QuickBooks 2015 Invoice Template Guide and Customization Tips

Managing financial transactions and sending professional statements to clients is essential for any business. Using the right tools can simplify this process, saving both time and effort. With customizable documents, businesses can ensure their communications are clear, accurate, and tailored to their needs.

Automating and streamlining this aspect of business management helps maintain a steady cash flow and improves client relationships. Whether you are a freelancer or running a small company, a well-structured billing system is crucial for maintaining professionalism and organization.

Personalizing the documents you send to clients allows you to reflect your brand identity, adding a personal touch while keeping everything efficient. This guide explores how to set up and customize billing forms for your needs, ensuring you can easily track payments and manage financial records.

QuickBooks 2015 Invoice Template Overview

Customizable billing documents are an essential tool for businesses to communicate payment details to their clients in a clear and professional manner. These documents are designed to reflect your brand while ensuring accuracy and ease of use for both you and your clients. They help streamline the payment process by offering pre-defined sections for essential information, such as service descriptions, amounts, and payment terms.

With a well-structured document, you can ensure consistency across all client communications, saving time and reducing the risk of errors. The format is flexible, allowing you to tailor it to your business needs, whether you’re invoicing for one-time services or recurring payments. Let’s explore the key features and benefits of using these tools for your business operations.

| Feature | Description |

|---|---|

| Customizable Layout | Modify the document layout to suit your brand’s look, including colors, fonts, and logos. |

| Pre-Defined Fields | Automatic sections for client name, service details, pricing, and payment terms to reduce manual input. |

| Recurring Payment Setup | Create recurring billing schedules for ongoing services or subscription models. |

| Tax and Discount Integration | Include tax rates and discounts directly within the document, making calculations automatic. |

| Easy Export and Print Options | Download or print documents for physical distribution or email to clients in just a few clicks. |

By utilizing these tools, you ensure that your billing process is not only accurate but also reflects a professional image that can build trust and credibility with clients.

Why Use QuickBooks 2015 Invoice Templates

Using pre-designed billing documents offers numerous advantages for businesses looking to streamline their financial processes. These ready-to-use forms help save time, reduce errors, and maintain consistency in client communications. With customizable options, businesses can ensure that their statements not only meet functional needs but also reflect their unique branding.

Efficiency and Time Savings

One of the biggest benefits of using customizable billing forms is the efficiency they bring. Instead of creating a new document for each transaction, you can quickly generate professional-looking records with minimal effort. This ensures that all relevant details are included and formatted correctly every time, allowing you to focus more on your core business activities.

- Instant document generation

- Pre-filled fields for faster completion

- Consistency in layout and design

Professional Appearance and Branding

Well-designed forms help businesses establish a professional image. Customizing your forms with your company’s logo, color scheme, and contact details reinforces your brand’s identity. Clients will appreciate the attention to detail, which can lead to improved trust and long-term relationships.

- Consistent branding across all communications

- Customizable sections for personalized messages

- Professional layout that enhances client confidence

By adopting these pre-made billing documents, you can ensure accuracy, consistency, and professionalism in every transaction, helping your business operate smoothly and efficiently.

How to Download QuickBooks 2015 Templates

Getting access to customizable forms for your business is a straightforward process, and it doesn’t require any special technical knowledge. Whether you’re starting a new business or looking to switch from manual document creation, these tools are easily available for download and integration. The following steps will guide you through the process of obtaining and setting up these ready-made forms to fit your needs.

Step 1: Access the Download Section

To begin, you need to visit the official website or relevant source where the customizable documents are available. Look for a section dedicated to product downloads or resources. You can usually find it under support or templates categories. Once you’ve located the section, search for the appropriate version that matches your system and business requirements.

Step 2: Choose the Right Format

Depending on the tool you’re using, you’ll typically have options for different formats. It’s important to select the one that aligns with your software version. Make sure you choose a format that is compatible with your current business tools, whether that’s a software application or a web-based platform. After selecting the correct file type, click the download button to begin the process.

Important Note: Always verify the source of the download to ensure you are getting official, secure files. Unverified sources may lead to compatibility issues or potential security risks.

Once downloaded, you can begin using the forms immediately or customize them further to suit your specific business needs. This simple process ensures you have the right documents ready to go without any unnecessary delays.

