How to Use Quickbook Templates for Invoices

Efficient management of billing and payment requests is crucial for any business seeking to maintain healthy cash flow. Utilizing structured formats for financial documents can significantly enhance organization and professionalism, allowing businesses to focus on growth rather than administrative tasks.

Creating effective financial documents requires attention to detail and consistency. By incorporating user-friendly designs, businesses can ensure clarity for clients while simplifying the overall invoicing process. This not only saves time but also reduces the likelihood of errors, which can lead to delays in payment.

Employing systematic approaches in crafting these essential documents empowers businesses to present their services or products in a clear and appealing manner. Understanding the various options available can help in tailoring documents to fit specific needs and preferences, ultimately improving client satisfaction and financial management.

Understanding Invoice Formats

Having a clear and organized structure for billing documents is essential for any business. These formats serve as a foundation for effective financial communication, ensuring that all necessary information is presented in a professional manner. By utilizing these formats, companies can streamline their processes, making it easier to track payments and manage client interactions.

Different styles of billing documents cater to various business needs, allowing for customization that reflects the company’s brand while providing clarity to clients. Here are some key components typically included in well-structured financial documents:

| Component | Description |

|---|---|

| Header | Contains the business name, logo, and contact information. |

| Client Information | Details about the recipient, including their name and address. |

| Date | The date of issuance for the financial document. |

| Itemized List | A breakdown of products or services provided with corresponding costs. |

| Total Amount Due | The sum of all charges, including taxes and discounts. |

| Payment Terms | Details regarding payment methods and due dates. |

Understanding these essential elements can help businesses create effective billing documents that enhance communication and promote timely payments. A well-designed structure not only improves efficiency but also reinforces a professional image, making it easier to build lasting relationships with clients.

Benefits of Using Billing Formats

Utilizing structured formats for financial documents offers numerous advantages for businesses. These organized layouts streamline the billing process, reduce errors, and enhance professionalism in client interactions. Adopting such formats can significantly improve efficiency and accuracy across various aspects of financial management.

Here are some key benefits of employing standardized financial documents:

- Time Efficiency: Pre-designed structures save time on document creation, allowing businesses to focus on core activities.

- Consistency: Using a uniform format ensures that all documents maintain a professional appearance, reinforcing brand identity.

- Error Reduction: Clear layouts minimize mistakes in calculations and information, leading to more accurate financial transactions.

- Improved Tracking: Organized documents make it easier to monitor payments and outstanding balances, enhancing cash flow management.

- Enhanced Communication: Well-structured documents present information clearly, helping clients understand charges and payment terms.

Incorporating these organized formats not only enhances operational efficiency but also fosters positive relationships with clients. Businesses that prioritize clarity and professionalism in their financial communications are more likely to succeed in the competitive marketplace.

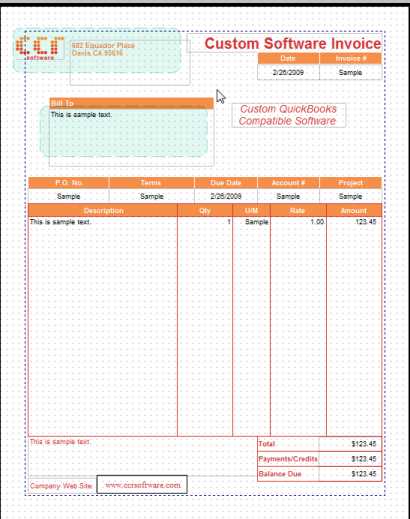

How to Create Your Own Format

Developing a personalized structure for financial documents allows businesses to reflect their unique branding while meeting specific needs. A well-crafted layout not only enhances the presentation but also improves clarity for clients. The process of creating a custom document can be straightforward when following a few key steps.

Steps to Design Your Format

Consider the following steps when designing your own financial document structure:

- Identify Essential Components: Determine what information is necessary for your document, such as:

- Business name and contact details

- Client information

- Date of issuance

- List of products or services provided

- Total amount due and payment terms

- Simple and clean designs for straightforward communication

- More elaborate styles that highlight branding elements

Finalizing Your Custom Document

Once you have developed your personalized structure, save it in a format that allows for easy duplication and distribution. Having a custom document ready will streamline your billing process and ensure consistent communication with your clients.

