Free Progress Invoice Template for Efficient Project Billing

In any project-based business, maintaining clear and efficient financial communication is crucial for success. A well-structured document for requesting partial payments ensures that both service providers and clients are on the same page throughout the course of a project. These documents help manage cash flow while keeping the project on track, reducing misunderstandings or delays.

Whether you are working on a large construction job or a smaller freelance task, having a standardized approach for billing at different stages of completion can save time and effort. This flexible solution allows for adjustments based on the work done, making it easier for clients to pay according to milestones rather than a lump sum at the end.

By using an organized and easy-to-understand format, both parties can ensure transparency and accountability. This method simplifies the tracking of payments, making it easier to stay on top of financial obligations and project timelines. A customizable solution offers the flexibility to adapt to various business needs and project types, ensuring maximum efficiency and accuracy in every transaction.

Progress Invoice Template Overview

Managing finances in a project-driven business can be challenging, especially when payments are due at different stages of completion. A well-organized document for requesting payments ensures both parties involved can easily track the financial progress of a job. This type of document is designed to reflect ongoing work, giving clients clear visibility of what has been completed and how much is due at each stage.

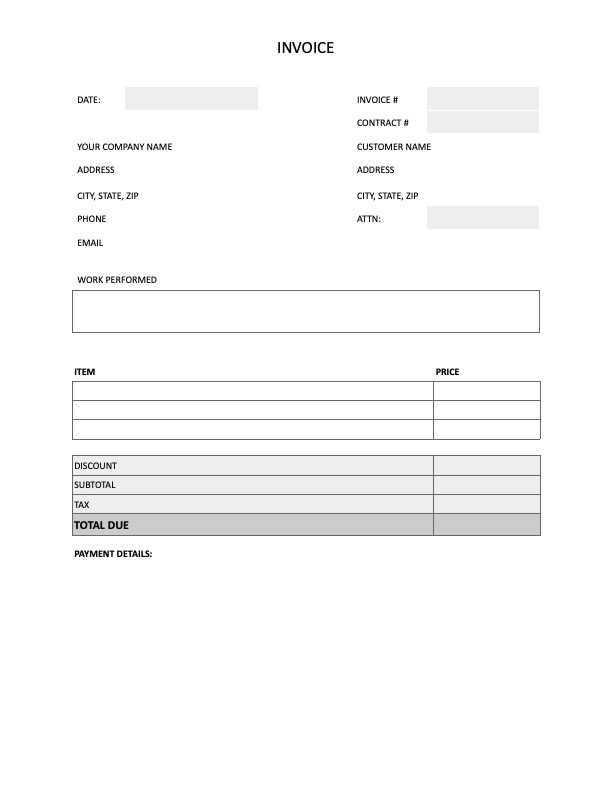

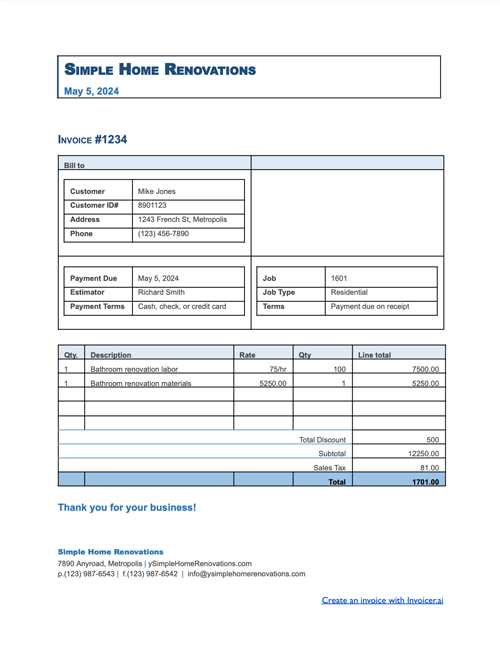

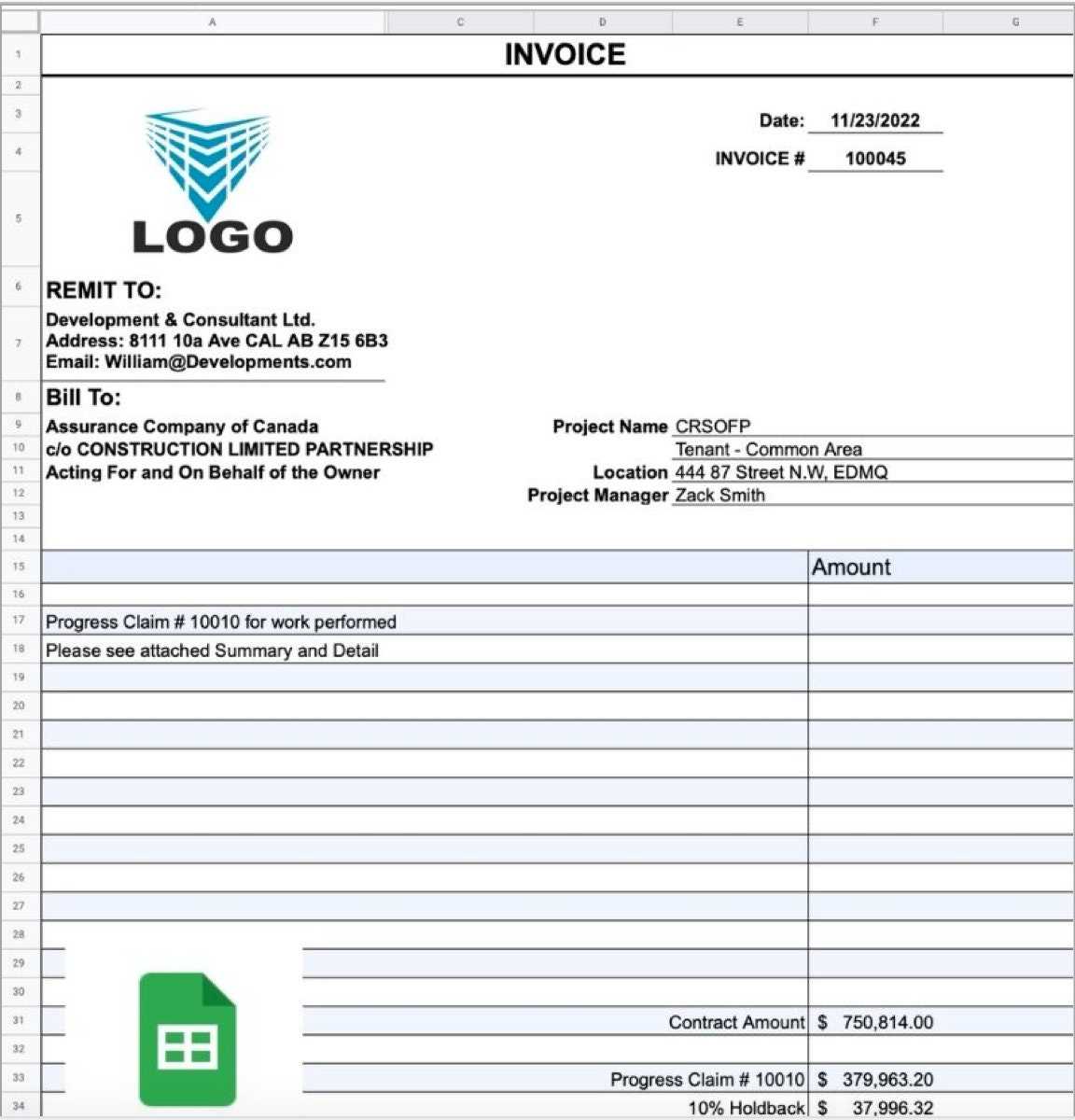

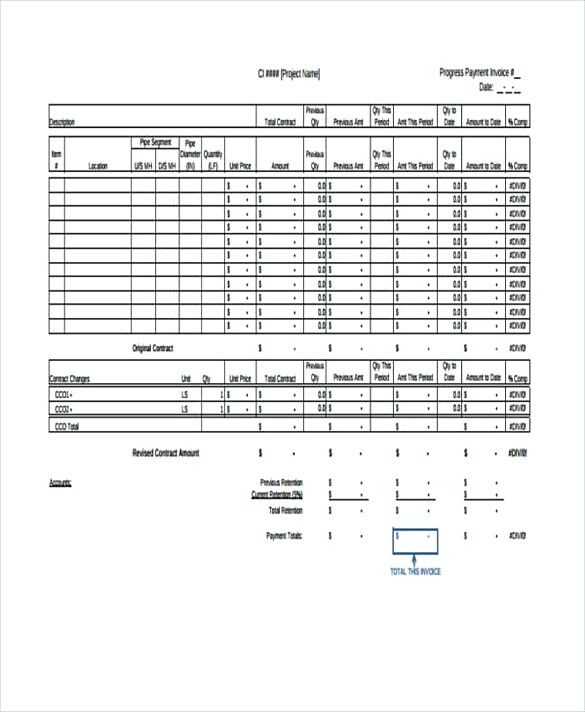

Key Features of the Document

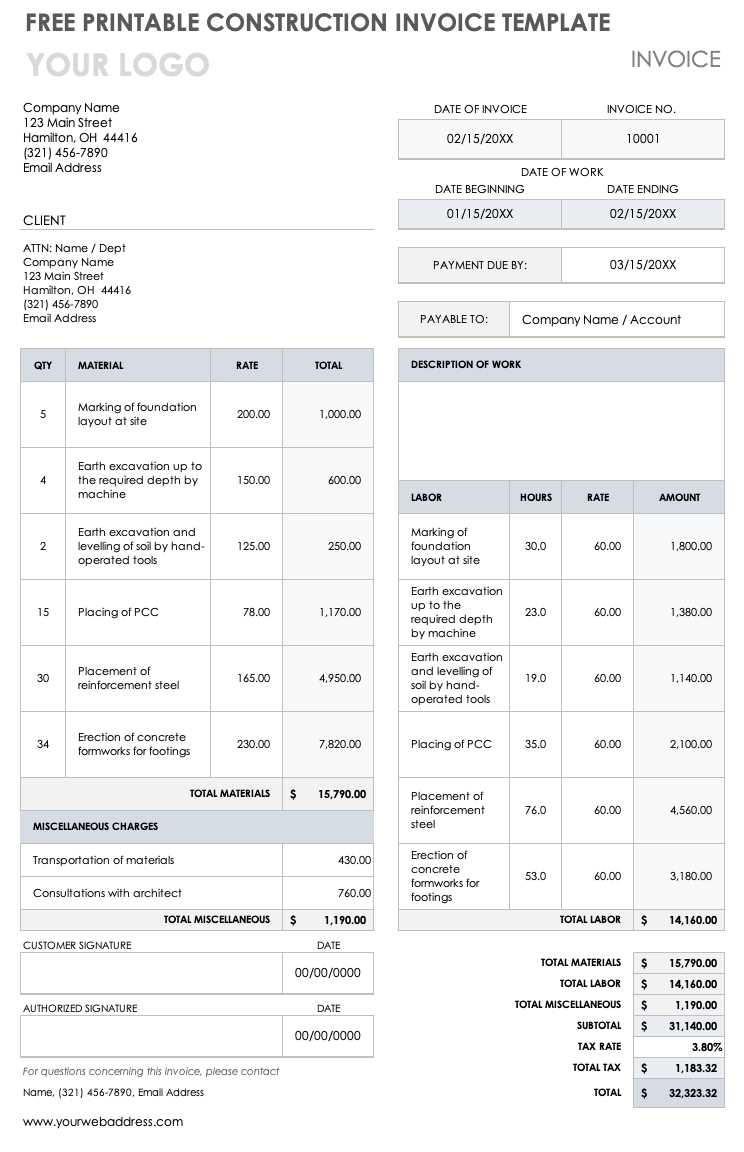

Typically, this type of document includes essential elements like a breakdown of tasks completed, total amounts due for each phase, and payment due dates. It provides transparency by linking the amounts charged to specific milestones, making it easier for clients to understand how their funds are being allocated. Additionally, such documents often allow for adjustments, such as adding taxes, labor charges, or material costs.

Benefits for Service Providers and Clients

For service providers, this solution helps to maintain steady cash flow throughout the course of a project, ensuring that payments are received as work progresses. Clients, on the other hand, benefit from a clear and predictable schedule for payments. This structured approach helps reduce disputes and enhances trust between both parties, as everyone knows exactly what to expect and when.

