Download Quick Invoice Template for Free

Managing finances efficiently is crucial for any business, regardless of size. One key aspect of this process is ensuring that requests for payment are clear, professional, and easy to generate. When time is of the essence, having ready-to-use documents at your disposal can significantly reduce administrative burdens and accelerate cash flow.

For many small businesses and freelancers, the challenge lies in creating accurate and professional documents that meet all necessary requirements. Fortunately, there are many tools available that allow you to create these documents quickly without the need for specialized software or a steep learning curve.

By utilizing a well-structured, pre-designed form, you can ensure consistency across all of your financial transactions. Whether you’re working with clients on an ongoing basis or handling one-off projects, these documents can help maintain a professional image while saving time and effort in the process.

What is a Quick Invoice Template

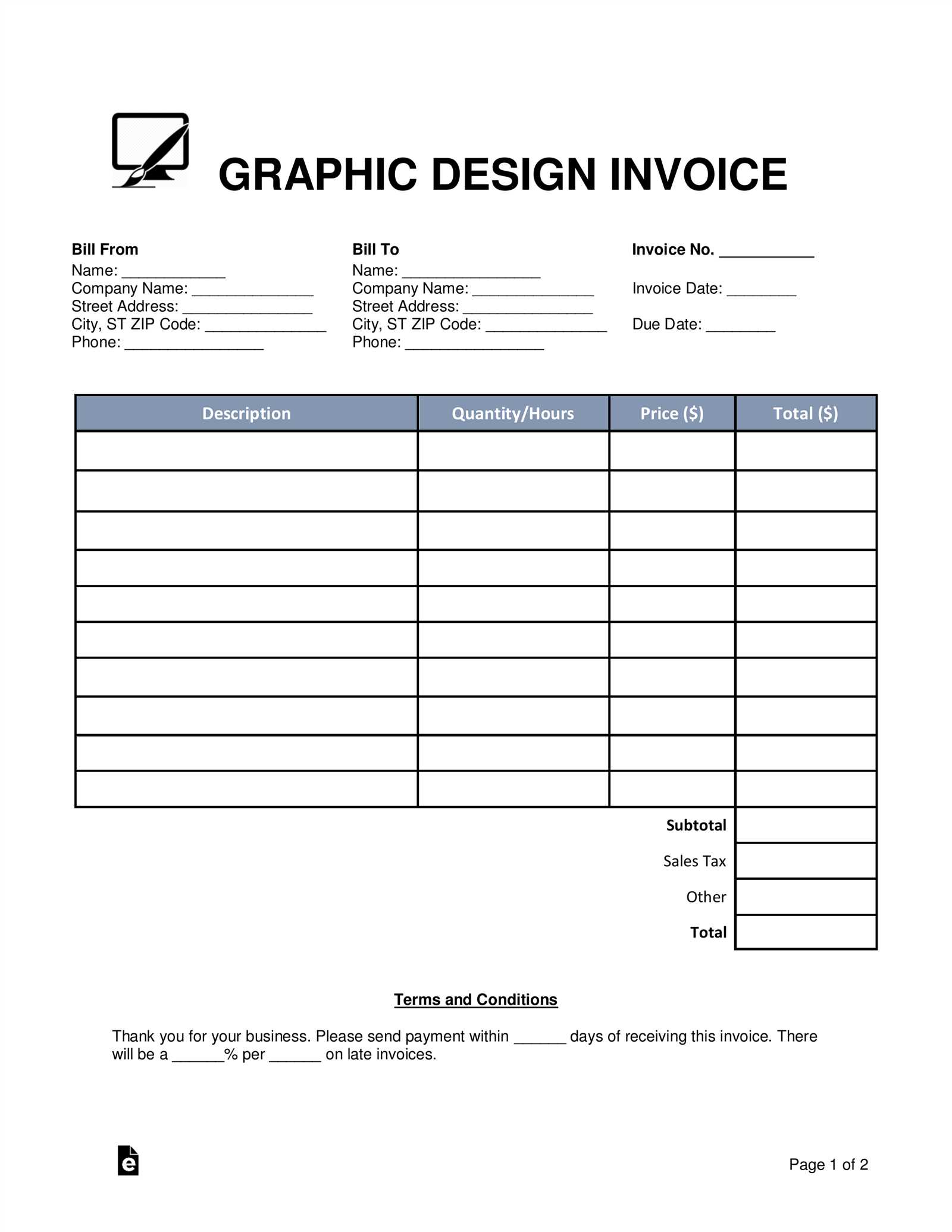

When it comes to handling payments for goods or services, having a standardized document is essential. This kind of document helps businesses clearly outline what is being charged, the amount due, and the terms for payment. It serves as an official record that both parties can reference, ensuring that there is no confusion about the financial transaction.