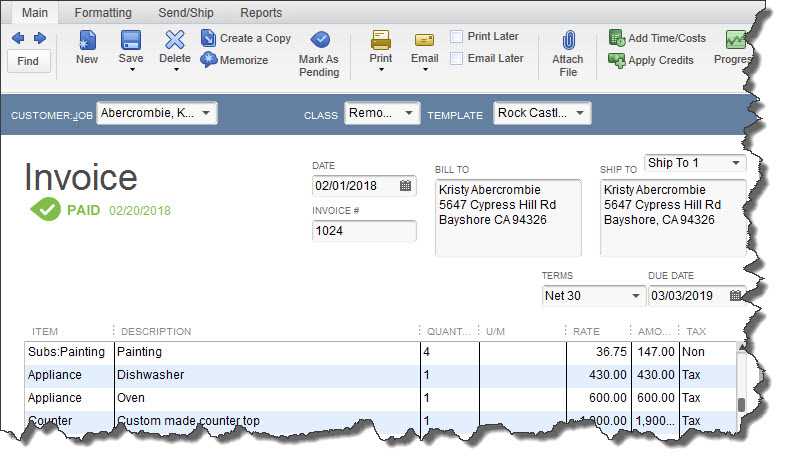

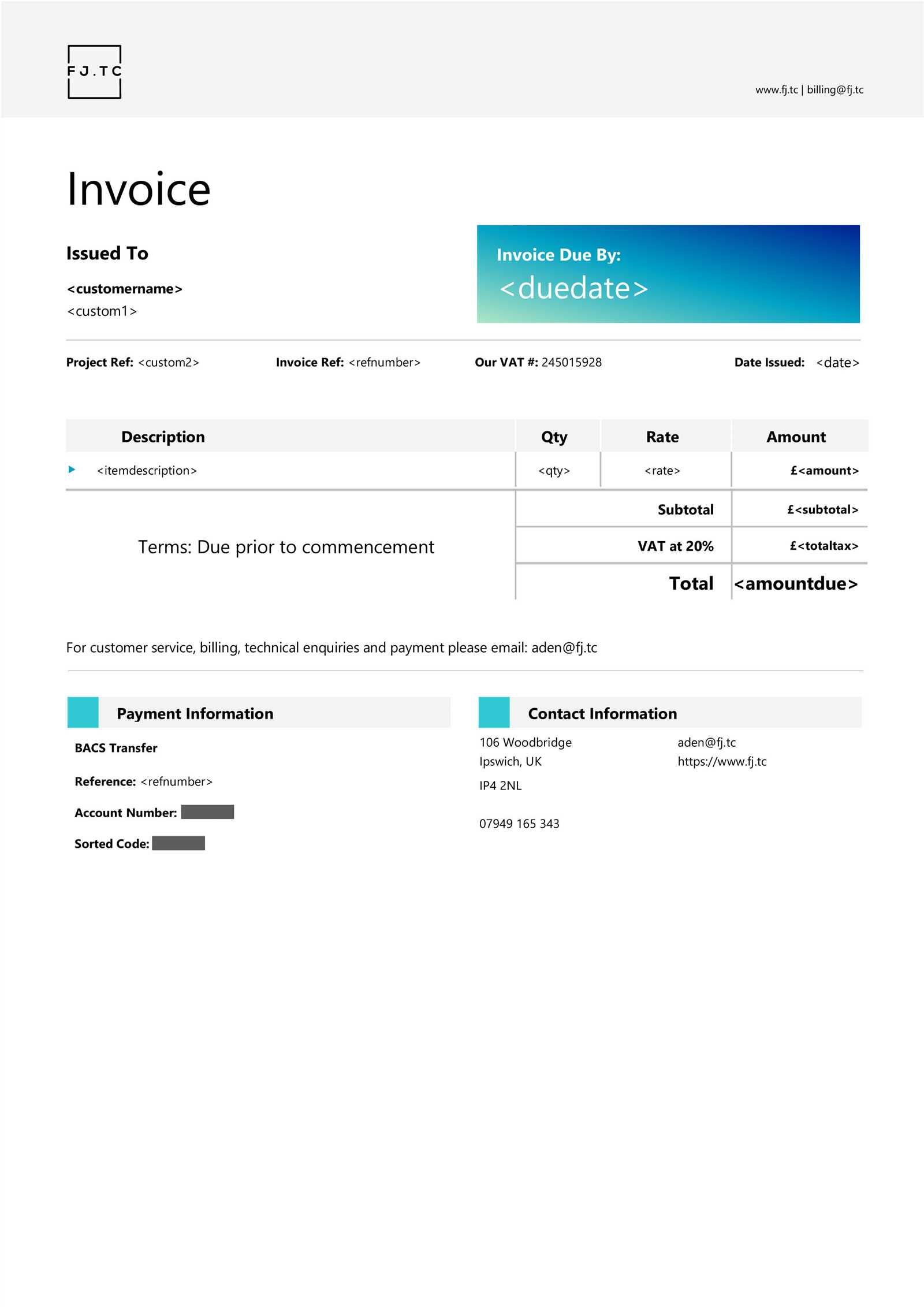

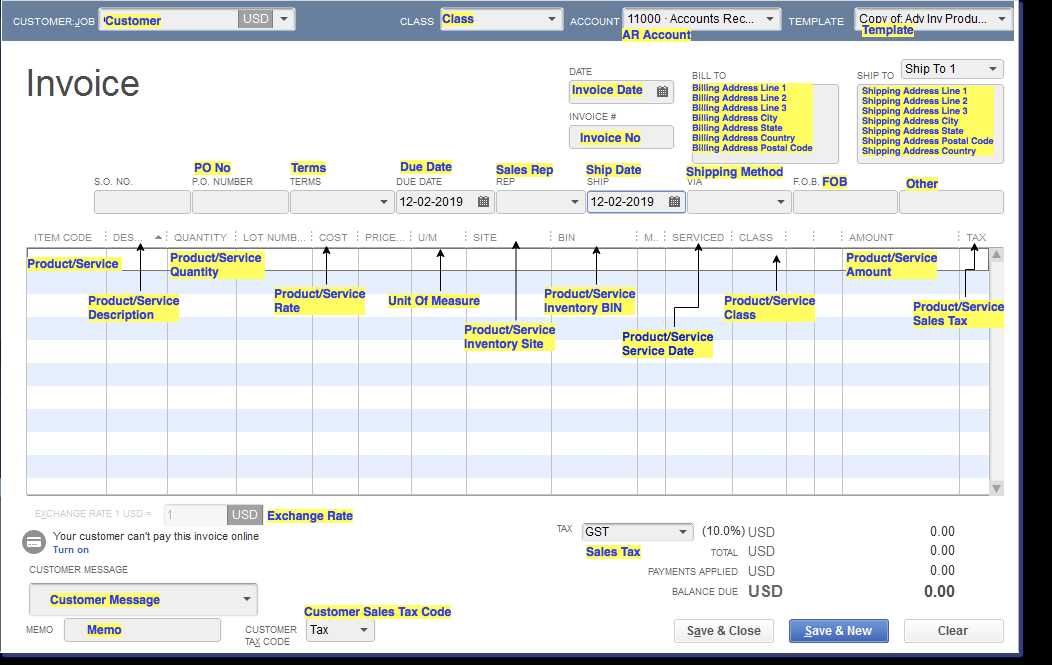

Customizing Billing Formats in Your Software

Personalizing your financial documents is essential for businesses looking to present a professional image while reflecting their brand identity. Tailoring these documents allows for the incorporation of specific elements that resonate with clients, ensuring clarity and enhancing overall communication. Adjusting the design and content can significantly impact how clients perceive your professionalism.

Steps to Customize Your Financial Document

Follow these steps to personalize your billing format within your software:

- Access Document Settings: Navigate to the section of the software that manages financial documents, usually found in the settings or preferences menu.

- Select a Default Format: Choose a basic layout as a starting point. This will provide a foundation upon which to build your custom design.

- Modify Appearance: Adjust visual elements, such as:

- Colors that match your branding

- Fonts that are easy to read

- Logos and images to enhance brand recognition

- Your business name and contact details

- Client’s information

- A detailed list of services or products

- Payment terms and due dates

Benefits of Customization

By customizing your financial documents, you enhance clarity, improve client relations, and reinforce your brand’s identity. This attention to detail not only helps in building trust but also promotes timely payments, ultimately contributing to the growth of your business.

