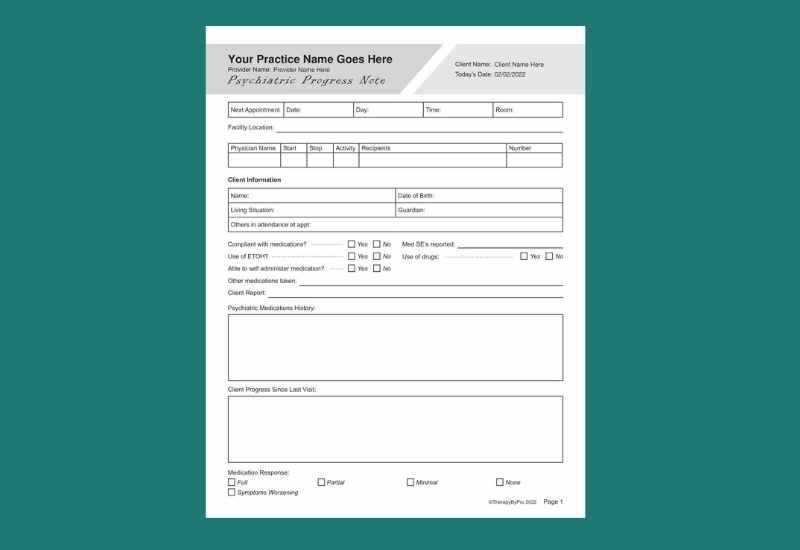

Psychiatrist Invoice Template for Easy Billing

Managing financial transactions is an essential part of running a healthcare practice. For those in the mental health field, maintaining clear and professional payment records ensures smooth interactions with clients and a well-organized business. A structured document for charging patients allows for greater accuracy and reduces the chances of errors that may lead to payment delays.

Customized billing forms provide a simple way to track services rendered, specify costs, and outline payment terms. This tool helps streamline the entire billing process, offering an efficient method to handle everything from routine appointments to specialized treatments. By utilizing a well-designed structure, professionals can ensure timely and precise settlements.

Whether you’re starting your practice or seeking to improve your current workflow, adapting a suitable system for invoicing can save both time and effort. With a reliable structure in place, you can focus more on providing care and less on administrative tasks. Additionally, having all the necessary elements in one document can help maintain financial transparency and foster trust with clients.

Why Use a Billing Document for Mental Health Services

Implementing an organized system for payment tracking is crucial in any healthcare practice. Using a structured format for billing ensures that both the provider and the client have a clear understanding of financial transactions. This tool helps to minimize errors, improve payment collection, and maintain a professional appearance in all client communications.

Benefits of a Well-Designed Billing Structure

There are several key advantages to using a customized form for charging patients:

- Efficiency: A pre-formatted document speeds up the billing process, saving time and reducing the chances of mistakes.

- Clarity: Clients receive clear and detailed information on the costs of services, making it easier for them to understand and settle payments.

- Professionalism: A polished, well-organized form conveys professionalism, enhancing your practice’s credibility.

- Consistency: Standardizing your billing process ensures all clients are charged according to the same structure, avoiding confusion.

How It Improves Financial Management

Having a reliable billing method in place simplifies tracking payments and outstanding balances. This not only helps maintain accurate financial records but also assists with tax preparation and compliance. A clear billing record can be easily referenced if any disputes arise or if additional details are needed for financial reporting.