A ready-to-use form, designed to simplify the process of creating such documents, can save valuable time. With these pre-made structures, all the essential information can be filled in quickly without having to start from scratch each time. This method ensures consistency across all billing requests and can easily be customized to fit specific needs, such as adding tax information, discounts, or personalized details for each transaction.

By using a pre-structured document, businesses and freelancers can create accurate and professional requests for payment with minimal effort. This allows them to focus on their core activities while still maintaining a high level of organization and professionalism in their financial dealings.

Benefits of Using Free Invoice Templates

Utilizing pre-designed forms for generating billing documents can significantly simplify the payment process for businesses and freelancers. These ready-made solutions offer a convenient and efficient way to create professional documents without requiring extensive time or technical knowledge. By using these resources, individuals can ensure that their financial communications are clear, consistent, and accurate.

One of the primary advantages is time-saving. Instead of crafting each document from scratch, users can quickly input the necessary details into a pre-structured layout. This streamlined approach reduces administrative workload and allows for faster invoicing, which is essential for maintaining steady cash flow.

Additionally, these forms are typically designed to comply with standard industry practices, ensuring that all important elements–such as pricing, payment terms, and contact information–are included. This makes them ideal for maintaining professionalism in client communications. Moreover, the ability to customize these documents means they can be tailored to suit the unique needs of different projects or clients, offering both flexibility and consistency in business transactions.

Finally, many of these solutions are cost-effective. As no subscription or purchase is required, businesses of any size can access them without any financial commitment. This accessibility helps reduce overhead costs, especially for small businesses and independent contractors who may not have the budget for expensive software or accounting tools.

How to Download a Quick Invoice Template

Accessing a pre-designed document for billing purposes is a simple process that can be done quickly and efficiently. There are many online resources where users can obtain these forms, often at no cost. The process typically involves selecting a format that suits your needs and downloading it to your computer or cloud storage for easy access whenever required.

Finding the Right Document

Start by searching for a well-reviewed website that offers customizable billing forms. Many platforms provide a variety of options, ranging from basic layouts to more detailed designs that include advanced features like tax calculations and payment terms. Once you’ve selected the one that fits your requirements, ensure the format is compatible with your preferred software–common file types include PDF, Word, and Excel.

Steps to Download

After selecting the document, look for a clear “Download” button or link. In most cases, simply clicking the button will initiate the download process. The file will either be saved directly to your computer or provide an option to save it to a cloud service like Google Drive or Dropbox. Ensure that the file is stored in an easily accessible location for future use. Once downloaded, you can open and customize the form with your business details and client information.

Top Features of a Free Invoice Template

When selecting a pre-designed form for generating payment requests, it’s important to consider the key features that can enhance your billing process. A well-crafted document not only ensures accuracy but also helps maintain a professional image. Below are some of the essential elements that make these resources so valuable for businesses of all sizes.

- Customizable Fields: The ability to easily add your business details, client information, and project specifics is crucial for tailoring the document to each transaction.

- Itemized Breakdown: A clear and organized list of services or products provided, along with individual pricing, makes it easy for clients to understand the charges.

- Tax and Discount Calculations: Many documents come with built-in fields for applying taxes and discounts, ensuring that you remain compliant and transparent in your billing.

- Payment Terms Section: Including terms such as due dates, late fees, and accepted payment methods ensures that both parties are clear on the conditions of the transaction.

- Professional Design: A clean, simple layout with logical organization enhances the appearance of your communication and builds trust with clients.

- Multiple File Formats: Most downloadable forms are available in different file formats, such as PDF, Word, or Excel, giving you flexibility in how you choose to edit or send the document.

- Instant Download: The ease of downloading a ready-to-use document means you can start using it immediately, saving time on creating forms from scratch.

By choosing a solution with these features, you can streamline your billing process, reduce the risk of errors, and maintain a high level of professionalism with every transaction.

How to Customize Your Invoice Template

Personalizing your billing documents is essential to make them reflect your brand and meet your specific business needs. Customizing allows you to tailor the layout and content to ensure clarity and professionalism in every transaction. With a few simple adjustments, you can adapt these forms to suit various clients and services.