Common Mistakes to Avoid

When managing financial documents, several pitfalls can hinder efficiency and professionalism. Awareness of these common errors is crucial for businesses aiming to maintain a smooth billing process and positive client relationships. By recognizing and addressing these mistakes, organizations can enhance accuracy and ensure timely payments.

Here are some frequent errors to steer clear of:

- Inaccurate Information: Double-check all details, including client names, addresses, and amounts due. Incorrect information can lead to confusion and payment delays.

- Missing Payment Terms: Clearly outline payment terms and due dates to prevent misunderstandings. Ambiguity can result in late payments or disputes.

- Failure to Customize: Using generic formats can diminish your brand’s image. Tailor documents to reflect your business identity for a more professional appearance.

- Neglecting Follow-Up: Failing to follow up on outstanding payments can affect cash flow. Establish a system for reminders to keep clients informed.

- Overcomplicating Layouts: While design is important, overly complex layouts can confuse clients. Aim for clarity and simplicity to ensure easy comprehension.

- Not Using a Backup System: Relying solely on one document format can lead to issues if it becomes corrupted or lost. Always have backups for your financial documents.

By avoiding these common pitfalls, businesses can improve their financial management processes, enhance communication with clients, and foster a more efficient billing experience.

Integrating Financial Software with Other Tools

Combining your financial management system with other applications can streamline operations, enhance productivity, and reduce manual data entry. Integration allows businesses to synchronize data across platforms, providing a more cohesive approach to financial tracking and reporting. Leveraging the right tools can significantly improve efficiency and accuracy in financial processes.

Benefits of Integration

Integrating your financial management system with other tools offers several advantages, including:

- Improved Data Accuracy: Automation reduces the risk of human error when transferring information between systems.

- Enhanced Reporting: Consolidated data from various sources enables better analysis and decision-making.

- Time Savings: Integration streamlines workflows, allowing teams to focus on more strategic tasks rather than manual data entry.

- Seamless Communication: Connecting different applications facilitates better communication and collaboration among teams.

Common Tools for Integration

Here are some popular tools that can be integrated with your financial management system:

| Tool | Description |

|---|---|

| CRM Software | Enhances client relationship management by syncing customer data and transaction history. |

| Project Management Apps | Tracks project expenses and budgets while linking financial data to specific projects. |

| Payment Processors | Facilitates seamless payment processing directly from invoices, improving cash flow. |

| Inventory Management Systems | Syncs inventory levels with financial records to maintain accurate stock information. |

By integrating your financial management system with these and other tools, you can create a more efficient and organized approach to managing your business’s finances.

Best Practices for Billing Clients

Establishing effective billing practices is essential for maintaining healthy cash flow and fostering strong client relationships. By adhering to recognized guidelines, businesses can enhance their invoicing processes, ensuring that clients receive clear and professional financial documents. This approach not only facilitates timely payments but also minimizes misunderstandings and disputes.

Essential Guidelines for Effective Billing

To streamline the billing process and enhance professionalism, consider the following best practices:

- Be Clear and Concise: Ensure that all information on your financial documents is easy to understand, including item descriptions, quantities, and prices.

- Establish Payment Terms: Clearly outline your payment expectations, including due dates and accepted payment methods, to avoid confusion.

- Personalize Communications: Address clients by name and tailor your documents to reflect their unique needs, which fosters better relationships.

- Follow Up: Implement a reminder system for overdue payments to encourage timely responses and maintain cash flow.

Common Mistakes to Avoid

Avoiding pitfalls in the billing process is equally important. Here are some common errors to steer clear of:

| Mistake | Consequence |

|---|---|

| Omitting Important Details | Can lead to confusion and delayed payments. |

| Inconsistent Formatting | May result in a lack of professionalism and client trust. |

| Neglecting to Follow Up | Can harm cash flow and create misunderstandings. |

| Failing to Update Client Information | Leads to errors in billing and potential disputes. |

By implementing these best practices, businesses can improve their billing processes, ensuring a smooth experience for both themselves and their clients.

Tracking Payments with Invoice Templates

Monitoring financial transactions is crucial for maintaining a healthy cash flow and ensuring the timely collection of funds. By utilizing structured billing documents, businesses can effectively track payments, identify outstanding balances, and manage their financial records with greater efficiency. This organized approach minimizes errors and helps establish stronger relationships with clients through transparency.

