Proforma Invoice Templates for Streamlined Business Transactions

In the world of business, clear communication and accurate documentation are key to ensuring smooth transactions between companies and their clients. When preparing for an upcoming sale or purchase, having the right paperwork in place can prevent confusion and help both parties stay on the same page. This is where specific business documents play an important role in outlining terms, prices, and other crucial details before the final agreement is made.

These documents act as preliminary agreements that provide a detailed breakdown of goods or services, quantities, pricing, and expected delivery or completion dates. They allow businesses to confirm details with clients before processing official orders, ensuring there are no misunderstandings. Using well-structured forms can save time and improve the efficiency of transactions, especially when dealing with international deals or large-scale operations.

In this guide, we will explore how businesses can benefit from using these preliminary documents, the essential components they should include, and tips for creating professional-looking versions that suit various needs. Whether you are a small business owner or managing large corporate transactions, understanding how to use these documents effectively can greatly enhance your operational flow.

Proforma Invoice Templates Overview

In business transactions, certain preliminary documents are used to outline key details of a deal before formal agreements are signed. These documents serve as a provisional agreement between buyer and seller, providing a clear overview of the goods or services involved, their respective costs, and other important terms. They are especially useful in situations where a formal contract is not yet finalized, but both parties need to ensure clarity and agreement on the transaction details.

Such documents typically contain a range of standard information to avoid confusion, including item descriptions, quantities, prices, and delivery terms. By using predefined structures, businesses can save time and reduce errors in their dealings with clients and suppliers. Additionally, having a clear format helps establish professionalism and trust between the parties involved.

| Field | Description |

|---|---|

| Document Title | Clearly states the purpose of the document (e.g., “Sales Order Summary”) |

| Item Description | Details of the goods or services being offered |

| Quantity | The amount of each item or service being transacted |

| Unit Price | Cost per item or service before any additional fees |

| Total Amount | The full price calculated based on quantity and unit price |

| Terms of Payment | Conditions under which payment will be made (e.g., advance, upon delivery) |

| Delivery Details | Information on when and how the goods will be delivered or services completed |

These forms not only help prevent potential disputes but also serve as a basis for official transactions later on. Using consistent formats and clear details is crucial for ensuring smooth operations and fostering trust with clients or partners. With a variety of options available, businesses can choose the right style to fit their needs and streaml

What is a Proforma Invoice

In the business world, certain documents are used to provide a preliminary record of the details of a potential transaction before any official commitments are made. These documents act as estimates or preliminary agreements between buyers and sellers, outlining the key aspects of the deal such as products, quantities, prices, and delivery terms. They serve as a way to confirm the terms of a transaction before proceeding with a formal agreement or payment.

Purpose and Use

These documents are commonly used when a buyer wants to understand the total cost and details of a purchase before finalizing the order. For example, an international transaction may require this type of paperwork to clarify shipping details, customs duties, and other logistical factors. The document provides all the information the buyer needs to make an informed decision, but does not yet represent a binding contract.

Key Characteristics

Unlike formal contracts, these preliminary records do not require immediate payment. They are often used to establish the groundwork for further negotiations or for securing financing, especially when dealing with larger or complex purchases. Typically, they include information such as a description of the products, the expected delivery time, payment terms, and any additional charges that may apply. This helps both parties agree on the basics before moving forward.

In essence, this type of document serves as a form of communication to ensure both sides are clear on the expectations and terms of the transaction, but it does not finalize the deal.

Key Benefits of Using Proforma Invoices

Using preliminary business documents before finalizing transactions offers numerous advantages for both buyers and sellers. These records help clarify essential details of a deal, improve communication, and set clear expectations. Their main function is to offer a snapshot of the terms of a potential transaction, providing an outline of the deal before it becomes official. Below are some of the most notable benefits of using these documents in business transactions.

Improved Communication and Clarity

One of the primary benefits of using such documents is the enhanced communication they provide between all parties involved. By clearly listing the terms of a transaction, both the buyer and the seller can review and agree on the details before any official paperwork is processed. This leads to a greater understanding and less room for miscommunication. Key advantages include:

- Clear pricing and payment terms

- Accurate description of goods or services

- Defined delivery schedules and responsibilities

Risk Reduction and Dispute Prevention

These documents can also help mitigate the risk of misunderstandings or disputes down the line. By agreeing on the details upfront, both parties are more likely to avoid disagreements related to the transaction. Benefits include:

- Reduction of errors in final transactions

- Establishing mutual expectations for both parties

- Providing a foundation for future negotiations if needed

Overall, these documents play a crucial role in streamlining the business process, providing a clear record of what has been agreed upon, and offering protection against potential conflicts. Their use helps ensure that both parties are on the same page before committing to the full deal.

How to Create a Proforma Invoice

Creating a preliminary document for a business transaction requires attention to detail and a clear structure. This document outlines the terms of the deal, including product descriptions, prices, and delivery conditions, but is not yet legally binding. The process of preparing this document involves several key steps that ensure accuracy and professionalism, helping both the seller and the buyer align on expectations before proceeding further.

Follow these basic steps to create an effective record for your transaction:

| Step | Description |

|---|---|

| Step 1: Choose a Format | Select a clear layout, either using software or a pre-made document, that suits your business needs. |

| Step 2: Add Contact Information | Include the names, addresses, and contact details of both the buyer and seller. |

| Step 3: Describe the Goods or Services | Provide detailed descriptions, including quantity, unit cost, and total amount for each item. |

| Step 4: Include Payment Terms | Specify the payment methods, deadlines, and any advance payment details if applicable. |

| Step 5: Specify Delivery Terms | Clarify shipping or service completion details, including expected delivery date or timeline. |

| Step 6: Review and Send | Double-check the information for accuracy, and then send the document to the buyer for confirmation. |

By following these steps, you can create a comprehensive document that outlines all relevant transaction details. This helps establish clear expectations and can prevent potential misunderstandings as the deal progresses.

