Quarterly Invoice Template for Streamlined Billing

Maintaining a smooth and efficient financial process is essential for any business. Regular billing cycles are crucial for ensuring that services and products are compensated in a timely manner. A well-structured approach can simplify this task and help businesses stay organized throughout the year.

By utilizing a standardized document, companies can ensure consistency and professionalism in their financial transactions. This tool not only streamlines the process but also provides a clear and concise record of charges for both the business and its clients.

In this guide, we will explore how to create and manage effective billing documents that meet the specific needs of your business. From basic designs to advanced customization, we will cover everything you need to know to make your invoicing process more efficient and less time-consuming.

Quarterly Invoice Template Overview

Managing billing periods effectively is essential for businesses to maintain a steady cash flow. A well-organized document designed for recurring financial transactions can save time and reduce errors. By using a structured approach, companies can simplify their billing cycles, ensuring clients are properly charged at regular intervals.

Such a document typically includes all necessary details, making it easy to track payments and manage client records. It ensures consistency and professionalism, offering both the business and the client a clear understanding of the charges, deadlines, and payment terms.

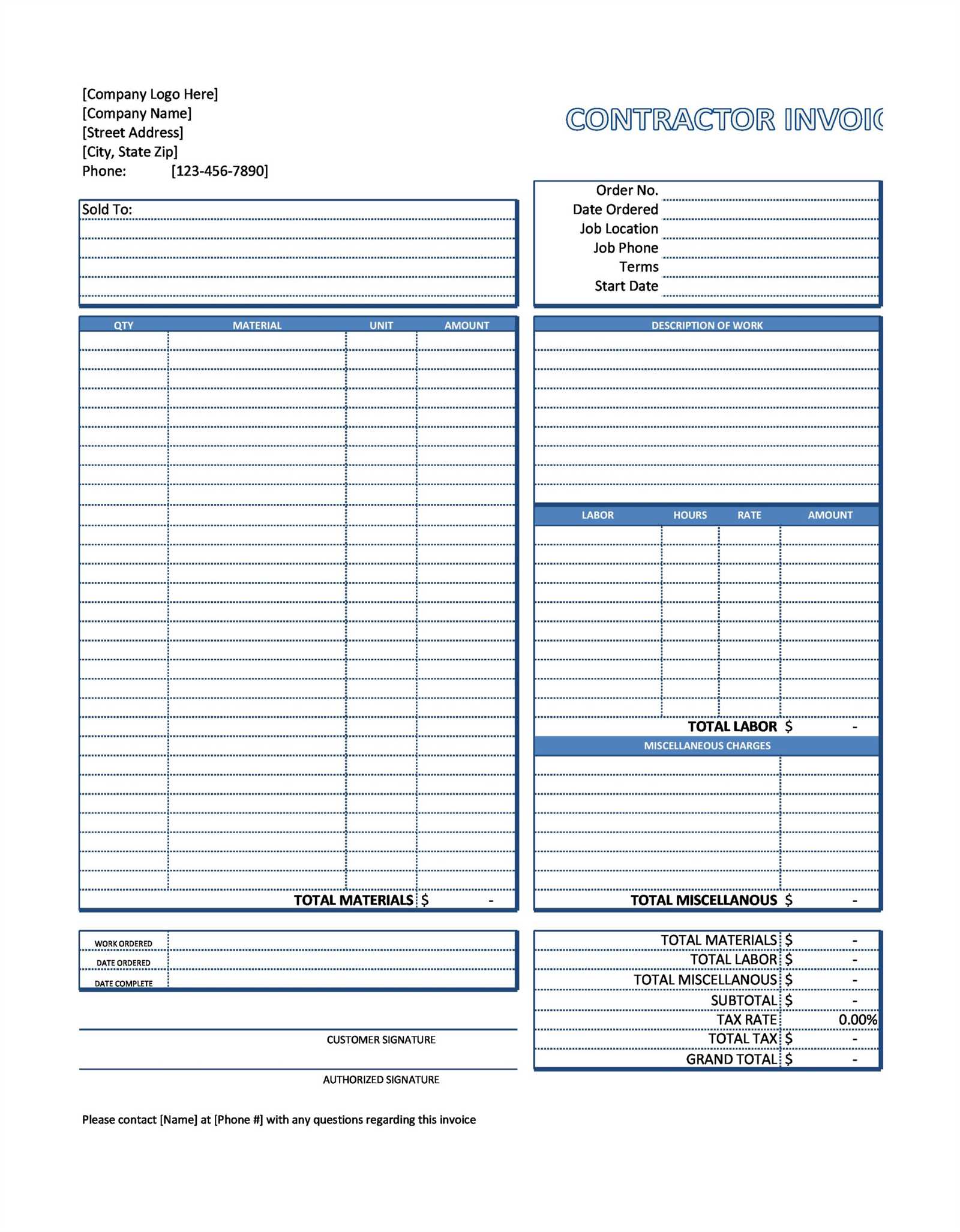

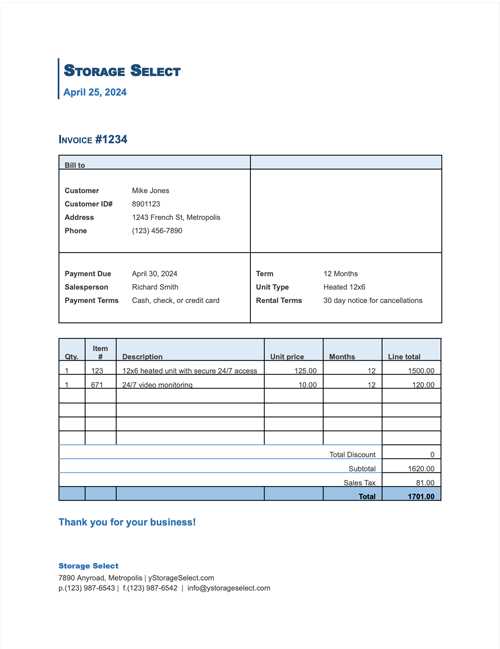

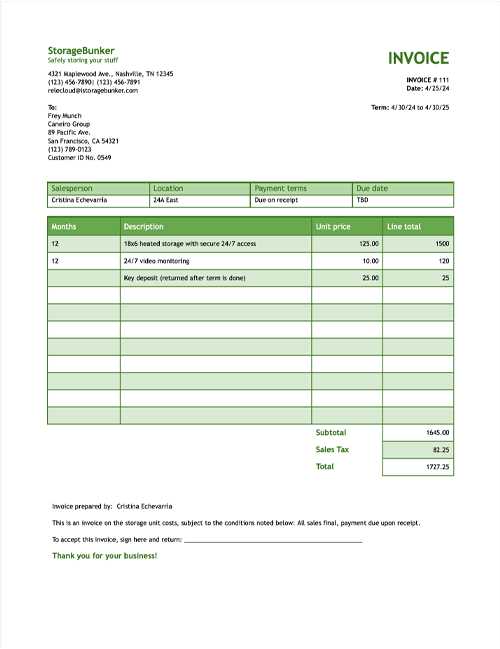

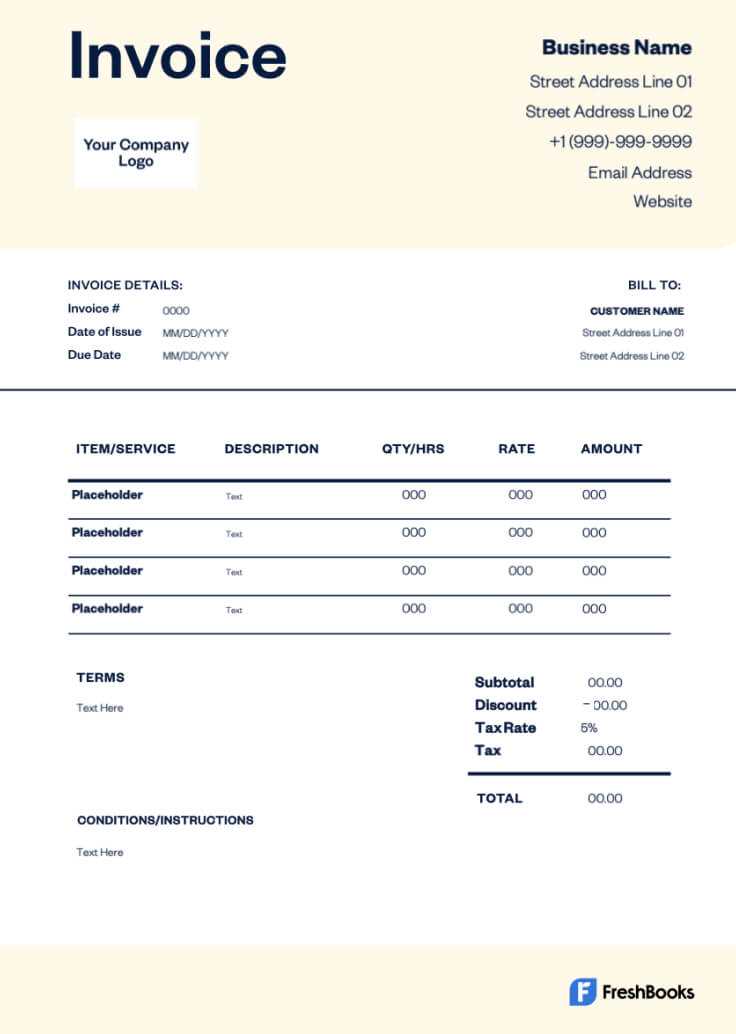

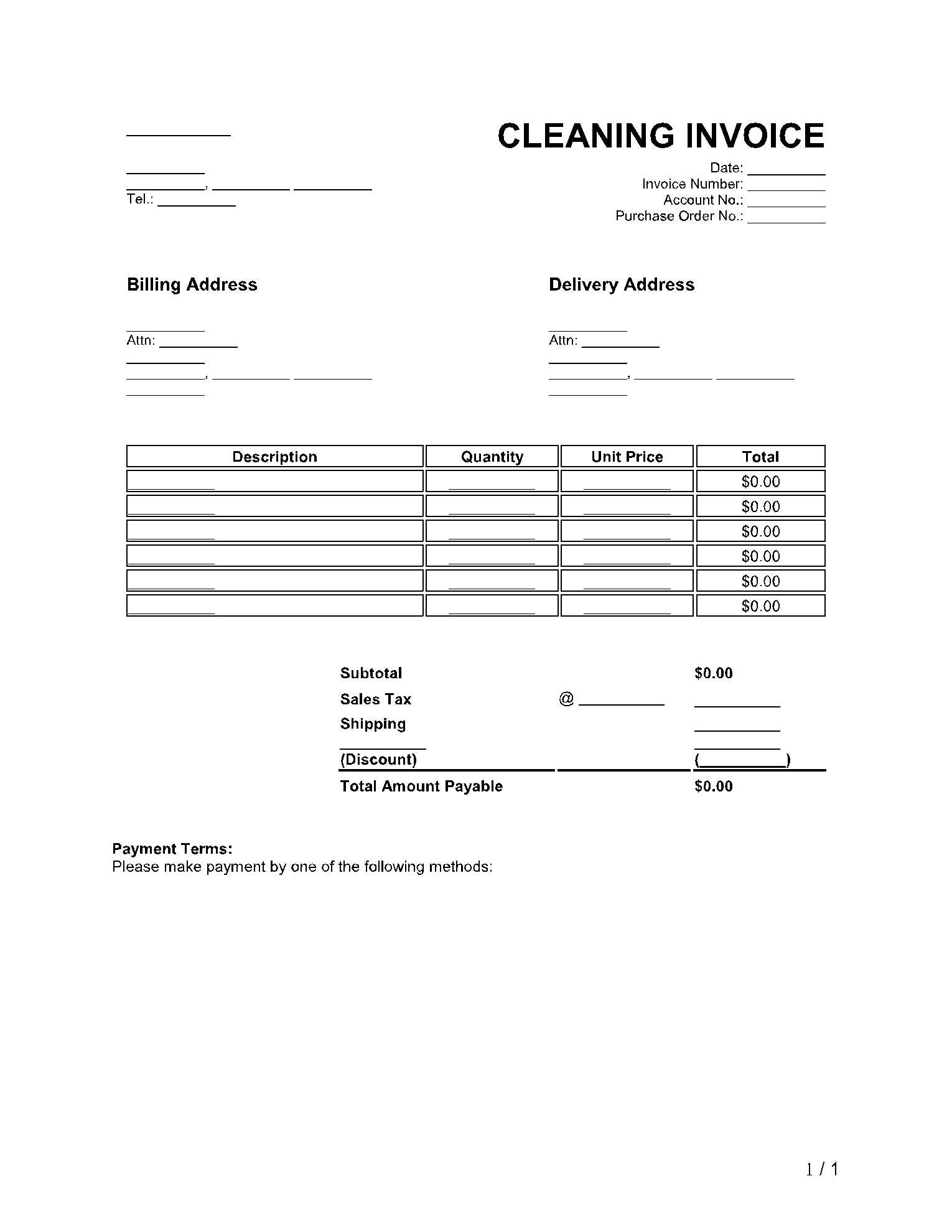

Here are the key elements usually included in this type of billing document:

- Business Information: Name, address, and contact details of the company.

- Client Information: Name, address, and contact details of the client.

- Description of Services: A breakdown of the services or products provided during the billing period.

- Payment Terms: The payment due date and any relevant terms or conditions.

- Total Amount: The total amount due for the services rendered during the given period.

By organizing these details into a coherent and professional format, businesses can ensure a smooth and transparent transaction process with their clients. Moreover, such documents can be easily customized to meet specific business needs, ensuring flexibility and adaptability in different industries.

What Is a Quarterly Invoice

A recurring financial document issued at regular intervals plays a crucial role in maintaining business cash flow. Typically, it is used to request payment for services or products provided over a specific time frame, such as three months. These documents serve as formal records of transactions between a company and its clients, detailing the charges for the period and the terms of payment.

The purpose of such a document is to ensure clear communication between the business and the client, reducing confusion regarding payment schedules and amounts. It helps businesses keep track of outstanding payments and provides clients with a concise summary of their financial obligations.

Key features of this document include:

- Time Period: A specified span, often covering three months, during which services or products are delivered.

- Clear Breakdown of Charges: A detailed list of the products or services rendered, along with their individual costs.

- Payment Deadline: The date by which payment is expected, usually aligned with the end of the billing cycle.

- Payment Methods: Clear instructions on how the payment should be made (bank transfer, credit card, etc.).

Using such a document helps businesses stay organized, ensuring they can manage recurring payments effectively and maintain a steady income stream over time.

