Project Invoice Template Excel for Simplified Billing

Managing financial transactions effectively is crucial for maintaining smooth operations in any business. Having a reliable system for organizing charges, payments, and project details can save time and minimize errors. By using a well-structured document to manage these tasks, you ensure accuracy and professionalism, which ultimately strengthens relationships with clients and partners.

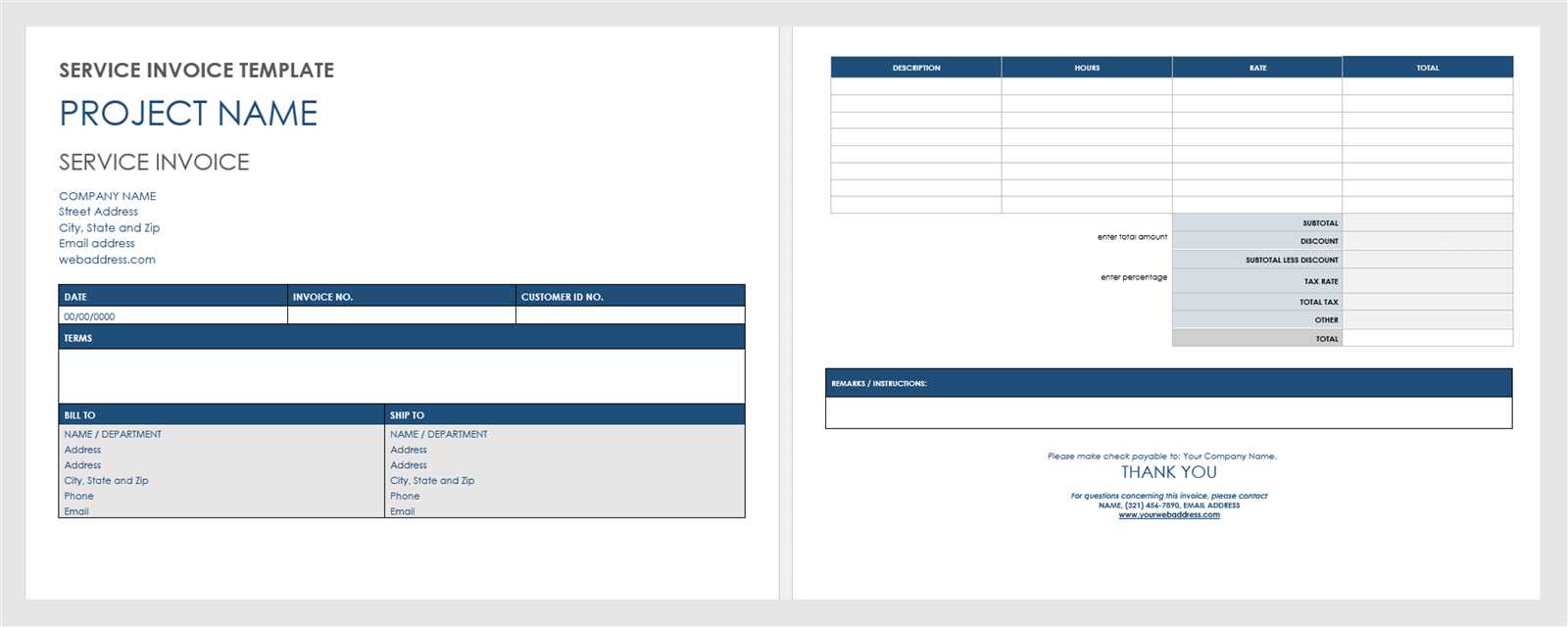

Customizable documents offer flexibility, allowing you to adjust the layout and fields to fit various services and projects. This flexibility is particularly useful when dealing with clients of different industries, as their needs may vary. From tracking time worked to calculating expenses, these tools can be tailored to reflect the specifics of your business model.

Incorporating automated calculations and easy-to-read formats helps streamline the process, reducing manual input and potential mistakes. Whether you’re billing for services rendered, materials provided, or time spent, an efficient document design can ensure that all the necessary details are captured correctly.

Understanding Project Invoice Templates

Effective documentation for financial transactions is essential for smooth business operations. When managing different types of charges, it’s important to have a clear and consistent format that can easily capture all necessary information. A well-organized system helps to avoid errors, ensures accuracy, and maintains a professional image.