Common Mistakes in Proforma Invoices

While preparing preliminary transaction documents, errors can easily occur, leading to confusion or delays in the process. These mistakes can affect both the buyer and seller, potentially leading to misunderstandings, payment issues, or logistical challenges. It’s important to be aware of these common pitfalls so they can be avoided and the process can run smoothly.

1. Missing Key Information

One of the most common mistakes is failing to include essential details, such as a clear description of the products or services, quantities, or payment terms. Missing this information can create uncertainty and cause delays in finalizing the transaction. Important elements to include are:

- Full descriptions of items or services

- Accurate pricing and total amounts

- Defined delivery schedules and locations

- Payment terms and conditions

2. Incorrect Pricing or Quantity

Errors in the prices or quantities listed can lead to disagreements or financial discrepancies later on. Double-checking unit costs, total amounts, and quantities is essential. A simple typo or miscalculation can undermine trust and delay the process. To avoid this:

- Verify all calculations before finalizing

- Ensure the correct currency is used, especially in international transactions

- Clearly distinguish between different units (e.g., per item, per set)

By paying attention to these details, businesses can ensure that both parties are clear on the terms and avoid preventable issues that may arise during the transaction.

Proforma Invoices vs Commercial Invoices

When managing business transactions, two common types of documents are often used to outline the details of an agreement: preliminary transaction records and official transaction documents. Though both serve to provide clarity about the terms of a deal, they differ in their purpose and the legal implications attached to them. Understanding the distinctions between these two types of records can help businesses select the right one based on their specific needs.

Preliminary Documents vs Finalized Records

The main difference between these two types of documents lies in their function and timing in the transaction process. Preliminary records are issued before a formal commitment is made, often to provide an estimate or an initial breakdown of costs and terms. In contrast, finalized records are typically created once the transaction has been agreed upon and are used to confirm the sale or purchase.

- Preliminary Record: Used before a final agreement; acts as a confirmation of terms.

- Finalized Record: Serves as a legally binding document confirming the completed transaction.

Key Differences in Usage

Here are some additional differences in how these documents are typically used:

- Purpose: Preliminary records are used for clarifying terms and securing approval, while finalized records are used for processing payments and confirming the completion of a deal.

- Legal Standing: Preliminary documents do not constitute a legal contract, whereas finalized records are legally binding and enforceable in case of disputes.

- Payment Terms: In most cases, payment terms are not yet required with preliminary records, while finalized documents set clear payment deadlines.

- Currency and Taxes: Finalized records will typically include applicable taxes and final amounts due, whereas preliminary records may only provide an estimate of these costs.

Understanding when to use each type of document is crucial for avoiding misunderstandings and ensuring that all parties involved are clear on the terms of the transaction.

Essential Information in Proforma Invoices

When preparing preliminary documents for a business transaction, it’s crucial to include all the necessary information to ensure clarity and avoid potential misunderstandings. These records provide a detailed overview of the terms and conditions of a deal, and the more comprehensive and accurate the details, the smoother the process will be for both parties involved. Below are the key elements that should be included in every preliminary document to ensure it serves its purpose effectively.

- Document Title: Clearly label the document to indicate its purpose, such as “Sales Estimate” or “Order Summary.”

- Buyer and Seller Information: Include the full contact details of both parties, including names, addresses, and phone numbers.

- Product or Service Descriptions: Provide detailed descriptions of the goods or services being offered, including model numbers, sizes, or other distinguishing features.

- Quantities and Prices: Clearly state the quantity of each item and its corresponding price, as well as the total amount for each line item and the overall total.

- Terms of Payment: Specify how and when the payment should be made, whether it is upon receipt, in installments, or on credit terms.

- Delivery Terms: Define the delivery method, expected shipping date, and any other relevant delivery details, such as shipping costs or insurance.

- Validity Period: Indicate the time frame in which the details provided in the document are valid, particularly when prices may change over time.

- Taxes and Additional Charges: Include any applicable taxes, shipping costs, or other fees that may apply to the transaction.

Including these essential details in your preliminary document helps prevent confusion, sets clear expectations, and facilitates smoother negotiations between parties. Whether you’re making a domestic sale or engaging in international trade, having these key points clearly outlined is fundamental to ensuring a successful transaction.

How to Customize Your Proforma Invoice Template

Customizing a preliminary business document to match your company’s branding and specific needs is essential for professionalism and clarity. By tailoring the structure and content of this record, you can ensure it reflects your business’s identity while meeting legal and operational requirements. The process involves adjusting several sections to align with your product offerings, client expectations, and the terms of the transaction.

Follow these steps to personalize your business document:

- Choose a Suitable Layout: Select a layout that suits your business style. Whether you prefer a simple format or a more complex design, the key is to maintain clarity and organization.

- Include Your Branding: Add your company logo, contact details, and website. This enhances brand visibility and makes the document look more professional.

- Update Business Information: Ensure that all your business details, such as address, tax identification number, and bank account information, are current and correct.

- Personalize Product or Service Descriptions: Tailor the descriptions of the goods or services to accurately reflect what you are offering. Include specific terms like model numbers or service features if necessary.

- Set Clear Payment Terms: Define how the payment should be made, such as by bank transfer, credit card, or other methods. If you offer discounts or installment options, include them here.

- Adjust Delivery Information: Customize the delivery terms to reflect your shipping methods, time frames, and any additional charges, such as handling fees.

- Include Legal or Custom Notes: If there are any specific conditions, warranties, or disclaimers, make sure they are clearly mentioned in the document.

