Proforma Invoice Template for Customs Clearance

When shipping goods internationally, certain paperwork is essential to ensure smooth processing through border controls. One such document provides a preliminary overview of the goods being shipped, including their value, quantity, and purpose. This document plays a critical role in the shipping process by aiding authorities in assessing the shipment without delay.

Understanding this document is crucial for businesses that frequently engage in global trade. It serves as an early version of the final transaction record and facilitates the swift movement of goods across borders. Without proper documentation, shipments may face unnecessary hold-ups or even rejection.

The structure of the document varies based on the shipping method, country regulations, and the nature of the items being transported. It provides all necessary details for evaluation and can help expedite the release of goods for their intended destination. By using a standardized format, businesses can minimize errors and ensure compliance with import-export laws.

Proforma Invoice Basics for Customs

When sending goods across international borders, a document outlining key shipment details is essential. This record provides vital information that helps authorities assess the shipment and determine its processing requirements. The document is typically used as a preliminary declaration before final paperwork is submitted, ensuring transparency and accuracy in the transaction.

The primary purpose of this document is to provide an accurate description of the goods, their value, and intended use. It assists in verifying whether the shipment complies with import/export regulations and helps prevent delays or complications during the shipping process.

- Details of the Shipment: Information such as product description, quantity, and value is included to ensure proper classification by authorities.

- Exporter and Importer Information: Names, addresses, and contact details of both the sender and the recipient are required to facilitate communication and accountability.

- Shipping Terms: This outlines the agreed-upon delivery method, destination, and payment responsibilities, ensuring all parties are aware of their obligations.

- Nature of the Transaction: Specifies whether the goods are sold, gifted, or donated, providing context for any special regulations or duties that may apply.

By ensuring that all necessary details are included, this document helps avoid confusion and facilitates the swift processing of goods. Accurate and thorough documentation is key to navigating international shipping requirements efficiently and legally.

Why You Need a Proforma Invoice

When preparing goods for international shipment, having a well-detailed document is essential to streamline the process and avoid delays. This document acts as a preliminary overview that helps both the sender and the receiver understand the scope of the transaction. It ensures that all parties are clear on what is being shipped and under what conditions.

There are several reasons why this document is critical for successful international transactions:

- Facilitates Trade Compliance: It helps ensure that the shipment meets regulatory standards and minimizes the chances of goods being held up or rejected by authorities.

- Reduces Shipping Delays: By providing necessary details upfront, it can speed up the approval process and ensure a smoother transition across borders.

- Prevents Unexpected Costs: This document provides an estimated value of the goods, helping the recipient anticipate any fees or taxes that may apply.

- Ensures Proper Record Keeping: It serves as a reference point for both the sender and receiver, ensuring transparency in the transaction.

In essence, using this document not only simplifies the logistics of shipping goods internationally but also minimizes the risks associated with the process. It helps establish a clear understanding between all involved parties, reducing misunderstandings and promoting smoother transactions.

How to Create a Proforma Invoice

Creating a detailed document for international shipments is essential to ensure clarity and avoid delays. This record outlines the transaction’s key elements, helping both the sender and recipient understand the goods’ details and terms. Follow these steps to prepare a complete and accurate document for global trade.

Here are the main steps to create this document:

- Gather Shipment Details: Collect all necessary information about the goods being shipped, including product names, quantities, values, and descriptions.

- Include Sender and Recipient Information: Ensure that the names, addresses, and contact details of both the sender and the receiver are clearly stated.

- Specify Payment Terms: Clarify how the payment will be made and whether the recipient is responsible for any additional costs such as taxes or duties.

- State the Delivery Terms: Include information on the shipping method, destination, and who will bear the shipping costs, whether it’s the seller or the buyer.

- Outline the Purpose of the Shipment: Explain the reason for sending the goods, whether for sale, repair, or donation, as this can influence regulatory requirements.

- Provide Additional Documentation: Attach any necessary supporting documents like certificates of origin or product compliance information if required by the destination country.

Once you have completed these steps, review the document for accuracy before sending it to the recipient or relevant authorities. Ensuring all details are correct will help speed up the approval process and prevent misunderstandings along the way.

