Professional QuickBooks Invoice Templates for Efficient Billing

When managing finances, a streamlined approach to creating and sending billing documents is crucial. Having an effective way to issue clear, professional-looking statements can significantly enhance your business’s credibility and reduce the time spent on administrative tasks. With the right tools, generating invoices becomes faster and more consistent, helping you focus on growing your company.

Customizable formats provide flexibility in designing payment requests that suit your specific needs. These pre-designed layouts allow you to quickly add your company details, services rendered, and payment terms, ensuring accuracy every time. This simplicity not only saves valuable time but also minimizes human error.

By choosing a suitable format, you can ensure your billing process is both efficient and professional. The right system supports automation, keeps track of payments, and even integrates with accounting software to further streamline your financial workflows.

Professional Billing Solutions for Your Business

Having well-designed, ready-to-use formats for payment requests is essential for maintaining an organized and efficient business operation. These pre-made layouts can help streamline the process, ensuring consistency in your communications with clients and reducing the time spent on administrative tasks. With a few simple adjustments, you can create accurate, clear, and professional-looking documents tailored to your company’s needs.

Key Features of Effective Billing Formats

- Customizable Layouts: Easily adjust the fields to suit your specific business requirements, from contact details to service descriptions and payment terms.

- Automatic Calculations: Many systems come with built-in features to automatically calculate totals, taxes, and discounts, reducing the risk of errors.

- Branding Integration: Personalize documents with your logo, color scheme, and other branding elements to maintain a professional image.

- Easy Payment Tracking: Keep track of paid and outstanding balances, simplifying financial management and follow-ups with clients.

How to Choose the Right Layout for Your Needs

When selecting a suitable design, it’s important to consider the nature of your business and the preferences of your clients. For example, service-based businesses may need a more detailed breakdown of tasks, while product-based companies can focus on clear descriptions and itemized pricing. It’s also crucial to think about how the format integrates with your existing accounting or financial management systems, ensuring a seamless workflow.

- Service-Based Businesses: Opt for layouts that allow for detailed time entries, descriptions, and hourly rates.

- Product-Based Businesses: Choose formats that clearly list products, quantities, and prices.

- Freelancers and Contractors: Simple and clean layouts are ideal, emphasizing hourly rates, project milestones, or lump-sum charges.

Incorporating these features into your b

Why Use Ready-Made Billing Formats

Creating customized payment requests from scratch can be time-consuming and prone to errors. Ready-made formats offer an easy solution, allowing businesses to quickly generate professional documents with minimal effort. These pre-designed layouts ensure consistency in every transaction and save valuable time that can be better spent on other aspects of the business.

Time and Efficiency Benefits

- Speed: With pre-built formats, you can generate and send payment requests in just a few clicks, eliminating the need for manual creation each time.

- Consistency: Each document follows a standardized structure, ensuring uniformity and reducing the chances of mistakes in the details.

- Reduced Administrative Work: Automating the process of creating and managing payment requests frees up time for more critical business operations.

Enhanced Accuracy and Professionalism

- Automatic Calculations: These formats often come with built-in fields to calculate totals, taxes, and discounts, minimizing the risk of human error.

- Pre-Designed Structure: The layout is already optimized for clarity and organization, presenting important information in an easy-to-read format.

- Branding Integration: Customization options allow businesses to add their logo, colors, and other branding elements, maintaining a professional image with every document sent.

By incorporating these ready-made solutions into your workflow, you can focus on what matters most–growing your business and serving your clients–while maintaining an efficient and error-free billing process.

Top Features of Billing Documents

When selecting a solution for generating payment requests, it’s important to consider the key features that can streamline your billing process. The right system offers more than just basic formatting–it can automate calculations, improve accuracy, and make your communication with clients more efficient. Here are some of the most valuable features to look for in a billing solution.

Essential Features for Efficient Billing

- Customizable Layouts: Personalize the document with your company’s branding, including logos, color schemes, and fonts, to create a consistent professional appearance.

- Automatic Calculations: Built-in formulas help automatically calculate totals, taxes, and discounts, reducing the risk of manual errors and saving time.

- Recurring Billing Options: Set up automatic billing for regular clients, ensuring that payments are requested on time without additional effort.

- Multicurrency Support: For businesses dealing with international clients, the ability to generate documents in various currencies simplifies the billing process.

Streamlining Payment Tracking and Management

- Real-Time Payment Updates: Monitor which payments have been received and which are outstanding, allowing for timely follow-ups with clients.

- Integrated Reminders: Automatic payment reminders can be sent to clients before or after the due date, reducing the need for manual tracking.

- Client History and Reports: Easily access a record of all past transactions, helping you maintain clear financial records and offering valuable insights into customer behavior.

These advanced features ensure that your billing process is not only quicker but also more reliable and tailored to your business needs.

