Professional Service Invoice Template for Easy and Efficient Billing

Creating accurate and clear billing documents is essential for smooth financial operations in any business. A well-structured document helps establish transparency between clients and service providers, ensuring that all expectations are met and payments are processed without issues. For many entrepreneurs and freelancers, having a reliable tool for generating these documents is crucial to maintaining professionalism and organization.

When it comes to managing payments, using an efficient format allows businesses to save time and avoid confusion. It ensures that every necessary detail, from payment terms to itemized lists, is included and easy to understand. By utilizing a customizable approach, companies can tailor these documents to their specific needs, creating a seamless experience for both parties involved.

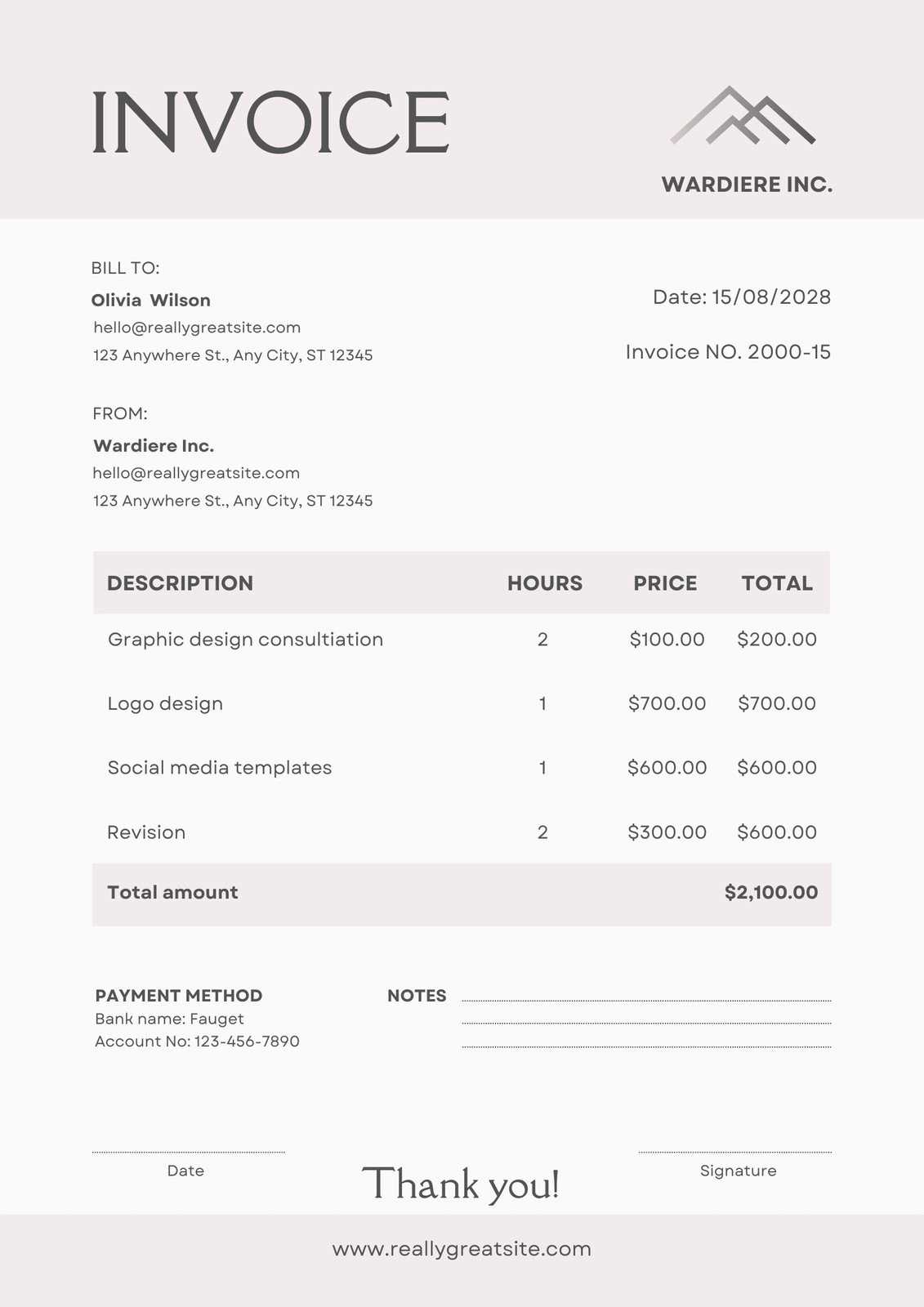

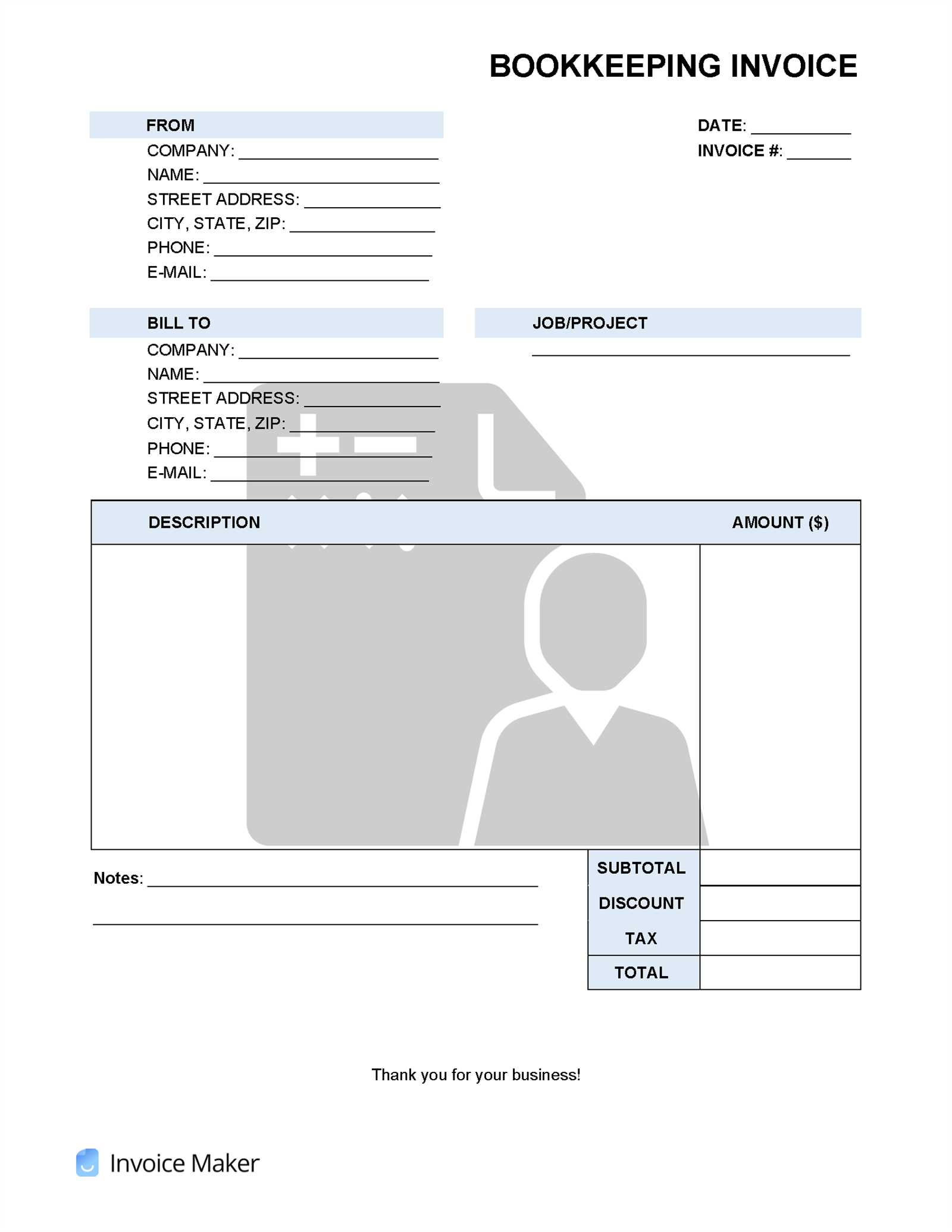

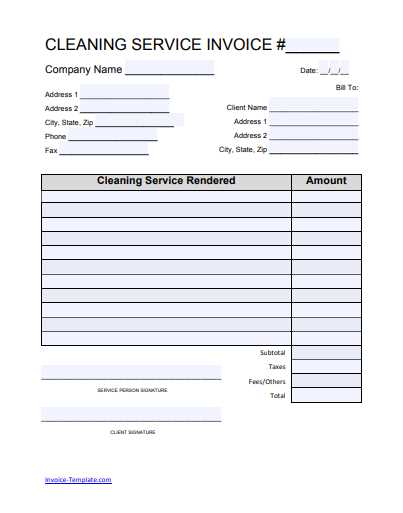

Professional Billing Document Format

Having an organized structure for payment requests is essential for businesses that want to maintain clear financial records and ensure smooth transactions with clients. A well-designed billing document can make a significant difference in ensuring that all relevant details are captured and that payments are processed efficiently. Whether you’re a freelancer, consultant, or small business owner, the ability to create customized billing forms is a valuable tool in managing finances.

Key Features to Include

An effective billing document should contain all the necessary information to prevent misunderstandings and delays in payments. Here are the key elements you should consider:

- Client Information: Name, address, and contact details for accurate identification.

- Company Details: Include your business name, address, and tax identification number.

- Description of Services: A detailed breakdown of the work performed or goods delivered.

- Payment Terms: Clearly outline when payments are due and any penalties for late payments.

- Total Amount: A clear and itemized list of the total due for the services provided.

Benefits of Using a Customizable Format

Customizable billing forms offer several advantages for businesses. By adjusting the design and layout, you can ensure that the document reflects your brand and meets the specific needs of your clients. Some of the key benefits include:

- Consistency: Every billing document follows a standardized format, making it easier for clients to understand.

- Brand Identity: Customizable layouts allow businesses to incorporate logos, fonts, and colors that reflect their unique identity.

- Efficiency: Pre-designed structures reduce the time spent creating documents from scratch, allowing you to focus on other important tasks.

Why Use a Billing Document Format

Creating structured and consistent payment requests is essential for ensuring smooth financial transactions between businesses and clients. A well-organized document not only helps avoid confusion but also makes the billing process more professional. Using a pre-designed format for these documents simplifies the task and ensures that important details are never overlooked.

Here are some of the main reasons why using a standardized format is beneficial for your business:

- Time Efficiency: Instead of starting from scratch each time, a pre-made layout allows you to quickly fill in the necessary details and send it out promptly.

- Consistency: Consistently using the same format for all transactions creates a sense of professionalism and helps clients easily understand the document’s content.