By making these adjustments, you can create a custom document that not only serves its intended purpose but also reinforces your brand identity. A well-designed and personalized document enhances professionalis

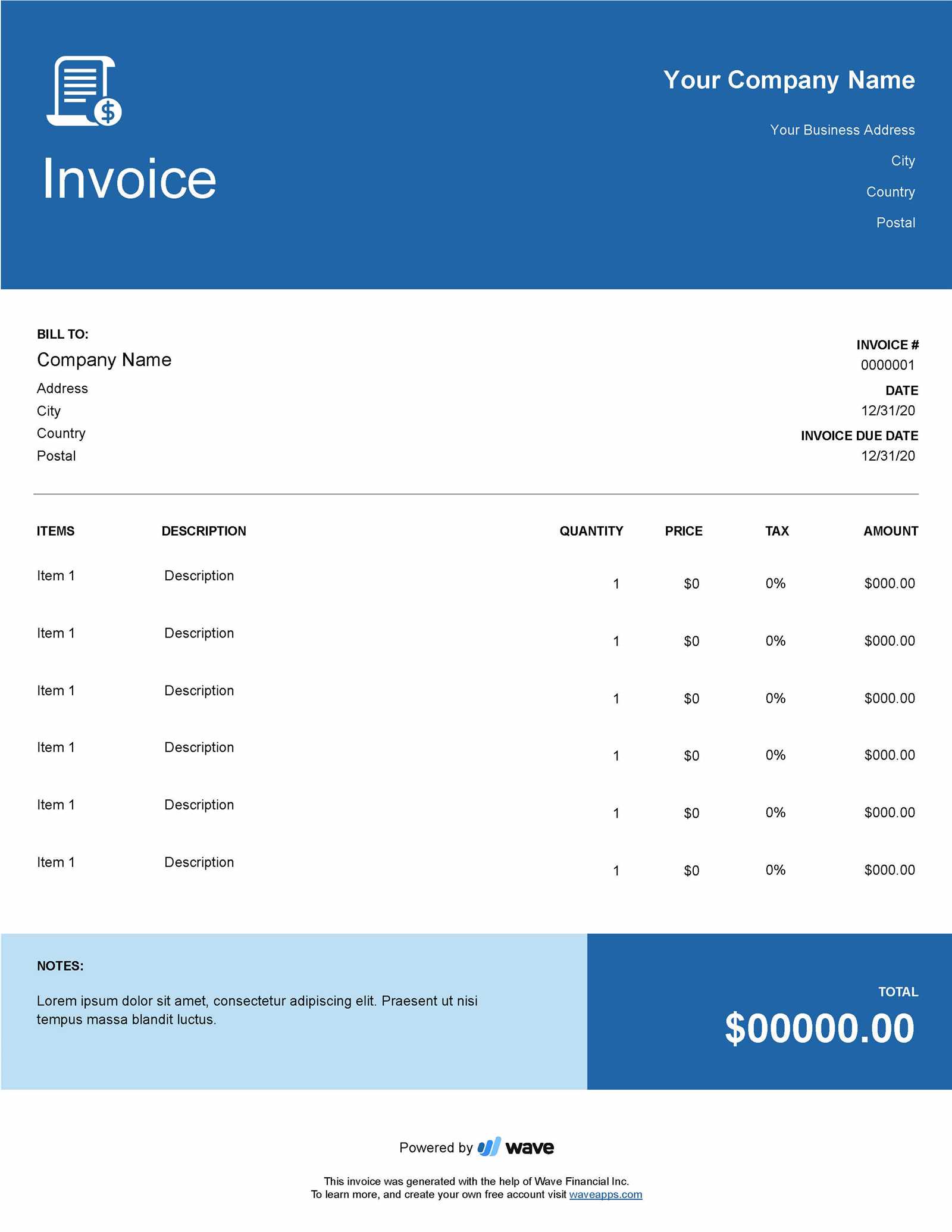

Best Software for Creating Proforma Invoices

When creating preliminary business documents, using the right software can significantly streamline the process, ensuring accuracy and efficiency. A variety of tools are available to help businesses generate professional, customizable records, making it easier to outline transaction details and share them with clients. These software options range from simple invoice generators to more comprehensive accounting platforms that can handle multiple aspects of business transactions.

Here are some of the best software solutions for creating detailed transaction records:

- QuickBooks: A widely used accounting software that allows users to generate professional estimates and billing records. It offers a variety of customizable templates and integrates seamlessly with other financial tools.

- Zoho Books: This platform provides simple yet powerful features for creating and managing business documents, including customizable templates. It’s ideal for small to medium-sized businesses that need an intuitive interface.

- FreshBooks: Known for its user-friendly design, FreshBooks makes it easy to create customized transaction records, track payments, and manage client details. It’s particularly popular with freelancers and small business owners.

- Wave: A free, cloud-based accounting tool that includes templates for generating transaction documents. It offers a straightforward design and integrates with banking systems for easy payment tracking.

- Invoicely: This tool allows users to create and manage estimates, billing records, and other business documentation. It’s great for businesses of all sizes, offering both free and premium plans.

- Microsoft Excel or Google Sheets: For businesses looking for a more manual approach, spreadsheet software can be customized to create simple and effective transaction records. Templates are widely available online, and these tools provide full control over design and layout.

Choosing the right software depends on the complexity of your business needs and your preference for automation. Whether you are looking for a simple, budget-friendly solution or a comprehensive accounting system, these tools provide flexibility and convenience for managing preliminary business transactions.

Why Businesses Use Proforma Invoices

Businesses use preliminary transaction records for a variety of reasons, ranging from clarifying terms to facilitating smoother negotiations. These documents serve as an early, informal step in the business process, helping both parties understand the costs, delivery terms, and other essential details before committing to a formal agreement. By providing a clear outline of what to expect, these records can help prevent misunderstandings and ensure that the final deal proceeds without complications.

1. Clarifying Terms Before Final Agreement

One of the key reasons businesses use such records is to establish clear terms before committing to a formal contract. This document acts as a summary of the potential deal, listing the goods or services, quantities, prices, and any other relevant terms. It gives both the buyer and the seller a chance to review and agree on the details, making adjustments if necessary before moving forward with a formal agreement.

