documentation, allowing clients to see exactly what they are being charged for taxes.

By managing both discounts and taxes carefully, businesses can create clear, accurate, and professional billing statements that reflect the true cost of services and ensure customer trust. This also helps businesses avoid potential issues with financial reporting or compliance down the road.

How to Add Payment Terms to Invoices

Establishing clear payment expectations is vital for maintaining smooth cash flow and fostering positive relationships with clients. Including payment terms on any financial document ensures that customers understand the agreed-upon deadlines, payment methods, and any applicable penalties for late payments. By specifying these terms upfront, businesses can reduce confusion and delays in receiving payments.

Key Elements of Payment Terms

Payment terms typically cover several important aspects of the transaction:

- Due Date – Clearly state the deadline by which payment should be made. Common options include 30, 60, or 90 days after the document date.

- Accepted Payment Methods – Indicate the types of payments accepted, such as credit card, bank transfer, or checks.

- Late Fees – Specify any additional charges that will apply if payment is not received by the due date. This could be a percentage of the total or a fixed amount.

- Early Payment Discounts – Some businesses offer a discount if the client pays before the due date. If applicable, include details about this incentive.

Example Payment Terms Table

| Payment Term | Details |

|---|---|

| Due Date | 30 days from the date of the document |

| Accepted Payments | Credit Card, Bank Transfer, or Check |

| Late Fee | 5% of the total amount after 30 days |

| Early Payment Discount | 2% discount for payments made within 10 days |

By clearly outlining payment terms, you help set expectations and avoid potential conflicts with clients. This clarity benefits both the business and the customer, leading to smoother transactions and quicker payments.