Why Use a Quarterly Invoice Template

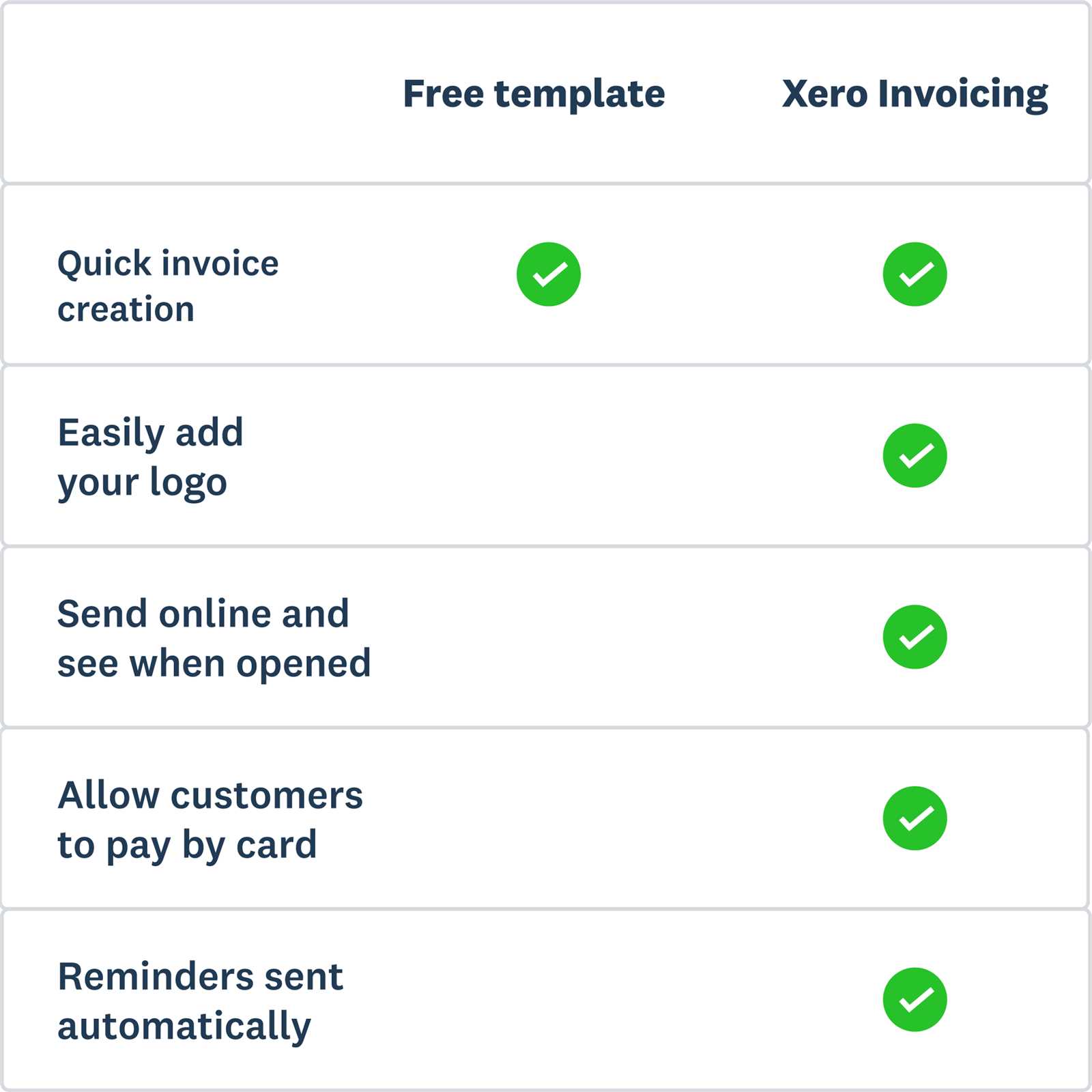

Using a standardized document for recurring billing offers numerous benefits to businesses, from simplifying the payment process to ensuring consistent communication with clients. With a structured format, businesses can reduce the chances of errors and streamline their financial workflow, saving valuable time and resources.

One of the main advantages of using such a document is its efficiency. Instead of manually creating a new document each time, you can simply customize a pre-designed format, ensuring all necessary details are included without the need for repeated work. This not only speeds up the billing process but also improves accuracy by reducing the risk of forgetting essential information.

Key reasons to adopt a standardized document include:

- Consistency: Each billing cycle follows the same format, providing clarity and preventing mistakes.

- Time Savings: Customizable designs allow you to quickly adapt the document to different clients without starting from scratch.

- Professionalism: A well-organized document enhances the business’s image, showcasing attention to detail and reliability.

- Trackability: Organized records make it easier to keep track of payments and outstanding balances.

Incorporating a pre-made design into your financial processes ensures smoother operations and fosters trust between your business and clients by presenting a polished and clear billing system.