Key Customizations to Consider

There are several elements you can adjust to make the document truly your own. The following are the most common areas for customization:

| Field | Customization Tips |

|---|---|

| Business Details | Add your business name, address, contact information, and logo to establish credibility and make the document uniquely yours. |

| Client Information | Ensure you include the client’s name, address, and contact details to avoid confusion and provide all necessary references. |

| Services or Products | List the items or services provided, including quantity, unit price, and total cost for each, to provide a clear breakdown of charges. |

| Payment Terms | Customize payment instructions, including due dates, methods, and late fees, to ensure all terms are clear and agreed upon. |

| Design and Formatting | Adjust fonts, colors, and layout to align with your brand’s style guide or personal preferences for a polished look. |

Saving and Using Customized Documents

Once you’ve made all the necessary adjustments, save the file in a format that suits your needs, whether as a PDF, Word, or Excel document. You can now use this customized version for future transactions, ensuring consistency and efficiency with every payment request you send.

How Quick Invoice Templates Save Time

Time is a critical resource for businesses of all sizes, and reducing time spent on administrative tasks is essential for improving efficiency. One of the most effective ways to save time when managing financial documents is by using pre-designed forms. These ready-made solutions eliminate the need to create a new document from scratch for every transaction, enabling users to focus on more important aspects of their business.

Key Ways These Documents Save Time

Using pre-structured documents for billing allows businesses to streamline their workflow. Below are some of the main ways these tools help save time:

| Feature | How It Saves Time |

|---|---|

| Pre-built Layout | With a predefined structure, you don’t need to worry about organizing fields or adjusting the layout. The format is already set, saving you the time spent on design and formatting. |

| Automatic Calculations | Many forms include built-in fields for tax calculations, discounts, and totals. These automatic functions eliminate the need for manual calculations, reducing errors and saving valuable time. |

| Quick Personalization | Simply input the necessary information like client details and services provided. This fast process means you don’t have to start from scratch each time, and your document is ready for use within minutes. |

| Multiple File Formats | Many tools offer the option to download documents in different file types, such as Word, PDF, or Excel. This flexibility means you can use the format that works best for your needs, further speeding up the process. |

Time Saved on Repetitive Tasks

When it comes to billing, many businesses find themselves creating similar documents over and over again. By using a standardized form, this repetitive task becomes much faster and easier. You can simply reuse the same layout for different clients and services, making the entire process more efficient and less time-consuming.

Common Mistakes to Avoid in Invoices

Creating accurate and professional billing documents is crucial for maintaining a smooth financial relationship with clients. However, even minor mistakes can lead to confusion, delays, or even disputes. To ensure that your requests for payment are clear and effective, it’s important to be aware of common errors and avoid them. Below are some frequent pitfalls that can affect the clarity and professionalism of your billing communications.

Common Mistakes to Watch Out For

- Incorrect Client Information: Failing to double-check client names, addresses, and contact details can lead to confusion or missed payments. Always verify this information before sending the document.

- Missing Payment Terms: Not including clear payment terms can result in misunderstandings. Ensure that you specify the due date, accepted payment methods, and any penalties for late payments.

- Unclear Service Description: Avoid vague descriptions of the products or services provided. Be specific and detailed to avoid confusion about what the client is being charged for.

- Forgetting to Include Tax Information: If your business is required to charge sales tax, be sure to list the tax amount separately and specify the tax rate. Failing to include this can lead to complications down the line.

- Using Incorrect Calculations: Double-check your math before finalizing the document. Simple arithmetic errors, such as wrong totals or tax calculations, can damage your credibility and create unnecessary issues.

- Lack of Consistent Branding: Your documents should reflect your business’s identity. Failing to include your logo, color scheme, or consistent fonts can make the communication look unprofessional.

How to Avoid These Mistakes

To prevent these errors, make it a habit to carefully review each document before sending it out. If possible, use a standardized form to ensure that you don’t forget essential details. Taking the time to review and edit your documents will help maintain professionalism and ensure smooth transactions with your clients.

Free Templates vs Paid Invoice Software

When it comes to managing payment requests, businesses often face the decision of whether to use free, pre-made documents or invest in specialized software. Each option has its own set of advantages and trade-offs, depending on your business needs, budget, and desired level of functionality. Understanding the differences between these two solutions can help you choose the best approach for your billing process.

Benefits of Using Pre-Made Documents

Pre-designed forms are often the go-to solution for small businesses or freelancers looking for an affordable and straightforward way to manage their transactions. These documents are typically easy to download, customize, and use immediately. Some of the key benefits include:

- Cost-Efficiency: The most significant advantage of these forms is that they are often free, making them an attractive option for businesses on a budget.

- Simplicity: Most pre-designed forms come with a clean layout, offering a user-friendly way to create documents without complex features.

