Proforma Invoice Template DOCX for Quick and Easy Use

For any business, having well-structured documentation is key to maintaining smooth operations, particularly when dealing with transactions and agreements. Preparing professional documents that outline expected services, prices, and terms can make a significant difference in client relationships and financial clarity.

In this guide, we will explore how you can efficiently create a detailed and customizable document that helps manage business exchanges. Whether you are working with local or international clients, such a document plays a crucial role in ensuring transparency and setting clear expectations for both parties.

We will cover how to design and adjust the layout to meet your specific needs, how to include important details, and how to make these documents easy to update for future use. By the end of this article, you will understand the best practices for creating these essential papers and how to use them in a variety of business settings.

Understanding Proforma Invoices and Their Uses

In business transactions, clear communication and documentation are essential for both the buyer and the seller. When preparing documents for goods or services that are yet to be delivered, it’s important to provide a formal, yet flexible, outline of what the transaction will entail. These documents serve as a preview or estimate, helping both parties align expectations before finalizing the agreement.

What Is the Purpose of This Document?

This type of document is typically used to outline the terms of a deal before the final sale or service is completed. It is not a request for payment but rather a detailed statement showing the anticipated costs, quantities, and conditions of the goods or services. The main purposes of such a document are:

- To provide a clear breakdown of expected charges.

- To confirm the buyer’s interest and intent to proceed.

- To facilitate customs procedures for international shipments.

How Does It Differ from Other Documents?

While similar to an official bill or purchase order, this document is not yet a binding agreement for payment. It differs from a final bill in that it’s issued before the actual exchange of goods or services. This makes it a useful tool for both the seller, who can prepare for the upcoming transaction, and the buyer, who can verify the terms and make adjustments if needed.

These documents are especially useful in situations where advance payment or partial payment is required, or in international trade, where customs authorities may require a preliminary statement of goods and value before the actual shipment occurs.

What Is a Proforma Invoice

This document serves as a preliminary outline for a transaction, providing both the seller and the buyer with an early summary of what to expect from the deal. Unlike a final bill, it is not a demand for payment but a proposal that outlines the expected costs, quantities, and terms for the goods or services to be exchanged. It helps to ensure both parties are on the same page before the final agreement is made.

Key Features of This Document

While this document is often confused with other financial documents, it has distinct features that set it apart:

- It is issued before the actual exchange of goods or services.

- It outlines the expected pricing, quantities, and terms of delivery.

- It is not a request for immediate payment but rather an estimate or preview.

When Is This Document Used?

This document is commonly used in scenarios where the buyer needs to understand the details of a transaction before proceeding. It is often used in international trade to help with customs clearance, or when a business needs to provide a potential buyer with an estimate before the final sale. It is particularly useful when partial or advance payments are required, as it establishes the basis for these transactions.

Why Use a Proforma Invoice Template

Having a pre-designed structure for drafting business documents is essential for maintaining consistency and efficiency. By using a ready-made framework, you can quickly create detailed and professional records without needing to start from scratch each time. This approach saves time, ensures accuracy, and helps you avoid missing critical details in your transactions.

Efficiency and Time Savings

When you use a pre-structured document, you eliminate the need to manually input the same information repeatedly. This streamlines the process and allows you to focus on other important tasks, reducing the overall time spent on administrative work.

Consistency and Accuracy

By relying on an established format, you ensure that every document you create is consistent in terms of layout, structure, and information. This not only makes your paperwork look more professional but also reduces the risk of errors, as you are following a predefined structure that includes all necessary fields.

Benefits of Using DOCX Format

The choice of file format plays a crucial role in the ease of use and accessibility of business documents. A widely-used file format like DOCX offers a range of advantages, especially when dealing with professional paperwork. This format ensures that your documents are not only easy to create but also simple to edit, share, and collaborate on with others.

Ease of Editing and Customization

One of the main benefits of using this file format is the flexibility it offers for editing. You can easily adjust the layout, text, and other details to suit your needs, whether it’s for a one-time transaction or a recurring business process. The intuitive interface of word processing software makes these changes quick and straightforward.

Compatibility and Accessibility

Another key advantage of using this format is its high level of compatibility across different platforms and devices. Whether you are using Windows, macOS, or cloud-based solutions, you can open and edit these files without any issues. Additionally, it’s simple to convert them into other formats, such as PDFs, for more secure sharing and printing.