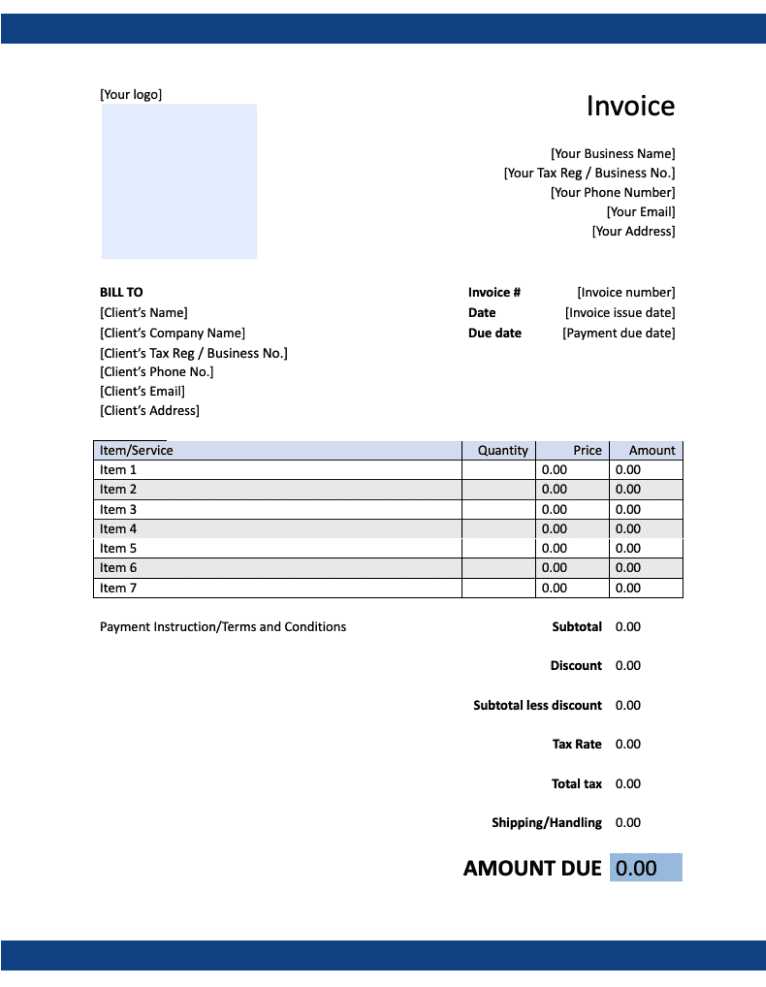

Benefits of Customizable Billing Formats

Having the ability to modify your billing system according to specific needs brings a number of advantages. A flexible structure allows mental health professionals to adjust the layout and details, ensuring that all relevant information is captured accurately. This level of customization can save time, improve client satisfaction, and enhance overall billing efficiency.

Personalization for Different Services

Customizable forms allow for the inclusion of various types of services, payment structures, and unique patient requirements. This adaptability is especially useful when offering diverse treatments or packages. By tailoring each document, you can ensure that every client receives a bill suited to the services they received.

| Service Type | Customization Example |

|---|---|

| Initial Consultation | Include detailed breakdown of consultation fees |

| Ongoing Therapy | Track session duration and frequency of visits |

| Emergency Sessions | Add extra charges for urgent care |

Streamlining Financial Management

By adjusting the format to fit the practice’s workflow, financial records become easier to manage and review. Customization enables professionals to include payment terms, due dates, and client account details, making it simpler to track outstanding balances. It also enhances transparency and builds trust with clients, knowing that their charges are clearly outlined and personalized to their specific treatment needs.

How to Create a Billing Document for Mental Health Services

Creating a clear and professional document for charging clients is essential for any healthcare practice. A well-structured form outlines all necessary details about the services provided, the total cost, and payment terms. This helps both the provider and the client maintain a transparent understanding of financial matters and ensures smooth transactions.

Essential Steps to Follow

To create an accurate and effective billing record, follow these key steps:

- Include Client Information: Start by listing the client’s full name, contact details, and any relevant identification numbers or references.

- Detail the Services Provided: List all treatments, consultations, or sessions provided, along with a brief description and the corresponding fees.

- Specify Payment Terms: Clearly state the payment deadline, accepted payment methods, and any penalties for late payments.

- Include Your Practice Information: Add your practice’s name, address, contact information, and any professional license numbers or affiliations if required.

- Calculate the Total Amount: Ensure all services are correctly priced, and provide a clear total amount due, including taxes if applicable.

Key Details to Include

To avoid confusion and ensure the document is complete, make sure to include the following:

- Date of Service: Indicate when the service was provided, especially if the charges span multiple sessions.

- Unique Reference Number: Assign a unique number to each billing document for easy tracking and organization.

- Payment Instructions: Include specific instructions for payment, such as bank account details or online payment links.

Essential Elements of Mental Health Billing

To ensure accurate financial transactions and smooth interactions with clients, it is important to include all necessary details in your billing documents. A comprehensive record not only helps to track services provided but also ensures transparency and clarity for both the provider and the client. Key elements must be present in every billing document to avoid confusion and potential disputes.

Key Components to Include

Each billing document should contain specific information to be effective and professional. The following elements are crucial:

- Client Information: Full name, address, and contact details are essential for proper identification and correspondence.

- Service Details: A breakdown of the treatment or consultation provided, including the type of service, date, and duration.

- Fees and Charges: Clear listing of the costs associated with each service, as well as any applicable taxes or additional fees.

- Payment Terms: Specify the payment due date, acceptable payment methods, and any penalties for late payments.

- Unique Reference Number: This number helps both the client and the provider easily track and identify the document.

- Provider Information: Your name, practice address, contact details, and professional credentials should be included to maintain professionalism.

Additional Considerations

For greater clarity and accuracy, consider adding the following:

- Insurance Information: If applicable, include details of insurance coverage, claims, and billing codes for reimbursement.

- Discounts or Adjustments: If any discounts or payment arrangements are made, they should be clearly listed to avoid misunderstandings.