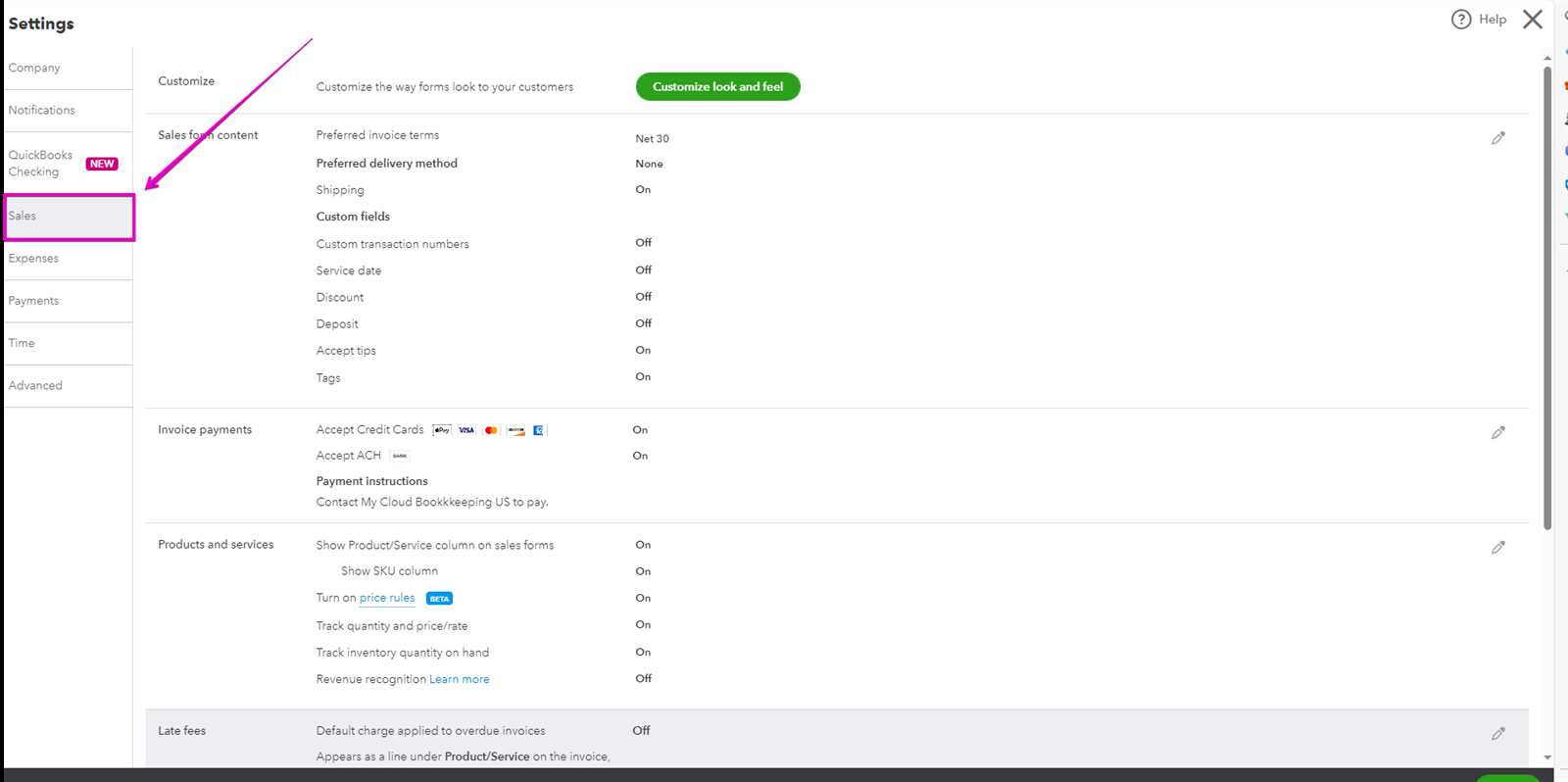

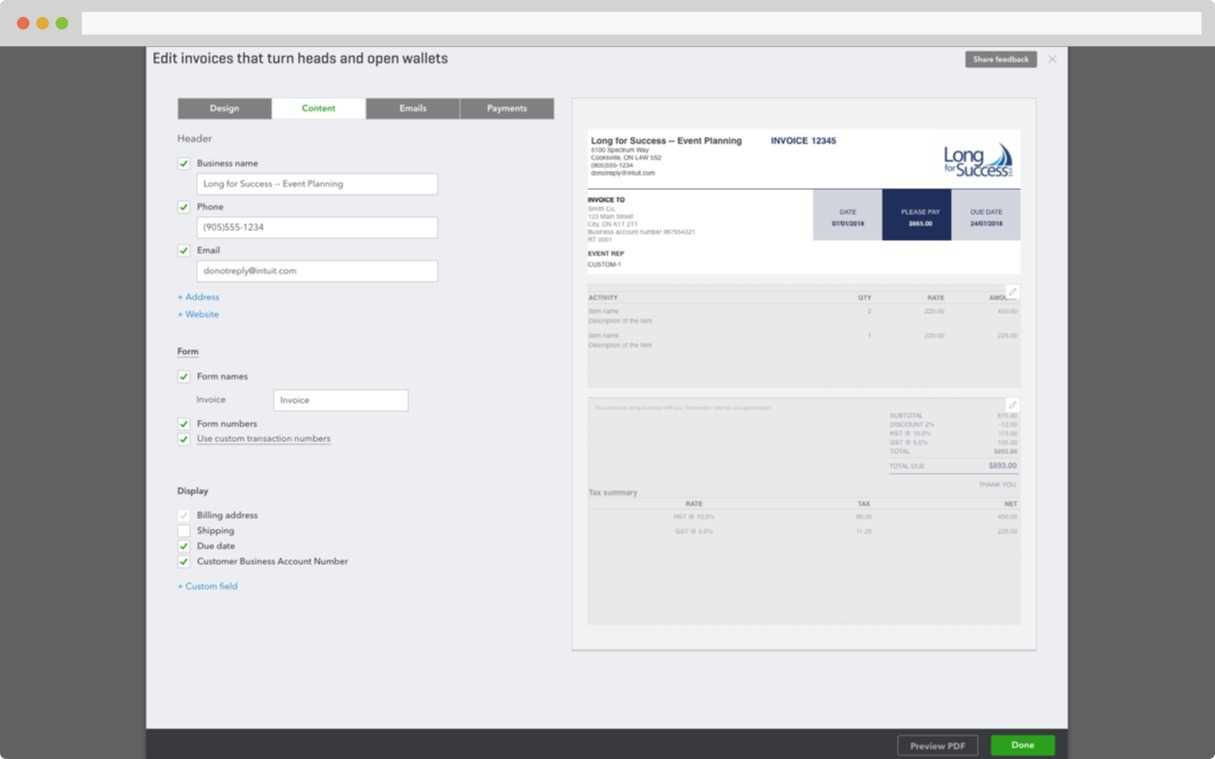

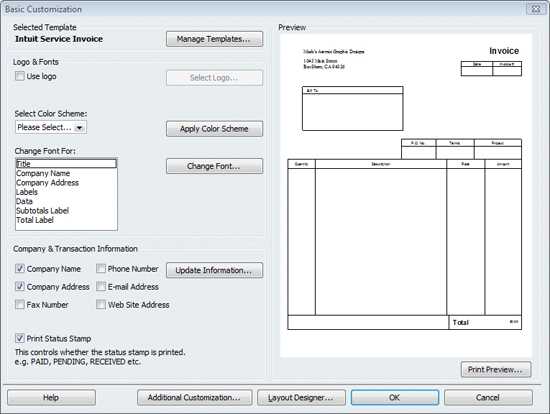

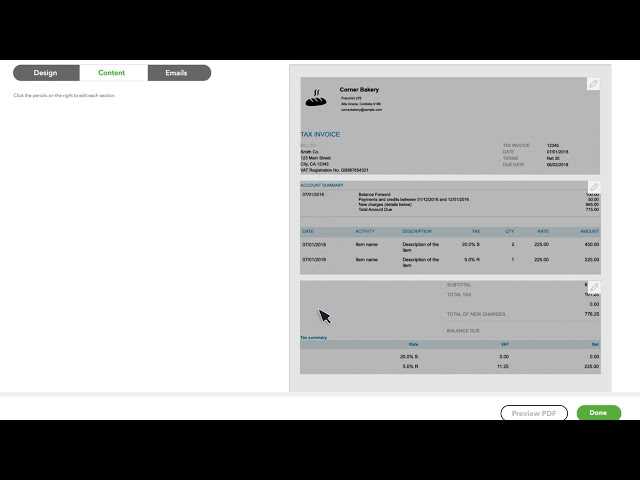

How to Customize Billing Layouts

Personalizing your payment request documents allows you to better reflect your business identity and meet your specific needs. Customizing the layout gives you control over how information is displayed, ensuring clarity and professionalism in every communication. This flexibility is particularly useful when you want to include specific details, adjust formatting, or align with your branding.