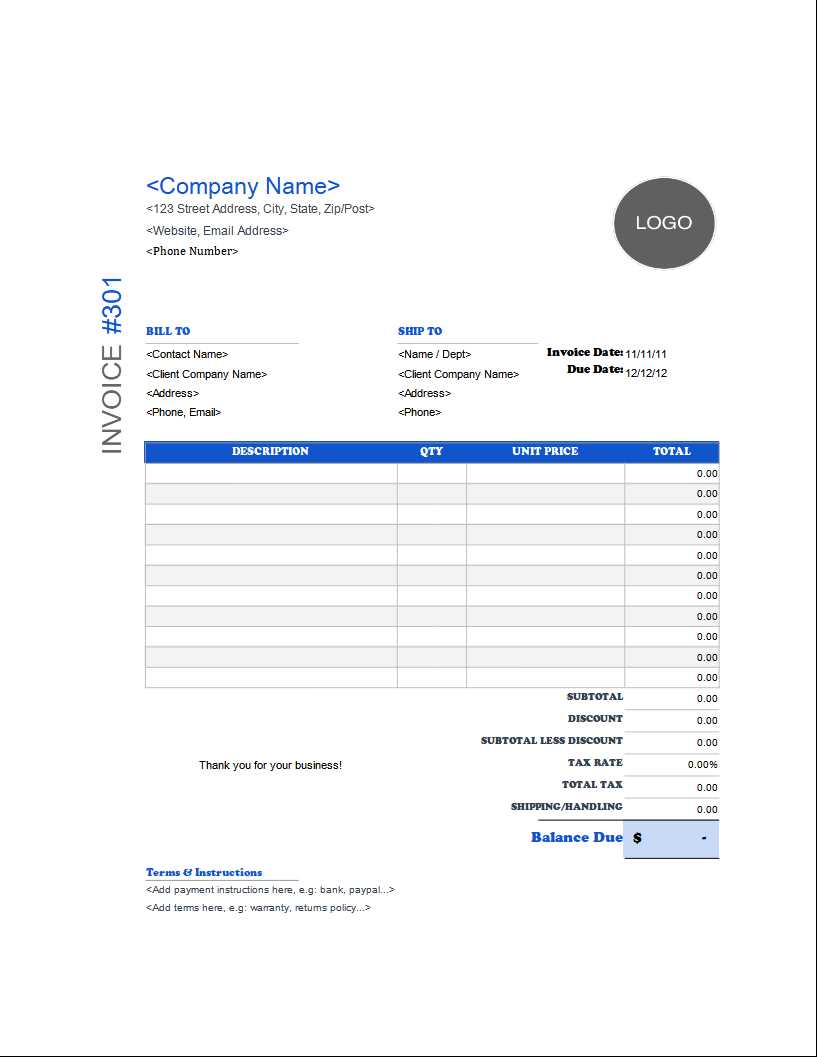

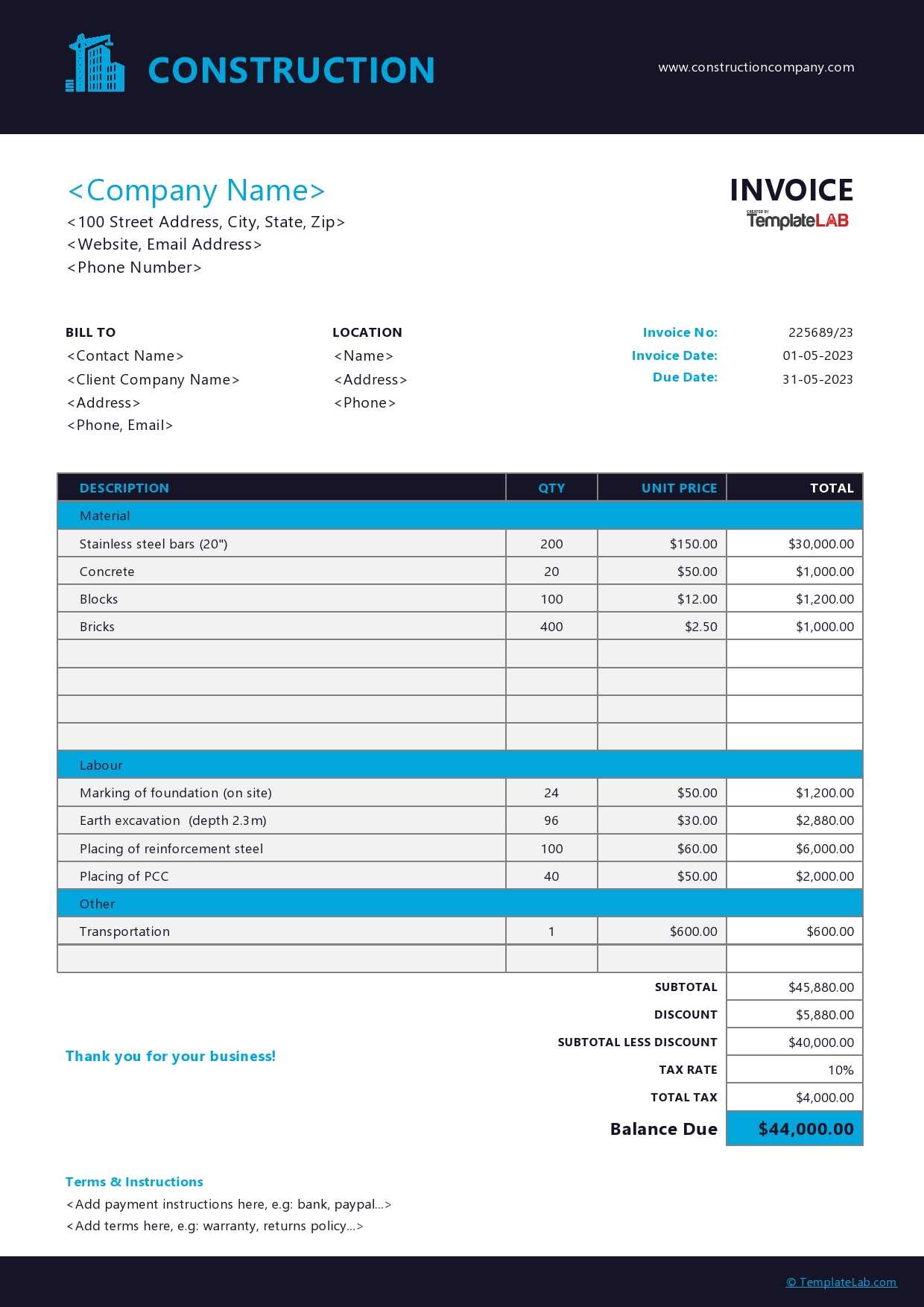

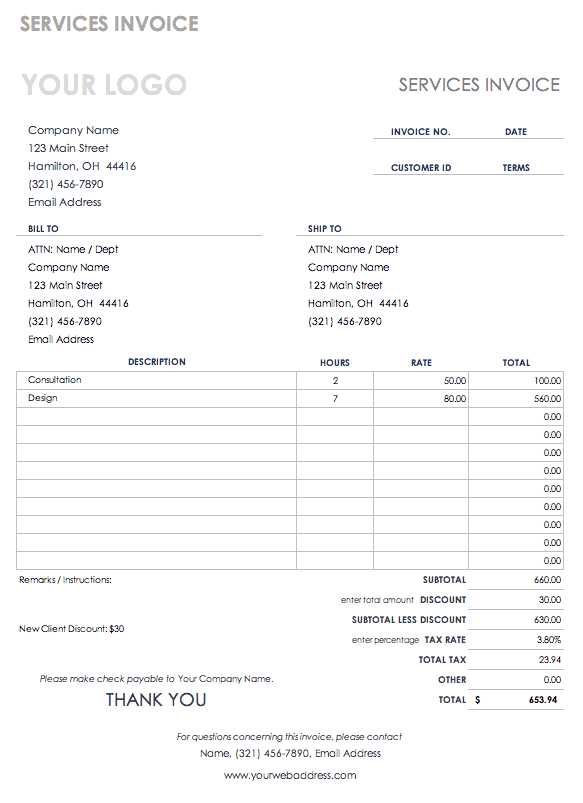

A well-structured document typically includes several key components, which help in organizing and tracking payments, hours worked, and project details. Some of the main elements are:

- Client Information: Includes the client’s name, contact details, and relevant project references.

