Property Rental Invoice Template Excel for Efficient Payment Management

Managing payments for leased properties can be a time-consuming task, especially when it comes to ensuring that all records are accurate and well-organized. Whether you’re a landlord, property manager, or tenant, having a reliable system for tracking financial transactions is crucial. Proper documentation helps avoid misunderstandings and maintains a smooth financial flow for both parties involved.

One of the most effective ways to streamline this process is by using specialized software or digital tools that simplify record-keeping. These tools allow for easy customization and provide a clear format to track due amounts, payment dates, and any adjustments made over time. The ability to create and manage such documents digitally offers flexibility and convenience, making the entire management process more efficient.

By utilizing digital solutions, users can ensure their financial records are up-to-date and compliant with any relevant regulations. Moreover, these tools can help automate recurring tasks, such as calculating fees and generating reports. In this guide, we’ll explore how to leverage these methods to stay on top of financial obligations with minimal effort.

Understanding Rent Payment Documentation

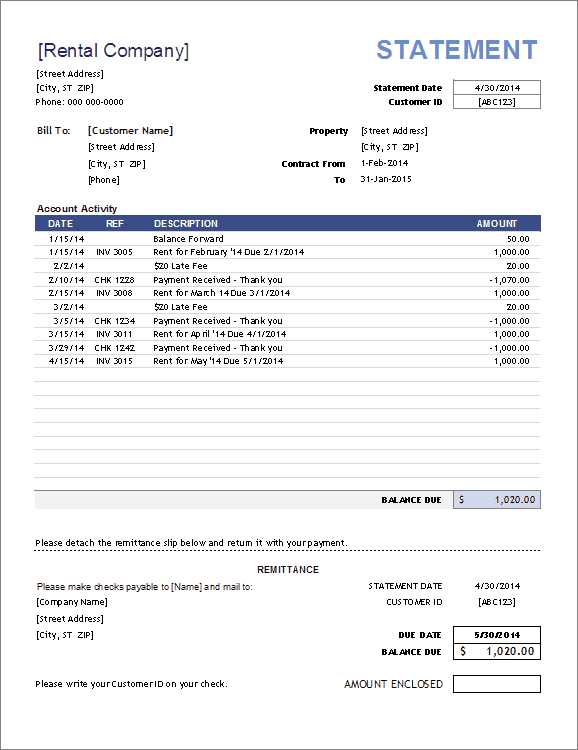

Managing financial transactions related to leased spaces requires clear, concise, and well-structured records. Proper documentation ensures that both landlords and tenants are aware of the amounts due, the payment schedule, and any additional charges that may apply. These documents also serve as a reference point in case of disputes or audits, ensuring transparency in financial dealings.

In this section, we’ll explore the key elements of such documents and how they are typically structured. Understanding these components is crucial for anyone involved in the leasing process, whether you’re managing multiple properties or simply renting a space for personal use.

Key Information to Include in Payment Records

Each payment record should contain specific details to ensure that both parties can quickly reference the transaction. This includes the payment amount, due date, and any adjustments, such as late fees or security deposit deductions. Clear labeling of these components minimizes confusion and ensures compliance with agreed terms.

| Component | Description |

|---|---|

| Amount Due | Total sum expected to be paid for the period |

| Due Date | The date by which payment should be made |

| Payment Method | How the payment is made (e.g., bank transfer, check, online payment) |

| Late Fees | Additional charges applied for delayed payments |

How to Structure the Document

To make these documents easy to read and use, they should follow a clear format. The da

Why Use a Digital Spreadsheet for Rent Management

Managing financial records for leased properties can quickly become overwhelming, especially when multiple tenants or units are involved. A digital spreadsheet offers a streamlined, efficient solution to keep track of all transactions in one place. Its flexibility and ease of use make it a popular choice for landlords and managers looking to simplify their accounting process.

By using a digital document, individuals can easily input, update, and organize payment information. This eliminates the need for manual record-keeping, reducing the risk of errors and ensuring that all financial details are readily accessible. Furthermore, spreadsheets allow for customization, which is especially helpful when dealing with varying payment schedules, rates, or additional charges.