How to Create a Proforma Invoice

Creating a formal document outlining the terms and details of a transaction is a straightforward process when you follow a clear structure. By including all the necessary components, you can provide both the buyer and seller with an accurate preview of the upcoming deal. Whether you’re dealing with a simple exchange or a more complex international transaction, the process of drafting this document is essential for smooth business operations.

Start by including your business name and contact details at the top of the page, followed by the recipient’s information. This ensures that both parties are easily identified. Then, list the goods or services being provided, specifying the quantities, descriptions, and prices for each item. Be sure to clearly indicate the total amount due, along with any applicable taxes or fees.

Lastly, include terms and conditions such as delivery details, payment instructions, and deadlines. It’s important to also specify whether any advance payments or deposits are required, and if so, to outline these clearly. By following these steps, you ensure that both parties have a clear understanding of the transaction before it is finalized.

Essential Elements of a Proforma Invoice

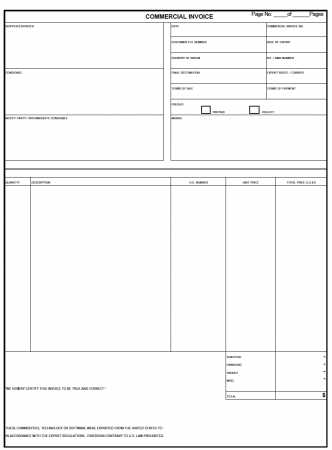

To ensure clarity and avoid misunderstandings, it’s important that any document outlining transaction details includes all the key elements. These elements provide a comprehensive overview of the deal, helping both parties understand the terms before proceeding with the exchange of goods or services. Properly structured documents help streamline business processes and reduce the risk of errors.

Key Information to Include

Every document should include certain fundamental details that ensure both the buyer and seller have a clear understanding of the transaction. Below is a list of the essential elements:

| Element | Description |

|---|---|

| Business Details | Include the full name, address, and contact information for both parties involved. |

| Item Description | A clear list of products or services being offered, including quantities and specifications. |

| Pricing | Provide detailed pricing for each item, along with any taxes or additional fees. |

| Terms of Payment | Specify payment due dates, accepted payment methods, and any required deposits. |

| Delivery Information | Detail delivery terms, such as the expected delivery date and shipping conditions. |

| Validity Period | Indicate the period during which the terms are valid, especially if the prices or availability are subject to change. |

Additional Optional Information

While the core elements are necessary, some businesses may also include extra details that provide further clarity, such as references to purchase orders, delivery terms, or special conditions specific to the transaction. These additional sections ensure that the document covers all aspects of the deal, preventing future disputes and misunderstandings.

Customizing Your DOCX Proforma Invoice

Personalizing your business documents is an important step to ensure they align with your specific needs and company branding. Customizing the structure, design, and content allows you to maintain a consistent professional appearance and provide clarity for your clients. By adjusting the details, layout, and format, you can create a document that not only meets your requirements but also enhances your business identity.