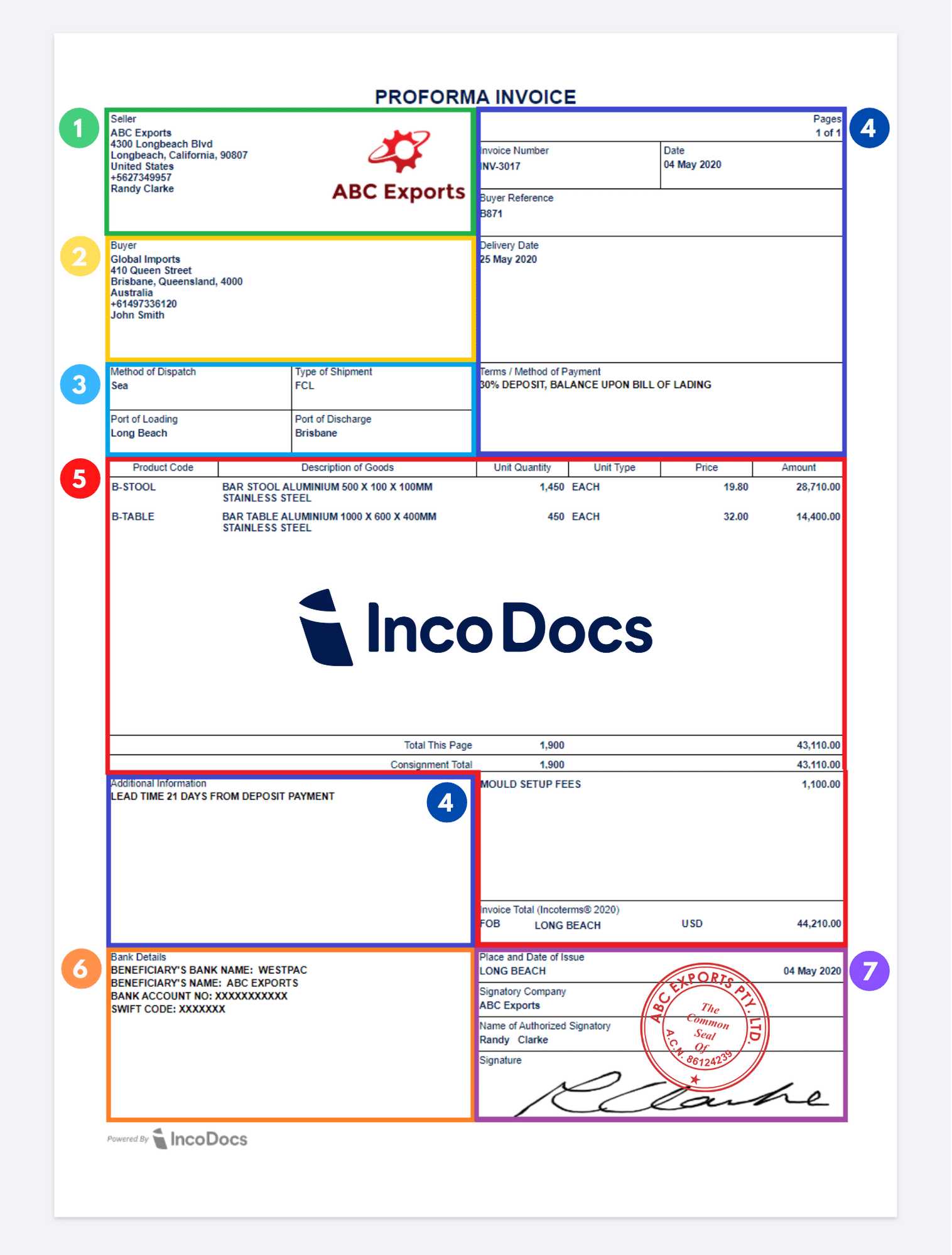

Key Elements of Proforma Invoices

A well-prepared document for international shipments contains essential information that ensures the shipment’s legitimacy and facilitates smooth processing. Understanding the critical components of this record is crucial to ensure all necessary details are included and the transaction is transparent.

The key elements of this document include:

- Sender and Recipient Information: Accurate contact details for both parties, including names, addresses, and phone numbers, are essential for communication and identification purposes.

- Goods Description: A clear and precise description of the items being shipped, including quantity, type, and value, helps avoid confusion and ensures proper classification.

- Shipping Method and Terms: It is important to specify the chosen delivery method, the responsible party for shipping costs, and any additional instructions regarding delivery.

- Payment Terms: This section outlines how and when payments will be made, along with any additional charges that the recipient may incur, such as taxes or duties.

- Purpose of the Shipment: Clearly stating whether the goods are sold, gifted, or transferred for any other reason is important for regulatory compliance and proper classification.

- Legal and Regulatory Information: Any necessary certifications or legal declarations, such as a certificate of origin or safety compliance, should be included where applicable to meet import/export requirements.

By ensuring these key components are accurately outlined, this document can effectively facilitate the smooth movement of goods across international borders, minimizing delays and complications during the shipping process.

Customs Clearance and Invoice Requirements

When shipping goods across borders, it is essential to comply with various regulations to ensure that shipments are processed smoothly. Proper documentation plays a critical role in meeting the requirements set by import/export authorities, which in turn helps avoid delays or issues during the shipping process.

Here are the primary requirements to consider when preparing documentation for international shipments:

- Complete and Accurate Description: A detailed description of the goods, including quantity, value, and nature, is crucial for proper classification and valuation by authorities.

- Sender and Recipient Information: The names, addresses, and contact details of both parties must be clearly stated to ensure proper communication and accountability.

- Value Declaration: The declared value of the goods plays a vital role in determining applicable duties and taxes. It should reflect the actual market value of the goods being shipped.

- Shipping Terms: Clearly stating who is responsible for the shipping costs and how the goods will be transported helps streamline the customs process.

- Purpose of Shipment: Whether the goods are being sold, donated, or transferred for another purpose should be specified, as this can impact the documentation needed for legal compliance.

- Supporting Documents: Depending on the type of goods being shipped, additional documentation such as certificates of origin, product safety certifications, or export licenses may be required to meet regulatory standards.

By ensuring that all required documentation is in order and that the details are accurate, businesses can facilitate the smooth movement of goods across borders while avoiding costly delays or penalties. Proper adherence to these requirements helps maintain the efficiency of global trade operations.

Common Mistakes in Proforma Invoices

When preparing documents for international transactions, even minor errors can lead to delays, increased costs, or misunderstandings. Identifying and avoiding common mistakes ensures smooth processing and compliance with regulations. Here are some of the most frequent issues found in these documents.

Incorrect or Incomplete Information

One of the most common mistakes is missing or inaccurate information about the goods or involved parties. This can include:

- Missing Contact Details: Incomplete or incorrect addresses, phone numbers, or emails can cause delays in communication and shipping.

- Wrong Description of Goods: Failing to properly describe items or inaccurately declaring their quantity or value can result in classification errors or complications with tax assessments.

- Omitting Payment Terms: Not clearly stating how and when payments will be made can lead to confusion and disputes.