- Quick Setup: These forms can be downloaded and customized in just a few minutes, allowing you to start generating payment requests right away.

Benefits of Using Paid Software

On the other hand, paid software solutions offer more advanced features designed to automate and streamline the billing process. While they come with a higher initial cost, the added functionality can be invaluable for growing businesses. Some of the advantages include:

- Automation: Many software options allow you to automate repetitive tasks, such as recurring billing, reminders, and payment tracking, saving you time and effort.

- Advanced Features: Paid solutions often include integrations with accounting software, advanced reporting tools, and customer management systems.

- Scalability: As your business grows, paid software can accommodate an increasing volume of transactions, making it a more sustainable long-term solution.

Which Option is Right for You?

If you’re a freelancer or a small business just starting, pre-designed forms are a practical and cost-effective option. However, if your business is growing rapidly or you require more advanced features, investing in paid software could offer significant time-saving and organizational benefits. It all depends on your specific needs and how much complexity you want in your billing process.

How to Create Professional Invoices Quickly

Creating a well-organized and professional billing document doesn’t need to be a time-consuming task. With the right tools and approach, you can produce accurate and polished payment requests in a fraction of the time. Whether you’re a freelancer or a small business owner, streamlining the process of preparing these documents can help maintain a professional image and ensure that your transactions are handled efficiently.

The first step is to use a structured layout that already includes all the necessary fields, such as client details, services provided, and payment terms. By having a standard framework, you avoid starting from scratch each time and ensure consistency in your communication. You can customize these layouts with your business branding, such as your logo, colors, and fonts, to add a personalized touch while keeping everything professional.

Additionally, automating certain aspects of the process can save even more time. Many tools allow you to pre-set information like payment terms, due dates, and recurring charges. Once your details are entered, the document can be generated almost instantly, reducing the time spent on administrative tasks and giving you more time to focus on your core business activities.

Finally, always double-check your document before sending it to ensure that all details are accurate. A quick review for potential mistakes–such as incorrect pricing, missing details, or formatting issues–can prevent delays and confusion later on. With a streamlined approach, you can create professional, reliable billing documents in no time.

Which File Formats Are Best for Invoices

Choosing the right file format for your billing documents is crucial for ensuring compatibility, security, and ease of use. The format you select can affect how easy it is to share, edit, or print the document, as well as how it appears to your clients. There are several commonly used file types for creating payment requests, each offering distinct advantages depending on your needs.

Some formats are more suited for easy editing, while others ensure that the document retains its appearance and structure across different devices and platforms. The most popular options include PDF, Word, and Excel, each with its own set of benefits for different situations.

PDF – Best for Professional Presentation and Security

PDF (Portable Document Format) is one of the most widely used file formats for billing documents. It preserves the original layout and formatting, ensuring that the document looks the same no matter what device it’s viewed on. PDFs are also secure, as they can be password-protected or encrypted, making them ideal for sending sensitive financial information.

Additionally, PDFs are easy to send via email and are universally supported, which means clients can view the document on almost any device without needing special software. This makes it a great choice for businesses that need a standardized and reliable format for their transactions.

Word and Excel – Best for Easy Customization and Data Manipulation

Word documents are useful if you prefer a more flexible format for editing text and layout. They allow you to make quick changes and are compatible with most word processors. However, Word documents may not retain their formatting as consistently as PDFs when shared across different platforms.

Excel files are ideal for businesses that need to handle complex calculations or track large volumes of transactions. With Excel, you can use formulas to automatically calculate totals, taxes, and discounts. While Excel is highly customizable and convenient for internal use, it may not always look as polished when sent to clients compared to a PDF.

Which Format Should You Choose?

If you prioritize professional presentation and security, PDF is likely the best option. However, if you need to frequently update or manipulate data, Excel or Word may be more suitable for your needs. For most businesses, using a combination of formats–such as creating documents in Excel for internal use and then exporting them to PDF for client communication–offers the best of both worlds.

Best Free Invoice Templates for Small Businesses

For small businesses, finding cost-effective solutions to manage billing and payments is essential. A well-designed billing document can help maintain professionalism and ensure that financial transactions are clear and accurate. Fortunately, there are many no-cost resources available that offer excellent pre-made solutions for generating detailed, polished payment requests. Below are some of the best options that cater specifically to the needs of small businesses.