Here are a few steps to follow when customizing your billing layouts:

- Choose a Base Design: Start by selecting a pre-made design that suits your business type. From there, you can adjust the fields and overall structure to fit your preferences.

- Edit Text Fields: Modify default text such as descriptions, terms, and headings. Ensure the language aligns with your company’s tone and policies.

- Insert Your Logo: Add your company logo at the top of the document to make it instantly recognizable to clients. Position it where it complements the design without overcrowding.

- Adjust Colors and Fonts: Choose colors and fonts that reflect your brand’s style. Consistency in design helps create a cohesive look across all client communications.

- Include Custom Fields: If necessary, add custom fields for additional information, such as special discount terms, project details, or custom payment instructions.

Once you’ve made these adjustments, your documents will be tailored to your business, offering a consistent and professional appearance with every transaction.

Benefits of Using Ready-Made Layouts

Using pre-designed formats for creating payment requests offers several advantages that can simplify your workflow. These ready-made layouts save valuable time and ensure that your documents are consistent and professional in appearance. With these solutions, businesses can focus on core operations rather than spending time on designing or formatting each payment request individually.

- Time-Saving: With pre-built designs, you don’t have to start from scratch. You can quickly input necessary details and generate documents within minutes, freeing up time for other tasks.

- Consistency: Ready-made formats ensure that every document follows the same structure and design, reducing the risk of errors and maintaining a consistent appearance across all communications.

- Ease of Use: These layouts are user-friendly and require minimal technical knowledge to customize, making them accessible to people with varying levels of expertise.

- Professional Appearance: Pre-designed formats come with a polished, well-organized look, ensuring that your documents appear professional to clients without any extra effort.

- Customizable for Specific Needs: While they come with a standard layout, these solutions are flexible enough to be adapted to your business’s specific needs, allowing you to add unique fields or adjust the design.

- Reduced Risk of Errors: With automatic calculations and a structured layout, these formats minimize human error, ensuring accuracy in totals, taxes, and other key details.

Incorporating ready-made solutions into your billing process can enhance productivity, improve document consistency, and provide a higher level of professionalism with minimal effort.