- Accuracy: A set structure reduces the risk of missing key information or making errors that could delay payments or cause misunderstandings.

- Customization: Customizable formats allow businesses to include their branding elements and adapt the document according to specific needs or client requirements.

By adopting a clear, easy-to-use system for managing payment requests, businesses can streamline operations, save time, and maintain better financial organization.

Benefits of a Customizable Billing Document

Having the ability to tailor payment request documents offers several key advantages for businesses. Customization ensures that your documents not only meet your specific needs but also align with your brand identity. With a flexible approach, you can create a more professional, organized, and personalized experience for both you and your clients.

Here are the primary benefits of using a customizable format for your payment requests:

- Brand Consistency: Customize the layout to match your company’s branding, including logos, fonts, and colors. This consistency reinforces your brand image and builds trust with clients.

- Client-Specific Adjustments: You can modify details to cater to individual client needs, such as adding personalized notes or adjusting payment terms based on project scope.

- Flexibility: Tailoring the structure allows you to include or remove specific sections, such as detailed descriptions of items, discounts, or tax information, based on the nature of the work.

- Improved Professionalism: A customized document looks polished and well-organized, contributing to a positive impression of your business.

- Enhanced Organization: With the ability to adjust each section to fit your workflow, you can maintain better financial tracking and ensure that all necessary information is included.

By utilizing a customizable format, you gain control over the appearance and content of your billing documents, making them more efficient, professional, and aligned with your business practices.

Key Elements of Billing Documents

To ensure clarity and professionalism in financial transactions, it is essential to include specific details in each payment request. A well-structured document provides all the necessary information for both parties to understand the terms of the transaction, reducing the chances of confusion and delay. Below are the key components that should always be present in such documents.

Essential Information to Include

- Sender Details: Your business name, address, contact information, and any relevant registration numbers should be clearly listed.

- Recipient Information: Include the client’s name, address, and contact details to ensure accuracy in communication.

- Unique Identifier: Assign a unique number or code to each document for easy tracking and reference in the future.

- Date of Issue: The date when the request is sent should be prominently displayed, helping both parties keep track of deadlines.

- Payment Terms: Specify when payment is due, any applicable late fees, and the preferred methods of payment.

Detailed Breakdown of Charges

- Description of Goods or Work: Provide a detailed list of the products or services provided, with clear descriptions and quantities.

- Unit Pricing: List the cost for each item or service and any applicable taxes or discounts.

- Total Amount Due: Clearly state the total amount owed, ensuring it aligns with the detailed breakdown of charges.

Including these key elements in your billing document helps ensure transparency and a smooth payment process, reducing potential misunderstandings and fostering positive client relationships.