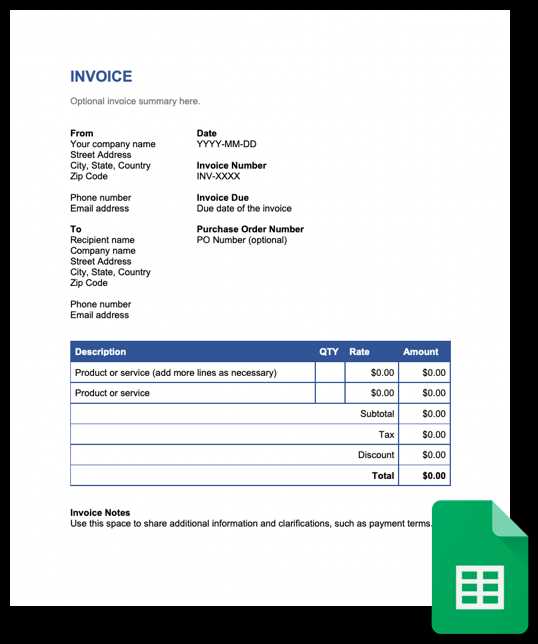

1. Simple and Professional Layout

For small businesses looking for something straightforward and easy to customize, a basic design with clearly labeled sections is ideal. A simple layout often includes fields for business and client information, a list of products or services provided, and space for taxes and discounts. These layouts are easy to fill out and require minimal editing, making them perfect for quick transactions.

Benefits: Fast to use, easy to understand, and customizable to fit different industries.

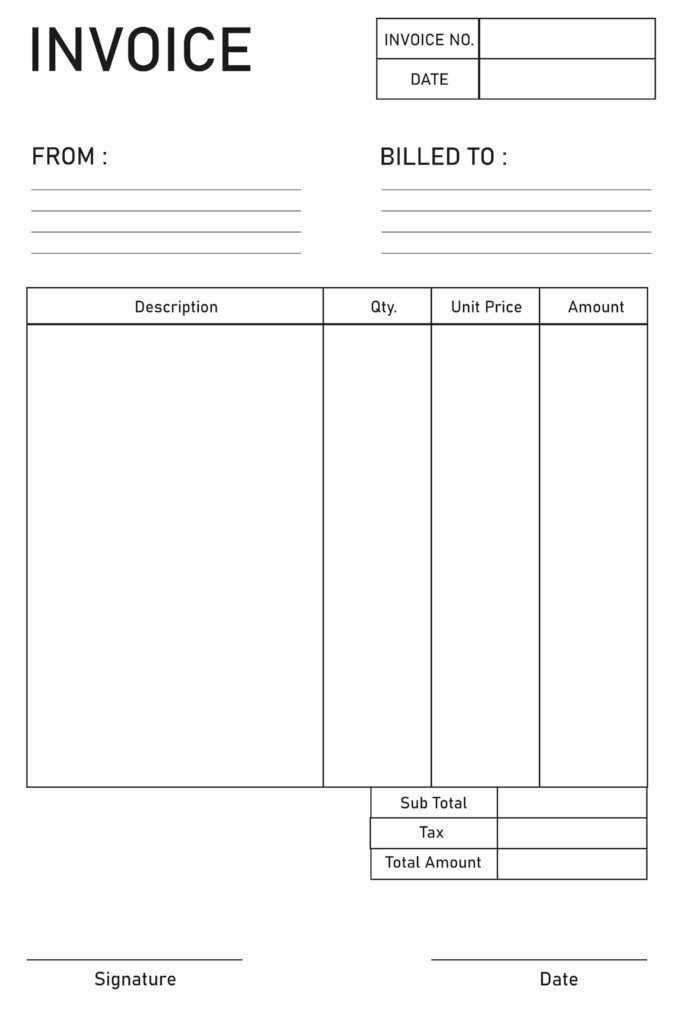

2. Itemized Billing Format

For businesses that offer multiple services or products, an itemized format is a great option. This design includes a table where each product or service is listed with its price, quantity, and total cost. This type of layout makes it easier for clients to see a breakdown of their charges, reducing confusion and increasing transparency.

Benefits: Great for businesses with a diverse product or service offering, clear presentation of charges, and transparency for clients.