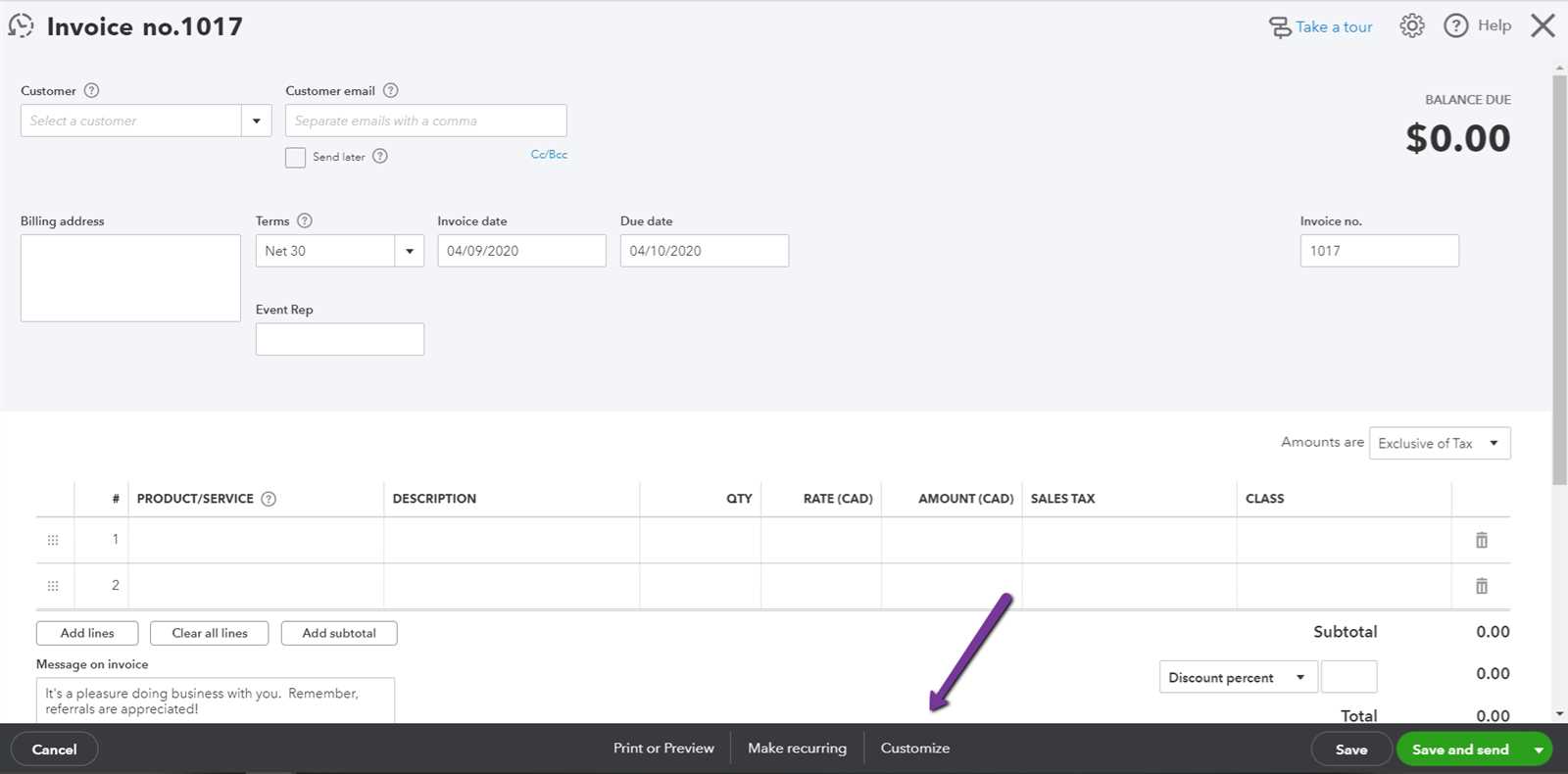

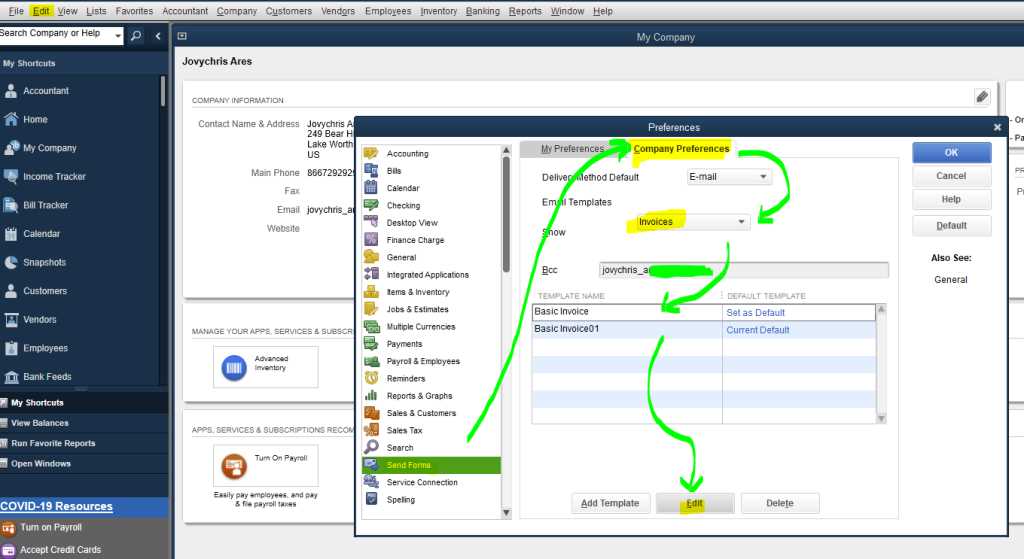

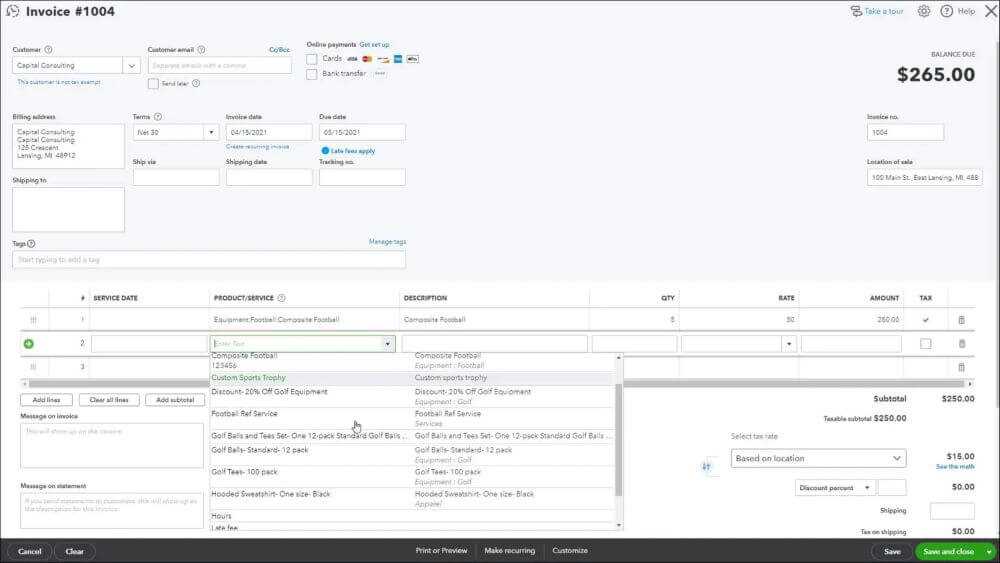

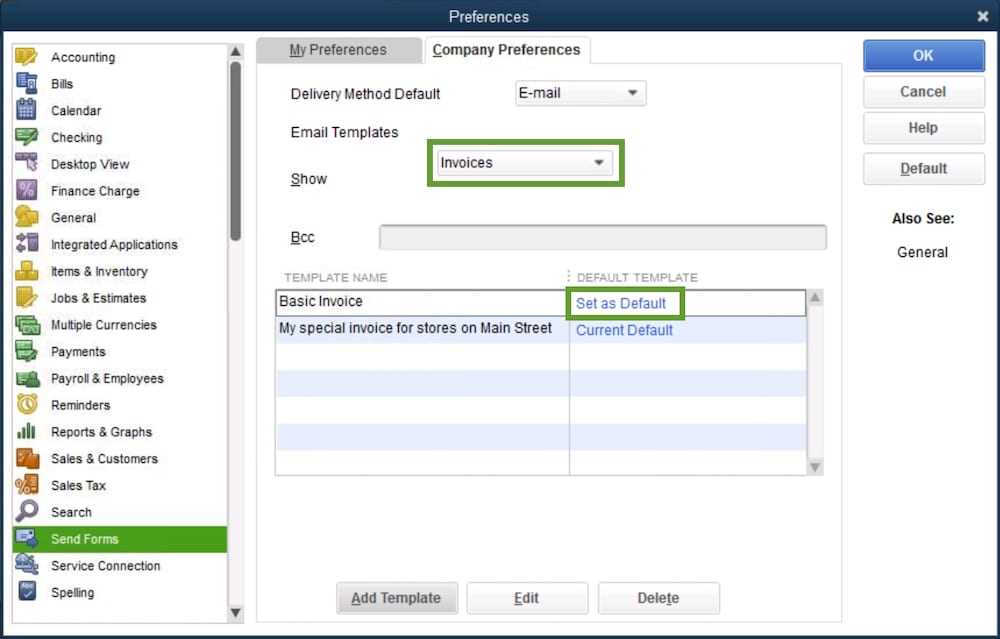

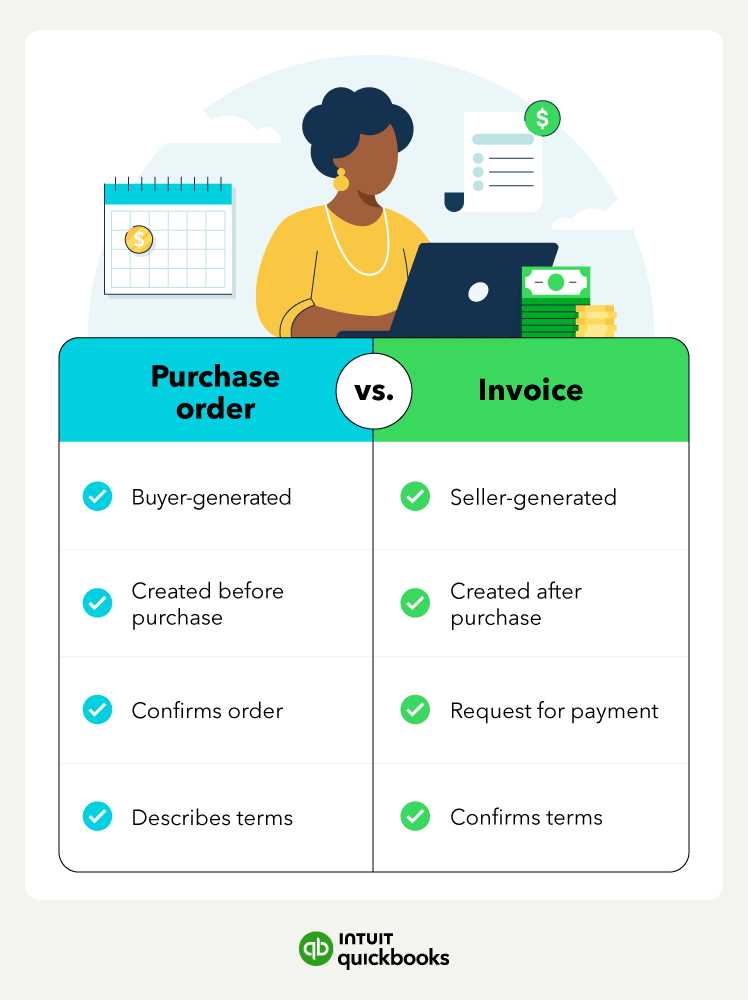

How to Create a Payment Request in Your Accounting Software

Generating a payment request using accounting software is a straightforward process that can be done in just a few simple steps. This approach helps ensure that your documents are accurate, consistent, and delivered on time. Whether you’re billing clients for products or services, the system provides an easy way to create, customize, and send payment requests efficiently.