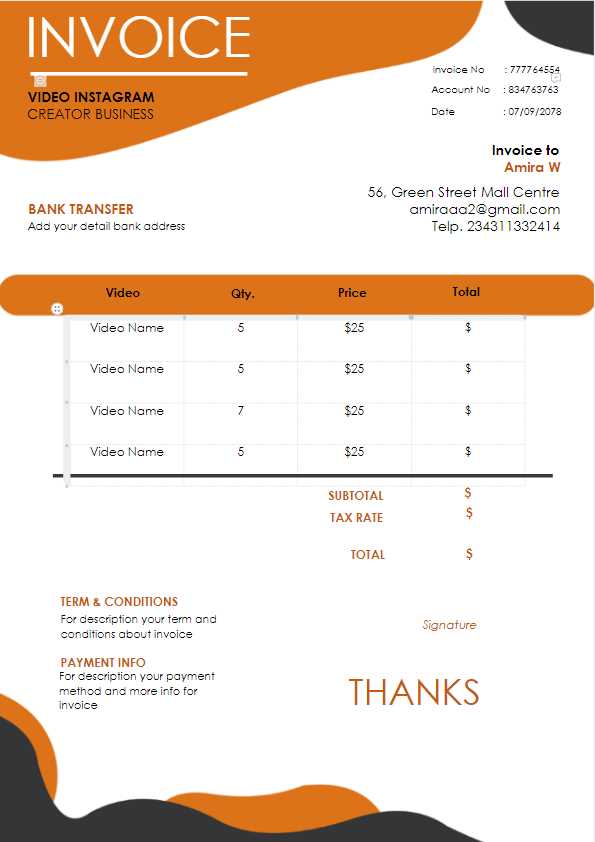

One of the main benefits of using a flexible format is the ability to modify sections to suit various types of transactions. Whether it’s for a small local sale or a larger international exchange, you can easily adjust pricing fields, terms, and descriptions. You can also incorporate your company’s logo, adjust fonts, and apply color schemes to match your corporate branding, creating a visually appealing and recognizable document.

Key areas to customize include:

- Business Information: Ensure your contact details and business name are prominently displayed for easy identification.

- Item Descriptions: Modify product or service names, add descriptions, and adjust pricing to reflect the specifics of each transaction.

- Layout and Design: Use consistent fonts, headers, and footers to maintain a professional look.

- Terms and Conditions: Edit payment terms, shipping instructions, and other agreements to reflect your current business practices.

By making these adjustments, you not only ensure that the document is tailored to your business but also that it is clear and user-friendly for your clients. This enhances both professionalism and communication in your transactions.

Top Tools for Editing Proforma Invoices

Having the right tools to modify business documents is essential for creating professional and accurate records. Whether you’re crafting detailed transaction summaries or preparing documents for clients, using reliable editing software ensures that you can make quick adjustments, maintain consistency, and streamline your workflow. Below are some of the top tools available for customizing and editing these types of documents.

Best Software Options for Document Editing

- Microsoft Word – A versatile word processor, perfect for creating and customizing professional documents. It offers easy formatting, collaboration features, and the ability to insert tables, images, and other essential elements.

- Google Docs – A cloud-based solution that allows for real-time collaboration, making it ideal for teams working on shared documents. It’s accessible from any device with an internet connection.

- LibreOffice Writer – A free, open-source word processing tool that supports a wide range of document formats. It offers robust editing features and is a great alternative for users looking for a no-cost solution.

- Zoho Writer – A part of the Zoho suite, this online word processor is designed for businesses. It provides advanced collaboration tools and integrates with other Zoho applications, offering a streamlined workflow.

- WPS Office – A powerful office suite that includes a word processor, spreadsheet program, and presentation tool. Its intuitive interface and wide compatibility with file formats make it a popular choice for editing documents.

Additional Tools for Enhancing Your Document

- Adobe Acrobat – For converting, editing, and securing documents in PDF format. It’s particularly useful when you need to finalize documents and ensure they cannot be easily altered by others.

- Canva – A graphic design tool that can be used to create visually appealing business documents. It offers customizable templates, making it easy to add logos, design elements, and branded content.

- Smallpdf – A simple online tool for converting, compressing, and editing PDFs. It’s perfect for users who need quick edits without needing advanced features.

Using these tools can help you create, modify, and finalize your business documents with ease, ensuring that they are both accurate and professionally presented.

Common Mistakes When Creating Invoices

Creating business documents for transactions is a routine task, but small errors can lead to confusion, delayed payments, or even disputes. These mistakes, though seemingly minor, can have significant consequences for both the seller and the buyer. It’s important to be aware of these common pitfalls to ensure that all transactions are documented clearly and professionally.

One of the most frequent mistakes is failing to include complete contact details for both parties. Without accurate names, addresses, and phone numbers, it can be difficult to resolve issues or clarify details later. Another common issue is neglecting to clearly state the payment terms, such as the amount due, payment methods, or deadlines. If these are not specified, both parties may have different expectations, which could cause delays or misunderstandings.

Another common error is overlooking the inclusion of item descriptions or providing vague details. Without a clear list of what is being exchanged, there is a greater chance of disputes over the nature of the transaction. Additionally, formatting mistakes, such as inconsistent pricing, incorrect totals, or missing taxes, can also complicate the process and delay the completion of the deal.

To avoid these issues, always double-check that all essential information is included and accurate, and ensure that the document is formatted clearly and consistently. Taking the time to verify each detail will help streamline the process and maintain positive business relationships.