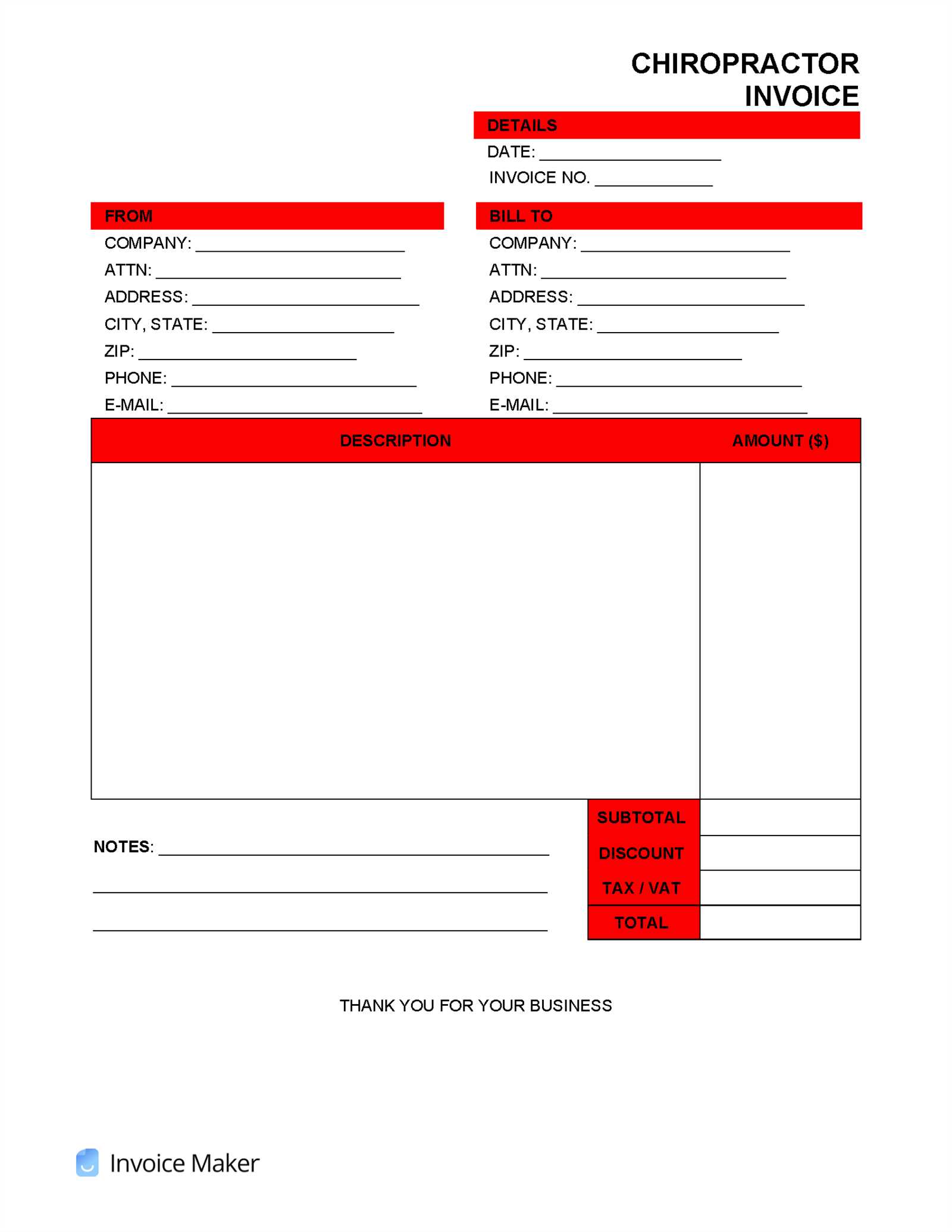

Choosing the Right Billing Format

Selecting the appropriate structure for charging clients is essential for maintaining clear, accurate, and professional financial records. The right format ensures that all relevant information is included, while also allowing for customization based on the specific needs of the services provided. An ideal format will simplify the process, make the document easy to understand, and help streamline your practice’s financial operations.

Factors to Consider When Choosing a Format

When selecting a billing structure, several key factors should be taken into account to ensure it suits your practice:

- Client Preferences: Consider whether your clients prefer digital or paper copies, as this can impact the format you choose.

- Service Variety: A format that can easily accommodate different types of treatments or packages will provide more flexibility in your billing system.

- Ease of Use: Choose a format that is simple to complete, ensuring you can generate documents quickly and with minimal effort.

- Customizability: Having a structure that allows for easy modifications can help you adjust to changing needs or new billing practices.