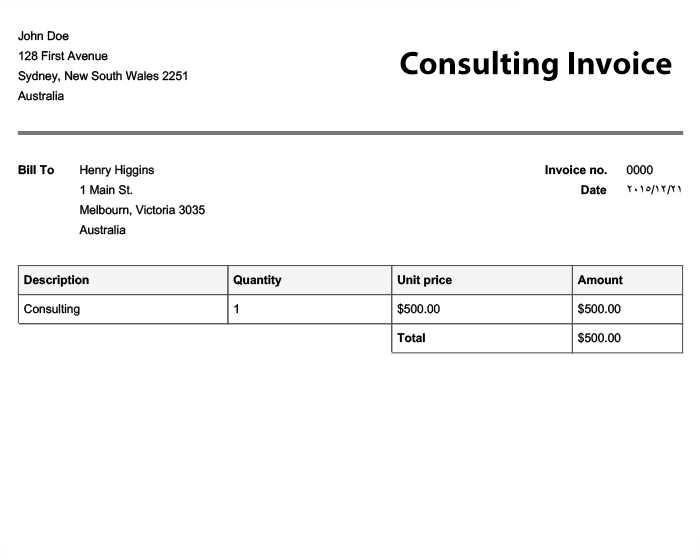

3. Service-Oriented Billing Form

Service-based businesses can benefit from a template specifically tailored to listing services rendered rather than physical products. These forms often allow for detailed descriptions of each service, the time spent, and the hourly or flat rate charged. The layout focuses on providing enough space for descriptions without cluttering the page.

Benefits: Ideal for consultants, contractors, or freelancers who charge for time or expertise, clear for clients to understand services delivered.

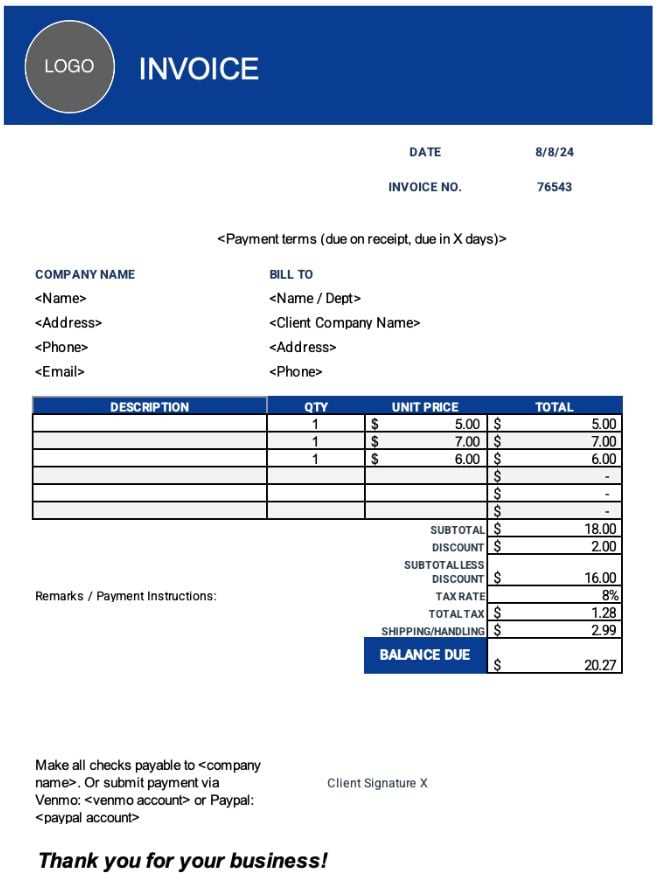

4. Modern and Stylish Design

For businesses that want to maintain a more contemporary look, modern invoice formats often incorporate sleek fonts, bold headings, and stylish color schemes. These designs are visually appealing and can help give your small business a polished, professional appearance, all while remaining functional and easy to fill out.

Benefits: Adds a professional, modern touch to your business communications, visually appealing for clients.

5. Time-Saving Automation Features

While many free forms don’t offer advanced features, some templates include automated functions, such as pre-set formulas for tax calculation and total amounts. These automated templates can save time by quickly performing basic calculations and updating totals as you input information. Though typically simpler than paid software, these features can still help improve efficiency.

Benefits: Time-saving calculations, automated updates, convenient for businesses that need to manage multiple transactions.

Where to Find These Templates

Many websites offer these customizable documents at no cost. Some popular platfor

How to Use Templates for Freelance Work

For freelancers, managing administrative tasks like creating payment requests can be time-consuming. To streamline this process, many opt for pre-designed documents that allow for quick customization and ensure that all necessary details are included. These pre-built forms can be a game-changer, helping freelancers stay organized and professional while reducing the time spent on paperwork.

1. Select a Suitable Layout for Your Business

First, choose a form that aligns with the type of work you do. If you offer hourly services, look for a layout that includes space for tracking time spent on each project. If you offer flat-rate pricing, choose a format that allows you to list the services provided along with their fixed prices. The right structure will make it easier for you to input information quickly, reducing the chances of errors.