To effectively monitor payments, consider implementing a systematic approach that includes the following elements:

| Tracking Method | Description |

|---|---|

| Payment Status Indicators | Use visual markers to indicate whether payments are pending, completed, or overdue, providing instant clarity on financial status. |

| Detailed Record-Keeping | Maintain comprehensive records of all transactions, including payment dates, amounts, and methods, to track cash flow accurately. |

| Automated Reminders | Set up automated notifications to remind clients of upcoming or overdue payments, helping to prompt timely responses. |

| Client Portals | Provide access to a dedicated portal where clients can view their transaction history and payment status, fostering transparency. |

By implementing these strategies, businesses can enhance their ability to track payments effectively, leading to improved financial management and client satisfaction.

How to Edit Existing Templates

Adjusting pre-designed documents can greatly enhance your business’s branding and functionality. Customizing these files allows for a more personalized touch, ensuring that all essential information is presented clearly and effectively. Making changes not only helps in maintaining consistency with your brand but also improves the overall user experience for your clients.

Steps to Modify Your Documents

Follow these straightforward steps to edit your existing files:

- Access the Editing Interface: Navigate to the section where your current documents are stored. Locate the file you wish to modify.

- Select the Document: Click on the specific file you want to change, which will open it for editing.

- Make Your Adjustments: Alter the text, adjust layouts, and incorporate any new elements that reflect your current branding or required details.

- Preview Changes: Before saving, review the modifications to ensure everything appears as intended.

- Save Your Work: After confirming that all changes are satisfactory, save the updated document for future use.

Benefits of Customization

Personalizing your documents can lead to improved client engagement and a more professional appearance. Custom elements can also highlight key information, making it easier for clients to understand the content at a glance.

Using Templates for Recurring Invoices

Employing pre-designed documents for regular billing cycles can significantly streamline your financial processes. By utilizing these formats, businesses can ensure consistent communication with clients, reducing the time spent on administrative tasks. This approach not only enhances efficiency but also contributes to a more organized invoicing system.

When setting up these documents, it is essential to include all necessary details to facilitate smooth transactions. Important elements such as payment terms, due dates, and itemized lists of services or products should be clearly defined. Utilizing established formats allows for quick adjustments to pricing or services as needed while maintaining the overall structure.

Benefits of Using Pre-Designed Documents for Regular Billing:

- Time Savings: Automating the creation of these files eliminates repetitive tasks, allowing you to focus on core business activities.

- Consistency: Maintaining a uniform format reinforces your brand identity and ensures that clients receive familiar documentation.

- Improved Accuracy: Reducing manual entry errors by relying on established formats minimizes discrepancies in billing.

- Easy Adjustments: Modifying these documents for specific needs is straightforward, ensuring that all changes are implemented quickly.

By adopting this strategy, businesses can enhance their overall efficiency and foster better relationships with clients through reliable and timely communication.