Comparing Different Formats

Below is a table comparing the most common types of billing formats, highlighting their key features and when they might be most appropriate:

| Format Type | Key Features | Best For |

|---|---|---|

| Basic Structure | Simple layout with minimal information | Small practices or single-session services |

| Detailed Breakdown | In-depth list of services, durations, and charges | Practices with long-term or multiple service types |

| Digital Format | Electronic, easily shared or emailed | Practices with tech-savvy clients or online payment systems |

| Customizable Format | Allows for easy edits and additions to the document | Practices with fluctuating service offerings |

Key Features of Professional Billing Documents

A well-structured billing document reflects professionalism and ensures smooth financial transactions between service providers and clients. It should contain all the necessary details to avoid confusion or disputes, while also adhering to legal and business standards. A clear and comprehensive bill helps maintain transparency, encourages prompt payments, and fosters trust between the client and the service provider.

Essential Elements of a Professional Bill

To ensure that your billing document is both effective and professional, include the following essential features:

- Clear Identification: Include both your practice’s and the client’s name, contact details, and unique reference number to identify the transaction.

- Itemized Services: Break down the services provided, detailing each session or treatment, including its duration and cost.

- Accurate Pricing: Ensure that all costs, taxes, and additional fees are calculated and displayed clearly, leaving no room for ambiguity.

- Payment Terms: Clearly outline the payment due date, available payment methods, and any late payment penalties.

- Legal and Compliance Information: Include any professional licenses, insurance details, or regulatory information required by law or industry standards.

Design and Presentation Tips

The layout and design of your billing document also play a significant role in its professionalism. A clean and organized format will make the document easier to read and understand. Consider the following tips:

- Consistent Branding: Use your practice’s logo, color scheme, and fonts to create a cohesive and professional look.

- Logical Layout: Arrange the sections of the document in a clear, sequential order to help the reader navigate through it easily.

- Readable Fonts: Choose fonts that are easy to read and large enough to avoid any strain on the reader’s eyes.

Common Errors in Billing Documents

Errors in financial documents can lead to confusion, delays in payment, or even disputes. It is crucial to ensure that all the details are accurately represented to maintain professional relationships and ensure timely compensation for services rendered. Below are some of the most common mistakes that can occur in the billing process, and how to avoid them.

Frequent Mistakes in Billing Documents

These errors often occur when preparing a financial record and can impact both the service provider and the client:

- Incorrect Client Information: Failing to include accurate client details, such as the correct name or contact information, can cause confusion and delay payments.

- Missing or Incorrect Dates: Not specifying the correct service dates or using the wrong date format can complicate record-keeping and cause misunderstandings.

- Unclear Service Descriptions: A lack of detail about the services provided or vague descriptions may leave clients uncertain about what they are being charged for.

- Calculation Errors: Incorrect math or omitted charges can lead to disputes and affect payment timelines.

- Failure to Include Payment Terms: Not clearly outlining payment methods, due dates, or late fees can lead to delayed payments and frustration.

How to Avoid These Mistakes

To ensure accuracy and avoid errors in your billing documents, follow these guidelines:

- Double-Check Client Information: Always verify the details provided by the client before generating the bill.

- Be Precise with Dates: Include exact service dates and ensure they are clearly marked to avoid confusion.

- Provide Detailed Descriptions: List each service with its corresponding cost, including any additional fees or charges.

- Review Calculations: Double-check all totals and ensure taxes or discounts are applied correctly.

- Clarify Payment Terms: Always state the payment due date, accepted payment methods, and any penalties for late payments clearly.

How to Avoid Billing Mistakes

Accurate financial documentation is essential for maintaining smooth business operations and positive client relationships. Mistakes in financial records can lead to payment delays, misunderstandings, or even disputes. To ensure that your financial documents are error-free, it’s important to implement a few key strategies and best practices.

Steps to Minimize Errors

Here are some effective ways to prevent common mistakes in your billing process:

- Double-Check All Information: Always verify client details, service dates, and the list of charges before sending the document. A small typo or incorrect detail can cause significant confusion.

- Use Billing Software: Automating the billing process with reliable software can reduce human error by generating accurate documents and calculating totals automatically.

- Standardize Your Format: Consistently using the same layout for all documents ensures that no important details are overlooked and that all documents follow a clear, professional format.

- Review Calculations: Always double-check your math, especially when applying discounts, taxes, or additional charges. Even small errors can lead to payment discrepancies.

- Keep Templates Updated: If you use a pre-designed document structure, make sure it reflects your current service offerings, rates, and payment policies. An outdated template can lead to confusion.

Best Practices for Ongoing Accuracy

To maintain consistent accuracy in your billing, consider these additional tips:

- Implement a Review Process: Have a second set of eyes review the document before sending it to the client. This can help catch errors that may have been missed in the initial draft.