- Services Rendered: A detailed breakdown of the work performed or items provided, with associated costs.

- Payment Terms: Specifies when payment is due, including late fees or discounts, if applicable.

- Taxes and Additional Charges: Covers any applicable taxes, shipping fees, or other additional costs.

Using a customizable document ensures flexibility in adapting to different types of work and payment arrangements. It also allows for updates and modifications as business needs evolve, without having to start from scratch each time. Customizing the structure ensures that all necessary details are included while remaining clear and concise for the client’s easy understanding.

By implementing a simple yet thorough design, businesses can improve efficiency and maintain consistency across all financial documents. Whether managing small tasks or larger projects, this approach simplifies the billing process and promotes a transparent relationship with clients.

Why Use Excel for Invoices

Choosing the right tool to manage financial documents is essential for maintaining accuracy and efficiency in business transactions. The simplicity and versatility of spreadsheets make them an ideal choice for creating detailed billing records. This platform allows for easy customization, automatic calculations, and seamless data management, making it an excellent option for small and medium-sized businesses alike.

Key Benefits of Using Spreadsheets

Spreadsheets offer several advantages when it comes to organizing and managing financial records:

- Ease of Use: Spreadsheets are user-friendly, with a simple interface that doesn’t require advanced technical skills to operate.

- Customization: You can easily adjust the layout, add or remove columns, and tailor the design to suit your specific needs.

- Automation: Built-in formulas help automate calculations, reducing the risk of errors and saving time.

- Data Management: Spreadsheets allow you to organize, store, and quickly access a large amount of data in one place.

- Cost-Effective: Unlike specialized software, spreadsheets are often already available as part of office software packages, reducing the need for additional expenses.

How Spreadsheets Improve Efficiency

Using a spreadsheet to manage financial records can streamline workflows and improve overall productivity. With automatic calculation features, it’s easy to add new entries, adjust amounts, and track changes without manually recalculating totals. Additionally, the ability to save and reuse documents simplifies the process of generating recurring records or updating previous files.

By choosing a spreadsheet-based approach, businesses can create organized, accurate, and professional billing documents quickly, while minimizing the risk of mistakes and ensuring consistency across all financial records.

Benefits of Customizable Invoice Formats

The ability to adjust and personalize financial documents is a significant advantage for businesses of all sizes. Customization allows you to tailor documents to fit the specific needs of different clients, projects, or services. A flexible structure enables businesses to present information in a way that enhances clarity and professionalism, fostering better communication with customers.

Flexibility is one of the most notable benefits of customizable formats. By adjusting the layout, you can emphasize the most important details–whether it’s project hours, materials, or total costs–making it easier for clients to understand the breakdown of charges.