Customizing Your QuickBooks 2015 Invoice Template

Personalizing your business forms allows you to reflect your company’s unique identity while ensuring that all necessary details are included. Customization not only enhances professionalism but also improves the ease of use for both you and your clients. This section will guide you through the various ways to adjust these documents to meet your specific needs.

Changing the Layout and Design

One of the most important aspects of customization is adjusting the layout and overall design to match your brand. You can modify elements such as colors, fonts, and logos. These small adjustments help create a more consistent visual identity across all of your documents and reinforce your company’s professional image.

- Upload your company logo for brand consistency.

- Adjust colors to match your brand’s theme.

- Change font styles to align with your business tone.

Modifying Fields and Information

Customizable forms allow you to add or remove fields based on your business requirements. For example, you can add extra sections for additional services, payment options, or even client-specific notes. Tailoring these fields ensures that your documents contain all relevant details without unnecessary clutter.

- Include specific service descriptions or itemized lists.

- Set up fields for payment terms and due dates.

- Incorporate tax calculations or discounts directly within the document.

By following these simple steps, you can easily adjust your business forms to not only look professional but also function according to your operational needs. Customization ensures a seamless experience for both you and your clients, improving workflow and reducing the chances of errors.

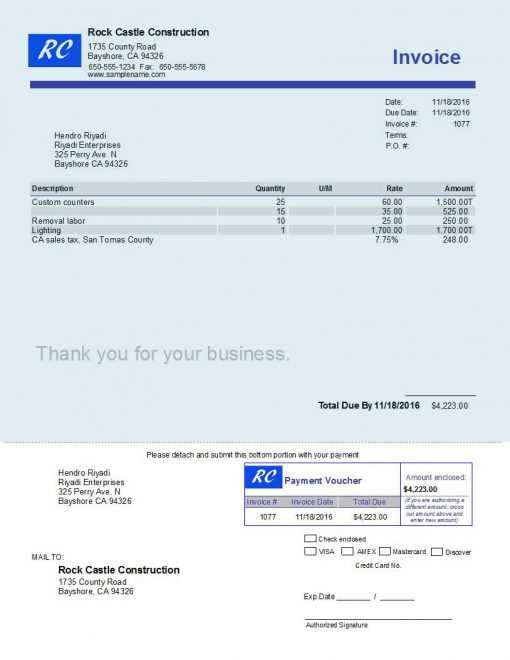

Steps to Create an Invoice in QuickBooks 2015

Creating a professional document for billing customers is an essential task for any business. This process allows you to efficiently manage payments, track sales, and ensure clients are charged correctly. In this guide, we will walk you through the necessary steps to generate such documents in the software. The approach is straightforward, and following each step will help you maintain a smooth financial workflow.

Step 1: Open the Software and Navigate to the Billing Section

First, launch the application and locate the billing area. This section is where you will initiate the creation of the financial document. Look for options related to sales or customer transactions. You should find a clear option to begin a new billing entry.

Step 2: Select the Customer and Set Up the Details

Once you have entered the appropriate section, choose the customer from your existing list or add a new one if necessary. The next step is to input the transaction details, such as the date, terms, and description of the products or services provided. This ensures that all relevant information is captured correctly.

Step 3: Add Items and Calculate Totals

- Enter the items or services that were sold to the customer.

- Specify the quantity, rate, and any applicable discounts.

- The system will automatically calculate the total cost for each item and the overall amount due.

Step 4: Customize the Document (Optional)

If needed, you can personalize the document by including your company’s logo, adjusting the layout, or adding specific notes. This is a great way to ensure the final document matches your business’s branding and provides the necessary instructions or information to your client.

Step 5: Review and Finalize the Document

Before sending it out, double-check all entries for accuracy. Ensure that the payment terms, due date, and amounts are correct. Once you’re satisfied with the information, you can finalize the document, which can be printed, saved, or emailed directly to the customer.