Benefits of Using a Digital Spreadsheet for Rent Management:

- Automated Calculations: Automatic math functions help calculate totals, taxes, and late fees without the need for manual input.

- Easy Customization: You can adjust the document to fit your unique needs, including adding specific columns or rows for different charges.

- Real-time Updates: As soon as a payment is made, you can update the document, keeping everything current.

- Clear Organization: Spreadsheets provide a clean, simple way to organize multiple transactions in one place, reducing clutter and confusion.

Using a digital solution helps save time, reduces the chance of mistakes, and ensures a more professional approach to managing lease-related finances.

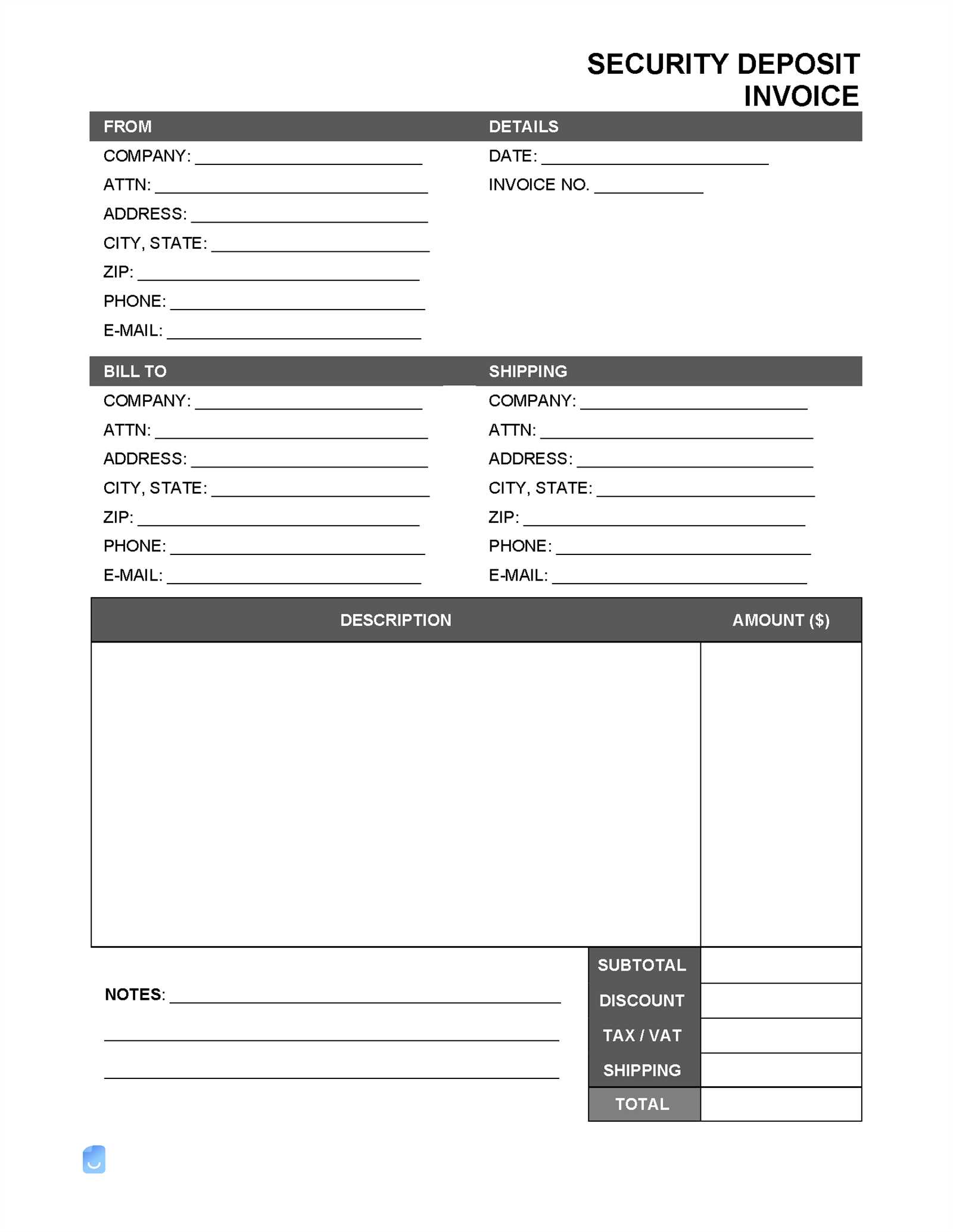

Benefits of Customizable Billing Documents

Using a customizable document for managing financial transactions allows for greater flexibility and accuracy when tracking payments. By tailoring the structure and layout to suit specific needs, individuals and businesses can create a more efficient and organized approach to record-keeping. This level of personalization ensures that all relevant details are captured clearly and consistently.

Customizable billing documents offer numerous advantages that simplify the management process and enhance overall efficiency. Whether you’re handling single or multiple transactions, being able to modify the document as needed allows for quick adjustments and the inclusion of unique payment terms or conditions.

- Flexibility: Easily adjust the format to suit various billing structures, such as different payment frequencies, amounts, or additional charges.

- Professional Appearance: Tailor the design to reflect your business or personal brand, giving a polished and consistent look to each document.