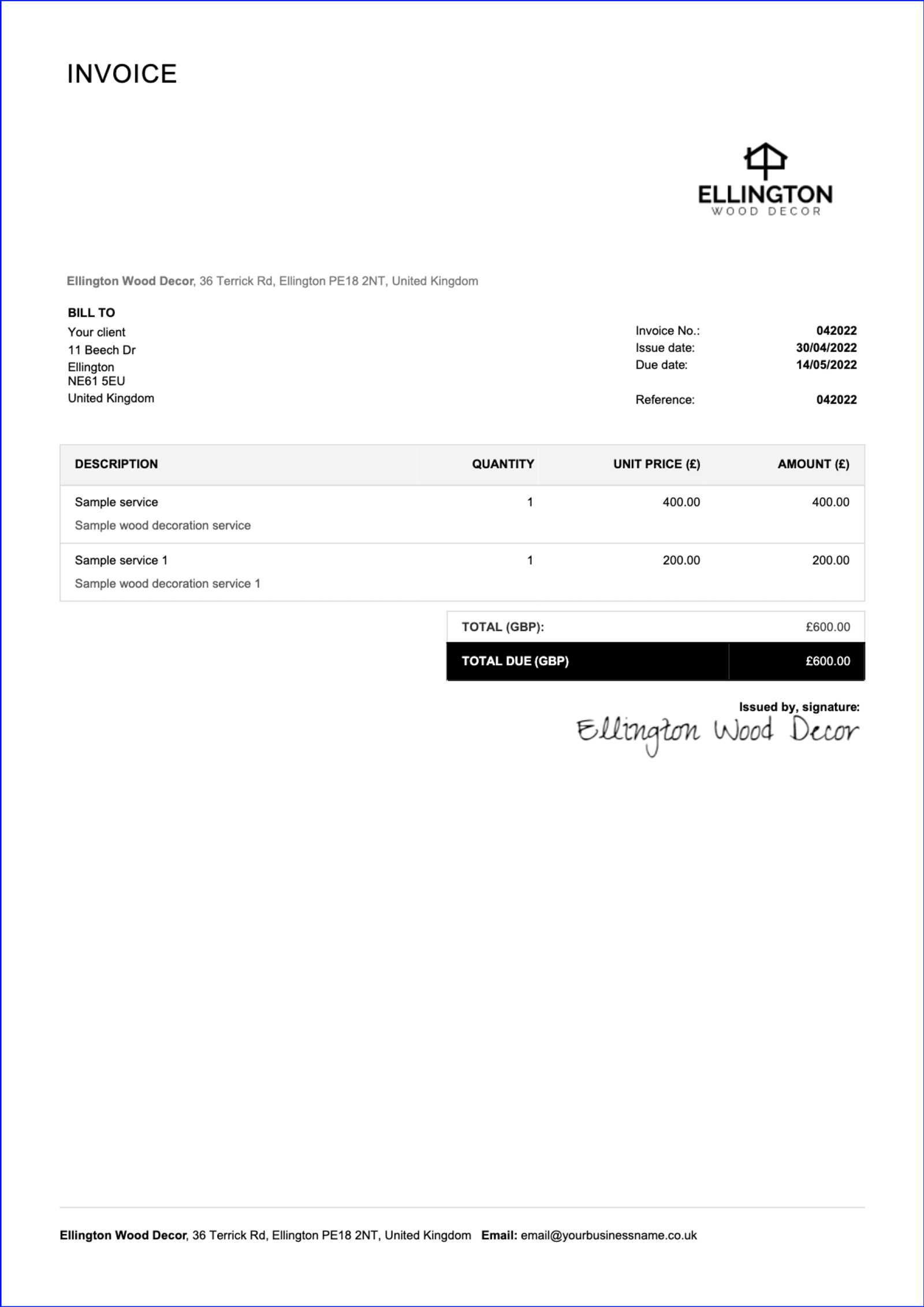

Another key advantage is branding consistency. Customizing financial documents gives businesses the opportunity to incorporate their logo, company colors, and fonts, which helps strengthen their identity and create a cohesive brand image. This consistency can improve the client’s perception of your professionalism and reliability.

Efficiency also plays a crucial role. Customizable formats allow businesses to streamline the process of document creation, reducing the time spent adjusting every new document from scratch. You can set up pre-filled fields for common services, terms, and conditions, making future entries faster and less prone to errors.

In addition, businesses can easily accommodate specific requirements for each client, such as special tax considerations, payment methods, or unique service packages. Customizing your documents ensures that all relevant details are captured, reducing misunderstandings and ensuring that your billing process is as smooth as possible.

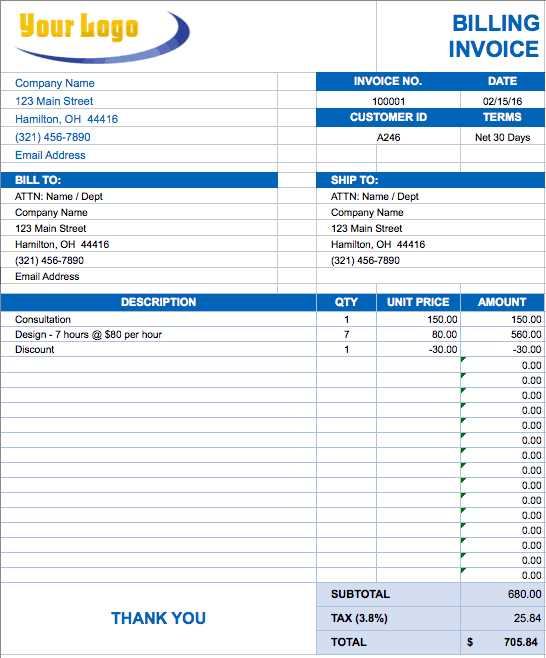

Key Components of an Invoice Template

A well-structured financial document is essential for tracking and managing transactions effectively. To ensure that all necessary details are captured, a comprehensive format should include several key sections. These components help provide clarity, transparency, and accuracy, which is crucial for both the service provider and the client.

Essential Sections of a Billing Document

Here are the most important parts of a well-organized financial record:

- Client Information: Includes the name, contact details, and unique reference number of the client or business. This helps ensure that the document is properly attributed to the right customer.

- Service Details: A detailed description of the services provided, including quantity, unit price, and total cost for each item or task.

- Dates: The start and end dates of the services provided, as well as the date the document was issued, to ensure timely and accurate tracking.

- Payment Terms: Specifies when payment is due, late fees if applicable, and accepted payment methods. This clarifies expectations for both parties.

- Subtotal and Total: A clear breakdown of the charges, including any taxes or discounts applied, with a final total that reflects the full amount due.

Additional Optional Information

Depending on the specific needs of the business or client, other elements may be included:

- Tax Information: If applicable, includes details about sales tax or VAT and the tax identification number.

- Notes or Special Instructions: A space for including any additional details, such as specific terms, payment instructions, or thanks to the client for their business.

- Unique Document Number: Helps in identifying and tracking individual transactions, especially for record-keeping and accounting purposes.

By including these key components, businesses can ensure that every document is clear, professional, and fully informative, making the payment process smoother for everyone involved.