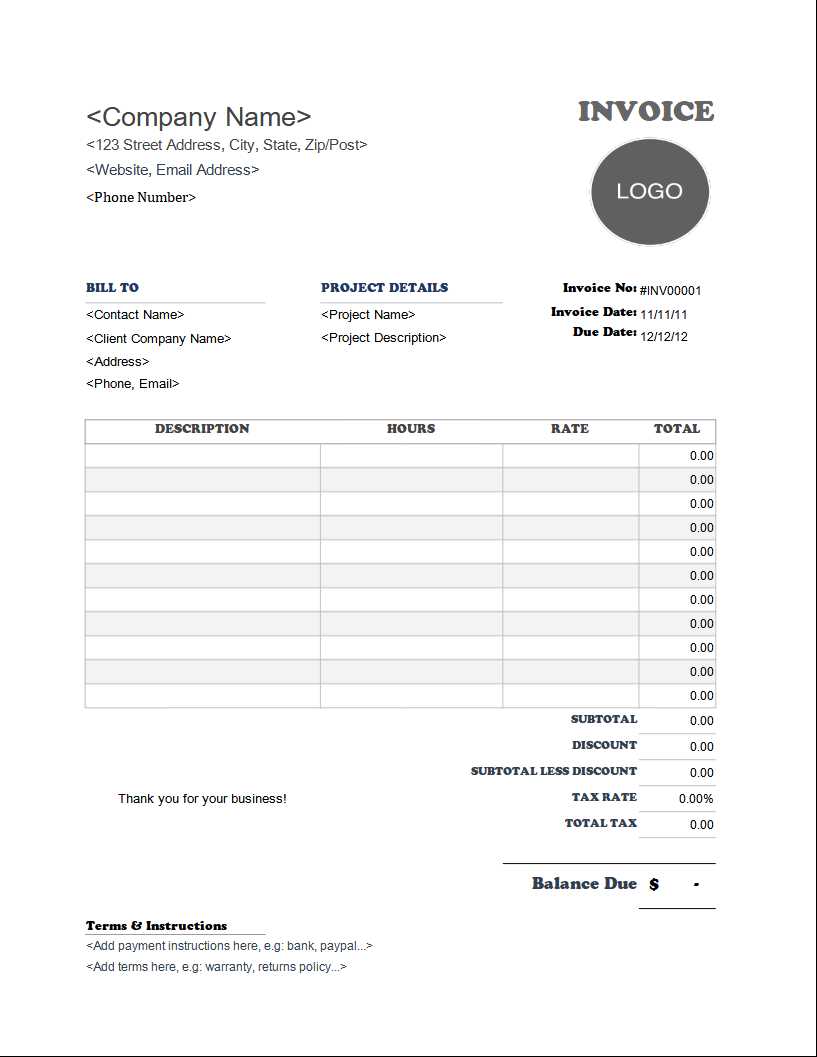

How to Create a Billing Document Format

Creating an effective and organized payment request form is essential for managing financial transactions with clients. A well-constructed layout ensures that all necessary details are included and that the document is easy to understand. Whether you are using digital tools or designing your own, the process of creating a custom billing document is straightforward if you follow a few key steps.

Here’s a simple guide to help you create a customized billing document format:

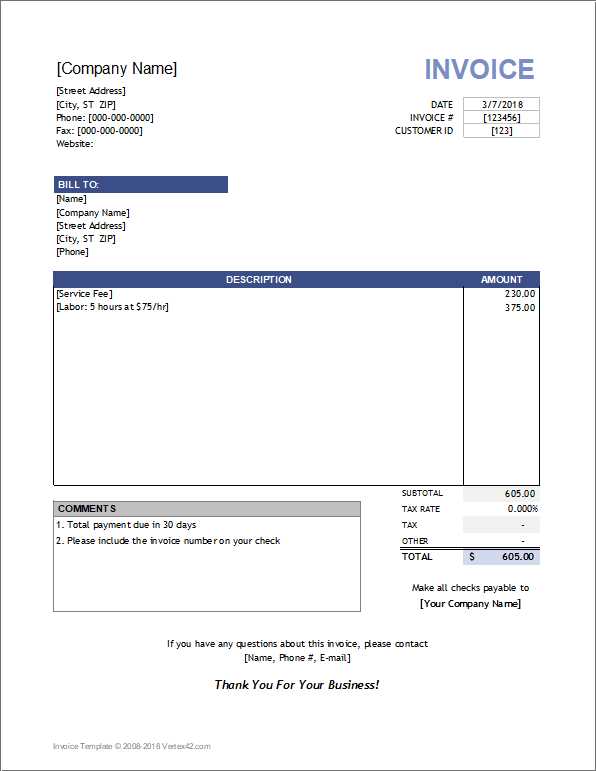

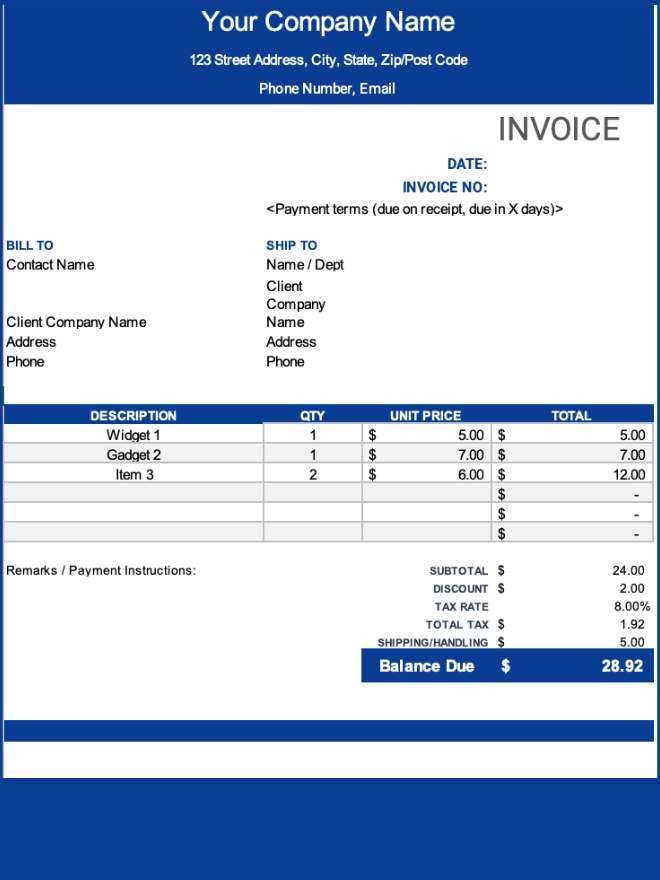

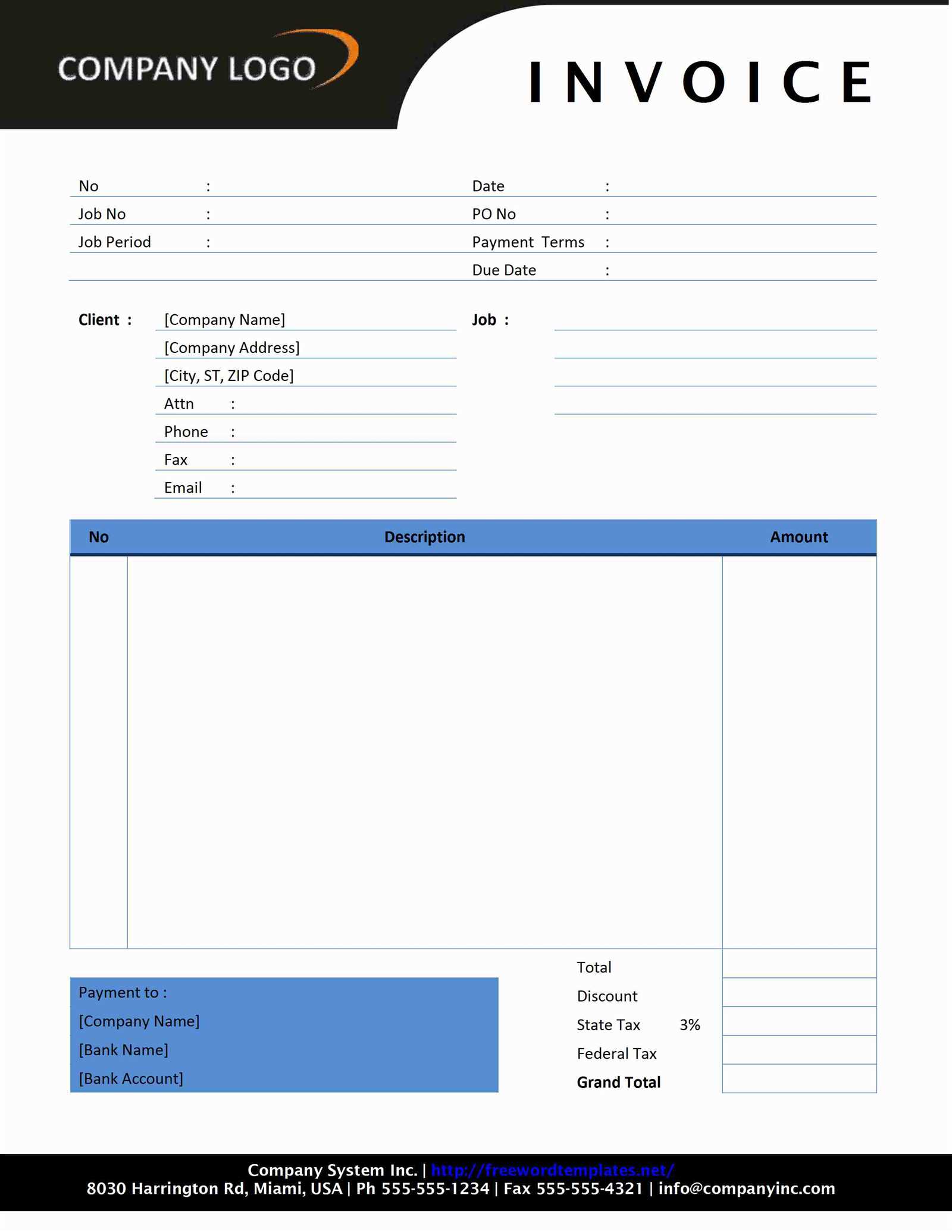

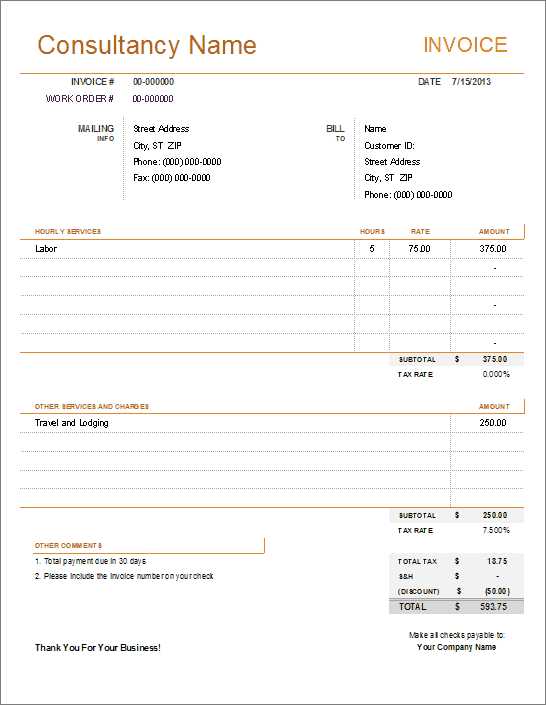

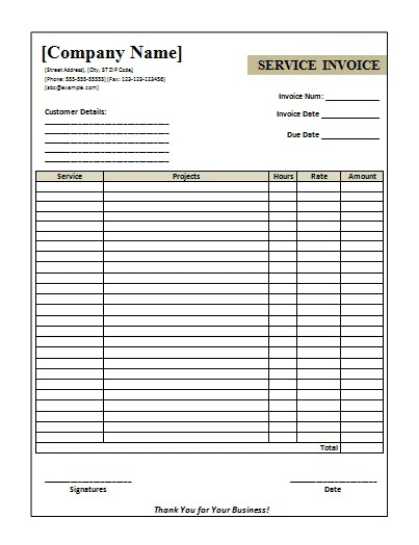

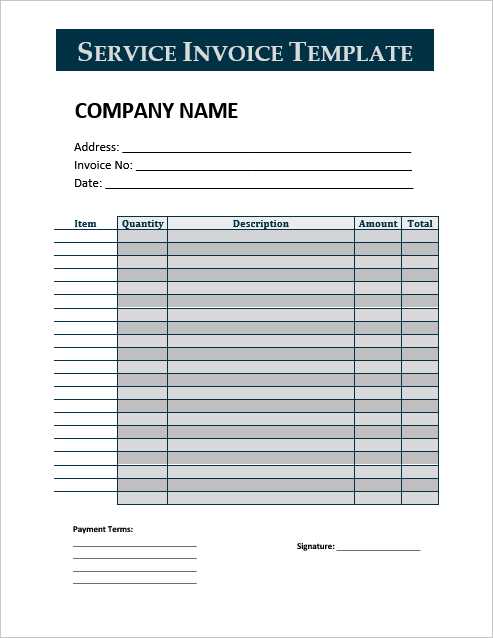

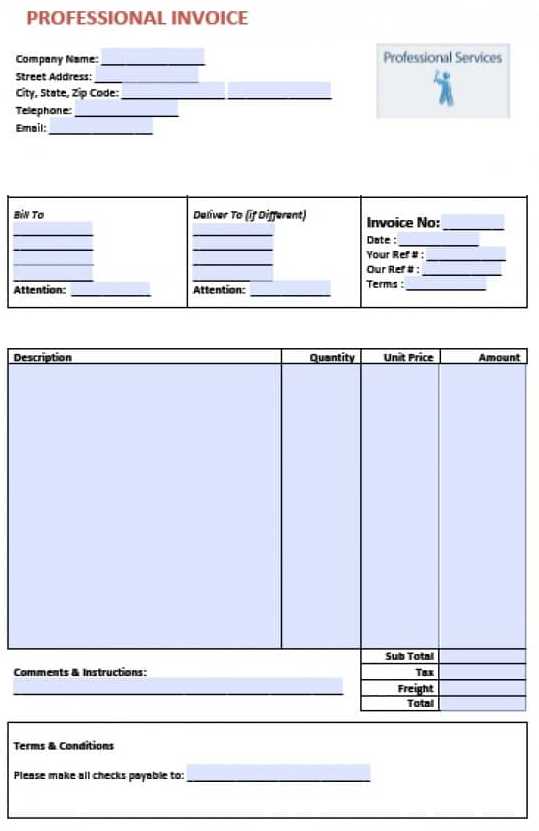

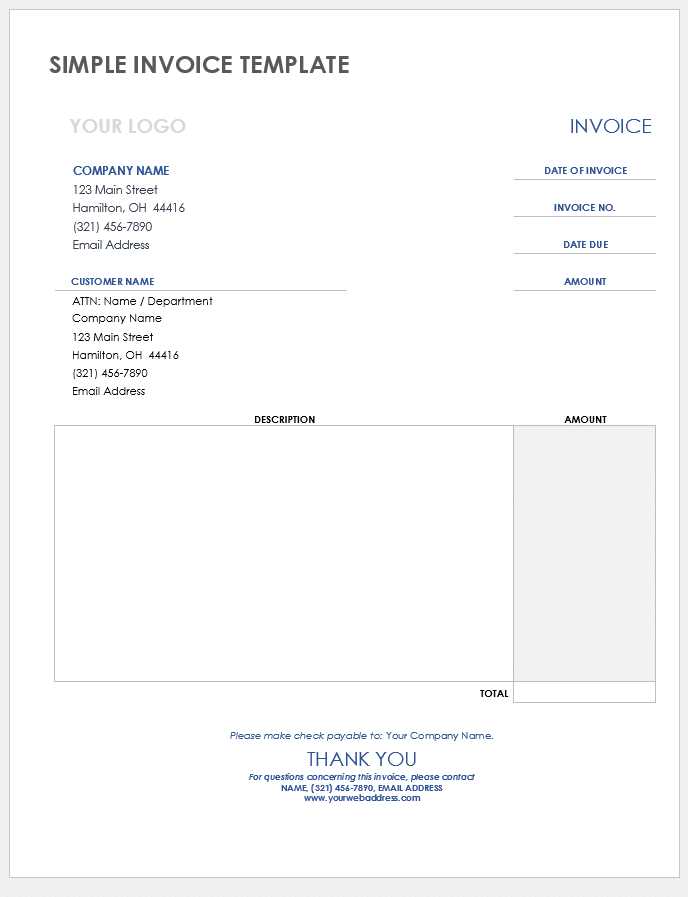

- Choose a Layout: Start by selecting a clean and professional layout. Many word processors or online tools offer pre-designed formats that can be adjusted according to your needs.

- Add Your Business Information: Include your business name, address, contact details, and any relevant identification numbers (such as tax ID or registration number) in the header section.

- Include Client Details: Make sure to include the client’s name, address, and any other identifying information to ensure clarity and accuracy.

- Detail the Products or Services Provided: List all items or work delivered with clear descriptions, quantities, and individual pricing. This breakdown helps avoid confusion over the charges.

- Specify Payment Terms: Clearly indicate the payment due date, methods of payment accepted, and any late fees or discounts for early payment.

- Summarize the Total Amount: Ensure the total amount is clearly displayed, including taxes, discounts, or any additional charges, and make sure it matches the detailed breakdown.

By following these steps, you can create a functional and customizable document that will streamline your billing process and ensure accurate, professional communication with your clients.

Free Billing Document Formats for Professionals

For businesses and freelancers looking to streamline their payment processes, free customizable forms can be an invaluable resource. These ready-made layouts help eliminate the need for designing documents from scratch, saving both time and effort. With the right tools, you can easily create clean, professional documents that meet the needs of your clients and reflect your business standards.

Many platforms offer free access to high-quality forms that can be tailored to suit your specific requirements. Here are some of the benefits of using these free resources:

- Cost Savings: Accessing pre-designed formats at no cost allows you to focus resources on other areas of your business.

- Easy Customization: These forms are designed to be easily editable, letting you adjust the layout, content, and branding elements to match your needs.