2. Customize the Document with Your Information

Once you’ve selected a layout, the next step is to customize it with your personal and business details. This includes your name, contact information, and any relevant branding like your logo or business name. Having this pre-set in the document will save time on future billing requests, as you won’t need to manually enter this information every time.

Tip: Many freelance billing forms allow you to save customized versions, making it easy to reuse them for future clients.

3. Add Client Details and Services

Once your personal information is ready, it’s time to input the client’s details. This should include their name, contact information, and any relevant project or contract references. After that, you can fill in the services or work completed, along with the pricing structure (hourly rate, flat fee, or other). This helps ensure clarity for both you and your client, reducing confusion about what is being billed.

4. Keep Track of Payments

Some pre-designed forms also include sections for payment terms, such as due dates and late fees. Be sure to specify your payment expectations clearly, whether you require full payment upfront, in installments, or upon completion of a project. This will help set professional boundaries and manage expectations effectively.

Tip: If the form allows, include space for tracking payment status, so you can easily see if the client has paid, is overdue, or has any outstanding balance.

By using structured, pre-designed forms, freelancers can save time, stay organized, and present themselves more professionally to clients, allowing them to focus on the creative aspects of their work rather than administrative tasks.

Why You Should Use an Invoice Template

For any business or freelancer, creating clear and consistent billing documents is crucial for smooth financial transactions. Using a pre-designed structure not only saves time but also ensures that you include all necessary details in a professional and organized manner. Instead of manually creating a document from scratch each time, using a standardized format helps to maintain accuracy and consistency, making the process easier for both you and your clients.

Benefits of Using a Structured Billing Document

There are several reasons why using a standardized document is beneficial for businesses of all sizes:

| Benefit | Explanation |

|---|---|

| Time Efficiency | By utilizing a pre-made structure, you eliminate the need to design a document from scratch each time you need to bill a client. This reduces the amount of time spent on administrative tasks, allowing you to focus on your core business activities. |

| Consistency | Using a standard format for all your billing documents ensures uniformity in how you present your work to clients, fostering a professional image and making it easier for clients to review the charges. |

| Accuracy | Pre-designed forms often include fields for essential details like services rendered, payment terms, and totals. This reduces the risk of forgetting or miscalculating key information. |

| Professionalism | A polished and well-structured billing document reflects positively on your business, creating a more professional impression with clients and improving their trust in your services. |

| Legal Protection | Including clear terms and conditions, as well as detailed information about the services provided, can help protect you legally in case of disputes or non-payment. |

By adopting a structured approach to your billing process, you make it easier to manage your finances, maintain professionalism, and streamline the payment collection process. Whether you are just starting your business or looking to improve your current methods, using a standardized form is a smart choice that can save you time and effort.

How to Add Taxes and Discounts to Your Invoice

When preparing a billing document, it’s important to include all the relevant financial details, such as applicable taxes and any discounts. These elements help ensure that both you and your clients are clear on the total amount due and that you remain compliant with local regulations. Whether you’re applying a sales tax or offering a special promotion, accurately reflecting these amounts is essential for a smooth transaction.

Adding Taxes to Your Billing Document

Taxes are often a necessary part of most transactions, depending on your location and the nature of your business. To calculate and add taxes, you first need to know the tax rate that applies to your product or service. This rate can vary by region, product type, or even client, so it’s important to confirm the appropriate tax rate before finalizing your document.

Steps to add taxes:

- Identify the applicable tax rate for the product or service.

- Calculate the tax amount by multiplying the subtotal (before taxes) by the tax rate.

- Include the tax amount in the designated “Tax” field on your document.

- Ensure the final amount after tax is clearly displayed as the total due.

For example, if the subtotal is $100 and the tax rate is 10%, you would calculate $100 × 0.10 = $10. This amount would then be added to the final total.

Applying Discounts to Your Billing Document

Discounts are another important aspect that can influence the final total amount your client owes. Whether it’s a seasonal offer, a first-time customer discount, or a volume-based price reduction, it’s important to specify the discount clearly to avoid confusion.

Steps to apply discounts:

- Determine the discount amount or percentage.

- If it’s a percentage, calculate the discount by multiplying the subtotal by the discount rate.

- Apply the discount by subtracting it from the subtotal or the total after tax.

- Clearly state the discount applied in the document and show both the original price and the reduced amount.

For example, if the subtotal is $200 and you’re offering a 15% discount, the discount would be $200 × 0.15 = $30. You would then subtract $30 from the subtotal to arrive at the final amount due.