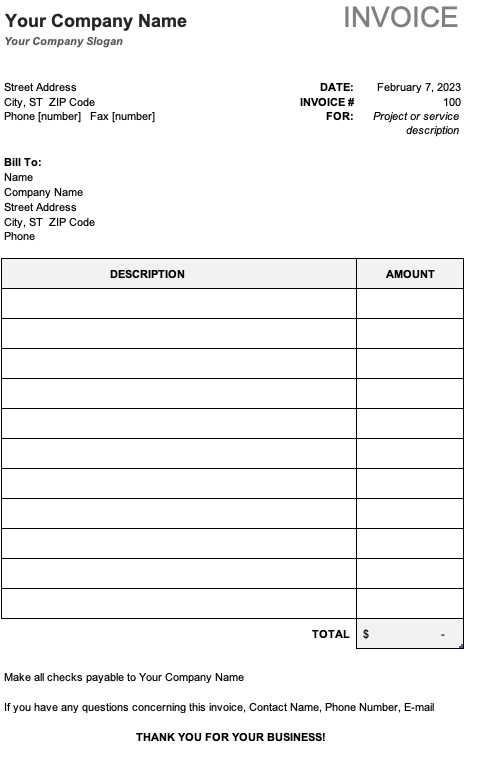

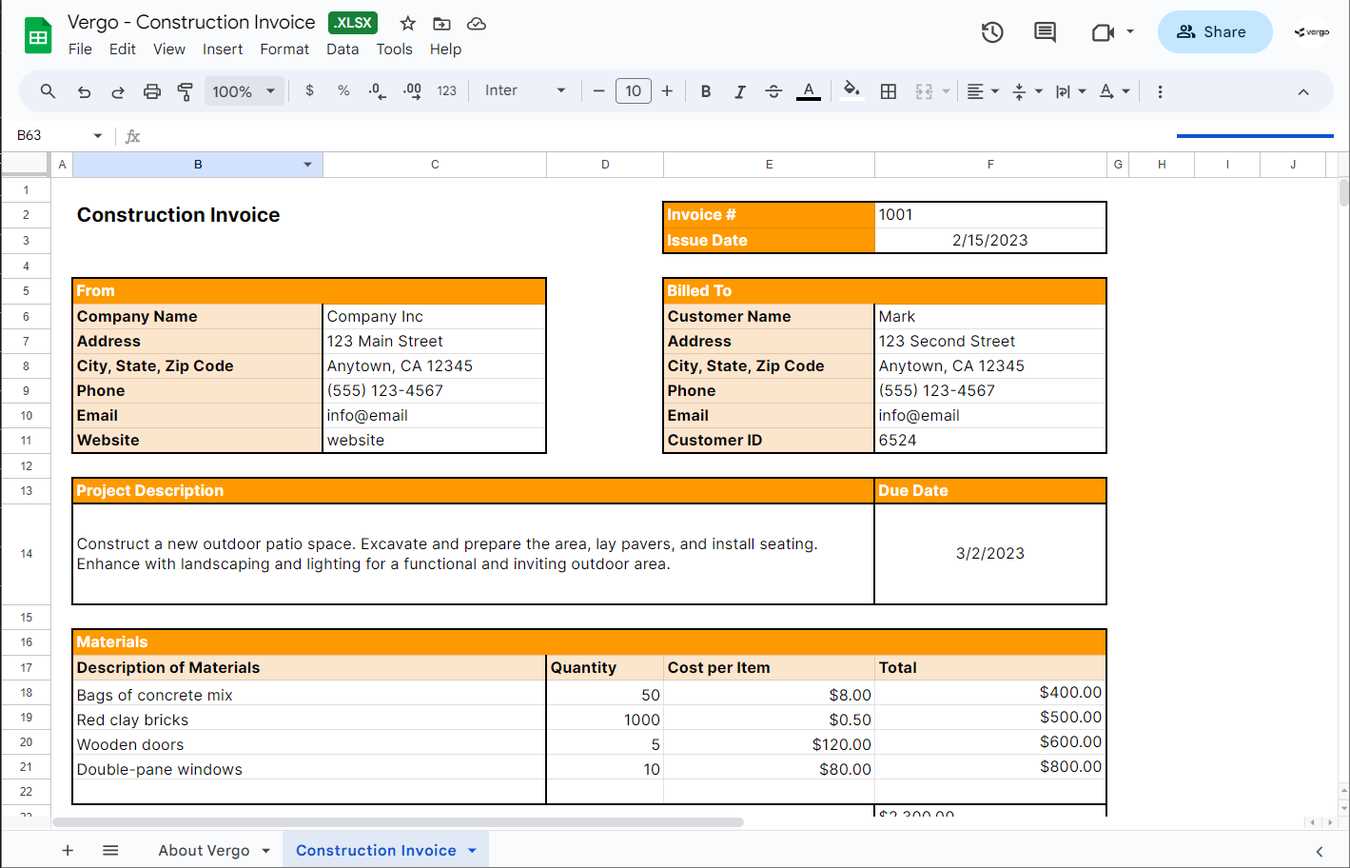

How to Create Your Own Template

Designing a custom document to manage billing and financial transactions is a straightforward process that allows you to tailor the layout and content to your specific needs. By starting with a clear structure, you can create a professional and organized record that is easy to update and reuse for future transactions.

To create your own document, follow these simple steps:

- Step 1: Start with a clean sheet, selecting a simple grid layout that allows for clear sections and easy input. Avoid clutter to keep the document legible.

- Step 2: Add sections for basic information such as the client’s name, contact details, and date of issue. Make sure these are prominently displayed at the top for easy reference.

- Step 3: Include fields for listing the services or products provided. These should have columns for quantity, unit price, and total cost to ensure all details are clear.

- Step 4: Add a section for payment terms, including due date, any applicable discounts or late fees, and accepted payment methods.

- Step 5: Leave space for additional details such as taxes, special instructions, or terms of service that are relevant to the transaction.

- Step 6: Make use of automatic calculation features to help sum totals, taxes, and discounts, ensuring everything is accurate and reduces the chance of errors.

Once the basic structure is in place, you can refine the design to match your branding by adding logos, colors, or custom fonts. The more tailored the document is, the more professional it will appear to clients. Save the file as a reusable format so that future records can be generated easily with minimal effort.

Best Practices for Project Invoices

Creating clear, accurate, and professional financial documents is key to ensuring smooth transactions and maintaining good client relationships. Adhering to best practices when managing billing records helps reduce misunderstandings, ensures timely payments, and strengthens the credibility of your business.

One of the most important aspects of these documents is clarity. Always ensure that the services provided, along with their costs, are easy to understand. Break down each task or item with clear descriptions and pricing to avoid confusion. The more detailed the record, the less likely it is that the client will have questions or need further clarification.

Consistency is also vital. Use the same format and structure across all your documents to maintain professionalism. This includes keeping the same font style, layout, and logo placement. A consistent design helps reinforce your brand and makes it easier for clients to read and understand your records.

Timeliness plays a major role as well. Always send out your documents promptly after services are completed. This allows you to manage cash flow effectively and ensures that clients have enough time to review the details. Including a clear due date and adhering to agreed-upon payment terms further facilitates smooth financial transactions.

Accuracy is non-negotiable. Double-check all figures, dates, and client details before sending out any document. Errors in amounts or dates can delay payments or create confusion, potentially damaging your professional relationship with clients. Where possible, use automated calculations to reduce the risk of human error.