Why Use a Progress Invoice Template

In any project where work is completed in phases, having a clear and structured method to request payments is essential. This approach helps both the service provider and the client stay aligned throughout the project’s timeline. Instead of waiting until the end, breaking down the payment schedule into smaller, manageable segments allows for a smoother financial process, reducing the risk of delays or disputes.

One of the main advantages of using this kind of document is its ability to provide clarity. By detailing exactly what work has been completed and the corresponding amount due, it ensures transparency. This method not only keeps both parties informed but also helps service providers maintain consistent cash flow, which is critical for the ongoing success of their business.

Flexibility is another key reason for using this approach. With the ability to adjust for changes in scope or unexpected costs, these documents can be easily updated as the project evolves. This makes them an ideal choice for industries like construction, consulting, or design, where the scope of work can shift as the project progresses.

Additionally, such a system simplifies accounting and project tracking. Service providers can quickly assess how much has been paid and how much is still owed, while clients can monitor the progress of their investment. This reduces confusion and provides both parties with a clear overview of financial obligations at any given time.

Key Features of a Progress Invoice

When it comes to requesting payments during a long-term project, certain features are essential to ensure clarity and efficiency. These documents must provide detailed information that reflects the work completed, the amount due for each phase, and the overall progress of the project. Their primary function is to break down the entire cost structure into manageable sections, making it easier for both the service provider and the client to track payments as the project advances.

Detailed Breakdown of Work and Costs

One of the most important elements is the clear description of the work completed at each stage. Each section of the job is usually accompanied by a cost estimate based on the work completed up to that point. This breakdown helps clients understand exactly what they are paying for, while also giving service providers a structured way to invoice for each milestone achieved.

Flexible Payment Scheduling

Another key feature is the flexibility to set specific payment milestones. Rather than waiting for the project to be completed, clients pay as the work progresses. This feature is particularly useful for larger projects, as it ensures that service providers receive compensation for completed tasks and clients have the chance to review and approve the work before further payments are made.

These features not only promote transparency but also streamline communication between clients and service providers, minimizing the risk of disputes and ensuring smoother financial transactions throughout the course of a project.

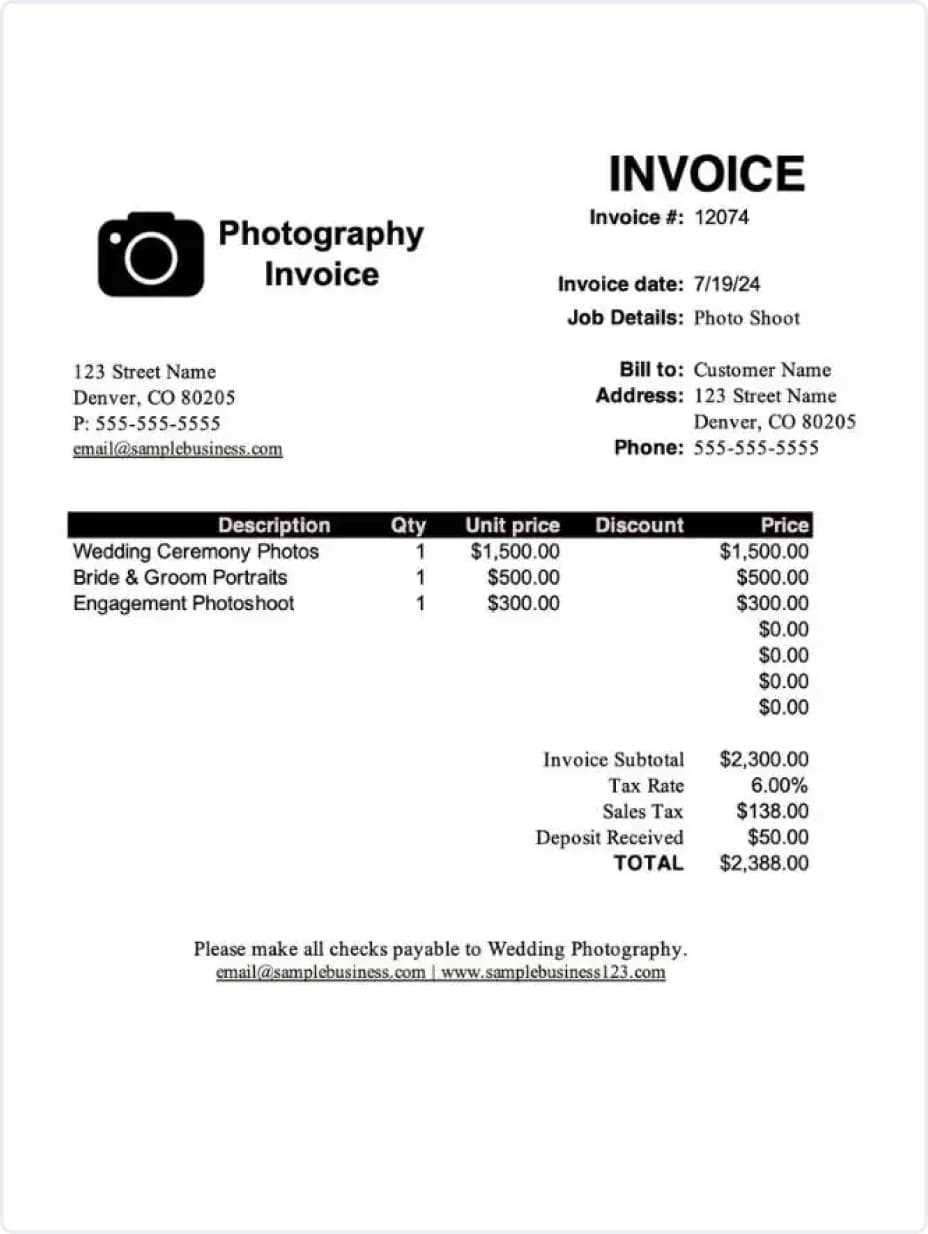

How to Create a Progress Invoice

Creating a structured document to request partial payments throughout a project is a straightforward process, but it requires careful attention to detail. This financial tool needs to clearly communicate the work completed, the amount due for each phase, and the overall status of the project. The key is ensuring that both the client and the service provider have a clear understanding of the amounts owed and the project’s progress at any given time.