Tip: Always ensure that both the discount and the adjusted final amount are easy to understand to maintain transparency and prevent misunderstandings.

By correctly adding taxes and discounts, you not only ensure that your documents are accurate and compliant, but you also enhance professionalism, making your business appear more organized and trustworthy to clients.

How to Organize Invoices for Recordkeeping

Properly organizing billing documents is crucial for maintaining accurate financial records. Whether you are a freelancer, a small business owner, or managing a larger company, keeping track of payment requests, receipts, and records can simplify your accounting process and ensure you’re prepared for tax season or audits. An organized system makes it easier to monitor your cash flow, identify overdue payments, and access important financial details when needed.

1. Create a Consistent Filing System

One of the most effective ways to keep track of your billing records is to establish a consistent filing system. Whether you prefer physical or digital documents, your system should be logical and easy to follow. Start by categorizing documents by client, project, or date. For example, you can file documents by the year or by month, or create folders for each client or job to ensure that all related documents are together in one place.

Tips for organizing:

- Use clear, concise naming conventions for your files (e.g., “ClientName_Invoice_Date”)

- Organize by year or month for quick access to historical documents

- Keep a separate folder for paid and unpaid documents to easily track outstanding amounts

2. Implement a Digital Tracking System

If you manage a large volume of documents, digital solutions are a great way to streamline your recordkeeping. Using cloud storage services or accounting software that integrates with your billing documents allows you to access your records from anywhere and reduces the risk of losing physical paperwork. Many tools also allow you to tag documents, add notes, and even set reminders for payment follow-ups.

Advantages of digital recordkeeping:

- Easy access and retrieval of documents from any device

- Automated backup and reduced risk of data loss

- Ability to generate reports and summaries for tax preparation

3. Maintain a Payment Log

Another effective strategy is to keep a separate log of all payments received and outstanding balances. A payment log can be a simple spreadsheet where you record the client name, invoice number, amount billed, payment date, and the status of the payment (e.g., paid, pending, overdue). This provides a quick reference to keep track of your income and identify any late payments that require follow-up.

Example of a payment log:

| Client Name | Invoice Number | Amount | Payment Status | Due Date |

|---|---|---|---|---|

| John Doe | INV001 | $500 | Paid | 01/15/2024 |

| Jane Smith | INV002 | $300 | Pending | 02/01/2024 |

This approach ensures that you don’t miss any payments and helps you stay organized when it’s time to review your financial status.

How Quick Invoice Templates Help Cash Flow

Effective management of your cash flow is essential for the financial health of any business. One of the key factors in maintaining a steady cash flow is ensuring that payment requests are sent promptly and clearly. By using structured forms for billing, you can streamline the process of requesting payments, reduce delays, and avoid misunderstandings that could affect your cash flow. A well-organized payment request not only speeds up the process but also creates a professional impression that encourages timely payments.

1. Faster Billing Leads to Faster Payments

When you use pre-designed billing documents, you can quickly fill in the necessary details and send them to clients without spending excessive time formatting or worrying about missing information. This efficiency helps ensure that you send out your payment requests sooner rather than later, leading to faster payment cycles. The sooner you send a request for payment, the sooner you receive the funds, which in turn improves your overall cash flow.

Tip: Sending your payment requests as soon as work is completed reduces the likelihood of delays, as clients are more likely to pay promptly when the request is fresh in their minds.

2. Clear and Accurate Billing Reduces Disputes

When clients receive clear, professional, and accurate billing forms, they are less likely to question the charges or delay payment due to confusion. By providing all the necessary information upfront – such as services provided, pricing, due dates, and payment terms – you minimize the chances of back-and-forth communications that can stall the payment process. This clarity ensures that your clients understand exactly what they are paying for and why, making them more likely to pay on time.

Tip: Including detailed descriptions of your services and ensuring that the totals are correct helps build trust and encourages timely settlement of bills.

3. Improved Organization Leads to Better Follow-Up

Pre-designed billing forms allow you to keep your financial records organized. When invoices are consistently formatted, it becomes much easier to track which clients have paid and which have outstanding balances. With better organization, you can set up automatic reminders or follow-up communications for overdue payments. This ensures that you don’t lose track of outstanding invoices, helping you manage your cash flow more effectively.

Tip: Using a digital system that tracks sent requests and payment statuses allows you to automate reminders, making the follow-up process less time-consuming.

Overall, by using structured payment request documents, you improve your ability to send clear, consistent, and timely requests. This reduces payment delays, enhances your professionalism, and contributes directly to maintaining a healthy cash flow for your business.