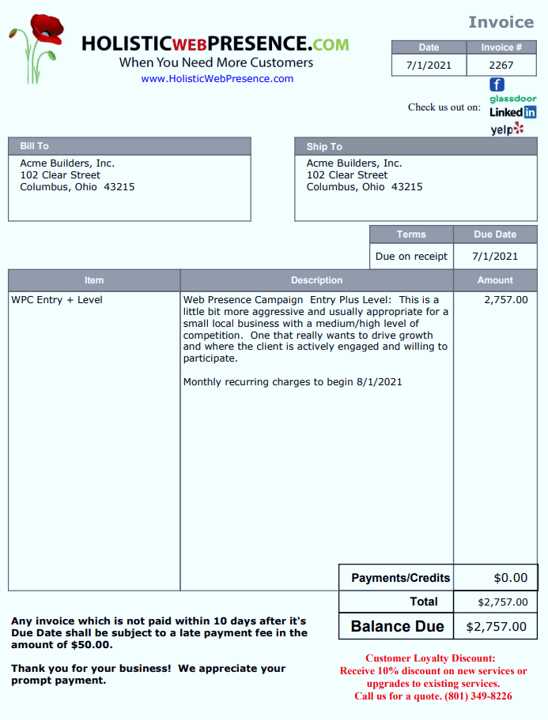

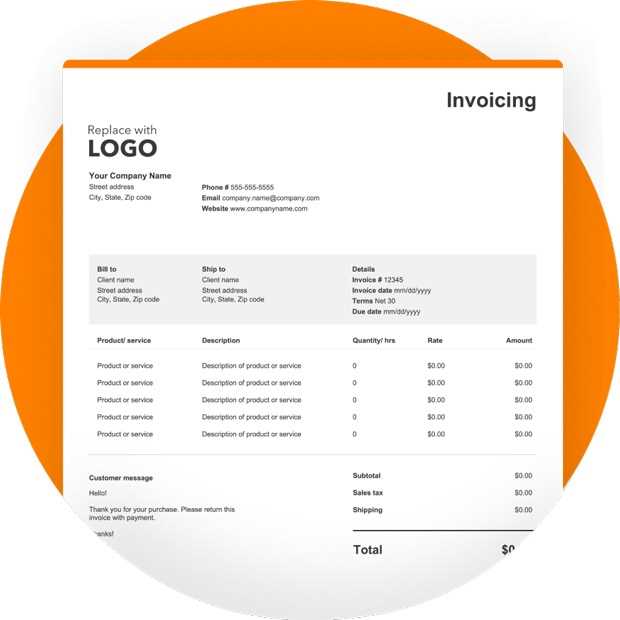

Choosing the Right Template Design

Selecting an appropriate design for your billing documents is crucial for effective communication and brand representation. The right layout not only enhances the visual appeal but also ensures that essential information is presented clearly. A well-structured document can significantly impact your clients’ perception and prompt timely payments.

Factors to Consider

When deciding on a design, keep the following elements in mind:

- Branding: Ensure the layout aligns with your company’s identity, incorporating colors and logos that reflect your brand.

- Clarity: Opt for designs that highlight key information, making it easy for clients to understand the charges and payment terms.

- Flexibility: Choose a format that can be easily modified to accommodate various services or pricing structures.

- Professionalism: A polished design communicates credibility, fostering trust in your business dealings.

Examples of Effective Designs

Consider these styles when selecting your document format:

- Minimalist: Simple designs that focus on essential information can create a clean and modern look.

- Bold: Eye-catching layouts with strong colors can draw attention and make your documents stand out.

- Classic: Traditional formats that include elegant fonts and structured layouts convey a sense of reliability and professionalism.

Ultimately, the right design will enhance your communication efforts and ensure your financial documents serve their intended purpose effectively.