Failure to Include Necessary Documentation

Another mistake is neglecting to provide supporting documents required for international shipments. These might include:

- Certificates of Origin: Some countries require proof that the goods come from a specific location to qualify for certain benefits or tariffs.

- Product Compliance Documentation: Certain items, especially electronics or chemicals, may need certification to meet safety or environmental regulations.

By avoiding these common mistakes and ensuring all details are correct, you can minimize the risk of delays, fees, and complications during the shipping process.

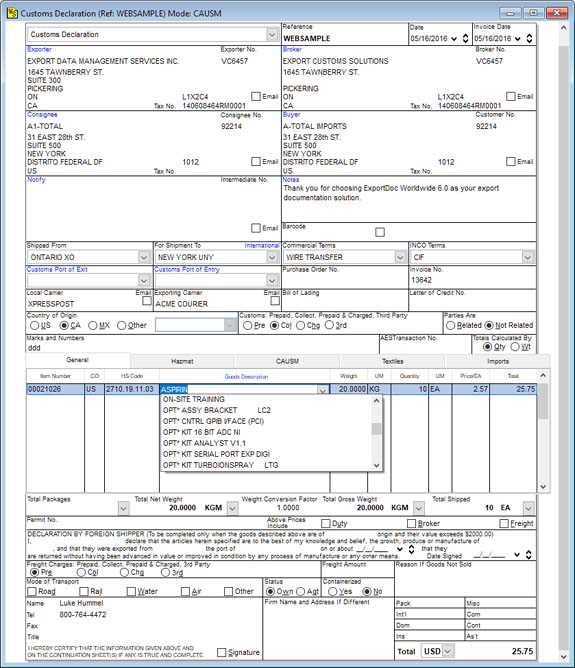

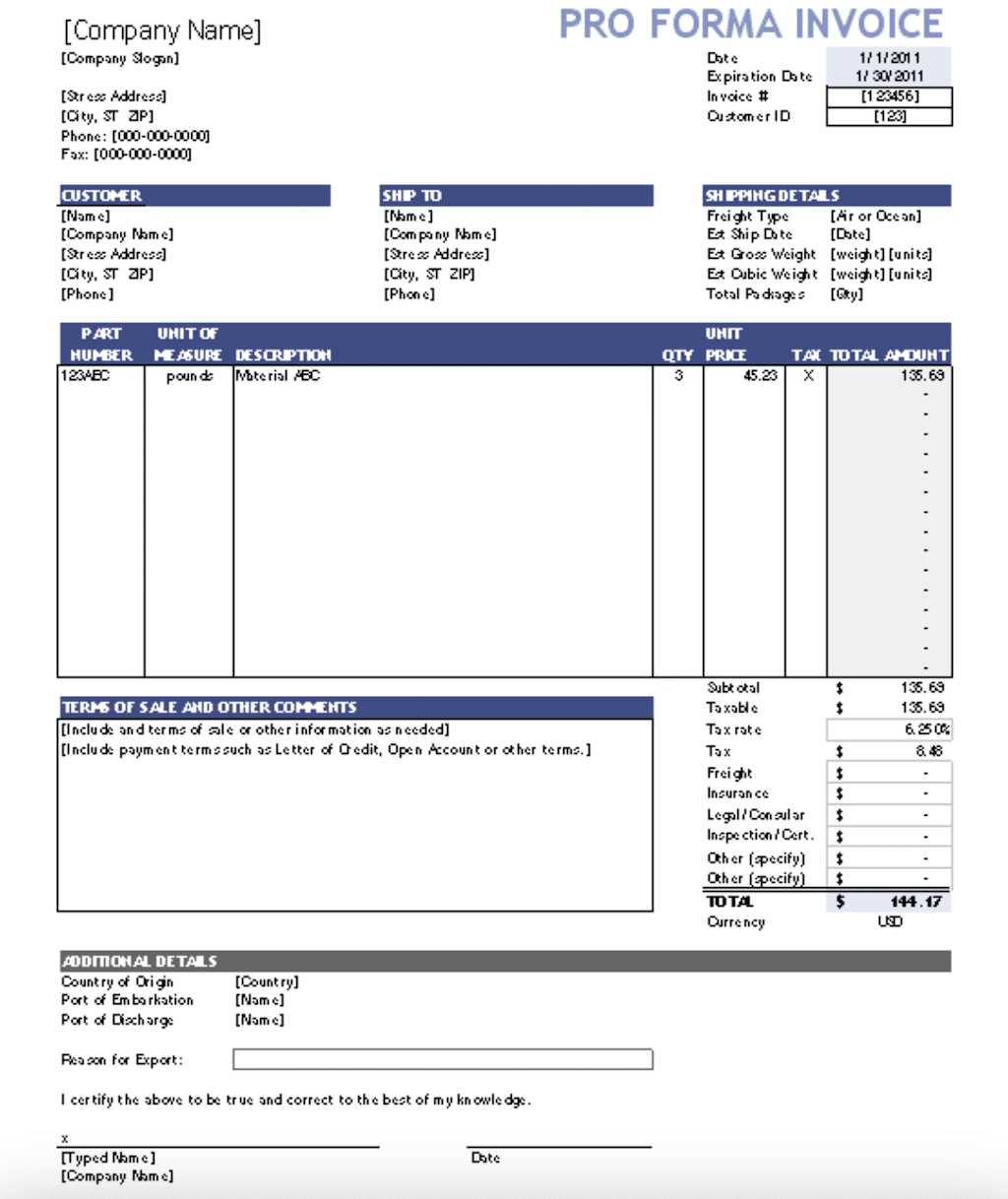

Steps to Complete the Template

Filling out the necessary documentation for international shipping requires careful attention to detail. The process involves collecting accurate information, entering it in the appropriate sections, and ensuring compliance with the regulations of the destination country. Here is a step-by-step guide to help you complete the required document efficiently.