How to Customize Your Billing Document

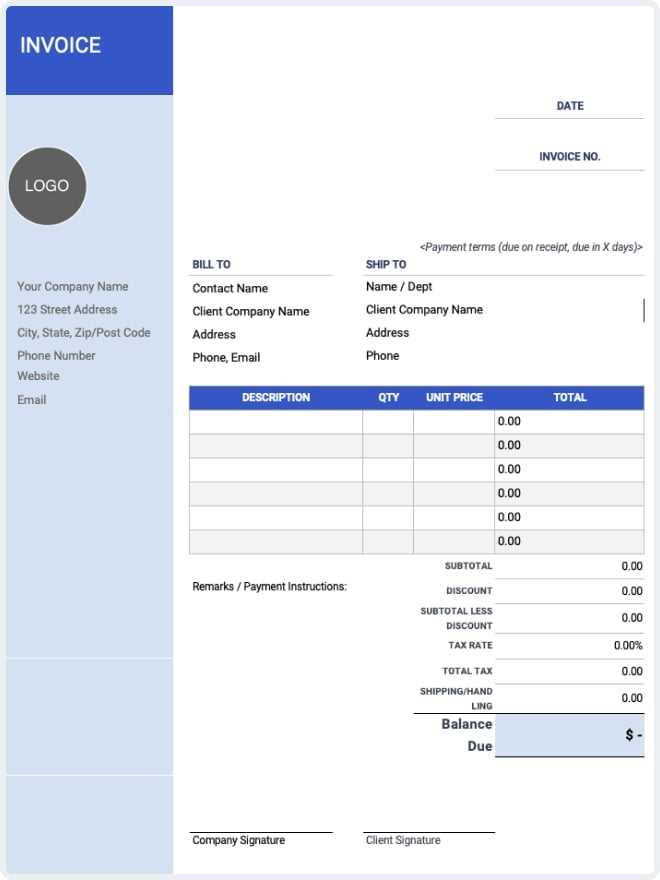

Personalizing your billing document is key to ensuring it fits your business needs and presents a professional image. Customization allows you to tailor the design, content, and layout to reflect your brand while maintaining the essential elements required for clear communication with clients.

Here are some essential steps to follow when customizing your billing form:

- Include Your Branding: Add your company logo, colors, and contact details to ensure the document reflects your brand identity.

- Adjust Layout: Organize the document to suit your needs, whether you prefer a simple list or a more detailed breakdown of charges.

- Modify Payment Terms: Customize payment terms such as due dates, late fees, or early payment discounts based on your business practices.

- Customize Fields: Add or remove fields to match the specific products or services you offer, ensuring you capture all relevant details.

- Choose the Right Currency and Tax Rates: Make sure your document displays the correct currency and tax rates based on your location and client’s location.

By customizing your document, you not only streamline your billing process but also enhance your relationship with clients, showing attention to detail and professionalism.

Best Practices for Recurring Billing

Implementing efficient practices for recurring financial documents ensures timely payments and smooth business operations. By adopting a structured approach, companies can minimize errors, maintain consistency, and build strong relationships with clients. Proper billing management also fosters transparency, reducing disputes and encouraging trust.

Here are some key practices to follow for effective billing cycles:

- Set Clear Payment Terms: Always define payment due dates, late fees, and accepted payment methods. Ensure clients understand these terms upfront.

- Send Invoices on Time: Consistently issue billing documents well before the due date to give clients enough time to process payments.

- Provide Detailed Descriptions: Break down the charges clearly, so clients understand exactly what they are being billed for, minimizing confusion.

- Keep Records Organized: Store and track all billing documents in an organized manner, making it easy to reference past transactions and manage finances.

- Automate Billing Where Possible: Use software or tools to automate the creation and sending of recurring documents, reducing manual errors and saving time.

By following these best practices, businesses can ensure a seamless and professional billing process that enhances client satisfaction and maintains financial stability.

Common Mistakes to Avoid

When managing recurring billing, businesses often make mistakes that can lead to confusion, missed payments, or strained client relationships. Identifying and avoiding these errors is crucial to ensure smooth and efficient financial transactions. By paying attention to the common pitfalls, companies can improve their processes and build trust with clients.

Here are some of the most frequent mistakes to watch out for:

| Mistake | Consequences | How to Avoid | |||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Incomplete or unclear details | Clients may be confused about what they are paying for, leading to disputes. | Provide a thorough breakdown of services or products and their associated costs. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Missed payment deadlines | Late payments disrupt cash flow and can damage business relationships. | Set clear deadlines and send reminders in advance of the due date. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Not including payment terms | Clients may not understand when or how payments are expected, causing delays. | Always specify payment due dates, accepted methods, and any penalties for late payments. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Incorrect or inconsistent formatting | Confusing or inconsistent layouts make it difficult to understand the document. | Use a consistent, clean, and professional layout for all billing documents. | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Failure to track outstanding balances | Unpaid amounts can go unnoticed, affecting overall financial health. | Keep accurate rec

Tracking Payments with Your DocumentProperly tracking payments is essential for maintaining a healthy cash flow and avoiding misunderstandings with clients. A well-organized document can serve not only as a record of charges but also as an effective tool for tracking which payments have been received and which are still outstanding. By incorporating payment tracking features into your financial documents, you can streamline the process and ensure you never lose track of a payment again. Here are some tips to efficiently track payments using your document: Key Elements for Payment Tracking

Automating Payment Tracking

By integrating these features into your document, you will improve your ability to monitor financial transactions, reduce errors, and maintain better relationships with clients through clear communication and organization. Choosing the Right Format for Billing DocumentsSelecting the appropriate format for your billing documents is crucial to ensure clear communication and streamline the payment process. A well-chosen format can make it easier for clients to understand charges, track due dates, and process payments. Whether you’re managing recurring payments or one-time charges, the format you choose should be both professional and practical. Here are some factors to consider when choosing the right format for your billing documents:

When evaluating your options, ensure the format aligns with your business needs and client expectations. A clear, easy-to-read structure will help maintain professionalism and reduce any potential issues related to payment processing. Integrating Billing Documents with Accounting ToolsIntegrating your billing documents with accounting tools can significantly streamline your financial processes, reducing manual work and increasing accuracy. By connecting your billing system with accounting software, you can automatically update financial records, track payments, and generate reports, saving time and minimizing errors. Here are some key advantages and steps to integrate your billing process with accounting tools: Benefits of Integration

Steps to Integrate Billing with Accounting Tools

By integrating your billing documents with accounting tools, you can enhance the efficiency and reliability of your financial management system, ensuring your business runs smoothly and you stay on top of payments and records. How to Organize Billing DocumentsEfficiently organizing your billing documents is crucial for smooth financial operations and ensuring timely payments. A well-structured system allows you to track payments, monitor outstanding balances, and avoid confusion with clients. Whether you’re dealing with recurring or one-time charges, proper organization makes managing your financial records easier and more accurate. Here are some strategies to help you organize your financial records effectively: Key Organizational Strategies

Organizing Your Records in a TableTo further streamline your organization process, use a table to track essential details about each transaction:

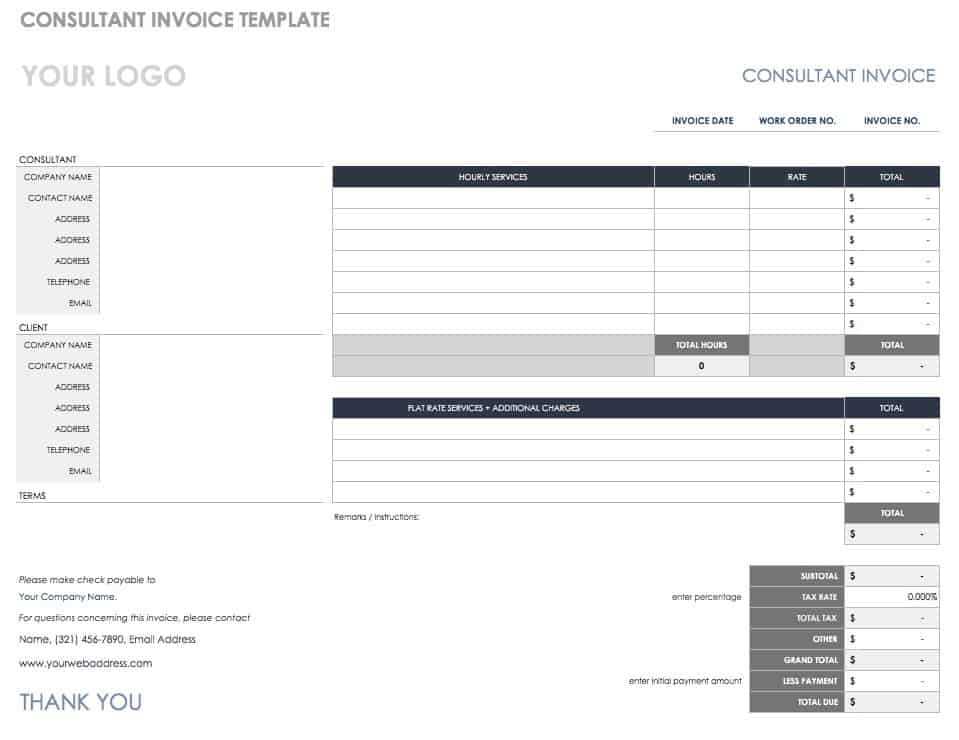

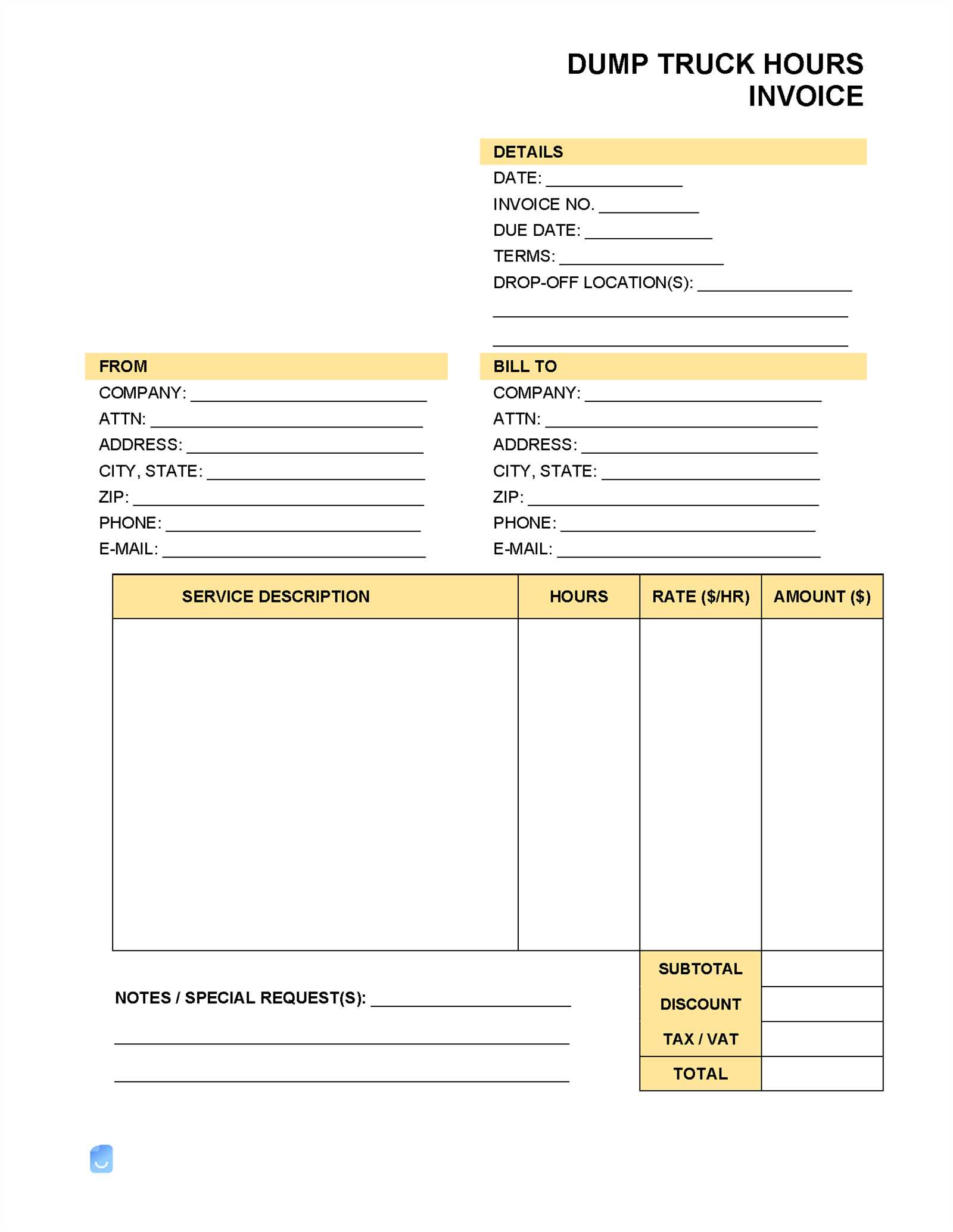

By implementing these strategies, businesses can ensure that clients have a clear understanding of what is expected, when payments are due, and what the consequences of late payments are. Clear communication leads to smoother transactions and more positive client interactions. Templates for Different Industries