How to Save Time with Templates

Time is one of the most valuable resources for any business, and finding ways to streamline tasks is essential. One effective way to reduce the time spent on repetitive document creation is by using pre-made document structures. These structures allow for quick customization and eliminate the need to start from scratch each time you need to prepare a new record. By creating or utilizing a set of ready-to-use layouts, you can speed up your workflow significantly.

Key Benefits of Using Pre-designed Documents

Pre-designed documents are particularly useful in situations where similar details are required for each transaction or agreement. Instead of manually entering the same information repeatedly, you can focus on filling in the specific details that change from one transaction to another. This helps to:

- Improve Efficiency: Pre-made structures reduce the time spent on formatting, so you can focus on adding content.

- Ensure Consistency: Using a consistent structure helps maintain uniformity across all your business records, making them look professional and well-organized.

- Minimize Errors: Templates provide a consistent framework, which reduces the likelihood of missing important details or formatting inconsistencies.

How to Maximize the Use of Templates

To make the most of ready-made structures, ensure that they are tailored to your specific needs. Customize the layout with your business logo, address, and payment terms, and save different versions for various types of transactions. By doing this, you’ll be able to quickly select the appropriate template and adjust only the necessary sections, which saves valuable time during high-volume periods.

Using templates not only speeds up the process but also helps maintain professional standards and consistency across all business documents. It’s an easy and effective way to boost productivity and improve the efficiency of your operations.

Best Practices for Proforma Invoices

Creating accurate and professional documents is crucial for businesses that handle transactions or agreements. By following best practices, you can ensure that your business records are clear, precise, and legally sound. These practices not only improve communication with your clients but also help avoid errors and disputes in the future. Below are some key tips to consider when preparing your documents.

Essential Guidelines for Accurate Documents

To create effective business records, it’s important to maintain consistency and accuracy. Here are some best practices to follow:

- Clear and Complete Information: Always include the full name, address, and contact details of both parties involved. This ensures there are no misunderstandings in case of disputes.

- Detailed Descriptions: Be specific when listing goods or services, including quantities, descriptions, and unit prices. Avoid vague terms to ensure both parties understand the transaction fully.

- Proper Payment Terms: State the payment amount, due date, and any late fees or discounts clearly. This prevents confusion over financial matters.

- Accurate Dates: Include the date the document was created and any relevant due dates. These dates are important for tracking payments and deadlines.

Formatting and Presentation

Professional presentation plays a significant role in how your documents are perceived. Here are some formatting tips:

- Use Consistent Layouts: Consistency in font style, size, and spacing makes the document easier to read and more professional.

- Logical Order: Structure your document in a logical sequence–typically, details like recipient information, item descriptions, and payment terms should appear in a clear, easy-to-follow order.

- Include Reference Numbers: Adding reference numbers or identifiers for each document helps track and manage records efficiently.