- Time Efficiency: With a ready-to-use structure, you can quickly generate payment requests without having to start from scratch every time.

- Professional Appearance: Many free resources are designed by experts, ensuring that your documents look polished and meet industry standards.

By utilizing free billing document formats, you can ensure consistency and professionalism while saving time and reducing administrative burdens in your business operations.

Best Software for Billing Document Creation

Using the right software to generate payment requests can significantly improve the efficiency and accuracy of your financial processes. The right tool simplifies the creation, customization, and tracking of these documents, ensuring that everything from the design to the details is accurate. With various software options available, selecting the one that best fits your needs can help you streamline your workflow and maintain professionalism in all your client transactions.

Top Features to Look For

When choosing software for creating billing documents, here are some features you should consider:

- Ease of Use: The software should be intuitive, allowing you to quickly generate and customize documents without a steep learning curve.

- Customization Options: Look for software that allows you to adjust the layout, add logos, and tailor the content to suit your business style.

- Integration with Other Tools: Consider software that integrates seamlessly with your accounting or CRM tools to make financial tracking and reporting easier.

- Automation Features: Features like recurring billing and automatic reminders for overdue payments can save time and reduce manual work.

Popular Billing Software Options

- QuickBooks: A popular choice for small businesses, QuickBooks offers a comprehensive invoicing solution with powerful accounting features.

- FreshBooks: Known for its user-friendly interface, FreshBooks is great for freelancers and small business owners who need to create and send billing documents quickly.

- Zoho Invoice: A free, cloud-based option that offers a range of customizable features for creating professional-looking billing requests.

- Wave: A free option that provides simple invoicing tools, perfect for small businesses or freelancers looking to save costs.

Choosing the right software can simplify your billing process, improve consistency, and help you maintain better financial control. Make sure to explore different options to find the one that best suits your needs.