Lastly, personalization can go a long way in strengthening business relationships. While it’s essential to maintain a professional appearance, adding a personal touch–such as a brief note thanking the client for their business–can help make the document feel more thoughtful and client-centered.

Integrating Client Details in Excel

Incorporating client information into your financial documents is a crucial step in maintaining accurate records and ensuring smooth communication. By efficiently organizing client details, you can create tailored documents that are clear, professional, and easy to manage. Integrating client data into a structured format streamlines the process of document generation, making it easier to track transactions and follow up on payments.

Essential Client Information to Include

When adding client details, it’s important to include the most relevant information to ensure that your documents are complete and easy to reference. Commonly, the following details are included:

| Client Name | Address | Contact Information | Client ID | |

|---|---|---|---|---|

| John Doe | 123 Maple St, City, Country | (555) 123-4567 | [email protected] | CID12345 |

| Jane Smith | 456 Oak Rd, Town, Country | (555) 987-6543 | [email protected] | CID67890 |

Benefits of Storing Client Details

Storing client information in a centralized location provides several advantages:

- Quick Access: Having all relevant details on one sheet allows for easy reference when generating new records or making updates.

- Accuracy: Using a structured format ensures that client details are consistently included and correctly formatted every time.

- Efficiency: By saving client information, you can quickly generate new documents without needing to re-enter details each time, reducing the chance of mistakes.

- Personalization: You can tailor the document to each client by including specific information, such as discounts or special terms, to make your communications more personalized and professional.

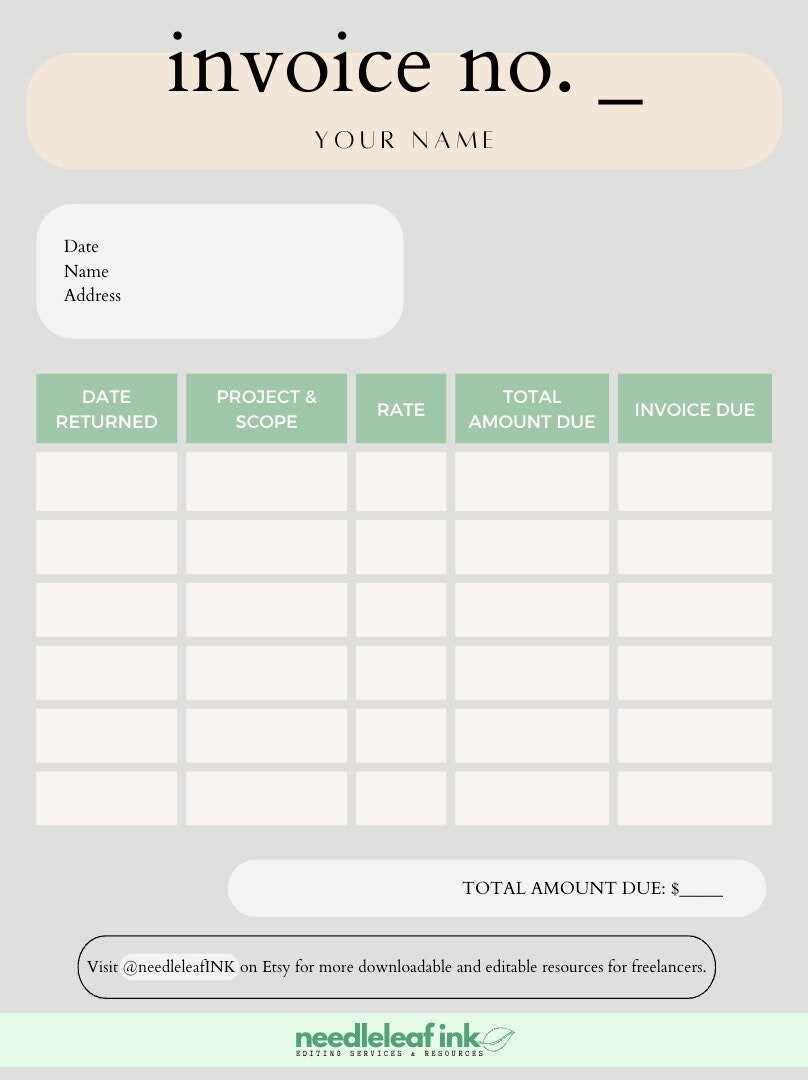

Tracking Project Hours and Costs

Accurately tracking time spent and expenses incurred during the completion of tasks is essential for efficient financial management. Proper monitoring allows businesses to assess the value of their efforts, ensure fair compensation, and stay within budget. By recording and categorizing hours worked and related costs, companies can generate transparent and reliable financial documents that reflect the true scope of their work.

Methods for Tracking Time and Expenses

There are several ways to effectively track time and costs throughout a job. Below are some commonly used strategies:

- Time Logs: Maintain a detailed record of hours worked each day, noting the start and end times for each task. This helps prevent underestimation or overestimation of work hours.

- Expense Records: Keep a detailed log of all costs related to the job, including materials, travel, or any external services. This ensures that all expenditures are accounted for when determining the final amount due.

- Categorized Entries: Organize time and expenses into specific categories, such as labor, equipment, and supplies, to make it easier to calculate totals for each area.

Benefits of Tracking Hours and Costs

Monitoring time and expenses offers a variety of advantages for businesses:

- Cost Control: By regularly tracking hours worked and costs incurred, you can identify any areas where the project is exceeding budget and take corrective actions.

- Accurate Billing: Knowing exactly how much time and resources have been spent ensures that you can bill clients fairly, based on the actual effort and materials involved.

- Transparency: Clients appreciate when they can see a clear breakdown of time and expenses, which fosters trust and reduces disputes over charges.

- Project Evaluation: Tracking hours and costs allows you to analyze the efficiency of your workflow, identify areas for improvement, and optimize future projects.

Including Payment Terms in Your Template

Clearly outlining payment terms is an essential part of any financial document. These terms set the expectations for both parties, ensuring transparency and reducing the risk of misunderstandings. By defining when and how payments are to be made, you create a mutual understanding between you and your client, helping to avoid delays and disputes.