Step-by-Step Guide to Creating a Payment Request

- Select the Client: Choose the client for whom you want to create the document. If the client is already in your system, simply search for their name. If not, you can add them manually.

- Choose a Layout: Pick from a variety of pre-designed formats or select a basic layout that you can later customize with specific details.

- Enter Transaction Details: Add the products or services you’re billing for, including quantities, rates, and any additional costs. The system will automatically calculate totals and taxes based on the information you input.

- Customize the Document: Include additional information such as payment terms, discounts, or custom notes. You can also modify the document with your company logo and branding elements.

- Preview the Payment Request: Before sending, preview the document to ensure all information is accurate. Double-check figures, client details, and any other relevant sections.

- Send the Payment Request: Once everything is reviewed, send the document via email, print it for mailing, or export it as a PDF for record-keeping.

Additional Tips for Streamlining the Process

- Use Recurring Payments: For regular clients or services, set up recurring payment requests to be automatically generated and sent at speci

Free Billing Layouts vs Premium Options

When choosing a format for creating payment requests, businesses often face the decision between using free solutions or investing in premium designs. While both options offer basic functionality, the key differences lie in the level of customization, features, and support available. Understanding the advantages and limitations of each can help you decide which option best suits your business needs.

Advantages of Free Billing Layouts

- No Cost: Free options are the most budget-friendly, requiring no investment upfront, making them ideal for startups or small businesses with limited resources.

- Simplicity: These layouts are usually straightforward and easy to use, offering a quick way to create basic payment requests without complicated setup processes.

- Basic Customization: You can still make some adjustments, such as adding your logo and adjusting text fields, providing a minimal level of personalization.

Benefits of Premium Billing Layouts

- Advanced Customization: Premium options often allow for deeper personalization, including custom fields, advanced styling options, and better alignment with your business branding.

- More Features: These solutions tend to come with additional features such as automated reminders, recurring billing, detailed reporting, and integration with other software systems.

- Priority Support: With paid options, you typically receive better customer support, including faster response times and access to troubleshooting guides or help centers.

- Enhanced Security: Premium designs often come with added security features to protect sensitive financial data and transactions, offering peace of mind to business owners.

While free solutions are great for basic needs, investing in premium formats can provide long-term benefits in terms of efficiency, scalability, and professional appearance as your business grows.

Best Practices for Billing Management

Effective billing is crucial for maintaining positive client relationships and ensuring consistent cash flow. Adopting best practices for creating and managing payment requests can help streamline your business operations, minimize errors, and speed up the payment process. By following proven strategies, you can ensure accuracy, improve client satisfaction, and save time in your financial workflows.

Key Tips for Efficient Billing

Best Practice Why It Matters Use Clear, Concise Language Clear terms and descriptions help avoid confusion and ensure that clients know exactly what they are being charged for. Always Include Payment Terms Define when payments are due, any applicable late fees, and accepted payment methods to avoid delays and misunderstandings. Provide Detailed Descriptions Include specific details about the products or services provided, helping the client easily identify the charges and reduce disputes. Automate Recurring Charges For clients with regular services, automate billing to ensure consistent revenue and reduce administrative workload. Track Payments and Follow Up Monitor paid and outstanding balances so you can quickly follow up on overdue payments, maintaining cash flow. Additional Strategies for Successful Billing

- Maintain a Consistent Layout: Use the same format for all client communications to present a professional image and maintain clarity.

- Send Reminders: Automated or manual reminders can help prompt clients to make payments on time, reducing the risk of late fees.

- Offer Multiple Payment Options: Allow clients to pay through various methods–credit cards, bank transfers, or online platforms–to increase convenience and speed up transactions.