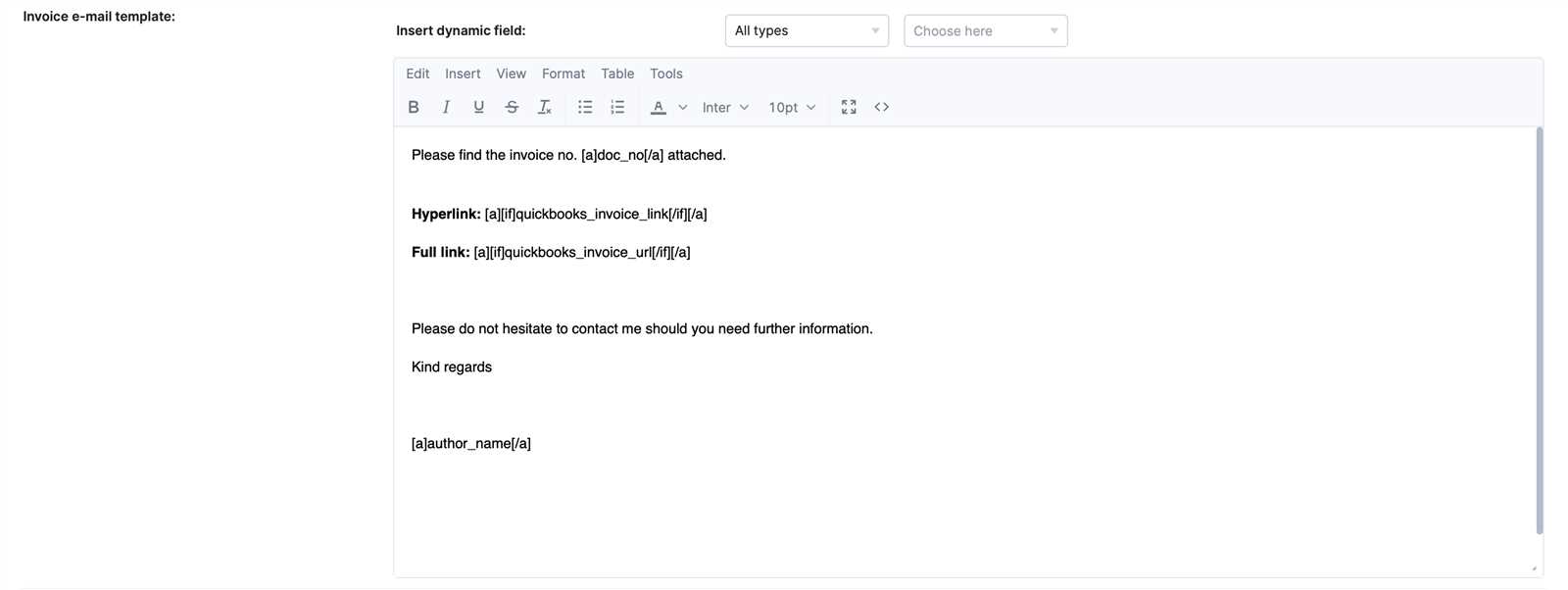

Exporting and Sharing Invoice Templates

Sharing and exporting your billing documents is essential for collaboration and efficient business operations. Whether you need to send a draft to a colleague for review or share finalized documents with clients, understanding the available options can streamline the process. This section covers various methods for transferring your formatted documents while maintaining their integrity.

Export Options

When preparing to share your billing formats, consider these common export methods:

| Format | Advantages | Best Used For |

|---|---|---|

| Ensures formatting remains intact; widely accessible. | Final documents sent to clients. | |

| Word Document | Easy to edit and customize; good for drafts. | Internal reviews or collaborative editing. |

| CSV | Facilitates data import into other systems. | Data analysis and record-keeping. |

| Excel | Allows for detailed calculations and analysis. | Financial reports and detailed tracking. |

Sharing Methods

Once your document is ready for distribution, consider the following methods:

- Email: A direct way to send documents to clients or team members.

- Cloud Storage: Upload your documents to services like Google Drive or Dropbox for easy access and sharing.

- Project Management Tools: Use platforms like Trello or Asana to attach and share documents with team members.

By utilizing these export and sharing methods, you can enhance your workflow and ensure that your formatted documents reach the appropriate audience efficiently.

Ensuring Compliance with Invoicing Standards

Adhering to established guidelines for billing documents is crucial for maintaining professionalism and legality in financial transactions. Compliance helps avoid disputes, ensures timely payments, and fosters trust between businesses and clients. This section outlines the key considerations for achieving compliance in your financial documentation processes.

Understand Legal Requirements: Different jurisdictions have varying regulations regarding what must be included in a billing document. Common requirements include:

- Business Information: Full name, address, and contact details of the service provider.

- Client Details: Accurate information about the recipient, including their name and address.

- Itemized Charges: A clear breakdown of goods or services provided, along with corresponding costs.

- Payment Terms: Specific details regarding payment deadlines, accepted methods, and any late fees.

Maintain Accuracy: Errors in your financial documents can lead to compliance issues. Ensure that:

- All entries are accurate and up-to-date.

- Prices are calculated correctly to avoid discrepancies.

- Tax rates are applied correctly according to the jurisdiction.

Regular Audits: Conducting periodic reviews of your financial documentation processes can help identify areas for improvement. Ensure that:

- You are aware of any changes in regulations.

- Your billing formats are updated to reflect best practices.

By focusing on compliance, you can create reliable financial documents that not only meet legal standards but also enhance your credibility and professionalism in the marketplace.

Tips for Professional Invoice Appearance

Creating visually appealing billing documents is essential for leaving a positive impression on clients. A well-designed document not only reflects professionalism but also enhances clarity and fosters trust. This section provides practical tips to ensure that your financial documents look polished and are easy to understand.

Maintain a Clean Layout

A cluttered document can confuse clients and detract from the information presented. Consider the following:

- Use Ample White Space: Ensure that there is enough space between different sections to facilitate readability.

- Organize Information Logically: Present details in a clear order, grouping related items together.

- Limit Fonts: Stick to one or two fonts to maintain consistency and avoid distractions.