Incorporating these terms into your financial documents not only enhances professionalism but also helps streamline the payment process. It allows clients to easily understand their obligations, including the deadline for payment, any discounts for early payments, and potential penalties for late payments. Providing clear payment instructions also makes it easier for clients to settle balances on time, improving cash flow management for your business.

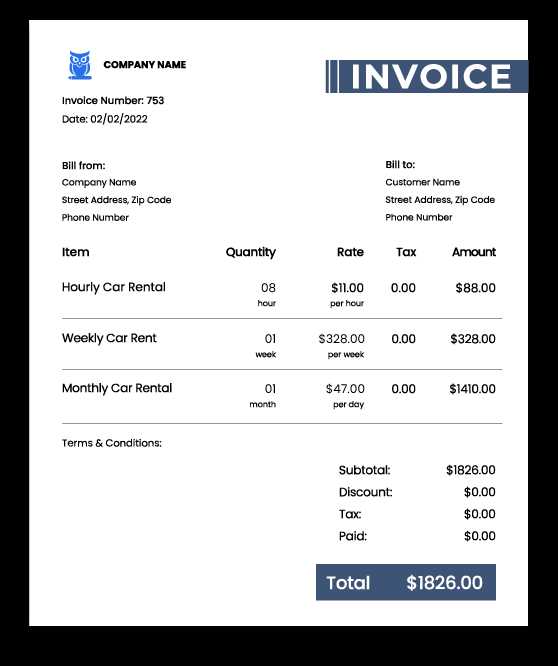

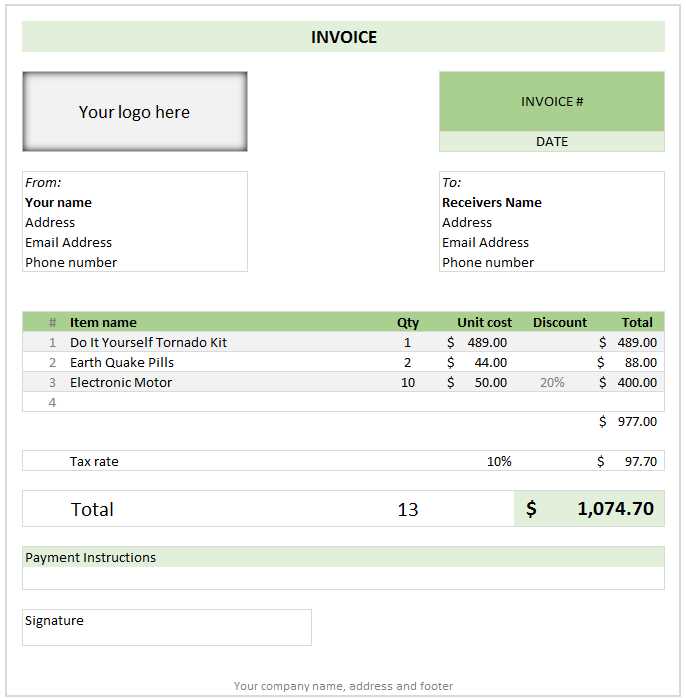

Adding Tax and Discounts to Invoices

Incorporating taxes and discounts into financial documents is an important step in accurately representing the final amount due. Taxes may vary based on location, product, or service, and applying the right rates ensures compliance with regulations. On the other hand, offering discounts helps incentivize timely payments and can be used to reward loyal clients or negotiate special terms.

To properly reflect these adjustments, it is essential to clearly show the applied tax rate and the discount value. This transparency helps clients understand the breakdown of costs and ensures that both parties are on the same page regarding the total amount due.

| Description | Amount | Tax (5%) | Discount (10%) | Total |

|---|---|---|---|---|

| Service Fee | $100 | $5 | -$10 | $95 |

| Materials | $50 | $2.5 | -$5 | $47.5 |

| Total | $150 | $7.5 | -$15 | $142.5 |

Clearly indicating the tax amount and discount applied in the document ensures clarity and avoids confusion, making it easier for both parties to verify the calculations and the final sum.

How to Manage Multiple Projects in Excel

Efficiently handling multiple tasks or jobs at once requires careful organization and tracking. Using a well-structured system helps you manage deadlines, budgets, and resources across various endeavors. By employing a central tool, you can consolidate all relevant data, making it easier to monitor progress, allocate resources, and ensure timely completion.

When managing multiple tasks, it’s important to create a system that allows you to track key aspects such as timelines, milestones, and costs for each job. This can be done through the use of customizable sheets that group similar data together, allowing for easy updates and comparisons. With the right approach, you can maintain control over all tasks and ensure that each one stays on track.

Tips for Preventing Common Mistakes

When managing financial documents or tracking job details, it’s easy to overlook key elements that can lead to errors. These mistakes can cause confusion, delays in payment, and even damage relationships with clients. However, by following a few simple practices, you can minimize the risk of these issues and ensure everything runs smoothly.

- Double-Check Details: Always review the information for accuracy. Verify the client’s contact details, job descriptions, and financial figures before finalizing any document.

- Use Clear Descriptions: Make sure all services, materials, or products are clearly outlined. Ambiguous terms can lead to misunderstandings and disputes later on.

- Set Realistic Deadlines: Ensure that the expected completion dates are achievable. Overpromising can create unnecessary pressure and lead to rushed work or delayed payments.

- Track Changes: If there are any updates to the terms or scope of work, make sure to document them. This avoids confusion and ensures everyone is on the same page.

- Review for Consistency: Make sure that the terms, rates, and amounts are consistent across all documents related to the job. Discrepancies can raise doubts and delay payment.

- Automate Where Possible: Use tools or systems that automate repetitive tasks. This reduces the chance of human error in calculations and data entry.

By taking these simple steps, you can avoid many common pitfalls and maintain a smooth workflow, ensuring professional and efficient handling of all financial matters.