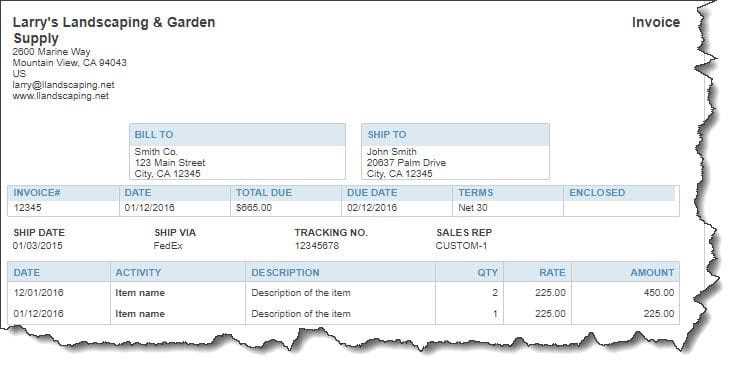

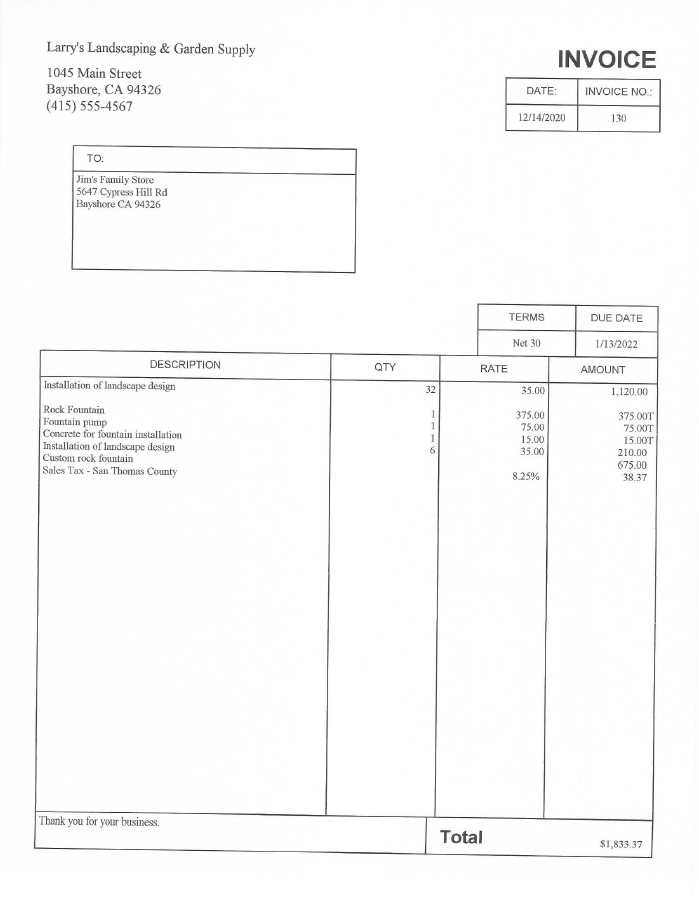

Understanding Fields in QuickBooks Invoice Templates

When creating professional billing documents, it’s essential to understand the different fields that make up the structure of the form. Each section serves a specific purpose, ensuring that all necessary information is included for both the business and the client. By familiarizing yourself with these areas, you can ensure that your documents are accurate, clear, and professional-looking.

Key Sections of the Billing Document

- Customer Information: This section captures the recipient’s details, including their name, address, and contact information. It is crucial for ensuring the document reaches the correct individual or company.

- Date: The date field marks when the transaction is processed. This is important for tracking when payment is due and for accounting purposes.

- Due Date: This field specifies the deadline for payment, helping both parties track when the balance should be settled.

- Description of Goods or Services: A clear and detailed description of what has been provided, ensuring the customer understands exactly what they are being charged for.

- Itemized List: This section breaks down each individual charge, such as quantity, unit price, and any applicable discounts or taxes. It ensures transparency in the billing process.

Additional Fields for Customization

- Notes: A customizable area where you can add terms, payment instructions, or any other relevant details specific to the transaction.

- Payment Terms: Specifies the payment method accepted, the due date, and any late fees or penalties that may apply if payment is not received on time.

- Company Branding: Including your business’s logo or slogan in the appropriate field gives the document a professional and personalized look.

Understanding Fields in QuickBooks Invoice Templates

When creating professional billing documents, it’s essential to understand the different fields that make up the structure of the form. Each section serves a specific purpose, ensuring that all necessary information is included for both the business and the client. By familiarizing yourself with these areas, you can ensure that your documents are accurate, clear, and professional-looking.

Key Sections of the Billing Document

- Customer Information: This section captures the recipient’s details, including their name, address, and contact information. It is crucial for ensuring the document reaches the correct individual or company.

- Date: The date field marks when the transaction is processed. This is important for tracking when payment is due and for accounting purposes.

- Due Date: This field specifies the deadline for payment, helping both parties track when the balance should be settled.

- Description of Goods or Services: A clear and detailed description of what has been provided, ensuring the customer understands exactly what they are being charged for.