| Step | Description |

|---|---|

| Step 1: Gather Information | Collect all the necessary details about the goods, sender, and recipient, including addresses, product descriptions, and payment terms. |

| Step 2: Provide Accurate Descriptions | Write clear and detailed descriptions of the items being shipped, ensuring accuracy in quantity, value, and nature of the products. |

| Step 3: Declare Values | Declare the correct value for each item being shipped. This is important for assessing duties and taxes. |

| Step 4: Include Supporting Documentation | Ensure you have the required supporting documents, such as certificates of origin, product compliance, or other relevant paperwork. |

| Step 5: Verify Shipping Terms | Clearly state the terms of shipping, including who is responsible for the shipping costs and how the goods will be transported. |

| Step 6: Final Check | Before submission, review all entries for accuracy to avoid any mistakes that could lead to delays or compliance issues. |

By following these steps carefully, you can ensure that the documentation is correctly completed and ready for processing, minimizing any risks during shipping.

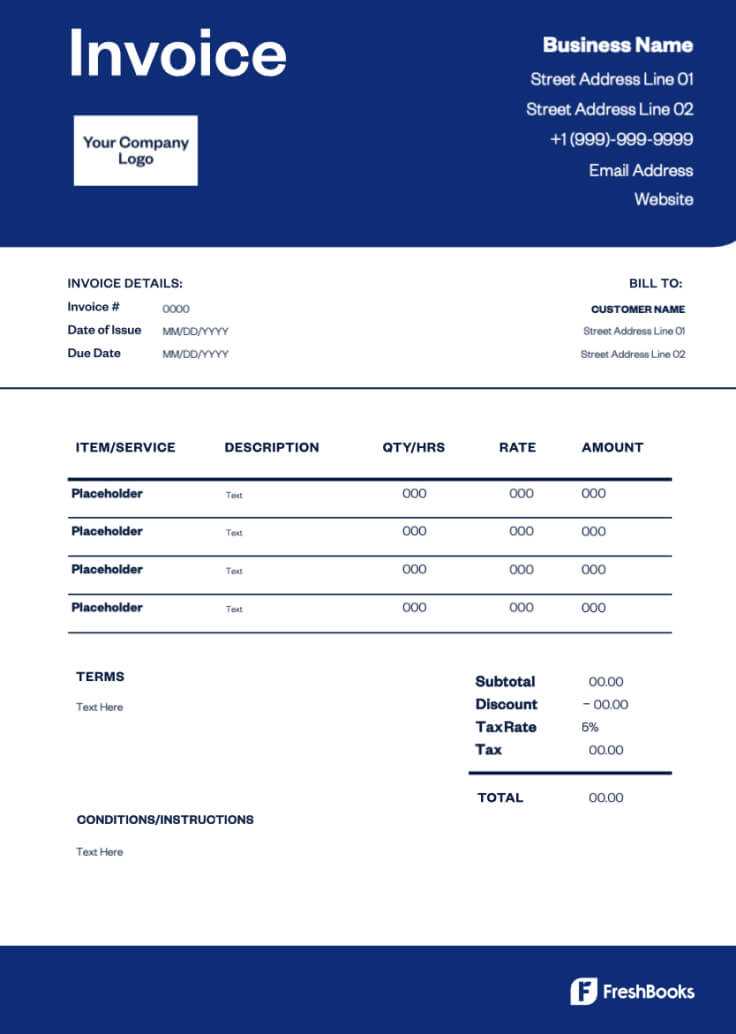

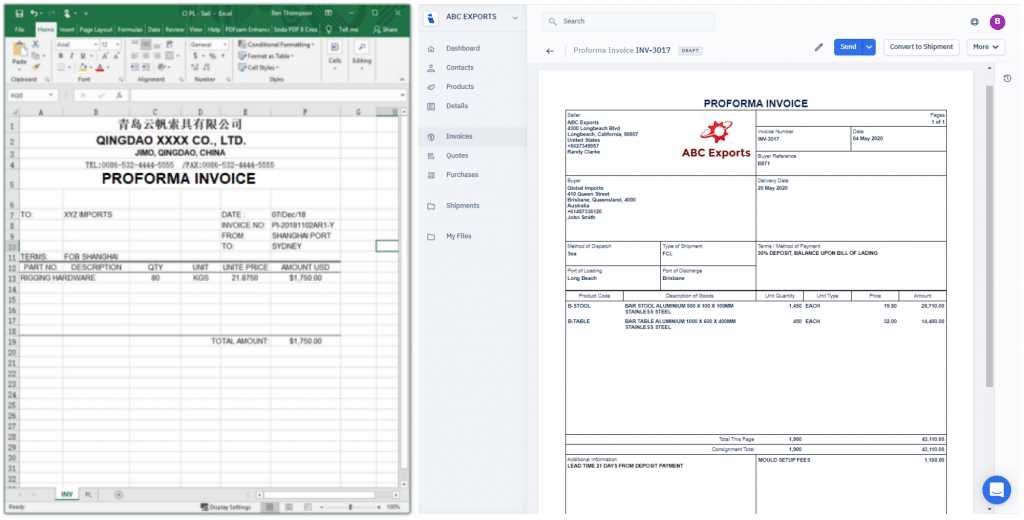

Digital Tools for Invoice Creation

Creating accurate and professional documentation for international shipments has become much easier with the availability of digital tools. These platforms automate much of the process, reducing the likelihood of errors and ensuring compliance with various regulations. They also offer features that streamline data entry, template customization, and document generation.