- Helps avoid confusion or disagreements down the line

- Outlines pricing, delivery schedules, and payment terms

- Ensures both parties are aligned before finalizing the deal

2. Supporting Financing and Transactions

Another reason businesses issue these documents is to support financing efforts or facilitate smooth transactions, particularly in international trade. Banks, lenders, or investors may request such documents to confirm the validity of the deal before providing loans or funds. These records offer proof of potential income and a breakdown of the deal’s financial aspects, helping businesses secure necessary resources to move forward.

- Assists with securing financing or loans

- Provides clarity for customs, tax purposes, or banking needs

- Helps ensure smooth processing of international transactions

By using these preliminary records, businesses can mitigate risks, set expectations, and ensure smoother negotiations. Whether for local or international transactions, these documents help businesses manage the details of agreements before committing to full-scale contracts.

Legal Considerations for Proforma Invoices

When creating preliminary business documents, it’s important to understand their legal standing and implications. These documents, though not legally binding contracts, still play a crucial role in the transaction process. They outline the terms and expectations between the buyer and seller, providing a foundation for future agreements. However, certain legal considerations must be kept in mind to ensure compliance with regulations and to avoid potential disputes.

One key legal aspect is that these records do not serve as official contracts. While they provide a detailed overview of the terms of a potential deal, they do not hold the same legal weight as finalized agreements. Therefore, it’s essential to ensure that any conditions or statements in these records are clear and accurate to avoid confusion once a formal contract is signed.

1. Clarification of Terms

It is crucial to clearly define the terms in these documents, as any ambiguity may lead to misinterpretation or legal challenges later. Key points such as the price, delivery terms, payment schedules, and return policies should be clearly stated to prevent future disputes. Since these records are often used in international trade, they must also comply with local and international laws, including customs regulations and taxation rules.

- Clearly outline payment terms, including due dates and methods of payment

- Provide an accurate description of the goods or services being offered

- Ensure compliance with local tax and customs laws in case of international transactions

2. No Legal Commitment

Although these records set the groundwork for the transaction, they are not legally binding agreements. They should include a disclaimer stating that the document is an estimate or a proposal, and that the final terms will be established upon formal agreement. This helps prevent any confusion about the nature of the document and protects both parties in case the deal is not finalized.

- Include a clear disclaimer that the document is not a legally binding agreement

- Ensure that both parties understand that the final contract will outline the official terms

- Consult legal professionals if necessary to ensure compliance with relevant laws

By understanding these legal considerations, businesses can use these docu

Integrating Proforma Invoices with Accounting Systems

Integrating preliminary transaction records with accounting systems can significantly streamline business processes. By connecting these early-stage documents directly to your financial software, you can ensure a seamless flow of information between departments, reduce manual entry errors, and improve the overall efficiency of your accounting practices. This integration allows businesses to track potential income, manage taxes, and generate accurate financial reports without duplicating efforts.

Benefits of Integration

Integrating preliminary business documents with accounting systems brings several key advantages:

- Automation of Data Entry: Integration eliminates the need for manually transferring details from the preliminary records into the accounting system, saving time and reducing the risk of errors.

- Accurate Financial Tracking: Linking these documents directly to your accounting software ensures that the potential income, taxes, and other financial data are automatically updated in real-time, giving you a more accurate overview of your business’s financial health.

- Improved Reporting: By consolidating data from all preliminary documents into your accounting system, it becomes easier to generate reports on sales, expenses, and other financial metrics, which can be used for analysis and decision-making.

- Streamlined Workflow: A smooth connection between preliminary records and accounting systems ensures that all relevant details are captured in the correct context, allowing for faster approvals and reducing delays in finalizing transactions.

How to Integrate with Your Accounting System

Here’s how you can integrate these preliminary documents with your accounting software:

- Choose Compatible Software: Ensure that the accounting system you are using supports integrations with the document management tools or platforms that generate your preliminary transaction records.

- Set Up Automated Data Syncing: Enable automatic syncing between your document system and accounting platform, so that information is transferred seamlessly without needing manual input.

- Customize Fields and Templates: Tailor the fields in your preliminary documents to align with the accounting system’s requirements, such as tax rates, item