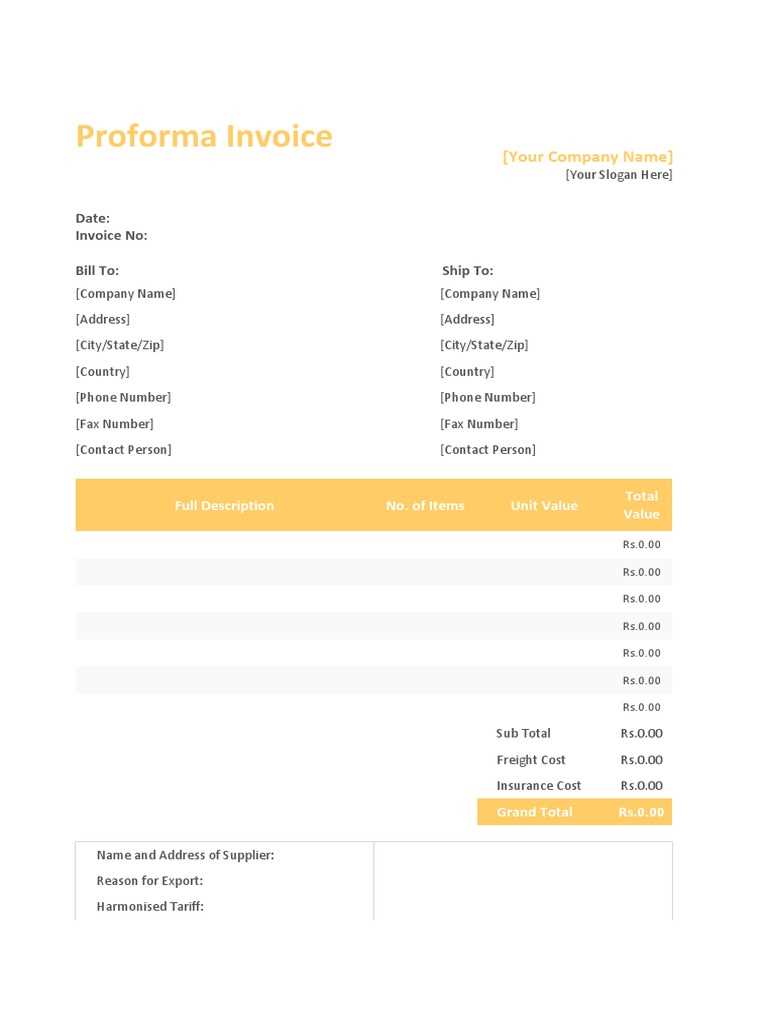

Sample Structure for Effective Documentation

| Section | Details | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Header | Business name, contact information, and document title. | ||||||||||||

| Recipient Information | Name, address, and contact details of the buyer or client. |

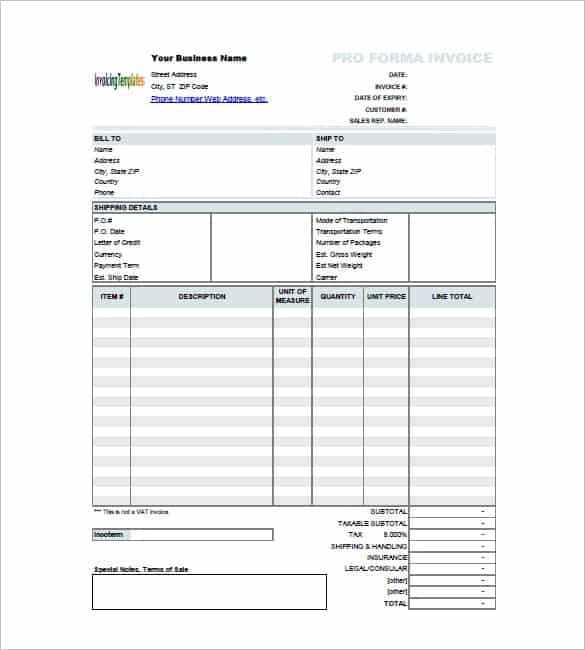

| Element | Details |

|---|---|

| Product Description | Provide clear and detailed descriptions of the items being sold, including specifications, quantities, and value. |

| Shipping and Delivery Terms | Indicate the mode of transport, shipping dates, delivery terms (Incoterms), and any potential charges involved in the delivery process. |

| Customs and Tariff Information | Detail any necessary customs codes and the expected tariff charges, which will help in the clearance process at customs checkpoints. |

| Payment Terms | Clearly outline the payment conditions, including the currency, method of payment, and the payment schedule. |

| Legal and Regulatory Compliance | Ensure that the document complies with both local and international trade laws, as well as any regulatory requirements specific to the country of operation. |

How to Ensure Smooth International Transactions

In order to prevent delays or misunderstandings in international trade, it is important to keep the following in mind:

- Accuracy: Be as precise as possible in describing the goods, services, and terms of the deal. This can help avoid complications during customs clearance or disputes later on.

- Understand International Regulations: Different countries may have different regulatio

Legal Considerations for Proforma Invoices

When preparing preliminary transaction documents, it’s important to understand the legal implications that come with their use. These documents, while not legally binding in terms of final payment, can have significant consequences for both buyers and sellers if not prepared or interpreted correctly. They serve as a formal agreement outlining the terms of the transaction and are often used in situations where the buyer or seller needs to present a document to secure financing or facilitate customs clearance.

For businesses involved in international trade or domestic agreements, knowing the legal aspects of such documents is essential to ensure compliance with local laws and regulations. There are specific guidelines on how these documents should be structured and what information needs to be included to avoid potential legal disputes.