The first step is to list the milestones of the project. Each milestone should represent a specific task or set of tasks that have been completed. These milestones will be tied to a corresponding payment amount. Next, you should include a detailed description of the work completed for each milestone. This provides transparency and helps clients understand exactly what they are paying for at each stage of the project.

Once the work and costs are outlined, set payment due dates for each milestone. Specify when payments should be made based on the completion of certain tasks or delivery dates. You can also include any applicable taxes, fees, or adjustments for materials, labor, or other additional expenses incurred during the project.

Finally, ensure that the document includes the necessary contact information for both the service provider and the client, along with clear payment instructions. Make sure that the document is easy to read and that the payment terms are clear to avoid confusion or delays.

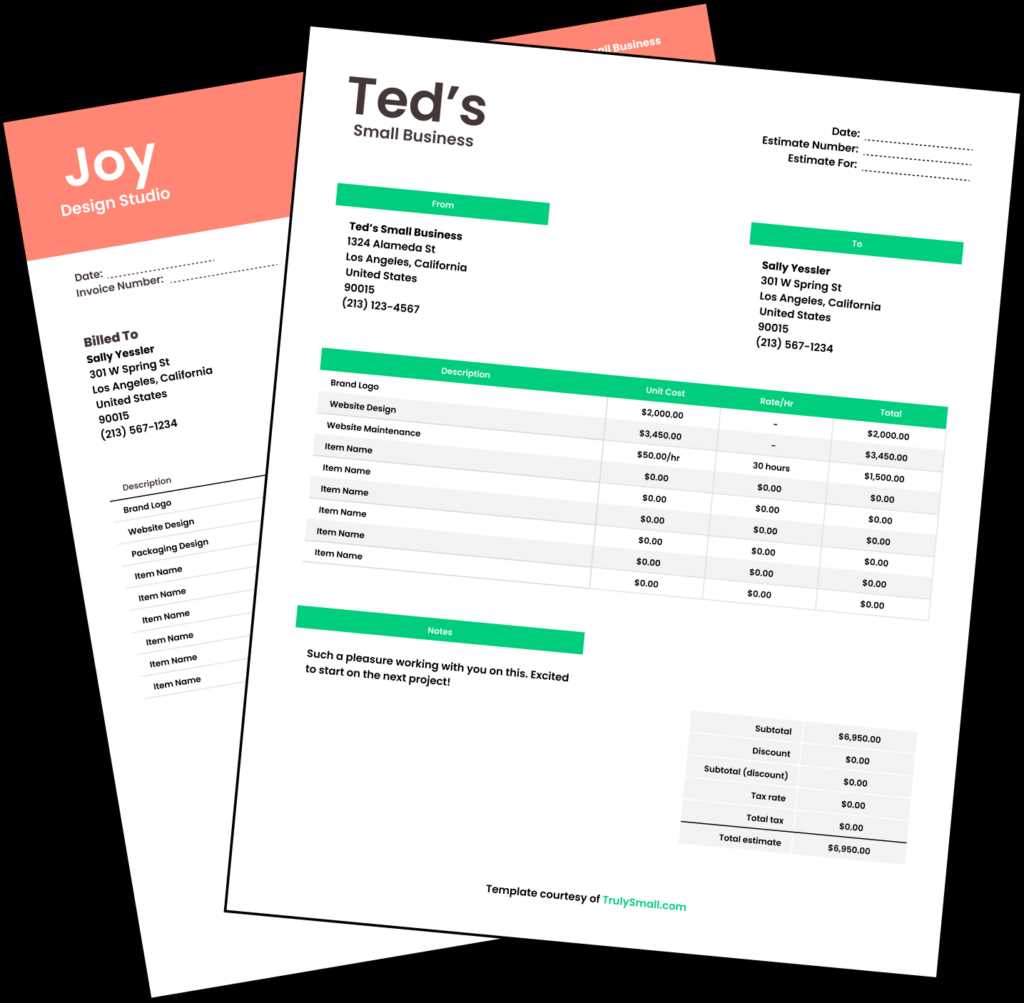

Customizing Your Progress Invoice Template

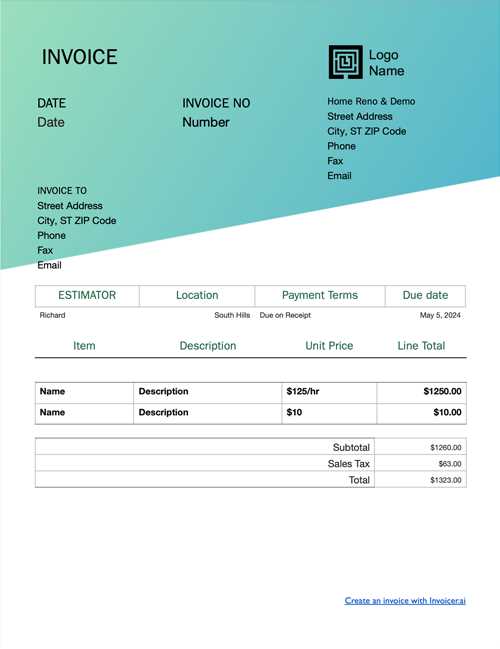

Personalizing your financial documents is essential to ensuring they reflect the specific needs of your project and business. Customizing a document for billing at various stages allows you to align it with your branding, project requirements, and client preferences. This process not only enhances professionalism but also improves clarity for both parties involved in the transaction.

Essential Elements to Customize

To create an effective document, consider the following key elements for customization:

- Company Branding: Add your company’s logo, color scheme, and contact information to make the document reflect your brand.

- Milestone Descriptions: Tailor the document to include specific tasks and deliverables relevant to your project.

- Payment Terms: Define when and how payments should be made, including any late fees or discounts for early payment.

- Client Information: Include personalized client details such as name, address, and contact information to avoid confusion.

- Tax Information: Customize sections to include applicable tax rates, discounts, or other financial adjustments as required.

Adding Flexibility and Clarity

Besides these core elements, you can make additional adjustments to increase flexibility and clarity:

- Editable Fields: Include editable sections that allow you to adjust pricing, dates, and completed tasks easily as the project evolves.