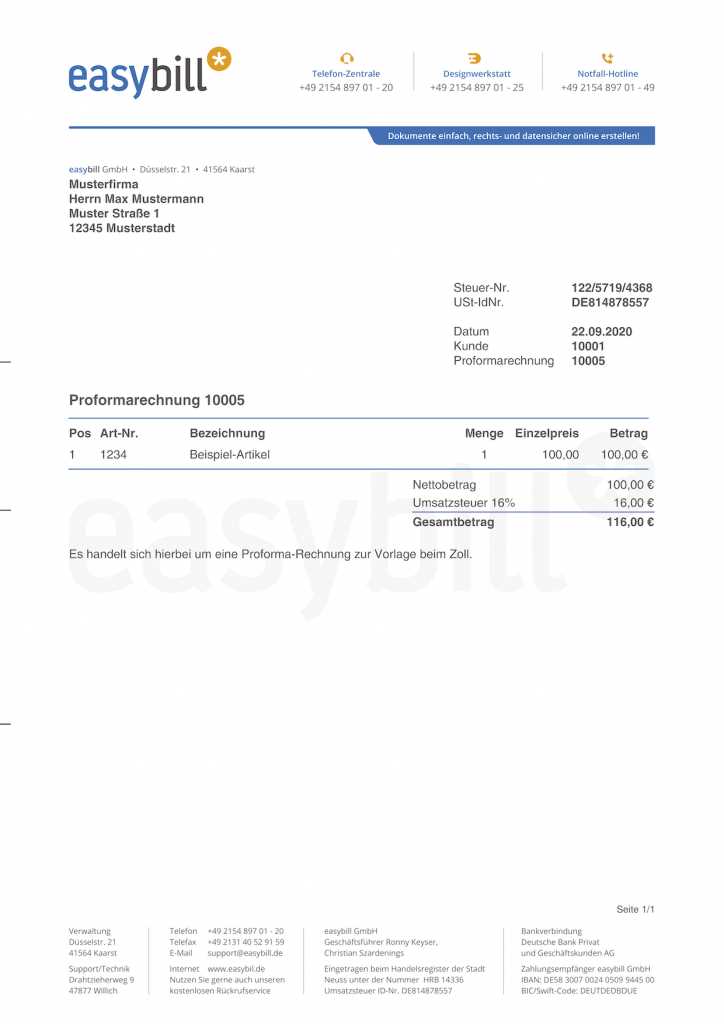

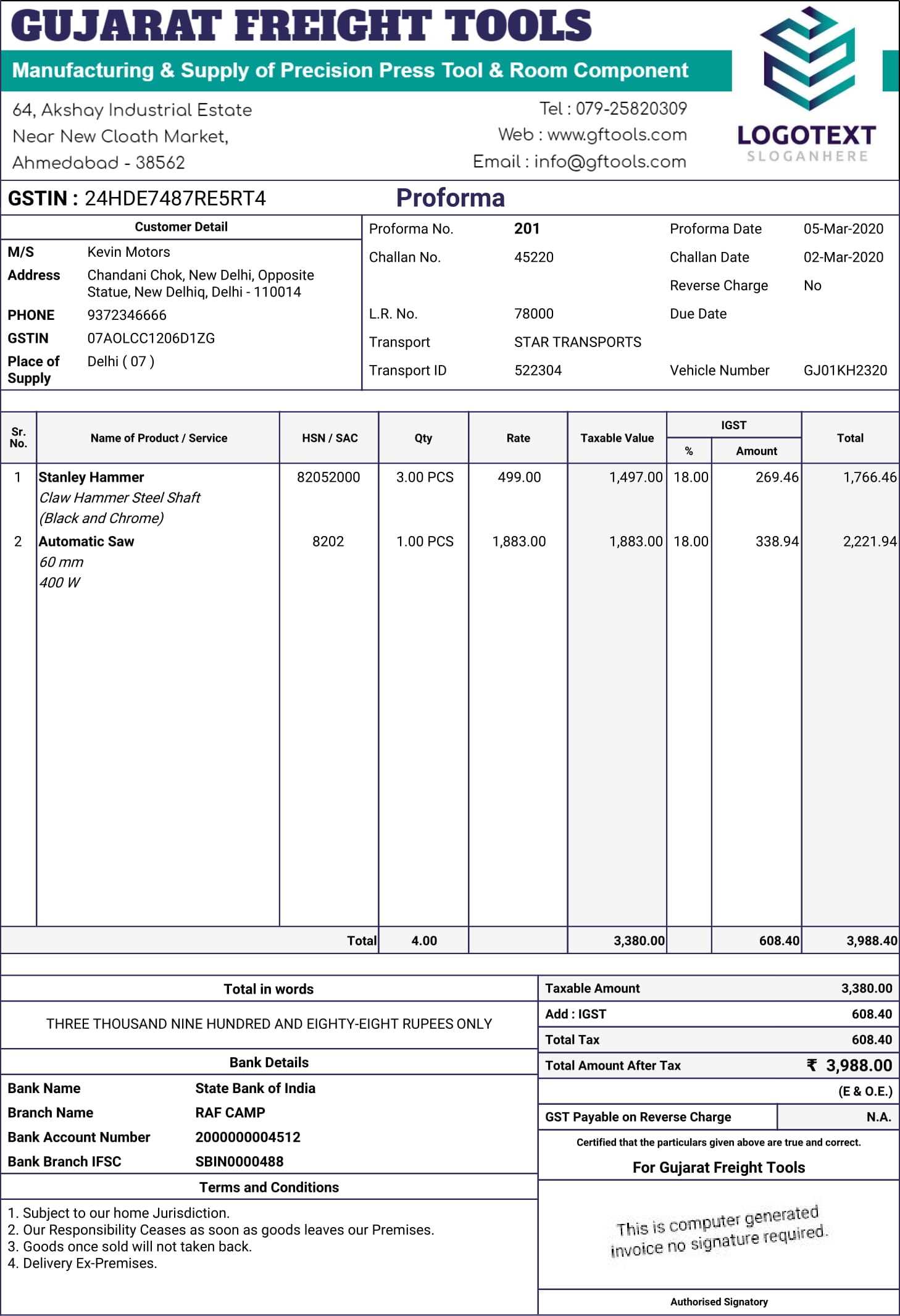

Proforma Invoices for International Trade

In international trade, detailed preliminary business documents play a crucial role in ensuring smooth transactions between buyers and sellers from different countries. These records help clarify the terms of a deal, outline expected costs, and serve as an initial step before formal agreements are finalized. For cross-border transactions, these documents are essential for customs clearance, tax calculations, and securing financing or letters of credit from financial institutions.

Here’s how these documents are used in international trade:

- Customs and Import Procedures: Customs authorities often require these documents to assess the value of goods, calculate duties, and process shipments. The document provides an estimated value of the goods being traded, helping speed up customs clearance.

- Tax Compliance: These records help ensure that all applicable taxes, including VAT, customs duties, and import/export taxes, are clearly outlined, preventing delays or penalties from tax authorities.

- Financing and Letters of Credit: Financial institutions may request a preliminary document to verify the transaction details before issuing a letter of credit or providing funding to support the trade.

- Clear Communication: These documents help ensure both parties understand the terms of the transaction, including pricing, payment methods, delivery times, and other essential conditions, reducing the risk of misunderstandings.

Below is an example of how key information might be presented in a preliminary document for international trade:

Details Information Buyer Information Company Name, Address, Contact Details Seller Information Company Name, Address, Contact Details Product Description Item Names, Models, Quantities Estimated Cost Unit Price, Total Price, Currency Delivery Terms Shipping Method, Delivery Time, Insurance Payment Terms Method of Payment, Payment Due Date How Proforma Invoices Improve Cash Flow

Preliminary transaction records can have a significant impact on a business’s cash flow by providing clarity on expected payments, improving payment collection processes, and minimizing financial uncertainties. By giving both parties a detailed breakdown of terms, costs, and expected timelines, these documents create a structured framework that facilitates smoother financial planning. As a result, businesses can better manage their cash flow, avoid payment delays, and secure funds for ongoing operations.