Several digital solutions are available to assist businesses in efficiently generating shipping and trade documents. These tools often include pre-built formats, customizable fields, and the ability to integrate with accounting or inventory management systems. Additionally, many of these platforms support multiple languages and currencies, making them ideal for global trade.

Some popular digital tools in the market include online invoicing platforms, document creation software, and enterprise resource planning (ERP) systems. These solutions not only simplify the creation process but also provide a secure way to store and manage business documents. Using such tools can significantly improve efficiency and reduce administrative overhead.

Ensuring Accurate Documentation

Accurate paperwork is crucial when shipping goods across borders. Any errors in the documentation can lead to delays, fines, or even confiscation of goods. Therefore, it is important to ensure that every detail in the paperwork is correct, from product descriptions to the financial values declared. Proper documentation ensures smooth processing and compliance with international trade regulations.

Key Considerations for Accuracy

To avoid mistakes and ensure proper processing, pay attention to the following elements:

- Correct Product Descriptions: Be precise when describing the goods, their uses, and quantities to avoid confusion or misclassification.

- Accurate Value Declarations: The value of goods must reflect the true market price to avoid issues with taxes or duties.

- Clear Terms of Sale: Specify the responsibilities of both the seller and the buyer in terms of shipping and payment arrangements.

Double-Check Supporting Documents

Before submitting the paperwork, ensure all supporting documents, such as certificates of origin or compliance documents, are accurate and match the details in the primary paperwork. Failing to include the right supporting documentation can cause delays or even rejections at the border.

By thoroughly reviewing all information and maintaining consistency between all required forms, you can greatly reduce the chances of encountering problems during the shipping and receiving process.