Incorporate Branding Elements

Integrating your brand identity into your financial documents can enhance recognition. Implement these elements:

- Logo: Include your business logo prominently at the top of the document.

- Color Scheme: Use colors that align with your brand for headings and borders.

- Consistent Language: Maintain a professional tone that reflects your brand’s voice throughout the document.

By focusing on these aspects, you can create billing documents that not only convey the necessary information but also reinforce your brand’s professionalism and attention to detail.

Managing Client Information Efficiently

Efficiently handling customer data is crucial for any business aiming to streamline operations and enhance communication. By organizing client details systematically, companies can improve their responsiveness and ensure that interactions are personalized and relevant. This section discusses effective strategies for managing customer information.

| Strategy | Description |

|---|---|

| Centralized Database | Utilize a single platform to store all client information, making it easily accessible for your team. |

| Regular Updates | Establish a routine for reviewing and updating client data to ensure accuracy and relevancy. |

| Segmentation | Group clients based on specific criteria such as purchase history or preferences to tailor communications. |

| Data Security | Implement robust security measures to protect sensitive information and maintain client trust. |

By applying these strategies, businesses can foster better relationships with their customers, enhance operational efficiency, and ultimately drive growth.

Common Features in Invoice Templates

Many designs share essential characteristics that enhance usability and clarity. Recognizing these features can help users choose the right layout for their business needs. This section highlights key elements commonly found in billing documents.

1. Header Information

This typically includes the company name, logo, and contact details, ensuring that clients can easily identify the sender and get in touch if necessary.

2. Client Details

Clear identification of the recipient’s name and contact information is vital. This section allows for personalized communication and helps prevent confusion.

3. Itemized List

A detailed breakdown of services or products rendered, including descriptions, quantities, and prices, provides transparency and aids in understanding charges.

4. Payment Terms

Stipulating the conditions under which payment is expected, such as due dates and accepted payment methods, helps set clear expectations for both parties.

5. Total Amount Due

The final total should be prominently displayed to ensure clarity and facilitate timely payments. Including taxes and any additional fees should be clearly indicated.

6. Notes or Comments Section

This optional area allows for additional information, such as personalized messages, discounts offered, or specific instructions, enhancing the client relationship.

By incorporating these common characteristics, billing documents can enhance professionalism and efficiency in business transactions.

How Templates Improve Business Workflow

Utilizing structured formats can significantly enhance operational efficiency within an organization. By standardizing various processes, these tools streamline tasks, reduce errors, and save valuable time. This section explores how well-designed formats contribute to smoother business operations.

Benefits of Using Structured Formats

- Consistency: Standard formats ensure uniformity in communications, which helps in maintaining a professional image across all transactions.

- Time Savings: Predefined layouts allow for quicker creation of documents, enabling employees to focus on core activities rather than formatting details.

- Reduced Errors: By using established formats, the likelihood of mistakes decreases, leading to more accurate records and less confusion.

- Improved Client Relationships: Consistent and clear documents foster better understanding and trust between businesses and their clients.

Enhancing Operational Efficiency

Structured formats allow teams to manage information more effectively. Employees can easily access and update data, facilitating better tracking of transactions and communications. This efficiency ultimately leads to quicker decision-making and more effective resource allocation, positively impacting overall productivity.

By embracing structured formats, organizations can create a more streamlined workflow, leading to improved performance and client satisfaction.

Frequently Asked Questions about Invoices

This section addresses some of the most common inquiries regarding billing documents. Understanding these key points can help individuals and businesses navigate the complexities of financial transactions more effectively.

What Information Should Be Included?

It is essential to include specific details to ensure clarity and professionalism. Key elements to incorporate are:

- Contact Information: The names, addresses, and contact numbers of both the sender and the recipient.

- Document Number: A unique identifier to help track the document.

- Itemized List: A clear breakdown of products or services provided, including quantities and prices.

- Payment Terms: Conditions under which payment is expected, including due dates and accepted payment methods.

How Can I Ensure Timely Payments?

To facilitate prompt payments, consider the following strategies:

- Clear Communication: Ensure that clients understand the payment terms and deadlines.

- Follow-Up Reminders: Send reminders as the due date approaches to prompt action.

- Incentives for Early Payment: Offering discounts for early payments can encourage timely transactions.

By addressing these frequently asked questions, businesses can enhance their billing practices and improve their overall financial management.