1. Clear Payment Terms

One of the most significant ways these documents help businesses improve cash flow is by clearly defining payment expectations upfront. With detailed terms regarding payment deadlines, amounts, and methods, both parties understand when and how funds are expected to be transferred. This reduces the chance of delays and miscommunication, ensuring timely payments.

- Outlines payment deadlines: Clear due dates ensure that customers are aware of when payments are expected, leading to fewer overdue accounts.

- Specifies payment methods: Identifying the accepted payment methods in advance makes it easier for customers to comply, reducing the risk of payment issues.

- Prevents misunderstandings: A detailed payment structure eliminates confusion, providing a mutual understanding of financial terms between buyer and seller.

2. Accelerating the Order Process

By providing customers with a detailed outline of expected costs and services, these documents help speed up the approval and order process. This often leads to quicker payments and faster transaction finalization, as customers are more likely to commit once they understand the terms clearly.

- Facilitates faster decision-making: With all necessary information presented upfront, customers can approve the terms quickly, reducing the wait time for finalizing agreements.

- Promotes quicker order fulfillment: When the financial and logistical terms are clear, businesses can proceed with orders more efficiently, leading to faster deliveries and quicker revenue recognition.

3. Reducing the Risk of Disputes

These documents also play an important role in reducing the potential for disputes, which can delay payment and negatively impact cash flow. By documenting all terms, including pricing, delivery schedules, and payment conditions, businesses can address potential concerns early on, preventing misunderstandin