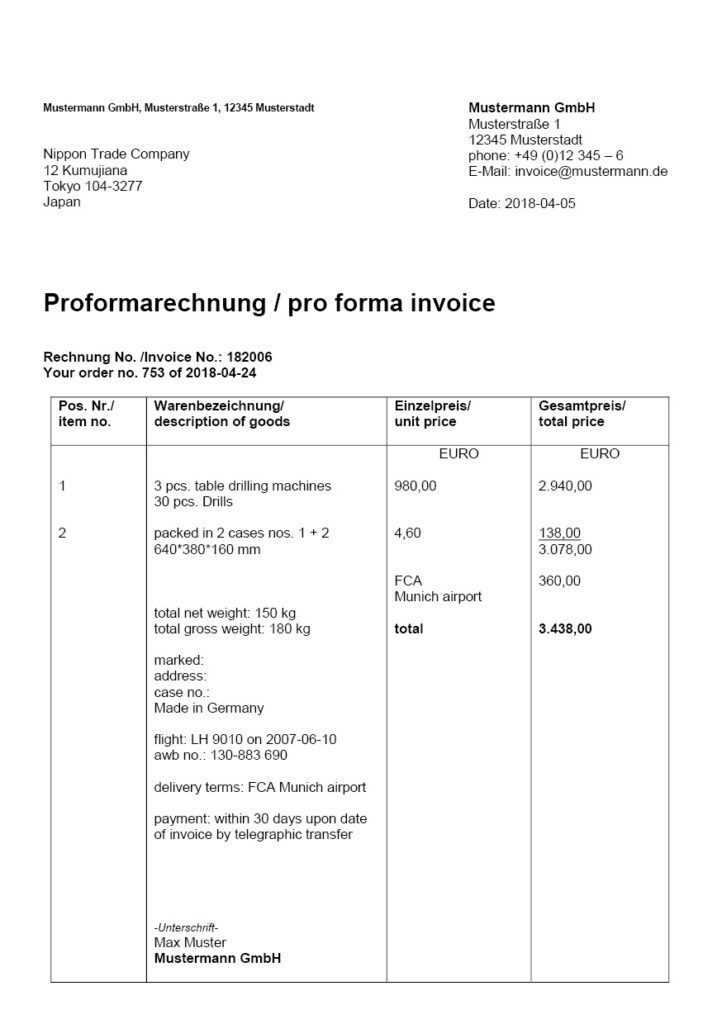

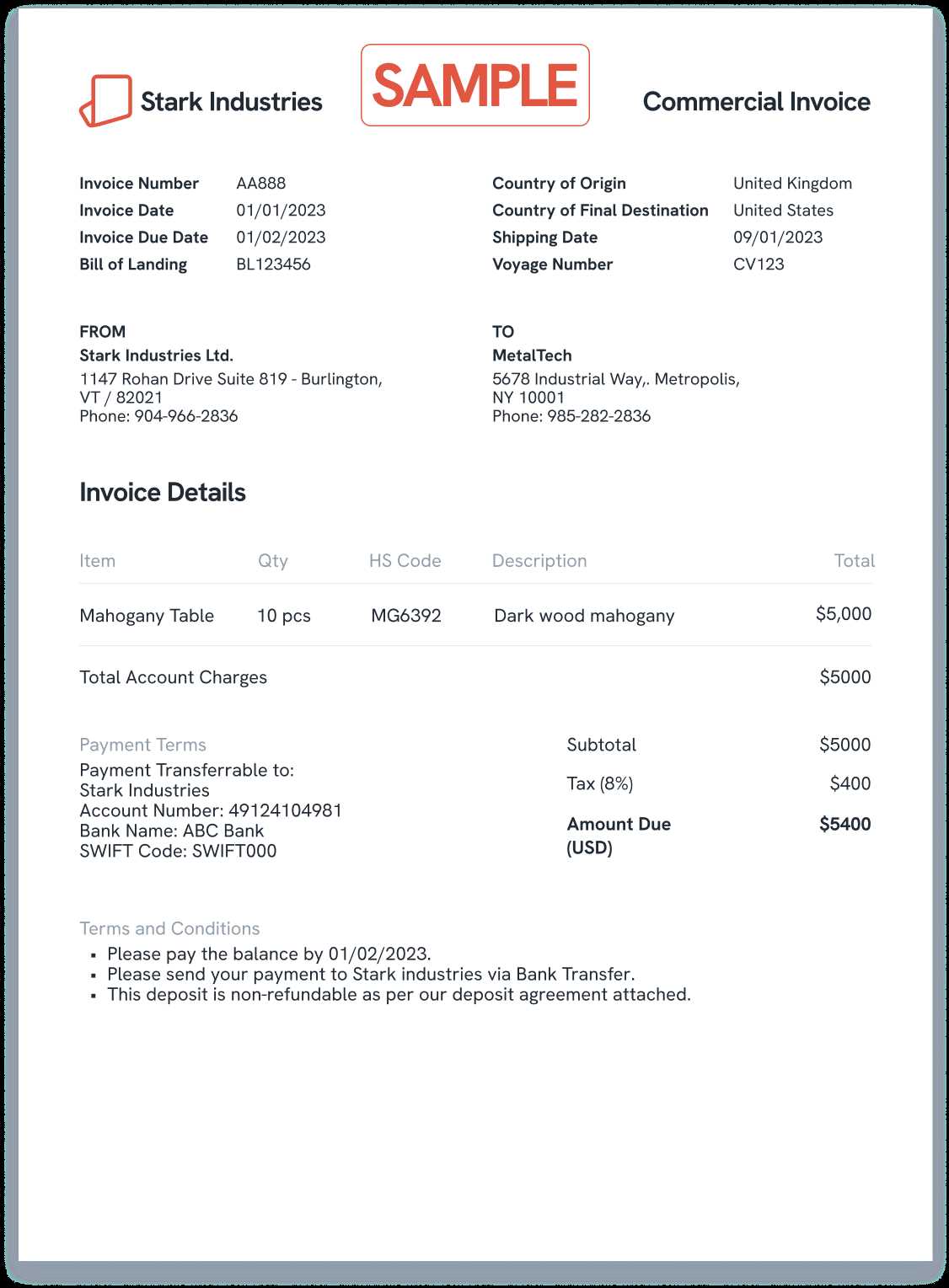

Proforma Invoice vs Commercial Invoice

When it comes to shipping and international trade, two types of financial documents are commonly used: one that serves as an initial estimate and the other as an official record of the transaction. While both provide details about the goods being exchanged, they serve different purposes in the process. Understanding the differences between these documents is crucial to avoid confusion during the shipping process.

Key Differences

Here is a comparison between the two types of documents:

| Aspect | Initial Estimate | Final Transaction Record |

|---|---|---|

| Purpose | Used for preliminary transactions, often to secure financing or customs clearance. | Serves as an official record of the completed sale, used for accounting and legal purposes. |

| Legality | Not a legally binding document; it is used to give an idea of the cost involved. | Legally binding and serves as proof of transaction. |

| Details Provided | Contains estimated values and item descriptions but may lack final pricing or taxes. | Contains exact pricing, taxes, and all transaction details. |

| Usage | Commonly used in international trade to facilitate customs processes. | Used for final settlement, bookkeeping, and tax purposes. |

When to Use Each Document

The document used depends on the stage of the transaction and the purpose at hand. The initial estimate is typically used to give an idea of the cost before final payment or shipment. Once the sale is complete, the official document is used to provide accurate details for record-keeping and payment processing.

Knowing when and how to use these documents ensures a smooth transaction and helps with compliance, reducing the risk of complications during shipping or financial settlements.

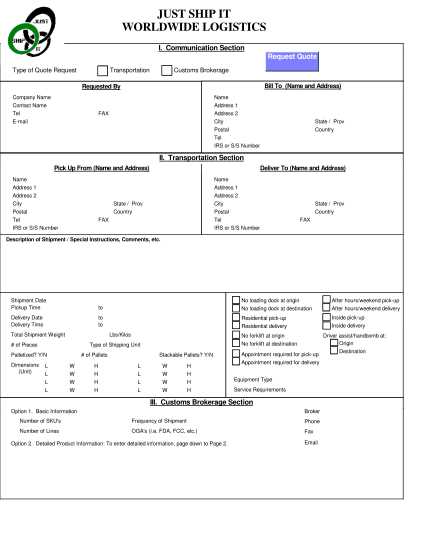

How to Handle Proforma Invoices in Shipping

When preparing for international shipments, providing accurate documentation is essential to ensure smooth operations and avoid delays. One crucial document often required in the initial stages of shipping is an estimated cost breakdown, which serves various purposes, from facilitating import-export processes to helping with tax assessments. Knowing how to manage and use this document properly can save both time and resources during shipment.

Steps to Effectively Handle Documents

Below are key steps to ensure the correct handling of this type of document during the shipping process:

- Provide Accurate Information: Ensure that all product details, including descriptions, quantities, and estimated values, are correctly listed to avoid discrepancies later on.

- Ensure Proper Timing: Submit the document early in the shipping process, especially when it’s needed for regulatory approval or other administrative requirements.

- Clear Communication: Clearly communicate with all parties involved, including suppliers, shipping agents, and customs brokers, to ensure everyone has the necessary details to proceed with the transaction smoothly.

- Follow Regulatory Guidelines: Adhere to local and international regulations regarding what information needs to be included to avoid issues during the customs review.

Common Mistakes to Avoid

There are several common errors that can complicate the process when managing this document:

- Inaccurate Product Descriptions: Providing vague or incorrect product descriptions can lead to delays and penalties during shipping.