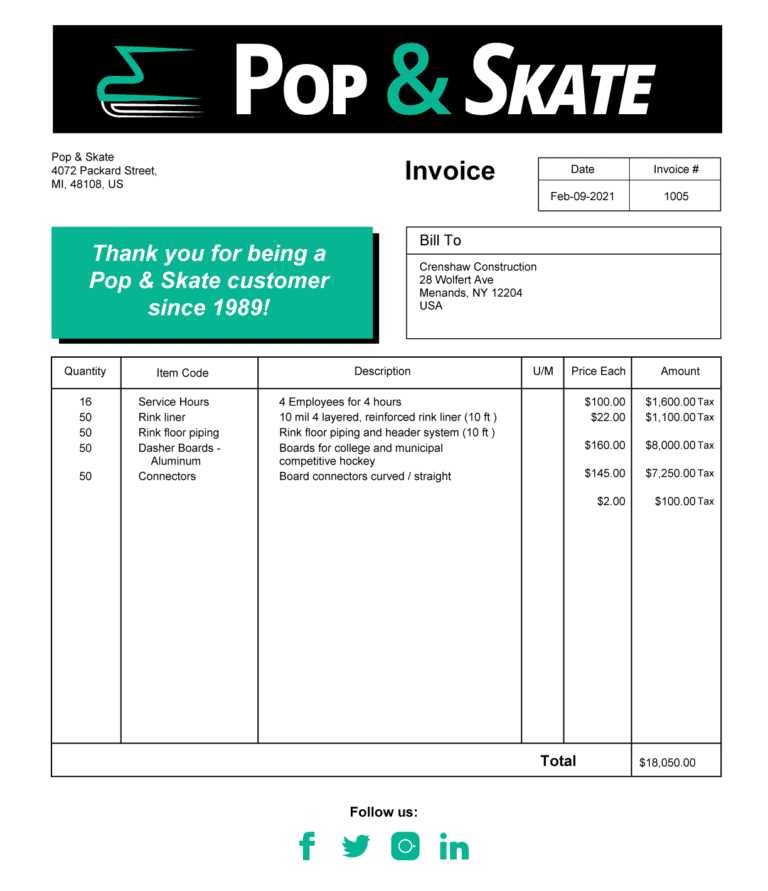

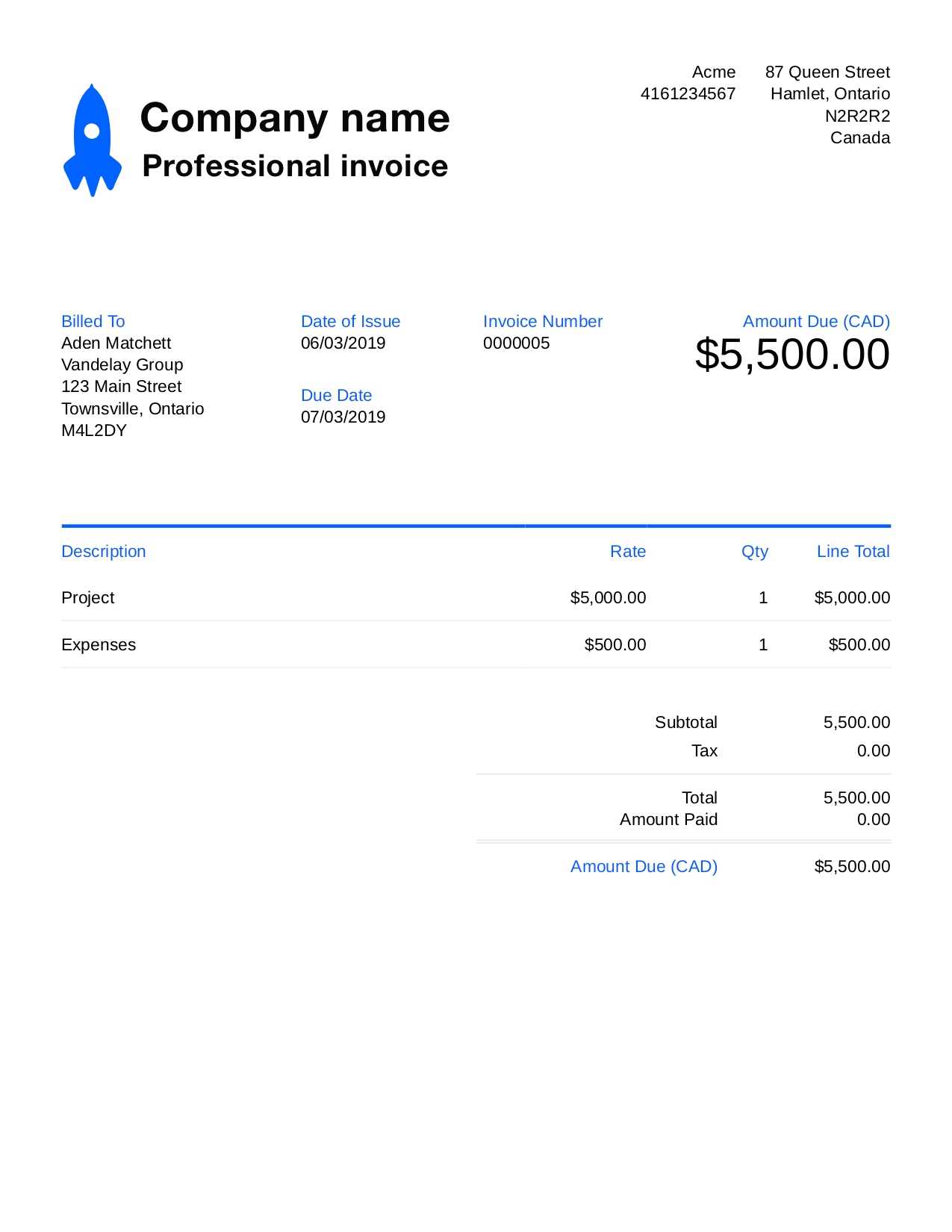

- How to Add Company Branding to Billing Documents

Including your company’s branding in billing documents is essential for maintaining a consistent and professional image across all client communications. Customizing these documents with your logo, color scheme, and other design elements not only makes them visually appealing but also reinforces your brand identity, helping clients easily recognize your business.

Steps to Incorporate Branding in Payment Requests

- Add Your Company Logo: Place your logo prominently at the top of the document. This is the first element clients will see, so make sure it’s clear and well-positioned.

- Use Brand Colors: Customize the layout with your company’s colors to create a cohesive look. Match the header, footer, or key sections of the document with the color palette used in your marketing materials.

- Choose Fonts That Reflect Your Brand: Use fonts that align with your company’s style guide. If your brand uses a specific typeface in other materials, incorporate it into your billing documents to maintain consistency.

- Include Contact Information: Add your website, social media links, and other contact details in the footer or header, making it easy for clients to reach you. This also reinforces your business’s digital presence.

- Personalize the Message: Include a thank-you note or a custom message that reflects your brand’s tone, whether it’s friendly, formal, or casual. This small touch can enhance the customer experience.

Why Branding Matters in Payment Requests

Branding your billing documents helps establish trust with your clients by presenting a unified and professional image. It also serves as a subtle marketing tool, reminding clients of your business every time they receive a document. By creating a unique, branded document, you distinguish yourself from competitors and build long-lasting client relationships.

Making these simple customizations can significantly enhance your brand visibility while streamlining the billing process.

How Pre-Designed Layouts Improve Efficiency

Using pre-designed formats for generating payment requests significantly enhances operational efficiency. These ready-to-use solutions streamline the creation process by automating key tasks such as calculation and formatting, freeing up time for other important aspects of business management. By minimizing manual input, businesses can reduce errors, accelerate workflows, and ensure consistency in all client communications.

Key Efficiency Benefits

- Time Savings: With pre-built formats, generating a document is a quick and easy process. Instead of creating each payment request from scratch, you can simply input the relevant details, saving valuable time.

- Consistency in Documents: A standardized layout ensures that every document follows the same structure and appearance. This consistency helps reduce confusion and gives clients a professional experience.

- Automated Calculations: These formats often include automatic tax, total, and discount calculations, reducing the need for manual input and minimizing the risk of errors.

- Reduced Administrative Work: By using a ready-made design, businesses can focus more on client relationships and business growth, rather than spending time adjusting formatting or performing repetitive tasks.

How Efficiency Impacts the Business

By streamlining the document creation process, businesses can reduce the time spent on administrative tasks and improve overall productivity. This increased efficiency not only makes daily operations smoother but also allows for faster payments, better client satisfaction, and improved financial management. With less time spent on paperwork, companies can focus on providing quality service and growing their business.

Incorporating pre-designed formats into your workflow is an easy way to improve your business efficiency while maintaining high standards for client communications.

Billing Solutions for Small Businesses

For small businesses, managing payment requests efficiently is crucial to maintaining healthy cash flow and ensuring that clients receive accurate, professional-looking documents. Using pre-designed layouts for these requests can streamline the process, reduce errors, and save time. These solutions can be customized to suit the specific needs of small businesses, ensuring that all the necessary information is included while also maintaining a consistent and professional image.