- Itemized List: This section breaks down each individual charge, such as quantity, unit price, and any applicable discounts or taxes. It ensures transparency in the billing process.

Additional Fields for Customization

- Notes: A customizable area where you can add terms, payment instructions, or any other relevant details specific to the transaction.

- Payment Terms: Specifies the payment method accepted, the due date, and any late fees or penalties that may apply if payment is not received on time.

- Company Branding: Including your business’s logo or slogan in the appropriate field gives the document a professional and personalized look.

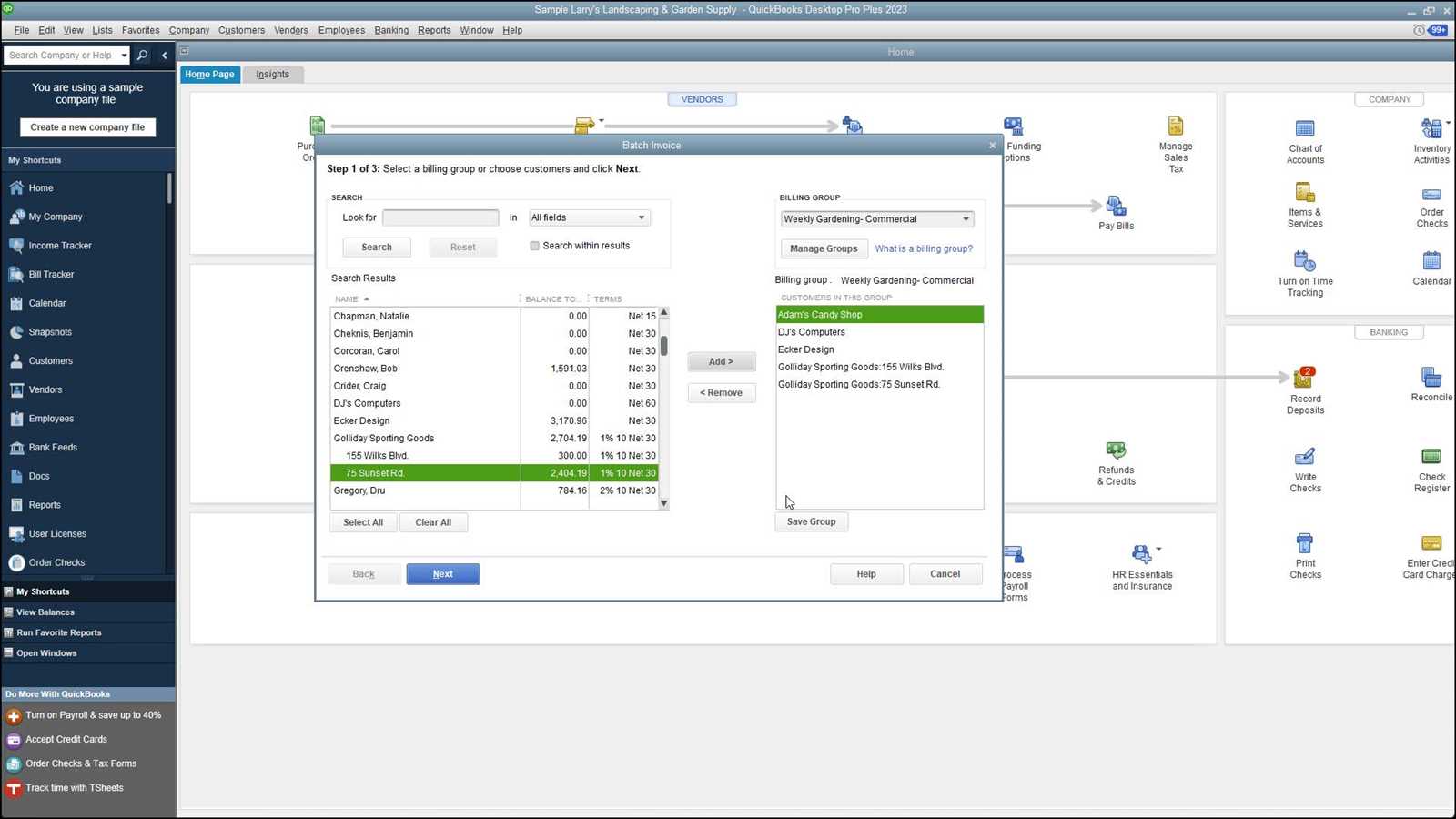

Creating Recurring Invoices in QuickBooks 2015

Setting up automatic billing for clients who require regular payments can save a significant amount of time and effort. With recurring billing options, businesses can streamline their accounting process by automatically generating documents at set intervals. This feature is particularly useful for subscription-based services or long-term contracts where the same amount is charged regularly.