- Multiple Currency Options: For international clients, customize the document to include different currencies and exchange rates.

- Payment Methods: Specify a variety of payment methods (bank transfer, credit card, online payment systems) to give clients more flexibility.

Customizing the document ensures that it meets both your project’s and your client’s specific needs while maintaining a high level of professionalism throughout the process.

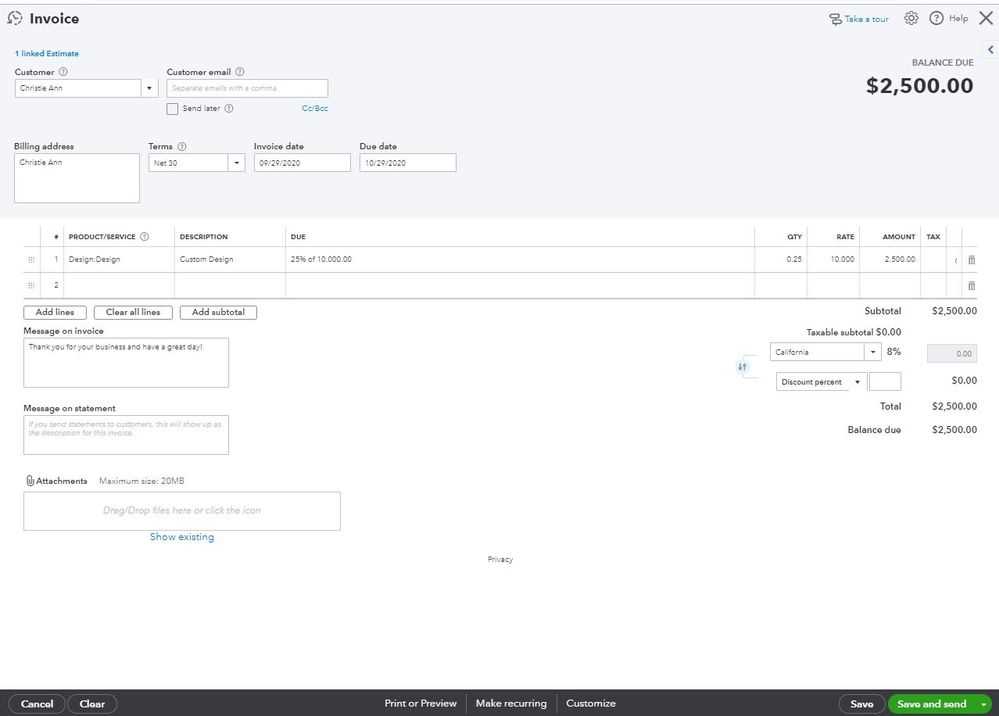

Top Tools for Creating Progress Invoices

When it comes to generating structured payment requests throughout a project, using the right tools can make the process more efficient and professional. These tools offer customizable features, templates, and automation to simplify the creation, management, and delivery of financial documents. Whether you are a freelancer or a large business, the right software can help streamline your billing system and ensure timely payments.

Here are some of the top tools available for creating effective and organized payment requests:

- FreshBooks: This user-friendly accounting software allows you to create customized payment requests for each project phase, track expenses, and manage multiple clients with ease. FreshBooks also offers invoicing automation, making it a great choice for freelancers and small businesses.

- QuickBooks: Ideal for small to medium-sized businesses, QuickBooks provides comprehensive accounting solutions, including the ability to generate detailed payment requests for ongoing projects. It integrates with other financial management tools and provides insights into cash flow and payment history.

- Zoho Invoice: Zoho offers a highly customizable platform that helps businesses create and send professional payment requests. Its features include recurring billing, automated reminders, and the ability to accept payments online.

- AND.CO: Perfect for freelancers, AND.CO makes it simple to create milestone-based payment requests, track work hours, and set up automatic reminders for clients. It also integrates with payment gateways, allowing you to collect funds directly from the document.

- Wave: Wave is a free financial management tool that includes options for customizing and sending payment requests. Its simplicity and ease of use make it a good option for smaller businesses or independent contractors.

Each of these tools provides flexible features tailored to specific business needs, ensuring that service providers can effectively track payments and maintain smooth communication with clients throughout the duration of the project.

Benefits of Using a Template

Using a pre-designed document for requesting payments during different stages of a project offers numerous advantages, especially for businesses managing multiple clients or ongoing tasks. These standardized formats save time, reduce errors, and help maintain consistency across various projects. By streamlining the process, both service providers and clients benefit from clarity and organization, ensuring smoother financial transactions throughout the project.

One of the key benefits of using such a document is time efficiency. Instead of creating a new payment request from scratch each time, you can simply fill in the necessary details for each milestone or task completed. This not only speeds up the process but also reduces the chances of overlooking important information.

Consistency is another important advantage. A standardized format ensures that all financial documents are presented in a uniform way, which enhances professionalism and makes it easier for clients to understand the payment structure. This consistency is especially helpful when managing multiple projects or clients, as it provides a clear and familiar structure for everyone involved.

Moreover, using a pre-designed document reduces the likelihood of errors and confusion. By having predefined sections for key information–such as work completed, payment due, and due dates–it minimizes the risk of missing important details. This level of organization helps to ensure that payments are tracked correctly, making it easier to manage cash flow.

Finally, a well-structured format can improve communication between clients and service providers. By clearly breaking down the work done and the payments due, both parties have a shared understanding of the project’s progress and financial status. This helps avoid misunderstandings and fosters a positive working relationship.

Common Mistakes in Progress Invoices

When creating payment requests for ongoing projects, certain mistakes can lead to confusion, delays, and even disputes between clients and service providers. Common errors in these documents often stem from a lack of clarity, insufficient details, or inconsistent formats. Identifying and avoiding these pitfalls is essential for maintaining a smooth and professional financial process.

Incomplete or Vague Descriptions

One of the most frequent mistakes is providing insufficient details about the work completed. Without clear descriptions of the tasks or milestones achieved, clients may be unsure about what they are paying for. It’s important to be as specific as possible–listing the exact work done, materials used, and hours spent–so both parties have a clear understanding of the progress made.