- Set Clear Payment Terms: Include unambiguous payment instructions, including methods, due dates, and penalties for late payments. Clear terms help prevent misunderstandings.

- Stay Organized: Keep a record of all issued financial documents, including both paid and outstanding ones, to ensure accurate tracking and follow-ups.

Automating Billing Document Generation

Automation in financial documentation can significantly streamline business operations, reduce human error, and ensure timely and accurate billing. By automating the creation of your financial records, you save valuable time, improve consistency, and avoid manual mistakes. Implementing automated systems can allow for faster processing and more reliable transactions with clients.

Benefits of Automating Billing Documents

There are several advantages to automating the creation of your financial documents:

- Time-Saving: Automation eliminates the need for manual entry, allowing you to quickly generate accurate records without spending time on repetitive tasks.

- Consistency: Automated systems ensure that every document follows the same format, which helps maintain consistency and professionalism in your transactions.

- Reduced Errors: By minimizing human intervention, automation reduces the likelihood of errors in calculations, client details, or other critical fields.

- Better Organization: Automation can help track and store all your records in a central system, making it easier to manage and retrieve past documents as needed.

- Increased Efficiency: With automated systems, documents are generated faster, and the overall billing process becomes more efficient, allowing for quicker payment processing.

How to Automate Your Billing Process

Here are some steps you can take to begin automating your billing document creation:

- Choose the Right Software: Look for specialized tools or software that offer automation features for generating financial records. Many options allow for customized templates and automatic calculations.

- Integrate with Your Practice Management System: Ensure your automation tool can integrate with your existing client management or practice software. This will help automatically pull in client information and service details.

- Set Up Recurring Billing: For regular clients, set up recurring billing that automatically generates new records at specified intervals, saving time on repetitive tasks.

- Customize Your Automation: Tailor the automated documents to include all necessary details, such as service descriptions, taxes, discounts, and payment terms, based on your business needs.

- Regularly Review and Update: Periodically check your automated system for accuracy, ensuring it is aligned with your current services, pricing, and business policies.

Software Tools for Easy Billing

Managing financial records can be time-consuming and prone to errors when done manually. Fortunately, various software tools are designed to simplify the process of creating and tracking financial documents. These tools help streamline billing, enhance accuracy, and improve overall workflow efficiency.

Popular Software Solutions for Billing

Several software platforms offer advanced features for generating, sending, and tracking financial records. Here are some popular options:

- QuickBooks: A widely used tool that automates many aspects of financial management, including generating and tracking payment records, integrating with bank accounts, and offering reporting features.

- FreshBooks: Known for its user-friendly interface, FreshBooks allows easy creation of detailed billing documents, time tracking, and client management, all in one platform.

- Zoho Books: A comprehensive solution for managing finances, Zoho Books includes customizable billing features, recurring billing options, and integration with other business tools.

- Wave: A free tool designed for small businesses, Wave offers an intuitive platform for creating professional financial documents, tracking expenses, and managing payments.

- Bill.com: This platform is ideal for businesses that need automated accounts payable and receivable, making it easy to manage payment processes and send professional billing statements.

Features to Look For

When selecting software for managing your billing, consider these essential features:

- Customization Options: Ensure the tool allows you to customize financial documents with your branding, specific payment terms, and required service descriptions.

- Automation: Look for software that can automate repetitive tasks, such as sending reminders for outstanding payments or generating recurring billing statements.

- Integration Capabilities: The software should be able to integrate with your existing accounting or client management systems for smooth data transfer and easy updates.

- Reporting and Analytics: Choose a tool that provides detailed insights into your financial performance, such as revenue trends and outstanding payments.

By utilizing the right software tools, you can automate and streamline your billing processes, reducing errors and saving time while ensuring a more efficient financial management system.

Understanding Payment Terms for Medical Services

Clear and well-defined payment terms are essential in managing financial transactions in any healthcare setting. Establishing proper payment conditions ensures transparency and sets expectations between service providers and clients. It helps avoid confusion, delays, and disputes regarding payment, creating a smooth financial workflow for both parties.

Common Payment Terms in Healthcare

When dealing with payment for medical services, various terms are often used to specify how and when payments should be made. These terms can vary based on the type of service provided and the relationship with the client. Below are some common payment terms:

| Payment Term | Description |

|---|---|

| Due on Receipt | Payment is expected immediately upon receiving the statement or service documentation. |

| Net 30 | Payment is due within 30 days from the date of the service or the issue of the billing statement. |

| Net 60 | Payment is due within 60 days from the date of the service or the statement. |

| Installment Payments | Payments are divided into smaller, scheduled payments over a set period. |

| Advance Payment | A full or partial payment made upfront before the service is provided. |

Why Payment Terms Matter

Establishing clear payment terms can prevent delays and misunderstanding. They set clear expectations for both the provider and the client, ensuring that payment timelines are respected. Additionally, these terms allow for better financial planning and budgeting for both parties. For healthcare providers, having well-defined terms can also improve cash flow and reduce administrative work related to late payments or overdue accounts.