Every industry has its own unique requirements when it comes to financial documents. Tailoring these documents to fit the specific needs of various sectors not only streamlines the billing process but also ensures clarity and accuracy for both businesses and clients. Whether you’re in consulting, retail, or services, adapting the format of financial records to suit your industry can significantly improve efficiency. Industry-Specific Features to Consider

Different sectors may need to include particular details on their records, depending on the nature of their work. For example, service-based businesses might emphasize hourly rates or project milestones, while product-based industries could focus more on itemized goods and quantities. Below are some examples of how these documents may differ across various industries:

Benefits of Industry-Specific Billing StatementsBy customizing financial documents to meet industry needs, businesses can ensure they are providing the most relevant information to clients, making the payment process smoother and less prone to errors. Additionally, tailored documents can help businesses maintain a professional appearance and increase client satisfaction by addressing their specific expectations. Ensuring Legal Compliance in Billing StatementsEnsuring legal compliance in financial documents is crucial for businesses to avoid potential legal disputes, fines, or delays in payment. It is essential for businesses to adhere to the laws and regulations that govern the structure, content, and timing of these documents. Understanding what is required legally helps maintain a professional image, fosters trust, and ensures that transactions are valid and enforceable in case of a dispute. Key Legal Requirements to Include

There are specific elements that must be included in financial records to ensure compliance with local, national, and international laws. These elements help both businesses and clients stay on the same page regarding expectations and obligations. Below is a table outlining the typical legal requirements for such documents:

Ensuring Compliance Across Different Jurisdictions

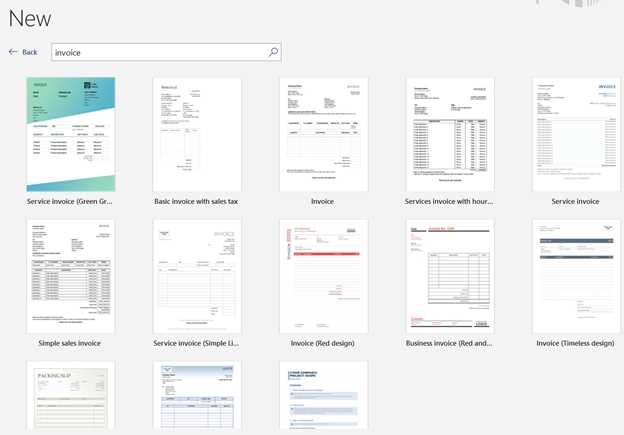

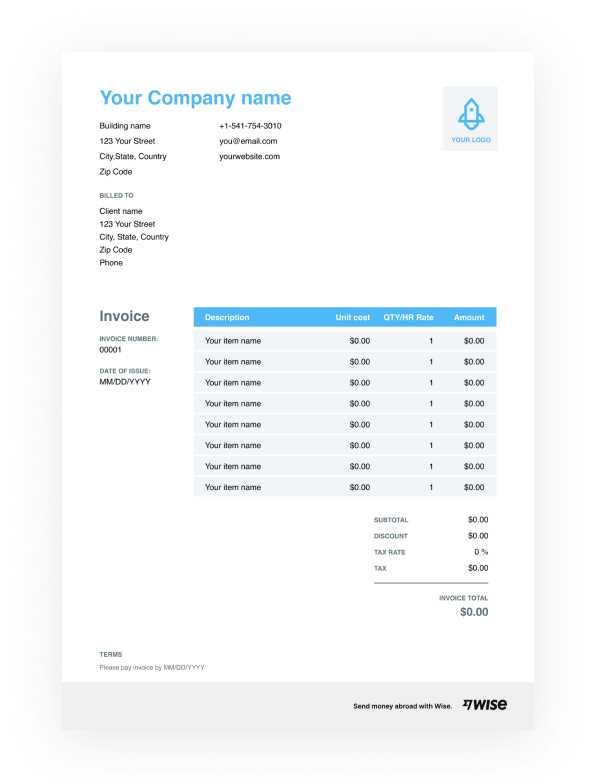

For b Saving Time with Pre-designed Templates

Using pre-designed formats for financial documentation can significantly reduce the time spent on preparing each document from scratch. These ready-made layouts provide businesses with an efficient way to streamline their processes, ensuring consistency while minimizing the effort involved. Instead of creating each record manually, businesses can leverage established structures that already include key sections and necessary fields, allowing them to focus on the actual content rather than formatting. One of the major advantages of utilizing pre-designed formats is that they often come with built-in features that reduce errors and ensure all necessary information is included. This not only speeds up the process but also improves the accuracy of the final document. By eliminating the need to re-enter repetitive data or structure documents every time, businesses can save valuable hours that can be better spent on other tasks. Key Time-Saving Benefits

By integrating pre-designed formats into their workflow, businesses can achieve greater efficiency, improve productivity, and ensure that each document meets the necessary professional standards without consuming unnecessary time or resources. How to Automate Your Billing

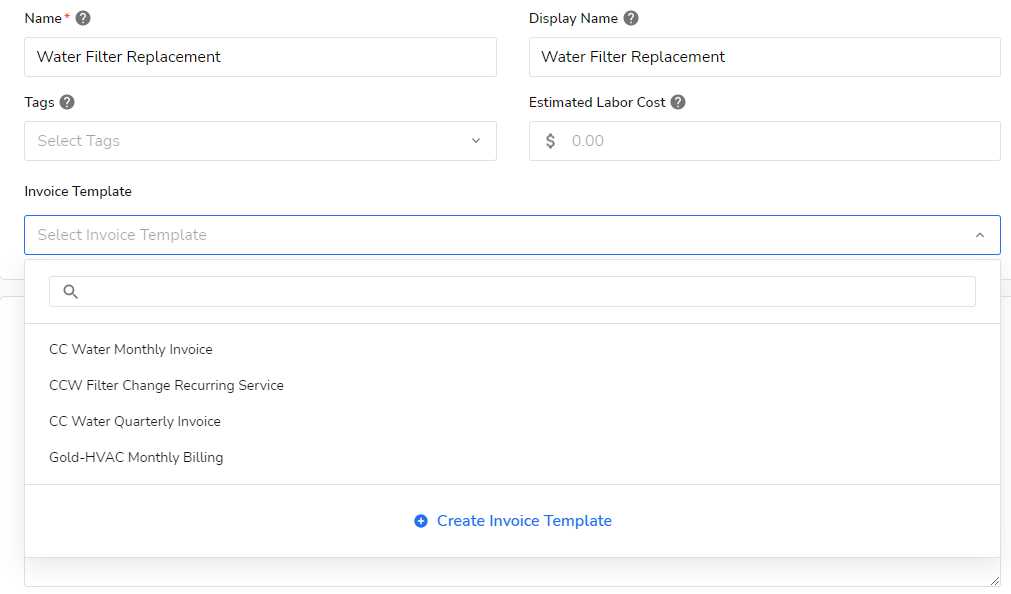

Automating billing processes can save your business time, reduce errors, and ensure consistent cash flow. By using automation tools, you can set up systems that handle recurring payments, reminders, and document generation without manual input. This not only improves operational efficiency but also enhances your client’s experience by ensuring timely and accurate billing. Automation tools allow businesses to streamline their invoicing process, removing the need for repetitive tasks. Once set up, these systems can generate and send payment requests at specified intervals, track payments, and even send reminders to clients about upcoming or overdue payments. The automation of these processes ensures you won’t miss important deadlines or forget to send a document, maintaining a seamless workflow. Steps to Automate Your Billing Process

By automating your billing process, you can avoid delays, enhance efficiency, and provide a smooth payment experience for both you and your clients. Additionally, automation helps reduce administrative overhead, allowing you to focus on growing your business rather than managing repetitive tasks. |