How to Automate Calculations in Excel

Automating calculations can save you valuable time and reduce the risk of errors when managing financial records or tracking expenses. By setting up formulas and using built-in functions, you can ensure that calculations are done quickly and accurately. This approach is especially helpful for handling large volumes of data and performing repetitive tasks that would otherwise be time-consuming and prone to mistakes.

- Use Basic Formulas: The simplest way to automate calculations is by using basic formulas such as addition, subtraction, multiplication, and division. For instance, you can create a formula to calculate totals by adding the cost of each item.

- Implement SUM and AVERAGE Functions: These functions are great for summing up values in a column or calculating averages, making them ideal for financial documents where totals need to be calculated.

- Apply IF Statements: The IF function allows you to set conditions, such as applying a discount if a certain threshold is met, or automatically adjusting totals based on specific criteria.

- Use VLOOKUP for Data Retrieval: This function helps you quickly retrieve related information from different data sets. It is particularly useful when you need to pull details like pricing or tax rates from another table or sheet.

- Enable Auto-fill and Flash Fill: These features allow you to quickly apply formulas or fill in sequences automatically. Once you enter a formula in one cell, you can use the drag feature to apply it across a range of cells.

- Set Up Dynamic Charts and Graphs: By linking calculations to visual elements like charts, you can create a dynamic presentation of data that updates automatically when new information is added.

By utilizing these methods, you can streamline your workflow and ensure that your financial documents are always accurate, efficient, and up-to-date.

Updating and Customizing Your Invoice Template

Maintaining flexibility in your financial documents is crucial for adapting to changing business needs and client requirements. Regularly updating and personalizing your records ensures they remain relevant, professional, and aligned with your brand. Whether you’re making minor adjustments or overhauling the entire structure, customizing these documents allows you to add specific details, reflect any new terms, and improve clarity.

To keep your documents fresh and tailored to each situation, consider incorporating the following updates:

- Modify Layouts: Adjust the arrangement of data fields to reflect the most important details at a glance. This could involve moving the payment terms section higher or including more space for item descriptions.

- Update Branding: Consistently reflect your business’s logo, colors, and fonts. Customizing these elements enhances your company’s professional appearance and reinforces brand recognition.

- Revise Payment Terms: As your business evolves, so should the terms you offer. Update payment deadlines, late fees, and discounts based on the latest policies to avoid confusion with clients.

- Add New Sections: Depending on the services or products you offer, adding additional sections like shipping information or tax breakdowns can provide more clarity and ensure your clients have all necessary details.

- Automate Repetitive Information: Set up placeholders for recurring client details such as name, address, and payment terms. This can streamline the creation process for future records.

- Keep Calculations Accurate: Ensure that any formulas or automated calculations reflect updated pricing or tax rates. This reduces the risk of errors and guarantees the numbers always match the current values.

By keeping your documents customizable and up-to-date, you can maintain a more organized and professional approach to managing finances. Personalizing each document makes it easier for clients to navigate and ensures your business stays agile as needs evolve.

Saving and Exporting Your Invoices

Once your financial documents are created, it’s important to store them securely and be able to share them efficiently. The right methods for saving and exporting your records ensure that they are accessible, easy to manage, and can be shared with clients or colleagues when necessary. Choosing the appropriate file format and organization system allows you to quickly retrieve or forward your documents without hassle.

Best Formats for Saving Financial Records

When deciding how to store your documents, consider these common formats:

| Format | Advantages | Use Case |

|---|---|---|

| Universally accessible, secure, preserves formatting | Sending to clients or archiving documents for long-term storage | |

| CSV | Easy to edit, lightweight, compatible with various software | Data analysis, bulk processing of multiple entries |

| Word | Editable, easy to format for professional purposes | Sending drafts or documents that require further editing |

Steps for Exporting Your Documents

Once your documents are ready, exporting them correctly ensures they are in the right format for sharing or archiving. Follow these basic steps to export your financial records:

- Select the Export Option: Most software will offer an export or save-as option where you can choose the file format you wish to use.

- Choose Your Desired Format: Pick a format based on your purpose (PDF for sharing with clients, CSV for data analysis, etc.).

- Set File Naming Conventions: Consistently name your files with relevant details such as client name and date to make it easy to locate them later.

- Store in a Secure Location: Save the exported file in a protected folder, either on a cloud storage service or a secured local drive, for easy access and backup.

By following these best practices for saving and exporting your documents, you can ensure that your records are well-organized, easily retrievable, and ready to be shared or stored securely when needed.

Ensuring Professional Look and Feel

A well-organized and aesthetically appealing document can create a positive impression on clients, fostering trust and enhancing your business’s professionalism. From the layout and design to the choice of fonts and colors, every detail contributes to how your document is perceived. By paying attention to these elements, you can make sure that your records not only convey the necessary information but also present it in a clear, refined manner.

Key Elements for a Professional Document

Consider the following aspects to maintain a polished appearance:

- Clean Layout: A well-structured design with plenty of white space allows for easy reading and a polished look.

- Consistent Font Usage: Stick to one or two professional fonts for headings and body text, ensuring they are easy to read.

- Clear Sectioning: Use headings, bullet points, and lines to separate different sections, making it simple to navigate through the document.

- Branding Elements: If applicable, incorporate your company’s logo and color scheme to maintain consistency with your brand identity.

- Proper Alignment: Ensure all text and figures are aligned correctly, especially numbers, to enhance the visual appeal and readability.

Design Tips for Maximum Impact

In addition to the fundamental elements, design choices can further elevate the document’s look. Keep these tips in mind:

- Use of Colors: Avoid overly bright or clashing colors. Stick to neutral tones or your business’s established color palette to convey professionalism.

- Minimalism: A clean, minimalist design often appears more sophisticated. Avoid cluttering the page with unnecessary details or decorations.

- Visual Hierarchy: Ensure headings, subheadings, and key details stand out using size, boldness, or other formatting to guide the reader’s eye naturally.

- Grid-Based Structure: Organize your content using grids for consistency in alignment, which helps maintain order and clarity throughout.

By incorporating these design principles, you ensure that your documents are not only functional but also exude a level of professionalism that helps build your reputation and trust with clients.