Designing a Clear Billing Document Layout

Creating a well-organized and easy-to-read payment request is crucial for effective communication between businesses and clients. A clear and visually appealing layout helps ensure that all necessary information is presented in a logical and accessible way. A cluttered or confusing design can lead to misunderstandings or delays, so focusing on simplicity and clarity is key to a successful document.

Key Design Principles

When designing your billing document, keep the following principles in mind to ensure clarity and professionalism:

- Use Clear Headers: Separate key sections such as client details, work description, payment terms, and total amount with clear headings. This helps readers quickly find the information they need.

- Keep It Simple: Avoid unnecessary graphics or complex fonts. A clean, minimalist design with easy-to-read fonts will make the document look more professional and easier to understand.

- Organize Information Logically: Present information in a structured order: client details, followed by a description of services or products, pricing, and payment terms. This flow helps guide the reader through the document.

- Highlight Important Information: Use bold text or larger font sizes to highlight critical details such as the total amount due, payment deadline, and any important terms or notes.

- Use Tables for Clarity: A table format is ideal for listing multiple items, services, or charges. This helps prevent confusion and makes it easy for both parties to see exactly what is being billed.

Design Tips for a Professional Look

- Incorporate Your Branding: Add your company logo and use your brand’s color scheme to make the document feel more personalized and aligned with your business identity.

- Maintain Consistent Formatting: Ensure font sizes, styles, and spacing are consistent throughout the document. This consistency enhances the document’s readability and appearance.

- Leave White Space: Don’t overcrowd the document. Adequate margins and spacing between sections make the content easier to read and less overwhelming.

By following these design principles, you can create a billing document that is not only functional but also visually appealing and easy to understand, helping to maintain professionalism and reduce the likelihood of payment delays.

Adding Client Information to Billing Documents

Including accurate and detailed client information in payment request documents is essential for ensuring proper communication and processing. By clearly identifying the recipient, you reduce the chances of confusion and ensure that both parties are on the same page regarding the transaction. The more precise the information, the easier it will be to track payments and manage client accounts.

Here are the key details you should include when adding client information:

| Client Name | The full name of the individual or company receiving the bill. |

|---|---|

| Client Address | The complete address where the payment request should be sent or associated with the account. |

| Contact Details | Email address and phone number for direct communication if needed. |

| Billing ID or Account Number | A unique identifier for the client, if applicable, to help differentiate between multiple clients or accounts. |

| Company Name (if applicable) | The business name, if the client is an organization rather than an individual. |

By ensuring that all of this information is correctly listed, you enhance the professionalism of the document and streamline communication, making the process of payment collection more straightforward and transparent for both parties.

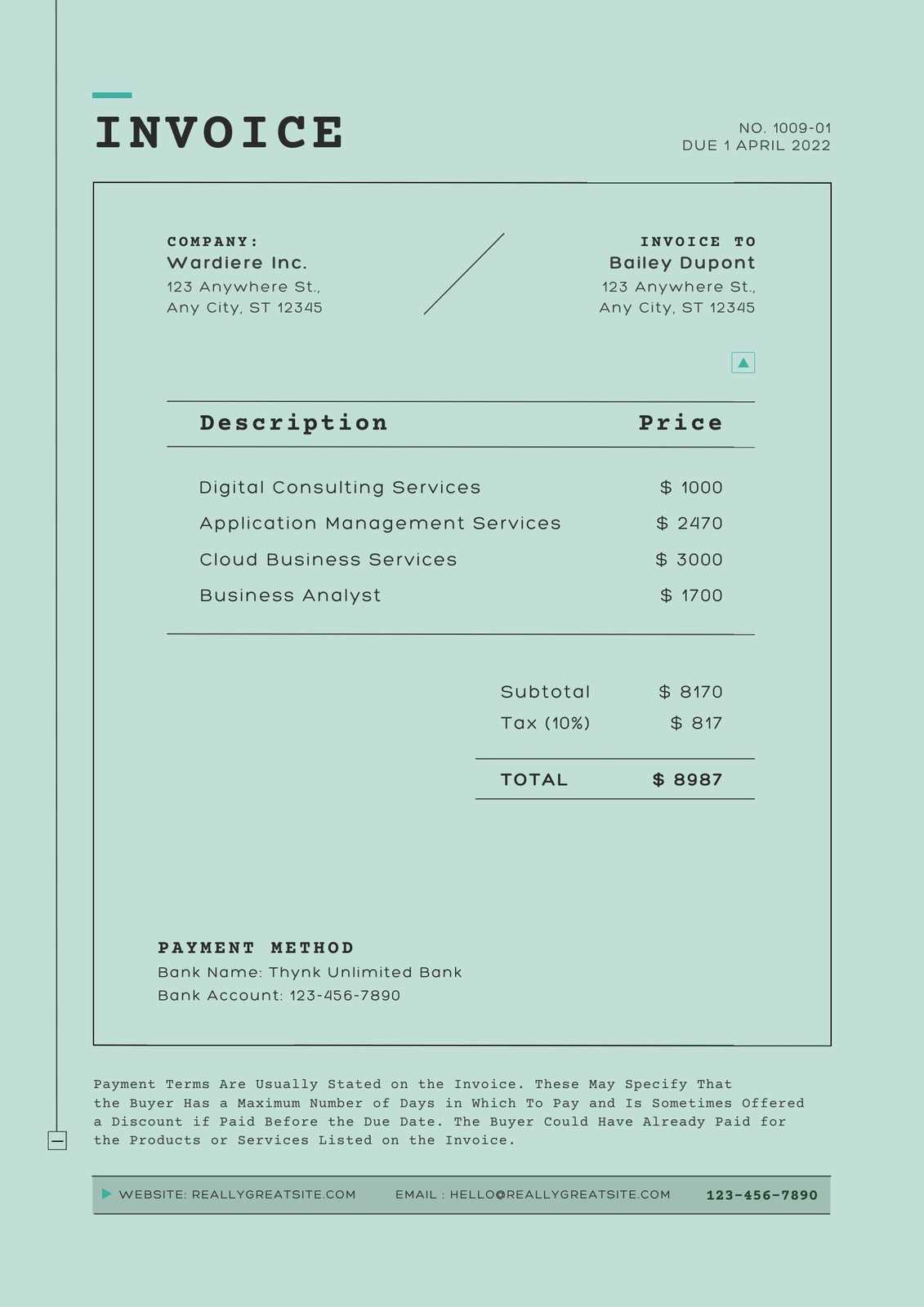

Understanding Payment Terms on Billing Documents

Payment terms are an essential part of any financial document, as they define the rules for when and how a payment should be made. Clear and well-defined terms help prevent misunderstandings between businesses and clients, ensuring that both parties are aware of their responsibilities and expectations. Properly communicated payment terms also help businesses maintain healthy cash flow and avoid late payments.