To set up recurring transactions, begin by accessing the recurring billing section within your financial management software. From there, you’ll be able to customize the frequency of the charges, whether it’s weekly, monthly, quarterly, or any other interval suited to your business model. Once the details are entered, the software will handle the generation of the document each time it’s due, ensuring consistency and accuracy.

Additionally, you can modify the setup to include automatic email reminders to clients, keeping them informed about upcoming payments. This reduces the chance of missed or delayed payments and helps maintain healthy cash flow for your business.

Creating Recurring Invoices in QuickBooks 2015

Setting up automatic billing for clients who require regular payments can save a significant amount of time and effort. With recurring billing options, businesses can streamline their accounting process by automatically generating documents at set intervals. This feature is particularly useful for subscription-based services or long-term contracts where the same amount is charged regularly.

To set up recurring transactions, begin by accessing the recurring billing section within your financial management software. From there, you’ll be able to customize the frequency of the charges, whether it’s weekly, monthly, quarterly, or any other interval suited to your business model. Once the details are entered, the software will handle the generation of the document each time it’s due, ensuring consistency and accuracy.

Additionally, you can modify the setup to include automatic email reminders to clients, keeping them informed about upcoming payments. This reduces the chance of missed or delayed payments and helps maintain healthy cash flow for your business.

Creating Recurring Invoices in QuickBooks 2015

Setting up automatic billing for clients who require regular payments can save a significant amount of time and effort. With recurring billing options, businesses can streamline their accounting process by automatically generating documents at set intervals. This feature is particularly useful for subscription-based services or long-term contracts where the same amount is charged regularly.

To set up recurring transactions, begin by accessing the recurring billing section within your financial management software. From there, you’ll be able to customize the frequency of the charges, whether it’s weekly, monthly, quarterly, or any other interval suited to your business model. Once the details are entered, the software will handle the generation of the document each time it’s due, ensuring consistency and accuracy.

Additionally, you can modify the setup to include automatic email reminders to clients, keeping them informed about upcoming payments. This reduces the chance of missed or delayed payments and helps maintain healthy cash flow for your business.

Creating Recurring Invoices in QuickBooks 2015

Setting up automatic billing for clients who require regular payments can save a significant amount of time and effort. With recurring billing options, businesses can streamline their accounting process by automatically generating documents at set intervals. This feature is particularly useful for subscription-based services or long-term contracts where the same amount is charged regularly.

To set up recurring transactions, begin by accessing the recurring billing section within your financial management software. From there, you’ll be able to customize the frequency of the charges, whether it’s weekly, monthly, quarterly, or any other interval suited to your business model. Once the details are entered, the software will handle the generation of the document each time it’s due, ensuring consistency and accuracy.

Additionally, you can modify the setup to include automatic email reminders to clients, keeping them informed about upcoming payments. This reduces the chance of missed or delayed payments and helps maintain healthy cash flow for your business.

Creating Recurring Invoices in QuickBooks 2015

Setting up automatic billing for clients who require regular payments can save a significant amount of time and effort. With recurring billing options, businesses can streamline their accounting process by automatically generating documents at set intervals. This feature is particularly useful for subscription-based services or long-term contracts where the same amount is charged regularly.

To set up recurring transactions, begin by accessing the recurring billing section within your financial management software. From there, you’ll be able to customize the frequency of the charges, whether it’s weekly, monthly, quarterly, or any other interval suited to your business model. Once the details are entered, the software will handle the generation of the document each time it’s due, ensuring consistency and accuracy.

Additionally, you can modify the setup to include automatic email reminders to clients, keeping them informed about upcoming payments. This reduces the chance of missed or delayed payments and helps maintain healthy cash flow for your business.

Creating Recurring Invoices in QuickBooks 2015

Setting up automatic billing for clients who require regular payments can save a significant amount of time and effort. With recurring billing options, businesses can streamline their accounting process by automatically generating documents at set intervals. This feature is particularly useful for subscription-based services or long-term contracts where the same amount is charged regularly.