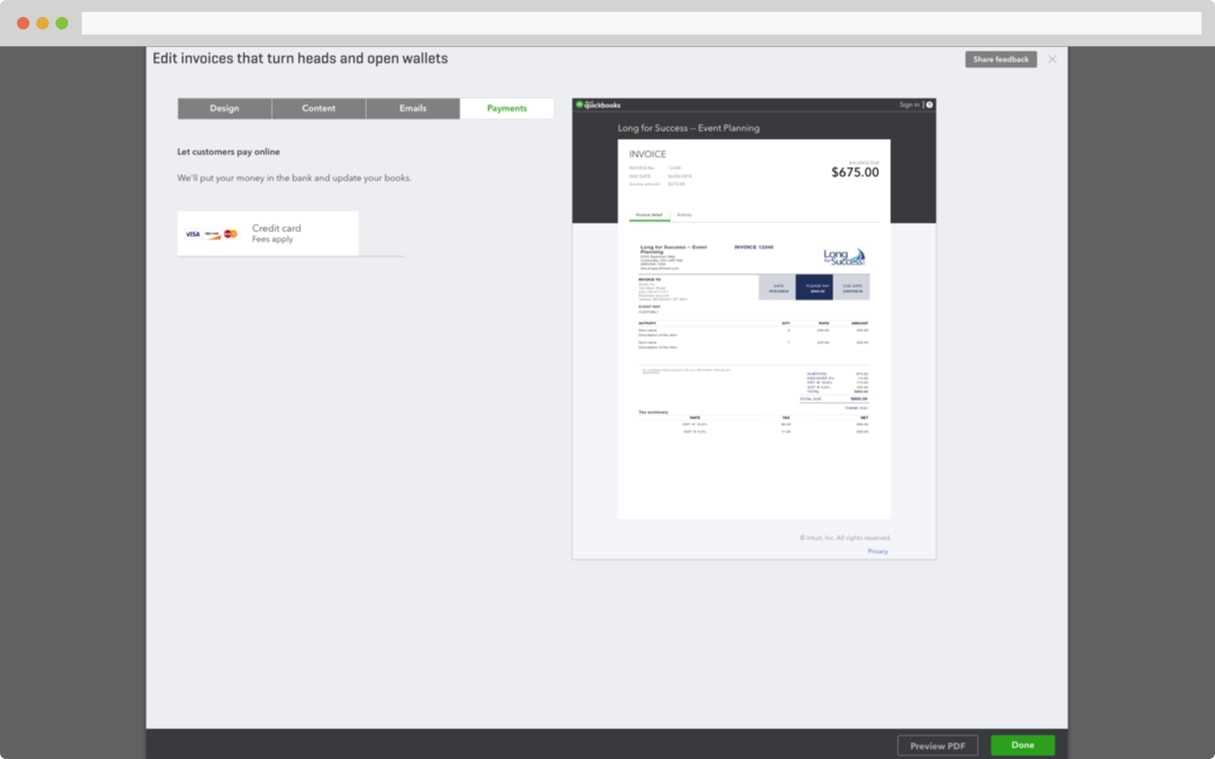

Automating Invoice Generation in QuickBooks

Automating the creation of financial documents can save time, reduce errors, and streamline the billing process for any business. By setting up automated systems to generate payment requests based on predefined criteria, businesses can ensure that all records are consistent and delivered on time. This approach eliminates the need for manual input and ensures that invoicing is both efficient and accurate.

Automation typically involves configuring settings that allow for the automatic generation of payment requests whenever a specific set of conditions is met, such as when a service is completed or a project milestone is achieved. This means that businesses can continue to focus on their core operations while the system takes care of the paperwork.

Benefits of automating this process include faster turnaround times, fewer chances for human error, and the ability to handle a larger volume of transactions without sacrificing accuracy. Automated systems also help businesses maintain a professional and organized appearance, as clients will consistently receive timely, error-free payment requests.

By using automated tools, businesses can significantly reduce administrative overhead, improve cash flow, and enhance overall customer satisfaction with prompt and well-organized financial documentation.

Integrating with Payment Systems

Integrating financial management software with payment systems allows businesses to streamline their billing and payment processes. This connection ensures that transactions are recorded automatically, payments are processed quickly, and both customers and businesses experience a smoother transaction flow. By linking payment solutions directly to accounting software, you eliminate the need for manual data entry and reduce the chances of errors.

Payment gateway integration enables businesses to accept payments via various methods, such as credit cards, bank transfers, or online payment platforms, all while maintaining synchronized financial records. This integration not only facilitates faster payments but also improves cash flow and ensures that transactions are accurately tracked in real time.

Benefits of integrating with payment systems include reduced administrative overhead, improved customer satisfaction, and enhanced reporting capabilities. Automated updates from payment systems mean that invoicing and accounting are more accurate, and businesses can easily monitor and reconcile transactions without extra effort. Additionally, it helps in creating a more professional image by offering seamless payment options to customers.

Integrating these systems provides a more efficient way to manage financial data, offering convenience, accuracy, and improved financial visibility for businesses of all sizes.

Customizing Your Template for Client Branding

Personalizing your financial documents to reflect your clients’ branding creates a more professional and cohesive experience. This customization not only enhances the overall presentation but also strengthens your clients’ brand identity by aligning the documents with their visual style. Tailoring the design elements ensures that your documents match their corporate color scheme, logos, and fonts, creating consistency across all communications.

Custom branding on financial documents helps clients feel more at ease and confident, knowing that the documents they receive are unique to their company’s image. This small but impactful detail can make your services appear more polished and dedicated to meeting your client’s needs.

| Customization Element | Purpose |

|---|---|

| Logo | Incorporate the client’s company logo to establish brand recognition. |

| Color Scheme | Use the client’s brand colors to maintain a uniform look. |

| Font Style | Match the client’s preferred typography for consistency. |

| Business Information | Ensure client-specific contact details are clearly displayed for easy communication. |

By implementing these customizations, you not only offer a tailored service but also contribute to a unified and professional brand experience for your clients. Whether it’s for a small business or a large corporation, ensuring their branding is reflected in financial documents is a simple yet effective way to enhance business relationships.

Common Errors in Auto Repair Invoices

When managing financial documents for service-based businesses, accuracy is crucial. Even minor mistakes can lead to confusion, delayed payments, or damage to client relationships. Identifying and addressing common errors in these documents can help maintain professionalism and ensure smooth transactions. Below are some frequent mistakes that businesses should avoid to streamline their billing process.