There are several key elements to include when outlining payment terms:

- Due Date: Specify the exact date by which payment is expected. Common timeframes include “Due on receipt,” “Net 30,” or “Net 60,” indicating how many days after the document date the payment should be made.

- Accepted Payment Methods: Clearly state the methods of payment you accept, such as bank transfer, credit card, PayPal, or check, to avoid confusion.

- Late Fees: Outline any penalties for overdue payments, including interest rates or fixed late fees. For example, “A late fee of 2% will be applied to payments made after 30 days.”

- Discounts for Early Payment: Offering a discount for early payment can encourage prompt settlements. For example, “A 5% discount will be applied if paid within 10 days.”

Clearly communicating payment terms not only helps your business get paid on time, but also promotes a sense of professionalism and trust with your clients. When these details are included and understood, it reduces the likelihood of disputes and ensures smooth financial transactions.

Including Tax Details on Billing Documents

Including tax information in payment requests is essential for maintaining transparency and ensuring compliance with local tax regulations. Accurate tax details help both businesses and clients understand the total amount due, including applicable taxes, and avoid confusion during the payment process. Failure to include proper tax information can lead to delays or disputes, making it crucial to be clear about the taxes that apply to each transaction.

Key Tax Information to Include

- Tax Rate: Clearly specify the applicable tax rate for the products or services provided. This can be a percentage, such as “Sales tax: 10%,” or a specific value depending on your location and the nature of the transaction.

- Taxable Amount: Indicate the amount on which the tax is being applied. This could be the total cost of the goods or services before tax or a specific portion of the transaction that is taxable.

- Total Tax Amount: Calculate and display the exact tax amount, so the client knows how much they are paying for tax purposes.

- Tax Identification Number (TIN): Include your business’s tax ID number, if applicable. This is particularly important for businesses that operate in regions where tax documentation is required for cross-border transactions.

Why Tax Details Matter

- Compliance: Including the correct tax information ensures your business complies with local, state, or national tax laws, avoiding potential legal issues.

- Clarity: Providing tax details on payment requests makes it clear to your clients what portion of the total amount is tax, reducing the chances of confusion or disputes.

- Record Keeping: Accurately detailing tax information helps with efficient bookkeeping and makes it easier to file taxes when the time comes.

By including the correct tax details on your billing documents, you ensure a smooth transaction process, help your clients understand the full cost, and maintain compliance with legal requirements.

How to Track Payment for Billing Documents

Effectively tracking payments is essential for managing cash flow and maintaining a clear financial record. Without proper tracking, it becomes difficult to identify which payments have been received, which are overdue, and how much is still outstanding. Establishing a systematic approach to monitoring payments ensures timely follow-ups and helps avoid disputes or confusion.

Methods for Tracking Payments

There are several ways to keep track of payments, depending on the tools and systems available to you:

- Manual Tracking: You can use a simple spreadsheet to list all issued documents and record payment statuses. Include columns for invoice numbers, due dates, amounts due, and payment dates.

- Accounting Software: Many businesses use accounting software that can automatically track payments, generate reports, and send reminders for overdue payments. Software like QuickBooks, FreshBooks, or Zoho can help streamline this process.

- Payment Reminders: Set up automatic reminders for clients when payments are due or overdue. Sending a friendly reminder a few days before the due date can often prevent delays.

- Bank Reconciliation: Regularly compare your bank statements with your records to ensure that all payments have been processed and recorded correctly.

Best Practices for Payment Tracking

- Stay Organized: Keep all payment records, including receipts or bank confirmations, organized in one place. This makes it easier to reference and verify transactions if needed.

- Regularly Update Records: Update your payment tracking system as soon as payments are received. This ensures that you always have an up-to-date overview of outstanding balances.

- Communicate with Clients: Maintain open communication with clients regarding due dates and payment statuses. Being proactive in your follow-up can help avoid late payments.

By implementing an efficient tracking system, you can stay on top of your financial transactions, improve cash flow management, and minimize the chances of overdue payments.

Managing Outstanding Billing Documents

Effectively managing unpaid transactions is crucial to maintaining a steady cash flow and ensuring that your business stays financially healthy. Outstanding payments can accumulate, causing unnecessary stress and potential disruption to your operations. By adopting a proactive approach, you can minimize overdue amounts and ensure timely settlements while maintaining positive relationships with clients.

Steps for Managing Unpaid Balances

Here are some key steps to take when dealing with overdue amounts:

- Track Payment Due Dates: Keep a detailed record of all issued bills, along with their due dates. Regularly review outstanding balances to stay informed about which payments are overdue.

- Send Payment Reminders: A friendly reminder a few days before or after the due date can encourage prompt payment. Make sure the reminder is polite but firm, outlining the terms and conditions of the payment agreement.

- Offer Payment Plans: If a client is facing financial difficulties, offering a structured payment plan can help ensure that you eventually receive the full amount. Set clear terms and deadlines to avoid further delays.

- Apply Late Fees: If your terms allow for late fees, ensure these are enforced. This will not only encourage timely payments but also protect your business from cash flow issues.

Dealing with Persisting Non-Payment

In cases where payments continue to be delayed despite your efforts, consider these actions:

- Direct Communication: Reach out to the client via phone or email for a more personal discussion. Sometimes a direct conversation can resolve misunderstandings or uncover payment issues.

- Engage a Collection Agency: If a payment remains unpaid for a long period, you might need to hire a collection agency to recover the debt. Ensure this is communicated in advance, as it can strain client relationships.

- Legal Action: As a last resort, you can take legal action to recover the debt, but this can be time-consuming and costly. Consider the long-term impact on your client relationships before proceeding with this step.

By staying organized and proactive in managing unpaid balances, you can reduce the risk of non-payment and keep your business finances in good standing. Clear communication and effective follow-up are key to maintaining both positive client relations and healthy cash flow.

Billing Document for Small Business Owners

For small business owners, creating accurate and clear payment requests is a critical part of ensuring that transactions are smooth and that cash flow remains stable. A well-designed billing document helps convey professionalism and ensures that all necessary details are included, reducing the chances of payment delays. By using a simple, easy-to-understand structure, small business owners can manage their finances more effectively while maintaining positive client relationships.

Here is a basic structure for a billing document suitable for small business owners:

| Field | Description |

|---|---|

| Business Name and Contact Information | Include your company’s name, address, phone number, and email. This makes it easy for clients to reach out if needed. |

| Client Information | List the client’s full name or company name, address, and contact details to ensure the bill is directed to the right party. |

| Document Number | Assign a unique identification number to each billing document. This helps in tracking payments and maintaining accurate records. |

| Itemized List of Charges | Provide a detailed list of the products or services provided, including the quantity, unit price, and total cost for each item or service. |

| Total Amount Due | Clearly state the total amount owed, including any applicable taxes or discounts. This makes it easy for the client to understand the full cost. |

| Payment Terms | Include payment due date and any late fee policies, as well as accepted payment methods (e.g., bank transfer, credit card, PayPal). |

| Notes or Special Instructions | Use this section to include any additional information, such as a thank you note or specific payment instructions. |

By following this simple structure, small business owners can ensure that all essential information is included, making it easier for clients to process payments promptly. Having a consistent format also helps establish credibility and professionalism, contributing to long-term business success.