Key Legal Aspects to Consider

Here are some of the key legal elements that need to be carefully considered when preparing preliminary transaction records:

- Accuracy and Clarity: It is essential that all details about the goods or services, such as quantity, value, and descriptions, are clear and precise. Inaccurate information can lead to disputes or even legal consequences if the document is used for customs or financial purposes.

- Non-Binding Nature: Unlike formal agreements or contracts, these documents are typically not lega

How to Convert DOCX to PDF

Converting files from one format to another is often necessary when you need to ensure compatibility across different platforms or when sharing documents with others. One common conversion is from a word processing format to a PDF, which is widely used for its ability to preserve document formatting and make it easily accessible on various devices. This section will guide you through the process of converting a word document into a PDF for easy sharing and professional presentation.

The conversion process is simple and can be done using various methods, from built-in software options to online tools. Here are a few ways to convert a document to PDF efficiently:

Using Microsoft Word

If you already have the document open in a word processing software like Microsoft Word, you can convert it directly to PDF with just a few clicks:

- Open the Document: Start by opening the document you wish to convert in Microsoft Word.

- Click on “File”: Navigate to the top menu bar and click on the “File” tab.

- Choose “Save As”: Select the “Save As” option from the dropdown menu.

- Select PDF Format: In the “Save as type” dropdown menu, choose “PDF (*.pdf)” as the file format.

- Save the Document: Choose the location where you want to save the file and click “Save”.

Now you have successfully converted your document into a PDF file that can be easily shared or printed.

Using Online Conversion Tools

If you don’t have access to Microsoft Word, there are several free online tools that can help you convert your document to PDF:

- Smallpdf: Smallpdf is a popular online tool that allows you to upload your file and convert it to PDF in a few simple steps. Just visit their website, upload your document, and download the converted file.

- ILovePDF: Similar to Smallpdf, ILovePDF offers an easy-to-use platform for converting documents. It supports a wide range of file formats and offers free conversions.

- Google Docs: You can also upload your file to Google Docs, open it, and then use the “Download” option to save the file as a PDF.

Online tools are convenient because they don’t require any software installation and can be accessed from any device with an internet connection.

Converting documents to PDF ensures that your content is preserved exactly as intended and can be easily opened by anyone without worrying about compatibil

Integrating Proforma Invoices with Accounting Software

Integrating financial documents with accounting software helps streamline business operations and improves overall efficiency. This integration allows for seamless management of sales, revenue tracking, and financial reporting. By incorporating these documents into an accounting system, businesses can automate various processes, ensuring accuracy and saving time.

Here are some benefits and methods of integrating these documents with your accounting software:

Benefits of Integration

- Automation of Data Entry: Automatically transferring details from documents to the accounting system reduces manual data entry and the risk of errors.

- Improved Accuracy: Integration ensures that financial records are up-to-date and accurate, eliminating the need for re-entering the same information in multiple places.

- Efficient Tracking and Reporting: With everything in one system, tracking payments, overdue amounts, and creating financial reports becomes much easier.

- Better Compliance: By maintaining accurate records, businesses can more easily comply with tax regulations and other legal requirements.

Steps to Integrate Documents with Accounting Software

- Select Compatible Software: Choose accounting software that supports integration with other business tools or documents, such as QuickBooks, Xero, or FreshBooks.

- Use Integration Features: Most modern accounting systems offer built-in tools or third-party apps that allow for seamless import of data from different file formats or document management platforms.

- Automate Document Entry: Set up automated workflows within your accounting software to import document details directly into the system. This can be done by using APIs or by linking your software with cloud-based document storage solutions.

- Review Data Accuracy: Before finalizing any integration, ensure that the imported data is correct and matches your documents’ content to avoid discrepancies in your accounting records.

Once integrated, this system enables smooth handling of all transactions, from preliminary agreements to finalized payments, ensuring that your business stays organized and prepared for audits or financial analysis. Proper integration leads to more efficient workflow management and provides clearer insights into your company’s financial health.

How to Handle Payment Terms on Invoices

Payment terms are crucial for ensuring timely and accurate transactions between businesses and their clients. Clearly defining payment expectations in your documents helps both parties understand their obligations and minimizes confusion. Setting up proper terms can also help maintain good customer relations and secure the financial health of your business.