Why Small Businesses Benefit from Pre-Made Billing Documents

Benefit Description Cost-Effective Pre-made layouts eliminate the need for costly software or design services, making them a budget-friendly choice for small businesses. Quick Setup Small businesses can easily implement ready-to-use formats, allowing them to start billing clients immediately without wasting time on customization or formatting. Consistency and Professionalism Using a standardized format ensures that every payment request is uniform, helping to establish a strong, professional image across all client communications. Ease of Customization These solutions can be easily tailored to include specific business details, such as company logo, payment terms, and customized service descriptions. Improved Cash Flow By automating calculations and creating clear, easy-to-read documents, businesses can minimize errors and improve the speed at which clients make payments. How to Choose the Right Solution for Your Small Business

- Consider Your Business Needs: Make sure the solution fits the unique needs of your business, whether that’s for one-time transactions or recurring services.

- Look for Flexibility: Choose a system that allows you to adjust payment terms, add notes, and modify the layout as your business evolves.

- Ensure Ease of Use: Opt for a solution that is simple to use, even for individuals without extensive technical knowledge, so you can focus m

Choosing the Right Layout for Your Business

Selecting the appropriate format for generating payment requests is an essential step in streamlining your billing process. The right layout ensures clarity, professionalism, and efficiency while reflecting the unique needs and branding of your business. When making this choice, it’s important to consider factors such as the nature of your services, client expectations, and ease of use.

Key Factors to Consider When Choosing a Layout

- Business Type: Different industries have varying requirements. For instance, service-based businesses might need customizable fields for time tracking, while product-based businesses may focus on detailed item descriptions and quantities.

- Customization Options: Choose a solution that allows you to add your company logo, modify text fields, and adjust the color scheme to reflect your brand’s identity.

- Client Preferences: Consider the preferences of your clients. Some may prefer a simple, straightforward layout, while others might appreciate a more detailed, itemized breakdown of charges.

- Ease of Use: The layout should be easy to navigate and update, even for team members who may not have technical experience. Simplicity is key for reducing errors and ensuring quick document generation.

- Legal and Tax Requirements: Ensure that the layout you choose complies with local tax laws, including fields for tax rates, discounts, and payment terms, if necessary.

Matching Your Brand’s Identity

Consistency in design helps reinforce your brand’s identity and builds trust with clients. Be sure to choose a layout that allows you to incorporate your business’s visual style, such as logos, fonts, and colors. A consistent look across all your business communications will help present a cohesive and professional image.

By evaluating these factors, you can select the layout that best supports your business operations while enhancing your client’s experience and ensuring smooth, timely payments.

How to Use Billing Automation

Automating the billing process can greatly enhance efficiency by reducing manual work, ensuring timely payments, and minimizing errors. By setting up automation for your payment requests, you can send out consistent, accurate documents without needing to handle each one individually. This not only saves time but also streamlines your financial operations, allowing you to focus more on growing your business.

Steps to Set Up Billing Automation

- Choose an Automated Solution: Select a platform or software that offers automated billing features. Make sure it supports automatic generation and delivery of documents based on your business needs.

- Set Up Recurring Billing: For clients with ongoing services, set up recurring billing cycles. You can define the frequency (weekly, monthly, etc.) and have the system automatically generate and send payment requests at the scheduled times.

- Customize Payment Terms: Define your payment terms in advance, such as due dates, late fees, and available payment methods. Automating these aspects ensures that all documents are sent with accurate and consistent terms.

- Automate Follow-Ups: Set up automatic reminders for clients who have overdue payments. The system can send friendly payment reminders at specified intervals to help maintain cash flow.

- Integrate with Other Systems: If you use accounting or CRM software, consider integrating your billing system with these platforms. Integration ensures that data flows seamlessly, reducing the need for double entry and enhancing accuracy.

Benefits of Billing Automation

- Time Efficiency: Automating repetitive tasks allows you to focus on more important aspects of your business, improving overall productivity.

- Reduced Errors: Automated calculations and document generation reduce the likelihood of human errors, ensuring that all information is accurate and consistent.

- Improved Cash Flow: Automation helps to send out payment requests on time, encouraging clients to pay faster and improving cash flow.

- Consistent Client Experience: Automation ensures that all clients receive the same professional-level service with accurate and timely communication.

By incorporating automation into your billing process, you can reduce administrative burdens and focus on what truly matters: growing your business while maintaining strong relationships with your clients.

Billing Solutions for Service-Based Businesses

For service-based businesses, managing payment requests can be complex due to varying pricing structures, hours worked, and client-specific agreements. Customizable solutions for generating payment requests help streamline this process, ensuring that all essential details, such as services rendered, time tracked, and rates, are clearly outlined. These formats are designed to save time, reduce errors, and improve communication with clients.

How Billing Formats Benefit Service-Based Businesses

- Clear Service Breakdown: Customizable solutions allow businesses to list each service separately, providing a detailed description of the work performed and ensuring transparency with clients.

- Accurate Time Tracking: Service-based businesses often rely on hourly rates. Pre-designed formats can include fields for tracking hours worked, making it easier to calculate accurate totals.

- Flexible Payment Options: Service businesses may offer a variety of payment terms, such as hourly rates, fixed fees, or project-based pricing. These formats allow for easy customization to reflect different pricing models.

- Professional Presentation: With a consistent format, businesses can present their services in a polished and professional manner, reinforcing trust and reliability with clients.

Key Features to Look for in Billing Solutions

- Customizable Fields: Choose a solution that lets you adjust the document to reflect specific client agreements, such as discounts, special rates, or custom terms.

- Automated Calculations: Ensure the system includes automatic calculations for hours worked, service totals, taxes, and discounts, helping to minimize errors and speed up the process.

- Clear Payment Terms: Make sure the solution allows you to easily define payment terms, due dates, and available payment methods, providing clients with all the necessary details.

- Recurring Billing Options: For businesses offering ongoing services, choose a solution that supports recurring billing, saving time and ensuring timely payment.

By using tailored billing formats, service-based businesses can enhance efficiency, improve client relationships, and ensure that their billing processes are as seamless as the services they provide.

How to Track Payments with Billing Documents

Managing and tracking client payments is a crucial part of maintaining healthy cash flow in any business. By utilizing automated payment tracking systems within your billing documents, you can easily monitor which payments have been made, which are outstanding, and when follow-ups are necessary. This not only saves time but also ensures accuracy and reduces the risk of overlooking overdue payments.

Steps to Track Payments Effectively

- Record Payments as They Are Received: As soon as a client makes a payment, update the corresponding billing document to reflect the payment status. This ensures that you always have an up-to-date view of your receivables.

- Use Payment Status Indicators: Many billing systems allow you to mark payment requests with status indicators such as “Paid,” “Unpaid,” or “Partially Paid.” This helps quickly identify which payments have been settled and which ones need attention.

- Track Multiple Payment Methods: If clients pay via different methods (e.g., credit card, bank transfer, cash), make sure to record the payment method on each billing document. This will provide a clear payment history and help reconcile accounts more easily.

- Set Up Automated Reminders: Automating reminders for overdue payments is an effective way to ensure timely payment. You can set these reminders to be sent automatically after a certain period, making it easier to follow up without additional manual effort.