Common Mistakes in Billing Documents

When creating billing documents, even small mistakes can lead to confusion, delayed payments, or disputes. It’s important to pay attention to detail to ensure that all necessary information is accurately included. Many errors can be easily avoided with proper formatting and careful review, which will help maintain professionalism and ensure smooth financial transactions.

Common Errors to Avoid

Here are some of the most common mistakes that can occur in billing documents:

| Error | Impact |

|---|---|

| Missing or Incorrect Client Information | Incorrect or incomplete client details can lead to confusion and delay payments. Always double-check the client’s name, address, and contact information. |

| Incorrect Item Descriptions | Vague or unclear descriptions of the goods or services provided can lead to disputes over what was actually delivered. Be specific about the products or services included in the charge. |

| Omitting Payment Terms | If payment terms are not clearly stated, clients may be unsure of when and how to pay, leading to delays. Always include due dates, accepted payment methods, and any late fees. |

| Failure to Include Tax Details | Leaving out tax calculations or miscalculating the amount due can create confusion and cause the client to question the final total. Make sure to specify the tax rate and any applicable charges. |

| Not Using a Unique Billing Number | Failure to assign a unique identifier to each billing document can make it difficult to track payments and follow up on overdue amounts. Ensure that every document has a clear, sequential number. |

| Inaccurate Total Amount | Incorrect totals, whether from math errors or missing charges, can cause clients to delay payments or dispute the charges. Double-check all amounts and calculations before finalizing the document. |

By avoiding these common mistakes, you can create clearer and more professional billing documents that are less likely to lead to payment delays or client confusion. Taking the time to check each detail helps ensure smooth financial operations and promotes better relationships with clients.

Automating Your Billing Process

Automating the billing process can significantly improve efficiency, reduce human error, and free up valuable time for other important tasks. By using software and tools to handle routine tasks, you can streamline the creation, sending, and tracking of payment requests. Automation not only saves time but also ensures consistency, accuracy, and timely follow-ups, which are essential for maintaining healthy cash flow and client relationships.

Benefits of Automation

- Time Savings: Automation eliminates the need for manual entry, allowing you to generate multiple billing documents in a fraction of the time.

- Consistency: Automated systems ensure that each document follows the same format and includes all necessary details, reducing the risk of omissions or errors.

- Timely Reminders: Automated reminders for overdue payments help you follow up with clients without having to remember specific due dates.

- Accurate Tracking: Automation ensures accurate tracking of all payments, making it easy to monitor which payments have been made and which are still pending.

Steps to Automate Your Billing

- Choose the Right Software: Select an accounting or billing tool that fits your business needs. Popular tools include QuickBooks, FreshBooks, and Zoho, which offer automated features like recurring billing and invoice generation.

- Set Up Templates: Create custom templates for your billing documents to ensure consistency. Templates can be reused for multiple clients, saving time while maintaining professionalism.

- Enable Recurring Billing: For clients with ongoing contracts, set up automated recurring billing to generate and send payment requests at regular intervals, such as weekly or monthly.

- Automate Payment Reminders: Set up automated email reminders to be sent to clients before and after the due date, reducing the need for manual follow-ups.

- Monitor Payment Status: Use automated systems to track the status of each payment, ensuring that overdue balances are flagged for further action.

By automating your billing process, you can streamline your operations, improve cash flow, and reduce administrative burden, allowing you to focus on growing your business.

Legal Considerations in Billing Documents

When creating billing documents, it’s important to understand the legal aspects involved to avoid potential disputes and ensure compliance with local laws. A well-crafted document not only serves as a record of the transaction but also as a legally binding agreement between you and your client. Being aware of the legal requirements related to payment terms, taxes, and late fees can help protect your business and foster transparency in client relationships.

Key Legal Elements to Include

- Clear Payment Terms: It is essential to include specific payment terms, including due dates, accepted payment methods, and any late fees or interest charges that may apply. Without clear terms, it may be difficult to enforce timely payments or resolve payment issues.

- Tax Compliance: Depending on your location, certain taxes may need to be added to your bills. Ensure that you’re correctly applying sales tax, VAT, or other applicable taxes. Always reference the legal tax rate to avoid discrepancies.

- Late Fees: If your terms include late fees or penalties for overdue payments, make sure that these are explicitly stated in the document. Be aware of local laws regarding the maximum allowable late fee amounts.

- Legal Jurisdiction: Specify the jurisdiction under which any disputes will be resolved. This is particularly important for businesses that deal with clients across different states or countries.

Best Practices for Legal Protection

- Document Everything: Always keep a copy of the billing document and any correspondence regarding the transaction. These documents serve as proof of your agreement with the client in case of disputes.

- Use Written Agreements: While a billing document can act as a contract, it’s advisable to have a separate written agreement that outlines the terms of the work, payment expectations, and other conditions. This will provide additional legal protection.

- Consult Legal Professionals: If you’re unsure about the legal implications of your billing practices, it’s wise to consult with a legal professional who can ensure that your documents comply with relevant laws and regulations.

By understanding and addressing the legal considerations in your billing documents, you can protect your business from potential risks and ensure that your transactions are fair, transparent, and legally enforceable.

How to Improve Billing Accuracy

Ensuring accuracy in billing is crucial for maintaining healthy client relationships and securing timely payments. Simple errors such as incorrect amounts, missing details, or ambiguous descriptions can lead to confusion, delays, and even disputes. By focusing on key areas of the billing process and implementing clear standards, businesses can minimize errors and improve the efficiency of their financial operations.

Best Practices for Accurate Billing

- Double-Check Details: Always verify the client’s information, payment terms, and any agreed-upon amounts before finalizing the document. Small mistakes like incorrect names or addresses can lead to delays.

- Use Itemized Lists: Provide a clear and detailed list of all items or services provided, including quantities, rates, and totals. This helps both you and the client clearly understand what is being charged.

- Automate Calculations: Use software or tools that automatically calculate totals, taxes, and discounts. This minimizes the risk of manual calculation errors and ensures consistency across all documents.

- Review Before Sending: Always take a moment to review the final billing document. A fresh set of eyes, or simply waiting a few minutes before reviewing, can help catch errors that might otherwise be missed.

Common Errors to Avoid

| Error | Impact |

|---|---|

| Incorrect Amounts | Small mistakes in pricing can result in significant discrepancies. Double-check totals, taxes, an |