Failure to Include Key Information

Another common mistake is omitting essential information, such as payment due dates, agreed-upon rates, or tax calculations. Leaving out these details can lead to confusion about when payments are expected or how much is owed. Always ensure that the document includes the total amount due, the due date for payment, and any additional fees, taxes, or discounts that apply.

Not updating the document regularly is also a common oversight. As the project progresses, it’s crucial to update the payment request to reflect completed milestones, revised costs, or additional work. Failing to adjust the document as the project evolves can result in incorrect billing and delays in payment.

By avoiding these errors, service providers can ensure that their payment requests are clear, professional, and less likely to cause issues or delays with clients.

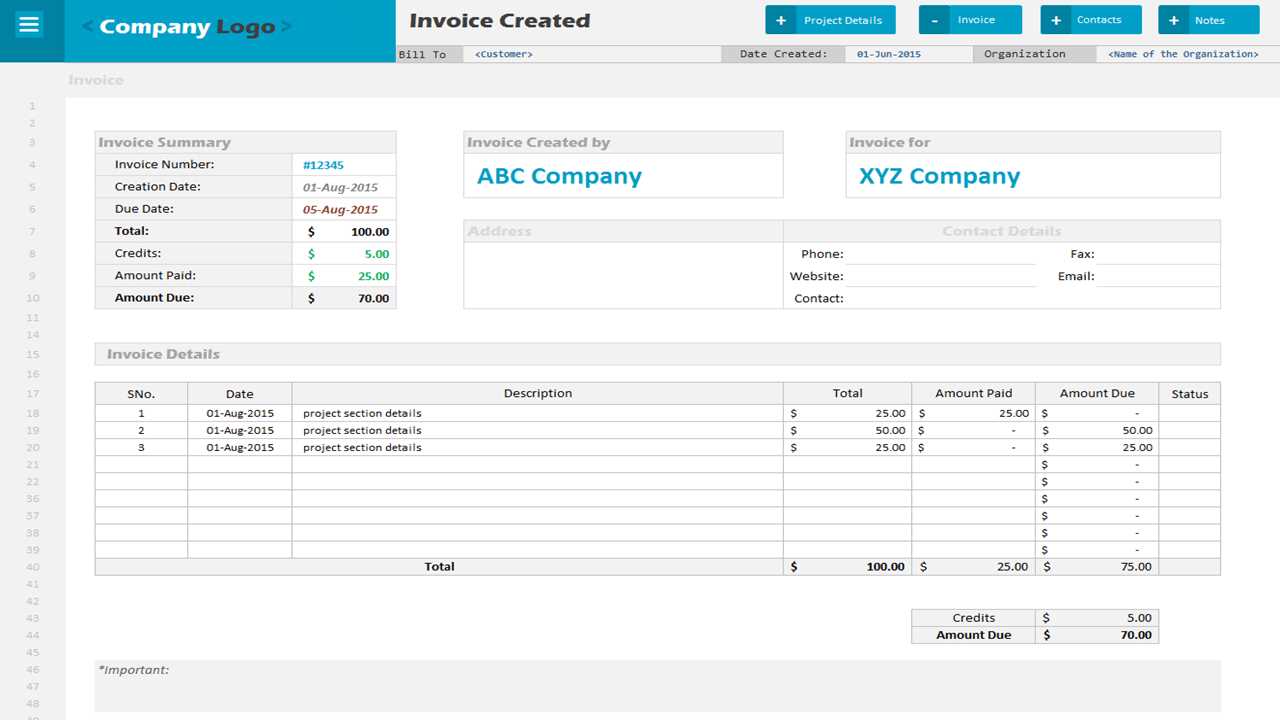

How to Track Payments with Progress Invoices

Tracking payments throughout a project is essential to maintaining cash flow and ensuring that all financial obligations are met. Using a structured system to monitor payments as work is completed allows service providers to stay on top of outstanding amounts and avoid delays. It also ensures that clients have a clear understanding of their financial commitments at each stage of the project.

The first step in tracking payments is to set clear milestones for each phase of the project. These milestones should correspond to specific tasks or deliverables that need to be completed before a payment is requested. Once each milestone is achieved, the payment request should reflect the amount due for that phase, allowing both parties to track how much has been paid and how much is still outstanding.

To simplify tracking, it’s helpful to use a digital accounting system or software that can automatically update and generate reports on payments. Many tools offer built-in features for tracking the status of each payment, marking when a payment is due, when it has been paid, and when it is overdue. This real-time tracking makes it easier to manage multiple clients or projects without losing sight of any financial details.

Another important practice is to regularly update payment records as payments are made. Keeping detailed records of each transaction–whether paid in full or partially–ensures that there is no confusion later on. It also helps identify any discrepancies or issues that may need to be addressed with clients promptly. By maintaining an organized system, service providers can ensure that all payments are received on time and that the project stays on budget.

Understanding Payment Milestones in Invoices

In project-based work, payment milestones play a crucial role in ensuring that both the service provider and the client have clear expectations about when payments are due. These milestones are tied to specific stages of the project and correspond to the completion of certain tasks or deliverables. By breaking down the total project cost into smaller, manageable payments, both parties can track progress and ensure that funds are disbursed as work is completed.

Milestones can vary depending on the nature of the project, but they generally represent key points of completion or achievement. Here’s a look at the most common types of milestones:

- Initial Deposit: Often required before any work begins, this upfront payment secures the project and demonstrates the client’s commitment.

- Phase Completion: As work progresses, payments are made based on the completion of specific phases or tasks, such as design, development, or construction stages.

- Partial Deliverables: For larger projects, payments may be tied to the delivery of partial results, such as submitting reports, providing prototypes, or completing a segment of work.

- Final Completion: The final payment is typically due upon full completion of the project, once all tasks and deliverables have been fulfilled to the client’s satisfaction.

To ensure that these milestones are clear and effective, it’s important to define each milestone carefully and set specific deliverables for each. This approach provides transparency, reduces misunderstandings, and ensures that both parties are aligned on the financial terms of the agreement throughout the project’s duration.

How to Manage Client Expectations with Progress Invoices

Managing client expectations throughout a project is key to maintaining a positive working relationship and ensuring that both parties are satisfied with the outcome. Using a structured approach to request payments at various stages of the project allows you to provide transparency, keep clients informed, and ensure that they are aligned with the project’s progress and financial commitments. By setting clear expectations from the start, you can minimize confusion and prevent disputes.