- Failure to Update Values: If the values provided are outdated or incorrect, it may result in issues with the final shipment and payment.

- Missing Required Details: Not including all required fields or information can result in the document being rejected by the relevant authorities.

By following the steps outlined and being mindful of potential mistakes, you can ensure that your shipment progresses efficiently and that the necessary paperwork supports the process seamlessly.

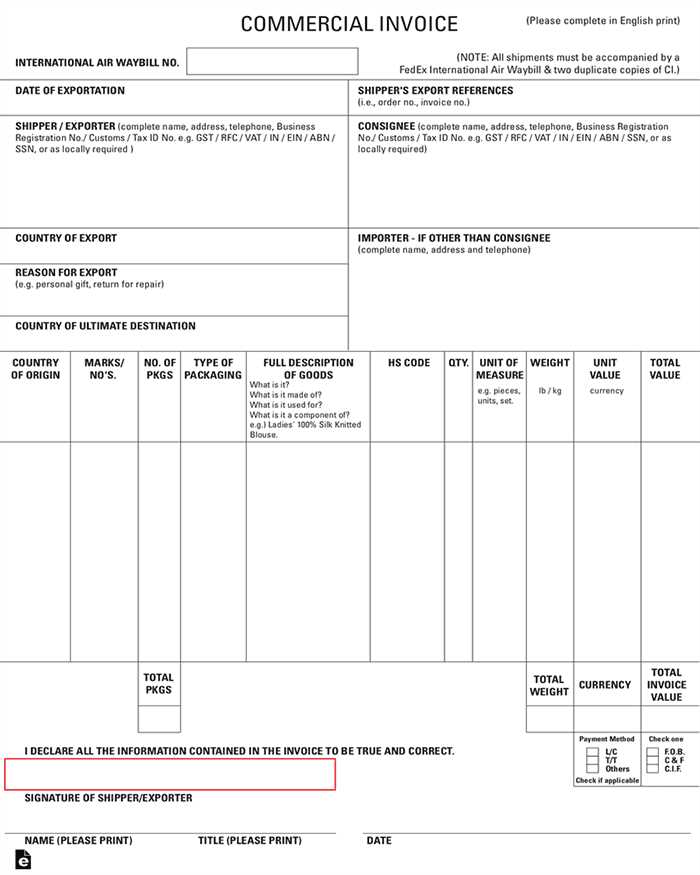

What Information to Include for Customs

When preparing essential documentation for international shipments, it’s important to include specific details to ensure the process runs smoothly. Certain information is required by authorities to assess the shipment correctly, whether for tariff purposes or other legal checks. Knowing what data to provide is crucial for a successful transaction and to avoid unnecessary delays.

Essential Details for International Shipments

Here are the key elements that should be included in your documentation:

- Sender and Receiver Information: This includes names, addresses, and contact information of both the sender and the recipient, as well as any third parties involved in the shipment.

- Detailed Product Descriptions: Clearly describe each item being shipped, including the quantity, material, and intended use. Avoid generic terms to prevent misunderstandings.

- Value of Goods: Provide an accurate cost for each item being shipped. This helps authorities assess applicable fees and taxes.

- Country of Origin: Specify where the goods are manufactured or assembled, as this can impact the duties and regulations applied to the shipment.

- HS Code: Include the Harmonized System code that corresponds to the type of product. This helps customs agents identify the product category and determine the correct tariff rates.

Additional Information to Consider

Some additional details may also be required depending on the nature of the shipment:

- Transport Details: Include the method of transportation (air, sea, or land), and provide shipment tracking numbers if applicable.

- Insurance Information: If the goods are insured, provide relevant insurance details such as policy numbers and coverage amounts.

- Terms of Sale: Clearly define the terms of the transaction, such as delivery terms (Incoterms), payment methods, and responsibilities for shipping costs.

By ensuring all these details are included, you can minimize the risk of delays and ensure the shipment is processed without complications.

Understanding Duty Calculations

When goods cross international borders, certain fees may be imposed based on their value, nature, and origin. These charges are essential for regulating trade and ensuring proper revenue collection by the authorities. Knowing how these fees are calculated can help businesses prepare for additional costs and avoid unexpected surprises during the import/export process.

Factors Affecting Duty Calculation

The amount of duty to be paid depends on several key factors:

- Value of Goods: One of the primary elements in determining the amount is the declared value of the goods. This value is typically based on the purchase price or market value, and it forms the basis for calculating most duties and taxes.

- Type of Product: Different products may be subject to different rates. Items like electronics, textiles, and agricultural goods may fall under distinct tariff categories with varying fees.

- Country of Origin: The country where the goods are produced or processed influences the applicable duty rate. Trade agreements or preferential tariffs may reduce or eliminate duties on certain goods from specific countries.

- Shipping Costs: In some cases, the shipping and insurance costs are added to the total value of the goods, which can impact the overall duty calculation.

How Duties Are Calculated

The most common way to calculate duties is through a percentage of the total value of the goods. This can be broken down into the following process:

- Determine the value of the goods being shipped.

- Identify the correct tariff rate based on the product and its country of origin.

- Calculate the duty amount by applying the tariff rate to the value of the goods.

- Factor in any additional costs such as shipping or insurance if required.

Understanding these calculations can help avoid mistakes and ensure smoother transactions when dealing with international shipments.

Legal Considerations for Preliminary Shipping Documents

When creating preliminary documents for international trade, businesses must ensure that the information presented adheres to both national and international laws. These documents play an essential role in the trade process, and inaccuracies or incomplete details can lead to legal complications or delays in transactions. Understanding the legal framework surrounding these documents is crucial for avoiding disputes and ensuring smooth cross-border operations.