Whether it’s for one-time sessions or long-term care, knowing the proper payment terms ensures smooth transactions and avoids potential financial complications in the future.

Setting Clear Payment Deadlines

Establishing clear payment deadlines is a fundamental aspect of maintaining efficient financial operations. By defining specific dates for payment, both service providers and clients have a mutual understanding of expectations. Clear deadlines reduce confusion and help avoid delays, ensuring that all parties stay on track.

Why Payment Deadlines Are Important

Setting defined payment deadlines offers several benefits that contribute to smoother financial transactions:

- Improved Cash Flow: Clear deadlines help service providers manage their revenue and cash flow more effectively.

- Avoiding Late Payments: Specifying a deadline minimizes the risk of overdue payments and encourages timely action from clients.

- Clear Communication: Deadlines ensure that both parties understand when payments are due, reducing potential misunderstandings.

- Better Financial Planning: Providers can forecast income and plan for expenses when payment dates are set clearly.

Best Practices for Setting Payment Deadlines

Here are some essential tips to ensure that payment deadlines are well-communicated and respected:

- State the Deadline Clearly: Ensure the payment date is clearly indicated on all relevant documents, such as contracts or service statements.

- Offer Multiple Payment Options: Providing different payment methods can encourage clients to pay on time.

- Consider Payment Reminders: Sending reminders ahead of the deadline can help clients stay aware of upcoming payments.

- Include Late Fees: Clearly outline any penalties for missed payments to incentivize timely payments.

By setting and enforcing clear payment deadlines, businesses can maintain a consistent cash flow, improve their financial management, and reduce the chances of late payments affecting their operations.

Legal Considerations for Medical Billing

When handling financial transactions in the healthcare sector, it is crucial to understand and comply with the various legal guidelines that govern payments. These regulations help protect both the provider and the client, ensuring that billing practices are transparent, fair, and legally sound. Failure to follow legal requirements can lead to disputes, fines, and even legal action. Therefore, it’s essential to be aware of the relevant laws when managing financial documentation.

Key Legal Aspects of Medical Billing

Several legal factors must be considered when managing billing in the healthcare field:

- Confidentiality: Providers must ensure that patient billing information is kept confidential in compliance with laws such as HIPAA (Health Insurance Portability and Accountability Act) in the U.S. This includes safeguarding personal and financial data from unauthorized access.

- Accurate Documentation: All services provided must be accurately documented to justify the charges. Any discrepancies or incorrect entries may lead to legal issues, including fraud allegations.

- Clear Contracts and Agreements: It is essential to have clear and legally binding agreements with clients that outline payment terms, rates, and expectations. These agreements should specify what services are included and any potential additional charges.

- Insurance Compliance: When dealing with insurance billing, it is crucial to comply with both the insurance provider’s rules and government regulations. Billing for services not covered by insurance or submitting fraudulent claims can lead to significant penalties.

- Taxation: Healthcare providers must be aware of the applicable taxes related to their services, including sales tax or VAT, and ensure compliance with local and federal tax laws.

Consequences of Non-Compliance

Not adhering to legal billing practices can have serious consequences, both financially and legally. Providers may face:

- Penalties or fines for incorrect billing

- Legal disputes or lawsuits from clients or insurance companies

- Loss of professional licensure or business licenses

- Damage to reputation and trust with clients

To avoid these issues, healthcare providers should ensure they are fully informed about the legal requirements surrounding billing and regularly review their practices to ensure compliance with current laws and regulations.

Staying Compliant with Healthcare Regulations

Compliance with healthcare regulations is vital for any practice in the medical field. These rules ensure that services are delivered ethically and that financial practices are transparent, protecting both providers and patients. By adhering to regulatory guidelines, medical professionals can avoid legal issues, maintain a good reputation, and provide better care to their patients. In this section, we’ll explore some key strategies for staying compliant with relevant healthcare regulations.

Understanding Key Healthcare Regulations

Several regulatory frameworks govern healthcare services, and it’s important for providers to understand and integrate them into their practices. Some of the most critical regulations include:

- Health Insurance Portability and Accountability Act (HIPAA): This U.S. law sets standards for protecting sensitive patient information. It requires providers to implement safeguards to protect patient privacy and ensures that billing practices are in compliance with data protection laws.