- Improved Accuracy: Customize fields to track specific details, reducing the chances of errors or omissions.

- Efficiency: Quickly modify the document for different clients or situations, saving time and effort on repetitive tasks.

- Enhanced Tracking: Add or remove columns to track extra information such as deposits, discounts, or payment histories.

With these benefits, customizable billing documents are not just about creating a simple record–they become an essential tool for ensuring smooth financial management and maintaining a high level of professionalism in transactions.

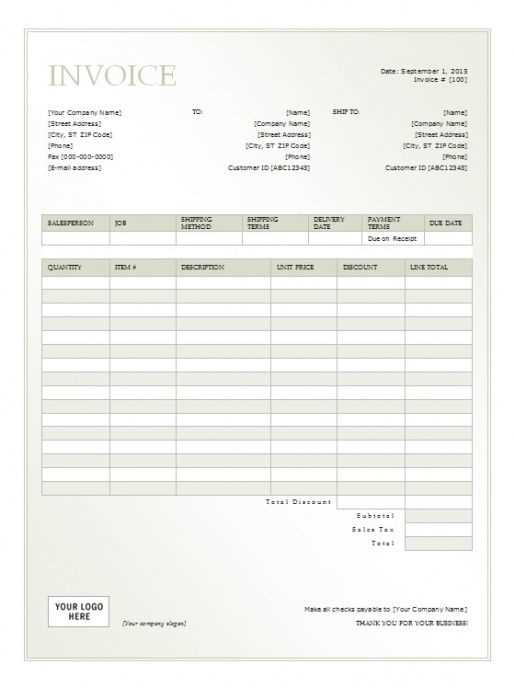

How to Create a Billing Document in a Spreadsheet

Creating a well-structured financial document in a digital spreadsheet is an essential skill for efficient payment tracking. By following a simple set of steps, you can quickly generate a clear and professional statement that outlines all relevant details, from amounts due to payment dates. This process allows for quick updates and easy access, helping you stay on top of transactions.

Here’s a step-by-step guide on how to create such a document:

- Open a New Spreadsheet: Start by opening a new file in your spreadsheet application.

- Set Up Headers: Label the columns with necessary categories, such as “Date”, “Description”, “Amount Due”, “Due Date”, and “Payment Method”.

- Input Data: Enter the transaction details for each payment period, including amounts, dates, and any additional charges or adjustments.

- Apply Formulas: Use formulas to calculate totals, apply late fees, or sum up outstanding amounts automatically.

- Customize the Layout: Adjust the row height, column width, and cell borders to ensure the document is easy to read.

- Save and Distribute: Once finalized, save the document in a preferred format and send it to the relevant parties.