Compliance with Regulations

Different countries have specific requirements for shipping documents, especially when goods are moved across borders. It is important to follow these regulations closely to avoid issues with authorities. Key aspects of compliance include:

- Accurate Description of Goods: The goods being shipped must be described correctly, as misclassification or false declarations can lead to legal penalties or confiscation.

- Value and Pricing Information: The value of goods must be stated clearly and truthfully. Providing incorrect values can lead to fines or even criminal charges in extreme cases.

- Proper Documentation for Trade Agreements: Depending on the country of origin and destination, certain trade agreements or tariff programs may apply, and proper documentation is necessary to benefit from these agreements.

Potential Legal Risks

Failure to meet legal requirements can expose a business to several risks, including:

- Fines and Penalties: Authorities may impose fines for discrepancies in the provided documents, such as incorrect product descriptions, pricing, or missing paperwork.

- Shipment Delays: Incorrect or incomplete documentation can cause significant delays at border crossings, leading to time and financial losses.

- Legal Disputes: Discrepancies in documents may lead to disputes with buyers, sellers, or shipping companies, resulting in costly and time-consuming legal actions.

To avoid these risks, it is essential to stay updated on the legal requirements of all countries involved in the transaction and ensure that all shipping documents are completed thoroughly and accurately.

How to Submit the Preliminary Trade Document

Submitting a preliminary trade document is a key step in the international trade process. This document serves as a preview of the goods being shipped and is often required for regulatory purposes, such as importation or clearance. It is essential to follow the correct procedures to ensure smooth processing and avoid delays. Below are the main steps involved in submitting this document.

Prepare the Document Thoroughly

Before submitting, ensure that all details are accurate and complete. Common elements to include are:

- Description of Goods: Clear and precise descriptions help authorities understand the contents of the shipment.

- Value of the Goods: A realistic value declaration is necessary to calculate taxes, duties, and fees correctly.

- Sender and Recipient Information: Include all relevant contact details of both parties to facilitate smooth communication.

Submission Methods

Once the document is prepared, it can be submitted in the following ways:

- Electronically: Many countries and companies now allow the submission of documents via online platforms, which can expedite the process. These systems may include trade portals or government e-filing services.

- Manually: If electronic submission is not available, hard copies may need to be submitted to the relevant authorities or agencies, such as customs or shipping companies. Ensure the document is signed and includes all required stamps or certifications.

Make sure to verify the submission deadlines and procedures based on the destination country and the type of goods being shipped. Timely and correct submission is crucial for avoiding delays or issues during transit.

Tips for Streamlining Customs Clearance

Efficiently navigating the shipping process and ensuring swift passage through regulatory procedures is crucial for timely delivery. Streamlining the steps involved in this process can minimize delays and reduce potential errors. Below are several strategies to enhance the efficiency of your shipments through regulatory checks.

Ensure Complete and Accurate Documentation

One of the primary causes of delays is incomplete or incorrect paperwork. Here’s how to prevent this:

- Double-check all details: Make sure that product descriptions, values, and country of origin are clear and correct.

- Include all necessary certifications: Depending on the type of goods, documents such as permits, certificates of origin, and compliance forms may be required.

- Use standardized forms: Follow the standard practices of the destination country to avoid confusion or the need for additional clarifications.

Choose the Right Shipping Method

Selecting the correct method for transportation can significantly impact the speed of the procedure:

- Pre-clearance: Some countries allow pre-clearance procedures where documentation can be submitted before arrival, reducing waiting times upon entry.

- Use trusted couriers: Reputable shipping companies are often familiar with the regulatory requirements and can help expedite the process.

- Proper classification of goods: Accurately classifying the goods being shipped helps avoid delays related to incorrect tariff codes.

By following these tips and planning ahead, you can streamline your shipments, ensuring smoother transitions through regulatory checks and faster delivery to the intended recipient.

Benefits of Using Proforma Invoices

When engaging in international trade or planning shipments, certain documents play a crucial role in ensuring that transactions go smoothly. These initial documents provide clarity and help streamline the processes involved in product movement. Below are some of the key advantages of utilizing these documents for businesses and individuals involved in cross-border transactions.

Clear and Transparent Communication

One of the primary benefits of utilizing these documents is their ability to offer transparent communication between both parties in a transaction. This helps establish mutual understanding about the details of the shipment, including the cost, description of goods, and terms of sale. Below are some of the aspects that improve communication:

- Detailed Product Information: A clear description of the goods ensures that the buyer knows exactly what is being purchased.

- Financial Transparency: Pricing is laid out in detail, preventing any confusion regarding the total amount due.

- Terms of Sale: Both parties understand the agreed terms, such as delivery times and payment methods.

Facilitating Quick Processing

These documents serve as a useful tool for expediting the processing of goods through various checkpoints. With accurate details provided upfront, it becomes easier to handle the logistics and regulatory requirements. This helps in:

- Faster Approval Times: Due to the clarity of the document, it’s easier for authorities and customs officials to approve the shipment faster.

- Reduced Delays: The document can speed up the shipment process by making sure all essential details are already provided.

- Better Preparation for Payment: Since the document outlines payment amounts and terms, it allows the receiving party to prepare and make payments more efficiently.

Comparison Table

| Benefit | Description |

|---|---|

| Clear Communication | Ensures both parties fully understand the transaction details, such as price and delivery terms. |

| Faster Processing | Helps authorities quickly assess and approve the shipment, reducing delays. |

| Financial Clarity | Outlines the pricing and payment expectations, reducing confusion. |

Incorporating such documents into the business process leads to smoother operations, quicker transactions, and greater overall satisfaction for both buyers and sellers.