- Use Reports to Monitor Outstanding Payments: Generate reports that show all outstanding payments, including those that are overdue or upcoming. These reports give you a comprehensive view of your financial standing and help prioritize follow-ups.

Benefits of Tracking Payments with Billing Systems

- Improved Cash Flow: By keeping track of paid and outstanding payments, businesses can better manage their cash flow, ensuring they have enough funds to cover operating expenses.

- Fewer Mistakes: Automated tracking reduces the chances of human error, ensuring that payments are correctly recorded and reconciling accounts becomes more straightforward.

- Timely Follow-Ups: By monitoring overdue payments, you can take action sooner and prevent late payments from becoming a recurring issue.

- Clear Financial Overview: Tracking payments in real-time helps create a clear picture of your financial situation, allowing for more accurate forecasting and decision-making.

Effective payment tracking systems can help keep your business finances organized, reduce administrative overhead, and foster better relationships with your clients by ensuring that all transactions are accurately recorded and managed.

Integrating Billing Solutions with Other Tools

Seamlessly connecting your billing system with other business tools can significantly enhance efficiency and streamline your overall workflow. By integrating payment request generation with accounting software, customer relationship management (CRM) systems, or payment processing platforms, you can automate many tasks, reduce data entry errors, and ensure consistency across different aspects of your business. This allows for better data synchronization, faster invoicing, and a more organized financial process.

Key Tools to Integrate with Your Billing System

- Accounting Software: Integrating your billing system with accounting software ensures that payments are automatically recorded in your financial records. This eliminates the need for double data entry and reduces the chances of errors when reconciling accounts.

- Customer Relationship Management (CRM) Systems: Connecting your billing solution with a CRM allows for easy access to client data. This integration helps tailor invoices to individual clients and improves communication by sending personalized payment requests based on the client’s purchase history and preferences.

- Payment Gateways: By integrating payment processing platforms, you can enable clients to pay directly from their billing documents. This can accelerate payment cycles and reduce the chances of overdue payments.

- Project Management Tools: Linking your billing system with project management tools ensures that work completed on client projects can be easily translated into billing records, especially for hourly or milestone-based projects.

- Time-Tracking Software: If your business offers hourly services, integrating a time-tracking tool with your billing system allows you to automatically import hours worked and generate accurate billing records without manual input.

Benefits of Integration

- Increased Efficiency: Automation between tools reduces manual data entry and streamlines your workflow, allowing you to focus more on delivering services and less on administrative tasks.

- Reduced Errors: Data synchronization between platforms helps eliminate discrepancies and human errors, ensuring that your financial records are always accurate and up-to-date.

- Faster Payments: Integration with payment gateways and CRM systems allows for quick, seamless payment processing directly from your billing documents, speeding up payment collection and improving cash flow.

- Better Client Insights: Accessing integrated customer data gives you a clearer picture of client behavior, allowing you to customize your billing documents and communication strategies to suit their preferences.

By integrating your billing system with other essential business tools, you can create a more cohesive, efficient, and organized financial process, ultimately leading to improved business operations a

Common Mistakes to Avoid in Billing

Accurate and timely billing is crucial to maintaining a healthy business cash flow. However, many businesses make avoidable errors in their billing process, which can lead to delayed payments, customer confusion, and financial discrepancies. Understanding these common mistakes and learning how to avoid them can help ensure that your payment requests are clear, professional, and efficient.

Common Billing Errors

- Missing or Incorrect Client Details: One of the most common mistakes is failing to include correct client information, such as the name, address, and contact details. Inaccurate or incomplete data can lead to confusion, payment delays, and damaged client relationships.

- Unclear Payment Terms: Not specifying payment terms, such as due dates, late fees, or discounts, can create ambiguity and lead to delayed payments. Always ensure that the terms are clearly defined and easy to understand.

- Not Tracking Payments: Failing to update payment statuses after receiving payment is a critical mistake. Keeping track of whether a payment has been made or is still outstanding will help avoid confusion and allow you to follow up on overdue amounts promptly.

- Overcomplicating the Format: A cluttered or overly complex payment request can confuse clients. Stick to a clean, simple format with clear line items and an easy-to-read layout to ensure that your clients can quickly understand the charges.

- Forgetting to Include Taxes: Not including sales tax or service tax in the billing document can lead to problems with compliance and upset clients who expect the final amount to include taxes. Always double-check that taxes are calculated correctly and included in the total amount due.

- Omitting Payment Methods: Not providing clear payment options is another common error. Always specify the available payment methods (e.g., bank transfer, credit card, check) to avoid confusion and ensure clients know how they can settle their bills.

How to Avoid These Mistakes

- Double-Check Client Information: Before sending out a billing document, always verify that client details are accurate and up to date.

- Clearly Define Payment Terms: Make sure your payment terms are easy to read and understand, including due dates, late fees, and discounts for early payments.

- Track Payments Regularly: As soon as you receive a payment, update the

Updating Your Billing Document Design

Maintaining an up-to-date billing document design is essential for ensuring that your payment requests reflect your current business practices, branding, and any legal requirements. Whether it’s adjusting the layout, adding new information, or aligning with recent changes in your services or pricing, updating your billing structure can improve clarity and professionalism. This process can also help streamline your workflow and make invoicing more efficient for both you and your clients.

Reasons to Update Your Billing Structure

- Reflecting Brand Changes: As your business evolves, it’s important to update your payment documents to reflect changes in your branding, including logos, color schemes, and font choices. This ensures that your documents align with your current marketing and brand identity.

- Adapting to Legal or Tax Changes: If tax laws, regulations, or industry standards change, your billing format may need to be updated to ensure compliance. This could include adding new fields for tax rates, regulatory requirements, or updated payment terms.

- Improving Client Communication: If clients are having difficulty understanding your documents, it’s time to reassess your layout. Clearer itemization, simpler language, or more detailed breakdowns can improve how clients interpret your billing documents.

- Incorporating New Payment Methods: With the rise of digital payments, you may want to update your document to include new payment options such as online payment links or mobile payment methods. This can help speed up the payment process.

Steps to Update Your Billing Document

- Assess the Current Layout: Review your existing billing documents to identify areas that need improvement, whether it’s adding missing information, improving the layout, or simplifying the design.

- Update Client Information Fields: Ensure that fields for client details, such as name, contact, and address, are correctly labeled and easy to complete. This reduces errors when filling out the documents and ensures clarity for your clients.

- Include New Terms and Conditions: If your terms of service, payment terms, or return policies have changed, be sure to update these sections in your document. Providing clients with clear and current terms can prevent misunderstandings.

- Enhance the Visual Design: Make your documents look more polished by choosing a clean, professional design that matches your brand. Use consistent fonts, colors, and logos to maintain a cohesive image across all of your communications.

- Test the New Layout: Before fully adopting the new design, test it with a few client profiles to ensure that everything is easy to read and understand. Collect feedback and make adjustments as necessary.

Updating your billing documents is an ongoing process that can enhance