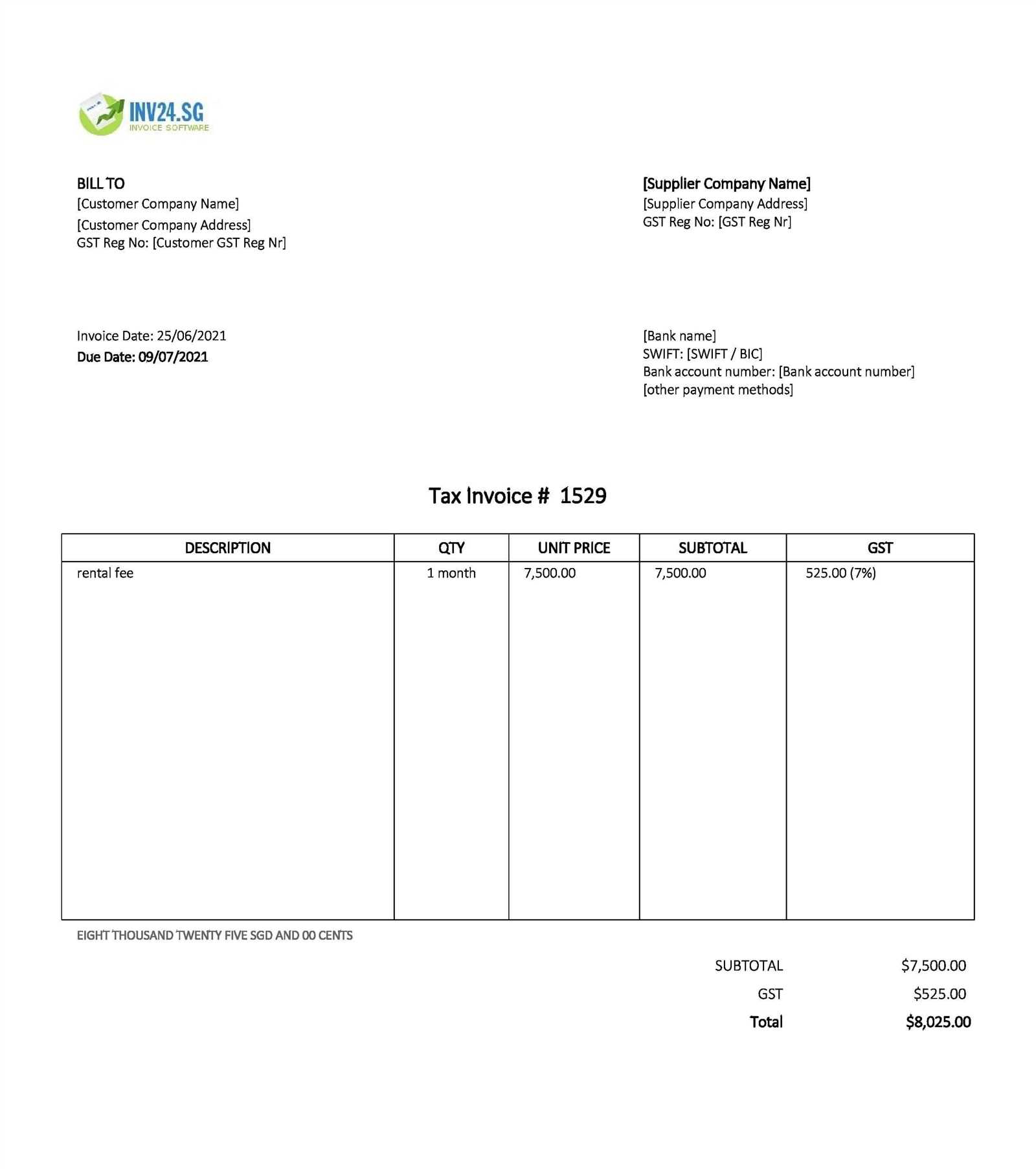

Here is a simple example of how your document might look:

| Date | Description | Amount Due | Due Date | Payment Method | ||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

01/05/2024

Key Elements of a Rental InvoiceWhen creating a financial document for leasing, it’s essential to include certain key components. These elements ensure both parties understand the details of the transaction and that payments are processed smoothly. Here’s a breakdown of the critical features to include in such a document.