Incorrect Client Details

Missing or inaccurate information such as the client’s name, address, or contact details can lead to confusion and delays in communication. Ensuring that all client information is up to date is a fundamental part of producing error-free documents.

- Verify client name and business name.

- Double-check contact details for accuracy.

- Ensure correct billing and service addresses.

Errors in Itemization

Failing to properly itemize services and parts can lead to confusion for both the client and the service provider. It’s important to list all services provided, along with quantities and rates, to avoid discrepancies later on.

- Break down services and parts clearly.

- List individual pricing for each item.

- Ensure that descriptions match the work completed.

Incorrect Payment Terms

Miscommunication regarding payment deadlines or discount terms can result in delayed or missed payments. Ensure that the payment terms are clear and that any applicable discounts or fees are properly indicated.

- State payment due dates explicitly.

- Clarify any early payment discounts or late fees.

- Ensure payment methods are clearly outlined.

By identifying and correcting these common mistakes, businesses can improve their billing practices, reduce disputes, and maintain positive relationships with their clients. Accurate and professional financial documentation is essential for smooth operations and maintaining trust in the business.

Using QuickBooks for Service Tracking

Tracking services and work done for clients is a vital part of any business that relies on providing hands-on assistance. Efficient management of these records helps ensure smooth operations, better client communication, and accurate billing. By organizing service data in a systematic way, businesses can monitor job progress, manage customer expectations, and analyze the overall performance of their services.

Many businesses today use advanced tools to streamline their service tracking. With the right software, service details such as dates, hours worked, and materials used can be easily recorded and accessed. This not only simplifies workflow but also enhances productivity by providing quick access to information when needed. Integrating this process into your everyday operations can help in reducing errors, improving accuracy, and keeping clients satisfied with timely updates.

Service tracking solutions typically allow businesses to:

- Record detailed service descriptions and time spent on tasks.

- Track inventory and parts used for each project.

- Monitor payment statuses and outstanding balances related to specific services.

- Generate reports to identify trends and optimize service offerings.

With the ability to track all these variables in one place, businesses can ensure consistency, make data-driven decisions, and improve their overall service management.

Tips for Faster Invoice Processing

Efficient processing of billing statements is crucial for maintaining cash flow and ensuring timely payments. By adopting streamlined practices, businesses can reduce delays, improve operational efficiency, and enhance client satisfaction. Several strategies can be implemented to make the entire invoicing process faster and more organized.

1. Automate the Billing Process

Automation is one of the most effective ways to speed up the invoicing process. By setting up automatic generation of billing statements, businesses can save time and minimize errors. Automated systems can fill in client information, service details, and pricing structures, ensuring consistency and reducing manual entry tasks.

2. Use Standardized Formats

Using a standardized format for all billing documents ensures that no important information is overlooked. A consistent layout makes it easier for clients to understand the charges and for your team to process them swiftly. This approach not only reduces the time spent on corrections but also helps maintain professionalism in every transaction.

Additionally, having a well-defined template can eliminate unnecessary back-and-forth between the client and the business, speeding up approvals and payments. This organized approach enables a more effective workflow, allowing businesses to handle more transactions in less time.

Managing Auto Repair Invoices Efficiently

Effectively handling billing statements is essential for smooth business operations and financial health. By maintaining clear and consistent records, businesses can streamline the payment process and avoid unnecessary delays. Efficient management ensures faster processing, accurate tracking, and quicker payments, which ultimately boosts profitability and client satisfaction.

1. Implement a Centralized System

Using a centralized platform to track all financial documents allows for easy access and retrieval. A unified system enables businesses to organize records by date, client, or service type, reducing the time spent searching for specific documents. This setup also allows for faster updates and better coordination between departments or staff members involved in the billing process.

2. Ensure Accuracy in Billing

Accuracy is key when managing billing records. Ensuring that all service details, pricing, and client information are correct helps avoid errors that can lead to delayed payments or client disputes. It is essential to double-check all entries before finalizing the documents, and where possible, use automated tools to reduce the chance of mistakes.

Efficiency is not only about speed but also about minimizing errors that could slow down the process. A combination of accuracy, proper organization, and timely updates will result in a smoother, more efficient process for managing financial documents.