- Affordable Care Act (ACA): The ACA requires that healthcare providers offer certain standards of care and follow specific guidelines regarding insurance billing and patient services. Compliance with ACA guidelines ensures that both service providers and patients are treated fairly.

- General Data Protection Regulation (GDPR): In Europe, GDPR governs the processing of personal data. Medical professionals must adhere to these rules to ensure that patient data is handled with the utmost care and security.

- National Health Service (NHS) Guidelines: In some countries, like the UK, providers must follow specific guidelines set forth by national health services to ensure that they meet government standards for treatment and financial documentation.

Best Practices for Compliance

Staying compliant with healthcare regulations requires ongoing attention to detail and regular updates to practices. Here are some best practices to help ensure compliance:

- Stay Educated: Regularly review and educate yourself and your staff on the latest regulations. This could include attending continuing education courses, subscribing to industry publications, or consulting with legal experts.

- Document Everything: Keep thorough records of patient interactions, services provided, and financial transactions. This will help you prove compliance in case of audits or disputes.

- Use Secure Technology: Implement secure systems for handling patient data and billing information, ensuring all information is encrypted and accessible only to authorized personnel.

- Seek Legal and Financial Advice: Consult with healthcare attorneys and financial advisors to ensure that all practices are in line with current laws and regulations.

By integrating these practices and staying informed about the latest changes in healthcare law, providers can maintain compliance, reduce risk, and focus on delivering the best possible care to their patients.

Handling Insurance and Claims on Invoices

Managing insurance and claims effectively is an essential aspect of healthcare billing. Ensuring that claims are submitted accurately and insurance details are included correctly can help prevent delays in payments and reduce the likelihood of disputes. This section covers the best practices for incorporating insurance information into financial records, as well as tips for submitting claims to insurance companies.

Key Elements to Include for Insurance Claims

When dealing with insurance payments, it’s important to provide the necessary information to ensure that claims are processed quickly and correctly. Here are the key elements to include:

- Insurance Provider Information: Always include the name and contact details of the insurance provider. This helps ensure the claim is routed to the correct department.

- Policy Number: Include the patient’s insurance policy number to identify the individual’s coverage. This is essential for confirming eligibility and billing the correct plan.

- Patient’s Details: Include the patient’s full name, date of birth, and identification number as per their insurance policy to avoid any discrepancies.

- Dates of Service: Ensure the dates of all services provided are clearly mentioned. Insurance companies often require this information to determine coverage eligibility.

- Service Codes: Use correct billing codes such as ICD (International Classification of Diseases) and CPT (Current Procedural Terminology) codes. These codes specify the exact services or treatments provided and are necessary for insurance processing.

Best Practices for Submitting Claims

Submitting claims to insurance companies requires careful attention to detail. Here are some best practices to follow when submitting claims:

- Double-Check Accuracy: Ensure all information is accurate and up to date. Even small errors, like incorrect dates or misspelled names, can delay payment or result in claim rejection.

- Follow Insurance Requirements: Different insurance providers may have different rules regarding claims submission. Make sure to follow their specific guidelines to avoid rejections.

- Timely Submission: Submit claims promptly, as many insurance companies have deadlines for claim submission. Missing these deadlines could result in delayed payments or denied claims.

- Track Claims: Keep track of each claim’s status and follow up if necessary. This will help ensure that payments are processed without unnecessary delays.

By integrating these practices into your billing system, you can streamline the process of handling insurance claims, ensuring timely reimbursements and minimizing errors. A smooth insurance claim process not only benefits the healthcare provider but also improves the experience for patients who rely on their coverage.

How to Include Insurance Details

When billing for healthcare services, including insurance information is crucial to ensure that the payment process is smooth and efficient. Properly documenting the patient’s insurance coverage allows for timely reimbursements and minimizes disputes. This section will guide you through the key components to include and the best practices for capturing insurance details.

Essential Insurance Information

To ensure accuracy and avoid delays, it’s important to gather and present the correct insurance information. Below are the key details that should be included:

- Insurance Provider Name: Always include the full name of the insurance company, as well as its contact information, to avoid confusion during the claims process.

- Policy Number: The patient’s policy number should be listed clearly to help identify the coverage under which the services were provided.

- Group Number: If applicable, include the group policy number for employer-sponsored insurance plans. This ensures the proper handling of claims for group policies.

- Patient’s Insurance Identification: Include any identification numbers or card details that are associated with the patient’s insurance plan.

- Coverage Type: Clearly specify the type of coverage the patient has, such as primary, secondary, or supplemental insurance.

Formatting Insurance Information

Formatting insurance details properly helps in both accuracy and efficiency. Here are some tips on how to format this information effectively:

- Positioning: Place the insurance information at the top of the billing document for easy access and quick reference.