Excel Features for Rental Invoice CreationWhen designing a financial document for lease agreements, a spreadsheet tool offers various useful features to streamline the process. These functionalities help in organizing data, performing calculations, and ensuring accurate and professional results. Here are the main features that can simplify the creation of such documents. Data Organization and CustomizationTables in spreadsheets allow users to clearly structure important information such as tenant details, due amounts, and payment dates. These structures make it easier to input and edit the required data, keeping everything neatly aligned. Automatic Calculations and AccuracyUsing formulas, you can automatically calculate totals, taxes, or fees, which reduces the chance of human error. Functions like SUM, IF, and VLOOKUP can be programmed to calculate payments based on various conditions. Common Mistakes in Rental InvoicesCreating a financial document for leasing agreements requires accuracy and attention to detail. Even small errors can lead to confusion, payment delays, or disputes. Here are the frequent mistakes to watch for and avoid to ensure a smooth and clear payment process. Omitting Important InformationLeaving out essential details such as due dates, payment instructions, or contact information can result in misunderstandings. Ensure all relevant information is included to make the document comprehensive. Errors in CalculationsIncorrect totals, missed fees, or mis Common Mistakes in Rental InvoicesCreating a financial document for leasing agreements requires accuracy and attention to detail. Even small errors can lead to confusion, payment delays, or disputes. Here are the frequent mistakes to watch for and avoid to ensure a smooth and clear payment process. Omitting Important InformationLeaving out essential details such as due dates, payment instructions, or contact information can result in misunderstandings. Ensure all relevant information is included to make the document comprehensive. Errors in CalculationsIncorrect totals, missed fees, or miscalculated taxes are common issues. Double-checking calculations, especially when adjustments are applied, is crucial for accuracy.

Using Excel for Rent Payment TrackingTracking lease payments can become complex, especially when handling multiple tenants or due dates. A spreadsheet application offers an efficient solution for managing and organizing payment information, ensuring timely records and reducing errors. Below are some key methods to help simplify this tracking process. Organizing Payment DetailsCreating a table for payment tracking allows you to record all necessary details, including tenant names, payment amounts, and dates. This layout keeps information easily accessible, allowing you to monitor which payments have been received and which are still outstanding. Automating CalculationsHow to Automate Rent Invoices in ExcelAutomating financial documents for leasing payments can save significant time and ensure accuracy. By using a spreadsheet application, you can streamline the creation and tracking of these documents, reducing manual work and minimizing errors. Here are some steps to help you set up automation for these records. Using Formulas for Automatic CalculationsFormulas such as SUM, IF, and VLOOKUP can automate calculations, helping to quickly generate totals, apply taxes, or calculate any fees. These functions update automatically, ensuring that your records remain accurate with minimal effort. Creating a Template with Dynamic Fields

By setting up Ensuring Accuracy in Rental BillingMaintaining precision in billing for lease agreements is crucial to avoid misunderstandings and payment issues. Accurate records foster trust and clarity between both parties, ensuring smooth transactions. Below are some essential practices to help maintain accuracy in your billing process. Double-Check Calculations: Always verify totals, fees, and any discounts applied. Use formulas to automate these calculations, reducing the chance of human error and making updates simpler if adjustments are needed. Verify Dates and Amounts: Confirm that all payment due dates and amounts are correct. Small errors in these fields can lead to significant confusion, so check carefully, especially when handling multiple payments or tenants. Regularly Update Information Free vs Paid Rental Invoice TemplatesWhen creating billing documents for lease payments, choosing between free and paid formats can impact both functionality and presentation. Each option has its own set of benefits and limitations. Here’s a comparison to help you decide which is the best fit for your needs.

|