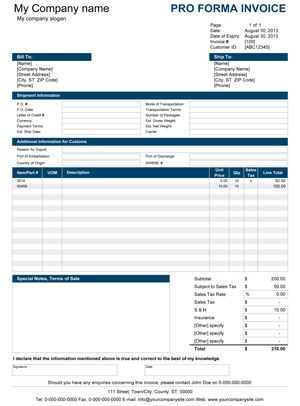

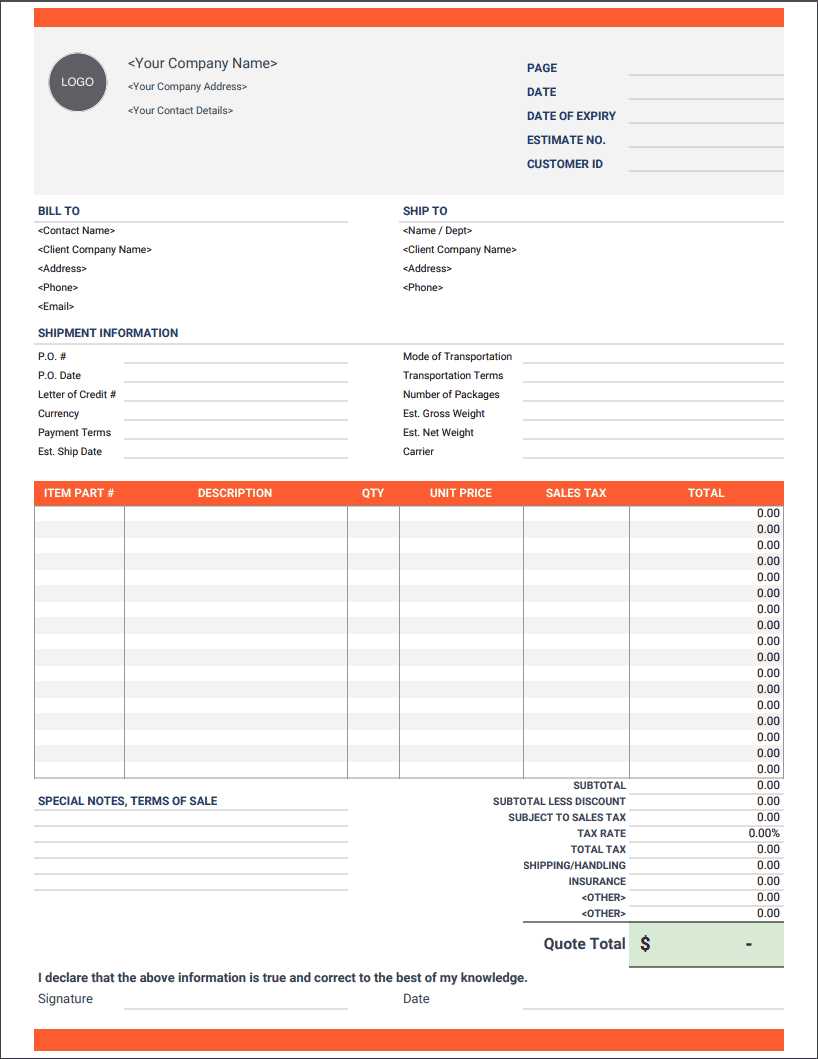

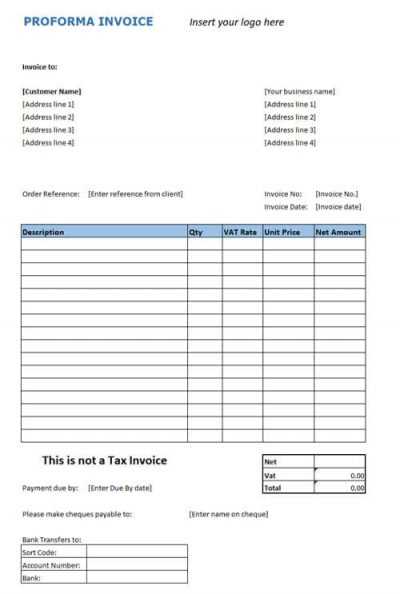

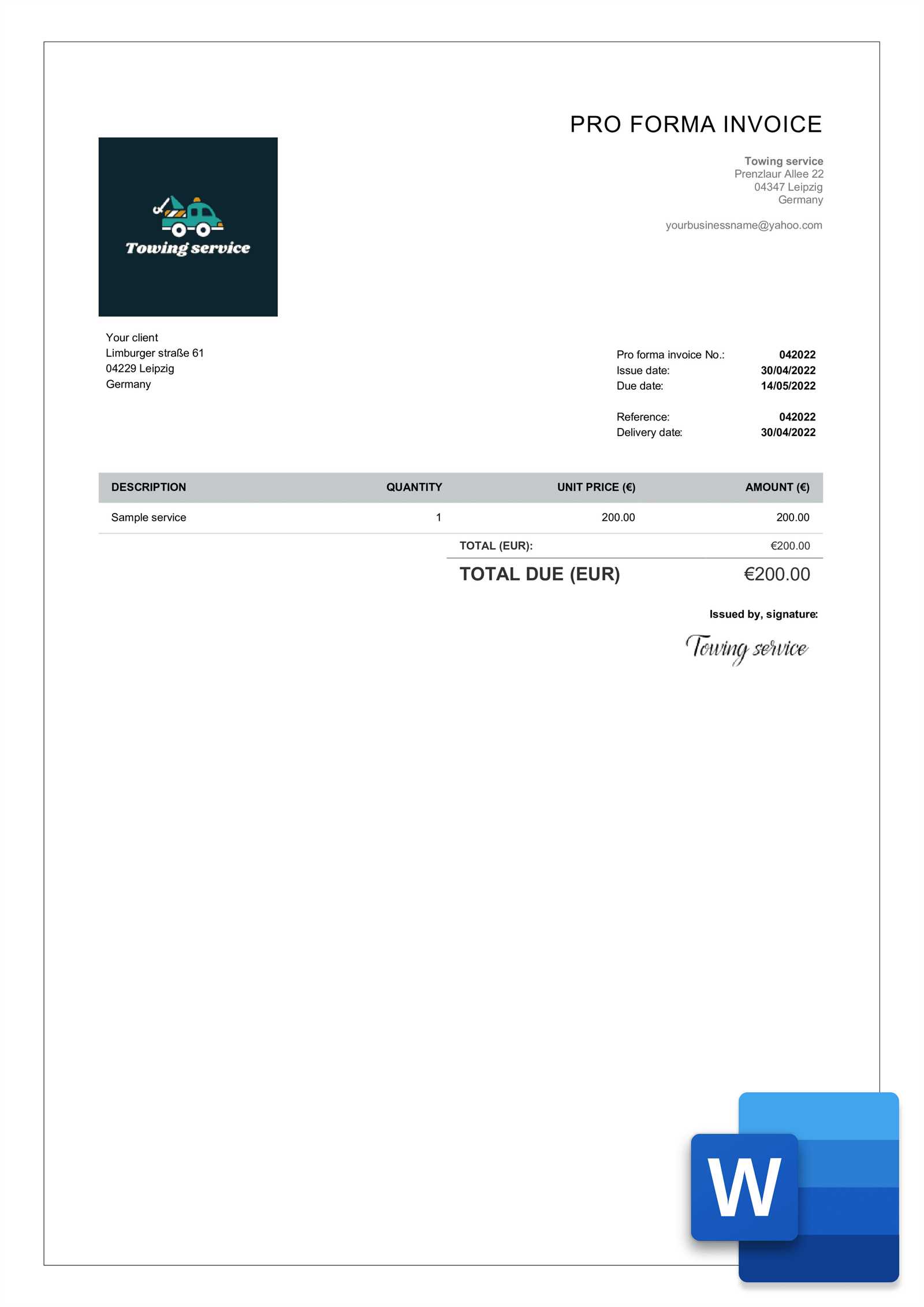

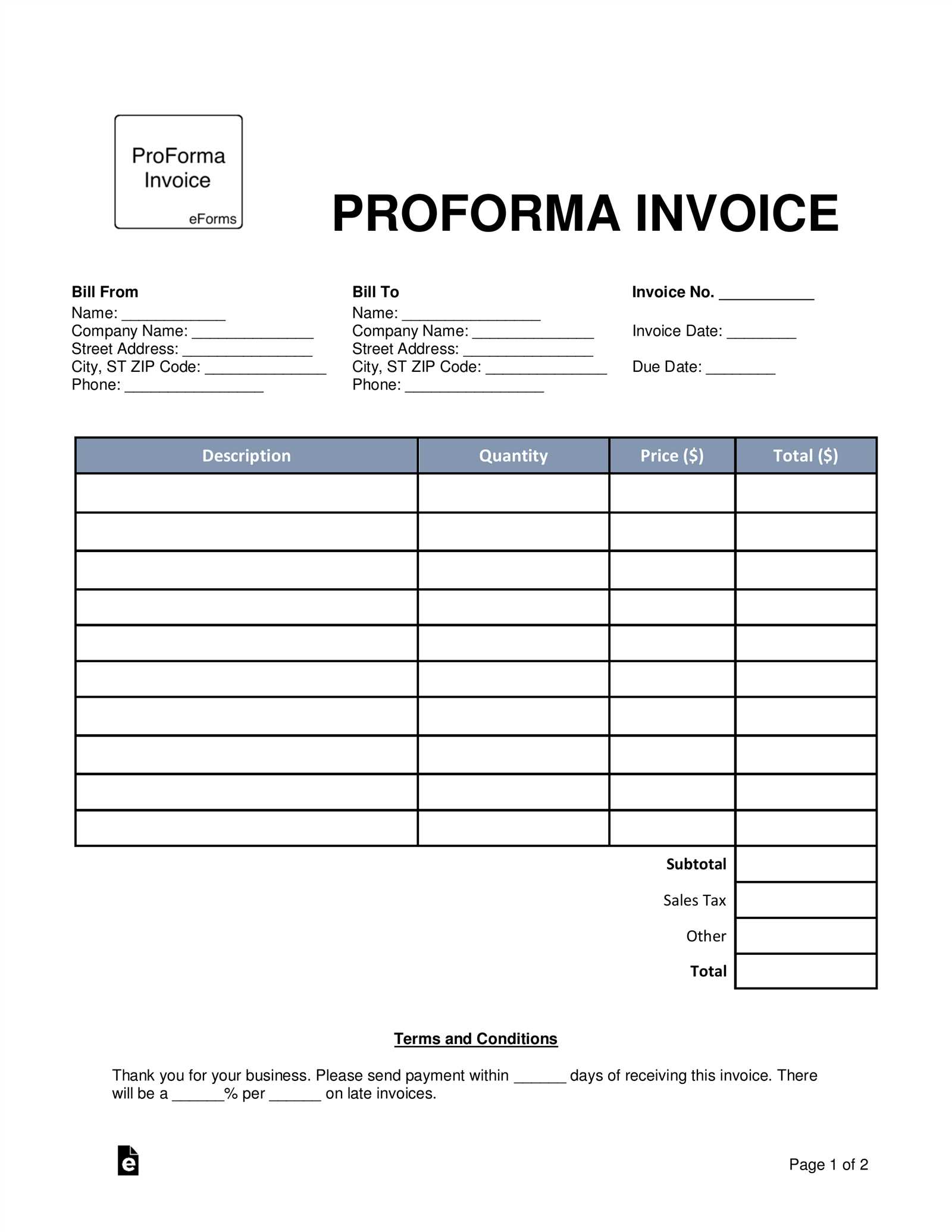

Examples of Proforma Invoice Templates

Preliminary business documents are essential tools for establishing clear expectations between buyers and sellers. They provide a snapshot of the transaction details before a formal agreement is finalized, helping both parties understand the terms, pricing, and other important elements. Below are examples of how such documents are typically structured and the key information they should include to ensure smooth and transparent transactions.

1. Basic Format for Product Sale

This example outlines the essential information required for a straightforward product sale. The document should contain details such as the product description, quantity, price, and expected delivery terms. Below is a simplified layout:

Details Information Seller’s Name Company Name, Address, Contact Buyer’s Name Company Name, Address, Contact Product Description Item name, model number, and quantity Unit Price Price per unit in the agreed currency Total Price Calculated as quantity multiplied by unit price Delivery Terms Expected delivery date and location Payment Terms Due date for payment and method (e.g., bank transfer, credit card) 2. Example for International Transactions

For international trade, a preliminary document should provide more detailed info

When to Use Proforma Invoices in Transactions

Preliminary transaction records are valuable tools in various stages of business dealings. They serve as an early representation of the terms of a deal before the final agreement is reached. These documents are often used when the buyer and seller need to confirm the details of a deal, establish payment terms, or prepare for customs or financing processes. Understanding when to use these documents can help businesses streamline their operations and avoid misunderstandings during the negotiation phase.

1. Before Finalizing a Formal Contract

One of the most common uses of these preliminary documents is during the negotiation phase, before a formal contract is signed. They offer both parties an overview of the proposed transaction, providing clarity on pricing, quantities, delivery schedules, and payment terms. This allows the buyer and seller to review the conditions and make adjustments before finalizing the agreement.

- Provides clarity: Both parties can confirm the terms of the deal before committing to a final contract.

- Prevents misunderstandings: The document serves as a reference point for the buyer and seller to ensure mutual understanding of the terms.

- Helps adjust terms: If either party needs to make changes, the preliminary document is a starting point for revisions before final agreement.

2. When Applying for Financing or Letters of Credit