Here are several strategies to manage client expectations effectively when requesting payments during a project:

- Define Milestones Clearly: Ensure that each stage of the project is well-defined, with clear deliverables tied to specific payments. This helps clients understand exactly what they are paying for and when they can expect each milestone to be completed.

- Communicate Payment Schedules: Clearly outline when payments will be due, based on the completion of certain tasks or phases. This allows clients to plan their cash flow and ensures they are prepared to make payments as work progresses.

- Provide Regular Updates: Keep clients informed about the progress of the project, especially as payment milestones approach. Regular updates ensure that there are no surprises and that clients feel in control of the project’s trajectory.

- Be Transparent About Costs: Make sure all costs, including materials, labor, and any potential additional charges, are outlined in detail. By providing a full breakdown of costs, you reduce the risk of misunderstandings about pricing.

- Address Concerns Promptly: If clients have concerns about the progress or payment schedule, address them immediately. Open communication helps build trust and prevents dissatisfaction from escalating.

By setting realistic expectations and maintaining open communication about progress and payments, you can ensure that both you and your client are on the same page. This approach fosters a professional relationship built on trust, which ultimately leads to smoother project completion and successful outcomes for both parties.

Progress Invoices for Contractors and Freelancers

For contractors and freelancers, managing payments throughout a project can be challenging, especially when dealing with long-term or complex tasks. Requesting payments at different stages of the project helps ensure that contractors and freelancers are compensated for their work as they go, rather than waiting until the entire project is completed. This approach not only improves cash flow but also builds trust with clients by showing transparency and progress throughout the work.

Benefits for Contractors

For contractors, breaking a large project into smaller, manageable payments is an effective way to maintain financial stability. The key benefits include:

- Cash Flow Management: Receiving payments at set intervals, based on completed milestones, ensures that contractors have a stead

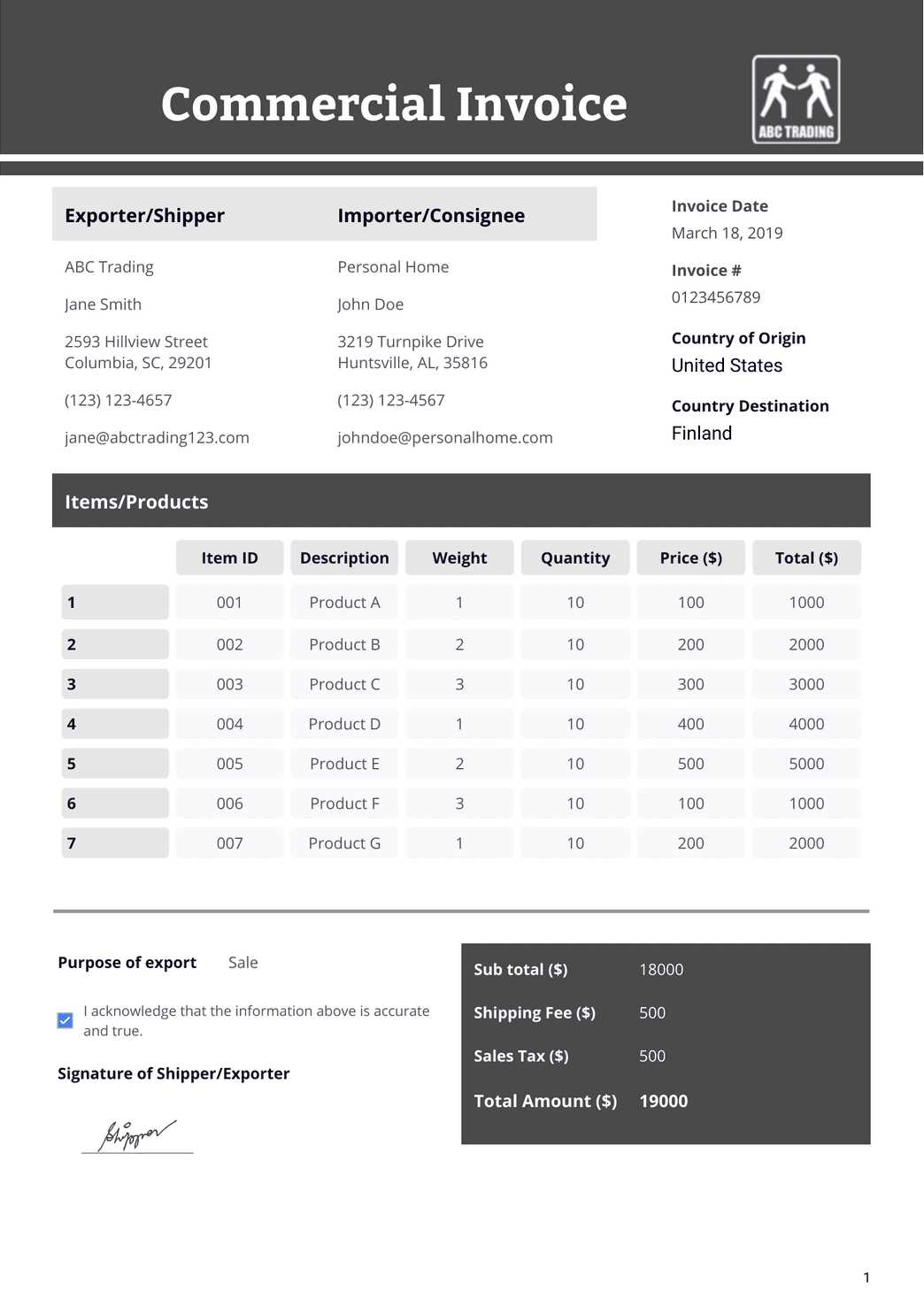

How to Include Taxes in Progress Invoices

Including taxes in your payment requests is essential to ensure that both you and your client are clear about the final amount due. Properly calculating and displaying taxes in each request not only ensures compliance with local tax laws but also provides transparency for the client. Taxes can vary depending on location, the nature of the service, and the agreed-upon terms, so it’s important to incorporate them correctly at each stage of the project.

Here are some steps to help you include taxes in your billing documents:

- Know Your Tax Rate: First, determine the applicable tax rate based on the region and industry. This could include state, federal, or local taxes, as well as any special rates for particular goods or services.