To set up recurring transactions, begin by accessing the recurring billing section within your financial management software. From there, you’ll be able to customize the frequency of the charges, whether it’s weekly, monthly, quarterly, or any other interval suited to your business model. Once the details are entered, the software will handle the generation of the document each time it’s due, ensuring consistency and accuracy.

Additionally, you can modify the setup to include automatic email reminders to clients, keeping them informed about upcoming payments. This reduces the chance of missed or delayed payments and helps maintain healthy cash flow for your business.

Creating Recurring Invoices in QuickBooks 2015

Setting up automatic billing for clients who require regular payments can save a significant amount of time and effort. With recurring billing options, businesses can streamline their accounting process by automatically generating documents at set intervals. This feature is particularly useful for subscription-based services or long-term contracts where the same amount is charged regularly.

To set up recurring transactions, begin by accessing the recurring billing section within your financial management software. From there, you’ll be able to customize the frequency of the charges, whether it’s weekly, monthly, quarterly, or any other interval suited to your business model. Once the details are entered, the software will handle the generation of the document each time it’s due, ensuring consistency and accuracy.

Additionally, you can modify the setup to include automatic email reminders to clients, keeping them informed about upcoming payments. This reduces the chance of missed or delayed payments and helps maintain healthy cash flow for your business.

Creating Recurring Invoices in QuickBooks 2015

Setting up automatic billing for clients who require regular payments can save a significant amount of time and effort. With recurring billing options, businesses can streamline their accounting process by automatically generating documents at set intervals. This feature is particularly useful for subscription-based services or long-term contracts where the same amount is charged regularly.

To set up recurring transactions, begin by accessing the recurring billing section within your financial management software. From there, you’ll be able to customize the frequency of the charges, whether it’s weekly, monthly, quarterly, or any other interval suited to your business model. Once the details are entered, the software will handle the generation of the document each time it’s due, ensuring consistency and accuracy.

Additionally, you can modify the setup to include automatic email reminders to clients, keeping them informed about upcoming payments. This reduces the chance of missed or delayed payments and helps maintain healthy cash flow for your business.

Creating Recurring Invoices in QuickBooks 2015

Setting up automatic billing for clients who require regular payments can save a significant amount of time and effort. With recurring billing options, businesses can streamline their accounting process by automatically generating documents at set intervals. This feature is particularly useful for subscription-based services or long-term contracts where the same amount is charged regularly.

To set up recurring transactions, begin by accessing the recurring billing section within your financial management software. From there, you’ll be able to customize the frequency of the charges, whether it’s weekly, monthly, quarterly, or any other interval suited to your business model. Once the details are entered, the software will handle the generation of the document each time it’s due, ensuring consistency and accuracy.

Additionally, you can modify the setup to include automatic email reminders to clients, keeping them informed about upcoming payments. This reduces the chance of missed or delayed payments and helps maintain healthy cash flow for your business.

Creating Recurring Invoices in QuickBooks 2015

Setting up automatic billing for clients who require regular payments can save a significant amount of time and effort. With recurring billing options, businesses can streamline their accounting process by automatically generating documents at set intervals. This feature is particularly useful for subscription-based services or long-term contracts where the same amount is charged regularly.

To set up recurring transactions, begin by accessing the recurring billing section within your financial management software. From there, you’ll be able to customize the frequency of the charges, whether it’s weekly, monthly, quarterly, or any other interval suited to your business model. Once the details are entered, the software will handle the generation of the document each time it’s due, ensuring consistency and accuracy.

Additionally, you can modify the setup to include automatic email reminders to clients, keeping them informed about upcoming payments. This reduces the chance of missed or delayed payments and helps maintain healthy cash flow for your business.

Creating Recurring Invoices in QuickBooks 2015

Setting up automatic billing for clients who require regular payments can save a significant amount of time and effort. With recurring billing options, businesses can streamline their accounting process by automatically generating documents at set intervals. This feature is particularly useful for subscription-based services or long-term contracts where the same amount is charged regularly.

To set up recurring transactions, begin by accessing the recurring billing section within your financial management software. From there, you’ll be able to customize the frequency of the charges, whether it’s weekly, monthly, quarterly, or any other interval suited to your business model. Once the details are entered, the software will handle the generation of the document each time it’s due, ensuring consistency and accuracy.

Additionally, you can modify the setup to include automatic email reminders to clients, keeping them informed about upcoming payments. This reduces the chance of missed or delayed payments and helps maintain healthy cash flow for your business.