In situations where financing or a letter of credit is required, businesses often use these documents to demonstrate the terms of the transaction to financial institutions. The preliminary record provides the lender or bank with a detailed breakdown of the transaction, helping them assess the amount of credit or financing needed. This is especially important in international trade, where banks often need to review the details before issuing payment guarantees.

- Supports financing requests: Financial institutions require detailed transaction records to evaluate the necessary funds for the deal.

- Facilitates letter of credit issuance: A detailed document allows banks to verify terms and conditions before providing a letter of credit.

- Minimizes risk: A well-structured do

How to Send Proforma Invoices to Clients

Sending preliminary transaction documents to clients is a crucial step in establishing clear expectations and ensuring smooth business dealings. These documents not only outline the terms and conditions of a deal but also serve as a reference for both parties to review before finalizing the agreement. Properly sending these records ensures that clients understand the details of the transaction and can respond accordingly. Below are the key steps to follow when sending these documents to clients.

1. Review the Document for Accuracy

Before sending the document to the client, it’s essential to ensure that all details are accurate. Double-check the product or service description, pricing, payment terms, and delivery schedule to make sure there are no discrepancies. This reduces the chance of confusion and helps maintain a professional image with your client.

- Confirm pricing: Verify the cost for each product or service to ensure it matches the agreed terms.

- Check payment terms: Make sure that the payment due dates, methods, and conditions are clearly outlined.

- Verify delivery details: Ensure the shipping or delivery method, timeline, and location are correct.

2. Send via Email or Business Communication Platforms

Once the document has been reviewed, the most efficient way to send it is through email or secure business communication platforms. Email provides an instant method of delivery, allowing the client to quickly receive the document and provide feedback. If you’re using a more formal communication system, ensure that the document is attached as a PDF or another commonly accepted file format to avoid any compatibility issues.

- Attach as PDF: PDF files are widely accepted and ensure that the document format remains intact when opened by the client.

- Include a clear subject line: Use a subject line like “Preliminary Transaction Details for Your Approval” to make it clear what the document pertains to.

- Provide contact information: Include your contact details in the email body so clients can reach out if they have any questions or need further clarification.

Sending these preliminary documents in a timely and professional manner is crucial for maintaining clear communication and ensuring that both parties are aligned before proceeding with a formal agreement.