- Calculate the Tax: Apply the appropriate tax rate to the total amount due for each completed milestone. You can either calculate it based on the subtotal before tax or include it as a percentage of the total cost.

- Clearly Show the Tax Breakdown: On the billing document, clearly list the tax amount as a separate line item, so the client can easily see the tax being applied to each phase of the project. This provides transparency and helps prevent confusion.

- Consider Tax Exemptions: If your project or service is eligible for tax exemptions or special rates, make sure to clearly note these on the document. This avoids errors and ensures that both parties are aware of any adjustments.

- Include Tax Identification Numbers: Depending on the tax laws in your country, it may be necessary to include your business’s tax ID number on the document. This adds credibility and ensures the client knows that you are a registered business entity.

By carefully considering taxes in your billing structure and clearly outlining the amounts due, you not only comply with legal requirements but also maintain a transparent and professional relationship with your client. This helps ensure that the financial process runs smoothly throughout the entire project.

Legal Aspects of Progress Invoices

When requesting payments during a project, it’s important to consider the legal implications to ensure that all financial transactions are legally binding and compliant with applicable laws. By understanding the legal aspects of billing documents, both service providers and clients can protect their rights, avoid disputes, and ensure that all payments are made in accordance with the terms of their agreement.

Key Legal Considerations

Here are some of the key legal aspects to keep in mind when structuring payment requests for ongoing work:

- Contractual Agreement: A well-defined contract is essential to establish the terms of payment, including milestones, payment schedules, and rates. Both parties should agree to the terms in writing to avoid misunderstandings or legal issues down the line.

- Payment Terms and Conditions: Specify clear payment terms such as due dates, late fees, and acceptable payment methods. This ensures that both you and your client understand the obligations and any penalties for late payments.

- Tax Compliance: Ensure that your payment requests comply with local tax laws, including sales tax, VAT, or other applicable taxes. Failing to account for taxes properly could lead to legal trouble, fines, or audits.

- Documentation and Record-Keeping: Keeping detailed records of all transactions, including payments received, amounts due, and the work completed, is crucial for legal protection. Proper documentation can serve as evidence in case of disputes or if the terms of the agreement are challenged.

- Intellectual Property and Ownership: If the work involves intellectual property, such as designs, software, or creative work, be sure to clarify ownership rights in the contract. This protects both parties and ensures that there is no confusion about who owns the work at different stages of the project.

Protecting Your Rights

To safeguard your interests and avoid legal issues, consider these additional steps:

- Retain Copies: Always keep copies of payment requests, client communications, and any signed agreements. These documents can be invaluable in case of disputes or if legal action becomes necessary.

- Dispute Resolution Clauses: Including a clause in your contract that outlines how disputes will be resolved–such as through mediation or arbitration–can help avoid lengthy legal battles and ensure a fair resolution.

- Early Payment Incentives: Some contracts include incentives for clients who pay ear

Integrating Progress Invoices with Accounting Software

Integrating payment requests with accounting software can streamline your financial management and help you maintain accurate records with minimal effort. By automating the process, you reduce the likelihood of errors, improve efficiency, and ensure that all financial transactions are tracked and updated in real-time. Accounting software can help you manage everything from payment tracking to tax calculations, offering a seamless experience for both you and your clients.

Here are the key advantages of integrating payment requests with accounting software:

- Automated Tracking: Once a payment is requested or received, it is automatically logged in your accounting system, helping you stay on top of outstanding balances without manual input.

- Real-Time Updates: As payments are made or milestones are completed, your software can update the financial records instantly, ensuring that your accounts reflect the most current data.

- Tax Calculations: Accounting software can automatically calculate the taxes due based on your location and project scope, reducing the risk of mistakes in your tax filings and keeping your business compliant.

- Improved Accuracy: By integrating the payment tracking system with accounting software, you eliminate the potential for human error that can occur when manually entering payment data. This ensures your records are always accurate and up-to-date.

- Financial Reporting: Accounting software allows you to generate financial reports with ease, giving you insight into your cash flow, outstanding payments, and overall project profitability.

To integrate payment requests with accounting software, follow these steps:

- Choose the Right Software: Select accounting software that is compatible with your business needs and integrates well with your payment systems. Popular choices include QuickBooks, FreshBooks, and Xero.

- Link Your Payment System: Many accounting platforms allow you to link to payment processors or online banking accounts, enabling automatic updates when payments are made or received.

- Set Up Milestones and Payment Triggers: Configure your accounting software to recognize when specific project milestones are met, triggering automatic payment requests and updates in the system.

- Monitor Your Finances: Regularly check your software to ensure all transactions are logged correctly and that your financial data is accurate. Adjust any settings as needed to reflect changes in the project scope or payment schedule.

Integrating your payment requests with accounting software is an effective way to streamline your financial operations, reduce manual tasks, and ensure that your records are always up-to-date. It helps you stay organized, save time, and focus on delivering excellent service to your clients while keeping track of your financial health.

When to Send a Progress Invoice to Clients

Knowing the right time to send payment requests during a project is crucial for both maintaining cash flow and ensuring client satisfaction. Sending requests at the right intervals based on completed milestones or stages ensures that you are compensated fairly and on time while keeping the client informed about the ongoing work. A well-timed payment request can also help avoid delays and promote a smooth, professional relationship between you and the client.

Typically, payment requests are issued based on a predefined schedule or project milestones. Below is a general guideline for when you might consider sending a payment request to your clients:

Project Stage When to Send a Payment Request Considerations Initial Work Phase Upon completion of preliminary work or project setup Often includes planning, research, or design. The first payment helps cover initial expenses. Midway Through the Project After reaching a significant milestone or halfway point Common for larger projects, this ensures cash flow and confirms that work is progressing as expected. End of Major Milestone After completing a key deliverable or phase This allows for compensation for work completed and sets the stage for the final stages. Project Completion Upon final delivery or at the end of the project Final payment is typically made once all work is completed, and all deliverables have been accepted. By following a well-defined schedule and sending payment requests when key stages of the project are completed, you help both yourself and your client stay organized. It ensures that payments are made in a timely manner and provides a clear record of completed work, making the entire process more transparent and professional.