- Clear Labels: Use clear headings such as “Insurance Provider,” “Policy Number,” and “Group Number” to separate each section for easy navigation.

- Legible Text: Ensure that all insurance details are legible and properly formatted, using a readable font size and spacing.

By including these details accurately, healthcare providers can ensure that the billing process is transparent and the chances of payment issues are minimized. Properly documenting insurance details will also help streamline communications with insurance companies and improve the overall efficiency of the reimbursement process.

Best Practices for Psychiatrist Invoicing

Effective billing is a critical aspect of managing healthcare services, ensuring timely payments and smooth financial operations. When it comes to providing mental health services, there are specific strategies and best practices that can streamline the payment process and minimize errors. These practices not only help in maintaining accuracy but also improve the overall relationship between the healthcare provider and the patient or insurance company.

Clear and Detailed Documentation

One of the fundamental principles of efficient billing is to provide clear and comprehensive records of services rendered. Below are some key practices to follow:

- List of Services: Always include a detailed breakdown of the services provided, including session length, type of therapy, and any special treatments performed.

- Accurate Codes: Use the correct medical codes for the services rendered. This helps avoid confusion and ensures the claim is processed correctly by insurance companies.

- Patient Information: Make sure that the patient’s full name, address, and other necessary contact details are included to avoid any mix-ups or delays in payments.

- Clarity of Fees: Clearly outline the charges for each service, and specify whether the fee is covered by insurance or needs to be paid out-of-pocket.

Timeliness and Consistency

Consistency and timely submission are essential components of a successful billing strategy. Adhere to these best practices:

- Timely Submissions: Submit claims promptly after the service is provided to avoid delays. Most insurance companies have a time frame for accepting claims.

- Follow Up Regularly: Follow up on any outstanding claims to ensure that payment is processed. Set reminders for both the patient and the insurance provider if necessary.

- Standardized Process: Use a consistent process for every patient, including a uniform format for documenting services, charges, and payment terms. This consistency will help avoid mistakes and facilitate smoother transactions.

By adopting these best practices, mental health professionals can ensure accurate billing, minimize errors, and maintain strong financial health for their practices. Proper documentation, timely submissions, and consistency in billing processes will lead to fewer disputes and quicker payments, ultimately improving patient satisfaction and business operations.

Tips for Efficient Billing Management

Managing financial transactions in healthcare can often be complex, requiring attention to detail, accuracy, and organization. Streamlining the process not only ensures timely payments but also reduces the likelihood of errors and disputes. To improve your billing workflow and keep things running smoothly, consider implementing the following strategies.

Organize Billing Records Effectively

Maintaining organized financial records is essential for quick reference and for ensuring that no important information is overlooked. Consider the following practices:

- Centralized Database: Store all billing information in a single, secure location for easy access and retrieval. A centralized database ensures that all patient records are organized and accessible whenever needed.

- Detailed Records: For each patient, include a complete record of services provided, billing rates, payment status, and any outstanding balances. This reduces the chances of overlooking key details.

- Use of Electronic Tools: Leverage digital solutions to automate record-keeping and minimize manual errors. Cloud-based platforms can simplify the organization of data and ensure it is up to date.

Regularly Review Billing Procedures

Consistent review of your billing processes helps identify potential inefficiencies and areas for improvement. Below are some ways to keep your procedures on track:

- Audit Payment Histories: Periodically audit past transactions to ensure accuracy and detect any discrepancies early on. Look for patterns of frequent mistakes or missed payments that may indicate an issue.

- Track Payment Trends: Pay attention to how long payments typically take to process. This will help identify delays and inform you when to follow up on outstanding balances.

- Monitor Compliance: Regularly check your procedures against any relevant legal or insurance requirements to ensure your records are always compliant with current regulations.

Utilize Automation for Routine Tasks

Automation can significantly reduce the time spent on repetitive tasks and improve accuracy. Here’s how you can use automation for more efficient billing management:

- Automate Payment Reminders: Set up automatic notifications to remind patients of upcoming or overdue payments, helping to reduce delays in payment processing.

- Automated Data Entry: Use tools that automatically input billing data from patient visits into your system, minimizing the need for manual input and reducing human errors.

- Recurring Billing: If you have patients on regular payment plans, automate recurring charges to avoid the need for manual updates and ensure timely payments.

Tracking and Reporting

Effective tracking and reporting can provide valuable insights into the financial health of your practice. The following practices can help you stay on top of your billing:

| Report Type | Purpose |

|---|---|

| Revenue Report | Helps track income generated over a specific period, providing insights into cash flow. |

| Outstanding Balances Report | Lists patients with overdue payments, allowing for timely follow-ups. |

| Payment Status Report | Provides a detailed status of all payments, helping to id |