Here’s how to handle and define payment terms effectively:

Key Considerations for Payment Terms

- Payment Due Date: Clearly state when the payment is expected. Common terms include “Due upon receipt” or “Net 30,” meaning the payment is due 30 days after the document date.

- Late Fees: Specify any fees for overdue payments. For example, you might include a 1.5% monthly late fee for overdue amounts.

- Discounts for Early Payment: Offering a discount for early payments (e.g., “2/10 Net 30” means a 2% discount if paid within 10 days) encourages faster payment and can improve cash flow.

- Accepted Payment Methods: List the accepted forms of payment, such as bank transfer, credit card, or check, to ensure there are no surprises later on.

How to Structure Payment Terms

- Be Specific and Clear: Use precise language to avoid any misunderstanding. Terms should be easy to understand and leave no room for confusion.

- Use Standardized Terms: If possible, use common industry terms to help clients easily recognize the expectations (e.g., “Net 30,” “COD” for cash on delivery).

- Include Contact Information: If the client has questions or disputes regarding the payment terms, provide contact details to resolve any issues promptly.

Having well-defined payment terms not only ensures your business gets paid on time but also builds trust with your clients. By setting clear expectations, you create a professional image and help prevent payment delays or misunderstandings that could impact your cash flow.

Managing Proforma Invoice Records

Effective record management is essential for keeping track of business transactions, ensuring accuracy, and maintaining compliance. Keeping organized records of documents that outline future payments or transactions is key to smooth financial operations. Proper management not only helps with tracking sales and payments but also facilitates easier auditing, reporting, and analysis.

Best Practices for Managing Records

- Organize by Date: Sort records chronologically for quick access. This helps maintain an orderly workflow and simplifies referencing past transactions.

- Use Digital Storage: Store records electronically in secure, cloud-based systems or dedicated business software to ensure they are easily accessible and backed up.

- Ensure Accuracy: Double-check all entries, especially regarding amounts, dates, and client information, to avoid errors in the future.

- Maintain Consistency: Keep a uniform structure for naming and filing your records to streamline future searches and retrieval.

- Set Up a Retention Policy: Implement guidelines for how long to keep records based on legal and business requirements. Regularly review and dispose of outdated documents.

Tools for Managing Records Efficiently

- Accounting Software: Use software like QuickBooks or Xero to keep track of all your financial records, including documents related to sales and future payments.

- Document Management Systems: Utilize specialized systems like Google Drive, Dropbox, or dedicated business platforms that offer features for secure storage, searchability, and organization.

- Spreadsheets: For smaller operations, Excel or Google Sheets can serve as an effective tool for tracking and managing records with customizable fields and formulas.

By implementing these practices and tools, you can ensure that your records are not only organized and accurate but also accessible when needed. Proper management of business documents is a key factor in maintaining financial health and streamlining future transactions.

Where to Download Proforma Invoice Templates

When you need to create documents outlining future payments or agreements with clients, having a reliable and professional-looking format can save time and effort. Fortunately, there are several resources available online where you can easily find customizable documents to suit your business needs. These downloadable resources allow you to streamline the process, ensuring that your paperwork remains consistent and professional.

Top Resources for Downloading Professional Templates

- Microsoft Office Templates: Microsoft provides a wide range of free downloadable files that can be easily edited using Word or Excel. These templates are ready for use, offering various styles for different business needs.

- Google Docs and Sheets: Google offers free document templates directly accessible from Google Docs and Sheets. You can search for a variety of document formats and choose one that best fits your requirements.

- Online Template Libraries: Websites like Template.net or Vertex42 offer a vast collection of business document templates, including customizable options. These platforms allow you to download the files in multiple formats for added convenience.

- Business Software Platforms: Many accounting software platforms, such as QuickBooks or Zoho, offer built-in templates for creating sales-related documents. These tools often include customization options to match your business branding.

Customizing Your Downloaded Document

- Tailor to Your Needs: Once downloaded, make sure to adjust the template’s text and fields to align with your company’s terms, including client details, pricing, and payment conditions.

- Branding: Add your company logo, colors, and contact information to ensure that your documents reflect your brand identity and appear professional.

- Review Accuracy: Always check the document before sending it to clients to ensure that all information is correct, including quantities, product descriptions, and pricing.

By utilizing these resources and tips for customization, you can easily download and personalize documents that will help you manage your business transactions more efficiently.